Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Liberty TripAdvisor Holdings, Inc. | tm2012777d2_8k.htm |

Exhibit 3.1

EXECUTION VERSION

CERTIFICATE OF DESIGNATIONS

OF

8% SERIES A CUMULATIVE REDEEMABLE PREFERRED STOCK

OF

LIBERTY TRIPADVISOR HOLDINGS, INC.

Liberty TripAdvisor Holdings, Inc., a corporation organized and existing under the General Corporation Law of the State of Delaware (the “Corporation”), hereby certifies that a duly authorized committee of the Board of Directors (the “Committee”) of the Corporation duly adopted the following resolutions on March 15, 2020 in accordance with Section 151(g) of the General Corporation Law of the State of Delaware:

BE IT RESOLVED, that pursuant to the authority expressly vested by the provisions of the Certificate of Incorporation and in accordance with Section 151(g) of the General Corporation Law of the State of Delaware, the Committee hereby creates, authorizes and provides for the issuance of a series of Preferred Stock consisting of 325,000 shares, out of the authorized and unissued shares of Preferred Stock, and that the designation and number of shares thereof, the powers, preferences and relative, participating, optional or other rights of such shares, and the qualifications, limitations or restrictions thereof, are as follows:

1. Designation and Amount. The designation of the series of preferred stock, par value $0.01 per share, of the Corporation authorized hereby is 8% Series A Cumulative Redeemable Preferred Stock (the “Series A Preferred Stock”). The total number of shares of the authorized and unissued preferred stock of the Corporation designated as the Series A Preferred Stock initially shall be 325,000. Shares of Series A Preferred Stock will be issued pursuant to the Investment Agreement and except as provided therein, no additional shares of Series A Preferred Stock will be issued by the Corporation.

2. Certain Definitions. For purposes of this Certificate of Designations, the following terms shall have the meanings ascribed below:

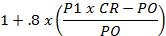

“Accretion Factor” shall mean a fraction expressed as follows:

Where

| P1 | = | the Reference Stock VWAP over the period of ten (10) consecutive Trading Days ending on the second (2nd) Trading Day preceding the Determination Date. | |

| PO | = | $17.08 | |

| CR | = | the applicable Conversion Rate in effect as of the Determination Date. |

“Adjusted Conversion Rate” shall mean the Base Conversion Rate, as adjusted pursuant to paragraph 9, as applicable.

“Applicable Amount” shall have the meaning set forth in paragraph 5(a)(ii) hereof.

“Applicable Rate” shall mean the Base Rate or the Penalty Rate, as applicable.

“Base Conversion Rate” shall mean 1.0.

“Base Rate” shall mean eight percent (8.00%) per annum.

“Board of Directors” shall mean the Board of Directors of the Corporation and any duly authorized committee thereof.

“Business Day” shall mean any weekday that is not a day on which banking institutions in New York, New York are authorized or required by law, regulation or executive order to be closed.

“Capital Stock” shall mean any and all shares of capital stock of the Corporation.

“Certificate of Designations” shall mean this Certificate of Designations of 8% Series A Cumulative Redeemable Preferred Stock of the Corporation, as may be amended from time to time.

“Certificate of Incorporation” shall mean the Corporation’s Restated Certificate of Incorporation, filed with the Secretary of State of the State of Delaware on August 27, 2014, as may be amended from time to time.

“Class B Tripadvisor Common Stock” means Class B common stock, $0.001 par value, of Tripadvisor.

“Closing Price” of a security on any date of determination means the closing sale price or, if no closing sale price is reported, the last reported sale price, of one share of such security on the NASDAQ Global Select Market on such date. If such security is not traded on the NASDAQ Global Select Market on any date of determination, the Closing Price of such security on such date of determination means the closing sale price as reported in the composite transactions for the principal U.S. national or regional securities exchange on which such security is so listed or quoted, or, if no closing sale price is reported, the last reported sale price on the principal U.S. national or regional securities exchange on which such security is so listed or quoted, or if such security is not so listed or quoted on a U.S. national or regional securities exchange, the last quoted bid price for such security in the over-the-counter market as reported by Pink Sheets LLC or similar organization, or, if that bid price is not available, the market price of such security on that date as determined by a nationally recognized investment banking firm (unaffiliated with the Corporation) retained by the Corporation for such purpose.

2

“Common Stock” shall mean (i) the Series A Common Stock, (ii) the Series B common stock, par value $0.01 per share, of the Corporation, (iii) the Series C Common Stock and (iv) all shares of any other class or series of common stock of the Corporation hereafter authorized.

“Company Change in Control” shall have the meaning set forth in the Investment Agreement; provided, that, for purposes of this Certificate of Designations, a Company/Tripadvisor Combination Transaction shall not be a Company Change in Control.

“Company/Tripadvisor Combination Transaction” means any share exchange, consolidation, merger or similar transaction or series of related transactions, between the Corporation and the Reference Company that results in a Company Change in Control and in which (i) the Corporation is the surviving or resulting company or (ii) (x) the Person succeeding the Corporation is owned by the stockholders of the Corporation and the Reference Company and (y) the securities of the successor or resulting Person to be received by the holders of Series A Preferred Stock in such transaction are received on a tax-free basis (except to the extent of any cash received) and after giving effect to any adjustments made pursuant to paragraph 9 hereof have substantially similar rights, including with respect to dividend rights, rights of redemption and rights on the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of such surviving or resulting Person as such holders held by virtue of the Series A Preferred Stock immediately prior to the transaction.

“Controlled Affiliates” shall have the meaning set forth in the Investment Agreement.

“Conversion Rate” shall mean the Base Conversion Rate, unless otherwise required to be modified pursuant to paragraph 9, in which case it shall refer to the Adjusted Conversion Rate.

“Current Market Price” of Reference Stock as of the record date for any issuance, distribution, dividend or other action shall mean the arithmetic average of the Reference Stock VWAP per share of Reference Stock, for the period of ten (10) consecutive Trading Days ending on the Trading Day before the record date with respect to such issuance, distribution, dividend or other action, appropriately adjusted to take into account the occurrence during such period of any event described in paragraph 9 hereof.

3

“Debt Instrument” shall mean any note, bond, debenture, indenture, guarantee or other instrument or agreement evidencing any Indebtedness, whether existing at the Original Issue Date or thereafter created, incurred, assumed or guaranteed.

“Determination Date” shall mean (i) the date the Purchaser delivers the Put Option Exercise Notice in connection with the Put Option Mandatory Redemption or (ii) the Mandatory Redemption Date or the Liquidation Date, as applicable.

“Distributed Entity” shall have the meaning set forth in the Investment Agreement.

“Distributed Property” shall have the meaning set forth in paragraph 9(a) hereof.

“Distribution Transaction” shall have the meaning set forth in the Investment Agreement.

“Dividend Payment Date” shall have the meaning set forth in paragraph 3(a) hereof.

“Dividend Payment Shares” shall have the meaning set forth in paragraph 3(c) hereof.

“Dividend Period” shall mean the period (x) from and including the Original Issue Date to (but not including) the first Dividend Payment Date and (y) each twelve (12) month period from and including the Dividend Payment Date for the preceding Dividend Period to (but not including) the next succeeding Dividend Payment Date.

“Eligible Common Stock” means (i) shares of Series A Common Stock and/or, (ii) Series C Common Stock if the Company offers to settle in Series C Common Stock and the Purchaser elects to receive payment in Series C Common Stock pursuant to paragraph 3 (Dividends) and/or paragraph 5 (Redemption; Put Right); provided, in each case, as of the date of issuance to the holders of Series A Preferred Stock, shares of such class or series are listed on a national securities exchange and are actively traded.

“Exchange Act” shall mean the Securities Exchange Act of 1934, as amended, and the rules and regulations of the SEC promulgated thereunder.

