Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHART INDUSTRIES INC | d889064d8k.htm |

Chart Industries Investor meetings, March 2020 Exhibit 99.1

Forward-Looking Statements Certain statements made in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning the Company’s business plans, including statements regarding completed acquisitions, cost synergies and efficiency savings, objectives, future orders, revenues, margins, earnings or performance, liquidity and cash flow, capital expenditures, business trends, governmental initiatives, including executive orders and other information that is not historical in nature. Forward-looking statements may be identified by terminology such as "may," "will," "should," "could," "expects," "anticipates," "believes," "projects," "forecasts," “outlook,” “guidance,” "continue," or the negative of such terms or comparable terminology. Forward-looking statements contained in this presentation or in other statements made by the Company are made based on management's expectations and beliefs concerning future events impacting the Company and are subject to uncertainties and factors relating to the Company's operations and business environment, all of which are difficult to predict and many of which are beyond the Company's control, that could cause the Company's actual results to differ materially from those matters expressed or implied by forward-looking statements. Factors that could cause the Company’s actual results to differ materially from those described in the forward-looking statements include: the Company’s ability to successful integrate recent acquisitions, and achieve the anticipated revenue, earnings, accretion and other benefits from these acquisitions; and the other factors discussed in Item 1A (Risk Factors) in the Company’s most recent Annual Report on Form 10-K filed with the SEC, which should be reviewed carefully. The Company undertakes no obligation to update or revise any forward-looking statement. This presentation contains non-GAAP financial information. Chart is a leading diversified global manufacturer of highly engineered equipment servicing multiple market applications in Energy and Industrial Gas. The majority of Chart's products are used throughout the liquid gas supply chain for purification, liquefaction, distribution, storage and end-use applications, a large portion of which are energy-related. Chart has domestic operations located across the United States and an international presence in Asia, Australia, Europe and the Americas. For more information, visit: http://www.chartindustries.com. © 2020 Chart Industries, Inc. Confidential and Proprietary

