Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COMERICA INC /NEW/ | a2020q1pressrelease-fo.htm |

| EX-99.1 - EXHIBIT 99.1 - COMERICA INC /NEW/ | a2020q1pressrelease-ex.htm |

&RPHULFD,QFRUSRUDWHG )LUVW4XDUWHU )LQDQFLDO5HYLHZ $SULO 6DIH+DUERU6WDWHPHQW Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,” “outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,” “outcome,” “continue,” “remain,” “maintain,” “on track,” “trend,” “objective,” “looks forward,” “projects,” “models” and variations of such words and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as they relate to Comerica or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of this presentation and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's management for future or past operations, products or services, and forecasts of Comerica's revenue, earnings or other measures of economic performance, including statements of profitability, business segments and subsidiaries as well as estimates of credit trends and global stability. Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from those discussed. Factors that could cause or contribute to such differences include credit risks (unfavorable developments concerning credit quality; declines or other changes in the businesses or industries of Comerica's customers, in particular the energy industry; and changes in customer behavior); market risks (changes in monetary and fiscal policies; fluctuations in interest rates and their impact on deposit pricing; and transitions away from LIBOR towards new interest rate benchmarks); liquidity risks (Comerica's ability to maintain adequate sources of funding and liquidity; reductions in Comerica's credit rating; and the interdependence of financial service companies); technology risks (cybersecurity risks and heightened legislative and regulatory focus on cybersecurity and data privacy); operational risks (operational, systems or infrastructure failures; reliance on other companies to provide certain key components of business infrastructure; the impact of legal and regulatory proceedings or determinations; losses due to fraud; and controls and procedures failures); compliance risks (changes in regulation or oversight; the effects of stringent capital requirements; and the impacts of future legislative, administrative or judicial changes to tax regulations); financial reporting risks (changes in accounting standards and the critical nature of Comerica's accounting policies); strategic risks (damage to Comerica's reputation; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financial institutions within Comerica's markets; the implementation of Comerica's strategies and business initiatives; management's ability to maintain and expand customer relationships; management's ability to retain key officers and employees; and any future strategic acquisitions or divestitures); and other general risks (changes in general economic, political or industry conditions; the effectiveness of methods of reducing risk exposures; the effects of catastrophic events, including the COVID-19 global pandemic; and the volatility of Comerica’s stock price). Comerica cautions that the foregoing list of factors is not all-inclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 12 of Comerica's Annual Report on Form 10-K for the year ended December 31, 2019. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. For any forward-looking statements made in this presentation or in any documents, Comerica claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. 2

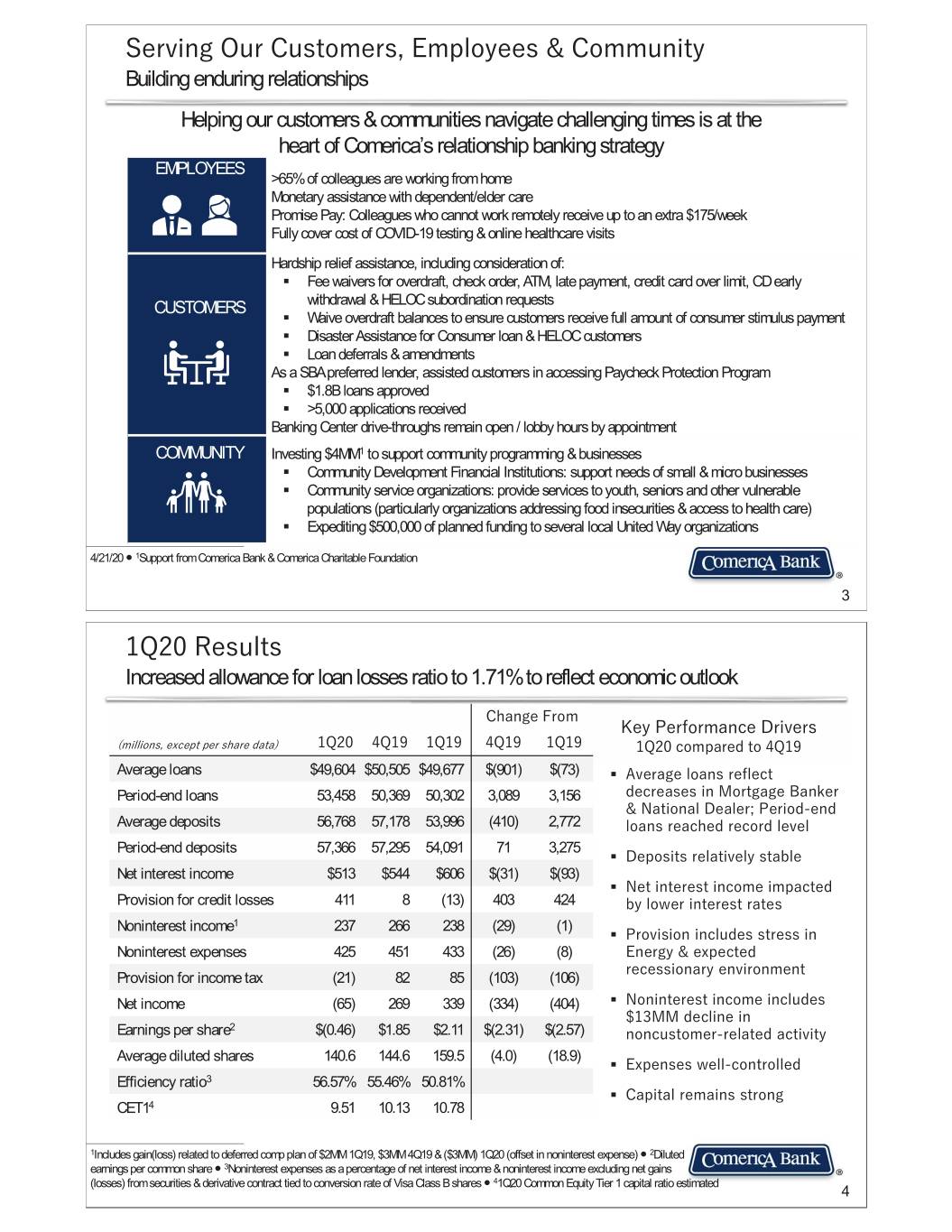

6HUYLQJ2XU&XVWRPHUV(PSOR\HHV &RPPXQLW\ Building enduring relationships Helping our customers & communities navigate challenging times is at the heart of Comerica’s relationship banking strategy EMPLOYEES >65% of colleagues are working from home Monetary assistance with dependent/elder care Promise Pay: Colleagues who cannot work remotely receive up to an extra $175/week Fully cover cost of COVID-19 testing & online healthcare visits Hardship relief assistance, including consideration of: ƒ Fee waivers for overdraft, check order, ATM, late payment, credit card over limit, CD early CUSTOMERS withdrawal & HELOC subordination requests ƒ Waive overdraft balances to ensure customers receive full amount of consumer stimulus payment ƒ Disaster Assistance for Consumer loan & HELOC customers ƒ Loan deferrals & amendments As a SBA preferred lender, assisted customers in accessing Paycheck Protection Program ƒ $1.8B loans approved ƒ >5,000 applications received Banking Center drive-throughs remain open / lobby hours by appointment COMMUNITY Investing $4MM1 to support community programming & businesses ƒ Community Development Financial Institutions: support needs of small & micro businesses ƒ Community service organizations: provide services to youth, seniors and other vulnerable populations (particularly organizations addressing food insecurities & access to health care) ƒ Expediting $500,000 of planned funding to several local United Way organizations 4/21/20 Ⴠ 1Support from Comerica Bank & Comerica Charitable Foundation 3 45HVXOWV Increased allowance for loan losses ratio to 1.71% to reflect economic outlook &KDQJH)URP .H\3HUIRUPDQFH'ULYHUV

PLOOLRQVH[FHSWSHUVKDUHGDWD

4 4

4

4

4

4FRPSDUHGWR4

Average loans $49,604 $50,505 $49,677 $(901) $(73) ƒ $YHUDJHORDQVUHIOHFW Period-end loans 53,458 50,369 50,302 3,089 3,156 GHFUHDVHVLQ0RUWJDJH%DQNHU 1DWLRQDO'HDOHU

3HULRGHQG Average deposits 56,768 57,178 53,996 (410) 2,772 ORDQVUHDFKHGUHFRUGOHYHO Period-end deposits 57,366 57,295 54,091 71 3,275 ƒ 'HSRVLWVUHODWLYHO\VWDEOH Net interest income $513 $544 $606 $(31) $(93) ƒ 1HWLQWHUHVWLQFRPHLPSDFWHG Provision for credit losses 411 8 (13) 403 424 E\ORZHULQWHUHVWUDWHV Noninterest income1 237 266 238 (29) (1) ƒ 3URYLVLRQLQFOXGHVVWUHVVLQ Noninterest expenses 425 451 433 (26) (8) (QHUJ\ H[SHFWHG UHFHVVLRQDU\HQYLURQPHQW Provision for income tax (21) 82 85 (103) (106) Net income (65) 269 339 (334) (404) ƒ 1RQLQWHUHVWLQFRPHLQFOXGHV 00GHFOLQHLQ 2 Earnings per share $(0.46) $1.85 $2.11 $(2.31) $(2.57) QRQFXVWRPHUUHODWHGDFWLYLW\ Average diluted shares 140.6 144.6 159.5 (4.0) (18.9) ƒ ([SHQVHVZHOOFRQWUROOHG Efficiency ratio3 56.57% 55.46% 50.81% ƒ &DSLWDOUHPDLQVVWURQJ CET14 9.51 10.13 10.78 1Includes gain(loss) related to deferred comp plan of $2MM 1Q19, $3MM 4Q19 & ($3MM) 1Q20 (offset in noninterest expense) Ⴠ 2Diluted earnings per common share Ⴠ 3Noninterest expenses as a percentage of net interest income & noninterest income excluding net gains (losses) from securities & derivative contract tied to conversion rate of Visa Class B shares Ⴠ 41Q20 Common Equity Tier 1 capital ratio estimated 4

