Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Lincolnway Energy, LLC | form8k.htm |

Exhibit 99.1

Lincolnway Energy Member Meeting March 23, 2020

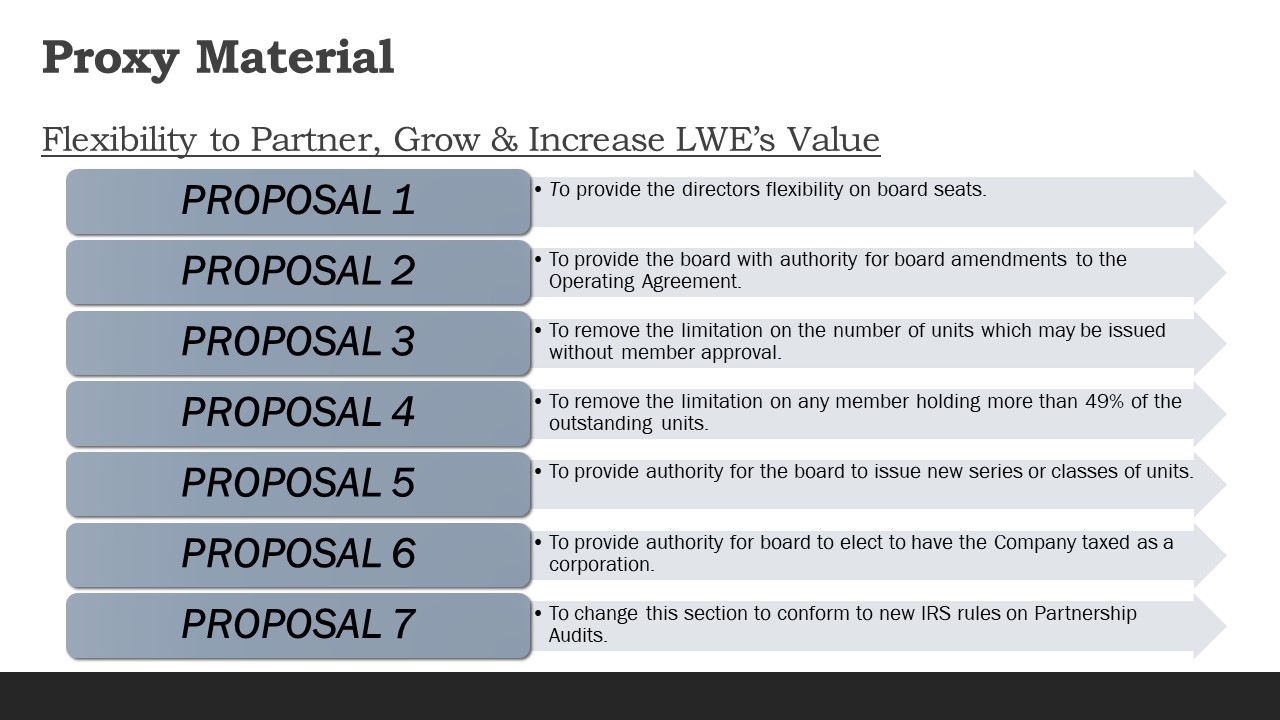

2 Proxy MaterialFlexibility to Partner, Grow & Increase LWE’s Value

Agenda IntroductionsDiscuss Husker AgPlant Improvement So Far and Future PlansInvestment, Management

and Board Make UpDiscuss LWE Member Investment in Class B UnitsQuestions and Discussions

4 This presentation may contain “forward-looking” statements as defined in the Private Securities

Litigation Reform Act of 1995. When the Company uses words such as “may,” “will,” “intend,” should,” “believe,” “expect,” “anticipate,” “project,” “estimate,” or similar expressions that do not relate solely to historical matters, it is

making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the

forward-looking statements. The Company’s expected results may not be achieved, and actual results may differ materially from expectations. Specifically the Company’s statements regarding: (i) its ability to implement a strategic long-term

plan ; (ii) its ability to reduce operating costs, including general and administrative expenses; (iii) its ability to improve its balance sheet and cash flows; (iv) its ability to stabilize and produce consistent and reliable cash flows; and

