Attached files

| file | filename |

|---|---|

| 10-K - 10-K - Federal Home Loan Bank of Cincinnati | fhlbcin201910-k.htm |

| EX-99.2 - EXHIBIT 99.2 - Federal Home Loan Bank of Cincinnati | ex992201910-k.htm |

| EX-99.1 - EXHIBIT 99.1 - Federal Home Loan Bank of Cincinnati | ex991201910-k.htm |

| EX-32 - EXHIBIT 32 - Federal Home Loan Bank of Cincinnati | ex32201910-k.htm |

| EX-31.2 - EXHIBIT 31.2 - Federal Home Loan Bank of Cincinnati | ex312201910-k.htm |

| EX-31.1 - EXHIBIT 31.1 - Federal Home Loan Bank of Cincinnati | ex311201910-k.htm |

| EX-4.2 - EXHIBIT 4.2 - Federal Home Loan Bank of Cincinnati | ex42201910-k.htm |

Exhibit 10.7

FEDERAL HOME LOAN BANK OF CINCINNATI

Incentive Compensation Plan

Plan Document

Plan Document

As of January 1, 2020

Approved November 21, 2019

i

FEDERAL HOME LOAN BANK OF CINCINNATI

Incentive Compensation Plan

Table Of Contents | |||

Page | |||

Overview | 1 | ||

1. | Plan Objectives | 2 | |

2. | Definitions | 2 | |

3. | Eligibility | 5 | |

4. | Incentive Award Opportunity | 6 | |

5. | Performance Mix | 7 | |

6. | Performance Measures | 7 | |

7. | Award Determination | 8 | |

8. | Preconditions to Award | 9 | |

9. | Vesting of Awards, Timing of Benefit Payments | 11 | |

10. | Plan Communication | 12 | |

11. | Administrative Control | 12 | |

12. | Miscellaneous Conditions | 13 | |

Appendices | 17 | ||

Appendix A: Plan Participants | 18 | ||

Appendix B: Award Opportunity and Performance Mix | 19 | ||

Appendix C: Annual Performance Measures | 20 | ||

Appendix D: Performance Measures Long-Term Deferred Component | 21 | ||

Appendix E: Performance Measures for Chief Risk Officer and ERM | 22 | ||

FEDERAL HOME LOAN BANK OF CINCINNATI

Incentive Compensation Plan

PLAN DOCUMENT

Overview

The Incentive Compensation Plan is a cash-based annual incentive plan with a deferral component established to provide incentive award opportunities related to the achievement of Bankwide and individual performance objectives by eligible Participants. Performance is evaluated on an annual basis using annual performance measures to determine a total incentive award opportunity. Subject to the conditions described herein, an approved award is paid in cash shortly after the close of the year to which the performance incentive relates. With regard to Participant Levels I through V, a portion of the earned incentive award is mandatorily deferred for three years after the end of the Plan year to which the incentive relates; and the payment of the Deferred Award is based on whether applicable safety and soundness measures are achieved during the three-year Deferral Period.

1. Plan Objectives

1.1 | The purpose of the Federal Home Loan Bank of Cincinnati's Incentive Compensation Plan is to achieve the following: |

1.1.1 | Promote awareness and achievement of the Bank's annual and long-term profitability and business goals; |

1.1.2 | Link performance and compensation to specific Bankwide and individual performance measures; |

1.1.3 | Provide a competitive reward structure for officers and other employees; |

1.1.4 | Provide a vehicle for closer Board involvement and communication with management regarding Bank strategic plans; and |

1.1.5 | Promote loyalty and dedication to the Bank and its objectives. |

2. | Definitions |

2.1 | When used in the Incentive Compensation Plan, the following words and phrases shall have the following meaning: |

2.1.1 | Annual Incentive Award means the award based upon the results of a single Plan year, the Eligibility Level, Performance Mix, and other factors detailed in this Plan. |

2.1.2 | Audit Committee means the Audit Committee of the Board. |

2.1.3 | Bank means the Federal Home Loan Bank of Cincinnati. |

2.1.4 | Board means the Bank's Board of Directors. |

2.1.5 | Chief Risk Officer means the Bank’s Chief Risk Officer. |

2.1.6 | Deferred Award means the portion of the Annual Incentive Award Opportunity that is mandatorily deferred for the applicable Deferral Period and which is payable if applicable safety and soundness measures over the Deferral Period are achieved. A rate of interest equal to the Pre-Map effective interest rate in the Defined Benefit Pension plan will be applied annually and be adjusted annually based on any changes in the rate reported by the Defined Benefit Pension plan administrator. |

