Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Physicians Realty Trust | exhibit991-march2020co.htm |

| 8-K - 8-K - Physicians Realty Trust | a8-kcovidx19updatex031.htm |

COVID-19 Supplemental Update March 2020

This document may contain “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements concern and are based upon, among other things, the possible expansion of the company’s portfolio; the sale of properties; the performance of its operators/tenants and properties; its ability to enter into agreements with new viable tenants for vacant space or for properties that the company takes back from financially troubled tenants, if any; its occupancy rates; its ability to acquire, develop and/or manage properties; the ability to successfully manage the risks associated with international expansion and operations; its ability to make distributions to shareholders; its policies and plans regarding investments, financings and other matters; its tax status as a real estate investment trust; its critical accounting policies; its ability to appropriately balance the use of debt and equity; its ability to access capital markets or other sources of funds; its ability to meet its earnings guidance; and its ability to finance and complete, and the effect of, future acquisitions. When the company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties. The company’s expected results may not be achieved, and actual results may differ materially from expectations. This may be a result of various factors, including, but not limited to: material differences between actual results and the assumptions, projections and estimates of occupancy rates, rental rates, operating expenses and required capital expenditures; the status of the economy; the status of capital markets, including the availability and cost of capital; issues facing the healthcare industry, including compliance with, and changes to, regulations and payment policies, responding to government investigations and punitive settlements and operators’/tenants’ difficulty in cost-effectively obtaining and maintaining adequate liability and other insurance; changes in financing terms; competition within the healthcare, seniors housing and life science industries; negative developments in the operating results or financial condition of operators/tenants, including, but not limited to, their ability to pay rent and repay loans; the company’s ability to transition or sell facilities with profitable results; the failure to make new investments as and when anticipated; acts of God affecting the company’s properties; the company’s ability to re-lease space at similar rates as vacancies occur; the failure of closings to occur as and when anticipated, including the receipt of third-party approvals and healthcare licenses without unexpected delays or conditions; the company’s ability to timely reinvest sale proceeds at similar rates to assets sold; operator/tenant or joint venture partner bankruptcies or insolvencies; the cooperation of joint venture partners; government regulations affecting Medicare and Medicaid reimbursement rates and operational requirements; regulatory approval and market acceptance of the products and technologies of life science tenants; liability or contract claims by or against operators/tenants; unanticipated difficulties and/or expenditures relating to future acquisitions and the integration of multi-property acquisitions; environmental laws affecting the company’s properties; changes in rules or practices governing the company’s financial reporting; the movement of U.S. and foreign currency exchange rates; and legal and operational matters, including real estate investment trust qualification and key management personnel recruitment and retention. Finally, the company assumes no obligation to update or revise any forward-looking statements or to update the reasons why actual results could differ from those projected in any forward-looking statements. 1

Stable Portfolio Built for the Long Term Portfolio Distribution (% GLA) Medical Office Resiliency Long-term triple-net leases with top quality Health System and Physician Specialty Specialist tenants provide highly resilient cash flow Hospital, 2% Medical Office, 96% LTACH, 2% Long Term Stability DOC’s 7.3 year remaining lease term leads the public MOB space, as does the Portfolio’s 58% occupancy by investment grade quality tenants(1) Unmatched Focus on Credit Dedicated credit department provides for robust monitoring of portfolio financial health, with recurring financial statement review of 98 of the Portfolio’s Top 100 tenants by ABR A Portfolio for the Future of Healthcare DOC’s historical emphasis on off-campus outpatient facilities will continue to benefit from accelerating healthcare trends as procedures move to more efficient sites of care Baylor Charles A. Sammons Cancer Center | Dallas, TX On Campus of the Baylor University Medical Center (1) Includes parent ratings where appropriate plus tenancy attributable to Northside Hospital (a non-rated entity) 2

