Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - CENTURY BANCORP INC | d827661dex322.htm |

| EX-32.1 - EX-32.1 - CENTURY BANCORP INC | d827661dex321.htm |

| EX-31.2 - EX-31.2 - CENTURY BANCORP INC | d827661dex312.htm |

| EX-31.1 - EX-31.1 - CENTURY BANCORP INC | d827661dex311.htm |

| EX-23.1 - EX-23.1 - CENTURY BANCORP INC | d827661dex231.htm |

| EX-21 - EX-21 - CENTURY BANCORP INC | d827661dex21.htm |

| EX-4.4 - EX-4.4 - CENTURY BANCORP INC | d827661dex44.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-15752

CENTURY BANCORP, INC.

(Exact name of registrant as specified in its charter)

| COMMONWEALTH OF MASSACHUSETTS | 04-2498617 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification number) | |

| 400 MYSTIC AVENUE, MEDFORD, MA | 02155 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number including area code:

(781) 391-4000

Securities registered pursuant to Section 12(b) of the Act:

| Title of class |

Trading Symbol(s) |

Name of exchange | ||

| Class A Common Stock, $1.00 par value | CNBKA | Nasdaq Global Market |

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulations S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ |

Accelerated filer |

☑ | |||

| Non-accelerated filer | ☐ | Smaller reporting company |

☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

State the aggregate market value of the registrant’s voting and nonvoting stock held by nonaffiliates, computed using the closing price as reported on Nasdaq as of June 30, 2019 was $319,749,083.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of February 29, 2020:

Class A Common Stock, $1.00 par value 3,652,349 Shares

Class B Common Stock, $1.00 par value 1,915,560 Shares

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

| (1) | Portions of the Registrant’s Annual Report to Stockholders for the fiscal year ended December 31, 2019 are incorporated into Part II, Items 5-8 of this Form 10-K. |

Table of Contents

CENTURY BANCORP INC.

FORM 10-K

| Page | ||||||

| PART I | ||||||

| ITEM 1 |

1-6 | |||||

| ITEM 1A |

6-7 | |||||

| ITEM 1B |

7 | |||||

| ITEM 2 |

8 | |||||

| ITEM 3 |

8 | |||||

| ITEM 4 |

8 | |||||

| PART II | ||||||

| ITEM 5 |

9 | |||||

| ITEM 6 |

9 | |||||

| ITEM 7 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

9 | ||||

| ITEM 7A |

10 | |||||

| ITEM 8 |

10 | |||||

| ITEM 9 |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

10 | ||||

| ITEM 9A |

10 | |||||

| ITEM 9B |

10 | |||||

| PART III | ||||||

| ITEM 10 |

97-102 | |||||

| ITEM 11 |

102-112 | |||||

| ITEM 12 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

112-113 | ||||

| ITEM 13 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

113-114 | ||||

| ITEM 14 |

114 | |||||

| PART IV | ||||||

| ITEM 15 |

115-117 | |||||

| ITEM 16 |

117 | |||||

| 118 | ||||||

i

Table of Contents

PART I

| ITEM 1. | BUSINESS |

The Company

Century Bancorp, Inc. (together with its bank subsidiary, unless the context otherwise requires, the “Company”) is a Massachusetts state-chartered bank holding company headquartered in Medford, Massachusetts. The Company is a Massachusetts corporation formed in 1972 and has one banking subsidiary (the “Bank”): Century Bank and Trust Company formed in 1969. At December 31, 2019, the Company had total assets of $5.5 billion. Currently, the Company operates 27 banking offices in 20 cities and towns in Massachusetts, ranging from Braintree in the south to Andover in the north. The Bank’s customers consist primarily of small and medium-sized businesses and retail customers in these communities and surrounding areas, as well as local governments and large healthcare and higher education institutions throughout Massachusetts, New Hampshire, Rhode Island, Connecticut, and New York.

The Company’s results of operations are largely dependent on net interest income, which is the difference between the interest earned on loans and securities and interest paid on deposits and borrowings. The results of operations are also affected by the level of income and fees from loans, deposits, as well as operating expenses, the provision for loan losses, the impact of federal and state income taxes and the relative levels of interest rates and economic activity.

The Company offers a wide range of services to commercial enterprises, state and local governments and agencies, non-profit organizations and individuals. It emphasizes service to small and medium-sized businesses and retail customers in its market area. The Company makes commercial loans, real estate and construction loans and consumer loans, and accepts savings, time, and demand deposits. In addition, the Company offers to its corporate and institutional customers automated lock box collection services, cash management services and account reconciliation services, and actively promotes the marketing of these services to the municipal market. Also, the Company provides full service securities brokerage services through a program called Investment Services at Century Bank, which is supported by LPL Financial, a third party full-service securities brokerage business.

The Company has municipal cash management client engagements in Massachusetts, New Hampshire and Rhode Island comprised of approximately 298 government entities.

Availability of Company Filings

Under the Securities Exchange Act of 1934, Sections 13 and 15(d), periodic and current reports must be filed with the Securities and Exchange Commission (the “SEC”). The Company electronically files with the SEC its periodic and current reports, as well as other filings it makes with the SEC from time to time. The SEC maintains an Internet site that contains reports and other information regarding issuers, including the Company, that file electronically with the SEC, at www.sec.gov, in which all forms filed electronically may be accessed. Additionally, our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and additional shareholder information are available free of charge on the Company’s website: www.centurybank.com.

Employees

As of December 31, 2019, the Company had 404 full-time and 56 part-time employees. The Company’s employees are not represented by any collective bargaining unit. The Company believes that its employee relations are good.

Financial Services Modernization

On November 12, 1999, President Clinton signed into law The Gramm-Leach-Bliley Act (“Gramm-Leach”) which significantly altered banking laws in the United States. Gramm-Leach enables combinations among banks,

1

Table of Contents

securities firms and insurance companies beginning March 11, 2000. As a result of Gramm Leach, many of the depression-era laws that restricted these affiliations and other activities that may be engaged in by banks and bank holding companies were repealed. Under Gramm-Leach, bank holding companies are permitted to offer their customers virtually any type of financial service that is financial in nature or incidental thereto, including banking, securities underwriting, insurance (both underwriting and agency) and merchant banking.

In order to engage in these financial activities, a bank holding company must qualify and register with the Federal Reserve Board as a “financial holding company” by demonstrating that each of its bank subsidiaries is “well capitalized,” “well managed,” and has at least a “satisfactory” rating under the Community Reinvestment Act of 1977 (the “CRA”). The Company has not elected to become a financial holding company under Gramm-Leach.

These financial activities authorized by Gramm-Leach may also be engaged in by a “financial subsidiary” of a national or state bank, except for insurance or annuity underwriting, insurance company portfolio investments, real estate investment and development and merchant banking, which must be conducted in a financial holding company. In order for the new financial activities to be engaged in by a financial subsidiary of a national or state bank, Gramm-Leach requires each of the parent bank (and any bank affiliates) to be “well capitalized” and “well managed;” the aggregate consolidated assets of all of that bank’s financial subsidiaries may not exceed the lesser of 45% of its consolidated total assets or $50 billion; the bank must have at least a satisfactory CRA rating; and, if the bank is one of the 100 largest banks, it must meet certain financial rating or other comparable requirements. The Company does not currently conduct activities through a financial subsidiary.

Gramm-Leach establishes a system of functional regulation, under which the federal banking agencies will regulate the banking activities of financial holding companies and banks’ financial subsidiaries, the SEC will regulate their securities activities, and state insurance regulators will regulate their insurance activities. Gramm-Leach also provides new protections against the transfer and use by financial institutions of consumers’ nonpublic, personal information.