2

2.1.7 | Deferral Period means the three-year period over which a portion of the Annual Incentive Award for a Participant in Level I, II, III, IV, or V is mandatorily deferred and over which applicable safety and soundness measures must be achieved before payment to the Participant. |

2.1.8 | Disability means a Participant who (i) is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, or (ii) is, by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, receiving income replacement benefits for a period of not less than three months under an accident and health plan covering employees of the Bank. All determinations as to the date and extent of disability shall be made upon the basis of such evidence, including independent medical reports and data, as the Human Resources, Compensation and Inclusion Committee (“Committee”) deems necessary and desirable. All determinations of the Committee shall be final and binding. |

2.1.9 | Enterprise Risk Management (“ERM”) means the Bank’s Enterprise Risk Management department. |

2.1.10 | Executive Officers means the Bank’s Named Executive Officers. |

2.1.11 | Extraordinary Events may include changes in business strategy, impact of severe economic fluctuations, significant growth or consolidation of the membership base or other factors that materially impact the Bank or the Federal Home Loan Bank system. |

2.1.12 | Final Award means the amount ultimately paid to a Participant under the Plan. With respect to Participants in Levels VI, VII, VIII and IX, each year the Final Award will be composed solely of that immediately preceding year’s Annual Incentive Award. With respect to Participants in Levels I, II, III, IV, and V the Final Award for each year will be composed of a combination of that immediately preceding year’s Annual Incentive Award and the Deferred Award. |

2.1.13 | Human Resources, Compensation and Inclusion Committee or Committee means the Human Resources, Compensation and Inclusion Committee of the Board. |

3

2.1.14 | Incentive Award Opportunity means the award that may be earned at various levels (Threshold, Target and Maximum) based on the Plan year results, the Eligibility Level, and Performance Mix and other factors detailed in this Plan. |

2.1.15 | Internal Audit Department means the Bank’s Internal Audit Department. |

2.1.16 | Participant means a person who, at the discretion of the Board, is eligible to take part in the Plan for a designated Plan year and/or Deferral Period, and whose position is included in one of the levels defined within this Plan or who has been separately named as a Participant for that Plan year by the President, with the concurrence of the Committee. |

2.1.17 | Performance Measure means each performance factor that is taken into consideration under the Plan in determining the value of the Final Award. |

2.1.18 | Performance Mix means the weighting of Performance Measures taken into consideration under the Plan in determining the value of the Final Award. |

2.1.19 | Performance Period means the period of time over which Bank performance is measured. In the case of a Participant in Level VI, VII, VIII, or IX this is the Plan year. In the case of any Participant in Level I, II, III,IV, or V this is the Plan year and the Deferral Period. |

2.1.20 | Plan means this Incentive Compensation Plan. |

2.1.21 | Plan Administrator means the Board or its designee(s). |

2.1.22 | Plan Year means the calendar year, January 1 through December 31, over which both Bank and Participant performance is measured. |

2.1.23 | President means the President of the Bank. |

2.1.24 | Retire, Retires, or Retirement mean a Participant’s Separation from Service after the Participant has (i) been employed with the Bank for at least five (5) years and (ii) reached at least age 62 or (iii) age plus service equals 70. |

2.1.25 | Senior Officer means an officer with a rank of Senior Vice President or above. |

4

2.1.26 | Separation from Service or Separates from Service means, generally, a termination of employment with the Bank. Except in the case of a Participant on a bona fide leave of absence as provided below, a Participant is deemed to have incurred a Separation from Service if the Bank and the Participant reasonably anticipate that the level of services to be performed by the Participant after a certain date will be reduced to 20% or less of the average services rendered by the Participant during the immediately preceding 36-month period (or the total period of employment, if less than 36 months), disregarding periods during which the Participant was on a bona fide leave of absence. A Participant who is absent from work due to military leave, sick leave, or other bona fide leave of absence shall incur a Separation from Service on the first date immediately following the later of (i) the six-month anniversary of the commencement of the leave or (ii) the expiration of the Participant’s right, if any, to reemployment under statute or contract. For purposes of determining whether a Separation from Service has occurred, the Bank means, with respect to employees it employs, the Bank and each corporation, trade or business that, together with the Bank, is treated as a single employer under Code Section 414(b) or (c), except that common ownership of at least 50% shall be determinative. The Committee will determine, in accordance with Code Section 409A, whether a Separation from Service has occurred. |

2.1.27 | Target Award Opportunity means the award that may be earned during a Performance Period for achieving target performance levels under each Performance Measure. |

3. | Eligibility |

3.1 | Eligibility shall normally be limited to all Employees who: |

• | occupy positions with an employment status of scheduled full time or scheduled part time as of December 31st of the Plan year; and |

