Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATION - THUNDER MOUNTAIN GOLD INC | ex32b.htm |

| EX-32 - CERTIFICATION - THUNDER MOUNTAIN GOLD INC | ex32a.htm |

| EX-31 - CERTIFICATION - THUNDER MOUNTAIN GOLD INC | ex31b.htm |

| EX-31 - CERTIFICATION - THUNDER MOUNTAIN GOLD INC | ex31a.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-08429

Thunder Mountain Gold, Inc.

(Exact Name of Registrant as Specified in its Charter)

Nevada |

| 91-1031015 |

(State of other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

11770 W. President Dr., Ste. F |

|

|

Boise, Idaho |

| 83713 |

(Address of Principal Executive Offices) |

| (Zip Code) |

(208) 658-1037

(Registrant’s Telephone Number, including Area Code)

Securities registered under Section 12(b) of the Exchange Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

|

|

|

NONE | NONE | NONE |

Securities registered under Section 12(g) of the Exchange Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

|

|

|

Common Stock, $0.001 par value | THMG THM | OTCQB TSX-V |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of III of this Form 10-K or any amendment to the Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer o Accelerated Filer o Non-Accelerated Filer x Smaller Reporting Company x Emerging Growth Company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrants most recently completed second fiscal quarter: $ 2,597,392 as of June 30, 2019.

The number of shares of the Registrant’s Common Stock outstanding as of March 1, 2020, was 60,145,579.

1

THUNDER MOUNTAIN GOLD, INC.

Form 10-K

December 31, 2019

ITEM 1 - DESCRIPTION OF BUSINESS3

ITEM 1B - UNRESOLVED STAFF COMMENTS8

ITEM 2 - DESCRIPTION OF PROPERTIES8

ITEM 3.  LEGAL PROCEEDINGS.19

ITEM 4.  MINE SAFETY DISCLOSURES19

ITEM 6 - SELECTED FINANCIAL DATA21

ITEM 7 - MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS21

ITEM 7A - QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK24

ITEM 8 - FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA25

ITEM 9 – CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE42

ITEM 9A - CONTROLS AND PROCEDURES42

ITEM 10 - DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE43

ITEM 11 - EXECUTIVE COMPENSATION47

ITEM 13 - CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE49

ITEM 15 – EXHIBITS, FINANCIAL STATEMENT SCHEDULES52

2

Cautionary Statement about Forward-Looking Statements

This Annual Report on Form 10-K includes certain statements that may be deemed to be “forward-looking statements.” All statements, other than statements of historical facts, included in this Form 10-K that address activities, events or developments that our management expects, believes or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements include discussion of such matters as:

The amount and nature of future capital, development and exploration expenditures;

The timing of exploration activities, and;

Business strategies and development of our Operational Plans.

Forward-looking statements also typically include words such as “anticipate”, “estimate”, “expect”, “potential”, “could” or similar words suggesting future outcomes. These statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate in the circumstances. Such statements are subject to a number of assumptions, risks and uncertainties, including such factors as the volatility and level of metal prices, uncertainties in cash flow, expected acquisition benefits, exploration, mining and operating risks, competition, litigation, environmental matters, the potential impact of government regulations, many of which are beyond our control. Readers are cautioned that forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those expressed or implied in the forward-looking statements. Except as required by law, we undertake no obligation to revise or update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Management's Discussion and Analysis is intended to be read in conjunction with the Company's financial statements and the integral notes (“Notes”) thereto for the fiscal year ending December 31, 2019. The following statements may be forward looking in nature and actual results may differ materially.

ITEM 1 - DESCRIPTION OF BUSINESS

Company History

The Company was originally incorporated under the laws of the State of Idaho on November 9, 1935, under the name of Montgomery Mines, Inc. In April 1978 controlling interest in the Montgomery Mines Corporation was obtained by a group of the Thunder Mountain property holders who then changed the corporate name to Thunder Mountain Gold, Inc. with the primary goal to further develop their holdings in the Thunder Mountain Mining District, Valley County, Idaho.

Change in Situs and Authorized Capital

The Company moved its situs from Idaho to Nevada, but maintains its corporate offices in Garden City, Idaho. On December 10, 2007, articles of incorporation were filed with the Secretary of State in Nevada for Thunder Mountain Gold, Inc., a Nevada Corporation. The Directors of Thunder Mountain Gold, Inc. (Nevada) were the same as for Thunder Mountain Gold, Inc. (Idaho).

On January 25, 2008, the shareholders approved the merger of Thunder Mountain Gold, Inc. (Idaho) with Thunder Mountain Gold, Inc. (Nevada), which was completed by a share for share exchange of common stock. The terms of the merger were such that the Nevada Corporation was the surviving entity. The number of authorized shares for the Nevada Corporation is 200,000,000 shares of common stock with a par value of $0.001 per share and 5,000,000 shares of preferred stock with a par value of $0.0001 per share.

3

The Company is structured as follows: The Company owns 100% of the outstanding stock of Thunder Mountain Resources, Inc. (TMRI), a Nevada Corporation. Thunder Mountain Resources, Inc. owns 100% of the outstanding stock of South Mountain Mines, Inc., an Idaho Corporation. South Mountain Mines, Inc. owns 75% of Owyhee Gold Territory, LLC.

We have no patents, licenses, franchises or concessions which are considered by the Company to be of importance. The business is not of a seasonal nature. Since the potential products are traded in the open market, we have no control over the competitive conditions in the industry. There is no backlog of orders.

There are numerous Federal and State laws and regulation related to environmental protection, which have direct application to mining and milling activities. The more significant of these laws deal with mined land reclamation and wastewater discharge from mines and milling operations. We do not believe that these laws and regulations as presently enacted will have a direct material adverse effect on our operations.

Subsidiary Companies

On May 21, 2007, the Company filed Articles of Incorporation with the Secretary of State in Nevada for Thunder Mountain Resources, Inc., a wholly-owned subsidiary of Thunder Mountain Gold, Inc. The financial information for the new subsidiary is included in the consolidated financial statements.

On September 27, 2007, Thunder Mountain Resources, Inc. (“TMRI”), a wholly owned subsidiary of Thunder Mountain Gold, Inc. (“THMG”), completed the purchase of all the outstanding stock of South Mountain Mines, Inc., an Idaho corporation. On November 8, 2012, South Mountain Mines, Inc., (“SMMI”) a wholly owned subsidiary of Thunder Mountain Resources, Inc., which in turn is a wholly owned subsidiary of the Company, and Idaho State Gold Company II LLC (“ISGC”) formed Owyhee Gold Territory LLC (“OGT”) (aka Owyhee Gold Trust, LLC) a limited liability company (LLC).

On November 4, 2016, SMMI was granted Managing Member and controlling Member of OGT, through a judicially ratified settlement with ISGC II.

Current Operations

Thunder Mountain Gold is a mineral exploration stage company with no producing mines. The Company intends to remain in the business of exploring for mining properties that have the potential to produce gold, silver, base metals and other commodities.

On February 27, 2019, the Company entered into an Option Agreement, (the “BeMetals Option Agreement”) with BeMetals Corp., a British Columbia corporation (“BeMetals”), and BeMetals USA Corp., a Delaware corporation (“BMET USA”), a wholly owned subsidiary of BeMetals. Under the terms of the BeMetals Option Agreement, BMET USA will be entitled to purchase 100% of the issued and outstanding shares of SMMI from TMRI, both wholly owned subsidiaries of the Company. The term of the agreement is for two years, upon certain conditions extendable to three years, with BeMetals required to issue a preliminary economic assessment ("PEA") completed by a mutually agreed third-party engineering firm. Upon Tranche 2, BeMetals issued 10 million BMET common shares (Consideration Shares) to TMRI, and BeMetals also purchased of 2.5 million shares of the Company’s common stock at a price of $0.10 per share, for an aggregate purchase price of $250,000, on a private placement. Over its term, this Agreement requires cash payments to the Company of $1,100,000. Through December 31, 2019, cash payments of $350,000, along with $250,000 in exchange for shares of the Company’s common stock have been received. BeMetals also agreed to pay the Company $25,000 per month for management services. The exercise of the Option Agreement price can be paid in combination with cash and BeMetals common shares. The calculation of the purchase price is an amount equal to the lesser of 50% of the market capitalization of BeMetals at the time; and the greater of either:

A.$10 million; or

B.20% the net present value of the South Mountain Project as calculated in a PEA

4

Payment may be satisfied by through the delivery of BMET common shares (Consideration Shares), a cash payment or a combination of Consideration Shares and cash. The BMET common shares will be issued at a deemed value based on the 5-day VWAP of Consideration Shares immediately prior to the date that BMET USA gives notice of its intention to exercise the option.