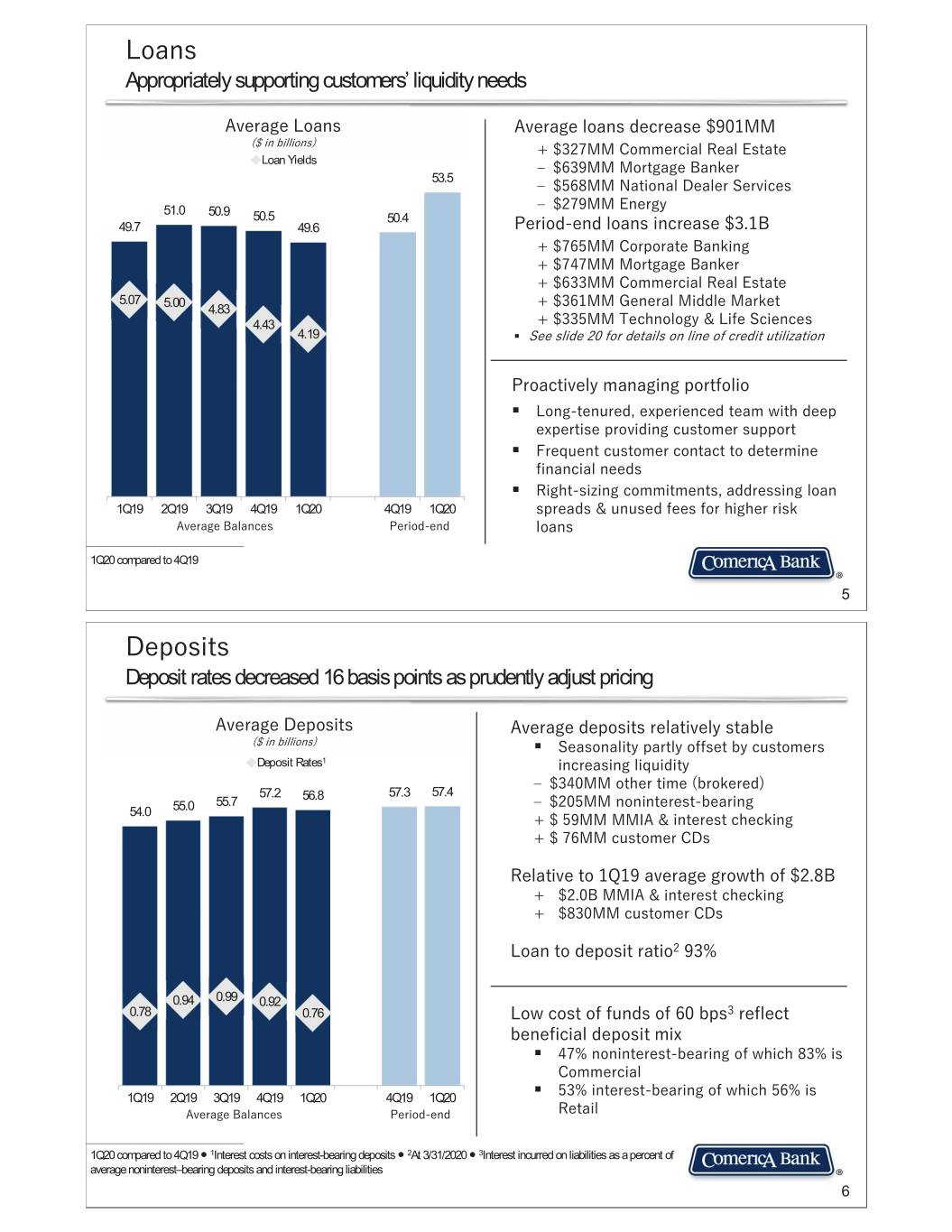

/RDQV Appropriately supporting customers’ liquidity needs $YHUDJH/RDQV $YHUDJHORDQVGHFUHDVH

00

LQELOOLRQV

00&RPPHUFLDO5HDO(VWDWH Loan Yields t

000RUWJDJH%DQNHU 53.5 t 001DWLRQDO'HDOHU6HUYLFHV 51.0 50.9 t

00(QHUJ\ 50.5 50.4 49.7 49.6 3HULRGHQGORDQVLQFUHDVH% 00&RUSRUDWH%DQNLQJ 000RUWJDJH%DQNHU 00&RPPHUFLDO5HDO(VWDWH 5.07 5.00 00*HQHUDO0LGGOH0DUNHW 4.83 4.43 007HFKQRORJ\ /LIH6FLHQFHV 4.19 ƒ 6HHVOLGHIRUGHWDLOVRQOLQHRIFUHGLWXWLOL]DWLRQ 3URDFWLYHO\PDQDJLQJSRUWIROLR ƒ /RQJWHQXUHGH[SHULHQFHGWHDPZLWKGHHS H[SHUWLVHSURYLGLQJFXVWRPHUVXSSRUW ƒ )UHTXHQWFXVWRPHUFRQWDFWWRGHWHUPLQH ILQDQFLDOQHHGV ƒ 5LJKWVL]LQJFRPPLWPHQWVDGGUHVVLQJORDQ 1Q19 2Q19 3Q19 4Q19 1Q20 4Q19 1Q20 VSUHDGV XQXVHGIHHVIRUKLJKHUULVN $YHUDJH%DODQFHV 3HULRGHQG ORDQV 1Q20 compared to 4Q19 5 'HSRVLWV Deposit rates decreased 16 basis points as prudently adjust pricing $YHUDJH'HSRVLWV $YHUDJHGHSRVLWVUHODWLYHO\VWDEOH

LQELOOLRQV

ƒ 6HDVRQDOLW\SDUWO\RIIVHWE\FXVWRPHUV Deposit Rates1 LQFUHDVLQJOLTXLGLW\ t 00RWKHUWLPH

EURNHUHG

57.2 57.3 57.4 55.7 56.8 t 00QRQLQWHUHVWEHDULQJ 54.0 55.0

0000,$ LQWHUHVWFKHFNLQJ 00FXVWRPHU&'V 5HODWLYHWR4

DYHUDJHJURZWKRI% %00,$ LQWHUHVWFKHFNLQJ 00FXVWRPHU&'V /RDQWRGHSRVLWUDWLR

0.94 0.99 0.92 0.78 0.76 /RZFRVWRIIXQGVRIESV UHIOHFW EHQHILFLDOGHSRVLWPL[ ƒ QRQLQWHUHVWEHDULQJRIZKLFKLV &RPPHUFLDO 1Q19 2Q19 3Q19 4Q19 1Q20 4Q19 1Q20 ƒ LQWHUHVWEHDULQJRIZKLFKLV $YHUDJH%DODQFHV 3HULRGHQG 5HWDLO 1Q20 compared to 4Q19 Ⴠ 1Interest costs on interest-bearing deposits Ⴠ 2At 3/31/2020 Ⴠ 3Interest incurred on liabilities as a percent of average noninterest–bearing deposits and interest-bearing liabilities 6

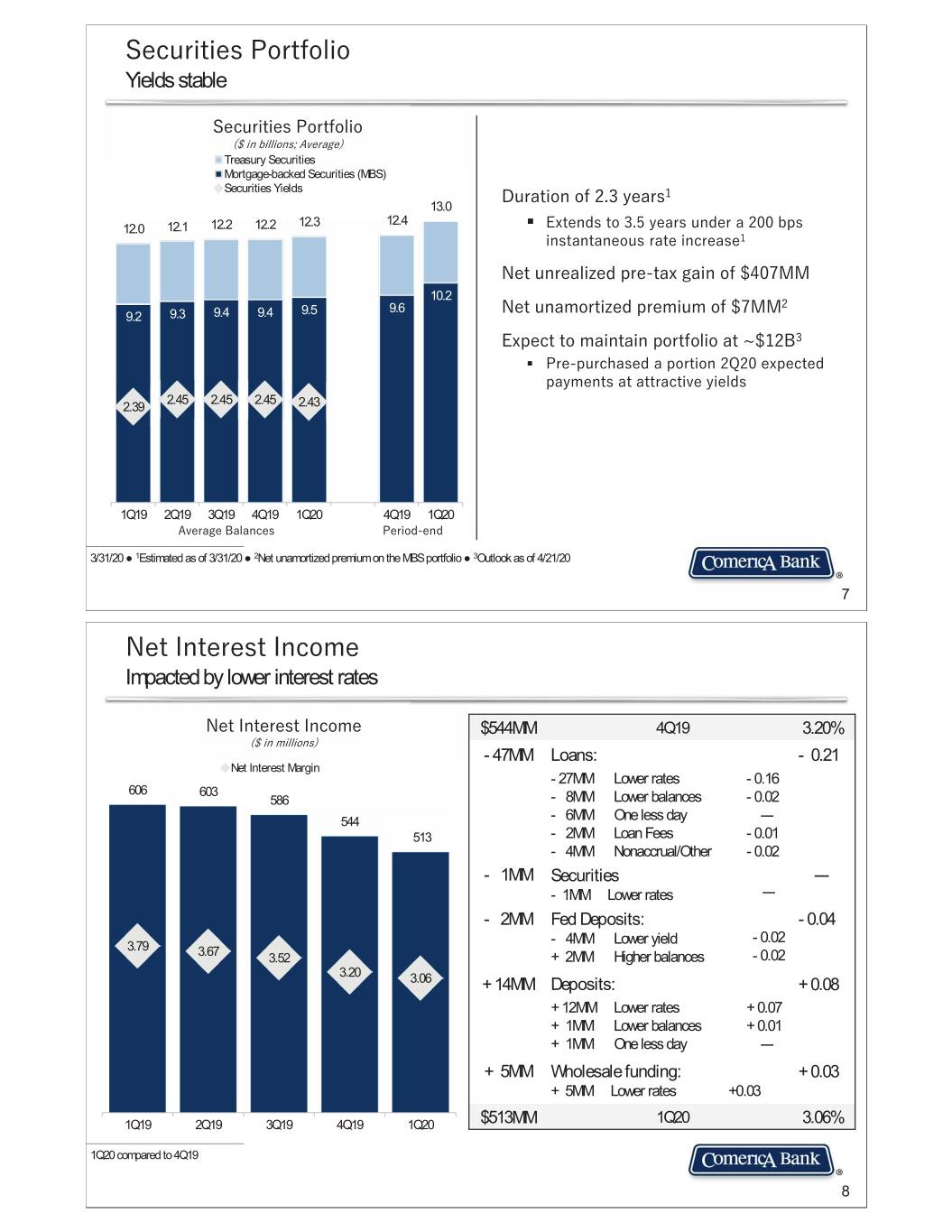

6HFXULWLHV3RUWIROLR Yields stable 6HFXULWLHV3RUWIROLR

LQELOOLRQV

$YHUDJH

Treasury Securities Mortgage-backed Securities (MBS) Securities Yields 'XUDWLRQRI\HDUV 13.0 12.3 12.4 12.0 12.1 12.2 12.2 ƒ ([WHQGVWR\HDUVXQGHUDESV LQVWDQWDQHRXVUDWHLQFUHDVH 1HWXQUHDOL]HGSUHWD[JDLQRI00 10.2 9.5 9.6 1HWXQDPRUWL]HGSUHPLXPRI00 9.2 9.3 9.4 9.4 ([SHFWWRPDLQWDLQSRUWIROLRDWf% ƒ 3UHSXUFKDVHGDSRUWLRQ4H[SHFWHG SD\PHQWVDWDWWUDFWLYH\LHOGV 2.45 2.45 2.45 2.39 2.43 1Q19 2Q19 3Q19 4Q19 1Q20 4Q19 1Q20 $YHUDJH%DODQFHV 3HULRGHQG 3/31/20 Ɣ 1Estimated as of 3/31/20 Ɣ 2Net unamortized premium on the MBS portfolio Ɣ 3Outlook as of 4/21/20 7 1HW,QWHUHVW,QFRPH Impacted by lower interest rates 1HW,QWHUHVW,QFRPH $544MM 4Q19 3.20%