Industry Leading Tenant Profile 96% 7.3 Year Leased Portfolio Wtd. Average Lease Term Remaining DOC’s portfolio provides industry leading stability, exceeding closest peers in occupancy and remaining lease term 58% 89% Investment Grade Rated Tenancy(1) Tenant Financial Visibility(2) Lease Expiration Schedule (% Consolidated Portfolio Leased GLA as of December 31, 2019) 30% 26.0% 25% 19.3% 20% Less than 5% of the Company’s Portfolio expires in any year prior to 2024 15% 9.5% 10.0% 10% 7.9% 6.3% 4.3% 4.7% 4.5% 4.4% 5% 3.1% 0% (1) Includes parent ratings where appropriate plus tenancy attributable to Northside Hospital (a non-rated entity) (2) Represents ABR from tenants where the entity’s financial performance is known, 3 either through public filings or reporting requirements embedded in leases

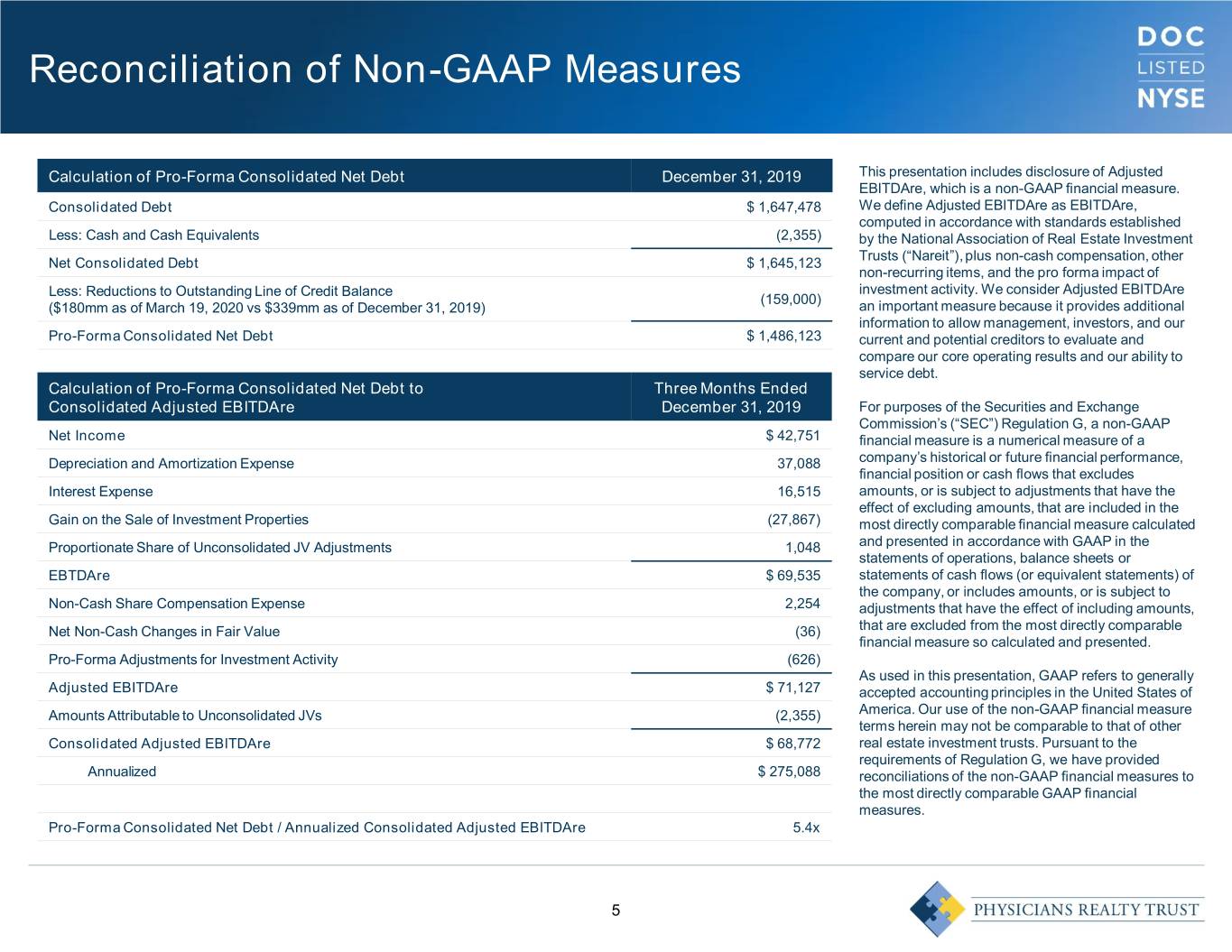

Conservative Leverage Profile $239.3mm Debt Maturity Schedule (As of December 31, 2019)(1) Raised YTD on ATM at $19.57 / sh $450 Senior Notes $425 $402 $400 Credit Facility ‘BBB-’ / ‘Baa3’ Mortgages $350 Investment Grade Ratings DOC’s well staggered $300 debt maturity schedule $265 limits refinancing risk, with $250 no meaningful term debt 96.3% due until 2023 Millions $202 $200 Unencumbered NOI as % of Portfolio $150 $100 $1.1 billion $70 Borrowing Capacity of Unsecured $50 $45 $24 $25 $25 Credit Agreement $7 $- $- $- $- 5.4x Consolidated Net Debt to Adjusted EBITDAre(1) Company statistics reflect consolidated DOC portfolio as of December 31, 2019 (1) Pro-forma for the Company’s $180mm line of credit balance as of March 19, 2020. Adjusted EBITDAre is a non-GAAP measure. Refer to slide 5 for a reconciliation of Net 4 Income to Adjusted EBITDAre

Reconciliation of Non-GAAP Measures Calculation of Pro-Forma Consolidated Net Debt December 31, 2019 This presentation includes disclosure of Adjusted EBITDAre, which is a non-GAAP financial measure. Consolidated Debt $ 1,647,478 We define Adjusted EBITDAre as EBITDAre, computed in accordance with standards established Less: Cash and Cash Equivalents (2,355) by the National Association of Real Estate Investment Trusts (“Nareit”), plus non-cash compensation, other Net Consolidated Debt $ 1,645,123 non-recurring items, and