Attached files

| file | filename |

|---|---|

| EX-32.2 - Shepherd's Finance, LLC | ex32-2.htm |

| EX-32.1 - Shepherd's Finance, LLC | ex32-1.htm |

| EX-31.2 - Shepherd's Finance, LLC | ex31-2.htm |

| EX-31.1 - Shepherd's Finance, LLC | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

[X] Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended December 31, 2019

or

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Transition Period From ________ to ________

Commission File Number 333-224557

SHEPHERD’S FINANCE, LLC

(Exact name of registrant as specified on its charter)

| Delaware | 36-4608739 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| Incorporation or organization) | Identification No.) |

13241 Bartram Park Blvd., Suite 2401, Jacksonville, Florida 32258

(Address of principal executive offices)

(302) 752-2688

(Registrant’s telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| None | None | None |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [X] | Smaller reporting company | [X] | |

| Emerging growth company | [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

DOCUMENTS INCORPORATED BY REFERENCE:

None.

FORM 10-K

SHEPHERD’S FINANCE, LLC

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Form 10-K of Shepherd’s Finance, LLC, other than historical facts, may be considered forward-looking statements within the meaning of the federal securities laws. Words such as “may,” “will,” “expect,” “anticipate,” “believe,” “estimate,” “continue,” “predict,” or other similar words identify forward-looking statements. Forward-looking statements appear in a number of places in this report, including without limitation, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and include statements regarding our intent, belief or current expectation about, among other things, trends affecting the markets in which we operate, our business, financial condition and growth strategies. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those predicted in the forward-looking statements as a result of various factors, including but not limited to those set forth in “Item 1A. Risk Factors.” If any of the events described in “Risk Factors” occur, they could have an adverse effect on our business, consolidated financial condition, results of operations and cash flows.

When considering forward-looking statements, our risk factors, as well as the other cautionary statements in this report and in our Form S-1 Registration Statement, should be kept in mind. Do not place undue reliance on any forward-looking statement. We are not obligated to update forward-looking statements.

| 3 |

Purpose and History

Our business is focused on commercial lending to participants in the residential construction and development industry. We believe this market is underserved because of the lack of traditional lenders currently fully participating in the market. We were originally formed as a Pennsylvania limited liability company on May 10, 2007. To meet our business objectives, we changed our name to Shepherd’s Finance, LLC on December 2, 2011. We converted to a Delaware limited liability company on March 29, 2012. We are located in Jacksonville, Florida. As used in this report, “we,” “us,” “our,” and “Company” refer to Shepherd’s Finance, LLC. We have an Internet website at www.shepherdsfinance.com. We are not incorporating by reference into this report any material from our website. The reference to our website is an inactive textual reference to the uniform resource locator (URL) and is for your reference only.

The commercial loans we extend are secured by mortgages on the underlying real estate. We extend and service commercial loans to small-to-medium sized homebuilders for the purchase of lots and/or the construction of homes thereon. In some circumstances, the lot is purchased with an older home on the lot which is then either removed or rehabilitated. If the home is rehabilitated, the loan is referred to as a “rehab” loan. We also extend and service loans for the purchase of lots and undeveloped land and the development of that land into residential building lots. In addition, we may, depending on our cash position and the opportunities available to us, do none, any or all of the following: purchase defaulted unsecured debt from suppliers to homebuilders at a discount (and then secure that debt with real estate or other collateral), and purchase defaulted secured debt from financial institutions at a discount.

Experience and Resources

Our Chief Executive Officer (“CEO”), Mr. Wallach, has been in the housing industry since 1985. He was the Chief Financial Officer of a multi-billion-dollar supplier of building materials to home builders for 12 years. He also was responsible for that company’s lending business for 20 years. During those years, he was responsible for the creation and implementation of many secured lending programs to builders. Some of these were performed fully by that company, and some were performed in partnership with banks. In general, the creation of all loans, and the resolution of defaulted loans, was his responsibility, whether the loans were company loans or loans in partnership with banks. Through these programs, he was responsible for the creation of approximately $2,000,000,000 in loans which generated interest spread of $50,000,000, after deducting for loan losses. Through the years, he managed the development of systems for reducing and managing the risks and losses on defaulted loans. Mr. Wallach also was responsible for that company’s unsecured debt to builders, which reached over $300,000,000 at its peak. He also gained experience in securing defaulted unsecured debt.

In addition, our Executive Vice President of Operations has 14 years of experience in this type of lending. Our Acting Chief Financial Officer (“CFO”), who served as our CFO from January 2018 to May 2019 and was appointed Acting CFO in July 2019, has 14 years of public accounting experience. Our Executive Vice President of Sales has been in the housing industry for over 35 years years, including holding executive level positions for the majority of that time.

Opportunity, Strategy, and Approach

Background and Strategy

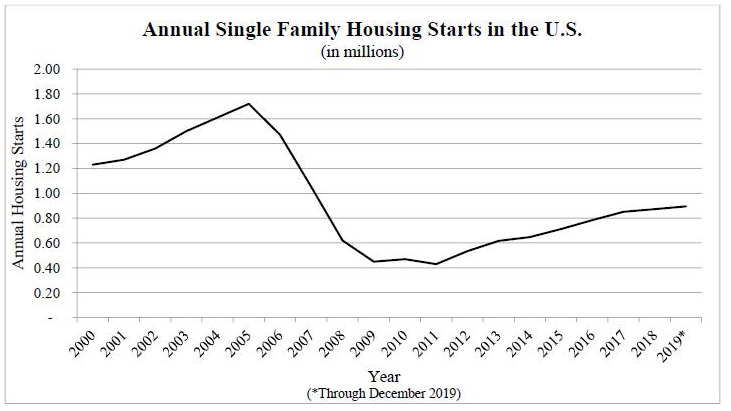

Finance markets are highly fragmented, with numerous large, mid-size, and small lenders and investment companies, such as banks, savings and loan associations, credit unions, insurance companies, and institutional lenders, all competing for investment opportunities. Many of these market participants have experienced losses, as a result of the housing market (which started to decline in 2006, reached its bottom in 2008, and is now getting back to historical norms as of December 31, 2019), and their participation in lending in it. As a result of credit losses and restrictive government oversight, the financial institutions are not participating in this market to the extent they had before the credit crisis (as evidenced by the general lack of availability of construction financing and the higher cost of financing for the deals actually done). We believe that these lenders, while increasing their willingness and capacity to lend, will be unable to satisfy the current demand for residential construction financing, creating attractive opportunities for niche lenders such as us for many years to come. Our goal is not to be a customer’s only source of commercial lending, but an extra, more user-friendly piece of their financing. In 2019, while more small banks returned to the construction lending market, the demand for our loan products has remained relatively constant. We attribute this to our sales staff, and an increase in the number of small home builders in the market.

| 4 |

Our loans are marketed by lending representatives who work for us and are driven to maintain long-term customer relationships. Compensation for loan originators is focused on the profitability of loans originated, not simply the volume of loans originated. As of December 31, 2019, we have retained 19 full-time employees (four of which are lending representatives) including our CEO. In his previous experience, our CEO had a nationwide staff of 20 lenders working in the field.

Our efforts are designed to create a loan portfolio that includes some or all of the following investment characteristics: (i) provides current income; (ii) is well-secured by residential real estate; (iii) is short term in nature; and (iv) provides high interest spreads.

Our investment policies may be amended or changed at any time by our board of managers. In the years ahead, we plan on continuing our expansion of lending, increasing our geographic diversity, growing our rehab lending program, and improving our financial performance. We will be adding systems and people to accomplish these goals.

