Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Jaguar Health, Inc. | jagx-20191231ex231b9cde5.htm |

| EX-32.2 - EX-32.2 - Jaguar Health, Inc. | jagx-20191231ex322bc710d.htm |

| EX-32.1 - EX-32.1 - Jaguar Health, Inc. | jagx-20191231ex3212c9236.htm |

| EX-31.2 - EX-31.2 - Jaguar Health, Inc. | jagx-20191231ex3120cb334.htm |

| EX-31.1 - EX-31.1 - Jaguar Health, Inc. | jagx-20191231ex311163973.htm |

| EX-23.2 - EX-23.2 - Jaguar Health, Inc. | jagx-20191231ex232e7a3ed.htm |

| EX-10.101 - EX-10.101 - Jaguar Health, Inc. | jagx-20191231ex10101a436.htm |

| EX-4.26 - EX-4.26 - Jaguar Health, Inc. | jagx-20191231ex426e78444.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

For the fiscal year ended December 31, 2019 |

|

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NO. 001-36714

JAGUAR HEALTH, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

46‑2956775 |

|

(State or other jurisdiction of |

(I.R.S. Employer |

|

incorporation or organization) |

Identification No.) |

201 Mission Street, Suite 2375

San Francisco, California 94105

(Address of principal executive offices)

Registrant’s telephone number, including area code:

(415) 371‑8300

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

|

Common Stock, Par Value $0.0001 Per Share |

JAGX |

The NASDAQ Capital Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

|

|

|

|

Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2019, the aggregate market value of the registrant’s common stock held by non-affiliates was approximately $8,457,091 based upon the closing sales price of the registrant’s common stock on The NASDAQ Global Market on such date.

The number of shares of the registrant’s Common Stock outstanding as of March 23, 2020 was 15,321,913 shares of voting common stock and 40,301,237 shares of non-voting common stock. The company also had 6,504,792 shares of convertible preferred stock outstanding (convertible into 33,149,556 shares of voting common stock, subject to certain voting restrictions as provided in the Certificate of Designation for the convertible preferred stock).

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the registrant’s 2020 Annual Meeting of Stockholders, or Proxy Statement, to be filed within 120 days of the end of the fiscal year ended December 31, 2019 are incorporated by reference in Part III hereof. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as a part hereof.

|

Item No. |

|

Page No. |

|

|

||

| 1 | ||

| 38 | ||

| 68 | ||

| 68 | ||

| 69 | ||

| 70 | ||

|

|

||

| 71 | ||

| 71 | ||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

72 | |

| 86 | ||

| 87 | ||

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

141 | |

| 141 | ||

| 142 | ||

|

|

||

| 143 | ||

| 143 | ||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

143 | |

|

Certain Relationships and Related Transactions, and Director Independence |

143 | |

| 143 | ||

|

PART IV |

|

|

| 144 | ||

| 153 | ||

i

Forward‑looking statements

This Form 10‑K contains forward‑looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical facts contained in this Form 10‑K, including statements regarding our future results of operations and financial position, business strategy, prospective products, product approvals, research and development costs, timing of receipt of clinical trial, field study and other study data, and likelihood of success, commercialization plans and timing, other plans and objectives of management for future operations, and future results of current and anticipated products are forward‑looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward‑looking statements.

In some cases, you can identify forward‑looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “aim,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward‑looking statements in this Form 10‑K are only predictions. We have based these forward‑looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward‑looking statements speak only as of the date of this Form 10‑K and are subject to a number of risks, uncertainties and assumptions described under the sections in this Form 10‑K titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Form 10‑K. Forward‑looking statements are subject to inherent risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control. The events and circumstances reflected in our forward‑looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward‑looking statements. Moreover, we operate in a dynamic industry and economy. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties that we may face. Except as required by applicable law, we do not plan to publicly update or revise any forward‑looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Jaguar Health, our logo, Canalevia and Neonorm are our trademarks that are used in this Form 10‑K. This Form 10‑K also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this Form 10‑K appear without the ©, ® or ™ symbols, but those references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

BUSINESS

We are a commercial stage plant medicine prescription pharmaceutical company focused on developing and commercializing novel, sustainably derived gastrointestinal products on a global basis. Our wholly‑owned subsidiary, Napo Pharmaceuticals, Inc. (“Napo”), focuses on developing and commercializing proprietary human gastrointestinal pharmaceuticals for the global marketplace from plants used traditionally in rainforest areas. Our Mytesi (crofelemer) product is approved by the U.S. Food and Drug Administration (“FDA”) for the symptomatic relief of noninfectious diarrhea in adults with HIV/AIDS on antiretroviral therapy.

Jaguar was founded in San Francisco, California as a Delaware corporation on June 6, 2013. Napo formed Jaguar to develop and commercialize animal health products. Effective as of December 31, 2013, Jaguar was a wholly‑owned subsidiary of Napo, and, until May 13, 2015, Jaguar was a majority‑owned subsidiary of Napo. On July 31, 2017, the merger of Jaguar Animal Health, Inc. and Napo became effective, at which point Jaguar Animal Health’s name changed to Jaguar Health, Inc. and Napo began operating as a wholly‑owned subsidiary of Jaguar focused on human health and the ongoing commercialization of, and development of follow‑on indications for Mytesi.

1

Most of the activities of the Company are now focused on the commercialization of Mytesi and development of follow‑on indications for crofelemer and a second‑generation anti‑secretory product, lechlemer. In the field of animal health, we have limited activities which are focused on developing and commercializing first‑in‑class gastrointestinal products for dogs, dairy calves, foals, and high value horses.

We believe Jaguar is poised to realize a number of synergistic, value adding benefits— an expanded pipeline of potential blockbuster human follow‑on indications of crofelemer, and a second‑generation anti‑secretory agent—upon which to build global partnerships. As previously announced, Jaguar, through Napo, now holds extensive global rights for Mytesi, and crofelemer manufacturing may occur at an FDA-inspected and approved facilities, including a recently constructed, multimillion-dollar commercial manufacturing facility. Additionally, several of the drug product candidates in Jaguar’s Mytesi pipeline are backed by strong Phase 2 and proof of concept evidence from completed human clinical trials.

Mytesi is a novel, first‑in‑class anti‑secretory agent which has a basic normalizing effect locally on the gut, and this mechanism of action has the potential to benefit multiple disorders. Mytesi is in development for multiple possible follow‑on indications, including cancer therapy‑related diarrhea (CTD); orphan‑drug indications for infants and children with congenital diarrheal disorders (CDDs) and short bowel syndrome (SBS); supportive care for inflammatory bowel disease (IBD); irritable bowel syndrome (IBS); and for idiopathic/functional diarrhea. In addition, a second‑generation proprietary anti‑secretory agent, lechlemer, is in development for cholera. Mytesi has received orphan‑drug designation for SBS.

Napo has a direct sales force of 9 sales representatives and a national sales director covering U.S. geographies with the highest commercial potential. In November 2019, we hired Ian Wendt, a seasoned industry veteran with a broad range of experience that includes commercializing supportive care and HIV treatments, as Vice President of Commercial Strategy. With support provided by concomitant marketing, promotional activities, patient education programs and peer education initiatives described below, we expect continued growth in the number of patients treated with Mytesi. He will lead business development initiatives that pave the way for Mytesi’s final development to the Cancer Therapy Related diarrhea (“CTD”) market and our commercial role for this next important indication for Mytesi. The goal of Napo’s internal sales team is to deliver a frequent and consistent selling message to targeted, high‑volume prescribers of antiretroviral therapies (ART) and to gastroenterologists who see large numbers of HIV patients. In 2017 we released the results of a survey of 350 people living with HIV and AIDS regarding the topic of “Talking to Your Doctor About Symptoms.” The survey results show that diarrhea remains prevalent in those living with HIV/AIDS, with 27% of respondents reporting that they currently have diarrhea, and 56% reporting that they have had diarrhea in the past. Additionally, the results of a 2017 Napo‑sponsored survey of 271 U.S. board certified gastroenterologists indicate that the number one GI complaint for people living with HIV/AIDS is diarrhea, and 93% of U.S. gastroenterologists see patients with HIV/AIDS in their practice.

