Attached files

| file | filename |

|---|---|

| EX-32.2 - eWELLNESS HEALTHCARE Corp | ex32-2.htm |

| EX-32.1 - eWELLNESS HEALTHCARE Corp | ex32-1.htm |

| EX-31.2 - eWELLNESS HEALTHCARE Corp | ex31-2.htm |

| EX-31.1 - eWELLNESS HEALTHCARE Corp | ex31-1.htm |

| EX-3.1A - eWELLNESS HEALTHCARE Corp | ex3-1a.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 000-55203

eWELLNESS HEALTHCARE CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 90-1073143 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) | |

| 333 Las Olas Way, Suite 100, Ft. Lauderdale, FL | 33301 | |

| (Address of principal executive offices) | (Zip Code) |

(855) 470-1700

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: Common stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of the 221,471,504 voting and non-voting common equity held by non-affiliates on June 30, 2019 (the last trading date in June 2019) computed by reference to the closing price of $199.75 on such date or the average bid and asked prices of such common equity as of the last business day of the registrant’s most recently completed second fiscal quarter was $44,238,932,924.

The number of shares of Common stock, $0.001 par value, outstanding on March 20, 2020 is 467,038,350.

DOCUMENTS INCORPORATED BY REFERENCE

None

eWellness Healthcare Corporation

Form 10-K

For the Year Ended December 31, 2019

Table of Contents

| 2 |

FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements”. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objections of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing.

Forward-looking statements may include the words “may,” “could,” “estimate,” “intend,” “continue,” “believe,” “expect” or “anticipate” or other similar words. These forward-looking statements present our estimates and assumptions only as of the date of this report. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the dates on which they are made.

Throughout this Annual Report references to “we”, “our”, “us”, “eWellness”, “the Company”, and similar terms refer to eWellness Healthcare Corporation and its wholly owned subsidiary.

eWellness Healthcare Corporation (f/k/a Dignyte, Inc.), (the “eWellness”, “Company”, “we”, “us”, “our”) was incorporated in the State of Nevada on April 7, 2011.

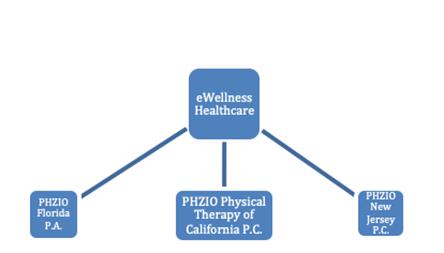

The Company has developed a new operating structure enabling it to operate in 48 states. The below noted chart illustrates the Company’s new operational structure that provides for three individual professional operating companies in California, New Jersey and most importantly Florida. With our Florida Professional Association (PA), we are able to provision our telehealth services in 46 states, (excluding: California, Delaware, Kansas and New Jersey). Thus, we formed two additional professional companies in California and New Jersey. Each professional company has executed a revocable operating agreement with the Company. These agreements are required by each individual state and states that Darwin Fogt, MPT, the sole officer, director and shareholder of each of the operating companies. All accounting services are supplied to these operating companies by the Company’s accounting team.

| 3 |

The Company and Nature of Business

eWellness Healthcare Corporation is a provider of the state of the art PHZIO platform for the physical therapy (“PT”) and telehealth markets and believes it is the first digital telehealth physical therapy company (“dtPT Company”) to offer real-time monitored physical therapy assessments and treatments to large-scale employers. The Company’s digital telehealth assessment and treatment platform (the “dtPT Platform” or “Platform”) has been designed to serve the $30 billion physical therapy market, the $4 billion musculoskeletal (“MSK”) market and the $8 billion corporate wellness market. Our dtPT Platform redefines the way physical therapy (“PT”) can be delivered. We believe that our Platform is able to transform the access, cost and quality dynamics of PT assessments and treatments. We began generating revenue during the fourth quarter of 2019.

We designed our Platform to enable its usage for all PT assessments and treatments by means of computer, smart phone and/or similar digital media devices (the “Access Devices”). This new approach will lower patient treatment costs, expand patient treatment access and improve patient compliance. Our dtPT Platform allows patients to avoid the time-consuming clinical experience to an immediate in-home PT experience. We believe that approximately 80% of all PT assessments and treatments can be performed using our Platform accessible via the Access Devices in the privacy of once home.

We believe that our innovative approach to solving the pervasive access, cost and quality challenges facing the current access to PT clinics, will lead to highly scalable and substantial growth in our revenues. The Company has signed 7 partnership and healthcare provider agreements to date. We believe that we are well positioned to participate in the rapidly evolving PT treatment market by introducing our innovative dtPT Platform enabling remote patient monitoring, post-discharge treatment plan adherence and in-home care. Our Platform incorporates research-based methods and focuses on, not only rehabilitation but also wellness, functional fitness, performance, and prevention.

Our dtPT Platform recognizes that the national healthcare industry (federal and private insurance) is moving toward a model of prevention and that physical therapy is expected to take a larger role in providing wellness services to patients. Due to the real-time patient monitoring feature, we believe that our dtPT Platform is reimbursable by insurance companies such as Anthem Blue Cross and Blue Shield.

The Company will initially rollout these new telehealth solutions within California, New Jersey, Georgia, Tennessee, Arizona and Canada, with plans to expand nationally over the next twelve months. With these new telehealth tools, eWellness will engage with the “At-Home” Physical Therapy and MSK treatment market. This market involves physical therapy practitioners treating patients in their home instead of a clinic. The “At-Home” market model when combined with the PHZIO and or MSK 360 offers patients and practitioners a means to receive and deliver PT and MSK services without having to leave work during normal business hours. Patients can receive physical therapy and MSK services at almost any hour of the day. A model that is not currently employed within traditional clinical settings.

During June 2019 the Company signed a Provider Service Agreement with CareIQ, a division of CorVel Healthcare Corporation, one of the largest Third-Party Insurance Administrators (“TPA”) in the U.S. with patients in all 50 states. https://www.corvel.com/about-us. Initially, PHZIO will be used to treat patients in five (5) states including: California, New Jersey, Georgia, Tennessee and Arizona. These initial states will be used to assess the effectiveness of the PHZIO digital physical therapy platform.

During October 2019, the Company introduced MSK 360 treatment platform as a new silo of business that focuses on the $4 Billion North American Musculoskeletal Treatment Market to address the global musculoskeletal diseases treatment market, that is expected to reach US$ 5.7 billion in 2025 from US $3.8 billion in 2017, according to a report by The Insight Partners. The musculoskeletal diseases treatment market is estimated to grow with a CAGR of 5.3% from 2018-2025. MSK disease affects the joints, bones and muscles and also back pain. More years are lived with musculoskeletal disability than any other long-term human condition.

Our PHZIO and MSK 360 platforms have been developed to significantly support us in becoming the leader in the new industry of digital telehealth in the MSK and PT markets. Our focus is to highlight that a majority of all future MSK PT treatments can be accomplished with a smart phone. This new digital adoption will lower employee treatment costs, expand employee treatment access and improve employee compliance. Our PHZIO and MSK 360 platform allows employees and PT’s to cut the cord from the old-school, wait in line, brick and mortar clinical experience to an immediate response digital, in-home PT experience. Nearly, 100% of all PT assessments and treatments can now be done on an employee’s smart phone in the privacy of their own home. Digital MSK treatments are clearly the next upgrade the industry needs to make.

| 4 |

The Company has created a strong path to initial revenue generation and substantial sales growth through executing on our Workers Compensation and MSK Sales Funnel. Our Workman’s Compensation and MSK Sales Funnel currently includes over 101 companies. Starting in the Summer of 2018 we pivoted our sales process to focus on the workman’s compensation PT industry. Additionally, we added the MSK market during the summer of 2019. Multiple agreements are anticipated to be executed from our workman’s compensation and MSK sales funnel through 2019 and beyond.

