Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - LA JOLLA PHARMACEUTICAL CO | exhibit321fy201910-k.htm |

| EX-31.1 - EXHIBIT 31.1 - LA JOLLA PHARMACEUTICAL CO | exhibit311fy201910-k.htm |

| EX-23.1 - EXHIBIT 23.1 - LA JOLLA PHARMACEUTICAL CO | exhibit231fy2019.htm |

| EX-21.1 - EXHIBIT 21.1 - LA JOLLA PHARMACEUTICAL CO | exhibit211fy2019.htm |

| EX-10.5 - EXHIBIT 10.5 - LA JOLLA PHARMACEUTICAL CO | exhibit105fy201910-k.htm |

| EX-10.1 - EXHIBIT 10.1 - LA JOLLA PHARMACEUTICAL CO | exhibit101fy201910-k.htm |

| EX-4.2 - EXHIBIT 4.2 - LA JOLLA PHARMACEUTICAL CO | exhibit42fy201910-k.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 1-36282

LA JOLLA PHARMACEUTICAL COMPANY

(Exact name of registrant as specified in its charter)

California | 33-0361285 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

4550 Towne Centre Court, San Diego, CA | 92121 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (858) 207-4264

Securities registered pursuant to Section 12(b) of the Act: | ||||||

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||

Common Stock, par value $0.0001 per share | LJPC | The Nasdaq Capital Market | ||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | x | |

Non-accelerated filer | o | Smaller reporting company | x | |

Emerging growth company | o | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of voting and non-voting shares of common stock held by non-affiliates of the Company as of June 28, 2019 was approximately $190.2 million, based on the closing price on the Nasdaq Capital Market reported for such date. Shares of common stock held by each officer and director and by each person who is known to own 10% or more of the outstanding shares of common stock have been excluded in that such persons may be deemed to be affiliates of the Company. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 3, 2020, there were 27,215,201 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required to be disclosed in Part III of this report is incorporated by reference from the registrant’s Definitive Proxy Statement for the 2020 Annual Meeting of Shareholders, which proxy statement is expected to be filed no later than 120 days after the end of the fiscal year covered by this report.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the federal securities laws. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Forward-looking statements can be identified by words such as “intends,” “believes,” “anticipates,” “indicates,” “plans,” “expects,” “suggests,” “may,” “should,” “potential,” “designed to,” “will” and similar expressions that predict or indicate future events and trends that do not relate to historical matters. You should not unduly rely on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. These risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements.

These forward-looking statements include, but are not limited to, statements regarding:

• | our ability to grow net sales of GIAPREZATM (angiotensin II); |

• | our ability to maintain an effective sales and marketing organization; |

• | the potential market size for GIAPREZA; |

• | our ability to obtain an uninterrupted supply of GIAPREZA from our contract manufacturers; |

• | GIAPREZA’s market exclusivity period as a result of the enforcement of regulatory exclusivity and the validity and enforceability of issued and pending patents covering GIAPREZA; |

• | our ability to obtain U.S. Food and Drug Administration (“FDA”) approval of LJPC-0118 (I.V. artesunate); |

• | our ability to obtain an uninterrupted supply of LJPC-0118 from our contract manufacturers; |

• | our ability to receive a tropical disease Priority Review Voucher (“PRV”) for LJPC-0118; |

• | our ability to hire and retain key employees; |

• | our overall financial performance, including but not limited to net product sales and net cash used in operating activities; and |

• | our capital requirements and our potential need for, and ability to obtain, additional financing. |

These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results to differ materially from the anticipated future results, performance or achievements expressed or implied by any forward-looking statements, including the factors described under the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You should evaluate all forward-looking statements made in this Annual Report on Form 10-K, including the documents we incorporate by reference, in the context of these risks, uncertainties and other factors.

We caution you that the risks, uncertainties and other factors referred to above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will affect us or our business in the way expected. All forward-looking statements in this Annual Report on Form 10-K apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this Annual Report on Form 10-K. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

1

PART I

In this Annual Report on Form 10-K, all references to “we,” “our,” “us,” “La Jolla” and “the Company” refer to La Jolla Pharmaceutical Company, a California corporation, and our subsidiaries, including La Jolla Pharma, LLC, on a consolidated basis.

Item 1. Business

Overview

La Jolla Pharmaceutical Company is dedicated to the development and commercialization of innovative therapies that improve outcomes in patients suffering from life-threatening diseases. In December 2017, GIAPREZATM (angiotensin II) was approved by the U.S. Food and Drug Administration (“FDA”) as a vasoconstrictor indicated to increase blood pressure in adults with septic or other distributive shock. GIAPREZA U.S. net sales were $23.1 million in 2019 compared to $10.1 million in 2018, an increase of 129%. In August 2019, GIAPREZA was approved by the European Commission (“EC”) for the treatment of refractory hypotension in adults with septic or other distributive shock who remain hypotensive despite adequate volume restitution and application of catecholamines and other available vasopressor therapies. LJPC-0118 (I.V. artesunate) is La Jolla’s investigational product for the treatment of severe malaria.

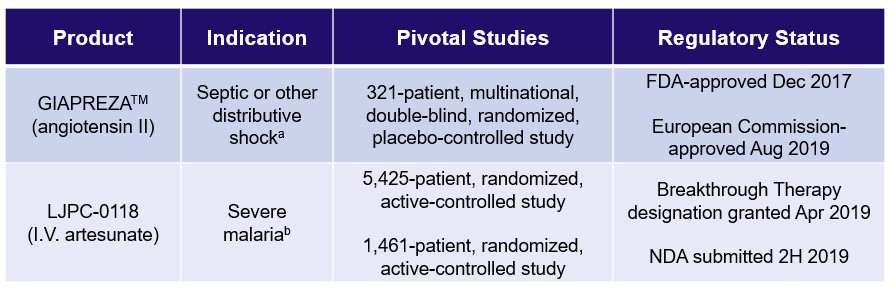

Product Portfolio

a U.S.: GIAPREZA is a vasoconstrictor to increase blood pressure in adults with septic or other distributive shock. European Union: GIAPREZA is indicated for the treatment of refractory hypotension in adults with septic or other distributive shock who remain hypotensive despite adequate volume restitution and application of catecholamines and other available vasopressor therapies. |

b This is a proposed indication. LJPC-0118 (I.V. artesunate) is investigational and not approved by any regulatory authority. |

GIAPREZATM (angiotensin II)

In December 2017, GIAPREZATM (angiotensin II) was approved by the FDA as a vasoconstrictor indicated to increase blood pressure in adults with septic or other distributive shock. GIAPREZA U.S. net sales were $23.1 million in 2019 compared to $10.1 million in 2018, an increase of 129%. In August 2019, GIAPREZA was approved by the EC for the treatment of refractory hypotension in adults with septic or other distributive shock who remain hypotensive despite adequate volume restitution and application of catecholamines and other available vasopressor therapies. GIAPREZA mimics the body’s endogenous angiotensin II peptide, which is central to the renin-angiotensin-aldosterone system, which in turn regulates blood pressure.

2

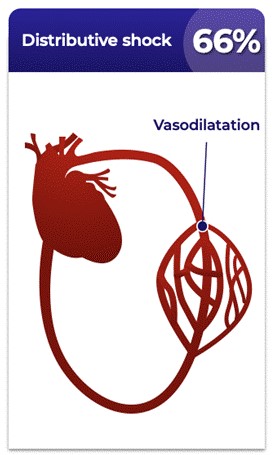

Distributive shock is the most common form of shock, as shown in the figure below.

Types of Shocka

a Vincent et al, New England Journal of Medicine 2013; 369(18):1726−1734 |

3

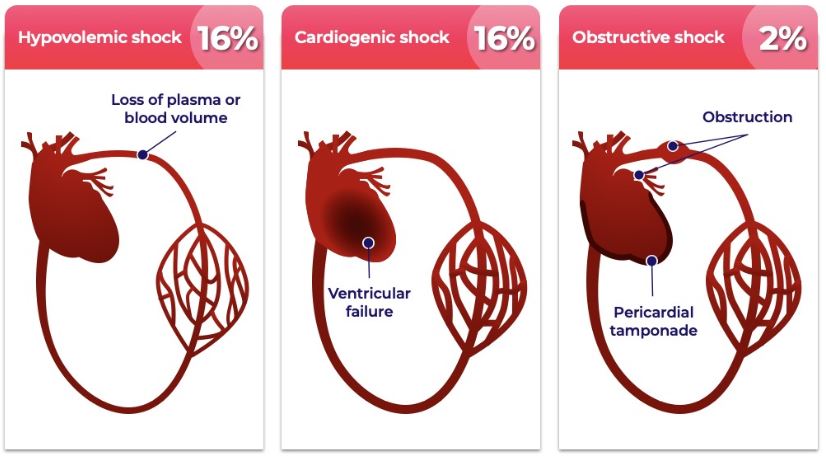

Distributive shock is a leading cause of death in hospitalized patients, and shock affects one-third of patients in the intensive care unit (“ICU”) (Sakr et al, Critical Care Medicine 2006; 34:589−597). The mortality rate of distributive shock exceeds that of most acute conditions requiring hospitalization, as shown in the figure below.

