Attached files

| file | filename |

|---|---|

| 10-K/A - 10-K/A - Howard Hughes Corp | q4201910-ka.htm |

| EX-32.1 - EXHIBIT 32.1 - Howard Hughes Corp | hhc10ka-20191231ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Howard Hughes Corp | hhc10ka-20191231ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Howard Hughes Corp | hhc10ka-20191231ex311.htm |

| EX-23.2 - EXHIBIT 23.2 - Howard Hughes Corp | hhc10ka-20191231ex232.htm |

Consolidated Financial Statements and Report of Independent Auditors DLV/HHPI Summerlin, LLC December 31, 2019

Contents Page Report of Independent Auditors 1 Consolidated balance sheets at December 31, 2019 and 2018 2 Consolidated statements of operations for the years ended December 31, 2019, 2018 and 2017 3 Consolidated statements of changes in members’ equity for the years ended December 31, 2019, 2018 and 2017 4 Consolidated statements of cash flows for the years ended December 31, 2019, 2018 and 2017 5 Notes to consolidated financial statements 7

Report of Independent Auditors Members of DLV/HHPI Summerlin, LLC We have audited the accompanying consolidated financial statements of DLV/HHPI Summerlin, LLC, which comprise the consolidated balance sheets as of December 31, 2019 and 2018, and the related consolidated statements of operations, changes in members’ equity and cash flows for the year then ended, and the related notes to the consolidated financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in conformity with U.S. generally accepted accounting principles; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of DLV/HHPI Summerlin, LLC, at December 31, 2019 and 2018, and the consolidated results of its operations and its cash flows for the years then ended in conformity with U.S. generally accepted accounting principles. Comparative Financial Statements We have not audited, reviewed or compiled the consolidated statements of operations, changes in members’ equity and cash flows for the year ended December 31, 2017, and the related notes to the consolidated financial statements, and, accordingly, we express no opinion on them. /s/ Ernst & Young LLP Dallas, Texas March 20, 2020

DLV/HHPI SUMMERLIN, LLC CONSOLIDATED BALANCE SHEETS December 31, 2019 and 2018 2019 2018 ASSETS Real estate under development$ 95,760,184 $ 76,469,496 Cash and cash equivalents 52,844,217 57,156,394 Property and equipment, net 21,947,940 22,693,090 Deferred costs 41,925,670 47,745,978 Restricted cash 3,081,365 3,042,286 Accounts receivable 524,431 198,954 Prepaid expenses and other assets 1,319,055 4,642,113 Note receivable 3,755,639 400,000 Related-party receivables 118,183 582,924 Total Assets$ 221,276,684 $ 212,931,235 LIABILITIES AND MEMBERS' EQUITY Accounts payable and accrued expenses$ 8,705,334 $ 3,531,480 Deferred revenue 97,695,772 110,847,098 Related party payables 7,318,178 4,250,392 Special Improvement District bonds 311,830 440,696 Customer deposits - 1,662,000 Club membership deposits 16,020,000 13,000,000 Line of credit 5,994,666 3,994,720 Finance lease obligations 268,208 488,212 Total Liabilities 136,313,988 138,214,598 Commitments and Contingencies (see Note 15) MEMBERS' EQUITY Members' capital (43,150,093) (27,098,402) Accumulated earnings 128,112,789 101,815,039 Total Members' Equity 84,962,696 74,716,637 Total Liabilities and Members' Equity$ 221,276,684 $ 212,931,235 The accompanying notes are an integral part of these consolidated financial statements. 2

DLV/HHPI SUMMERLIN, LLC CONSOLIDATED STATEMENTS OF OPERATIONS For the Years Ended December 31, 2019, 2018 and 2017 2017 2019 2018 (unaudited) REVENUES Real estate sales$ 114,916,263 $ 99,904,340 $ 58,016,446 Club operations 5,420,319 2,654,701 569,372 Total revenues 120,336,582 102,559,041 58,585,818 COSTS & EXPENSES Cost of real estate sales 60,087,296 37,795,633 19,342,117 Cost of club operations 14,229,416 10,544,113 4,626,353 Commissions, closing costs and fees 13,815,097 11,881,148 7,474,904 Selling, marketing and other expenses 3,531,117 3,484,453 3,280,873 Depreciation 1,411,942 1,109,429 592,764 Homeowners association subsidy 1,039,149 982,184 - Total costs and expenses 94,114,017 65,796,960 35,317,011 Operating income 26,222,565 36,762,081 23,268,807 Other income (expense) 75,185 (65,018) (34,453) Net income$ 26,297,750 $ 36,697,063 $ 23,234,354 The accompanying notes are an integral part of these consolidated financial statements. 3

DLV/HHPI SUMMERLIN, LLC CONSOLIDATED STATEMENTS OF CHANGES IN MEMBERS’ EQUITY For the Years Ended December 31, 2019, 2018 and 2017 HHPI Discovery Total Balance at December 31, 2016 (unaudited) $ 32,652,554 $ 2,132,666 $ 34,785,220 Contributions - - - Distributions (10,000,000) - (10,000,000) Net income 23,234,354 - 23,234,354 Balance at December 31, 2017 (unaudited) 45,886,908 2,132,666 48,019,574 Contributions - - - Distributions (10,000,000) - (10,000,000) Net income 36,697,063 - 36,697,063 Balance at December 31, 2018 72,583,971 2,132,666 74,716,637 Contributions - - - Distributions (16,051,691) - (16,051,691) Net income 26,297,750 - 26,297,750 Balance at December 31, 2019$ 82,830,030 $ 2,132,666 $ 84,962,696 The accompanying notes are an integral part of these consolidated financial statements. 4

