Attached files

| file | filename |

|---|---|

| EX-32.1 - Omega Flex, Inc. | ex32-1.htm |

| EX-31.2 - Omega Flex, Inc. | ex31-2.htm |

| EX-31.1 - Omega Flex, Inc. | ex31-1.htm |

| EX-23.1 - Omega Flex, Inc. | ex23-1.htm |

| EX-21.1 - Omega Flex, Inc. | ex21-1.htm |

| EX-10.21 - Omega Flex, Inc. | ex10-21.htm |

| EX-10.20 - Omega Flex, Inc. | ex10-20.htm |

| EX-10.17 - Omega Flex, Inc. | ex10-17.htm |

| EX-10.3 - Omega Flex, Inc. | ex10-3.htm |

| EX-10.2 - Omega Flex, Inc. | ex10-2.htm |

| EX-4.1 - Omega Flex, Inc. | ex4-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

Or

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________________________ to ______________________

| Commission File Number | 000-51372 |

Omega Flex, Inc.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 23-1948942 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 451 Creamery Way, Exton, PA | 19341 | |

| (Address of principal executive offices) | (Zip Code) |

| Registrant’s telephone number, including area code | 610-524-7272 |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Common | OFLX | NASDAQ Global Market |

Securities registered pursuant to section 12(g) of the Act:

Not applicable

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” and “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (check one):

| Large accelerated filer [ ] | Accelerated filer [X] | Non-accelerated filer [ ] | Smaller reporting company [ ] |

| Emerging Growth Company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act Yes [ ] No [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of voting and non-voting common shares held by non-affiliates of the registrant as of June 28, 2019, the last business day of the second quarter of 2019, was $220,797,258.

The number of shares of common stock outstanding as of March 1, 2020 was 10,094,322.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III (Items 10, 11, 12, 13, and 14) is incorporated by reference from the registrant’s definitive proxy statement (to be filed pursuant to Regulation 14A no later than April 29, 2020) for the 2020 annual meeting of shareholders to be held on June 3, 2020.

Omega Flex, Inc.

TABLE OF CONTENTS

| -2- |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 10-K that are not historical facts — but rather reflect our current expectations concerning future results and events — constitute forward-looking statements. The words “believes,” “expects,” “intends,” “plans,” “anticipates,” “intend,” “estimate,” “potential,” “continue,” “hopes,” “likely,” “will,” and similar expressions, or the negative of these terms, identify such forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of Omega Flex, Inc., or industry results, to differ materially from future results, performance or achievements expressed or implied by such forward-looking statements.

Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s view only as of the date of this annual report statement. We undertake no obligation to update the result of any revisions to these forward-looking statements which may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, conditions or circumstances.

GENERAL

DESCRIPTION OF OUR BUSINESS

Overview of the Company

The Company’s business is controlled as a single operating segment that consists of the manufacture and sale of flexible metal hose (also described as corrugated tubing), as well as the sale of the Company’s related proprietary fittings and a vast array of accessories.

The Company is a leading manufacturer of flexible metal hose, which is used in a variety of ways to carry gases and liquids within their particular applications. Some of the more prominent uses include:

| ● | carrying fuel gases within residential and commercial buildings; | |

| ● | carrying gasoline and diesel gasoline products (both above and below the ground) in a double containment piping to contain any possible leaks, which is used in automotive and marina refueling, and fueling for back-up generation; | |

| ● | using copper-alloy corrugated piping in medical or health care facilities to carry medical gases (oxygen, nitrogen, vacuum) or pure gases for pharmaceutical applications; and | |

| ● | industrial applications where the customer requires the piping to have both a degree of flexibility and/or an ability to carry corrosive compounds or mixtures, or to carry at both very high and very low (cryogenic) temperatures. |

The Company manufactures flexible metal hose at its facilities in Exton, Pennsylvania, and Houston, Texas in the United States, and in Banbury, Oxfordshire in the United Kingdom, and primarily sells its products through distributors, wholesalers and to original equipment manufacturers (“OEMs”) throughout North America and Europe, and to a lesser extent other global markets.

| -3- |

Industry Overview

The flexible metal hose industry is highly fragmented and diverse, with more than 10 companies producing flexible metal hose in the United States, and at least that many in Europe and Asia. Because of its simple and ubiquitous nature, flexible metal hose can be applied and has been applied to a number of different applications across a broad range of industries.

The major market categories for flexible metallic hose include (1) automotive, (2) aerospace, (3) residential, commercial, and institutional construction, and (4) general industrial. Omega Flex participates in the latter two markets for flexible metallic hose. The residential and commercial construction markets utilize corrugated stainless steel tubing (CSST) primarily for flexible gas piping, double containment piping for conveying diesel fuel and gasoline from a storage tank to a dispenser or back-up generator. The Company utilizes corrugated copper tubing for medical gases in medical care facilities, including hospitals, clinics, dental and veterinary offices and long-term care facilities. The general industrial market includes all of the processing industries, the most important of which include primary steel, petrochemical, pharmaceutical, and specialty applications for the transfer of fluids at both extremely low and high temperatures, (such as the conveying of cryogenic liquids) and a highly fragmented Original Equipment Manufacturers (OEM) market, as well as the maintenance and repair market.

None of our competitors appear to be dominant in more than one market. We are a leading supplier of flexible metal hose in each of the markets in which we participate. Our assessment of our overall competitive position is based on several factors. The flexible gas piping market in the U.S. is currently concentrated in the residential housing market. Based on the reports issued by the national trade groups on housing construction, the level of acceptance of flexible gas piping in the construction market, and the average usage of flexible gas piping in a residential building, we believe that we are able to estimate with a reasonable level of accuracy the size of the total gas piping market. In addition, the Company is a member of an industry trade group comprised of the largest manufacturers of CSST in the United States, which compiles and distributes sales volume statistics for its members relative to flexible gas piping. Based on our sales and the statistics described above, the Company believes it can estimate its position within that market. For other applications, industry trade groups collect and report data related to these markets, and we can then compare and estimate our status within that group as a whole. In addition, the customer base for the products that we sell, and the identity of the manufacturers aligned with those customers is fairly well known, which again allows the Company to extract information and estimate its market position. Lastly, the term “leading” implies a host of factors other than sales volume and market share position. It includes the range and capability of the product line, history of product development and new product launches, all of which information is in the public domain. Based on all of this information, the Company is reasonably confident that it is indeed a leader in the major market segments in which it participates.

Development of Business

Incorporated in 1975 under the name of Tofle America, Inc., the Company was originally established as the subsidiary of a Japanese manufacturer of flexible metal hose. For a number of years, we were a manufacturer of flexible metal hose that was sold primarily to customers using the hose for incorporation into finished assemblies for industrial applications. We later changed our name to Omega Flex, Inc., and in 1996, we were acquired by Mestek, Inc. (Mestek).

In January 2005, Mestek announced its intention to distribute its equity ownership in our common stock to the Mestek shareholders. A registration statement for the Omega Flex common stock was filed with the Securities and Exchange Commission and the registration statement was declared effective on July 22, 2005. We also listed our common stock on the NASDAQ National Market (now the NASDAQ Global Market) under the stock symbol “OFLX”, and began public trading of our common stock on August 1, 2005. All Mestek shareholders as of the record date for the distribution received one share of Omega Flex common stock for each share of Mestek common stock owned as of the record date. We are now a totally separate company from Mestek, and we do not use or share any material assets or services of Mestek in conducting our business.