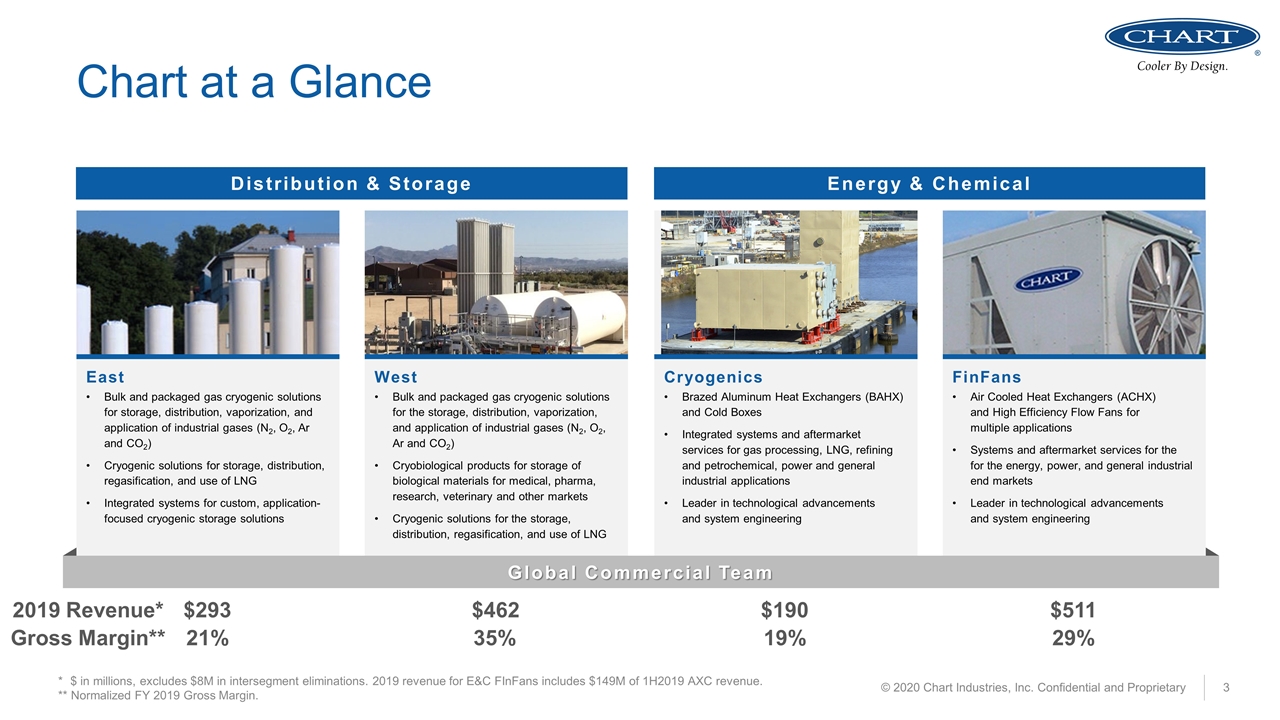

Chart at a Glance Cryogenics Brazed Aluminum Heat Exchangers (BAHX) and Cold Boxes Integrated systems and aftermarket services for gas processing, LNG, refining and petrochemical, power and general industrial applications Leader in technological advancements and system engineering FinFans Air Cooled Heat Exchangers (ACHX) and High Efficiency Flow Fans for multiple applications Systems and aftermarket services for the for the energy, power, and general industrial end markets Leader in technological advancements and system engineering East Bulk and packaged gas cryogenic solutions for storage, distribution, vaporization, and application of industrial gases (N2, O2, Ar and CO2) Cryogenic solutions for storage, distribution, regasification, and use of LNG Integrated systems for custom, application-focused cryogenic storage solutions West Bulk and packaged gas cryogenic solutions for the storage, distribution, vaporization, and application of industrial gases (N2, O2, Ar and CO2) Cryobiological products for storage of biological materials for medical, pharma, research, veterinary and other markets Cryogenic solutions for the storage, distribution, regasification, and use of LNG Energy & Chemical Distribution & Storage $293 Global Commercial Team $462 $190 21% 35% 19% $511 29% * $ in millions, excludes $8M in intersegment eliminations. 2019 revenue for E&C FInFans includes $149M of 1H2019 AXC revenue. ** Normalized FY 2019 Gross Margin. 2019 Revenue* Gross Margin** © 2020 Chart Industries, Inc. Confidential and Proprietary

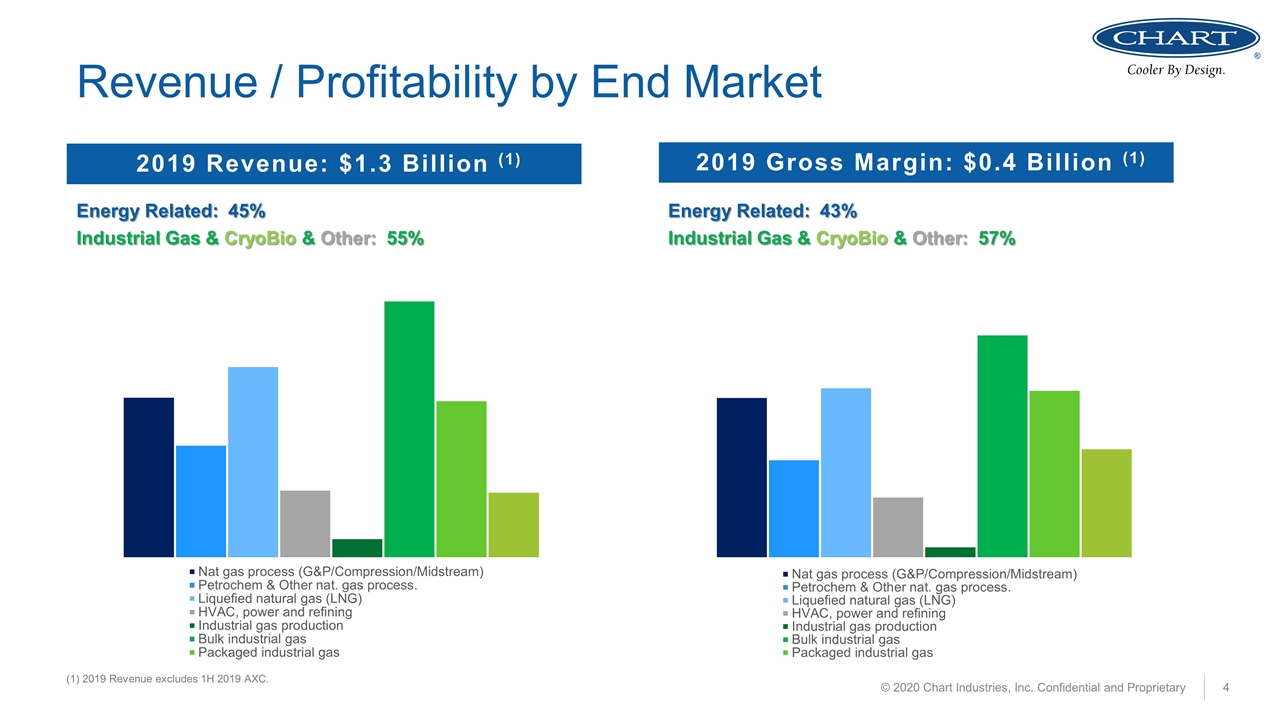

Revenue / Profitability by End Market © 2020 Chart Industries, Inc. Confidential and Proprietary Energy Related: 45% Industrial Gas & CryoBio & Other: 55% (1) 2019 Revenue excludes 1H 2019 AXC. 2019 Revenue: $1.3 Billion (1) 2019 Gross Margin: $0.4 Billion (1) Energy Related: 43% Industrial Gas & CryoBio & Other: 57%