“Fair Market Value” means, with respect to any security or other property, the fair market value of such security or other property as determined by the Board of Directors acting in good faith.

“Indebtedness” shall mean (i) any liability, contingent or otherwise, of the Corporation or any Subsidiary (x) for borrowed money (whether or not the recourse of the lender is to the whole of the assets of the Corporation or any Subsidiary or only to a portion thereof), (y) evidenced by a note, debenture or similar instrument (including a purchase money obligation) given other than in connection with the acquisition of inventory or similar property in the ordinary course of business, or (z) for the payment of money relating to indebtedness represented by obligations under a lease that is required to be capitalized for financial accounting purposes in accordance with generally accepted accounting principles; (ii) any liability of others described in the preceding clause (i) which the Corporation or any Subsidiary has guaranteed or which is otherwise its legal liability; (iii) any obligations secured by any mortgage, pledge, lien, encumbrance, charge or adverse claim affecting title or resulting in an encumbrance against any real or personal property, or a security interest of any kind (including any conditional sale or other title retention agreement, any lease in the nature thereof, any option or other agreement to sell and any filing of or agreement to give any financing statement under the Uniform Commercial Code (or equivalent statutes) of any jurisdiction) to which the property or assets of the Corporation or any Subsidiary are subject whether or not the obligations secured thereby shall have been assumed by or shall otherwise be the Corporation’s or any Subsidiary’s legal liability; and (iv) any amendment, renewal, extension or refunding of any liability of the types referred to in clause (i), (ii) or (iii) above.

4

“Investment Agreement” shall mean that certain Investment Agreement, dated as of March 15, 2020, by and between the Corporation, the Purchaser, and for the limited purposes provided therein, Gregory B. Maffei, as such agreement may be amended in accordance therewith.

“Junior Stock” shall mean the Common Stock and any other class or series of Capital Stock now existing or hereafter authorized and issued, in accordance with the Certificate of Incorporation, other than the Series A Preferred Stock, any class or series of Parity Stock and any class or series of Senior Stock.

“Liquidation Date” shall mean the date of the liquidation, dissolution or winding up of the Corporation.

“Liquidation Price” measured per share of the Series A Preferred Stock as of any date of determination shall mean the sum of (i) $1,000, plus (ii) an amount equal to all unpaid dividends (whether or not declared) accrued with respect to such share which pursuant to paragraph 3 hereof have been added to the Liquidation Price as of a Dividend Payment Date.

“Mandatory Redemption” shall have the meaning set forth in paragraph 5(a)(i) hereof.

“Mandatory Redemption Date” as to all shares of Series A Preferred Stock shall mean the first to occur of (x) the first (1st) Business Day following the fifth (5th) anniversary of the Original Issue Date and (y) the date upon which there occurs a Company Change in Control.

“Mandatory Redemption Price” with respect to each share of Series A Preferred Stock, shall mean the greater of (x) the Liquidation Price of such share as of the Mandatory Redemption Date or the Put Option Mandatory Redemption Date, as applicable, plus all unpaid dividends (whether or not declared) on such share accrued from the most recent Dividend Payment Date through the date such share is redeemed and (y) (i) the initial Liquidation Price of such share of Series A Preferred Stock on and determined as of the Original Issue Date multiplied by the Accretion Factor minus (ii) all dividends paid in cash or shares of Eligible Common Stock (valued for this purpose as determined pursuant to paragraph 3(c) hereof) on such share from the Original Issue Date through the date such share is redeemed.

5

“Market Disruption Event” shall mean:

(i) any suspension of, or limitation imposed on, trading of the Eligible Common Stock by any exchange or quotation system on which the Closing Price is determined pursuant to the definition of the term “Closing Price” (the “Relevant Exchange”) during the one-hour period prior to the close of trading for the regular trading session on the Relevant Exchange (or for purposes of determining the VWAP per share of Eligible Common Stock, any period or periods aggregating one half-hour or longer during the regular trading session on the relevant day) and whether by reason of movements in price exceeding limits permitted by the Relevant Exchange as to securities generally, or otherwise relating to the Eligible Common Stock or options contracts relating to the Eligible Common Stock on the Relevant Exchange; or

(ii) any event that disrupts or impairs (as determined by the Board of Directors in its good faith discretion) the ability of market participants during the one-hour period prior to the close of trading for the regular trading session on the Relevant Exchange (or for purposes of determining the VWAP per share of Eligible Common Stock, any period or periods aggregating one half-hour or longer during the regular trading session on the relevant day) in general to effect transactions in, or obtain market values for, the Eligible Common Stock on the Relevant Exchange or to effect transactions in, or obtain market values for, options contracts relating to the Eligible Common Stock on the Relevant Exchange.

“Mirror Preferred Stock” shall have the meaning set forth in the Investment Agreement.

“Notice of Redemption” shall have the meaning set forth in paragraph 5(c) hereof.

“Original Issue Date” shall mean, with respect to the shares of Series A Preferred Stock, the date on which shares of Series A Preferred Stock are first issued.

“Parity Stock” shall mean any class or series of Capital Stock hereafter authorized and issued in accordance with the Certificate of Incorporation that expressly ranks on a parity basis with the Series A Preferred Stock as to the dividend rights, rights of redemption and rights on the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation. Any Mirror Preferred Stock issued in accordance with paragraph 9 hereof and the Investment Agreement will be considered Parity Stock.

“Penalty Rate” shall mean the Base Rate plus four percent (4.00%) per annum.

6

“Permissible Action” shall have the meaning set forth in paragraph 3(f) hereof.

“Person” shall mean any individual, corporation, company, limited liability company, general or limited partnership, trust, estate, proprietorship, joint venture, association, organization or other entity.

“PIK Election” shall have the meaning set forth in paragraph 3(b) hereof.

“Publicly Traded Securities” shall have the meaning set forth in paragraph 5(a)(i) hereof.

“Purchaser” shall have the meaning set forth in the Investment Agreement.

“Put Option” shall have the meaning set forth in paragraph 5(g) hereof.

“Put Option Exercise Notice” shall have the meaning set forth in paragraph 5(g) hereof.

“Put Option Mandatory Redemption Date” shall have the meaning set forth in paragraph 5(g) hereof.

“Record Date” shall mean for the dividends payable on any Dividend Payment Date the date five (5) days immediately preceding such Dividend Payment Date; provided, that if such date is not a Business Day, the record date shall be the next succeeding Business Day after such date.

“Redemption Default” shall have the meaning set forth in paragraph 3(d) hereof.

“Redemption Director Effective Time” shall have the meaning set forth in paragraph 8(a)(ii) hereof.

“Reference Company” shall mean any Person that is the issuer of the Reference Stock and initially means Tripadvisor for so long as Tripadvisor Common Stock constitutes Reference Stock.

“Reference Stock” shall mean, shares of Tripadvisor Common Stock, which term shall include, where appropriate, in the case of any reclassification, recapitalization or other change in shares of Reference Stock, or in the case of a consolidation or merger of the Reference Company with or into another Person affecting the shares of Reference Stock, such capital stock or equity interests to which a holder of shares of Reference Stock immediately prior to the occurrence of such event is entitled to receive upon the occurrence of such event.

“Reference Stock VWAP” per share of Reference Stock on any Trading Day shall mean the per share volume-weighted average price as displayed under the heading Bloomberg VWAP on Bloomberg (or, if Bloomberg ceases to publish such price, any successor service reasonably chosen by the Corporation) page TRIP (or its equivalent successor if such page is not available) in respect of the period from the open of trading on the relevant Trading Day until the close of trading on such Trading Day for such specified period (or if such volume-weighted average price is unavailable, the market price of one share of Reference Stock on the last Trading Day determined, using a volume-weighted average method, by a nationally recognized investment banking firm (unaffiliated with the Corporation) retained for such purpose by the Corporation).