the pro forma impact of Less: Reductions to Outstanding Line of Credit Balance investment activity. We consider Adjusted EBITDAre (159,000) ($180mm as of March 19, 2020 vs $339mm as of December 31, 2019) an important measure because it provides additional information to allow management, investors, and our Pro-Forma Consolidated Net Debt $ 1,486,123 current and potential creditors to evaluate and compare our core operating results and our ability to service debt. Calculation of Pro-Forma Consolidated Net Debt to Three Months Ended Consolidated Adjusted EBITDAre December 31, 2019 For purposes of the Securities and Exchange Commission’s (“SEC”) Regulation G, a non-GAAP Net Income $ 42,751 financial measure is a numerical measure of a Depreciation and Amortization Expense 37,088 company’s historical or future financial performance, financial position or cash flows that excludes Interest Expense 16,515 amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the Gain on the Sale of Investment Properties (27,867) most directly comparable financial measure calculated Proportionate Share of Unconsolidated JV Adjustments 1,048 and presented in accordance with GAAP in the statements of operations, balance sheets or EBTDAre $ 69,535 statements of cash flows (or equivalent statements) of the company, or includes amounts, or is subject to Non-Cash Share Compensation Expense 2,254 adjustments that have the effect of including amounts, Net Non-Cash Changes in Fair Value (36) that are excluded from the most directly comparable financial measure so calculated and presented. Pro-Forma Adjustments for Investment Activity (626) As used in this presentation, GAAP refers to generally Adjusted EBITDAre $ 71,127 accepted accounting principles in the United States of Amounts Attributable to Unconsolidated JVs (2,355) America. Our use of the non-GAAP financial measure terms herein may not be comparable to that of other Consolidated Adjusted EBITDAre $ 68,772 real estate investment trusts. Pursuant to the requirements of Regulation G, we have provided Annualized $ 275,088 reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures. Pro-Forma Consolidated Net Debt / Annualized Consolidated Adjusted EBITDAre 5.4x 5