Mortality Rate

AMI=acute myocardial infraction; HF=heart failure a Based on the 28-day mortality rates of: (i) 35% from the vasopressin arm of Russell et al, New England Journal of Medicine 2008; 358:877-87; (ii) 49% from the norepinephrine arm of De Backer et al, New England Journal of Medicine 2010; 362:779-89; and (iii) 54% from the placebo arm (high-dose norepinephrine or equivalent) of Khanna et al, New England Journal of Medicine 2017; 377:419-430 b 30-day mortality rate from Medicare.gov |

4

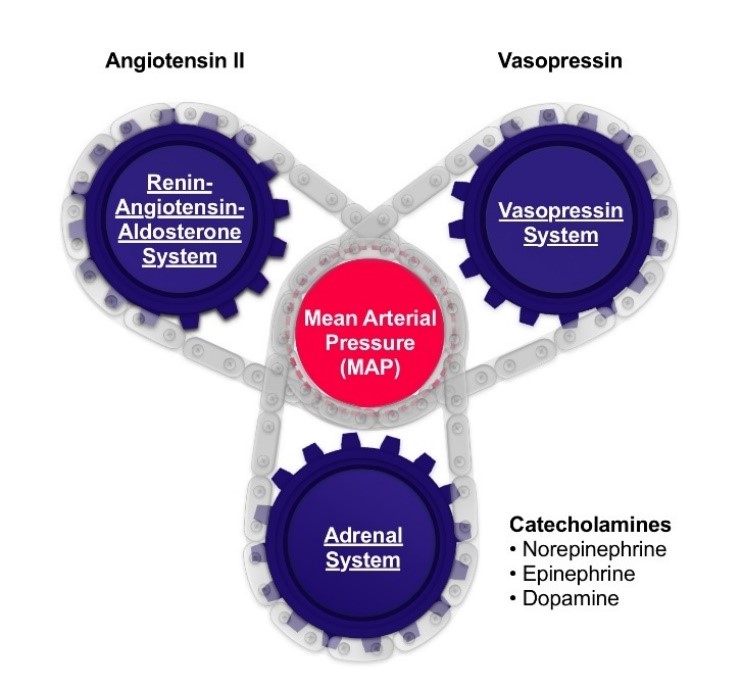

The renin-angiotensin-aldosterone system is one of three systems that work in harmony to regulate blood pressure, as shown in the figure below. GIAPREZA regulates blood pressure through the renin-angiotensin-aldosterone system. Other therapeutic options regulate blood pressure through the adrenal system and vasopressin system.

In Healthy Individuals, Three Systems Work in Harmony to Regulate Blood Pressure

5

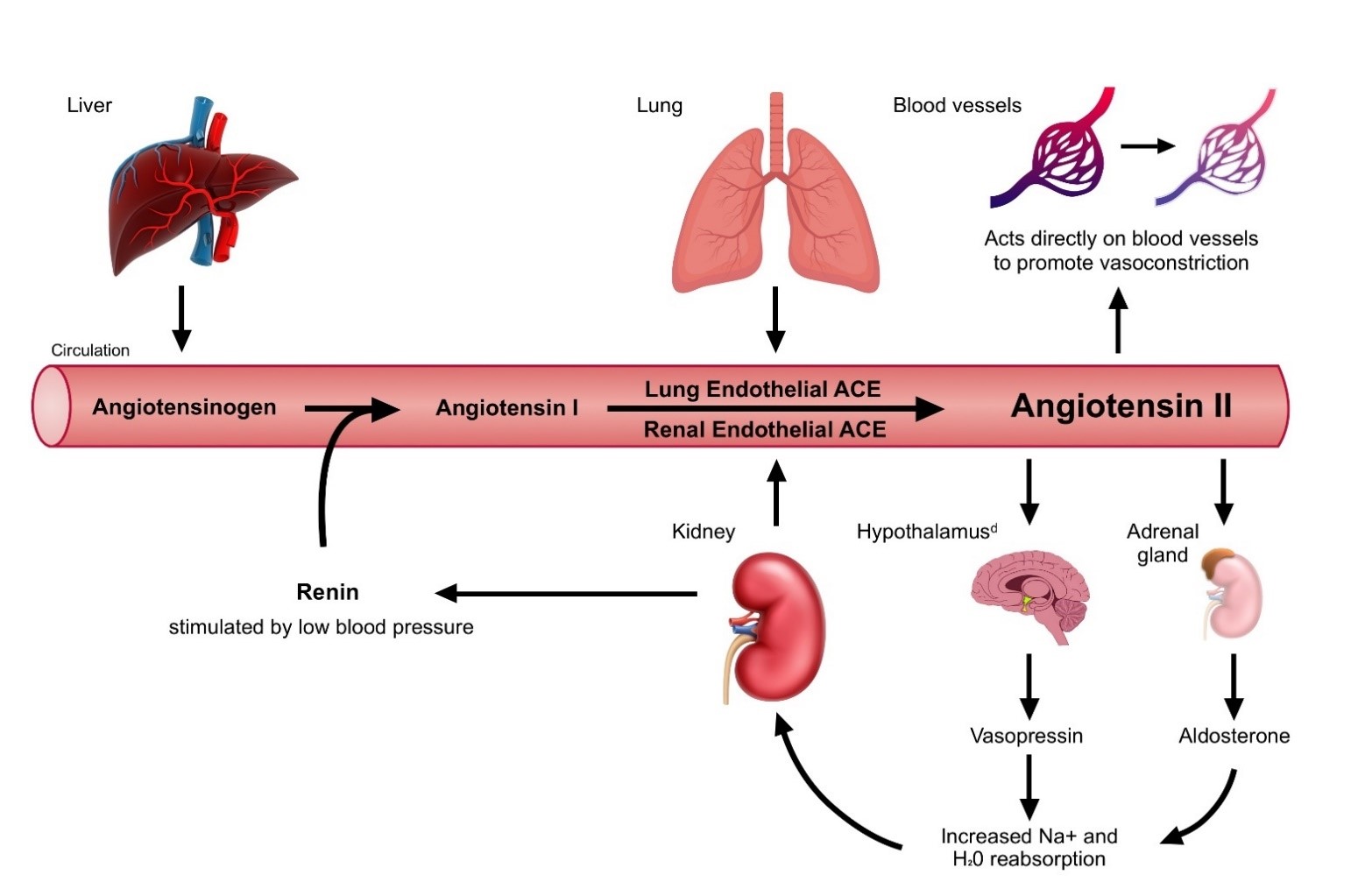

Angiotensin II is a powerful vasoconstrictor, acting on blood vessels to cause vasoconstriction and stimulating the release of aldosterone and vasopressin, which increase blood volume and blood pressure, as shown in the figure below.

Renin-Angiotensin-Aldosterone Systema,b,c

ACE=angiotensin-converting enzyme a Image adapted from Chow et al, Anesthesia & Analgesia Practice 2018; 11(7):175−180 b Hendry et al, Nursing Standard 2012; 27(11):35−40 c Harrison-Bernard, Advances in Physiology Education 2009; 33: 270-274 d Treschan et al, Anesthesiology 2006; 105:599−612 |

6

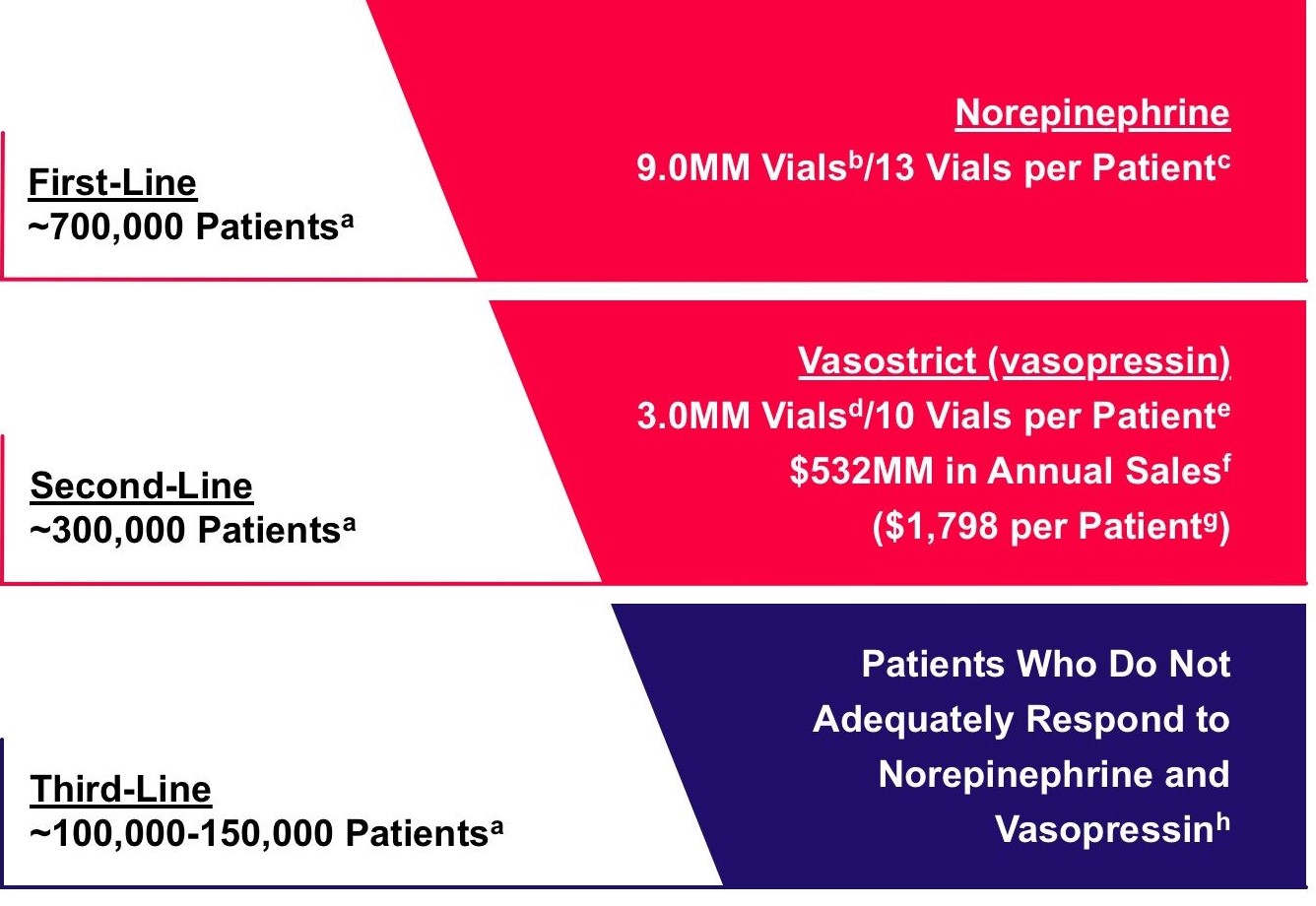

Annually in the U.S., approximately 100,000−150,000 patients fail to respond to current vasopressor options, as shown in the figure below.