In October 2019 The Company signed a Direct to Consumer Marketing Agreement with Wosler Holdings, Inc., a Delaware Corporation d/b/a/ Slingshot Health (“Slingshot”) (https://www.slingshothealth.com), Through this agreement, Slingshot seeks to involve EWLL affiliated PT Providers, and EWLL seeks to gain their affiliated PT Providers access to the Slingshot consumer healthcare patients through the Slingshot platform. The Parties anticipate commencing these new direct to consumer sales and marketing efforts during the fourth quarter ended December 31, 2019. The Company believes that Slingshot Healthcare is one of the leading on-line platforms for digital healthcare to consumers. Slingshot Health is a healthcare marketplace connecting people to health and wellness providers, placing control directly in the hands of those seeking and delivering care. By removing layers of bureaucracy surrounding our healthcare system, Slingshot is achieving its mission of creating better access, more affordability and greater transparency in healthcare. Through Slingshot’s proprietary platform, consumers enter the services they want, their location, availability and the price they are willing to pay. Slingshot then matches them to a local provider who can deliver the service. Healthcare consumers receive high-quality, affordable services and providers earn more overall.

In October 2019, EWLL’s PHZIO Canada (“PHZIO Canada”) signed a one-year Pilot Program Agreement with C&C Insurance Consultants d/b/a/ StudentVIP.ca (“StudentVIP.ca”) (https://studentvip.ca/about-us/), Through this agreement, StudentVIP.ca seeks to market PHZIO.com services to its student health insurance clients. StudentVIP.ca is one of Canada’s largest student health insurance provider servicing over 100,000 college students. The Parties anticipate commencing these new direct to consumer sales and marketing efforts during the first quarter of 2020.

Our PHZIO and MSK 360 platforms completely disrupts the current in-clinic business model of the $30 billion PT industry, the 4 billion MSK market and the $8 billion corporate wellness industries. Innovators in other industries have solved access, cost and quality inefficiencies through the implementation of technology platforms and business models that deliver products and services on-demand and create new economies by connecting and empowering both consumers and businesses. We have taken the same approach to solving the pervasive access, cost and quality challenges facing the current access to PT and MSK clinics. eWellness’ underlying technology platform is complex, deeply integrated and purpose-built over the past five years for the evolving PT and MSK treatment marketplaces. eWellness’ PHZIO and MSK 360 platforms are highly scalable and can support substantial growth of third-party licensees. eWellness’ PHZIO and MSK 360 platforms provides for broad interconnectivity between PT practitioners and their patients, uniquely positioning the Company as a focal point in the rapidly evolving PT industry to introduce innovative, technology- based solutions, such as remote patient monitoring, post-discharge treatment plan adherence and in-home care.

Our Principal Products and Services

The principal features of our new digital telehealth physical therapy delivery system are as follows:

● ● |

SaaS technology platform solution for providers bundling rehabilitation services and employer wellness programs PTs can evaluate and screen patients and calculate joint angles using drawing tool | |

| ● | First real-time remote monitored one-to-many PT treatment platform for home use | |

| ● | Ability for PTs to observe multiple patients simultaneously in real-time | |

| ● | Solves what has been a structural problem and limitation in post-acute care practice growth. | |

| ● | PT practices can experience 20% higher adherence and compliance rates versus industry standards | |

| ● | Tracking to 30% increase in net income for a PT practice. |

| 5 |

We have commenced treating patients on various commercial contracts and started to generate revenues during the last quarter of the year ended December 31, 2019. We continue to train physical therapists on how to use our Platform, with many of these therapists treating various patients on our system on a complimentary basis. To date, our dtPT Platform has delivered over 4,000 PT assessments and treatments.

During the 2nd half of 2019, we intensified our focus on PT assessments and treatments covered under the Workers’ Compensation Insurance program which is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment. Changes in regulations related Workers’ Compensation Insurance have provided us with an opportunity to offer our MSK 360 Program as described below. Under the new regulation patients can choose to be treated in-clinic or through dtPT. Until recently, patients nearly all choose in-clinic treatment. In response to this change we developed our MSK360 Program.

We are in the final stage of developing a fourth program related to Rheumatoid Arthritis Exercises (“RA 360 Program”). We expect to make the RA 360 Program available during the third quarter of 2020.

To date, we have existing provider agreements with approximately 16 corporations based on which their employees can utilize our Platform. Additionally, we are actively pursuing as clients for our services numerus large corporate self-insured companies, TPA’s and insurance companies to sign provider agreements with us. We have historically had to devote up to one year in sales and marketing and sales activities and efforts to sign new provider agreements and to date we have executed and existing 16 provider agreements with the following companies that we expect to generate revenues during the first quarter of 2020 as follows:

Pepsi, Corvel, Imperial, Rogers, Manulife, CanadaLife, Navy & Stage Benefits, Health and Dental Plan, Slingshot Health, BBD Benefits By Design, Morneau Shapell, Green Shield Canada, Bruce Power.

Our dtPT Platform under the domain name PHZIO.com currently offers three treatment programs (i) PHIZO Program; (ii) MSK 360 Program and (iii) Pre-HabPT Program.

Background on our PHZIO Technology

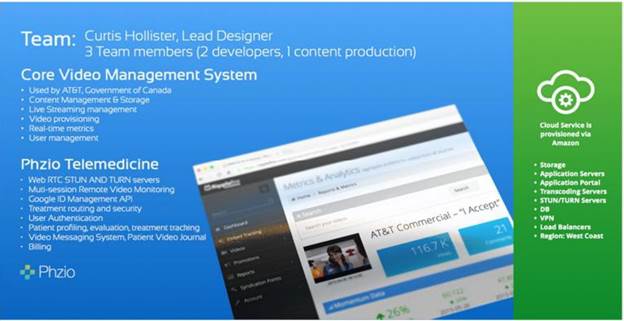

The Company’s Chief Technology Officer (“CTO”), Curtis Hollister, oversees the operational aspects of the PHZIO platform via a team located in Ottawa, Canada. The below noted chart contains information on our PHZIO System.

| 6 |

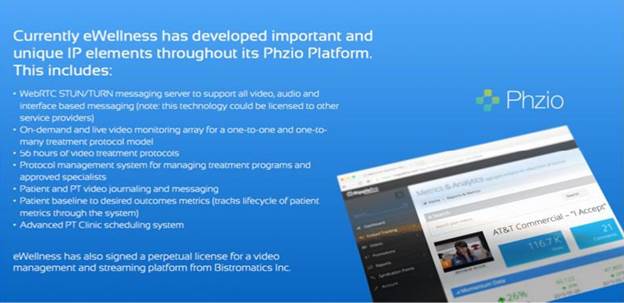

IP and Licensing

We have licensed our telemedicine platform from Bistromatics Inc., a company owned by our CTO, for perpetuity for any telemedicine application in any market worldwide. The below noted chart highlights what we have built to date.

