Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT 23.2 - 3FORCES INC. | live_ex23z2.htm |

| EX-23.1 - EXHIBIT 23.1 - 3FORCES INC. | live_ex23z1.htm |

As filed with the Securities and Exchange Commission on April 14, 2020 Registration No. 333-236357

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Live Inc.

(Exact name of registrant as specified in its charter)

California |

| 7370 |

| 81-4128534 |

(State or other jurisdiction of incorporation or organization) |

| (Primary Standard Industrial Classification Code Number) |

| (I.R.S. Employer Identification Number) |

7702 E Doubletree Ranch Rd, Unit 300

Scottsdale, AZ 85258

Telephone 480-289-9019

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Keith Wong

Chief Executive Officer

7702 E Doubletree Ranch Rd, Unit 300

Scottsdale, AZ 85258

Telephone 480-289-9019

(Name, address, including zip code, and telephone number, including area code, of agent of service)

Copies of communications to:

Daniel H. Luciano, Esq.

242A West Valley Brook Road

Califon, New Jersey 07830

Telephone.: 908-832-5546

From time to time after the effective date of this Registration Statement

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

1

| Large accelerated filer ☐

| | | Accelerated filer ☐ | |

| Non-accelerated filer ☐ | | | Smaller reporting company ☒

| |

| (Do not check if a smaller reporting company) | | | Emerging growth company ☒ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

Title of Each Class Of Securities To Be Registered | Amount To Be Registered | Proposed Maximum Offering Price Per Share (1) | Proposed Maximum Aggregate Offering Price (1) |

Amount of Registration Fee |

Common stock, $0.0001 par value per share | 115,500 shares | $ 0.11 | $ 12,705 | $1.65 |

(1) Estimated solely for purposed of calculating the registration fee under Rule 457(a) and (o) of the Securities Act. This registration statement shall also cover any additional shares of common stock which become issuable by reason of any stock split, stock dividend, anti-dilution provisions or similar transaction effected without the receipt of consideration which results in an increase in the number of the outstanding shares of common stock of the registrant.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING, PURSUANT TO SECTION 8(a), MAY DETERMINE.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED April 14, 2020

2

115,500 SHARES

COMMON STOCK

LIVE INC.

This Prospectus is being furnished to you as a shareholder of Wonder International Education & Investment Group Corporation, an Arizona corporation (“Wonder”), in connection with the planned distribution (the “Distribution”) of 115,500 shares of Live Inc. held by Wonder to the shareholders of Wonder . Immediately following the effectiveness of this registration statement, Wonder will distribute the 115,500 shares of Live Inc. to its shareholders on a ratable basis. Immediately prior to the Distribution, Wonder owned 115,500 shares of common stock of Live Inc. Immediately after the Distribution, Wonder will own no shares of common stock of Live Inc. This registration statement only covers the Distribution and does not cover the resale of such shares by the Wonder shareholders . We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

Neither Live Inc. nor Wonder shareholders are required to vote on or take any other action in connection with the Distribution. We are not asking you for a proxy, and we request that you do not send us a proxy. Wonder shareholders will not be required to pay any consideration for the common stock they receive in the Distribution, and they will not be required to surrender or exchange any shares in either company that they may hold. We are not selling any shares of common stock and therefore will not receive any proceeds from this offering.

Currently, Mr. Keith Wong is the controlling stockholder of the Company and will continue to be the controlling stockholder post Distribution. He owns approximately 97% of the outstanding common stock at the present time and approximately the same percentage amount of the outstanding common stock following the Distribution. He will receive 77,000 shares out of the total of 115,500 shares (or 66.67% of the shares) issued in the Distribution.

There is currently no public or established market for our shares. Consequently, our shareholders will not be able to sell their shares in any organized market place and may be limited to selling their shares privately. Accordingly, an investment in our Company is an illiquid investment.

We will receive no proceeds from the Distribution.

Upon effectiveness of this Registration Statement, we will be subject to limited reporting obligations under Section 15(d) of the Exchange Act. In order for us to become a fully reporting company under Section 12(g) of the Exchange Act, we will have to file a Registration Statement on Form 8-A. If we do not become subject to Section 12 of the Exchange Act, under the referenced Section 15(d), we will not be required to comply with (i) the proxy statement requirements which means shareholders may have less notice of pending matters, and (ii) the Williams Act which requires disclosure of persons or groups that acquire 5% of a company’s publicly traded stock and also regulates tender offers. In addition, our officer, director and 10% stockholders will not be required to submit reports to the SEC on their stock ownership and stock trading activity. These reports include Form 3, 4 and 5. Therefore, as a shareholder, less information and disclosure concerning these matters will be available to you. In addition, if we fail to become a full reporting company under Section 12(g) of the Exchange Act, our periodic reporting obligations may be automatically suspended in our next fiscal year. At the present time, the Company does not intend to become a full reporting company, however it may elect to do so in the future as circumstances dictate.

This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE OUR SECURITIES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE "RISK FACTORS" BEGINNING AT PAGE 9.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

We are selling the shares without an underwriter and may not be able to sell all or any of the shares offered herein.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY

3

OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES, AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

The date of this prospectus is April 14, 2020

4

|

TABLE OF CONTENTS |

| ||

PROSPECTUS SUMMARY |

| 6 |

|

SUMMARY OF FINANCIAL DATA |

| 8 |

|

THE OFFERING |

| 17 |

|

| 17 |

| |

DIVIDEND POLICY |

| 18 |

|

MARKET FOR SECURITIES |

| 18 |

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION |

| 20 |

|

BUSINESS DESCRIPTION |

| 25 |

|

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS |

| 36 |

|

EXECUTIVE COMPENSATION |

| 40 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| 41 |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

| 42 |

|

DESCRIPTION OF CAPITAL STOCK |

| 43 |

|

SELECTED FINANCIAL DATA |

| 43 |

|

SUPPLEMENTARY FINANCIAL INFORMATION |

| 44 |

|

EXPERTS |

| 44 |

|

LEGAL MATTERS |

| 44 |

|

SHARES ELIGIBLE FOR FUTURE SALE |

| 44 |

|

WHERE YOU CAN FIND MORE INFORMATION |

| 45 |

|

|

|

|

|

5

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors” beginning on page 9, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements, before making an investment decision.

The Company

Live Inc. (“Company,” “our” or “we”) was formed on September 6, 2016 under the laws of the State of California under the name of Taluhu Inc. We changed our name to Live Inc. on October 3, 2016. We are a cloud based internet company in the business of cloud based platforms in entertainment broadcasting, job search, and discount market. We plan to operate three separate platforms and websites, a job search platform limited to the Philippines, followed by a discount market, and entertainment platforms.