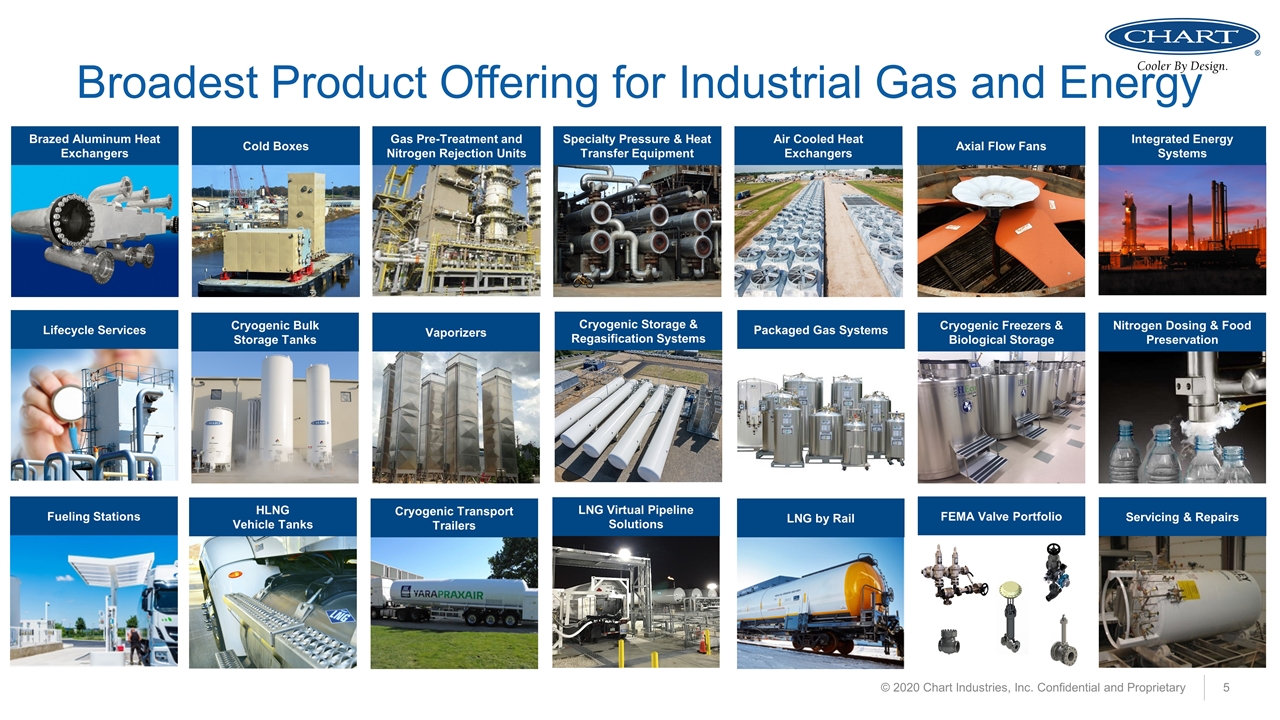

Broadest Product Offering for Industrial Gas and Energy © 2020 Chart Industries, Inc. Confidential and Proprietary Brazed Aluminum Heat Exchangers Packaged Gas Systems Cryogenic Bulk Storage Tanks Cryogenic Freezers & Biological Storage Nitrogen Dosing & Food Preservation LNG Virtual Pipeline Solutions Servicing & Repairs Vaporizers Gas Pre-Treatment and Nitrogen Rejection Units Fueling Stations HLNG Vehicle Tanks Cold Boxes Cryogenic Transport Trailers LNG by Rail Integrated Energy Systems Cryogenic Storage & Regasification Systems Lifecycle Services FEMA Valve Portfolio Air Cooled Heat Exchangers Axial Flow Fans Specialty Pressure & Heat Transfer Equipment

