Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2019 |

||

|

OR |

||

|

☐ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-9025

VISTA GOLD CORP.

(Exact Name of Registrant as Specified in its Charter)

|

British Columbia |

|

98-0542444 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

7961 Shaffer Parkway, Suite 5 |

|

|

|

Littleton, Colorado |

|

80127 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(720) 981-1185

(Registrant’s Telephone Number, including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

||

|

Common Shares, no par value |

VGZ |

NYSE American |

||

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐No☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐No☒

Indicate by checkmark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☐ Accelerated Filer ☒ Non-Accelerated Filer ☐Smaller Reporting Company ☒Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐No☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $76,409,000

The number of shares of the Registrant’s Common Stock outstanding as of February 14, 2020 was 100,698,124.

Documents incorporated by reference: To the extent herein specifically referenced in Part III, portions of the Registrant’s Definitive Proxy Statement on Schedule 14A for the 2020 Annual General Meeting of Shareholders are incorporated herein. See Part III.

|

|

Page |

| 1 | |

| 2 | |

| 6 | |

| 6 | |

| 6 | |

| 6 | |

| 11 | |

| 14 | |

| 23 | |

| 24 | |

| 45 | |

| 46 | |

| 46 | |

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

50 |

| 57 | |

|

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

78 |

| 78 | |

| 78 | |

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

78 |

| 79 | |

| 79 | |

| 79 | |

| 79 | |

| 79 | |

| 81 | |

CAUTIONARY NOTE TO INVESTORS REGARDING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES AND PROVEN AND PROBABLE MINERAL RESERVES

Our technical report entitled “NI 43-101 Technical Report Mt Todd Gold Project 50,000 tpd Preliminary Feasibility Study Northern Territory, Australia” with an effective date of September 10, 2019 and an issue date of October 7, 2019, referenced herein, uses the terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” as defined in Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). These definitions differ from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Act of 1933, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average metal price is used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of a mineral deposit in these categories will ever be converted into reserves under SEC Industry Guide 7. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic, technical and legal feasibility. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or preliminary feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically, technically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this report and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by other companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

The term “mineralized material” as used in this annual report on Form 10-K, although permissible under SEC Industry Guide 7, does not indicate “reserves” by SEC Industry Guide 7 standards. We cannot be certain and investors are cautioned not to assume that all or any part of the mineralized material will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves” that can be economically or legally extracted.

The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) and, following a two-year transition period, the SEC Modernization Rules will replace the historical property disclosure requirements for mining registrants that are included in SEC Industry Guide 7. The Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules until its fiscal year beginning January 1, 2021. Under the SEC Modernization Rules, the definitions of “proven mineral reserves” and “probable mineral reserves” have been amended to be substantially similar to the corresponding CIM Definition Standards and the SEC has added definitions to recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” which are also substantially similar to the corresponding CIM Definition Standards; however there are differences in the definitions and standards under the SEC Modernization Rules and the CIM Definition Standards and therefore once the Company begins reporting under the SEC Modernization Rules there is no assurance that the Company’s mineral reserve and mineral resource estimates will be the same as those reported under CIM Definition Standards as contained in the technical report or that the economics for the Mt Todd project estimated in the technical report will be the same as those estimated in any technical report prepared by the Company under the SEC Modernization Rules in the future.

1

“acid rock drainage” results from the interaction of meteoric water with oxidizing sulfide minerals.

“arsenopyrite” means an iron arsenic sulfide. It is the most common arsenic mineral and the primary ore of arsenic metal.

“assay” means to test ores or minerals by chemical or other methods for the purpose of determining the amount of valuable metals contained.

“bedding” means the characteristic structure of sedimentary rock in which layers of different composition, grain size or arrangement are layered one on top of another in a sequence with oldest on the bottom and youngest at the top.

“bismuthinite” means a mineral consisting of bismuth sulfide; it is an ore for bismuth.

“chalcopyrite” means a brass-yellow colored sulfide of copper and iron. It is a copper mineral.

“claim” means a mining title giving its holder the right to prospect, explore for and exploit minerals within a defined area.

“clastic” refers to sedimentary rock (such as shale or siltstone) or sediment. An accumulation of transported weathered debris.

“comminution” means the process in which solid materials are broken into small fragments by crushing, grinding, and other processes.

“conglomerate” refers to clastic sedimentary rock that contains rounded particles that are greater than two millimeters in diameter. The space between the pebbles is generally filled with smaller particles and/or a chemical cement that binds the rock together.

“cut-off grade” means the grade below which mineralized material will be considered waste.

“deposit” is an informal term for an accumulation of mineralized material.

“exploration stage enterprise” refers to an issuer engaged in the search for mineral deposits (reserves) which are not in either the development or production stage, per SEC Industry Guide 7. A development stage enterprise is engaged in the preparation of an established, commercially minable deposit (reserve) which is not in the production stage. A production stage enterprise is engaged in the exploitation of commercially viable mineral deposits (reserves).

“facies” means the characteristics of a rock mass that reflects its depositional environment.

“fault” means a fracture in rock along which there has been displacement of the two sides parallel to the fracture.

“feasibility study” is a comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of realistically assumed mining, processing, metallurgical, economic, marketing, legal, environmental, social and governmental considerations together with any other relevant operational factors and detailed financial analysis, that are necessary to demonstrate at the time of reporting that extraction is reasonably justified or economically viable. The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of a project. The confidence level of the study will be higher than that of a preliminary feasibility study.

“felsic” is a term used to describe an igneous rock that has a large percentage of light-colored minerals such as quartz, feldspar and muscovite. Felsic rocks are generally rich in silicon and aluminum and contain only small amounts of magnesium and iron.

2

“ferruginous” means containing iron oxides or rust.

“foliation” means planar arrangement of structural or textural features in any rock type.

“fold” is a bend or flexure in a rock unit or series of rock units caused by crust movements.

“g Au/t” means grams of gold per tonne.

“galena” means a lead sulfide mineral commonly found in hydrothermal veins; it is the primary ore of lead.

“geosyncline” means a major trough or downwarp of the Earth’s crust, in which great thicknesses of sedimentary and/or volcanic rocks have accumulated.

“greywackes” means fine-grained sandstone generally characterized by its hardness, dark color and poorly sorted angular grains of quartz, feldspar and small rock fragments set in a compact, clay-fine matrix.

“heap leach” means a gold extraction method that percolates a cyanide solution through ore heaped on an impermeable pad or base.

“hornfels” refers to nonfoliated metamorphic rock that is typically formed by contact metamorphism around igneous intrusions.

“indicated mineral resource” and “indicated resource” means “indicated mineral resource” as defined by the CIM in the CIM Definition Standards and is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the appropriate application of technical and economic parameters in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An indicated mineral resource has a lower level of confidence than that applying to a measured mineral resource and may only be converted to a probable mineral reserve.

“inferred mineral resource” and “inferred resource” means “inferred mineral resource” as defined by the CIM in the CIM Definition Standards and is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

“intrusion” refers to an igneous rock body that formed from magma that forced its way into, through or between subsurface rock units.

“intrusives” refers to igneous rocks that crystallize below the earth’s surface.

“ironstone” is a sedimentary rock, either deposited directly as a ferruginous sediment or created by chemical replacement, that contains a substantial proportion of an iron compound from which iron either can be or once was smelted commercially.

“joint” means a fracture in a rock along which there has been no displacement.

“measured mineral resource” and “measured resource” means “measured mineral resource” as defined by the CIM in the CIM Definition Standards and is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with confidence sufficient to allow the application of technical and economic parameters to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological

3

evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A measured mineral resource has a higher level of confidence than that applying to either an indicated mineral resource or an inferred mineral resource. It may be converted to a proven mineral reserve or to a probable mineral reserve.

“mica” any of a group of phyllosilicate minerals having similar chemical compositions and highly perfect basal cleavage.