Key to the success of our sales representatives in growing Mytesi sales is differentiating and targeting the right doctors—those HIV specialists who are high prescribers of ART and those gastrointestinal doctors who see large populations of people living with HIV/AIDS. The target list of prescribers for our sales reps includes a pool of approximately 1,300 high volume ART prescribing HIV specialists, and gastroenterologists who see the largest number of people living with HIV/AIDs, and we’ve strategically focused our sales force in the US geographies with the highest potential, including San Francisco, southern California, Arizona, Nevada, Florida, New York City/Long Island, Connecticut, New Jersey/eastern Pennsylvania, Texas, Chicago, Alabama, Mississippi, Louisiana, DC/eastern Virginia, Indianapolis, and Ohio.

Medical education presentations led by health care providers (HCPs) participating in the Napo Speakers Bureau—a group that includes HIV/AIDS specialists, infectious disease specialists, gastroenterologists, colorectal surgeons, and nurse practitioners—focus on the prevalence and pathophysiology of gastrointestinal consequences of HIV infection and on the latest treatment options for HIV‑related diarrhea. Presentations given by patient advocate members provide information to PLWH about the prevalence of diarrhea in People Living With HIV/AIDS (“PLWH”) and offer guidance about talking to HCPs regarding diarrhea‑related concerns.

2

With the introduction of newer antiretroviral (ARV) drug therapy, there has been a reduction in the severity of ARV‑induced diarrhea. However, a significant portion of this patient population still suffers from diarrhea caused by HIV enteropathy, which is due to the direct and indirect effects of HIV on the intestinal mucosa. Chronic diarrhea remains a significant complaint of people living with HIV/AIDS, particularly those who are older and have lived with the virus in their gut for 10+ years. According to data from the U.S. Centers for Disease Control and Prevention, currently more than 50% of people living with HIV are over age 50; by 2020 this figure will increase to 70%.

Napo continues to pursue AIDS Drug Assistance Program (ADAP) formulary listing. ADAPs provide life‑saving HIV treatments to low income, uninsured, and underinsured individuals living with HIV/AIDS in all 50 states and the territories. The ADAP program provides Mytesi free of charge to patients who qualify and copay support for some patients who have insurance coverage. As announced on January 24, 2019, Mytesi has also been added to the formulary for Florida’s ADAP, which is the third-largest in the U.S. based on enrollment. As a result of this addition, based on data from healthcare research firm Decision Resource Group, approximately 86% of ADAP‑eligible US lives now have access to Mytesi, which is now on the ADAP formularies for 30 states, including the five programs with the largest enrollment.

Napo has an agreement with the ADAP Crisis Task Force. The agreement establishes a reduced price provided by Napo to ADAPs in all U.S. states and territories for purchases of Mytesi. Formed in 2002, the Task Force negotiates reduced drug prices for all ADAPs. Task Force membership is currently comprised of representatives from Arizona, California, Florida, Illinois, Massachusetts, New York, North Carolina, Tennessee, Texas, Virginia, and Washington state HIV/AIDS divisions. Per the terms of the agreement, all state ADAPs are guaranteed the same reduced price for the drug. ADAPs provide HIV related services and approved medications to more than half a million people in the U.S. each year, and we expect this agreement to help further expand the number of patients able to benefit from the novel, first in class anti secretory mechanism of action of Mytesi.

As announced on June 26, 2019, we signed an agreement with Integrium, LLC, a clinical research organization, in support of a study to evaluate the effect of Mytesi on the gastrointestinal microbiome in people living with HIV. The study, which is currently still enrolling, is being funded by an investment in Jaguar by California‑based PoC Capital. We look forward to adding microbiome data to our overall understanding of the gut health of Mytesi patients, especially as Jaguar works towards expanding Mytesi access to new groups of patients who need symptomatic relief from diarrhea and diarrhea‑related symptoms, such as bloating and abdominal discomfort. Mytesi is currently reimbursed by Medicaid in all 50 states. It is also currently covered on 100% of the top 10 commercial insurance plan national formularies, representing more than 245 million U.S. lives. Additionally, Napo operates a co‑pay coupon program, which helps ensure that the majority of participating patients do not have a Mytesi co‑pay greater than $25. Information about NapoCares, which assists patients with benefit verification, prior authorization, and claims appeals, can be found at https://mytesi.com/mytesi_savings/.

As announced on October 10, 2019, Jaguar has engaged Angel Pond Capital LLC (“Angel Pond”) to explore potential licensing agreements and collaborations for Mytesi in China. Angel Pond was founded by Ted Wang, a former Goldman Sachs partner, with a mission to help bring quality U.S. medical care to the growing needs of patients in China. Angel Pond has offices in New York and Hangzhou, China. Jaguar has engaged Angel Pond as an advisor to help facilitate and negotiate the out-license of our Mytesi and crofelemer technology in China, including identifying additional potential strategic partners in China beyond those Jaguar has already engaged in discussions and due diligence. Cancer therapy-related diarrhea is our lead potential follow-on indication for Mytesi, and cancer is a leading cause of death in China—making the country a compelling region for addressing the unmet medical need of the devastating diarrhea associated with cancer treatment.

As announced on October 30, 2019, Napo has entered into a two-year distribution agreement with TannerGAP, Inc. ("Tanner"), a division of Tanner Pharma Group, a global provider of integrated specialty access solutions. The agreement names Tanner as a distributor of Mytesi on a named patient supply basis outside of the United States, Canada and Israel in regions where the product is not yet registered. Jaguar’s ongoing commitment is to enhance Mytesi access for people living with HIV—across all populations, all countries, and the Company believes this agreement will help accelerate that access to Mytesi on a named patient access basis in underserved international markets. Tanner possesses extensive knowledge and experience in the distribution of pharmaceutical products on a

3

global basis, including the servicing of requests for a particular medicine in markets where that medicine is not licensed.

As we announced on February 20, 2020, the nonprofit American Botanical Council has given the 2019 Varro E. Tyler Commercial Investment in Phytomedicinal Research Award to Napo in recognition of Napo's ongoing commitment to the sustainable development and production of natural therapeutic preparations. Specifically, this award acknowledges the successful development and approval of crofelemer, which is derived from the medicinal Croton lechleri tree in the Amazon rainforest. Previous recipients of this award include Jaguar’s partner, Italy‑based Indena S.p.A., one of the world's largest producers of clinically-tested botanical extracts for the food, dietary supplement, cosmetic, and pharmaceutical markets.

As announced on March 23, 2020, Jaguar submitted a request on March 21, 2020 to the FDA for Emergency Use Authorization for crofelemer (Mytesi) for the symptomatic relief of diarrhea and other gastrointestinal symptoms in patients with coronavirus (“COVID-19”) and for patients with COVID-19 who have diarrhea associated with certain antiviral treatments. The American College of Gastroenterology, a medical association that represents thousands of gastroenterologists from around the world that has been studying coronavirus cases, found that coronavirus may present with not only respiratory symptoms, but also with diarrhea.

Pipeline within a product—crofelemer

According to the World Health Organization, there are nearly 1.7 billion cases of diarrheal disease globally every year, and the disease caused an estimated 1.5 million deaths in 2012. Although not all types of diarrhea are secretory in nature, we view the current, initial approval of Mytesi as the opening of the door to an important pipeline—underscored by the current approval by the FDA of the Chemistry, Manufacturing and Controls (CMC) for this natural product, as well as acknowledgement by the FDA of the safety of the product for chronic use for the approved indication.

Crofelemer is in development for the symptomatic relief of cancer therapy‑related diarrhea (CTD). A significant proportion of patients undergoing cancer therapy experience diarrhea. Novel targeted cancer therapy agents, such as epidermal growth factor receptor antibodies and tyrosine kinase inhibitors, with or without cycle chemotherapy agents, may activate intestinal chloride secretory pathways leading to increased chloride secretion into the gut lumen, coupled with significant loss of water that would result in secretory diarrhea.