• | are not in a probationary period due to poor performance or disciplinary action or have received an overall rating equal to or below 3.0 at the time of payment of the Final Award. |

3.2 | Employees of the Bank who are hired into an eligible position by August 31st of the Plan year shall be eligible for participation in the Plan in accord with Section 3.1, and shall receive a prorated incentive award. |

5

3.3 | Employees of the Bank who are hired into an eligible position on or after September 1st of the Plan year will only be eligible to participate for that Plan year if specifically nominated by the President and shall receive a prorated incentive award. |

3.4 | The Chief Risk and Compliance Officer and other ERM officers and staff will participate in the Plan but their award opportunities will be weighted 75 percent on the Bank-wide program and 25 percent on ERM-specific goals. |

3.5 | Due to its unique role for the Bank and reporting relationship to the Board, the Internal Audit Department will not be included as eligible positions under the Plan, but will be eligible for a similar plan administered by the Audit Committee. |

3.6 | There will be nine levels of participation, with participation in the cash and deferral features of the Plan as follows: |

Applicable Feature | |||

Annual Cash Payment | Mandatory Deferral | ||

Level I: | President | Yes | Yes |

Level II: | Executive Vice Presidents | Yes | Yes |

Level III: | Senior Vice Presidents | Yes | Yes |

Level IV | First Vice Presidents | Yes | Yes |

Level V: | Vice Presidents | Yes | Yes |

Level VI: | Assistant Vice Presidents/Functional Officers | Yes | No |

Level VII: | Professional Staff (Grade 15 and above) | Yes | No |

Level VIII: | Other Exempt Employees (Grade 14 and below) | Yes | No |

Level IX: | Other Non-exempt Employees | Yes | No |

4. | Incentive Award Opportunity |

4.1 | Each Plan year, the Bank will provide an award opportunity to Participants. The award opportunity shall be a percentage of each Participant's compensation. Certain executive positions have a greater and more direct impact than others on the annual success of the Bank; therefore, these differences are recognized by varying award opportunities for each Participant level. (See Appendix B – Incentive Award Opportunity and Performance Mix for current Plan year award opportunities.) |

6

4.2 | Compensation for Levels I through VI is defined as the applicable Participants’ base salary including any salary adjustments made during the Plan year. |

4.3 | Compensation for levels VII, VIII and IX is defined as the sum of the applicable Participant’s base pay including any salary adjustments made during, as well as shift differential and overtime paid through the Plan year. |

4.4 | In addition to the incentive award opportunity described above, the President may also approve an additional discretionary incentive award opportunity (the “President’s Award”) for employees in Levels VII, VIII and IX. Based upon the recommendation of a Senior Officer, an employee in Level VII, VIII or IX may be nominated for a President’s Award in order to recognize extraordinary individual performance or to address competitive compensation practices within the Bank’s labor market. Generally, the President’s Award will not exceed an additional ten percent (10%) incentive opportunity for the Participant based on compensation as defined in section 4.3. |

5. | Performance Mix |

5.1 | Participants will earn their incentive award by achieving a combination of Bankwide objectives and individual goals. |

5.2 | A Level I, II, III, IV, VII, VIII, or IX Participant will earn an incentive award based solely on the achievement of Bankwide objectives. |

5.3 | The incentive award of a Level V or VI Participant will be weighted between Bankwide objectives and individual goals and will vary by Participant level. The more control and influence a Participant has on Bankwide goals, the greater the Participant's weighting on Bank goals will be. Likewise, the less control and influence a Participant has on Bankwide goals, the greater the weighting on that Participant's individual goals. See Appendix B – Incentive Award Opportunity and Performance Mix for current Plan year weightings. |

6. | Performance Measures |

6.1 | Bankwide and individual performance measures will be established with respect to each Plan year. Three achievement levels will be set for each Bankwide and, where applicable, individual measure, and include: |

Threshold | The minimum achievement level accepted for the Performance Measure. |

7

Target | The planned achievement level for the Performance Measure. |

Maximum | The achievement level for the Performance Measure which substantially exceeds (as defined by the Committee) the planned level of achievement. |

6.2 | Bankwide measures will be established by the Committee with Board approval. See Appendix C - Annual Bank Performance Measures and Bank Safety and Soundness Measures for the Deferred Award. |

6.3 | Participants in Levels V and VI typically will have three to five major individual goals established that reflect the priorities of the Participant for the Plan year. Each goal will be weighted to reflect its relative importance, with a minimum weight of 10 percent per goal. In order to be eligible to receive an incentive award based on his or her individual performance, a Level IV or V Participant must submit his or her individual goals in writing to their Senior Officer and the President may approve or modify those goals. |