7

“Registrar” shall mean the Transfer Agent acting in its capacity as registrar for the Series A Preferred Stock, and its successors and assigns.

“Relevant Exchange” shall have the meaning set forth in the definition of the term “Market Disruption Event.”

“Senior Stock” shall mean any class or series of Capital Stock that ranks senior to the Series A Preferred Stock or has preference or priority over the Series A Preferred Stock as to dividend rights, rights of redemption or rights on the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation.

“Series A Common Stock” shall mean the Series A Common Stock, par value $0.01 per share, of the Corporation.

“Series A Dividend Amount” shall mean, for any Dividend Payment Date, the amount accrued as a dividend per share of Series A Preferred Stock since the prior Dividend Payment Date, as determined pursuant to paragraph 3 hereof.

“Series A Preferred Redemption Director” shall have the meaning set forth in paragraph 8(a)(ii) hereof.

“Series A Preferred Stock” shall have the meaning set forth in paragraph 1 hereof.

“Series A Preferred Threshold Director” shall have the meaning set forth in paragraph 8(a)(i) hereof.

“Series C Common Stock” shall mean the Series C Common Stock, par value $0.01 per share, of the Corporation.

“Special Liquidation Price” with respect to each share of Series A Preferred Stock, shall mean the Liquidation Price of such share as of the Liquidation Date plus all unpaid dividends (whether or not declared) on such share accrued from the most recent Dividend Payment Date through the Liquidation Date.

“Spinoff Exchange Offer” shall have the meaning set forth in the Investment Agreement.

8

“Subsidiary” shall mean, with respect to any person, any corporation, general or limited partnership, limited liability company, joint venture or other entity (a) that is consolidated with such person for purposes of financial reporting under generally accepted accounting principles or (b) in which such person (i) owns, directly or indirectly, more than fifty percent (50%) of the voting power represented by the outstanding voting securities or more than fifty percent (50%) of the equity securities, profits interest or capital interest, (ii) is entitled to elect at least one-half of the board of directors or similar governing body or (iii) in the case of a limited partnership or limited liability company, is a general partner or managing member and has the power to direct the policies, management and affairs of such entity, respectively; provided, neither Tripadvisor nor any of its Subsidiaries will be deemed to be a Subsidiary of the Corporation or a Subsidiary of any of the Corporation’s Subsidiaries, whether or not they otherwise would be a Subsidiary of the Corporation or any of the Corporation’s Subsidiaries under the foregoing definition.

“Threshold Amount” shall have the meaning set forth in paragraph 8(a)(i) hereof.

“Trading Day” shall mean a Business Day on which the Relevant Exchange is scheduled to be open for business and on which there has not occurred a Market Disruption Event.

“Transfer” shall have the meaning set forth in the Investment Agreement.

“Transfer Agent” shall mean the Corporation or such other Person as the Corporation may appoint, acting as Transfer Agent, Registrar and paying agent for the Series A Preferred Stock.

“Tripadvisor” shall mean Tripadvisor, Inc., a Delaware corporation.

“Tripadvisor Common Stock” shall have the meaning set forth in the Investment Agreement.

“Tripadvisor Stock” shall mean Tripadvisor Common Stock and the Class B Tripadvisor Common Stock.

“VWAP” per share of Eligible Common Stock on any Trading Day shall mean the per share volume-weighted average price as displayed under the heading Bloomberg VWAP on Bloomberg (or, if Bloomberg ceases to publish such price, any successor service reasonably chosen by the Corporation) LTRPA or LTRPK, as applicable, (or its equivalent successor if such page is not available) in respect of the period from the open of trading on the relevant Trading Day until the close of trading on such Trading Day for such specified period (or if such volume-weighted average price is unavailable, the market price of one share of Eligible Common Stock on the last Trading Day determined, using a volume-weighted average method, by a nationally recognized investment banking firm (unaffiliated with the Corporation) retained for such purpose by the Corporation).

9

3. Dividends.

(a) Subject to the prior preferences and other rights of any Senior Stock not issued in violation of this Certificate of Designations or the Investment Agreement and the provisions of paragraph 3(f) hereof, the holders of the Series A Preferred Stock shall be entitled to receive preferential dividends that shall accrue and cumulate as provided herein. Dividends on each share of Series A Preferred Stock shall accrue on a daily basis at the Applicable Rate of the Liquidation Price from and including the Original Issue Date to and including the date on which such shares cease to be outstanding, whether or not such dividends have been declared and whether or not there are any funds of the Corporation legally available for the payment of dividends, and such dividends shall be cumulative. Accrued dividends on the Series A Preferred Stock shall be payable, in accordance with the terms and conditions of this Certificate of Designations, annually on March 1 of each year, commencing on the first such date following the Original Issue Date (each, a “Dividend Payment Date”), to the holders of record of the Series A Preferred Stock as of the close of business on the applicable Record Date, and any accrued dividends that have been declared will be paid on the Dividend Payment Date in accordance with paragraph 3(b) hereof; provided, however, if any such Dividend Payment Date is not a Business Day, then payment or addition to the Liquidation Price of any dividend otherwise payable on that date will be made on the next succeeding day that is a Business Day, without any interest or other payment in respect of such delay. For purposes of determining the amount of dividends “accrued” (i) as of any date that is not a Dividend Payment Date, such amount shall be calculated on the basis of the Applicable Rate for actual days elapsed from the last preceding Dividend Payment Date (or in the event the first Dividend Payment Date has not yet occurred, the Original Issue Date) to the date as of which such determination is to be made, based on a 365-day year, (ii) as of any Dividend Payment Date (other than the first Dividend Payment Date), such amount shall be calculated on the basis of the Applicable Rate, based on a 360-day year of twelve 30-day months, and (iii) as of the first Dividend Payment Date, such amount shall be calculated on the Applicable Rate for actual days elapsed from the Original Issue Date to the date prior to the Dividend Payment Date, based on a 365-day year.

(b) Dividends payable with respect to the Series A Preferred Stock, when and as declared by the Board of Directors, will be paid, at the Corporation’s election, in (i) cash, (ii) shares of Eligible Common Stock (the election referred to in this clause (ii), the “PIK Election”), or (iii) a combination thereof and if not so declared and paid, the applicable Series A Dividend Amount will be added to the then applicable Liquidation Price of the Series A Preferred Stock in accordance with the definition thereof; provided, however, that the Corporation will only make a PIK Election if there is an effective shelf registration statement with respect to the applicable Eligible Common Stock in which the dividend is to be paid. Not less than ten (10) Business Days prior to the applicable Dividend Payment Date, the Corporation will provide notice to the holders of the Series A Preferred Stock of its election as to the form of payment of the Series A Dividend Amount.

