Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KANSAS CITY SOUTHERN | ksu-20200325.htm |

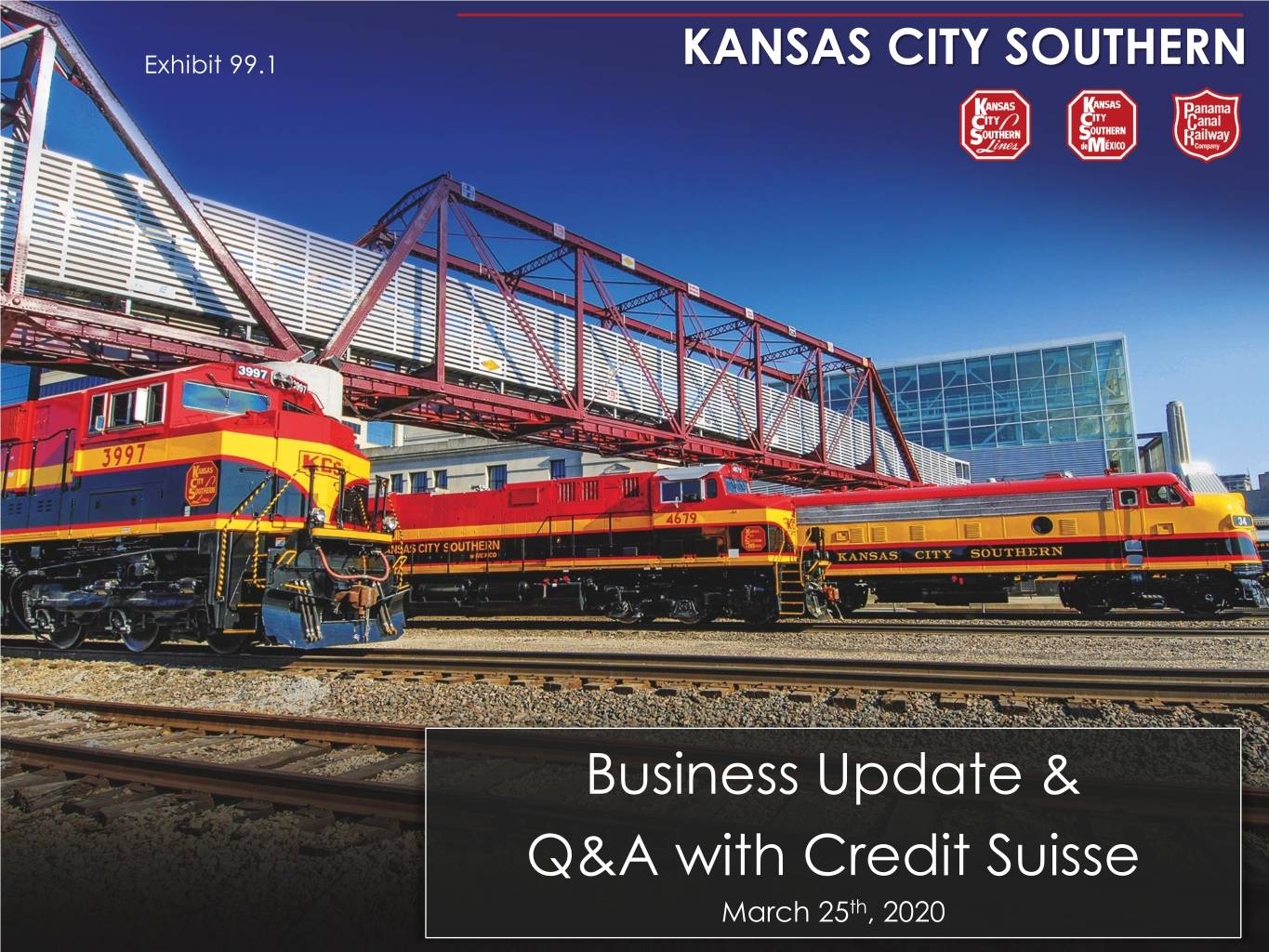

Exhibit 99.1 KANSAS CITY SOUTHERN Business Update & Q&A with Credit Suisse © KANSAS © KANSAS CITY SOUTHERN KCS March 25th, 2020