6.4 | All individual performance goals are to remain in effect for the entire Plan year, however, after the Plan year commences, at the sole discretion of the Committee with Board approval, the Committee may revise Bank Performance Measures and/or the President may also revise individual performance goals for the Plan year. All material changes, which occur after initial Finance Agency review and which impact Executive Officers are subject to further Finance Agency review. |

7. | Award Determination |

7.1 | The method of determining the Annual Incentive Award will be according to the following sequence: |

7.1.1 | Define the dollar value of the Target Award Opportunity for the Participant. |

7.1.2 | Determine the amount of the Target Award Opportunity that is attributable to Bank performance and to individual performance. |

7.1.3 | After the Plan year ends, evaluate actual Bank performance against the Bankwide Performance Measures stated in Appendix C. Assess Bank performance as it relates to the threshold, target and maximum awards, interpolating between the threshold, target, and maximum awards as necessary. |

8

7.1.4 | Using the award opportunity table described in Appendix B, determine the Bank incentive award by relating the level of actual Bank performance derived in 7.1.3 to the award opportunity for the Participant's level. Interpolate between the threshold, target, and maximum awards as necessary. |

7.1.5 | After the Plan year ends, where applicable, evaluate actual individual Participant performance against the individual performance goals. Assess performance as it relates to the threshold, target, and maximum performance measures. |

7.1.6 | Using the award opportunity table in Appendix B, determine the individual incentive award by relating the level of actual individual performance derived in 7.1.5 to the award opportunity for the Participant's Level. Interpolate between the threshold, target and maximum awards as necessary. |

7.1.7 | Sum the Bank and individual awards to determine a total award for each Participant. The President with Committee approval may recommend the Board adjust the award of a Participant or one or more Levels of Participants. The Committee may recommend the Board adjust the award of the President. All material changes, which occur after initial Finance Agency review and which impact Executive Officers are subject to further Finance Agency review. |

7.1.8 | Determine whether the Participant is eligible to receive an incentive award for the Plan year and applicable Deferral Period by applying the rules of Sections 8 and 9 below. |

8. | Preconditions to Award |

8.1 | Certain preconditions must be satisfied before a final award may be made to a Participant: |

8.1.1 | The Bank must achieve one or more of the threshold measures of performance as defined in Appendix C; |

8.1.2 | The President must determine and the Committee must concur that Bank performance is consistent with bestowing achievement awards; and |

8.1.3 | The Participant's immediate supervisor and the President must determine that the individual's overall performance meets their expectations. The President's performance (Level I) will be |

9

appraised by the Committee. All other Participants will be appraised by the President and/or the Participant's immediate supervisor.

8.2 | Should any individual Participant's performance meet these expectations but the Bank fail to achieve one or more of its threshold performance measures no Final Award will be made to any Participant (see exception in Section 8.3). Likewise, if the Bank achieves all its threshold performance measures but a Participant's performance fails to meet such expectations no Final Award will be made to that Participant. |

8.3 | In the event the Bank does not achieve threshold performance levels, the President may recommend, with the concurrence of the Committee, an incentive award for extraordinary individual performance. Additionally or alternatively, at the Committee’s sole discretion, an incentive award may be recommended for Bank performance below threshold subject to final approval by the Board of Directors. All material changes, which occur after initial Finance Agency review and which impact Executive Officers are subject to further Finance Agency review. |

8.4 | The Level I, II, III, IV, and V Participants shall not receive a Final Award under this Plan if during the most recent examination of the Bank by the Federal Housing Finance Agency (“FHFA”), the Bank received the lowest Composite Rating (as defined in the FHLBank Rating System) indicating the Bank has been found to be operating in an unacceptable manner, exhibits serious deficiencies in corporate governance, risk management or financial condition and performance, or in substantial noncompliance with laws, FHFA regulations or supervisory guidance. Any awards to Levels VI, VII and VIII under these conditions are at the sole discretion of the Committee. |

8.5 | Furthermore, the incentive award calculated may be reduced (but not to a number that is less than zero), for all Participants or for an individual Participant, as applicable, if the Committee in its discretion determine that any of the following occur such that if it had occurred prior to the payment of the award, it would have negatively impacted the goal results and/or been determined that it should have reduced the associated payout calculation: |

8.5.1 | Operational errors or omissions resulting in material revisions to: the financial results, information submitted to FHFA or payout calculation, or other data used to determine the award; |