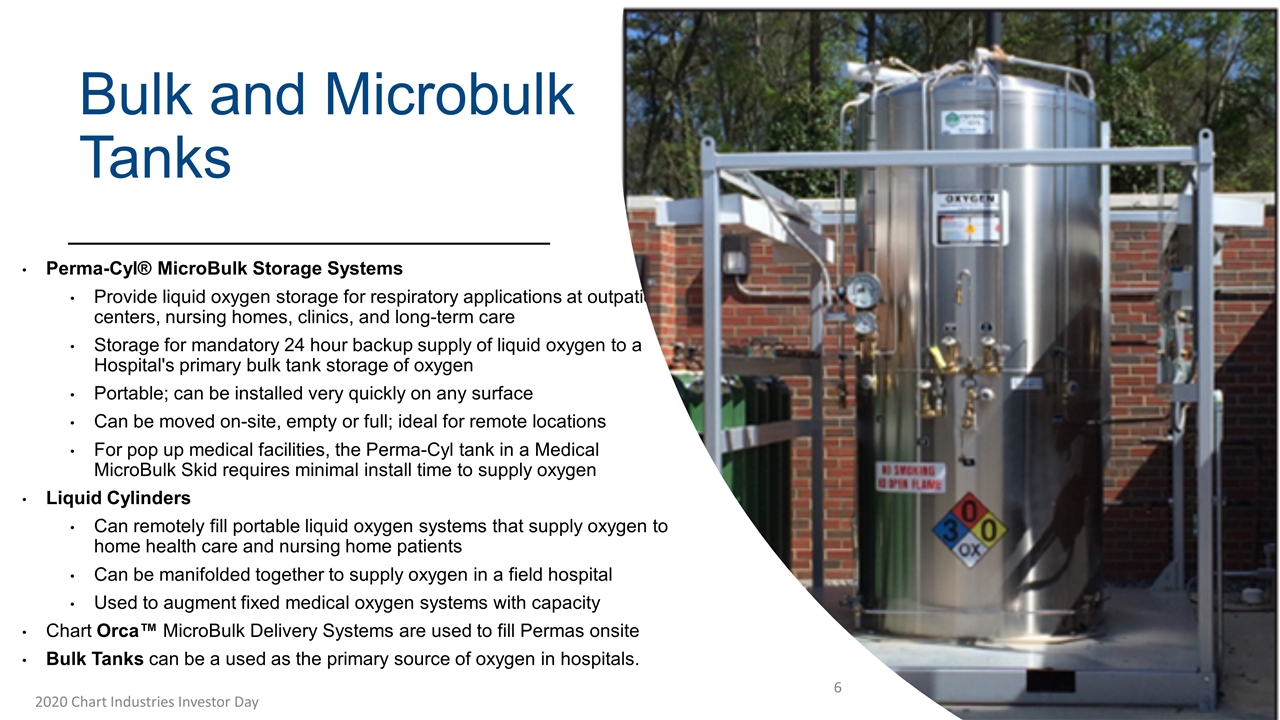

Bulk and Microbulk Tanks Perma-Cyl® MicroBulk Storage Systems Provide liquid oxygen storage for respiratory applications at outpatient centers, nursing homes, clinics, and long-term care Storage for mandatory 24 hour backup supply of liquid oxygen to a Hospital's primary bulk tank storage of oxygen Portable; can be installed very quickly on any surface Can be moved on-site, empty or full; ideal for remote locations For pop up medical facilities, the Perma-Cyl tank in a Medical MicroBulk Skid requires minimal install time to supply oxygen Liquid Cylinders Can remotely fill portable liquid oxygen systems that supply oxygen to home health care and nursing home patients Can be manifolded together to supply oxygen in a field hospital Used to augment fixed medical oxygen systems with capacity Chart Orca™ MicroBulk Delivery Systems are used to fill Permas onsite Bulk Tanks can be a used as the primary source of oxygen in hospitals. 2020 Chart Industries Investor Day

Cryobiological Shippers Vapor shippers used for shipment of biological samples, including viruses IATA (International Air Transport Association) approved containers rated as safe to transport hazardous biological samples Stainless steel freezers are used for storage of vaccinations, tissue, cells, blood and plasma) 2020 Chart Industries Investor Day

Liquid Nitrogen Dosing Systems Liquid Nitrogen Dosing Systems are critical to food preservation, bottling water and other beverages These are used for canned drinking water in emergency situations Chart supports the emergency water distribution efforts of non-profit Can'd Aid 2020 Chart Industries Investor Day

Why Do Customers Choose Chart? © 2020 Chart Industries, Inc. Confidential and Proprietary UPFRONT ENGINEERING TURNKEY SOLUTIONS BROADEST PRODUCT OFFERING APPLIED R&D AND LIFECYCLE SERVICES + +

Our Focused Strategy A B D C Broadest Product Offering for Industrial Gas & Energy Application and Customer Expansion Cryo-pump opportunity Repair & Service Specialty Markets Innovative Solutions Upfront Engineering Partnerships for new turnkey solutions Retrofit for efficiencies existing brownfield sites Margin Expansion Strategic location manufacturing International manufacturing for traditional US products 80/20 Strategic sourcing Thinking Disruptive Alternative business models Smart products (IOT) Community & Employees Environmental, Social & Governance Building capabilities to support other strategic pillars Branding © 2020 Chart Industries, Inc. Confidential and Proprietary 1. Market Trends 2. Profitable Growth E