Payment(s) may be accelerated to exercise the Option Agreement, and restrictions will exist on resale of BeMetals common shares. The Company will not be granted any anti-dilution rights in respect of the Consideration Shares. There is no assurance that the transactions contemplated under the BeMetals Option Agreement will be completed.

Reports to Security Holders

The Registrant does not issue annual or quarterly reports to security holders other than the annual Form 10-K and quarterly Forms 10-Q as electronically filed with the SEC. Electronically filed reports may be accessed at www.sec.gov. Information may be obtained on the operation of the Public Reference Room by calling the SEC at 1 (800) SEC-0330.

Our business, operations, and financial condition are subject to various risks. This is particularly true since we are in the business of conducting exploration for mineral properties that have the potential for discovery of economic mineral resources. We urge you to consider the following risk factors in addition to the other information contained in, or incorporated by reference into, this Annual Report on Form 10-K.

We have limited income and resources.

The Company has historically incurred losses, however, under the BeMetals Option Agreement, the Company now has a recurring source of revenue, and recorded net income in 2019. The Company`s ability to continue as a going concern is no longer just dependent on equity capital raises and borrowings. The Company continues to have the ability to raise capital in order to fund its future exploration and working capital requirements. The Company’s plans for the long-term continuation as a going concern include financing the Company’s future operations through sales of its common stock and/or debt and the eventual profitable exploitation of its mining properties.

There is no guarantee that funds would be available from either source. If we are unsuccessful in raising additional funds, we will not be able to develop our properties and will be forced to liquidate assets.

We have no proven reserves.

We have no proven reserves at any of our properties. We only have measured, indicated and inferred, along with assay samples at South Mountain; and assay samples at some of our other exploration properties.

We believe we have the ability to continue as a going concern

The liquidity of the Company was enhanced on February 27, 2019 when the Company entered into the BeMetals Option Agreement with BeMetals Corp The Company generated net income of $1,087,083 for the period ending December 31, 2019. This net income is the result of the payments, and the stock issuance under the BeMetals Option Agreement. In prior periods, we have incurred significant net losses in each year since inception. Our accumulated deficit as of December 31, 2019 and 2018 was $5,751,527 and $6,833,610, respectfully. We expect to continue to incur profits for the remaining term of the BeMetals contract. However, we may incur losses in the future.

Additional sources of cash, or relief of demand for cash, include additional external debt, the sale of shares of our stock, or alternative methods such as mergers or sale of our assets. No assurances can be given, however, that we will be able to obtain any of these potential sources of cash. We historically required cash funding from outside sources to sustain existing operations, to meet current obligations and to fund ongoing capital requirements and may be required to do so in the future.

5

Based upon current plans, Thunder Mountain Gold management is confident that the Company will have the financial strength and opportunities to meet its financial obligations for the next 12 months. Factors considered substantiating this conclusion include:

A.The Option Agreement for the South Mountain Project with BeMetals Corp. positions the Company for cash infusions, as well as equity considerations, that will more than cover the Company`s financial obligations for the next 12 months, and

B.The ability to raise additional equity capital based upon the success of the exploration and development conducted by BeMetals during this option period, and

C.The Officers of the Company and their willingness to fund any liabilities not currently covered by the Company, and finally,

D.The potential for additional strategic partnerships and funding surrounding the Company`s Trout Creek Project in Nevada, by which discussions are currently being held.

While there is much work to do, it is important to note that if BeMetals decides not to proceed with the South Mountain Project, BeMetals will not be obligated to make any additional payments. In that event, we will immediately commence with marketing the Project to other groups that have an interest in the Project.

We believe we have the ability to continue as a going concern, even though our total accumulated deficit of $5,751,527 as of December 31, 2019. Our plans for the long-term continuation as a going concern include financing our future operations through sales of our common stock and/or debt and the eventual profitable exploitation of our mining properties. If we are not successful with our plans, equity holders could then lose all or a substantial portion of their investment.

At December 31, 2019, we had current assets of $271,239. For the year ended December 31, 2019 net cash used for operating activities was $316,295. Our future liquidity and capital requirements will depend on many factors, including timing, cost and progress of our exploration efforts, our evaluation of, and decisions with respect to, our strategic alternatives, and costs associated with the regulatory approvals. If it turns out that we do not have enough cash to complete our exploration programs, we will make every effort to raise additional funds from public offerings, private placements or loans.

Our exploration efforts may be adversely affected by metals price volatility causing us to cease exploration efforts.

The success of any exploration efforts is derived from the price of metal prices that are affected by numerous factors including: 1) expectations for inflation; 2) investor speculative activities; 3) relative exchange rate of the U.S. dollar to other currencies; 4) global and regional demand and production; 5) global and regional political and economic conditions; and 6) production costs in major producing regions. These factors are beyond our control and are impossible for us to predict.

There is no guarantee that current favorable prices for metals and other commodities will be sustained. If the market prices for these commodities weaken, we will temporarily suspend or cease exploration efforts.

The BeMetals Option Agreement may be adversely affected by exploration results, or adversely affected by metals price volatility causing us to cease exploration efforts. Consideration to be received by the Company is highly contingent upon future events.

There is no guarantee that the BeMetals Option Agreement will be exercised. This Agreement, and associated payments to the Company, are a contingent consideration, and may be terminated at any time by BeMetals during the Option period. The completion and exercise of the BeMetals Option Agreement is affected by the success of BeMetals exploration efforts is contingent upon 1) certain conditions precedent; 2) the price of metals that are affected by numerous factors including inflation, investor speculative activities, relative exchange rate of the U.S. dollar to other currencies, global and regional demand and production, global and regional political and economic conditions, and production costs in major producing regions. These factors are beyond our control and are impossible for us to predict.

6

There is no guarantee that the BeMetals consideration shares, in the event BeMetals Corp. elects to use its shares as consideration, that may be issued to the Company will be tradeable or liquid, and the future valuation is subject to significant uncertainty and cannot be determined at this time. The amount of consideration shares is dependent upon the results of BeMetals Corp. exploration results, and the corresponding Preliminary Economic Analysis (PEA) that BeMetals Corp. will produce. The Company will provide additional information to shareholders of the Company regarding the BeMetals Option Agreement in either a Schedule 14A proxy circular or a Schedule 14C information statement to be prepared in connection with obtaining the required shareholder approval to the BeMetals Option Agreement.

There is no guarantee that current prices for metals and other commodities will be sustained. If the market prices for these commodities weaken, then the BeMetals Option Agreement may not be exercised.

Our mineral exploration efforts may not be successful.

Mineral exploration is highly speculative. It involves many risks and often does not produce positive results. Even if we find a valuable mineral deposit, it may take many additional years or more before production is possible because of the need for additional detailed exploration, pre-production studies, permitting, financing, construction and start up.

During that time, it may not be economically feasible to produce those minerals. Establishing ore reserves requires us to make substantial capital expenditures and, in the case of new properties, to construct mining and processing facilities. As a result of these costs and uncertainties, we will not be able to develop any potentially economic mineral deposits.

We face strong competition from other mining companies for the acquisition of new properties.

If we do find an economic mineral reserve, and it is put into production, it should be noted that mines have limited lives and as a result, we need to continually seek to find new properties. In addition, there is a limited supply of desirable mineral lands available in the United States or elsewhere where we would consider conducting exploration activities. Because we face strong competition for new properties from other exploration and mining companies, some of whom have greater financial resources than we do, we may be unable to acquire attractive new mining properties on terms that we consider acceptable.

Mining operations may be adversely affected by risks and hazards associated with the mining industry.

Mining operations involve a number of risks and hazards including: 1) environmental hazards; 2) political and country risks; 3) industrial accidents; 4) labor disputes; 5) unusual or unexpected geologic formations; 6) high wall failures, cave-ins or explosive rock failures, and; 7) flooding and periodic interruptions due to inclement or hazardous weather conditions. Such risks could result in: 1) damage to or destruction of mineral properties or producing facilities; 2) personal injury; 3) environmental damage; 4) delays in exploration efforts; 5) monetary losses, and; 6) legal liability.

We have no insurance against any of these risks. To the extent we are subject to environmental liabilities, we would have to pay for these liabilities. Moreover, in the event that we ever become an operator of a mine, and unable to fully pay for the cost of remedying an environmental problem, should it occur, we might be required to suspend operations or enter into other interim compliance measures.

