Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2019

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 000-54546

AMERI METRO, INC.

(Exact name of registrant as specified in its charter)

|

|

Delaware | 45-1877342 |

(State or other jurisdiction of | (I.R.S. Employer Identification No.) |

incorporation or organization) |

|

2575 Eastern Blvd. Suite 101

York, Pennsylvania 17402

(Address of principal executive offices) (zip code)

Registrant's telephone number, including area code: 717-434-0668

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.000001 par value per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

[ ] Yes [ X ] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

[ ] Yes [ X ] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[ X ] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

[ X ] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

1

[ X ] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "non-accelerated filer", "smaller reporting company" and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large Accelerated filer [ ] | Accelerated filer [ ] |

Non-accelerated filer [ X ] | Smaller reporting company [X] |

Emerging growth company [ ] | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [ X ] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

$0

Indicate the number of shares outstanding of each of the registrant's classes of preferred stock and common stock as of the latest practicable date.

|

|

|

|

Class | Outstanding at April 14, 2020 |

|

|

Preferred Stock, par value $0.000001 | 1,800,000 shares |

Class A Common Stock, par value $0.000001 | 1,600,000 shares |

Class B Common Stock, par value $0.000001 | 1,860,889,622 shares |

Class C Common Stock, par value $0.000001 | 66,000,000 shares |

Class D Common Stock, par value $0.000001 | 48,000,000 shares |

2

AMERI METRO, INC.

TABLE OF CONTENTS

INDEX

|

| Page |

PART I |

| 4 |

ITEM 1. BUSINESS |

| 4 |

ITEM 2. PROPERTIES |

| 36 |

ITEM 3. LEGAL PROCEEDINGS |

| 36 |

ITEM 4. MINE SAFETY DISCLOSURES |

| 36 |

PART II |

| 37 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

| 37 |

ITEM 6. SELECTED FINANCIAL DATA |

| 37 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

37 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

| 43 |

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. |

|

60 |

ITEM 9A. CONTROLS AND PROCEDURES |

| 60 |

PART III |

| 61 |

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE |

| 61 |

ITEM 11. EXECUTIVE COMPENSATION |

| 64 |

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

| 70 |

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

| 71 |

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES |

| 72 |

PART IV |

| 73 |

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

| 73 |

3

PART I

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the documents incorporated by reference, include “forward-looking statements” that involve risks and uncertainties, as well as assumptions that, if they prove incorrect or never materialize, could cause our results to differ materially and adversely from those expressed or implied by such forward-looking statements. Examples of forward-looking statements include, but are not limited to any statements, predictions and expectations regarding our earnings, revenues, sales and operations, operating expenses, anticipated cash needs, capital requirements and capital expenditures, needs for additional financing, use of working capital, plans for future products, services and distribution channels, anticipated growth strategies, planned capital raises, ability to attract distributors and customers, sources of net revenue, anticipated trends and challenges in our business and the markets in which we operate, the impact of economic and industry conditions on our customers and our business, customer demand, our competitive position, the outcome of any litigation against us, critical accounting policies and the impact of recent accounting pronouncements. Additional forward-looking statements include, but are not limited to, statements pertaining to other financial items, plans, strategies or objectives of management for future operations, our financial condition or prospects, and any other statement that is not historical fact. Forward-looking statements are often identified by the use of words such as “may,” “might,” “intend,” “should,” “could,” “can,” “would,” “continue,” “expect,” “believe,” “anticipate,” “estimate,” “predict,” “potential,” “plan,” “seek” and similar expressions and variations or the negativities of these terms or other comparable terminology.

These forward-looking statements are based on the expectations, estimates, projections, beliefs and assumptions of our management based on information currently available to management, all of which is subject to change. Such forward-looking statements are subject to risks, uncertainties and other factors that are difficult to predict and could cause actual results to differ materially from those stated or implied by our forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified under “Risk Factors” in this Form 10-K and incorporated by reference herein. We undertake no obligation to revise or update publicly any forward-looking statements to reflect events or circumstances after the date of such statements for any reason except as otherwise required by law.

The information contained in this Form 10-K is not a complete description of our business or the risks associated with an investment in our common stock. We urge you to carefully review and consider the various disclosures made by us in our Quarterly Report, and this Annual Report on Form 10-K for the year ended July 31, 2019 and in our other reports filed with the U.S. Securities and Exchange Commission (the “SEC”).

ITEM 1. BUSINESS

Ameri Metro, Inc. (“Ameri Metro” and the “Company”) was formed to engage primarily in high-speed rail for passenger and freight transportation, and related transportation projects. The Company initially intends to develop a Midwest high-speed rail system for passengers and freight. Currently the Company is engaged in raising capital and entering into relationships to further its planned activities. These initial planned activities are “ATFI Roadway” and “Port Trajan”, a northeast freight corridor.

Since its incorporation, the Company has developed its business plan, appointed officers and directors, engaged initial project consultants, and had meetings with certain agencies and groups related to potential future projects. Presently, the Company has not physically started any of the projects disclosed in our business plan section. However, as disclosed in the “Current Potential Projects” section, the Company has entered into agreements with related and non-related parties. The Company will start these projects once capital is raised. The Company’s business model and proceeds raised from financings will allow the Company to begin the ATFI Roadway and Port Trajan project as well as other current potential projects.

The Company Founder, Shah Mathias, has organized and established three related non-profit corporations and is an independent consultant of a fourth non-profit (ATFI) for the purpose of funding current potential projects of the Company identified by Transportation Economics Management Systems (TEMS), TEMS, a transportation/rail/sea vessel consulting firm working for and with the Company has completed preliminary studies on behalf of the end user both public and private. The Company can introduce related and non-related entities to the four non-profit entities for the purpose of funding projects they have.

These are the 4 Non-Profit entities with the ability to officiate Master Bond Indentures when sponsored by a state end user:

1.Alabama Toll Facilities, Inc. (ATFI) (A Non-Related Party)

2.Hi Speed Rail Facilities, Inc. (HSRF)(A Related Party)

3.Hi Speed Rail Facilities Provider, Inc. (HSFP)(A Related Party)

4.Global Infrastructure Finance & Development Authority (GIF&DA)(A Related Party)

4

These three non–profit related entities will play a vital role in financing. The non-profits statutes provide a vehicle to issue bonds and help secure infrastructure potential projects. The non-profit entities have the discretion to turn over the infrastructure of potential projects to the state, or the governing body after it has successfully developed and paid for the potential projects.

With the funding raised from financings, the Company will then be able to consult the end users, related and non-related entities, and non-profits (who will sponsor bond offerings to fund the projects) and to contract with one or more of the largest construction firms in the United States who will carry out the actual construction management on the large projects we plan on building. The Company does not have the work force, nor expertise to perform the actual physical work from start to finish. However, the Company anticipates engaging the largest construction management and construction firms in the industry, such as AECOM, to meet the project’s needs. AECOM, as noted in its filings with the SEC, has over thirty years of experience undertaking similar projects and produced $20 billion in revenue in 2018. They operate with a capacity of 87,000 employees, and provide planning, consulting, architectural, and engineering design services to commercial and governmental clients across 7 continents. AECOM also offers construction services, including building construction and energy, infrastructure and industrial construction. In addition, they can provide program and facility management which entails maintenance, training, logistics, consulting, technical assistance, systems integration, and information technology services.

The Company anticipates these firms will want to be involved due to the scale of each project the Company has under contract, and those potential projects the Company can engage in as a result of their relationship with the non-profit entities.

The Company also believes the economic studies performed by TEMS will confirm that the cost of the projects will be supported by the usage and revenues generated by the project. This will allow the Company, and the associated construction firms contracted with, to sustain profit. The types of projects the Company is proposing to build have generally been successful in the United States over the last 200 years and will attempt to improve the way passengers and freight are transported around the United States.

On December 1, 2010, the Company formed its wholly-owned subsidiary, Global Transportation & Infrastructure, Inc. (“GTI”). GTI was formed to provide development and construction consulting services for Alabama Toll Facilities, Inc. "ATFI” is a non-related, non-profit company supported by the State of Alabama, to act as the exclusive entity, as set forth in House Joint Resolutions, H.J.R 459 and H.J.R. 456, to finance the development of the 357 mile Alabama Toll Road (starting on the coastline of Alabama and running northward to the boarder of Tennessee).