Safe Harbor Statement This presentation contains “forward-looking statements” within the meaning of the securities laws concerning potential future events involving KCS and its subsidiaries, which could materially differ from the events that actually occur. Words such as “projects,” “estimates,” “forecasts,” “believes,” “intends,” “expects,” “anticipates,” and similar expressions are intended to identify many of these forward-looking statements. Such forward-looking statements are based upon information currently available to management and management’s perception thereof as of the date hereof. Differences that actually occur could be caused by a number of external factors over which management has little or no control, including: competition and consolidation within the transportation industry; the business environment in industries that produce and use items shipped by rail; loss of the rail concession of KCS’ subsidiary, Kansas City Southern de México, S.A. de C.V.; the termination of, or failure to renew, agreements with customers, other railroads and third parties; access to capital; disruptions to KCS’ technology infrastructure, including its computer systems; natural events such as severe weather, hurricanes and floods; market and regulatory responses to climate change; legislative and regulatory developments and disputes; rail accidents or other incidents or accidents on KCS’ rail network or at KCS’ facilities or customer facilities involving the release of hazardous materials, including toxic inhalation hazards; fluctuation in prices or availability of key materials, in particular diesel fuel; public health threats or outbreaks of communicable diseases; dependency on certain key suppliers of core rail equipment; changes in securities and capital markets; unavailability of qualified personnel; labor difficulties, including strikes and work stoppages; acts of terrorism or risk of terrorist activities; war or risk of war; domestic and international economic, political and social conditions; the level of trade between the United States and Asia or Mexico; fluctuations in the peso-dollar exchange rate; increased demand and traffic congestion; the outcome of claims and litigation involving KCS or its subsidiaries; and other factors affecting the operation of the business. More detailed information about factors that could affect future events may be found in filings by KCS with the Securities and Exchange Commission, including KCS’ Annual Report on Form 10-K for the year ended 12/31/2019 (File No. 1-4717) and subsequent reports. Forward- looking statements are not, and should not be relied upon as, a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at or by which any such performance or results will be achieved. As a result, actual outcomes and results may differ materially from those expressed in forward- looking statements. KCS is not obligated to update any forward-looking statements to reflect future events or developments. All reconciliations to GAAP can be found on the KCS website, kcsouthern.com/investors. © KANSAS © KANSAS CITY SOUTHERN KCS 2