(v) its ability to manage operating costs and increase unitholder value are all forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are

beyond our control, are difficult to predict, and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. For these reasons, among others, investors are cautioned not to place

undue reliance upon any forward-looking statements in this presentation. Additional factors are discussed in the Company’s filings with the U.S. Securities and Exchange Commission, which are available for review at www.sec.gov. The Company

undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.Important Additional InformationThe Company, its directors and certain of its executive officers

are participants in the solicitation of proxies from the Company’s Members in connection with matters to be considered at the Company’s Special Meeting of Members (the “Special Meeting”). The Company has filed a definitive proxy statement and

proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its solicitation of proxies from the Company’s Members. MEMBERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING PROXY

CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION. Information regarding the identities of the Company’s directors and executive officers, and their direct or indirect

interests, by security holdings or otherwise, are set forth in the proxy statement and other materials filed with the SEC in connection with the Special Meeting. Members can obtain the proxy statement, any amendments or supplements to the

proxy statement, and any other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. These documents are also available at no charge in the “Investors—2019 Special Meeting Materials” section of the

Company’s website at www.lincolnwayenergy.com. Safe Harbor

LWE’s Focus 1. Top Tier Plant Management Team2. Viable Business Model to Maximize Profitability3.

Economic Decision-Making Process for:Financial Results Commodity ProcurementMarket ImpactTechnology / Production EnhancementsManagement AccountabilityGovernment Influence

6 Impact to LWE

Energy Cut 70 gallons raw water per minute extraWe are using 3 million gallons less per month of raw

fresh water57 million btus per hour X $3.00 X 24hrs= $4104-DayOr $1,500,000 per year or $0.02 per gallon 29,000 btus per gallon previously 24,000 btus per gallon currently .95 kilowatt per gallon <.7 kilowatt – Today Still evaluating

horsepower requirements Confident will keep falling with increased production – BEP “Best Efficiency Point”!!

Ingredients & Chemicals Shut off methanator $ (3,000)Shut off ammonia $ (9,100)Reduced urea $

(21,067) Reduced enzyme $ (56,436) No more protease $ (24,500) Sulfuric acid reduction $ (4,247)Caustic reduction $ (18,362)Added new chemicals $ 23,000Total Estimated Reductions =$ >113,700 per monthAnnualized $1.36 million or $0.017 per

gallon

Plant Run Rate Increasing gallons from 62 mmgy to 75 mmgy decreases overhead by $0.03 per gallon.

Total fixed overhead at $1.16 million Increasing from 62-75mmgy represents a 20% decrease per gallon Bottom line delta impact = $ 2,250,000 annually

Repair and Maintenance 2019 R&M was >$0.065 per gallon 2020 R&M about $0.01 , targeting

$0.02 $0.04 delta equates to $3,000,000

Syrup & DDG SyrupPreviously sold 5400 tons a month of syrup at $6/tonToday converting the syrup to

1200 tons DDG at $135 Annualized increase of $1,555,200 or $0.02/gallonDDG Rail car discounts on loads under 105 tons = $8/ton 490 tons per day X $8 = $3920 day or $ 1,430,800 per year or $0.019/gallon

Merchandising Leveraging the Husker Ag Partnership Clarity and Intel to the marketsManaging the

balance of Farm Gate and Commercial GrainIncrease Contract Offerings to ProducersRisk Management Practices

Results Driving Success (**estimated changes) Energy $0.02 $ 1,500,000Ingredients & chemicals

$0.017 $ 1,360,000Fixed Overhead Improvement $0.03 $ 2,250,000Repair and Maintenance $0.04 $ 3,000,000Syrup and DDG $0.03 $ 2,250,000 Merchandising Practices $0.04 $ 3,000,000Ethanol, Corn, DDG, HedgingTotal Delta (estimate) >$0.177