Macro Trends Driving Our Business Reducing annual CO2 emissions from 36.8 to 16.5 billion tons Global power demand to increase 40% by 2035 and 85% by 2050 Water scarcity impacts 40% of the world’s population © 2019 Chart Industries, Inc. Confidential and Proprietary Paris Agreement IMO 2020 Subsidies / economic drivers Shift to “Gas economy” (i.e. India) Energy Transition Population Growth Sustainability Emissions Standards LNG by Rail Regulatory Drivers Significant Efforts By Countries Around the Globe

Two Growth Drivers Liquefaction, including Big LNG Marine Transportation (Rail, OTR, Trailers) Fueling Power © 2019 Chart Industries, Inc. Confidential and Proprietary #1 = Global LNG / Clean Energy Infrastructure Buildout #2 = Specialty Markets Storage Food & Beverage Hydrogen Lasers Water Treatment Space Cannabis

Leveraging Our Global Operations © 2020 Chart Industries, Inc. Confidential and Proprietary Corporate Headquarters Ball Ground, GA D&S West Ball Ground, GA New Prague, MN Fremont, CA McCarran, NV Houston, TX Brentwood, NH Americas E&C Cryogenics New Iberia, LA La Crosse, WI The Woodlands, TX Franklin, IN E&C FinFan Tulsa, OK Beasley, TX Monterey, MX (J.V.) D&S East Decin, Czech Republic Goch, Germany Monheim, Germany Gablingen, Germany Ornago, Italy Lery, France Pershore, UK Europe E&C Cryogenics Ornago, Italy Imbagnolo, Italy Busto Arsizio, Italy E&C FinFan Pombia, Italy D&S East Changzhou, China Chengdu, China Nanjing, China Chennai, India Sydney, Australia E&C FinFan Hyderabad, India Changshu, China Asia-Pacific

Being Responsible Globally © 2020 Chart Industries, Inc. Confidential and Proprietary Produce products used in clean energy and emissions reductions Customer offering of LifeCycle services to prolong product life and efficiency Community involvement Environmental Inclusive hiring practices Investing in training for all levels of employees Safety as a priority with zero accidents as the target of the program Focus on the communities in which we manufacture Over 18% of employees are veterans of their respective armed forces Social Separate Chairman and CEO 3 out of 8 female directors 7 out of 8 directors are independent Annual director elections and committee reviews Governance