Because we are small and do not have much capital, we must limit our exploration. This may prevent us from realizing any revenues, thus reducing the value of the stock.

Because our Company is small and does not have much capital, we must limit the time and money we expend on exploration of interests in our properties. In particular, we may not be able to: 1) devote the time we would like to exploring our properties; 2) spend as much money as we would like to exploring our properties; 3) rent the quality of equipment or hire the contractors we would like to have for exploration; and 4) have the number of people working on our properties that we would like to have. By limiting our operations, it may take longer to explore our properties. There are other larger exploration companies that could and may spend more time and money exploring the properties that we have acquired.

7

We will have to suspend our exploration plans if we do not have access to all the supplies and materials we need.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials after we have conducted preliminary exploration activities on our properties. If we cannot find the products and equipment we need in a timely manner, we will have to delay or suspend our exploration plans until we do find the products and equipment we need.

We face substantial governmental regulation and environmental risks, which could prevent us from exploring or developing our properties.

Our business is subject to extensive federal, state and local laws and regulations governing mining exploration development, production, labor standards, occupational health, waste disposal, use of toxic substances, environmental regulations, mine safety and other matters. New legislation and regulations may be adopted at any time that results in additional operating expense, capital expenditures or restrictions and delays in the exploration, mining, production or development of our properties.

The Company has recorded $65,000 of liabilities in Accrued Reclamation cost regarding the South Mountain Mine project. Various laws and permits require that financial assurances be in place for certain environmental and reclamation obligations and other potential liabilities. Once we undertake any trenching or drilling activities, a reclamation bond and a permit will be required under applicable laws. Currently, we have no obligations for financial assurances of any kind, and are unable to undertake any trenching, drilling, or development on any of our properties until we obtain financial assurances pursuant to applicable regulations to cover potential liabilities.

If we fail to maintain an effective system of internal controls, we may not be able to detect fraud or report our financial results accurately, which could harm our business and we could be subject to regulatory scrutiny.

Internal control systems provide only reasonable assurance that fraud and errors will be detected within the normal course of operations. Company’s management strives to maintain internal controls that are effective and commensurate for the size and scope of the business being conducted by the Company. The Company realizes the need to be proactive in this area and continues to evaluate ways for improving internal controls that are practical and cost effective for the size, structure, and future existence of our organization. The Company’s Chief Financial Officer initiates and records all transactions. The transactions are reviewed and approved by the Company’s President and CEO and reviewed by the Company’s Vice President and COO. Capital Items and expenditures more than $5,000 must be approved by the Board of Directors, even if it is a line item in a Board Approved Budget. In addition, The Company has a Corporate Code of Business Conduct and Ethics (the "Code") which is acknowledged by officers and directors. This Corporate Governance applies to Thunder Mountain Gold Inc. and its subsidiaries (collectively, the "Company").

ITEM 1B - UNRESOLVED STAFF COMMENTS

Not required for smaller reporting companies.

ITEM 2 - DESCRIPTION OF PROPERTIES

The Company, including its subsidiaries, owns mining rights, mining claims, and properties in the mining areas of Nevada and Idaho, which includes its South Mountain Property in Idaho, and its Trout Creek Property in Nevada.

The Company owns 100% of the outstanding stock of Thunder Mountain Resources, Inc., a Nevada Corporation. Thunder Mountain Resources, Inc. owns 100% of the outstanding stock of South Mountain Mines, Inc. (SMMI), an Idaho Corporation., Inc. Thunder Mountain Resources, Inc. completed the direct purchase of 100% ownership of South Mountain Mines, Inc. on September 27, 2007, which consisted of 17 patented mining claims (approximately 327 acres) located in Owyhee County in southwestern Idaho. After the purchase, Thunder Mountain Resources staked 21 unpatented lode mining claims and obtained mineral leases on 545 acres of adjoining private ranch land.

The current land package at South Mountain consists of 17 patented mining claims encompassing approximately 326 acres, 21 unpatented mining lode claims covering approximately 290 acres, and approximately 489 acres of leased private land. In addition, the project owns 360 acres of private land (mill site) not contiguous with the mining claims.

8

All holdings are in the South Mountain Mining District, Owyhee County, Idaho.

The Company’s plan of operation for the next twelve months, subject to business conditions, will be to continue to advance the South Mountain Project under the BeMetals Option Agreement, including continued baseline environmental and engineering work necessary to complete a Preliminary Economic Analysis. As time permits, the Company will also work on advancing the Trout Creek gold project, Lander County, Nevada.

South Mountain Project, Owyhee County, Idaho

Under the BeMetals Corporation (TSX-V: BMET) Option Agreement, BeMetals and Thunder Mountain Gold formed a project team early in 2019 that is focused on advancing the South Mountain Project. This Boise Idaho-based team includes key management of Thunder Mountain Gold Inc., who have coordinated re-establishment of the Project site prior to the start of drilling. In addition, BeMetals appointed a project manager and project geologist for this team, along with technical and underground support.

BeMetals (BMET) commenced drilling at South Mountain in July of 2019 and drilled twenty-one holes totaling 7,517 feet (2,290 meters) from five underground drilling stations within the Sonneman level. The drilling program was designed to test potential down plunge extensions, and overall continuity to the mineralized zones and confirm the grade distribution of the current polymetallic mineral resource. All of the drill core recovered from the drilling was logged on site and assayed by ALS Chemex. Selected intervals and results are summarized below in Tables 1 and 2.

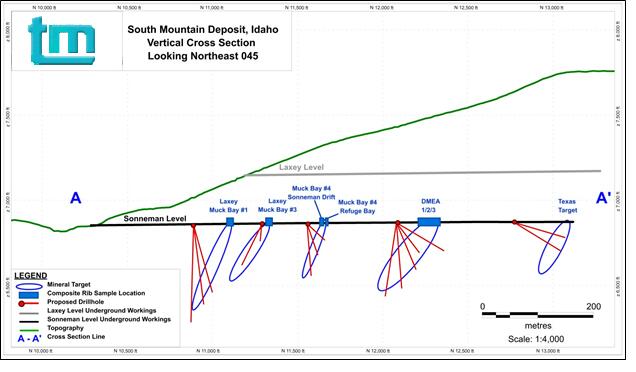

Long Section of Sonneman Level, (Looking northeast), showing Phase One 21 borehole locations

South Mountain Project - Background

The South Mountain Project is considered an advanced stage, high-grade zinc-silver-gold exploration or pre-development project. The land package at South Mountain consists of a total of 17 patented mining claims encompassing approximately 326 acres, 21 unpatented mining lode claims covering approximately 290 acres, and approximately 489 acres of leased private land. In addition, the project owns 360 acres of private land (mill site) not contiguous with the mining claims. All holdings are located in the South Mountain Mining District, Owyhee County, Idaho.

The property is located approximately 70 air miles southwest of Boise, Idaho and approximately 24 miles southeast of Jordan Valley, Oregon. It is accessible by highway 95 driving south from the Boise area to Jordan Valley Oregon, then by traveling southeast approximately 22 miles back into Idaho, via Owyhee County road that is dirt and improved to

9

within 4 miles of historic mine site. The last 4 miles up the South Mountain Mine road are unimproved dirt road. The property is accessible year-round to within 4 miles of the property, where the property is accessible from May thru October without plowing snow. There is power distribution within 4 miles of the site as well. The climate is considered high desert. The Company has water rights on the property, and there is a potable spring on the property that once supplied water to the main camp.

South Mountain Mine History

The limited historic production peaked during World War II when, based on smelter receipts, the production of direct shipped ore totaled as follows:

Grade | Total Metal | |

Zinc | 14.5% | 15,593,100 lbs (7,072,900 Kg) |

Silver | 10.6 opt (363.4 g/t) | 566,440 ozs (17,618,200 grams) |

Gold | 0.058 opt (1.99 g/t) | 3,120 ozs (96,980 grams) |

Copper | 1.4% | 1,485,200 lbs (6,320 Kg) |

Lead | 2.4% | 2,562,300 lbs (1,162,250 Kg) |

Anaconda Smelter – Toole Utah - Crude Ore Shipment Head Grades

1941-1953 Total Tons: 53,653 (48,670 tonnes)

In addition to the direct-ship ore, a flotation mill was constructed and operated during the late-1940s and early-1950s.