Over the years, most of the Company’s business has been generated from Omega Flex, Inc., and concentrated in North America, but the Company also has foreign subsidiaries located in the United Kingdom, which are largely focused on European and other international markets. The Company also has a local subsidiary which owns the Company’s Exton, Pennsylvania real estate.

| -4- |

Overview of Current Business

Products

The Company’s business is managed as a single operating segment that consists of the manufacture and sale of flexible metal hose and accessories.

The Company has had the most success within the residential construction industry with its flexible gas piping products, TracPipe®, which was introduced in 1997, and its more robust counterpart TracPipe® CounterStrike®, which came to market in 2004. Partnered with the development of our AutoFlare® and AutoSnap® patented fittings and accessories, both have enjoyed wide acceptance due to their reliability and durability. Within the residential construction industry, the flexible gas piping products that we offer and similar products offered by our competitors have sought to overcome the use of black iron pipe that has traditionally been used by the construction industry in the United States and Canada for the piping of fuel gases within a building. Prior to the introduction of the first CSST system in 1989, nearly all construction in the United States and Canada used traditional black iron pipe for gas piping. However, the advantages of CSST in areas subject to high incidence and likelihood of seismic events had been first demonstrated in Japan. In seismic testing, the CSST was shown to withstand the stresses on a piping system created by the shifting and movement of an earthquake better than rigid pipe. The advantages of CSST over the traditional black iron pipe also include lower overall installation costs because it can be installed in long uninterrupted lines within the building.

The flexibility of the tube allows it to be bent by hand without any tools when a change in direction in the line is required. In contrast, black iron pipe requires that each bend in the pipe have a separate fitting attached. This requires the installer to thread the ends of the black iron pipe, apply an adhesive to the threads, and then screw on the fitting, all of which is labor intensive and costly, including testing and rework if the work is not done properly. As a result of these advantages, the Company estimates that CSST now commands slightly over one-half of the market for fuel gas piping in new and remodeled residential construction in the United States, and the use of rigid iron pipe, and to a lesser degree copper tubing, accounts for the remainder of the market. The Company plans to continue its growth trend by demonstrating its advantages against other technologies, in both the residential and commercial markets, in both the United States and overseas in geographic areas that have access to natural gas distribution systems.

In 2004, we introduced a new brand of flexible gas piping sold under the registered trademark “CounterStrike®”. CounterStrike® is designed to be more resistant to damage from transient electrical arcing. This feature is particularly desirable in areas that are subject to high levels of lightning strikes, such as the Southeast and Ohio Valley sections of the United States. In a lightning strike, the electrical energy of the lightning can energize all metal systems and components in a building. This electrical energy, in attempting to reach ground, may arc between metal systems that have different electrical resistance, and arcing can cause damage to the metal systems. In standard CSST systems, an electrical bond between the CSST and the building’s grounding electrode would address this issue, but lightning is an extremely powerful and unpredictable force. CounterStrike® CSST is designed to be electrically conductive and therefore disperse the energy of any electrical charge over the entire surface of the CounterStrike® line. In 2007, we introduced a new version of CounterStrike® CSST that was tested to be even more resistant to damage from electrical arcing than the original version, and substantially more effective than standard CSST products. As a result of its robust performance, the new version of CounterStrike® has been widely accepted in the market, and thus during 2011, the Company made the decision to sell exclusively CounterStrike® within the United States. This move demonstrated the Company’s commitment to innovation and safety, and further enhanced our leadership in the marketplace.

In 2008, the Company introduced its first double containment piping product – DoubleTrac®. DoubleTrac® double containment piping has earned stringent industry certifications for its ability to safely contain and convey liquid fuels. DoubleTrac® received certification from Underwriters Laboratory, the testing and approval agency, that our product is fully compliant with UL971A, which is the product standard in the United States for metallic underground fuel piping, ULc S667 which is the product standard in Canada for metallic underground fuel piping, as well as approvals from other relevant state agencies that have more stringent testing procedures for the product. Similar to our flexible gas piping, DoubleTrac® provides advantages over older rigid pipe technologies. DoubleTrac® is made and can be installed in long continuous runs, eliminating the need for manually assembling rigid pipe junctions at the end of a pipe or at a turn in direction. In addition, DoubleTrac® has superior performance in terms of its ability to safely convey fuel from the storage tank to the dispenser, primarily because DoubleTrac® is essentially a zero permeation piping system, far exceeding the most stringent government regulations. Originally designed for applications involving automotive fueling stations running from the storage tank to the fuel dispenser, the ability of DoubleTrac® to handle a variety of installation challenges has broadened its applications to include refueling at marinas, fuel lines for back-up generators, and corrosive liquids at waste treatment plants. In short, in applications where double containment piping is required to handle potentially contaminating fluids or corrosive fluids, DoubleTrac® is engineered to handle those demanding applications.

| -5- |

DEF-Trac®, a complementary product which is very similar to DoubleTrac®, was brought to the marketplace in 2011. DEF-Trac® piping is specifically engineered to handle the demanding requirements for diesel emissions fluid (DEF). Federal regulations require all diesel engines to use DEF to reduce the particulate contaminants from the diesel combustion process. However, DEF is highly corrosive and cannot be pre-mixed with the diesel fuel. This requires that new diesel trucks and automobiles must have separate tanks built into the vehicle so that the diesel emissions fluid can be injected into the catalytic converter after the point of combustion. Similarly, a large portion of fueling stations carrying diesel fuel are now also selling DEF through a separate dispenser. In addition to being highly corrosive, DEF also has a high freezing temperature, requiring a heat trace in the piping in applications in northern areas of the United States. DEF-Trac® flexible piping is uniquely suited to handle all of these challenges, as the stainless steel inner core is corrosion resistant, and DEF-Trac® also comes with options for heat trace that is extruded directly into the wall of the product. In summary, DEF-Trac® provides a complete solution to the demanding requirements of this unique application, as such, DEF-Trac® has been met with enormous acceptance from the industry that was searching for a solution to the new environmental requirement. The advantageous market position of DEF-Trac® has leveraged the penetration of DoubleTrac® into the broader market for automotive fueling applications.

In September 2013, the Company announced that it would be releasing a newly developed fitting, AutoSnap®, as part of its flexible gas piping product line. After successfully completing all required testing by independent testing agencies, as well as extensive field trials across the United States by trained TracPipe® CounterStrike® installers, AutoSnap® was officially introduced to the market in January 2014 to wide acceptance. With its patent-pending design, the product simplified the installation process, and addressed installer preferences for both speed and ease of installation. The AutoSnap® fitting now commands a significant portion of the Company’s fittings demand.