On November 12, 2016, the Company entered into a Services Agreement with Bistromatics, Inc. (the “Bistromatics Agreement”), a Company incorporated under the laws of Canada (“Bistromatics”). Pursuant to the Bistromatics Agreement, Bistromatics will provide operational oversight of the Company’s Phzio System including development, content editing, client on boarding, clinic training, support & maintenance, billing, hosting and oversight and support of CRM and helpdesk system. The Company has agreed to pay a monthly base fee of $50,000 monthly until Bistromatics has successfully signed and collected the first monthly service fee for 100 Physical Therapy Clinics to start using our Platform. When, and if, Bistromatics provides the Company with evidence of the 100 Physical Therapy Clinics, the monthly service fee will be $100,000. Bistromatics will have the ability to convert any outstanding amounts that fall in arrears for 60 days into common stock at the same terms as the next round of financing or the Company’s common stock market price, whichever is higher. Bistromatics will also have the right to appoint 40% of the directors.

Competition

We have identified multiple privately held telemedicine and exercise platform companies that utilize Avatar/Kinect-based telerehb platforms including: Reflexion Health, RespondWell, Physmodo, Jintronx, MotionCare 360 and Five Plus. Additionally, we have identified other video-based physical therapy solutions such as: Bluejay, PT Pal, VitalRock, Physiotech, SimplyTherapy and YouTube. Yet, none of these companies have real-time PT monitoring, one-to-many platform, treatments reimbursable by payors and strong program compliance and adherence by patients.

The PHZIO Program

Our PHZIO treatment enables patients to engage with live or on-demand video based dtPT assessments and treatments from their home or office. Following a physician’s exam and prescription for physical therapy to treat back, knee or hip pain, a patient can be examined by a physical therapist and if found appropriate inducted in our PHZIO program that includes a progressive 6-month telemedicine exercise program (including monthly in-clinic checkups). All PHZIO treatments are monitored by a licensed therapist that sees everything the patient is doing while providing their professional guidance and feedback in real-time. This ensures treatment compliance by the patient, maintains the safety and integrity of the prescribed exercises, tracks patient metrics and captures pre-and post-treatment evaluation data. This innovative assessment and treatment program enable any PT practice to be able to treat more patients while utilizing the same resources.

| 7 |

A Monitored In-office & Telemedicine Exercise Program: Our initial 6-month PHZIO exercise program has been designed to provide patients, who are accepted into the program, with traditional one-on-one PT evaluations, re-evaluations (one to four weeks throughout the PHZIO program depending on type of insurance), and after the conclusion of the program a Physical Performance Test. These PTs are known as Induction & Evaluation PTs (“IEPTs”). All patient medical data, information and records are retained in the files of the IEPT. The IEPT will also evaluate the progress of the patient’s participation in our PHZIO program.

| ● | Physician Diagnosis: Following a physician’s diagnosis of a patient with non-acute back pain, who is also likely overweight and pre-diabetic, a physician may prescribe the patient to participate in the eWellness PHZIO exercise program. | |

| ● | Enrollment Process: The accepted patients are assessed by a PT, located at a PT Licensee clinic and then enrolled in our PHZIO program by going online to our PHZIO program virtual private network (“VPN”) and creating a login name and password. The patient will then populate their calendar with planned times when they anticipate exercising. They will also be provided with a free exercise ball, resistance stretch bands, stretch strap and yoga mat at induction. | |

| ● | Exercising Begins: The day after the patient receives the equipment, the patient will log on to our VPN at least 3 times per week, to watch and follow the prescribed 40-minute on-line exercise program. The PHZIO platform also allows two-way communication (videoconferencing) with one of our licensee’s On-line PTs (“OLPT’s”), who is responsible for monitoring on-line patients. The OLPT’s are also available to answer patient’s questions. When available the patients exercise sessions are recorded and stored in our system as proof that they completed the prescribed exercises. There are 250 various 40-minute exercise videos that are viewed by our patients in successive order. | |

| ● | Driving Patients to work out between 6:00am-9:30am 5 days per week: Our PHZIO system has a calendar function so that patients can schedule when they will login to our PHZIO system. This calendar enables a PT Licensee to better spread the load of patients participating in any forty-minute on-line exercise program during our 15 hours of weekly operations, 6am through 9:30am Monday through Friday are to most optimal hours for patient engagement. Also, if the patient is not on-line at the planned exercise time, our system can send them an automated reminder, via text, voicemail and or e-mail messaging. |

Trackable Physical Therapy. The exercise PHZIO prescription and instruction will be delivered with a series of on-line videos easily accessed by each patient on the internet. Each video will be approximately 40 minutes in length with exercises, which will specifically address the common impairments associated with diabetes and/or obesity. Exercise programs will be able to be performed within each patient’s own home or work location without requiring standard gym equipment. Each patient will be required to log in to the system which will monitor performance automatically to ensure their compliance. Each patient will be required to follow up with their referring physician and PT at designated intervals and metrics such as blood pressure, blood sugars, BMI, etc. will be recorded to ensure success of the program.

Patient Program Goals. Our PHZIO program was designed so that the average patient is targeted to lose 2 pounds per week, totaling up to 48 pounds over the duration of the program to progress toward healthier defined BMI, reduction body fat percentage by at least 8%, reduced reliance on medication for blood glucose regulation and dosage or frequency and a goal of at least a 50% adherence to continuing the PHZIO program independently at conclusion of program.

Trackable Video Exercise Program. The PHZIO program video includes all aspects of wellness preventative care to ensure the best results: cardiovascular training, resistance training, flexibility, and balance and stabilization; research studies on all such distinct impairments have shown to provide effective treatment results. Each video integrates each of the four components to guarantee a comprehensive approach to the wellness program, but each video will specifically highlight one of the four components. All PHZIO Program videos can be viewed on the Access Devices.

| 8 |

Specific Video Programs. Each patient will receive a prescription for six months (26 week) of physical therapy and exercise that is provided by viewing on-line programs produced by us where the patient can do these exercises and stretching on their own at least 3 days per week for at least 40 minutes. To view the videos, the patient would log onto the Platform and would be directed to watch the appropriate video in sequence. As the patient is logged-in, the monitoring PT will be able to monitor how often and if the entire video session was viewed. This data would be captured and sent weekly to the prescribing physician and the monitoring PT for review. At all times, a licensed OLPT/PTA will have access to each patient utilizing the videos and will be able to communicate with a patient via videoconferencing and/or instant messaging. This will help improve adherence to the program as well as the success and safety of the patients’ treatments. A patient will also be instructed to walk or ride a bike at least 30 minutes three days per week in addition to participating in our program.

If the patient is not viewing the videos, then the prescribing physician and/or the monitoring PT would reach out to the patient by telephone and/or e-mail to encourage the patient to keep up their physical fitness regime. After each series, the patient returns for an office visit to the prescribing physician for blood tests, blood pressure and a weight management check- up as well as a follow-up visit with the PT for assessment of the patient’s progress toward established goals.

Exercise Patient Kits. Most patients will receive a home exercise tool kit which will include: an inflatable exercise ball, a hand pump, a yoga mat, a yoga strap and varying levels of resistance bands. Each of the PHZIO exercise videos will include exercises that incorporate the items in the tool kit. By using a bare minimum of equipment, patients should be able to participate more easily at home or at their workplace. Our estimated cost of the kit is $49, which we pay and factor into a PT licensees’ revenue stream and internal projections. The cost of the exercise kits may also be billed to the patients account.

