Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - WASHINGTON PRIME GROUP INC. | a8-kdatedfebruary262020.htm |

| EX-99.2 - SUPPLEMENTAL REPORT FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER, 31 2019 - WASHINGTON PRIME GROUP INC. | a2019q4exhibit992suppl.htm |

| EX-99.1 - NEWS RELEASE DATED FEBRUARY 26, 2020 - WASHINGTON PRIME GROUP INC. | exhibit991-4q19.htm |

1 Fourth Quarter 2019 Update

Safe Harbor Some of the information contained in this presentation includes forward looking statements. Such statements are subject to a number of risks and uncertainties which could cause actual results in the future to differ materially and adversely from those described in the forward looking statements. Investors should consult the Company’s filings with the Securities and Exchange Commission (SEC) for a description of the various risks and uncertainties which could cause such a difference before deciding whether to invest. This presentation also contains non GAAP financial measures and comparable net operating income (NOI). Reconciliation of this non GAAP financial measure to the most directly comparable GAAP measure can be found within the Company’s quarterly supplemental information package and in filings made with the SEC, which are available on the investor relations section of its website at www.washingtonprime.com. 2

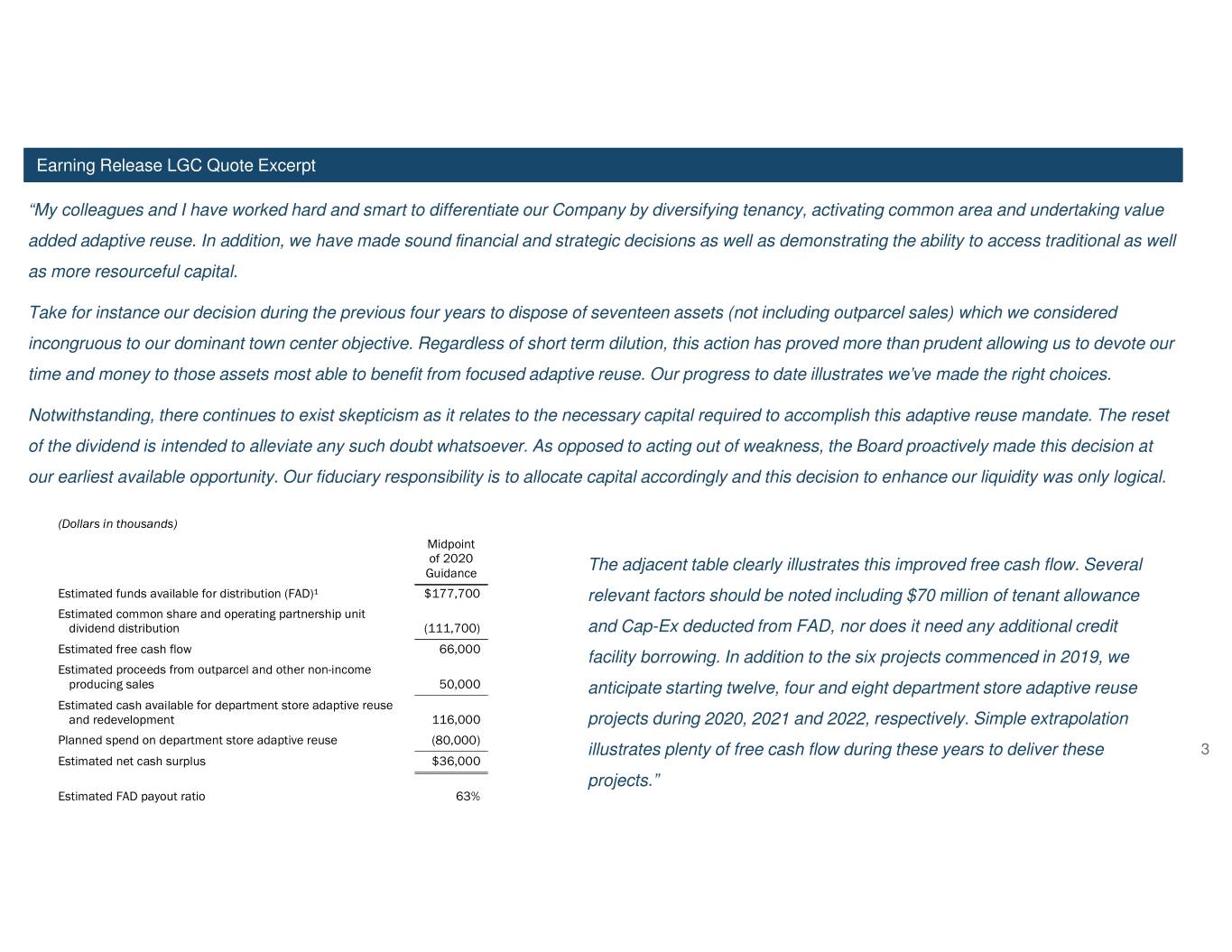

Earning Release LGC Quote Excerpt “My colleagues and I have worked hard and smart to differentiate our Company by diversifying tenancy, activating common area and undertaking value added adaptive reuse. In addition, we have made sound financial and strategic decisions as well as demonstrating the ability to access traditional as well as more resourceful capital. Take for instance our decision during the previous four years to dispose of seventeen assets (not including outparcel sales) which we considered incongruous to our dominant town center objective. Regardless of short term dilution, this action has proved more than prudent allowing us to devote our time and money to those assets most able to benefit from focused adaptive reuse. Our progress to date illustrates we’ve made the right choices. Notwithstanding, there continues to exist skepticism as it relates to the necessary capital required to accomplish this adaptive reuse mandate. The reset of the dividend is intended to alleviate any such doubt whatsoever. As opposed to acting out of weakness, the Board proactively made this decision at our earliest available opportunity. Our fiduciary responsibility is to allocate capital accordingly and this decision to enhance our liquidity was only logical. (Dollars in thousands) Midpoint of 2020 The adjacent table clearly illustrates this improved free cash flow. Several Guidance Estimated funds available for distribution (FAD)¹ $177,700 relevant factors should be noted including $70 million of tenant allowance Estimated common share and operating partnership unit dividend distribution (111,700) and Cap-Ex deducted from FAD, nor does it need any additional credit Estimated free cash flow 66,000 facility borrowing. In addition to the six projects commenced in 2019, we Estimated proceeds from outparcel and other non -income producing sales 50,000 anticipate starting twelve, four and eight department store adaptive reuse Estimated cash available for department store adaptive reuse and redevelopment 116,000 projects during 2020, 2021 and 2022, respectively. Simple extrapolation Planned spend on department store adaptive reuse (80,000) illustrates plenty of free cash flow during these years to deliver these 3 Estimated net cash surplus $36,000 projects.” Estimated FAD payout ratio 63%