8.5.2 | Submission of significant information to the Securities and Exchange Commission, Office of Finance and/or FHFA materially beyond any deadline or applicable grace period, other |

10

than late submissions that are caused by acts of God or other events beyond the reasonable control of the Participants; or

8.5.3 | Failure by the Bank to make sufficient progress, as determined by the Committee, in the timely remediation of examination and other supervisory findings and matters requiring attention. |

9. | Vesting of Awards, Timing of Benefit Payments |

9.1 | Except as provided in Sections 9.2, 9.3, or 9.4 below, a Participant must be employed by the Bank both on the last day of the Performance Period and on the date the Final Award payment is made as authorized by the Board. |

9.2 | Any Participant on an approved bona fide leave of absence on the date the Board authorizes the payment of the Final Award applicable to that Participant shall be paid his or her Final Award according to the normal payment schedule. |

9.3 | Except as provided in Section 9.3.1, 9.3.2, or 9.4 below, in the event a Participant voluntarily or involuntarily terminates employment during the Performance Period, no Final Award will be made to the Participant. |

9.3.1 | A Participant who dies or becomes Disabled during the Performance Period may receive a Final Award which is prorated for the applicable period, but only if the President nominates and the Board approves such action. In any such case, all Deferral Period payments will be made at the target level. Any Participant who becomes eligible for a prorated Final Award pursuant to this Section will be paid such Final Award, as soon as practicable following his or her death or Disability but in all events, no later than 2½ months following the close of the calendar year in which the death or Disability occurred. |

9.3.2 | A Participant who Retires during the Performance Period may receive an Annual Incentive Award prorated for the applicable period. Any incentive award payments made pursuant to this Section will continue to be earned and evaluated according to the otherwise applicable criteria and shall be paid according to the normal payment schedule. If the Participant has a Deferred Award, those awards will continue to vest and will be paid out according to the applicable criteria and according to the normal payment schedule. |

9.4 | If a Participant ceases employment during the Performance Period or after the Performance Period but before the Board approves the Final Award for |

11

that Performance Period, the President may nominate and the Board may approve the Participant to receive a Final Award. In any such case, the Participant’s Final Award shall be paid according to the normal payment schedule.

9.5 | Each Final Award shall be paid no later than 2½ months following the close of the calendar year in which the applicable Performance Period ends. This means that any Annual Incentive Award (because it is not subject to mandatory deferral) shall be paid no later than 2½ months following the close of the calendar year to which it relates; and any Deferred Incentive Award will be paid no later than 2½ months following the close of the calendar year in which the mandatory three-year Deferral Period ends. In the case of Executive Officers, the Final Award is subject to Agency review prior to payment. |

9.6 | All Final Awards will be paid out in cash and will be subject to applicable payroll tax withholdings. |

9.7 | No Final Award shall be considered as compensation under any employee benefit plan of the Bank, except as determined by the Board. |

10. | Plan Communication |

10.1 | The Plan administrator will communicate with Participants regarding the Plan according to the following schedule: |

First quarter of the Plan year | Communicate Bankwide and individual goals for Plan year. |

Quarterly | Interim assessments of progress toward achieving Bank and individual goals. |

End of Plan year | Final assessment of Bank and individual performance. |

11. | Administrative Control |

11.1 | The Board has ultimate authority over the Plan, however, the Board may delegate any and all of its authority regarding the administration and amendment of the Plan to a committee or individual designee. Notwithstanding the foregoing, the Board reserves unto itself the authority to terminate the Plan. |

11.2 | The Bank's First Vice President, Human Resources will assist, as requested, the President and the Committee in the administration of the |

12

particular provisions of the Plan delegated and specified throughout the Plan as the duties of the Committee and/or the President.

11.3 | In addition to the authority expressly provided in the Plan, the Board or its designee shall have such authority in its sole discretion to control and manage the operation and administration of the Plan and shall have all authority necessary to accomplish these purposes, including, but not limited to, the authority to interpret the terms of the Plan, and to decide questions regarding the Plan and the eligibility of any person to participate in the Plan and to receive benefits under the Plan. The Board’s determinations and interpretations regarding the Plan (or those of the Board’s designee) shall be final, binding, and conclusive. |

11.4 | The Board has the right to revise, modify, or terminate the Plan in whole or in part at any time or for any reason, and the right to modify any recommended incentive award amount (including the determination of a greater or lesser award, or no award), without the consent of any Participant. Any payment under the Plan may be impacted by Extraordinary Events, a failure to meet certain minimum financial performance or control requirements, and is subject to the claw back provisions described in Section 12.1. In the case of Plan termination, unless otherwise agreed by the Board, all Annual Incentive Awards and Deferred Awards hereunder which have not yet been paid are cancelled and forfeited. |