In 2019, the Company commercialized MediTrac®, corrugated medical tubing (“CMT”), following its 2018 launch with several beta sites. Developed for the healthcare industry, the product can be used in hospitals, ambulatory care centers, dental, physician and veterinary clinics, laboratories, and any facility that uses medical gas. Made from a copper alloy with an exterior fire-retardant jacket, MediTrac® is made and sold in long continuous-length rolls. MediTrac’s flexible nature and storage in rolls allows it t to be transported to and installed in health care facilities much more easily and quickly than traditional medical grade rigid copper pipe, which comes in 20 foot long sections. MediTrac® is unrolled from a spool and installed in a medical facility in one long continuous length, and is bent by hand when a change in direction is needed. The long lengths and ability to change direction with ease eliminates labor that would otherwise be needed to braze connections to straight sections of copper pipe or elbows or tees for changes in direction, while increasing installation efficiency and operational safety and minimizing downtime for healthcare facilities. Easy to assemble axial swaged brass fittings connect with all K, L and DWV medical tubing that is sized from ½” to 2” in diameter, and provides a leak-tight seal using ordinary hand tools. The patent-pending fitting also prevents tampering or disassembly through the use of a tamper-proof sleeve that is required by the Health Care Facilities Code (NFPA 99 – 2018 edition). Rated for 185 psig, MediTrac® can deliver the necessary volume of gas wherever it is needed across a facility. A recent case study comparing the installation of rigid copper pipe and MediTrac® showed that MediTrac® increases installation efficiency by a factor of five (i.e., a 500% increase in efficiency). By reducing the number of joints and brazed connections, MediTrac® also reduces possible contamination into the medical gas system along with the fire risk associated with brazing. . MediTrac® is currently listed to UL 1365 and has an ASTM E84 rating of 25/50, and meets all 2018 requirements of the Health Care Facilities Code (NFPA 99 – 2018).

| -6- |

In addition to the flexible gas piping and other previously described markets, our flexible metal hose is used in a wide variety of other applications. Our involvement in these markets is important because just as the flexible gas piping applications have sprung from our expertise in manufacturing annular metal hose, other applications may also evolve from our participation in the industry. Flexible metal hose is used in a wide variety of industrial and processing applications where the characteristics of the flexible hose in terms of its flexibility, and its ability to absorb vibration and thermal expansion and contraction, have substantial benefits over rigid piping. For example, in certain pharmaceutical processing applications, the process of developing the specific pharmaceutical may require rapid freezing of various compounds through the use of liquefied gases, such as liquefied nitrogen, helium or Freon. The use of flexible metal tubing is particularly appropriate in these types of applications. Flexible metal hose can accommodate the thermal expansion caused by the liquefied gases carried through the hose, and the total length of the hose will not significantly vary. In contrast, fixed or rigid metal pipe would expand and contract along its length as the liquid gases passed through it, causing stresses on the pipe junctions that would over time cause fatigue and failure. Alternatively, within certain industrial or commercial applications using steam, either as a heat source or in the industrial process itself, the pumps used to transfer the liquid or steam within the system are subject to varying degrees of vibration. Additionally, flexible metal hoses can also be used as connections between the pump and the intake of the fluids being transferred to eliminate the vibration effects of the pumps on the piping transfer system. All of these areas provide opportunities for the flexible metal hose arena, and thus the Company continues to participate in these markets, as it seeks new innovative solutions which will generate additional revenue streams for the future.

Manufacturing

In each instance, whether the application is for CSST for fuel gases, flexible metal hose for handling specialty chemicals or gases, flexible double containment piping, unique industrial applications requiring the ability to withstand wide variations in temperature and vibration, or copper alloyed CMT for medical facilities, all of our success rests on our metal hose. Most of our flexible metal hoses range in diameter from 1/4” to 2” while certain applications require diameters of up to 16”. All of our smaller diameter pipe (2” inner diameter and smaller) is made by a proprietary process that is known as the rotary process. The proprietary process that we use to manufacture our annular hose is the result of a long-term development effort begun in 1995. Through continuous improvement over the years, we have developed and fine-tuned the process so that we can manufacture annular flexible metal hose on a high speed, continuous process. We believe that our own rotary process for manufacturing annular corrugated metal hose is the most cost efficient method in the industry, and that our rotary process provides us with a significant advantage in many of the industries in which we participate. As a result, we are able to provide our product on a demand basis. Over the years, the Company has had great success in achieving on-time delivery performance to the scheduled ship date. The quick inventory turnover reduces our costs for in-process inventory, and further contributes to our gross margin levels. We have also improved our productivity on a historical basis.

Raw Materials

We use various materials in the manufacture of our products, primarily stainless steel for our flexible metal hose and plastics for our jacketing material on TracPipe® CounterStrike® flexible gas piping and DoubleTrac® double containment piping, as well as a copper alloy for our MediTrac® CMT. We also purchase all of our proprietary fittings for use with the TracPipe® and CounterStrike® flexible gas piping, DoubleTrac® double containment piping, and MediTrac® CMT. Although we have multiple sources qualified for all of our major raw materials and components, we have historically used only one or two sources of supply for such raw materials and components. Our current orders for stainless steel and fittings are each placed with one or two suppliers. If any one of these sources of supply were interrupted for any reason, then we would have to devote additional time and expense in obtaining the same volume of supply from our other qualified sources. This potential transition, if it were to occur, could affect our operations and financial results during the period of such transition. During 2019, the commodity prices of nickel were reasonably similar to last year, but ended higher. Copper was reasonably flat. The Company experienced increases in most of its core components, as our vendors sought to recoup pricing and production burdens. Nickel is a prime material in stainless steel which the Company utilizes to manufacture CSST, and copper is a key component of the Company’s brass fittings and our MediTrac® CMT. Fortunately, the Company was able to maintain reasonably stable margins during 2019. This was accomplished by implementing our own pricing actions to help offset the upward movements in our material costs. The supply of our main raw materials appears to be sufficient with ample volume. We believe that with our purchase commitments for stainless steel, polyethylene and for our proprietary fittings, we have adequate sources of supply for these raw materials and components. We have not had difficulty in obtaining the raw materials, component parts or finished goods from our suppliers. We believe that the supply sufficiency of stainless steel will continue until there is a reduction in global capacity, such as mine closures, which would then cause a constriction. Volatility in the commodities marketplace and competitive conditions in the sale of our products could potentially restrict us from passing along raw materials or component part price increases to our customers.

| -7- |

Business Seasonality

The demand for our flexible piping products that are related to construction activity including TracPipe®, Counterstrike®, DoubleTrac® and MediTrac®, may be affected by the construction industry’s demand, which generally tightens during the winter months of each year due to cold and inclement weather. Accordingly, sales are usually higher in the spring, summer and fall.

Customers

We sell our products to customers scattered across a wide and diverse set of industries ranging from construction to pharmaceutical with close to 9,500 customers on record. These sales channels include sales through independent sales representatives, distributors, original equipment manufacturers, direct sales, and sales through our website on the internet. We utilize various distribution companies in the sale of our TracPipe® and Counterstrike® flexible gas piping, and these distribution customers in the aggregate represent a significant portion of our business. In particular, the Company has one significant customer, Ferguson Enterprises, whose various branches had sales in the range of 14% to 15% of total sales during the period of 2017 to 2019, and was in the range of 22% to 24% of the Company’s accounts receivable balance over the last two years. All of this business is done on a purchase order basis for immediate resale commitments or stocking, and there are no long-term purchase commitments. In the event we were to lose an account, we would not expect any long-term reduction in our sales due to the broad end-user acceptance of our products. We would anticipate that in the event of a loss of any one or more distributors, that after an initial transition period, the sale of our products would resume at or near their historical levels. Furthermore, in the case of certain national distribution chains, which is the case regarding the Company’s largest customer noted above, and other distributors, it is possible that there would continue to be purchasing activity from one or more regional or branch distribution customers. We sell our products within North America, primarily in the United States and Canada, and we also sell our products internationally, primarily in Europe through our manufacturing facility located in Banbury, England. Our sales outside of North America were in the range of 10% to 11% of our total sales during the last three years, with most of the sales occurring in the United Kingdom and elsewhere in Europe. We do not have a material portion of our long-lived assets located outside of the United States.