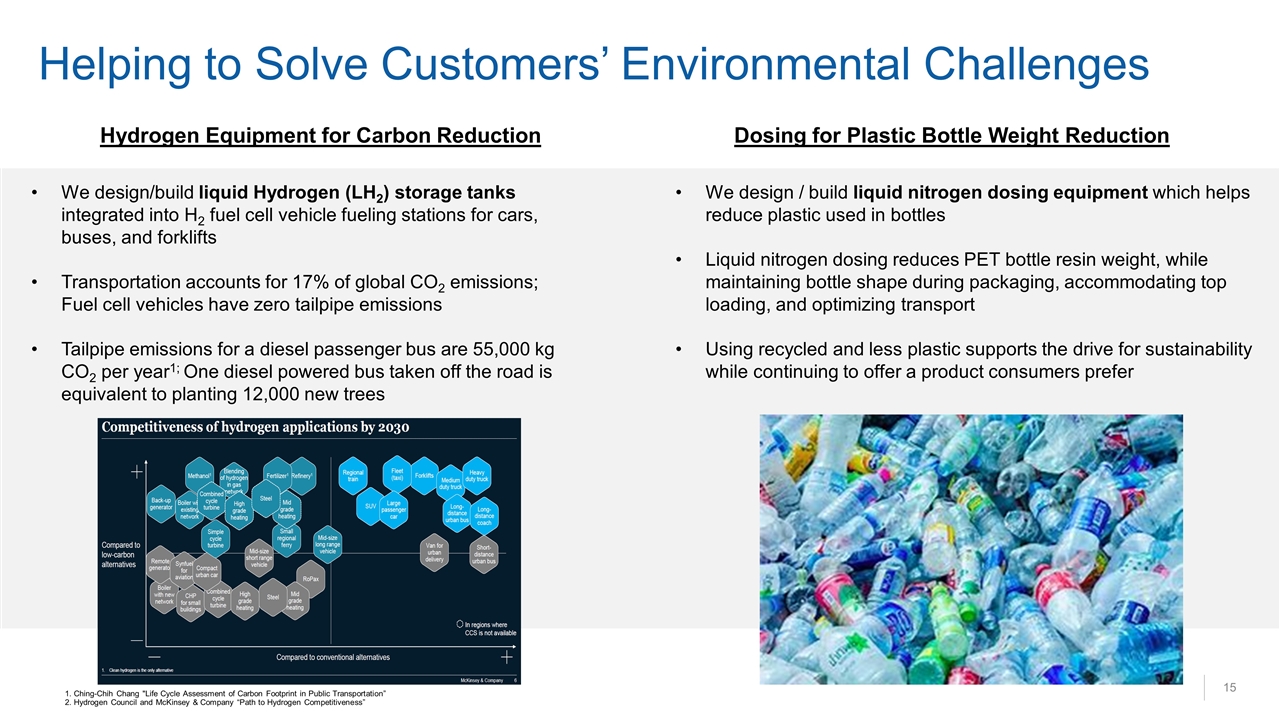

Helping to Solve Customers’ Environmental Challenges 1. Ching-Chih Chang "Life Cycle Assessment of Carbon Footprint in Public Transportation” 2. Hydrogen Council and McKinsey & Company “Path to Hydrogen Competitiveness” We design/build liquid Hydrogen (LH2) storage tanks integrated into H2 fuel cell vehicle fueling stations for cars, buses, and forklifts Transportation accounts for 17% of global CO2 emissions; Fuel cell vehicles have zero tailpipe emissions Tailpipe emissions for a diesel passenger bus are 55,000 kg CO2 per year1; One diesel powered bus taken off the road is equivalent to planting 12,000 new trees Hydrogen Equipment for Carbon Reduction Dosing for Plastic Bottle Weight Reduction We design / build liquid nitrogen dosing equipment which helps reduce plastic used in bottles Liquid nitrogen dosing reduces PET bottle resin weight, while maintaining bottle shape during packaging, accommodating top loading, and optimizing transport Using recycled and less plastic supports the drive for sustainability while continuing to offer a product consumers prefer

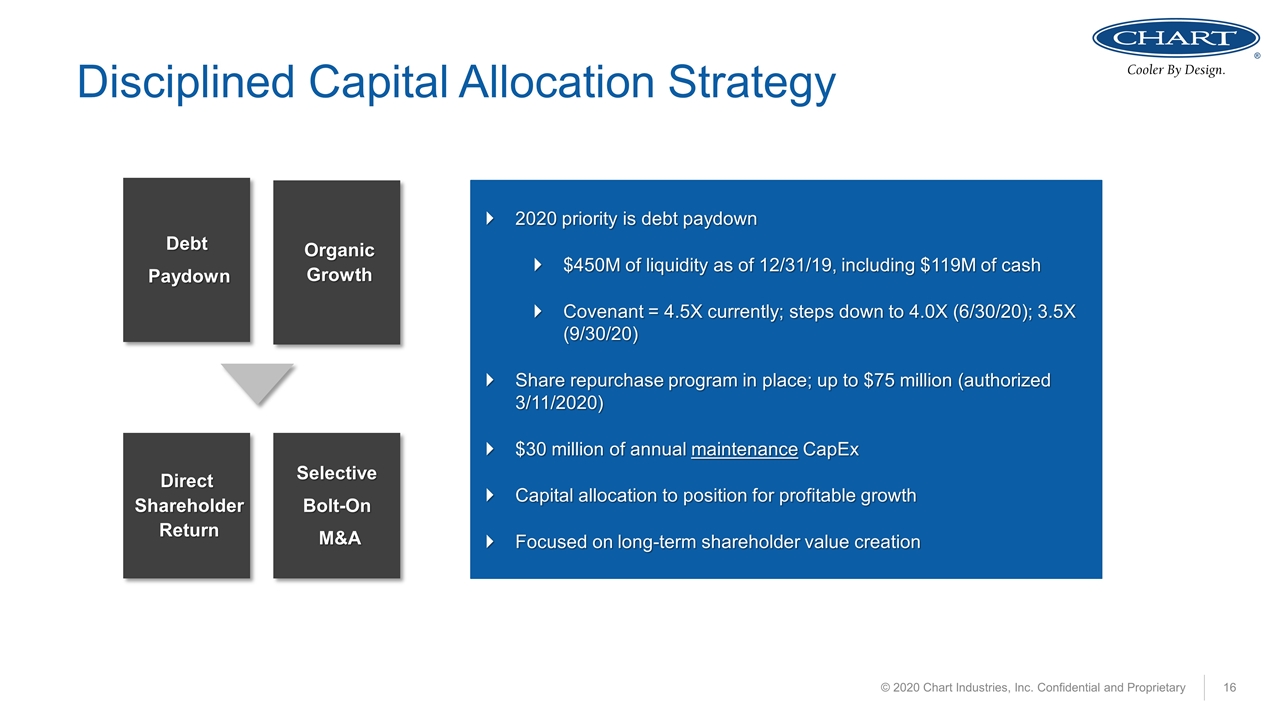

Disciplined Capital Allocation Strategy © 2020 Chart Industries, Inc. Confidential and Proprietary 2020 priority is debt paydown $450M of liquidity as of 12/31/19, including $119M of cash Covenant = 4.5X currently; steps down to 4.0X (6/30/20); 3.5X (9/30/20) Share repurchase program in place; up to $75 million (authorized 3/11/2020) $30 million of annual maintenance CapEx Capital allocation to position for profitable growth Focused on long-term shareholder value creation Organic Growth Selective Bolt-On M&A Direct Shareholder Return Debt Paydown