“mineral reserve” means the economically mineable part of a measured mineral resource and/or indicated mineral resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at preliminary feasibility or feasibility level as appropriate that include application of mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social, governmental or other relevant factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified.

“mineral resource” means a concentration or occurrence of solid material of economic interest in or on the earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling.

“mineralization” means the concentration of valuable minerals within a body of rock.

“mineralized material” under SEC Industry Guide 7 is a mineralized body that has been delineated by appropriately spaced drilling and/or underground sampling to support a sufficient tonnage and average grade of metal(s). Such a deposit does not qualify as a reserve until a comprehensive evaluation based upon unit cost, grade, recoveries, and other material factors conclude legal and economic feasibility. Mineralized material is generally equivalent to measured plus indicated mineral resources but does not include inferred mineral resources.

“mudstone” is a fine-grained sedimentary rock whose original constituents were clays or muds.

“ore” means material containing minerals in such quantity, grade and chemical composition that they can be economically extracted.

“ore sorting” means technology that separates “ore” and “waste” based on physical and/or chemical properties of the material being sorted.

“oxide” means mineralized rock in which some of the original minerals have been oxidized (i.e., combined with oxygen). Oxidation tends to make the ore more porous and permits a more complete permeation of cyanide solutions so that minute particles of gold in the interior of the minerals will be more readily dissolved.

“preliminary economic assessment” as defined by NI 43-101 is a study, other than a preliminary feasibility study or feasibility study, that includes an economic analysis of the potential viability of mineral resources.

“preliminary feasibility study” and “PFS” as defined by the CIM in the CIM Definition Standards is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on mining, processing, metallurgical, economic, marketing, legal, environmental, social and government considerations and the evaluation of any other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the mineral resource may be converted to a mineral reserve at the time of reporting. A preliminary feasibility study is at a lower confidence level than a feasibility study.

“probable reserves” under SEC Industry Guide 7 means reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling and

4

measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

“probable mineral reserves” as defined by the CIM in the CIM Definition Standards is the economically mineable part of an indicated and, in some circumstances, a measured mineral resource. The confidence in the mining, processing, metallurgical, economic, and other relevant factors applying to a probable mineral reserve is lower than that applying to a proven mineral reserve.

“proven reserves” under SEC Industry Guide 7 means reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well established.

“proven mineral reserves”, as defined by the CIM in the CIM Definition Standards, is the economically mineable part of a measured mineral resource A proven mineral reserve implies a high degree of confidence in the mining, processing, metallurgical, economic and other relevant factors.

“pyrrhotite” means a bronze-colored magnetic ferrous sulfide mineral consisting of iron and sulfur.

“pyrite” means a pale brass-yellow colored iron sulfide mineral consisting of iron and sulfur.

“qualified person” as defined under NI 43-101 means an individual who (a) is an engineer or geoscientist with a university degree, or equivalent accreditation, in an area of geoscience, or engineering, relating to mineral exploration or mining; (b) has at least five years of experience in mineral exploration, mine development or operation, or mineral project assessment or any combination of these that is relevant to his or her professional degree or area of practice; (c) has experience relevant to the subject matter of the mineral project and the technical report; (d) is in good standing with a professional association; and (e) in the case of a professional association in a foreign jurisdiction, has a membership designation that (i) requires attainment of a position of responsibility in their profession that requires the exercise of independent judgment; and (ii) requires (A) a favorable, confidential peer evaluation of the individual’s character, professional judgment, expertise and ethical fitness; or (B) a recommendation for membership by at least two peers, and demonstrated prominence or expertise in the field of mineral exploration or mining. Note: a professional association is a self-regulatory organization of engineers, geoscientists or both that, among other criteria, requires compliance with the professional standards of competence and ethics established by the organization and has disciplinary powers over its members.

“recovery” means that portion of the metal contained in the ore that is successfully extracted by processing and is expressed as a percentage.

“sampling” means selecting a fractional, but representative, part of a mineral deposit for analysis.

“scats” means material in a ball mill or sag mill that has become rounded and no longer susceptible to additional size reduction. Basically, this material may be rejected from the grinding circuit for additional crushing because it contributes to higher energy consumption within the mill.

“schist” is a metamorphic rock containing abundant particles of mica, characterized by strong foliation and originating from a metamorphism in which directed pressure played a significant role.

“sediment” means solid material settled from suspension in a liquid.

“sedimentary rock” means rock formed from the accumulation and consolidation of sediment, usually in layered deposits.

“shale” is a fine grained, clastic sedimentary rock composed of mud that is a mix of flakes of clay minerals and tiny fragments (silt-sized particles) or other minerals, especially quartz and calcite.

5

“silicified” means to become converted into or impregnated with silica.

“siltstone” is a sedimentary rock that has a grain size in the silt range, finer than sandstone and coarser than claystones.

“sphalerite” means a zinc sulfide mineral commonly found in hydrothermal veins; it is the primary ore of zinc.

“strike” when used as a noun, means the direction, course or bearing of a vein or rock formation measured on a level surface and, when used as a verb, means to take such direction, course or bearing.

“sulfide” means a compound of sulfur and some other element. From a metallurgical perspective, sulfide rock is primary ore that has not been oxidized. Both ore and waste may contain sulfide minerals.

“tailings” means material rejected from a mill after most of the valuable minerals have been extracted.

“tonne” means a metric tonne and has the weight of 1,000 kg or 2,204.6 pounds.

“tpd” means tonnes per day.

“tuffs” are a type of rock consisting of consolidated volcanic ash ejected from vents during a volcanic eruption.

“vein” means a fissure, fault or crack in a rock filled by minerals that have traveled upwards from some deep source.

“waste” means rock lacking sufficient grade and/or other characteristics of ore.

In this annual report on Form 10-K, unless the context otherwise requires, the terms “we”, “us”, “our”, “Vista”, “Vista Gold”, or the “Company” refer to Vista Gold Corp. and its subsidiaries.

References to C$ refer to Canadian currency, AUD or A$ to Australian currency and USD or $ to United States currency, all in thousands, unless specified otherwise, except per share, per ton, or per ounce amounts.

|

To Convert Metric Measurement Units |

|

To Imperial Measurement Units |

|

Multiply by |

|

|

Hectares |

|

Acres |

|

2.4710 |

|

|

Meters |

|

Feet |

|

3.2808 |

|

|

Kilometers |

|

Miles |

|

0.6214 |

|

|

Tonnes |

|

Tons (short) |

|

1.1023 |

|

|

Liters |

|

Gallons |

|

0.2642 |

|

|

Grams |

|

Ounces (troy) |

|

0.0322 |

|

|

Grams per tonne |

|

Ounces (troy) per ton (short) |

|

0.0292 |

|

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report, including all exhibits hereto and any documents that are incorporated by reference as set forth on the face page under “Documents incorporated by reference”, contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and forward-looking information under Canadian securities laws that are intended to be covered by the safe harbor created by such legislation. All statements, other than statements of historical facts, included in this annual report on Form 10-K, our other filings with the SEC and Canadian securities commissions and in press releases and public statements by our officers or representatives that address activities, events

6

or developments that we expect or anticipate will or may occur in the future are forward-looking statements and forward-looking information, including, but not limited to, those listed below:

Operations

|

· |

our belief that the results of the 2019 PFS (as defined below) demonstrate a technically sound project with robust economics at current gold prices; |

|

· |

our belief that our investments to evaluate, engineer, permit and de-risk the Project have added to the underlying value of the Project and demonstrate strong development potential; |

|

· |

our plans and available funding to continue to identify and study potential Mt Todd optimizations, project improvements and efficiencies; |

|

· |

the feasibility of Mt Todd; |

|

· |

our belief that selectively screening and rejecting sub-economic material will improve gold recoveries and lower process operating costs at Mt Todd; |

|

· |

estimates of future operating and financial performance; |

|

· |

our plans to advance work at Mt Todd to take advantage of our strategic position; |

|

· |

our expectation of Mt Todd’s impact, including environmental and economic impacts; |

|

· |

our expectation that the 2018 Mt Todd Mine Management Plan will be approved by the Northern Territory Department of Primary Industries and Resources; |

|

· |

plans and estimates concerning potential Mt Todd development, including the use of high pressure grinding roll crushers and access to a water supply, as well as the ability to obtain all required permits; |

|

· |

dewatering of the pit will not present any major issues when resuming operations in the Batman pit; |

|

· |

estimates of mineral reserves and mineral resources; |

|

· |

our intention to improve the value of our gold projects; |

|

· |

the potential that development projects may lead to gold production or value-adding strategic transactions; and |

|

· |

the timing, performance and results of feasibility studies; |

|

· |

our belief that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and regulations in all of the jurisdictions in which we operate and that our operations are conducted in material compliance with applicable laws and regulations; |

|

· |

our estimates with respect to historical mine production at Mt Todd; |

|

· |

our expectation that plus 5/8” HPGR crusher product at Mt Todd is harder than the minus 5/8” crushed product and that the hardness of ore in the Batman deposit is relatively constant; |

|

· |

our expectation that use of HPGR crushers at Mt Todd will produce a product that can be ground more efficiently and reduce energy requirements as compared to a SAG mill design; |

|

· |

our expectation that ore sorting will improve mill feed grade at Mt Todd by approximately 8%, resulting in run-of-mine average mill feed grade of 0.91 g Au/t compared to the Batman pit reserve grade of 0.84 g Au/t, and that total costs for grinding, leaching and tailings handling will be lower than previously estimated; |

|

· |

the expectation that reclamation of the heap leach pad at Mt Todd will include disposal of pad liner and regrading only as the existing heap leach pad will be left in place and processed through the mill at the end of mine life; and |

|

· |

our expectation that existing infrastructure at Mt Todd will reduce initial capital expenditure and significantly reduce capital risk related to infrastructure construction; |

7

Business and industry

|

· |

our belief that our existing working capital will be sufficient to fully fund our currently planned corporate, project holding, and discretionary programs for more than 12 months; |

|

· |

our belief that we are in a position to actively pursue strategic alternatives that provide the best opportunity to maximize value for the Company; |

|

· |

our belief that the At-the-Market program will provide additional financing flexibility at a low cost; |

|

· |

the potential monetization of our non-core assets, including our mill equipment which is for sale, and our Midas Gold Shares; |

|

· |

potential funding requirements and sources of capital, including near-term sources of additional cash; |

|

· |

our expectation that the Company will continue to incur losses and will not pay dividends for the foreseeable future; |

|

· |

our potential entry into agreements to find, lease, purchase, option or sell mineral interests; |

|

· |

our belief that we are in compliance in all material respects with applicable laws and regulations including applicable mining, health, safety and environmental statutes and regulations in all of the jurisdictions in which we operate; |

|

· |

our belief that we maintain reasonable amounts of insurance; |

|

· |

our expectations related to potential changes in regulations or taxation initiatives; |

|

· |

our expectation that we will continue to be a passive foreign investment company; |

|

· |

the expected impact of the adoption of new accounting standards on our financial statements; |

|

· |

the potential that we may grant options and/or other stock-based awards to our directors, officers, employees and consultants; |

|

· |

Pursuant to the Los Reyes Option Agreement (defined in Item 2: Properties – Guadalupe de los Reyes Gold/Silver Project, Sinaloa, Mexico), our belief that: |

|

o |

Prime Mining and Minera Alamos will have no interest in the Guadalupe de los Reyes gold/silver project if the Option Agreement terminates; |

|

o |

we will receive any future payments and that we will be granted the Open-Pit NSR and the Underground NSR pursuant to the terms of the Option Agreement; |

|

o |

if we exercise the Back-in Right, we will enter into a joint venture agreement on acceptable terms, if at all; |

|

o |

we will receive future royalty cancelation payments; |

|

· |

preliminary estimates of the reclamation and other related costs associated with certain mining claims in British Columbia; and |

|

· |

the potential that future expenditures may be required for compliance with various laws and regulations governing the protection of the environment. |

Forward-looking statements and forward-looking information have been based upon our current business and operating plans, as approved by the Company’s Board of Directors (the “Board”); our cash and other funding requirements and timing and sources thereof; results of preliminary feasibility and feasibility studies, mineral resource and reserve estimates, preliminary economic assessments and exploration activities; advancements of the Company’s required permitting processes; current market conditions and project development plans. The material assumptions used to develop the forward-looking statements and forward-looking information included in this annual report on Form 10-K include: our expectations of metal prices; our forecasts and expected cash flows, our projected capital and operating

8

costs, our expectations regarding mining and metallurgical recoveries, mine life and production rates. The words “estimate”, “plan”, “anticipate”, “expect”, “intend”, “believe”, “will”, “may” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties, assumptions and other factors which may cause our actual results, performance or achievements to be materially different from any results, performance or achievements expressed or implied by such forward-looking statements and forward-looking information. These factors include risks such as:

Operating Risks

|

· |

preliminary feasibility and feasibility study results and preliminary assessment results and the accuracy of estimates and assumptions on which they are based; |

|

· |

resource and reserve estimate results, the accuracy of such estimates and the accuracy of sampling and subsequent assays and geologic interpretations on which they are based; |

|

· |

technical and operational feasibility and the economic viability of deposits; |

|

· |

our ability to raise sufficient capital on favorable terms or at all to meet the substantial capital investment at Mt. Todd; |

|

· |

our ability to obtain, renew or maintain the necessary authorizations and permits for Mt Todd, including its development plans and operating activities; |

|

· |

the timing and results of a feasibility study on Mt Todd; |

|

· |

delays in commencement of construction at Mt Todd; |

|

· |

increased costs that affect our operations or our financial condition; |

|

· |

our reliance on third parties to fulfill their obligations under agreements with us; |

|

· |

whether projects not managed by us will comply with our standards or meet our objectives; |

|

· |

whether our acquisition, exploration and development activities, as well as the realization of the market value of our assets, will be commercially successful and whether any transactions we enter into will maximize the realization of the market value of our assets; |

|

· |

the success of future joint ventures, partnerships and other arrangements relating to our properties; |

|

· |

perception of potential environmental impact of Mt Todd; |

|

· |

known and unknown environmental and reclamation liabilities, including reclamation requirements at Mt Todd; |

|

· |

potential challenges to the title to our mineral properties; |

|

· |

opposition to Mt Todd could have a material adverse effect; |

|

· |

future water supply issues at Mt Todd; |

|

· |

litigation or other legal claims; and |

|

· |

environmental lawsuits. |

Financial and Business Risks

|

· |

fluctuations in the price of gold; |

|

· |

lack of adequate insurance to cover potential liabilities; |

|

· |

the lack of cash dividend payments by us; |

|

· |

our history of losses from operations; |

|

· |

our ability to attract, retain and hire key personnel; |

9

|

· |

volatility in our stock price and gold equities generally; |

|

· |

our ability to raise additional capital or raise funds from the sale of non-core assets on favorable terms, if at all; |

|

· |

general economic conditions may have material adverse consequences; |

|

· |

industry consolidation which could result in the acquisition of a control position in the Company for less than fair value; |

|

· |

evolving corporate governance and public disclosure regulations; |

|

· |

intense competition in the mining industry; |

|

· |

tax initiatives on domestic and international levels; |

|

· |

fluctuation in foreign currency values; |

|

· |

potential adverse findings by the Australian Government upon review of our Australian research and development grants; and |

|

· |

our likely status as a PFIC for U.S. federal tax purposes; |

|

· |

Vista may experience cybersecurity threats; |

|

· |

Vista is subject to anti-bribery and anti-corruption laws; and |

|

· |

Certain directors and officers serve as directors and officers of other companies in the natural resources sector. |

Industry Risks

|

· |

inherent hazards of mining exploration, development and operating activities; |

|

· |

a shortage of skilled labor, equipment and supplies; |

|

· |

the accuracy of calculations of mineral reserves, mineral resources and mineralized material and fluctuations therein based on metal prices, and inherent vulnerability of the ore and recoverability of metal in the mining process; |

|

· |

changes in environmental regulations to which our exploration and development operations are subject; and |

|

· |

changes in climate change regulations could result in increased operating costs. |

For a more detailed discussion of such risks and other important factors that could cause actual results to differ materially from those in such forward-looking statements and forward-looking information, please see “Item 1A. Risk Factors” below in this annual report on Form 10-K. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results to be materially different than anticipated, estimated or intended. There can be no assurance that these forward-looking statements will prove to be accurate as actual results and future events could differ materially from those anticipated in the statements. Except as required by law, we assume no obligation to publicly update any forward-looking statements and forward-looking information, whether as a result of new information, future events or otherwise.