(c) In the event the Corporation makes the PIK Election, it will cause to be delivered to the holders of Series A Preferred Stock, for each share of Series A Preferred Stock held by a holder, a number of shares of Eligible Common Stock equal to the Series A Dividend Amount divided by the VWAP of a share of Eligible Common Stock determined over the three (3) Trading Day period ending on the second (2nd) Trading Day preceding the applicable Dividend Payment Date. The shares of Eligible Common Stock to be issued to the holder in accordance with the foregoing are referred to herein as the “Dividend Payment Shares”. To the extent the number of Dividend Payment Shares deliverable to a holder of Series A Preferred Stock is not a whole number of shares, the Corporation will pay to such holder cash in respect of any fractional share based upon the VWAP price used in calculating the number of Dividend Payment Shares. Upon issuance and delivery to the holder, the Corporation shall be deemed to represent and warrant to the holder, as of such date, that (i) the Corporation is a corporation duly organized, validly existing and in good standing under the laws of its jurisdiction of incorporation and has the corporate power and authority to consummate the payment of the Dividend Payment Shares to each holder; (ii) to the extent such holder is subject to Section 16 of the Exchange Act, the Board of Directors has taken such action as is necessary to cause the exemption of the acquisition of the Dividend Payment Shares by each holder, as applicable, from the liability provisions of Section 16(b) of the Exchange Act pursuant to Rule 16b-3; (iii) the Dividend Payment Shares to be issued to each holder have been duly authorized and, when issued and delivered in accordance with the terms of this Certificate of Designations, will have been validly issued and will be fully paid and nonassessable; and (iv) the Corporation has timely filed all reports required to be filed by the Corporation, under the Exchange Act, during the twelve (12) months immediately preceding the applicable Dividend Payment Date, and as of their respective filing dates, each of such filings complied in all material respects with the applicable requirements of the Exchange Act and the rules and regulations promulgated thereunder, and, at the time filed, none of such filings contained as of such date any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading; and when filed with the Securities and Exchange Commission, the financial statements included in such filings were prepared in accordance with U.S. GAAP consistently applied (except as may be indicated therein or in the notes or schedules thereto), and such financial statements fairly present the consolidated financial position of the Corporation and its consolidated cash flows for the periods then ended, subject, in the case of unaudited interim financial statements, to normal, recurring year-end audit adjustments. Notwithstanding anything to the contrary contained herein, the maximum number of shares of Eligible Common Stock that may be issued under this paragraph 3(c) is subject to compliance with the shareholder approval requirements of the rules and regulations of The Nasdaq Stock Market LLC.

10

(d) The Applicable Rate for the purposes of this paragraph 3 shall be the Base Rate; provided, that in the event the Corporation fails to redeem on the Mandatory Redemption Date or the Put Option Mandatory Redemption Date all shares of Series A Preferred Stock, then in that event (a “Redemption Default”), the Applicable Rate shall increase to the Penalty Rate, commencing on the first day after the Mandatory Redemption Date or the Put Option Mandatory Redemption Date, as applicable, on which a Redemption Default occurs and for each subsequent Dividend Period thereafter so long as any shares of Series A Preferred Stock remain outstanding. For the avoidance of doubt, notwithstanding the foregoing, in the event of a Redemption Default the holders of Series A Preferred Stock shall retain all rights and remedies hereunder and at law and in equity to enforce the Corporation’s obligations hereunder.

(e) For the avoidance of doubt, in the event the Corporation does not declare and pay the Series A Dividend Amount on a Dividend Payment Date, then all dividends (whether or not declared) that have accrued on a share of Series A Preferred Stock during the Dividend Period ending on such Dividend Payment Date and which are unpaid will be added to the Liquidation Price (as provided in the definition thereof) of such share and will remain a part thereof until such time as the shares of Series A Preferred Stock have been redeemed in full and the Mandatory Redemption Price thereof has been paid in full.

(f) So long as any shares of Series A Preferred Stock shall be outstanding, the Corporation shall not declare or pay any dividend whatsoever with respect to any Junior Stock or any Parity Stock, whether in cash, property or otherwise, nor shall the Corporation declare or make any distribution on any Junior Stock or any Parity Stock, or set aside any cash or property for any such purposes, nor shall any Junior Stock or Parity Stock, be purchased, redeemed or otherwise acquired by the Corporation or any of its Subsidiaries, nor shall any monies be paid, set aside for payment or made available for a sinking fund for the purchase or redemption of any Junior Stock or Parity Stock, unless and until (x) (i) all dividends to which the holders of the Series A Preferred Stock shall have been entitled for all current and all previous Dividend Periods shall have been paid or declared and the consideration sufficient for the payment thereof set aside so as to be available for the payment thereof (which shall be deemed satisfied to the extent of a PIK Election by the Corporation) and (ii) following the occurrence of the Mandatory Redemption Date or Put Option Mandatory Redemption Date, as applicable, the Corporation shall have paid, in full, or set aside the consideration sufficient for the payment thereof, all redemption payments with respect to the Series A Preferred Stock that it is then obligated to pay; provided, however, that nothing contained in this paragraph 3(f) shall prevent (A) purchases, redemptions or other acquisitions of shares of Junior Stock in the ordinary course in connection with any employment contract, benefit plan or other similar arrangement approved by the Board of Directors with or for the benefit of employees, officers, directors or consultants provided that no such purchase of Junior Stock from Gregory B. Maffei will be permitted other than in connection with net settling of options and repurchases of unvested restricted stock in accordance with the terms thereby; (B) exchanges or conversions of shares of any class or series of Junior Stock, or the securities of another company, for any other class or series of Junior Stock; (C) the purchase of fractional interests in shares of Junior Stock pursuant to the conversion or exchange provisions of such Junior Stock or the security being converted or exchanged; (D) the payment of any dividends in respect of Junior Stock where the dividend is in the form of the same stock as that on which the dividend is being paid; (E) distributions of Junior Stock or rights to purchase Junior Stock; (F) direct or indirect distributions of equity interests of a Subsidiary or other Person (whether by redemption, dividend, share distribution, merger or otherwise) to all or substantially all of the holders of one or more classes or series of Common Stock, on a pro rata basis with respect to each such class or series (other than with respect to the payment of cash in lieu of fractional shares), or such equity interests of such Subsidiary or other Person are available to be acquired by such holders of one more classes or series of Common Stock (including through any rights offering, exchange offer, exercise of subscription rights or other offer made available to such holders), on a pro rata basis with respect to each such class or series (other than with respect to the payment of cash in lieu of fractional shares), whether voluntary or involuntary (provided, that such distribution does not constitute all or substantially all of the assets of the Corporation as of the record date applicable to such distribution) or (G) stock splits, stock dividends or other distributions, reclassifications, recapitalizations (each of the events described in clause (A) through (G), a “Permissible Action”), and (y) to the extent the taking of any Permissible Action results in any diminution in the Fair Market Value of the Series A Preferred Stock, the Board of Directors shall in good faith make an equitable adjustment to the Liquidation Price in effect at the effective time of the Permissible Action to the extent necessary to preserve such Fair Market Value of the Series A Preferred Stock.

11

4. Distributions Upon Liquidation, Dissolution or Winding Up.

Subject to the prior payment in full of the preferential amounts to which any Senior Stock is entitled, in the event of any liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, the holders of shares of the Series A Preferred Stock shall be entitled to receive from the assets of the Corporation available for distribution to the stockholders, before any payment or distribution shall be made to the holders of any Junior Stock, an amount in cash, or to the extent the amount of cash distributable in such liquidation is less than the Special Liquidation Price, property at its Fair Market Value, as determined by the Board of Directors in good faith, or a combination thereof, per share, equal to the Special Liquidation Price, which payment shall be made pari passu with any such payment made to the holders of any Parity Stock. The holders of the Series A Preferred Stock shall be entitled to no other or further distribution of or participation in any remaining assets of the Corporation after receiving in full the amount set forth in the immediately preceding sentence. If, upon distribution of the Corporation’s assets in liquidation, dissolution or winding up, the assets of the Corporation to be distributed among the holders of the Series A Preferred Stock and to all holders of any Parity Stock shall be insufficient to permit payment in full to such holders of the preferential amounts to which they are entitled, then the entire assets of the Corporation to be distributed to holders of the Series A Preferred Stock and such Parity Stock shall be distributed pro rata to such holders based upon the aggregate of the full preferential amounts to which the shares of Series A Preferred Stock and such Parity Stock would otherwise respectively be entitled. Neither the consolidation or merger of the Corporation with or into any other corporation or corporations nor the sale, transfer or lease of all or substantially all the assets of the Corporation shall itself be deemed to be a liquidation, dissolution or winding up of the Corporation within the meaning of this paragraph 4. Notice of the liquidation, dissolution or winding up of the Corporation shall be mailed, first class mail, postage prepaid, not less than twenty (20) days prior to the date on which such liquidation, dissolution or winding up is expected to take place or become effective, to the holders of record of the Series A Preferred Stock at their respective addresses as the same appear on the books of the Corporation or are supplied by them in writing to the Corporation for the purpose of such notice.