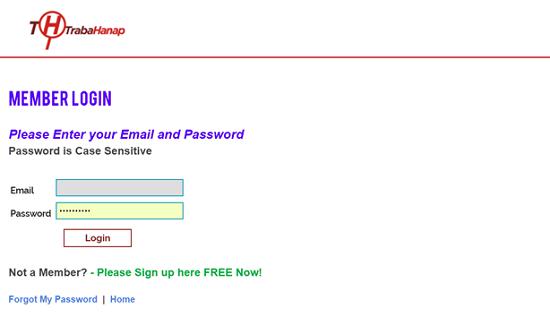

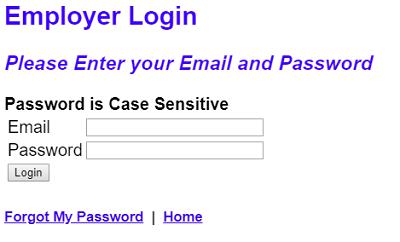

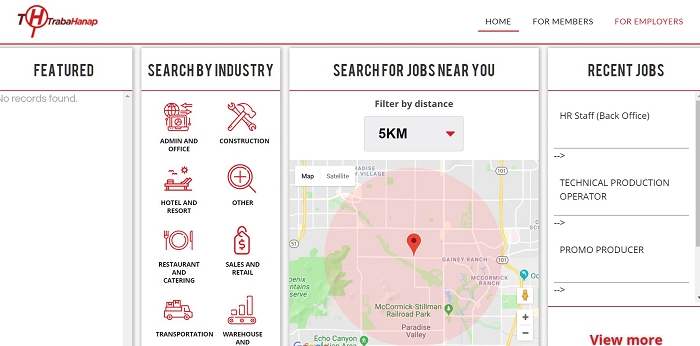

For our job platform, www.Trabahanap.com, we will bring the employers and job hunters together to hire employees and to find jobs. This platform has been developed by the Company and will be marketed by our Philippine partner, ABS-CBN, a large national TV network in the Philippines. It was launched in the Philippines during June 2019.

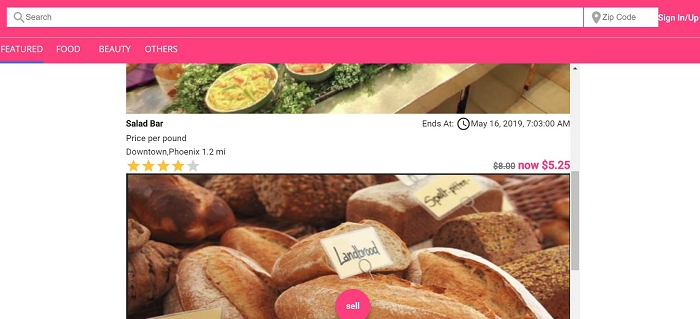

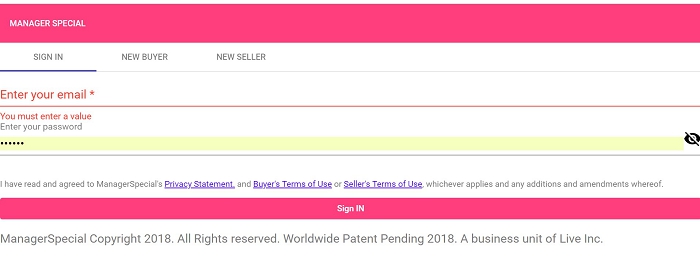

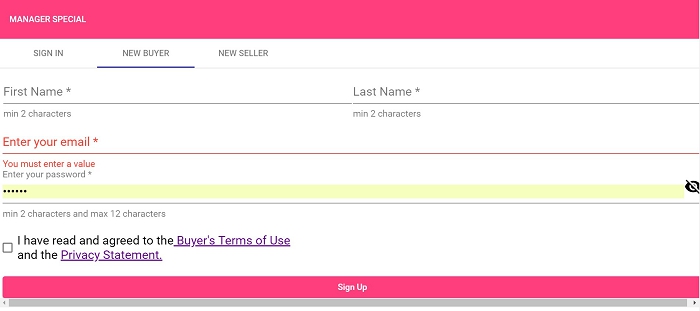

For our discount market platform, www.ManagerSpecial.com, we will provide a discount market place for the sellers and buyers to find one another for specialized products. Primarily, ManagerSpecial.com will help sellers move products and services that have a limited useful life, such as bakery goods, produce, hotel rooms, and anything thing that has a short expiration date. Sellers usually offer deep discounts to buyers to move their excess inventories. Instead of letting the inventories become worthless after a certain time, we help the sellers turn a total loss to a partial gain. We also help the buyers purchase quality products at a deep discount. We plan to launch ManagerSpecial.com in Arizona during May 2020.

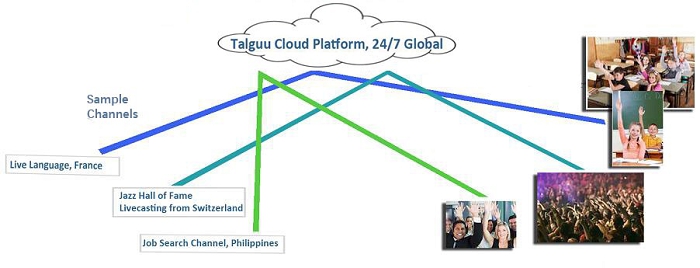

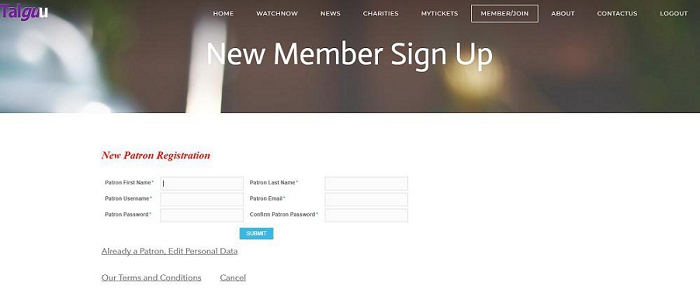

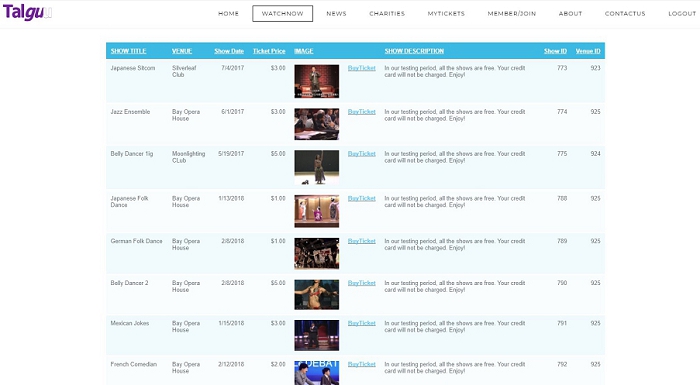

For our entertainment broadcasting platform, www.Talguu.com, each channel will deliver content circumscribed by a specific theme, such as personal health care, do-it-yourself topics, business formation and management, among others. The content will be provided by one or more providers who will produce and deliver the content on one of our channels. The content will be subscribed by individual viewers for a fee or on a gratuity basis. We will receive an agreed percentage of the fees. This platform will be launched in December 2020.

The contents of our websites, www.Talguu.com, www.Trabahanap.com, and www.ManagerSpecial.com are not included in this Registration Statement and are not part of this Prospectus.

Our offices are located at 7702 E. Doubletree Ranch Road, Unit 300, Scottsdale, Arizona 85258. Our telephone number is 480.289-9018.