As part of the Company’s near term plan, Napo had a meeting with the FDA in March 2019 to review the protocol for Napo’s planned Phase 3 clinical trial in cancer subjects to evaluate the effects of Mytesi in prevention and/or relief of CTD. Participants in the meeting, which was with the FDA’s Division of Gastroenterology and Inborn Errors Products (DGIEP) and the FDA’s Division of Oncology Products, included Pravin Chaturvedi, Ph.D., Napo’s/Jaguar’s Chairman of the Scientific Advisory Board (SAB) and Acting Chief Scientific Officer, regulatory affairs, medical safety monitoring, and biostatistics specialists, and academic key opinion leaders (KOLs)/SAB members from leading oncology treatment institutions, one of whom will serve as the principal investigator for Napo’s planned trial. Following the meeting with the FDA, we reached agreement with the DGIEP in the following key areas related to our planned investigational new drug application (IND) submission for a supplemental new drug application (sNDA) for crofelemer (Mytesi) for the symptomatic relief of CTD:

•Acceptance of the nonclinical safety package for crofelemer from NDA 202292 (the NDA for Mytesi’s currently approved HIV indication) without the need for any additional nonclinical or preclinical safety studies for our planned sNDA

•Acceptance of the Chemistry, Manufacturing and Controls (CMC) submissions for use of 125‑mg delayed release crofelemer tablets (Mytesi) from NDA 202292, with the proviso of requiring additional details on the drug product specification assays and a summary of assay results for Mytesi lots that are planned to be used in the proposed single pivotal clinical trial in CTD

4

•No additional drug‑drug interaction studies are required for crofelemer at this time

Napo’s planned next steps are to continue interactions with the FDA and KOLs/SAB members from leading oncology treatment institutions to incorporate the input from our dialog with the FDA into the pivotal Phase 3 protocol. Our goal is to ensure that the protocol addresses the need for a treatment for CTD, the practicalities of patient enrollment and trial design, and that expert statisticians from both Napo and FDA agree on endpoints relevant to crofelemer’s mechanism of action. Our planned study for diarrhea related to CTD is analogous to the successful pivotal program we ran for Mytesi’s currently approved HIV indication, and as part of risk mitigation we intend to use the same formulation and dosing as the current commercialized Mytesi.

In support of our focus on the potential CTD indication, an ongoing investigator-initiated trial (IIT) utilizing Mytesi is underway. Enrollment is ongoing for the HALT D study in breast cancer patients receiving regimens containing Herceptin and Perjeta (“HALT D Investigator Initiated Trial”). The final report for the study, which is sponsored by Georgetown University and funded by Genentech, a member of the Roche Group, is expected to be read out in late-2020. The study’s primary endpoint has an 81% power to detect a 40% difference in the percent and/or number of patients experiencing any grade of diarrhea for two consecutive days at a p value of 0.1. (The statistical power of a study, sometimes referred to as a study’s sensitivity, is a measure of how likely the study is to distinguish an actual effect from one of chance). For the sake of clarity, the estimates of the percent of patients experiencing such diarrhea is postulated to be 60% in the placebo patients and 20% in the study’s crofelemer treated arms. An interim analysis was conducted to ensure that the study has a chance to ultimately achieve the primary endpoint. As announced November 14, 2019, Georgetown University's Data Safety Monitoring Committee ("DSMC") reviewed the interim analysis for futility for the study and notified the Principal Investigator that the study is allowed to enroll to completion. At that point in time, enrollment in the study exceeded 85%. The treatment period for each patient is 3 months. Although this study is not required to support the clinical program for Mytesi for FDA approval for CTD, the final results may inform Jaguar and Napo about potential exploratory clinical endpoints for our planned Phase 3 clinical study for CTD and development activities aimed at additional indications for Mytesi.

According to data appearing in “Treatment Guidelines for CID” (chemotherapy induced diarrhea) in the April 2004 issue of Gastroenterology and Endoscopy News, diarrhea is the most common adverse event reported in chemotherapy patients. Approved third-party supportive care products for chemotherapy induced nausea and vomiting (CINV) include Sustol, Aloxi, Akynzeo and Sancuso. According to Transparency Market Research, sales of therapeutics for the prevention of CINV approximated $620 million in 2013, and sales of such therapeutics are expected to reach $1 billion in 2020.

Diarrhea has been reported as the most common side effect of the recently approved CDK 4/6 inhibitor abemaciclib and the pan HER TKI neratinib, with occurrence ranging from 86% to >95% and grade 3 over 40%, in published studies. Diarrhea in this patient population has the potential to cause dehydration, potential infections, and non adherence to treatment. A novel anti diarrheal like Mytesi may hold promise for treating secretory diarrhea—and therefore also support long term cancer treatment adherence—in this population.

Plans are in place with Sheikh Khalifa Medical City (SKMC) in Abu Dhabi for a Phase 2 sponsored study of crofelemer, the active pharmaceutical ingredient in Mytesi, for congenital diarrheal disorders (CDDs) and short bowel syndrome (SBS) in children. The Company expects this study to be initiated in the second quarter of 2020.

CDDs are a group of rare, chronic intestinal channel diseases, with onset in early infancy, that are characterized by severe, lifelong diarrhea and a lifelong need for nutritional intake either parenterally or with a feeding tube. CDDs are related to specific genetic defects inherited as autosomal recessive traits. The incidence of CDDs is prevalent in regions where consanguineous marriage (related by blood) is part of the culture. CDDs are directly associated with serious secondary conditions including dehydration, metabolic acidosis, and failure to thrive, prompting the need for immediate therapy to prevent death and limit lifelong disability.

SBS is a complex condition characterized by malabsorption of fluids and nutrients due to congenital deficiencies or surgical resection of small bowel segments. Consequently, patients suffer from symptoms such as debilitating diarrhea, malnutrition, dehydration and imbalances of fluids and salts. This could be due to either a

5

genetic disorder or premature birth. In countries such as the United Arab Emirates and Saudi Arabia, SBS occurs with much higher incidence.

As announced on December 16, 2019, a clinical research study initiated and sponsored by The University of Texas Health Science Center at Houston (UTHealth) is being supported by Napo. The study will evaluate the safety and effectiveness of crofelemer for treatment of chronic idiopathic diarrhea in patients. Chronic idiopathic diarrhea is a common complaint of patients presenting to family practitioners and internists, and is one of the most common reasons for referral to gastroenterologists. It is estimated that the prevalence of chronic idiopathic diarrhea in developed countries (including the U.S.) is approximately 3-5%. It has a significant negative effect on health-related quality of life and causes a high economic burden on patients and society. The American Gastroenterological Association Burden of Illness study (2012) showed that the estimated annual direct and indirect costs associated with chronic idiopathic diarrhea is up to $524 million per year and $136 million per year, respectively. The principal investigator for the Study is Dr. Brooks D. Cash, MD, AGAF, FACG, FACP, FASGE, Chief - Division of Gastroenterology, Hepatology and Nutrition, Sterling Professor of Medicine, McGovern Medical School at UTHealth, Co-Director, Ertan Digestive Disease Center at Memorial Hermann-Texas Medical Center. The Study is titled Yield of Diagnostic Tests and Management of Crofelemer for Chronic Idiopathic Diarrhea in Non-HIV Patients: A Pilot Study, and is a single-center trial at UTHealth.