Response to Current Vasopressor Options

a Annually in the U.S. b Year ended December 31, 2019 per Symphony Health Solutions c Estimate based on Russell et al, New England Journal of Medicine 2008; 358:877−87 and Asfar et al, New England Journal of Medicine 2014; 370:1583−93 d Annual sales per Endo International plc SEC filings, divided by price per vial per Wolters Kluwer PriceRx e Estimate based on Dunser et al, Circulation 2003; 107:2313−2319 and Gordon et al, Critical Care Medicine 2014; 42(6):1325−1333 f Year ended December 31, 2019 per Endo International plc SEC filings g $179.79 per vial per Wolters Kluwer PriceRx, multiplied by 10 vials per patient h Estimate based on: 35.4% 28-day mortality rate in vasopressin arm of Russell et al, New England Journal of Medicine 2008; 358:877-87; 48.5% 28-day mortality rate in norepinephrine arm of De Backer et al, New England Journal of Medicine 2010; 362:779-789; and 54.6% non-responder rate on vasopressin from Sacha et al, Annals of Intensive Care 2018; 8:35 |

7

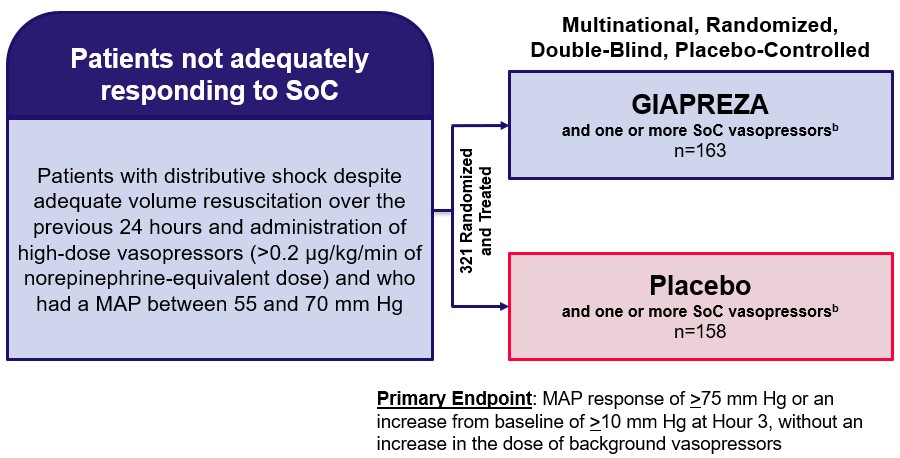

Angiotensin II for the Treatment of High-Output Shock (“ATHOS-3”)

GIAPREZA was approved by the FDA and the EC based on the results of ATHOS-3, which were published in the New England Journal of Medicine in August 2017. Angiotensin II for the Treatment of High-Output Shock (“ATHOS-3”) was a multinational, randomized, double-blind study in which 321 adults with septic or other distributive shock who remained hypotensive despite fluid and vasopressor therapy received either GIAPREZA or placebo, both in addition to background standard of care therapy. The primary endpoint was mean arterial pressure (“MAP”) response, defined as a MAP of 75 mm Hg or higher or an increase in MAP from baseline of at least 10 mm Hg without an increase in the dose of background vasopressors at Hour 3. The ATHOS-3 study design is shown in the figure below.

ATHOS-3 Study Designa

MAP=mean arterial pressure; SoC=standard of care a Khanna et al, New England Journal of Medicine 2017; 377:419-430 b SoC vasopressors included norepinephrine, epinephrine, dopamine and vasopressin |

8

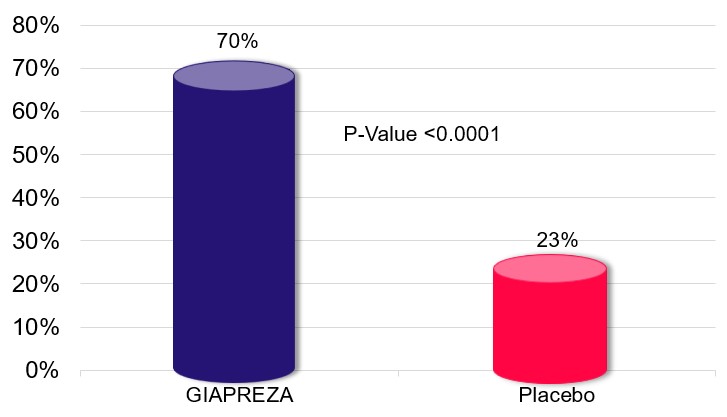

GIAPREZA significantly improved blood pressure response. Specifically, the primary endpoint was achieved by 70% of GIAPREZA-treated patients compared to 23% of placebo-treated patients (P-value <0.0001).

Primary Endpoint: Mean Arterial Pressure (“MAP”) Responsea,b

a GIAPREZA FDA prescribing information b MAP response of >75 mm Hg or an increase from baseline of >10 mm Hg at Hour 3, without an increase in the dose of background vasopressors. |

9

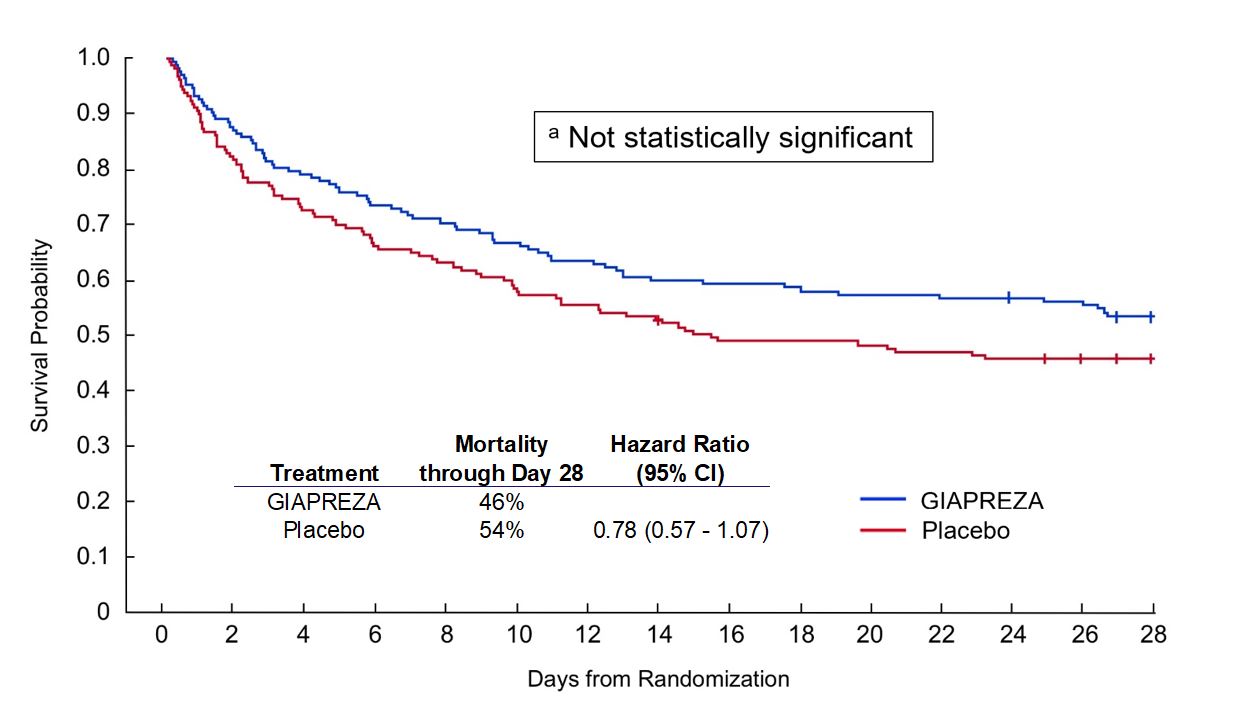

In addition, a positive survival trend was observed. Mortality through Day 28 was 46% on GIAPREZA and 54% on placebo (hazard ratio 0.78; 95% confidence interval 0.57−1.07).

Positive Survival Trend Observeda,b

b Curves from Khanna et al, New England Journal of Medicine 2017; 377:419-430; Mortality through Day 28 and Hazard Ratio (95% CI) from GIAPREZA FDA prescribing information |

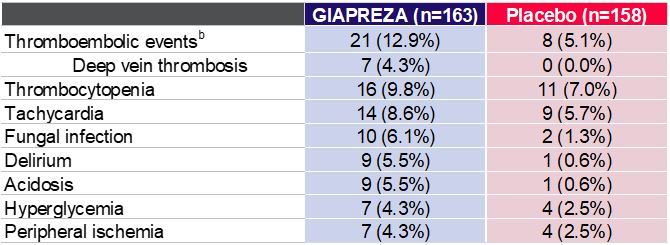

The most common adverse reactions that were reported in greater than 10% of GIAPREZA-treated patients were thromboembolic events. Adverse reactions occurring in ≥4% of patients treated with GIAPREZA and ≥1.5% more often than in placebo-treated patients are shown in the following table.

Adverse Reactions Occurring in ≥4% of Patients Treated with GIAPREZA and ≥1.5% More Often than

in Placebo-treated Patientsa

a GIAPREZA FDA prescribing information b Including arterial and venous thrombotic events |

10

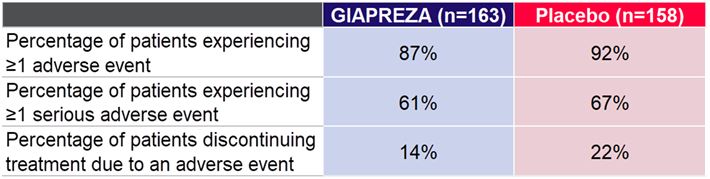

The percentage of patients experiencing ≥1 adverse event, the percentage of patients experiencing ≥1 serious adverse event and the percentage of patients discontinuing treatment due to an adverse event are shown in the following table.

Percentage of Patients Experiencing ≥1 Adverse Event, ≥1 Serious Adverse Event and Discontinuing Treatment Due to an Adverse Eventa

a Khanna et al, New England Journal of Medicine 2017; 377:419-430 |

LJPC-0118 (I.V. artesunate)

LJPC-0118 (I.V. artesunate) is La Jolla’s investigational product for the treatment of severe malaria. The active pharmaceutical ingredient in LJPC-0118, artesunate, was compared to quinine in patients with severe falciparum malaria infection in two randomized, active-controlled, clinical studies. In both studies, in-hospital mortality in the artesunate group was statistically significantly lower than in-hospital mortality in the quinine group. The FDA granted Breakthrough Therapy designation and Orphan Drug designation for LJPC-0118 for the treatment of malaria in April 2019 and July 2019, respectively. La Jolla filed a New Drug Application (“NDA”) with the FDA for LJPC-0118 for the treatment of severe malaria in the second half of 2019.