We are a development stage company. For the nine months ended September 30, 2019, we have generated no revenues and had a loss from operations of $244,845 and as of September 30, 2019, we have a working capital deficit of $799,102. We will need funds from a public or private offering or loans from Mr. Wong to continue our existing operation as well as to implement our Plan of Operations (See “Management's Discussion And Analysis Or Plan Of Operation”). For these and other reasons, our independent auditors have raised substantial doubt about our ability to continue as a going concern. Accordingly, we will require additional financing, including the equity funding sought in this prospectus.

We filed a Form S-1 Registration Statement with the Securities and Exchange Commission which was declared effective on October 31, 2019. The offering (the “Public Offering”) covered by the registration statement seeks to raise a total of $2,500,000 in offering proceeds at a price per share of $3.38. We have not received any funds in connection with this offering.

The Distribution

On December 5, 2019, Wonder entered into a consulting agreement with the Company pursuant to which Wonder received 115,500 shares of common stock of the Company in exchange for certain consulting services to be performed by Wonder. As part of that agreement, the Company agreed to file this registration statement at its own expense to cover the planned distribution ( the “Distribution”) of 115,500 shares of Live Inc. held by Wonder to the shareholders of Wonder. Immediately following the effectiveness of this registration statement, Wonder will distribute the 115,500 shares of Live Inc.

6

to its shareholders on a ratable basis. Immediately prior to the Distribution, Wonder owns 115,500 shares of common stock of Live Inc. Immediately after the Distribution, Wonder will own no shares of common stock of Live Inc. This registration statement only covers the Distribution and does not cover the resale of such shares by the Wonder shareholders. Mr. Wong is the majority shareholder of Wonder and will receive 77,000 shares out of the total of 115,500 shares (or 66.67% of the shares) issued in the Distribution.

We will receive no proceeds from the Distribution.

Shares covered by the Distribution | A total of 115,500 shares (or 1.38% of our issued and outstanding shares of common stock). |

Use of Proceeds | We will not receive any funds from the Distribution. We are obligated however to pay for the costs of the registration statement. |

Recipients of Distribution | The shareholders of Wonder will receive the shares of the Distribution on a pro-rata basis. The Company will distribute our shares in book-entry form and thus we will not issue any physical stock certificates. You will not be required to make any payment for your shares in the Distribution or take any other action to receive your shares of common stock. A book-entry account statement reflecting your ownership of whole shares of our common stock will be mailed to you, or your brokerage account will be credited the shares, within 30 days of the date of the Distribution.

|

Certain US Tax Consequences | The value of the Company shares received by the Wonder shareholders is taxable as a dividend. |

Public Market | There is no public market for our common stock at this time. While we plan to find a market maker to file a Rule 211 application with the Financial Industry Regulatory Authority market (“FINRA”) in order to apply for the inclusion of our common stock in QB tier of OTC Markets, such efforts may not be successful and our shares may never be quoted and owners of our common stock may not have a market in which to sell the shares. Also, no estimate may be given as to the time that this application process will require. Even if our common stock is quoted or granted a listing, a market for the common shares may not develop. |

We qualify as an "emerging growth company" within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not "emerging growth companies" including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company.

We will continue to qualify as an emerging growth company until the earliest to occur of (1) the last day of the fiscal year during which we had total annual gross revenues of at least $1 billion (as indexed for inflation), (2) the last day of the fiscal year following the fifth anniversary of the date of our initial public offering under this prospectus, (3) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt and (4) the date on which we are deemed to be a “large accelerated filer,” as defined under the Securities Exchange Act of 1934, as amended (which we refer to as the “Exchange Act”). We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the JOBS Act, that allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

7

Under U.S. federal securities legislation, our common stock is known as a "penny stock". Penny stock is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor's account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor's account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

The following table summarizes selected historical financial data regarding our business and should be read in conjunction with our financial statements and related notes contained elsewhere in this prospectus and the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The summary balance sheet and statement of operations for the fiscal years ended December 31, 2019 and 2018 , respectively, are derived from the financial statements of Live, Inc., a California corporation, included elsewhere in this prospectus. These financials include all adjustments, consisting of normal recurring adjustments, that our management considers necessary for a fair presentation of our financial position and results of operations as of the dates and for the periods presented. The results of operations for past accounting periods are not necessarily indicative of the results to be expected for any future accounting period.

Balance Sheet

|

| December 31, 2019 |

|

| December 31, 2018 | ||

|

|

|

|

|

| ||

Cash |

| $ | 370,255 |

|

| $ | 256,407 |

Total Assets |

|

| 412,816 |

|

|

| 257,426 |

Liabilities |

|

| 1,262,201 |

|

|

| 791,189 |

Total Stockholders’ Deficit |

|

| (849,305) |

|

|

| (533,763) |

Statement of Operations

|

|

| Year Ended December 31, 2019 |

|

|

| Year Ended December 31, 2018 |

|

|

|

|

|

|

|

|

Revenues |

| $ | - |

|

| $ | 29,845 |

Net Loss |

|

| - |

|

|

| (18,954) |

|

|

|

|

|

|

|

|

8

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. Please note that throughout this prospectus, the words “we”, “our”, “us”, or “Live Inc.” refer to the Company and its subsidiaries and not to the selling stockholders.

RISKS RELATED TO OUR FINANCIAL CONDITION

THERE IS SUBSTANTIAL DOUBT ABOUT THE COMPANY’S ABILITY TO CONTINUE AS A GOING CONCERN. The report of Michael Gillespie and Associates PLLC, our former independent registered public accounting firm, with respect to our financial statements at December 31, 2018 and the report of Prager Metis CPAs, LLC our current independent registered public accounting firm, with respect to our financial statements at December 31, 2019, each contain an explanatory paragraph as to our potential inability to continue as a going concern. As a result, this may adversely affect our ability to obtain new financing on reasonable terms or at all. Investors may be investing in a company that will not have the funds necessary to continue to deploy its business strategies.

WE HAVE A LIMITED OPERATING HISTORY THAT YOU CAN USE TO EVALUATE US, AND THE LIKELIHOOD OF OUR SUCCESS MUST BE CONSIDERED IN LIGHT OF THE PROBLEMS, EXPENSES, DIFFICULTIES, COMPLICATIONS AND DELAYS FREQUENTLY ENCOUNTERED BY A SMALL DEVELOPING COMPANY. We were incorporated in California on September 6, 2016. We have limited financial resources and have not started generating revenues. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small developing company starting a new business enterprise and the highly competitive environment in which we will operate. Since we have a limited operating history, we cannot assure you that our business will be profitable or that we will ever generate sufficient revenues to meet our expenses and support our anticipated activities.

FAILURE TO RAISE ADDITIONAL CAPITAL TO FUND FUTURE OPERATIONS COULD HARM OUR BUSINESS AND RESULTS OF OPERATIONS. As reflected on our balance sheet as of December 31, 2018 contained herein, we have total current assets of $257,426 and total current liabilities of $791,189. We will require additional financing in order to maintain its corporate existence and to implement its business plans and strategy. The timing and amount of our capital requirements will depend on several factors, including our initial operational results with respect to user acceptance of our three platforms, the need for other expenditures, and competitive pressures. If additional funds are raised through the issuance of equity or convertible debt securities, the percentage ownership of our then-existing stockholders will likely be reduced significantly. We cannot make assurances that any financing will be available on terms favorable to us or at all. If adequate funds are not available on acceptable terms, our ability to fund our business strategy, ongoing operations, take advantage of unanticipated opportunities, or otherwise respond to competitive pressures could be significantly limited. Our business, financial condition and results of operations will be harmed by such limitations.