Pursuant to the executed agreement with ATFI, “Assignment Agreement For Construction,” GTI will act as the consultant for such a toll road, including implementation of the financing mechanism for the design, planning, engineering and related costs for its construction, and to engage in the construction of freight transportation and related transportation projects by contracting with some of the largest construction firms in the industry. ATFI is a non-related entity, and along with other related entity projects that are supported by the ATFI 357 mile toll road in Alabama, the Company intends to act as the conduit to bring the ATFI toll roadway to completion. The ATFI toll roadway and other related potential projects stemming from the ATFI toll roadway project, are at different stages, of a six-stage process supported by agreements and contracts.

The Company has a six stage process for potential future project opportunities:

1.Management’s Decision to take on a project

2.Enter into Letters of Intent, Agreements, Construction Contracts

3.Obtain State(s) sponsorship of the project through legislative actions (where applicable)

4.Engineering and Design Studies, Architectural Design, Feasibility Studies

5.Raise Capital through Bond Financing and/or Company stock offerings or other borrowings

6.Management of the physical construction as a general contractor

The Company’s current list of potential project opportunities is contained in the Business Plan Section. The common thread with all these future opportunities is that the Company has not yet started Stage 5 or Stage 6, but continues to spend time, effort, and resources to advance each current potential project. Each current potential project requires the raising of capital, which we expect to be accomplished through one or more of the non-profit entities mentioned on the previous page.

With the Alabama legislation Joint Resolution HJR 459 and HJR 456 signed by the Governor, the ATFI current potential project along with the ancillary projects are designed to support the sustainability and to ensure the success of the ATFI current potential project. The Company, pursuant to the construction agreements, is acting as Master General Contractor for the building of the toll road. The Company will also build ancillary projects and related transportation systems, including but not limited to rail and toll bridges, upon the successful issuance of the bond offering. The Company plans to improve port operations and cargo facilities while building a 357 mile toll road from the coast of Alabama to the southern border of the State of Tennessee.

5

The contracts between ATFI and the Company are in full force and effect under the House Joint Resolution HJR 459 and 456 unless new legislation is issued to rescind the current HJR 459 and HJR 456. The related and non-related party contracts are in full force and effect in association with the current potential projects.

The Company makes no guarantee we will succeed in our business plan to help the United States by improving the infrastructure and changing the way cargo and the population travel, but according to the United States Government it is a high priority to improve states’ infrastructure without taxing the American public. The Company’s business model and ATFI legislative rights that are in place stand a reasonable chance of making a difference.

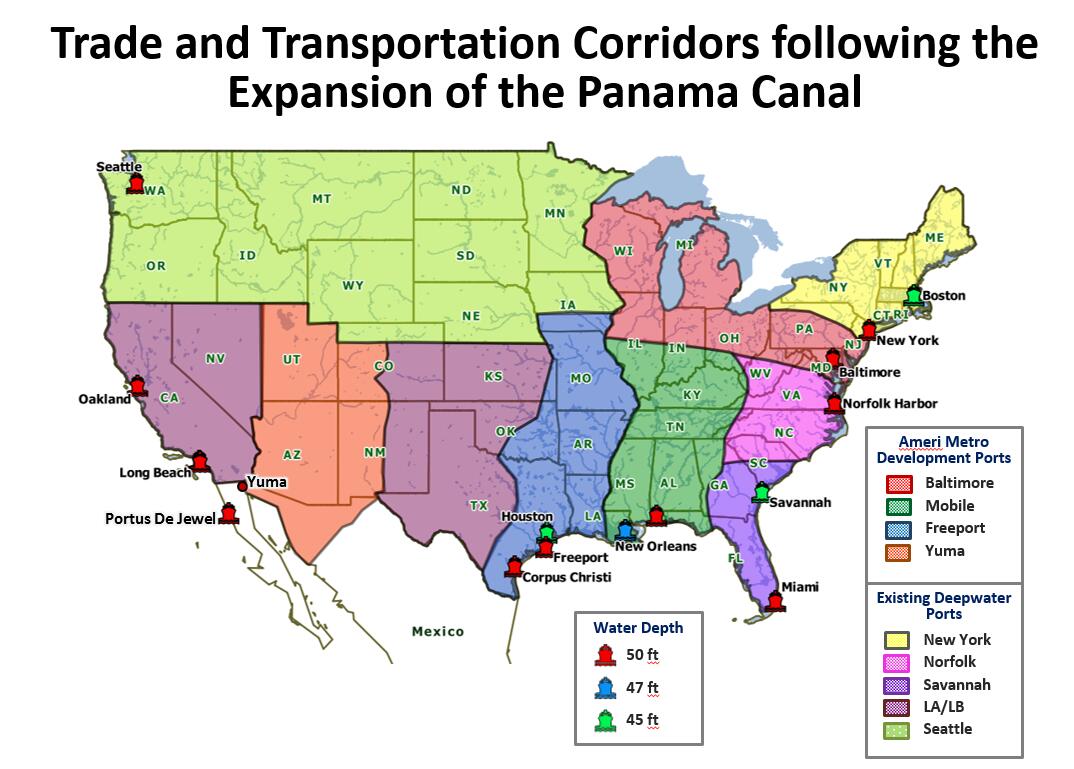

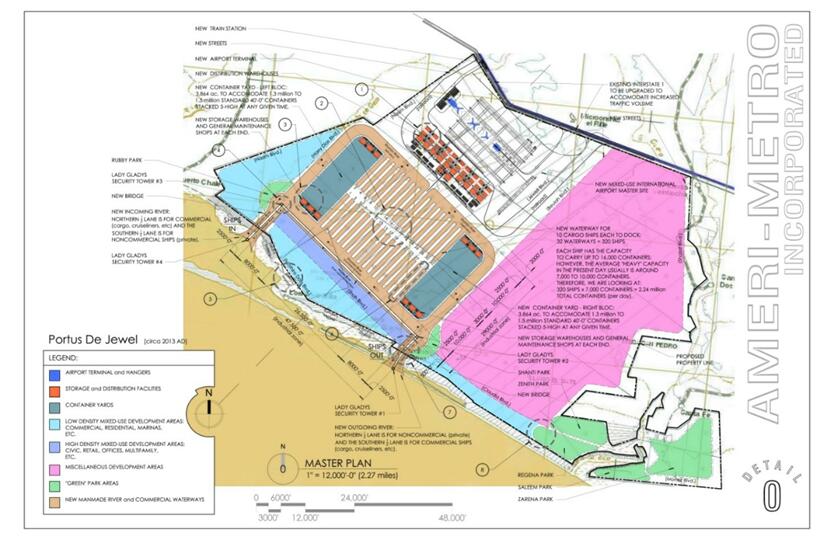

As Super Cargo ships increase in size, studies show that the US ports do not have the sufficient water depth of fifty feet to berth these mega ships. The map below shows the Alabama Port which ties to the ATFI toll road have the sufficient water depth of fifty feet.

There are current studies taking place by US ports on how they will solve the problem. The new challenge to US ports stems from the Panama Canal being widened and deepened to accommodate such ships. Most US ports shown in the map below still lack the water depth to receive such ships substantiated by public reports found on the ASCE American Society of Civil Engineers website under “Report Card For America’s Infrastructure”. The Panama Canal studies below were completed by TEMS:

6

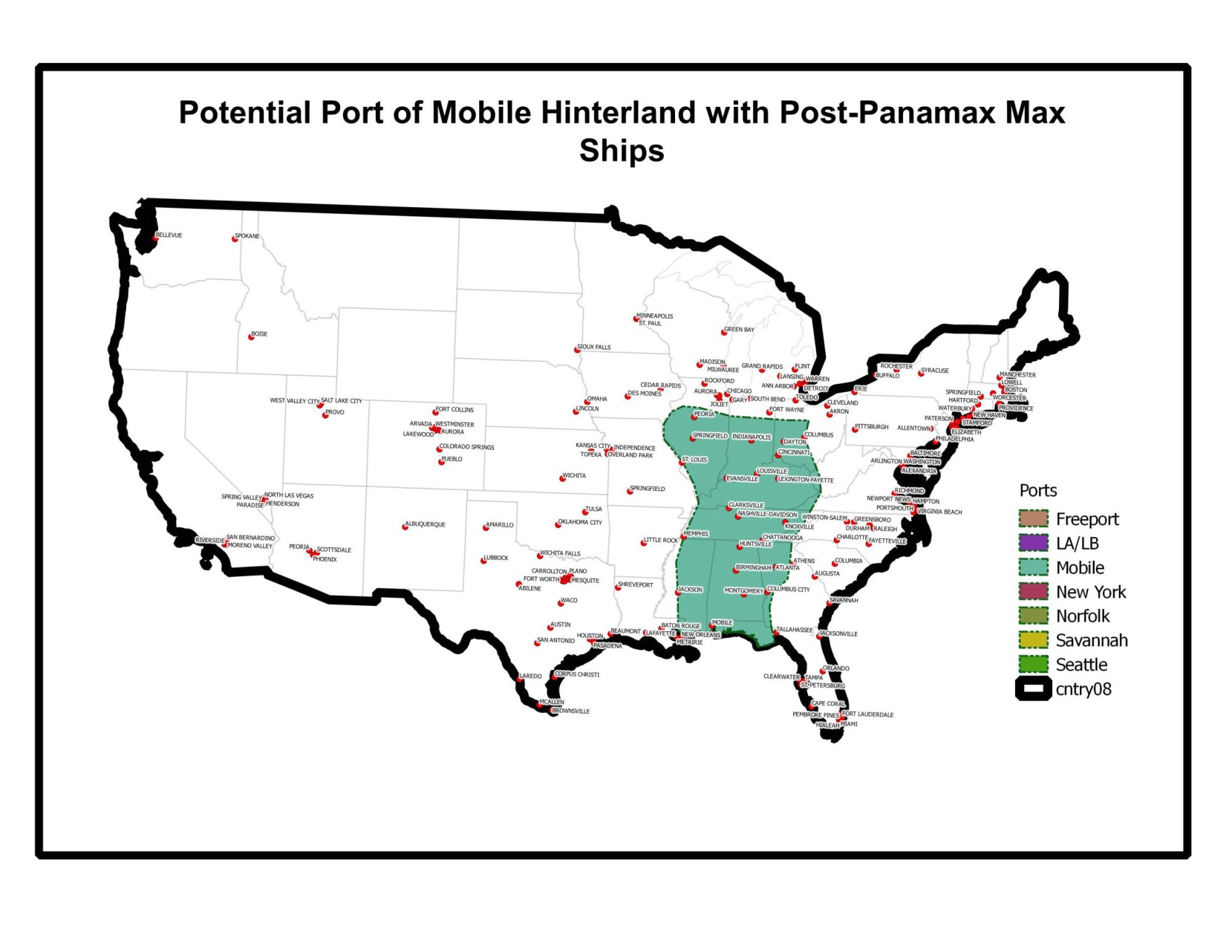

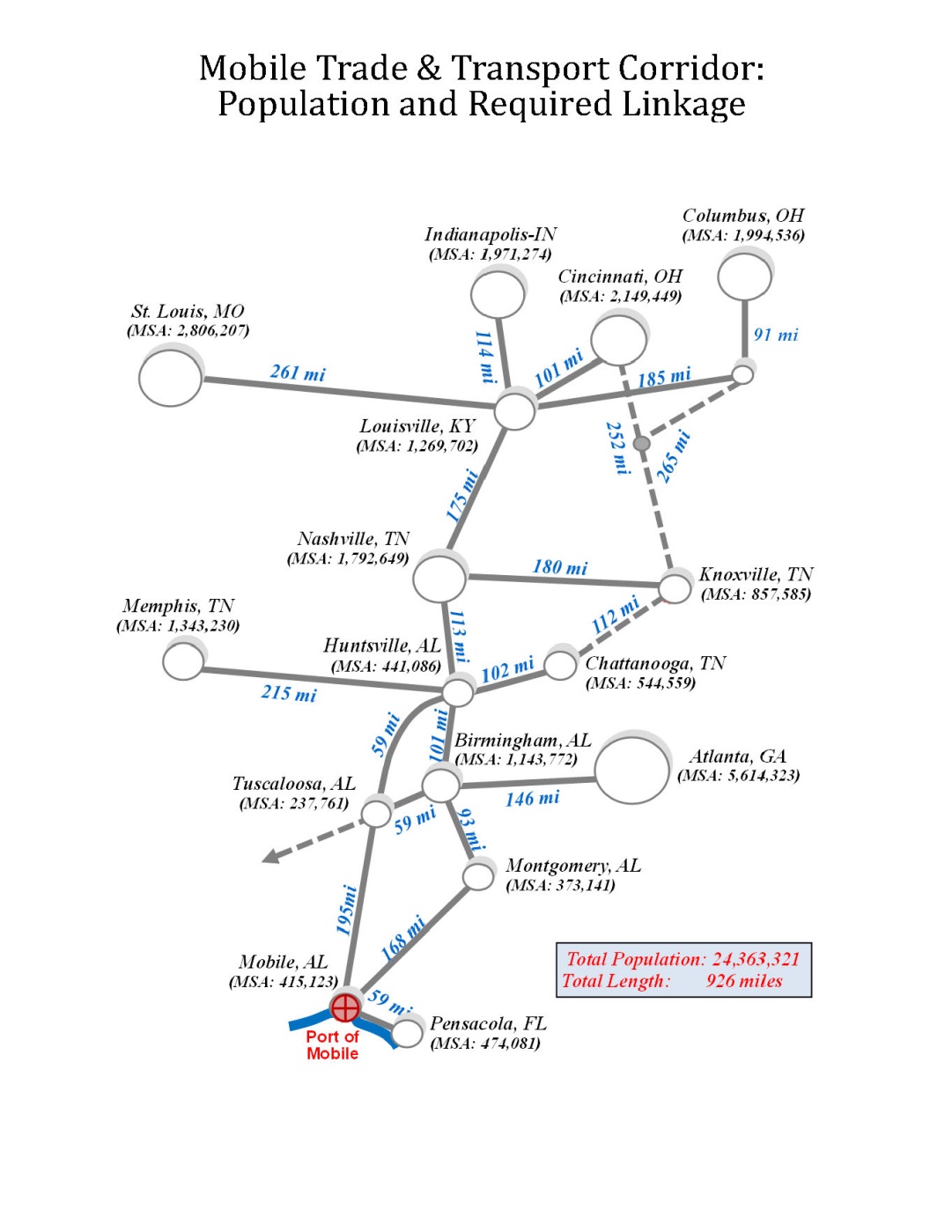

The Company’s first current potential project “Port Trajan” is directly connected to our current Alabama port potential project “Port De Claudius, Inc.” through the new Alabama Toll Road (“ATFI”) connecting to Route 81 in Knoxville Tennessee, which today is a major shipping corridor from Tennessee to Maine with South Central Pennsylvania (the location of Port Trajan) becoming one of the current distribution locations for the north east. We believe that the ports of Mobile and Baltimore, each with 50 feet of water depths, stand to be the ports used in making cargo movement to the north east corridor more efficient as the size of cargo ships continues to increase. These ports, based on studies performed by TEMS, have the ability to be deepened and the cost to do so will be offset by the economic impact they create according to studies performed to date by TEMS.

The Company’s funding plans include stock offering and non-related and related parties officiating bond offerings to fund the current potential projects identified.

The major elements of the infrastructure for the current potential projects as part of the Company’s planned activities are stated below:

Trade and Transportation Corridors

Development of container ports for Class C, D and E ships

Development of inland transportation corridors including new greenfield highways and railroads

Building of inland ports and multimodal transportation centers

Development of new urban centers along the new infrastructure

Development of ancillary facilities including airport (express service), distribution centers, and logistics centers.

High Speed Rail

Development of modern rail equipment operating at speeds exceeding 250 mph

Use rail to connect rural, small urban and major metropolitan areas

Track improvement, including replacement and upgrades, additional sidings, signal and communications systems, and grade-crossing improvements

Building of new greenfield routes

Construction or improvement of railroad grade crossings and passenger stations

Acquiring new train equipment including train sets and spares

Transportation Infrastructure

Development of new road systems to accommodate driverless cars and trucks, including electric cars and infrastructure to support the highway and rail systems that will be used in Trade and Transportation Corridors and the High Speed Rail Systems.