Earning Release LGC Quote Excerpt “During last quarter’s earnings release and conference call, we provided a summary of incremental Net Asset Value (NAV) potential of ~$2.00 per share for three redevelopment assets. This analysis assumes we sell fully entitled land parcels to developers of residential, lodging and office product while retail remains the responsibility of WPG. Note, the capital investment required to deliver this fully entitled land parcels is deducted from NAV. “In this light, we are pleased to announce the first of the three redevelopments is underway at Clay Terrace. This redevelopment will be comprised of a ~290 unit multifamily rental project, a ~140 guest room hotel, new office space totaling 200,000 SF and an additional ~70,000 SF of space intended for lifestyle and food and beverage tenancy. “In closing, Washington Prime Group will continue to improve its assets via differentiated tenancy and dynamic activations. Our Company is also increasingly embracing the fact we are an essential participant regarding the logistics, distribution and delivery of goods and services, which speak to an omnichannel perspective. As the dominant town center within our respective trade areas, it is imperative we provide convenience in addition to interesting alternatives where our guests can eat, shop, work, play and live. With this in mind, my colleagues and I are going to get back to our jobs and continue to grind it out.” 4

4Q 19 and YE 2019 Highlights Stable Operating Metrics o Tier One sales PSF increased 4.0% YOY to $413 as of December 31, 2019; o New leasing spreads increased 1.6% during the trailing 12 months ended December 31, 2019 for Tier One and Open Air assets; o Tier One occupancy cost improved 60 basis points to sector leading 11.2% as of December 31, 2019; o As of December 31, 2019, combined Tier One and Open Air occupancy decreased 130 basis points YOY to 93.4% of which 120 basis points was attributable to the bankruptcies of Charlotte Russe, Gymboree, and Payless ShoeSource; o Sequentially from the third quarter , Open Air comparable NOI improved by 250 basis points to 5.1%, Tier One comparable NOI improved by 90 basis points to (7.9%) , and combined Tier One and Open Air comparable NOI improved by 90 basis points to (4.6%) for the fourth quarter; o Open Air and Tier One represent 27% and 66%, respectively, of total NOI as of December 31, 2019; o YOY 2019 comparable NOI increased 2.1% for Open Air and decreased 8.0% for Tier One, resulting in a combined decrease of 5.2%; o The combined decrease in YOY 2019 comparable NOI of $24.5M is primarily attributable to $14.8M of cotenancy and rental income loss from 2019 bankruptcies (Bon-Ton Stores, Sears and Toys R Us) and $6.1M from the bankruptcies of Charlotte Russe, Gymboree, and Payless ShoeSource; and o Excluding the aforementioned cotenancy impact and rental income loss, YOY comparable NOI for combined Tier One and Open Air would have been (2.2%) and (0.8%) for the fourth quarter and full year 2019, respectively. 5