Crofelemer is also being evaluated in another investigator-initiated trial for the management of functional diarrhea in non-HIV patients. The principal investigator for this clinical study is Dr. Anthony Lembo, Professor, Gastroenterology, Beth Israel Deaconess Medical Center, Harvard Medical School, Boston, MA. This clinical study is a randomized double-blind, placebo-controlled study in adult subjects with functional diarrhea. Eligible patients will have functional diarrhea defined by Rome IV criteria as >25% loose watery stools and <25% hard/lumpy stools. The study plans to randomize 80 patients and the subjects will be randomized 1:1 for 4 weeks to either the placebo or crofelemer 125 mg delayed-release tablets (Mytesi) arm, administered twice daily for 4 weeks. Following the four-week placebo-controlled period, all subjects will receive Mytesi for an additional four weeks in an open label extension phase. The safety and tolerability of crofelemer and the clinical response during the placebo-controlled period will be evaluated in this study. Subjects will be allowed to use limited amounts of an antimotility drug (loperamide) during the placebo-controlled and open-label extension phase to manage uncontrolled diarrhea. However, no more than 11 doses of 2 mg loperamide will be permitted during any given week per subject. This study is planned to be initiated around mid-2020 and is estimated to be completed by mid 2021.

Napo has previously received orphan drug designation from the FDA for pediatric short bowel syndrome (SBS). The Orphan Drug Act provides for granting special status to a drug or biological product to treat a rare disease or condition upon request of a sponsor. Orphan drug designation qualifies the sponsor of the drug for various development incentives, including extended exclusivity, tax credits for qualified clinical testing, and relief of filing fees.

Jaguar’s and Napo’s portfolio development strategy involves meeting with Key Opinion Leaders (KOLs) to identify indications that are potentially high‑value because they address important medical needs that are significantly or globally unmet, obtain input on protocol practicality and protocol generation, and then strategically sequencing indication development priorities, second‑generation product pipeline development, and partnering goals on a global basis, as well as identifying possible opportunities for a Special Protocol Assessment (SPA) from the FDA. When granted, SPA provides that, upon request, FDA will evaluate within 45 days certain protocols to assess whether they are adequate to meet scientific and regulatory requirements identified by the sponsor. In 2007, under the SPA process, Napo obtained agreement with the FDA for the design of the pivotal study protocol for the currently approved indication of crofelemer (Mytesi) for the symptomatic relief of noninfectious diarrhea in adults with HIV/AIDS on antiretroviral therapy. The 2007 SPA agreement was an important milestone for Napo, allowing Napo to address and mitigate regulatory uncertainty prior to the completion of its final Phase 3 trial of crofelemer for its currently approved indication.

Napo Pharmaceuticals has submitted an Emergency Use Authorization (EUA) request for the use of Mytesi for the symptomatic relief of diarrhea and other gastrointestinal symptoms in patients infected with COVID-19. A new study published in the American Journal of Gastroenterology looked at data from 204 patients with COVID-19 in

6

China’s Hubei province and found that 48.5% of these patients arrived at the hospital with digestive symptoms such as diarrhea, vomiting, or abdominal pain. Napo has also requested the issuance of EUA of Mytesi for the symptomatic relief of diarrhea from the proposed empirical use of antiviral drugs including HIV protease inhibitors such as lopinavir/ritonavir (Kaletra) in patients infected with COVID-19.

Mytesi is the only antidiarrheal drug that has been approved by the US FDA for the treatment of chronic, noninfectious diarrhea in adult HIV/AIDS patients receiving antiretroviral therapy (ART). This approval was on the basis of the drug’s safety and efficacy in reducing the number of weekly and daily watery stools in patients and improvement of stool consistency, from unformed to formed stools, over a 24-week treatment period.

Unlike other available diarrhea treatments, crofelemer does not act by inhibiting intestinal motility. It has minimal oral absorption and does not have any clinically significant food or drug interactions, thereby allowing patients to maintain their appropriate dosing of treatment to suppress their viral load and maintain adequate CD4 levels in people living with HIV/AIDS (PLWHA). Crofelemer is also the only approved antidiarrheal drug that is approved for chronic use. Moreover, it is not an opioid, like other traditionally used treatments; thus avoiding both the acute side effect of constipation and the potential for abuse. Napo Pharmaceuticals plans to ensure an adequate supply of Mytesi tablets to support any requests for administration of Mytesi to address the COVID-19 pandemic.

Napo’s HIV Scientific Advisory Board has focused primarily on physician education, and community and global awareness regarding the importance and availability of solutions for neglected comorbidities, such as the first‑in‑class anti‑secretory mechanism of action of Mytesi for its currently approved indication.

According to a 2017 report from Research and Markets, the combined global market for prescription and OTC gastrointestinal agents is expected to reach $21 billion by 2025. Jaguar estimates that a first in class anti secretory agent should be able to achieve a significant portion of the market share.

Our management team has significant experience in gastrointestinal product development for both humans and animals. Napo was founded 30 years ago to perform drug discovery and development by leveraging the knowledge of traditional healers working in rainforest areas. Ten members of the Jaguar and Napo team have been together for more than 15 years. Dr. Steven King, our Executive Vice President of sustainable supply, ethnobotanical research and intellectual property, and Lisa Conte, our founder, President and CEO, have worked together for more than 30 years. Together, these dedicated personnel successfully transformed crofelemer, which is extracted from trees growing in the rainforest, to Mytesi, which is a natural, sustainably harvested, FDA‑approved drug.

There are significant barriers to entry for Mytesi (crofelemer). Through Napo, we hold an extensive global patent portfolio. At the present time, we hold approximately 144 issued worldwide patents, with coverage in many cases that extends until 2031. These issued patents cover multiple indications, including HIV‑AIDS diarrhea, IBS, IBD, manufacturing, enteric protection from gastric juices, among others. We also have approximately 39 pending patent applications worldwide in the human health areas that are being prosecuted.

Mytesi is the first oral drug approved by the FDA under botanical guidance, which provides another barrier to entry from potential generic competition. The FDA requires that the manufacturer of crofelemer use a validated proprietary bioassay to release the drug substance and drug product of Mytesi. While most generic products are fashioned to meet chemical release specifications that are in the public domain, the specifics of this assay are not publicly available. There is no pathway by which a generic product can be developed for a drug approved under botanical guidance. In addition, Mytesi is not systemically absorbed, so the classic approach of creating a generic drug by matching pharmacokinetic blood levels is not possible. A generic player would have to conduct costly and risky clinical trials.

While Jaguar’s commercial and development efforts have evolved to focus primarily on Mytesi and human pipeline indications since its merger with Napo, the Company is continuing limited initiatives related to Canalevia, our drug product candidate for treatment of chemotherapy‑induced diarrhea (“CID”) in dogs and exercise-induced diarrhea (“EID”) in dogs. CID in dogs is typically caused by the same mechanism of action as in humans, and hence

7

the work in dogs serves as a preclinical proof of concept for the diarrhea in humans that is related to targeted cancer therapy. CID is an interesting model for human medical need and is being pursued as a prescription indication for animal health. We believe there is an important unmet medical need for the treatment of CID in dogs. Certain cancer treatment agents provided to dogs are human drugs or have the same mechanism of action as human cancer drugs, and these agents and mechanisms of action often have meaningful rates of diarrhea in humans as well.

The U.S. Food & Drug Administration's Center for Veterinary Medicine (“CVM”) indicated in March 2020 that Jaguar’s Chemistry, Manufacturing, and Controls (“CMC”) Technical Section is complete in support of our application for conditional approval under MUMS of Canalevia (crofelemer delayed-release tablets) for the treatment of CID in dogs. The CMC Technical Section is one of the four major technical sections required as part of our application for conditional approval of Canalevia for CID. As previously announced, the CVM has already indicated that two of Jaguar's other major technical sections – the Reasonable Expectation of Effectiveness Technical Section and the Environmental Impact Technical Section – are complete for Canalevia for this proposed indication. The Target Animal Safety Technical Section is the last open major technical section.

The Target Animal Safety Technical Section contains data from a 2017 target animal safety study indicating that the no‑observed‑adverse‑effect level (“NOAEL”) of Canalevia in dogs is approximately six times greater than previously demonstrated and that Canalevia is also safe for use in puppies. The safety of residues of veterinary drugs is most commonly addressed through the conduct of target animal safety studies that provide for the determination of the NOAEL.

The 2017 toxicology study is the first study to demonstrate the safety of Canalevia in puppies as young as 12 weeks of age. Prior crofelemer toxicology studies only involved adult dogs.