RISKS RELATED TO OUR BUSINESS

LACK OF COMMERCIAL ACCEPTABILITY. We launched our Philippines job search platform, www.Trabahanap.com, in June 2019, and we intend to launch our ManagerSpecial.com platform in May 2020, and our internet based broadcasting platform, www.Talguu.com, in December 2020. To date, for www.Talguu.com and www.Managerspecial.com, we have a limited or non-existent user base, limited content providers and limited or no indications of commercial acceptability. As of December 31, 2019, we have over 250,000 users on our Trahabanap platform. While we believe that our platforms will be commercially received, we cannot predict if our products will be a commercial success.

WE HAVE NO OPERATING HISTORY ON WHICH TO EVALUATE OUR POTENTIAL FOR FUTURE SUCCESS. Our business has had no material operations to date. Consequently, evaluating an investment in us and predicting our future results based upon our past performance is not possible, particularly with respect to our ability to develop our products and services, to generate and sustain a revenue base sufficient to cover operating expenses or to achieve profitability. We face many of the risks and uncertainties encountered by early stage companies, and our future operating results may differ from what we expect due to many factors, including: (i) slower than expected growth; (ii) the uncertain adoption by consumers of the services that we intend to provide; and (iii) potential competition from other service providers.

OUR THREE PLATFORMS COULD FAIL TO ATTRACT OR RETAIN USERS OR GENERATE REVENUE. For our job search platform, we will need to attract enough employers willing to use our platform in the Philippines and, in particular, to pay for our platform. For our ManagerSpecial platform, we need to convince enough sellers to offer their

9

discount products to our buyers and our ability to attract enough buyers. For our internet livecasting platform, our success will depend not only on our ability to attract and engage our livecasting users and to monetize these users; we also need to attract and migrate the users from ManagerSpecial to try out livecasting channels. In part, this will depend on our ability to attract independent content providers that produce content that will attract users willing to pay for such content. We may not be successful in our efforts to generate meaningful revenue from our three platforms over the long term. If we fail to engage users, marketers, or employers, or if we are unsuccessful in our monetization efforts, we may fail to attract or retain users or to generate enough revenue, operating margin, or other value to justify our investments, and our business may fail.

WE HAVE RESTATED OUR FINANCIAL STATEMENTS FOR THE DECEMBER 31, 2017 YEAR END PERIOD. Our December 31, 2017 audited financial statements were restated to correct the accounting for the forgiveness of accrued compensation (See Note 6-RESTATEMENT to our audited financial statements for the annual periods ended December 31, 2017 and 2018 herein). The restatement could impair our reputation or could cause a loss of confidence by shareholders or potential investors, including prospective investors to our Public Offering. This event potentially could have a material adverse effect on our business, financial condition, results of operations and future stock price.

OUR COMPANY CANNOT PREDICT IF IT CAN ACHIEVE PROFITABLE OPERATIONS. The Company has only had limited operations to date and requires significant additional financing to reach its projected milestones, which includes further product development relating to the launch of our internet broadcasting platform, product marketing to attract users and general overhead expenditures. While the Company considers its business to be highly prospective, nonetheless it may be difficult for the Company to attract funding necessary to reach its projected milestones. Moreover, even if it achieves its projected milestones, the Company cannot predict whether it will reach profitable operations.

OUR BUSINESS IS HIGHLY COMPETITIVE. COMPETITION PRESENTS AN ONGOING THREAT TO THE SUCCESS OF OUR BUSINESS. We face significant competition in every aspect of our business, including from companies that provide job search or placement capabilities, web based content similar to what we plan on offering and websites offering discount products and services. We compete with companies that offer full-featured products that replicate the range of content and related capabilities we provide. We also compete with companies that develop applications, particularly mobile applications, that provide social or other communications functionality, such as messaging, photo- and video-sharing, and micro-blogging, and companies that provide web- and mobile-based information and entertainment products and services that are designed to engage users and capture time spent online and on mobile devices. In addition, we face competition from traditional, online, and mobile businesses that provide media for marketers to reach their audiences and/or develop tools and systems for managing and optimizing advertising campaigns.

Most, if not all, of our current and potential competitors may have significantly greater resources or better competitive positions in certain product segments, geographic regions or user demographics than we do. These factors may allow our competitors to respond more effectively than us to new or emerging technologies and changes in market conditions.

Our competitors may develop products, features, or services that are like ours or that achieve greater acceptance, may undertake more far-reaching and successful product development efforts or marketing campaigns, or may adopt more aggressive pricing policies. Certain competitors could use strong or dominant positions in one or more markets to gain competitive advantage against us in our target market or markets. As a result, our competitors may acquire and engage users or generate revenue at the expense of our own efforts, which may negatively affect our business and financial results.

We believe that our ability to compete effectively depends upon many factors both within and beyond our control, including:

● | the popularity, usefulness, ease of use, performance, and reliability of our products and content compared to our competitors' products; |

● | the size and composition of our user base; |

● | the engagement of our users with our products and competing products; |

● | the timing and market acceptance of products, including developments and enhancements to our or our competitors' products; |

● | our ability to monetize our products; |

● | our customer service and support efforts; |

10

● | acquisitions or consolidation within our industry, which may result in more formidable competitors; |

● | our ability to cost-effectively manage and grow our operations; |

● | our reputation and brand strength relative to those of our competitors; and |

● | our management’s ability to manage a start-up enterprise. |

OUR COSTS ARE CONTINUING TO GROW, WHICH COULD HARM OUR BUSINESS AND PROFITABILITY. Operating our business will be costly and we expect our expenses to continue to increase in the future as we expand our broadcast channels and the broadcast hours per channel. We expect to continue to use cloud based servers, recruit users and content producers and employ other efforts to operate and expand our business around the world, including in countries and/or projects where we may not have a clear path to monetization. In addition, we intend to increase marketing, sales, and other operating expenses to grow our operations and to remain competitive. Increases in our costs may adversely affect our business and profitability. Our expenses are expected to grow faster than our revenue in the near term and may be greater than we anticipate, and our investments may not be successful.

WE DEPEND ON OUR TWO OFFICERS AND THE LOSS OF THEIR SERVICES WOULD FORCE US TO EXPEND TIME AND RESOURCES IN PURSUIT OF REPLACEMENTS WHICH COULD ADVERSELY AFFECT OUR BUSINESS. We consider our two officers to be essential to the success of the business. Currently, they are subject to written consulting agreements which allows them to terminate their agreement at any time. One of our officers are only working part time. Although they have not indicated any intention of leaving the Company, the loss of either officer, in particular Mr. Wong, could have a negative impact on our ability to fulfill our business plan and achieve profitable operations.

WE MAY INCUR SIGNIFICANT COSTS TO BE A PUBLIC COMPANY TO ENSURE COMPLIANCE WITH U.S. CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS AND WE MAY NOT BE ABLE TO ABSORB SUCH COSTS. We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect these costs to approximate at between $18,000 to $50,000 per year, consisting of legal, accounting, EDGAR conversion and transfer agent fees. We expect all these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We may not be able to cover these costs from our operations and may need to raise or borrow additional funds. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations.