LQPLOOLRQV

- 47MM Loans: - 0.21 Net Interest Margin - 27MM Lower rates -0.16 606 603 586 - 8MM Lower balances -0.02 544 - 6MM One less day --- 513 - 2MM Loan Fees -0.01 - 4MM Nonaccrual/Other -0.02 - 1MM Securities --- - 1MM Lower rates --- - 2MM Fed Deposits: -0.04 - 4MM Lower yield -0.02 3.79 3.67 3.52 + 2MM Higher balances -0.02 3.20 3.06 + 14MM Deposits: + 0.08 + 12MM Lower rates + 0.07 + 1MM Lower balances + 0.01 + 1MM One less day --- + 5MM Wholesale funding: + 0.03 + 5MM Lower rates +0.03 1Q19 2Q19 3Q19 4Q19 1Q20 $513MM 1Q20 3.06% 1Q20 compared to 4Q19 8

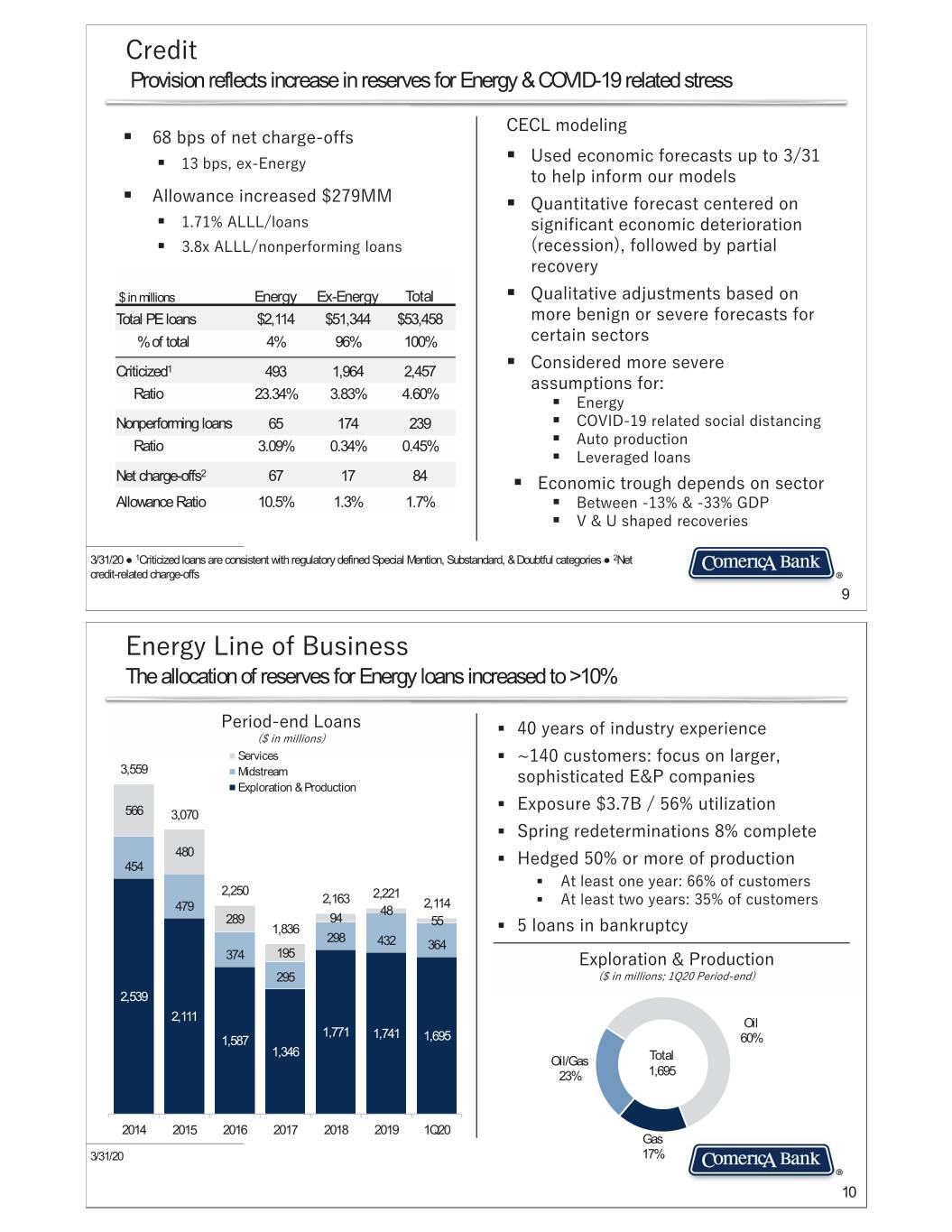

&UHGLW Provision reflects increase in reserves for Energy & COVID-19 related stress &(&/PRGHOLQJ ƒ ESVRIQHWFKDUJHRIIV ƒ ESVH[(QHUJ\ ƒ 8VHGHFRQRPLFIRUHFDVWVXSWR WRKHOSLQIRUPRXUPRGHOV ƒ $OORZDQFHLQFUHDVHG

00 ƒ 4XDQWLWDWLYHIRUHFDVWFHQWHUHGRQ ƒ $///ORDQV VLJQLILFDQWHFRQRPLFGHWHULRUDWLRQ ƒ [$///QRQSHUIRUPLQJORDQV

UHFHVVLRQ

IROORZHGE\SDUWLDO UHFRYHU\ $ in millions Energy Ex-Energy Total ƒ 4XDOLWDWLYHDGMXVWPHQWVEDVHGRQ Total PE loans $2,114 $51,344 $53,458 PRUHEHQLJQRUVHYHUHIRUHFDVWVIRU % of total 4% 96% 100% FHUWDLQVHFWRUV Criticized1 493 1,964 2,457 ƒ &RQVLGHUHGPRUHVHYHUH DVVXPSWLRQVIRU

Ratio 23.34% 3.83% 4.60% ƒ (QHUJ\ Nonperforming loans 65 174 239 ƒ &29,'

UHODWHGVRFLDOGLVWDQFLQJ Ratio 3.09% 0.34% 0.45% ƒ $XWRSURGXFWLRQ ƒ /HYHUDJHGORDQV 2 Net charge-offs 67 17 84 ƒ (FRQRPLFWURXJKGHSHQGVRQVHFWRU Allowance Ratio 10.5% 1.3% 1.7% ƒ %HWZHHQ *'3 ƒ 9 8VKDSHGUHFRYHULHV 3/31/20 Ɣ 1Criticized loans are consistent with regulatory defined Special Mention, Substandard, & Doubtful categories Ɣ 2Net credit-related charge-offs 9 (QHUJ\/LQHRI%XVLQHVV The allocation of reserves for Energy loans increased to >10% 3HULRGHQG/RDQV ƒ \HDUVRILQGXVWU\H[SHULHQFH

LQPLOOLRQV

ServicesServices ƒ fFXVWRPHUV

IRFXVRQODUJHU 3,559 Midstream VRSKLVWLFDWHG( 3FRPSDQLHV Exploration & Production ƒ ([SRVXUH%XWLOL]DWLRQ 566 3,070 ƒ 6SULQJUHGHWHUPLQDWLRQVFRPSOHWH 480 454 ƒ +HGJHGRUPRUHRISURGXFWLRQMixed ƒ $WOHDVWRQH\HDU

RIFXVWRPHUV18% 2,250 2,221 2,163 2,114 ƒ $WOHDVWWZR\HDUV

RIFXVWRPHUV 479 48 289 94 55 1,836 ƒ ORDQVLQEDQNUXSWF\ 298 432 364 374 195 ([SORUDWLRQ 3URGXFWLRQ 295

LQPLOOLRQV

43HULRGHQG

2,539 2,111 Oil 1,771 1,741 1,587 1,695 60% 1,346 Oil/Gas Total 23% 1,695 2014 2015 2016 2017 2018 2019 1Q20 Gas 3/31/20 17% 10

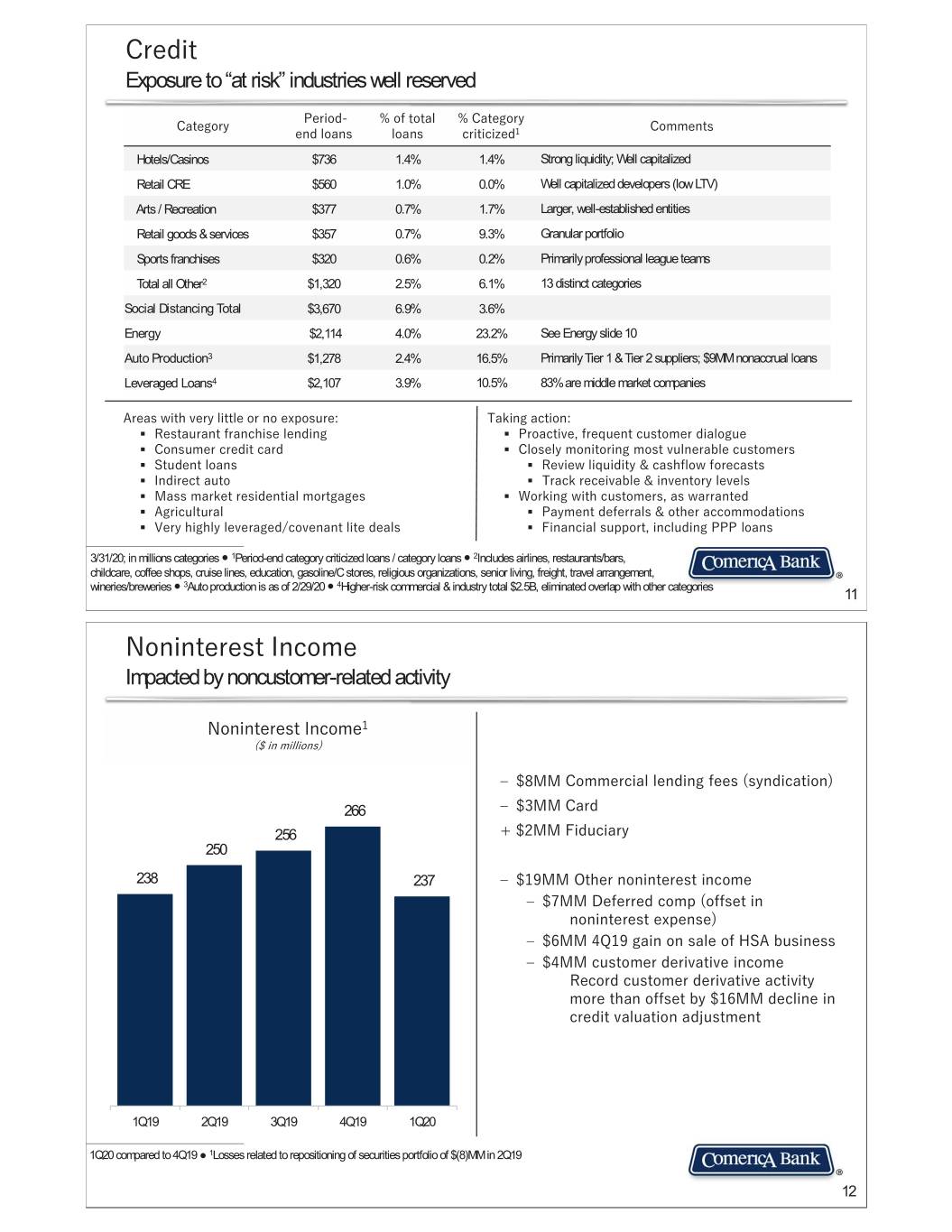

&UHGLW Exposure to “at risk” industries well reserved 3HULRG RIWRWDO &DWHJRU\ &DWHJRU\ &RPPHQWV HQGORDQV ORDQV FULWLFL]HG Hotels/Casinos $736 1.4% 1.4% Strong liquidity; Well capitalized Retail CRE $560 1.0% 0.0% Well capitalized developers (low LTV) Arts / Recreation $377 0.7% 1.7% Larger, well-established entities Retail goods & services $357 0.7% 9.3% Granular portfolio Sports franchises $320 0.6% 0.2% Primarily professional league teams Total all Other2 $1,320 2.5% 6.1% 13 distinct categories Social Distancing Total $3,670 6.9% 3.6% Energy $2,114 4.0% 23.2% See Energy slide 10 Auto Production3 $1,278 2.4% 16.5% Primarily Tier 1 & Tier 2 suppliers; $9MM nonaccrual loans Leveraged Loans4 $2,107 3.9% 10.5% 83% are middle market companies $UHDVZLWKYHU\OLWWOHRUQRH[SRVXUH