Holding Company Regulation

The Company is a bank holding company as defined by the Bank Holding Company Act of 1956, as amended (the “Holding Company Act”), and is registered as such with the Board of Governors of the Federal Reserve Bank (the “FRB”), which is responsible for administration of the Holding Company Act. Although the Company may meet the qualifications for electing to become a financial holding company under Gramm-Leach, the Company has elected to retain its pre-Gramm-Leach status for the present time under the Holding Company Act. As required by the Holding Company Act, the Company files with the FRB an annual report regarding its financial condition and operations, management and intercompany relationships of the Company and the Bank. It is also subject to examination by the FRB and must obtain FRB approval before (i) acquiring direct or indirect ownership or control of more than 5% of the voting stock of any bank, unless it already owns or controls a majority of the voting stock of that bank, (ii) acquiring all or substantially all of the assets of a bank, except through a subsidiary which is a bank, or (iii) merging or consolidating with any other bank holding company. A bank holding company must also give the FRB prior written notice before purchasing or redeeming its equity securities, if the gross consideration for the purchase or redemption, when aggregated with the net consideration paid by the company for all such purchases or redemptions during the preceding 12 months, is equal to 10% or more of the company’s consolidated net worth.

The Holding Company Act prohibits a bank holding company, with certain exceptions, from (i) acquiring direct or indirect ownership or control of more than 5% of any class of voting shares of any company which is not a bank or a bank holding company, or (ii) engaging in any activity other than managing or controlling banks, or furnishing services to or performing services for its subsidiaries. A bank holding company may own, however, shares of a company engaged in activities which the FRB has determined are so closely related to banking or managing or controlling banks as to be a proper incident thereto.

2

Table of Contents

The Company and its subsidiaries are examined by federal and state regulators. The FRB has regulatory authority over holding company activities and performed a review of the Company and its subsidiaries as of September 2017.

USA PATRIOT Act

Under Title III of the USA PATRIOT Act, also known as the “International Money Laundering Abatement and Anti-Terrorism Act of 2001”, all financial institutions are required in general to identify their customers, adopt formal and comprehensive anti-money laundering programs, scrutinize or prohibit altogether certain transactions of special concern, and be prepared to respond to inquiries from U.S. law enforcement agencies concerning their customers and their transactions. Additional information-sharing among financial institutions, regulators, and law enforcement authorities is encouraged by the presence of an exemption from the privacy provisions of the Gramm-Leach Act for financial institutions that comply with this provision and the authorization of the Secretary of the Treasury to adopt rules to further encourage cooperation and information-sharing. The effectiveness of a financial institution in combating money laundering activities is a factor to be considered in any application submitted by the financial institution under the Holding Company Act or Bank Merger Act.

Sarbanes-Oxley Act

The Sarbanes-Oxley Act, signed into law July 30, 2002, addresses, among other issues, corporate governance, auditor independence and accounting standards, executive compensation, insider loans, whistleblower protection and enhanced and timely disclosure of corporate information. The SEC has adopted a substantial number of implementing rules and the Financial Industry Regulatory Authority (FINRA) has adopted corporate governance rules that have been approved by the SEC and are applicable to the Company. The changes are intended to allow stockholders to monitor more effectively the performance of companies and management. As directed by Section 302(a) of the Sarbanes-Oxley Act, the Company’s Chief Executive Officer and Chief Financial Officer are each required to certify that the Company’s quarterly and annual reports do not contain any untrue statement of a material fact. This requirement has several parts, including certification that these officers are responsible for establishing, maintaining and regularly evaluating the effectiveness of the Company’s disclosure controls and procedures and internal controls over financial reporting; that they have made certain disclosures to the Company’s auditors and the Board of Directors about the Company’s disclosure controls and procedures and internal control over financial reporting, and that they have included information in the Company’s quarterly and annual reports about their evaluation of the Company’s disclosure controls and procedures and internal control over financial reporting, and whether there have been significant changes in the Company’s internal disclosure controls and procedures or in other factors that could significantly affect such controls and procedures subsequent to the evaluation and whether there have been any significant changes in the Company’s internal control over financial reporting that have materially affected or reasonably likely to materially affect the Company’s internal control over financial reporting, and compliance with certain other disclosure objectives. Section 906 of the Sarbanes-Oxley Act requires an additional certification that each periodic report containing financial statements fully complies with the requirements of Section 13(a) and 15(d) of the Securities Exchange Act of 1934 and that the information in the report fairly presents, in all material respects, the financial conditions and results of operations of the Company.

Dodd-Frank Wall Street Reform and Consumer Protection Act

On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “D-F Act”) became law. The D-F Act was intended to address many issues arising in the recent financial crisis and is exceedingly broad in scope, affecting many aspects of bank and financial market regulation. The D-F Act requires, or permits by implementing regulation, enhanced prudential standards for banks and bank holding companies inclusive of capital, leverage, liquidity, concentration and exposure measures. In addition, traditional bank regulatory principles such as restrictions on transactions with affiliates and insiders were enhanced. The D-F Act also contains reforms of consumer mortgage lending practices and creates a Bureau of Consumer Financial Protection, which is granted broad authority over consumer financial practices of banks and others. It is expected as the specific new or incremental requirements applicable to the Company become effective that the costs and

3

Table of Contents

difficulties of remaining compliant with all such requirements will increase. The D-F Act broadened the base for FDIC assessments to average consolidated assets less tangible equity of financial institutions and also permanently raises the current standard maximum FDIC deposit insurance amount to $250,000. The Act extended unlimited deposit insurance on non-interest bearing transaction accounts through December 31, 2012.

In addition, the D-F Act added a new Section 13 to the Bank Holding Company Act, the so-called “Volcker Rule,” (the “Rule”) which generally restricts certain banking entities such as the Company and its subsidiaries or affiliates, from engaging in proprietary trading activities and owning equity in or sponsoring any private equity or hedge fund. The Rule became effective July 21, 2012. The final implementing regulations for the Rule were issued by various regulatory agencies in December 2013 and under an extended conformance regulation compliance was required to be achieved by July 21, 2015. The conformance period for investments in and relationships with certain “legacy covered funds” was extended to July 21, 2017. Under the Rule, the Company may be restricted from engaging in proprietary trading, investing in third party hedge or private equity funds or sponsoring new funds unless it qualifies for an exemption from the rule. The Company has little involvement in prohibited proprietary trading or investment activities in covered funds and the Company does not expect that complying with the requirements of the Rule will have any material effect on the Company’s financial condition or results of operation. The federal banking agencies have issued amendments to the Rule to provide greater clarity and certainty about what activities are prohibited and to improve the effective allocation of compliance resources, and to conform the Rule to the EGRRCPA (discussed below). The federal banking agencies have also issued a notice of proposed rulemaking to liberalize the covered fund rules.

Tax Cuts and Jobs Act

On December 22, 2017, the Tax Cuts and Jobs Act (the “Tax Act”) was enacted, which represents the most comprehensive reform to the U.S. tax code in over thirty years. The majority of the provisions of the Tax Act took effect on January 1, 2018. The Tax Act lowered the Company’s federal tax rate from 34% to 21%. Also, for tax years beginning after December 31, 2017, the corporate Alternative Minimum Tax (“AMT”) has been repealed. For 2018 through 2021, the AMT credit carryforward can offset regular tax liability and is refundable in an amount equal to 50% (100% for 2021) of the excess of the minimum tax credit for the tax year over the amount of the credit allowable for the year against regular tax liability. Accordingly, it is anticipated that the full amount of the alternative minimum tax credit carryforward will be recovered in tax years beginning before 2022. The Tax Act also contains other provisions that may affect the Company currently or in future years. Among these are changes to the deductibility of meals and entertainment, the deductibility of executive compensation, the dividend received deduction and net operating loss carryforwards. Tax Act changes for individuals include lower tax rates, mortgage interest and state and local tax limitations as well as an increase in the standard deduction, among others.

