Attached files

| file | filename |

|---|---|

| EX-32.2 - FORM 10-K, EXHIBIT 32.2 - GAMCO INVESTORS, INC. ET AL | form10k2019ex322.htm |

| EX-32.1 - FORM 10-K, EXHIBIT 32.1 - GAMCO INVESTORS, INC. ET AL | form10k2019ex321.htm |

| EX-31.2 - FORM 10-K, EXHIBIT 31.2 - GAMCO INVESTORS, INC. ET AL | form10k2019ex312.htm |

| EX-31.1 - FORM 10-K, EXHIBIT 31.1 - GAMCO INVESTORS, INC. ET AL | form10k2019ex311.htm |

| EX-23.1 - FORM 10-K, EXHIBIT 23.1 - GAMCO INVESTORS, INC. ET AL | form10k2019ex231.htm |

| EX-21.1 - FORM 10-K, EXHIBIT 21.1 - GAMCO INVESTORS, INC. ET AL | form10k2019ex211.htm |

| EX-4.9 - GAMCO INVESTORS, INC. ET AL | form10k2019ex49.htm |

UNITED STATES

SECURITIES & EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ⌧ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2019

or

| [ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ______ to ______

Commission File No. 001-14761

GAMCO INVESTORS, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

13-4007862

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

191 Mason Street, Greenwich, CT 06830

One Corporate Center, Rye, NY 10580

|

(203) 629-2726

|

|

|

(Address of principle executive offices)(Zip Code)

|

Registrant’s telephone number, including area code

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

||

|

Class A Common Stock, $0.001 par value

|

GBL

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes □ No ⌧

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes □ No ⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days Yes ⌧ No □

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit such files). Yes ⌧ No

□

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or

an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer □

|

Accelerated filer ⌧

|

|

|

Non-accelerated filer □

|

Smaller reporting company ⌧

|

Emerging growth company □

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. □

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2.) Yes □ No ⌧

The aggregate market value of the class A and class B common stock held by non-affiliates of the registrant as of June 30, 2019 (the last business day of

the registrant’s most recently completed second fiscal quarter) was $106,010,177.

As of February 29, 2020, 8,305,806 shares of class A common stock (including 660,950 restricted stock awards) and 19,024,117 shares of class B common stock

were outstanding. 18,313,741 shares of class B common stock were held by a subsidiary of GGCP, Inc.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the registrant’s definitive proxy statement relating to the 2020 Annual Meeting of Shareholders are

incorporated by reference in Items 10, 11, 12, 13 and 14 of Part III of this report.

1

|

GAMCO INVESTORS, INC. AND SUBSIDIARIES

|

|||

|

INDEX

|

|||

|

|

|

||

|

|

|

||

|

|

Page

|

||

|

Part I

|

|||

|

Item 1.

|

Business

|

3

|

|

|

Item 1A.

|

Risk Factors

|

13

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

21

|

|

|

Item 2.

|

Properties

|

21

|

|

|

Item 3.

|

Legal Proceedings

|

21

|

|

|

Item 4.

|

Mine Safety Disclosures

|

21

|

|

|

Part II

|

|||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

|

22

|

|

|

Item 6.

|

Selected Financial Data

|

22

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

23

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

36

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

38

|

|

|

Item 9.

|

Changes and Disagreements with Accountants on Accounting and Financial Disclosure

|

66

|

|

|

Item 9A.

|

Controls and Procedures

|

66

|

|

|

Item 9B.

|

Other Information

|

66

|

|

|

Part III

|

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

67

|

|

|

Item 11.

|

Executive Compensation

|

67

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

67

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

67

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

67

|

|

|

PART IV

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

68

|

|

|

Item 16.

|

Form 10-K Summary

|

71

|

|

2

Unless indicated otherwise, or the context otherwise requires, references in this report to “GAMCO Investors, Inc.,” “GAMCO,” “the Company,” “the Firm,”

“GBL,” “we,” “us,” and “our” or similar terms are to GAMCO Investors, Inc., its predecessors, and its subsidiaries.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Our disclosure and analysis in this Form 10-K contains some forward-looking statements. Forward-looking statements give our current expectations or

forecasts of future events. You can identify these statements because they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will,” “should,”

“may,” and other words and terms of similar meaning. They also appear in any discussion of future operating or financial performance. In particular, these include statements relating to future actions, future performance of our products, expenses,

the outcome of any legal proceedings, and financial results. Although we believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know about our business and operations, there can be no

assurance that our actual results will not differ materially from what we expect or believe. Some of the factors that could cause our actual results to differ from our expectations or beliefs include, without limitation: the adverse effect from a

decline in the securities markets that adversely affects our assets under management; a decline in the performance of our products; a general downturn in the economy; changes in government policy or regulation; changes in our ability to attract or

retain key employees (“teammates”); unforeseen costs and other effects related to legal proceedings or investigations of governmental and self-regulatory organizations; and the ongoing impacts of the Tax Cuts and Jobs Act with respect to tax rates

and the non-deductibility of certain portions of named executive officer compensation. We are providing these statements as permitted by the Private Litigation Reform Act of 1995. Our actual results and condition could differ materially from those

implied or expressed in the forward-looking statements for any reason, including the factors set forth in “Risk Factors” in Part I, Item 1A of and elsewhere in this Form 10-K. We do not undertake to update publicly any forward-looking statements if

we subsequently learn that we are unlikely to achieve our expectations or if we receive any additional information relating to the subject matters of our forward-looking statements.

PART I

ITEM 1: BUSINESS

Overview

GAMCO (New York Stock Exchange (“NYSE”): GBL), a company incorporated

under the laws of Delaware, is a widely-recognized provider of investment advisory services to open-end funds, closed-end funds, a société

d’investissement à capital variable (“SICAV”) and approximately 1,700 institutional and private wealth management (“Institutional and PWM”) investors principally in

the United States (“U.S.”). We generally manage assets on a fully discretionary basis and invest in a variety of U.S. and international securities through various investment styles including value, growth, non-market correlated, and convertible

securities. Our revenues are based primarily on the Company’s level of assets under management (“AUM”) and fees associated with our various investment products.

Since our inception in 1977, our value assets are identified with our research-driven approach to equity investing and our Private Market Value (PMV) with

a CatalystTM investment approach.

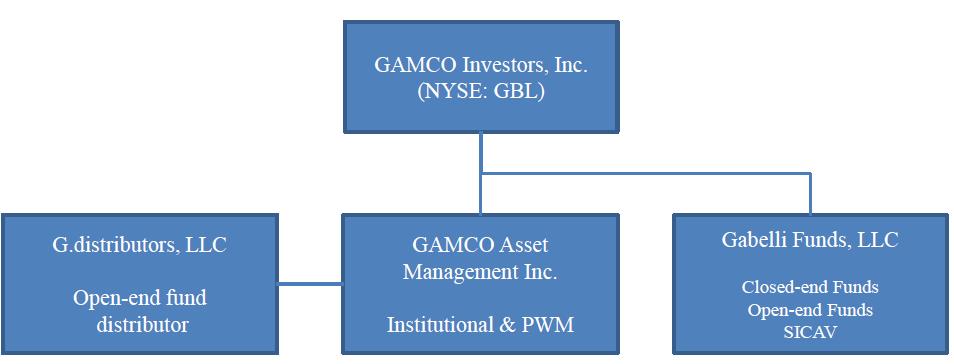

As of December 31, 2019, we had $36.5 billion of AUM. We conduct our investment advisory business principally through two subsidiaries, which are

registered investment advisors: Gabelli Funds, LLC (open-end and closed-end funds) (“Gabelli Funds”) and GAMCO Asset Management Inc. (Institutional and PWM) (“GAMCO Asset”). G.distributors, LLC (“G.distributors”), our broker-dealer subsidiary, acts

as an underwriter and distributor of our open-end funds.