MSK 360 Program

The musculoskeletal (MSK) system, which consists of our bones, muscles and joints, experience strain as we move. MSK related issues are a leading cause of absenteeism in the workplace and in many cases can lead to short- or long-term disability. These costs are a significant factor in any workplace and have cascading effects on employee productivity. We believe that to accelerate physical health, it is critical to prevent and address MSK timely to reduce future health costs.

Patients can receive virtual care through the MSK 360 Program with the guidance of a registered PT via our Platform through their Access Devices. As patients will not need to travel to their health appointments during the workday, telerehabilitation is a timesaver, and therefore a cost saver.

The employee will first be evaluated to determine the priority of patients’ treatments based on the severity of their condition if they are suitable for our MSK 360 Program. If a patient has experienced a major injury (e.g. fracture), he/she will be instructed to receive in-person PT care.

Any EPS and/or LW insureds may, after an in-home or in-office PT assessment, enroll in a 6-month comprehensive treatment program. The main treatment objective of our MSK360 Program is to graduate at least 60% of inducted patients through our 6-month program. Patients should expect to experience an average of a 20% reduction in BMI, a two-inch reduction in waist size, weight loss of at least 10 pounds, significant overall improvement in balance, coordination, flexibility, strength and lumbopelvic stability. Patients also should score better on Functional Outcomes Scales (Oswestry and LEFS) which indicates improved functional activity levels due to reduced low back, knee and hip pain.

PreHabPT Program

Any individuals covered by EPS and/or LW who are seeking non-emergency orthopedic surgery shall first receive an online consultation, in-home or in-office PT therapy evaluation and will be prescribed a four to eight-week pre-habilitation physical therapy (“PreHabPT”) exercise program prior to any surgery. Another in-home or in-office PT evaluation will be made following surgery and a treatment plan will be initiated. A PreHabPT Program is an eight-week physician to patient pre-surgical (Prehab) digital therapeutic exercise treatment for patients that anticipate having total join replacement (knee, hip and or shoulder) or back surgeries.

| 9 |

PurePT

PurePT is a patient and independent PT Program for connecting new patients to PT’s that are seeking to be treated with our PHZIO treatment system. Patient program assessments can be made in the privacy of a patient’s home or office. PurePT connects new patients to PT’s, particularly in states that have direct access rules where patient’s insurance will reimburse for treatment without requiring a physician’s prescription. PurePT puts the patient first.

Our Marketing Strategy

We pivoted and intensified our focus on generating revenues from PT assessments and treatments covered under the Workers’ Compensation Insurance program where changes in regulations related Workers’ Compensation Insurance have provided us with an opportunity to offer our MSK 360 Program as described above. Under the new regulation patients can choose to be treated in-clinic or through dtPT. Until recently, patients nearly all choose in-clinic treatment. In response to this change we developed our MSK360 Program.

Competition

The healthcare industry, including the physical therapy business, is highly competitive. The physical therapy business is highly fragmented with no company having a significant market share nationally. We believe that we are first dtPT Company to offer real-time monitored physical therapy assessments and treatments to large-scale employers.

The global Telehealth Market is likely to expand considerably with impetus from the ability of telehealth to serve rural populations. According to a report published on August 1, 2019 by Fortune Business Insights, titled “Telehealth Market: Global Market Analysis, Insights, and Forecast, 2019-2026,” the market was valued at US$ 49.8 Billion in 2018. Based on this report, the telehealth market will reach US$ 266.8 Billion by 2026.

Competitive factors affecting our business include quality of care, cost, treatment outcomes, convenience of treatment programs offered, and relationships with, and ability to meet the needs of, referral and payor sources. We compete, directly or indirectly, with many types of healthcare providers including the physical therapy departments of hospitals, private therapy clinics, physician-owned therapy clinics, and chiropractors. We may face more intense competition if consolidation of the therapy industry continues. We believe that our new approach to physical therapy will lower patient treatment costs, expand patient treatment access and improve patient compliance. Our dtPT Platform allows patients to avoid the time-consuming clinical experience to an immediate in-home PT experience. We believe that approximately 80% of all PT assessments and treatments can be performed using our Platform accessible via the Access Devices in the privacy of once home.

We believe that our business model based on digital telehealth physical therapy resulting in potential strategic competitive advantage We also believe that our competitive position is enhanced by our strategy by making physical therapy more easily accessible to patients. We offer convenient hours for the PT assessments and treatments. Our dtPT Platform allows patients to avoid the time-consuming clinical experience to an immediate in-home PT experience. We believe that approximately 80% of all PT assessments and treatments can be performed using our Platform accessible via the Access Devices in the privacy of once home. We have identified, as direct competitors, a number of privately held telemedicine and exercise platform companies as mentioned below:

Physera: Physera provides direct access to world-class physical therapists with personalized exercises programs for convenient and low-cost treatment of musculoskeletal pain. The Company has raised $10.8 million. Estimated revenues are less than $1 million in 2019. Post money valuation is currently $50 million.

Reflexion Health: Reflexion Health, Inc. develops and publishes a prescription software for medical professionals and their patients. It offers a rehab measurement tool to track patient adherence for the prescribed rehab plan. The company was incorporated in 2012 and is based in San Diego, California. The Company has raised $29.8 million. Estimated revenues are just over $1.3 million in 2019. Post money valuation is currently $100 million.

| 10 |

Hinge Health: Hinge Health focuses on musculoskeletal health. Hinge Health’s back and joint pain care pathways combine wearable sensor-guided exercise therapy with behavioral change through 1-on-1 health coaching and education. The Company has raised $36.1 million. Estimated revenues are just over $1.6 million in 2019. Post money valuation is currently $500 million.

Peerwell: PeerWell’s PreHab and ReHab app delivers customized daily lessons to those with scheduled surgery. The Company has raised $9.1 million. Estimated revenues are under $2.5 million in 2019. Post money valuation is currently $50 million.

Force Therapeutics: Force Therapeutics was founded in 2010 to transform the delivery of injury rehabilitation through web and mobile applications. In addition to its smart platform for mobile and web content delivery, FORCE Therapeutics produces high definition, evidenced based exercise videos for its applications. The Company has raised $25.7 million. Estimated revenues are under $1.6 million in 2019. Post money valuation is currently $100 million.

Respondwell: Respondwell offers a tele-rehabilitation platform that enables healthcare service providers to connect, monitor, and collect data about their patients. It provides its services for total joint replacement patients. Respondwell enables patients to access videos of physical therapies that are conducted by virtual instructors. The platform offers in-product rewards to increase patient engagement. It offers two online programs: Therapy@Home and Fitness@home. Estimated revenues are $5 million in 2019. The company is owned by Zimmer Biomet NYSE: ZBH.

We believe that none of the above direct competitors have real time patient monitoring, confirming patient adherence and compliance. We also believe that none of these companies offers an MSK Program, nor the depth of video exercise content and or abilities to monitor one-to-many-patient treatments as offered by our PHZIO Program.