From the 1954 South Mountain Mill report, recoveries were reported as follows:

1954 South Mountain Mill Report

Metal | Head Grades | Recovery |

Zinc | 6.7% | 80% |

Silver | 17.5 opt (600 g/t) | 85% |

Gold | 0.02 opt (0.7 g/t) | 75% |

Copper | 3.2% | 90% |

Lead | 1% | 90% |

These are historic grades and recoveries not confirmed by the Company, but reportedly

mined from a small 39,600-ton (35,900 tonnes) copper rich block in the Texas zone.

South Mountain Mines Inc. (an Idaho Corporation) owned the patented claims from 1975 to the time the Company purchased the entity in 2007. They conducted extensive exploration work including extending the Sonneman Level by approximately 1,500 feet to intercept the down-dip extension of the Texas sulfide mineralization mined on the Laxey Level approximately 400 feet up-dip from the Sonneman. High grade sulfide mineralization was intercepted and confirmed on the Sonneman Extension. In 1985 South Mountain Mines Inc. completed a feasibility study based on historic and newly developed ore zones exposed in their underground workings and drilling. Although they determined positive economics, and that the resource was still open at depth with a large upside potential, the project was idled and placed into care and maintenance.

In 2008, the Company contracted Kleinfelder, Inc., a nationwide engineering and consulting firm, to complete a technical report “Resources Data Evaluation, South Mountain Property, South Mountain Mining District, Owyhee County, Idaho”. The technical report was commissioned by Thunder Mountain Resources, Inc. to evaluate all the existing data available on the South Mountain property. Kleinfelder utilized a panel modeling method using this data to determine potential mineralized material remaining and to make a comparison with the resource determined by South Mountain Mines in the mid-1980s. Kleinfelder’s calculations provided a potential resource that is consistent with South Mountain Mines’ (Bowes 1985) historic reserve model.

In 2009, the Company contracted a third-party consulting firm that incorporated all the new drill and sampling data into an NI 43-101 Technical Report. This report was completed as part of the Company’s dual listing on the TSX Venture Exchange in 2010. The Company is also traded in the U.S. on the OTCQB under ticker THMG.

10

In January of 2018, the Company engaged Hard Rock Consulting LLC (HRC) from Denver, Colorado to update the South Mountain Project 43-101. HRC concluded that significant potential exists to increase the known mineral resource with additional drilling, as well as to upgrade existing mineral resource classifications with additional infill drilling. HRC also determined that the conceptual geologic model is sound, and, in conjunction with drilling results, indicates that mineralization is essentially open in all directions, and is continuous between underground levels and extends to the surface.

Hard Rock Consulting also noted that:

THMG technical staff has thorough understanding of the geology of the South Mountain Project, and that the appropriate deposit model is being applied for exploration.

Because the Project is largely located on and surrounded by private land, it greatly simplifies Project approvals compared to mining projects involving public lands.

Initial metallurgical testing demonstrates that the South Mountain massive sulfide mineralization is amenable to differential flotation and concentration.

The current mineral resource at the South Mountain Project is more than sufficient to warrant continued planning and development to further advance the Project.

Gold Breccia

HRC also reviewed the data on the anomalous gold-bearing multi-lithic breccia that was identified by THMG conducting reconnaissance work at South Mountain. In 2010, five holes were drilled in the anomaly for a total footage of 3,530 feet, and 705 total samples taken every five feet of drill hole. Of the 705 samples taken, 686 samples contained anomalous gold, or 97% of the samples. The highest-grade intercept ran 0.038 ounce per ton. HRC reviewed the reports done on the breccia completed by both Kinross and Newmont; of note was Newmont’s comparison of the geology to the Battle Mountain Complex in Nevada.

The Technical Report was authored by Ms. J.J. Brown, P.G., SME-RM, Mr. Jeffrey Choquette, P.E., and Mr. Randy Martin, SME-RM, all of Hard Rock Consulting, each of whom is an independent qualified person for the purposes of NI 43-101 The NI 43-101 Technical Report has an effective date of April 7, 2018 and has been filed in Canada on SEDAR in accordance with NI 43-101. The Report can be reviewed on the Company`s website at www.thundermountaingold.com.

Note to United States investors concerning estimates of measured, indicated and inferred resources. Disclosure of the NI-43-101 has been prepared in accordance with the requirements of Canadian securities laws, including Canadian National Instrument 43-101 (“NI 43-101”), which differ from the current requirements of the U.S. Securities and Exchange Commission (“SEC”) set out in Industry Guide 7. The Highlights of South Mountain NI-43-101 section refers to “mineral resources,” “measured mineral resources,” “indicated mineral resources,” and “inferred mineral resources.” While these categories of mineralization are recognized and required by Canadian securities laws, they are not recognized by Industry Guide 7 and are not normally permitted to be disclosed in SEC filings. United States investors are cautioned not to assume that all or any of measured, indicated or inferred mineral resources will ever be converted into mineral reserves. Under Industry Guide 7, mineralization may not be classified as a “reserve” unless the mineralization can be economically or legally extracted at the time the “reserve” determination is made. "Inferred mineral resources" have a great amount of uncertainty as to their existence and economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian reporting standards; however, Industry Guide 7 normally only permits issuers to report mineralization that does not constitute "reserves" by Industry Guide 7 standards as in-place tonnage and grade without reference to unit measures. Accordingly, information contained in this 10-k containing descriptions of South Mountain’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of Industry Guide 7.

11

Phase I Drilling at South Mountain under BeMetals Option Agreement

The principal objectives of the Phase 1 work plan at South Mountain was to test for potential extensions of the mineralized zones and confirm the grade distribution of the current polymetallic mineral resource estimate. The Company has now successfully completed the phase 1 program comprised of 20 underground drill holes for a total of approximately 2,290 meters. Geological logging and sampling of all drill holes have now been completed with all analytical results received. These results have been compiled into the Project’s geological database and will be used to design the phase 2 drilling program for 2020. Following a planned phase 2 drilling program, all new results will be integrated into an updated mineral resource estimation for the Project, expected to be completed towards the end of this year. Further expansion and definition of the DMEA, Texas, and MB4 zones, as well as other targets within reach of underground drill testing from the Sonneman level, provide excellent exploration upside for the 2020 program.

Table 1. BeMetal`s Analytical and Assay Results for the Phase 1 Drilling Program

Drill Hole ID, Zone & Interval | From (m) | To (m) | Core Interval (m) | Zn % | Ag g/t | Au g/t | Pb % | Cu % |

DMEA Zone |

|

|

|

|

|

|

|

|

SM19-002 |

|

|

|

|

|

|

|

|

Interval 1 | 46.88 | 57.39 | 10.51 | 17.81 | 226 | 2.41 | 1.59 | 0.16 |

Interval 2 | 67.85 | 71.63 | 3.78 | 5.45 | 145 | 8.39 | 0.58 | 0.15 |

Interval 3 | 85.83 | 96.39 | 10.56 | 11.42 | 123 | 4.43 | 0.36 | 0.52 |

|

|

|

|

|

|

|

|

|

SM19-003 |

|

|

|

|

|

|

|

|

Interval 1 | 51.18 | 75.35 | 24.17 | 11.12 | 267 | 3.44 | 3.75 | 0.29 |

Including | 51.18 | 60.78 | 9.60 | 11.74 | 437 | 5.99 | 8.68 | 0.38 |

Including | 62.09 | 75.35 | 13.26 | 11.77 | 169 | 1.88 | 0.54 | 0.25 |

Interval 2 | 77.60 | 81.24 | 3.64 | 9.74 | 331 | 1.94 | 1.11 | 0.34 |

SM19-005 | 75.13 | 86.37 | 11.23 | 7.97 | 128 | 1.20 | 0.91 | 0.24 |

|

|

|

|

|

|

|

|

|

SM19-006 | 28.01 | 43.71 | 15.70 | 21.27 | 147 | 8.04 | 0.77 | 0.30 |

|

|

|

|

|

|

|

|

|

SM19-007 | 26.97 | 39.17 | 12.20 | 18.16 | 122.6 | 4.41 | 1.55 | 0.16 |

|

|

|

|

|

|

|

|

|

SM19-014 |

|

|

|

|

|

|

|

|

Interval 1 | 105.31 | 120.40 | 15.09 | 9.59 | 127.1 | 1.50 | 0.69 | 0.28 |

Interval 2 | 138.07 | 143.88 | 5.81 | 4.88 | 76.9 | 2.55 | 0.21 | 0.12 |

Interval 3 | 155.17 | 158.95 | 3.78 | 14.49 | 145.5 | 0.37 | 0.25 | 0.48 |

Interval 4 | 184.40 | 189.56 | 5.15 | 0.28 | 79.9 | 2.08 | 0.15 | 0.06 |

Interval 5 | 250.65 | 258.94 | 8.29 | 8.11 | 178.7 | 0.48 | 0.57 | 1.73 |

Interval 6 | 266.33 | 268.16 | 1.83 | 1.32 | 158.9 | 2.56 | 0.56 | 0.11 |

Texas Zone |

|

|

|

|

|

|

|

|

SM19-010 |

|

|

|

|

|

|

|

|

Interval 1 | 24.41 | 31.62 | 7.21 | 4.37 | 155.2 | 0.13 | 0.03 | 2.07 |

Interval 2 | 53.11 | 63.15 | 10.04 | 0.40 | 135.1 | 0.07 | 0.01 | 1.75 |

* Note: 1.00 meter (m) is equal to 3.28 feet (ft). One gram per tonne (g/t) is equal to 0.032 ounces per ton (oz/t, or o.p.t.)