Economic Growth, Regulatory Relief, and Consumer Protection Act

On May 24, 2018, the Economic Growth, Regulatory Relief, and Consumer Protection Act, or the EGRRCPA, became law. This is arguably the most significant financial institution legislation since the D-F Act. The EGRRCPA changes certain of the regulatory requirements of the D-F Act and includes provisions intended to relieve the regulatory burden on “community banks.” Among other things, for qualifying community banks with less than $10 billion in total consolidated assets, the EGRRCPA contains a safe harbor from the D-F Act “ability to repay” mortgage requirements, an exemption from the Volcker Rule, may permit filing of simplified Call Reports, and potentially will result in some alleviation of the D-F Act and U.S. Basel III capital mandates. The EGRRCPA requires the federal banking agencies to develop a community bank leverage ratio (defined as the ratio of tangible equity capital to average total consolidated assets) for banks and holding companies with total consolidated assets of less than $10 billion and an appropriate risk profile. The required regulations must specify a minimum community bank leverage ratio of not less than 8% and not more than 10%. The federal banking agencies jointly issued a final rule, effective January 1, 2020, which would set the minimum ratio at 9%. Qualifying banks that exceed the minimum community bank leverage ratio will be deemed to be in compliance

4

Table of Contents

with all other capital and leverage requirements including the capital ratio requirements that are required to be considered well capitalized under Section 38 of Federal Deposit Insurance Act.

Deposit Insurance Premiums

The Bank’s deposits have the benefit of FDIC insurance up to applicable limits. The FDIC’s Deposit Insurance Fund is funded by assessments on insured depository institutions, which depend on the risk category of an institution and the amount of assets that it holds. The FDIC may increase or decrease the assessment rate schedule on a semi-annual basis.

On September 29, 2009, the FDIC adopted a Notice of Proposed Rulemaking (NPR) that required insured institutions to prepay their estimated quarterly risk-based assessments for the fourth quarter of 2009 and for all of 2010, 2011 and 2012. The FDIC Board voted to adopt a uniform three-basis point increase in assessment rates effective on January 1, 2011 and extend the restoration period from seven to eight years. This rule was finalized on November 2, 2009. The Company’s quarterly risk-based deposit insurance assessments were paid from this amount until June 30, 2013. The Company received a refund of $2.4 million of prepaid FDIC assessments in June 2013.

In February 2011, the FDIC approved a rule to change the assessment base from adjusted domestic deposits to average consolidated total assets minus average tangible equity. The rule has kept the overall amount collected from the industry very close to the amount collected prior to the new calculation.

In December 2018, the FDIC issued a final rule to implement the EGRRCPA providing a limited exception for a capped amount of reciprocal deposits from treatment as brokered deposits for qualifying institutions.

On January 24, 2019, the FDIC notified the Company that $1.2 million of small bank assessment credits were available to offset quarterly FDIC assessment charges. The FDIC Deposit Insurance Fund Reserve Ratio reached 1.40% as of June 30, 2019, and the FDIC first applied small bank credits on the September 30, 2019 assessment invoice (for the second quarter of 2019). The FDIC will continue to apply small bank credits so long as the Reserve Ratio is at least 1.35%. After applying small bank credits for four quarters, the FDIC will remit the value of any remaining small bank credits in the next assessment period in which the Reserve Ratio is at least 1.35%. The Company’s remaining small bank assessment credit was $485,000 on December 31, 2019.

Risk-Based Capital Guidelines

Federal banking regulators have issued risk-based capital guidelines, which assign risk factors to asset categories and off-balance-sheet items. Also, the Basel Committee has issued capital standards entitled “Basel III: A global regulatory framework for more resilient banks and banking systems” (“Basel III”). The Federal Reserve Board has finalized its rule implementing the Basel III regulatory capital framework. The rule that came into effect in January 2015 sets the Basel III minimum regulatory capital requirements for all organizations. It included a new common equity Tier I ratio of 4.5 percent of risk-weighted assets, raised the minimum Tier I capital ratio from 4 percent to 6 percent of risk-weighted assets and would set a new conservation buffer of 2.5 percent of risk-weighted assets. The implementation of the framework did not have a material impact on the Company’s financial condition or results of operations.

Competition

The Company experiences substantial competition in attracting deposits and making loans from commercial banks, thrift institutions and other enterprises such as insurance companies and mutual funds. These competitors include several major commercial banks whose greater resources may afford them a competitive advantage by enabling them to maintain numerous branch offices and mount extensive advertising campaigns. A number of these competitors are not subject to the regulatory oversight that the Company is subject to, which increases these competitors’ flexibility.

5

Table of Contents

Forward-Looking Statements

Certain statements contained herein are not based on historical facts and are “forward-looking statements” within the meaning of Section 21A of the Securities Exchange Act of 1934. Forward-looking statements, which are based on various assumptions (some of which are beyond the Company’s control), may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” “anticipate,” “continue” or similar terms or variations on those terms, or the negative of these terms. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors, including, but not limited to, those related to the economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset/liability management, the financial and securities markets, and the availability of and costs associated with sources of liquidity. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

| ITEM 1A. | RISK FACTORS |

The risk factors that may affect the Company’s performance and results of operations include the following:

| i. | the Company’s business is dependent upon general economic conditions in Massachusetts, New Hampshire, Rhode Island, Connecticut, and New York. The national and local economies may adversely affect the Company’s performance and results of operations; |

| ii. | the Company’s earnings depend, to a great extent, upon the level of net interest income generated by the Company, and therefore the Company’s results of operations may be adversely affected by increases or decreases in interest rates or by the shape of the yield curve; |

| iii. | the banking business is highly competitive and the profitability of the Company depends upon the Company’s ability to attract loans and deposits in Massachusetts, New Hampshire, Rhode Island, Connecticut, and New York, where the Company competes with a variety of traditional banking companies, some of which have vastly greater resources, and nontraditional institutions such as credit unions and finance companies; |

| iv. | at December 31, 2019, approximately 65.9% of the Company’s loan portfolio was comprised of commercial and commercial real estate loans, exposing the Company to the risks inherent in financings based upon analyses of credit risk, the value of underlying collateral, including real estate, and other more intangible factors, which are considered in making commercial loans; |

| v. | at December 31, 2019, approximately 27.9% of the Company’s loan portfolio was comprised of residential real estate and home equity loans, exposing the Company to the risks inherent in financings based upon analyses of credit risk and the value of underlying collateral. Accordingly, the Company’s profitability may be negatively impacted by errors in risk analyses, by loan defaults and the ability of certain borrowers to repay such loans may be adversely affected by any downturn in general economic conditions; |

| vi. | economic conditions and interest rate risk could adversely impact the fair value and the ultimate collectibility of the Company’s investments. Should an investment be deemed “other than temporarily impaired”, the Company would be required to write-down the carrying value of the investment through earnings. Such write-down(s) may have a material adverse effect on the Company’s financial condition and results of operations; |

| vii. | write-down of goodwill and other identifiable intangible assets would negatively impact our financial condition and results of operations. At December 31, 2019, our goodwill and other identifiable intangible assets were approximately $2.7 million; |