As we continue to grow our business, we are focusing some of our efforts on our rehab program, which we believe in the long run will face less bank competition and have more stable demand than our new construction program.

Risk and Mitigation

We believe that while creating speculative construction loans is a high-risk venture, the reduction in competition, the differences in our lending versus typical small bank lending, and our loss mitigation techniques will all help this to continue to be a profitable business.

We engage in various activities to try to mitigate the risks inherent in this type of lending by:

| ● | Keeping the loan-to-value ratio (“LTV”), between 60% and 75% on a portfolio basis, however, individual loans may, from time to time, have a greater LTV; | |

| ● | Generally using deposits from the builder on home construction loans to ensure the completion of the home. Lending losses on defaulted loans are usually a higher percentage when the home is not built, or is only partially built; | |

| ● | Having a higher yield than other forms of secured real estate lending; | |

| ● | Using interest escrows for some of our loans; | |

| ● | Aggressively working with builders who are in default on their loan before and during foreclosure. This technique generally yields a reduced realized loss; and | |

| ● | Market grading. We review all lending markets, analyzing their historic housing start cycles. Then, the current position of housing starts is examined in each market. Markets are classified into volatile, average, or stable, and then graded based on that classification and our opinion of where the market is in its housing cycle. This grading is then used to determine the builder deposit amount, LTV, and yield. |

| 5 |

The following table contains items that we believe differentiate us from our competitors:

| Item | Our Methods | Comments | ||

| Lending Regulation | We follow various state and federal laws, but are not regulated and controlled by bank examiners from the government. We follow best practices we have learned through our experience, some of which are required of banks. | For instance, banks are not required to buy title insurance by law, but typically banks do purchase title insurance for the properties on which they lend. We generally do not, as it is very difficult to collect on title policies. Instead, we use title searches to protect our interests. | ||

| FDIC Insurance | We do not offer FDIC insurance to our unsecured notes investors. | Our yield to our customers, and our cost of funds is typically higher than that of most banks. We charge our borrowers higher interest rates than do most banks. We also save money by not paying for FDIC insurance. | ||

| Capital Structure | Typically, our unsecured notes offered through our notes program are due in one to four years, or when the Note matures. | This results in liquidity risk (i.e., funding borrowing requests or maturities of debt). | ||

| Community Reinvestment Act (CRA)(1) | We do not participate in the CRA. | Our sole purpose in making each individual loan is to maximize our returns while maintaining proper risk management. | ||

| Leverage | We try to maintain a 15% ratio of equity (including redeemable preferred equity) to loan assets. | Our equity to loan asset ratio was 13% as of December 31, 2019. The higher the ratio, the more potential losses the company can absorb without impacting debt holders. | ||

| Product Diversification | We generally make loans to builders to purchase lots and/or to construct or rehab homes. | We have extensive experience in our field. | ||

| Geographic Diversity | We lend in 21 states as of December 31, 2019. | We believe that this geographic diversity helps in down markets, as not all housing markets decrease at the same rate and time. | ||

| Governmental Bailouts | Most likely not eligible. | We are not likely to be eligible for bank bailouts, which have happened periodically. We maintain a better leverage ratio to counter this. | ||

| Underwriting | We focus on items that, in our experience, tend to predict risk. | These items include using collateral, controlling LTVs, controlling the number of loans in one subdivision, underwriting appraisals, conducting property inspections, maintaining certain files and documents similar to those that a bank might maintain. |

| (1) | The CRA subjects a bank who receives FDIC insurance to regulatory assessment to determine if the bank meets the credit needs of its entire community, and to consider that determination in its evaluation of any application made by the bank for, among other things, approval of the acquisition or establishment of a bank branch. |

| 6 |

Lines of Business

Our efforts are designed to create a portfolio that includes some or all of the following investment characteristics: (i) provides current income; (ii) is well-secured by residential real estate; (iii) is short term in nature; and (iv) provides high interest spreads. While we primarily provide commercial construction loans to homebuilders (for residential real estate), we may also purchase defaulted unsecured debt from suppliers to homebuilders at a discount (and then secure that debt with real estate or other collateral), purchase defaulted secured debt from financial institutions at a discount, and purchase real estate in which we will operate our business.

Our investment policies may be amended or changed at any time by our board of managers.

Commercial Construction Loans to Homebuilders

We extend and service commercial loans to small-to-medium sized homebuilders for the purchase of lots and/or the construction of homes thereon. Our customers generally benefit from doing business with us not just because they are able to sell additional homes (which we finance), but because, as they build additional homes, they are able to increase sales of homes that are built as contracted homes, where the eventual home owner obtains the loan. Builders generally have more success selling homes when a model or spec home is available for customers to see. We also extend and service loans for the purchase of undeveloped land and the development of that land into residential building lots. In addition, we lend money to purchase and rehabilitate older existing homes. Most of the loans are for “spec homes” or “spec lots,” meaning they are built or developed speculatively (with no specific end-user home owner in mind).

In a typical home construction transaction, a homebuilder obtains a loan to purchase a lot and build a home on that lot. In some cases, the builder has a contract with a customer to purchase the home upon its completion. In other cases, the home is built as a spec home, but the homebuilder believes it will sell before or shortly after completion, and therefore, building the home before it is under contract will increase the homebuilder’s sales and profitability. The builder may also believe that the construction of a spec home will increase the number of contract sales the homebuilder will have in a given year, as it may be easier to sell contract homes when the customer can see the builder’s work in the spec home. In some cases, these speculatively built homes are constructed with the intention to keep them as a model for a period of time, to increase contract sales, and then be sold. These are called model homes. While we may lend to a homebuilder for any of these types of new construction homes, as of December 31, 2019, about 78% of our construction loans have been spec homes and 22% have been contracts.

In a typical rehab transaction, we fund all of the purchase price, and then all or a portion of the cost to complete the project. In some circumstances, we are unable to see the inside of the home prior to closing, so we assume that anything from drywall to completion needs to be redone, as well as what we can see from the outside. Because we are flexible in our need to see the inside of the home, and we only use experienced builders as customers for this type of lending, we believe that this differentiates us from banks.

We fund the loans that we originate using available cash resources that are generated primarily from borrowings, our purchase and sale agreements, proceeds from the fixed rate subordinated notes (“Notes”) offered pursuant to our public offering (“Notes Program”), equity, and net operating cash flow. We intend to continue funding loans we originate using the same sources.

There is a seasonal aspect to home construction, and this affects our monthly cash flow. In general, since the home construction loans, we create will last less than a year on average, and since we are geographically diverse, the seasonality impact is somewhat mitigated.