12. | Miscellaneous Conditions |

12.1 | Any undue incentives (the amount of the incentive over and above what should have been paid barring inaccurate, misstated and/or misleading achievement of financial or operational goals) paid to officers of the Bank (i.e., levels I-VI) based on achievement of financial or operational goals within this Plan that subsequently are deemed to be inaccurate, misstated or misleading shall be recoverable from the officer by the Bank. Inaccurate, misstated and/or misleading achievement of financial or operational goals includes, but is not limited to, overstated revenue, income, capital, return measures and/or understated credit risk, market risk, operational risk or expenses. Furthermore, the value of any benefits delivered or accrued related to the undue incentive shall be reduced and/or recovered by the Bank to the fullest extent possible. |

12.2 | Notwithstanding any Plan provision to the contrary, mere participation in the Plan will not entitle a Participant to an award. |

12.3 | The right of the Bank to discipline or discharge a Participant shall not be affected by reason of any provision of this Plan. The designation of an employee as a Participant in the Plan does not guarantee employment. |

13

Nothing in this Plan shall be deemed (i) to give any employee or Participant any legal or equitable rights against the Bank, except as expressly provided herein or provided by law; or (ii) to create a contract of employment with any employee or Participant, to obligate the Bank to continue the service of any employee or Participant, or to affect or modify any employee's or Participant's term of employment in any way.

12.4 | No employee has a guaranteed right to any award under this Plan, and any attempt by an employee to sell, transfer, assign, pledge, or otherwise encumber any anticipated award shall be void, and the Bank shall not be liable in any manner for or subject to the debts, contracts, liabilities, engagements or torts of any person who might anticipate an award under this program. |

12.5 | This Plan shall at all times be entirely unfunded and no provision shall at any time be made with respect to segregating assets of the Bank for payment of any award under this program. If the Bank in its sole and absolute discretion chooses to maintain one or more trusts for the purpose of facilitating the payment of benefits or expenses hereunder, the following provisions shall apply: |

12.5.1 | the Bank may set aside in such trust such amount as it deems, in its sole and absolute discretion, necessary to assist it in meeting its obligations to Participants and beneficiaries hereunder; |

12.5.2 | any amount so set aside shall remain subject to the claims of the Bank’s general creditors; and |

12.5.3 | no such trust nor the assets held therein shall be located outside of the United States of America. |

12.6 | The Plan shall be construed, regulated and administered in accordance with the laws of the state of Ohio, unless otherwise preempted by the laws of the United States. |

12.7 | If any provision of the Plan is held invalid or unenforceable, its invalidity or unenforceability shall not affect any other provision of the Plan, and the Plan shall be construed and enforced as if such provision had not been included herein. |

12.8 | If a Participant dies before receiving his or her award, any amounts determined to be paid under this Plan shall be paid to the Participant’s surviving spouse, if any, or if none, to the Participant’s estate. The Bank's determination as to the identity of the proper payee of any amount under this Plan shall be binding and conclusive and payment in accordance with |

14

such determination shall constitute a complete discharge of all obligations on account of such amount.

12.9 | Claims and Appeals Procedures. A Participant (such Participant being referred to below as a “Claimant”) may deliver to the Committee a written claim for a determination with respect to any claim under this Plan. If such a claim relates to the contents of a notice received by the Claimant, the claim must be made within sixty (60) days after such notice was received by the Claimant. The claim must state with particularity the determination desired by the Claimant. |

The Committee shall consider a Claimant's claim within a reasonable time, but no later than one-hundred-twenty (120) days after receiving the claim. If the Committee determines that special circumstances require an extension of time for processing the claim, written notice of the extension shall be furnished to the Claimant prior to the termination of the initial one-hundred-twenty (120) day period. Upon reaching its decision, the Committee shall notify the Claimant in writing.

On or before sixty (60) days after receiving a notice from the Committee that a claim has been denied, in whole or in part, a Claimant (or the Claimant's duly authorized representative) may file with the Committee a written request for a review of the denial of the claim. The Committee shall render its decision on review promptly, in writing, and deliver it to the Claimant no later than one-hundred-twenty (120) days after it receives the Claimant’s written request for a review of the denial of the claim. If the Committee fails to render a decision within that time frame, the claim is deemed denied. The Committee’s decision upon review is final and binding upon the Participant, any beneficiary of the Participant, or any other person who claims to derive a benefit under this Plan by reference to the Participant.