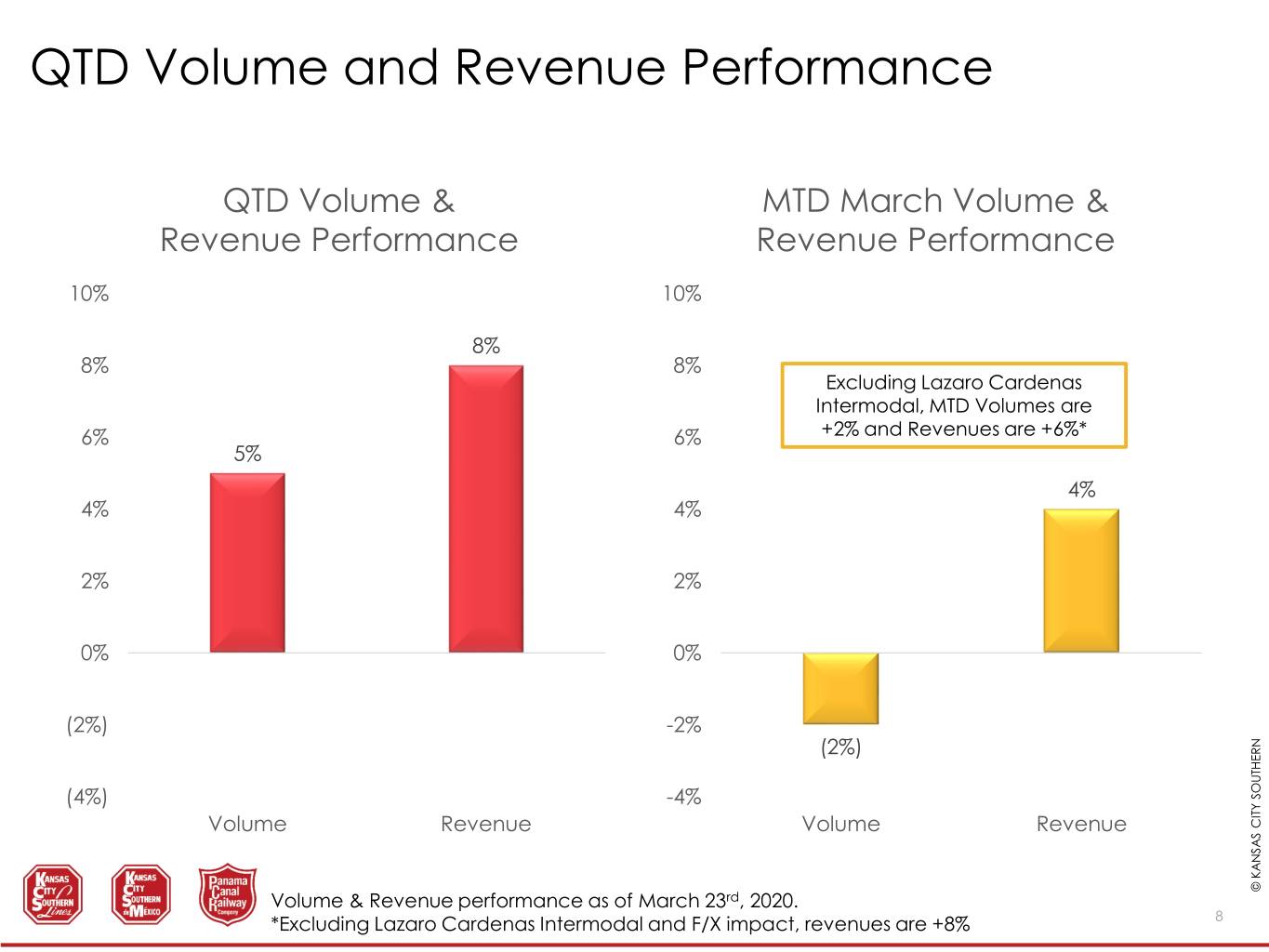

Key Messages . Strong financial position – BBB Credit Rating – $600M undrawn revolving credit facility . Proactive response to COVID-19 – Safety is our #1 priority – Business continuity plans in place – Actively managing costs in uncertain volume environment . Strong start to the year – QTD volume +5% and revenue +8% – March MTD volume -2% and revenue 4%; impacted by lower Lazaro Cardenas container volume and FX . PSR & active expense management – On track to deliver $61M of PSR savings in 2020 – Ability to scale variable expenses with volume © KANSAS © KANSAS CITY SOUTHERN KCS Volume & Revenue performance as of March 23rd, 2020. 3

Robust Credit Ratings & Metrics • From Single B in 2009 to BBB today • Only 26% of companies are BBB or above • Low 2x leverage ratio Strong Cash Flow Solid • 85% FCF CAGR since 2015 Financial Profile Ample Liquidity • $600M undrawn revolving credit facility • No debt maturities until 2023 Balanced Capital Allocation Policy • 40-50% capital projects & strategic investments • 50-60% share repurchases & dividends © KANSAS © KANSAS CITY SOUTHERN KCS Amounts and ratios as of 12/31/19 unless otherwise stated 4

COVID-19 RESPONSE © KANSAS © KANSAS CITY SOUTHERN KCS 5

COVID-19 Management . Safety of employees & communities is our #1 priority – Actively communicating with employees – Sickness protocols in place – Departmental staffing plans implemented . Business continuity plans in place – Dispatching from multiple locations – No current impact to train operations . Maintaining frequent communication with customers – Auto OEM’s are only known customer facility closures – Tracking daily and actively managing costs in uncertain volume environment . No current interruption to KCS’ materials and fuel supply chain © KANSAS © KANSAS CITY SOUTHERN KCS 6