Our AUM are organized into three groups:

|

·

|

Open and Closed-End Funds:

We provide advisory services to 24 open-end funds and 16 closed-end funds under the Gabelli, GAMCO, and Comstock brands (collectively, the “Funds”). As of December 31, 2019, the Funds had $21.3 billion of AUM. Additionally, we provide

administrative services to 9 open-end funds, with AUM of $1.9 billion on December 31, 2019, under the TETON Westwood and Keeley brands.

|

|

·

|

Institutional and Private

Wealth Management: We provide advisory services to a broad range of investors, including corporate retirement plans, foundations, endowments, jointly-trusteed plans and public funds, private wealth clients and also serve as

sub-advisor to third party investment funds including registered investment companies. Portfolios may be customized to comply with client-specific guidelines and risk profiles. As of December 31, 2019, Institutional and PWM had $14.6 billion

of AUM. Over the last 42 years, the Firm has generated over $28.4 billion in investment returns for our Institutional and PWM clients.

|

3

|

·

|

SICAV: We provide

advisory services to one SICAV under the GAMCO brand, the GAMCO International SICAV. The SICAV has two sub-fund strategies, the GAMCO Merger Arbitrage Fund and the GAMCO All Cap Value Fund. The GAMCO Merger Arbitrage strategy is sub-advised

by Associated Capital Group, Inc. (“AC”) and had $575 million of AUM as of December 31, 2019. The GAMCO All Cap Value strategy had $19 million of AUM as of December 31, 2019.

|

Portfolio managers oversee our AUM and are supported by in-depth analysis across numerous industries by our research analyst teammates. These analysts are

internationally domiciled with an average of 15 years of industry experience.

GBL is a holding company incorporated in April 1998 in advance of our initial public offering (“IPO”) in February 1999. GGCP Holdings, LLC, a subsidiary of

GGCP, Inc. (“GGCP”), which is majority-owned by Mr. Mario J. Gabelli (“Mr. Gabelli”), owns a majority of the outstanding shares of Class B common stock (“Class B Stock”) of GBL. As of December 31, 2019, such ownership represented approximately 92% of

the combined voting power of the outstanding common stock and approximately 67% of the equity interest. As of December 31, 2019, through publicly traded AC (NYSE: AC), which was spun-off from GBL on November 30, 2015, AC owns 2,935,401 shares of

Class A common stock (“Class A Stock”) representing approximately 1% of the combined voting power and approximately 11% of the equity interest. AC is majority-owned by GGCP Holdings, LLC. Accordingly, Mr. Gabelli is deemed to control GBL.

At the time of the spin-off, AC owned and operated the alternatives and the institutional research businesses previously owned and operated by GBL. At the

time of the distribution, the stock price of AC was $29.50 per share. As of December 31, 2019, the stock price of AC was $39.20 per share.

Our executive offices are located at 191 Mason Street, Greenwich, CT 06830 and One Corporate Center, Rye, NY 10580. Our telephone number is (203) 629-2726.

We post or provide a link on our website (www.gabelli.com) to the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission (“SEC”): our annual report on Form

10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”). All such filings on our

website are available free of charge.

On March 20, 2009, we distributed our ownership in Teton Advisors, Inc. (“Teton”), the advisor to the TETON Westwood funds, to our shareholders. At the

time of the distribution the stock price of Teton was $2.75 per share. At December 31, 2019, the stock price of Teton was $47.15 per share.

During 2019, we returned $39.6 million to shareholders through dividends and our stock buyback program. We paid $2.2 million, or $0.08 per share, in cash

dividends to our common shareholders and repurchased 1,834,434 shares at an average investment of $20.36 per share, or $37.4 million.

Since the IPO in February 1999, when 6 million GBL shares were sold at $17.50 per share and total shares outstanding were 30 million for a market

capitalization of $525 million, we have returned to shareholders $2.0 billion in total, of which $1.0 billion was in the form of the spin-offs of AC and Teton, $501.1 million was through our stock buyback program, and $495.6 million was from

dividends, as well as $57 million to charities on their behalf.

Environmental, Social, and Governance (ESG)

As part of GAMCO’s stewardship of investments on behalf of clients, we have historically viewed governance, active ownership, proxy voting, and engagement

as important ways to protect shareholder value. To that end, the Firm has been a leading voice on certain governance matters since May 1988 when it initiated its “Magna Carta of Shareholder Rights.” We actively vote our own proxies and file

shareholder proposals on issues that we believe increase shareholder value. Such activity is part of our incorporation of environmental, social, and governance (“ESG”) considerations as long term investors.

Since its formation in April 1989, the Proxy Voting Committee of the Company has formulated guidelines and reviewed proxy statements for the purpose of

determining how to vote proxies related to portfolio securities held by our clients. The main driver of these guidelines is to vote in the best economic interest of our clients. As we state in our Magna Carta of Shareholder Rights, we are neither for nor against management. We are for

shareholders. We do not consider any issue routine. We take into consideration all of our research on the company, its directors, and their short and long-term goals for the company. In cases where issues that we generally do not approve of are

combined with other issues, the negative aspects of the issues will be factored into the evaluation of the overall proposals, but will not necessitate a vote in opposition to the overall proposals.

4

Additionally, across various investment products, we use ESG criteria, which include certain sustainable themes such as water scarcity, health and

wellness, and renewable energy.

Past and Future - Giving Back to Society

Generating returns for our stakeholders is not the sole gauge we use in measuring our success. Since the inception of our shareholder-designated charitable

contribution (“SDCC”) program in 2013, shareholders have designated contributions of approximately $27 million to over 150 501(c)(3) initiatives. As a result of the board of directors (the “Board of Directors”) most recent SDCC approval, $4.5 million

was designated by shareholders to 501(c)(3) organizations in November 2019. This program underscores our commitment to managing socially responsible portfolios since 1987, which has evolved to include integrating ESG factors into the analysis of

companies and the structuring of portfolios.

Since our IPO in February 1999, approximately $57 million will have been donated to charities by us, including the current year’s SDCC.

Business Strategy

Our business strategy targets global growth of the franchise by leveraging our proven asset management strengths, including our brands, long-term

performance record, diverse product offerings, and experienced investment, research, and client relationship professionals. To achieve performance and growth in AUM and profitability, we are deploying a strategy which includes several factors:

|

·

|

Gabelli Private Market Value

(PMV) with a CatalystTM Investment Approach is at the core of our business. This methodology has evolved from the value investing principles articulated by Graham & Dodd in 1934

and enhanced by Roger Murray and Bruce Greenwald. Mr. Gabelli’s contribution to their principles was the introduction of the Private Market Value (PMV) with a CatalystTM value investment methodology in 1979.

|

|

|

Private Market Value (PMV) with a CatalystTM investing is a disciplined, research-driven approach based on intensive security analysis.

In this process, select stocks are identified with an intrinsic value based on our estimate of current asset value, future growth, and earnings power that is significantly different from the value reflected in the public market. We then

calculate the stock’s PMV, defined as the price an informed industrial buyer would likely pay to acquire the business. We then look for a catalyst: a company specific event or industry-wide phenomena, such as a change in regulations that will

help realize returns.