Distribution of Sales

As mentioned previously, we sell our products primarily through independent outside sales organizations, including independent sales representatives, distributors, fabricating distributors, wholesalers, and original equipment manufacturers (OEMs). We have a limited internal sales function that sells our products to key accounts, including OEMs and distributors of bulk hose. We believe that within each geographic market in which the independent sales representative, distributor or wholesaler is located that our outside sales organizations are the first or second most successful outside sales organization for the particular product line within that geographic area.

| -8- |

Competition

There are approximately 10 manufacturers of flexible metal hose in the United States, and approximately that number in Europe and Asia. The U.S. manufacturers include Titeflex Corporation, Ward Manufacturing, Microflex, United Flexible, Hose Master and several smaller privately held companies. No one manufacturer, as a general rule, participates in more than two of the major market categories, automotive, aerospace, residential and commercial construction, and general industrial, with most concentrating in just one. We estimate that we are at or near the top position of the two major categories in which we participate in regards to market share. In the flexible gas piping market, the U.S. market is currently concentrated in the residential housing market. Based on the reports issued by the national trade groups on housing construction, the level of acceptance of flexible gas piping in the construction market, and the average usage of flexible gas piping in a residential building, as well as through our sales position within that market, we are able to estimate with a high level of accuracy the size of the total gas piping market. In addition, the Company is a member of an industry trade group, which compiles and distributes sales statistics for its members relative to flexible gas piping. For other applications, industry trade groups collect and report on the size of the relevant market, and we can estimate our percentage of the relevant market based on our sales as compared to the market as a whole. The larger of our two markets, the construction industry, has seen a modest increase in the number of residential housing starts in 2019, as compared to the previous year. As discussed elsewhere, black iron pipe or copper tubing was historically used by all builders of commercial and residential buildings until the advent of flexible gas piping and changes in the relevant building codes. Since that time, flexible gas piping has taken an increasing share of the total amount of fuel gas piping used in construction.

Due to the number of applications in which flexible metal hose may be used, and the number of companies engaged in the manufacture and sale of flexible metal hose, the general industrial market is very fragmented, and we estimate that no one company has a predominant market share of the business over other competitors. In the market for double containment piping, we compete primarily against rigid pipe systems that are more costly to install than DoubleTrac® double containment piping. For medical tubing applications, the main competitor is medical grade (Type K or Type L) rigid copper pipe. MediTrac® is the only corrugated medical tubing in the United States that is approved to the stringent requirements of UL 1365. The general industrial markets within Europe are very mature and tend to offer opportunities that are interesting to us in niche markets or during periods in which a weak dollar increases the demand for our products on a competitive basis. Such has been the case for several years and has created new relationships for us. Currently, we are not heavily engaged in the manufacture of flexible metal hose for the aerospace or automotive markets, but we continue to review opportunities in all markets for our products to determine appropriate applications that will provide growth potential and high margins. In some cases, where the product offering is considered a commodity, price is the overriding competing factor. In other cases, a proprietary product offering or superior performance will be the major factors with pricing being secondary and in some cases, a non-factor. The majority of our sales are to distributors and wholesalers, and our relationships with these customers are on an arms-length basis in that neither we, nor the customers are so dependent on the other to yield any significant business advantage. From our perspective, we are able to maintain a steady demand for our products due to the broad acceptance of our products by end users, regardless of which distributor or wholesaler sells the product.

Backlog

Management does not believe that backlog figures are material to an understanding of our business because most products are shipped promptly after the receipt of orders.

Intellectual Property

We have a comprehensive portfolio of intellectual property, including approximately 270 patents issued in various countries around the world. The patents cover (a) the fittings used by the flexible gas piping to join the piping to a junction or assembly, (b) pre-sleeved CSST for use in underground applications, (c) an electrically conductive jacket for flexible gas piping that we sell under the trademark CounterStrike®, and (d) a tubing containment system for our DoubleTrac® double containment piping and CMT fittings. In combination, our AutoFlare® and AutoSnap® fittings are the leading products used with flexible gas piping because they offer a metal-to-metal seal between the fitting and the tubing, and because of their robustness and ease of use. The metal-to-metal contact provides for a longer lasting and more reliable seal than fittings which use gaskets or sealing compounds that can deteriorate over time. In applications involving fuel gases in a building, the ability to maintain the seal and prevent the leaking of such gases over long periods of time is valued by our customers. In addition, the AutoSnap® fitting provides the installer with greater ease of use by preassembling all the securing elements inside the body of the fitting. We also have received a patent for the composition of the polyethylene jacket used in our CounterStrike® flexible gas piping product, which has increased ability to dissipate electrical energy in the event of a nearby lightning strike. The tubing containment system of our DoubleTrac® double containment piping, which is also patented in the U.S. and in other countries, allows for the monitoring and collection of any liquids that may leak from the stainless steel containment layer. We have filed patent applications for the MediTrac® fittings to cover the unique requirements in the United States for fittings that permanently affix the fitting to the CMT system, and provides a tamper-proof connection to the CMT system. The expiration dates for the several patents covering our AutoFlare® fittings will be expiring through 2020 and the Counterstrike® patent will expire in 2025. We currently have several patent applications pending in the United States and internationally covering improvements to our AutoFlare® fittings and our CounterStrike® polyethylene jacket, and also have a patent pending on our new AutoSnap® fitting. Finally, and as mentioned above, our unique rotary process for manufacturing flexible metal hose has been developed over the last ten years, and constitutes a valuable trade secret. In 2007, a Pennsylvania court issued a ruling that confirms our proprietary rotary manufacturing process does constitute a “trade secret” under Pennsylvania law, and is entitled to protection against unauthorized disclosure or misappropriation.

| -9- |

Employees

As of December 31, 2019, the Company had 151 employees. Most of our employees are located in our manufacturing facilities in Exton, Pennsylvania, which contain our factory personnel, engineering, finance, human resources and most of our sales staff. Our factory workforce in Exton, Pennsylvania, is not party to a collective bargaining agreement. A small amount of employees work at our facility in Houston, Texas. We also maintain an office in Middletown, Connecticut where certain management, sales and administrative personnel reside. A number of individual sales personnel are also scattered across the United States. We also maintain a manufacturing facility in Banbury, United Kingdom, which contains employees of similar functions to those in the U.S., but on a much smaller scale. The sales personnel in England handle all sales and service for our products in Europe, most notably the United Kingdom, and the majority of our transactions with other international territories.