Insurance/Reimbursement

Thus far in the state of California our initial licensee has successfully gained reimbursement from Blue Cross, Blue Shield and CIGNA insurance companies. The licensee receiver reimbursements that are equivalent to in-clinic patient reimbursements. For PT licensee patients, whose insurance companies provide little or no reimbursement for Physical Therapy Telemedicine Reimbursement, they may have higher co-payments for participating in the PHZIO program or be responsible to pay the full cost of such services.

Expansion into other markets where telemedicine has high support. On December 20, 2013, we executed a 25-year licensing agreement with a London, Ontario based telemedicine company Physical Relief Telemedicine Health Care Services (“PRTHCS”), pursuant to which we granted PRTHCS a limited, transferable right to use and promote our PHZIO Program within the province of Ontario; additional Canadian territories may be added at the parties’ mutual discretion. PRTHCS has a known track-record in the telemedicine industry in Canada. To date PRTHCS has been unsuccessful in licensing our PHZIO platform to any Canadian based PT clinics.

Our Planned Expansion into other States where Telemedicine has high support. The most common path being taken by states is to cover telemedicine services in their Medicaid program. 42 states now provide some form of Medicaid reimbursement for telemedicine services (mostly physician to physician consultations). More importantly 16 states have now expanded their definition of telemedicine to include physical therapy and have also required that state and private insurance plans cover telemedicine services. Those 16 states with the broadest telemedicine policies include: Alaska, Georgia, Hawaii, Louisiana, Maine, Maryland, Michigan, Mississippi, Missouri, Montana, New Mexico, Oklahoma, Oregon, Texas, Virginia and Vermont.

Intellectual Property

With adequate funding, we anticipate the patent protection and trademark protection associated with our technology platform and unique physical therapy treatments. We have licensed our telemedicine platform from Bistromatics Inc., a company owned by our CTO, for perpetuity for any telemedicine application in any market worldwide.

| 11 |

REGULATIONS AND HEALTHCARE REFORM

Numerous federal, state and local regulations regulate healthcare services and those who provide them. Some states into which we may expand have laws requiring facilities employing health professionals and providing health-related services to be licensed and, in some cases, to obtain a certificate of need (that is, demonstrating to a state regulatory authority the need for, and financial feasibility of, new facilities or the commencement of new healthcare services). Only one of the states in which we intend to roll out our services requires a certificate of need for the operation of our physical therapy business functions. Our therapists, however, are required to be licensed, as determined by the state in which they provide services. Failure to obtain or maintain any required certificates, approvals or licenses could have a material adverse effect on our business, financial condition and results of operations.

State Legislation

Insurance reimbursement for our PHZIO services is likely to improve in 2019 and beyond based upon current draft legislation in Congress that seeks to significantly expand Medicare’s reimbursement for telemedicine services including for physical therapy. If passed, this legislation would drive private healthcare insurers to also reimburse for physical therapy associated with telemedicine. We have received authorization from the California State Board of Physical Therapy (“CSBPT”) that we could operate our PHZIO platform and bill patients’ insurance within the Association’s rules in the state of California.

On July 21, 2017, bill SB 291 (now P.L.2017, c.117) became effective in New Jersey. The law establishes coverage of telemedicine and telehealth services, both under New Jersey Medicaid and commercial health insurance plans. The law does not explicitly impose a payment parity requirement (i.e., mandating that reimbursement for telemedicine and telehealth services be equal to reimbursement rates for identical in-person services). Instead the law sets the in-person reimbursement rate as the maximum ceiling for telemedicine and telehealth reimbursement rates.

On January 17, 2018 an amendment (“SB 1315”) to the New Jersey Physical Therapy Licensing Act of 1983 (“PT Licensing Act”), became effective. This law expands the scope of practice of PTs to include identification of balance disorders; wound debridement and care; utilization review; screening, examination, evaluation, and application of interventions for the promotion, improvement, and maintenance of fitness, health, wellness, and prevention services in populations of all ages exclusively related to physical therapy practice.

Stark Law

Provisions of the Omnibus Budget Reconciliation Act of 1993 (42 U.S.C. § 1395nn) (the “Stark Law”) prohibit referrals by a physician of “designated health services” which are payable, in whole or in part, by Medicare or Medicaid, to an entity in which the physician or the physician’s immediate family member has an investment interest or other financial relationship, subject to several exceptions. Unlike the Fraud and Abuse Law, the Stark Law is a strict liability statute. Proof of intent to violate the Stark Law is not required. Physical therapy services are among the “designated health services”. Further, the Stark Law has application to the Company’s management contracts with individual physicians and physician groups, as well as, any other financial relationship between us and referring physicians, including any financial transaction resulting from a clinic acquisition. The Stark Law also prohibits billing for services rendered pursuant to a prohibited referral. Several states have enacted laws like the Stark Law. These state laws may cover all (not just Medicare and Medicaid) patients. Many federal healthcare reform proposals in the past few years have attempted to expand the Stark Law to cover all patients as well. As with the Fraud and Abuse Law, we consider the Stark Law in planning our clinics, marketing and other activities, and believe that our operations follow the Stark Law. If we violate the Stark Law, our financial results and operations could be adversely affected. Penalties for violations include denial of payment for the services, significant civil monetary penalties, and exclusion from the Medicare and Medicaid programs.

| 12 |

HIPAA

To further combat healthcare fraud and protect patient confidentially, Congress included several anti-fraud measures in the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”). HIPAA created a source of funding for fraud control to coordinate federal, state and local healthcare law enforcement programs, conduct investigations, provide guidance to the healthcare industry concerning fraudulent healthcare practices, and establish a national data bank to receive and report final adverse actions. HIPAA also criminalized certain forms of health fraud against all public and private insurers. Additionally, HIPAA mandates the adoption of standards regarding the exchange of healthcare information to ensure the privacy and electronic security of patient information and standards relating to the privacy of health information. Sanctions for failing to comply with HIPAA include criminal penalties and civil sanctions. In February of 2009, the American Recovery and Reinvestment Act of 2009 (“ARRA”) was signed into law. Title XIII of ARRA, the Health Information Technology for Economic and Clinical Health Act (“HITECH”), provided for substantial Medicare and Medicaid incentives for providers to adopt electronic health records (“EHRs”) and grants for the development of health information exchange (“HIE”). Recognizing that HIE and EHR systems will not be implemented unless the public can be assured that the privacy and security of patient information in such systems is protected, HITECH also significantly expanded the scope of the privacy and security requirements under HIPAA. Most notable are the new mandatory breach notification requirements and a heightened enforcement scheme that includes increased penalties, and which now apply to business associates as well as to covered entities. In addition to HIPAA, many states have adopted laws and/or regulations applicable in the use and disclosure of individually identifiable health information that can be more stringent than comparable provisions under HIPAA.

We believe that our current business operations are fully compliant with applicable standards for privacy and security of protected healthcare information. We cannot predict what negative effect, if any, HIPAA/HITECH or any applicable state law or regulation will have on our business.