Supporting Ancillary Development

Development or expansion of a feeder bus system linking outlying areas to railroad stations

Operation of a "hub-and-spoke" passenger rail system providing service to and through one or more major hubs to locations throughout the United States

Provision of multi-modal connections to improve system access, hotels, retail, parking garages, sorting facilities / distribution facilities

Supporting Transportation Systems

Ancillary development opportunities, airports, inland ports, sea ports, toll roads and technology parks

As the US and World populations are rapidly increasing, infrastructure is becoming inadequate and dilapidated as stated on the American Society of Civil Engineers website. Government authorities are unable to keep up with preventative maintenance and replacement work because of the lack of funding. Studies have consistently shown that the development of infrastructure promotes economic growth. However, the global financial crises have sent governments into restructuring their budgets and reduced the possibility for funding new infrastructure development.

The Company’s management team has recognized the need for a solution to limit the financial burden on governments and taxpayers alike. The Company plans to use Private Public Partnerships to fund some or all of the capital requirements for the current potential project opportunities. The Company’s use of proceeds from the offering will potentially make it possible for the Company to fulfill its consulting agreements with ATFI and Related Parties to begin immediately the feasibility studies and investment grade studies needed to officiate the bond offerings, specifically for the “Port Trajan” current potential project as detailed in the “current potential project” section.

Once TEMS completes feasibility and environmental studies, it will be the Company’s goal, through the financial markets to raise capital from bond offerings.

7

In order to support the functionality of financial structure between the end user, whether public or private, and the non-profit, whether related or non-related, Shah Mathias created the sixteen related entities listed below of which the Company owns 25% of each via non-voting common shares, with the remaining 75% (and 100% voting control) owned by Mr. Mathias. The Company acting in its Master Consulting role will be the conduit between one or more of the related entities who will secure by contract the project from the end user and approach the non-profits for bond offering of the project. The construction management services will be performed by one or more of the largest construction management firms in the United States by utilizing existing well-established construction firms in or near the project location to perform the physical work on each project. The Company’s consulting staffing needs are already in place and any additional needs can be met easily. Once a project is started, the consulting management team of the Company would rely heavily on the work force of some of the largest construction management firms in the country. The seventeenth related entity, HSRF Trust, was created to place the bond offering revenue in trust managed by agreements with ING (now Voya).

1.HSR Freight Line, Inc.

2.HSR Passenger Services, Inc.

3.HSR Technologies, Inc.

4.HSR Logistics, Inc.

5.KSJM International Airport, Inc.

6.Port of Ostia, Inc.

7.Port of De Claudius, Inc.

8.Atlantic Energy & Utility Products, Inc.

9.Malibu Homes, Inc.

10.Ameri Cement, Inc.

11.Lord Chauffeurs LTD.

12.Penn Insurance Services LLC

13.Cape Horn Abstracting

14.Eastern Development & Design, Inc.

15.Slater & West, Inc.

16.Platinum Media Inc.

17.HSRF Trust

Presently, none of these related entities recognized any revenue. These entities play a vital role in terms of becoming the entity that builds and owns the potential project while the bond debt is being paid back. The ultimate beneficial owner of the project could be one of these entities or in the case of State projects, the State would become the beneficial owner of the project built once the bond debt is retired. This business model will control cost over runs and allow for more tightly managed projects during construction and then management of the operations of the project until the debt is paid back.

In summary and for clear understanding of the process:

The State who has a project to build would be able to have the project built by sponsoring the bond offering on behalf of one of the related entities below. The related entities would build and manage the project, assume the liability of the debt and then return the project back to the State upon retirement of the bond debt. In the case of non-State projects, the related entity could be the beneficial owner of the project at the end of the bond debt retirement.

1) HSR Freight line, Inc. This company will handle all services related to the use of track time, train sets leases and freight forwarding services. HSR Freight Line, Inc. intends to offer high speed rail, freight forwarding and parcel handling services to existing national and global carriers. As opposed to independently developing a freight corridor, carriers will be able to lease train sets with their trade logos and slogans in their own color schemes at various rates depending on the time frames, in addition to toll fees for track time. The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

2) HSR Passenger Services, Inc. This company will handle all ticketing, booking, reservations, food & beverage services, hotel booking and car rental booking services. HSR Passenger Service Inc. will offer concession space at the travel plazas, technology parks and develop motels, hotels, fast food restaurant establishments and convenience stores. The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

8

3) HSR Technologies, Inc. This company will handle all build to suit manufacturing facilities for train sets and centralized signalization services along the rail road tracks and train stations. Within the technology parks HSR Technologies, Inc. will be a sole provider of all fiber optics, telecommunication and all related technologies services including equipment maintenance.

A.Maintenance for train engines, rail cars and rail track through a maintenance agreement with equipment lease holders.

B.Total maintenance for all Industrial sites for assembly plants, train stations, train terminals, manufacturing plants, parts distribution centers, rail roads, rail crossings, rail yards, cargo terminals, parking lot, parking garages, hotel, motels, food and beverage vending machines, all retail shopping centers, office complexes and all on/off site improvements.

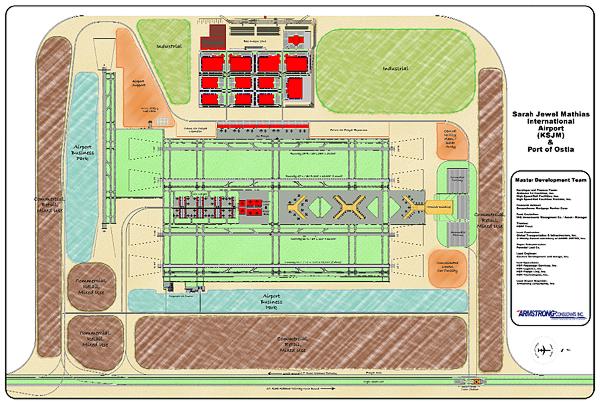

C.The airline industry is congested throughout existing terminal space. The proposed KSJM International Airport in Alabama will offer services to eliminate burden on existing terminal space for airline carriers. Federal Aviation Administration (FAA) certified inspection stations will service the airline industry. This company will also provide marine services, oil platforms and petro chemical industry services due to proximity to the Gulf of Mexico.

The Company interfaces with the entity, in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

4) HSR Logistics, Inc. This company will handle coordination, delivery and movement of all machinery equipment, material goods and will operate all warehousing facilities.

The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

5) KSJM International Airport, Inc. This company formed to serve as a master airport facility. It will provide four types of airport terminals and one international airline inspection service terminal operated by HSR Technologies Inc.:

a)Passenger Terminals, operated by HSR Passenger Services Inc.

b)Air Cargo Terminals, operated by Port of Ostia, Inc.

c)Corporate Jet Center Terminal

d)International Airline, FAA inspections maintenance service terminals, operated by KSJM International Airport, Inc.

e)Domestic Airline FAA inspection maintenance service terminals, operated by HSR Technologies Inc.

The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

6) Port of Ostia, Inc. This company will handle foreign and domestic Air Cargo, and while supporting ground services such as freight forwarding services will be provided by HSR Freight Line, Inc. and air and ground logistics will be provided by HSR Logistics, Inc. The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

7) Port of De Claudius, Inc. This company will handle foreign and domestic inbound / outbound sea container inland port operation and warehouse distribution center. The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

8) Atlantic Energy & Utility Products, Inc. This company will provide electric, gas, water, sanitary sewer service, trash removal, cable TV, Dish network and internet services. Petroleum products and services will also be provided during and after construction, along with fuel services on the toll road, all industrial and technology parks, including the airport, inland ports and incoming and outgoing vessels. The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

9

9) Malibu Homes, Inc. This company will provide residential home building services. The Company interfaces with the entity, in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

10) Ameri Cement, Inc. This company handles all cement needs for building (357 miles four lane) Alabama Toll Road "ATFl” and others future projects. The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

11) Lord Chauffeurs LID. This company operates all passenger ground transportation car service for passengers such as limo and taxi, as well as the corporate jet center. The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

12) Penn Insurance Services LLC. This company provides all insurance services to all entities and risk management services for all entities, but not limited to the entities. The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

13) Cape Horn Abstracting. This company provides all-land title examination services for all entities to insure against any pre -closing and post-closing claims of ownership or deed restriction. The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

14) Eastern Development & Design, Inc. This company provides all civil engineering and architectural services with strong cost control measures thereby reducing engineering and architectural cost over runs. The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

15) Slater & West, Inc. This company provides contract administration services and handles all work force human resource matters, including background checks, loss prevention services, vendor invoice verification against goods and services provided, and to clear invoice for payment. The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

16) Platinum Media, Inc. Designed to provide all media related services. The Company interfaces with the entity in three separate stages: Stage 1 interface - as consultant for a fee, Stage 2 interface – as consultant for construction services for a fee and Stage 3 interface – as a 25% non-controlling interest shareholder, sharing in post construction operations revenue.