OUR OFFICERS AND DIRECTORS BENEFICIALLY OWN A SIGNIFICANT AMOUNT OF THE OUTSTANDING COMMON STOCK AS OF THE DATE OF THIS FILING AND COULD TAKE ACTIONS DETRIMENTAL TO YOUR INVESTMENT FOR WHICH YOU WOULD HAVE NO REMEDY. Our officers and directors beneficially own approximately 97% of the outstanding common stock as of the date of this filing. They will continue to have the ability to substantially influence the management, policies, and business operations. In addition, the rights of the holders of our common stock will be subject to, and may be adversely affected by, the rights of holders of any preferred stock that may be issued in the future. Because of the shareholdings of the officers and directors as well as their management control, such officer and director may cause the company to engage in business combinations without seeking shareholder approval.

OUR OFFICERS AND DIRECTORS INTEND TO DEVOTE A SUFFICIENT AMOUNT OF TIME TO OUR BUSINESS. HOWEVER, WE MAY HAVE CONFLICTS OF INTERESTS IN ALLOCATING HIS TIME BETWEEN OUR COMPANY AND THOSE OF OTHER BUSINESSES AND DETERMINING TO WHICH ENTITY A PARTICULAR BUSINESS OPPORTUNITY SHOULD BE PRESENTED WHICH MAY NOT BE SUFFICIENT TO SUCCESSFULLY DEVELOP OUR BUSINESS. Our officers and directors have business interests apart from the Company. While we do not face direct competition with respect to their current business interests, we do face competition in the amount of time that each officer intends to devote to our business. Currently, they each devote a sufficient

11

amount of time to the affairs of the Company. However, the amount of time which they may actually devote to our business may not be sufficient to fully develop our business.

WE COULD EXPERIENCE UNFORESEEN DIFFICULTIES IN BUILDING AND OPERATING KEY PORTIONS OF OUR TECHNICAL INFRASTRUCTURE. We have designed and built our own application programs and key portions of our platforms through which we provide our services, and we plan to continue to significantly expand the size of our infrastructure primarily through cloud servers and software development. The infrastructure expansion we are undertaking is complex, and unanticipated delays in the completion of these projects or availability of components may lead to increased project costs, operational inefficiencies, or interruptions in the delivery or degradation of the quality of our products. In addition, there may be issues related to this infrastructure that are not identified during the testing phases of design and implementation, which may only become evident after we have started to fully utilize the underlying equipment, that could further degrade the user experience or increase our costs.

OUR PRODUCTS AND INTERNAL SYSTEMS RELY ON SOFTWARE THAT IS HIGHLY TECHNICAL, AND IF IT CONTAINS UNDETECTED ERRORS, OUR BUSINESS COULD BE ADVERSELY AFFECTED. Our services and internal systems rely on software, including software developed or maintained internally and/or by third parties that is highly technical and complex. In addition, our products and internal systems depend on the ability of such software to store, retrieve, process, and manage immense amounts of data. The software on which we rely has contained, and may now or in the future contain, undetected errors, bugs, or vulnerabilities. Some errors may only be discovered after the code has been released for external or internal use. Errors or other design defects within the software on which we rely may result in a negative experience for users and marketers who use our products, delay product introductions or enhancements, result in measurement or billing errors, or compromise our ability to protect the data of our users and/or our intellectual property. Any errors, bugs, or defects discovered in the software on which we rely could result in damage to our reputation, loss of users, loss of revenue, or liability for damages, any of which could adversely affect our business and financial results.

In addition, our software and cloud based software, our cloud hosting companies, our data centers, our hardware and our own inhouse staff or contractors may cause or be subject to, unfriendly intrusions, sabotages, or viruses to our systems. Any of these events can result in minor or major harms to our Company. We have instituted passwords and hierarchical access protocols to safe guard our digital assets. There is no guarantee these measures would always succeed.

POTENTIAL DATA BREACHES. If we are successful, our services will generate and process a large quantity of personal data of user, including credit card and other financial information. We face risks inherent in handling large volumes of data and in protecting the security of such data. In particular, we face a number of challenges relating to the user data, including:

| • | protecting the data in and hosted on our system, including against hacking on our system by outside parties or our employees; |

| • | addressing concerns related to privacy and sharing, safety, security and others; |

| • | complying with applicable laws, rules and regulations relating to the collection, use, disclosure of personal information, including any requests from regulatory and government authorities relating to such data; |

| • | Any systems failure, whether or not caused by us, or security breach or lapse that results in the release of user data could harm our reputation and brand and, consequently, our business, in addition to exposing us to potential legal liability. |

As we expand our operations, we may be subject to these laws in other jurisdictions where our customers and other participants are located. The laws, rules and regulations of other jurisdictions may impose more stringent or conflicting requirements and penalties than those in the United States and Philippines, compliance with which could require significant resources and costs. Our privacy policies and practices concerning the collection, use and disclosure of user data will be posted on our websites. Any failure, or perceived failure, by us to comply with our posted privacy policies or with any regulatory requirements or privacy protection-related laws, rules and regulations could result in proceedings or actions against us by authorities or others. These proceedings or actions may subject us to significant penalties and negative publicity, require us to change our business practices, increase our costs and severely disrupt our business. In addition, we may be subject to litigation resulting from any data breaches, which likewise will severely disrupt our business.

PROBLEMS WITH CONTENT DELIVERY SERVICES, BANDWIDTH PROVIDERS, DATA CENTERS OR OTHER THIRD PARTIES COULD HARM OUR BUSINESS, FINANCIAL CONDITION OR RESULTS OF OPERATIONS. Our business relies significantly on third-party vendors, such as data centers, content delivery services and bandwidth providers. If any third-party vendor fails to provide their services or if their services are no longer available to us

12

for any reason and we are not immediately able to find replacement providers, our business, financial conditions or results of operations could be materially adversely affected.

Additionally, any disruption in network access or related services provided by these third-party providers or any failure of these third-party providers to handle current or higher volumes of use could significantly harm our business operations. If our service is disrupted, we may lose revenues due to our inability to provide services to our franchised learning centers and we may be obligated to compensate these franchisees for their loss. Our reputation also may suffer in the event of a disruption. Any financial or other difficulties our providers face may negatively impact our business and we are unable to predict the nature and extent of any such impact. We exercise very little control over these third-party vendors, which increases our vulnerability to problems with the services they provide. Any errors, failures, interruptions or delays experienced in connection with these third-party technologies and information services could negatively impact our relationships with our franchisees and materially adversely affect our brand reputation and our business, financial condition or results of operations and expose us to liabilities to third parties.

WE EXPECT OUR QUARTERLY RESULTS TO FLUCTUATE WHICH MAY ADVERSELY AFFECT OUR STOCK PRICE. We expect that our quarterly results will fluctuate significantly. We believe that period-to-period comparisons of our operating results are not meaningful. Additionally, if our operating results in one or more quarters do not meet securities analysts' or your expectations, the price of our common stock could decrease.