Severe malaria is a serious and sometimes fatal disease caused by a parasite that commonly infects a certain type of mosquito. Symptoms include: fever, chills, sweating, hypoglycemia and shock. Severe malaria is often complicated by central nervous system infections that may lead to delirium, which may progress to coma. Infections usually occur a few weeks after being bitten. In 2013, an estimated 2 million cases of severe malaria occurred worldwide (World Health Organization), and, in 2018, an estimated 405,000 people died from malaria worldwide (World Health Organization). La Jolla may be eligible to receive a tropical disease Priority Review Voucher (“PRV”) for LJPC-0118, as malaria is defined as a disease qualifying for a tropical disease PRV under Section 524 of the U.S. Federal Food, Drug, and Cosmetic Act (“FDCA”).

11

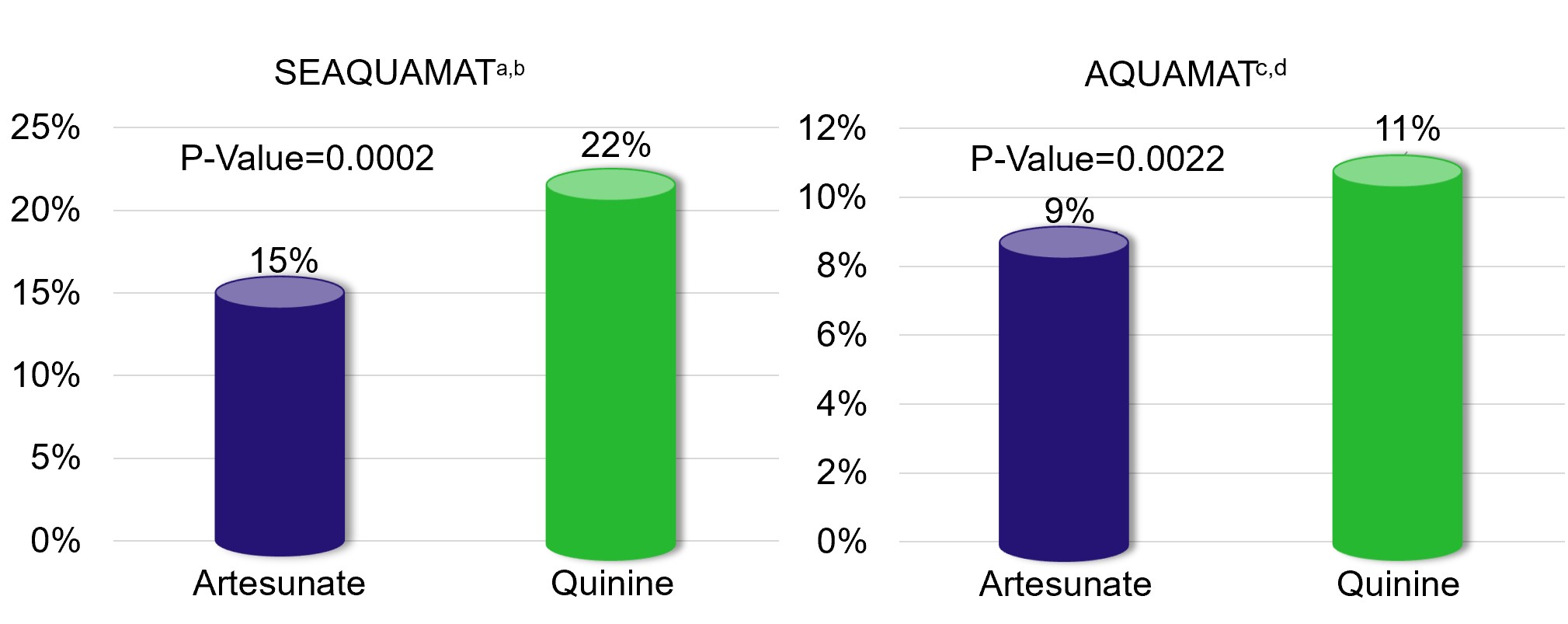

Two pivotal, randomized, active-controlled studies compared artesunate to quinine in the treatment of severe malaria. 1,461 patients were randomized in the South East Asian Quinine Artesunate Malaria Trial (“SEAQUAMAT”) (Dondorp et al, Lancet 2005; 366: 717-25), and 5,425 patients were randomized in the African Quinine Artesunate Malaria Trial (“AQUAMAT”) (Dondorp et al, Lancet 2010; 376: 1647-57). In-hospital mortality was the primary endpoint in both studies. In both studies, in-hospital mortality in the artesunate group was statistically significantly lower than in-hospital mortality in the quinine group, as shown in the figures below.

Primary Endpoint: In-hospital Mortality

a Dondorp et al, Lancet 2005; 366: 717-25 b South East Asian Quinine Artesunate Malaria Trial c Dondorp et al, Lancet 2010; 376: 1647-57 d African Quinine Artesunate Malaria Trial |

According to the U.S. Center for Disease Control (“CDC”), I.V. artesunate is now the first-line drug for the treatment of severe malaria in the U.S. following the discontinuation of I.V. quinidine and is the recommended World Health Organization first-line treatment for severe malaria, but is neither FDA-approved nor commercially available in the U.S. I.V. artesunate is available from the CDC under an expanded-access investigational new drug (“IND”) protocol for patients with severe malaria.

LJPC-401 (synthetic human hepcidin)

LJPC-401 (synthetic human hepcidin) is La Jolla’s investigational product for the potential treatment of conditions characterized by iron overload. In November 2019, La Jolla announced mixed results from two Phase 2 studies of LJPC-401. Based on these results, the development of LJPC-401 has been de-prioritized, and La Jolla does not expect to invest significant additional resources in this program.

Sales and Marketing Organization

La Jolla employs an experienced sales and marketing team dedicated to the commercialization of GIAPREZA. As of February 24, 2020, this team consists of 40 professionals, including 28 critical care specialists and 3 health systems account directors.

Customers

In 2019, 444 hospitals in the U.S. purchased GIAPREZA. Hospitals purchase our products through a network of specialty and wholesale distributors. We do not believe that the loss of one of these distributors would significantly impact our ability to distribute GIAPREZA, as we expect that sales volume would be absorbed by the remaining distributors. Due to the relatively short lead-time required to fill orders for GIAPREZA, backlog is not material to our business.

12

Competition

Catecholamines (primarily norepinephrine), which are available as generics and inexpensive, are typically used first line to treat distributive shock, while Vasostrict® (Endo International plc) is typically used second line. In the randomized, Phase 3 study ATHOS-3, GIAPREZA demonstrated clinical benefit in patients who were not adequately responding to available vasopressors, including catecholamines and Vasostrict. GIAPREZA’s principal competition as a treatment in patients not adequately responding to available vasopressors is the use of these same vasopressors, particularly norepinephrine, at increased doses. If we are unable to successfully change treatment practices, the commercial prospects for GIAPREZA will be limited.

Manufacturing

We do not currently own or operate manufacturing facilities for the production of GIAPREZA or LJPC-0118. We rely on third-party manufacturers to produce GIAPREZA and LJPC-0118 and expect to continue to do so to meet our development and commercial needs.

In all of our manufacturing agreements, we require that third-party contract manufacturers produce active pharmaceutical ingredients (“APIs”) and drug products in accordance with the FDA’s current Good Manufacturing Practices (“cGMPs”) and all other applicable laws and regulations. We maintain confidentiality agreements with potential and existing manufacturers in order to protect our proprietary rights related to GIAPREZA and LJPC-0118.

The long-term commercial success of GIAPREZA will depend in part on the ability of our contract manufacturers to supply cGMP-compliant API and drug product without interruption.

Regulatory Exclusivity

GIAPREZA is a New Chemical Entity (“NCE”) approved by the FDA. In the U.S., NCEs approved by the FDA are eligible for market exclusivity under the FDCA, which can prevent the approval of generic versions of the NCE for 5 to 7.5 years from the date of the initial approval of the NCE. Specifically, the FDCA provides a 5-year period of marketing exclusivity within the U.S. to the applicant that gains approval of an NDA for an NCE. A drug is an NCE if the FDA has not previously approved any other new drug containing the same active moiety, which is the molecule or ion responsible for the action of the drug substance. During the exclusivity period, the FDA may not accept for review an Abbreviated New Drug Application (“ANDA”) or a 505(b)(2) NDA submitted by another company for another version of such drug where the applicant does not own or have a legal right of reference to all of the data required for approval. However, an application may be submitted 4 years after the NDA approval of the NCE if it contains a certification of patent invalidity or non-infringement. This certification will trigger an automatic stay in the approval of any generic competition until the earlier of: (a) 30 months from the certification; or (b) a court ruling of patent invalidity or non-infringement for the relevant patents. In the absence of a court ruling, the 30-month stay will be extended by such amount of time (if any) that is required for 7.5 years to have elapsed from the date of NDA approval of the NCE.

Intellectual Property

Patents and other proprietary rights are important to our business. As of December 31, 2019, we owned or had in-licensed 10 issued U.S. patents, 12 pending U.S. patent applications, 3 issued foreign patents and 45 pending foreign patent applications that cover GIAPREZA. The U.S. patents and patent applications expire between 2029 and 2040, and the foreign patents and patent applications expire between 2034 and 2040. The following table summarizes our issued patents and pending applications for GIAPREZA and our product candidates.

United States | Foreign | |||||||||||

Description | Issued | Pending | Expiration | Issued | Pending | Expiration | ||||||

GIAPREZA | 10 | 12 | 2029−2040 | 3 | 45 | 2034−2040 | ||||||

Other | 19 | 16 | 2022−2040 | 30 | 66 | 2022−2040 | ||||||

We plan to file additional patent applications that, if issued, would provide further protection for GIAPREZA. Although we believe the bases for these patents and patent applications are sound, they are untested, and there is no assurance that they will not be successfully challenged. There can be no assurance that any patent previously

13

issued will be of commercial value, that any patent applications will result in issued patents of commercial value or that our products will not be held to infringe patents held by others.