12.10 | Deadline to File Legal Action and Venue. Any legal actions, suits or proceedings pertaining to this Plan shall be brought in the courts of Hamilton County, Ohio (whether federal or state) and the Participant, by submission of his or her individual goals hereunder to the President (or in the case of the President, to the Board or Committee), on his or her behalf and on behalf of his or her beneficiaries, persons claiming to be a beneficiary or any other persons who claim to derive a benefit under this Plan by reference to the Participant hereby irrevocably submits to the exclusive jurisdiction of said courts. The Participant on his or her behalf and on behalf of his or her beneficiaries, persons claiming to be a beneficiary or any other persons who claim to derive a benefit under this Plan by reference to the Participant hereby waives, to the fullest extent permitted by law, any objections he or she, his or her beneficiaries or any |

15

such persons may now or hereafter have to the laying of venue in any suit, action or proceeding hereunder in any court, as well as any right he or she, his or her beneficiaries or any such persons may now or hereafter have to remove any such suit, action or proceeding once commenced to another court in any jurisdiction on the grounds of forum non conveniens or otherwise.

No legal action to recover benefits under this Plan or any other action arising from, or related to, this Plan may be brought by any Claimant on any matter pertaining to this Plan unless the legal action is commenced in the proper forum as required by this Section within:

(a) 180 days of the date on which the Claimant knew or reasonably should have known of the principal facts on which the claim is based, or

(b) 180 days after the Claimant has exhausted the claims procedures set forth in Section 12.9.

For purpose of applying the foregoing provisions, knowledge of all facts that the Participant knew or reasonably should have known shall be imputed to every Claimant who is or claims to be a beneficiary of the Participant or otherwise claims to derive a benefit under this Plan by reference to the Participant.

12.11 | Any agreements or representations, oral or otherwise, express or implied, with respect to the subject matter of this Plan which are not contained herein will have no effect or enforceability. |

12.12 | This Plan and the awards hereunder are exempt from the Employee Retirement Income Security Act of 1973, as amended, on account of the Bank being a governmental entity. This Plan and the awards hereunder are intended to comply with or be exempt from Section 409A of the Internal Revenue Code of 1986, as amended, and the regulations promulgated thereunder. Additionally, this Plan and the awards hereunder are intended to comply with the requirements of FHFA regulations and supervisory guidance and in accordance with Section 1116 of the Housing and Economic Recovery Act of 2008. |

16

APPENDICES

17

APPENDIX A:

Plan Participants – 2020 Plan Year

Level | Title | |

I | President & CEO* | |

II | Executive Vice Presidents * | |

III | Senior Vice Presidents* | |

IV | First Vice Presidents* | |

V | Vice Presidents* | |

VI | Assistant Vice Presidents, Functional Officers* | |

VII | Professional Staff (Grades 15 and above) | |

VIII | Professional Staff (exempt status below grade 15) | |

IX | Administrative Staff (non-exempt) | |

* Levels I-VI represent Officers of the Bank

18

APPENDIX B:

Incentive Award Opportunity to be applied to each Plan year (as a percentage of compensation)1 2

Achievement Levels

Level | Threshold | Target | Maximum | Deferral |

I | 50.0% | 75.0% | 100.0% | 50% |

II | 40.0% | 60.0% | 80.0% | 50% |

III | 35.0% | 52.5% | 70.0% | 50% |

IV | 32.5% | 48.75% | 65.0% | 40% |

V | 30.0% | 45.0% | 60.0% | 35% |

VI | 12.5% | 18.75% | 25.0% | NA |

VII | 7.75% | 11.625% | 15.5% | NA |

VIII | 5.25% | 7.875% | 10.5% | NA |

IX | 4.0% | 6.0% | 8.0% | NA |

Weightings to be applied to each Plan year:

Level | Bank | Individual |

I | 100% | 0% |

II | 100% | 0% |

III | 100% | 0% |

IV | 100% | 0% |

V | 75% | 25% |

VI | 60% | 40% |

VII | 100% | 0% |

VIII | 100% | 0% |

IX | 100% | 0% |

For each year within the deferral period, a rate of interest equal to the pension plan pre-map effective interest rate will be applied annually, which may be increased or decreased.

1 Earned incentive awards that fall between any of the designated achievement levels (i.e., threshold, target, and maximum) will be interpolated.