DLV/HHPI SUMMERLIN, LLC CONSOLIDATED STATEMENTS OF CASH FLOWS For the Years Ended December 31, 2019, 2018 and 2017 2017 2019 2018 (unaudited) Cash flows from operating activities Net income$ 26,297,750 $ 36,697,063 $ 23,234,354 Depreciation 1,411,942 1,109,429 592,764 Loss on asset disposal - 3,162 - Effects of changes in operating assets and liabilities: Additions to real estate development (68,174,224) (43,468,660) (30,776,776) Cost of real estate sales 60,087,296 37,795,633 19,342,117 Deferred costs 1,033,078 (1,129,053) (71,596) Accounts receivable (325,477) (18,818) (180,136) Note receivable 1,400,000 - - Prepaid expenses and other assets 3,323,058 (3,854,484) (567,682) Accounts payable 3,144,609 (3,008,155) (4,500,706) Customer real estate deposits (1,662,000) 1,662,000 - Deferred revenues (17,906,964) 7,886,441 (3,750,446) Membership deposits 3,020,000 4,450,000 8,550,000 Related-party receivables and payables (1,263,831) 281,689 (81,562) Net cash provided by operating activities 10,385,237 38,406,247 11,790,331 Cash flows from investing activities Development of property and equipment (634,694) (5,314,598) (19,035,973) Proceeds from repayment of advance to related party 300,000 - - Advance to related party - (300,000) - Net cash used in investing activities (334,694) (5,614,598) (19,035,973) Cash flows from financing activities Special Improvement District bonds payments (51,892) (57,195) (68,970) Class B members subscriptions refunds - - (1,740,000) Capital lease obligations payments (220,004) (297,370) (302,984) Members' capital distributions (16,051,691) (10,000,000) (10,000,000) Line of credit advances 1,999,946 3,994,720 - Net cash used in financing activities (14,323,641) (6,359,845) (12,111,954) Net increase (decrease) in cash, cash equivalents, and restricted cash (4,273,098) 26,431,804 (19,357,596) Cash, cash equivalents, and restricted cash, beginning of period 60,198,680 33,766,876 53,124,472 Cash, cash equivalents, and restricted cash, end of period $ 55,925,582 $ 60,198,680 $ 33,766,876 The accompanying notes are an integral part of these consolidated financial statements. 5

DLV/HHPI SUMMERLIN, LLC CONSOLIDATED STATEMENTS OF CASH FLOWS (continued) For the Years Ended December 31, 2019, 2018 and 2017 2017 2019 2018 (unaudited) Supplemental disclosure of cash flow information: Cash paid for interest, net of amount capitalized$ 15,190 $ 22,722 $ 4,550 Development of property and equipment included in accounts payable$ - $ 1,882,571 $ - Special Improvement District bond liability relieved from sale of land$ 76,974 $ 138,036 $ 78,954 Sale of land in exchange for a note receivable$ 5,000,000 $ - $ - Imputed interest on note receivable issued$ 244,361 $ - $ - Transfer of real estate and land development costs to property and equipment$ - $ 3,187,911 $ 18,190,819 Class B members subscriptions converted to lot deposits$ - $ - $ 1,675,500 The accompanying notes are an integral part of these consolidated financial statements. 6

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 1 – DESCRIPTION OF THE BUSINESS Organization DLV/HHPI Summerlin, LLC (the “Company”) was formed on June 13, 2014, under the laws of the State of Delaware, in the United States of America (“US”). On March 17, 2015, the limited liability company agreement was amended changing the members of the Company to DLV Summerlin, LLC, a Delaware limited liability company (“Discovery”) and Howard Hughes Properties, Inc., a Nevada corporation (“HHPI”). The Company is a joint venture, which wholly-owns certain entities incorporated under the laws of the State of Delaware, for the purpose of developing and operating a luxury golf club with related amenities and a residential community located in Summerlin, Nevada, a suburb of Las Vegas. The golf club and residential community (hereinafter collectively referred to as the “Project”) is expected to have approximately 260 dwellings on 555 acres which will be offered for sale as a mix of custom lots, detached built product units, and multi-family built product units. Under the terms of the Company’s limited liability agreement, HHPI contributed real estate to the joint venture with a book value of $12,051,598, which is net of Special Improvement District bonds of $1,326,319. The agreed upon fair market value of the real estate contributed is $125,430,000. Discovery contributed cash with a value of $3,750,000, a portion of which was used to fund land improvements. Discovery is required to fund up to $30,000,000 in capital contributions. Following the recording of the parcel map by HHPI, the primary remaining major entitlement was a Site Development Plan (“SDP”) approval for the Project’s overall development plan, residential plan, and golf course. The SDP approval was a condition precedent to commencing construction, starting sales and formally executing the joint venture documents. The approval of the SDP was obtained on March 17, 2015 and the operations of the Company commenced. The consolidated financial statements as of December 31, 2019 and 2018 reflect the financial position of the Company and its wholly owned subsidiary Discovery Property Company, LLC (“DPC”) after the consolidation of its wholly owned subsidiaries Summit Club, LLC (the “Club”), DPC SPEC I, LLC and DPC Clubhouse I, LLC. The Club was formed on December 22, 2015, and began operations in March 2017. DPC SPEC I, LLC was formed on August 16, 2017. DPC Clubhouse I, LLC was formed on November 13, 2018. NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Basis of presentation The consolidated financial statements are prepared on the accrual basis in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and include all of the accounts of the Company’s wholly owned subsidiaries in accordance with the provisions and guidance included in Financial Accounting Standards Board (the “FASB”) Accounting Standards Codification (“ASC”). All intercompany transactions and balances have been eliminated during consolidation. Real estate under development Real estate assets are stated at cost less any provisions for impairments. Costs directly associated with the acquisition and development of the Project including interest, real estate taxes, indirect costs incurred in managing the development, legal and other costs clearly related to the Project are capitalized and presented in the balance sheets within real estate under development. Selling and marketing costs, which includes advertising are expensed as incurred. 7