In general, our Institutional and PWM AUM are managed to meet the specific needs and objectives of each client by utilizing investment strategies

that are within our areas of expertise: “all cap value”, “small cap value”, “small and mid (SMID) cap value”, “ESG”, “large cap growth”, “international growth,” and “convertibles”.

|

|

·

|

Establishing New Relationship

Offices Internationally. We have ten offices, comprised of six domestic offices located in Rye, NY; Greenwich, CT; Morristown, NJ; Palm Beach, FL; Reno, NV; and St. Louis, MO, and four international offices located in London, Hong

Kong, Shanghai, and Tokyo. We will continue to evaluate adding additional offices throughout the world in order to serve our clients and meet global research requirements.

|

|

·

|

Incentive Fees. As of

December 31, 2019, approximately $1.7 billion of our AUM are managed on a performance fee basis including $575 million of SICAV assets, $476 million of preferred issues of closed-end funds, $306 million in The GDL Fund, $238 million of

Institutional and PWM assets, and $102 million in the Gabelli Merger Plus+ Trust Plc.

|

|

·

|

Expanding Fund Distribution. We

continue to expand our distribution network, primarily through national and regional brokerage firms, and have developed additional classes of shares for most of our open-end funds for sale through these firms and other third party

distribution channels. We have increased our wholesale distribution efforts to market the multi-class shares, which have been designed to meet the needs of investors seeking advice through financial consultants. We also seek relationships

with financial intermediaries that manage discretionary fund models in order to have our funds placed within such models.

|

|

·

|

Increasing Presence in and

Marketing for Private Wealth Management Market. Our private wealth management business focuses, in general, on serving clients who have established an account relationship of $2.5 million or more with us. According to industry

estimates, the number of households with over $2.5 million in investable assets will continue to grow, subject to ups and downs in the equity and fixed income markets. With our 42-year history of serving this segment, including our long-term

performance record, customized portfolios tax-sensitive investment strategy, brand name recognition, and broad array of product offerings, we believe that we are well-positioned to capitalize on growth opportunities in this market. Our

objective is to develop long term client relationships.

|

5

|

·

|

Increasing Marketing for

Institutional Market. The Institutional business was principally developed through direct marketing channels. We augmented our institutional sales force with the addition of staff to market directly to the consultant community.

Institutional investment consultants serve as gatekeepers to the majority of corporate retirement plans, public retirement plans, endowments, and foundations, which represent our primary institutional target markets. Consultants perform

evaluations and make recommendations for investment firms they believe can best meet their clients’ investment objectives. We are focusing on marketing our capabilities and expertise to investment consulting firms to continue building long

term relationships.

|

|

·

|

Attracting and Retaining

Experienced Professionals. We offer significant variable compensation that provides opportunities to our staff. The ability to attract and retain highly-experienced investment and other professionals with a long-term commitment to

us and our clients has been, and will continue to be, a significant factor in our long-term growth.

|

|

·

|

Hosting of Institutional

Investor Symposiums. We have a tradition of sponsoring institutional investor symposiums that bring together prominent portfolio managers, members

of academia, and other leading business professionals to present, discuss, and debate current issues and topics in the investment industry. These symposiums have included:

|

|

-2019

|

“Healthcare at a Crossroads: What’s the Path Forward?”

|

|

-2019

|

“Rule 852(b)(6), the Dynamics and Implications for the Fund Industry” -

|

|

-2017

-2015

|

“Digital Evolution in Financial Services”

“Capital Allocation – The Tug of War”

|

|

-2013

|

“Value Investing 20 Years Later: A Celebration of the Roger Murray Lecture Series”

|

|

-2006

|

“Closed-End Funds: Premiums vs. Discounts, Dividends and Distributions”

|

|

-2003

|

“Dividends, Taxable versus Non-Taxable Issues”

|

|

-2001

-1998

|

“Virtues of Value Investing”

“The Role of Hedge Funds as a Way of Generating Absolute Returns”

|

|

-1997

|

“Active vs. Passive Stock Selection”

|

|

·

|

Capitalizing on Acquisitions,

Alliances, and Lift-outs. We intend to selectively and opportunistically pursue acquisitions, alliances, and lift-outs that

broaden our product offerings, add new sources of distribution, and augment organic growth. On March 11, 2008, Gabelli Funds assumed the role of investment advisor to the AXA Enterprise Mergers and Acquisitions Fund, subsequently renamed

Gabelli Enterprise Mergers and Acquisitions Fund, a fund that had been sub-advised by GAMCO since its inception on February 28, 2001. On August 1, 2010, the clients of Florida-based NMF Asset Management became part of the Institutional and

PWM operation of GAMCO Asset. On November 2, 2015, the investment team of Dinsmore Capital, a specialist in convertible bond investing and formerly the manager of The Bancroft Fund and the Ellsworth Growth & Income Fund joined Gabelli

Funds. During 2018, the clients of Trevor, Stewart, Burton & Jacobsen and Loeb Partners Corporation joined GAMCO.

|

|

·

|

Building Out Fixed Income

Capabilities. We look to increase our competitive ability to attract new clients interested in fixed income vehicles. The Gabelli U.S. Treasury Money Market Fund, with an investment objective of high current income consistent with

the preservation of principal and liquidity, increased AUM by over $600 million in 2019 as a result of increased marketing and new clients.

|

We believe that our growth to date is traceable to the following factors:

| ● |

Strong Industry Fundamentals: According

to data compiled by the U.S. Federal Reserve, the investment management industry has grown faster than more traditional segments of the financial services industry, including the banking and insurance industries. Since GBL began managing

assets for Institutional and PWM clients in 1977, world equity markets have grown at a 10.0% compound annual growth rate through December 31, 2019 to approximately $87.0 trillion(a). The U.S. equity market comprises about $34.4

trillion(a) or roughly 40% of world equity markets. We believe that demographic trends and the growing role of money managers in the placement of capital compared to the traditional role played by banks and life insurance

companies will result in continued growth of the investment management industry.

|

(a) Source: Birinyi Associates, LLC

| ● |

Long-Term Performance: We have a

superior long-term record of achieving relatively high returns for our Institutional and PWM clients. We believe that our performance record represents a competitive advantage and a recognized component of our franchise.

|

6

| ● |

Stock Market Gains: Since we began

managing for Institutional and PWM clients in 1977, our traditional value-oriented Institutional and PWM composite has earned a compound annual return of 15.6% gross and 14.7% net of fees versus a compound annual return of 11.8% for the S&P 500 through December 31, 2019. For 2019, the GAMCO composite increased 21.9% gross and 21.3% net of fees versus a gain of 31.5%

for the S&P 500.

|

| ● |

Widely-Recognized “Gabelli” and “GAMCO” Brand

Names: For much of our history, our CEO, portfolio managers, investment style, and investment products have been featured in a variety of print and digital media publications, including U.S. and international publications such

as The Wall Street Journal, Financial Times, Money Magazine, Barron’s, Fortune, Business Week, Nikkei Financial News, Forbes, and Investor’s Business Daily. We have published Deals…Deals…and More Deals written by our investment professionals. It examines the history and current practice of merger arbitrage and has been translated into Japanese, Chinese, Italian, and Spanish. Global Convertible Investing: The Gabelli Way is a comprehensive guide to effective investing in convertible securities. Our investment

professionals also appear on leading financial news programs, including CNBC and Bloomberg, and we are active on numerous digital platforms, including Gabelli TV on YouTube and Twitter (@MarioGabelli, @InvestGabelli, and @InvestESG), among others.

|

| ● |

Diversified Product Offerings: Since the

inception of our investment management activities, we have sought to expand the breadth of our product offerings. We currently offer a wide spectrum of investment products and strategies, including product offerings in U.S. equities, U.S.

fixed income, international equities, and convertible securities.

|

Business Description

Our AUM’s are clustered in two groups: Funds and Institutional and PWM.