7DNLQJDFWLRQ

ƒ 5HVWDXUDQWIUDQFKLVHOHQGLQJ ƒ 3URDFWLYHIUHTXHQWFXVWRPHUGLDORJXH ƒ &RQVXPHUFUHGLWFDUG ƒ &ORVHO\PRQLWRULQJPRVWYXOQHUDEOHFXVWRPHUV ƒ 6WXGHQWORDQV ƒ 5HYLHZOLTXLGLW\ FDVKIORZIRUHFDVWV ƒ ,QGLUHFWDXWR ƒ 7UDFNUHFHLYDEOH LQYHQWRU\OHYHOV ƒ 0DVVPDUNHWUHVLGHQWLDOPRUWJDJHV ƒ :RUNLQJZLWKFXVWRPHUVDVZDUUDQWHG ƒ $JULFXOWXUDO ƒ 3D\PHQWGHIHUUDOV RWKHUDFFRPPRGDWLRQV ƒ 9HU\KLJKO\OHYHUDJHGFRYHQDQWOLWHGHDOV ƒ )LQDQFLDOVXSSRUWLQFOXGLQJ333ORDQV 3/31/20; in millions categories Ⴠ 1Period-end category criticized loans / category loans Ⴠ 2Includes airlines, restaurants/bars, childcare, coffee shops, cruise lines, education, gasoline/C stores, religious organizations, senior living, freight, travel arrangement, wineries/breweries 3Auto production is as of 2/29/20 4Higher-risk commercial & industry total $2.5B, eliminated overlap with other categories Ⴠ Ⴠ 11 1RQLQWHUHVW,QFRPH Impacted by noncustomer-related activity 1RQLQWHUHVW,QFRPH

LQPLOOLRQV

t 00&RPPHUFLDOOHQGLQJIHHV

V\QGLFDWLRQ

266 t 00&DUG 256 00)LGXFLDU\ 250 238 237 t

002WKHUQRQLQWHUHVWLQFRPH t 00'HIHUUHGFRPS

RIIVHWLQ QRQLQWHUHVWH[SHQVH

t 004

JDLQRQVDOHRI+6$EXVLQHVV t 00FXVWRPHUGHULYDWLYHLQFRPH 5HFRUGFXVWRPHUGHULYDWLYHDFWLYLW\ PRUHWKDQRIIVHWE\00GHFOLQHLQ FUHGLWYDOXDWLRQDGMXVWPHQW 1Q19 2Q19 3Q19 4Q19 1Q20 1Q20 compared to 4Q19 Ɣ 1Losses related to repositioning of securities portfolio of $(8)MM in 2Q19 12

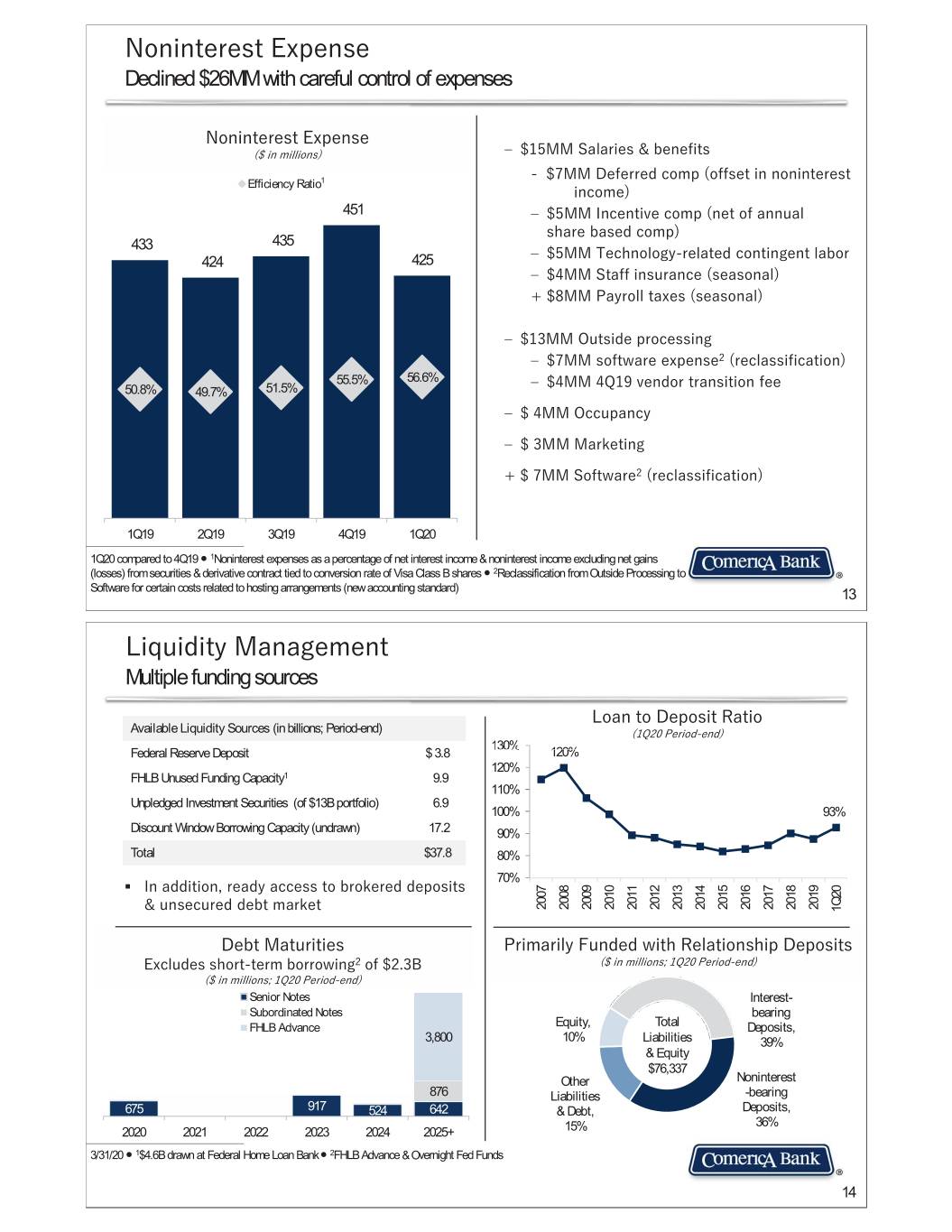

1RQLQWHUHVW([SHQVH Declined $26MM with careful control of expenses 1RQLQWHUHVW([SHQVH

LQPLOOLRQV

t 006DODULHV EHQHILWV 00'HIHUUHGFRPS

RIIVHWLQQRQLQWHUHVW Efficiency Ratio1 LQFRPH

451 t 00,QFHQWLYHFRPS

QHWRIDQQXDO VKDUHEDVHGFRPS

433 435 t 007HFKQRORJ\UHODWHGFRQWLQJHQWODERU 424 425 t 006WDIILQVXUDQFH

VHDVRQDO

003D\UROOWD[HV

VHDVRQDO

t 002XWVLGHSURFHVVLQJ t 00VRIWZDUHH[SHQVH

UHFODVVLILFDWLRQ

55.5% 56.6% t 004

YHQGRUWUDQVLWLRQIHH 50.8% 49.7% 51.5% t 002FFXSDQF\ t 000DUNHWLQJ 006RIWZDUH

UHFODVVLILFDWLRQ

1Q19 2Q19 3Q19 4Q19 1Q20 1Q20 compared to 4Q19 Ⴠ 1Noninterest expenses as a percentage of net interest income & noninterest income excluding net gains (losses) from securities & derivative contract tied to conversion rate of Visa Class B shares Ⴠ 2Reclassification from Outside Processing to Software for certain costs related to hosting arrangements (new accounting standard) 13 /LTXLGLW\0DQDJHPHQW Multiple funding sources /RDQWR'HSRVLW5DWLR Available Liquidity Sources (in billions; Period-end)

43HULRGHQG

130%30% Federal Reserve Deposit $ 3.8 120%120% 120% FHLB Unused Funding Capacity1 9.9 110% Unpledged Investment Securities (of $13B portfolio) 6.9 100% 93% Discount Window Borrowing Capacity (undrawn) 17.2 90% Total $37.8 80% 70% ƒ ,QDGGLWLRQUHDG\DFFHVVWREURNHUHGGHSRVLWV 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 XQVHFXUHGGHEWPDUNHW 1Q20 'HEW0DWXULWLHV 3ULPDULO\)XQGHGZLWK5HODWLRQVKLS'HSRVLWV ([FOXGHVVKRUWWHUPERUURZLQJ RI%

LQPLOOLRQV

43HULRGHQG

LQPLOOLRQV

43HULRGHQG

Senior Notes Interest- Subordinated Notes bearing FHLB Advance Equity, Total Deposits, 3,800 10% Liabilities 39% & Equity $76,337 Other Noninterest 876 Liabilities -bearing 675 917 524 642 & Debt, Deposits, 36% 2020 2021 2022 2023 2024 2025+ 15% 3/31/20 Ⴠ 1$4.6B drawn at Federal Home Loan Bank Ⴠ 2FHLB Advance & Overnight Fed Funds 14