Table 2 below shows the latest results received from holes SM19-016, SM19-017 and SM19-018.

12

Table 2. Drill Holes SM19-016, SM19-017 and SM19-018: Analytical and Assay Results

Drill Hole ID: Zone & Interval | From (m) | To (m) | Core Interval (m) | Zn % | Ag g/t | Au g/t | Pb % | Cu % |

DMEA Zone |

|

|

|

|

|

|

|

|

SM19-016 |

|

|

|

|

|

|

|

|

Interval 1 | 112.33 | 132.05 | 19.72† | 0.07 | 8.39 | 1.52 | 0.01 | 0.002 |

Interval 2 | 136.55 | 146.64 | 10.09 | 3.15 | 151.3 | 1.68 | 0.66 | 0.22 |

Interval 3 | 158.27 | 163.59 | 5.32† | 0.59 | 46.8 | 1.81 | 0.11 | 0.04 |

Interval 4 | 184.18 | 188.64 | 4.47† | 5.04 | 482.0 | 4.27 | 5.80 | 0.43 |

Interval 5 | 227.32 | 230.83 | 3.51 | 8.85 | 136.2 | 0.17 | 1.25 | 1.67 |

MB4 Target Zone |

|

|

|

|

|

|

|

|

SM19-017 |

|

|

|

|

|

|

|

|

Interval 1 | 1.37 | 5.23 | 3.86* | 12.90 | 314.1 | 0.26 | 0.88 | 1.08 |

Interval 2 | 16.32 | 24.08 | 7.76* | 10.23 | 91.4 | 0.07 | 0.36 | 0.55 |

SM19-018 |

|

|

|

|

|

|

|

|

Interval 1 | 0.00 | 18.62 | 18.62* | 5.15 | 73.2 | 0.11 | 0.02 | 0.41 |

Including | 8.53 | 18.62 | 10.09* | 8.06 | 97.0 | 0.15 | 0.02 | 0.68 |

Note: Reported widths in tables 1 & 2 are drilled core lengths as true widths are unknown at this time. It is estimated based upon current data that true widths might range between 60-80% of the drilled intersection. For drill holes SM19-017* and SM19-018* true widths are unknown as these are the first drill intersections of the MD4 target. Intervals cut offs are based upon visual contacts of massive sulfide units with no more than 1.75 meters of internal skarn. For SM19-010 a nominal 0.5% copper cut off has been applied to determine the boundaries of the intersections for this skarn hosted mineralization with no more than 1.4m of internal dilution. For SM19-016† (intervals 1, 3 and 4) a nominal 0.46 g/t gold cut off has been applied to determine the boundaries of the intersections with no internal dilution. For SM19-017 & 018 a nominal 2.4% zinc cut off has been applied to determine the boundaries of the intersections for this skarn hosted mineralization with no more than 2m of internal dilution. (Note: See details below in QA/QC section). 1.00 meter (m) is equal to 3.28 feet (ft). One gram per tonne (g/t) is equal to 0.032 ounces per ton (oz/t, or o.p.t.)

The above drill holes returned significant intersections of both massive sulfide and skarn styles of mineralization. Important sulfide minerals are pyrrhotite, sphalerite, galena, arsenopyrite and chalcopyrite. During the planned phase 2 campaign at South Mountain, the Company will carry out mineralogy and metallurgical test work studies to confirm historical other previous high-grade results.

Drill holes SM19-015, SM19-019, SM19-020 deviated from the target and did not return the anticipated drill intercepts. However, this information is valuable in determining to the design and target areas of mineralization in the 2020 phase 2 program. Drill hole SM19-021 was terminated at 10 meters with a significant drill rig break down near the planned conclusion of the phase 1 program.

13

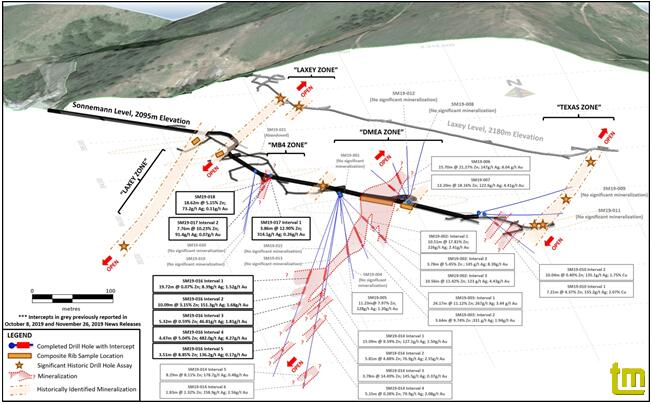

Figure 1: 3D Perspective View inclined at 20 degrees looking north-north-east, showing locations of rib-sampling, priority target zones, and the phase 1 drill holes and highlighted the recent SM19-016, SM19-017 and SM19-018

Underground core drilling is being conducted to extend and upgrade the South Mountain resource - testing the continuity and down-dip extensions of the high-grade polymetallic massive sulfide zones. The Company plans additional core drilling in the DMEA and Laxey zones to complete the confirmation and extensional drilling. In addition, there are plans to retrieve bulk samples for metallurgical test work. More than 15,000 feet (4,500 meters) have been drilled at South Mountain and included in the model. The South Mountain historic ore zones remain open down-dip on the zones encountered. The successful drilling and development work prove that the South Mountain resource continues to grow with potential to increase the resource substantially.

14

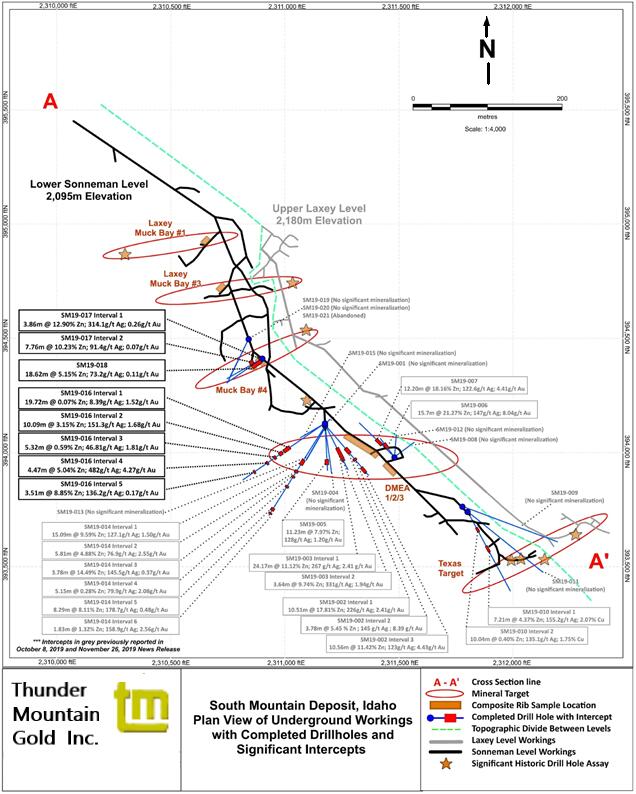

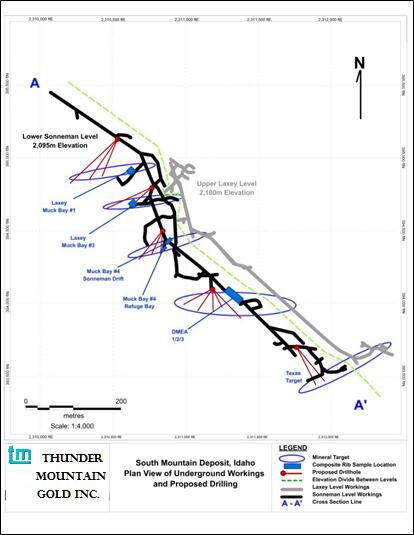

Figure 2: Plan View of the Sonneman & Laxey Levels, South Mountain Deposit,

showing locations of rib-sampling, priority target zones, and drill holes SM19-016, SM19-017 and SM19-018

15

Figure 3: Plan View of Sonneman & Laxey Levels,

showing locations of previously reported rib sampling

Underground Pre-Development Work Completed in 2012 thru 2014

The reconstruction of the Sonneman and Laxey drifts continued successfully until January 2014 when the Project went into care and maintenance. The Sonneman Level advanced 2,711 feet from the portal and is constructed to 12 feet by 12 feet for future development and mining. Approximately 350 feet of drift remains to be rehabilitated to reach the historic Texas massive sulfide zone located at the end of the old workings. This advance through this zone will allow for the drill stations and underground drilling to further define the high-grade resource encountered by William Bowes group in the 1980s.

