Attached files

| file | filename |

|---|---|

| EX-10.1 - PLEA AGREEMENT AND SETTLEMENT - PG&E Corp | ex10-1.htm |

| 8-K - CURRENT REPORT - PG&E Corp | form8k.htm |

Exhibit 99.1

|

WEIL, GOTSHAL & MANGES LLP

Stephen Karotkin (pro hac vice) (stephen.karotkin@weil.com) Ray C. Schrock, P.C. (pro hac vice) (ray.schrock@weil.com) Jessica Liou (pro hac vice) (Jessica.liou@weil.com) Matthew Goren (pro hac vice) (matthew.goren@weil.com) 797 Fifth Avenue New York, NY 10153-0119 Tel: 212 310 8000 Fax: 212 310 8007 KELLER BENVENUTTI KIM LLP

Tobias S. Keller (#151445) (tkeller@kbkllp.com) Jane Kim (#298192) (jkim@kbkllp.com) 650 California Street, Suite 1900 San Francisco, CA 94108 Tel: 415 496 6723 Fax: 650 636 9251 Attorneys for Debtors and Debtors in Possession |

CRAVATH, SWAINE & MOORE LLP

Paul H. Zumbro (pro hac vice) (pzumbro@cravath.com) Kevin J. Orsini (pro hac vice) (korsini@cravath.com) Omid H. Nasab (pro hac vice) (onasab@cravath.com) 825 Eighth Avenue New York, NY 10019 Tel: 212 474 1000 Fax: 212 474 3700 |

|

|

UNITED STATES BANKRUPTCY COURT

NORTHERN DISTRICT OF CALIFORNIA SAN FRANCISCO DIVISION |

||

|

In re:

PG&E CORPORATION, -and-

PACIFIC GAS AND ELECTRIC COMPANY,

Debtors.

◻ Affects

PG&E Corporation

◻ Affects

Pacific Gas & Electric Company

☒ Affects both Debtors

*All papers shall be filed in the Lead Case, No. 19-30088 (DM)

|

Ch. 11 Lead Case No. 19-30088 (DM)

(Jointly Administered) DEBTORS’ MOTION PURSUANT TO 11 U.S.C. §§ 105 AND 363 AND FED. R. BANKR. P. 9019 FOR

ENTRY OF AN ORDER (I) APPROVING CASE RESOLUTION CONTINGENCY PROCESS AND (II) GRANTING RELATED RELIEF

|

|

|

Date: April 1, 2020

Time: 10:00 a.m. (Pacific Time)

Place: United States Bankruptcy Court

Courtroom 17, 16th Floor

San Francisco, CA 94102

Objection Deadline: March 30, 2020 at 4:00 p.m. (Prevailing Pacific Time)

|

||

PG&E Corporation (“PG&E Corp.”)

and Pacific Gas and Electric Company (the “Utility”), as debtors and debtors in possession (collectively, “PG&E” or the “Debtors”) in the above-captioned chapter 11 cases (the “Chapter 11 Cases”), hereby submit this Motion for entry of an order (i) approving the Case Resolution Contingency Process (as defined below) attached hereto as Exhibit A, to be implemented in the unlikely event the Debtors fail to meet certain dates regarding the administration of these Chapter 11 Cases, and (ii) granting related relief.

A proposed form of order granting the relief requested herein is annexed hereto as Exhibit B. In support of the relief requested herein, the Debtors submit the Declaration of Jason Wells (the “Wells Declaration”), filed contemporaneously herewith.

2

TABLE OF CONTENTS

Page

|

I.

|

PRELIMINARY STATEMENT

|

7

|

||

|

II.

|

JURISDICTION

|

10

|

||

|

III.

|

BACKGROUND

|

11

|

||

|

A.

|

General

|

11

|

||

|

B.

|

AB 1054

|

11

|

||

|

C.

|

The Debtors’ Plan

|

11

|

||

|

D.

|

Development of the Case Resolution Contingency Process

|

13

|

||

|

IV.

|

TERMS OF THE CASE RESOLUTION CONTINGENCY PROCESS

|

13

|

||

|

V.

|

BASIS FOR RELIEF REQUESTED

|

18

|

||

|

1.

|

The Case Resolution Contingency Process is a Sound Exercise of the Debtors’ Business Judgment and Should be Approved Pursuant to Sections

105(a) and 363(b)(1) of the Bankruptcy Code.

|

20

|

||

|

2.

|

Approval of the Case Resolution Contingency Process is in the Best Interests of the Debtors’ Estates and Should be Approved Pursuant to

Bankruptcy Rule 9019.

|

23

|

||

|

VI.

|

CONCLUSION

|

25

|

||

|

VII.

|

NOTICE

|

26

|

||

3

TABLE OF AUTHORITIES

Page(s)

|

Cases

|

|

|

Air Line Pilots Ass'n, Int'l v. Am.

Nat'l Bank & Trust Co. (In re Ionosphere Clubs, Inc.),

|

|

|

156 B.R. 414 (S.D.N.Y. 1993), aff’d 17 F.3d 600 (2d Cir. 1993)

|

25

|

|

In re ASARCO, L.L.C.,

|

|

|

650 F.3d 593 (5th Cir. 2011)

|

21

|

|

In re AWTR Liquidation Inc.,

|

|

|

548 B.R. 300 (Bankr. C.D. Cal. 2016)

|

21

|

|

City Sanitation v. Allied Waste Servs.

of Mass., LLC (In re Am. Cartage, Inc.),

|

|

|

656 F.3d 82 (1st Cir. 2011)

|

24

|

|

Comm. of Asbestos-Related Litigants v.

Johns-Manville Corp. (In re Johns-Manville Corp.),

|

|

|

60 B.R. 612 (Bankr. S.D.N.Y. 1986)

|

21

|

|

|

|

|

Official Comm. of Unsecured Creditors of

Cybergenics Corp. v. Chinery,

|

|

|

330 F.3d 548 (3d Cir. 2003) (en banc)

|

20

|

|

In re Drexel Burnham Lambert Grp., Inc.,

|

|

|

124 B.R. 499 (Bankr. S.D.N.Y. 1991)

|

23, 24

|

|

In re Energy Future Holdings Corp.,

|

|

|

Case No. 14-10979 (CSS) (Bankr. D. Del. Sept. 19, 2016)

|

21

|

|

In re Exide Techs,

|

|

|

Case No. 13-11482 (KJC) (Bankr. D. Del. Feb. 4, 2015)

|

22

|

|

In re Integrated Resources, Inc.,

|

|

|

147 B.R. 650 (Bankr. S.D.N.Y. 1992)

|

21

|

|

In re Laser Realty, Inc. v. Fernandez

(In re Fernandez),

|

|

|

2009 Bankr. LEXIS 2849 (Bankr. D.P.R. Mar. 31, 2009)

|

25

|

|

In re Lionel Corp.,

|

|

|

722 F.2d 1063 (2d Cir. 1983)

|

20

|

|

|

|

|

In re Manuel Mediavilla, Inc.,

|

|

|

568 B.R. 551 (B.A.P. 1st Cir. 2017)

|

25

|

|

Martin v. Kane (In re A&C Props.),

|

|

|

784 F.2d 1377 (9th Cir. 1986)

|

23, 24

|

4

|

In re Montgomery Ward Holding Corp.,

|

|

|

242 B.R. 147 (D. Del. 1999)

|

21

|

|

Myers v. Martin (In re Martin),

|

|

|

91 F.3d 389 (3d Cir. 1996)

|

23

|

|

Nellis v. Shugrue,

|

|

|

165 B.R. 115 (S.D.N.Y. 1994)

|

23, 24

|

|

Newman v. Stein,

|

|

|

464 F.2d 689 (2d Cir. 1972)

|

23

|

|

In re Pac. Gas & Elec. Co.,

|

|

|

304 B.R. 395 (Bankr. N.D. Cal. 2004)

|

24

|

|

In re Pac. Gas & Elec. Co.,

|

|

|

Case No. 01-30923 (DM) (Bankr. N.D. Cal. Mar. 27, 2002)