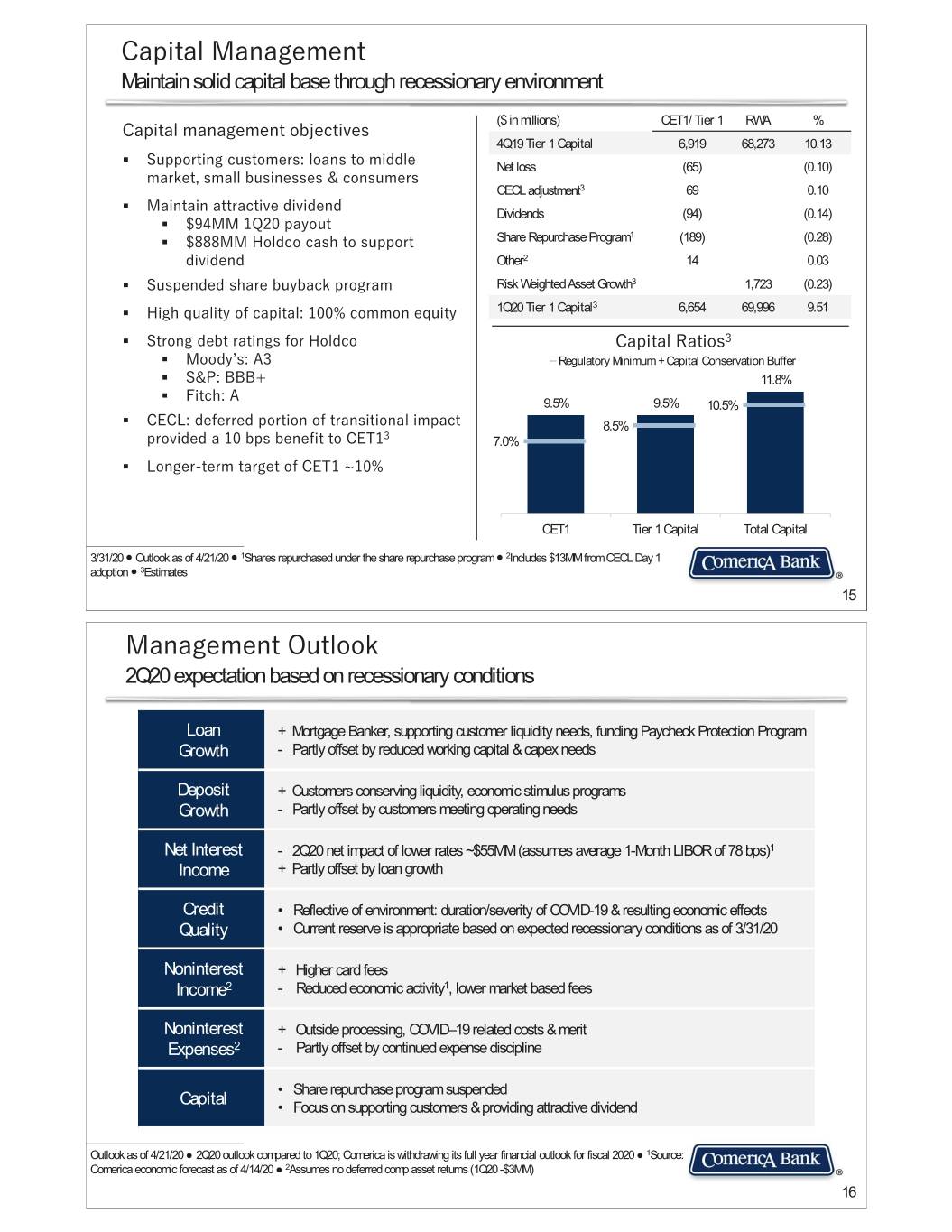

&DSLWDO0DQDJHPHQW Maintain solid capital base through recessionary environment ($ in millions) CET1/ Tier 1 RWA % &DSLWDOPDQDJHPHQWREMHFWLYHV 4Q19 Tier 1 Capital 6,919 68,273 10.13 ƒ 6XSSRUWLQJFXVWRPHUV

ORDQVWRPLGGOH Net loss (65) (0.10) PDUNHWVPDOOEXVLQHVVHV FRQVXPHUV CECL adjustment3 69 0.10 ƒ 0DLQWDLQDWWUDFWLYHGLYLGHQG Dividends (94) (0.14) ƒ

004SD\RXW 1 ƒ 00+ROGFRFDVKWRVXSSRUW Share Repurchase Program (189) (0.28) GLYLGHQG Other2 14 0.03 ƒ 6XVSHQGHGVKDUHEX\EDFNSURJUDP Risk Weighted Asset Growth3 1,723 (0.23) 3 ƒ +LJKTXDOLW\RIFDSLWDO

FRPPRQHTXLW\ 1Q20 Tier 1 Capital 6,654 69,996 9.51 ƒ 6WURQJGHEWUDWLQJVIRU+ROGFR &DSLWDO5DWLRV ƒ 0RRG\bV

$ Regulatory Minimum + Capital Conservation Buffer ƒ 6 3

%%% 11.8% ƒ )LWFK

$ 9.5% 9.5% 10.5% ƒ &(&/

GHIHUUHGSRUWLRQRIWUDQVLWLRQDOLPSDFW 8.5% SURYLGHGDESVEHQHILWWR&(7 7.0% ƒ /RQJHUWHUPWDUJHWRI&(7f CET1 Tier 1 Capital Total Capital 3/31/20 Ⴠ Outlook as of 4/21/20 Ⴠ 1Shares repurchased under the share repurchase program Ⴠ 2Includes $13MM from CECL Day 1 adoption Ⴠ 3Estimates 15 0DQDJHPHQW2XWORRN 2Q20 expectation based on recessionary conditions Loan + Mortgage Banker, supporting customer liquidity needs, funding Paycheck Protection Program Growth - Partly offset by reduced working capital & capex needs Deposit + Customers conserving liquidity, economic stimulus programs Growth - Partly offset by customers meeting operating needs Net Interest - 2Q20 net impact of lower rates ~$55MM (assumes average 1-Month LIBOR of 78 bps)1 Income + Partly offset by loan growth Credit • Reflective of environment: duration/severity of COVID-19 & resulting economic effects Quality • Current reserve is appropriate based on expected recessionary conditions as of 3/31/20 Noninterest + Higher card fees Income2 - Reduced economic activity1, lower market based fees Noninterest + Outside processing, COVID–19 related costs & merit Expenses2 - Partly offset by continued expense discipline • Share repurchase program suspended Capital • Focus on supporting customers & providing attractive dividend Outlook as of 4/21/20 Ɣ 2Q20 outlook compared to 1Q20; Comerica is withdrawing its full year financial outlook for fiscal 2020 Ɣ 1Source: Comerica economic forecast as of 4/14/20 Ɣ 2Assumes no deferred comp asset returns (1Q20 -$3MM) 16

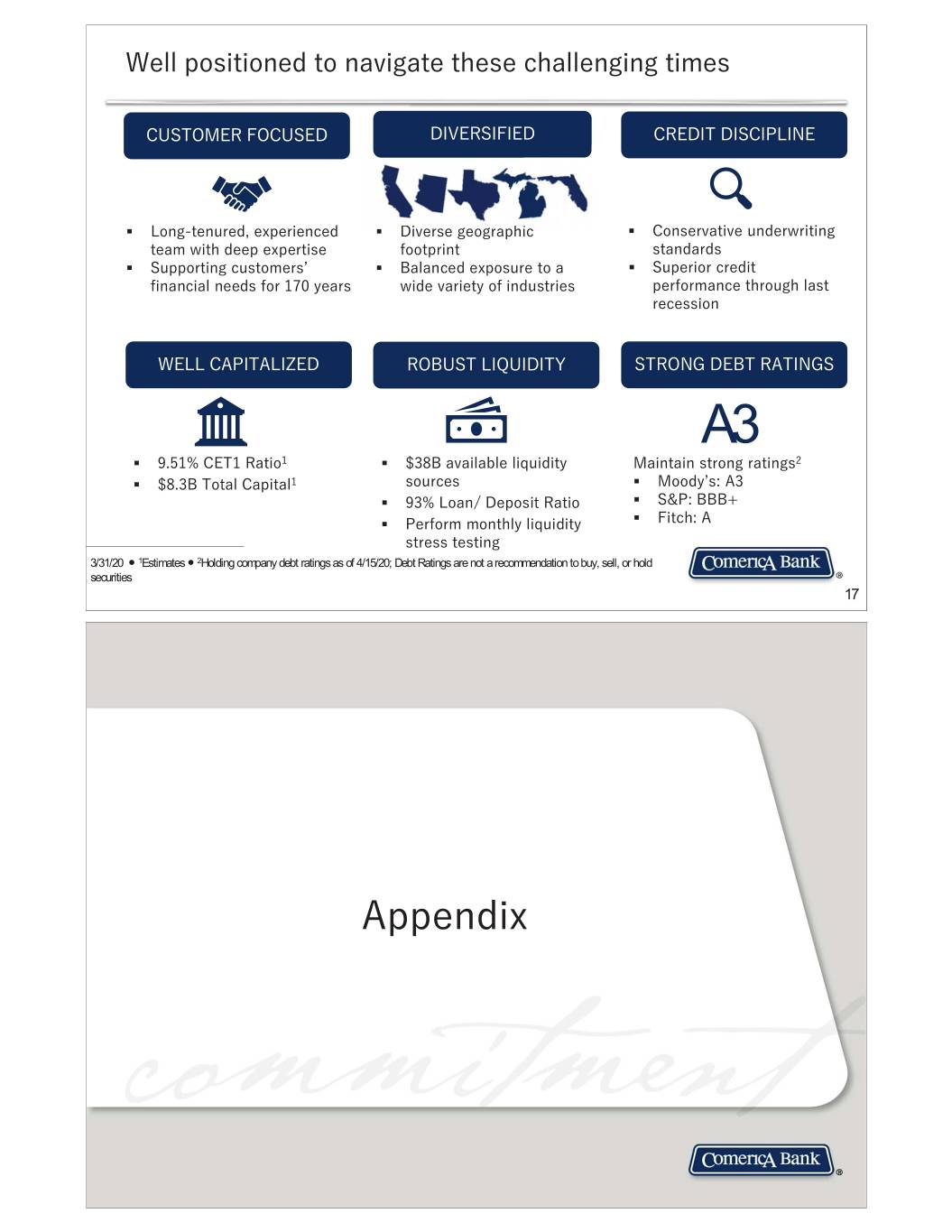

:HOOSRVLWLRQHGWRQDYLJDWHWKHVHFKDOOHQJLQJWLPHV &86720(5)2&86(' ',9(56,),(' &5(',7',6&,3/,1( ƒ /RQJWHQXUHGH[SHULHQFHG ƒ 'LYHUVHJHRJUDSKLF' KL ƒ &RQVHUYDWLYHXQGHUZULWLQJ WHDPZLWKGHHSH[SHUWLVH IRRWSULQW VWDQGDUGV ƒ 6XSSRUWLQJFXVWRPHUVb ƒ %DODQFHGH[SRVXUHWRD ƒ 6XSHULRUFUHGLW ILQDQFLDOQHHGVIRU\HDUV ZLGHYDULHW\RILQGXVWULHV SHUIRUPDQFHWKURXJKODVW UHFHVVLRQ :(//&$3,7$/,=(' 52%867/,48,',7< 67521*'(%75$7,1*6 A3 ƒ