BUSINESS UPDATE © KANSAS © KANSAS CITY SOUTHERN KCS 7

QTD Volume and Revenue Performance QTD Volume & MTD March Volume & Revenue Performance Revenue Performance 10% 10% 8% 8% 8% Excluding Lazaro Cardenas Intermodal, MTD Volumes are 6% 6% +2% and Revenues are +6%* 5% 4% 4% 4% 2% 2% 0% 0% (2%) -2% (2%) (4%) -4% Volume Revenue Volume Revenue © KANSAS © KANSAS CITY SOUTHERN Volume & Revenue performance as of March 23rd, 2020. KCS *Excluding Lazaro Cardenas Intermodal and F/X impact, revenues are +8% 8

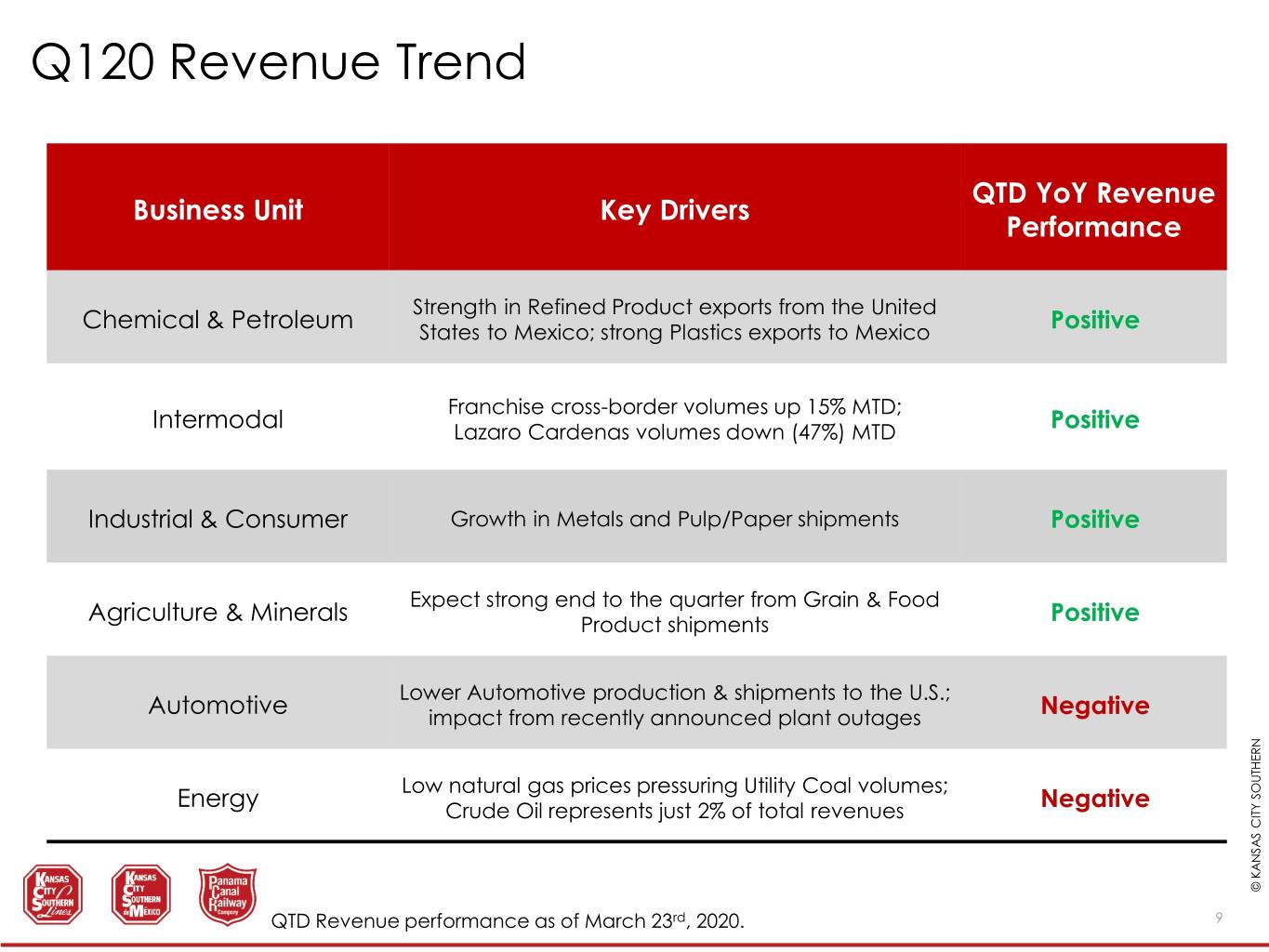

Q120 Revenue Trend QTD YoY Revenue Business Unit Key Drivers Performance Strength in Refined Product exports from the United Chemical & Petroleum States to Mexico; strong Plastics exports to Mexico Positive Franchise cross-border volumes up 15% MTD; Intermodal Lazaro Cardenas volumes down (47%) MTD Positive Industrial & Consumer Growth in Metals and Pulp/Paper shipments Positive Expect strong end to the quarter from Grain & Food Agriculture & Minerals Product shipments Positive Lower Automotive production & shipments to the U.S.; Automotive impact from recently announced plant outages Negative Low natural gas prices pressuring Utility Coal volumes; Energy Crude Oil represents just 2% of total revenues Negative © KANSAS © KANSAS CITY SOUTHERN KCS QTD Revenue performance as of March 23rd, 2020. 9

KCS Refined Products Business Benefiting from Growth in Non-Pemex Imports into Mexico . QTD Mexico Energy Reform volumes are up 46% vs. 2019 . Pemex production continues to decline . Non-Pemex imports to Mexico grew 54% in the 2nd half of 2019 . Non-Pemex sales are growing as a % of total sales © KANSAS © KANSAS CITY SOUTHERN KCS QTD volume performance as of March 23rd, 2020. 10

PSR & EXPENSE MANAGEMENT © KANSAS © KANSAS CITY SOUTHERN KCS 11