Other Regulatory Factors

Political, economic and regulatory influences are fundamentally changing the healthcare industry in the United States. Congress, state legislatures and the private sector continue to review and assess alternative healthcare delivery and payment systems. Based upon newly finalized FDA rules, we believe that our PHZIO platform is exempt from Federal Drug Administration (“FDA”) regulation. Yet, in the unlikely event that these rules change in the future, the FDA could then require us to seek 510K approvals for our on-line services that could create delays in provisioning our PHZIO services. (See FDA ruling noted below) Also, potential alternative approaches could include mandated basic healthcare benefits, controls on healthcare spending through limitations on the growth of private health insurance premiums, the creation of large insurance purchasing groups, and price controls. Legislative debate is expected to continue in the future and market forces are expected to demand only modest increases or reduced costs. For instance, managed care entities are demanding lower reimbursement rates from healthcare providers and, in some case, are requiring or encouraging providers to accept capitated payments that may not allow providers to cover their full costs or realize traditional levels of profitability. We cannot reasonably predict what impact the adoption of any federal or state healthcare reform measures or future private sector reform may have on our business.

FDA Ruling: Examples of Mobile App’s which it Intends to Exclude from Regulation

On September 25, 2013, the FDA issued Finalized Guidance of medical mobile applications (“Apps”). The FDA has issued a ruling on Apps that may meet the definition of a medical device, but they have determined that they will not exercise enforcement on these Apps. The Guidance contains an appendix that provides examples of mobile apps that MAY meet the definition of medical device but for which FDA intends to exercise enforcement discretion. These mobile apps may be intended for use in the diagnosis of disease or other conditions, or in the cure, mitigation, treatment, or prevention of disease. Even though these mobile apps may meet the definition of medical device, the FDA intends to exercise enforcement discretion for these mobile apps because they pose lower risk to the public. The FDA understands that there may be other unique and innovative mobile apps that may not be covered in this list that may also constitute healthcare related mobile apps. This list is not exhaustive; it is only intended to provide clarity and assistance in identifying the mobile apps that will not be subject to regulatory requirements at this time. Based on our understanding of the Guidance, although there can be no guarantee, we believe our PHZIO platform will not be subject to regulatory requirements because such services seem to fall within the statutory examples.

| 13 |

Employees

At the year ended December 31, 2019, we had 2 employees in the United States, approximately 7 employees through Bistromatics in Canada and various consultants. We utilize the services of consultants for safety testing, regulatory and legal compliance and other services.

Legal Proceedings

In June 2018, a settlement agreement was signed between the Company and holder of the note payable with the following terms for the cancellation of the note payable, accrued interest and all warrants granted relating to the various notes:

| 1. | The Company will issue 54,189 shares of commons stock that is immediately tradeable under Securities and Exchange Commission Rule 144, but subject to a daily trading limit of 500 shares per day; | |

| 2. | The Company will issue 25,811 shares of common stock that shall be subject to a 180-day holding period and are also subject to a daily trading limit of 25,000 shares per day; | |

| 3. | The holder of the note payable shall bear all fees and expenses, including attorneys’ fees, associated with the transfer and trading of the Company’s shares; | |

| 4. | Beyond issuing the shares noted above, the Company shall not take any additional action that would cause the note holder to incur tax consequence from the transfer or would affect the note holder’s tax consequences in any way. |

The Company issued the 80,000 shares of common stock on June 20, 2018. At December 31, 2019, the Company had no indebtedness to this holder of the note payable of principal or accrued interest or exercisable warrants relating to the note.

Transfer Agent

The transfer agent of the Company’s stock is VStock Transfer LLC, 18 Lafayette Place, Woodmere, NY 11598, (212) 828-8436.

NOTES REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this annual report are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These include statements about the Company’s expectations, beliefs, intentions or strategies for the future, which are indicated by words or phrases such as “anticipate,” “expect,” “intend,” “plan,” “will,” “the Company believes,” “management believes” and similar words or phrases. The forward-looking statements are based on the Company’s current expectations and are subject to certain risks, uncertainties and assumptions. The Company’s actual results could differ materially from results anticipated in these forward-looking statements. All forward-looking statements included in this document are based on information available to the Company on the date hereof, and the Company assumes no obligation to update any such forward-looking statements.

Investing in our securities involves a great deal of risk. Careful consideration should be made of the following factors as well as other information included in this Annual Report before deciding to purchase our common stock. Our business, financial condition or results of operations could be affected materially and adversely by any or all of these risks.

THE FOLLOWING MATTERS MAY HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION, LIQUIDITY, RESULTS OF OPERATIONS OR PROSPECTS, FINANCIAL OR OTHERWISE. REFERENCE TO THIS CAUTIONARY STATEMENT IN THE CONTEXT OF A FORWARD-LOOKING STATEMENT OR STATEMENTS SHALL BE DEEMED TO BE A STATEMENT THAT ANY ONE OR MORE OF THE FOLLOWING FACTORS MAY CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE IN SUCH FORWARD-LOOKING STATEMENT OR STATEMENTS.

| 14 |

Risks Related to our Financial Condition

Our Independent Registered Public Accounting Firm has expressed substantial doubt as to our ability to continue as a going concern.

The audited financial statements have been prepared assuming that we will continue as a going concern and do not include any adjustments that might result if we cease to continue as a going concern. We believe that to continue as a going concern we will need approximately $500,000 per year simply to cover the administrative, legal and accounting fees. We plan to fund these expenses primarily through cash flow, the sale of restricted shares of our common stock and the issuance of convertible notes.

Based on our financial statements for the years ended December 31, 2019 and 2018, our independent registered public accounting firm has expressed substantial doubt as to our ability to continue as a going concern. To date we have not generated any revenue.

Investing in our securities involves a great deal of risk. Careful consideration should be made of the following factors as well as other information included in this Prospectus before deciding to purchase our common stock. Our business, financial condition or results of operations could be affected materially and adversely by any or all these risks.

We may need to raise additional capital to fund continuing operations and an inability to raise the necessary capital or to do so on acceptable terms could threaten the success of our business.

To date, our operations have been funded entirely from the proceeds from equity and debt financings or loans from our management. We currently anticipate that our available capital resources will be insufficient to meet our expected working capital and capital expenditure requirements for the near future. We anticipate that we will require an additional $1.5 million during the next twelve months to fulfill our business plan. However, such resources may not be sufficient to fund the long-term growth of our business. If we determine that it is necessary to raise additional funds, we may choose to do so through strategic collaborations, licensing arrangements through our “White Labeling” strategy, public or private equity or debt financing, a bank line of credit, or other arrangements.

We cannot be sure that any additional funding will be available on terms favorable to us or at all. Any additional equity financing may be dilutive to our shareholders, new equity securities may have rights, preferences or privileges senior to those of existing holders of our shares of Common stock. Debt or equity financing may subject us to restrictive covenants and significant interest costs. If we obtain funding through a strategic collaboration or licensing arrangement, we may be required to relinquish our rights to our product or marketing territories. If we are unable to obtain the financing necessary to support our operations, we may be required to defer, reduce or eliminate certain planned expenditures or significantly curtail our operations.

We have a history of net losses; we may never achieve or sustain profitability or positive cash flow from operations.

We have incurred net losses in each fiscal year since our inception, including net losses of $9,460,785 for the year ended December 31, 2019 and $4,451,462 for the year ended December 31, 2018. As of the year ended December 31, 2019, we had an accumulated deficit of $30,862,019. We expect to continue to incur substantial expenditures to develop and market our services and could continue to incur losses and negative operating cash flow for the foreseeable future. We may never achieve profitability or positive cash flow in the future, and even if we do, we may not be able to continue being profitable.

We have a limited operating history under our current platform, it is difficult to evaluate our business and future prospects and increases the risks associated with investment in our securities.