&(75DWLR ƒ %DYDLODEOHOLTXLGLW\ 0DLQWDLQVWURQJUDWLQJV ƒ %7RWDO&DSLWDO VRXUFHV ƒ 0RRG\bV

$ ƒ

/RDQ'HSRVLW5DWLR ƒ 6 3

%%% ƒ 3HUIRUPPRQWKO\OLTXLGLW\ ƒ )LWFK

$ VWUHVVWHVWLQJ 3/31/20 Ⴠ 1Estimates Ⴠ 2Holding company debt ratings as of 4/15/20; Debt Ratings are not a recommendation to buy, sell, or hold securities 17 $SSHQGL[

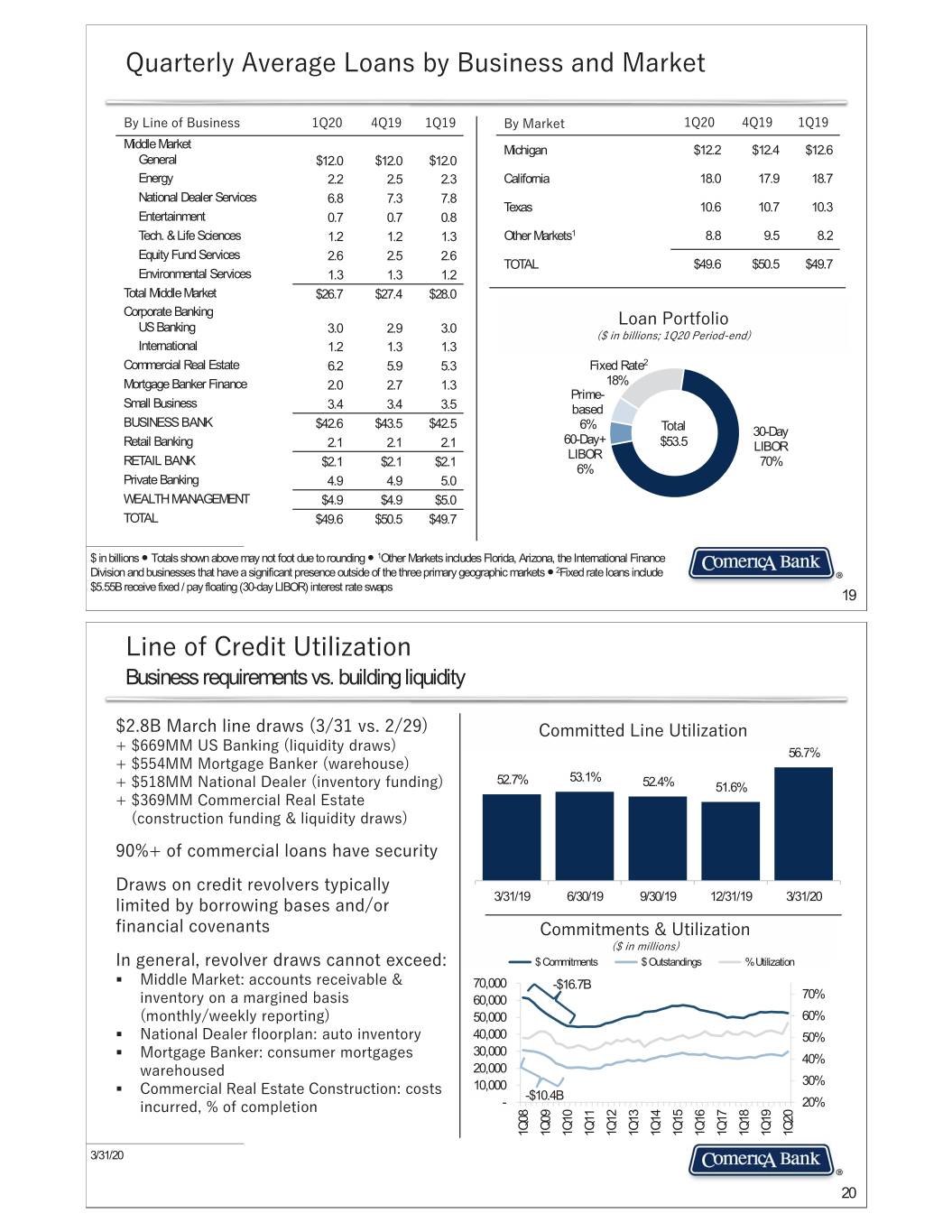

4XDUWHUO\$YHUDJH/RDQVE\%XVLQHVVDQG0DUNHW %\/LQHRI%XVLQHVV 4 4

4

%\0DUNHW 4 4

4

Middle Market Michigan $12.2 $12.4 $12.6 General $12.0 $12.0 $12.0 Energy 2.2 2.5 2.3 California 18.0 17.9 18.7 National Dealer Services 6.8 7.3 7.8 Texas 10.6 10.7 10.3 Entertainment 0.7 0.7 0.8 Tech. & Life Sciences 1.2 1.2 1.3 Other Markets1 8.8 9.5 8.2 Equity Fund Services 2.6 2.5 2.6 TOTAL $49.6 $50.5 $49.7 Environmental Services 1.3 1.3 1.2 Total Middle Market $26.7 $27.4 $28.0 Corporate Banking /RDQ3RUWIROLR US Banking 3.0 2.9 3.0

LQELOOLRQV

43HULRGHQG

International 1.2 1.3 1.3 Commercial Real Estate 6.2 5.9 5.3 Fixed Rate2 Mortgage Banker Finance 2.0 2.7 1.3 18% Prime- Small Business 3.4 3.4 3.5 based BUSINESS BANK $42.6 $43.5 $42.5 6% Total 30-Day 60-Day+ Retail Banking 2.1 2.1 2.1 $53.5 LIBOR LIBOR RETAIL BANK $2.1 $2.1 $2.1 70% 6% Private Banking 4.9 4.9 5.0 WEALTH MANAGEMENT $4.9 $4.9 $5.0 TOTAL $49.6 $50.5 $49.7 $ in billions Ⴠ Totals shown above may not foot due to rounding Ⴠ 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets Ⴠ 2Fixed rate loans include $5.55B receive fixed / pay floating (30-day LIBOR) interest rate swaps 19 /LQHRI&UHGLW8WLOL]DWLRQ Business requirements vs. building liquidity %0DUFKOLQHGUDZV

YV

&RPPLWWHG/LQH8WLOL]DWLRQ

0086%DQNLQJ

OLTXLGLW\GUDZV

5656.7%7% 000RUWJDJH%DQNHU

ZDUHKRXVH

52.7% 53.1% 001DWLRQDO'HDOHU

LQYHQWRU\IXQGLQJ

52.4% 51.6%

00&RPPHUFLDO5HDO(VWDWH

FRQVWUXFWLRQIXQGLQJ OLTXLGLW\GUDZV

RIFRPPHUFLDOORDQVKDYHVHFXULW\ 'UDZVRQFUHGLWUHYROYHUVW\SLFDOO\ 3/31/19 6/30/19 9/30/19 12/31/19 3/31/20 OLPLWHGE\ERUURZLQJEDVHVDQGRU ILQDQFLDOFRYHQDQWV &RPPLWPHQWV 8WLOL]DWLRQ