~50% of KCS’ Cost Structure is Directly Variable to Prolonged Volume Decline % of Total Cost Type Components Operating Expense Fuel T&E Labor Direct Variable Car Hire ~50% Cost Car Maintenance Trackage Rights Auto/Intermodal Ramp Operations Semi-Variable Car & Locomotive Depreciation Casualties & Insurance ~10% Cost Locomotive Maintenance Corporate Overhead Maintenance of Way Fixed Cost Network Depreciation ~40% Non T&E Transportation Labor © KANSAS © KANSAS CITY SOUTHERN 12 KCS Based on 2019 adjusted operating expense; all reconciliations to GAAP can be found on the KCS website in the Investors section

On Track to Deliver 2020 PSR Savings ($ in millions) Total PSR Program Annualized OpEx Savings of $125M FY 2019 FY 2020 OpEx Category Primary Drivers Actual OpEx Incremental Savings OpEx Savings Compensation & Reduced headcount & crew $8 $15 Benefits costs Disposal of certain locomotives Depreciation and rail cars $5 $4 Train consolidation and Fuel efficiency/technology $19 $21 Equipment Lease returns & car cycle times $13 $17 Purchased Restructured contracts, and $13† Services and reduced repair expenses $4 Materials & Other Total $58 $61 © KANSAS © KANSAS CITY SOUTHERN KCS †Includes a $5.1M benefit from a one-time settlement 13

Multiple Opportunities for Cost Savings in the U.S. and Mexico . Immediate focus on cost reductions through service design changes . Reducing corporate costs . Right sizing asset fleets – Active locomotive fleet down 16% since Q418 peak • About 10% of current locomotive fleet is stored – System car fleet down by 12% of since the end 2018 • More than 500 grain cars in storage today • Reviewing automotive fleet due to plant closures . YTD February transportation results from PSR initiatives are promising: – Carloads up 7% on flat crew starts – Overtime rate down to 11% from 14% in 2019 – Recrews fell by 44% . Continue to modernize Mexico work rules – Service, operational & safety requirements should dictate crew size © KANSAS © KANSAS CITY SOUTHERN KCS 14