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Real estate under development (continued) The Company records impairment losses on its real estate under development when events or circumstances indicate that the assets might be impaired and the undiscounted cash flows estimated to be generated by those assets are less than the carrying amount of the assets. In such a case, an impairment loss would be recorded to adjust the carrying amount to fair value. Management has determined that there were no impairment charges required for the years ended December 31, 2019, 2018, and 2017. Revenue and cost recognition In May 2014, the FASB issued ASU 2014-09, “Revenues from Contracts with Customers (Topic 606)”. The standard’s core principle is that a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. The Company adopted the standard as of January 1, 2019 using the modified retrospective method. There was no effect on prior period financials. Sale of Real Estate Revenues from real estate sales are recognized at a point in time when the land sale closing process is complete. The transaction price is fixed based on the terms of the contract, and generally representative of a single performance obligation. The fixed transaction price, which is the amount of consideration received in full upon transfer of the land title to the buyer, is allocated to this single obligation and is received at closing of the land sale less any amounts previously paid on deposit. In situations where the Company has completed the closing of a real estate sale and consideration is paid in full, but a portion of the Company’s performance obligation relating to the development of the land is still unsatisfied, revenue related to the Company’s obligation is recognized over time. The Company recognizes only the portion of the improved land sale where the improvements are fully satisfied based on a cost input method. The aggregate amount of the transaction price allocated to the unsatisfied obligation is recorded as deferred land sales and presented in deferred revenue. The Company measures the completion of its unsatisfied obligation based on the costs remaining relative to the total cost at the date of closing. When real estate under development is sold, the cost of sales includes actual costs incurred and estimates of future development costs benefiting the property sold. In accordance with ASC 970-360-30-1, when developed land is sold, costs are allocated to each lot based upon the relative sales value. For purposes of allocating development costs, estimates of future revenues and development costs are re-evaluated throughout the year, with adjustments being allocated prospectively to the remaining lots available for sale. Sale of Developer Product The Company contracts with customers to sell real estate and construct a vertical improvement (developer product). The transaction price is fixed based on the terms of the contract. Subsequent changes due to customer submitted change orders represent a contract modification. Contracts requiring developer product contain two performance obligations; (1) the real estate and development of community amenities, and (2) the construction of the vertical development. The transaction price, which is the amount of consideration stipulated in the contract plus any contract modifications, is allocated to the multiple performance obligations based on the respective established standalone selling prices. Revenue related to the sale of real estate and development of community amenities is recognized over time, as described above in Sale of Real Estate. Revenue from the sale of a developer product is recognized over time as the Company satisfies the performance obligations. 8

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Revenue and cost recognition (continued) The Company receives cash payments in the form of vertical improvement deposits from customers who have contracted to purchase a developer product unit based on billing schedules established in the Company’s purchase agreement contracts. The amounts are recorded in cash and cash equivalents, and a corresponding vertical product liability is established at the date of receipt, which is presented in deferred revenue. The Company recognized revenue on developer products using an input method of cost incurred relative to total cost of the vertical product for measuring progress. In instances where the revenue recognized exceeds the vertical deposits received, a corresponding contract asset and contract liability is recorded. The following table presents the Company’s revenues disaggregated by revenue source: 2019 2018 From contracts with customers Real estate$ 81,276,849 $ 90,693,646 Vertical product 33,639,413 9,210,694 Membership dues 2,700,430 1,474,143 Total revenue from contracts with customers 117,616,692 101,378,483 Point in time revenue Club operations 2,719,890 1,180,558 Total revenues$ 120,336,582 $ 102,559,041 Below is a discussion of the performance obligations, significant judgements and other required disclosures related to revenues from contracts with customers. Contract Assets and Liabilities Contract assets are the Company's right to consideration in exchange for goods or services that have been transferred to a customer. Contract liabilities are the Company's obligation to transfer goods or services to a customer for which the Company has received consideration. The beginning and ending balances of contract assets and liabilities are as follows. Contract assets are included in accounts receivable and contract liabilities are included in deferred revenue on the accompanying balance sheets: Contract Contract Assets Liabilities Balance as of January 1, 2019$ - $ 110,847,097 Balance as of December 31, 2019$ 377,937 $ 98,073,708 9