As previously announced, Jaguar has received MUMS (Minor Use and Minor Species) designation status from the FDA for Canalevia for the indication of CID in dogs. MUMS designation is modeled on the orphan‑drug designation for human drug development and offers possible financial incentives to encourage MUMS drug development, such as the availability of grants to help with the cost of developing the MUMS drug.

As previously announced, Jaguar has two separate indications for Canalevia being considered for Conditional Approval by the CVM. The second proposed indication is for exercise-induced diarrhea (EID) in dogs. Jaguar will be leveraging the use of many of the same major technical sections for EID that have been submitted in support of the Company's application for Canalevia for the indication of CID in dogs. With receipt of Conditional Approval of Canalevia for CID, we expect to launch Canalevia CA-1 for this indication in the first quarter of 2021.

Crofelemer is extracted from the Croton lechleri tree, which we sustainably harvest and manage through programs that we have been developing over the past 30 years. This process has involved working with local and indigenous communities to plant trees, obtaining permits for export, and creating a supply network that is robust and reliable.

We continue to have working relationships with partners that began in the 1990s. Additionally, through the establishment of a nonprofit called the Healing Forest Conservancy (HFC), our team has created a long‑term mechanism for benefit sharing that recognizes the intellectual contribution of indigenous populations. This program is intended to contribute to the continued strength and effectiveness of the valued and strategically important relationships we have carefully cultivated over the past 30 years.

Product Pipeline

In addition to our Mytesi (crofelemer) product that is approved by the U.S. FDA for the symptomatic relief of noninfectious diarrhea in adults with HIV/AIDS on antiretroviral therapy, we are also developing a pipeline of prescription drug product candidates to address unmet needs in gastrointestinal health through Napo. Mytesi (crofelemer) is a novel, first‑in‑class anti‑secretory agent which has a basic normalizing effect locally on the gut, and this mechanism of action has the potential to benefit multiple disorders. Clinical trials demonstrated that nearly 80% of Mytesi users experienced an improvement in their diarrhea over a four‑week period. At week 20 of the pivotal trial, over half the patients had no watery stools, or a 100% decrease, and 83% had at least a 50% decrease in watery stools. Our Mytesi pipeline currently includes prescription drug product candidates for four follow‑on indications, several of

8

which are backed by Phase 2 evidence from completed Phase 2 trials. In addition, a second‑generation proprietary anti‑secretory agent, lechlemer, is in development for cholera.

Napo Prescription Drug Product Candidates

|

Product Candidates |

|

Indication |

Completed Milestones |

Current Phase of |

Anticipated Near‑Term |

|

Mytesi |

Cancer therapy‑related diarrhea (CTD) |

•Two investigator‑initiated (IIT) clinical trials funded by Genentech‑Roche & a third-party cancer agent manufacturer •Met with FDA in March 2019 to discuss the anticipated protocol for a planned pivotal trial |

Phase 3 |

•Final study reported expected in late 2020 |

|

|

Mytesi |

Supportive care for IBD |

•Safety •Multiple Phase 2 studies completed in various secretory diarrhea (not IBD) |

Phase 2 |

•Protocol development with KOLs for discussions with FDA |

|

|

Formulation of crofelemer |

Rare disease indications (SBS & CDD) |

•Phase 1 study •Previously received orphan drug designation for SBS |

Phase 2 |

•Initiate POC trial in Abu Dhabi, post US approval of trial design (2H, 2020) |

|

|

Mytesi |

Irritable bowel syndrome—diarrhea predominant (IBS‑D) |

•Phase 1 study •Two Phase 2 studies completed |

Phase 2 |

•Publication of supplemental analysis of Phase 2 data |

|

|

Mytesi |

Idiopathic/functional diarrhea |

•Safety •Clinical study initiated at The University of Texas Health Science Center at Houston •Multiple Phase 2 studies completed in various secretory diarrhea •IIT request accepted |

Phase 2 |

•Initiation of IIT |

|

|

SB‑300 (lechlemer) |

Second‑generation anti‑secretory agent for multiple indications including cholera |

•Animal and human studies in secretory diarrhea; successful cholera trial design for anti‑secretory mechanism of action with API |

Pre IND |

•Pre clinical toxicology funded by NIAID •Formulation / POC

|

|

*Clinical trials are funding dependent

9

Estimated Size of Mytesi Target Markets

We believe the medical need for Mytesi is significant, compelling, and unmet, and that doctors are looking for a drug product with a mechanism of action that is distinct from the options currently available to resolve diarrhea. A growing percentage of HIV patients have lived with the virus in their gut for 10+ years, often causing gut enteropathy and chronic or chronic‑episodic diarrhea. According to data from the U.S. Centers for Disease Control and Prevention, by 2020 more than 70% of Americans with HIV are expected to be 50 and older (1).

|

Market |

|

Number of |

Market Size/Potential |

|

HIV‑D |

0 |

We estimate the U.S. market revenue potential for Mytesi to be approximately $100 million in gross annual sales |

|

|

CTD |

0 |

An estimated 650,000 U.S. cancer patients receive chemotherapy in an outpatient oncology clinic(2). Comparable supportive care (i.e., CINV) product sales of ~$620 million in 2013(3). Global CINV market projected to reach a valuation of $2.7 billion by 2022(4) |

|

|

IBD |

0 |

Estimated 1,171,000 Americans have IBD(5) |

|

|

IBS‑D |

3 |

Most IBS products have an estimated revenue potential of greater than $1.0 billion(6) |

|

|

CDD/SBS |

0 |

Financial benefits of Orphan‑drug Designation |

|

|

Cholera (hydration maintenance) PRV (SB‑300) |

0 |

In recent transactions by other companies, priority review vouchers have sold for $67 million to $350 million(7) |

|

(1)HIV Among People Aged 50 and Older (https://www.cdc.gov/hiv/group/age/olderamericans/index.html)

(2)Centers for Disease Control and Prevention. Preventing Infections in Cancer Patients: Information for Health Care Providers (cdc.gov/cancer/preventinfections/providers.htm)

(3)Heron Therapeutics, Inc. Form 10‑K for the fiscal year ended December 31, 2016

(4)Report published by Allied Market Research, titled, "Chemotherapy-induced Nausea and Vomiting (CINV) Market-Global Opportunity Analysis and Industry Forecast, 2014-2022” (https://www.prnewswire.com/news-releases/chemotherapy-induced-nausea-and-vomiting-cinv-market-expected-to-reach-2659-million-by-2022-611755395.html)

(5)Kappelman, M. et al. Recent Trends in the Prevalence of Crohn’s Disease and Ulcerative Colitis in a Commercially Insured US Population. Dig Dis Sci. 2013 Feb; 58(2): 519‑525

(6)Merrill Lynch forecasts peak US sales of roughly $1.5 bn for Ironwood’s Linzess (https://247wallst.com/healthcare-business/2015/04/27/key-analyst-sees-nearly-30-upside-in-ironwood/); Rodman & Renshaw estimate peak annual sales of Synergy Pharmaceuticals’ Trulance at $2.3 bn in 2021 (https://www.benzinga.com/analyst-ratings/analyst-color/17/04/9304883/what-synergys-new-patents-mean-for-its-commercial-prospe)

10

(7)In Aug. 2015, AbbVie Inc. bought a priority review voucher from United Therapeutics Corp for $350 million (https://www.wsj.com/articles/united-therapeutics-sells-priority-review-voucher-to-abbvie-for-350-million-1439981104 ). In July 2014, BioMarin announced that it had sold a priority review voucher to Sanofi and Regeneron for $67.5 million. (https://investors.biomarin.com/2014-07-30-BioMarin-Sells-Priority-Review-Voucher-for-67-5-Million).