Material Contracts

In May 2018, we closed a $125.0 million royalty financing agreement (the “Royalty Agreement”) with HealthCare Royalty Partners (“HCR”). Under the terms of the Royalty Agreement, we received $125.0 million in exchange for tiered royalty payments on worldwide net sales of GIAPREZA. HCR is entitled to receive quarterly royalties on worldwide net sales of GIAPREZA beginning April 1, 2018. Quarterly payments to HCR under the Royalty Agreement start at a maximum royalty rate, with step-downs based on the achievement of annual net product sales thresholds. Through December 31, 2021, the royalty rate will be a maximum of 10%. Starting January 1, 2022, the maximum royalty rate may increase by 4% if an agreed-upon, cumulative net product sales threshold has not been met, and, starting January 1, 2024, the maximum royalty rate may increase by an additional 4% if a different agreed-upon, cumulative net product sales threshold has not been met. The Royalty Agreement is subject to maximum aggregate royalty payments to HCR of $225.0 million. The Royalty Agreement expires upon the first to occur of January 1, 2031 or when the maximum aggregate royalty payments have been made. The Royalty Agreement was entered into by our wholly-owned subsidiary, La Jolla Pharma, LLC, and HCR has no recourse under the Royalty Agreement against La Jolla Pharmaceutical Company or any assets other than GIAPREZA.

In December 2014, we entered into a patent license agreement with George Washington University (“GW”), which was amended and restated on March 1, 2016 (the “GW License”) and subsequently assigned to La Jolla Pharma, LLC. Pursuant to the GW License, GW exclusively licensed to us certain intellectual property rights relating to GIAPREZA, including the exclusive rights to certain issued patents and patent applications covering GIAPREZA. Under the GW License, we are obligated to use commercially reasonable efforts to develop, commercialize, market and sell GIAPREZA. We have paid a one-time license initiation fee, annual maintenance fees, an amendment fee, additional payments following the achievement of certain development and regulatory milestones and royalties. As a result of the EC’s approval of GIAPREZA in August 2019, we made a milestone payment to GW in the amount of $0.5 million in the first quarter of 2020. We are obligated to pay a 6% royalty on net sales of GIAPREZA. The patents and patent applications covered by the GW License are expected to expire between 2029 and 2034, and the obligation to pay royalties under this agreement extends through the last-to-expire patent covering GIAPREZA.

Government Regulation

Pharmaceutical products, including GIAPREZA, are subject to extensive government regulation. In the U.S., the FDA regulates pharmaceutical products. FDA regulations govern the testing, research and development activities, manufacturing, quality, storage, advertising, promotion, labeling, sale and distribution of pharmaceutical products. Accordingly, there is a rigorous process for the approval of new drugs and ongoing oversight of marketed products. We may also be subject to foreign regulatory requirements governing clinical studies and drug products if products are tested or marketed abroad. The approval process outside of the U.S. varies from jurisdiction to jurisdiction and the time required may be longer or shorter than that required for FDA approval.

Regulation in the U.S.

The FDA testing and approval process requires substantial time, effort and financial resources. We cannot assure you that any of our product candidates will ever obtain approval. The FDA approval process for new drugs includes, without limitation:

• | preclinical studies; |

• | submission in the U.S. of an IND for clinical studies conducted in the U.S.; |

• | adequate and well-controlled clinical studies to establish safety and efficacy of the product; |

• | review and approval of an NDA in the U.S.; and |

• | inspection of the facilities used in the manufacturing of the drug to assess compliance with the FDA’s cGMP regulations. |

Any products manufactured or distributed by us pursuant to FDA approvals are subject to continuing regulation by the FDA, including record-keeping requirements and reporting of adverse experiences with the drug. Drug manufacturers and their subcontractors are required to register their establishments with the FDA and certain

14

state agencies and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with cGMPs, which impose certain procedural and documentation requirements on us and our third-party manufacturers. Even after regulatory approval is obtained, under certain circumstances, such as later discovery of previously unknown safety risks, the FDA can withdraw approval or subject the drug to additional restrictions.

The FDA closely regulates the marketing and promotion of drugs. Drugs may only be marketed in a manner consistent with their FDA-approved labeling. Approval may be subject to post-marketing surveillance and other record-keeping and reporting obligations. Product approvals may be withdrawn if compliance with regulatory standards is not maintained or if problems occur following initial marketing.

The failure to comply with FDA’s requirements can result in adverse publicity, warning letters, corrective advertising, restrictions on marketing or manufacturing, refusals to review pending product applications, refusals to permit the import or export of products, seizures, injunctions, and civil and criminal penalties.

Tropical Disease Priority Review Voucher

Under Section 524 of the FDCA, the FDA is authorized to award a tropical disease PRV to sponsors of applications for certain products for the prevention or treatment of certain tropical diseases. A tropical disease PRV may be used by the sponsor that obtains the tropical disease PRV or may be transferred to another sponsor that may use it to obtain Priority Review for a different application. A Priority Review designation means that the FDA’s goal is to take action on an NDA or a Biologics License Application (which need not relate to a tropical disease) within 6 months of its filing (compared to 10 months under standard review), which means that a tropical disease PRV can result in a reduction in FDA review time of up to 4 months. Without a PRV, Priority Review designation is for drugs that, if approved, would be significant improvements in the safety or effectiveness of the treatment or prevention of serious conditions. In order to be eligible for a tropical disease PRV, the application must: (i) be for a tropical disease as defined in Section 524 of the FDCA; (ii) be submitted under Section 505(b)(1) of the FDCA or Section 351 of the Public Health Service Act (“PHSA”); (iii) be for a product that contains no active ingredient that has been approved in any other application submitted under Section 505(b)(1) of the FDCA or Section 351 of the PHSA; and (iv) qualify for Priority Review.

Third-party Payor Coverage and Reimbursement

In the U.S. and most major foreign markets, drugs like GIAPREZA that are administered in the hospital must be purchased by the hospital and generally are not reimbursed by third-party payors. Hospitals instead are reimbursed for patient cases based on patients’ diagnosed conditions under the U.S. Medicare diagnosis-related group (“DRG”) system or other like systems for non-Medicare patients in the U.S. and in most major foreign markets. Adoption of new drugs that are administered in the hospital generally occurs more slowly than adoption of new drugs that are taken on an outpatient basis, which generally are paid for by third-party payors.

U.S. Health Care Fraud and Abuse Laws and Compliance Requirements

We are subject to various federal and state laws targeting fraud and abuse in the health care industry. These laws may impact, among other things, our sales and marketing efforts. In addition, we may be subject to patient privacy regulation by both the federal government and the states in which we conduct our business. The laws that may affect our ability to operate include:

• | The federal Anti-Kickback Statute, which prohibits, among other things, persons from soliciting, receiving, offering or paying remuneration, directly or indirectly, in cash or in kind, to induce or reward, or in return for, either the referral of an individual for, or the purchase, order or recommendation of, an item or service reimbursable under a federal health care program, such as the Medicare and Medicaid programs. The term “remuneration” has been broadly interpreted to include anything of value, including for example gifts, cash payments, donations, the furnishing of supplies or equipment, waivers of payment, ownership interests, and providing any item, service or compensation for something other than fair market value. |

• | Federal false claims and civil monetary penalties laws, including the federal civil False Claims Act, which prohibits anyone from, among other things, knowingly presenting, or causing to be presented, for payment to federal programs (including Medicare and Medicaid) claims for items or services that are false or fraudulent. Although we may not submit claims directly to payors, manufacturers can be held liable under these laws in a variety of ways. These include: providing inaccurate billing or coding information to |

15

customers; improperly promoting a product’s off-label use; violating the federal Anti-Kickback Statute; or misreporting pricing information to government programs.

• | Provisions of the federal Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), which created new federal criminal statutes that prohibit, among other things, knowingly and willfully executing a scheme to defraud any health care benefit program or making false statements in connection with the delivery of or payment for health care benefits, items or services. |

• | The federal Physician Payment Sunshine Act requirements, under the Patient Protection and Affordable Care Act (“PPACA”), which require manufacturers of certain drugs and biologics to track and report to U.S. Centers for Medicare & Medicaid Services (“CMS”) payments and other transfers of value they make to U.S. physicians and teaching hospitals as well as physician ownership and investment interests in the manufacturer. |

• | Provisions of HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act and its implementing regulations (“HITECH”), which impose certain requirements relating to the privacy, security and transmission of individually identifiable health information. |

• | Section 1927 of the Social Security Act, which requires that manufacturers of drugs and biological products covered by Medicaid report pricing information to CMS on a monthly and quarterly basis, including the best price available to any customer of the manufacturer, with certain exceptions for government programs, and pay prescription rebates to state Medicaid programs based on a statutory formula derived from reported pricing information. |

• | State law equivalents of each of the above federal laws, such as the recently effective California Consumer Privacy Act, many of which differ from each other in significant ways and may not have the same effect, which complicates our compliance efforts. |

Regulation in Non-U.S. Jurisdictions

In addition to regulations in the U.S., we may be subject to a variety of foreign regulations governing clinical studies and commercial sales and distribution of GIAPREZA or future products. For example, clinical studies conducted in the European Union must be done under a clinical trial application (“CTA”), which is usually supported by an Investigational Medicinal Product Dossier (“IMPD”), and the oversight of ethics committees. If we market GIAPREZA in foreign countries, we also will be subject to foreign regulatory requirements governing marketing approval for pharmaceutical products. The requirements governing the conduct of clinical studies, product approval, pricing and reimbursement vary widely from country to country. Whether or not FDA approval has been obtained, approval of a product by the regulatory authorities of foreign countries must be obtained before marketing the product in those countries. The approval process varies from country to country, and the time required for such approvals may differ substantially from that required for FDA approval. Foreign regulatory approval processes involve many of the risks associated with FDA marketing approval discussed above. There is no assurance that any FDA approval of any of our product candidates will result in similar foreign approvals or vice versa. The process for clinical studies in the European Union and other countries is similar, and studies are heavily scrutinized by the designated ethics committees and regulatory authorities. In addition, foreign regulations may include applicable post-marketing requirements, including safety surveillance, anti-fraud and abuse laws, and implementation of corporate compliance programs and reporting of payments or other transfers of value to health care professionals and entities.