|

21

|

|

In re Planned Protective Servs., Inc.,

|

|

|

130 B.R. 94 (Bankr. C.D. Cal. 1991)

|

24

|

|

Port O'Call Invest. Co. v. Blair (In re

Blair),

|

|

|

538 F.2d 849 (9th Cir. 1976)

|

24

|

|

Prot. Comm. for Indep. Stockholders of

TMT Trailer Ferry, Inc. v. Anderson,

|

|

|

390 U.S. 414 (1968)

|

23, 24

|

|

Smith v. Van Gorkom,

|

|

|

488 A.2d 858 (Del. 1985)

|

21

|

|

Southmark Corp. v. Grosz (In re

Southmark Corp.),

|

|

|

49 F.3d 1111 (5th Cir. 1995)

|

20

|

|

In re Thompson,

|

|

|

965 F.2d 1136 (1st Cir. 1992)

|

24

|

|

In re TK Holdings Inc.,

|

|

|

Case No. 17-11375 (BLS) (Bankr. D. Del. Dec. 13, 2017)

|

21

|

|

In re Tronox Inc.,

|

|

|

Case No. 09-10156 (ALG) (Bankr. S.D.N.Y. Dec. 23, 2009)

|

22

|

|

In re Walter,

|

|

|

83 B.R. 14 (B.A.P. 9th Cir. 1988)

|

20

|

|

In re WCI Cable, Inc.,

|

|

|

282 B.R. 457 (Bankr. D. Or. 2002)

|

24

|

|

Woodson v. Fireman's Fund Ins. Co. (In

re Woodson),

|

|

|

839 F.2d 610 (9th Cir. 1988)

|

23, 24

|

5

|

Statutes

|

|

|

11 U.S.C. § 105(a)

|

20, 21

|

|

11 U.S.C. § 363(b)

|

20, 21

|

|

11 U.S.C. § 1107(a)

|

11

|

|

11 U.S.C. § 1108

|

11

|

|

28 U.S.C. § 157

|

10

|

|

28 U.S.C. § 1334

|

10

|

|

28 U.S.C. § 1408

|

10

|

|

28 U.S.C. § 1409

|

10

|

|

Assembly Bill 1054 (Holden, Chapter 79, Statutes of 2019)

|

passim

|

|

Cal. Const. Art. I, § 19 (c)

|

25

|

|

Other Authorities

|

|

|

B.L.R. 5011-1(a)

|

10

|

|

Fed. R. Bankr. P. 1015(b)

|

11

|

|

Fed. R. Bankr. P. 2002

|

26

|

|

Fed. R. Bankr. P. 9019

|

23, 24, 27

|

|

Order Referring Bankruptcy Cases and

Proceedings to Bankruptcy Judges,

|

|

|

General Order 24

|

10 |

6

MEMORANDUM OF POINTS AND AUTHORITIES

I. PRELIMINARY

STATEMENT1

The Debtors remain committed to achieving a fair and equitable resolution of these Chapter 11 Cases – a resolution that affords

fair treatment to wildfire victims and other economic stakeholders, provides Californians with access to safe, reliable, and affordable service, results in a transformed utility, and satisfies the requirements of Assembly Bill 1054 (Holden, Chapter

79, Statutes of 2019) (“AB 1054”). To that end, after filing their initial plan of reorganization in September of last year, the Debtors have engaged in ongoing

discussions with representatives of Governor Gavin Newsom (the “Governor’s Office”) regarding the terms of the Debtors’ restructuring, the requirements of AB

1054, and the concerns expressed in Governor Newsom’s December 13, 2019 letter [Docket No. 5138-1] (the “December 13 Letter”).

The Plan now on file resolves the Debtors’ prepetition liabilities and provides fair and expeditious compensation to wildfire

victims. Among other things, the Plan provides:

| ● |

Approximately $13.5 billion of cash and common stock of Reorganized PG&E Corp. for the payment of individual and other wildfire claims;

|

| ● |

$11 billion in cash to satisfy insurance subrogation claims;

|

| ● |

Reinstatement of $9.575 billion in existing, prepetition Utility funded debt claims;

|

| ● |

Refinancing of $11.85 billion in existing, prepetition Utility debt with newly issued debt; and

|

| ● |

Payment in full of general unsecured claims and certain other liabilities, with interest at the legal rate.

|

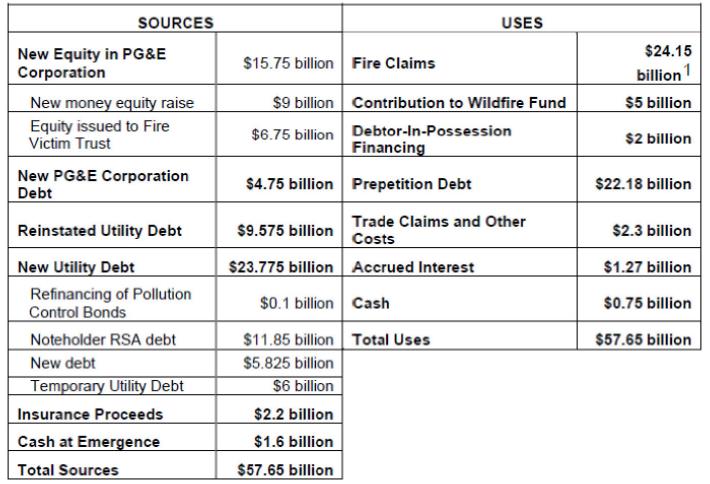

The Debtors intend to fund the obligations under the Plan, including the Debtors’ contributions to the Go-Forward Wildfire Fund

created under AB 1054, from a variety of sources as described in the Plan OII2 and as set forth below:

1 Capitalized terms used but not herein defined have the meanings ascribed to such terms in the Debtors’ and Shareholder Proponents’ Joint Chapter 11 Plan of Reorganization dated March 16, 2020 [Docket No. 6320] (the “Plan”).

2 The CPUC proceeding related to the Chapter 11 Cases, (I.) 19-09-016, “Order Instituting Investigation on the Commission’s Own Motion to Consider the Ratemaking and Other Implications of a Proposed Plan for Resolution of Voluntary Case filed by Pacific Gas and Electric

7

The Debtors also contemplate a single post-emergence 30-year securitization transaction of approximately $7.5 billion (the “Securitization”), with reduced principal payments in the early years, which would replace the Temporary Utility Debt and be neutral, on average, to customers and

also would accelerate the deferred payments to the Fire Victim Trust to be funded under the Plan. The Securitization includes offsetting credits to be funded initially from a reserve account and further funded with the value of net operating losses

contributed in the year in which the net operating losses are utilized. The Securitization structure is anticipated to yield a full (nominal) offset each year to securitized charges. The Plan is not contingent on the approval of the Securitization

and, as noted below, in the event the Securitization is not approved, the Debtors have committed to use the proceeds of the net operating losses to amortize the Temporary Utility Debt referred to in the above chart.

In addition to the financial restructuring embodied in the Plan, the Debtors have committed to a number of changes to their

corporate governance and regulatory affairs. As described in the Debtors’ Post-Hearing Brief filed on March 13, 2020 in the Plan OII (the “Debtors’ OII Proposals”),

the Debtors have agreed to substantial modifications relating to PG&E’s board of

Company, pursuant to Chapter 11 of the Bankruptcy Code, in the United States Bankruptcy Court, Northern District of California, San Francisco Division, In re Pacific Gas and Electric Corporation and Pacific Gas and Electric Company, Case No. 19-30088” (the “Plan OII”).

8

directors, Utility safety, general corporate governance and operations, and executive compensation, and an enhanced oversight and enforcement process. The Debtors’ OII Proposals, in large part, support the proposals

in the ruling issued by the CPUC Assigned Commissioner in the Plan OII to address the Debtors’ governance and organization, and the Debtors also have agreed to work with the Governor’s Office on certain of the initial corporate governance matters.