10

Overview

Vista Gold Corp. and its subsidiaries (collectively, “Vista,” the “Company,” “we,” “our,” or “us”) operate in the gold mining industry. We are focused on the evaluation, acquisition, exploration and advancement of gold exploration and potential development projects that may lead to gold production or value adding strategic transactions such as earn-in right agreements, option agreements, leases to third parties, joint venture arrangements with other mining companies, or outright sales of assets for cash and/or other consideration. We look for opportunities to improve the value of our gold projects through exploration drilling and/or technical studies focused on optimizing previous engineering work. We do not currently generate cash flows from mining operations.

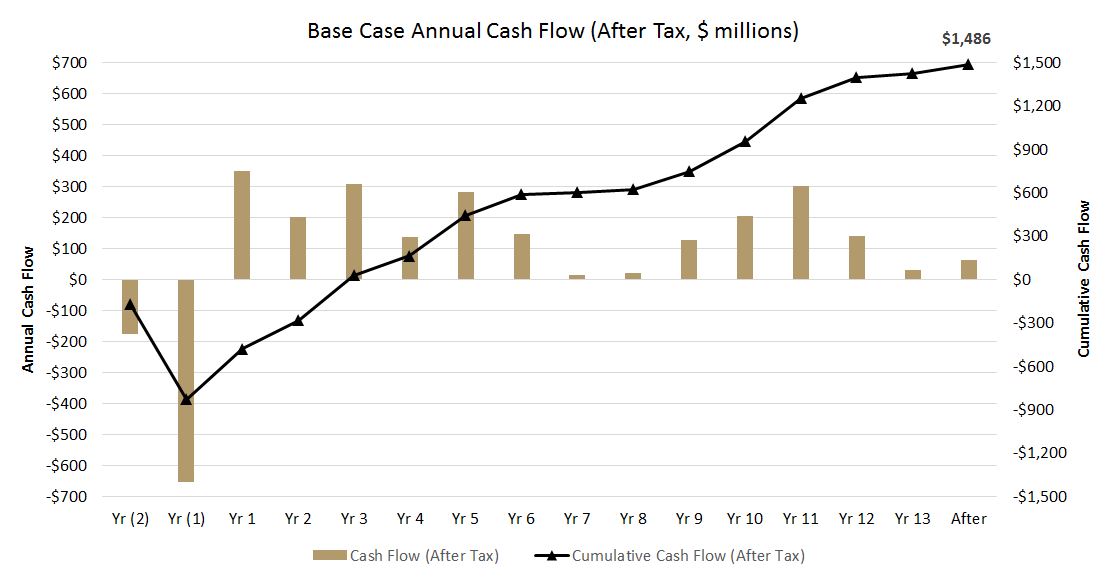

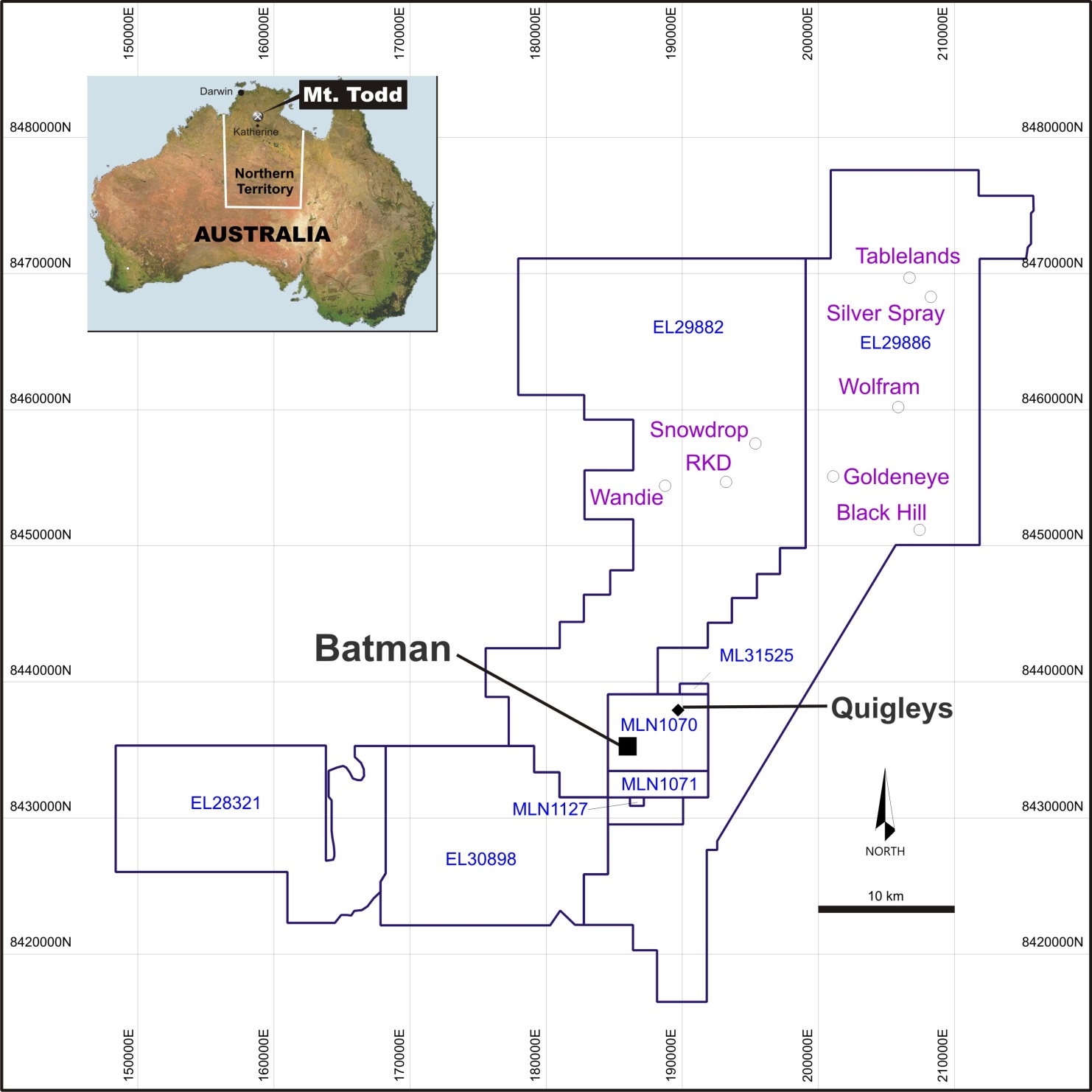

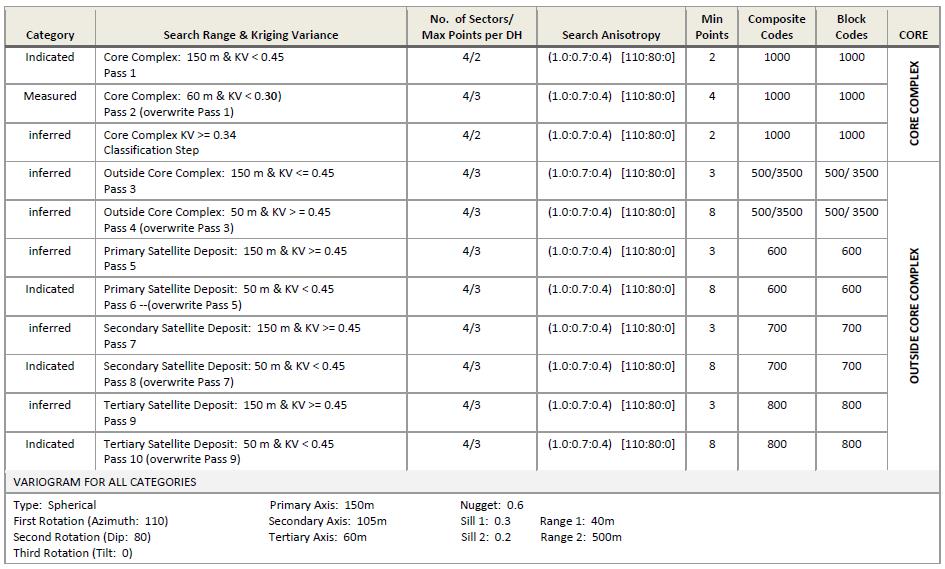

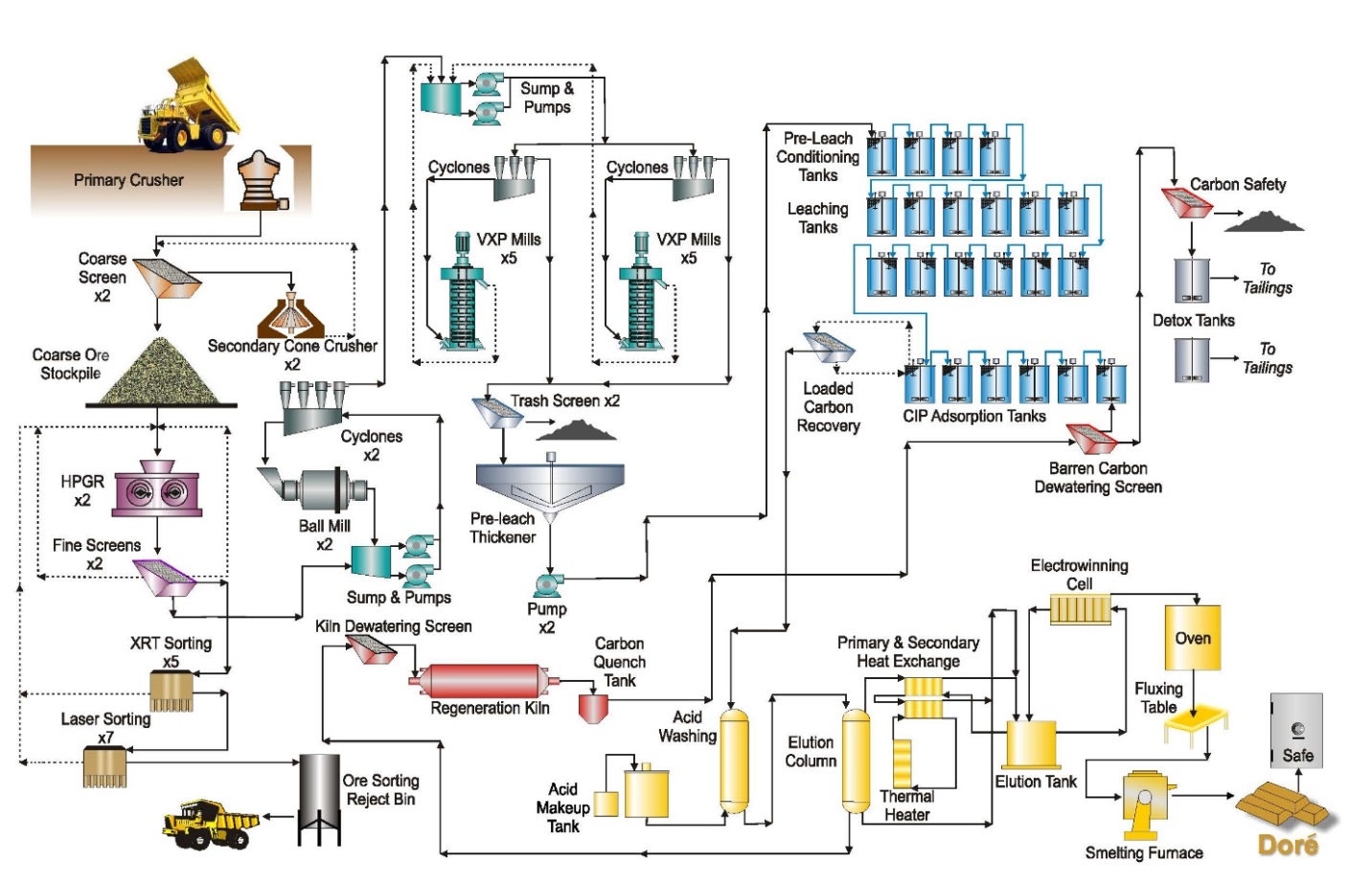

The Company’s flagship asset is its 100% owned Mt Todd gold project (“Mt Todd” or the “Project”) in Northern Territory (“NT”) Australia. Mt Todd is the largest undeveloped gold project in Australia. We have invested substantial amounts to evaluate, engineer, permit and de-risk the Project. We believe these efforts have added to the underlying value of the Project and demonstrate strong development potential. In January 2018, the Company announced positive results of an updated preliminary feasibility study for Mt Todd (the “2018 PFS”). In 2018 and 2019, we continued additional metallurgical