LQPLOOLRQV

,QJHQHUDOUHYROYHUGUDZVFDQQRWH[FHHG

$ Commitments $ Outstandings % Utilization ƒ 0LGGOH0DUNHW

DFFRXQWVUHFHLYDEOH 70,000 -$16.7B LQYHQWRU\RQDPDUJLQHGEDVLV 60,000 70%

PRQWKO\ZHHNO\UHSRUWLQJ

50,000 60% ƒ 1DWLRQDO'HDOHUIORRUSODQ

DXWRLQYHQWRU\ 40,000 50% 30,000 ƒ 0RUWJDJH%DQNHU

FRQVXPHUPRUWJDJHV 40% ZDUHKRXVHG 20,000 10,000 30% ƒ &RPPHUFLDO5HDO(VWDWH&RQVWUXFWLRQ

FRVWV -$10.4B LQFXUUHGRIFRPSOHWLRQ - 20% 1Q08 1Q09 1Q10 1Q11 1Q12 1Q13 1Q14 1Q15 1Q16 1Q17 1Q18 1Q19 1Q20 3/31/20 20

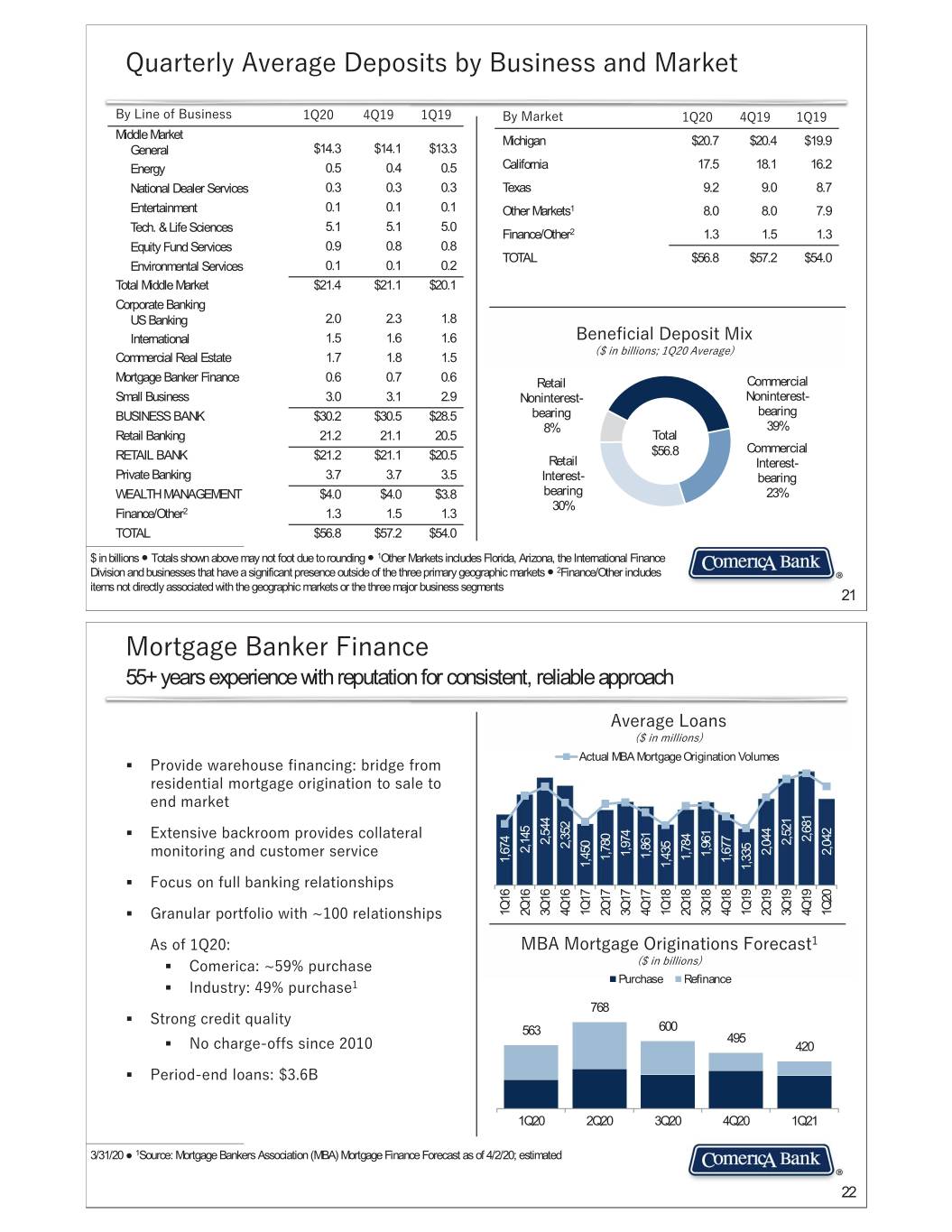

4XDUWHUO\$YHUDJH'HSRVLWVE\%XVLQHVVDQG0DUNHW %\/LQHRI%XVLQHVV 4 4

4

%\0DUNHW 4 4

4

Middle Market Michigan $20.7 $20.4 $19.9 General $14.3 $14.1 $13.3 Energy 0.5 0.4 0.5 California 17.5 18.1 16.2 National Dealer Services 0.3 0.3 0.3 Texas 9.2 9.0 8.7 Entertainment 0.1 0.1 0.1 Other Markets1 8.0 8.0 7.9 Tech. & Life Sciences 5.1 5.1 5.0 Finance/Other2 1.3 1.5 1.3 Equity Fund Services 0.9 0.8 0.8 TOTAL $56.8 $57.2 $54.0 Environmental Services 0.1 0.1 0.2 Total Middle Market $21.4 $21.1 $20.1 Corporate Banking US Banking 2.0 2.3 1.8 International 1.5 1.6 1.6 %HQHILFLDO'HSRVLW0L[

LQELOOLRQV

4$YHUDJH

Commercial Real Estate 1.7 1.8 1.5 Mortgage Banker Finance 0.6 0.7 0.6 Retail Commercial Small Business 3.0 3.1 2.9 Noninterest- Noninterest- BUSINESS BANK $30.2 $30.5 $28.5 bearing bearing 8% 39% Retail Banking 21.2 21.1 20.5 Total Commercial RETAIL BANK $21.2 $21.1 $20.5 $56.8 Retail Interest- Private Banking 3.7 3.7 3.5 Interest- bearing WEALTH MANAGEMENT $4.0 $4.0 $3.8 bearing 23% 30% Finance/Other2 1.3 1.5 1.3 TOTAL $56.8 $57.2 $54.0 $ in billions Ⴠ Totals shown above may not foot due to rounding Ⴠ 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets Ⴠ 2Finance/Other includes items not directly associated with the geographic markets or the three major business segments 21 0RUWJDJH%DQNHU)LQDQFH 55+ years experience with reputation for consistent, reliable approach $YHUDJH/RDQV

LQPLOOLRQV

Actual MBA Mortgage Origination Volumes ƒ 3URYLGHZDUHKRXVHILQDQFLQJ

EULGJHIURP UHVLGHQWLDOPRUWJDJHRULJLQDWLRQWRVDOHWR 600 HQGPDUNHW 500 400 ƒ ([WHQVLYHEDFNURRPSURYLGHVFROODWHUDO 300 2,681 2,544 2,521 2,352 200 2,145 2,044 2,042 1,974 1,961 PRQLWRULQJDQGFXVWRPHUVHUYLFH 1,861 1,784 1,780 1,677 1,674 1,450 1,435 100 1,335 ƒ )RFXVRQIXOOEDQNLQJUHODWLRQVKLSV 0 ƒ *UDQXODUSRUWIROLRZLWKfUHODWLRQVKLSV 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 $VRI4

0%$0RUWJDJH2ULJLQDWLRQV)RUHFDVW ƒ &RPHULFD

f

SXUFKDVH

LQELOOLRQV

Purchase Refinance ƒ ,QGXVWU\

SXUFKDVH 768 ƒ 6WURQJFUHGLWTXDOLW\ 563 600 495 ƒ 1RFKDUJHRIIVVLQFH 420 ƒ 3HULRGHQGORDQV

% 1Q20 2Q20 3Q20 4Q20 1Q21 3/31/20 Ɣ 1Source: Mortgage Bankers Association (MBA) Mortgage Finance Forecast as of 4/2/20; estimated 22

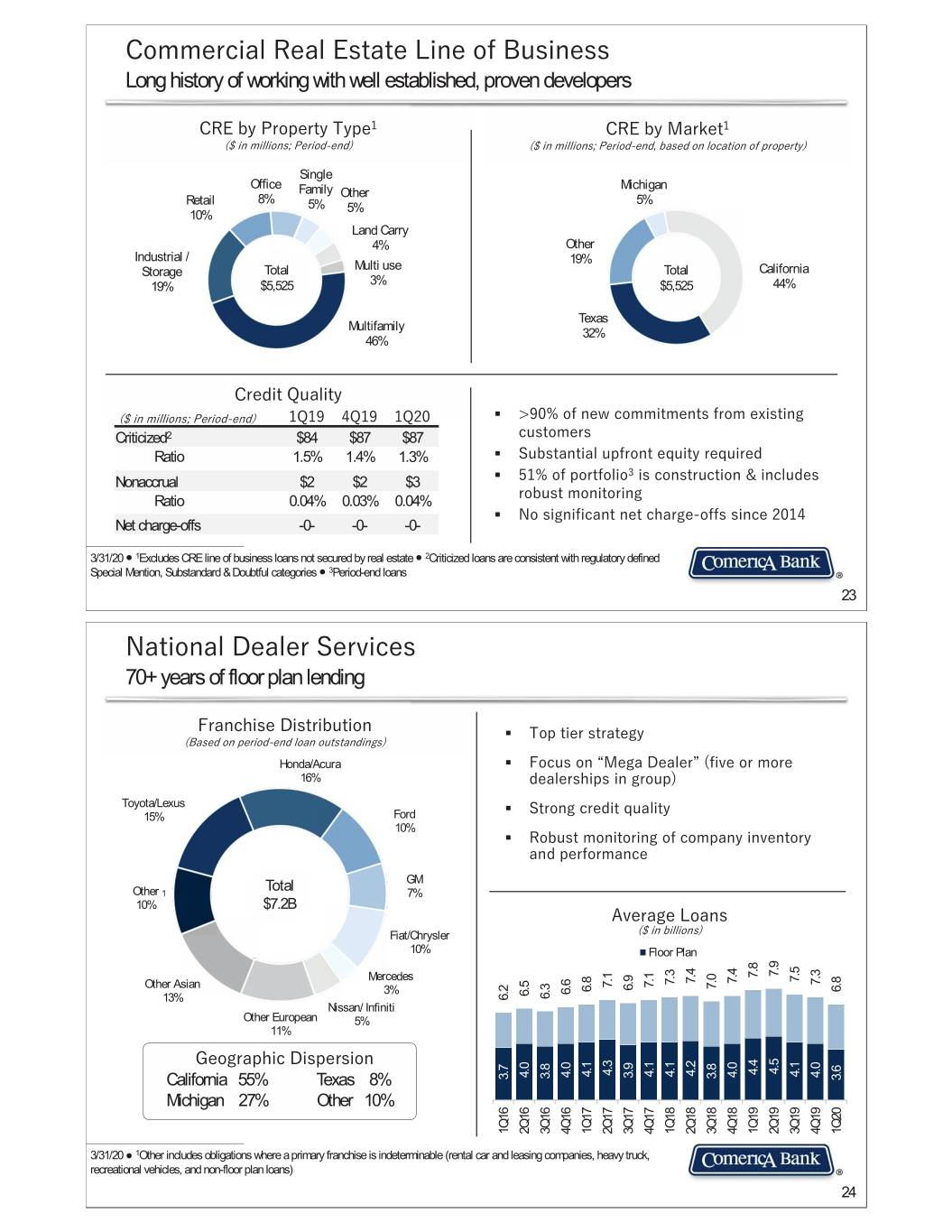

&RPPHUFLDO5HDO(VWDWH/LQHRI%XVLQHVV Long history of working with well established, proven developers &5(E\3URSHUW\7\SH &5(E\0DUNHW

LQPLOOLRQV

3HULRGHQG

LQPLOOLRQV

3HULRGHQGEDVHGRQORFDWLRQRISURSHUW\

Single Office Michigan Family Other Retail 8% 5% 5% 5% 10% Land Carry 4% Other Industrial / 19% Storage Total Multi use Total California 19% $5,525 3% $5,525 44% Texas Multifamily 32% 46% &UHGLW4XDOLW\

LQPLOOLRQV

3HULRGHQG

4

4

4 ƒ !

RIQHZFRPPLWPHQWVIURPH[LVWLQJ Criticized2 $84 $87 $87 FXVWRPHUV Ratio 1.5% 1.4% 1.3% ƒ 6XEVWDQWLDOXSIURQWHTXLW\UHTXLUHG Nonaccrual $2 $2 $3 ƒ RISRUWIROLR LVFRQVWUXFWLRQ LQFOXGHV Ratio 0.04% 0.03% 0.04% UREXVWPRQLWRULQJ ƒ 1RVLJQLILFDQWQHWFKDUJHRIIVVLQFH Net charge-offs -0- -0- -0- 3/31/20 Ⴠ 1Excludes CRE line of business loans not secured by real estate Ⴠ 2Criticized loans are consistent with regulatory defined Special Mention, Substandard & Doubtful categories Ⴠ 3Period-end loans 23 1DWLRQDO'HDOHU6HUYLFHV 70+ years of floor plan lending )UDQFKLVH'LVWULEXWLRQ ƒ 7RSWLHUVWUDWHJ\

%DVHGRQSHULRGHQGORDQRXWVWDQGLQJV

Honda/Acura ƒ )RFXVRQn0HJD'HDOHU|

ILYHRUPRUH 16% GHDOHUVKLSVLQJURXS

Toyota/Lexus ƒ 6WURQJFUHGLWTXDOLW\ 15% Ford 10% ƒ 5REXVWPRQLWRULQJRIFRPSDQ\LQYHQWRU\ DQGSHUIRUPDQFH Total GM Other 1 7% 10% $7.2B $YHUDJH/RDQV Fiat/Chrysler

LQELOOLRQV

10% Floor Plan 7.9 7.8 Mercedes 7.5 7.4 7.4 7.3 7.3 7.1 7.1 Other Asian 7.0 6.9 6.8 6.8 6.6 3% 6.5 6.3 13% 6.2 Nissan/ Infiniti Other European 5% 11% *HRJUDSKLF'LVSHUVLRQ 4.5 4.4 4.3 4.2 4.1 4.1 4.1 4.1 4.0 4.0 4.0 4.0 3.9 3.8 3.8 3.7 California 55% Texas 8% 3.6 Michigan 27% Other 10% 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 3/31/20 Ɣ 1Other includes obligations where a primary franchise is indeterminable (rental car and leasing companies, heavy truck, recreational vehicles, and non-floor plan loans) 24