In addition to the foregoing, the Debtors also have agreed in connection with and subject to, among other things, the approval of

the Case Resolution Contingency Process and the Governor’s support for the Plan and the Securitization, to implement certain other commitments as further described below.

This Motion reflects the final component of the Debtors’ comprehensive restructuring – an agreement with the Governor’s Office on

the case resolution contingency process set forth in Exhibit A hereto and described below (the “Case Resolution Contingency Process”), which addresses the unlikely circumstance in which the Plan is not confirmed or fails to go effective in accordance with certain required dates.

In summary, as more fully described below, if the Confirmation Order is not entered by June 30, 2020, the Debtors will appoint a

Chief Transition Officer (the “CTO”)3 and will commence a sale process. If the Confirmation Order is entered by June 30, 2020, but the Effective Date

of the Plan does not occur by September 30, 2020, the Debtors will appoint the CTO, which will extend the deadline for the occurrence of the Effective Date to December 31, 2020. If the Effective Date does not occur by such extended date, the Debtors

will then commence the sale process.

While the Debtors continue to believe that the Plan as previously proposed complies with AB 1054, the Debtors believe that the

foregoing commitments address all of the concerns raised in the Governor’s December 13 Letter. The Debtors’ management and professionals have worked diligently with the Governor’s Office in order to build the state’s confidence that the Reorganized

3 The authority and scope of responsibility of the CTO are set forth on Annex A to the Case Resolution Contingency Process.

9

Therefore, by this Motion the Debtors seek entry of an order authorizing and approving the Case Resolution Contingency Process (the

“Case Resolution Contingency Process Order”). The Case Resolution Contingency Process will be an exhibit to the Case Resolution Contingency Process Order and

incorporated by reference as if fully set forth therein. Approval of the Case Resolution Contingency Process will facilitate the Debtors’ ability to timely exit these Chapter 11 Cases, provide a positive signal to the financing markets, and further

solidify support for the Plan and the likelihood of a smooth and largely consensual resolution of these Chapter 11 Cases.

The Debtors’ support for the Case Resolution Contingency Process Order is based on, and subject to, the Debtors’ understanding that

the Governor’s Office will file a responsive pleading in the Bankruptcy Court prior to the hearing on the Motion stating (1) if the relief requested in the Motion is granted and the CPUC approves the Debtors’ Plan with governance, financial and

operational proposals consistent with the Debtors’ OII Proposals, and such modifications as the CPUC believes are appropriate, the Plan will, in the Governor’s judgment, be compliant with AB 1054, and (2) the Securitization (subject to CPUC

approval), if it meets all legal requirements, would be in the public interest and would strengthen the Utility’s go-forward business.

Accordingly, as set forth below, entry into, and approval of, the Case Resolution Contingency Process represents a sound exercise

of the Debtors’ business judgment and should be approved.

II. JURISDICTION

The Court has jurisdiction to consider this matter pursuant to 28 U.S.C. §§ 157 and 1334, the Order Referring Bankruptcy Cases and Proceedings to Bankruptcy Judges, General Order 24 (N.D. Cal.

Feb. 22, 2016), and Rule 5011-1(a) of the Bankruptcy Local Rules for the United States District Court for the Northern District of California. This is a core proceeding pursuant to 28 U.S.C. § 157(b). Venue is proper before the Court pursuant to 28

U.S.C. §§ 1408 and 1409.

10

III. BACKGROUND

A. General

On January 29, 2019 (the “Petition Date”),

the Debtors commenced voluntary cases under chapter 11 of the Bankruptcy Code. The Debtors continue to operate their businesses and manage their properties as debtors in possession pursuant to section 1107(a) and 1108 of the Bankruptcy Code. No

trustee or examiner has been appointed in either of the Chapter 11 Cases. The Chapter 11 Cases are being jointly administered for procedural purposes only pursuant to Bankruptcy Rule 1015(b).

Additional information regarding the circumstances leading to the commencement of the Chapter 11 Cases and information regarding

the Debtors’ businesses and capital structure is set forth in the Amended Declaration of Jason P. Wells in Support of First Day Motions and Related Relief

[Docket No. 263].

B. AB 1054

On July 12, 2019, Governor Newsom signed into law AB 1054, which, among other things, establishes a statewide fund (the “Go-Forward Wildfire Fund”) that participating utilities may access to pay for liabilities arising in connection with wildfires that occur after July 12, 2019. The

Debtors’ ability to access the Go-Forward Wildfire Fund is subject to the conditions set forth in the statute, including confirmation of a plan of reorganization that meets certain requirements by no later than June 30, 2020. A condition to the

occurrence of the Effective Date of the Plan is the Bankruptcy Court’s approval of the Debtors’ participation in the Go-Forward Wildfire Fund is in full force and effect.

C. The

Debtors’ Plan

On September 9, 2019, the Debtors filed their original joint chapter 11 plan of reorganization [Docket No. 3841], which was

thereafter amended on September 23, 2019 [Docket No. 3966] and November 4, 2019 [Docket No. 4563] (collectively, the “Debtors’ Original Plan”).

On December 6, 2019, the Debtors, certain funds and accounts managed or advised by Knighthead Capital Management, LLC and certain

funds and accounts managed or advised by Abrams Capital Management, L.P. (together, the “Shareholder Proponents”), the Tort Claimants

11

Committee, and certain professionals representing approximately 70% in number of the holders of Fire Victim Claims entered into an agreement (the “Tort Claimants RSA”) to resolve, among other things, the treatment and discharge of individual Fire Victim Claims under the Debtors’ Original Plan, as amended to incorporate the terms of the settlement embodied in

the Tort Claimants RSA. Prior to entering into the Tort Claimants RSA, the Debtors previously negotiated settlements with the holders of Public Entities Wildfire Claims and the holders of Subrogation Wildfire Claims. On December 19, 2019 [Docket

No. 5174], the Court entered an order approving the Tort Claimants RSA.

On January 22, 2020, the Debtors, the Shareholder Proponents, and certain members of the Ad Hoc Noteholder Committee entered into

an agreement (the “Noteholder RSA”) to, among other things, resolve all issues relating to the treatment of the Utility’s prepetition funded debt under the

Debtors’ and Shareholder Proponents’ Plan. On February 5, 2020, the Court entered an order approving the Noteholder RSA [Docket No. 5637].

The Plan, filed on March 16, 2020 [Docket No. 6320], incorporates the terms of the settlements embodied in the Subrogation Claims

RSA and plan treatment set forth in the Tort Claimants RSA and the Noteholder RSA. Among other things, the Plan also provides for (i) payment in full, with interest at the legal rate, reinstatement, or refinancing of all prepetition funded debt

obligations, all prepetition trade claims, and employee-related claims, (ii) assumption of all power purchase agreements and community choice aggregation servicing agreements, and (iii) assumption of all pension obligations, other employee

obligations, and collective bargaining agreements with labor. The Plan represents a global consensus and has the support of all classes of fire victim claims and virtually all other voting classes.

In addition, the Debtors believe the Plan provides for and will allow the Debtors to participate in the Go-Forward Wildfire Fund

and satisfaction of the legislative requirements of AB 1054. Of course, such compliance is subject to the review and approval of the CPUC, which approval process is underway.

The Debtors’ Disclosure Statement with respect to the Plan has been approved by the Bankruptcy Court and the solicitation of votes

with respect to the Plan will commence shortly.

12

D. Development

of the Case Resolution Contingency Process

Since the filing of the Debtors’ Original Plan, the Plan Proponents and their advisors have been engaged in ongoing discussions

with the Governor’s representatives and advisors to discuss the restructuring and the implications of AB 1054. These discussions have focused largely on safety, corporate governance and operation of the Utility, and assuring that the Reorganized

Debtors’ capital structure will be stable, flexible, and will position the Reorganized Debtors to attract long-term capital. The Plan Proponents have also sought to address a primary concern expressed by the Governor that the state of California must

have some realistic alternative available if the Plan is not consummated within the timeframe set forth in AB 1054.