6

Table of Contents

| viii. | natural disasters can disrupt our operations, result in damage to the Company’s properties, reduce or destroy the value of the collateral for the Company’s loans and negatively affect the economies in which the Company operates, which could have a material adverse effect on the Company’s results of operations and financial condition. A significant natural disaster, such as a tornado, hurricane, earthquake, fire or flood, could have a material adverse impact on the Company’s ability to conduct business, and the Company’s insurance coverage may be insufficient to compensate for losses that may occur. Acts of terrorism, war, civil unrest or pandemics, including COVID 19, could cause disruptions to the Company’s business or the economy as a whole. While the Company has established and regularly test disaster recovery procedures, the occurrence of any such event could have a material adverse effect on the Company’s business, operations and financial condition. |

| ix. | changes in the extensive laws, regulations and policies governing companies generally and bank holding companies and their subsidiaries, such as the Act and the Tax Act, could alter the Company’s business environment or affect the Company’s operations; |

| x. | the potential need to adapt to industry changes in information technology systems, on which the Company is highly dependent to secure bank and customer financial information, could present operational issues, require significant capital spending or impact the Company’s reputation; |

| xi. | in the ordinary course of our business, we collect and store sensitive data, including intellectual property, our proprietary business information and that of our customers, and business partners, and personally identifiable information of our customers and employees, in our data centers and on our networks. The secure processing, maintenance and transmission of this information is critical to our operations and business strategy. Despite our security measures, our information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. Any such breach could compromise our networks and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, liability under laws that protect the privacy of personal information, and regulatory penalties, disrupt our operations and the services we provide to customers, and damage our reputation, and cause a loss of confidence in our products and services, which could adversely affect our results of operations and competitive position; |

| xii. | the Company’s loan customers may not repay loans according to their terms, and the collateral securing the payment of loans may be insufficient to assure repayment or cover losses. If loan customers fail to repay loans according to the terms of the loans, the Company may experience significant credit losses which could have a material adverse effect on its operating results and capital ratios; |

| xiii. | the Company is subject to extensive regulation, supervision and examination. Any change in the laws or regulations or failure by the Company to comply with applicable law and regulation, or a change in regulators’ supervisory policies or examination procedures, whether by the Massachusetts Commissioner of Banks, the FDIC, the Federal Reserve Board, other state or federal regulators, the United States Congress, or the Massachusetts legislature could have a material adverse effect on the Company’s business, financial condition, results of operations, and cash flows. Changes in accounting policies, practices and standards, as may be adopted by the regulatory agencies as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, and other accounting standard setters, could also impact the Company’s financial results; and |

These factors, as well as general economic and market conditions in the United States of America, may materially and adversely affect the Company’s performance, results of operations and the market price of shares of the Company’s Class A common stock.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

No written comments received by the Company from the SEC regarding the Company’s periodic or current reports remain unresolved.

7

Table of Contents

| ITEM 2. | PROPERTIES |

The Company owns its main banking office, headquarters, and operations center in Medford, Massachusetts, which were expanded in 2004, and 11 of the 26 other facilities in which its branch offices are located. The remaining offices are occupied under leases expiring on various dates from 2020 to 2028. The Company believes that its banking offices are in good condition.

During the third quarter of 2019, the Company purchased the existing Boylston Street, Brookline branch location that the Company was leasing. Also, during the third quarter, the Company purchased a future branch location in Salem, New Hampshire. The Company plans to open this branch during the fourth quarter of 2020.

| ITEM 3. | LEGAL PROCEEDINGS |

The Company and its subsidiaries are parties to various claims and lawsuits arising in the course of their normal business activities. Although the ultimate outcome of these suits cannot be ascertained at this time, it is the opinion of management that none of these matters, even if it resolved adversely to the Company, will have a material adverse effect on the Company’s consolidated financial position.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

8

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

| (a) | The Class A Common Stock of the Company is traded on the NASDAQ National Global Market under the symbol “CNBKA.” The Company’s Class B Common Stock is not traded on any national securities exchange or other public trading market. |

The shares of Class A Common Stock are generally not entitled to vote on any matter, including in the election of Company Directors, but, in limited circumstances, may be entitled to vote as a class on certain extraordinary transactions, including any merger or consolidation (other than one in which the Company is the surviving corporation or one which by law may be approved by the directors without any stockholder vote) or the sale, lease, or exchange of all or substantially all of the property and assets of the Company. Since the vote of a majority of the shares of the Company’s Class B Common Stock, voting as a separate class, is required to approve certain extraordinary corporate transactions, the holders of Class B Common Stock have the power to prevent any takeover of the Company not approved by them.

| (b) | Approximate number of equity security holders as of December 31, 2019: |

| Title of Class |

Approximate Number of Record Holders |

|||

| Class A Common Stock |

900 | |||

| Class B Common Stock |

150 | |||

| (c) | The following schedule provides information with respect to the Company’s equity compensation plans under which shares of Class A Common Stock are authorized for issuance as of December 31, 2019: |

| Equity Compensation Plan Information | ||||||||||||

| Plan Category |

Number of Shares to be Issued Upon Exercise of Outstanding Options (a) |

Weighted-Average Exercise Price of Outstanding Options (b) |

Number of Shares Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Shares Reflected in Column (a)) (c) |

|||||||||

| Equity compensation plans approved by security holders |

— | $ | — | 233,934 | ||||||||

| Equity compensation plans not approved by security holders |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

— | $ | — | 233,934 | ||||||||

| (d) | The performance graph information required herein is shown on page 10. |

| ITEM 6. | SELECTED FINANCIAL DATA |

The information required herein is shown on pages 12 through 14.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

The information required herein is shown on pages 15 through 38.

9

Table of Contents

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

The information required herein is shown on page 35.

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

The information required herein is shown on pages 39 through 92.

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

None.

| ITEM 9A. | CONTROLS AND PROCEDURES |

The Company’s principal executive officer and principal financial officer have evaluated the Company’s disclosure controls and procedures as of December 31, 2019. Based on this evaluation, the principal executive officer and principal financial officer have concluded that the Company’s disclosure controls and procedures are effective. The Company’s disclosure controls and procedures also effectively ensure that information required to be disclosed in the Company’s filings and submissions with the Securities and Exchange Commission under the Securities Exchange Act of 1934 is accumulated and reported to Company management (including the principal executive officer and principal financial officer) and is recorded, processed, summarized and reported within the time periods specified by the Securities and Exchange Commission. In addition, the Company has reviewed its internal control over financial reporting and there have been no changes that occurred during the fourth fiscal quarter that have materially affected, or are reasonably likely to materially affect its internal control over financial reporting or in other factors that could significantly affect its internal control over financial reporting.

On May 14, 2013, the Committee of Sponsoring Organizations of the Treadway Commission (COSO) released an updated version of its Internal Control — Integrated Framework (2013) (2013 Framework). The 2013 Framework’s internal control components (i.e., control environment, risk assessment, control activities, information and communication, and monitoring activities) remain predominantly the same as those in the 1992 Framework. However, the 2013 Framework was expanded to include 17 principles which must be present and functioning in order to have an effective system of internal controls. The Company implemented the 2013 Framework effective December 31, 2014.

Management’s report on internal control over financial reporting is shown on page 96. The audit report of the registered public accounting firm is shown on page 94.

| ITEM 9B. | OTHER INFORMATION |

None.