Generally, our real estate loans are secured by one or more of the following:

| ● | the parcels of land to be developed; | |

| ● | finished lots; | |

| ● | new or rehabbed single-family homes; and/or | |

| ● | in most cases, personal guarantees of the principals of the borrower entity. |

| 7 |

Most of our lending is based on the following general policies:

| Customer Type | Small-to-Medium Size Homebuilders |

| Loan Type | Commercial |

| Loan Purpose | Construction/Rehabilitation of Homes or Development of Lots |

| Security | Homes, Lots, and/or Land |

| Priority | Generally, our loans are secured by a first priority mortgage lien; however, we may make loans secured by a second or other lower priority mortgage lien. |

| Loan-to-Value Averages | 60-75% |

| Loan Amounts | Average home construction loan is $300,000. Development loans vary greatly. |

| Term | Demand, however most home construction loans typically payoff in under one year, and development loans are typically three to five-year projects. |

| Rate | Cost of Funds (“COF”) plus 3%, minimum rate of 7% |

| Origination Fee | 5% for home construction loans, development loans on a case by case basis |

| Title Insurance | Only on high risk loans and rehabs |

| Hazard Insurance | Always |

| General Liability Insurance | Always |

| Credit | Builder should have significant building experience in the market, be building in the market currently, be able to make payments of interest, be able to make the required deposit, have acceptable personal credit, and have open lines of credit (unsecured) with suppliers reasonably within terms. Required deposits may be able to be avoided if we do not fund the purchase of land. We generally do not advertise to find customers, but use our loan representatives. We believe this approach will allow us to focus our efforts on builders that meet our acceptable risk profile. |

| Third Party Guarantor | None, however the loans are generally guaranteed by the owners of the borrower. |

We may change these policies at any time based on then-existing market conditions or otherwise, at the discretion of our CEO and board of managers.

| 8 |

The following is a summary of our loan portfolio to builders for home construction loans as of December 31, 2019:

(All dollar [$] amounts shown in table in thousands.)

| State | Number of | Number of | Value

of Collateral (1) | Commitment Amount | Gross Amount | Loan

to Ratio (2) | Loan Fee | |||||||||||||||||||||

| Colorado | 1 | 1 | $ | 630 | $ | 425 | $ | 424 | 67 | % | 5 | % | ||||||||||||||||

| Connecticut | 1 | 1 | 340 | 224 | 55 | 66 | % | 5 | % | |||||||||||||||||||

| Florida | 17 | 112 | 32,259 | 24,031 | 16,826 | 74 | % | 5 | % | |||||||||||||||||||

| Georgia | 3 | 4 | 2,085 | 1,343 | 917 | 64 | % | 5 | % | |||||||||||||||||||

| Idaho | 1 | 1 | 310 | 217 | 173 | 70 | % | 5 | % | |||||||||||||||||||

| Indiana | 2 | 3 | 1,687 | 1,083 | 383 | 64 | % | 5 | % | |||||||||||||||||||

| Michigan | 4 | 11 | 3,696 | 2,566 | 1,820 | 69 | % | 5 | % | |||||||||||||||||||

| New Jersey | 3 | 6 | 1,925 | 1,471 | 1,396 | 76 | % | 5 | % | |||||||||||||||||||

| New York | 2 | 3 | 1,370 | 940 | 743 | 69 | % | 5 | % | |||||||||||||||||||

| North Carolina | 6 | 20 | 5,790 | 4,009 | 2,471 | 69 | % | 5 | % | |||||||||||||||||||

| Ohio | 3 | 9 | 4,117 | 2,664 | 2,153 | 65 | % | 5 | % | |||||||||||||||||||

| Oregon | 1 | 2 | 1,137 | 796 | 739 | 70 | % | 5 | % | |||||||||||||||||||

| Pennsylvania | 3 | 24 | 20,791 | 13,322 | 11,772 | 64 | % | 5 | % | |||||||||||||||||||

| South Carolina | 11 | 25 | 8,809 | 6,419 | 4,786 | 73 | % | 5 | % | |||||||||||||||||||

| Tennessee | 3 | 4 | 1,367 | 1,069 | 503 | 78 | % | 5 | % | |||||||||||||||||||

| Texas | 3 | 4 | 1,984 | 1,270 | 843 | 64 | % | 5 | % | |||||||||||||||||||

| Utah | 2 | 4 | 1,862 | 1,389 | 1,000 | 75 | % | 5 | % | |||||||||||||||||||

| Virginia | 1 | 3 | 1,245 | 815 | 734 | 65 | % | 5 | % | |||||||||||||||||||

| Washington | 1 | 2 | 1,040 | 728 | 445 | 70 | % | 5 | % | |||||||||||||||||||

| Wisconsin | 1 | 1 | 539 | 332 | 285 | 62 | % | 5 | % | |||||||||||||||||||

| Wyoming | 1 | 1 | 228 | 160 | 143 | 70 | % | 5 | % | |||||||||||||||||||

| Total | 70 | 241 | $ | 93,211 | $ | 65,273 | $ | 48,611 | 70 | %(3) | 5 | % | ||||||||||||||||

| (1) | The value is determined by the appraised value. | |

| (2) | The loan to value ratio is calculated by taking the commitment amount and dividing by the appraised value. | |

| (3) | Represents the weighted average loan to value ratio of the loans. |

| 9 |

The following is a summary of our loan portfolio to builders for home construction loans as of December 31, 2018:

(All dollar [$] amounts shown in table in thousands.)

| State | Number of | Number of | Value

of Collateral (1) | Commitment Amount | Gross Amount | Loan

to Ratio (2) | Loan Fee | |||||||||||||||||||||

| Arizona | 1 | 1 | $ | 1,140 | $ | 684 | $ | 214 | 60 | % | 5 | % | ||||||||||||||||

| Colorado | 2 | 4 | 2,549 | 1,739 | 1,433 | 68 | % | 5 | % | |||||||||||||||||||

| Florida | 18 | 104 | 32,381 | 22,855 | 12,430 | 71 | % | 5 | % | |||||||||||||||||||

| Georgia | 5 | 6 | 5,868 | 3,744 | 2,861 | 64 | % | 5 | % | |||||||||||||||||||

| Idaho | 1 | 2 | 605 | 424 | 77 | 70 | % | 5 | % | |||||||||||||||||||

| Indiana | 2 | 5 | 1,567 | 1,097 | 790 | 70 | % | 5 | % | |||||||||||||||||||

| Michigan | 4 | 26 | 5,899 | 3,981 | 2,495 | 67 | % | 5 | % | |||||||||||||||||||

| New Jersey | 5 | 15 | 4,999 | 3,742 | 2,820 | 75 | % | 5 | % | |||||||||||||||||||

| New York | 2 | 4 | 1,555 | 1,089 | 738 | 70 | % | 5 | % | |||||||||||||||||||

| North Carolina | 5 | 12 | 3,748 | 2,580 | 1,712 | 69 | % | 5 | % | |||||||||||||||||||

| North Dakota | 1 | 1 | 375 | 263 | 227 | 70 | % | 5 | % | |||||||||||||||||||

| Ohio | 2 | 3 | 3,220 | 1,960 | 1,543 | 61 | % | 5 | % | |||||||||||||||||||

| Pennsylvania | 3 | 34 | 24,808 | 14,441 | 10,087 | 58 | % | 5 | % | |||||||||||||||||||

| South Carolina | 15 | 29 | 9,702 | 6,738 | 4,015 | 69 | % | 5 | % | |||||||||||||||||||

| Tennessee | 1 | 2 | 750 | 525 | 347 | 70 | % | 5 | % | |||||||||||||||||||

| Texas | 1 | 1 | 179 | 125 | 26 | 70 | % | 5 | % | |||||||||||||||||||

| Utah | 4 | 4 | 1,788 | 1,206 | 486 | 67 | % | 5 | % | |||||||||||||||||||

| Virginia | 3 | 6 | 1,675 | 1,172 | 806 | 70 | % | 5 | % | |||||||||||||||||||

| Total | 75 | 259 | $ | 102,808 | $ | 68,365 | $ | 43,107 | 67 | %(3) | 5 | % | ||||||||||||||||

| (1) | The value is determined by the appraised value. | |

| (2) | The loan to value ratio is calculated by taking the commitment amount and dividing by the appraised value. | |

| (3) | Represents the weighted average loan to value ratio of the loans. |

2020 Outlook

In 2020, we anticipate using proceeds from the Notes Program, the loan purchase and sale agreements, and other sources to generate additional loans (mostly spec home construction loans), increase loan balances, and increase our customer and geographic diversity. We anticipate that the rehab program will grow as a percentage of our origination volume.