5. Redemption; Put Right.

(a) Mandatory Redemption.

(i) On the Mandatory Redemption Date, the Corporation shall redeem (the “Mandatory Redemption”) all outstanding shares of Series A Preferred Stock out of funds legally available therefor at the Mandatory Redemption Price per share, in cash; provided, however, that in the event the Mandatory Redemption occurs as a result of a Company Change in Control resulting from a merger, consolidation, binding share exchange or other extraordinary transaction in which (A) the Corporation is a constituent corporation and (B) all of the consideration payable to holders of the Eligible Common Stock (disregarding cash payable in lieu of fractional shares) consists of publicly traded equity securities of the acquiring or resulting entity that are listed on a national securities exchange and actively traded (“Publicly Traded Securities”), then the Mandatory Redemption Price payable in respect of the Series A Preferred Stock will be paid in shares of such Publicly Traded Securities pursuant to paragraph 5(a)(ii) below. For the avoidance of doubt, any shares of Series A Preferred Stock that remain outstanding after the Mandatory Redemption Date pursuant to this paragraph 5(a) shall continue to accrue dividends in accordance with the provisions in paragraph 3(d) hereof for so long as such shares remain outstanding. The Corporation shall not redeem any shares of Series A Preferred Stock except as expressly authorized in this paragraph 5.

12

(ii) In connection with a Mandatory Redemption resulting from a Company Change in Control in which the holders of the Series A Preferred Stock are to be redeemed for Publicly Traded Securities in accordance with paragraph 5(a)(i) above, the Corporation will provide in the applicable merger agreement or other agreement that in connection with such transaction the holders of Series A Preferred Stock will receive in respect of each share of Series A Preferred Stock the Applicable Amount of the shares or other units of Publicly Traded Securities issued to the holders of Eligible Common Stock in such transaction. The “Applicable Amount” will be a number of shares or other units of Publicly Traded Securities equal to (A) the Mandatory Redemption Price of a share of Series A Preferred Stock as of the second (2nd) Trading Day preceding the closing of the transaction constituting the Company Change in Control divided by (B) the VWAP of a share of Eligible Common Stock over the ten (10) consecutive Trading Days ending on the second (2nd) Trading Day preceding such closing, multiplied by (C) the ratio or exchange specified for the exchange of shares of Eligible Common Stock per share or unit of Publicly Traded Securities (provided that such ratio or specified exchange is subject to Section 4.12 (Exchange Ratio) of the Investment Agreement).

(b) Partial Redemption. If on the Mandatory Redemption Date, the Corporation, pursuant to applicable law or the terms of any bona fide Debt Instrument or Senior Stock, in each case, not issued or incurred in violation of this Certificate of Designations or the Investment Agreement, shall not have funds legally available to redeem, or otherwise be prohibited or restricted from redeeming, all outstanding shares of Series A Preferred Stock, those funds that are legally available and not so restricted or prohibited will be used to redeem the maximum possible number of such shares of Series A Preferred Stock. At any time and from time to time thereafter when additional funds of the Corporation are legally available and not so restricted or prohibited for such purpose, such funds shall be used in their entirety to redeem the outstanding shares of Series A Preferred Stock that the Corporation failed to redeem on the Mandatory Redemption Date until the balance of such shares has been redeemed. The shares of Series A Preferred Stock to be redeemed in accordance with this paragraph 5(b) shall be redeemed pro rata from among the holders of outstanding shares of Series A Preferred Stock.

(c) Notice of Redemption and Certificates. The Corporation shall mail notice of redemption to each holder of shares of Series A Preferred Stock (such notice, a “Notice of Redemption”) in accordance with paragraph 15 hereof not later than thirty (30) days prior to the Mandatory Redemption Date. Such Notice of Redemption shall contain: (A) the Board of Directors’ good faith estimate of Mandatory Redemption Price, (B) the Mandatory Redemption Date, (C) the instructions a holder must follow with respect to the redemption, including the method for surrendering the certificates for the shares of Series A Preferred Stock to be redeemed for payment of the Mandatory Redemption Price, and (D) any other matters required by law. The Corporation shall further supplement the Notice of Redemption with the actual Mandatory Redemption Price as soon as such value can be readily determined, but in no event later than one (1) Business Day prior to the Mandatory Redemption Date. On or before the Mandatory Redemption Date, each holder of shares of Series A Preferred Stock to be redeemed on such Mandatory Redemption Date, shall, if a holder of shares in certificated form, surrender the certificate or certificates representing such shares (or, if such registered holder alleges that such certificate has been lost, stolen or destroyed, a lost certificate affidavit and agreement reasonably acceptable to the Corporation to indemnify the Corporation against any claim that may be made against the Corporation on account of the alleged loss, theft or destruction of such certificate) to the Corporation, in the manner and at the place designated in the Notice of Redemption, and thereupon the Mandatory Redemption Price, for such shares shall be payable to the order of the Person whose name appears on such certificate or certificates as the owner thereof (or any other Person designated by such owner) in accordance with the terms and conditions of this Certificate of Designations.

13

(d) Deposit of Mandatory Redemption Price. If the Notice of Redemption shall have been mailed as provided in paragraph 5(c) hereof, and if on or before the Mandatory Redemption Date specified in such Notice of Redemption, the consideration necessary for such redemption shall have been set aside so as to be available therefor and only therefor, then on and after the close of business on the Mandatory Redemption Date, the shares of Series A Preferred Stock called for redemption, notwithstanding that any certificate therefor shall not have been surrendered for cancellation, shall automatically be redeemed and no longer be deemed outstanding, and all rights with respect to such shares shall forthwith cease and terminate, except the right of the holders thereof to receive upon surrender of their certificates the consideration payable upon redemption thereof.

(e) Status of Redeemed Shares. Any shares of Series A Preferred Stock that are redeemed, purchased or otherwise acquired by the Corporation shall be retired and shall be restored to the status of authorized and unissued shares of preferred stock of the Corporation and may be reissued as part of another series of the preferred stock of the Corporation, but such shares shall not be reissued as Series A Preferred Stock.

(f) Certain Restrictions. If and so long as the Corporation shall fail to redeem on the Mandatory Redemption Date all shares of Series A Preferred Stock required to be redeemed on such date, the Corporation shall not redeem, or discharge any sinking fund obligation with respect to any Junior Stock or Parity Stock and shall not purchase or otherwise acquire any shares of Series A Preferred Stock, Junior Stock or Parity Stock, unless and until all then shares of Series A Preferred Stock to be redeemed are redeemed pursuant to the terms hereof.