17) HSRF Trust. This company is a statutory trust administrator of private and public funds and will safeguard the bondholder's interest. No money moves to any parties without trust authorization.

The Company anticipates the following will occur by a regional or local municipalities upon the adoption and implementation of Trade, Transportation and a High-Speed Rail Systems as part of the Company’s current potential projects. To date, the Company has not developed any rail systems.

The Company will engage TEMS to provide feasibility and investment grade studies, engage some of the largest construction management firms in the United States, and locate well-established construction contractors and manufacturers to provide cost estimates on completing the current potential projects. The Company in its Trade and Transportation corridors will use technology well known to US contractors, however, because high-speed rail travel is already in-place in much of Europe and Asia, the Company anticipates working with European companies to furnish the high-speed rail equipment, such as locomotives and passenger cars.

The Company will furnish project proposals with supporting feasibility study, appraisals, and cost/benefit analysis prepared by TEMS. The Company will then provide those tools to a related entity or related non-profit entity so they can present such project proposals to the municipalities (state or local) as a complete and finished project. The local or regional municipality will then independently analyze and discuss the Company's proposal.

The two related non-profit entities created for Trade and Transportation and High Speed Rail projects are:

Hi Speed Rail Facilities, Inc.

10

In 2010, the Company entered into an agreement with HSRF (one of the Company's related non-profit companies) Pursuant to the agreement, the Company will be responsible for the construction of projects while the non-profit will be responsible for financing the construction and operating various high speed rail and related projects across the United States. HSRF is designed to focus on the building of train tracks and stations. Pursuant to the agreement between the Company and HSRF, the Company will act as the agent and representative of HSRF to perform all required tasks and actions to develop and construct such projects by utilizing a large well-established construction management firm. The Company anticipates that having this agreement in place and by having HSRF already organized will expedite the process of commencing a project once the Company raises funds. Material aspects of the agreement are presented below in the “Business Plan” section.

Hi Speed Rail Facilities Provider, Inc.

In 2010, the Company entered into a written agreement with HSRFP (one of the Company's related non-profit companies). The Company will be responsible for the construction of projects while the nonprofit will be responsible for financing construction and operating various high speed rail and related projects across the United States. Pursuant to the agreement, the Company was appointed as the agent and representative of HSRFP to perform all required tasks and actions to develop and construct such projects by utilizing a large well-established construction management firm. HSRFP was organized to provide a vehicle to issue bonds and help secure infrastructure projects for the Company, focusing on facilities ancillary to the high speed rail, such as rail yards, rail assembly plants maintenance facilities. The Company anticipates that having this agreement in place and by having HSRF already organized will expedite the process of commencing a project once the Company raises funds. Material aspects of the agreement are presented below in the “Business Plan” section.

ING Investment Management

Each of the non-profits has entered into an investment management agreement with ING Investment Management (“ING”) whereby ING will manage any funds raised in bond offerings and provide investment advisory services. This non-binding agreement would only take effect upon the raising of revenue bonds, which to date has not occurred. ING would serve to invest, reinvest and supervise the management of any such funds raised, for any project in the future, while such funds were held in an investment account and until use for the intended funds are needed for project purposes. The Company and the non-profits have not commenced raising funds through any bond offerings.

Supporting Information

The United States Census Bureau predicts that the American population will reach 420 million by 2050, a trend that will overwhelm our nation’s transportation infrastructure according to the information provided on their website.

Current estimates suggest that overall freight demand will double over the next 40 years from 15 billion tons today to 30 billion tons. The number of trucks on the road is also expected to double. Already under unsustainable strain, the nation’s freight transportation infrastructure and highways will face even greater challenges as the total volume of freight increases.

Extensive infrastructure expansion, such as new ports, trade corridors and high-speed rail (HSR), is critical to help mitigate problems associated with rising fuel costs, crowded highways, and greenhouse gas emissions. Population growth and development in the U.S. have made our nation increasingly reliant on rail and highway infrastructure to transport people and freight.

Clearly, a strong, efficient freight transportation system is vital to the nation’s economy. Our nation’s already strained and outdated railways must be upgraded to handle the projected increases in freight shipping to relieve congestion on our highways. We believe that new trade corridors are needed to support the additions of new ports and infrastructure in marine shipping. New high speed rail routes will also increase connectivity between US cities to support the emerging new economy.

Business Plan

The Company, as a consultant through its Master Consulting role along with TEMS has collectively identified current potential projects worth five hundred and six billion dollars. The Company has therefore approached the related non-profits for master bond indentures for each project, to meet the need of the related and non-related end users of each current potential project.

The Company acting as a Master Consultant, and Master General Contractor through agreements with the related and non-related non-profits, and the related entities will perform construction management services and consulting services for a fee (see material aspects of agreements below). The related and non-related non-profits provide a source of capital through bond indentures upon TEMS providing investment grade studies that will confirm the potential project revenue and will support the debt on behalf of the beneficial owner of a given project.

The contractual agreements and material aspects of the agreements are presented below:

11

Master Agreement For Construction with the Four Non-profits

The Company is in contractual, “Master Agreement For Construction”, agreements with High Speed Rail Facilities Inc., High Speed Rail Facilities Provider Inc., Global Infrastructure Finance & Development Authority, Inc. and Alabama Toll Facilities Inc., all four are nonprofit entities referred to as the “Cartel” who could issue bonds on behalf of government, civilian and commercial end user projects directly, or on behalf of the affiliate entities listed below. The material aspects of the “Master Agreement For Construction” are as follows:

1.AMERI as the agent and representative of CARTEL shall perform all required tasks and actions to develop and construct the Project as agent and representative of CARTEL without limitation by taking such actions as necessary to secure the first and future phases of the financing applicable to the design, planning, engineering and related soft and hard costs of the construction of the Project and related activities. The specifications, designs, construction standards, subcontractor agreements, insurance requirements, hiring and employment policies and similar items shall be developed by AMERI, subject to approval by CARTEL, and as necessary offered for review and approval by appropriate governmental and regulatory agencies.

2.AMERI shall assure that the Project is constructed according to specifications and requirements imposed by the Federal Railroad Administration (FRA). The work done by AMERI through itself, its contractors, subcontractors, agents, employees and affiliated organizations, shall be subject to inspections as mandated by law to demonstrate compliance with all applicable standards. AMERI shall be responsible for coordinating all construction of the Project including construction work performed by subcontractors and others. AMERI shall supervise all phases of the construction of the Project, and it shall be responsible to CARTEL for all acts or omissions of its employees, subcontractors, agents, consultants and other parties under its control. AMERI shall contract with all subordinate parties in its own name and behalf and not in the name of or on behalf of CARTEL unless later agreed upon by the parties. AMERI shall provide to CARTEL, on an on-going basis, a list of all subcontractors and others engaged by AMERI for work on the project, together with correct and complete copies of all contracts and agreements with such parties.

3.The engagement of any subcontractor or subordinate parties for work on the project shall not excuse AMERI from complying in all respects with this contract. AMERI shall have full responsibility for every portion of the construction of the Project furnished or performed by any subcontractor or subordinate party and every act or omission (whether willful, negligent or otherwise) of AMERI’s employees, subcontractors and their employees, and all other parties engaged for work upon the Project. All construction, acts and omissions of any party participating in the construction of the Project shall be deemed those of AMERI for the purposes of this agreement. AMERI shall be responsible for assuring that the construction of the Project is performed in a good and workmanlike manner and in accordance with the highest standards of care for the industry. AMERI shall take all reasonable precautions to prevent injury, damages or loss to persons or property throughout the Project, including especially issues of environmental protection.

4.The term of this Agreement shall continue until the completion of the Project and thereafter unless and until terminated by mutual agreement of CARTEL and AMERI and it may continue into if not so terminated.

5.The parties agree that the face amount of the contract between them for CARTEL to complete the Projects shall be determined by the face amount of each Master Trust Indenture less unrelated construction and land cost at cost plus forty percent (40%), plus two percent (2%) over the adjustment for the increase in inflation regardless of the cost to AMERI to perform the required services hereunder.