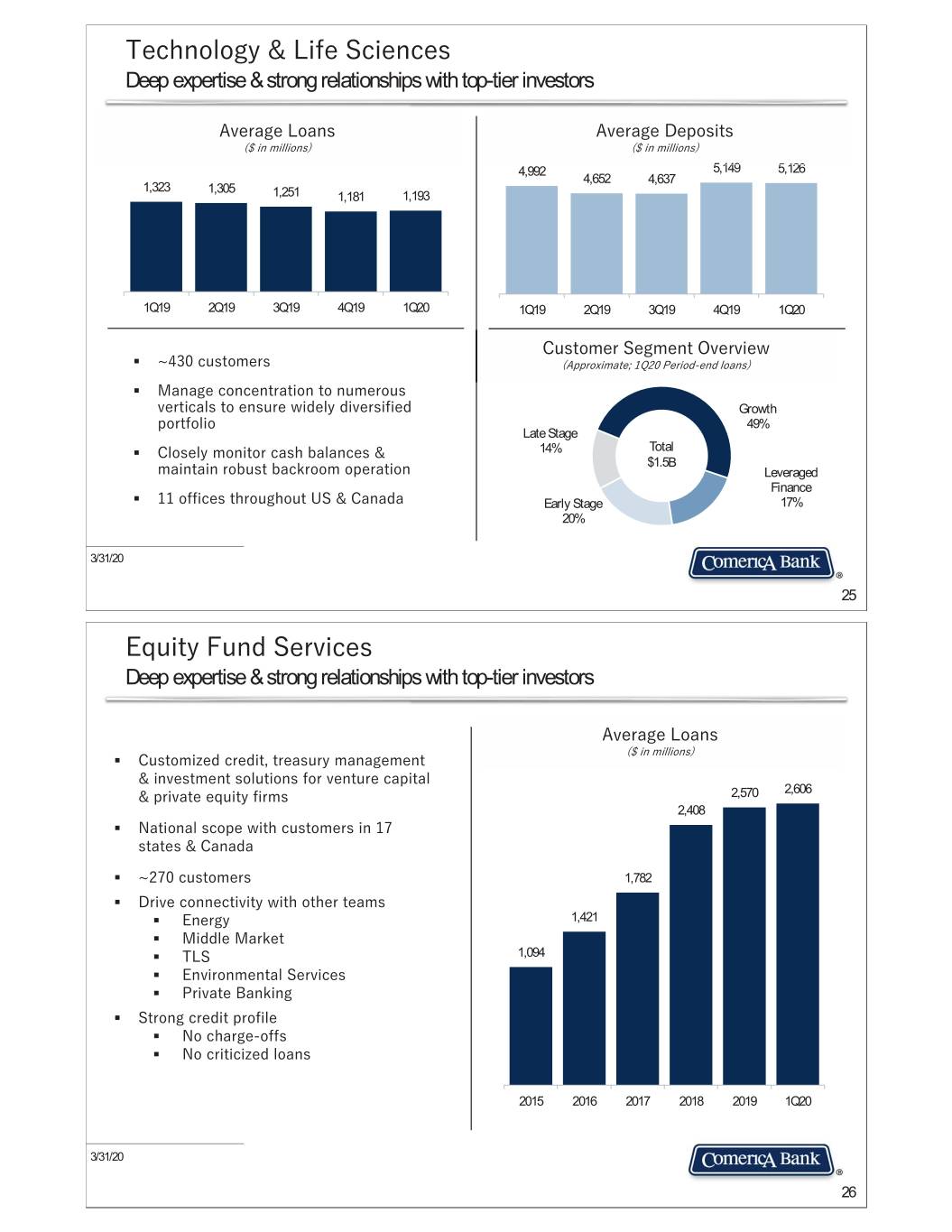

7HFKQRORJ\ /LIH6FLHQFHV Deep expertise & strong relationships with top-tier investors $YHUDJH/RDQV $YHUDJH'HSRVLWV

LQPLOOLRQV

LQPLOOLRQV

4,992 55,149149 55,126 126 4,652 4,637 1,323 1,305 1,251 1,181 1,193 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 &XVWRPHU6HJPHQW2YHUYLHZ ƒ fFXVWRPHUV

$SSUR[LPDWH

43HULRGHQGORDQV

ƒ 0DQDJHFRQFHQWUDWLRQWRQXPHURXV YHUWLFDOVWRHQVXUHZLGHO\GLYHUVLILHG Growth SRUWIROLR 49% Late Stage ƒ &ORVHO\PRQLWRUFDVKEDODQFHV 14% Total $1.5B PDLQWDLQUREXVWEDFNURRPRSHUDWLRQ Leveraged Finance ƒ RIILFHVWKURXJKRXW86 &DQDGD Early Stage 17% 20% 3/31/20 25 (TXLW\)XQG6HUYLFHV Deep expertise & strong relationships with top-tier investors $YHUDJH/RDQV

LQPLOOLRQV

ƒ &XVWRPL]HGFUHGLWWUHDVXU\PDQDJHPHQW LQYHVWPHQWVROXWLRQVIRUYHQWXUHFDSLWDO 2,606 SULYDWHHTXLW\ILUPV 2,570 2,408 ƒ 1DWLRQDOVFRSHZLWKFXVWRPHUVLQ VWDWHV &DQDGD ƒ fFXVWRPHUV 1,782 ƒ 'ULYHFRQQHFWLYLW\ZLWKRWKHUWHDPV ƒ (QHUJ\ 1,421 ƒ 0LGGOH0DUNHW ƒ 7/6 1,094 ƒ (QYLURQPHQWDO6HUYLFHV ƒ 3ULYDWH%DQNLQJ ƒ 6WURQJFUHGLWSURILOH ƒ 1RFKDUJHRIIV ƒ 1RFULWLFL]HGORDQV 2015 2016 2017 2018 2019 1Q20 3/31/20 26

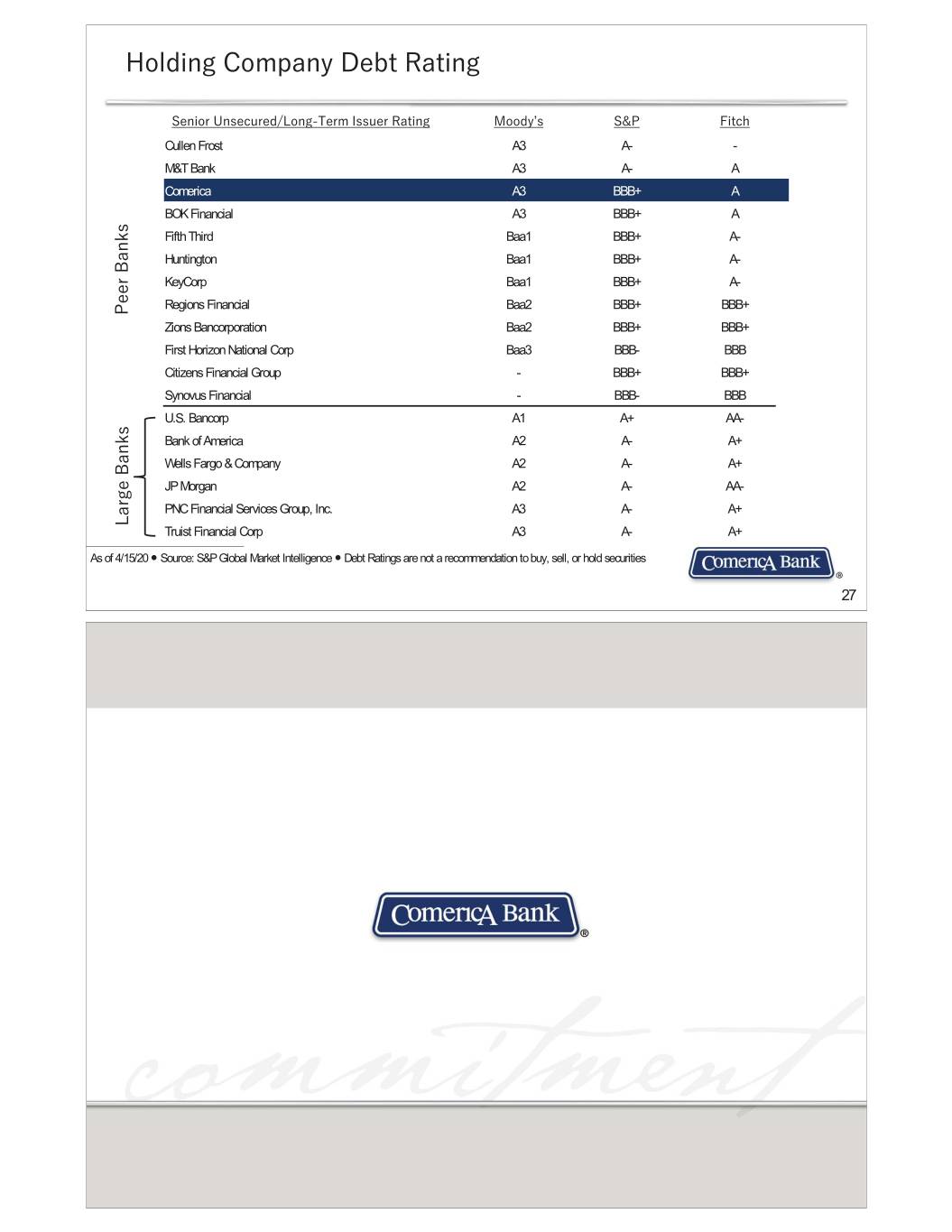

+ROGLQJ&RPSDQ\'HEW5DWLQJ 6HQLRU8QVHFXUHG/RQJ7HUP,VVXHU5DWLQJ 0RRG\bV 6 3 )LWFK Cullen Frost A3 A- - M&T Bank A3 A- A Comerica A3 BBB+ A BOK Financial A3 BBB+ A Fifth Third Baa1 BBB+ A- Huntington Baa1 BBB+ A- KeyCorp Baa1 BBB+ A- Regions Financial Baa2 BBB+ BBB+ 3HHU%DQNV Zions Bancorporation Baa2 BBB+ BBB+ First Horizon National Corp Baa3 BBB- BBB Citizens Financial Group - BBB+ BBB+ Synovus Financial - BBB- BBB U.S. Bancorp A1 A+ AA- Bank of America A2 A- A+ Wells Fargo & Company A2 A- A+ JP Morgan A2 A- AA- PNC Financial Services Group, Inc. A3 A- A+ /DUJH%DQNV Truist Financial Corp A3 A- A+ As of 4/15/20 Ⴠ Source: S&P Global Market Intelligence Ⴠ Debt Ratings are not a recommendation to buy, sell, or hold securities 27