On December 13, 2019, Governor Newsom informed the Debtors that the Debtors’ Original Plan and related restructuring transactions

provided therein did not, in his judgment, comply with AB 1054 and, therefore, would not result in a reorganized entity positioned to meet the compact of providing safe, reliable and affordable service to the Debtors’ customers.

Ultimately, these discussions culminated in the Case Resolution Contingency Process, which together with the filing of the

Utility’s March 13, 2020 brief in the Plan OII that incorporates the Debtors’ OII Proposals and the undertakings described below, address the issues raised in the December 13 Letter and, the Debtors believe, will lead to the support of the Governor’s

Office for the Plan. The Case Resolution Contingency Process will provide for and facilitate an expeditious and successful resolution of these Chapter 11 Cases and avoid the need, expressed by the Governor’s Office, for the state of California to

seek relief in this Court that could undermine the timely confirmation and consummation of the Plan.

IV. TERMS OF

THE CASE RESOLUTION CONTINGENCY PROCESS

A summary of the terms and provisions of the Case Resolution Contingency Process is set forth below.4

4 The following summary is qualified in its entirety by the terms of the Case Resolution Contingency Process annexed

hereto. In the event of any discrepancy between this summary and the terms of the Case Resolution Contingency Process, the terms of the Case Resolution Contingency Process shall govern.

13

|

Failure to Meet Required Dates

|

The Debtors will obtain entry of the Case Resolution Contingency Process Order which shall require the Confirmation Order (a proposed form

of which the Debtors will submit in form and substance acceptable to the Governor’s Office, provided that if the Bankruptcy Court declines to enter such order unless the Debtors modify the Order in a manner not acceptable to the Governor’s

Office, the Debtors may modify the order to address the Bankruptcy Court’s requirements) to be entered by June 30, 2020 (the “Confirmation Order Required Date”);

provided, that neither of the following shall constitute a failure to meet the Confirmation Order Required Date: (i) the Confirmation Order contains conditions subsequent related to the entry of, appeal of, or compliance with the CPUC’s

decision in the Plan OII or (ii) the pendency of any appeal, motion for reconsideration or similar relief of the Confirmation Order.

In the event the Confirmation Order Required Date does not occur on or prior to June 30, 2020:

1. The

Debtors shall be authorized and directed, no later than ten (10) business days after the Confirmation Order Required Date has not been met, to appoint a Chief Transition Officer (CTO), with the authority and scope of responsibility set

forth on Annex A to the Case Resolution Contingency Process;

2. The

Debtors and the Governor’s Office shall agree to (or, if no such agreement is reached, the Bankruptcy Court shall order pursuant to the process set forth in the Case Resolution Contingency Process) a form of bidding procedures (as ordered

by the Bankruptcy Court, the “Bidding Procedures”), which Bidding Procedures shall include the provisions described below;

3. The

Debtors shall be authorized and directed to commence the Sale Process (defined below) in accordance with the Bidding Procedures; and

4. The

CTO shall remain in place until the completion of the Sale Process.

The Case Resolution Contingency Process Order and the Confirmation Order shall require that the Effective Date of the Plan is to occur by

September 30, 2020, subject to the following:

1. If

the Effective Date has not occurred by September 30, 2020, the Debtors shall be authorized and directed, no later than ten (10) business days after such date, to appoint a CTO to the extent not already appointed.

2. The

CTO shall remain in place until the earlier of (a)

|

14

|

completion of the Sale Process, if a sale process is required, or (b)

the Effective Date of a Plan.

3. If

the CTO is appointed as required above, then the deadline for the Effective Date shall be extended to December 31, 2020 (the “Effective Date Required Date”).

If (i) the CTO is not appointed or retained as required above or (ii) the Effective Date has not occurred by the Effective Date Required Date, then the Debtors shall pursue a Sale Process in accordance with the Bidding Procedures.

|

|

|

Operational Observer

|

The Case Resolution Contingency Process Order shall provide that, upon entry of such Order, the state of California can select an

operational observer (the “Operational Observer”). The Operational Observer shall have the right to observe the Debtors’ compliance and progress with

respect to natural gas operations and safety and wildfire and other disaster mitigation activities including: vegetation management programs; system hardening programs (both electrical infrastructure and microgrid implementation); risk

analysis; implementation of mitigation measures (including the use of and effectiveness of the Emergency Operations Center and PSPS); public and workforce safety; and programs to assure compliance with any applicable safety and operational

metrics. The Operational Observer shall have the authority to observe meetings of the boards of directors (including committee meetings) and management meetings related to performance and safety issues, conduct field visits, interviews and

inspections, review documentation related to safety performance, and undertake any other tasks reasonably required in furtherance of its duties.5 The Operational Observer shall provide periodic reports to the Utility CEO, the

Debtors’ boards of directors, and the Governor’s Office. The Operational Observer shall not divulge confidential or proprietary information of the Debtors without the Debtors’ consent; provided, that the Debtors shall be deemed to have

consented to the disclosure of such information to the Governor’s Office and its advisors.

|

|

Chief Transition Officer

|

If a CTO is required to be appointed pursuant to the Case Resolution Contingency Process, the Debtors shall select the Operational Observer

as the CTO or, if the Operational

|

5 The Reorganized Debtors may limit the Operational Observer’s attendance at meetings or access to information based

on a claim of privilege only if, in the opinion of counsel, such restriction is necessary to preserve the privilege.

15

|

Observer is not available or able to take on the role, another named individual or firm from a list of identified candidates. If the CTO is

replaced, the subsequent CTO must also be selected from such list of identified candidates.

If a CTO is required to be appointed pursuant to the Case Resolution Contingency Process, the CTO shall have the authority and scope of

responsibility set forth in Annex A to the Case Resolution Contingency Process.

|

|

|

Bidding Procedures

|

The Bidding Procedures shall include, among other things, the following:

1. Provisions

authorizing and directing the Debtors to conduct the Sale Process.

2. A

schedule that allows for the closing of a sale (or effective date of a plan) no later than September 30, 2021.

3. Provisions

that allow the state of California or a bidder supported by the state of California to participate as a bidder in the process.

4. Customary

confidentiality and non-disclosure provisions applicable to all bidders or potential bidders participating in the process.

5. Provisions

that prohibit extension or modification of any dates set forth in the Bidding Procedures to the extent such extensions or modifications would result in a process being unable to be completed by September 30, 2021 or would limit the ability

of a bidder supported by the state of California to participate as a bidder in the process, without such extension or modification being consented to by the Governor’s Office or approved by the Bankruptcy Court; provided, that in the event

such a modification or extension is ordered without the consent of the Governor’s Office, exclusivity shall be immediately terminated without further order of the Bankruptcy Court for the state of California, or a party supported by the

state of California, to sponsor a plan for either or both Debtors.

6. Provisions

that permit the Debtors’ boards of directors to exercise their fiduciary duties under applicable law in connection with the Sale Process; provided, that (i) the Debtors shall not terminate the Sale Process without the consent of the

Governor’s Office or approval of the Bankruptcy Court and (ii) in the event the Debtors terminate the Sale Process without the consent of the

|

16

|

Governor's Office, exclusivity shall be immediately terminated without further order of the Bankruptcy Court for the state of California or a party supported by the state of California to

sponsor a plan for either or both Debtors.

7. Provisions setting forth the responsibilities of the Sale Committee(s) (defined below).

8. Provisions setting forth qualification requirements for bidders, which shall permit the state of California or a party supported by the state of California to

qualify as a bidder.

|

|

|

Sale Process

|

1. No

later than ten (10) business days after the date on which a Sale Process is required to be pursued pursuant to the terms of the Case Resolution Contingency Process, the Debtors shall be authorized and directed to appoint a sale committee

(the “Sale Committee”) of the board of directors of PG&E Corp. (and, to the extent necessary, to appoint a similar committee with the same members

and scope of the Utility). The members of such Sale Committee(s) shall be selected by the Debtors’ boards of directors and be acceptable to the Governor’s Office. The Sale Committee(s) shall oversee the Sale Process and make

recommendations to the full boards of directors regarding the Sale Process.