Appendix © 2020 Chart Industries, Inc. Confidential and Proprietary

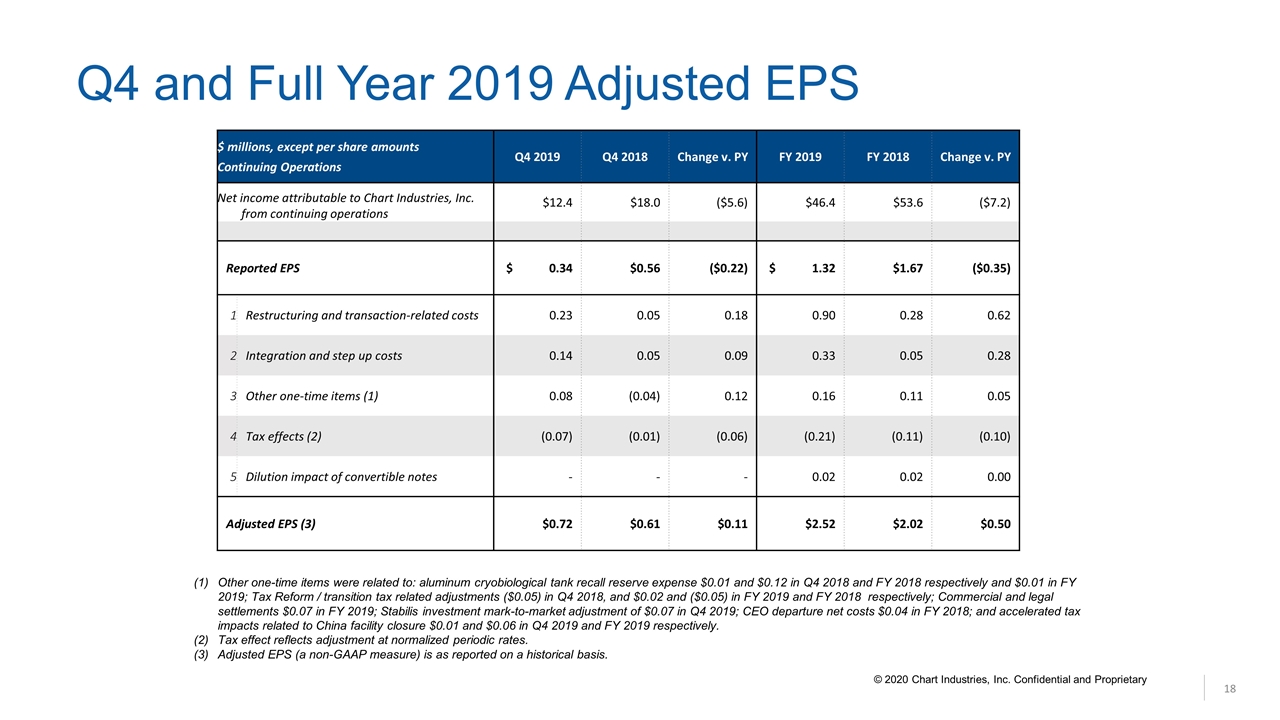

Q4 and Full Year 2019 Adjusted EPS Other one-time items were related to: aluminum cryobiological tank recall reserve expense $0.01 and $0.12 in Q4 2018 and FY 2018 respectively and $0.01 in FY 2019; Tax Reform / transition tax related adjustments ($0.05) in Q4 2018, and $0.02 and ($0.05) in FY 2019 and FY 2018 respectively; Commercial and legal settlements $0.07 in FY 2019; Stabilis investment mark-to-market adjustment of $0.07 in Q4 2019; CEO departure net costs $0.04 in FY 2018; and accelerated tax impacts related to China facility closure $0.01 and $0.06 in Q4 2019 and FY 2019 respectively. Tax effect reflects adjustment at normalized periodic rates. Adjusted EPS (a non-GAAP measure) is as reported on a historical basis. $ millions, except per share amounts Continuing Operations Q4 2019 Q4 2018 Change v. PY FY 2019 FY 2018 Change v. PY Net income attributable to Chart Industries, Inc. from continuing operations $12.4 $18.0 ($5.6) $46.4 $53.6 ($7.2) Reported EPS $ 0.34 $0.56 ($0.22) $ 1.32 $1.67 ($0.35) 1 Restructuring and transaction-related costs 0.23 0.05 0.18 0.90 0.28 0.62 2 Integration and step up costs 0.14 0.05 0.09 0.33 0.05 0.28 3 Other one-time items (1) 0.08 (0.04) 0.12 0.16 0.11 0.05 4 Tax effects (2) (0.07) (0.01) (0.06) (0.21) (0.11) (0.10) 5 Dilution impact of convertible notes - - - 0.02 0.02 0.00 Adjusted EPS (3) $0.72 $0.61 $0.11 $2.52 $2.02 $0.50 © 2020 Chart Industries, Inc. Confidential and Proprietary