2 See Section 3 with regards to the further weighting that applies to the ERM department.

19

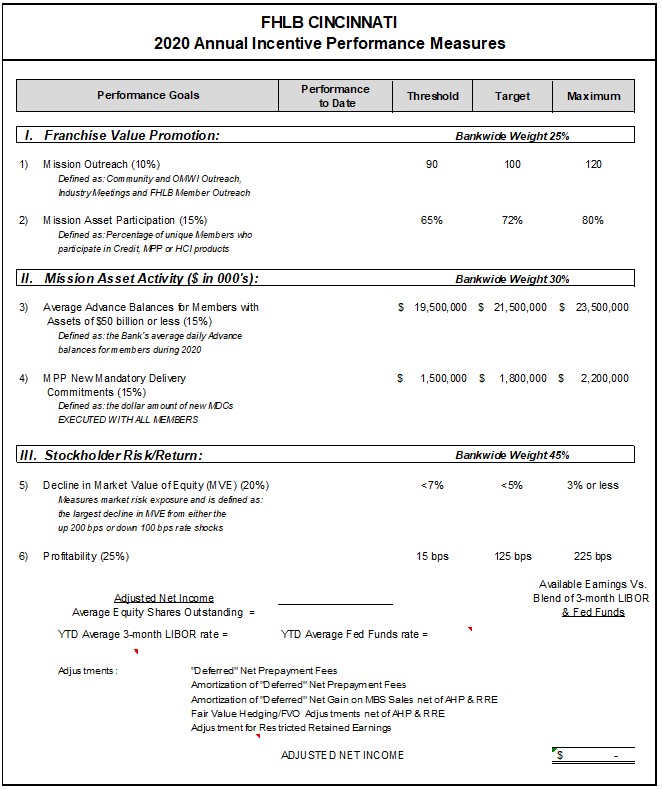

APPENDIX C:

2020 Annual Bank Performance Measures

There will be six (6) Bank annual performance measures for the 2020 Plan Year.

20

APPENDIX D:

Bank Safety and Soundness Measures for the Deferred Award

There will be one safety and soundness measure for the Deferred Award for the period covering 2020-2022.

2020-2022 (2019 Deferred Annual Incentive): | Weight |

Market Capitalization Ratio (1) greater than 100% | 100% |

(1) Ratio of Market Value of Equity (MVE) to Par Value of Regulatory Capital Stock measured as lower of up 200 bps and sliding scale for down rate shock. | |

21

APPENDIX E:

2020 Incentive Compensation Program

For Chief Risk Officer and Enterprise Risk Management Department

Composition of Annual Incentive Compensation Program

The incentive program for the Chief Risk Officer and ERM Department will be comprised of both the bank-wide goals and ERM department specific goals related to risk management.

Bank-Wide Program: 75%

ERM-Department Program: 25%

Goals

Threshold: Aggregate of 3 goals completed

Target: Aggregate of 4 goals completed

Outstanding: Aggregate of 5 goals completed

Each specific ERM department goal may be granted partial credit in increments of 0.25 (a 1.00 would indicate a strategy was completed and thus given 100 percent credit). However, individual goals with achievement of less than 100 percent will be counted as eligible only if at least three individual goals are achieved at a 100 percent level. Each eligible goal receives the same weight.

The ERM Department goals are consistent with the Bank-wide Risk Management Plan.

The objectives for each goal indicate the minimum specific actions to be implemented in order to achieve the goal.

Satisfactory achievement of goals is determined by the President with documentation provided by the Chief Risk Officer and confirmation by Human Resources and Internal Audit.

Goal 1: Data Project

1. | Execute 2020 activities per the 2019 FMRA data project. |

2. | Complete initial tollgate associated with the bank strategy to centralize data management. |

3. | Develop a high level data management roadmap using input from the consulting engagement. |

Goal 2: Modeling

1. | Achieve cost efficiencies outlined in the 2020 budget regarding collateral pricing. |

2. | Develop a credit rating model for unsecured counterparties. |

3. | Validate the credit rating model for unsecured counterparties. |

22

Goal 3: Improve reporting

1. | Revise and enhance the tracking report within ERM (Model, EUC, risk assessment, operating incidents, and SOX). |

2. | Co-ordinate information supporting the Bankwide Risk Dashboard. |

3. | Develop quantitative metrics to better support the Bankwide Risk Dashboard risk positioning. |

Goal 4: Risk Management

1. | Provide assistance over the transition of duties from Operations Risk regarding Vendor Management and Records Management. |

2. | Co-ordinate activities described as “1-B” functions by holding four meetings in 2020. |

3. | Enhance current market risk measures by developing forward market risk metrics. |

Goal 5: Governance Risk Compliance

1. | Make a recommendation to proceed or not with Governance/Risk/Compliance and if decision to proceed then make a product recommendation. |

2. | Create a charter for a sub-committee of the Disclosure Committee to review SOX activities, hold at least 3 meetings of the sub-committee, provide a SAD report to the Disclosure Committee, and prepare minutes of the three meetings. |

23