$>13,360,000

Filing for New Air Permit - 100 mmgy Debottleneck Pumps & Piping < $500,000 Add Sieve Capacity

–$500,000Produce at 80 - 85 mmgy Add 6th Fermenter, Milling, Boiler Capacity, Degas, - $4 millionNew Run Rate 90 -100 millionKeep Evaluating High Protein Low Carbon Fuels Pay Distributions Looking Ahead

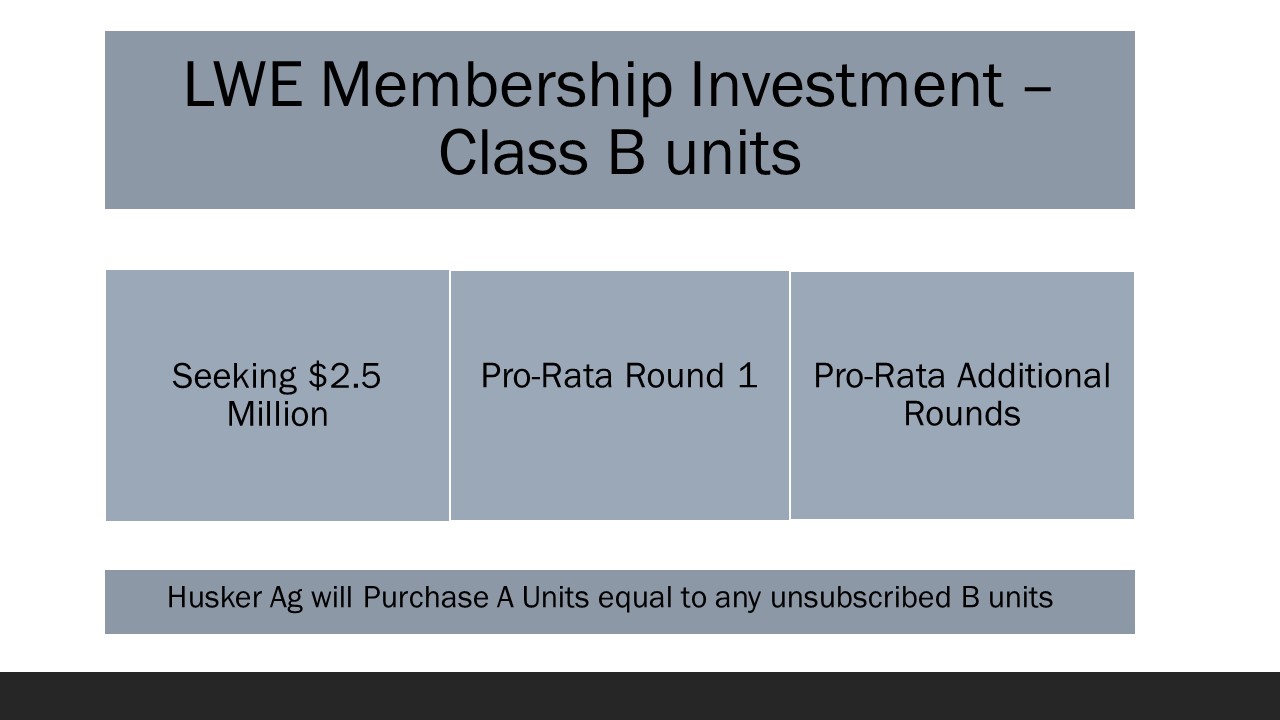

Husker Ag- Class A Units

Husker Ag will Purchase A Units equal to any unsubscribed B units

Class B UnitsItems You Need to Know Completion of the Vote:Next closing of $5,000,000 Series A

purchase by Husker Ag – March 31Members will be notified when Series B offering starts – on or about April 1All interested members who are accredited investors will be provided full private placement memo and subscription documents.

We are taking Questions via the Messaging Link