4Q 19 and YE 2019 Highlights Robust and Diversified Leasing Progress o Leasing volume during 2019 exhibited 6% YOY increase totaling 4.4M SF and number of lease transactions increased 11% YOY; o This follows leasing volume of 4.2M SF and 4.0M SF in 2018 and 2017, respectively, totaling 12.6M SF during previous three years ; o Of the aforementioned 4.4M SF in 2019, 57% of new leasing was attributable to lifestyle tenancy which includes food, beverage, entertainment, home furnishings, fitness and professional services; and o The Company continues to incent its leasing and property management professionals in order to further diversify tenancy as illustrated by 180 leases qualifying under various incentive programs during 2019. Leasing Activity New New Renewal Renewal Total Total Square Feet Portfolio YTD as of DEC 31 19 Lease Count Square Feet Lease Count Square Feet Lease Count Square Feet Change YOY (%) Size 274 1,691,180 824 2,747,365 1,098 4,438,545 6% 56M SF 6

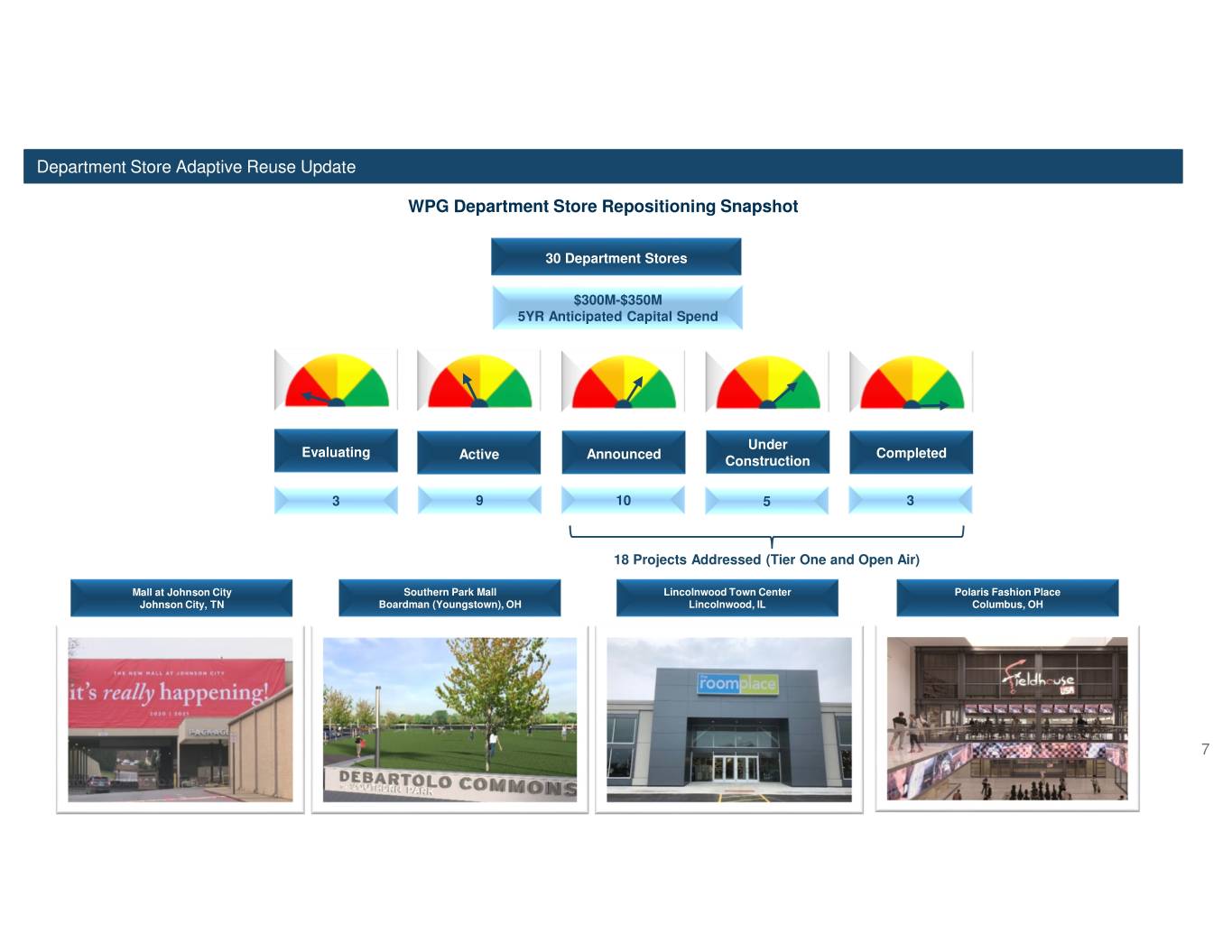

Department Store Adaptive Reuse Update WPG Department Store Repositioning Snapshot 30 Department Stores $300M-$350M 5YR Anticipated Capital Spend Under Evaluating Completed Active Announced Construction 3 9 10 5 3 18 Projects Addressed (Tier One and Open Air) Mall at Johnson City Southern Park Mall Lincolnwood Town Center Polaris Fashion Place Johnson City, TN Boardman (Youngstown), OH Lincolnwood, IL Columbus, OH 7

Department Store Adaptive Reuse Update o The Company resolved 18, or 72%, of the 25 department stores of which the Company has control; o As exhibited within the most recent 4Q 19 supplemental, the Company continues to provide real time updates relating to the 30 department stores within its Tier One and Open Air assets identified for repositioning (excluding space owned by third parties such as Seritage Growth Properties). As of December 31, 2019, five of these department store spaces remained occupied by Sears; These include the following projects, all of which are situated within Tier One assets: The Mall at Johnson City, Johnson City, Tennessee: HomeGoods will anchor the replacement of the former Sears; Polaris Fashion Place®, Columbus, Ohio: FieldhouseUSA will anchor the mixed use redevelopment of former Sears; Town Center at Aurora®, Aurora, Colorado: FieldhouseUSA will anchor the planned mixed use redevelopment of the former Sears; Markland Mall, Kokomo, Indiana: A national retailer has executed a letter of intent to replace the former Carson Pirie Scott (Bon-Ton Stores); Southern Park Mall, Boardman (Youngstown), Ohio: The demolition of the former Sears is underway and is to be