In no event will the profits to AMERI from the projects be less than forty percent (40%), plus two percent (2%) over the adjustment for the increase in inflation. Construction contract is based upon 97% of the face amount of each Master Trust Indenture over the course of the construction period. Amounts payable by CARTEL shall be due fifteen (15) days from the date of the submission of invoices from AMERI to CARTEL, time being of the essence. For any payments received after the fifteenth (15th) day, a late fee of five percent (5%) of the unpaid amount if paid within ten (10) days thereafter; and any amounts paid after said ten-day period shall accrue late fees at the rate of eighteen percent (18%) per annum plus a collection fee of three percent (3%) and attorney’s fees of five percent (5%) of the unpaid balance. A deposit of Ten Dollars ($10.00) shall be paid by CARTEL to AMERI upon the execution of this agreement; with a subsequent payment of three percent (3%) of the face amount of the contract upon the bond funding for the initial phase of the project; and a subsequent payment of an additional two percent (2%) of the face amount of the contract upon mobilization of the project. These percentages shall apply to the first phase and to all subsequent phases of the project.

12

6.The parties agree that this Agreement is not intended to create, nor shall it create, a partnership between them or any business relationship other than that specifically created by the terms hereof. Likewise, no partnership or other business relationship shall be created between CARTEL, AMERI and any subcontractors or subordinate parties contracted to work on the Project.

7.The business and affairs of the Project shall be controlled by AMERI without the requirement that the approval of CARTEL be obtained for any actions taken, subject only to the submission of such reports and accountings being furnished by AMERI to CARTEL as the parties may agree from time to time. Detailed and complete records of all aspects of the Project shall be kept by CARTEL and AMERI for their use and for inspection by any third parties, agencies, regulators or others authorized by law or agreement to access them.

8.AMERI may conduct the business of the Project from such location or locations as it may elect, whether in the State of Delaware, the Commonwealth of Pennsylvania, or elsewhere. However, as stated below, Pennsylvania law shall govern this agreement.

9.AMERI may act through such subagents and subcontractors, attorneys and representatives as it deems necessary in its sole discretion; and to compensate such parties under such terms as it may agree.

10.The funding for the Project shall be raised through the issuance of bonds through a marketing plan determined by AMERI, and all proceeds thereof shall be deposited in custodial accounts administered by fiduciaries and according to such terms as CARTEL TRUST shall institute for the safekeeping and distribution according to sound business practices. AMERI shall act as Sponsor for the CARTEL Direct Offering and Bond Issuer.

The Company will provide consulting services for a fee according to contractual agreements between all four nonprofit entities and affiliate entities listed below. The contractual agreements and material aspects of the agreements are presented below:

The Company is in contractual, “Consulting Agreement”, agreements with High Speed Rail Facilities Inc., High Speed Rail Facilities Provider Inc., Global Infrastructure Finance & Development Authority Inc., and Alabama Toll Facilities Inc. All four are nonprofit entities, who have the capability to fund government, civilian, and commercial end user projects directly or on behalf of the affiliate entities listed below. The material aspects of the “Consulting Agreement” are as follows:

1.HSRF hereby appoints AMERI as its agent and representative to perform all required tasks and actions to develop and construct the Project as agent and representative of HSRF without limitation by taking such actions as necessary to secure the first and future phases of the financing applicable to the design, planning, engineering and related soft and hard costs of the construction of the Project and related activities.

2.AMERI hereby accepts such appointment and agrees to perform as agent and representative of HSRF as specified.

3.The term of this Agreement shall continue until the completion of the Project and thereafter until terminated by mutual agreement of HSRF and AMERI, and it may continue into if not so terminated.

4.AMERI shall be compensated for arranging financing and developing the sponsorship mechanism for the Project by a specific fee equal to one and one half percent (1.5%) of the face amount of the master indenture. Additionally, services other than arranging financing that are performed by AMERI for HSRF financing shall be compensated in accordance with separate agreements addressing other aspects of the Project. In addition to the payment of fees for its services AMERI shall be entitled to prompt reimbursement of all costs and expenses advanced or incurred by it in furtherance of its duties hereunder. All fees are deemed earned upon delivering of a bond indenture document, HSRF is responsible for additional financing fees to direct or indirect financiers, a mortgage banker, or financing facilitator.

5.The parties agree that this Agreement is not intended to create, nor shall it create, a partnership between them or any business relationship other than that specifically created by the terms hereof.

6.The business and affairs of the Project shall be controlled by AMERI without the requirement that the approval of HSRF be obtained for any actions taken, subject only to the submission of such reports and accountings being furnished by AMERI METRO to HSRF as the parties may agree from time to time.

7.AMERI may conduct the business of the Project from such location or locations as it may elect, whether in the UNITED KINGDOM, the Commonwealth of Pennsylvania, or elsewhere.

13

8.AMERI may act through such subagents and subcontractors, attorneys and representatives as it deem necessary in its sole discretion; and to compensate such parties under such terms as it may agree.

9.The funding for the Project shall be raised through the issuance of bonds through a marketing plan determined by AMERI, and all proceeds thereof shall be deposited in custodial accounts administered by fiduciaries and according to such terms as AMERI METRO shall institute for the safekeeping and distribution according to sound business practices. AMERI shall act as Sponsor for the HSRF Direct offering and Bond Issuer, stock offering.

10.AMERI shall maintain current and complete records of all aspects of its performance on behalf of HSRF and in furtherance of the Project, with such records being available to HSRF and to other parties as legally required. Such records shall be examined and audited by independent auditors and accountants selected by AMERI, with such statements of account being rendered as required by good accounting practices.

11.AMERI shall comply with all legal requirements of all applicable agencies and jurisdictions for the project, including but not limited to labor and hiring practices, compensation of subcontractors and workers, and taxes and insurance. In order to assure such compliance, AMERI may employ attorneys and advisors as it may in its sole discretion determine, securing such legal advice and opinions as will reasonably protect the Project and the parties thereto.

12.AMERI shall maintain during and after the completion of the Project all records of the Project, and they shall be available for inspection as required by law and the agreement of the parties.

Additionally, the agreements between the other related and non-related non-profits are the same.

The Company has been in joint meetings with related entities and private, public municipalities and regional governmental agency end users concerning current potential projects that have had studies completed in differing stages. The Company and related entities met with and made presentations to these parties. The scope of work associated with current potential projects consist of development relating to sea ports, airports, rail corridors, toll roads, inland ports, intermodal facilities, sewer, water and power grids, all being anticipated to be revenue producing projects. However for the Company to proceed on any of these current potential projects, a substantial amount of capital must be raised through officiating bond funding through one or more of the related and non-related non-profits. The following is a result of meetings and negotiations over the last 6 years, bringing the Company to the stage of raising capital to operate and fulfill its business objectives. The result of our activities over the years are the current potential projects listed below.

Brief Descriptions of Current Potential Projects

Current Potential Project (according to priority)

Throughout all Current Potential Projects, when we refer to one or more of the largest construction firms in the United States we are identifying construction management firms such as one of the largest firms in the country with 87,000 employees, seventeen billion in generated revenue for 2016 and 30 plus years of experience providing all of the services each of our current potential projects would require. For clarity and disclosure the Company has not engaged any firm at this time, but it is our business model to do so upon completed studies prior to bond offering. The Company’s current executive team along with consulting firms such as TEMS and fee based legal teams we have identified, working together with financial market underwriters who have the experience to bring the potential project to a point of starting through bond offering, is reason for the Company to call these “Current Potential Projects” There are a number of large construction management, engineering, architectural firms that we will engage to commence project build out. We will rely heavily on firms to perform, while we stay within our Master Construction and Master Consulting role. The Company is making no guarantee construction firms or construction management firms will contract with the Company, but it is our business model to utilize the well-established firms within the country to fulfill our business plan.

Current Potential Project 1

Port Trajan – Is directly affected by Alabama Toll Facilities, Inc. "ATFI", which is responsible for building a new toll road. ATFI is a non-related, non-profit company with a project supported by the State of Alabama legislation and signed by Governor Bob Riley, according to House Joint Resolutions, H.J.R 459 and H.J.R. 456. The Company will be responsible for building the 357 mile toll road. Port Trajan is complimented by the ATFI roadway, and are mutually dependent of one another. The new Alabama Toll Road, when built, will provide a faster way to reach Interstate 81 in Knoxville, Tennessee. It will eventually connect to Port Trajan in Pennsylvania, which travels north to the state of Maine.