Commercial Loans – Real Estate Development Loan Portfolio Summary

In a typical development transaction, a homebuilder/developer purchases a specific parcel or parcels of land. Developers must secure financing in order to pay the purchase price for the land as well as to pay expenses incurred while developing the lots. This is the financing we provide. Once financing has been secured, the lot developers create individual lots. Developers secure permits allowing the property to be developed and then design and build roads and utility systems for water, sewer, gas, and electricity to service the property. The individual lots are then sold before a home is built on them; paid off, built on and then sold; or built on, then sold and paid off (in these cases, we may subordinate our loan to the home construction loan).

The following is a summary of our loan portfolio to builders for land development as of December 31, 2019:

(All dollar [$] amounts shown in table and footnotes in thousands.)

| States | Number of Borrowers | Number of Loans | Value of Collateral(1) | Commitment Amount(2) | Gross

Amount Outstanding | Loan to Value Ratio(3) | Interest Spread | |||||||||||||||||||||

| Pennsylvania | 1 | 3 | $ | 10,191 | 7,000 | $ | 7,389 | 73 | % | 7 | % | |||||||||||||||||

| Florida | 2 | 3 | 1,301 | 1,356 | 891 | 68 | % | 7 | % | |||||||||||||||||||

| North Carolina | 1 | 1 | 400 | 260 | 99 | 25 | % | 7 | % | |||||||||||||||||||

| South Carolina | 1 | 2 | 1,115 | 1,250 | 618 | 55 | % | 7 | % | |||||||||||||||||||

| Total | 5 | 9 | $ | 13,007 | $ | 9,866 | $ | 8,997 | 69 | %(4) | 7 | % | ||||||||||||||||

| (1) | The value is determined by the appraised value adjusted for remaining costs to be paid and third-party mortgage balances. Part of this collateral is $1,470 of preferred equity in our Company. In the event of a foreclosure on the property securing these loans, the portion of our collateral that is preferred equity in our Company might be difficult to sell, which could impact our ability to eliminate the loan balance. |

| 10 |

| (2) | The commitment amount does not include unfunded letters of credit. |

| (3) | The loan to value ratio is calculated by taking the outstanding amount and dividing by the appraised value calculated as described above. |

| (4) | Represents the weighted average loan to value ratio of the loans. |

The following is a summary of our loan portfolio to builders for land development as of December 31, 2018:

| States | Number of Borrowers | Number of Loans | Value of Collateral(1) | Commitment Amount(2) | Gross

Amount Outstanding | Loan to Value Ratio(3) | Interest Spread | |||||||||||||||||||||

| Pennsylvania | 1 | 3 | $ | 8,482 | $ | 5,000 | $ | 5,037 | 59 | % | 7 | % | ||||||||||||||||

| Florida | 2 | 4 | 537 | 1,206 | 501 | 93 | % | 7 | % | |||||||||||||||||||

| South Carolina | 1 | 2 | 1,115 | 1,250 | 482 | 43 | % | 7 | % | |||||||||||||||||||

| Total | 4 | 9 | $ | 10,134 | $ | 7,456 | $ | 6,020 | 59 | %(4) | 7 | % | ||||||||||||||||

| (1) | The value is determined by the appraised value adjusted for remaining costs to be paid and third-party mortgage balances. Part of this collateral is $1,320 of preferred equity in our Company. In the event of a foreclosure on the property securing these loans, the portion of our collateral that is preferred equity in our Company might be difficult to sell, which could impact our ability to eliminate the loan balance. |

| (2) | The commitment amount does not include unfunded letters of credit. |

| (3) | The loan to value ratio is calculated by taking the outstanding amount and dividing by the appraised value calculated as described above. |

| (4) | Represents the weighted average loan to value ratio of the loans. |

Credit Quality Information

See the notes to our financial statements for credit quality information.

Competition

Historically, our industry has been highly competitive. We compete for opportunities with numerous public and private investment vehicles, including financial institutions, specialty finance companies, mortgage banks, pension funds, opportunity funds, hedge funds, REITs, and other institutional investors, as well as individuals. Many competitors are significantly larger than us, have well-established operating histories and may have greater access to capital, resources and other advantages over us. These competitors may be willing to accept lower returns on their investments or to modify underwriting standards and, as a result, our origination volume and profit margins could be adversely affected.

We believe that this is a good time to extend commercial loans to builders in the residential real estate market because, currently, this market appears underserved, home values are average, and many of our competitors have sustained losses due to declines in home values in the second half of the previous decade and, therefore, are reluctant to lend in this space at this time. We expect our loans to be different than other lenders in the markets in which we are active. Typically, the differences are:

| ● | our loans may have a higher fee; |

| 11 |

| ● | our loans typically require a small deposit which is refundable, versus a large upfront payment for the lot which is not refundable; and | |

| ● | some of our loans may have lower costs as a result of not requiring title insurance. |

Regulatory Matters

Financial Regulation

Our operations are not subject to the stringent regulatory requirements imposed upon the operations of commercial banks, savings banks, and thrift institutions. We are not subject to periodic compliance examinations by federal or state banking regulators. Further, our Notes are not certificates of deposit or similar obligations or guaranteed by any depository institution and are not insured by the FDIC or any governmental or private insurance fund, or any other entity.

The Investment Company Act of 1940

An investment company is defined under the Investment Company Act of 1940, as amended (the “Investment Company Act”), to include any issuer engaged primarily in the business of investing, reinvesting, or trading in securities. Absent an exemption, investment companies are required to register as such with the SEC and to comply with various governance and operational requirements. If we were considered an “investment company” within the meaning of the Investment Company Act, we would be subject to numerous requirements and restrictions relating to our structure and operation. If we were required to register as an investment company under the Investment Company Act and to comply with these requirements and restrictions, we may have to make significant changes in our structure and operations to comply with exemption from registration, which could adversely affect our business. Such changes may include, for example, limiting the range of assets in which we may invest. We intend to conduct our operations so as to fit within an exemption from registration under the Investment Company Act for purchasing or otherwise acquiring mortgages and other liens on and interest in real estate. In order to satisfy the requirements of such exemption, we may need to restrict the scope of our operations.

Environmental Compliance

We do not believe that compliance with federal, state, or local laws relating to the protection of the environment will have a material effect on our business in the foreseeable future. However, loans we extend or purchase are secured by real property. In the course of our business, we may own or foreclose and take title to real estate that could be subject to environmental liabilities with respect to these properties. We (or our loan customers) may be held liable to a governmental entity or to third parties for property damage, personal injury, investigation, and clean-up costs incurred by these parties in connection with environmental contamination or may be required to investigate or clean up hazardous or toxic substances or chemical release at a property. The costs associated with the investigation or remediation activities could be substantial. In addition, if we become the owner of or discover that we were formerly the owner of a contaminated site, we may be subject to common law claims by third-parties based on damages and costs resulting from environmental contamination emanating from the property. To date, we have not incurred any significant costs related to environmental compliance and we do not anticipate incurring any significant costs for environmental compliance in the future. Generally, when we are lending on property which is being developed into single family building lots, an environmental assessment is done by the builder for the various governmental agencies. When we lend for new construction on newly developed lots, the lots have generally been reviewed while they were being developed. We also perform our own physical inspection of the lot, which includes assessing potential environmental issues. Before we take possession of a property through foreclosure, we again assess the property for possible environmental concerns, which, if deemed to be a significant risk compared to the value of the property, could cause us to forego foreclosure on the property and to seek other avenues for collection.