testing that demonstrated improved gold recovery compared to the 2018 PFS. These test results, other findings and the outcome of an independent benchmarking study were incorporated into an updated preliminary feasibility study, which was issued in October 2019 (as further described below, the “2019 PFS”). The 2019 PFS successfully confirmed the efficiency of ore sorting across a broad range of head grades, the natural concentration of gold in the screen undersize material prior to sorting, the economics of fine grinding and the resulting improved gold recoveries, and the selection of FLSmidth’s VXP mill as the preferred fine grinding mill.

Vista was originally incorporated on November 28, 1983 under the name “Granges Exploration Ltd.” It amalgamated with Pecos Resources Ltd. during June 1985 and continued as Granges Exploration Ltd. In June 1989, Granges Exploration Ltd. changed its name to Granges Inc. Granges Inc. amalgamated with Hycroft Resources & Development Corporation during May 1995 and continued as Granges Inc. Effective November 1996, Da Capo Resources Ltd. and Granges, Inc. amalgamated under the name “Vista Gold Corp.” and, effective December 1997, Vista continued from British Columbia to the Yukon Territory, Canada under the Business Corporations Act (Yukon Territory). On June 11, 2013, Vista continued from the Yukon Territory, Canada to the Province of British Columbia, Canada under the Business Corporations Act (British Columbia). The current addresses, telephone and facsimile numbers of our offices are:

|

Executive Office |

|

Registered and Records Office |

|

7961 Shaffer Parkway, Suite 5 |

|

1200 Waterfront Centre – 200 Burrard Street |

|

Littleton, Colorado, USA 80127 |

|

Vancouver, British Columbia, Canada V7X 1T2 |

|

Telephone: (720) 981-1185 |

|

Telephone: (604) 687-5744 |

|

Facsimile: (720) 981-1186 |

|

Facsimile: (604) 687-1415 |

11

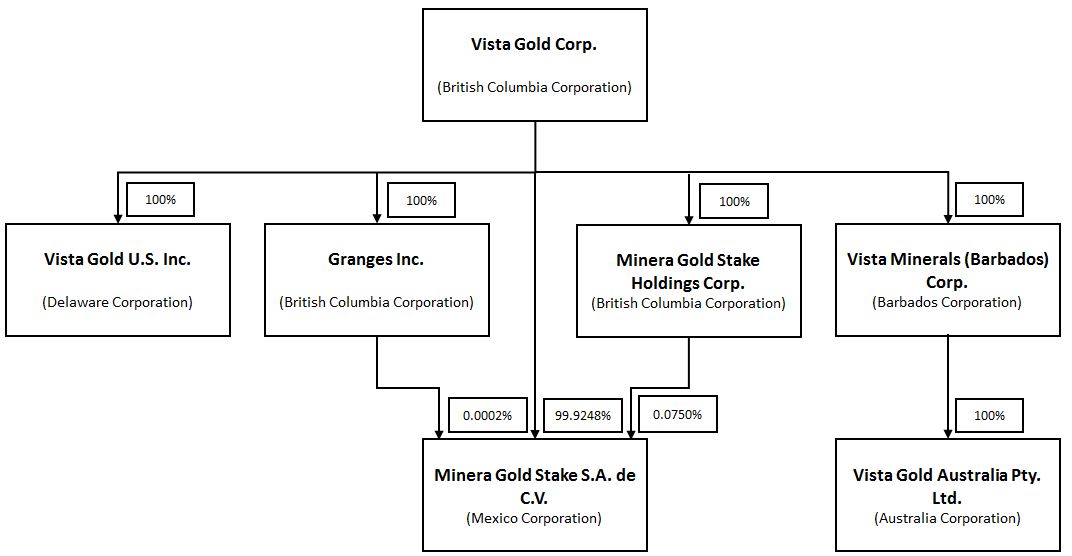

Corporate Organization Chart

The name, place of incorporation, continuance or organization and percent of equity securities that we own or control as of February 6, 2020 for each of our subsidiaries is set out below.

Employees

As of December 31, 2019, we had 15 full-time and no part-time employees globally. In addition, we use consultants with specific skills to assist with various aspects of our corporate affairs, project evaluation, due diligence, corporate governance and property management.

Segment Information

We have one reportable segment, consisting of evaluation, acquisition and exploration activities which are focused principally in Australia. We evaluate, acquire, explore and advance gold exploration and potential development projects, which may lead to gold production or value adding strategic transactions such as earn-in right agreements, option agreements, leases to third parties, joint venture arrangements, or outright sales of assets. We reported no operating revenues during the years ended December 31, 2019 and 2018. Geographic location of mineral properties and plant and equipment is provided in Notes 4 – Mineral Properties and 5 – Plant and Equipment to our Consolidated Financial Statements under the section heading “Item 8. Financial Statements and Supplementary Data” below.

Reclamation

We generally will be required to mitigate long-term environmental impacts by stabilizing, contouring, re-sloping and re-vegetating various portions of a site after mining and mineral processing operations are completed. These reclamation efforts would be conducted in accordance with detailed plans, which must be reviewed and approved by the appropriate regulatory agencies.

The Mt Todd site was not reclaimed when the mine closed in the late 1990’s. Liability for the reclamation of the environmental conditions existing prior to the 2006 commencement of Vista’s involvement with the Project remains the responsibility of the NT Government until after we have provided notice to the NT Government that we intend to

12

proceed with development and assume rehabilitation liability for Mt Todd. Vista does not expect to give such notice until a production decision has been made, the Project is fully permitted to construct the mine, and necessary financing for Project construction can be arranged.

In 2016, the Province of British Columbia Ministry of Energy and Mines (“MEM”) requested that the Company prepare and present to MEM a reclamation plan for closure and abandonment of certain mining claims in British Columbia that the Company disposed of in 1996. Vista presented a reclamation plan to MEM in April 2017; however, execution of the reclamation plan has not started, as acceptance by MEM is pending. Assuming no other potentially responsible parties are identified and based on preliminary estimates of the reclamation and other related costs, we have accrued $240 as of December 31, 2019.

Government Regulation

Our exploration and development activities and other property interests are subject to various national, state, provincial and local laws and regulations in Australia and other jurisdictions, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We have obtained or have pending applications for those licenses, permits or other authorizations currently required to conduct our exploration and other programs. We believe we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and regulations in all of the jurisdictions in which we operate. With the exception of the British Columbia claims noted above, management of the Company is not aware of any current orders or directions relating to the Company with respect to the aforementioned laws and regulations.

Australia Laws

Mineral projects in the NT are subject to Australian federal and NT laws and regulations regarding environmental matters and the discharge of hazardous wastes and materials. As with all mining projects, Mt Todd is expected to have a variety of environmental impacts should development proceed. In Australia, environmental legislation plays a significant role in the mining industry. We are required under Australian laws and regulations (federal, state and territorial) to acquire permits and other authorizations before Mt Todd can be developed and mined. In September 2014, the environmental impact statement (“EIS”) for Mt Todd was approved. The Environmental Protection Agency of the Northern Territory Government (“NTEPA”) advised that it had assessed the environmental impacts of the proposed gold mine at Mt Todd and authorized the Company to proceed with development, subject to a number of recommendations as outlined in the assessment report (the “Assessment Report”). The Assessment Report included a request for authorization under the federal Environmental Protection and Biodiversity Conservation Act 1999 (“EPBC”) as it relates to the Gouldian Finch. In January 2018, the authorization under the EPBC was approved by the Australia Department of the Environment and Energy. We must comply with the terms of our Authority Certificate under the Northern Territory Aboriginal Sacred Sites Act 1989 which deals with the handling of archeological material within sacred sites. We are also subject to statutory requirements under the Mining Management Act, which includes the requirement to complete a Mine Management Plan (“MMP”) before the start of mining operations. The Mt Todd MMP was formally submitted in November 2018 and is under review by the NT Department of Primary Industries and Resources (“DPIR”).

Environmental Regulation

Our projects are subject to various federal, state and local laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. Our policy is to conduct business in a way that safeguards public health and the environment. We believe that our operations are conducted in material compliance with applicable laws and regulations.

Changes to current local, territorial, state or federal laws and regulations in the jurisdictions where we operate could require additional capital expenditures and increased operating and/or reclamation costs. We are unable to predict what additional legislation, if any, might be proposed or enacted, or what additional regulatory requirements could impact the economics of our projects.

13

During 2019, none of our project sites had any material non-compliance occurrences with any applicable environmental regulations. See “Item 1. Business – Reclamation” above.

Competition

We compete with other mining companies in connection with the acquisition, exploration, financing and development of gold properties. There is competition among mining companies for a limited number of gold acquisition and exploration opportunities. Some of these competing mining companies have substantially greater financial and technical resources than Vista. As a result, we may have difficulty acquiring attractive gold projects at reasonable prices. We compete with other mining companies to retain expert consultants required to complete our geological and project development studies. We also compete with other mining companies to hire mining engineers, geologists and other skilled personnel in the mining industry, and for exploration and development services.

Gold Price History

The price of gold is volatile and is affected by numerous factors, all of which are beyond our control, such as the sale or purchase of gold by various central banks and financial institutions, inflation, recession, fluctuation in the relative values of the U.S. dollar and foreign currencies, changes in global gold demand and political and economic conditions.

The following table presents the high, low and average afternoon fixed prices in U.S. dollars for an ounce of gold on the London Bullion Market over the past five years:

|

Year |

|

High |

|

Low |

|

Average |

|

|||

|

2015 |

|

|

1,296 |

|

|

1,049 |

|

|

1,160 |

|

|

2016 |

|

|

1,366 |

|

|

1,077 |

|

|

1,251 |

|

|

2017 |

|

|

1,346 |

|

|

1,151 |

|

|

1,257 |

|

|

2018 |

|

|

1,355 |

|

|

1,178 |

|

|

1,269 |

|

|

2019 |

|

|

1,546 |

|

|

1,270 |

|

|

1,393 |

|

|

2020 (to February 6, 2020) |

|

|

1,584 |

|

|

1,527 |

|

|

1,561 |

|

Data Source: www.kitco.com

Available Information

We make available, free of charge, on or through our website, at www.vistagold.com, our annual report on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934. Our website and the information contained therein or connected thereto are not intended to be, and are not, incorporated into this annual report on Form 10-K.