Funds: At December 31, 2019, we

had $21.3 billion of AUM in Fund AUM, representing 58.4% of our total AUM. Our equity Funds were $18.5 billion in AUM on December 31, 2019, 5.7% above the $17.5 billion on December 31, 2018. We also are the investment advisor to a SICAV with AUM of

$594 million at December 31, 2019, compared to the $507 million in AUM at December 31, 2018.

Open-end Funds

As of December 31, 2019, we had $10.5 billion of AUM in 23 open-end equity Funds and $2.8 billion in our Gabelli U.S. Treasury Money Market Fund. We market

our open-end Funds primarily through third party distribution programs, including no-transaction fee (“NTF”) programs, and have developed additional share classes for many of our funds for distribution through these third party distribution channels.

As of December 31, 2019, third party distribution programs accounted for approximately 73% of our AUM in open-end equity funds and approximately 27% of our AUM in open-end equity funds were sourced through direct sales relationships.

Closed-end Funds

We act as investment advisor to 16 closed-end funds, 14 of which trade on the NYSE or its affiliated exchange. These funds cannot be redeemed by the fund’s

shareholders, except in limited cases. The trading price of the shares is determined by supply and demand in the marketplace and, as a result, the shares may trade at a premium or discount to the net asset value of the fund. The closed-end funds are:

Gabelli Equity Trust (GAB), GDL Fund (GDL), Gabelli Multimedia Trust (GGT), Gabelli Healthcare & Wellness Rx Trust (GRX), Gabelli Convertible and Income Securities Fund (GCV), Gabelli Utility Trust (GUT), Gabelli Dividend & Income

Trust (GDV), Gabelli Global Utility & Income Trust (GLU), GAMCO Global Gold, Natural Resources & Income Trust (GGN), GAMCO Natural Resources, Gold & Income Trust (GNT), The Gabelli Global Small and Mid Cap Value Trust (GGZ), the Bancroft

Fund Ltd. (BCV), the Ellsworth Growth and Income Fund Ltd. (ECF), and the Gabelli Go Anywhere Trust (GGO). We launched the Gabelli Value Plus+ Trust Plc (GVP) in 2015 and the Gabelli Merger Plus+ Trust Plc (GMP) in 2017, both of which

trade on the London Stock Exchange. As of December 31, 2019, the 16 closed-end funds had total assets of $8.0 billion, representing 37.6% of the total assets in our Funds business.

SICAV

We provide investment advisory services to the GAMCO International SICAV, which has two sub-fund strategies, the GAMCO Merger Arbitrage Fund and the GAMCO

All Cap Value Fund. Total AUM in the SICAV was $594 million at December 31, 2019.

7

Institutional and Private Wealth

Management: At December 31, 2019, we had $14.6 billion of AUM in approximately 1,700 Institutional and PWM accounts, representing 40% of our total AUM. As of December 31, 2019, the PWM clients, generally defined as individuals having

minimum investable assets of $2.5 million, comprised approximately 82% of the total number of Institutional and PWM accounts and approximately $4.5 billion, or 31%, of the Institutional and PWM AUM. We believe that PWM clients are attracted to us by

our returns and the tax efficient nature of the underlying investment process for the taxable portion of their assets. As of December 31, 2019, institutional client accounts comprised approximately 8% of the total number of Institutional and PWM

accounts and approximately $4.2 billion, or 29%, of the Institutional and PWM AUM. As of December 31, 2019, foundation and endowment fund assets comprised approximately 9% of the total number of Institutional and PWM accounts and approximately $1.2

billion, or 8%, of the Institutional and PWM AUM. As of December 31, 2019, the sub-advisory clients, where we act as sub-advisor to third party investment funds, comprised approximately 1% of the total number of Institutional and PWM accounts and

approximately $4.7 billion, or 32%, of total Institutional and PWM AUM.

The ten largest Institutional and PWM relationships comprised approximately 49% of GAMCO Asset AUM and 19% of our total AUM as of December 31, 2019, and

approximately 32% of GAMCO Asset revenues and 9% of our total revenues for the year ended December 31, 2019.

Investment advisory agreements for our Institutional and PWM clients are typically subject to termination by the client without penalty on 30 days’ notice

or less.

Assets Under Management

The following table sets forth total AUM by product type as of the dates shown:

Assets Under Management

By Product Type

(dollars in millions)

|

%

|

||||||||||||||||

|

At December 31,

|

Change

|

|||||||||||||||

|

2019

|

2018

|

2017

|

2019/2018

|

|||||||||||||

|

Equity:

|

||||||||||||||||

|

Open-end Funds

|

$

|

10,481

|

$

|

10,589

|

$

|

13,747

|

(1.0

|

)

|

||||||||

|

Closed-end Funds

|

8,005

|

6,959

|

8,053

|

15.0

|

||||||||||||

|

Institutional & Private Wealth

|

||||||||||||||||

|

Management

|

14,565

|

14,078

|

18,852

|

3.5

|

||||||||||||

|

SICAV

|

594

|

507

|

510

|

17.2

|

||||||||||||

|

Total Equity

|

33,645

|

32,133

|

41,162

|

4.7

|

||||||||||||

|

Fixed Income:

|

||||||||||||||||

|

Money Market Mutual Fund (a)

|

2,810

|

2,195

|

1,870

|

28.0

|

||||||||||||

|

Institutional & Private Wealth

|

||||||||||||||||

|

Management

|

20

|

26

|

31

|

(23.1

|

)

|

|||||||||||

|

Total Fixed Income

|

2,830

|

2,221

|

1,901

|

27.4

|

||||||||||||

|

Total AUM

|

$

|

36,475

|

$

|

34,354

|

$

|

43,063

|

6.2

|

|||||||||

|

|

||||||||||||||||

|

Breakdown of Total AUM:

|

||||||||||||||||

|

Funds

|

21,296

|

19,743

|

23,670

|

7.9

|

||||||||||||

|

Institutional & Private Wealth

|

||||||||||||||||

|

Management

|

14,585

|

14,104

|

18,883

|

3.4

|

||||||||||||

|

SICAV

|

594

|

507

|

510

|

17.2

|

||||||||||||

|

Total AUM

|

$

|

36,475

|

$

|

34,354

|

$

|

43,063

|

6.2

|

|||||||||

(a) The Fund is 100% invested in U.S. Treasury obligations.

8

Summary of Investment Products

We manage assets in the following wide spectrum of investment products and strategies:

|

U.S.