Below are risks and uncertainties that could adversely affect our operations that we believe are material to investors. Other risks and uncertainties may exist that we do not consider material based on the information currently available to us at this time.

| 12 |

Risks Related to our Business

Our business is not industry-diversified. The United States economy is experiencing a slow recovery after the significant downturn in the homebuilding industry beginning in 2007, which was one of the worst credit and liquidity crises since the 1930s. Further deterioration in industry or economic conditions could further decrease demand and pricing for new homes and residential home lots. A decline in housing values similar to the recent national downturn in the real estate market would have a negative impact on our business. Smaller value declines will also have a negative impact on our business. These factors may decrease the likelihood we will be able to generate enough cash to repay the Notes.

Developers and homebuilders to whom we may make loans use the proceeds of our loans to develop raw land into residential home lots and construct homes. The developers obtain the money to repay our development loans by selling the residential home lots to homebuilders or individuals who will build single-family residences on the lots, or by obtaining replacement financing from other lenders. A developer’s ability to repay our loans is based primarily on the amount of money generated by the developer’s sale of its inventory of single-family residential lots. Homebuilders obtain the money to repay our loans by selling the homes they construct or by obtaining replacement financing from other lenders, and thus, the homebuilders’ ability to repay our loans is based primarily on the amount of money generated by the sale of such homes.

The homebuilding industry is cyclical and is significantly affected by changes in industry conditions, as well as in general and local economic conditions, such as:

| ● | employment level and job growth; | |

| ● | demographic trends, including population increases and decreases and household formation; | |

| ● | availability of financing for homebuyers; | |

| ● | interest rates; | |

| ● | affordability of homes; | |

| ● | consumer confidence; | |

| ● | levels of new and existing homes for sale, including foreclosed homes and homes held by investors and speculators; and | |

| ● | housing demand generally. |

These conditions may occur on a national scale or may affect some of the regions or markets in which we operate more than others.

We generally lend a percentage of the values of the homes and lots. These values are determined shortly prior to the lending. If the values of homes and lots in markets in which we lend drop fast enough to cause the builders losses that are greater than their equity in the property, we will be forced to liquidate the loan in a fashion which will cause us to lose money. If these losses when combined and added to our other expenses are greater than our revenue from interest charged to our customers, we will lose money overall, which will hurt our ability to pay interest and principal on the Notes. Values are typically affected by demand for homes, which can change due to many factors, including but not limited to, demographics, interest rates, overall economy, cost of building materials and labor, availability of financing for end-users, inventory of homes available and governmental action or inaction. The tightening credit markets have made it more difficult for potential homeowners to obtain financing to purchase homes. If housing prices decline or sales in the housing market decline, our customers may have a hard time selling their homes at a profit. This could cause the amount of defaulted loans that we will own to increase. An increase in defaulted loans would reduce our revenue and could lead to losses on our loans. A decline in housing prices will further increase our losses on defaulted loans. If the amount of defaulted loans or the loss per defaulted loan is large enough, we will operate at a loss, which will decrease our equity. This could cause us to become insolvent, and we will not be able to pay back Note holders’ principal and interest on the Notes.

| 13 |

The homebuilding industry could experience adverse conditions, and the industry’s implementation of strategies in response to such conditions may not be successful.

The United States homebuilding industry experienced a significant downturn beginning in 2007. During the course of the downturn, many homebuilders focused on generating positive operating cash flow, resizing and reshaping their product for a more price-conscious consumer and adjusting finished new home inventories to meet demand, and did so in many cases by significantly reducing the new home prices and increasing the level of sales incentives. Notwithstanding these strategies, homebuilders continued to experience an elevated rate of sales contract cancelations, as many of the factors that affect new sales and cancelation rates are beyond the control of the homebuilding industry. Although the homebuilding industry has recently experienced positive gains, there can be no assurance that these gains will continue. The homebuilding industry could suffer similar, or worse, adverse conditions in the future. Continued decreases in new home sales would increase the likelihood of defaults on our loans and, consequently, reduce our ability to repay Note holders’ principal and interest on the Notes.

We have $55,369,000 of loan assets as of December 31, 2019. A 35% reduction in total collateral value would reduce our earnings and net worth by $4,657,000. Larger reductions would result in lower earnings and lower net worth.

As of December 31, 2019, we had $55,369,000 of loan assets on our books. These assets are recorded on our balance sheet at the lower of the loan amount or the value of the collateral after deduction for expected selling expenses. A reduction in the value of the underlying collateral could result in significant losses. A 35% reduction, for instance, would result in a $4,657,000 loss. Accordingly, our business is subject to risk of a loss of a portion of our Note holders’ investments if such a reduction were to occur.

We have $8,997,000 of development loan assets as of December 31, 2019, which unlike our construction loans, are long term loans. This longer duration as well as the nature of collateral (raw ground and lots) creates more risk for that portion of our portfolio.

Development loans are riskier than construction loans for two reasons: the duration of the loan and the nature of the collateral. The duration (being three to five years as compared to generally less than one year on construction loans) allows for a greater period of time over which the collateral value could decrease. Also, the collateral value of development loans is more likely to change in greater percentages than that of built homes. For example, during a 70% reduction in housing starts, newly completed homes still have value, but lots may be worthless. This added risk to this portion of our portfolio adds risk to our investors as our net worth would be significantly impacted by losses.

Currently, we are reliant on a single developer and homebuilder, the Hoskins Group, who is concentrated in the Pittsburgh, Pennsylvania market, for a significant portion of our revenues and a portion of our capital. Our second largest customer is in the Orlando, Florida market and is also a significant portion of our portfolio.

As of December 31, 2019, 25% of our outstanding loan commitments consisted of loans made to Benjamin Marcus Homes, LLC and Investor’s Mark Acquisitions, LLC, both of which are owned by Mark Hoskins (collectively all three parties are referred to herein as the “Hoskins Group”). We refer to the loans to the Hoskins Group as the “Pennsylvania Loans.” The Hoskins Group is concentrated in the Pittsburgh, Pennsylvania market. The Hoskins Group also has a preferred equity interest in us. Therefore, currently, we are reliant upon a single developer and homebuilder who is concentrated in a single city, for a significant portion of our revenues and a portion of our capital. Any event of bankruptcy, insolvency, or general downturn in the business of this developer and homebuilder or in the Pittsburgh housing market generally will have a substantial adverse financial impact on our business and our ability to pay back Note holders’ investments in the Notes in the long term. Adverse conditions affecting the local housing market could include, but are not limited to, declines in new housing starts, declines in new home prices, declines in new home sales, increases in the supply of available building lots or built homes available for sale, increases in unemployment, and unfavorable demographic changes. One of our independent managers, Gregory L. Sheldon, also serves an advisor to the Hoskins Group and, consequently, Mr. Sheldon may face conflicts of interest in the advice that he provides to us and the Hoskins Group, including if any such adverse condition were to materialize.

| 14 |

Also, as of December 31, 2019, 15% of our outstanding loan commitments consisted of loans made to a customer in Orlando, Florida.

We have foreclosed assets as of December 31, 2019, which unlike our loans, are recorded on our balance sheet at the value of the collateral, net of estimated selling expenses.

A reduction in the value of the underlying collateral of our foreclosed assets could result in significant losses. For example, a 35% reduction in the value of the underlying collateral (net of estimated selling expenses) would result in a $1,720,000 loss. Our business is subject to increased risk of not being able to repay timely our Note holders’ investments if such a reduction were to occur.