replaced by DeBartolo Commons which includes an athletic green space, an ice skating rink and entertainment venue; Southern Park Mall, Boardman (Youngstown), Ohio: The redevelopment project will also feature a new entertainment hub anchored by Steel Valley Brew Works as well as an indoor golf facility and several new food and beverage options. The renovation also includes a permanent DeBartolo-York Family installation situated within the common area; Port Charlotte Town Center, Port Charlotte, Florida: A national entertainment concept has executed a letter of intent to replace Sears; Longview Mall, Longview, Texas: National retailers have executed letters of intent to replace the former Sears; Mesa Mall, Grand Junction, Colorado: Three department store replacements include a national sporting goods retailer replacing the former Herberger’s department store (Bon-Ton Stores), Dillard’s will replace the former Sears and HomeGoods will replace the former Sports Authority all of which have executed letters of intent; Southern Hills Mall, Sioux City, Iowa: The Company has executed a letter of intent with a national off price retailer and has received a letter of intent from a national home furnishings retailer to replace the former Sears location; Southgate Mall, Missoula, Montana: Dillard’s opened a second location during June 2019 replacing the former Herberger’s (Bon-Ton Stores). The Company also recently announced SCHEELS All Sports will replace the current JCPenney which is expected to close during the second quarter of 2020 of which the Company proactively gained control of JCPenney to allow for the adaptive reuse; Grand Central Mall, Parkersburg, West Virginia: The Company announced HomeGoods, PetSmart, Ross Dress for Less and T.J. Maxx will collectively replace the former Sears location; Morgantown Mall, Morgantown, West Virginia: The Company has executed a lease with Dunham’s Sports replacing space previously occupied by Elder Beerman (Bon-Ton Stores). A national discount retailer and an entertainment concept have provided letters of intent to replace the former Belk department store and the former Sears will be replaced with outdoor greenspace for athletic and entertainment use; 8 Lincolnwood Town Center, Lincolnwood, Illinois: The RoomPlace opened August 2019 replacing Carson Pirie Scott (Bon-Ton Stores); and The Mall at Fairfield Commons, Dayton, Ohio: Round1 Entertainment opened November 2019 replacing the lower level of the former Sears, and the upper level is currently under construction and will be occupied by Morris Furniture, which is expected to open during the second quarter of this year.

9