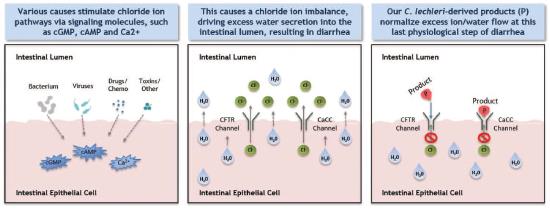

The following diagram illustrates the mechanism of action of our human and animal gastrointestinal drug products and drug product candidates, which normalize chloride and water flow and transit time of fluids within the intestinal lumen.

Business Strategy

Our goal is to become a leading pharmaceutical company with first‑in‑class, sustainably derived products that address significant unmet gastrointestinal medical needs globally. To accomplish this goal, we plan to:

Expand Mytesi by leveraging our significant gastrointestinal knowledge, experience and intellectual property portfolio

Mytesi is a novel, first‑in‑class anti‑secretory agent which has a basic normalizing effect locally on the gut, and this mechanism of action has the potential to benefit multiple gastrointestinal disorders. Our Mytesi (crofelemer) product is approved by the U.S. FDA for the symptomatic relief of noninfectious diarrhea in adults with HIV/AIDS on antiretroviral therapy. Jaguar, through Napo, holds extensive global rights for Mytesi. Mytesi is in development for multiple possible follow‑on indications, including diarrhea related to targeted cancer therapy; orphan‑drug indications for infants and children with congenital diarrheal disorders and short bowel syndrome; supportive care for inflammatory bowel disease; irritable bowel syndrome; and for idiopathic/functional diarrhea. In addition, a second‑generation proprietary anti‑secretory agent is in development for cholera.

Our management team collectively has more than 100 years of experience in the development of gastrointestinal prescription drug and non‑prescription products. This experience covers all aspects of product development, including discovery, preclinical and clinical development, GMP manufacturing, and regulatory strategy. Key members of this team successfully developed Mytesi.

Establish and expand commercial capabilities in Mytesi sales and marketing efforts

Napo’s direct sales organization is comprised of Mytesi field sales representatives strategically positioned to cover U.S. geographies with the highest potential. With support provided by concomitant marketing, promotional activities, patient empowerment programs, including an integrated social digital campaign, and medical education initiatives described below, we expect a proportional response in the number of patients treated with Mytesi.

11

Leverage our relationships with key opinion leaders regarding development of follow‑on indications

Approximately 16 key opinion leaders (KOLs) who are recognized specialists in HIV patient care, CTD, IBD, IBS, cholera, SBS, and CDD are currently participating in our scientific advisory board or KOL advisory program in some manner.

Establish partnerships to support moving pipeline indications to pivotal clinical trials

Jaguar is actively pursuing the development of a robust pipeline of potential follow‑on indications for crofelemer, and the Company’s goal is to establish partnerships to support moving pipeline indications to pivotal clinical trials.

Strategically sequence the development of follow‑on indications of Mytesi and seek geographically‑focused licensing opportunities

As announced September 24, 2018, Jaguar and Knight Therapeutics Inc. (“Knight”) entered into a Distribution, License and Supply Agreement that grants Knight the exclusive right to commercialize Mytesi and related products in Canada and Israel.

Although it is possible that we may enter into additional corporate partnering relationships related to Mytesi, our intention would be to retain all or co‑commercialization and promotional rights in the U.S., so that we do not become primarily a royalty‑collecting organization, and we are opposed to entering into any Mytesi partnering relationship that would require splitting indications. We are seeking to put limited geographically‑focused partnerships in place in the near term, while also considering possibilities for a worldwide partnership with a leading global entity (excluding the U.S. exclusive commercial rights) in the field of gastrointestinal care and cancer in the long term.

Reduce risks relating to product development

Risk reduction is a key focus of our product development planning. Mytesi is approved for chronic indication, providing us the ability to leverage this corresponding safety data when seeking approval for planned follow‑on indications that are also chronic or chronic episodic indications. In an effort to reduce risk further, we have implemented the following approach: First, we meet with key opinion leaders, typically at medical conferences—as we did at Digestive Disease Week for IBS and IBD, the American Society of Clinical Oncology annual meeting, and the Multinational Association of Supportive Care and Congress. Next, we confirm unmet medical needs with these key opinion leaders and discuss the practicality of patient enrollment and trial implementation. We then generate protocols to discuss with the FDA, seeking, when possible, special protocol assessments. Our goal is to have de‑risked the program as much as we believe we possibly can, by the time we start devoting significant funds to a clinical trial, in particular the regulatory pathway. We believe this approach will lead to better long‑term outcomes for our products in development.

We believe that Jaguar is poised to realize a number of synergistic, value adding benefits—and an expanded pipeline of important human follow‑on indications and a second‑generation anti secretory agent—upon which to build global partnerships.

In May 2016, the New Drug Application (“NDA”) and commercial rights for human applications of crofelemer (Mytesi) previously licensed to Salix Pharmaceuticals, Inc. (“Salix”) were transferred to Napo. The active pharmaceutical ingredient (“API”) in Mytesi is crofelemer, our proprietary gastrointestinal anti‑secretory agent sustainably harvested from the rainforest.

Diarrhea is a common adverse event seen with chemotherapy agents typically used in breast and colon cancers, and in particular in the more recently introduced therapeutic classes of epidermal growth factor receptor (“EGFR”) monoclonal antibodies and tyrosine kinase inhibitors (“TKI”) often used for chronic adjuvant care

12

management of cancer. The increased need for and use of these agents has made diarrhea one of the most disabling issues for cancer patients.

We will seek partnerships outside the United States for the above indications while focusing on development and commercial access in the United States directly. We are also focused on investigating (lechlemer) for various gastrointestinal indications. Lechlemer is a proprietary Jaguar pharmaceutical product, a standardized botanical extract distinct from crofelemer, also sustainably derived from the Croton lechleri tree.

We believe lechlemer, which has the same mechanism of action as crofelemer and is significantly less costly to produce, may support efforts to receive a priority review voucher from the U.S. FDA for a cholera indication. Priority review vouchers are granted by the FDA to drug developers as an incentive to develop treatments for neglected diseases and rare pediatric diseases. Additionally, we believe lechlemer represents a long‑term pipeline opportunity as a second‑generation anti‑secretory agent, on a global basis, for multiple gastrointestinal diseases—especially in resource‑constrained countries where the cost of goods is a factor, in part, because requirements often exist in such regions for drug prices to decrease annually.

The Company has presented Phase 2 data on crofelemer for the treatment of devastating dehydration in cholera patients from the renowned International Centre for Diarrhoeal Disease Research (icddr,b) in Bangladesh, and Napo plans to follow the same study design for a trial conducted in association with icddr,b in support of the development of lechlemer for potential cholera‑related indication.

As announced, Napo received preclinical services from the National Institute of Allergy and Infectious Diseases (“NIAID”) to support the development of lechlemer for the proposed cholera indication. Under NIAID’s suite of preclinical services, NIAID‑funded contractors conducted toxicology testing for 7‑day rat and dog studies. NIAID is part of the National Institutes of Health, which is an agency of the U.S. Department of Health and Human Services.

Our portfolio development strategy is based on identifying indications that are potentially high‑value because they address important medical needs that are significantly or globally unmet, and then strategically sequencing indication development priorities, second‑generation product pipeline development, and partnering goals on a global basis.

Our technology for proprietary gastrointestinal disease products is central to the product pipelines of both human and veterinary indications. Crofelemer is also the API in Canalevia, our lead prescription drug product candidate, intended for the treatment of chemotherapy‑induced diarrhea in dogs.

Mytesi Clinical Data

Mytesi has been clinically demonstrated to have:

•Minimal absorption, with plasma concentrations below the level of detection

•No clinically relevant drug‑drug interactions

•No effect on viral load or CD4 counts

•Adverse events comparable to those with placebo

The efficacy of Mytesi 125‑mg delayed‑release tablets twice daily was evaluated in a randomized, double‑blind, 24‑week, multicenter study (the ADVENT trial) comprised of a placebo‑controlled (1 month) treatment period and a placebo‑free (5 month) treatment period. The study enrolled HIV‑positive patients on stable ART with a history of diarrhea for 1 month or more. In the Mytesi 125mg bid group, more than twice as many patients (18% vs. 8% on placebo, p<0.01) achieved the highly rigorous endpoint defined as reduction to ≤2 watery stools per week for 2

13

out of the 4 weeks in the placebo‑controlled period (the average baseline in the ADVENT population was 20 watery stools per week).