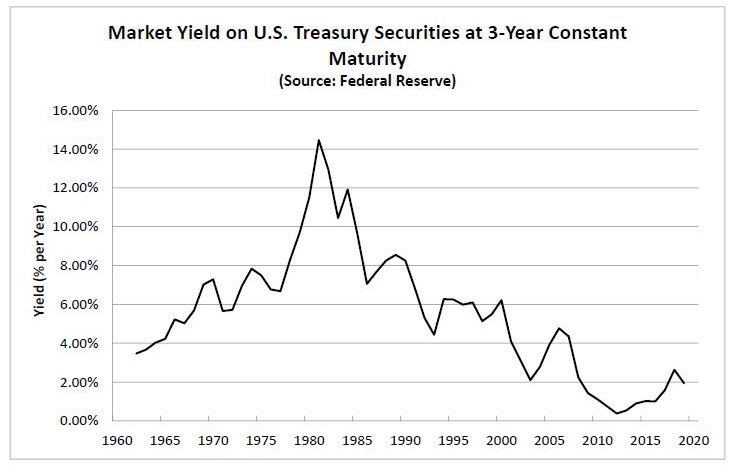

Increases in interest rates, reductions in mortgage availability, or increases in other costs of home ownership could prevent potential customers from buying new homes and adversely affect our business and financial results.

Most new home purchasers finance their home purchases through lenders providing mortgage financing. Immediately prior to 2007, interest rates were at historically low levels and a variety of mortgage products were available. As a result, home ownership became more accessible. The mortgage products available included features that allowed buyers to obtain financing for a significant portion or all of the purchase price of the home, had very limited underwriting requirements or provided for lower initial monthly payments. Accordingly, more people were qualified for mortgage financing.

Since 2007, the mortgage lending industry has experienced significant instability, beginning with increased defaults on subprime loans and other nonconforming loans and compounded by expectations of increasing interest payment requirements and further defaults. This, in turn, resulted in a decline in the market value of many mortgage loans and related securities. Lenders, regulators and others questioned the adequacy of lending standards and other credit requirements for several loan products and programs offered in recent years. Credit requirements tightened, and investor demand for mortgage loans and mortgage-backed securities declined. In general, fewer loan products, tighter loan qualifications, and a reduced willingness of lenders to make loans make it more difficult for many buyers to finance the purchase of homes. These factors served to reduce the pool of qualified homebuyers and made it more difficult to sell to first-time and move-up buyers.

Mortgage rates may rise significantly over the next several years. The benefit of recent trends loosening credit to potential end users of homes may be outweighed by the rise of interest rates for those borrowers, which might lower demand for new homes.

A reduction in the demand for new homes may reduce the amount and price of the residential home lots sold by the developers and homebuilders to which we loan money and/or increase the amount of time such developers and homebuilders must hold the home lots in inventory. These factors increase the likelihood of defaults on our loans, which would adversely affect our business and consolidated financial results.

Most of our assets are commercial construction loans to homebuilders and/or developers which are a higher than average credit risk, and therefore could expose us to higher rates of loan defaults, which could impact our ability to repay amounts owed to Note holders.

Our primary business is extending commercial construction loans to homebuilders, along with some loans for land development. These loans are considered higher risk because the ability to repay depends on the homebuilder’s ability to sell a newly built home. These homes typically are not sold by the homebuilder prior to commencement of construction. Therefore, we may have a higher risk of loan default among our customers than other commercial lending companies. If we suffer increased loan defaults, in any given period, our operations could be materially adversely affected, and we may have difficulty making our principal and interest payments on the Notes.

| 15 |

If we lose or are unable to hire or retain competent personnel, we may be delayed or unable to implement our business plan, which would adversely affect our ability to repay the Notes.

We do not have an employment agreement with any of our employees and cannot guarantee that they will remain affiliated with us. We do not have key man insurance on any of our employees. If any of our key employees were to cease their affiliation with us, our consolidated operating results could suffer. We believe that our future success depends, in part, upon our ability to hire and retain additional personnel. We cannot assure Note holders that we will be successful in attracting and retaining such personnel, which could hinder our ability to implement our business plan.

Employee misconduct could harm us by subjecting us to monetary loss, significant legal liability, regulatory scrutiny, and reputational harm.

Our reputation is critical to maintaining and developing relationships with our existing and potential customers and third parties with whom we do business. There is a risk that our employees could engage in misconduct that adversely affects our business. For example, if an employee were to engage-or be accused of engaging-in illegal or suspicious activities including fraud or theft, we could suffer direct losses from the activity, and in addition we could be subject to regulatory sanctions and suffer serious harm to our reputation, financial condition, customer relationships, and ability to attract future customers or employees. Employee misconduct could prompt regulators to allege or to determine based upon such misconduct that we have not established adequate supervisory systems and procedures to inform employees of applicable rules or to detect and deter violations of such rules. It is not always possible to deter employee misconduct, and the precautions we take to detect and prevent misconduct may not be effective in all cases. Misconduct by our employees, or even unsubstantiated allegations of misconduct, could result in a material adverse effect on our reputation and our business.

A failure in, or breach of, our operational or security systems or infrastructure, or those of our third-party vendors, including as a result of cyber-attacks, could disrupt our business, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs, and cause losses.

We rely heavily on communications and information systems to conduct our business. Information security risks for our business have generally increased in recent years in part because of the proliferation of new technologies; the use of the Internet and telecommunications technologies to process, transmit, and store electronic information, including the management and support of a variety of business processes, including financial transactions and records, personally identifiable information, and customer and investor data; and the increased sophistication and activities of organized crime, hackers, terrorists, activists, and other external parties. As customer, public, and regulatory expectations regarding operational and information security have increased, our operating systems and infrastructure must continue to be safeguarded and monitored for potential failures, disruptions, and breakdowns. Certain of our software and technology systems have been developed internally and may be vulnerable to unauthorized access or disclosure. Our business, financial, accounting, and data processing systems, or other operating systems and facilities, may stop operating properly or become disabled or damaged as a result of a number of factors, including events that are wholly or partially beyond our control. For example, there could be electrical or telecommunication outages; natural disasters such as earthquakes, tornadoes, and hurricanes; disease pandemics; events arising from local or larger scale political or social matters, including terrorist acts; and, as described below, cyber-attacks.

Our business relies on its digital technologies, computer and email systems, software, and networks to conduct its operations. Although we have information security procedures and controls in place, our technologies, systems, and networks and, because the nature of our business involves the receipt and retention of personal information about our customers, our customers’ personal accounts may become the target of cyber-attacks or information security breaches that could result in the unauthorized release, gathering, monitoring, misuse, loss, or destruction of our customers’, or other third parties’ confidential information. Third parties with whom we do business or who facilitate our business activities, including intermediaries or vendors that provide service or security solutions for our operations, and other third parties, could also be sources of operational and information security risk to us, including from breakdowns or failures of their own systems or capacity constraints. In addition, hardware, software, or applications we develop or procure from third parties may contain defects in design or manufacture or other problems that could unexpectedly compromise information security.

| 16 |

While we have disaster recovery and other policies and procedures designed to prevent or limit the effect of the failure, interruption, or security breach of our information systems, there can be no assurance that any such failures, interruptions, or security breaches will not occur or, if they do occur, that they will be adequately addressed. Our risk and exposure to these matters remain heightened because of the evolving nature of these threats. As a result, cyber security and the continued development and enhancement of our controls, processes, and practices designed to protect our systems, computers, software, data, and networks from attack, damage, or unauthorized access remain a focus for us. As threats continue to evolve, we may be required to expend additional resources to continue to modify or enhance our protective measures or to investigate and remediate information security vulnerabilities. Disruptions or failures in the physical infrastructure or operating systems that support our business and customers, or cyber-attacks or security breaches of the networks or systems, could result in regulatory fines, penalties or intervention, reputation damage, reimbursement or other compensation costs, and/or additional compliance costs, any of which could have a material effect on our results of operations or financial condition. Furthermore, if such attacks are not detected immediately, their effect could be compounded.