The historic 2,200-foot long Laxey Level drift has been rehabilitated to 10 feet by 10 feet for approximately 720 feet. At that point the old tunnel had recently collapsed at an intrusive dike and preparations were being made to advance through the caved area. This old tunnel was rehabilitated and accessed along its full length in 2008, at which point it intercepted the Texas massive sulfide zone, one of many that had limited mining during and after the World War II period. Excellent high-grade massive sulfide is exposed in this area, and the core drilling during 2013 proved its continuity between the Laxey Level and the surface, an up-dip distance of nearly 400 feet.

During the development of the Sonneman Level during 2012-2013 several massive sulfide mineralized zones were mined through. Detailed rib sampling along some of these zones yielded the following results:

16

Highlights from 2013-2014 Rib-Sampling Program

• DMEA Zones 1/2/3; 130 ft. (39.62m) @ 16.76% Zinc (“Zn”), 4.11 ounces per ton (“o.p.t.”) (140.91 grams per tonne (“g/t”)) Silver (“Ag”), 0.089 o.p.t. (3.08 g/t Gold) (“Au”), 0.78% Copper (“Cu”) and 0.38% Lead (“Pb”)

• Muck Bay #4 Zone; 23 ft. (7.01m) @ 14.69% Zn, 7.18 o.p.t. (246.17 g/t) Ag, 0.34% Cu and 0.65% Pb

• Laxey Zone; 40 ft. (12.19m) @ 16.44% Zn, 13.97 o.p.t. (478.97 g/t) Ag, 0.020 o.p.t. (0.68 g/t) Au, 0.70% Cu and 0.86% Pb

(Results previously reported in the Company`s annual / quarterly reports; news releases; and the May 2019 independent technical report titled, “National Instrument 43-101 Technical Report Updated Mineral Resource Estimate for the South Mountain Project Owyhee County, Idaho, USA.” 1.00 meter (m) is equal to 3.28 feet (ft). One gram per tonne (g/t) is equal to 0.032 ounces per ton (oz/t, or o.p.t.))

QUALITY ASSURANCE AND QUALITY CONTROL PROCEDURES

The South Mountain Project employs a rigorous QC/QA program that includes blanks, duplicates and appropriate certified standard reference material. All samples are introduced into the sample stream prior to sample handling/crushing to monitor analytical accuracy and precision. The insertion rate for the combined QA/QC samples is 10 percent or more depending upon batch sizes. ALS Global completed the analytical work with the core samples processed at their preparation facility in Reno, Nevada, U.S.A. All analytical and assay procedures are conducted in the ALS facility in North Vancouver, BC. The samples are processed by the following methods as appropriate to determine the grades; Au-AA23-Au 30g fire assay with AA finish, ME-ICP61-33 element four acid digest with ICP-AES finish, ME-OG62-ore grade elements, four acid with ICP-AES finish, Pb-OG62-ore grade Pb, four acid with ICP-AES finish, Zn-OG62-ore grade Zn, four acid digest with ICP-AES finish, Ag-GRA21-Ag 30g fire assay with gravimetric finish.

Qualified Person – Larry Kornze is the Qualified Person as defined by National Instrument 43-101 responsible for the technical data reported in this report.

This property is without known reserves and the proposed program is exploratory in nature according to Instruction 3 to paragraph (b)(5) of Industry Guide 7. There are currently no permits required for conducting exploration in accordance with the Company`s current board approved exploration plan.

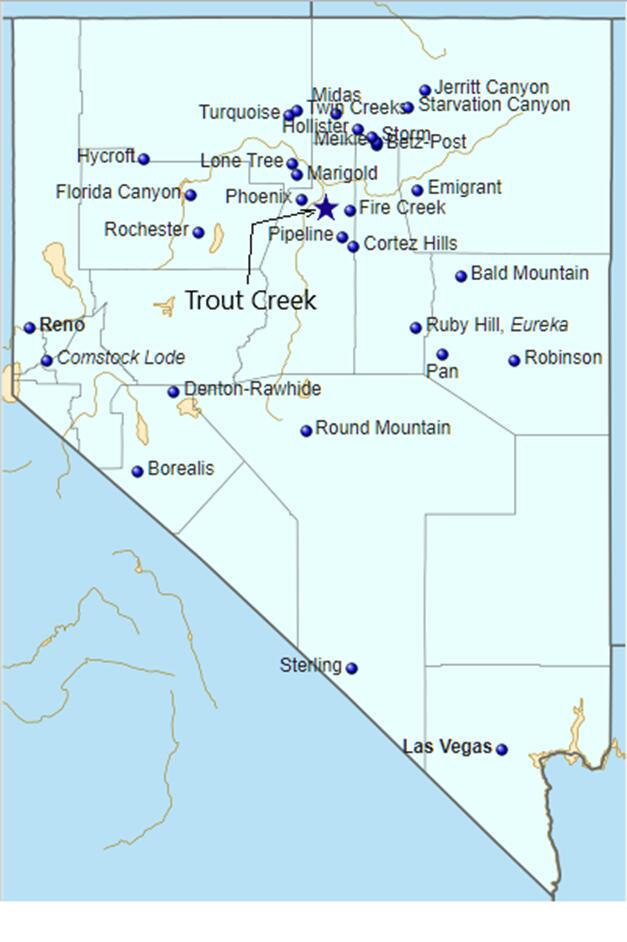

Trout Creek Project, Lander County, Nevada

The Trout Creek project is a highly prospective gold exploration target located along the western flank of the Shoshone Mountain Range in the Reese River Valley in Lander County, Nevada. The claim package consists of 78 unpatented mining claims (approximately 1560 acres) that are situated along a recognizable structural zone in the Eureka-Battle Mountain mineralized gold trend. Because the project is surrounded by Newmont Mining`s land package, Thunder Mountain struck a joint venture agreement with Newmont Mining on some of their adjoining mineral rights sections and aliquot parcels from 2011 thru 2016. On October 27, 2016 the Company terminated the exploration agreement with Newmont Mining Corporation to concentrate their efforts on the South Mountain Project. The Company retained the 78-claim package by paying annual fees to BLM of $3,255 and Lander County $940 fees.

17

The Project is located approximately 155 air miles northeast of Reno, Nevada, or approximately 20 miles south of Battle Mountain, Nevada, in Sections 10, 11, 14, 16, 21, 22, 27; T.29N.; R.44E. Mount Diablo Baseline & Meridian, Lander County, Nevada. Latitude: 40 23’ 36” North, Longitude: 117 00’ 58” West. The property is generally accessible year-round by traveling south from Battle Mountain Nevada on state highway 305, which is paved.

The Trout Creek target is anchored by a regional gravity anomaly on a well-defined northwest-southeast trending break in the alluvial fill thickness and underlying bedrock. Previous geophysical work in the 1980s revealed an airborne magnetic anomaly associated with the same structure, and this was further verified and outlined in 2008 by Company personnel, with consultation from Jim Wright – Wright Geophysics using a ground magnetometer. The target is covered by alluvial fan deposits of generally unknown thickness, shed from the adjacent Shoshone Range, a fault block mountain range composed of Paleozoic sediments of both upper and lower plate rocks of the Roberts Mountains thrust.