(g) Put Right. Following the first (1st) anniversary of the Original Issue Date, the Purchaser shall have the right, but not the obligation, to exercise an option to cause the Corporation to redeem all, but not less than all, of the outstanding shares of Series A Preferred Stock (the “Put Option”) for the Mandatory Redemption Price. The Put Option may be exercised by the Purchaser within fifteen (15) calendar days after the filing of the Corporation’s Form 10-Q for the quarters ending each of March 31st, June 30th and September 30th and Form 10-K for the year ending December 31st of each year following the first anniversary of the Original Issue Date (provided that if the Corporation is delinquent in any such filings the aforementioned fifteen (15) calendar day period will commence on the anniversary of the prior year’s corresponding Form 10-Q or Form 10-K filing, as applicable), by delivery of a written notice to the Corporation (“Put Option Exercise Notice”) and, upon delivery of the Put Option Exercise Notice, the Corporation shall have one hundred and eighty (180) days from the delivery of such Put Option Exercise Notice (such date, or, if earlier, the date on which the Corporation actually consummates such Put Option, the “Put Option Mandatory Redemption Date”) to redeem all outstanding shares of Series A Preferred Stock out of funds legally available therefor at the Mandatory Redemption Price per share, payable, in, at the election of the Corporation, any combination of cash, shares of Eligible Common Stock or shares of Reference Stock (with such shares of Eligible Common Stock or Reference Stock valued for this purpose at a price per share equal to the VWAP of a share of the applicable Eligible Common Stock or Reference Stock VWAP, respectively, determined over the three (3) Trading Day period ending of the second (2nd) Trading Day preceding the Put Option Mandatory Redemption Date); provided, that (x) the number of shares of Eligible Common Stock issued or deliverable by the Corporation will not exceed, after giving effect to such issuance or delivery, 15% of the outstanding shares of the Corporation, and (y) the Corporation may, to raise cash funds for the payment of the Mandatory Redemption Price, initiate a sale process to identify a third party buyer for the Purchaser’s shares of Series A Preferred Stock, and the Purchaser shall cooperate in good faith with respect to, and may participate in, such process (subject to the restrictions on Transfer in the Investment Agreement); provided, further, that such process shall not relieve the Corporation of the obligation to pay the full Mandatory Redemption Price. At least two (2) Business Days prior to the Put Option Mandatory Redemption Date, the Corporation shall deliver in writing to the Purchaser a Notice of Redemption in accordance with the terms of paragraph 5(c) above; provided, that references to the Mandatory Redemption Date shall be substituted for the Put Option Mandatory Redemption Date. The provisions of paragraphs 5(d), (e) and (f) shall apply mutatis mutandis to the Put Option. If the Corporation is unable to consummate the Put Option by the Put Option Mandatory Redemption Date, the Purchaser may cause the Corporation to, upon which the Corporation shall be required to, sell, subject to the applicable requirements of the General Corporation Law of the State of Delaware, Tripadvisor Common Stock in such amount as is required in order to fully redeem all outstanding shares of Series A Preferred Stock. Notwithstanding anything to the contrary contained herein, the maximum number of shares of Eligible Common Stock that may be issued under this paragraph 5(g) is subject to compliance with the shareholder approval requirements of the rules and regulations of The Nasdaq Stock Market LLC.

14

6. Protective Provisions.

In addition to any vote required by the Certificate of Incorporation or by applicable law, for so long as any of the shares of Series A Preferred Stock shall remain outstanding, the Corporation shall not (i) amend, alter or repeal any provision of this Certificate of Designations in a manner that adversely affects the powers, preferences or rights of the Series A Preferred Stock set forth in this Certificate of Designations, (ii) authorize, approve or issue any Parity Stock or Senior Stock, (iii) commence any voluntary liquidation, dissolution or winding up of the affairs of the Corporation, (iv) decrease in the number of directors on the Board of Directors below the number the holders of Series A Preferred Stock are entitled to appoint pursuant to this Certificate of Designations, or (v) take any action that would result in the issuer of the Series A Preferred Stock not being treated as a corporation for U.S. federal income tax purposes, in each case, without the written consent or affirmative vote of the majority of the holders of the then outstanding shares of Series A Preferred Stock, given in writing or by vote at a meeting, consenting or voting (as the case may be), separately as a series. If the Corporation shall propose to take such action, then the Corporation shall give notice of such proposed action to each holder of record of shares of Series A Preferred Stock appearing on the stock books of the Corporation as of the date of such notice at the address of said holder shown therein and shall cause to be filed with the Transfer Agent a copy of such notice. Such notice shall specify (x) the effective date of such action and (y) the other material terms of such action. Such notice shall be given at least twenty (20) Business Days prior to the effective date thereof. If at any time the Corporation shall abandon or cancel the proposed action for which notice has been given under this paragraph 6 prior to the effective date thereof, the Corporation shall give prompt notice of such abandonment or cancellation to each holder of record of shares of Series A Preferred Stock appearing on the stock books of the Corporation as of the date of such notice at the address of said holder shown therein.

7. Voting.

The holders of shares of Series A Preferred Stock shall have no voting rights whatsoever pursuant to this Certificate of Designations, except as specified herein or required by applicable law. For avoidance of doubt, and without limiting the generality of the foregoing, no vote or consent of holders of shares of Series A Preferred Stock will be required for (a) the creation or designation of any class or series of Junior Stock, or (b) any amendment to the Certificate of Incorporation or this Certificate of Designations that would increase the number of authorized shares of preferred stock of the Corporation.

8. Series A Preferred Director.

(a) Appointment.

(i) In connection with the issuance of shares of Series A Preferred Stock on the Original Issue Date pursuant to the terms of this Certificate of Designations and as contemplated by the Investment Agreement so long as there remain outstanding shares of Series A Preferred Stock having an aggregate Liquidation Price as determined from time to time in excess of an amount equal to 25% of the aggregate Liquidation Price of the shares of Series A Preferred Stock issued on and determined as of the Original Issue Date (the “Threshold Amount”), the registered holders of the Series A Preferred Stock will have the exclusive right to appoint one director to the Board of Directors acting by written consent of a majority of the shares thereof (the “Series A Preferred Threshold Director”).

(ii) In the event of a Redemption Default (the “Redemption Director Effective Time”), until no shares of Series A Preferred Stock are outstanding, the registered holders of the Series A Preferred Stock will have the exclusive right to appoint one additional director to the Board of Directors acting by written consent of a majority of the shares thereof (the “Series A Preferred Redemption Director”).

(b) Board Size.

(i) As of the Original Issue Date, the total authorized number of directorships of the Corporation shall be automatically increased by one directorship (which shall be the Series A Preferred Threshold Director directorship), and, following such time, such newly created Series A Preferred Threshold Director directorship shall be filled, at Purchaser’s sole discretion, by written consent of the registered holders of the outstanding shares of Series A Preferred Stock.

15

(ii) Immediately upon the Redemption Director Effective Time, the total authorized number of directorships of the Corporation shall be automatically increased by one directorship (which shall be the Series A Preferred Redemption Director directorship), and, following such time, such newly created Series A Preferred Redemption Director directorship shall be filled, at the Purchaser’s sole discretion, by written consent of the registered holders of the outstanding shares of Series A Preferred Stock.

(c) Term.

(i) The Series A Preferred Threshold Director will not be subject to the classification requirements set forth in Article V, Section B of the Certificate of Incorporation and will serve (once appointed pursuant to this paragraph 8) until such Series A Preferred Threshold Director is removed or resigns or the Threshold Amount is no longer satisfied. In the event the Series A Preferred Threshold Director is removed or resigns, the registered holders of shares of Series A Preferred Stock shall have the exclusive right to fill such vacancy by written consent of the registered holders of the outstanding shares of Series A Preferred Stock. Upon the Threshold Amount no longer being satisfied, (i) the right of the holders of Series A Preferred Stock to appoint the Series A Preferred Threshold Director and the term of office of such Series A Preferred Threshold Director will immediately expire, (ii) the person then serving as the Series A Preferred Threshold Director will immediately cease to be a director of the Corporation, and (iii) the Series A Preferred Threshold Director directorship shall be eliminated and the total authorized number of directorships of the Corporation shall be automatically reduced thereby. The Series A Preferred Threshold Director may only be appointed by the registered holders of Series A Preferred Stock in accordance with this paragraph 8, and if such Series A Preferred Threshold Director is not so appointed, the applicable Series A Preferred Threshold Director directorship shall remain vacant until such time as the registered holders of Series A Preferred Stock fill such vacancy in accordance with this paragraph 8.