2. The

Debtors’ shall appoint a Chief Restructuring Officer to manage the Sale Process and report to the Sale Committee. The Debtors’ current Chief Restructuring Officer shall fulfill that function; provided, that if the Debtors’ current Chief

Restructuring Officer is not available to fulfill such function, the Sale Committee shall select a nationally recognized replacement with similar characteristics and experience to fulfill such function.

3. If a Sale Process is required, the Debtors shall be athorized and directed to implement the Sale Process in a manner consistent with the Bidding Procedures and on the timeframes set forth therein and

subject to the terms of the Case Resolution Contingency Process.

4. Unless

the Governor’s Office otherwise agrees, the Debtors shall be authorized and directed, no later than ten (10) business days after the later of (i) the date on which a Sale Process is required to be pursued pursuant to the terms of the Case

Resolution Contingency Process, and (ii) the date of entry of the Bidding Procedures, to file a

|

17

|

motion (the “Sale Motion”) with the Bankruptcy Court proposing a sale process that contains provisions allowing qualified

bidders to bid for either a purchase of substantially all of the assets or a plan sponsorship proposal that would result in the plan sponsor owning the equity of the Reorganized Debtors or the Reorganized Utility and is consistent with the

Bidding Procedures and otherwise in form and substance acceptable to the Governor’s Office, the Sale Committee(s), and the Board(s) (the “Sale Process”).

5. The Sale Process shall be conducted in accordance with the Bankruptcy Code and the California Public Utilities Code.

The Debtors shall be authorized and directed to do the following:

1. Take all actions necessary to implement this requirement as soon as possible.

2. Take all actions necessary to prepare for the Sale Process so that the Sale Process, if required, can be implemented on the timeframes set forth in the Case Resolution

Contingency Process.

|

As stated above, in connection with and subject to the approval of the Case Resolution Contingency Process, the Governor’s Office’s

support for the Plan and the Securitization, and the occurrence of the Plan Effective Date, the Debtors have agreed to certain other matters as follows:

| a) |

Dividend Restriction. Reorganized HoldCo will not pay common dividends until it has recognized $6.2

billion in Non-GAAP Core Earnings following the Effective Date. That amount would be deployed as capital investment or reduction in debt. “Non-GAAP Core Earnings” means GAAP earnings adjusted for those non-core items identified in the Disclosure Statement.6 This limitation on dividends

will delay the recommencement of common dividends by approximately one year as compared to the financial projections provided in the Disclosure Statement;

|

| b) |

Fire Victim Claims Costs. As noted above, the Reorganized Utility intends to file an application with

the CPUC for approval of the Securitization. If the CPUC does not grant approval of the Securitization, the Reorganized Utility will not seek to

|

6 See Disclosure Statement for Debtors’ and Shareholder Proponents’ Joint Chapter

11 Plan of Reorganization, dated March 17, 2020, Exhibit B, p. 168 [Docket No. 6353]. The non-core items identified in the Disclosure Statement are Bankruptcy and Legal Costs; Investigation Remedies and Delayed Cost Recovery; GT&S

Capital Audit; Amortization of Wildfire Insurance Fund Contribution; and Net Securitization Inception Charge. Id. at 174.

18

|

recover in rates any portion of the amounts paid in respect of Fire Claims under the Plan;

|

| c) |

Purchase Option. On February 18, 2020, in the Plan OII, the Assigned Commissioner issued a ruling

that set forth various proposals. One such proposal was an Enhanced Regulatory Reporting and Enforcement Process (“Enhanced Regulatory Process”)

that includes six steps to be implemented over an extended period of time which could, under extreme circumstances, culminate in a review and potential revocation of the Utility’s certificate of public convenience and necessity (“CPCN”), i.e., its license to operate as a public utility. The Debtors agree that if the CPUC revokes the CPCN through the Enhanced Regulatory Process,

the state of California will have the option to purchase all of the issued and outstanding equity interests of the Reorganized Utility (including common stock and any options or other equity awards issued or granted by the Reorganized

Utility), directly or via a state-designated entity, at an aggregate price to the holders of such equity interests equal to (i) the estimated one-year forward income computed by reference to rate base times equity ratio times return on

equity (in each case as authorized by the CPUC and FERC), multiplied by (ii) the average one-year forward Price to Earnings ratio of the utilities then comprising the Philadelphia Utilities Index (“PHLX”), multiplied by 0.65; and

|

| d) |

Net Operating Losses. The Debtors’ payment of wildfire claims under the Plan will result in

substantial net operating losses (“NOLs”). Consistent with the Debtors’ financial projections provided in the Disclosure Statement, the Reorganized

Utility agrees to use cash flows generated by application of these NOLs in future years in connection with the Securitization. If this Securitization is not approved or consummated, the Reorganized Utility agrees to use these cash flows

to amortize the $6 billion in Temporary Utility Debt referred to in the chart above.

|

The Debtors also have agreed, subject to the approval of this Motion and the Governor’s Office’s support for the Plan and the

Securitization, to the following:

| ● |

As a condition to the occurrence of the Plan Effective Date, the secured debt to be issued in connection with the funding of the Plan shall receive an investment grade rating

from at least one of Standard & Poor’s or Moody’s on the Effective Date. This condition may be waived with the consent solely of the Plan Proponents and the Governor’s Office; and

|

| ● |

The Plan Documents (including documents included in the Plan Supplement) and any amendments to the Plan will be in form and substance acceptable to the Governor’s Office;

provided, that if the Court declines to enter a form of Confirmation Order or to confirm the Plan unless the Plan Proponents modify the Confirmation Order or the Plan in a manner not acceptable to the Governor’s Office, the Plan

Proponents may modify the Confirmation Order to address the Court’s requirements.

|

19

V. BASIS FOR

RELIEF REQUESTED

The Debtors believe that the Case Resolution Contingency Process, along with the Debtors’ OII Proposals, as those proposals may be

modified by the CPUC, and the other undertakings described herein will satisfy the state’s objectives and will secure the Governor’s Office’s support for confirmation and consummation of the Plan. The Debtors also believe the Case Resolution

Contingency Process and the commitments of the Debtors therein address the concerns raised in the December 13 Letter. The Debtors believe that the Case Resolution Contingency Process together with the Debtors’ OII Proposals represent a milestone in

these Chapter 11 Cases, will facilitate access to the Go-Forward Wildfire Fund, and will pave the way for confirmation of the Plan in keeping with the June 30, 2020 deadline of AB 1054.

1. The Case

Resolution Contingency Process is a Sound Exercise of the Debtors’ Business Judgment and Should be Approved Pursuant to Sections 105(a) and

363(b)(1) of the Bankruptcy Code.

The Court may approve the Case Resolution Contingency Process pursuant to sections 105(a) and 363(b) of the Bankruptcy Code.

Section 363(b) provides, in pertinent part, that “[t]he [debtor], after notice and a hearing, may use, sell, or lease, other than in the ordinary course of business, property of the estate.” 11 U.S.C. § 363(b)(1). Section 105(a) further provides

that the “court may issue any order, process, or judgment that is necessary or appropriate to carry out the provisions of this title.” 11 U.S.C. § 105(a). Section 105(a) has been interpreted to provide Bankruptcy Courts with broad equitable powers

to “craft flexible remedies that, while not expressly authorized by the Code, effect the result the Code was designed to obtain.” Official Comm. of Unsecured Creditors of Cybergenics Corp. v. Chinery, 330 F.3d 548, 568 (3d Cir. 2003) (en banc); see also Southmark Corp. v. Grosz (In re

Southmark Corp.), 49 F.3d 1111, 1116 (5th Cir. 1995) (section 105(a) of the Bankruptcy Code “authorizes bankruptcy courts to fashion such orders as are necessary to further the substantive provisions of the Code”). Together, these sections

of the Bankruptcy Code provide the Court with ample authority and discretion to grant the relief requested herein. See In re Lionel Corp., 722 F.2d 1063, 1071 (2d Cir. 1983); In re Walter, 83 B.R. 14, 17 (B.A.P. 9th Cir. 1988) (“The bankruptcy court has considerable discretion in deciding whether to approve or disapprove the use of estate property by a debtor in

possession, in the light

20

of sound business justification.”); In re ASARCO, L.L.C., 650 F.3d 593, 601 (5th Cir. 2011) (“The business judgment standard in section 363 is

flexible and encourages discretion.”); In re Montgomery Ward Holding Corp., 242 B.R. 147, 153 (D. Del. 1999) (use of assets outside the ordinary course of business permitted if “sound business purpose justifies such actions”); Comm. of

Asbestos-Related Litigants v. Johns-Manville Corp. (In re Johns-Manville Corp.), 60 B.R. 612, 616 (Bankr. S.D.N.Y. 1986) (“Where the debtor articulates a reasonable basis for its business decisions (as distinct from a decision made arbitrarily or

capriciously), courts will generally not entertain objections to the debtor’s conduct.”).