In Europe, the European Union General Data Protection Regulation (2016/679) (“GDPR”) contains provisions specifically directed at the processing of health information. The GDPR provides for potentially significant sanctions and contains extraterritoriality measures intended to bring non-EU companies under the regulation. In addition to the GDPR, individual countries in Europe and elsewhere in the world have enacted similar data privacy legislation. This legislation imposes increased compliance obligations and regulatory risk, including the potential for significant fines for noncompliance.

16

Other Laws and Regulations

We are subject to a variety of financial disclosure and securities trading regulations as a public company in the U.S., including laws relating to the oversight activities of the U.S. Securities and Exchange Commission (“SEC”) and the regulations of the Nasdaq Capital Market, on which our shares of common stock are traded. We are also subject to various laws and regulations relating to safe working conditions, laboratory practices and the experimental use of animals.

Employees

As of February 24, 2020, we employed 91 employees, of which 90 were full time. None of our employees are covered by collective bargaining agreements.

Corporate and Other Information

The Company was incorporated in Delaware in 1989 and reincorporated in California in 2012. Our principal office is located at 4550 Towne Centre Court, San Diego, CA 92121, and our telephone number is (858) 207-4264. Shares of our common stock trade on the Nasdaq Capital Market under the symbol “LJPC.” Our website address is www.ljpc.com. Information contained on or accessible through our website is not a part of this Annual Report on Form 10-K, and the inclusion of our website address in this Annual Report on Form 10-K is an inactive textual reference only.

We file electronically with the SEC our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. We make available on our website at www.ljpc.com, free of charge, copies of these reports as soon as reasonably practicable after filing or furnishing these reports with the SEC. The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors

An investment in shares of our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below and the other information contained in this Annual Report on Form 10-K before deciding to invest in shares of our common stock. The risks described below are not the only ones facing our Company. Additional risks not presently known to us or that we currently consider immaterial may also adversely affect our business. We have attempted to identify below the major factors that could cause differences between actual and planned or expected results, but we cannot assure you that we have identified all of those factors. Our business, financial condition, results of operations and prospects could be materially adversely affected by any of these risks or uncertainties. In such case, the trading price of shares of our common stock could decline, and you could lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

We are substantially dependent on the commercial success of GIAPREZATM (angiotensin II).

The success of our business is substantially dependent on our ability to successfully commercialize GIAPREZATM (angiotensin II), our only commercial product. Although employees in our Company have prior experience launching pharmaceutical products at prior companies, GIAPREZA is the first product we have launched. Furthermore, the market for effective pharmaceutical sales and marketing professionals is competitive, and maintaining these capabilities is expensive and challenging. If we are unable to maintain an effective sales and marketing organization, GIAPREZA sales could be adversely affected, and our business could suffer.

In the U.S. and most major foreign markets, drugs like GIAPREZA that are administered in the hospital must be purchased by the hospital and generally are not reimbursed by third-party payors. Hospitals instead are reimbursed for patient cases based on patients’ diagnosed conditions under the U.S. Medicare diagnosis-related group (“DRG”) system or other like systems for non-Medicare patients in the U.S. and in most major foreign markets. Adoption of new drugs that are administered in the hospital generally occurs more slowly than adoption of new drugs that are taken on an outpatient basis, which generally are paid for by third-party payors. If we are

17

unsuccessful at convincing hospitals and health care providers to increase their rate of adoption of GIAPREZA, our business will suffer.

Catecholamines (primarily norepinephrine), which are available as generics and inexpensive, are typically used in the first line to treat distributive shock, while Vasostrict® (Endo International plc) is typically used in the second line. In the randomized, Phase 3 study ATHOS-3, GIAPREZA demonstrated clinical benefit in patients who were not adequately responding to available vasopressors, including catecholamines and Vasostrict. GIAPREZA’s principle competition as a treatment in patients not adequately responding to available vasopressors is the use of these same vasopressors, particularly norepinephrine, at increased doses. If we are unable to successfully change treatment practices, the commercial prospects for GIAPREZA will be limited, and our business will suffer.

Our estimate of the potential market size for GIAPREZA is based on prescription and sales data for relevant in-market products, the results of clinical studies, medical literature and other information. If the potential market size for GIAPREZA is smaller than our estimate, the commercial prospects for GIAPREZA may be limited, and our business may suffer.

The commercial success of GIAPREZA will depend on our ability to obtain an uninterrupted supply of GIAPREZA from our contract manufacturers.

We do not currently own or operate manufacturing facilities for the production of GIAPREZA or LJPC-0118 (I.V. artesunate). We rely on sole-source third-party manufacturers to produce GIAPREZA and LJPC-0118 and expect to continue to do so to meet our development and commercial needs. In all of our manufacturing agreements, we require that third-party contract manufacturers produce active pharmaceutical ingredients (“APIs”) and drug products in accordance with the U.S. Food and Drug Administration’s (“FDA’s”) current Good Manufacturing Practices (“cGMPs”) and all other applicable laws and regulations. The long-term commercial success of GIAPREZA will depend in part on the ability of our contract manufacturers to supply cGMP-compliant API and drug product without interruption. If there is an interruption in the supply of GIAPREZA from our contract manufacturers, our business will suffer.

GIAPREZA’s market exclusivity period will depend on the validity and enforceability of issued and pending patents covering GIAPREZA.

As of December 31, 2019, we owned or had in-licensed 10 issued U.S. patents, 12 pending U.S. patent applications, 3 issued foreign patents and 45 pending foreign patent applications that cover GIAPREZA. The U.S. patents and patent applications expire between 2029 and 2040, and the foreign patents and patent applications expire between 2034 and 2040. Although we believe the bases for these patents and patent applications are sound, they are untested, and there is no assurance that they will not be successfully challenged. There can be no assurance that any patent previously issued will protect GIAPREZA from generic competition or that any patent application will result in an issued patent that will protect GIAPREZA from generic competition. Furthermore, there can be no assurance that GIAPREZA will not be held to infringe valid patents held by others. If our owned and in-licensed intellectual property do not protect GIAPREZA from generic competition, GIAPREZA sales will decline, and our business will suffer. If GIAPREZA is held to infringe valid patents held by others, we could be subject to liability, and our business could suffer.

Product liability lawsuits against us could cause us to incur substantial liabilities and reduce GIAPREZA sales.

Patients suffering from distributive shock are gravely ill and have a high mortality rate. Although 28-day mortality in patients treated with GIAPREZA was lower than in patients treated with placebo in the randomized, Phase 3 study ATHOS-3, there was a higher incidence of arterial and venous thrombotic and thromboembolic events in patients treated with GIAPREZA in this study. Some patients who are treated with GIAPREZA will die due to their underlying illness or suffer adverse events (which may or may not be drug related). As such, we may face product liability lawsuits. Although we carry product liability insurance, product liability lawsuits against us could cause us to incur substantial liabilities and reduce GIAPREZA sales. Furthermore, any such lawsuits could impair our business reputation and result in the initiation of investigations by regulators.

18

Our ability to continue commercializing GIAPREZA is dependent on our fulfillment of contractual obligations to certain parties.

In May 2018, we closed a $125.0 million royalty financing agreement (the “Royalty Agreement”) with HealthCare Royalty Partners (“HCR”). Under the terms of the Royalty Agreement, we received $125.0 million in exchange for tiered royalty payments on worldwide net sales of GIAPREZA. HCR is entitled to receive quarterly royalties on worldwide net sales of GIAPREZA beginning April 1, 2018. Quarterly payments to HCR under the Royalty Agreement start at a maximum royalty rate, with step-downs based on the achievement of annual net product sales thresholds. Through December 31, 2021, the royalty rate will be a maximum of 10%. Starting January 1, 2022, the maximum royalty rate may increase by 4% if an agreed-upon, cumulative net product sales threshold has not been met, and, starting January 1, 2024, the maximum royalty rate may increase by an additional 4% if a different agreed-upon, cumulative net product sales threshold has not been met. The Royalty Agreement is subject to maximum aggregate royalty payments to HCR of $225.0 million. The Royalty Agreement expires upon the first to occur of January 1, 2031 or when the maximum aggregate royalty payments have been made. The Royalty Agreement was entered into by our wholly-owned subsidiary, La Jolla Pharma, LLC, and HCR has no recourse under the Royalty Agreement against La Jolla Pharmaceutical Company or any assets other than GIAPREZA. However, under the terms of the Royalty Agreement, La Jolla Pharma, LLC has certain obligations, including the obligation to use commercially reasonable and diligent efforts to commercialize GIAPREZA. If La Jolla Pharma, LLC is held to not have met these obligations, HCR would have the right to terminate the Royalty Agreement and demand payment from La Jolla Pharma, LLC of either $125.0 million or $225.0 million (depending on which obligation La Jolla Pharma, LLC is held to not have met), minus aggregate royalties already paid to HCR. In the event that La Jolla Pharma, LLC fails to timely pay such amount if and when due, HCR would have the right to foreclose on the GIAPREZA-related assets.

In December 2014, we entered into a patent license agreement with George Washington University (“GW”), which was amended and restated on March 1, 2016 (the “GW License”) and subsequently assigned to La Jolla Pharma, LLC. Pursuant to the GW License, GW exclusively licensed to us certain intellectual property rights relating to GIAPREZA, including the exclusive rights to certain issued patents and patent applications covering GIAPREZA. Under the GW License, La Jolla Pharma, LLC is obligated to use commercially reasonable efforts to develop, commercialize, market and sell GIAPREZA and make certain payments to GW, including a 6% royalty on net sales of GIAPREZA. If La Jolla Pharma, LLC is held to not have met its obligations, GW could terminate the GW License and La Jolla Pharma, LLC would no longer have rights to the GW issued patents and patent applications covering GIAPREZA.

Our ability to obtain FDA approval of LJPC-0118 is uncertain.

La Jolla filed a New Drug Application (“NDA”) with the FDA for LJPC-0118 for the treatment of severe malaria in the second half of 2019. There can be no assurance that the FDA will approve LJPC-0118 in a timely manner, or at all.

Our ability to receive a tropical disease Priority Review Voucher is uncertain.