Environmental

Our manufacturing processes do not require the use of significant quantities of hazardous substances or materials, and therefore we are able to operate our Exton facility as a “small quantity generator” under the Resource Conservation and Recovery Act, 42 U.S.C. §§ 321 et seq. As a result, compliance with federal, state and local environmental laws do not pose a material burden on our business, and we are not required to expend any material amounts on capital expenditures for environmental control facilities for our manufacturing facility.

Internet Website

You may learn more about our company by visiting our website at www.omegaflexcorp.com. Among other things, you can access our filings with the Securities and Exchange Commission, which maintains a website at www.sec.gov that contains the Company’s various reports, proxy and information statements. These filings include proxy statements, annual reports (Form 10-K), quarterly reports (Form 10-Q), and current reports (Form 8-K), as well as Section 16 reports filed by our officers and directors (Forms 3, 4 and 5). All of these reports will be available on the website as soon as reasonably practicable after we file the reports with the SEC. In addition, we have made available on our website under the heading “Compliance Policies” the charters for the Audit, Compensation and Nominating/Governance Committees of our Board of Directors and our Code of Business Ethics. We intend to make available on our website any future amendments or waivers to our Code of Business Ethics. The information on our website is not part of this report.

You should carefully consider the following risk factors and all the other information contained in this annual report and our other filings in evaluating our business and investment in our common stock. We have not disclosed general risk factors that may be applicable to any for-profit organization, such as general economic conditions, interest rates, labor supply and technological changes. Investors are cautioned to take into consideration the specific risk factors we have disclosed below and general risk factors before making an investment decision.

| -10- |

Risk Relating to Our Business

We are primarily dependent on one product line for most of our sales.

Most of the Company’s sales are derived from the sale of TracPipe® and CounterStrike® flexible gas piping systems, including Autoflare® and AutoSnap® fittings and a variety of accessories. Sales of our flexible metal hose for other applications represent a small portion of our overall sales and income. Any event or circumstance that adversely affects our TracPipe® or CounterStrike® flexible gas piping could have a greater impact on our business and financial results than if our business were more evenly distributed across several different product lines. The effects of such an adverse event or circumstance would be magnified in terms of our Company as a whole as compared to one or more competitors whose product lines may be more diversified, or who are not as reliant on the sales generated by their respective flexible gas piping products. Therefore, risks relating to our TracPipe® and CounterStrike® flexible gas piping business – in particular loss of distributors or sales channels, technological changes, loss of our key personnel involved in the flexible gas piping product line, increases in commodity prices, particularly in stainless steel and polyethylene – could damage our business, competitive position, results of operations or financial condition.

Our manufacturing plant(s) may be damaged or destroyed.

The majority of the company’s manufacturing capacity is currently located in Exton, Pennsylvania, where we own two manufacturing facilities which are in close proximity to each other, and in Banbury, United Kingdom where we rent a manufacturing facility. On a smaller scale the Company also manufactures product in Houston, Texas. We do not have any operational manufacturing capacity for flexible metal hose outside of these locations. We cannot replicate our manufacturing methods at a supplier’s facility due to the confidential and proprietary nature of our manufacturing process. If one of the manufacturing facilities were destroyed or damaged in a significant manner, we would likely experience a delay or some interruption of our flexible metal hose operations. This could lead to a reduction in sales volume if customers were to purchase their requirements from our competitors, claims for breach of contract by certain customers with contracts for delivery of flexible metal hose by a certain date, and costs to replace our destroyed or damaged manufacturing capacity. The fittings and accessories for the flexible metal hose are manufactured for us by suppliers not located in Exton, Pennsylvania, and the Company also has outside warehouses which contain finished goods inventory. Disruption of or damage to our supply of these items could damage our business, competitive position, results of operations or financial condition.

We are dependent on certain raw materials and supplies that could be subject to volatile price escalation.

As a manufacturer of flexible metal hose, we must use certain raw materials in the manufacture of the hose. The primary raw material is stainless steel that is used in the forming of the hose, and various other steel products used in the wire braid overlay over some flexible metal hoses for additional strength and durability, as well as copper alloy for MediTrac® CMT. We also use polyethylene in pellet form for the forming and extrusion of a polyethylene jacket over CSST for use in fuel gas applications, underground installations, and other installations that require that the metal hose be isolated from the environment. Finally, we also purchase our proprietary brass and stainless steel fittings used with the flexible metal hose that provide a mechanical means of attaching the hose to an assembly or junction. We attempt to limit the effects of volatile raw material prices, and to ensure adequate and timely supply of material, by committing to annual purchase contracts for the bulk of our steel and polyethylene requirements, and for our fitting requirements. The contracts typically represent a significant portion of the Company’s annual planned usage, and are set at a designated fixed price or a range of prices. These agreements sometimes require the Company to accept delivery of the commodity in the quantities committed, at the agreed upon prices. Transactions in excess of the pre-arranged commitments are conducted at current market prices at the Company’s discretion. The Company has identified multiple qualified vendors to produce or manufacture our critical purchase requirements. The Company does however tend to rely on one or two sources for each or our primary components to leverage the relationship and pricing. Therefore, there is no assurance that the Company would be able to eliminate all or most of the adverse effects of a sudden increase in the cost of materials or key components, or that the loss of one or more of our key sources would not lead to higher costs or a disruption in our business, which could damage our business, competitive position, results of operations or financial condition.

| -11- |

Susceptibility of litigation and significant legal costs or settlements.

In the ordinary and normal conduct of the Company’s business, it is subject to periodic lawsuits, investigations and claims (collectively, the “Claims”). The Company has continued to receive repeat pattern Claims relating to our flexible gas piping products, although the pace of the new Claims has declined. While the Company does not believe the Claims have legal merit, and has successfully defended itself vigorously against such Claims, there is no guarantee that the pace of claims will not increase or subside. Any significant increase in the number of Claims, the financial magnitude of Claims brought against the Company, the costs of defending the Claims, particularly under higher retentions of the Company’s current product liability insurance policies, could have a detrimental impact on the Company’s business, competitive position, results of operations or financial condition, perhaps materially.

We face intense competition in all of our markets.

The markets for flexible metal hose are intensely competitive. There are a number of competitors in all markets in which we operate, and generally none of these markets have one dominant competitor – rather a large number of competitors exist, each having a proportion of the total market. One or more of our competitors may develop technologies and products that are more effective or which may cost less than our current or future products, or could potentially render our products noncompetitive or obsolete. Our prior success has been due to our ability to develop new products and product improvements, and establish and maintain an effective distribution network which to some extent came at the expense of several competing manufacturers. Our business, competitive position, results of operations or financial condition could be negatively impacted if we are unable to maintain and develop our competitive products.

We may not retain our independent sales organizations.

Almost all of the Company’s products and product lines are sold by outside sales organizations. These independent sales organizations or sales representatives are geographically dispersed in certain territorial markets across the United States, Canada and elsewhere. These outside sales organizations are independent of us, and are typically owned by the individual principals of such firms. We enter into agreements with such outside sales organizations for the exclusive representation or distribution of our products, but such agreements are generally for terms of one year or less. At the expiration of the agreement, the agent or distributor may elect to represent a different manufacturer. As a result, we have no ability to control which flexible metal hose manufacturer any such sales organization may represent or carry. The competition to retain quality outside sales organizations is also intense between manufacturers of flexible metal hose since it is these sales organizations that generally can direct the sales volume to distributors and, ultimately, contractors and installers in important markets across the country, and in other countries in which we operate. The failure to obtain the best outside sales organization within a particular geographic market can limit our ability to generate sales of our products. While we currently have a fully developed sales and distribution network of superior outside sales organizations, there can be no assurance that any one or more of the outside sales organizations will elect to remain with us, or that our competitors will not be able to disrupt our distribution network by causing one or more of our sales representatives to drop our product lines. Our business, competitive position, results of operation or financial condition could be negatively impacted if we cannot maintain adequate sales and distribution networks.