Equities: (88.7% of AUM)

|

Global and International Equities:

(1.9% of AUM)

|

|

All Cap Value

|

International Growth

|

|

Large Cap Value

|

International Small Cap Growth

|

|

Large Cap Growth

|

Global Growth

|

|

Mid Cap Value

|

Global Value

|

|

Small Cap Value

|

Global Content & Connectivity

|

|

Small Cap Growth

|

Global Utilities

|

|

Micro Cap

|

Gold

|

|

Natural Resources

|

Small and Mid Cap

|

|

Income

|

|

|

Utilities

|

U.S. Fixed Income: (7.7% of AUM)

|

|

Non-Market Correlated

|

Corporate

|

|

Option Income

|

Government

|

|

Multimedia

|

Asset-backed

|

|

ESG

|

Intermediate

|

|

Healthcare

|

Short-term

|

|

Convertible

Securities: (1.7% of AUM)

|

|

|

Convertible Securities

|

Additional Information on Mutual Funds

Through Gabelli Funds, we act as the investment advisor to all of the Funds.

Shareholders of the open-end Funds are allowed to exchange shares among the same class of shares of the other open-end Funds as economic and market

conditions and investor needs change at no additional cost. However, certain open-end Funds impose a 2% redemption fee on shares redeemed within seven days or less after a purchase. We periodically introduce new funds designed to complement and

expand our investment product offerings, respond to competitive developments in the financial marketplace, and meet the changing needs of investors.

Our marketing efforts for the open-end Funds are currently focused on increasing the distribution and sales of our existing funds as well as creating new

products for sale through our distribution channels. We believe that our marketing efforts for the Funds will continue to generate additional revenues from investment advisory fees. We had traditionally distributed most of our open-end Funds by using

a variety of direct response marketing techniques, including telemarketing and advertising, and, as a result, we maintain direct relationships with many of our no-load open-end Fund shareholders. Beginning in late 1995, we expanded our product

distribution by offering several of our open-end Funds through third party distribution programs, including NTF programs. In 1998 and 1999, we further expanded these efforts to include substantially all of our open-end Funds in third party

distribution programs. Approximately 27% of the AUM in the open-end equity funds are still attributable to our direct response marketing efforts. Third party distribution programs have become an increasingly important source of asset growth for us.

Of the $10.5 billion of AUM in the open-end equity Funds as of December 31, 2019, approximately 73% were generated through third party distribution programs. We are responsible for paying the distribution fees charged by many of the third party

distribution programs, although a portion of such distribution fees under certain circumstances are payable by the Funds. The multi-class shares are available in all of the Funds, with the exception of the Gabelli Capital Asset Fund. We believe that

the use of multi-class shares expands the distribution of our open-end Funds into the advised sector of the mutual fund investment community. We introduced Class I shares, which are no-load shares with higher minimum initial investment and without

distribution fees, available directly through G.distributors or through brokers that have entered into selling agreements with respect to Class I shares. The no-load shares are designated as Class AAA shares and are available for new and current

investors. In general, distribution through third party programs has greater variable cost components and lower fixed cost components than distribution through our traditional direct sales methods.

We provide investment advisory and management services pursuant to an investment management agreement with each fund (“Fund IMAs”). The Fund IMAs generally

provide that we are responsible for the overall investment and administrative services, subject to the oversight of each fund’s board of directors or trustees and in accordance with each fund’s fundamental investment objectives and policies. The Fund

IMAs permit us to enter into separate agreements for sub-administrative and accounting services on behalf of the respective funds.

9

Our affiliated advisor provides the Funds with administrative services pursuant to the Fund IMAs. Such services include, without limitation, supervision of

the calculation of net asset value, preparation of financial reports for shareholders of the funds, internal accounting, tax accounting and reporting, regulatory filings, and other services. Most of these administrative services are provided through

sub-contracts with independent third parties. Transfer agency and custodial services are provided directly to the funds by independent third parties.

Each of our Fund IMAs may continue in effect from year to year only if specifically approved at least annually by (i) the fund’s board of directors or

trustees or (ii) the fund’s shareholders and, in either case, the vote of a majority of the fund’s independent or non-interested directors or trustees who are not parties to the agreement or “interested persons” of any such party, within the meaning

of the Investment Company Act of 1940, as amended (“Company Act”). Each fund may terminate its Fund IMA at any time upon 60 days’ written notice by (i) a vote of the majority of the board of directors or trustees cast in person at a meeting called

for the purpose of voting on such termination or (ii) a vote at a meeting of shareholders of the lesser of either 67% of the voting shares represented in person or by proxy (if at least 50% of the shares are present at the meeting) or 50% of the

outstanding voting shares of such fund. Each Fund IMA automatically terminates in the event of its assignment, as defined in the Company Act. We may terminate a Fund IMA without penalty on 60 days’ written notice.

Open-End Fund Distribution

G.distributors, a wholly-owned subsidiary of GBL, is a broker-dealer registered under the Exchange Act, and is regulated by the Financial Industry

Regulatory Authority (“FINRA”). G.distributors’ revenues are derived primarily from the distribution of our open-end Funds. G.distributors distributes our open-end Funds pursuant to distribution agreements with each Fund. It also distributes funds

managed by Teton and its affiliates. Under each distribution agreement with an open-end Fund, G.distributors offers and sells such open-end Fund’s shares on a continuous basis and pays the majority of the costs of marketing and selling the shares,

including printing and mailing prospectuses and sales literature, advertising, maintaining sales and customer service teammates and sales and services fulfillment systems, and payments to the sponsors of third party distribution programs, financial

intermediaries, and G.distributors’ sales teammates. G.distributors receives fees for such services pursuant to distribution plans adopted under provisions of Rule 12b-1 (“12b-1”) of the Company Act. Distribution fees from the open-end Funds are

computed daily based on average net assets. For the years ended December 31, 2019 and 2018, distribution fees from the open-end Funds amounted to $29.2 million and $35.1 million, respectively, while payments to third-parties for selling the open-end

Funds totaled $27.2 million and $32.3 million, respectively. G.distributors is the principal underwriter for the Funds distributed in multiple classes of shares, which carry either a front-end, back-end or no sales charge. For the years ended

December 31, 2019 and 2018, underwriting fees and sales charges retained amounted to $1.3 million and $0.9 million, respectively.

Under the distribution plans, the Class AAA shares of the open-end Funds (except The Gabelli U.S. Treasury Money Market Fund, Gabelli Capital Asset Fund

and The Gabelli ABC Fund) and the Class A and ADV shares of certain funds pay G.distributors a distribution fee of 0.25% per year (except the Class A shares of the TETON Westwood funds which pay 0.50% per year, except for the TETON Westwood

Intermediate Bond Fund which pays 0.35%, and the Class A shares of the Gabelli Enterprise Mergers and Acquisitions Fund which pay 0.45% per year) on the average daily net assets of the fund. Class C shares have a 12b-1 distribution plan with a

distribution fee totaling 1.00%.

G.distributors’ distribution agreements with each fund may continue in effect from year to year only if specifically approved at least annually by (i) the

fund’s board of directors or trustees or (ii) the fund’s shareholders and, in either case, the vote of a majority of the fund’s board of directors or trustees who are not parties to the agreement or “interested persons” of any such party, within the

meaning of the Company Act. Each fund may terminate its distribution agreement, or any agreement thereunder, at any time upon 60 days’ written notice by (i) a vote of the majority of its board of directors or trustees cast in person at a meeting

called for the purpose of voting on such termination or (ii) a vote at a meeting of shareholders of the lesser of either 67% of the voting shares represented in person or by proxy (if at least 50% of the shares are present at the meeting) or 50% of

the outstanding voting shares of such fund. Each distribution agreement automatically terminates in the event of its assignment, as defined in the Company Act. G.distributors may terminate a distribution agreement without penalty upon 60 days’

written notice.