10

Table of Contents

Table of Contents

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| (dollars in thousands, except share data) |

||||||||||||||||||||

| FOR THE YEAR |

||||||||||||||||||||

| Interest income |

$ | 159,139 | $ | 137,056 | $ | 113,436 | $ | 96,699 | $ | 90,093 | ||||||||||

| Interest expense |

63,350 | 44,480 | 27,820 | 22,617 | 20,134 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income |

95,789 | 92,576 | 85,616 | 74,082 | 69,959 | |||||||||||||||

| Provision for loan losses |

1,250 | 1,350 | 1,790 | 1,375 | 200 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income after provision for loan losses |

94,539 | 91,226 | 83,826 | 72,707 | 69,759 | |||||||||||||||

| Other operating income |

18,399 | 16,248 | 16,552 | 16,222 | 15,993 | |||||||||||||||

| Operating expenses |

72,129 | 69,693 | 67,119 | 64,757 | 62,198 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

40,809 | 37,781 | 33,259 | 24,172 | 23,554 | |||||||||||||||

| Provision for income taxes |

1,110 | 1,568 | 10,958 | (362 | ) | 533 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 39,699 | $ | 36,213 | $ | 22,301 | $ | 24,534 | $ | 23,021 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core earnings—Non-GAAP (1) |

$ | 39,699 | $ | 36,213 | $ | 30,749 | $ | 24,534 | $ | 23,021 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average shares outstanding Class A, basic |

3,633,044 | 3,608,179 | 3,604,029 | 3,600,729 | 3,600,729 | |||||||||||||||

| Average shares outstanding Class B, basic |

1,934,865 | 1,959,730 | 1,963,880 | 1,967,180 | 1,967,180 | |||||||||||||||

| Average shares outstanding Class A, diluted |

5,567,909 | 5,567,909 | 5,567,909 | 5,567,909 | 5,567,909 | |||||||||||||||

| Average shares outstanding Class B, diluted |

1,934,865 | 1,959,730 | 1,963,880 | 1,967,180 | 1,967,180 | |||||||||||||||

| Total shares outstanding at year-end |

5,567,909 | 5,567,909 | 5,567,909 | 5,567,909 | 5,567,909 | |||||||||||||||

| Earnings per share: |

||||||||||||||||||||

| Basic, Class A |

$ | 8.63 | $ | 7.89 | $ | 4.86 | $ | 5.35 | $ | 5.02 | ||||||||||

| Basic, Class B |

$ | 4.31 | $ | 3.95 | $ | 2.43 | $ | 2.68 | $ | 2.51 | ||||||||||

| Diluted, Class A |

$ | 7.13 | $ | 6.50 | $ | 4.01 | $ | 4.41 | $ | 4.13 | ||||||||||

| Diluted, Class B |

$ | 4.31 | $ | 3.95 | $ | 2.43 | $ | 2.68 | $ | 2.51 | ||||||||||

| Dividend payout ratio—Non-GAAP (1) |

5.6 | % | 6.1 | % | 9.9 | % | 9.0 | % | 9.6 | % | ||||||||||

| AT YEAR-END |

||||||||||||||||||||

| Assets |

$ | 5,492,424 | $ | 5,163,935 | $ | 4,785,572 | $ | 4,462,608 | $ | 3,947,441 | ||||||||||

| Loans |

2,426,119 | 2,285,578 | 2,175,944 | 1,923,933 | 1,731,536 | |||||||||||||||

| Deposits |

4,400,111 | 4,406,964 | 3,916,967 | 3,653,218 | 3,075,060 | |||||||||||||||

| Stockholders’ equity |

332,581 | 300,439 | 260,297 | 240,041 | 214,544 | |||||||||||||||

| Book value per share |

$ | 59.73 | $ | 53.96 | $ | 46.75 | $ | 43.11 | $ | 38.53 | ||||||||||

| SELECTED FINANCIAL PERCENTAGES |

||||||||||||||||||||

| Return on average assets |

0.76 | % | 0.74 | % | 0.48 | % | 0.57 | % | 0.59 | % | ||||||||||

| Return on average stockholders’ equity |

12.44 | % | 13.05 | % | 8.75 | % | 10.80 | % | 11.26 | % | ||||||||||

| Net interest margin, taxable equivalent |

2.10 | % | 2.18 | % | 2.25 | % | 2.12 | % | 2.18 | % | ||||||||||

| Net charge-offs (recoveries) as a percent of average loans |

0.01 | % | (0.04 | )% | 0.00 | % | 0.00 | % | (0.04 | )% | ||||||||||

| Average stockholders’ equity to average assets |

6.12 | % | 5.71 | % | 5.50 | % | 5.29 | % | 5.25 | % | ||||||||||

| Efficiency ratio—Non-GAAP (1) |

58.4 | % | 59.2 | % | 57.8 | % | 62.7 | % | 64.1 | % | ||||||||||

| (1) | Non-GAAP Financial Measures are reconciled in the following tables: |

12

Table of Contents

Financial Highlights

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Calculation of Efficiency Ratio: |

||||||||||||||||||||

| Total Operating Expenses |

$ | 72,129 | $ | 69,693 | $ | 67,119 | $ | 64,757 | $ | 62,198 | ||||||||||

| Less: Other Real Estate Owned Expenses |

(134 | ) | (59 | ) | — | — | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Adjusted Operating Expenses (numerator) |

$ | 71,995 | $ | 69,634 | $ | 67,119 | $ | 64,757 | $ | 62,198 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Interest Income |

95,789 | 92,576 | 85,616 | 74,082 | 69,959 | |||||||||||||||

| Total Other Operating Income |

18,399 | 16,248 | 16,552 | 16,222 | 15,993 | |||||||||||||||

| Tax Equivalent Adjustment |

9,068 | 8,854 | 13,979 | 12,917 | 11,140 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Income (denominator) |

$ | 123,256 | $ | 117,678 | $ | 116,147 | $ | 103,221 | $ | 97,092 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Efficiency Ratio, Year—Non-GAAP |

58.4 | % | 59.2 | % | 57.8 | % | 62.7 | % | 64.1 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Calculation of Dividend Payout Ratio: |

||||||||||||||||||||

| Dividends Paid (numerator) |

$ | 2,207 | $ | 2,203 | $ | 2,200 | $ | 2,201 | $ | 2,200 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (denominator) |

$ | 39,699 | $ | 36,213 | $ | 22,301 | $ | 24,534 | $ | 23,021 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividend Payout Ratio—Non-GAAP |

5.6 | % | 6.1 | % | 9.9 | % | 9.0 | % | 9.6 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Calculation of Core Earnings: |

||||||||||||||||||||

| Net Income |

$ | 39,699 | $ | 36,213 | $ | 22,301 | $ | 24,534 | $ | 23,021 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Add: Deferred Tax Remeasurement Charge |

— | — | 8,448 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core earnings—Non-GAAP |

$ | 39,699 | $ | 36,213 | $ | 30,749 | $ | 24,534 | $ | 23,021 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

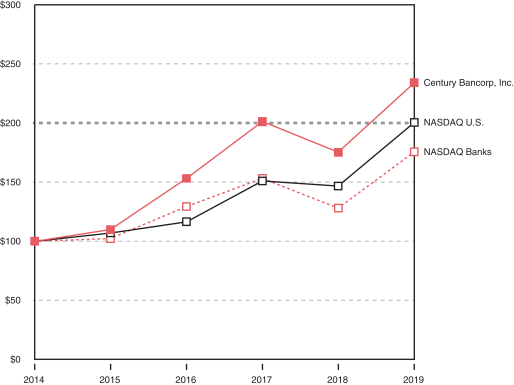

The stock performance graph below compares the cumulative total shareholder return of the Company’s Class A Common Stock from December 31, 2014 to December 31, 2019 with the cumulative total return of the NASDAQ Market Index (U.S. Companies) and the NASDAQ Bank Stock Index. The lines in the graph represent monthly index levels derived from compounded daily returns that include all dividends. If the monthly interval, based on the fiscal year-end, was not a trading day, the preceding trading day was used.