We are dependent on certain sales channels for a significant portion of our business.

Of the various sales channels that we use to sell our products, a significant portion of such sales are made through our wholesale stocking distributors that include Ferguson Enterprises and several other distributors. These and other distributors purchase our products, and stock the goods in warehouses for resale, either to their own local branches or to end-users. Because of the breadth and penetration of the distribution networks, and the range of complementary products they offer for sale, these wholesale distributors are able to sell large amounts of our products to end users across the United States and Canada. The decision by a major wholesaler distributor to stop distributing our products such as TracPipe® and CounterStrike® flexible gas piping, and to distribute a competitive flexible gas piping product, could significantly affect our business, competitive position, results of operations or financial condition.

| -12- |

Our business may be subject to the supply and availability of fuel gas supplies and infrastructure.

Our TracPipe® and CounterStrike® flexible gas piping products are used to convey fuel gas, primarily natural gas, but also propane, within a building from the exterior wall of the building to any gas-fired appliances within the building. Because those products are used in the transmission of fuel gas, the applications are limited to geographic areas where such fuel gas is available. Certain geographic areas of the United States and other countries do not have the infrastructure to make natural gas available. Other types of fuel gas may be used in areas where there are no natural gas pipelines, but these alternate fuel gas sources have other distribution issues that may constrict their availability. Our prospects for future growth of the TracPipe® and CounterStrike® products are largely limited to those areas that have natural gas transmission lines available for use in residences and commercial buildings.

With increasing debate on the effect of human activities on climate change, there has been a focus on transitioning energy and heating in buildings away from fossil fuels, such as natural gas and liquid propane. Several municipalities in the United States have announced policy decisions to move away from fossil fuel applications in the future. Although there are significant technical and economic hurdles, it is possible that a large scale movement, in individual cities and states or on a federal level, away from fossil fuels may increase in the future. Such moves could reduce the demand for our flexible gas piping products, which represent a major part of the company’s sales and net profits. As a result, it is possible in the future that proposals to limit or eliminate the use of fossil fuels could adversely impact the financial results of the company, perhaps materially.

If we are not able to protect our intellectual property rights, we may not be able to compete as effectively.

We possess a wide array of intellectual property rights, including patents, trademarks, copyrights, and applications for the above, as well as trade secrets, manufacturing know-how, and other proprietary information. Certain of these intellectual property rights form the basis of our competitive advantage in the market place through a superior product design, a superior business process, superior manufacturing methods or other features that provide an advantage over our competitors. The intellectual property rights are sometimes subject to infringement or misappropriation by other organizations, and failing an amiable resolution, we may be forced to resort to legal proceedings to protect our rights in such intellectual property.

In the past, the Company has needed to protect itself and resort to legal action, in one instance regarding a trade secret, and in another where we sued a flexible gas pipe competitor for infringement on one or more of our U.S. patents covering our AutoFlare® fittings. In both instances, the Company received favorable rulings, thus solidifying the validity of our intellectual property. Although the Company has had past success, the results we may obtain from resorting to any such legal proceedings are never assured, and it is possible that an adverse decision may be delivered in any particular proceeding. As a result, we may not be able to retain the exclusive rights to utilize and practice such intellectual property rights, and one or more of our competitors could utilize and practice such intellectual property rights. This development may lessen our competitive advantage vis-à-vis one or more competitors, and lead to a reduction in sales volume in one or more product lines, a reduction in profit margin in such product lines, or both, which would damage our business, competitive position, results of operations or financial condition.

If we were to lose the services of one or more of our senior management team, we may not be able to execute our business strategy

Our future success depends in a large part upon the continued service of key members of our senior management team. The senior executives are critical to the development of our products and our strategic direction, and have a keen knowledge of business operations and processes. Their unique abilities, experience and expertise cannot be easily duplicated or replaced. As much as possible, senior executives strive to educate and develop other layers of staff and succession planning, but the loss of any of our senior management could seriously harm our business.

| -13- |

Certain of our competitors may have greater resources, or they may acquire greater resources.

Some of our competitors have substantially more resources than are available to us as a stand-alone company. For example, in the CSST market, two of our competitors are divisions of large corporations with revenues measured in the billions of dollars. These competitors may be able to devote substantially greater resources to the development, manufacture, distribution and sale of their products than would be available to us as a stand-alone company. One or more competitors may acquire several other competitors, or may be acquired by a larger entity, and through a combination of resources be able to devote additional resources to their businesses. These additional resources could be devoted to product development, reduced costs in an effort to obtain market share, greater flexibility in terms of profit margin as part of a larger business organization, increased investment in plant, machinery, distribution and sales concessions. As a stand-alone company, the resources that may be devoted by us to meet any potential developments by larger, well-financed competitors may be limited.

We may substantially increase our debt in the future, or be restricted from accessing funds.

We are currently not carrying any long-term debt, although the Company has a line of credit facility available for use as described in Note 5, Line of Credit, to the Consolidated Financial Statements included in this report. We may consider borrowing funds for purposes of working capital, capital purchases, research and development, potential acquisitions and business development. If we do use credit facilities, interest costs associated with any such borrowings and the terms of the loan could potentially adversely affect our profitability. Additionally, the current line of credit has debt covenants associated with it which may restrict the level of borrowing the Company may take on. Lack of access to financing, or desirable terms or at all, could damage our business, competitive position, results of operations or financial condition.

Changes in the method pursuant to which the LIBOR rates are determined and potential phasing out of LIBOR after 2021 may affect our financial results.

Borrowings under our line of credit facility bear interest at variable rates based on LIBOR or Prime. The LIBOR or Prime rates and certain other interest “benchmarks” may be subject to regulatory guidance and/or reform that could cause interest rates under our current or future debt agreements to perform differently than in the past or cause other unanticipated consequences. The United Kingdom’s Financial Conduct Authority, which regulates LIBOR, has announced that it intends to stop encouraging or requiring banks to submit rates for the calculation of LIBOR rates after 2021, and it is unclear if LIBOR will cease to exist or if new methods of calculating LIBOR will evolve. If LIBOR ceases to exist or if the methods of calculating LIBOR change from their current form, interest rates on our current or future debt obligations may be adversely affected.

Our business may be subject to varying demands based on market interest rates.

Our TracPipe® and CounterStrike® flexible gas piping products are used in the construction industry, both in residential, commercial and industrial segments, for the piping of fuel gas within a building. The demand for new or remodeled construction in the construction industry – and in particular the residential construction industry – is susceptible to fluctuations in interest rates charged by banks and other financial institutions as well as consumer demand. The purchasers of new or remodeled construction generally finance the construction or acquisition of the residential, commercial or industrial buildings, and any increase in the interest rates on such financing will raise the acquisition cost of the potential purchaser. While interest rates have been reasonably low over the recent past, they have increased slightly over the last year. If costs increase significantly, a higher amount of potential buyers may not be able to support the level of financing under a higher interest rate environment. Increased acquisition costs may lead to a decline in the demand for new or remodeled construction, and as a result may also lead to a reduced demand for our products used in construction industry, which could damage our business, competitive position, results of operations or financial condition.

| -14- |

Our business may be subject to cyclical demands.