La Jolla may be eligible to receive a tropical disease Priority Review Voucher (“PRV”) for LJPC-0118, as malaria is defined as a disease qualifying for a tropical disease PRV under Section 524 of the FDCA. The FDA is authorized to award a tropical disease PRV to sponsors of applications for certain products for the prevention or treatment of certain tropical diseases. A tropical disease PRV may be used by the sponsor that obtains the tropical disease PRV or may be transferred to another sponsor that may use it to obtain Priority Review for a different application. In order to be eligible for a tropical disease PRV, the application must: (i) be for a tropical disease as defined in Section 524 of the FDCA; (ii) be submitted under Section 505(b)(1) of the FDCA or Section 351 of the Public Health Service Act (“PHSA”); (iii) be for a product that contains no active ingredient that has been approved in any other application submitted under Section 505(b)(1) of the FDCA or Section 351 of the PHSA; and (iv) qualify for Priority Review. Even if LJPC-0118 is approved by the FDA, there can be no assurance that we will receive a tropical disease PRV. Furthermore, even if we receive a tropical disease PRV, there can be no assurance that it will be of any value to us.

Our ability to hire and retain key employees is uncertain.

As of February 24, 2020, we employed 91 employees. The market for effective professionals in the pharmaceutical industry is competitive, and hiring and retaining these professionals are expensive and challenging.

19

If we are unable to hire and retain key employees, we may be unable to effectively execute on our operating plan, and our business could suffer.

Business interruptions resulting from geopolitical actions, natural disasters, public health crises or other catastrophic events could have an adverse impact on our business.

Business interruptions resulting from geopolitical actions, such as war and terrorism, natural disasters, public health crises, such as a pandemic, or other catastrophic events could have an adverse impact on our business. For example, if one of these events were to adversely affect one of our contract manufacturers, our supply of GIAPREZA could be interrupted. Furthermore, in the case of a pandemic, the ability of our critical care specialists to access hospitals and call on physicians may be curtailed, which may adversely affect product sales.

Our overall financial performance, including but not limited to net product sales and net cash used in operating activities, may not meet our expectations.

Our overall financial performance, including but not limited to net product sales and net cash used in operating activities, is difficult to predict and may fluctuate from quarter to quarter and year to year. Historical financial performance may not be indicative of future financial performance. For example, our net product sales may be below expectations, and our costs to operate our business, including cost of product sales, research and development expenses and selling, general and administrative expenses, could exceed our estimates. If our overall financial performance does not meet our expectations, our business could suffer.

Our capital requirements and our potential need for, and ability to obtain, additional financing are uncertain.

As of December 31, 2019, we had cash of $87.8 million. GIAPREZA is our only approved product and our only source of product revenue. To reach the point at which we are able to generate positive cash flow from operations, we may need to raise additional capital. The amount and timing of future funding requirements, if any, will depend on many factors, including the success of our commercialization efforts for GIAPREZA, our ability to receive a tropical disease PRV and our ability to control expenses. If necessary, we will raise additional capital through equity or debt financings or collaboration agreements. We can provide no assurance that additional financing will be available to us on favorable terms, or at all. If we need to raise additional capital and are unable to do so, we may be forced to curtail or cease our operations.

RISKS RELATED TO OUR INDUSTRY

We are subject to various federal, state and foreign laws and regulations governing the health care industry that could result in substantial penalties for noncompliance.

We are subject to various federal, state and foreign laws and regulations governing the health care industry that could result in substantial penalties for noncompliance. These laws and regulations may impact our ability to operate, including our sales and marketing efforts. In addition, we may be subject to patient privacy regulation by federal, state and foreign governments that govern jurisdictions in which we conduct our business. The laws and regulations that may affect our ability to operate include:

• | The federal Anti-Kickback Statute, which prohibits, among other things, persons from soliciting, receiving, offering or paying remuneration, directly or indirectly, in cash or in kind, to induce or reward, or in return for, either the referral of an individual for, or the purchase, order or recommendation of, an item or service reimbursable under a federal health care program, such as the Medicare and Medicaid programs. The term “remuneration” has been broadly interpreted to include anything of value, including for example gifts, cash payments, donations, the furnishing of supplies or equipment, waivers of payment, ownership interests, and providing any item, service or compensation for something other than fair market value. |

• | Federal false claims and civil monetary penalties laws, including the federal civil False Claims Act, which prohibits anyone from, among other things, knowingly presenting, or causing to be presented, for payment to federal programs (including Medicare and Medicaid) claims for items or services that are false or fraudulent. Although we may not submit claims directly to payors, manufacturers can be held liable under these laws in a variety of ways. These include: providing inaccurate billing or coding information to customers; improperly promoting a product’s off-label use; violating the federal Anti-Kickback Statute; or misreporting pricing information to government programs. |

20

• | Provisions of the federal Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), which created new federal criminal statutes that prohibit, among other things, knowingly and willfully executing a scheme to defraud any health care benefit program or making false statements in connection with the delivery of or payment for health care benefits, items or services. |

• | The federal Physician Payment Sunshine Act requirements, under the Patient Protection and Affordable Care Act (“PPACA”), which require manufacturers of certain drugs and biologics to track and report to U.S. Centers for Medicare & Medicaid Services (“CMS”) payments and other transfers of value they make to U.S. physicians and teaching hospitals as well as physician ownership and investment interests in the manufacturer. |

• | Various federal, state and foreign data privacy and security laws and regulations. These include provisions of HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act and its implementing regulations (“HITECH”), which impose certain requirements relating to the privacy, security and transmission of individually identifiable health information in the U.S. and the General Data Protection Regulation (“GDPR”) in the European Union that became effective in May 2018. We may not be directly subject to certain of these laws and regulations, such as privacy and security requirements under HIPAA; however, we may be subject to criminal penalties for knowingly, aiding and embedding these violations. |

• | Section 1927 of the Social Security Act, which requires that manufacturers of drugs and biological products covered by Medicaid report pricing information to CMS on a monthly and quarterly basis, including the best price available to any customer of the manufacturer, with certain exceptions for government programs, and pay prescription rebates to state Medicaid programs based on a statutory formula derived from reported pricing information. |

• | State and/or foreign law equivalents of each of the above federal laws, such as the recently effective California Consumer Privacy Act, many of which differ from each other in significant ways and may not have the same effect, which complicates our compliance efforts. |

If we are found to be in violation of any of the laws or regulations described above or any other laws or regulations that apply to us, we may be subject to substantial penalties, including civil and criminal penalties, damages, fines and possible exclusion from participation in Medicare, Medicaid and other federal health care programs. If we are subjected to substantial penalties, our business will suffer, and we may be forced to curtail or cease our operations.

Drug development involves a lengthy and expensive process with an uncertain outcome.

Drug development involves a lengthy and expensive process with an uncertain outcome. Failure can occur at any time during drug development. The results of nonclinical studies and early clinical studies may not be predictive of the results of later-stage clinical studies. For example, the safety or efficacy results of clinical studies do not ensure that later clinical studies will demonstrate similar results. Even if clinical studies demonstrate the safety and efficacy of the product candidate, there is no assurance that such product candidate will receive regulatory approval.

Drugs approved by the FDA are subject to ongoing regulation.

Any products manufactured or distributed by us pursuant to FDA approvals are subject to continuing regulation by the FDA, including record-keeping requirements and reporting of adverse experiences with the drug. Drug manufacturers and their subcontractors are required to register their establishments with the FDA and certain state agencies and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with cGMPs, which impose certain procedural and documentation requirements on us and our third-party manufacturers. Even after regulatory approval is obtained, under certain circumstances, such as later discovery of previously unknown safety risks, the FDA can withdraw approval or subject the drug to additional restrictions.

Our use of hazardous materials could subject us to liability, fines and sanctions.

Laboratory and clinical testing sometimes involve the use of hazardous, radioactive or otherwise toxic materials. We are subject to federal, state and local laws and regulations governing how we use, manufacture, handle, store and dispose of these materials. Although we believe that our safety procedures for handling and disposing of such materials comply in all material respects with all federal, state and local laws and regulations, there is always the risk of accidental contamination or injury from these materials. If we fail to comply with such laws and regulations, we could be subject to liability, fines and sanctions, and our business may suffer.

21

RISKS RELATED TO OWNERSHIP OF OUR COMMON STOCK

The price per share of our common stock may fluctuate significantly, and you may lose all or part of your investment.

The price per share of our common stock may fluctuate significantly, and you may lose all or part of your investment. These fluctuations could be based on various factors, including factors described elsewhere in this Annual Report on Form 10-K and below:

• | changes in analyst estimates, ratings and price targets; |

• | negative press reports or other negative publicity, whether or not true, about our business; |

• | developments concerning the pharmaceutical and biotechnology industry in general; |

• | market sentiment towards pharmaceutical and biotechnology stocks; |

• | developments concerning the overall economy; and |

• | market sentiment toward equity securities. |

We have never paid a dividend on shares of our common stock, and you should rely on price appreciation of shares of our common stock for return on your investment.

We have never paid a dividend on shares of our common stock. Even if we decide to declare and pay dividends, the timing, amount and form of future dividends, if any, will depend on our future results of operations, financial condition, contractual restrictions and other factors. You should not rely on dividend income from shares of our common stock and should rely on price appreciation of shares of our common stock for return on your investment.

Conversion of our convertible preferred stock would result in substantial dilution for our existing shareholders of common stock.

As of December 31, 2019, there were approximately 27.2 million shares of common stock outstanding. We may be required to issue up to approximately 6.7 million additional shares of common stock upon conversion of existing convertible preferred stock. The issuance of these additional shares would represent approximately 20% dilution to our existing shareholders of common stock.

If we need to obtain additional financing in the future, such financing could result in dilution to your investment, adversely affect the price per share of our common stock and/or create future operating and financial restrictions.

As of December 31, 2019, we had cash of $87.8 million. GIAPREZA is our only approved product and our only source of product revenue. To reach the point at which we are able to generate positive cash flow from operations, we may need to raise additional capital. The amount and timing of future funding requirements, if any, will depend on many factors, including the success of our commercialization efforts for GIAPREZA, our ability to receive a tropical disease PRV and our ability to control expenses. If necessary, we will raise additional capital through equity or debt financings. We can provide no assurance that additional financing will be available to us on favorable terms, or at all. If we issue additional equity securities or securities convertible into equity securities, you will suffer dilution to your investment, and such issuance may adversely affect the price per share of our common stock. Any new debt financing we enter into may involve covenants that restrict our operations, which may include limitations on borrowing and specific restrictions on the use of our assets, as well as prohibitions on our ability to create liens or pay dividends.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

Our corporate headquarters is located at 4550 Towne Centre Court, San Diego, California 92121. We lease 83,008 square feet of office and laboratory space.