13

Table of Contents

Financial Highlights

Comparison of Five-Year

Cumulative Total Return*

| Value of $100 Invested on December 31, 2014 at: |

2015 | 2016 | 2017 | 2018 | 2019 | |||||||||||||||

| Century Bancorp, Inc. |

$ | 109.76 | $ | 153.14 | $ | 201.10 | $ | 175.20 | $ | 234.04 | ||||||||||

| NASDAQ Banks |

102.21 | 129.34 | 153.13 | 128.02 | 175.61 | |||||||||||||||

| NASDAQ U.S. |

106.96 | 116.45 | 150.96 | 146.67 | 200.49 | |||||||||||||||

| * | Assumes that the value of the investment in the Company’s Common Stock and each index was $100 on December 31, 2014 and that all dividends were reinvested. |

14

Table of Contents

Table of Contents

Management’s Discussion and Analysis of Results of Operations and Financial Condition

16

Table of Contents

Management’s Discussion and Analysis of Results of Operations and Financial Condition

17

Table of Contents

Management’s Discussion and Analysis of Results of Operations and Financial Condition

18

Table of Contents

Management’s Discussion and Analysis of Results of Operations and Financial Condition

19

Table of Contents

Management’s Discussion and Analysis of Results of Operations and Financial Condition

The following table sets forth the fair value and percentage distribution of securities available-for-sale at the dates indicated.

Fair Value of Securities Available-for-Sale

| At December 31, | 2019 | 2018 | 2017 | |||||||||||||||||||||

| Amount | Percent | Amount | Percent | Amount | Percent | |||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||

| U.S. Treasury |

$ | — | 0.0 | % | $ | 1,992 | 0.6 | % | $ | 1,984 | 0.5 | % | ||||||||||||

| U.S. Government Sponsored Enterprises |

— | 0.0 | % | 3,915 | 1.2 | % | — | 0.0 | % | |||||||||||||||

| SBA Backed Securities |

54,211 | 20.8 | % | 70,194 | 20.9 | % | 80,950 | 20.5 | % | |||||||||||||||

| U.S. Government Agency and Sponsored Enterprises Mortgage-Backed Securities |

184,187 | 70.7 | % | 162,890 | 48.4 | % | 225,775 | 57.0 | % | |||||||||||||||

| Privately Issued Residential Mortgage-Backed Securities |

396 | 0.2 | % | 672 | 0.2 | % | 892 | 0.2 | % | |||||||||||||||

| Obligations Issued by States and Political Subdivisions |

18,076 | 6.9 | % | 93,503 | 27.7 | % | 82,600 | 20.9 | % | |||||||||||||||

| Other Debt Securities |

3,632 | 1.4 | % | 3,593 | 1.0 | % | 3,629 | 0.9 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | 260,502 | 100.0 | % | $ | 336,759 | 100.0 | % | $ | 395,830 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The majority of the Company’s securities AFS are classified as Level 2, as defined in Note 1 of the “Notes to Consolidated Financial Statements.” The fair values of these securities are obtained from a pricing service, which provides the Company with a description of the inputs generally utilized for each type of security. These inputs include benchmark yields, reported trades, broker/dealer quotes, issuer spreads, two-sided markets, benchmark securities, bids, offers and reference data. Management’s understanding of a pricing service’s pricing methodologies includes obtaining an understanding of the valuation risks, assessing its qualification, verification of sources of information and processes used to develop prices and identifying, documenting, and testing controls. Management’s validation of a vendor’s pricing methodology includes establishing internal controls to determine that the pricing information received by a pricing service and used by management in the valuation process is relevant and reliable. Market indicators and industry and economic events are also monitored. The decline in fair value from amortized cost for individual available-for-sale securities that are temporarily impaired is not attributable to changes in credit quality. Because the Company does not intend to sell any of its debt securities and it is not more likely than not that it will be required to sell the debt securities before the anticipated recovery of their remaining amortized cost, the Company does not consider these investments to be other-than-temporarily impaired at December 31, 2019.

Securities available-for-sale totaling $13,301,000, or 0.2% of assets, are classified as Level 3, as defined in Note 1 of the “Notes to Consolidated Financial Statements.” These securities are generally municipal securities with no readily determinable fair value. The Company also utilizes internal pricing analysis on various municipal securities using market rates on comparable securities. The securities are carried at fair value with periodic review of underlying financial statements and credit ratings to assess the appropriateness of these valuations.

Debt securities of Government Sponsored Enterprises refer primarily to debt securities of Fannie Mae and Freddie Mac.

20

Table of Contents

Management’s Discussion and Analysis of Results of Operations and Financial Condition

The following table sets forth the amortized cost and percentage distribution of securities held-to-maturity at the dates indicated.

Amortized Cost of Securities Held-to-Maturity

| At December 31, | 2019 | 2018 | 2017 | |||||||||||||||||||||

| Amount | Percent | Amount | Percent | Amount | Percent | |||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||

| U.S. Treasury |

$ | — | 0.0 | % | $ | 9,960 | 0.5 | % | $ | — | 0.0 | % | ||||||||||||

| U.S. Government Sponsored Enterprises |

98,867 | 4.2 | % | 234,228 | 11.5 | % | 104,653 | 6.2 | % | |||||||||||||||

| SBA Backed Securities |

44,379 | 1.9 | % | 52,051 | 2.5 | % | 57,235 | 3.4 | % | |||||||||||||||

| U.S. Government Sponsored Enterprise Mortgage-Backed Securities |

2,207,874 | 93.9 | % | 1,750,408 | 85.5 | % | 1,539,345 | 90.4 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | 2,351,120 | 100.0 | % | $ | 2,046,647 | 100.0 | % | $ | 1,701,233 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The following two tables set forth contractual maturities of the Bank’s securities portfolio at December 31, 2019. Actual maturities may differ from contractual maturities because borrowers may have the right to call or prepay obligations with or without call or prepayment penalties.

Fair Value of Securities Available-for-Sale Amounts Maturing

| Within One Year |

% of Total |

Weighted Average Yield |

One Year to Five Years |

% of Total |

Weighted Average Yield |

Five Years to Ten Years |

% of Total |

Weighted Average Yield |

Over Ten Years |

% of Total |

Weighted Average Yield |

Total | % of Total |

Weighted Average Yield |

||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury |

$ | — | 0.0 | % | 0.00 | % | $ | — | 0.0 | % | 0.00 | % | $ | — | 0.0 | % | 0.00 | % | $ | — | 0.0 | % | 0.00 | % | $ | — | 0.0 | % | 0.00 | % | ||||||||||||||||||||||||||||||

| U.S. Government Sponsored Enterprises |

— | 0.0 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SBA Backed Securities |