IF OUR COSTS AND EXPENSES ARE GREATER THAN ANTICIPATED AND WE ARE UNABLE TO RAISE ADDITIONAL WORKING CAPITAL, WE MAY BE UNABLE TO FULLY FUND OUR OPERATIONS AND TO OTHERWISE EXECUTE OUR BUSINESS PLAN. Our currently available working capital will be sufficient to continue our existing operations through June 2020. Should our costs and expenses prove to be greater than we currently anticipate, or should we change our current business plan in a manner that will increase or accelerate our anticipated costs and expenses, the depletion of our working capital would be accelerated. To the extent it becomes necessary to raise additional cash in the future as our current cash and working capital resources are depleted, we will seek to raise it through the public or private sale of debt or equity securities (including funds from our Public Offering), funding from joint-venture or strategic partners, debt financing or short-term loans, or a combination of the foregoing. We may also seek to satisfy indebtedness without any cash outlay through the private issuance of debt or equity securities. We currently do not have any binding commitments for, or readily available sources of, additional financing. We cannot give you any assurance that we will be able to secure the additional cash or working capital we may require to continue our operations.

IF WE REQUIRE ADDITIONAL CAPITAL AND EVEN IF WE ARE ABLE TO RAISE ADDITIONAL FINANCING, WE MIGHT NOT BE ABLE TO OBTAIN IT ON TERMS THAT ARE NOT UNDULY EXPENSIVE OR BURDENSOME TO THE COMPANY OR DISADVANTAGEOUS TO OUR EXISTING SHAREHOLDERS. If we require additional capital and even if we are able to raise additional cash or working capital through the public or private sale of debt or equity securities, funding from joint-venture or strategic partners, debt financing or short-term loans, or the satisfaction of indebtedness without any cash outlay through the private issuance of debt or equity securities, the terms of such transactions may be unduly expensive or burdensome to the Company or disadvantageous to our existing shareholders. For example, we may be forced to sell or issue our securities at significant discounts to market, or pursuant to onerous terms and conditions, including the issuance of preferred stock with disadvantageous dividend, voting or veto, board membership, conversion, redemption or liquidation provisions; the issuance of convertible debt with disadvantageous interest rates and conversion features; the issuance of warrants with cashless exercise features; the issuance of securities with anti-dilution provisions; and the grant of registration rights with significant penalties for the failure to quickly register. If we raise debt financing, we may be required to secure the financing with all of our business assets, which could be sold or retained by the creditor should we default in our payment obligations.

OUR SUCCESS IS DEPENDENT ON OUR ABILITY TO RETAIN AND ATTRACT KEY PERSONNEL.

Many of our management personnel have worked for us for less than one year. Our efficiency may be limited while these employees and future employees are being integrated into our operations. In addition, we may be unable to find and hire additional qualified management and professional personnel to help lead us.

Our expenses will increase as we build an infrastructure to implement our business model. For example, we expect to hire additional employees, expand information technology systems and lease more space for our corporate offices to the extent we have capital available. Due to our current limited capital, we initially intend to offer independent contractor arrangements. If any of these and other expenses are not accompanied by increased revenue, our operating losses will be greater than we anticipate.

13

A SIGNIFICANT OR PROLONGED ECONOMIC DOWNTURN WOULD HAVE A MATERIAL ADVERSE EFFECT ON OUR RESULTS OF OPERATIONS. Our results of operations are affected by general economic conditions and the level of economic activity in the industries and markets that we serve. On an aggregate basis, our users may be less likely to purchase our software solutions and programs during economic downturns and periods of economic uncertainty. To the extent our users delay or reduce purchasing our services, our results of operations will be adversely affected. A continued economic downturn or period of economic uncertainty and a decline in the level of purchases of our users would have a material adverse effect on our business, financial condition and results of operations.

AN OCCURRENCE OF AN UNCONTROLLABLE EVENT SUCH AS THE COVID-19 PANDEMIC MAY NEGATIVELY AFFECT OUR OPERATIONS. The occurrence of an uncontrollable event such as the COVID-19 pandemic may negatively affect our operations. A pandemic typically results in social distancing, travel bans and quarantine, and this may limit access to our facilities, customers, management, support staff and professional advisors. These factors, in turn, may not only impact our operations, financial condition and demand for our products, but our overall ability to react timely to mitigate the impact of this event. Also, it may hamper our efforts to comply with our filing obligations with the Securities and Exchange Commission.

RISKS RELATED TO OUR COMMON STOCK

THE RECEIPT OF OUR COMMON STOCK IN THIS OFFERING WILL RESULT IN A TAXABLE EVENT TO YOU. As stated herein, the distribution of the common stock to you will result in a taxable event to you and you will not have any income from this event to offset such taxable obligation.

YOU MAY NOT BE ABLE TO LIQUIDATE YOUR INVESTMENT SINCE THERE IS NO ASSURANCE THAT A PUBLIC MARKET WILL DEVELOP FOR OUR COMMON STOCK OR THAT OUR COMMON STOCK WILL EVER BE APPROVED FOR TRADING ON A RECOGNIZED EXCHANGE. There is no established public trading market for our securities. Although we intend to be quoted on the OTC-QB tier of OTC Markets in the future, our shares are not and have not been quoted on any exchange or quotation system. We cannot assure you that a market maker will agree to file the necessary documents with the FINRA, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate its investment, which will result in the loss of your investment.

SHOULD OUR STOCK BECOME QUOTED ON THE OTC BULLETIN BOARD, IF WE FAIL TO REMAIN CURRENT ON OUR REPORTING REQUIREMENTS, WE COULD BE REMOVED FROM THE OTC BULLETIN BOARD WHICH WOULD LIMIT THE ABILITY OF BROKER-DEALERS TO SELL OUR SECURITIES AND THE ABILITY OF STOCKHOLDERS TO SELL THEIR SECURITIES IN THE SECONDARY MARKET. Companies quoted on the OTC-QB tier of OTC Markets, such as we are seeking to become, must be reporting issuers under Section 12 of the Securities Exchange Act of 1934, as amended, and must be current in their reports under Section 13, in order to maintain price quotation privileges on the OTC-QB. If we fail to remain current on our reporting requirements, we could be removed from the OTC-QB tier. As a result, the market liquidity for our securities could be severely adversely affected by limiting the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market. In addition, we may be unable to get re-quoted on the OTC-QB tier, which may have an adverse material effect on our Company.

ONCE PUBLICLY TRADING, THE APPLICATION OF THE “PENNY STOCK” RULES COULD ADVERSELY AFFECT THE MARKET PRICE OF OUR COMMON SHARES AND INCREASE YOUR TRANSACTION COSTS TO SELL THOSE SHARES. The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

• | that a broker or dealer approve a person’s account for transactions in penny stocks; and |

• | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

• | obtain financial information and investment experience objectives of the person; and |

14

• | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

• | sets forth the basis on which the broker or dealer made the suitability determination; and |

• | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

WE DO NOT EXPECT TO PAY DIVIDENDS IN THE FUTURE; ANY RETURN ON INVESTMENT MAY BE LIMITED TO THE VALUE OF OUR COMMON STOCK. We do not currently anticipate paying cash dividends in the foreseeable future. The payment of dividends on our Common Stock will depend on earnings, financial condition and other business and economic factors affecting it at such time as the board of directors may consider relevant. Our current intention is to apply net earnings, if any, in the foreseeable future to increasing our capital base and development and marketing efforts. There can be no assurance that the Company will ever have sufficient earnings to declare and pay dividends to the holders of our Common Stock, and in any event, a decision to declare and pay dividends is at the sole discretion of our Board of Directors. If we do not pay dividends, our Common Stock may be less valuable because a return on your investment will only occur if its stock price appreciates.