As cargo ships increase in size and the need for deeper water at US ports on the east coast increase (substantiated by TEMS studies) the Company’s projects, Port De Claudius, Inc. (PDC) (current potential project #6) and Port Ostia (current potential project #7), support the movement of cargo from the Alabama coast line by utilizing the ATFI roadway to the north east distribution center of Port Trajan.

14

The Company will build Port Trajan immediately upon bond financing because the land under agreement is connected to the existing Norfolk and Southern intermodal port, which is presently receiving cargo containers by rail. Also, the intermodal port is located in south central Pennsylvania, connecting a population of 50 million people. The Company will generate immediate revenue from the Port Trajan build out, and permits are ready to be issued for 4.2 million square feet of warehousing. These are the reasons Port Trajan will be the first project in our current project list. The feasibility and economic impact studies will be performed by TEMS. The state will sponsor the bonds, GIF&DA will officiate the bond offering, the Company will act as the consultant to bring the entire project to a starting point, and the large construction management firm will perform all management and construction related steps.

On January 9, 2013, the Company signed a letter of intent with Jewel Real Estate 10-86 Master LLLP, a related party to purchase land to develop for future sale.

On January 13, 2013, the Company entered into a letter of intent with Port De Claudius, Inc., a related party trading as Port Trajan. The Company is contracted to provide services for the build out of the Port Trajan’s five terminals, along with the sale of real property together with development rights for a fee.

The Company was unable to meet the deposit requirements of the Jewel Real Estate 10-86 Master LLLP related party contract, and so in November 2013 the deposit requirements were amended to require a cash deposit of $1,000 to hold the purchase option open for the Company until a bond offering is acquired. Future plans are to issue in excess of 10,000,000 shares of common stock to aid funding the land purchase. As of January 31, 2016, the $1,000 deposit requirement outlined above, has been deposited on this contract.

On August 8, 2016, the Company entered into a material definitive agreement for construction (“Construction Agreement”) with Port De Claudius, Inc. (“PDC”). Pursuant to the Construction Agreement, the Company shall engage one or more firm to perform all tasks and actions required to develop and construct the Port Trajan Pennsylvania commercial properties (the “Project”). Furthermore, to secure the first and future phases of the financing applicable to the design, planning, engineering, and related soft and hard costs of the construction of the Project. Pursuant to the Construction Agreement, the specifications, designs, construction standards, subcontractor agreements, insurance requirements, hiring and employment policies and similar items shall be developed by the Company, subject to approval by PDC. The Company shall assure that the Project is constructed according to specifications and requirements imposed by the Pennsylvania Department of Transportation (PADOT) and the Federal Highway Administration. The Company shall supervise all phases of the construction of the Project, and it shall be responsible to the PDC for all acts or omissions of its employees, subcontractors, agents, consultants and other parties under its control. The Company shall be responsible for assuring that the construction of the Project is performed in a good and workmanlike manner, and in accordance with the highest standards of care for the industry.

On September 11, 2016, the Company consolidated all memorandums of understanding, letters of intent, and agreements into one agreement called the “sales agreement”. As a result of the September 11, 2016 consolidation, an agreement for the assignment of assets took place.

For Phase One (the “Sale Agreement”) with Jewel's Real Estate 10-86 Master LLLP (the “Seller”), Global Infrastructure Finance & Development Authority, Inc., division of Hi Speed Rail Facilities Inc. (the “Financier”), PDC, and HSRF Statutory Trust as Trustee (the "Trustee"), as dictated by the Construction Agreement, the Sale Agreement that was thereafter amended on September 13, 2016, an amendment was signed for the closing date of the transaction to October 14, 2016. Pursuant to the “Sale Agreement”, Jewel's Real Estate 10-86 Master LLLP (the “Seller/Assignor”) to the Company (Assignee) assigned together all rights, title and interest in and to any contractual agreements to Port De Claudius, Inc. (PDC) on completion of Phase One.

The Project consists of two phases, Phase One consists of land purchase and onsite /offsite improvement. A dry closing with no funds being disbursed was originally scheduled for September 21, 2016. The dry closing was later changed by amendment to October 14, 2016, and the closing took place on that date. Phase Two is to take place on or before December 1, 2018 and consists of vertical construction of buildings and apparatuses.

The estimated cost for both Phases is Two Billion Dollars ($2,000,000,000) at cost plus forty percent (40%), and plus two percent (2%) for the increase in inflation regardless of the cost to the Company to perform the required services. In no event will the profit to the Company from the amount paid by PDC be less than Eight Hundred Million Dollars ($800,000,000). A mobilization fee of $2,729,514 shall be due and payable by PDC to the Company upon the closing of Bond offering for Phase One. The cost of Phase One is $950,000,000 and the net Phase One revenue to the Company shall be $66,719,514. We are identifying Port Trajan as the priority project that will provide the capital to begin investment grade studies for other current potential projects. Economic and environmental studies performed by TEMS will be paid for by profits of the Company from Port Trajan. These funded studies will then lead to officiating a bond offering through one of the related non-profits on behalf of one of the related entities in the Company’s role as consultant, awarding the work to a one or more of the largest construction and construction management firms. There are currently no contractual agreements with any of these firms. However, agreements could be put in depending upon the firm’s years of experience, work force, and proven

15

processes and systems. It is our opinion that large construction and construction management firms will welcome the opportunity to be awarded these projects.

The changing character of marine transportation means that with the opening of the Panama Canal, only three ports on the East Coast will be able to receive Class C, D, and E container vessels that require 50 feet of water. Baltimore is one of the three East Coast Ports that can accommodate such ships, and therefore has strong potential for developing a Trade and Transportation corridor that can provide inland distribution of containers(according to TEMS completed studies). A key part of the development of the Baltimore Trade and Transportation Corridor is the Port Trajan Project, which will be an important Inland Port for the Port of Baltimore.

Port Trajan Project

The Port Trajan project is a transportation project located in the Antrim Township, Greencastle, Pennsylvania on the Interstate 81 corridor and the railroad. The railroad, or "Crescent Corridor", is an existing 2,500 mile network of rail and terminals. An intermodal facility is an existing active rail-truck facility in this corridor and the State of Pennsylvania that provided forty six million dollars of the one hundred million dollars that developed this facility. This intermodal facility is an existing facility, and Port Trajan will be enhancing this shipping corridor by fulfilling its development objective. Port De Claudius, Inc. intends to develop 2,700 acres of land next to this corridor, which has been designated the “Port Trajan Project”. Port De Claudius, Inc. an affiliate entity, anticipates that it will construct a distribution center consisting of 5 terminals, and a rail line between the main rail tracks to the highway for the transition of shipping containers from the rail line to waiting trucks. The distribution center will provide the facility for repackaging the shipments, to be transported to the final destination by truck, by constructing over time, up to thirty million square feet of warehouse space on 2,700 acres. The 2,700 acres is part of the January 9, 2013 letter of intent with Jewel Real Estate 10-86 Master LLLP a related party. The permitting for 4.2 million square feet of warehousing to be built on part of the 2,700 acres is ready to be issued.

Port De Claudius, Inc. anticipates that such project will be completed in phases, the first of which is the purchase of an initial 345 acres at $350,000 per acre. The purchase price will include all on-site horizontal improvements, off-site improvements will be acquired at an additional $20,000,000. The land is currently owned by a related company and Port De Claudius, Inc. and has entered into a letter of intent for its purchase with the Company.

Port De Claudius, Inc. trading as Port Trajan has engaged with Inchcape Shipping Services (ISS) to manage and act as port agent at Port Trajan. Inchcape Shipping Services (ISS) is a global operation that directs traffic from sea and air cargo to and from the ports. They have been in business since 1875.

As part of the development of the Port of Baltimore Trade and Transportation Corridor, the development of inland ports such as Port Trajan is critical. However, since the Harrisburg-Hagerstown corridor is already a major logistics center for the Northeast USA, the development of Port Trajan can begin immediately and even before the Baltimore Trade and Transport Corridor is developed.