22

Item 3. Legal Proceedings

We are not currently a party to any material legal proceedings.

Item 4. Mine Safety Disclosures

Not applicable.

23

PART II

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Market Information

Shares of our common stock are traded on the Nasdaq Capital Market, under the symbol “LJPC.”

Holders of Record

As of February 3, 2020, we had 4 holders of record. Certain shares of common stock are held in “street” name, and, accordingly, the number of beneficial owners of such shares of common stock is not known or included in the foregoing number. This number of holders of record also does not include shareholders whose shares may be held in trust by other entities.

Dividends

We have never paid dividends on shares of our common stock, and we do not have any plans to pay dividends in the foreseeable future.

24

Item 6. Selected Financial Data

We are a smaller reporting company, as defined by Rule 12b-2 under the Securities and Exchange Act of 1934 and in Item 10(f)(1) of Regulation S-K, and are not required to provide the information under this item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of our financial condition and results of operations together with our audited financial statements and the related notes and other financial information included elsewhere in this Annual Report on Form 10-K. Some of the information contained in this discussion and analysis or elsewhere in this Annual Report on Form 10-K, including information with respect to our plans and strategy for our business, include forward-looking statements that involve risks and uncertainties. You should review the “Risk Factors” set forth in this Annual Report on Form 10-K for a discussion of important factors that could cause our actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Discussion and analysis of our 2017 financial condition and results of operations compared to our 2018 financial condition and results of operations can be found in Item 7 of the Company’s Annual Report on Form 10-K filed on March 4, 2019.

Business Overview

La Jolla Pharmaceutical Company is dedicated to the development and commercialization of innovative therapies that improve outcomes in patients suffering from life-threatening diseases. In December 2017, GIAPREZATM (angiotensin II) was approved by the U.S. Food and Drug Administration (“FDA”) as a vasoconstrictor indicated to increase blood pressure in adults with septic or other distributive shock. GIAPREZA U.S. net sales were $23.1 million in 2019 compared to $10.1 million in 2018, an increase of 129%. In August 2019, GIAPREZA was approved by the European Commission (“EC”) for the treatment of refractory hypotension in adults with septic or other distributive shock who remain hypotensive despite adequate volume restitution and application of catecholamines and other available vasopressor therapies. LJPC‑0118 (I.V. artesunate) is La Jolla’s investigational product for the treatment of severe malaria.

Results of Operations

The following table summarizes our results of operations for each of the periods below (in thousands):

Year Ended December 31, | |||||||||||

2019 | 2018 | Change | |||||||||

Net product sales | $ | 23,054 | $ | 10,056 | $ | 12,998 | |||||

Cost of product sales | (2,392 | ) | (1,643 | ) | (749 | ) | |||||

Research and development expense | (85,329 | ) | (117,302 | ) | 31,973 | ||||||

Selling, general and administrative expense | (45,134 | ) | (85,162 | ) | 40,028 | ||||||

Other expense, net | (6,707 | ) | (5,418 | ) | (1,289 | ) | |||||

Net loss | $ | (116,508 | ) | $ | (199,469 | ) | $ | 82,961 | |||

Net Product Sales

Net product sales consist solely of revenue recognized from sales of GIAPREZA to hospitals in the U.S. through a network of specialty and wholesaler distributors (“Customers”). GIAPREZA U.S. net sales were $23.1 million for the year ended December 31, 2019 compared to $10.1 million for the year ended December 31, 2018, an increase of 129%. La Jolla launched GIAPREZA in the U.S. in March 2018.

Cost of Product Sales

Cost of product sales primarily consists of royalties paid or payable to GW and the costs to produce, package and deliver GIAPREZA to our Customers. These costs include raw materials, labor and manufacturing and

25

quality control, as well as shipping and distribution costs. For the year ended December 31, 2019, cost of product sales was $2.4 million compared to $1.6 million for the same period in 2018.

Research and Development Expense

Research and development expense consists of non-personnel and personnel expenses. The following table summarizes these expenses for each of the periods below (in thousands):

Year Ended December 31, | |||||||||||

2019 | 2018 | Change | |||||||||

Non-personnel expenses: | |||||||||||

LJPC-401 | $ | 17,603 | $ | 16,353 | $ | 1,250 | |||||

GIAPREZA | 6,007 | 16,871 | (10,864 | ) | |||||||

LJPC-0118 | 1,746 | 6,352 | (4,606 | ) | |||||||

Other programs | 6,731 | 6,001 | 730 | ||||||||

Facility | 7,318 | 7,574 | (256 | ) | |||||||

Other | 3,991 | 7,464 | (3,473 | ) | |||||||

Total non-personnel expense | $ | 43,396 | $ | 60,615 | $ | (17,219 | ) | ||||

Personnel expenses: | |||||||||||

Salaries, bonuses and benefits | 27,072 | 35,574 | (8,502 | ) | |||||||

Share-based compensation expense | 14,861 | 21,113 | (6,252 | ) | |||||||

Total personnel expense | $ | 41,933 | $ | 56,687 | $ | (14,754 | ) | ||||

Total research and development expense | $ | 85,329 | $ | 117,302 | $ | (31,973 | ) | ||||

During the year ended December 31, 2019, total research and development non-personnel expense decreased primarily as a result of decreases in GIAPREZA- and LJPC-0118-related expenses. GIAPREZA-related expenses decreased as a result of the completion of certain development activities relating to the application for approval to market GIAPREZA in the European Union, which was granted in 2019. LJPC‑0118‑related expenses decreased as a result of the completion of certain development activities relating to the NDA for LJPC-0118, which was filed in 2019. During the year ended December 31, 2019, total research and development personnel expense, including share-based compensation expense, decreased as a result of reduced headcount in 2019 from a Company-wide realignment in October 2018, partially offset by $4.4 million of one-time charges in 2019 resulting from another Company-wide realignment in November 2019. We anticipate research and development expense will decrease significantly in 2020 as a result of the de-prioritization of LJPC-401 and the Company-wide realignment in November 2019.

26

Selling, General and Administrative Expense

Selling, general and administrative expense consists of non-personnel and personnel expenses. The following table summarizes these expenses for each of the periods below (in thousands):

Year Ended December 31, | |||||||||||

2019 | 2018 | Change | |||||||||

Non-personnel expenses: | |||||||||||

Sales and marketing | $ | 7,194 | $ | 23,933 | $ | (16,739 | ) | ||||

Professional fees | 4,398 | 4,939 | (541 | ) | |||||||

Facility | 1,519 | 1,268 | 251 | ||||||||

Other | 2,805 | 2,629 | 176 | ||||||||

Total non-personnel expense | $ | 15,916 | $ | 32,769 | $ | (16,853 | ) | ||||

Personnel expenses: | |||||||||||

Salaries, bonuses and benefits | 20,346 | 38,355 | (18,009 | ) | |||||||

Share-based compensation expense | 8,872 | 14,038 | (5,166 | ) | |||||||

Total personnel expense | $ | 29,218 | $ | 52,393 | $ | (23,175 | ) | ||||

Total selling, general and administrative expense | $ | 45,134 | $ | 85,162 | $ | (40,028 | ) | ||||

During the year ended December 31, 2019, total selling, general and administrative non-personnel expenses decreased primarily as a result of decreases in sales and marketing-related expenses associated with the initial commercial launch of GIAPREZA in the U.S., which occurred in March 2018. During the year ended December 31, 2019, total selling, general and administrative expense, including share-based compensation expense, decreased as a result of reduced headcount in 2019 from a Company-wide realignment in October 2018. We anticipate selling, general and administrative expense will decrease modestly in 2020 as a result of a reduction in general and administrative personnel associated with the Company-wide realignment in November 2019, partially offset by a modest increase in sales and marketing personnel.

Other Expense, Net

Other income (expense), net primarily consists of interest accrued for our deferred royalty obligation, distributions in connection with our non-voting profits interest in a related party and interest income generated from cash held in savings accounts. During the year ended December 31, 2019, other expense, net increased to $6.7 million from $5.4 million for the same period in 2018, an increase of $1.3 million. This increase was primarily due to a $3.5 million increase in interest accrued for our deferred royalty obligation, partially offset by the receipt of distributions of $1.9 million in connection with the Company’s non-voting profits interest in a related party and a $0.2 million increase in interest income generated from cash held in savings accounts.

Liquidity and Capital Resources

Since January 2012, when the Company was effectively restarted, through December 31, 2019, our cash used in operating activities was $425.9 million. As of December 31, 2019, we had an accumulated deficit of $1,037.3 million and have financed our operations through public and private offerings of securities, a royalty financing, revenues from net product sales, interest income on invested cash balances and other income.

As of December 31, 2019 and 2018, we had cash of $87.8 million and $172.6 million, respectively. Based on our current operating plans and projections, we believe that our existing cash will be sufficient to fund operations for at least one year from the date this Annual Report on Form 10-K is filed with the U.S. Securities and Exchange Commission (the “SEC”).

Cash used for operating activities was $85.0 million and $152.4 million for the years ended December 31, 2019 and 2018, respectively. The decrease in cash used for operating activities was a result of the decrease in our net loss, primarily offset by changes in non-cash expenses and working capital.

27

Cash used for investing activities was $0.7 million and $2.3 million for the years ended December 31, 2019 and 2018, respectively. The decrease in cash used in investing activities was the result of purchases of property and equipment in 2018.

Cash provided by financing activities was $0.9 million and $236.4 million for the years ended December 31, 2019 and 2018, respectively. The decrease in cash provided by financing activities was primarily the result of the receipt of $109.8 million of net proceeds from the sale of shares of our common stock in an underwritten public offering in March 2018 and $124.3 million of net proceeds from the Royalty Agreement in May 2018.

Off−Balance Sheet Arrangements

We have no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on our financial condition, changes in our financial condition, expenses, results of operations, liquidity, capital expenditures or capital resources.

Contractual Obligations