— | 0.0 | % | 0.00 | % | 33,796 | 13.0 | % | 1.97 | % | 15,598 | 6.0 | % | 2.23 | % | 4,817 | 1.8 | % | 2.26 | % | 54,211 | 20.8 | % | 2.07 | % | |||||||||||||||||||||||||||||||||||

| U.S. Government Agency and Sponsored Enterprise Mortgage-Backed Securities |

164 | 0.1 | % | 2.14 | % | 77,472 | 29.7 | % | 2.16 | % | 106,551 | 40.9 | % | 2.27 | % | — | 0.0 | % | 0.00 | % | 184,187 | 70.7 | % | 2.22 | % | |||||||||||||||||||||||||||||||||||

| Privately Issued Residential Mortgage-Backed Securities |

396 | 0.2 | % | 2.20 | % | — | 0.0 | % | 0.00 | % | — | 0.0 | % | 0.00 | % | — | 0.0 | % | 0.00 | % | 396 | 0.2 | % | 2.20 | % | |||||||||||||||||||||||||||||||||||

| Obligations of States and Political Subdivisions |

17,616 | 6.7 | % | 2.48 | % | 385 | 0.1 | % | 3.92 | % | 75 | 0.1 | % | 4.04 | % | — | 0.0 | % | 0.00 | % | 18,076 | 6.9 | % | 2.24 | % | |||||||||||||||||||||||||||||||||||

| Other Debt Securities |

300 | 0.1 | % | 1.92 | % | 1,282 | 0.6 | % | 2.08 | % | 2,050 | 0.7 | % | 6.00 | % | — | 0.0 | % | 0.00 | % | 3,632 | 1.4 | % | 4.24 | % | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total |

$ | 18,476 | 7.1 | % | 2.46 | % | $ | 112,935 | 43.4 | % | 2.11 | % | $ | 124,274 | 47.7 | % | 2.33 | % | $ | 4,817 | 1.8 | % | 2.26 | % | $ | 260,502 | 100.0 | % | 2.22 | % | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

21

Table of Contents

Management’s Discussion and Analysis of Results of Operations and Financial Condition

Amortized Cost of Securities Held-to-Maturity

Amounts Maturing

| Within One Year |

% of Total |

Weighted Average Yield |

One Year to Five Years |

% of Total |

Weighted Average Yield |

Five Years to Ten Years |

% of Total |

Weighted Average Yield |

Over Ten Years |

% of Total |

Weighted Average Yield |

Total | % of Total |

Weighted Average Yield |

||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury |

$ | — | 0.0 | % | 0.00 | % | $ | — | 0.0 | % | 0.00 | % | $ | — | 0.0 | % | 0.00 | % | $ | — | 0.0 | % | 0.00 | % | $ | — | 0.0 | % | 0.00 | % | ||||||||||||||||||||||||||||||

| U.S. Government Sponsored Enterprises |

34,934 | 1.5 | % | 2.33 | % | 63,933 | 2.7 | % | 2.48 | % | — | 0.0 | % | 0.00 | % | — | 0.0 | % | 0.00 | % | 98,867 | 4.2 | % | 2.43 | % | |||||||||||||||||||||||||||||||||||

| SBA Backed Securities |

— | 0.0 | % | 0.00 | % | 6,782 | 0.3 | % | 1.82 | % | 37,597 | 1.6 | % | 2.40 | % | — | 0.0 | % | 0.00 | % | 44,379 | 1.9 | % | 2.31 | % | |||||||||||||||||||||||||||||||||||

| U.S. Government Sponsored Enterprise Mortgage- Backed Securities |

38,642 | 1.6 | % | 2.51 | % | 1,820,328 | 77.5 | % | 2.60 | % | 336,474 | 14.3 | % | 2.60 | % | 12,430 | 0.5 | % | 2.81 | % | 2,207,874 | 93.9 | % | 2.60 | % | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total |

$ | 73,576 | 3.1 | % | 2.42 | % | $ | 1,891,043 | 80.5 | % | 2.59 | % | $ | 374,071 | 15.9 | % | 2.58 | % | $ | 12,430 | 0.5 | % | 2.81 | % | $ | 2,351,120 | 100.0 | % | 2.59 | % | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

At December 31, 2019 and 2018, the Bank had no investments in obligations of individual states, counties, municipalities or nongovernment corporate entities which exceeded 10% of stockholders’ equity. In 2019, sales of securities totaling $17,478,000 in gross proceeds resulted in a net realized gain of $61,000. In 2018, sales of securities totaling $27,517,000 in gross proceeds resulted in a net realized gain of $302,000. There were no sales of state, county or municipal securities during 2019, 2018 and 2017.

Management reviews the investment portfolio for other-than-temporary impairment of individual securities on a regular basis. The results of such analysis are dependent upon general market conditions and specific conditions related to the issuers of our securities.

Loans

The Company’s lending activities are conducted principally in Massachusetts, New Hampshire, Rhode Island, Connecticut and New York. The Company grants single-family and multi-family residential loans, commercial and commercial real estate loans, municipal loans, and a variety of consumer loans. To a lesser extent, the Company grants loans for the construction of residential homes, multi-family properties, commercial real estate properties and land development. Most loans granted by the Company are secured by real estate collateral. The ability and willingness of commercial real estate, commercial, construction, residential and consumer loan borrowers to honor their repayment commitments are generally dependent on the health of the real estate market in the borrowers’ geographic areas and of the general economy.

22

Table of Contents

Management’s Discussion and Analysis of Results of Operations and Financial Condition

The following summary shows the composition of the loan portfolio at the dates indicated.

| December 31, | 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||||||||||||||||||||||

| Amount | Percent of Total |

Amount | Percent of Total |

Amount | Percent of Total |

Amount | Percent of Total |

Amount | Percent of Total |

|||||||||||||||||||||||||||||||

| (dollars in thousands) |

||||||||||||||||||||||||||||||||||||||||

| Construction and land development |

$ | 8,992 | 0.4 | % | $ | 13,628 | 0.6 | % | $ | 18,931 | 0.9 | % | $ | 14,928 | 0.8 | % | $ | 27,421 | 1.6 | % | ||||||||||||||||||||

| Commercial and industrial |

812,417 | 33.5 | % | 761,625 | 33.3 | % | 763,807 | 35.1 | % | 612,503 | 31.8 | % | 452,235 | 26.1 | % | |||||||||||||||||||||||||

| Municipal |

120,455 | 5.0 | % | 97,290 | 4.3 | % | 106,599 | 4.9 | % | 135,418 | 7.0 | % | 85,685 | 4.9 | % | |||||||||||||||||||||||||

| Commercial real estate |

786,102 | 32.4 | % | 750,362 | 32.8 | % | 732,491 | 33.7 | % | 696,173 | 36.2 | % | 721,506 | 41.7 | % | |||||||||||||||||||||||||

| Residential real estate |

371,897 | 15.3 | % | 348,250 | 15.2 | % | 287,731 | 13.2 | % | 241,357 | 12.5 | % | 255,346 | 14.7 | % | |||||||||||||||||||||||||

| Consumer |

21,071 | 0.9 | % | 21,359 | 0.9 | % | 18,458 | 0.8 | % | 11,013 | 0.6 | % | 10,744 | 0.6 | % | |||||||||||||||||||||||||

| Home equity |

304,363 | 12.5 | % | 292,340 | 12.9 | % | 247,345 | 11.4 | % | 211,857 | 11.0 | % | 178,020 | 10.3 | % | |||||||||||||||||||||||||

| Overdrafts |

822 | 0.0 | % | 724 | 0.0 | % | 582 | 0.0 | % | 684 | 0.1 | % | 579 | 0.1 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

$ | 2,426,119 | 100.0 | % | $ | 2,285,578 | 100.0 | % | $ | 2,175,944 | 100.0 | % | $ | 1,923,933 | 100.0 | % | $ | 1,731,536 | 100.0 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

At December 31, 2019, 2018, 2017, 2016 and 2015, loans were carried net of (premiums) discounts of $(292,000), $(364,000), $46,000, $313,000 and $360,000, respectively. Net deferred loan fees of $220,000, $496,000, $588,000, $641,000 and $988,000 were carried in 2019, 2018, 2017, 2016 and 2015, respectively.