(ii) The Series A Preferred Redemption Director will not be subject to the classification requirements set forth in Article V, Section B of the Certificate of Incorporation and will serve (once appointed pursuant to this paragraph 8) until such Series A Preferred Redemption Director is removed or resigns or no shares of Series A Preferred Stock are outstanding. Following the Director Redemption Effective Time, once no shares of Series A Preferred Stock are outstanding (i) the right of the holders of Series A Preferred Stock to appoint the Series A Preferred Redemption Director and the term of office of such Series A Preferred Redemption Director will immediately expire, (ii) the person then serving as the Series A Preferred Redemption Director will immediately cease to be a director of the Corporation, and (iii) the Series A Preferred Redemption Director directorship shall be eliminated and the total authorized number of directorships of the Corporation shall be automatically reduced thereby. The Series A Preferred Redemption Director may only be appointed by the registered holders of Series A Preferred Stock in accordance with this paragraph 8, and if such Series A Preferred Redemption Director is not so appointed, the Series A Preferred Redemption Director directorship shall remain vacant until such time as the registered holders of Series A Preferred Stock fill such vacancy in accordance with this paragraph 8.

(d) Removal.

16

(i) The Series A Preferred Threshold Director may only be removed by written consent of the registered holders of the outstanding shares of Series A Preferred Stock.

(ii) The Series A Preferred Redemption Director may only be removed by written consent of the registered holders of the outstanding shares of Series A Preferred Stock.

(e) Transfer Restrictions. Shares of Series A Preferred Stock may not be Transferred to any Person, except in accordance with the terms of the Investment Agreement. Any attempted Transfer in violation of the foregoing, shall be null and void ab initio.

9. Anti-Dilution Adjustments:

(a) Adjustments. The Conversion Rate will be subject to adjustment, without duplication, under the following circumstances:

(i) the issuance of Reference Stock as a dividend or distribution to all or substantially all holders of the Reference Stock, or a subdivision or combination of Reference Stock or a reclassification of Reference Stock into a greater or lesser number of shares of Reference Stock, in which event the Conversion Rate will be adjusted based on the following formula:

CR1 = CR0 x (OS1 / OS0)

| CR0 | = |

the Conversion Rate in effect immediately prior to the close of business on (i) the record date for such dividend or distribution, or (ii) the effective date of such subdivision, combination or reclassification | |

| CR1 | = |

the new Conversion Rate in effect immediately after the close of business on (i) the record date for such dividend or distribution, or (ii) the effective date of such subdivision, combination or reclassification | |

| OS0 | = | the number of shares of Reference Stock outstanding immediately prior to the close of business on (i) the record date for such dividend or distribution or (ii) the effective date of such subdivision, combination or reclassification | |

| OS1 | = | the number of shares of Reference Stock outstanding immediately after the close of business on (i) the record date for such dividend or distribution, or (ii) the effective date of such subdivision, combination or reclassification |

Any adjustment made pursuant to this clause (i) shall be effective immediately prior to the open of business on the Trading Day immediately following the record date, in the case of a dividend or distribution, or the effective date in the case of a subdivision, combination or reclassification. If any such event is declared but does not occur, the Conversion Rate shall be readjusted, effective as of the date the board of directors of the Reference Company announces that such event shall not occur, to the Conversion Rate that would then be in effect if such event had not been declared.

17

(ii) the dividend, distribution or other issuance to all or substantially all holders of Reference Stock of rights, options or warrants entitling them to subscribe for or purchase shares of Reference Stock, at less than the Current Market Price as of the record date for such issuance, in which event the Conversion Rate will be increased based on the following formula:

CR1 = CR0 x (OS0 + X) / (OS0 + Y)

| CR0 | = |

the Conversion Rate in effect immediately prior to the close of business on the record date for such dividend, distribution or issuance | |

| CR1 | = |

the new Conversion Rate in effect immediately following the close of business on the record date for such dividend, distribution or issuance | |

| OS0 | = |

the number of shares of Reference Stock outstanding immediately prior to the close of business on the record date for such dividend, distribution or issuance | |

| X | = |

the total number of shares of Reference Stock issuable pursuant to such rights, options or warrants | |

| Y | = | the number of shares of Reference Stock equal to the aggregate price payable to exercise such rights, options or warrants divided by the Current Market Price of a share of Reference Stock as of the record date for such dividend, distribution or issuance |

For purposes of this clause (ii), in determining whether any rights, options or warrants entitle the holders to purchase the Reference Stock at less than the Current Market Price as of the record date for such dividend, distribution or issuance, there shall be taken into account any consideration the Reference Company receives for such rights, options or warrants, and any amount payable on exercise thereof, with the value of such consideration, if other than cash, to be the Fair Market Value thereof.

Any adjustment made pursuant to this clause (ii) shall become effective immediately prior to the open of business on the Trading Day immediately following the record date for such dividend, distribution or issuance. In the event that such rights, options or warrants are not so issued, the Conversion Rate shall be readjusted, effective as of the date the board of directors of the Reference Company publicly announces its decision not to issue such rights, options or warrants, to the Conversion Rate that would then be in effect if such dividend, distribution or issuance had not been declared. To the extent that such rights, options or warrants are not exercised prior to their expiration or shares of Reference Stock are otherwise not delivered pursuant to such rights, options or warrants upon the exercise of such rights, options or warrants, the Conversion Rate shall be readjusted to the Conversion Rate that would then be in effect had the adjustments made upon the dividend, distribution or issuance of such rights, options or warrants been made on the basis of the delivery of only the number of shares of Reference Stock actually delivered.

18

(iii) the Reference Company shall, by dividend or otherwise, distribute to all or substantially all holders of its Reference Stock (subject to an exception for cash in lieu of fractional shares) shares of any class or series of capital stock of the Reference Company (other than Reference Stock as covered by paragraph 9(a)(i) hereof), evidences of its indebtedness, cash, assets, other property or securities (including in a Distribution Transaction) or rights, options or warrants to acquire capital stock or other securities (including in a Distribution Transaction) of the Reference Company, but excluding (A) dividends or distributions referred to in paragraph 9(a)(i) hereof or (B) rights, options or warrants referred to in paragraph 9(a)(ii) hereof (any of such shares of capital stock, indebtedness, assets, property or rights, options or warrants to acquire Reference Stock or other securities of the Reference Company, hereinafter in this paragraph 9(a)(iii) called the “Distributed Property”), then, in each such case the Conversion Rate shall be adjusted based on the following formula:

CR1 = CR0 x [SP0 / (SP0 - FMV)]

| CR0 | = |

the Conversion Rate in effect immediately prior to the close of business on the record date for such dividend or distribution | |

| CR1 | = |

the new Conversion Rate in effect immediately after the close of business on the record date for such dividend or distribution | |

| SP0 | = |

the Current Market Price of a share of Reference Stock as of the record date for such dividend or distribution | |

| FMV | = | the Fair Market Value of the portion of Distributed Property distributed with respect to each outstanding share of Reference Stock on the record date for such dividend or distribution |

Provided, however, that in the event the Distributed Property consists of shares of a Distributed Entity distributed to stockholders of the Reference Company in a Distribution Transaction, then, in lieu of the adjustment pursuant to this clause (iii), the holders of the Series A Preferred Stock, acting by written consent of a majority of the outstanding shares thereof, may elect to engage in a Spinoff Exchange Offer and, in the event such Spinoff Exchange Offer is completed pursuant to the terms of the Investment Agreement, then no such adjustment will be made pursuant to this clause (iii).

(b) Calculation of Adjustments. All adjustments to the Conversion Rate shall be calculated by the Corporation to the nearest 1/10,000th of one share of Reference Stock (or if there is not a nearest 1/10,000th of a share, to the next lower 1/10,000th of a share). No adjustment to the Conversion Rate will be required unless such adjustment would require an increase or decrease of at least one percent; provided, however, that any such adjustment that is not required to be made will be carried forward and taken into account in any subsequent adjustment; provided, further that any such adjustment of less than one percent that has not been made will be made upon the Mandatory Redemption Date, the Put Option Mandatory Redemption Date or Liquidation Date.