We have operated our PHIZO platform since November 2014. As a result, our platform and business model have not been fully proven, and we have only a limited operating history on which to evaluate our business and future prospects. We have encountered, and will continue to encounter, risks and difficulties frequently experienced by growing companies in rapidly changing industries, including our ability to achieve market acceptance of our platform and attract, retain and incentivize clients to use our platform, as well as respond to competition and plan for and scale our operations to address future growth. We may not be successful in addressing these and other challenges we may face in the future, and our business and future prospects may be materially and adversely affected if we do not manage these and other risks successfully. Given our limited operating history, we may be unable to effectively implement our business plan which could materially harm our business or cause us to scale down or cease our operations.

| 15 |

Risks Related to our Platform and our Business

Our Platform may not be accepted in the marketplace.

Uncertainty exists as to whether our Platform will be accepted by the market without additional widespread PT or patient acceptance. Several factors may limit the market acceptance of our Platform, including the availability of alternative products and services as well as the price of our Platform services relative to alternative products. There is a risk that PT or patient acceptance will be encouraged to continue to use other products and/or methods instead of ours. We are assuming that, notwithstanding the fact that our Platform is new in the market, PT or patient acceptance will elect to use our Platform because it will permit to safe valuable PT’s time.

PT or patient needs to be persuaded that our Platform service is justified for the anticipated benefit, but there is no assurance that enough numbers of patients will be convinced to enable a successful market to develop for our Platform.

Our revenues will be dependent upon acceptance of our Platform product by the market. The failure of such acceptance will cause us to curtail or cease operations.

Our revenues are expected to come from our Platform. As a result, we will continue to incur operating losses until such time as revenues reach a mature level and we are able to generate enough revenues from our Platform to meet our operating expenses. There can be no assurance that PTs or patients will adopt our Platform. If we are not able to market and significantly increase the number of PTs or patients that use our Platform, or if we are unable to charge the necessary prices, our financial condition and results of operations will be materially and adversely affected.

Defects or malfunctions in our Platform could hurt our reputation, sales and profitability.

The acceptance of our Platform depends upon its effectiveness and reliability. Our Platform is complex and is continually being modified and improved, and as such may contain undetected defects or errors when first introduced or as new versions are released. To the extent that defects or errors cause our Platform to malfunction and our customers’ use of our Platform is interrupted, our reputation could suffer, and our potential revenues could decline or be delayed while such defects are remedied. We may also be subject to liability for the defects and malfunctions.

There can be no assurance that, despite our testing, errors will not be found in our Platform or new releases, resulting in loss of future revenues or delay in market acceptance, diversion of development resources, damage to our reputation, adverse litigation, or increased service, any of which would have a material adverse effect upon our business, operating results and financial condition.

Software failures, breakdowns in the operations of our servers and communications systems or the failure to implement system enhancements could harm our business.

Our success depends on the efficient and uninterrupted operation of our servers and communications systems. A failure of our network or data gathering procedures could impede services and could result in the loss of PT and patients. While our operations will have disaster recovery plans in place, they might not adequately protect us. Despite any precautions we take, damage from fire, floods, hurricanes, power loss, telecommunications failures, computer viruses, break-ins and similar events at our computer facilities could result in interruptions in the flow of data to our servers and from our servers to our clients. In addition, any failure by our computer environment to provide our required data communications capacity could result in interruptions in our service. In the event of a server failure, we could be required to transfer our client data collection operations to an alternative provider of server hosting services. Such a transfer could result in delays in our ability to deliver our products and services to our clients.

| 16 |

Additionally, significant delays in the planned delivery of system enhancements, improvements and inadequate performance of the systems once they are completed could damage our reputation and harm our business. Long-term disruptions in the infrastructure caused by events such as natural disasters, the outbreak of war, the escalation of hostilities and acts of terrorism, particularly involving cities in which we have offices, could adversely affect our businesses. Although, we plan to carry property and business interruption insurance for our business operations, our coverage might not be adequate to compensate us for all losses that may occur.

We face risks related to the storage of customers’ and their end users’ confidential and proprietary information.

Our Platform is designed to maintain the confidentiality and security of our patients’ confidential and proprietary data that are stored on our server systems, which may include sensitive personal data. However, any accidental or willful security breaches or other unauthorized access to these data could expose us to liability for the loss of such information, time-consuming and expensive litigation and other possible liabilities as well as negative publicity. Techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are difficult to recognize and react to. We may be unable to anticipate these techniques or implement adequate preventative or reactionary measures.

We might incur substantial expense to further develop our Platform which may never become sufficiently successful.

Our growth strategy requires the successful launch of our Platform. Although management will take every precaution to ensure that our Platform will, with a high degree of likelihood, achieve commercial success, there can be no assurance that this will be the case. The causes for failure of our Platform once commercialized can be numerous, including:

| ● | market demand for our Platform proves to be smaller than we expect; | |

| ● | further Platform development turns out to be costlier than anticipated or takes longer; our Platform requires significant adjustment post commercialization, rendering the Platform uneconomic or extending considerably the likely investment return period; additional regulatory requirements may increase the overall costs of the development; patent conflicts or unenforceable intellectual property rights; and PTs and clients may be unwilling to adopt and/or use our Platform. | |

| ● | Compliance with changing regulations concerning corporate governance and public disclosure may result in additional expenses. |

We are required to comply with certain provisions of Section 404 of the Sarbanes-Oxley Act of 2002 and if we fail to comply in a timely manner, our business could be harmed, and our stock price could decline.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require an annual assessment of internal controls over financial reporting, and for certain issuers an attestation of this assessment by the issuer’s independent registered public accounting firm. The standards that must be met for management to assess the internal controls over financial reporting as effective are evolving and complex, and require significant documentation, testing, and possible remediation to meet the detailed standards.

We expect to incur expenses and to devote resources to Section 404 compliance on an ongoing basis. It is difficult for us to predict how long it will take or costly it will be to complete the assessment of the effectiveness of our internal control over financial reporting for each year and to remediate any deficiencies in our internal control over financial reporting. As a result, we may not be able to complete the assessment and remediation process on a timely basis. In addition, although attestation requirements by our independent registered public accounting firm are not presently applicable to us, we could become subject to these requirements in the future and we may encounter problems or delays in completing the implementation of any resulting changes to internal controls over financial reporting. If our Chief Executive Officer or Chief Financial Officer determine that our internal control over financial reporting is not effective as defined under Section 404, we cannot predict how the market prices of our shares will be affected; however, we believe that there is a risk that investor confidence and share value may be negatively affected.

| 17 |

These and other new or changed laws, rules, regulations and standards are, or will be, subject to varying interpretations in many cases due to their lack of specificity. As a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. Our efforts to comply with evolving laws, regulations and standards are likely to continue to result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. Further, compliance with new and existing laws, rules, regulations and standards may make it more difficult and expensive for us to maintain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. Members of our board of directors and our principal executive officer and principal financial officer could face an increased risk of personal liability in connection with the performance of their duties. As a result, we may have difficulty attracting and retaining qualified directors and executive officers, which could harm our business. We continually evaluate and monitor regulatory developments and cannot estimate the timing or magnitude of additional costs we may incur as a result.

We cannot be certain that we will obtain patents for our Platform and technology or that such patents will protect us from competitors.