The demand for our products may be subject to cyclical demands in the markets in which we operate. Our customers who use our products in industrial and commercial applications are generally manufacturing capital equipment for their customers. Similarly, our TracPipe® and CounterStrike® flexible gas piping products are used primarily in residential construction, both in single-family buildings, and in larger multi-unit buildings. Should there be any change in factors that affect the rate of new residential construction, our growth rate would likely be impacted. To the extent that interest rates increase, in conjunction with an economic cycle or as part of the general economic conditions in the United States or abroad, the demand for our products in such applications may decrease as well, which could damage our business, competitive position, results of operations or financial condition.

Our business may be subject to seasonal or weather related factors.

The demand for our products may be affected by factors relating to seasonal demand for the product, or a decline in demand due to inclement weather. Our TracPipe® and CounterStrike® flexible gas piping products are installed in new or remodeled buildings, including homes, apartment buildings, office buildings, warehouses, and other commercial or industrial buildings. Generally, the rate of new or remodeled buildings in the United States and in the other geographic markets in which we are present decline in the winter months due to the inability to dig foundations, problems at the job site relating to snow, or generally due to low temperatures and stormy weather. As the rate of construction activity declines during the winter, the demand for our corrugated stainless steel tubing may also decrease or remain static.

The concentration of ownership of our common stock may depress its market price.

Approximately 71% of the issued and outstanding common stock is owned or controlled by inside affiliated parties to the Company, with the largest being: The Estate of John E. Reed, Stewart B. Reed, Kevin R. Hoben and Mark F. Albino. Stewart B. Reed currently serves on the Board of Directors, where he presided as Chairman until December 2018, and Mr. Hoben and Mr. Albino also serve on the Board of Directors, and are officers of the Company. Mr. Hoben was elevated to Chairman in December 2018. This concentration of ownership may have the effect of reducing the volume of trading of the common stock on the NASDAQ, which could result in lower prices for the common stock because there is not a sufficient supply of shares to create a vibrant market for our shares on the NASDAQ.

The concentration of ownership of common stock could exert significant influence over matters requiring shareholder approval, including takeover attempts.

Because of their significant ownership of our common stock, our officer and directors and their respective affiliates may, as a practical matter, be able to exert influence over matters requiring approval by our shareholders, including the election of directors and the approval of mergers or other business combinations. This concentration also could have the effect of delaying or preventing a change in control of the Company.

Our business may be subject to the impact of currency volatility.

The Company has operations in the United Kingdom, and does business transactions elsewhere in the world outside of the United States. While the magnitude of these transactions outside of the United States have thus far not been significant, and typically not in currencies of high volatility, it is possible that they could be material. In June 2016, the United Kingdom made the decision to leave the European Union, an event commonly known as Brexit, as described below. As a result of Brexit, and the political and economic uncertainty that ensued, the British Pound weakened in comparison to other currencies. This in turn had a direct negative impact on the Company’s financial statements and results, most notably during 2018, as we experienced losses when settling transactions in other currencies, and experienced unfavorable results due to the translation of financial statements with a lower exchange rate. During 2017 and 2019 the impact of currency volatility on the financial statements was not as severe, but going forward, it is possible that the British Pound, other currencies that we engage in, or even the U.S. Dollar may weaken, and materially impact the financial position, operations and liquidity of the Company.

| -15- |

A cyber attack or other computer system breach could harm us.

In recent years, the topic of cybersecurity, or the lack thereof, has been an issue of high concern. The Company currently maintains a robust firewall and other safeguards to either prevent or detect against nefarious actors looking to breach or infiltrate our data, and has backup systems in place. The Company’s website is housed and maintained by a third party who maintain their own controls. The Company currently has a very low volume of sales coming through the internet, and processes very few credit card transactions. While it currently appears that the Company has a low level of risk related to cybercrime, the vulnerability still exists and could affect the Company negatively.

Our business may be subject to the impact of Brexit.

The Company’s main operating subsidiary, Omega Flex Limited, is headquartered in Banbury, United Kingdom. The result of the referendum held by the United Kingdom during June 2016 to withdraw from the European Union (“Brexit”) has created a level of uncertainty regarding the final terms of that withdrawal that has not yet been completely agreed upon by the United Kingdom (UK) and the European Union (EU). Some clarity was provided during January 2020, when the UK officially left the EU, but the UK and EU have now entered a transition period which is anticipated to last approximately one year. Depending upon the negotiated terms reached by the parties, there could be risks related to border and customs controls and on the movement of people and goods between the UK and EU, and the rest of the world. These border and customs controls could increase costs on materials imported into the UK and finished goods exported from the UK. In addition, it is possible that logistical delays created by those controls could delay shipments of materials and supplies into the Banbury manufacturing plant, and could also affect our ability to ship goods to customers outside of the UK, into the EU, Africa, and the Near East. Omega Flex Limited has stockpiled materials and supplies for its manufacturing operations in Banbury in light of Brexit, and are positioned to stage some finished goods inventory in warehouses in the EU, in an attempt to cushion any possible adversity experienced regarding changes in border and customs controls. Most of the business of Omega Flex Limited is domestic, and should therefore not be unduly disrupted. However, the macroeconomic effects of Brexit on the economies of the UK and the EU are unknown, and those effects could dampen economic activity and the overall demand for the Company’s products in those markets. However, it is not expected that increased costs, logistical delays, nor possible economic declines in those markets would be material to the Company.

Our business may be subject to macroeconomic effects caused by increased trade tariffs and reduced international trade, as well as other global risks.

Recent events have caused various governments around the world to impose increased trade tariffs on imported goods. These increased tariffs may cause the cost of materials to rise and may add additional expense on exported goods. However, the company does not believe that increased tariffs will materially affect the company’s sales or operating margins, as most of the raw materials and supplies used to manufacture our products are sourced domestically in the United States. Further, exports of our flexible gas piping products from our Exton, Pennsylvania facility are primarily to Canada, which recently agreed to a revised North American trade treaty, and to a lesser extent to the Caribbean and South America. Sales to Europe, Asia and Africa are primarily handled from our Banbury, England facility, which are not affected by U.S. trade tariffs and retaliatory tariffs, but may be subject to other constraints as discussed in the Brexit risk factor, above.

Conflicts, wars, natural disasters, infectious disease outbreaks or terrorist acts could also cause significant damage or disruption to our operations, employees, facilities, systems, suppliers, supply chain, distributors, resellers or customers in the United States and internationally for extended periods of time and could also affect demand for our products. In December 2019, a strain of coronavirus surfaced in Wuhan, China, and the outbreak appears to be spreading throughout the region and the world. The extent to which the coronavirus impacts our operations and our results will depend on future developments, which are highly uncertain and unpredictable, including new information concerning the severity of the coronavirus and the actions to contain or treat its impact, among others.