In a supplemental analysis of the ADVENT study population, 78% of patients in the Mytesi 125mg BID group experienced a decrease in watery stools at week 4. Among these patients that experienced a decrease, 61% had at least a 50% decrease in watery stools. At week 20, 89% of patients in the Mytesi BID group experienced a decrease in watery stools. Among these patients that experienced a decrease, 83% had at least a 50% decrease in watery stools, and over half of patients had no watery stools at all (100% decrease).

Products in Development

Cancer Therapy‑Related Diarrhea (CTD)

CTD is a common problem with a relevant mechanism for crofelemer

|

National Cancer Institute Criteria for Grading Severity of Diarrhea |

||||

|

|

Grade 1 |

Grade 2 |

Grade 3 |

Grade 4 |

|

Patients without a colostomy |

|

|

|

Physiologic consequences requiring intensive care; hemodynamic collapse |

Diarrhea is a common adverse event seen with chemotherapy agents in the therapeutic classes of epidermal growth factor receptor (“EGFR”) tyrosine kinase inhibitors (“TKI’s”) and EGFR monoclonal antibodies (for breast, lung, and other malignancies). The increased need for and use of these agents has made diarrhea one of the most disabling issues for cancer patients. Crofelemer offers the potential for an appropriate mechanism of action against this likely secretory diarrhea and has prompted interest among physicians concerned about this diarrheal symptom, stimulating the aforementioned investigator‑initiated trials. Diarrhea is also a common adverse event seen with chemotherapy agents used in colorectal and gastric cancers, and chronic maintenance chemotherapy. There are currently no anti‑diarrhea agents approved generally for chemotherapy‑induced diarrhea.

Clinical Study

A study titled HALT‑D: DiarrHeA Prevention and ProphyLaxis with Crofelemer in HER2 Positive Breast Cancer Patients Receiving Trastuzumab, Pertuzumab, and Docetaxel or Paclitaxel with or without Carboplatin is currently underway in conjunction with Georgetown University. The primary objective of the study is to characterize the incidence and severity of diarrhea in patients receiving investigational therapy in the setting of prophylactic anti‑diarrheal management.

As we announced on August 19, 2019, statistically significant top line results have been achieved in a key preclinical pharmacological study to evaluate the effects of crofelemer on diarrhea induced in healthy dogs by a maximally tolerated dose of a specific tyrosine kinase inhibitor (TKI). The results of the study, which was funded by a third-party cancer agent manufacturer of an FDA-approved TKI, are expected to provide additional scientific rationale and support for the use of crofelemer in providing symptomatic relief of noninfectious diarrhea in human patients receiving TKI-and/or-other targeted cancer therapy-containing regimens in future human clinical investigations. The top line results of the study show that combined crofelemer groups demonstrated superior benefit for “responders” (p= 0.01). The results from this key preclinical study show concordance and remarkable similarity to the substantial benefits that were observed in the pivotal human trial of crofelemer (ADVENT trial) that resulted in the approval of the drug for the symptomatic relief of noninfectious diarrhea in adult patients with HIV/AIDS on antiretroviral therapy. We are applying our lessons from the ADVENT trial and this preclinical study in our clinical study design

14

that we are discussing with the FDA to allow the conduct of a single pivotal study for CTD in all solid tumor human patients.

As we announced October 22, 2019, additional findings from the above preclinical study evaluating the effects of crofelemer on diarrhea induced by a specific TKI show that the animals in the crofelemer groups received approximately 20% higher doses of the TKI than the animals in the placebo group through the four weeks of the treatment period. The TKI dose reductions over the four-week period were statistically higher for the control group compared to the crofelemer QID group and trending toward statistical significance in the BID group. In general, the treatment effect of crofelemer was 1.5 to 2.5 times better than placebo for multiple endpoints in this study. Specifically, the preclinical study showed that crofelemer treatment resulted in lesser incidence and severity of diarrhea with the maintenance and tolerability of a higher dose of the selected TKI. The study points to potential benefits Jaguar hopes to see in future human studies of crofelemer's ability to provide symptomatic relief of noninfectious diarrhea in patients receiving a targeted cancer therapy in an adjuvant or metastatic setting.

Irritable Bowel Syndrome—Diarrhea Predominant (IBS‑D)

Diarrhea is a common symptom of irritable bowel syndrome (IBS), a frustrating, underdiagnosed and undertreated condition. IBS‑D is a subtype characterized mainly by loose or watery stools at least 25 percent of the time. According to the U.S. FDA, studies estimate that IBS affects 10 to 15 percent of adults in the United States.

Abdominal pain is the key symptom of IBS, and the pain, which is associated with a change in stool frequency or consistency, can be severe. To improve the diagnosis and outcomes for IBS patients and to update clinicians on the latest research, Dr. William Chey, a gastroenterologist and professor of medicine and nutrition sciences at the University of Michigan, along with an international team of collaborators, compiled Rome IV, an updated compendium of diagnostic criteria on functional GI disorders such IBS. Rome IV contains a chapter titled Centrally Mediated Disorders of Gastrointestinal Pain.

Although new agents for IBS‑D have come on the market, there is an unmet medical need for long‑term, safe management of the abdominal pain associated with IBS‑D. We recognize that patients suffering from IBS‑D may require a poly‑pharmacy approach to lifetime management of their disease. Mytesi, which represents a novel mechanistic approach with the benefit of a long‑term safety profile, could possibly be an important addition to the treatment of IBS‑D, if approved for this indication.

Mytesi has been demonstrated to be safe for chronic use, and two studies provide statistically significant results of crofelemer use for abdominal pain in women.

The largest group of IBS sufferers are those with the subtype referred to as IBS‑M (mixed diarrhea and constipation). IBS‑M is also referred to as IBS‑A, because the condition often involves frequent alternating between IBS‑D and IBS‑C (constipation predominant). IBS‑M is distressing for patients as well as difficult to diagnose and manage, and is often associated with pain and urgency as well as significant abdominal distension and bloating. No approved drugs currently exist for IBS‑M. Leading gastroenterologists have stated that IBS‑C drugs may cause diarrhea in an IBS‑M patient, and an IBS‑D drug may cause significant constipation. Since Mytesi has not caused constipation in clinical trials or real‑world experience, we therefore, believe an opportunity exists for an IBS‑M indication for Mytesi. Resultingly, and due to the demonstrated safety of Mytesi for chronic use and its demonstrated benefit for abdominal pain in women, Napo is considering expanding development efforts to evaluate the IBS‑M indication.

Clinical Study

Crofelemer has been tested in safety studies and two significant Phase 2 studies for d‑IBS (diarrhea‑predominate Irritable Bowel Syndrome) as detailed below.

15

Completed Studies—IBS‑D

As we announced on January 8, 2020, a study appearing in the December 2019 issue of Clinical and Translational Gastroenterology, a peer-reviewed journal published by the American College of Gastroenterology, indicates that crofelemer could be a treatment option for abdominal pain associated with diarrhea-predominant irritable bowel syndrome (IBS-D). This multicenter, phase 2, randomized, double-blind, placebo-controlled trial evaluated the effect of crofelemer on abdominal pain in women with IBS-D. A total of 240 women were enrolled, and participants were randomized to crofelemer (125 mg) or placebo twice daily for 12 weeks. Following an analysis by the FDA-issued revised recommendations for outcome measures in IBS clinical trials in 2010, the proportion of monthly abdominal pain responders was significantly higher in the crofelemer group during months 1 through 2 (58.3% vs 45.0%, p = 0.030) as well as during the entire 3 months (54.2% vs 42.5%, p = 0.037) when compared with placebo. No significant differences were observed in the proportion of stool consistency monthly responders based on the revised FDA guidelines.