We believe that our success and competitive position will depend in part on our ability to obtain and maintain patents for our Platform, which is both costly and time consuming. We still are in the process to evaluate the patent potentials of our Platform. Patent Offices typically requires 12-24 months or more to process a patent application. There can be no assurance that any of our potential patent applications will be approved. However, we have decided to launch our Platform without patent protection. There can be no assurance that any potential patent issued or licensed to us will provide us with protection against competitive products, protect us against changes in industry trends which we have may not have anticipated or otherwise protect the commercial viability of our Platform, or that challenges will not be instituted against the validity or enforceability of any of our future patents or, if instituted, that such challenges will not be successful. The cost of litigation to uphold the validity of a patent and enforce it against infringement can be substantial. Even issued patents may later be modified or revoked by the Patent and Trademark Office or in legal proceedings. Patent applications in the United States are maintained in secrecy until the patent issues and, since publication of patents tends to lag behind actual discoveries, we cannot be certain that if we obtain patents for our product, we were the first creator of the inventions covered by a pending patent applications or the first to file patent applications on such inventions.

Liability issues are inherent in the Healthcare industry and insurance is expensive and difficult to obtain, we may be exposed to large lawsuits.

Our business exposes us to potential liability risks, which are inherent in the healthcare industry. While we will take precautions, we deem to be appropriate to avoid liability suits against us, there can be no assurance that we will be able to avoid significant liability exposure. Liability insurance for the healthcare industry is generally expensive. We have obtained professional indemnity insurance coverage for our Platform. There can be no assurance that we will be able to maintain such coverage on acceptable terms, or that any insurance policy will provide adequate protection against potential claims. A successful liability claim brought against us may exceed any insurance coverage secured by us and could have a material adverse effect on our results or ability to continue our Platform.

We depend upon reimbursement by third-party payers.

Substantially all revenues are anticipated to be derived from private third-party PT clinics that gain their revenue to pay our licensing fees from insurance payers. Initiatives undertaken by industry and government to contain healthcare costs affect the profitability of our licensee clinics. These payers attempt to control healthcare costs by contracting with healthcare providers to obtain services on a discounted basis. We believe that this trend will continue and may limit reimbursement for healthcare services. If insurers or managed care companies from whom we receive substantial payments were to reduce the amounts paid for services, our profit margins may decline, or we may lose PT licensees if they choose not to renew our contracts with these insurers at lower rates. In addition, in certain geographical areas, our operations may be approved as providers by key health maintenance organizations and preferred provider plans; failure to obtain or maintain these approvals would adversely affect our financial results. Although we created a business plan that will enable us to achieve revenue based on current reimbursement policies, if our belief that the insurance industry is poised for change, to offer more reimbursement for the services we seek to provide is not realized, we may not achieve the success we predict and we may not be able to carry out all the plans we disclose herein related to telemedicine. Ultimately, a shift in thinking and a willingness to adapt to new physical therapy telemedicine services and reimbursement thereof by healthcare providers is needed for the successful integration of our PHZIO telemedicine platform in mainstream healthcare environments.

| 18 |

We will need to increase the size of our organization and may experience difficulties in managing growth.

At present, we are a small company. We expect to experience a period of expansion in headcount, infrastructure and overhead and anticipate that further expansion will be required to address potential growth and market opportunities. Future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain and integrate new managers. Our future financial performance and its ability to compete effectively will depend, in part, on its ability to manage any future growth effectively.

Dependence on Key Existing and Future Personnel

Our success will depend, to a large degree, upon the efforts and abilities of our officers and key management employees. The loss of the services of one or more of our key employees could have a material adverse effect on our operations. In addition, as our business model is implemented, we will need to recruit and retain additional management and key employees in virtually all phases of our operations. Key employees will require a strong background in our industry. We cannot assure that we will be able to successfully attract and retain key personnel.

Currently, our management’s participation in our business and operations is limited

To date, we have been unable to offer cash compensation to our officers due to our lack of revenue. Accordingly, each of the Company’s executive officers maintain jobs outside of their position at eWellness. Although each of our executive officers have prepared to devote their efforts, on a full-time basis, towards our objectives once we can afford executive compensation commensurate with that being paid in the marketplace, until such time, our officers will not devote their full time and attention to the operations of the Company. None of our officers have committed a specific portion of their time or an approximate number of hours per week in writing to the objectives of the company and no assurances can be given as to when we will be financially able to engage our officers on a full-time basis and therefore, until such time, it is possible that the inability of such persons to devote their full-time attention to the Company may result in delays in progress toward implementing our business plan.

We operate in a highly competitive industry

Although we are not aware of any other Distance Monitored Physical Therapy Telemedicine Program precisely like ours, and targeting our specific population, we shall encounter competition from local, regional or national entities, some of which have superior resources or other competitive advantages in the larger physical therapy space. Intense competition may adversely affect our business, financial condition or results of operations. We may also experience competition from companies in the wellness space. These competitors may be larger and more highly capitalized, with greater name recognition. We will compete with such companies on brand name, quality of services, level of expertise, advertising, product and service innovation and differentiation of product and services. As a result, our ability to secure significant market share may be impeded. Although we believe our PHZIO services will enable us to service more patients than traditional physical therapy providers, if these more established offices or providers start offering similar services to ours, their name recognition or experience may enable them to capture a greater market share.

Limited product testing and operations

We have built out the technology platform and video library necessary to execute our planned business strategy. Of course, there may be other factors that prevent us from successfully marketing a product including, but not limited to, our limited cash resources. Further, our proposed reimbursement plan and the eventual operating results could susceptible to varying interpretations by scientists, medical personnel, regulatory personnel, statisticians and others, which may delay, limit or prevent our executing our proposed business plan.

| 19 |

We face substantial competition, and others may discover, develop, acquire or commercialize products before or more successfully than we do

We operate in a highly competitive environment. Our products compete with other products or treatments for diseases for which our products may be indicated. Other healthcare companies have greater clinical, research, regulatory and marketing resources than us. In addition, some of our competitors may have technical or competitive advantages for the development of technologies and processes. These resources may make it difficult for us to compete with them to successfully discover, develop and market new products.

We depend upon the cultivation and maintenance of relationships with the physicians in our markets.

Our success is dependent upon referrals from physicians in the communities that our PT licensees will service and their ability to maintain good relations with these physicians and other referral sources. Physicians referring patients to their clinics are free to refer their patients to other therapy providers or to their own physician owned therapy practice. If our PT licensees are unable to successfully cultivate and maintain strong relationships with physicians and other referral sources, our business may decrease, and our net operating revenues may decline.

We also depend upon our ability to recruit and retain experienced PTs

Our future revenue generation is dependent upon referrals from physicians in the communities our clinics serve, and our ability to maintain good relations with these physicians. Our PT licensees are the front line for generating these referrals and we are dependent on their talents and skills to successfully cultivate and maintain strong relationships with these physicians. If they cannot recruit and retain our base of experienced and clinically skilled therapists, our business may decrease, and our net operating revenues may decline.

Our revenues may fluctuate due to weather

We anticipate having a considerable number of PT licensees in locations in states that normally experience snow and ice during the winter months. Also, a considerable number of our clinics may be in states along the Gulf Coast and Atlantic Coast, which are subject to periodic winter storms, hurricanes and other severe storm systems. Periods of severe weather may cause physical damage to our facilities or prevent our staff or patients from traveling to our clinics, which may cause a decrease in our future net operating revenues.

We may incur closure costs and losses