Once a debtor articulates a valid business justification under section 363 of the Bankruptcy Code, a presumption arises that the

debtor’s decision was made on an informed basis, in good faith, and in the honest belief that the action was in the best interest of the company. In re Integrated Resources, Inc., 147 B.R. 650, 656 (Bankr. S.D.N.Y. 1992) (quoting Smith v. Van Gorkom, 488 A.2d 858, 872 (Del. 1985)); see

also, In re AWTR Liquidation Inc., 548 B.R. 300, 314 (Bankr.

C.D. Cal. 2016) (referencing the Cal. Prac. Guide: Corps. (The Rutter Group 2015) Ch. 6-C); In re Johns-Manville Corp., 60 B.R. at 615-16 (“[T]he Code favors the continued operation of a business by a debtor and a presumption of reasonableness attaches to a debtor’s management decisions”).

Courts have relied on both sections 363(b) and 105(a) when approving compromises that support a plan and benefit the estate and the

other stakeholders, such as the Case Resolution Contingency Process, routinely finding that such relief is entirely consistent with the applicable provisions of the Bankruptcy Code. See, e.g., In re Pac. Gas & Elec. Co., Case No. 01-30923 (DM) (Bankr. N.D. Cal. Mar. 27, 2002) [Docket No. 5558] (order approving proposed settlement of approximately $2 billion in asserted

unsecured claims against the debtor as part of plan support agreement under sections 363(b) and 105(a) of the Bankruptcy Code); In re TK Holdings Inc., Case No. 17-11375 (BLS) (Bankr. D. Del. Dec. 13, 2017) [Docket No. 1359] (order approving postpetition plan support agreement pursuant to sections 363(b) and 105(a)

of the Bankruptcy Code); In re Energy Future Holdings Corp., Case No.

14-10979 (CSS) (Bankr. D. Del. Sept. 19, 2016) [Docket No. 9584] (order granting debtors’ motion pursuant to sections 363(b) and 105(a)

21

The Case Resolution Contingency Process was formulated and agreed to after months of substantial arms’-length, good faith

discussions with the Governor’s Office. The Debtors believe the approval of the Case Resolution Contingency Process, together with the Debtors’ OII Proposals, and the other undertakings described above, address the issues raised in the December 13

Letter. The support of the Governor’s Office for the Plan represents a significant step forward in these Chapter 11 Cases and eliminates the substantial costs, risks, and uncertainties that would otherwise be incurred with respect to a potential

action by the state of California to pursue a state takeover of the Utility as previously noted in the Governor’s Financing Objection [Docket No. 5445].

In addition, the Case Resolution Contingency Process benefits the Debtors’ estates and constituents by providing a clear process

and timeline for the resolution of these Chapter 11 Cases in the unlikely event that the Debtors are unable to obtain confirmation and consummation of the Plan as set forth in the Case Resolution Contingency Process.

In view of the foregoing, the Debtors concluded that agreement to the Case Resolution Contingency Process is in the best interests

of the Debtors, their estates and their economic stakeholders. The Debtors, with the assistance and advice of their retained professionals, have fully evaluated the assertions made and issues raised in the December 13 Letter, as well as the risks of

failing to meet the requirements of AB 1054 and of contesting a potential state takeover of the Utility. The Debtors have determined that, against that backdrop, agreement to the Case Resolution Contingency Process and achieving the support of the

Governor’s Office is a prudent exercise of the Debtors’ business judgment.

22

2. Approval

of the Case Resolution Contingency Process is in the Best Interests of the Debtors’ Estates and Should be Approved Pursuant to Bankruptcy Rule 9019.

The Debtors further submit that approval of the Case Resolution Contingency Process is in the best interests of the Debtors’

estates and all stakeholders and should be approved as a compromise under Bankruptcy Rule 9019, in the event such rule is applicable.

Bankruptcy Rule 9019(a) provides “[o]n motion by the trustee and after notice and a hearing, the court may approve a compromise and

settlement.” Fed. R. Bankr. R. 9019(a). This rule empowers Bankruptcy Courts to approve settlements “if they are in the best interests of the estate.” In re Drexel Burnham Lambert Grp., Inc., 124 B.R. 499, 505 (Bankr. S.D.N.Y. 1991); see also Myers v. Martin (In re Martin), 91 F.3d 389, 394 (3d Cir. 1996). Compromises and settlements are normal and welcomed occurrences in

chapter 11 because they allow a debtor and its creditors to avoid the financial and other burdens associated with litigation over contentious issues and expedite the administration of the bankruptcy estate. See Prot. Comm. for Indep. Stockholders of TMT Trailer Ferry, Inc. v. Anderson, 390 U.S. 414, 424

(1968); Martin v. Kane (In re A&C Props.), 784 F.2d 1377, 1380-81

(9th Cir. 1986). The decision to approve a particular compromise lies within the sound discretion of the Court. See Nellis v. Shugrue, 165 B.R. 115, 123 (S.D.N.Y. 1994); Woodson v. Fireman's Fund Ins. Co. (In re Woodson), 839 F.2d 610, 620 (9th Cir. 1988). A proposed compromise and settlement should be approved when it is “fair and equitable” and “in the best interest

of the [debtor’s] estate.” In re A&C Props., 784 F.2d at 1381.

The court must apprise itself “of all facts necessary for an intelligent and objective opinion of the probabilities of ultimate success should the claim be litigated.” Prot. Comm. for Indep. Stockholders of TMT Trailer Ferry, Inc., 390 U.S. at 424. The court must also recognize “that since the very purpose

of a compromise is to avoid the trial of sharply disputed issues and to dispense with wasteful ligation, the court must not turn the settlement hearing into a trial or a rehearsal of a trial.” Newman v. Stein, 464 F.2d 689, 692 (2d Cir. 1972) (quotation marks omitted).

Courts in this jurisdiction typically consider the following factors in determining whether a compromise should be approved:

(i) the probability of success in litigation, with due

23

The standard for approval of compromises under Bankruptcy Rule 9019 is deferential to the debtor’s judgment and merely requires the

Court to ensure that the compromise does not fall below the lowest point in the range of reasonableness in terms of benefits to the estate. See City Sanitation v. Allied Waste Servs. of Mass., LLC (In re Am. Cartage, Inc.), 656 F.3d 82, 91-92 (1st Cir. 2011) (“The task of both the bankruptcy court and any

reviewing court is to canvass the issues and see whether the [compromise] falls below the lowest point in the range of reasonableness . . . If a trustee chooses to accept a less munificent sum for a good reason (say, to avoid potentially costly

litigation), his judgment is entitled to some deference.”) (citing In re

Thompson, 965 F.2d 1136, 1145 (1st Cir. 1992)); Nellis, 165

B.R. at 123 (a court need not be aware of or decide the particulars of each individual claim resolved by the compromise or “assess the minutia of each and every claim”; rather, a court “need only canvass the issues and see whether the [compromise]

falls ‘below the lowest point in the range of reasonableness.’”); see also In re Pac. Gas & Elec. Co., 304 B.R. at 417; In re Planned Protective Servs., Inc., 130 B.R. 94, 99 n.7 (Bankr. C.D. Cal. 1991) (same).