An extensive data package on the area was made available to Thunder Mountain Gold by Newmont during the joint exploration agreement period (2011-2016) that significantly enhanced the target area. This, along with fieldwork consisting of mapping and sampling the altered and mineralized structures that can be followed through the Shoshone Range. Of importance is that these structures align with the Cortez-Pipeline deposits and the Phoenix deposit (part of the Eureka-Battle Mountain-Getchell Trend).

In addition to the geologic fieldwork, Wright Geophysics conducted a ground gravity survey and CSMAT over the pediment target area and this provided insight into the gravel-bedrock contact as well as defining the favorable structural setting within the buried bedrock. An untested drill target was identified under the gravel pediment along these structures, and the geophysics showed that the bedrock was within 500 feet of the surface, which is reasonable depth for exploration drilling and potential mining if a significant mineralization is encountered.

The ongoing exploration field work, including claim maintenance and assessment, is financed by the Company through sale of unregistered common stock using private placements with accredited investors. Future work will be funded in the same manner or through a strategic partnership with another mining company.

18

There are currently no environmental permits required for the planned exploration work on the property. In the future, a notice of intent may be required with the Bureau of Land Management. This property is without known reserves and the proposed program is exploratory in nature according to Instruction 3 to paragraph (b)(5) of Industry Guide 7.

Competition

We are an exploration stage company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Employees

Three of the Company’s officers began deferring compensation for services on April 1, 2015. On July 31, 2018, the Company stopped expensing and deferring compensation for the three Company officers in the interest of marketing the SMMI project. As part of the BeMetals agreement, the Company resumed compensation for these officers on May 15, 2019. The officers deferred compensation balances at December 31, 2019 and 2018 represent the balances deferred prior to the BeMetals agreement and are as follows: Eric Jones, President and Chief Executive Officer - $420,000; Jim Collord, Vice President and Chief Operating Officer - $420,000; and Larry Thackery, Chief Financial Officer - $201,500.

None

Item 4. Mine Safety Disclosures

Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine in the United States are required to disclose in their periodic reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities.

During the three months and nine-month periods ended December 31, 2019, the Company did not have any operating mines and therefore had no such specified health and safety violations, orders or citations, related assessments or legal actions, mining-related fatalities, or similar events in relation to the Company’s United States operations requiring disclosure pursuant to Section 1503(a) of the Dodd-Frank Act.

ITEM 5 - MARKET FOR REGISTRANT'S COMMON STOCK, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information:

Our common stock is traded on the over-the-counter bulletin board (OTCQB) market regulated by the Financial Industry Regulatory Authority (FINRA) under the symbol “THMG” The OTCQB quotations do not reflect inter-dealer prices, retail mark-ups, commissions or actual transactions.

On September 24, 2010, the Company’s common stock also began trading on the Toronto Stock Exchange Venture Exchange (“TSX-V”) in Canada and is quoted under the trading symbol “THM”.

19

Holders:

As of December 31, 2019, there were approximately 1,468 shareholders of record of the Company’s common stock with an unknown number of additional shareholders who hold shares through brokerage firms.

Transfer Agent:

Our independent stock transfer agent in the United States is Computershare Shareholder Services, located at 8742 Lucent Blvd., Suite 225, Highlands Ranch, CO 80129. In Canada, our Agent is Computershare, TORU - Toronto, University Ave, 100 University Ave, 8th Floor, Toronto, ON M5J 2Y1, CANADA

Dividends:

No dividends were paid by the Registrant in 2019 or 2018, and the Company has no plans to pay a dividend in the foreseeable future. Dividends undertaken by the Company are solely at the discretion of the Board of Directors.

Securities Authorized for Issuance under Equity Compensation Plans:

On July 17, 2011, the Company Shareholders approved the Company`s Stock Incentive Plan (SIP). The SIP has a fixed maximum percentage of 10% of the Company’s outstanding shares that are eligible for the plan pool, whereby the number of Shares under the SIP increase automatically with increases in the total number of shares. This “Evergreen” provision permits the reloading of shares that make up the available pool for the SIP, once the options granted have been exercised. The number of shares available for issuance under the SIP automatically increases as the total number of shares outstanding increase, including those shares issued upon exercise of options granted under the SIP, which become re-available for grant after exercise of option grants. The number of shares subject to the SIP and any outstanding awards under the SIP will be adjusted appropriately by the Board of Directors if the Company’s common stock is affected through a reorganization, merger, consolidation, recapitalization, restructuring, reclassification, dividend (other than quarterly cash dividends) or other distribution, stock split, spin-off or sale of substantially all the Company’s assets.

The SIP also has terms and limitations, including without limitation that the exercise price for stock options and stock appreciation rights granted under the SIP must equal the stock’s fair market value, based on the closing price per share of common stock, at the time the stock option or stock appreciation right is granted. The SIP is also subject to other limitation including; a limited exception for certain stock options assumed in corporate transactions; stock options and stock appreciation rights granted under the SIP may not be “re-priced” without shareholder approval; stock-based awards under the SIP are subject to either three-year or one-year minimum vesting requirements, subject to exceptions for death, disability or termination of employment of an employee or upon a change of control; and shareholder approval is required for certain types of amendments to the SIP.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities:

On February 27, 2019, the Company entered into an Option Agreement, (the “BeMetals Option Agreement”) with BeMetals Corp., a British Columbia corporation (“BeMetals”), and BeMetals USA Corp., a Delaware corporation (“BMET USA”), a wholly owned subsidiary of BeMetals. Under the terms of the BeMetals Option Agreement, in the second quarter 2019, BeMetals purchased 2.5 million shares of the Company’s common stock at a price of $0.10 per share, for an aggregate purchase price of $250,000, in a private placement. Use of proceeds are for general corporate working capital. This private placement was approved by the TSX-V.

On April 27, 2018, Thunder Mountain Gold, Inc. (the “Company’) closed a private offering solely to accredited investors. The Company sold, in the aggregate, 2,550,000 Units, consisting of 2,550,000 shares of Common Stock, par value $0.001, together with a Warrant to purchase an aggregate of 1,275,000 shares of Common Stock at an exercise price of $0.20 per share. The Unit price is $0.14 per Unit, consisting of the one share of Common Stock and Warrant to purchase one-half of a share of Common Stock. (with a minimum purchase of one share). The Warrants have a one-year term and are immediately exercisable. There is no minimum offering. There is no placement agent fee paid in the offering, and no accountable or unaccountable expense allowance.

20

Paul Beckman, an insider of the Company, purchased 1,000,000 Units under the Placement. Upon completion of the Placement, Mr. Beckman holds 12,133,645 common shares or approximately 21% of the total common shares issued and outstanding of the Company.

ITEM 6 - SELECTED FINANCIAL DATA

Not required for smaller reporting companies.

ITEM 7 - MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operation (“MD&A”) is intended to help the reader understand our financial condition. MD&A is provided as a supplement to, and should be read in conjunction with, our financial statements and the accompanying integral notes (“Notes”) thereto. The following statements may be forward-looking in nature and actual results may differ materially.

Plan of Operation:

FORWARD LOOKING STATEMENTS: The following discussion may contain forward-looking statements that involve a number of risks and uncertainties. Factors that could cause actual results to differ materially include the following: inability to locate property with mineralization, lack of financing for exploration efforts, competition to acquire mining properties; risks inherent in the mining industry, and risk factors that are listed in the Company's reports and registration statements filed with the Securities and Exchange Commission.

The Company commenced advancement of the South Mountain Project in 2019 with BeMetals Corp. – Vancouver B.C. (TSX-V: BMET) – under an option agreement to complete the pre-development work and produce a preliminary economic analysis (PEA). The Company’s plan of operation for the next twelve months is to continue supporting BeMetals Corp. during their option period and help ensure that the South Mountain PEA is completed on schedule and within budget.

Results of Operations:

In 2019, the Company received $350,000 in cash and shares of BeMetals common stock with a fair value of $1,883,875 on the date of receipt. A gain on mineral interest of $1,754,398 was recognized for the excess of consideration received over the carrying value amount of the Company’s investment in the South Mountain project of $479,477. In addition, the Company earned $200,000 in management services income during the for the year ended December 31, 2019 in accordance with the BeMetals agreement.