A Master Trust Indenture through Global Infrastructure Finance & Development Authority, Inc., with the cooperation of HSRF Statutory Trust, as trustee relating to Port De Claudius, Inc., trading as Port Trajan of Pa., can offer to raise $8,000,000,000 billion of revenue bonds. The Company plans to act as Consultant awarding the general contractor scope of work to an existing, well established firm as the horizontal and vertical site improvements general contractor for Port De Claudius, Inc.

The Company intends to assist to begin bond offerings relating to the project. The Company will also work with its transportation consultant, TEMS, to complete within the ninety day period, an investment grade study that will make it possible through bond rating agencies, to officiate a bond offering for this project. To date no money has exchanged hands related to this transaction. The Company’s contractual role, after any assignments of any agreements involving the entity, is still in full force and effect, related to both the “Master Agreement For Construction” and “Consulting Agreement” described above within the “Business Plan”. To clarify for purposes of this project, Port De Claudius Inc. and Port of Ostia, Inc. are related entities for this project.

The Company will engage contractors by paying the mobilization fees to declare the contractors in the bond offering, pay for feasibility studies and investment grade studies, bond rating agency fees and also pay for the performance bond to insure the completion of the construction to protect the bond holders.

The Company will receive compensation from the bond proceeds at bond closing to reimburse the Company for its initial capital investment into the project. The Company will than realize revenue to sustain its continued growth and ability to get other projects started by using its revenue as initial capital investment while always being reimbursed from the bond proceeds that follow other projects. As discussed earlier the sources of realized revenue for the Company are as follows: Construction Management fees, Consulting Fees, and twenty five percent profit sharing from each of the related entities who are responsible for contracting by agreement. The Company will oversee the well-established firm awarded the contract while they perform all scopes of work on the related entity(s) behalf for each project they secure.

16

The Company is not in the real estate development business, it is a Super General Contractor and consultant to related and non-related parties for a fee, and partner with each related entity receiving twenty five percent profit sharing per project. In this project the Company will work for Port De Claudius, Inc., an affiliate entity, and engage some or all of the other affiliate entities to act as project overseers /managers for the project, putting out for bids and awarding local, well-established national and international firms to perform each specific scope of work on the project, ensuring it is completed on time and within budget. This also includes all of the following current potential projects.

The Company’s (current) Six Stage Process for Port Trajan:

1.Managements Final Investment Decision to take on a projectCompleted

2.Enter into Letter of Intents, Agreements, Construction Contracts Completed

3.To have the State(s) sponsor the project by legislative actions (where applicable)N/A

4.Engineer and design studies, Architectural Design, Feasibility StudiesStarted

5.Raising Capital through Bond Financing or Company stock offeringsS-1 submitted

6.Management of the physical construction as a general contractor Est. 90 days after effective S-1

Footnotes:

1)There are 4.2 million sq. ft. of warehouse space approved to date with permits available today.

Current Potential Project 2

Alabama Toll Road-Mobile Trade and Transportation Corridor (ATFI Alabama Toll Road Facility Inc.)

The Company’s current project “Port Trajan” is directly connected to our current Alabama port project “Port De Claudius, Inc.” through the Alabama Toll Road Inc. (ATFI) project, connecting to Interstate 81 in Knoxville Tennessee Interstate 81is a major shipping corridor from Tennessee to Maine, and South Central Pennsylvania (location of Port Trajan) is now operating as one of the distribution locations for the northeast. The port of Mobile and Baltimore with 50 foot water depths stand to be the ports used in making cargo movement to the northeast corridor more efficient as the size of cargo ships continue to increase. These ports have the ability to be deepened and the cost to do so will be offset by the economic impact they create, according to studies performed by TEMS.

As its first step, Alabama Toll Facilities, Inc. (ATFI) was created and obtained status as a nonprofit corporation pursuant to Section 501(c)(3) of the Internal Revenue Code. As a nonprofit corporation, ATFI is allowed to officiate bond offerings in order to finance the cost of acquisition and construction and equipping of the toll road project, Alabama Toll Road.

In 2007, the toll road project was presented to the Alabama legislature which on June 7, 2007, adopted Act no. 2007-506 entitled "Expressing Support for the Alabama Toll Road Project". This Act stated that it recognized the need to utilize other financial resources to meet the needs of that highway and other infrastructure items such as that offered by ATFI. The Act urged approval of the bonds offered by ATFI as special revenue bonds with the project eventually vesting to the state upon retirement of the bonds. The Act further supports designating ATFI as the exclusive entity for creation and development of the toll road project. ATFI has full approval by the state of Alabama to officiate the bond offering.

As a second step, on September 23, 2009, Penndel Land Company (“Penndel”), a company wholly owned by Mr. Shah Mathias, entered into an agreement with ATFI by which Penndel was appointed as the agent and representative of ATFI to perform all required tasks and actions to develop and construct the toll road. This agreement was established prior to the formation of the Company.

Thirdly, on December 1, 2010, the Company formed a wholly-owned subsidiary, Global Transportation & Infrastructure, Inc. ("GTI") in the state of Delaware to provide development and construction services for the Alabama highway project and to include securing financing for the design, planning, engineering and related costs of construction.

In December 2010, Penndel assigned its agreements with ATFI to GTI. As such the Company, through its subsidiary, GTI, has the development rights for such toll road. Under the terms of the agreement, GTI will provide development and construction services. GTI will also act as an agent and representative of ATFI who is sponsored by the state of Alabama according to House Joint Resolutions, H.J.R 459 and H.J.R. 456, to take actions necessary to secure the first and future phases of the financing applicable to the design, planning, engineering and related soft and hard costs of the construction of a toll road in the state of Alabama and related activities.

In 2010, the Company was developing this project at the time of the merger with Yellowwood. The planned toll road is designated as a 357 mile 4-lane road designed to be built from Orange Beach, Alabama to the Tennessee state line with the intent of connecting various rural sections of Alabama to Tennessee and more urban areas.

17

Alabama Indenture Agreement- On December 1, 2010, ATFI nonprofit entered into a Master Trust Indenture agreement with as HSRF Statutory trust as a Trustee, which has agreed to serve as the trustee for the bond offering of up to $7,000,000,000 of ATFI Revenue Bonds once it determines to effect such an offering. The Alabama Indenture indicates that the developer for the project will be GTI. In April 2012 the Alabama Indenture was amended to reflect a Master Indenture of $20,000,000,000. The Master Agreement provides the basic terms and conditions of any bond issuance such as use of an escrow agent, rights of bond holders, sale of bonds, etc.

The Company acquired from Penndel Land Company (majority owned by Mr. Mathias) the contract rights to a construction agreement with ATFI, a non-profit company supported by the State of Alabama to act as the exclusive entity as set forth in H.J.R 459 and H.J.R. 456, as project developer for such a toll road and on which Mr. Mathias served as one of its four directors. Mr. Shah Mathias (the Founder, Head of Mergers and Acquisitions and Business Development, and non-board member of the Company) was one of the directors of ATFI and has subsequently resigned from his position.

When the Company secures financing, ATFI will effect a bond offering to purchase the land on which the toll road is to be located. The Company has envisioned long-range ideas and plans to develop currently undeveloped areas through which the planned Alabama Toll Road will traverse. These plans through its affiliates, include the development of an airport called Sarah Jewel Mathias International Airport (KSJM), sea shipping port called Port De Claudius, Inc., air cargo port called Port of Ostia and a high-speed rail line.

The Company will build seventeen hundred miles of railroad tracks in parallel with ATFI. The Company has plans, through its affiliates, to build four tracks north and south bound, two tracks for passenger services and two tracks for freight. Volkmann Railroad Builders has been engaged by the Company to construct and built the railroad. Volkmann is a thirty five year old company that has built railroads for NASA, the mining industry, oil and gas exploration and freight carriers.

In support of H.J.R. 459 and H.J.R.456 the following ancillary projects are being planned by the Company.

1.Design built inland port called Port De Claudius, Inc.;

2.Design built airport called Sarah Jewel Mathias International Airport (KSJM);

3.Design built air cargo port called Port of Ostia;

4.Design built railroad and train stations;

5.Design built Fiber Optic Lines;

6.Design built All Utilities underground or overhead;

7.Design built Power Grids;

8.Design built Cell Phone Towers;

9.Design built Motels, Travel Plazas, Fast Food Establishments;

10.Design built Outdoor Advertisements, Signage;

11.Design built Natural Gas Pipelines & Distillate Pipelines;