An investment in our securities involves a high degree of risk. The risks described below are not the only ones facing the Company or otherwise associated with an investment in our securities. Additional risks not presently known to us or which we currently consider not material may also adversely affect our business. If any of the following risks actually occur, our business, financial condition and operating results could be materially adversely affected.

Operating Risks

We cannot be assured that Mt Todd is feasible or that a feasibility study will accurately forecast economic results.

Mt Todd is our principal asset. Our future profitability depends largely on the economic feasibility of the Project. Before arranging financing for Mt Todd, we will have to complete a feasibility study. The results of our feasibility study may not be as favorable as the results of our prefeasibility studies. There can be no assurance that the mining and

14

comminution processes including ore sorting, gold production rates, revenue, capital and operating costs including taxes and royalties will not vary unfavorably from the estimates and assumptions included in such feasibility study.

Mt Todd requires substantial capital investment and we may be unable to raise sufficient capital on favorable terms or at all.

The construction and operation of Mt Todd will require significant capital. Our ability to raise sufficient capital and/or secure a development partner on satisfactory terms, if at all, will depend on several factors, including a favorable feasibility study, acquisition of the requisite permits, macroeconomic conditions, and future gold prices. Uncontrollable factors or other factors such as lower gold prices, unanticipated operating or permitting challenges, perception of environmental impact or, illiquidity in the debt markets or equity markets, could impede our ability to finance Mt Todd on acceptable terms, or at all.

If we decide to construct the mine at Mt Todd, we will be assuming certain reclamation obligations resulting in a material financial obligation.

The Mt Todd site was not reclaimed when the original mine closed. Although we are not currently responsible for the reclamation of these historical disturbances, we will accept full responsibility for them if and when we make a decision to finance and construct the mine and provide notice to the NT Government of our intention to take over and assume the management, operation and rehabilitation of Mt Todd. At such time, we will be required to provide a bond or other surety in a form and amount satisfactory to the NT Government (in whose jurisdiction Mt Todd is located) that would cover the prospective expense to reclaim the property. In addition, the regulatory authorities may increase reclamation and bonding requirements from time to time. The satisfaction of these bonding requirements and continuing or future reclamation obligations will require a significant amount of capital.

We may not be able to get the required permits to begin construction at Mt Todd in a timely manner or at all.

Any delay in acquiring the requisite permits, or failure to receive required governmental approvals could delay or prevent the start of construction of Mt Todd. If we are unable to acquire permits to mine the property, then the Project cannot be developed and operated. In addition, the property would have no reserves under SEC Industry Guide 7 and NI 43-101, which could result in an impairment of the carrying value of the Project.

There may be other delays in the construction of Mt Todd.

Delays in commencing construction could result from factors such as availability and performance of engineering and construction contractors, suppliers, consultants, and employees; availability of required equipment; and availability of capital. Any delay in performance by any one or more of the contractors, suppliers, consultants, employees or other persons on which we depend, or lack of availability of required equipment, or delay or failure to receive required governmental approvals, or financing could delay or prevent commencement of construction at Mt Todd. There can be no assurance of whether or when construction at Mt Todd will start or that the necessary personnel, equipment or supplies will be available to the Company if and when construction is started.

Increased costs could impede our ability to become profitable.

Capital and operating costs at mining operations are subject to variation due to a number of factors, such as changing ore grade, changing metallurgy, and revisions to mine plans in response to the physical shape and location of the ore body. In addition, costs are affected by the cost of capital, tax and royalty regimes, trade tariffs, the global cost of mining and processing equipment, commodity prices, foreign exchange rates, fuel, electricity, operating supplies and appropriately skilled labor. These costs are at times subject to volatile price movements, including increases that could make future development and production at Mt Todd less profitable or uneconomic. This could have a material adverse effect on our business prospects, results of operations, cash flows and financial condition.

15

We cannot be assured that we will have an adequate water supply for mining operations at Mt Todd.

Water at Mt Todd is expected to be provided from a fresh water reservoir that is fed by seasonal rains. Insufficient rainfall, or drought-like conditions in the area feeding the reservoir could limit or extinguish this water supply. Sufficient water resources may not be available, resulting in curtailment or stoppage of operations until the water supply is replenished. This could have a material adverse effect on our business prospects, results of operations, cash flows and financial condition.

We could be subject to litigation, allegations or other legal claims.

Our assets or our business activities may be subject to disputes that may result in litigation or other legal claims. We may be subject to allegations through press, social media, the courts or other mediums that may or may not be founded. We may be required to respond to or defend against these claims and/or allegations, which will divert resources away from our principal business. There can be no assurance that our defense of such claims and/or allegations would be successful, and we may be required to make material settlements. This could have a material adverse effect on our business prospects, results of operations, cash flows, financial condition and corporate reputation.

We rely on third parties to fulfill their obligations under agreements.

Our business strategy includes entering into agreements with third-parties (“Partners”), who may earn the right to obtain an interest in certain of our projects, in part by managing the respective project. Whether or not we hold a majority interest in a respective project, our Partner(s) may: (i) have economic or business interests or goals that are inconsistent with or opposed to ours; (ii) exercise veto rights to block actions that we believe to be in the best interests of the project; (iii) take action contrary to our policies or objectives; or (iv) as a result of financial or other reasons, be unable or unwilling to fulfill their obligations under the respective joint venture, option, earn-in right or other agreement(s), such as contributing capital for the expansion or maintenance of projects. Any one or a combination of these could result in liabilities for us and/or could adversely affect the value of the related project(s) and, by association, damage our reputation and consequently our ability to acquire or advance other projects and/or attract future Partners.

Our exploration and development interests are subject to evolving environmental regulations.

Our property and royalty interests are subject to environmental regulations. Environmental legislation is becoming more restrictive in some jurisdictions, with stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect our interests. Currently, our property and royalty interests are subject to government environmental regulations in Australia, Indonesia, Mexico and the U.S.

We could be subject to environmental lawsuits.

Neighboring landowners and other third parties could file claims based on environmental statutes and common law for personal injury and property damage allegedly caused by environmental nuisance, the release of hazardous substances or other waste material into the environment on or around our properties. There can be no assurance that our defense of such claims would be successful. This could have a material adverse effect on our business prospects, financial condition, results of operation, and corporate reputation.

We may have material undisclosed environmental liabilities of which we are not aware.

Vista has been engaged in gold exploration since 1983. Since inception the Company has been involved in numerous exploration projects in many jurisdictions. There may be environmental liabilities associated with disturbances at any of these projects for which the Company may be identified as a potentially responsible party, regardless of its level of involvement in creating the related disturbance. We may not be aware of such claims against the Company until regulators provide notice thereof. Consequently, we may have material undisclosed environmental responsibilities which

16

could negatively affect our business prospects, financial condition and cash flows, results of operations, and corporate reputation.

There may be challenges to our title to mineral properties.

There may be challenges to our title to our mineral properties. If there are title defects with respect to any of our properties, we may be required to compensate other persons or reduce or lose our interest in the affected property. Also, in any such case, the investigation and resolution of title issues could divert Company resources from our core strategies.

Opposition to Mt Todd could have a material adverse effect.

There is generally an increasing level of public concern relating to extractive industries. Opposition to extractive industries, or our development and operating plans at Mt Todd specifically, could have adverse effects on our reputation and support from other stakeholders. As a result, we may be unable to attract a partner, secure adequate financing or complete other activities necessary to continue our planned activities. Any resulting delays or an inability to develop and operate Mt Todd as planned could have a material adverse effect on our business prospects, results of operations, cash flows, financial condition and corporate reputation.