G.distributors also offers our open-end Fund products through our website, www.gabelli.com, where directly registered investors can access their personal

account information and buy, sell, and exchange fund shares. Fund prospectuses, quarterly reports, fund applications, daily net asset values, and performance charts are all available online.

10

Competition

We compete with other investment management firms and mutual fund companies, insurance companies, banks, brokerage firms, and other financial institutions

that offer products that have similar features and investment objectives. Many of these investment management firms are subsidiaries of large diversified financial companies. Many others are much larger in terms of AUM and revenues and, accordingly,

have much larger sales organizations and marketing budgets. Historically, we have competed primarily on the basis of the long-term investment performance of many of our investment products in addition to brand recognition of the Firm and market

awareness of its founder, Mr. Gabelli. We have taken steps to increase our distribution channels, brand consistency and marketing communications and thought-leadership efforts. Other trends affecting the investment management business include the

widespread popularity of index mutual funds and exchange-traded funds (“ETFs”), which have tax and cost advantages over traditional investment companies.

The market for providing investment management services to Institutional and PWM clients is also highly competitive. Approximately 30% of our investment

advisory fee revenue for the year ended December 31, 2019 was derived from our Institutional and PWM business. Selection of investment advisors by U.S. institutional investors is often subject to a screening process and favorable recommendations by

investment industry consultants. Many of these investors require their investment advisors to have a successful and sustained performance record, often five years or longer with focus also on one-year and three-year performance records. We have

significantly increased our AUM on behalf of U.S. institutional investors since our entry into the institutional asset management business in 1977.

Intellectual Property

Service marks and brand name recognition are important to our business. We have rights to the service marks under which our products are offered. We have

registered certain service marks in the U.S. and will continue to do so as new trademarks and service marks are developed or acquired. We have rights to use the “Gabelli” name, the “GAMCO” name, and other names. Pursuant to an assignment agreement,

Mr. Gabelli has assigned to us all of his rights, title, and interests in and to the “Gabelli” name for use in connection with investment management services, mutual funds and securities brokerage services. However, under the agreement, Mr. Gabelli

will retain any and all rights, title, and interests he has or may have in the “Gabelli” name for use in connection with (i) charitable foundations controlled by Mr. Gabelli or members of his family and (ii) entities engaged in private investment

activities for Mr. Gabelli or members of his family. In addition, the funds managed by Mr. Gabelli outside GBL have entered into a license agreement with us permitting them to continue limited use of the “Gabelli” name under specified circumstances.

Regulation

Virtually all aspects of our businesses are subject to various federal, state, and foreign laws and regulations. These laws and regulations are primarily

intended to protect investment advisory clients and shareholders of investment funds. Under such laws and regulations, agencies that regulate investment advisors and broker-dealers have broad powers, including the power to limit, restrict or prohibit

such an advisor or broker-dealer from carrying on its business in the event that it fails to comply with such laws and regulations. In such an event, the possible sanctions that may be imposed include civil and criminal liability, the suspension of

individual employees, injunctions, limitations on engaging in certain lines of business for specified periods of time, revocation of the investment advisor, and other registrations, censures, and fines.

Our business is subject to extensive regulation at the federal, state, and foreign level by the SEC and other regulatory bodies. Certain of our

subsidiaries are registered with the SEC under the Investment Advisers Act of 1940, as amended (“Advisers Act”), and the funds are registered with the SEC under the Company Act. We also have a subsidiary that is registered as a broker-dealer with the

SEC and is subject to regulation by FINRA and various states.

The subsidiaries of GBL that are registered with the SEC under the Advisers Act (Gabelli Funds, GAMCO Asset and Gabelli Fixed Income L.L.C.) are regulated

by and subject to examination by the SEC. The Advisers Act imposes numerous obligations on registered investment advisors, including fiduciary duties, disclosure obligations, and record keeping, operational, and marketing requirements. The SEC is

authorized to institute proceedings and impose sanctions for violations of the Advisers Act, ranging from censure to termination of an investment advisor’s registration. The failure of an advisory subsidiary to comply with the requirements of the SEC

could have a material adverse effect on us.

We derive a substantial majority of our revenues from investment advisory services through our various investment management agreements. Under the Advisers

Act, our investment management agreements may not be assigned without the client’s consent. Under the Company Act, advisory agreements with registered investment companies such as our Funds terminate automatically upon assignment. The term

“assignment” is broadly defined and includes direct as well as assignments that may be deemed to occur, under certain circumstances, upon the transfer, directly or indirectly, of a controlling interest in GBL.

11

In its capacity as a broker-dealer, G.distributors is required to maintain certain minimum net capital amounts. These requirements also provide that equity

capital may not be withdrawn, advances to affiliates may not be made, and cash dividends may not be paid if certain minimum net capital requirements are not met. G.distributors’ net capital, as defined, met or exceeded all minimum requirements as of

December 31, 2019. As a registered broker-dealer, G.distributors is also subject to periodic examination by FINRA, the SEC, and the states.

Subsidiaries of GBL are subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and to regulations promulgated thereunder,

insofar as they are “fiduciaries” under ERISA with respect to certain of their clients. ERISA and applicable provisions of the Internal Revenue Code of 1986, as amended (the “Code”), impose certain duties on persons who are fiduciaries under ERISA

and prohibit certain transactions involving ERISA plan clients. Our failure to comply with these requirements could have a material adverse effect on us.

Investments by GBL and on behalf of our Funds and Institutional and PWM clients often represent a significant equity ownership position in an issuer’s

class of stock. As of December 31, 2019, we had five percent or more beneficial ownership with respect to 98 equity securities. This activity raises frequent regulatory, legal, and disclosure issues regarding our aggregate beneficial ownership level

with respect to portfolio securities, including issues relating to issuers’ shareholder rights plans or “poison pills,” and various federal and state regulatory limitations, including state gaming laws and regulations, federal communications laws and

regulations, and federal and state public utility laws and regulations, as well as federal proxy rules governing shareholder communications and federal laws and regulations regarding the reporting of beneficial ownership positions. Foreign country

regulations may have different levels of ownership limitations. Our failure to comply with these requirements could have a material adverse effect on us.

The USA Patriot Act of 2001 contains anti-money laundering and financial transparency laws and mandates the implementation of various new regulations

applicable to broker-dealers, mutual funds and other financial services companies, including standards for verifying client identification at account opening and obligations to monitor client transactions and report suspicious activities. Anti-money

laundering laws outside of the U.S. contain some similar provisions. Our failure to comply with these requirements could have a material adverse effect on us.

We and certain of our affiliates are subject to the laws of non-U.S. jurisdictions and non-U.S. regulatory agencies or bodies. In connection with our

office in London and our plans to market certain products in Europe, we are required to comply with the laws of the United Kingdom and other European countries regarding these activities. Our subsidiary, GAMCO Asset Management (UK) Limited, is

regulated by the Financial Conduct Authority. In connection with our registration in the United Kingdom, we have minimum capital requirements that have been consistently met or exceeded. We opened offices in Hong Kong, Shanghai, and Tokyo and,

therefore, are subject to national and local laws in those jurisdictions. We are subject to requirements in numerous jurisdictions regarding reporting of beneficial ownership positions in securities issued by companies whose securities are

publicly-traded in those countries.