Item 1B – UNRESOLVED STAFF COMMENTS

None.

| -16- |

The Company utilizes two facilities in Exton, Pennsylvania, which is located about one hour west of Philadelphia. One facility which is owned by the Company, contains about 83,000 square feet of manufacturing and office space. The other facility which is located nearby provides another 30,000 square feet of space, mostly used for manufacturing. The Company previously had a rental agreement running through January 2018 for this facility, but in early 2017 consummated an agreement to purchase the land and structure for cash. The majority of the manufacturing of our flexible metal hose is performed at the Exton facilities. Also within the US, the Company leases a facility in Houston, Texas, which contains manufacturing, stocking and sales operations, and a corporate office located in Middletown, Connecticut. In the United Kingdom, the Company rents a facility in Banbury, England, which manufactures products and serves sales, warehousing and operational functions as well.

In the ordinary and normal conduct of the Company’s business, it is subject to periodic lawsuits, investigations and claims (collectively, the “Claims”). Most of the Claims, including a putative class-action claim, relate to potential lightning damage to our flexible gas piping products, which impact legal and product liability related expenses. The Company does not believe the Claims have legal merit, and therefore has commenced a vigorous defense in response to the Claims. It is possible that the Company may incur increased litigation costs in the future due to a variety of factors, including a higher numbers of Claims, higher legal costs, and higher insurance deductibles or retentions.

In 2010, the Company took its first Claim to trial in Pennsylvania, and the jury returned a verdict that the Company was not negligent in designing and selling the TracPipe® product, but also returned a verdict for plaintiff on strict liability. The Company appealed that portion of the verdict, and in December 2014, the Supreme Court of Pennsylvania ruled in favor of the Company, and returned the case to the trial court for further hearings. The cash bond of $1,600,000, which was previously included in Other Long Term Assets and posted as security for a subsequent appeal, was returned to the Company in May 2018. This case was finally settled and closed on August 7, 2018.

In March 2017, a putative class action case was re-filed against the Company and other parties in Missouri state court after the predecessor case was dismissed without prejudice by the federal court. The Company successfully removed the case to federal court and is currently vigorously defending the case.

The Company has in place commercial general liability insurance policies that cover most Claims, which are subject to deductibles or retentions, ranging primarily from $25,000 to $1,000,000 per claim (depending on the terms of the policy and the applicable policy year), up to an aggregate amount. Litigation is subject to many uncertainties and management is unable to predict the outcome of the pending suits and claims. The potential liability for a given claim could range from zero to a maximum of $1,000,000, depending upon the circumstances, and insurance deductible or retention in place for the respective claim year. The aggregate maximum exposure for all current open Claims, excluding the Missouri class action case, as of December 31, 2019 is estimated to not exceed approximately $3,300,000, which represents the potential costs that may be incurred over time for the Claims within the applicable insurance policy deductibles or retentions. From time to time, depending upon the nature of a particular case, the Company may decide to spend in excess of a deductible or retention to enable more discretion regarding the defense, although this is not common. It is possible that the results of operations or liquidity of the Company, as well as the Company’s ability to procure reasonably priced insurance, could be adversely affected by the pending litigation, potentially materially. The Company is currently unable to estimate the ultimate liability, if any, that may result from the pending litigation, or potential litigation from future claims or claims that have not yet come to our attention, and accordingly, the liability in the consolidated financial statements primarily represents an accrual for legal costs for services previously rendered, and outstanding or anticipated settlements for Claims. The liabilities recorded on the Company’s books at December 31, 2019 and December 31, 2018 were $215,000 and $150,000, respectively, and are included in Other Liabilities.

Item 4 – MINE SAFETY DISCLOSURES

The Company does not have any disclosures applicable to mine safety.

| -17- |

Item 5 - MARKET FOR REGISTRANT’S COMMON EQUITY, AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock

Our common stock is listed on the NASDAQ Global Market, under the symbol OFLX. The number of shareholders of record as of December 31, 2019, based on inquiries of the registrant’s transfer agent, was 338. For this purpose, shareholders whose shares are held by brokers on behalf of such shareholders (shares held in “street name”) are not separately counted or included in that total.

Shareholder Return Performance Presentation

The Shareholder Return Performance Presentation shall not be deemed to be “soliciting material” or subject to Regulations 14A or 14C of the Securities and Exchange Commission or to the liabilities of Section 18 of the Securities and Exchange Act of 1934 (the “Exchange Act”) and shall not be deemed incorporated by reference by any general statement incorporating by reference this annual report into any filing under the Securities Act of 1933 or under the Exchange Act, and shall not otherwise be deemed filed under such Acts.

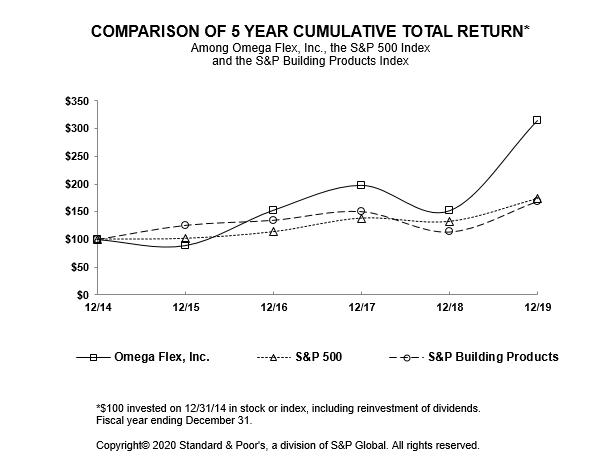

The following graph shows the changes on a cumulative basis in the total shareholder return on the Omega Flex common stock, and compares those changes in shareholder return with the total return on the S&P 500 Index and the total return on the S&P 500 Building Products Index. The graph begins with a base value of $100 on December 31, 2014, and shows the cumulative changes over the last five years, ending on December 31, 2019. The graph assumes $100 was invested on December 31, in each of the three alternatives, and that all dividends have been reinvested.

| -18- |

| Company / Index | Base Period 12/31/14 | Indexed Returns – Year Ending | ||||||||||||||||||||||

| 12/14 | 12/15 | 12/16 | 12/17 | 12/18 | 12/19 | |||||||||||||||||||

| Omega Flex, Inc. | 100.00 | 89.21 | 152.95 | 197.78 | 151.97 | 314.62 | ||||||||||||||||||

| S&P 500 | 100.00 | 101.38 | 113.51 | 138.29 | 132.23 | 173.86 | ||||||||||||||||||

| S&P Building Products | 100.00 | 125.42 | 134.51 | 150.02 | 113.44 | 168.25 | ||||||||||||||||||

Dividends

The Company currently has a policy of paying regular quarterly dividends, which is expected to continue. In addition, the Company may pay special dividends from time to time, as we did during December 2019 and January 2017. Further details regarding dividends are contained in Note 6, Shareholders’ Equity to the Consolidated Financial Statements included in this report.

The Board, in its sole discretion, has a general policy of reviewing the cash needs of the Company from time to time, and based on results of operations, financial condition and capital expenditure plans, possible acquisitions, as well as other factors that the Board may consider relevant, determining on a quarterly basis whether to declare a regular quarterly dividend, or a special dividend.

Item 6 - SELECTED FINANCIAL DATA