We are susceptible to customer fraud, which could cause us to suffer losses on our loan portfolio.

Because most of our customers do not publicly report their financial condition and therefore typically are not required to be audited on a regular basis, we are susceptible to a customer’s fraud, which could cause us to suffer losses on our loan portfolio. The failure of a customer to accurately report its financial position, compliance with loan covenants, or eligibility for additional borrowings could result in our providing loans that do not meet our underwriting criteria, defaults in loan payments, and the loss of some or all of the principal of a particular loan or loans. Customer fraud can come in other forms, including but not limited to fraudulent invoices for work done, appraisal fraud, and fraud related to inspections done by third parties.

We have entered into loan purchase and sale agreements with third parties to sell them portions of some of our loans. This increases our leverage. While the agreements are intended to increase our profitability, large loan losses and/or idle cash, could actually reduce our profitability, which could impair our ability to pay principal and/or interest on the Notes.

The loan purchase and sale agreements we entered into have allowed us to increase our loan assets and debt. If loans that we create have significant losses, the benefit of larger balances can be outweighed by the additional loan losses. Also, while these transactions are booked as secured financing, they are not lines of credit. Accordingly, we will have increased our loan balances without increasing our lines of credit, which can cause a decrease in liquidity. One solution to this liquidity problem is having idle cash for liquidity, which then could reduce our profitability. If either of these problems is persistent and/or significant, our ability to pay interest and principal on our Notes may be impaired.

Additional competition may decrease our profitability, which would adversely affect our ability to repay the Notes.

We may experience increased competition for business from other companies and financial institutions that are willing to extend the same types of loans that we extend at lower interest rates and/or fees. These competitors also may have substantially greater resources, lower cost of funds, and a better-established market presence. If these companies increase their marketing efforts to our market niche of borrowers, or if additional competitors enter our markets, we may be forced to reduce our interest rates and fees in order to maintain or expand our market share. Any reduction in our interest rates, interest income, or fees could have an adverse impact on our profitability and our ability to repay the Notes.

Our real estate loans are illiquid, which could restrict our ability to respond rapidly to changes in economic conditions.

The real estate loans we currently hold and intend to extend are illiquid. As a result, our ability to sell under-performing loans in our portfolio or respond to changes in economic, financial, investment, and other conditions may be very limited. We cannot predict whether we will be able to sell any real estate loan for the price or on the terms set by us, or whether any price or other terms offered by a prospective purchaser would be acceptable to us. We also cannot predict the length of time needed to find a willing purchaser and to close the sale of a loan. The relative illiquidity of our loan assets may impair our ability to generate sufficient cash to make required interest and principal payments on the Notes.

| 17 |

Our systems and procedures might be inadequate to handle our potential growth. Failure to successfully improve our systems and procedures would adversely affect our ability to repay the Notes.

We may experience growth that could place a significant strain upon our operational systems and procedures. Initially, all of our computer systems used electronic spreadsheets and we utilized other methods that a small company would use. Over time, we added a loan document system which many banks use to produce closing documents for loans. During March 2018, we replaced our previous electronic spreadsheet system for Notes investors with a proprietary system. In addition, during July 2019, we replaced our loan asset tracking system with a new proprietary system. We may fail to implement these systems effectively. Additionally, our efforts to make these improvements may divert the focus of our personnel. If any of these systems fail, we could have a material adverse effect on our business, financial condition, results of operations, and, ultimately, our ability to repay principal and interest on the Notes.

If we do not meet the requirements to maintain effective internal controls over financial reporting, our ability to raise new capital will be harmed.

If we do not maintain effective internal controls over our financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002, then it could result in delaying future SEC filings or future offerings. If future SEC filings or future offerings are delayed, it could have an extreme negative impact on our cash flow causing us to default on our obligations, including on the Notes.

We are subject to risk of significant losses on our loans because we do not require our borrowers to insure the title of their collateral for our loans.

It is customary for lenders extending loans secured by real estate to require the borrower to provide title insurance with minimum coverage amounts set by the lender. We do not require most of our homebuilders to provide title insurance on their collateral for our loans to them. This represents an additional risk to us as the lender. The homebuilder may have a title problem which normally would be covered by insurance, but may result in a loss on the loan because insurance proceeds are not available.

If a large number of our current and prospective borrowers are unable to repay their loans within a normal average number of months, we will experience a significant reduction in our income and liquidity, and may not be able to repay the Notes as they become due.

Construction loans that we extend are expected to be repaid in a normal average number of months, typically nine months, depending on the size of the loan. Development loans are expected to last for many years. We have interest paid on a monthly basis, but also charge a fee which will be earned over the life of the loan. If these loans are repaid over a longer period of time, the amount of income that we receive on these loans expressed as a percentage of the outstanding loan amount will be reduced, and fewer loans with new fees will be able to be made, since the cash will not be available. This will reduce our income as a percentage of the Notes, and if this percentage is significantly reduced it could impair our ability to pay principal and interest on the Notes.

Our cost of funds is substantially higher than that of banks.

Because we do not offer FDIC insurance, and because we want to grow our Notes Program faster than most banks want to grow their CD base, our Notes offer significantly higher rates than bank CDs. Our cost of funds is higher than banks’ cost of funds due to, among other factors, the higher rate that we pay on our Notes and other sources of financing. This may make it more difficult for us to compete against banks when they rejoin our niche lending market in large numbers. This could result in losses which could impair or eliminate our ability to pay interest and principal on our outstanding Notes.

| 18 |

We are subject to the general market risks associated with real estate construction and development.

Our financial performance depends on the successful construction and/or development and sale of the homes and real estate parcels that serve as security for the loans we make to homebuilders and developers. As a result, we are subject to the general market risks of real estate construction and development, including weather conditions, the price and availability of materials used in construction of homes and development of lots, environmental liabilities and zoning laws, and numerous other factors that may materially and adversely affect the success of the projects.

Our operations are not subject to the stringent banking regulatory requirements designed to protect investors, so repayment of Note holders’ investments is completely dependent upon our successful operation of our business.

Our operations are not subject to the stringent regulatory requirements imposed upon the operations of commercial banks, savings banks, and thrift institutions, and are not subject to periodic compliance examinations by federal or state banking regulators. For example, we will not be well diversified in our product risk, and we cannot benefit from government programs designed to protect regulated financial institutions. Therefore, an investment in our Notes does not have the regulatory protections that the holder of a demand account or a certificate of deposit at a bank does. The return on any Notes purchased by a Note holder is completely dependent upon our successful operations of our business. To the extent that we do not successfully operate our business, our ability to pay interest and principal on the Notes will be impaired.

We are an “emerging growth company” under the federal securities laws and are subject to reduced public company reporting requirements.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, and are eligible to take advantage of certain exemptions from, or reduced disclosure obligations relating to, various reporting requirements that are normally applicable to public companies.