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Revenue and cost recognition (continued) Remaining Unsatisfied Performance Obligations The Company’s remaining unsatisfied performance obligations as of December 31, 2019 represent a measure of the total dollar value of work to be performed on contracts executed and in progress. The aggregate amount of the transaction price allocated to the Company's remaining unsatisfied performance obligations as of December 31, 2019 and 2018 is approximately $123,760,000 and $141,000,000, respectively. The Company’s remaining performance obligations are adjusted to reflect any known cancellations, revisions to project scope and cost, and deferrals as appropriate. Cash and cash equivalents Cash and cash equivalents are short-term, highly liquid investments that are both readily convertible to known amounts of cash, and so near maturity that they present insignificant risk of changes in value because of the associated interest rates. Cash and cash equivalents are comprised of cash on hand, current accounts and fixed deposits with original contractual maturities of three months or less. Restricted cash Restricted cash reflects amounts held in deposit as required per the terms of the Company’s line of credit agreement. Property and equipment Property and equipment consists primarily of land improvements, club amenities, office furnishings, equipment and vehicles. Property and equipment also includes assets leased under capital lease agreements. In the case of property and equipment held under capital leases, the asset and the related obligations are initially recorded at the amount equal to the present value of future minimum lease payments computed on the basis of the interest rate implicit in the lease or the incremental borrowing rate. Expenditures that increase capacities or extend useful lives are capitalized. Routine maintenance, repairs, and renewal costs are expensed as incurred. Property and equipment are stated at cost, less accumulated depreciation and any provision for impairment. Depreciation and amortization are provided for primarily on the straight-line method over the estimated service lives of the assets. Estimated service lives for fixed assets are as follows: Asset Years Equipment 4 – 10 Office Furnishings 7 Vehicles 5 – 10 Amenity Buildings 40 Golf Course 15 10

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Related-party receivables Related-party receivables include shared office expense and club charges to sale agents and employees that will be repaid from future commissions on lot closings or payroll. Accounts and note receivable The Company grants credit to customers that arise in the normal course of operations. The receivable accounts consist of amounts billed to customers and accruals for amounts not yet billed. The Company writes off accounts when management believes the receivables are uncollectible based on the overall creditworthiness of the customers and payment disputes. An allowance is established based on reviews of individual accounts, recent loss experience, current economic conditions, and other pertinent factors. As of December 31, 2019 and 2018, management deemed all accounts are collectible, thus no allowance was recorded. Deferred costs Deferred costs include cost of lots sold plus closing and transfer fees and commissions paid on real estate sales. Deferred costs are measured based on the costs remaining relative to the total cost at the date of closing. Prepaid expenses and other assets Prepaid expenses and other assets include prepayments of insurance and refundable cash bond deposits, club inventory, supplies and vendor advances. Prepaid expenses are amortized over the terms of the related policies. Inventory is stated at the lower of cost or market. Accounts payable and related-party payables Accounts payable and related-party payables include development expenditures, marketing expenses, club operations and professional fees for the Project. Customer real estate deposits Customer real estate deposits consist of escrow funds received to hold a lot and funds received for customer change orders on construction contracts. Class B member subscriptions Class B member subscriptions represents Class B member shares that are non-voting, non-transferable and redeemable over the passage of time. The shares entitle the holder to a pre-selected land lot within the Project. Members can elect to redeem all, but not less than all, of their Class B shares and have the Company apply the proceeds to the purchase price due at closing under their real estate purchase agreement. If a member does not elect to execute their redemption rights, they will only be eligible to receive a distribution upon liquidation of the Company. The Class B shares are accounted for under the deposit method and recorded as a liability in the accompanying financial statements. Per ASC 480, Distinguishing Liabilities from Equity, the accounting guidance requires the Class B shares to be treated as debt securities and not equity securities due to the characteristics of the shares issued. 11

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Leases Leases entered into by the Company that do not transfer substantially all the risks and benefits of ownership of the leased asset from the lessor are classified as operating leases. Operating lease payments are recognized as an expense in the statement of operations on a straight-line basis over the lease term. Assets acquired pursuant to leases that transfer substantially all the rewards and risks of ownership to the Company are accounted for as leased property under finance leases. Payments to the lessors are treated as having capital and interest elements. Lease costs are capitalized if they relate to the real estate held for development or expensed if they relate to sales and marketing in the period to which they relate. Income taxes Federal, state and local income taxes have not been provided for in the accompanying financial statements as the members are responsible for reporting their allocable share of the Company’s tax basis income, gains, deductions, losses and credits on their tax return. In accordance with ASC 740, Accounting for Uncertainty in Income Taxes, the Company must determine whether a tax position meets the “more likely than not” threshold based on the technical merits of the position. Once a position meets the recognition threshold, measurement of the position reported in the financial statement is determined. The Company has determined no material unrecognized tax benefits or liabilities exist as of December 31, 2019 and 2018 and no provision for income tax is required in the accompanying consolidated financial statements. If applicable, the Company recognizes interest and penalties related to underpayment of income taxes as income tax expense. The Company is not currently under exam by a taxing authority. As of December 31, 2019 and 2018, the Company has no amounts related to accrued interest and penalties. The Company does not anticipate any significant changes to its tax positions over the next year. Although the Company believes its tax returns are correct, the final determination of tax examinations and any related litigation could be different from what was reported on the returns. Generally, the Company is currently open to audit under the statute of limitations by the Internal Revenue Service as well as state taxing authorities for the years ended December 31, 2016 through 2018. Use of estimates The process of preparing financial statements in conformity with GAAP requires management to make significant estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The significant areas requiring the use of assumptions, judgments, and estimates relate to real estate under development and contingencies. Fair value of financial instruments The carrying values of cash and cash equivalents, receivables, accounts payable, and other assets and liabilities are reasonable estimates of their fair values because of the short maturities of these instruments. 12