While a court must “evaluate . . . all . . . factors relevant to a fair and full assessment of the wisdom of the proposed

compromise,” Anderson, 390 U.S. at 424-25, a court need not conduct a

“mini-trial” of the merits of the claims being settled, Port O'Call Invest.

Co. v. Blair (In re Blair), 538 F.2d 849, 851-52 (9th Cir. 1976), or conduct a full independent investigation. Drexel Burnham Lambert Grp., 134 B.R. at 505. As one court explained in assessing a global settlement of claims,

24

“[t]he appropriate inquiry is whether the Settlement Agreement in its entirety is appropriate for the . . . estate.” Air Line Pilots Ass'n, Int'l v. Am. Nat'l Bank

& Trust Co. (In re Ionosphere Clubs, Inc.), 156 B.R. 414, 430 (S.D.N.Y. 1993), aff’d 17 F.3d 600 (2d Cir. 1993) (emphasis added).

As demonstrated above, the Case Resolution Contingency Process is fair and reasonable and in the best interests of the Debtors,

their estates, all of their economic stakeholders, and should be approved. As stated, approval of the Case Resolution Contingency Process (together with the filing of the Debtors’ OII Proposals) will eliminate the costs, potential litigation, and

risks associated with the issues raised in the December 13 Letter, including the potential litigation that would arise from an attempted state takeover of the Utility. Such issues are complex, time consuming, and involve uncertain areas of state and

federal law, including thorny issues of “just compensation” that would arise if the state attempted to acquire the Debtors by exercise of eminent domain. Cal. Const. Art. I, § 19 (c). Elimination of the risk and uncertainty of that potential

litigation will, among other things, expedite distributions to fire victims. Courts routinely acknowledge that uncertainty of litigation and federal policy weigh in favor of approval of settlements. See In re Laser Realty, Inc. v. Fernandez (In re Fernandez), 2009 Bankr. LEXIS 2849, at *9-10 (Bankr. D.P.R.

Mar. 31, 2009) (“The Court concluded that the uncertainty of the litigation between the debtors and Citibank weighs heavily in favor of the approval of the Settlement Agreement.”); In re Manuel Mediavilla, Inc., 568 B.R. 551, 567 (B.A.P. 1st Cir. 2017) (recognizing “federal policy encouraging settlement of

bankruptcy litigation.”). Further, approval of the Case Resolution Contingency Process should promote expedited distributions to fire victims.

VI. CONCLUSION

The Case Resolution Contingency Process is supported by the Debtors, the Shareholder Proponents, and the Governor’s Office.

Approval will expedite the successful conclusion of these Chapter 11 Cases within the timeframe established by AB 1054. Based on the foregoing, the Debtors respectfully request that the Court approve the Case Resolution Contingency Process as such

action is a reasonable exercise of the Debtors’ business judgment and is supported by valid business justifications.

25

VII. NOTICE

Notice of this Motion will be provided to (i) the Office of the United States Trustee for Region 17 (Attn: Andrew Vara, Esq. and

Timothy Laffredi, Esq.); (ii) counsel to the Creditors Committee; (iii) counsel to the Tort Claimants Committee; (iv) the Securities and Exchange Commission; (v) the Internal Revenue Service; (vi) the Office of the California Attorney General;

(vii) the CPUC; (viii) the Nuclear Regulatory Commission; (ix) the Federal Energy Regulatory Commission; (x) the Office of the United States Attorney for the Northern District of California; (xi) counsel for the agent under the Debtors’ debtor in

possession financing facility; (xii) the Governor's Office; (xiii) counsel for the Shareholder Proponents; and (xiv) those persons who have formally appeared in these Chapter 11 Cases and requested service pursuant to Bankruptcy Rule 2002. The

Debtors respectfully submit that no further notice is required.

No previous request for relief sought herein has been made by the Debtors to this or any other court.

26

WHEREFORE the Debtors respectfully request entry of an order granting (i) the relief requested herein as a sound exercise of the

Debtors’ business judgment, appropriate under section 363(b) and 105(a) of the Bankruptcy Code and Bankruptcy Rule 9019, and in the best interests of their estates, creditors, shareholders, and all other parties in interest, and (ii) the Debtors such

other and further relief as the Court may deem just and appropriate.

| Dated: March 20, 2020 |

WEIL, GOTSHAL & MANGES LLP

CRAVATH, SWAINE & MOORE LLP

KELLER BENVENUTTI KIM LLP

|

||

|

|

By:

|

/s/ Stephen Karotkin | |

| Stephen Karotkin |

|||

| Attorneys for Debtors and Debtors in Possession | |||

27

EXHIBIT A

Case Resolution Contingency Process

Case Resolution Contingency Process

| 1. |

Failure to Meet Required Dates

|

Required Dates. The Required Dates Approval Order (as defined below) shall include a requirement that the

Confirmation Order1 be entered by June 30, 2020 (the “Confirmation Order Required Date”). The Required Dates Approval Order shall also provide that neither

of the following shall constitute a failure to meet the Confirmation Order Required Date: (i) the Confirmation Order contains conditions subsequent related to the entry of, appeal of, or compliance with the CPUC's decision in the PG&E Bankruptcy

OII or (ii) the pendency of any appeal, motion for reconsideration or similar relief of the Confirmation Order.

In the event the Confirmation Order Required Date does not occur on or prior to June 30, 2020:

| ◾ |

The Debtors shall be authorized and directed, no later than ten business days after the Confirmation Order Required Date has not been met, to appoint a Chief Transition Officer as described

below.

|

| ◾ |

The Debtors and the Governor’s Office shall agree to (or, if no such agreement is reached, the Bankruptcy Court shall order pursuant to the process set forth below) a form of bidding

procedures (as ordered by the Bankruptcy Court, the “Bidding Procedures”). The Bidding Procedures shall include, among other things, the following:

|

| ◾ |

Provisions authorizing and directing the Debtors to conduct the Sale Process (defined below).

|

| ◾ |

A schedule that allows for the closing of a sale (or effective date of a plan) no later than September 30, 2021.

|

| ◾ |

Provisions that allow the state of California or a bidder supported by the state of California to participate as a bidder in the process.

|

| ◾ |

Customary confidentiality and non-disclosure provisions applicable to all bidders or potential bidders participating in the process.

|

| ◾ |

Provisions that prohibit extension or modification of any dates set forth in the Bidding Procedures to the extent such extensions or modifications would result in a process being unable to

be completed by September 30, 2021 or would limit the ability of a bidder supported by the state of California to participate as a bidder in the process, without such extension or modification being consented to by the Governor’s Office

or approved by the Bankruptcy Court; provided, that in the event such a modification or extension is ordered without the consent of the Governor’s Office, exclusivity shall be immediately terminated without further order of the

Bankruptcy Court for the state of California, or a party supported by the state of California to sponsor a plan for either or both Debtors.

|

| ◾ |

Provisions that permit the Debtors’ boards of directors to exercise their fiduciary duties under applicable law in connection with the Sale Process; provided, that (i) the Debtors shall not

terminate the Sale Process without the consent of the Governor’s Office or approval of the Bankruptcy Court and (ii) in the event the Debtors terminate the Sale Process without the consent of the Governor’s Office, exclusivity shall be

immediately terminated without further order of the Bankruptcy Court for the state of California or a party supported by the state of California to sponsor a plan for either or both Debtors.

|

| ◾ |

Provisions setting forth the responsibilities of the Sale Committee(s) (defined below).

|

| ◾ |

Provisions setting forth qualification requirements for bidders, which shall permit the state of California or a party supported by the state of California to qualify as a bidder.

|

| • |

The Debtors shall be authorized and directed to commence the Sale Process in accordance with the Bidding Procedures.

|

| • |

The Chief Transition Officer shall remain in place until the completion of the Sale Process.