The following table summarizes the remaining maturity distribution of certain components of the Company’s loan portfolio on December 31, 2019. The table excludes loans secured by 1–4 family residential real estate, loans for household and family personal expenditures, and municipal loans. Maturities are presented as if scheduled principal amortization payments are due on the last contractual payment date.

| Remaining Maturities of Selected Loans at December 31, 2019 |

||||||||||||||||

| One Year or Less | One to Five Years | Over Five Years | Total | |||||||||||||

| (dollars in thousands) | ||||||||||||||||

| Construction and land development |

$ | 568 | $ | — | $ | 8,424 | $ | 8,992 | ||||||||

| Commercial and industrial |

45,963 | 33,963 | 732,491 | 812,417 | ||||||||||||

| Commercial real estate |

31,485 | 105,580 | 649,037 | 786,102 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 78,016 | $ | 139,543 | $ | 1,389,952 | $ | 1,607,511 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following table indicates the rate variability of the above loans due after one year.

| December 31, 2019 | One to Five Years | Over Five Years | Total | |||||||||

| (dollars in thousands) | ||||||||||||

| Predetermined interest rates |

$ | 99,014 | $ | 378,347 | $ | 477,361 | ||||||

| Floating or adjustable interest rates |

40,529 | 1,011,605 | 1,052,134 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 139,543 | $ | 1,389,952 | $ | 1,529,495 | ||||||

|

|

|

|

|

|

|

|||||||

The Company’s commercial and industrial (“C&I”) loan customers include large healthcare and higher education institutions. During 2017, the Company increased its lending activities to these types of organizations. This increase may expose the Company to concentration risks inherent in financings based upon analysis of credit risk, the value of underlying collateral, and other more intangible factors, which are considered in originating commercial loans. The percentage of these types of organizations to total C&I loans has remained stable at 87% at December 31, 2019, compared to 86% at December 31, 2018.

23

Table of Contents

Management’s Discussion and Analysis of Results of Operations and Financial Condition

C&I loan customers also include various small and middle-market established businesses involved in manufacturing, distribution, retailing and services. Most clients are privately owned with markets that range from local to national in scope. Many of the loans to this segment are secured by liens on corporate assets and the personal guarantees of the principals. The regional economic strength or weakness impacts the relative risks in this loan category. There is little concentration in any one business sector, and loan risks are generally diversified among many borrowers.

Commercial real estate loans are extended to educational institutions, hospitals and other non-profit organizations. Loans are normally extended in amounts up to a maximum of 80% of appraised value and normally for terms between three and thirty years. Also included in commercial real estate loans are loans extended to finance various manufacturing, warehouse, light industrial, office, retail and residential properties in the Bank’s market area, which generally includes Massachusetts, New Hampshire, and Rhode Island.

Amortization schedules are long term and thus a balloon payment is generally due at maturity. Under most circumstances, the Bank will offer to rewrite or otherwise extend the loan at prevailing interest rates. During recent years, the Bank has emphasized nonresidential-type owner-occupied properties. This complements our C&I emphasis placed on the operating business entities and will continue. The regional economic environment affects the risk of both nonresidential and residential mortgages.

Municipal loans customers include loans to municipalities or related interests, primarily for infrastructure projects. The Company had increased its lending activities to municipalities through 2016. Municipal loans decreased during 2017 and 2018 as a result of loan payoffs. Municipal loans increased during 2019 as a result of increased loan originations.

Residential real estate (1–4 family) includes two categories of loans. Included in residential real estate are approximately $48,023,000 of C&I type loans secured by 1–4 family real estate. Primarily, these are small businesses with modest capital or shorter operating histories where the collateral mitigates some risk. This category of loans shares similar risk characteristics with the C&I loans, notwithstanding the collateral position.

The other category of residential real estate loans is mostly 1–4 family residential properties located in the Bank’s market area. General underwriting criteria are largely the same as those used by Fannie Mae. The Bank utilizes mortgage insurance to provide lower down payment products and has provided a “First Time Homebuyer” product to encourage new home ownership. Residential real estate loan volume has increased and remains a core consumer product. The economic environment impacts the risks associated with this category.

Home equity loans are extended as both first and second mortgages on owner-occupied residential properties in the Bank’s market area. Loans are underwritten to a maximum loan to property value of 75%.

Bank officers evaluate the feasibility of construction projects based on independent appraisals of the project, architects’ or engineers’ evaluations of the cost of construction and other relevant data. As of December 31, 2019, the Company was obligated to advance a total of $11,062,000 to complete projects under construction.

Loans are placed on nonaccrual status when any payment of principal and/or interest is 90 days or more past due, unless the collateral is sufficient to cover both principal and interest and the loan is in the process of collection. The Company monitors closely the performance of its loan portfolio. In addition to internal loan review, the Company has contracted with an independent organization to review the Company’s commercial and commercial real estate loan portfolios. This independent review was performed in each of the past five years. The status of delinquent loans, as well as situations identified as potential problems, is reviewed on a regular basis by senior management and monthly by the Board of Directors of the Bank.

24

Table of Contents

Management’s Discussion and Analysis of Results of Operations and Financial Condition

Nonaccrual loans remained relatively stable from 2016 through 2019. Nonaccrual loans decreased during 2016, primarily as a result of a decrease in home equity and residential real estate nonperforming loans.

The composition of nonperforming assets is as follows:

| December 31, |

2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

| Total nonperforming loans |

$ | 2,014 | $ | 1,313 | $ | 1,684 | $ | 1,084 | $ | 2,336 | ||||||||||

| Other real estate owned |

— | 2,225 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming assets |

$ | 2,014 | $ | 3,538 | $ | 1,684 | $ | 1,084 | $ | 2,336 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Accruing troubled debt restructured loans |

$ | 2,361 | $ | 2,559 | $ | 2,749 | $ | 3,526 | $ | 2,893 | ||||||||||

| Loans past due 90 and still accruing |

— | — | — | — | — | |||||||||||||||

| Nonperforming loans as a percent of gross loans |

0.08 | % | 0.15 | % | 0.08 | % | 0.06 | % | 0.13 | % | ||||||||||

| Nonperforming assets as a percent of total assets |

0.04 | % | 0.07 | % | 0.04 | % | 0.02 | % | 0.06 | % | ||||||||||

The composition of impaired loans is as follows:

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Residential real estate, multi-family |

$ | — | $ | — | $ | 4,212 | $ | 198 | $ | 916 | ||||||||||

| Home equity |

— | — | — | — | 90 | |||||||||||||||

| Commercial real estate |

2,346 | 2,650 | 2,554 | 3,149 | 1,678 | |||||||||||||||

| Construction and land development |

— | — | — | 94 | 98 | |||||||||||||||

| Commercial and industrial |

906 | 401 | 348 | 389 | 443 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total impaired loans |

$ | 3,252 | $ | 3,051 | $ | 7,114 | $ | 3,830 | $ | 3,225 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

At December 31, 2019, 2018, 2017, 2016 and 2015 impaired loans had specific reserves of $102,000, $145,000, $164,000, $173,000 and $250,000, respectively.

The Company was servicing mortgage loans sold to others without recourse of approximately $204,690,000, $209,160,000, $229,533,000, $229,730,000 and $185,299,000 at December 31, 2019, 2018, 2017, 2016 and 2015, respectively. The Company had no loans held for sale at December 31, 2019, 2018, 2017, 2016 and 2015.