OUR COMMON STOCK PRICE IS LIKELY TO BE HIGHLY VOLATILE WHICH MAY SUBJECT US TO SECURITIES LITIGATION THEREBY DIVERTING OUR RESOURCES WHICH MAY AFFECT OUR PROFITABILITY AND RESULTS OF OPERATION. The market price for our common stock is likely to be highly volatile as the stock market in general and the market for Internet-related stocks.

The following factors will add to our common stock price’s volatility:

• | actual or anticipated variations in our quarterly operating results; |

• | announcements by us of acquisitions; |

• | additions or departures of our key personnel; and. |

• | sales of our common stock |

Many of these factors are beyond our control. These factors may decrease the market price of our common stock, regardless of our operating performance. In the past, plaintiffs have initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may in the future be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

UPON EFFECTIVENESS OF THIS REGISTRATION STATEMENT, WE WILL NOT BE A FULLY REPORTING COMPANY UNDER SECTION 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934, RATHER WE WILL BE SUBJECT TO THE REPORTING REQUIREMENTS OF SECTION 15(D) OF THE EXCHANGE ACT WHICH IS LESS RESTRICTIVE ON US AND OUR INSIDERS. In order for us to become a fully reporting company under Section 12(g) of the Exchange Act, we will have to file a Registration Statement on Form 8-A. If we do not become subject to Section 12 of the Exchange Act, we will be subject to Section 15(d) of the Exchange Act, and as such we will not be required to comply with (i) the proxy statement requirements which means shareholders may have less notice of pending matters, and

15

(ii) the Williams Act which requires disclosure of persons or groups that acquire 5% of a company’s publicly traded stock and also regulates tender offers. In addition, our officer, director and 10% stockholder will not be required to submit reports to the SEC on their stock ownership and stock trading activity. These reports include Form 3, 4 and 5. Therefore, as a shareholder, less information and disclosure concerning these matters will be available to you. In addition, if we fail to become a full reporting company under Section 12(g) of the Exchange Act, our periodic reporting obligations may be automatically suspended in our next fiscal year.

REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO EMERGING GROWTH COMPANIES MAY MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS. We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

• have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

• comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

• submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and

• disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We will remain an emerging growth company for up to five full fiscal years, although if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any January 31 before that time, we would cease to be an emerging growth company as of the following December 31, or if our annual revenues exceed $1 billion, we would cease to be an emerging growth company the following fiscal year, or if we issue more than $1 billion in non-convertible debt in a three-year period, we would cease to be an emerging growth company immediately.

Notwithstanding the above, we are also currently a “smaller reporting company,” meaning that we are not an investment company, an asset-backed issuer, nor a majority-owned subsidiary of a parent company that is not a smaller reporting company, and has a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. If we are still considered a “smaller reporting company” at such time as we cease to be an “emerging growth company,” we will be subject to increased disclosure requirements. However, the disclosure requirements will still be less than they would be if we were not considered either an “emerging growth company” or a “smaller reporting company.” Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; are not required to conduct say-on-pay and frequency votes until annual meetings occurring on or after January 21, 2015; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports. Decreased disclosures in its SEC filings due to its status as an “emerging growth company” or “smaller reporting company” may make us less attractive to investors given that it will be harder for investors to analyze the Company’s results of operations and financial prospects and, as a result, it may be difficult for us to raise additional capital as and when we need it.

IN THE FUTURE, WE MAY ISSUE ADDITIONAL COMMON AND PREFERRED SHARES, WHICH WOULD REDUCE INVESTORS’ PERCENT OF OWNERSHIP AND MAY DILUTE OUR SHARE VALUE. Our Articles of Incorporation authorize the issuance of 10,000,000,000 shares of common stock. As of the date of this prospectus, the Company had 7,515,500 shares of common stock issued and outstanding. Accordingly, we may issue up to an additional 9,992,484,500 shares of common stock without shareholder approval. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

16

Background on Distribution.

On December 5, 2019 , the Company entered into a consulting agreement with the Wonder International Education & Investment Group Corporation, an Arizona corporation (“Wonder”) pursuant to which Wonder received 115,500 shares of common stock of the Company in exchange for certain consulting services to be performed by Wonder. The agreement extends until December 4, 2020. Under the Agreement, Wonder is obligated to use its best efforts to find business partners in South East Asia for the Company. In fulfillment of its obligations under the agreement, Wonder currently is in discussions with a potential business partner in South East Asia relating to the Company’s job search platform.

In addition , as part of that agreement, the Company agreed to file this registration statement at its own expense. Upon effectiveness of this registration statement, the 115,500 shares of common stock presently held by Wonder will be distributed to its shareholders on a ratable basis (“Distribution”). Mr. Wong is the sole officer and director and the majority shareholder of Wonder, owning 66.67% of the outstanding Wonder common stock. Consequently, he will receive 77,000 shares out of the total of 115,500 shares (or 66.67% of the shares) issued in the Distribution.

The Company entered into the consulting agreement and agreed to the Distribution, in part, to expand its shareholder base for a future listing on OTC Markets Pink Sheet or QB platforms. At the present time, the Company has 10 shareholders of record. Immediately following the Distribution (upon the effectiveness of this registration statement), the Company will have in excess of 300 shareholders of record.

Reasons for Furnishing this Prospectus.

We are furnishing this Prospectus solely to provide information on our company to the Wonder shareholders who will receive shares of our common stock in the Distribution. You should not construe this Prospectus as an inducement or encouragement to buy, hold or sell any of our securities.

Important Federal Income Tax Consequences

The shares received by the Wonder shareholders are taxable as a dividend. We do not have any ruling from the U.S. Internal Revenue Service, nor do we have a favorable opinion by our accounting firm or any other expert confirming the Distribution’s tax status, nor do we plan to obtain one. Wonder shareholders should consult with their own tax advisor as to the particular consequences of the Distribution to them.

Results of the Distribution

Upon effectiveness of this registration statement, you will be furnished a copy of this prospectus along with a book entry evidencing the number of shares of our common stock you received in the Distribution.

We will receive no proceeds from the Distribution. Please refer to the sections of this prospectus entitled "Risk Factors" before making an investment in the common stock of the Company.

PLAN OF DISTRIBUTION

There is no public market for our common stock. Our common stock is currently held by nine shareholders. Therefore, the current and potential market for our common stock is limited and the liquidity of our shares may be severely limited. No market maker has agreed to file an application with FINRA. There can be no assurance as to whether a market maker will file an application with FINRA or such market maker’s application will be accepted by FINRA nor can we estimate the time period that will be required for the application process. In the absence of quotation or listing, no market is available for investors in our common stock to sell their shares. We cannot provide any assurance that a meaningful trading market will ever develop or that our common stock will ever be quoted or listed for trading.