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Distributions of cash and allocation of net income Distributions of cash are made in accordance with the terms of the Company’s Operating Agreement (the Agreement). There were $16,051,691, $10,000,000, and $10,000,000 of distributions made to HHPI during the years ended December 31, 2019, 2018 and 2017, respectively. In general, net income or loss of the Company shall be allocated to the members such that, the Member’s adjusted capital account is equal to the amount that the member would receive in a hypothetical liquidation of the Company’s net assets at its recorded book value, as defined, at each balance sheet date. Recent accounting pronouncements In February 2016, the FASB issued ASU 2016-02, “Leases”. ASU 2016-02, codified in ASC 842, amends the existing accounting standards for lease accounting, including requiring lessees to recognize most leases on their balance sheets and making targeted changes to lessor accounting. ASU 2016-02 will be effective for the Company on December 31, 2021. Early adoption of ASU 2016-02 as of its issuance is permitted. The new leases standard requires a modified retrospective approach for all leases existing at, or entered into after, the date of the initial application, with an option to use certain transition relief. Management is currently evaluating the impact of adopting the new leases standard on the accompanying consolidated financial statements. NOTE 3 - REAL ESTATE UNDER DEVELOPMENT Real estate under development as of December 31, 2019 and 2018, consists of the following: 2019 2018 Land cost, improvements, entitlements and designs$ 263,931,049 $ 194,729,877 Development administration, taxes and insurance 21,845,312 16,423,632 $ 285,776,361 $ 211,153,509 Less: Amenitites placed in service (21,410,828) (21,378,730) Less: Cost attributed to sales since inception (Note 5) (168,605,349) (113,305,283) $ 95,760,184 $ 76,469,496 13

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 4 – PROPERTY AND EQUIPMENT, NET Property and equipment, net as of December 31, 2019 and 2018, consists of the following: 2019 2018 Land improvements$ 10,451,358 $ 10,238,823 Amenity buildings 4,273,781 4,273,781 Golf course 6,308,332 6,343,621 Equipment 1,116,399 916,138 Office furnishing 1,013,153 943,860 Vehicles 845,068 625,077 Equipment and vehicles under capital lease 868,978 868,978 24,877,069 24,210,278 Less: accumulated depreciation (2,929,129) (1,517,188) $ 21,947,940 $ 22,693,090 NOTE 5 – DEFERRED COSTS Deferred costs at December 31, 2019 and 2018, consists of the following: 2019 2018 Cost attributed to sales since inception (*)$ 168,605,349 $ 113,305,283 Commissions 21,284,276 16,421,206 Closing costs 1,912,582 1,543,481 Incentive fees 33,223,785 25,673,937 225,025,992 156,943,907 Less cost realized up to December 31: Cost of real estate sales (139,963,946) (79,876,650) Commissions, closing costs and incentive fees (43,136,376) (29,321,279) $ 41,925,670 $ 47,745,978 (*) Transfer from real estate under development NOTE 6 – RESTRICTED CASH On November 30, 2017, DPC SPEC I, LLC entered into a $7,500,000 revolving line of credit agreement with First Security Bank of Nevada. Under terms of the agreement, DPC was required to maintain a deposit of $3,000,000 as a compensating balance, restricted as to use. At December 31, 2019 and 2018, the funds were held in a 12-month fixed term deposit account earning interest at 1.3%. Interest earned in each of the years 2019, 2018 and 2017 was $39,079, $39,079, and $3,207, respectively. 14