We will remain an “emerging growth company” until the earliest of (1) the last day of the first fiscal year in which we have total annual gross revenues of $1.07 billion or more, (2) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement, (3) the date on which we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act (which would occur if the market value of our common equity held by non-affiliates exceeds $700 million, measured as of the last business day of our most recently completed second fiscal quarter, and we have been publicly reporting for at least 12 months) or (4) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period. Under the JOBS Act, emerging growth companies are not required to (1) provide an auditor’s attestation report on management’s assessment of the effectiveness of internal control over financial reporting, pursuant to Section 404 of the Sarbanes-Oxley Act, (2) comply with new requirements adopted by the Public Company Accounting Oversight Board, or the PCAOB, which require mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor must provide additional information about the audit and the issuer’s financial statements, (3) comply with new audit rules adopted by the PCAOB after April 5, 2012 (unless the SEC determines otherwise), (4) provide certain disclosures relating to executive compensation generally required for larger public companies or (5) hold shareholder advisory votes on executive compensation.

Additionally, the JOBS Act provides that an “emerging growth company” may take advantage of an extended transition period for complying with new or revised accounting standards that have different effective dates for public and private companies. This means an “emerging growth company” can delay adopting certain accounting standards until such standards are otherwise applicable to private companies. However, we have elected to “opt out” of such extended transition period, and will therefore comply with new or revised accounting standards on the applicable dates on which the adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of such extended transition period for compliance with new or revised accounting standards is irrevocable.

| 19 |

We are required to devote resources to comply with various provisions of the Sarbanes-Oxley Act, including Section 404 relating to internal controls testing, and this may reduce the resources we have available to focus on our core business.

Pursuant to Section 404 of the Sarbanes-Oxley Act and the related rules adopted by the SEC and the Public Company Accounting Oversight Board, or PCAOB, our management is required to report on the effectiveness of our internal controls over financial reporting. We may encounter problems or delays in completing any changes necessary to our internal controls over financial reporting. Among other things, we may not be able to conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. Any failure to comply with the various requirements of the Sarbanes-Oxley Act may require significant management time and expenses and divert attention or resources away from our core business. In addition, we may encounter problems or delays in completing the implementation of any requested improvements provided by our independent registered public accounting firm.

We are exposed to risk of environmental liabilities with respect to properties of which we take title. Any resulting environmental remediation expense may reduce our ability to repay the Notes.

In the course of our business, we may foreclose and take title to real estate that could be subject to environmental liabilities. We may be held liable to a governmental entity or to third parties for property damage, personal injury, investigation and clean-up costs incurred by these parties in connection with environmental contamination, or may be required to investigate or clean up hazardous or toxic substances or chemical release at any property. The costs associated with investigation or remediation activities could be substantial. In addition, as the owner or former owner of a contaminated site, we may be subject to common law claims by third parties based on damages and costs resulting from environmental contamination emanating from the property. If we ever become subject to significant environmental liabilities, our business, financial condition, liquidity, and results of operations could be materially and adversely affected.

Our underwriting standards and procedures are more lenient than conventional lenders.

We invest in loans with borrowers who will not be required to meet the credit standards of conventional mortgage lenders, which is riskier than investing in loans made to borrowers who are required to meet those higher credit standards. Because we generally approve loans more quickly than some other lenders or providers of capital, there may be a risk that the due diligence we perform as part of our underwriting procedures will not reveal the need for additional precautions. If so, the interest rate that we charge and the collateral that we require may not adequately protect us or generate adequate returns for the risk undertaken.

The collateral securing our real estate loans may not be sufficient to pay back the principal amount in the event of a default by the borrowers.

In the event of default, our real estate loan investments are generally dependent entirely on the loan collateral to recover our investment. Our loan collateral consists primarily of a mortgage on the underlying property. In the event of a default, we may not be able to recover the premises promptly and the proceeds we receive upon sale of the property may be adversely affected by risks generally related to interests in real property, including changes in general or local economic conditions and/or specific industry segments, declines in real estate values, increases in interest rates, real estate tax rates and other operating expenses including energy costs, changes in governmental rules, regulations and fiscal policies (including environmental legislation), acts of God, and other factors which are beyond our or our borrowers’ control. Current market conditions may reduce the proceeds we are able to receive in the event of a foreclosure on our collateral. Our remedies with respect to the loan collateral may not provide us with a recovery adequate to recover our investment.

| 20 |

Risks Related to Conflicts of Interest

Our CEO (who is also on our board of managers) will face conflicts of interest as a result of the secured lines of credit made to us, which could result in actions that are not in the best interests of our Note holders.

We have two lines of credit from Daniel M. Wallach (our CEO and chairman of the board of managers) and his affiliates. The first line of credit has a maximum principal borrowing amount of $1,250,000 and is payable to Mr. Wallach and his wife, Joyce S. Wallach, as tenants by the entirety (the “Wallach LOC”). The second line of credit has a maximum principal borrowing amount of $250,000 and is payable to the 2007 Daniel M. Wallach Legacy Trust (the “Wallach Trust LOC,” and together with the Wallach LOC, the “Wallach Affiliate LOCs”). As of December 31, 2019, we borrowed $0 on the Wallach Trust LOC, with availability on that line of credit of $250,000, and $44,000 on the Wallach LOC, with remaining availability on that line of credit of $1,206,000. The interest rates on the Wallach Affiliate LOCs generally equal the prime rate plus 3% and were 7.75% as of December 31, 2019. The Wallach Affiliate LOCs are collateralized by a lien against all of our assets. The Notes are subordinated in right of payment to all secured debt, including these Wallach Affiliate LOCs. Pursuant to the promissory note for each Wallach Affiliate LOC, the lenders have the option of funding any amount up to the face amount of the note, in the lender’s sole and absolute discretion. Therefore, Mr. Wallach will face conflicts of interest in deciding whether and when to exercise any rights pursuant to the Wallach Affiliate LOCs. If these Wallach affiliates exercise their rights to collect on their collateral upon a default by us, we could lose some or all of our assets, which could have a negative effect on our ability to repay the Notes.

Some of our employees and managers may face conflicts of interest as a result of their and their relatives’ investment in the Notes, which could result in actions that are not in your best interests.

Employees, managers, members, and relatives of managers and members have invested in the Notes, with $3,849,000 outstanding as of December 31, 2019. While investment in the Notes by our affiliates may align their interests with those of other Note holders, it could also create conflicts of interest by influencing those employees’ or managers’ actions during times of financial difficulties. For example, the fact that certain of our managers hold Notes, and the value of Notes they hold, could influence their decision to redeem Notes at a time or times when it would be prudent to use our cash resources to build capital, pay down other outstanding obligations, or grow our business. There may be other situations not presently foreseeable in which the ownership of Notes by related persons may create conflicts of interest. These conflicts of interest could result in action or inaction by management that is adverse to other holders of the Notes.

As a result of his large equity ownership in the Company, our CEO will face a conflict of interest in deciding the amount of distributions to equity owners, which could result in actions that are not in the best interests of Note holders.

As of December 31, 2019, our CEO (who is also on the board of managers) beneficially owned 80.7% of the common equity of the Company. He and his wife also own 48% the Series C cumulative preferred units outstanding as of December 31, 2019. Since the Company is taxed as a partnership for federal income tax purposes, all profits and losses flow through to the equity owners. Therefore, Mr. Wallach and his affiliated equity owners of the Company will be motivated to distribute profits to the equity owners on an annual basis, rather than retain earnings in the Company for Company purposes. There is currently no limit in the indenture or otherwise on the amount of funds that may be distributed by the Company to its equity owners. If substantial funds are distributed to the equity owners, the liquidity and capital resources of the Company will be reduced and our ability to repay the Notes may be negatively impacted.

We have three lines of credit from affiliates which allow us to incur a significant amount of secured debt. These lines are collateralized by a lien against all of our assets. Our purchase and sale agreements function as secured debt as well. We expect to incur a significant amount of additional debt in the future, including issuance of the Notes, which will subject us to increased risk of loss.