Regulatory matters

The investment management industry is likely to continue facing a high level of regulatory scrutiny and become subject to additional rules designed to

increase disclosure, tighten controls, and reduce potential conflicts of interest. In addition, the SEC has substantially increased its use of focused inquiries, which request information from investment advisors and a number of fund complexes

regarding particular practices or provisions of the securities laws. We participate in some of these inquiries in the normal course of our business. Changes in laws, regulations, and administrative practices by regulatory authorities, and the

associated compliance costs, have increased our cost structure and could in the future have a material adverse impact. Although we have installed procedures and utilize the services of experienced administrators, accountants, and lawyers to assist us

in adhering to regulatory guidelines and satisfying these requirements, and maintain insurance to protect ourselves in the case of client losses, there can be no assurance that the precautions and procedures that we have instituted and installed, or

the insurance that we maintain to protect ourselves in case of client losses, will protect us from all potential liabilities.

See Legal Proceedings in Part I, Item 3 of this Form

10-K for additional information.

12

Teammates

As of February 29, 2020, we had a full-time staff of 189 teammates, of whom 64 served in the portfolio management, portfolio management support, and

trading areas (including 25 portfolio managers for the Funds and Institutional and PWM), 66 served in the marketing and shareholder servicing areas, and 59 served in the administrative area.

Status as a Smaller Reporting Company

We are a “smaller reporting company” as defined by Rule 12b-2 of the Exchange Act and in Item 10(f)(1) of Regulation S-K. As a result,

we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “smaller reporting companies.” We will, in general, remain a smaller reporting company unless the

market value of GBL common stock that is held by non-affiliates exceeds $250 million as of the last business day of our most recently completed second fiscal quarter.

We may take advantage of some or all of the reduced regulatory and reporting requirements that will be available to us as long as we

qualify as a smaller reporting company.

ITEM 1A: RISK

FACTORS

We caution the reader that the following risks and those risks described elsewhere in this report and in our other SEC filings could

have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows or could cause a decline in the Company’s stock price.

Risks Related to Our Industry

We earn substantially all of our revenue based on assets under management and, therefore, a reduction in assets

under management would reduce our revenues and profitability. Assets under management fluctuate based on many factors including market conditions, investment performance, and terminations of investment contracts.

Substantially all of our revenues are directly related to the amount of our AUM. Under our investment advisory contracts with our

clients, the investment advisory fees we receive are typically based on the market value of AUM. In addition, we receive asset-based distribution fees with respect to the open-end Funds managed by Gabelli Funds or Teton and its affiliates over time

pursuant to distribution plans adopted under provisions of Rule 12b-1 under the Company Act. Rule 12b-1 fees typically are based on the average AUM and represented approximately 9.4% and 10.3% of our total revenues for the years ended December 31,

2019 and 2018, respectively. Accordingly, a decline in the prices of securities generally may cause our revenues and net income to decline by either causing the value of our AUM to decrease, which would result in lower investment advisory and Rule

12b-1 fees, or causing our clients to withdraw funds in favor of investments they perceive to offer greater opportunity or lower risk, which would also result in lower fees. The securities markets are highly volatile, and securities prices may

decrease for many reasons beyond our control, including, but not limited to, economic and political events, war (whether or not directly involving the U.S.), acts of terrorism, unanticipated changes in currency exchange rates, interest rates,

inflation rates, the yield curve, defaults by derivative counterparties, bond default risks, sovereign debt crisis, and other factors that are difficult or impossible to predict. If a decline in securities prices caused our revenues to decline, it

could have a material adverse effect on our earnings. Lastly, as we are a traditional asset manager, we do not receive additional revenue streams from alternative asset strategies such as hedge funds, private equity, or venture capital.

Changes in laws or regulations or in governmental policies and compliance with existing laws or regulations could

limit the sources and amounts of our revenues, increase our costs of doing business, decrease our profitability, and materially and adversely affect our business.

Our business is subject to extensive regulation in the U.S., primarily at the federal level, including regulation by the SEC under the Company Act and the

Advisers Act as well as other securities laws, by the Department of Labor under ERISA, and regulation by FINRA and state regulators. The Funds managed by Gabelli Funds are registered with the SEC as investment companies under the Company Act. The

Advisers Act imposes numerous obligations on investment advisors, including record-keeping, advertising and operating requirements, fiduciary and disclosure obligations, custodial requirements, and prohibitions on fraudulent activities. The Company

Act imposes similar obligations, as well as additional detailed operational requirements, on registered investment companies and investment advisors. In addition, our businesses are also subject to regulation by the Financial Services Authority in

the United Kingdom, and we are also subject to the laws of other non-U.S. jurisdictions and non-U.S. regulatory agencies or bodies.

13

Our failure to comply with applicable laws or regulations could result in fines, censure, suspensions of teammates, or other sanctions,

including revocation of our subsidiaries’ registrations as an investment advisor or broker-dealer. Industry regulations are designed to protect our clients and investors in our funds and other third parties who deal with us and to ensure the

integrity of the financial markets. Our industry is frequently altered by new laws or regulations and by revisions to, and evolving interpretations of, existing laws and regulations, both in the U.S. and in other nations. Changes in laws or

regulations or in governmental policies could limit the sources and amounts of our revenues including but not limited to distribution revenue under the Company Act, increase our costs of doing business, decrease our profitability, and materially and

adversely affect our business.

To the extent that provisions of the Tax Cuts and Jobs Act (the “Act”) affect the deductibility of named executive officer (“NEO”)

compensation, we may be impacted.

The Act eliminates the performance based compensation exception for NEO compensation deductibility, limiting the amount of deductible NEO compensation to

$1 million annually per NEO. To the extent that some of the compensation of our NEOs is affected by this change, we would have a lower amount of deductible compensation and a higher effective tax rate than we would have had without this loss of

deductibility.

To the extent we are forced to compete on the basis of price, we may not be able to maintain our current fee structure.

The investment management business is highly competitive and has relatively low barriers to entry. To the extent we are forced to compete on the basis of

price, we may not be able to maintain our current fee structure. Although our investment advisory fees vary from product to product, historically we have competed primarily on the performance of our products and not on the level of our investment

advisory fees relative to those of our competitors. In recent years, however, there has been a trend toward lower fees in the investment management industry. In order to maintain our fee structure in a competitive environment, we must be able to

continue to provide clients with investment returns and service that make investors willing to pay our fees. In addition, the board of directors or trustees of each Fund managed by Gabelli Funds must make certain findings as to the reasonableness of

its fees. We cannot be assured that we will succeed in providing investment returns and service that will allow us to maintain our current fee structure. Fee reductions on existing or new business could have an adverse effect on our profit margins

and results of operations.

We derive a substantial portion of our revenues from investment advisory contracts that may be terminated on short notice or may not be

renewed by clients.

A substantial majority of our revenues are derived from investment management agreements and distribution arrangements. Investment management agreements

and distribution arrangements with the Funds are terminable without penalty on 60 days’ notice (subject to certain additional procedural requirements in the case of termination by a Fund) and must be specifically approved at least annually, as

required by law. Such annual renewal requires, among other things, approval by the disinterested members of each Fund’s board of directors or trustees. Investment advisory agreements with our Institutional and PWM clients are typically terminable by

the client without penalty on 30 days’ notice or less. Any failure to renew or termination of a significant number of these agreements or arrangements would have a material adverse effect on us.

Investors in the open-end Funds can redeem their investments in these Funds at any time without prior notice, which could adversely

affect our earnings.