If the shares of our common stock ever become tradable, the trading price of our common stock could be subject to wide fluctuations in response to various events or factors, many of which are beyond our control. As a result, investors may be unable to sell their shares at or greater than the price at which they are being offered.

Distribution Shares

17

This Prospectus covers the distribution of 115,500 shares of our common stock owned by Wonder to its shareholders (“Distribution Shares”). The mechanics of the Distribution will be performed by the Company or our transfer agent, Action Stock Transfer.

The Distribution Shares when received by each Wonder shareholder will be “restricted securities” as that term is defined under Rule 144 promulgated under the Securities Act of 1933, as amended (“Securities Act”). The Distribution Shares will be tradable in accordance with exemptions from registration under the Securities Act, except that any shares acquired by our affiliates, as that term is defined in Rule 144 under the Securities Act, may only be sold in compliance with the limitations described below. After giving effect to the Distribution, Mr. Keith Wong will hold a total of approximately 8,156,692 shares, or approximately 97% of the common stock outstanding as of the date of this Prospectus. Sale limitations under Rule 144 for affiliates include the requirement for current public information about the Company; selling the shares pursuant to broker transactions; and limitations on the number of shares sold within a three-month period. Restricted shares may be sold in the public market only if registered or if they qualify for an exemption from registration promulgated under the Securities Act. Subject to the provisions of Rule 144, all of the outstanding shares of common stock that are currently restricted will be available for sale in the public market over the next six months under Rule 144.

In general, under Rule 144 as currently in effect, a person, or group of persons whose shares are required to be aggregated, who is deemed to have been an affiliate at any time during the three months preceding a sale, who has beneficially owned shares that are restricted securities as defined in Rule 144 for at least six months is entitled to sell, within any three-month period commencing 90 days after the date of this Prospectus, a number of shares that does not exceed 1% of the then outstanding shares of our common stock, which will be approximately 83,920 shares.

In addition, a person who is not deemed to have been one of our affiliates at any time during the 90 days preceding a sale and who has beneficially owned shares of our common stock for at least six months, including the holding period of any prior owner, except if the prior owner was one of our affiliates, would be entitled to sell all of their shares, provided the availability of current public information about our company. To the extent that shares were acquired from one of our affiliates, a person's holding period for the purpose of effecting a sale under Rule 144 would commence on the date the shares were acquired from the affiliate.

We have never paid cash or any other form of dividend on our common stock, and we do not anticipate paying cash dividends in the foreseeable future. Moreover, any future credit facilities might contain restrictions on our ability to declare and pay dividends on our common stock. We plan to retain all earnings, if any, for the foreseeable future for use in the operation of our business and to fund the pursuit of future growth. Future dividends, if any, will depend on, among other things, our results of operations, capital requirements and on such other factors as our board of directors, in its discretion, may consider relevant.

There is no established public market for our common stock, and a public market may never develop. No market maker has agreed to file an application with FINRA. There can be no assurance as to whether such a market maker will agree to file an application or the market maker’s application will be accepted by FINRA nor can we estimate the time period that will be required for the application process. Even if our common stock were quoted in a market, there may never be substantial activity in such market. If there is substantial activity, such activity may not be maintained, and no prediction can be made as to what prices may prevail in such market.

If we become able to have our shares of common stock quoted on the OTC-QB tier of OTC Markets, we will then try, through a broker-dealer and its’ clearing firm, to become eligible with the DTC to permit our shares to be traded electronically. If an issuer is not “DTC-eligible,” its shares cannot be electronically transferred between brokerage accounts, which, based on the realities of the marketplace as it exists today (especially OTC Markets), means that shares of a issuer will not be able to be traded (technically the shares can be traded manually between accounts, but this may take days and is not a realistic option for issuers relying on broker-dealers for stock transactions - like all the companies on the OTC Markets). What this means is that while DTC-eligibility is not a requirement to trade on the OTC Markets, it is however a necessity to efficiently process trades on the OTC Markets if a company’s stock is going to trade with any volume. There are no assurances that our shares will ever become DTC-eligible or, if they do, how long it may take.

18

We do not have common stock or equity subject to outstanding options or warrants to purchase or securities convertible into our common stock or equity. In general, under Rule 144, a holder of restricted common shares who is an affiliate at the time of the sale or any time during the three months preceding the sale can resell shares, subject to the restrictions described below.

If we become a public reporting company under the Exchange Act for at least 90 days immediately before the sale, then at least six months must have elapsed since those shares were acquired from us or an affiliate, and we must remain current in our filings for an additional period of six months; in all other cases, at least one year must have elapsed since the shares were acquired from us or an affiliate before they are tradable.

The number of shares sold by such person within any three-month period cannot exceed the greater of:

- | 1% of the total number of our common shares then outstanding; or |

- | The average weekly trading volume of our common shares during the four calendar weeks preceding the date on which notice on Form 144 with respect to the sale is filed with the SEC (or, if Form 144 is not required to be filed, then four calendar weeks preceding the date the selling broker receives the sell order) (This condition is not currently available to the Company because its securities do not trade on a recognized exchange). |

Conditions relating to the manner of sale, notice requirements (filing of Form 144 with the Securities and Exchange Commission) and the availability of public information about us must also be satisfied.

All of the presently outstanding shares of our common stock are "restricted securities" as defined under Rule 144 promulgated under the Securities Act and may only be sold pursuant to an effective registration statement or an exemption from registration, if available.

1) the issuer of the securities that was formerly a reporting or non-reporting shell company has ceased to be a shell company;

2) the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act;

3) the issuer of the securities has filed all reports and material required to be filed under Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding twelve months (or shorter period that the Issuer was required to file such reports and materials), other than Form 8-K reports; and

4) at least one year has elapsed from the time the issuer filed the current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company.

We are not a “shell company” under Rule 405 of the Securities Act Rule 12b-2 of the Exchange Act.

Current Public Information

In general, for sales by affiliates and non-affiliates, the satisfaction of the current public information requirement depends on whether we are a public reporting company under the Exchange Act:

19

- | If we have been a public reporting company for at least 90 days immediately before the sale, then the current public information requirement is satisfied if we have filed all periodic reports (other than Form 8-K) required to be filed under the Exchange Act during the 12 months immediately before the sale (or such shorter period as we have been required to file those reports). |

- | If we have not been a public reporting company for at least 90 days immediately before the sale, then the requirement is satisfied if specified types of basic information about us (including our business, management and our financial condition and results of operations) are publicly available. |

However, no assurance can be given as to:

- | the likelihood of a market for our common shares developing, |

- | the liquidity of any such market, |

- | the ability of the shareholders to sell the shares, or |

- | the prices that shareholders may obtain for any of the shares. |

No prediction can be made as to the effect, if any, that future sales of shares or the availability of shares for future sale will have on the market price prevailing from time to time. Sales of substantial amounts of our common shares, or the perception that such sales could occur, may adversely affect prevailing market prices of the common shares.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain matters discussed herein are forward-looking statements. Such forward-looking statements contained in this prospectus which is a part of our registration statement involve risks and uncertainties, including statements as to:

- | our future operating results;

|

- | our business prospects; |

- | any contractual arrangements and relationships with third parties;

|

- | the dependence of our future success on the general economy; |