19

(c) When No Adjustment Required.

(i) Except as otherwise specifically provided in this paragraph 9, the Conversion Rate will not be adjusted for the issuance of Reference Stock or any securities convertible into or exchangeable for Reference Stock or carrying the right to purchase any of the foregoing.

(ii) No adjustment of the Conversion Rate will be made as a result of the issuance of, the distribution of separate certificates representing, the exercise or redemption of, or the termination or invalidation of, rights pursuant to any stockholder rights plans.

(d) Successive Adjustments. After an adjustment to the Conversion Rate under this paragraph 9, any subsequent event requiring an adjustment under this paragraph 9 shall cause an adjustment to each such Conversion Rate as so adjusted.

(e) Multiple Adjustments. For the avoidance of doubt, if an event occurs that would trigger an adjustment to the Conversion Rate pursuant to this paragraph 9 under more than one subsection hereof, such event, to the extent fully taken into account in a single adjustment, shall not result in multiple adjustments hereunder.

(f) Other Adjustments. In the event the Mandatory Redemption Date, the Put Option Mandatory Redemption Date or Liquidation Date is scheduled to occur after the record date for any dividend, distribution, or other event with respect to which the Conversion Rate is to be adjusted pursuant to this paragraph 9, but prior to the completion of such dividend, distribution or other event, the Mandatory Redemption Date, the Put Option Mandatory Redemption Date or Liquidation Date, as applicable, at the election of the Corporation, may be delayed until the completion of such dividend, distribution or other event, provided, that the Corporation has taken appropriate action to set aside or hold separate, for the benefit of the holders of such shares of Series A Preferred Stock, the amounts payable (including securities) by the Corporation to the holders of such shares of Series A Preferred Stock.

(g) Notice of Adjustments. Whenever the Conversion Rate is adjusted as provided under this paragraph 9, the Corporation shall as soon as reasonably practicable following the occurrence of an event that requires such adjustment (or if the Corporation is not aware of such occurrence, as soon as reasonably practicable after becoming so aware) compute the adjusted applicable Conversion Rate in accordance with this paragraph 9 and prepare and transmit to the holders of shares of Series A Preferred Stock an Officer’s Certificate setting forth the applicable Conversion Rate, the method of calculation thereof in reasonable detail, and the facts requiring such adjustment and upon which such adjustment is based.

10. Preemptive Rights.

The holders of shares of Series A Preferred Stock will not have any preemptive right to subscribe for or purchase any Capital Stock or other securities which may be issued by the Corporation.

20

11. No Sinking Fund.

Shares of Series A Preferred Stock shall not be subject to or entitled to the operation of a retirement or sinking fund.

12. Exclusion of Other Rights.

Except as may otherwise be required by law and except for the equitable rights and remedies that may otherwise be available to holders of Series A Preferred Stock, the shares of Series A Preferred Stock shall not have any powers, designations, preferences, or relative, participating, optional or other rights, other than those specifically set forth in this Certificate of Designations.

13. Replacement Certificates.

If physical certificates representing shares of Series A Preferred Stock are issued, the Corporation shall replace any mutilated certificate at the holder’s expense upon surrender of that certificate to the Transfer Agent. The Corporation shall replace certificates representing shares of Series A Preferred Stock that become destroyed, stolen or lost at the holder’s expense upon delivery to the Corporation and the Transfer Agent of satisfactory evidence that the certificate has been destroyed, stolen or lost, together with any indemnity that may be required by the Transfer Agent and the Corporation.

14. Taxes.

(a) Transfer Taxes. The Corporation shall pay any and all stock transfer, documentary, stamp and similar taxes that may be payable in respect of any issuance or delivery of shares of Series A Preferred Stock or other securities issued on account of Series A Preferred Stock pursuant hereto or certificates representing such shares or securities. The Corporation shall not, however, be required to pay any such tax that may be payable in respect of any transfer involved in the issuance or delivery of shares of Series A Preferred Stock or other securities in a name other than that in which the shares of Series A Preferred Stock with respect to which such shares or other securities are issued or delivered were registered, or in respect of any payment to any Person other than a payment to the registered holder thereof, and shall not be required to make any such issuance, delivery or payment unless and until the Person otherwise entitled to such issuance, delivery or payment has paid to the Corporation the amount of any such tax or has established, to the satisfaction of the Corporation, that such tax has been paid or is not payable.

(b) Withholding. Subject to the Investment Agreement, all payments and distributions (or deemed distributions) on the shares of Series A Preferred Stock shall be subject to withholding and backup withholding of tax to the extent required by applicable law, and amounts withheld, if any, shall be treated as received by holders.

15. Notices.

All notices referred to in this paragraph 15 shall be in writing and, unless otherwise specified herein, all notices hereunder shall be deemed to have been given upon the earlier of (i) receipt thereof, (ii) three (3) Business Days after the mailing thereof if sent by registered or certified mail (unless first class mail shall be specifically permitted for such notice under the terms of this Certificate of Designations) with postage prepaid, or (iii) one (1) Business Day after the mailing thereof if sent by overnight courier, addressed: (x) if to the Corporation, to its office at 12300 Liberty Boulevard, Englewood, Colorado, 80112, (y) if to any holder of Series A Preferred Stock, to such holder at the address of such holder as listed in the stock record books of the Corporation (which may include the records of the Transfer Agent) or (z) to such other address as the Corporation or any such holder, as the case may be, shall have designated by notice similarly given.

21

16. Waiver.

Notwithstanding any provision in this Certificate of Designations to the contrary, any provision contained herein and any right of the holders of Series A Preferred Stock granted hereunder may be waived as to all shares of Series A Preferred Stock (and the holders thereof) upon the written consent of the Board of Directors and the holders of the shares of Series A Preferred Stock then outstanding.

17. Severability.

If any term of the Series A Preferred Stock set forth herein is invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, all other terms set forth herein which can be given effect without the invalid, unlawful or unenforceable term will, nevertheless, remain in full force and effect, and no term herein set forth will be deemed dependent upon any other such term unless so expressed herein.

18. Heading of Subdivisions.

The headings of the various subdivisions hereof are for convenience of reference only and shall not affect the interpretation of any of the provisions hereof.

19. Interpretation.

When a reference is made in this Certificate of Designations to paragraphs or clauses, such reference is to a paragraph of or clause of this Certificate of Designations unless otherwise indicated. The words “include”, “includes” and “including” when used herein are deemed in each case to be followed by the words “without limitation.” The words “hereof”, “herein” and “hereunder” and words of like import used in this Certificate of Designations refer to this Certificate of Designations as a whole and not to any particular provision of this Certificate of Designations. Any reference to “days” means calendar days unless Business Days or Trading Days are expressly specified. When calculating the period of time before which, within which or following which any act is to be done or step taken pursuant to this Certificate of Designations, the date that is the reference date in calculating such period will be excluded and if the last day of such period is not a Business Day, the period shall end at 5:00 p.m. New York, New York time on the next succeeding Business Day. The term “or” is not exclusive and means “and/or” unless the context in which such phrase is used shall dictate otherwise. Terms defined in the singular in this Certificate of Designations also include the plural and vice versa.

22

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Designations to be executed by its duly authorized officer on this 15th day of March 2020.

| LIBERTY TRIPADVISOR HOLDINGS, INC. | ||||

| By: | ||||

| /s/ Gregory B. Maffei | ||||

| Name: | Gregory B. Maffei | |||

|

Title: |

President and Chief Executive Officer |

|||

[SIGNATURE PAGE TO SERIES A PREFERRED STOCK CERTIFICATE OF DESIGNATIONS]