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 7 – NOTE RECEIVABLE In March 2018, the Company entered into a note agreement with a member for $5,000,000 in connection with the sale of a custom lot. The note requires annual principal installments of $1,000,000 beginning in March 2019 until paid in full. The note is without interest and is secured by the lot. The outstanding balance at December 31, 2019 and 2018 is $4,000,000 and $5,000,000, respectively. In July 2016, the Company entered into a note agreement with a member for $400,000 in connection with the sale of a custom lot. The note matures on or before July 22, 2019 without interest and is secured by the lot. The note balance was paid in full during 2019. The outstanding balance at December 31, 2019 and 2018 was $0 and $400,000, respectively. NOTE 8 – DEFERRED REVENUE Deferred revenues at December 31, 2019 and 2018, consists of the following: 2019 2018 Lots sold - Type 1$ 109,542,588 $ 95,425,000 Lots sold - Type 2 151,960,088 120,242,500 Lots sold - Type 3 96,200,000 82,600,000 Built product - Desert Villas 10,471,055 3,750,000 Built product - Desert Bungalows 50,200,496 28,279,281 Built product - Club Villas 13,982,500 4,537,500 Built product - Golf Cottages 2,200,000 2,000,000 Built product - Point Villas 15,789,991 11,747,500 450,346,718 348,581,781 Less: Real estate sales recognized (352,650,946) (237,734,683) $ 97,695,772 $ 110,847,098 NOTE 9 – RELATED-PARTY TRANSACTIONS On March 17, 2015, the Company entered into the Development Management Agreement with DLV Summerlin Management, LLC (“DLVSM”). Under the terms of the agreement, DLVSM agreed to provide sales, marketing, administrative and supervision services to the Project. DLVSM is entitled to an initial monthly management fee of $125,000 during the first twenty-four (24) months. In addition, DLVSM is entitled to a base management fee equal to 7.5% of the gross sales proceeds and memberships. For the years ended December 31, 2019, 2018 and 2017, the Company incurred development management fees of $7,549,848, $7,522,750 and $4,857,125, respectively. These fees are included in deferred costs in the accompanying balance sheets and in commissions, closing costs and fees in the accompanying consolidated statements of operations. DPC leases office space from an entity affiliated with HHPI (see Note 15). 15