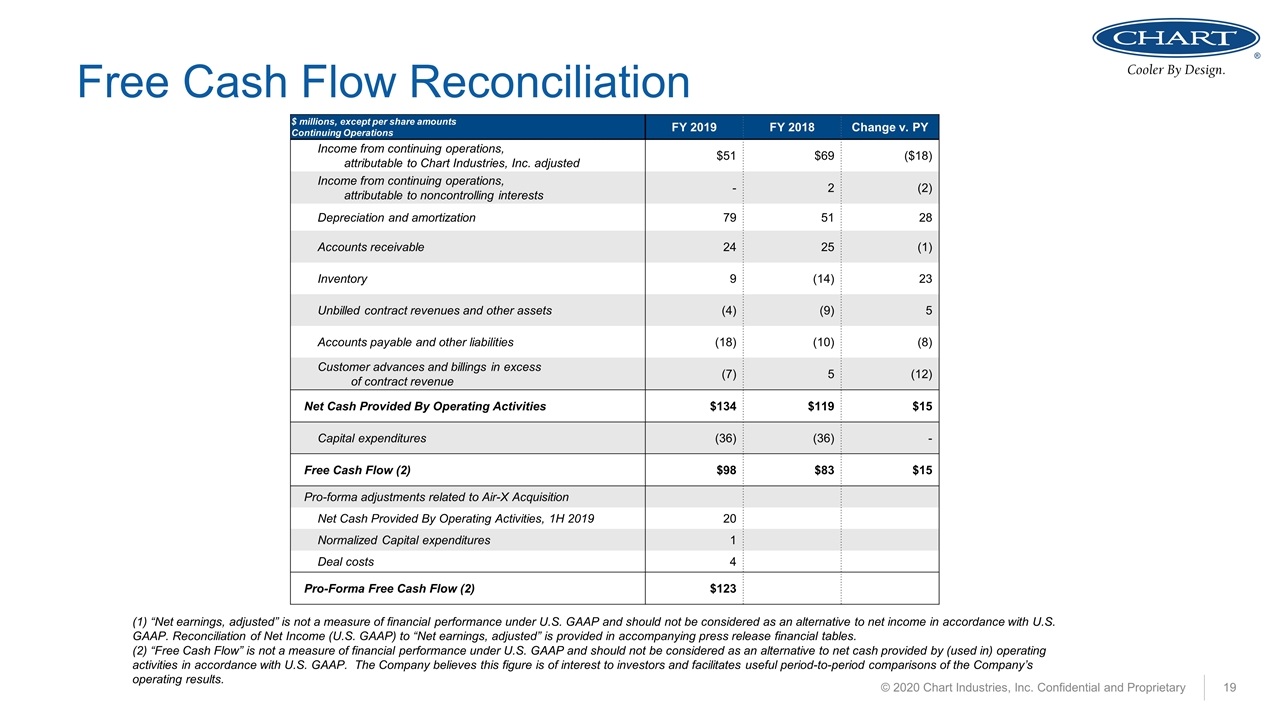

Free Cash Flow Reconciliation © 2020 Chart Industries, Inc. Confidential and Proprietary (1) “Net earnings, adjusted” is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to net income in accordance with U.S. GAAP. Reconciliation of Net Income (U.S. GAAP) to “Net earnings, adjusted” is provided in accompanying press release financial tables. (2) “Free Cash Flow” is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to net cash provided by (used in) operating activities in accordance with U.S. GAAP. The Company believes this figure is of interest to investors and facilitates useful period-to-period comparisons of the Company’s operating results. $ millions, except per share amounts Continuing Operations FY 2019 FY 2018 Change v. PY Income from continuing operations, attributable to Chart Industries, Inc. adjusted $51 $69 ($18) Income from continuing operations, attributable to noncontrolling interests - 2 (2) Depreciation and amortization 79 51 28 Accounts receivable 24 25 (1) Inventory 9 (14) 23 Unbilled contract revenues and other assets (4) (9) 5 Accounts payable and other liabilities (18) (10) (8) Customer advances and billings in excess of contract revenue (7) 5 (12) Net Cash Provided By Operating Activities $134 $119 $15 Capital expenditures (36) (36) - Free Cash Flow (2) $98 $83 $15 Pro-forma adjustments related to Air-X Acquisition Net Cash Provided By Operating Activities, 1H 2019 20 Normalized Capital expenditures 1 Deal costs 4 Pro-Forma Free Cash Flow (2) $123