|

The Plan Commitments Approval Order and the Confirmation Order shall provide that the Effective Date of the Plan shall occur by September 30, 2020 subject to the following:

| • |

If the Effective Date has not occurred by September 30, 2020, the Debtors shall be authorized and directed, no later than ten business days after such date, to appoint a Chief Transition

Officer as described below to the extent not already appointed.

|

| • |

The Chief Transition Officer shall remain in place until the earlier of (a) completion of the Sale Process, if a Sale Process is required, or (b) the Effective Date of a Plan.

|

| • |

If the Chief Transition Officer is appointed as required above, then the deadline for the Effective Date shall be extended to December 31, 2020 (the “Effective Date Required Date”). If (i) the Chief Transition Officer is not appointed or retained as required above or (ii) the Effective Date has not occurred by the Effective Date

Required Date, then the Debtors shall pursue a Sale Process in accordance with the Bidding Procedures.

|

Chief Transition Officer.

| • |

When a Chief Transition Officer is required to be appointed pursuant to the terms hereof, the Debtors shall select the Operational Observer (defined below) as the Chief Transition Officer,

or, if the Operational Observer is not available or able to take on the role, another individual or firm from the following list of candidates: [NAMES].2

|

| • |

The Chief Transition Officer shall have the authority and scope of responsibility set forth on Annex A.

|

| • |

If the Chief Transition Officer is replaced, the subsequent Chief Transition Officer must also be selected from the list of candidates set forth in this section.

|

Sale Process.

| • |

No later than ten business days after the date on which a Sale Process is required to be pursued pursuant to the terms hereof, the Debtors shall be authorized and directed to appoint a sale

committee (the “Sale Committee”) of the board of directors of PG&E Corp. (and, to the extent necessary, to appoint a similar committee with the same

members and scope of the Utility). The members of such Sale Committee(s) shall be selected by the Debtors’ boards of directors and be acceptable to the Governor’s Office. The Sale Committee(s) shall oversee the Sale Process and make

recommendations to the full boards of directors regarding the Sale Process.

|

| • |

The Debtors shall appoint a Chief Restructuring Officer to manage the Sale Process and report to the Sale Committee. The Debtors’ current Chief Restructuring Officer shall fulfill that

function; provided, that if the Debtors’ current Chief Restructuring Officer is not available to fulfill such function, the Sale Committee shall select a nationally recognized replacement with similar characteristics and experience to

fulfill such function.

|

| • |

If a Sale Process is required, the Debtors shall be authorized and directed to implement the Sale Process in a manner consistent with the Bidding Procedures and on the timeframes set forth

therein and subject to the terms hereof.

|

| • |

Unless the Governor’s Office otherwise agrees, the Debtors shall be authorized and directed, no later than ten business days after the later of (i) the date on which a Sale Process is

required to be pursued pursuant to the terms hereof, and (ii) the date of entry of the Bidding Procedures, to file a motion (the “Sale Motion”) with the

Bankruptcy Court proposing a sale process that contains provisions allowing qualified bidders to bid for either a purchase of substantially all of the assets or a plan sponsorship proposal that would result in the plan sponsor owning the

equity of the Reorganized Debtors or the Reorganized Utility and is consistent with the Bidding Procedures and otherwise in form and substance acceptable to the Governor’s Office, the Sale Committee(s), and the Board(s) (the “Sale Process”).

|

| • |

The Sale Process shall be conducted in accordance with the Bankruptcy Code and the California Public Utilities Code.

|

The Debtors shall be authorized and directed to do the following:

| • |

Take all actions necessary to implement this requirement as soon as possible.

|

| • |

Take all actions necessary to prepare for the Sale Process so that the Sale Process, if required hereunder, can be implemented as and on the timeframes set forth herein.

|

Operational Observer.

The Required Dates Approval Order shall provide that, upon entry of such Order, the state of California can select an operational observer (the “Operational Observer”).3 The Operational Observer shall have the right to observe the Debtors’ compliance and progress with respect to natural gas operations and safety and wildfire

and other disaster mitigation activities including: vegetation management programs; system hardening programs (both electrical infrastructure and microgrid implementation); risk analysis; implementation of mitigation measures (including the use and

effectiveness of the emergency operations center and PSPS); public and workforce safety; and programs to assure compliance with any applicable safety and operational metrics. The Operational Observer shall have the authority to observe meetings of

the boards of directors (including committee meetings) and management meetings related to performance and safety issues, conduct field visits, interviews and inspections, review documentation related to safety performance, and undertake any other

tasks reasonably required in furtherance of its duties.4 The Operational Observer shall provide periodic reports to the Utility CEO, the Debtors’ boards of directors and the Governor’s Office. The Operational Observer shall not divulge

confidential or proprietary information of the Debtors without the Debtors’ consent; provided, that the Debtors shall be deemed to have consented to the disclosure of such information to the Governor’s Office and its advisors. The Operational

Observer shall keep a record of information shared with the Governor’s Office and shall make such information available to the Debtors.

Required Dates Approval Motion

On or prior to March 20, 2020, the Debtors shall file a motion seeking approval of the foregoing procedure, which motion and related form of order shall be in form and substance

acceptable to the Governor’s Office (the “Required Dates Approval Motion”). The Debtors shall request expedited hearing of the Required Dates Approval Motion on a

schedule acceptable to the Governor’s Office. The Order approving the Required Dates Approval Motion, which shall be in form and substance acceptable to the Governor’s Office, shall be referred to as the “Required Dates Approval Order”.

1 “Confirmation Order” means an order of the Bankruptcy Court on the

docket confirming the Plan in form and substance acceptable to the Governor’s Office; provided, that if the Bankruptcy Court declines to enter a form of Confirmation Order unless the Debtors modify the Confirmation Order in a manner not acceptable

the Governor’s Office, the Debtors may modify the Confirmation Order to address the Bankruptcy Court’s requirements.

2 The Governor’s Office has proposed two names. The Debtors will diligence those names and revert with any questions or concerns.

3 Consider naming the Operational Observer in the document.

4 The Reorganized Debtors may limit the Operational Observer’s attendance at meetings or access to information based on a claim of privilege only if, in the opinion of

counsel, such restriction is necessary to preserve the privilege.

28

ANNEX A

SCOPE OF CHIEF TRANSITION OFFICER

The Chief Transition Officer shall report to the Utility CEO and shall provide updates to the SNO Committees (as applicable) and the Debtors’ boards of directors with regard to

safety and operational matters.

Subject to the direction and oversight as set forth above, the Chief Transition Officer’s scope of responsibility shall include the following:

| 1. |

Responsibility for overseeing, and managing to the extent necessary, PG&E’s progress respect to vegetation management programs, system hardening programs (both electrical infrastructure

and microgrid implementation), risk analysis, and other issues that impact public safety.

|

| 2. |

Monitoring the use of the Emergency Operations Center and PSPS.

|

| 3. |

Responsibility for overseeing, and managing to the extent necessary, financial reporting related to issues that impact public safety and the public interest.

|

| 4. |

Interfacing with the CRO and the CSO.

|

| 5. |

Responsibility for overseeing, and managing to the extent necessary, PG&E’s progress toward and compliance with its Safety and Operational Metrics (to the extent the CPUC has approved

such Metrics or PG&E has adopted or proposed such Metrics).

|

| 6. |

Providing periodic (and no less than monthly) reporting to the CPUC.

|

The Chief Transition Officer’s authority does not alter the authority, responsibility, or accountability of other members of management except to the extent of the scope

specifically delegated to the Chief Transition Officer. Notwithstanding the foregoing, the Chief Transition Officer shall not be authorized to dispose of the assets, business or stock of the Debtors. The Chief Transition Officer shall not divulge

confidential or proprietary information of the Debtors without the Debtors’ consent; provided, that the Debtors shall be deemed to have consented to the disclosure of such information to the Governor’s Office and its advisors. The Chief Transition

Officer shall keep a record of information shared with the Governor’s Office and shall make such information available to the Debtors.

EXHIBIT B

[PROPOSED] Order

[PROPOSED] Order