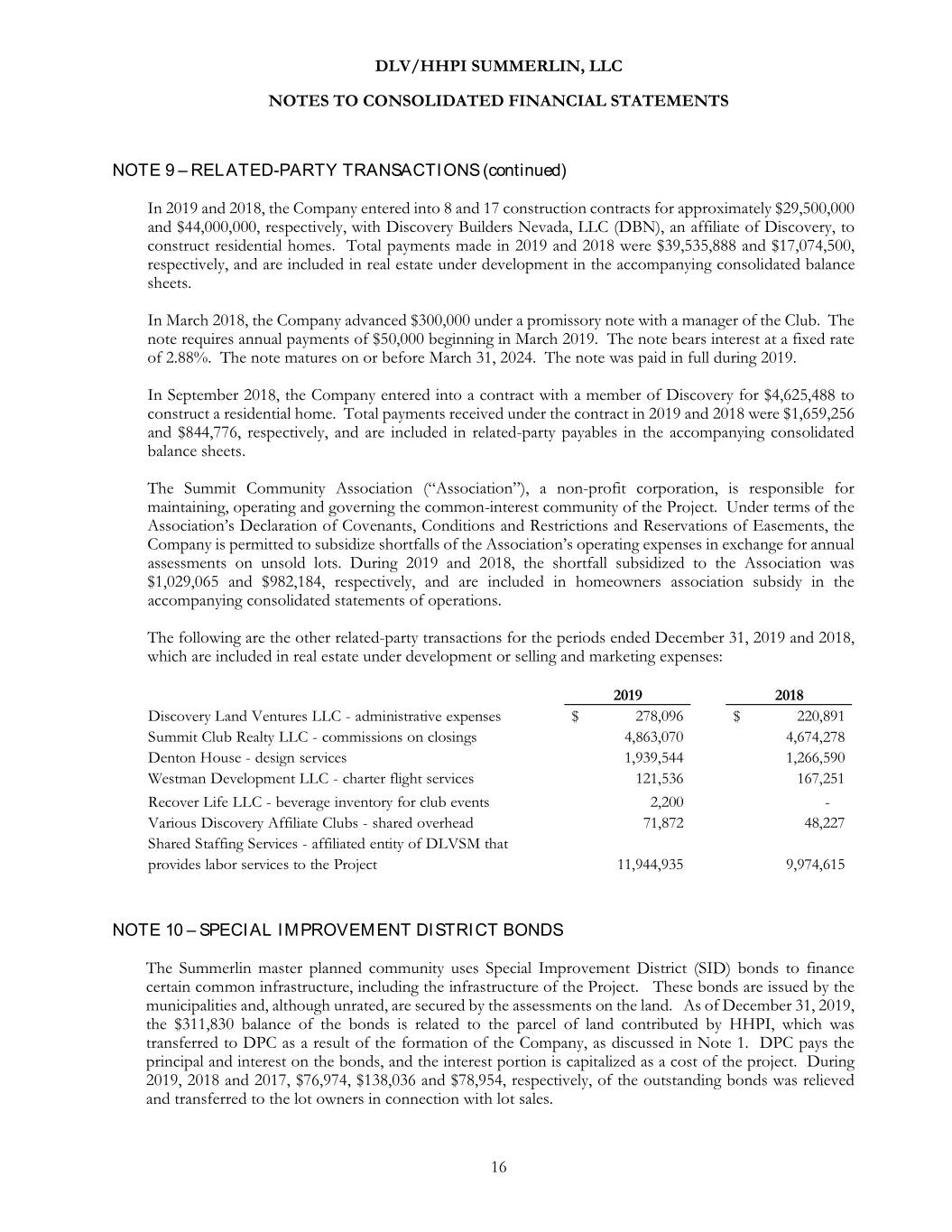

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 9 – RELATED-PARTY TRANSACTIONS (continued) In 2019 and 2018, the Company entered into 8 and 17 construction contracts for approximately $29,500,000 and $44,000,000, respectively, with Discovery Builders Nevada, LLC (DBN), an affiliate of Discovery, to construct residential homes. Total payments made in 2019 and 2018 were $39,535,888 and $17,074,500, respectively, and are included in real estate under development in the accompanying consolidated balance sheets. In March 2018, the Company advanced $300,000 under a promissory note with a manager of the Club. The note requires annual payments of $50,000 beginning in March 2019. The note bears interest at a fixed rate of 2.88%. The note matures on or before March 31, 2024. The note was paid in full during 2019. In September 2018, the Company entered into a contract with a member of Discovery for $4,625,488 to construct a residential home. Total payments received under the contract in 2019 and 2018 were $1,659,256 and $844,776, respectively, and are included in related-party payables in the accompanying consolidated balance sheets. The Summit Community Association (“Association”), a non-profit corporation, is responsible for maintaining, operating and governing the common-interest community of the Project. Under terms of the Association’s Declaration of Covenants, Conditions and Restrictions and Reservations of Easements, the Company is permitted to subsidize shortfalls of the Association’s operating expenses in exchange for annual assessments on unsold lots. During 2019 and 2018, the shortfall subsidized to the Association was $1,029,065 and $982,184, respectively, and are included in homeowners association subsidy in the accompanying consolidated statements of operations. The following are the other related-party transactions for the periods ended December 31, 2019 and 2018, which are included in real estate under development or selling and marketing expenses: 2019 2018 Discovery Land Ventures LLC - administrative expenses$ 278,096 $ 220,891 Summit Club Realty LLC - commissions on closings 4,863,070 4,674,278 Denton House - design services 1,939,544 1,266,590 Westman Development LLC - charter flight services 121,536 167,251 Recover Life LLC - beverage inventory for club events 2,200 - Various Discovery Affiliate Clubs - shared overhead 71,872 48,227 Shared Staffing Services - affiliated entity of DLVSM that provides labor services to the Project 11,944,935 9,974,615 NOTE 10 – SPECIAL IMPROVEMENT DISTRICT BONDS The Summerlin master planned community uses Special Improvement District (SID) bonds to finance certain common infrastructure, including the infrastructure of the Project. These bonds are issued by the municipalities and, although unrated, are secured by the assessments on the land. As of December 31, 2019, the $311,830 balance of the bonds is related to the parcel of land contributed by HHPI, which was transferred to DPC as a result of the formation of the Company, as discussed in Note 1. DPC pays the principal and interest on the bonds, and the interest portion is capitalized as a cost of the project. During 2019, 2018 and 2017, $76,974, $138,036 and $78,954, respectively, of the outstanding bonds was relieved and transferred to the lot owners in connection with lot sales. 16

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 11 – CLASS B MEMBER SUBSCRIPTIONS DPC initiated a financing program with outside investors in order to fund on-going development expenditures for the Project. Outside investors contribute funds to DPC for a Class B interest in the Company per terms of a Subscription Agreement. The Class B interest is non-voting, non-transferable and redeemable over the passage of time. The Class B interest can be redeemed and the proceeds applied to the purchase of a specified lot at an agreed upon amount. The redemption timing is triggered by the recording date of a subdivision plat with respect to lots and the offering plan date with respect to condominium units. A member has up to 90 days from the date of plat recording or offering plan to execute redemption and purchase a vacant lot. During 2015, twenty-five subscription agreements were issued accounting for $41,833,925 of Class B contributions to DPC. In 2017 one subscription agreement for $1,740,000 was refunded. There are no unredeemed member subscriptions at December 31, 2019 and 2018. NOTE 12 – MEMBERSHIP DEPOSITS DPC began selling refundable golf memberships at Summit Club in March 2017 for the purpose of permitting members the recreational use of the club facilities. DPC will construct a golf course and all club facilities in exchange for the golf memberships. The Club is a non-equity membership club. Members who resign are entitled to a refund, upon resale of the existing membership, equal to the greater of 80% of the then-current deposit price, or the amount previously paid by the resigning member. DPC currently intends, but may limit the number available in any category at its sole discretion, to issue the following types of memberships: 245 golf memberships 30 national golf memberships 100 social memberships A total of eighteen and twenty-nine golf memberships were sold during 2019 and 2018 for $3,500,000 and $4,450,000, respectively. A total of 104 golf memberships were sold through December 31, 2019. No national golf or social memberships have been sold. DPC has the right to issue 6 honorary memberships and 15 charter memberships. As of December 31, 2019, 2 honorary memberships have been granted. NOTE 13 – LINE OF CREDIT On November 30, 2017, DPC SPEC I, LLC entered into a loan agreement with First Security Bank of Nevada for a $7,500,000 revolving line of credit for the development and construction of spec units within the Project. The loan is secured by estate lots 110, 111 and 112. In 2019, the line of credit was increased by $1,500,000, and the Company exercised its 12-month extension option. The loan matures November 30, 2020, and accrues interest at 6%. The outstanding balance due at December 31, 2019 and 2018, was $5,994,666 and $3,994,720, respectively. Interest paid during 2019, 2018 and 2017 totalled $333,913, $131,693 and $0, respectively, and was capitalized into real estate under development. The Company is in compliance with its covenants as of December 31, 2019 and 2018. 17