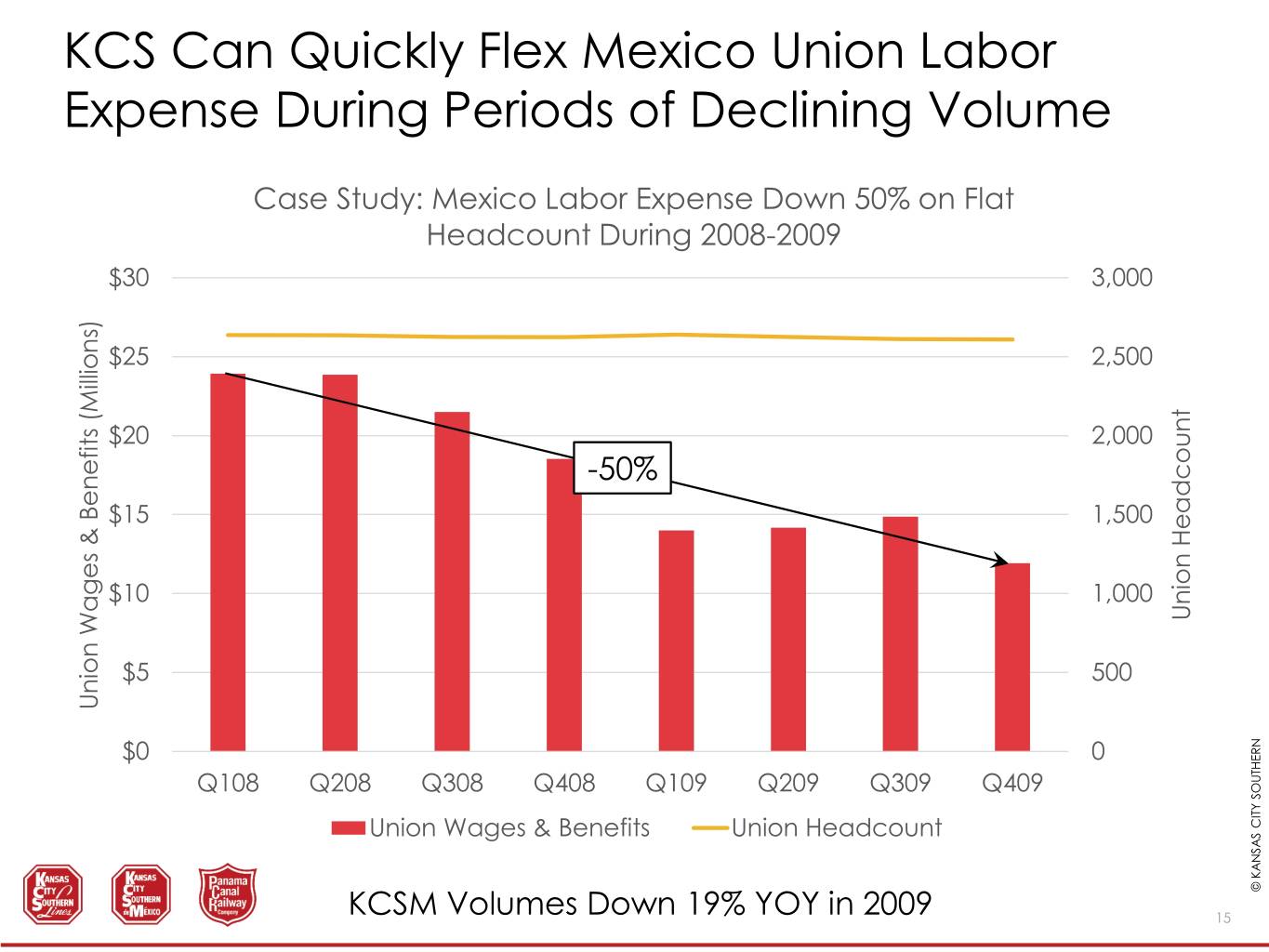

KCS Can Quickly Flex Mexico Union Labor Expense During Periods of Declining Volume Case Study: Mexico Labor Expense Down 50% on Flat Headcount During 2008-2009 $30 3,000 $25 2,500 (Millions) $20 2,000 -50% $15 1,500 $10 1,000 Union Headcount Union $5 500 Union Wages & Benefits Benefits & Wages Union $0 0 Q108 Q208 Q308 Q408 Q109 Q209 Q309 Q409 Union Wages & Benefits Union Headcount KCSM Volumes Down 19% YOY in 2009 © KANSAS CITY SOUTHERN KCS 15

Thank You! www.KCSouthern.com © KANSAS © KANSAS CITY SOUTHERN KCS 16