These observed trends of improvement in monthly abdominal pain responders suggest that crofelemer may have a use for treatment in abdominal pain in IBS-D patients without having significant changes to bowel habits. Currently, there are very few treatment options to address the visceral pain associated with IBS-D. Crofelemer has a distinct and novel antisecretory mechanism of action of modulation of cystic fibrosis transmembrane conductance regulator (CFTR) and/or calcium-activated chloride channels (CaCC) that may provide a new non-opiate or antibiotic-based option to treat the visceral abdominal pain and discomfort for IBS-D patients.

Irritable bowel syndrome (IBS) is a gastrointestinal condition defined by abdominal pain and altered bowel habits in the absence of another disease that can account for these symptoms. IBS is the most commonly diagnosed gastrointestinal condition and has a population prevalence of up to 12% in North America and is more prevalent in women than in men. Currently, IBS is a clinical diagnosis based on abdominal pain associated with a change in bowel habits. Patients with IBS, but particularly those with IBS-D, report significantly reduced quality of life, higher indirect costs, and greater impairments in daily and work activities.

Phase 2a—a randomized double‑blind placebo‑controlled, dose‑ranging (placebo, 125 mg, 250 mg, and 500 mg bid) study over a 12‑week treatment period in 246 patients with d‑IBS (Rome II criteria), including both males and females, whose average age was 50 years old.

n = 245 subjects

61 placebo

62 125 mg crofelemer BID

59 250 mg crofelemer BID

62 500 mg crofelemer BID

IBS symptoms (pain, urgency, stool frequency and consistency, and adequate relief) were self‑reported by the patients via an interactive voice response system. Patients needed to exhibit active disease during the two‑week baseline period as defined by a mean daily stool frequency greater than or equal to 2/day, pain score greater than or equal to 1 and stool consistency greater than or equal to 3 (5‑point Lickert scale for pain and consistency) to be enrolled. Patients received treatment for 12 weeks followed by a two‑week treatment free period.

The protocol‑specified primary efficacy measure was daily stool consistency. Statistical analysis of the primary endpoint found no significant differences between placebo and any of the crofelemer dose groups (p ≥ 0.1434), and no significant dose relationship was seen with regard to change from Baseline to Month 3 in stool consistency scores (p = 0.1165) in the ITT population.

A supplementary analysis of Rome Foundation‑defined stool consistency and abdominal pain showed positive results. Responders were subjects who had a stool consistency score of ≥ 4 for < 25% of days in a given week and ≥ 30% improvement in abdominal pain scores a given week (i.e., Rome Foundation‑defined stool consistency and abdominal pain responders).

16

When we look at a supplemental analysis at a reduction in a composite abdominal pain/stool consistency endpoint, the regulatory endpoint in accordance with FDA guidance, we see at the 125 mg dose bid a significant 15% difference with just women patients compared to placebo; and a significant 11% when we include both men and women. The current IBS‑d products on the market have a 7‑8% reduction (Viberzi and Xifaxan).

In this analysis, Rome Foundation‑defined stool consistency and abdominal pain responders were significantly more likely during the entire 3 months in the 125 mg BID group when compared with placebo (24.2% versus 13.1%, p = 0.0399) and there was a statistical trend in favor of crofelemer 125 mg BID during Months 1 through 2 (27.4% versus 16.4%, p = 0.0640). Similar positive effects of crofelemer 125 mg BID were observed in female subjects (n = 183). When the supplementary analysis was applied to the female patients, crofelemer at a dose of 125 mg BID was superior to placebo at Month 3 (26.1% vs 10.9%, p=0.0337).

•Results: The 125mg bid of crofelemer exhibited a consistent response during each month among most efficacy endpoints in women with d‑IBS reaching statistical significance (p<0.05) for pain.

•Crofelemer had little effect on the stool consistency score, though there was a trend toward reduced stool frequency.

•Treatment benefits were not apparent in men, although relatively few men enrolled in the trial (13‑16/group).

•As with previous trials of crofelemer, no drug‑related serious adverse events were reported. Adverse event rates were similar across all dose groups, although, in the two highest doses (250 and 500 mg bid), there was a higher percentage of dropouts. There were no drug‑related or dose‑related differences in constipation. During the two‑week treatment‑free follow‑up period symptoms approached baseline levels.

Safety: Crofelemer at doses of 125, 250 and 500 mg had a safety profile that was generally similar to placebo among men and women with IBS‑D.

Phase 2—a Randomized, double‑blind, placebo‑controlled study to assess the safety and efficacy of crofelemer for the symptomatic treatment of diarrhea predominant irritable bowel syndrome (d‑IBS) in 240 female subjects 18 years or older with active d‑IBS according to the Rome II criteria for the diagnosis of d‑IBS.

The study consisted of a 2‑week screening period and a 12‑week blinded treatment period followed by a 4‑week treatment‑free follow‑up period. During the 12‑week treatment period, 240 subjects were given 125 mg of crofelemer BID or placebo BID and recorded daily assessments of their IBS symptoms in the interactive voice response system.

The primary endpoint was the change from baseline for the overall percentage of abdominal pain/discomfort free days (PFDs). On a daily basis, respondents recorded the intensity of their abdominal pain/discomfort for that day using the 5‑point Likert scale: 0=none, 1=mild, 2=moderate, 3=intense, 4=severe. Any day that a score of zero (0) was recorded was considered a PFD.

Stool consistency and abdominal pain endpoints were analyzed using definitions of symptom improvement from a recent FDA guidance on IBS endpoints (March 2010) and recommendations of the Rome Foundation (letter dated 28 June 2010) concerning the IBS endpoints described in this guidance.

Results: The overall increase in pain‑free days (protocol‑specified primary endpoint) for subjects in the crofelemer group was not statistically significant when compared with subjects in the placebo group (p = 0.5107)

17

A supplementary analysis of abdominal pain showed positive results. Responders were subjects who had ≥ 30% improvement in abdominal pain scores a given week (i.e., FDA‑defined abdominal pain responders; this definition of abdominal pain responders was presented in the March 2010 guidance on IBS endpoints).

In this analysis, abdominal pain responders were significantly more likely during Months 1 through 2 (58.3% versus 45.0%, p = 0.0303) and during the entire 3 months (54.2% versus 42.5%, p = 0.0371) in the crofelemer group when compared to placebo.

Safety: The overall safety profile for crofelemer 125 mg BID for 12 weeks was comparable to that observed with placebo and was consistent with the IBS population under study.

Rare Pediatric Disease Indications: Congenital Diarrheal Disorders and Short Bowel Syndrome (SBS)

Congenital diarrheal disorders (CDD) are a group of rare, chronic intestinal channel diseases, occurring in early infancy, that are characterized by severe, lifelong diarrhea and a lifelong need for nutritional intake either parenterally or with a feeding tube. CDDs are related to specific genetic defects inherited as autosomal recessive traits, and the incidence of CDDs is much more prevalent in regions where consanguineous marriage is part of the culture. CDDs are directly associated with serious secondary conditions, including dehydration, metabolic acidosis, and failure to thrive, prompting the need for immediate therapy to prevent death and limit lifelong disability.

Potential Orphan‑Drug: Congenital Diarrheal Disorders (CDD) & Short Bowel Syndrome (SBS)

Clinical Study—CDD

We have completed safety studies of crofelemer in children as young as 3 months of age, and Napo has accepted a request for support submitted by Dr. Mohamad Miqdady, Chief of Pediatric Gastroenterology, Hepatology and Nutrition at Sheikh Khalifa Medical City (SKMC) in Abu Dhabi, for an investigator‑initiated trial of crofelemer, the active pharmaceutical ingredient in Mytesi, for CDD in children.

A pre‑clinical study in mice, conducted by an independent third‑party investigator, is underway to support possible orphan‑drug designation for crofelemer for Congenital Diarrheal Disorders (CDD). This animal model study is examining the effects of crofelemer on diarrhea caused by microvillous inclusion disease (MVID), a very rare autosomal recessive disorder which belongs to the CDD category.