Total operating expenses for the year ended December 31, 2019 of $695,295 increased from the same respective time frame ending 2018 by $87,502 or 14%. Exploration expenses for the twelve months ended December 31, 2019 decreased by $179,041 when compared to same period in 2018. This decrease can be attributed to the engagement of Hard Rock Consulting LLC to update the NI 43-101 in 2018. In addition, starting in June 2019, BeMetals has reimbursed the Company for exploration and other costs. Legal and accounting costs increased from the same period in 2018 by $17,213 for a total of $135,015. Management and administrative expense increased by $265,445 or 113% principally due to stock options compensation of $117,088 issued to our officers and directors in March 2019, and due to additional expenses incurred with the BeMetals agreement in 2019.

Liquidity and Capital Resources:

The consolidated financial statements for the year ended December 31, 2019 have been prepared under the assumption that we will continue as a going concern. Such assumption contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As shown in the consolidated financial statements for the period ended December 31, 2019, we have sufficient cash reserves to cover normal operating expenditures for the following 12 months.

21

The liquidity of the Company was enhanced on February 27, 2019 when the Company entered into the BeMetals Option Agreement with BeMetals Corp., and BMET USA, a wholly owned subsidiary of BeMetals. Under the terms of the BeMetals Option Agreement, BMET USA will be entitled to purchase 100% of the issued and outstanding shares of SMMI from TMRI, both wholly owned subsidiaries of the Company. The term of the agreement is for two years with BeMetals completing a preliminary economic assessment ("PEA") completed by a mutually agreed third-party engineering firm. Over its term, this agreement requires cash payments to the Company of $1,350,000; $1,100,000 in cash and $250,000 in exchange for shares of the Company’s common stock. Through December 31, 2019, cash proceeds of $350,000 and $250,000 in exchange for shares of the Company’s common stock have been received. BeMetals also agreed to pay the Company $25,000 per month for management services. In the event that BeMetals decides not to proceed with the South Mountain Project, BeMetals will not be obligated to make any additional payments.

BeMetals issued 10 million BMET common shares (Consideration Shares) to TMRI in May 2019. The fair value of the shares on the transaction date was $1,883,875. These shares include certain resale restrictions, including a hold period, under applicable Securities Laws in addition to the restrictions set out in section 4.6 of the BeMetals Option Agreement.

The Company has historically incurred losses, however, under the BeMetals Option Agreement, the Company now has a recurring source of revenue, and its ability to continue as a going concern is no longer just dependent on equity capital raises and borrowings. The Company believes it has the ability to raise capital in order to fund its future exploration and working capital requirements if necessary.

Potential additional sources of cash, or relief of demand for cash, include additional external debt, the sale of shares of our stock, or alternative methods such as mergers or sale of our assets. No assurances can be given, however, that we will be able to obtain any of these potential sources of cash.

Our plans for the long-term continuation as a going concern include financing our future operations through sales of our common stock and/or debt and the eventual profitable exploitation of our mining properties. Our plans may also, at some future point, include the formation of mining joint ventures with senior mining company partners on specific mineral properties whereby the joint venture partner would provide the necessary financing in return for equity in the property.

In addition to the BeMetals Corp. Option Agreement, we believe that the Company will be able to meet its financial obligations by the following:

February 25, 2020, we had $163,399 cash in our bank accounts.

We do not include in this consideration any option payments mentioned below.

Management is committed to manage expenses of all types to not exceed the on-hand cash resources of the Company at any point in time, now or in the future.

The Company will also consider other sources of funding, including potential mergers and/or additional farm-out of its other exploration property.

For the year ended December 31, 2019, net cash used in operating activities was $316,295, consisting of net income of $1,087,083 offset by the non-cash items (including a noncash gain on mineral interest of $1,754,398) and changes in current assets and current liabilities. Cash provided by investing activities for the year ended December 31, 2019 totaled $350,000 from the receipt of $350,000 under the BeMetals Option Agreement. Net cash received financing activities was $250,000 from the sale of shares of the Company’s common stock, additional borrowings of $40,000, less payment on borrowings of $70,000 and distribution to non-controlling interest of $5,000.

Our future liquidity and capital requirements will depend on many factors, including timing, cost and progress of our exploration efforts, our evaluation of, and decisions with respect to, our strategic alternatives, and costs associated with the regulatory approvals. If it turns out that we do not have enough cash to complete our exploration programs, we will attempt to raise additional funds from a public offering, a private placement, mergers, farm-outs or loans.

22

We know that additional financing will be required in the future to fund our planned operations. We do not know whether additional financing will be available when needed or on acceptable terms, if at all. If we are unable to raise additional financing when necessary, we may have to delay our exploration efforts or any property acquisitions or be forced to cease operations. Collaborative arrangements may require us to relinquish our rights to certain of our mining claims.

Private Placement

On February 27, 2019, the Company entered into an Option Agreement, (the “BeMetals Option Agreement”) with BeMetals Corp., a British Columbia corporation (“BeMetals”), and BeMetals USA Corp., a Delaware corporation (“BMET USA”), a wholly owned subsidiary of BeMetals. Under the terms of the BeMetals Option Agreement, in the second quarter 2019, BeMetals purchased 2.5 million shares of the Company’s common stock at a price of $0.10 per share, for an aggregate purchase price of $250,000, in a private placement. Use of proceeds are for general corporate working capital. This private placement was approved by the TSX-V.

On February 20, 2018, the Board of Directors approved a Private Placement financing of up to $750,000 from the sale of equity units at a price of $0.14 per unit. Each unit consists of one share of the Company’s common stock and one-half of one common share purchase warrant. On April 27, 2018 the Company closed its Private Placement. In total, 2,550,000 units were sold representing 2,550,000 shares of common stock and 1,275,000 warrants to purchase common stock for $0.20 over the next 12 months. Total proceeds were $357,000. Of this amount, $252,988 was received in cash and $104,012 was in exchange for retirement of a related party convertible note payable and related accrued interest payable.

The offerings are believed exempt from registration pursuant to the exemption for transactions by an issuer not involving any public offering under Section 4(6) the Securities Act of 1933, as amended. The securities offered, sold, and issued in connection with the private placement have not been or are not registered under the Securities Act of 1933, as amended, or any state securities laws and may not be offered or sold in the United States absent registration with the Securities and Exchange Commission or an applicable exemption from the registration requirements.

Contractual Obligations

During 2008 and 2009, three lease arrangements were made with landowners that own land parcels adjacent to the Company’s South Mountain patented and unpatented mining claims. The leases were for a seven-year period, with options to renew, with annual payments (based on $20 per acre) listed in the following table. The leases have no work requirements.

Payments due by period | |||||

Total* | Less than 1 year | 2-3 years | 4-5 years | More than 5 years | |

Acree Lease (yearly, June)(1) | $16,950 | $3,390 | $6,780 | $3,390 | $ - |

Lowry Lease (yearly, October)(1)(2) | $56,400 | $11,280 | $22,560 | $11,280 | $ - |

OGT LLC(3) | $35,000 | $5,000 | $10,000 | $10,000 | $ 5,000 |

Total | $108,350 | $19,670 | $39,340 | $24,670 | $ 5,000 |

(1)Amounts shown are for the lease periods years 12 through 16, a total of 4 years that remains after 2019. Lease was extended an additional 10 years at $30/acre after 2014.

(2)The Lowry lease has an early buy-out provision for 50% of the remaining amounts owed in the event the Company desires to drop the lease prior to the end of the first seven-year period.

(3) OGT LLC, managed by the Company’s wholly owned subsidiary SMMI, receives a $5,000 per year payment for up to 10 years, or until a $5 million capped NPI Royalty is paid.

Critical Accounting Policies

We have identified our critical accounting policies, the application of which may materially affect the financial statements, either because of the significance of the financials statement item to which they relate, or because they require management’s judgment in making estimates and assumptions in measuring, at a specific point in time, events

23

which will be settled in the future. The critical accounting policies, judgments and estimates which management believes have the most significant effect on the financial statements are set forth below:

a)Estimates. Our management routinely makes judgments and estimates about the effect of matters that are inherently uncertain. As the number of variables and assumptions affecting the future resolution of the uncertainties increase, these judgments become even more subjective and complex. Although we believe that our estimates and assumptions are reasonable, actual results may differ significantly from these estimates. Changes in estimates and assumptions based upon actual results may have a material impact on our results of operation and/or financial condition.

b)Stock-based Compensation. The Company records stock-based compensation in accordance with ASC 718, “Compensation – Stock Compensation” using the fair value method. All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable.

c)Income Taxes. We have current income tax assets recorded in our financial statements that are based on our estimates relating to federal and state income tax benefits. Our judgments regarding federal and state income tax rates, items that may or may not be deductible for income tax purposes and income tax regulations themselves are critical to the Company’s financial statement income tax items.