Open-end Fund investors may redeem their investments in those Funds at any time without prior notice. Investors may reduce the aggregate amount of AUM for

any number of reasons, including investment performance, changes in prevailing interest rates, and financial market performance. In a declining stock market, the pace of mutual fund redemptions could accelerate. Poor performance relative to other

asset management firms tends to result in decreased purchases of open-end fund shares and increased redemptions of open-end fund shares. The redemption of investments in the Funds managed by Gabelli Funds would adversely affect our revenues, which

are substantially dependent upon the AUM in our Funds. If redemptions of investments in the open-end Funds caused our revenues to decline, it could have a material adverse effect on our earnings.

Certain changes in control of our company would automatically terminate our investment management agreements with our clients, unless

our Institutional and PWM clients consent and, in the case of Fund clients, the Funds’ boards of directors and shareholders vote to continue the agreements, and could prevent us for a two-year period from increasing the investment advisory fees we

are able to charge our mutual fund clients.

14

Under the Company Act, an investment management agreement with a fund must provide for its automatic termination in the event of its assignment. The fund’s

board and shareholders must vote to continue the agreement following its assignment, the cost of which ordinarily would be borne by us. Under the Advisers Act, a client’s investment management agreement may not be assigned by the investment advisor

without the client’s consent. An investment management agreement is considered to be assigned to another party when a controlling block of the advisor’s ownership is transferred. In our case, an assignment of our investment management agreements may

occur if, among other things, we sell or issue a certain number of additional common shares in the future. We cannot be certain that our clients will consent to assignments of our investment management agreements or approve new agreements with us if

an assignment occurs. Under the Company Act, if a fund’s investment advisor engages in a transaction that results in the assignment of its investment management agreement with the fund, the advisor may not impose an unfair burden on that fund as a

result of the transaction for a two-year period after the transaction is completed. The term “unfair burden” has been interpreted to include certain increases in investment advisory fees. This restriction may discourage potential purchasers from

acquiring a controlling interest in our company.

Catastrophic and unpredictable events could have a material adverse effect on our business.

A terrorist attack, political unrest, war (whether or not directly involving the U.S.), power failure, cyber-attack, technology failure, natural disaster,

or many other possible catastrophic or unpredictable events could adversely affect our future revenues, expenses, and earnings by, among other things: causing disruptions in U.S., regional or global economic conditions; interrupting our normal

business operations; inflicting teammate casualties, including loss of our key executives; requiring substantial expenditures and expenses to repair, replace, and restore normal business operations; and reducing investor confidence.

We have a disaster recovery plan to address certain contingencies, but it cannot be assured that this plan will be effective or sufficient in responding

to, eliminating, or ameliorating the effects of all disaster scenarios. If our teammates or vendors we rely upon for support in a catastrophic event are unable to respond adequately or in a timely manner, we may lose clients resulting in a decrease

in AUM, which may have a material adverse effect on revenues and net income.

The soundness of other financial institutions could adversely affect our business.

Financial services institutions are interrelated as a result of trading, clearing, counterparty, or other relationships. We and the investments we manage

may have exposure to many different industries and counterparties, and we routinely execute transactions with counterparties in the financial services industry, including brokers and dealers, commercial banks, investment banks, clearing

organizations, mutual and hedge funds, and other institutions. Many of these transactions expose us, or the accounts we manage, to credit risk in the event of the counterparty’s default. There is no assurance that any such losses would not materially

and adversely impact the Company’s revenues and earnings.

Risks Related to Our Business

Control by Mr. Gabelli of a majority of the combined voting power of our common stock may give rise to conflicts of interests.

Since our IPO in 1999, Mr. Gabelli, through his control and majority ownership of GGCP, has beneficially owned a majority of our outstanding Class B Stock,

currently representing approximately 92% of voting control. As long as Mr. Gabelli indirectly beneficially owns a majority of the combined voting power of our common stock, he will have the ability to elect all of the members of our Board of

Directors and thereby control our management and affairs, including determinations with respect to acquisitions, dispositions, borrowings, issuances of common stock or other securities, and the declaration and payment of dividends on the common

stock. In addition, Mr. Gabelli will be able to determine the outcome of matters submitted to a vote of our shareholders for approval and will be able to cause or prevent a change in control of our company. As a result of Mr. Gabelli’s control, none

of our agreements with Mr. Gabelli and other companies controlled by him can be assumed to have been arrived at through arm’s-length negotiations, although we believe that the parties endeavor to implement market-based terms. There can be no

assurance that we would not have received more favorable terms, or offered less favorable terms to, an unaffiliated party.

We depend on Mr. Gabelli and other key teammates.

We are dependent on the efforts of Mr. Gabelli, our Chairman of the Board, Chief Executive Officer, Co-Chief Investment Officer of the Value team (along

with Christopher Marangi and Kevin Dreyer), and the primary portfolio manager for a significant majority of our AUM. The loss of Mr. Gabelli’s services could have a material adverse effect on us.

On February 6, 2008, Mr. Gabelli entered into an amended and restated employment agreement (as amended, the “2008 Employment Agreement”) with the Company,

which was initially approved by the Company’s shareholders on November 30, 2007 and approved again on May 6, 2011 and May 5, 2015, and which limits his activities outside of the Company. Under the 2008 Employment Agreement, the manner of computing

Mr. Gabelli’s remuneration from GAMCO is unchanged.

15

Mr. Gabelli has agreed that while he is employed by us he will not provide investment management services outside of GAMCO, AC, and GGCP, except for

certain permitted accounts. These permitted accounts, excluding personal accounts, held assets at December 31, 2019 and 2018 of approximately $264.1 million and $239.0 million, respectively. Mr. Gabelli continues to be a member of the team that

manages the TETON Westwood Mighty MitesSM Fund, whose advisor, Teton, was spun-off from GBL in March 2009. Effective February 27, 2017, Gabelli Funds became the sub-advisor to the TETON Westwood Mighty MitesSM Fund. The assets

in the TETON Westwood Mighty MitesSM Fund at December 31, 2019 and 2018 were $1.0 billion and $1.1 billion, respectively. The 2008 Employment Agreement may not be amended without approval by the committee of our Board of Directors

responsible for administering compensation and Mr. Gabelli.

In addition to Mr. Gabelli, our future success depends to a substantial degree on our ability to retain and attract other qualified

teammates to conduct our investment management business, including Messrs. Marangi and Dreyer, the other Co-Chief Investment Officers of the Value team. The market for qualified portfolio managers is extremely competitive. We anticipate that it will

be necessary for us to add portfolio managers and investment analysts as we further diversify our investment products and strategies. There can be no assurance, however, that we will be successful in our efforts to recruit and retain teammates. In

addition, our investment professionals and senior marketing teammates have direct contact with our Institutional and PWM clients, which can lead to strong client relationships. The loss of these teammates could jeopardize our relationships with

certain Institutional and PWM clients, and result in the loss of such accounts. The loss of key management professionals or the inability to recruit and retain sufficient portfolio managers and marketing teammates could have a material adverse effect

on our business.

There may be adverse effects on our business from a decline in the performance of the securities markets.

Our results of operations are affected by many economic factors, including the performance of the securities markets. The securities

markets in general have experienced significant volatility, and such volatility may continue or increase in the future. At December 31, 2019, approximately 92% of our AUM was invested in portfolios consisting primarily of equity securities. Any

decline in the securities markets, in general, and the equity markets, in particular, could reduce our AUM and consequently reduce our revenues. In addition, any such decline in the equity markets, failure of these markets to sustain their prior

levels of growth, or continued short-term volatility in these markets could result in investors withdrawing from the equity markets or decreasing their rate of investment, either of which would be likely to adversely affect us. Also, from time to