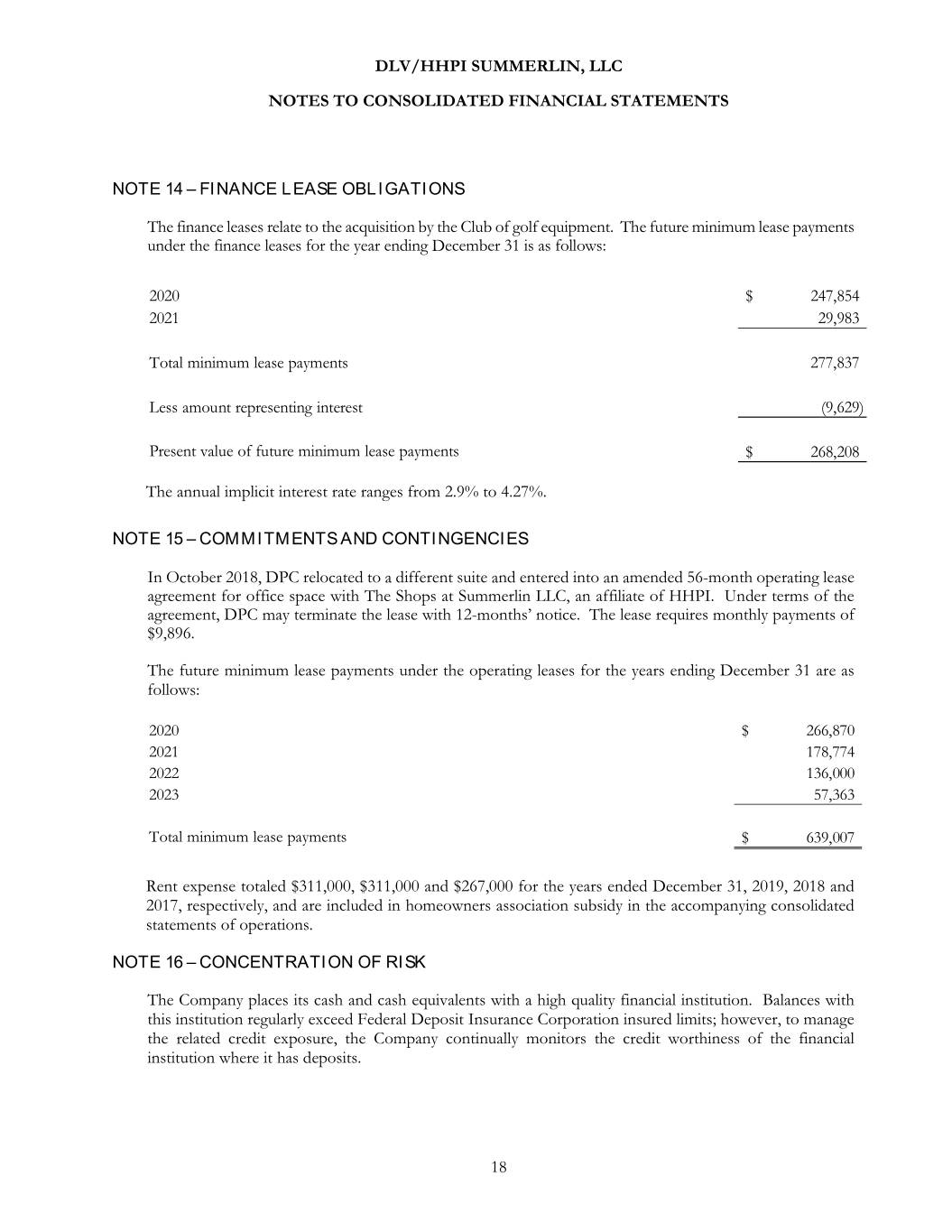

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 14 – FINANCE LEASE OBLIGATIONS The finance leases relate to the acquisition by the Club of golf equipment. The future minimum lease payments under the finance leases for the year ending December 31 is as follows: 2020 $ 247,854 2021 29,983 Total minimum lease payments 277,837 Less amount representing interest (9,629) Present value of future minimum lease payments $ 268,208 The annual implicit interest rate ranges from 2.9% to 4.27%. NOTE 15 – COMMITMENTS AND CONTINGENCIES In October 2018, DPC relocated to a different suite and entered into an amended 56-month operating lease agreement for office space with The Shops at Summerlin LLC, an affiliate of HHPI. Under terms of the agreement, DPC may terminate the lease with 12-months’ notice. The lease requires monthly payments of $9,896. The future minimum lease payments under the operating leases for the years ending December 31 are as follows: 2020 $ 266,870 2021 178,774 2022 136,000 2023 57,363 Total minimum lease payments $ 639,007 Rent expense totaled $311,000, $311,000 and $267,000 for the years ended December 31, 2019, 2018 and 2017, respectively, and are included in homeowners association subsidy in the accompanying consolidated statements of operations. NOTE 16 – CONCENTRATION OF RISK The Company places its cash and cash equivalents with a high quality financial institution. Balances with this institution regularly exceed Federal Deposit Insurance Corporation insured limits; however, to manage the related credit exposure, the Company continually monitors the credit worthiness of the financial institution where it has deposits. 18

DLV/HHPI SUMMERLIN, LLC NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 17 – SUBSEQUENT EVENTS The Company has evaluated subsequent events for potential recognition and disclosure through March 20, 2020, the date the financial statements were available to be issued. 19