Our exploration and development activities, strategic transactions, or any acquisition activities may not be commercially successful and could fail to lead to gold production or fail to add value.

Substantial expenditures are required to acquire gold properties, establish mineral reserves through drilling and analysis, develop metallurgical processes to extract metal from the ore and develop the mining and processing facilities and infrastructure at any site chosen for mining. We cannot be assured that any mineral reserves or mineral resources acquired, discovered or established will be in sufficient quantities or at sufficient grades to justify commercial operations, attract a strategic partner or strategic transaction, or that the funds invested in them will ever be recovered.

Financial and Business Risks

A substantial or extended decline in gold prices would have a material adverse effect on the value of our assets, on our ability to raise capital and could result in lower than estimated economic returns.

The value of our assets, our ability to raise capital and our future economic returns are substantially dependent on the price of gold. The gold price fluctuates continually and is affected by numerous factors beyond our control. Factors tending to influence gold prices include:

|

· |

gold sales or leasing by governments and central banks or changes in their monetary policy, including gold inventory management and reallocation of reserves; |

|

· |

speculative short or long positions on futures markets; |

|

· |

the relative strength of the U.S. dollar; |

|

· |

expectations of the future rate of inflation; |

|

· |

interest rates; |

|

· |

changes to economic conditions in the United States, China, India and other industrialized or developing countries; |

|

· |

geopolitical conflicts; |

|

· |

changes in jewelry, investment or industrial demand; |

|

· |

changes in supply from production, disinvestment and scrap; and |

|

· |

forward sales by producers in hedging or similar transactions. |

A substantial or extended decline in the gold price could:

|

· |

negatively impact our ability to raise capital on favorable terms, or at all; |

|

· |

jeopardize the development of Mt Todd; |

17

|

· |

reduce our existing estimated mineral resources and reserves by removing material from these estimates that could not be economically processed at lower gold prices; |

|

· |

reduce the potential for future revenues from gold projects in which we have an interest; |

|

· |

reduce funds available to operate our business; and |

|

· |

reduce the market value of our assets, including our investment in Midas Gold Shares. |

General economic conditions may have material adverse consequences.

General economic conditions and financial market turmoil may arise from many sources. These conditions could potentially impact the natural resource sector and Vista. This could include contraction in credit markets resulting in widening of credit risk, imposition of trade tariffs among various countries, devaluations, high volatility in global equity, commodity, foreign exchange and gold markets, and a lack of market liquidity. These and other factors could have a material adverse effect on our business prospects, results of operations, cash flows and financial condition.

Industry consolidation could result in the acquisition of a control position in the Company for less than fair value.

Consolidation within the industry is a growing trend. As a result of the broad range of market and industry factors including the price of gold, we believe the current market value of the common shares in the capital of the Company (the “Common Shares”) does not reflect the fair value of the Company’s assets. These conditions could result in the acquisition of a control position, or attempted acquisition of a control position in the Company at what we believe to be less than fair value. This could result in substantial costs to us and divert our management’s attention and resources. A completed acquisition could result in realized losses of shareholder value.

We have a history of losses, and we do not expect to generate earnings from operations or pay dividends in the near term, if at all.

We are an exploration stage enterprise. As such, we devote our efforts to exploration, analysis and, if warranted, development of our projects. We do not currently produce gold and do not currently generate operating earnings from gold production. We finance our business activities principally by issuing equity and selling non-core assets.

We have incurred losses in all periods since 1998, except for the year ended December 31, 2011, during which we recorded non-cash net gains, and the year ended December 31, 2015 during which we recorded gains related to research and development (“R&D”) refunds. We expect to continue to incur losses. We have no history of paying cash dividends and we do not expect to be able to pay cash dividends or to make any similar distribution in the foreseeable future, if at all.

We may be unable to raise additional capital on favorable terms, or at all.

Our exploration and, if warranted, development activities and the construction and start-up of any mining operation require substantial amounts of capital. In order to develop Mt Todd, acquire attractive gold projects, and/or continue our business, we will have to secure a development partner or otherwise source sufficient equity and debt capital, raise additional funds from the sale of non-core assets and / or seek additional sources of capital from other external sources. There can be no assurance that we will be successful in raising additional capital on acceptable terms. If we cannot raise sufficient additional capital, we may be required to substantially reduce or cease operations, any of which may affect our ability to continue as a going concern.

Our business is subject to evolving corporate governance and public disclosure regulations that have increased both our compliance costs and the risk of noncompliance.

We are subject to changing rules and regulations promulgated by a number of governmental and self-regulated organizations, including the British Columbia Securities Commission, the SEC, the Toronto Stock Exchange (the “TSX”), the NYSE American, and the Financial Accounting Standards Board. These rules and regulations continue to evolve in scope and complexity and many new requirements have been created in response to laws enacted by the United

18

States Congress, making compliance increasingly more difficult and uncertain, which could have an adverse effect on reputation and our stock price.

We face intense competition in the mining industry.

The mining industry is intensely competitive in all of its phases. Some of our competitors are much larger, established companies with greater financial and technical resources than ours. We compete with other companies for attractive mining properties, for capital, for equipment and supplies, for outside services and for qualified managerial and technical employees. Access to financing, equipment, supplies, skilled labor and other resources may also be affected by competition from non-mining related commercial sectors. If we are unable to raise sufficient capital, we will be unable to execute exploration and development programs or such programs may be reduced in scope. Competition for equipment and supplies could result in shortage of necessary supplies and/or increased costs. Competition for outside services could result in increased costs, reduced quality of service and/or delays in completing services. If we cannot successfully retain or attract qualified employees, our ability to advance the development of Mt Todd, to attract necessary financing, to meet all of our environmental and regulatory responsibilities, or to take opportunities to improve our business, could be negatively affected. This could have a material adverse effect on our business prospects, results of operations, cash flows and financial condition.

The occurrence of events for which we are not insured may affect our cash flow and overall profitability.

We maintain insurance policies that mitigate certain risks related to our operations. This insurance is maintained in amounts that we believe to be reasonable based on the circumstances surrounding each identified risk. However, we may elect to limit or not have insurance for certain risks because of the high premiums associated with insuring those risks or for various other reasons. In other cases, insurance may not be available for certain risks. We do not insure against political risk. Occurrence of events for which we are not insured adequately, or at all, could result in significant losses that could materially adversely affect our financial condition and our ability to fund our business.

Our share price may be volatile and your investment in our Common Shares could suffer a decline in value.

Broad market and industry factors may adversely affect the price of our Common Shares, regardless of our actual operating performance. Factors that could cause fluctuation in the price of our Common Shares may include, among other things:

|

· |

changes in financial estimates by us or by any securities analysts who might cover our stock market performance; |

|

· |

stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in the mining industry; |

|

· |

speculation about our business in the press or the investment community; |

|

· |

conditions or trends in our industry or the economy generally; |

|

· |

changes in the prices of gold; |

|

· |

announcements by us or our competitors of significant acquisitions, strategic partnerships or divestitures; |

|

· |

additions or departures of key personnel; and |

|

· |

sales of our Common Shares, including sales by our directors, officers or significant stockholders. |

In the past, securities class action litigation has often been instituted against companies following periods of volatility in their stock price. This type of litigation could result in substantial costs to us and divert our management’s attention and resources.

Currency fluctuations may adversely affect our costs.

We have material property interests in Australia. Most costs in Australia are incurred in the local currency. The appreciation of the Australian dollar, if any, against the U.S. dollar effectively increases our cost of doing business in Australia. This could have the effect of increasing the amount of capital required to continue to explore and develop Mt Todd, and/or reducing the pace at which it is developed.

19

Our Australian R&D grants are subject to review.

The Australian R&D tax incentive program, under which we have received certain grants related to qualifying R&D programs and expenditures, is a self-assessment process, and as such, the Australian Government has the right to review our qualifying programs and related expenditures. If such a review were to occur, and as a result of the review and failure of a related appeal a qualified program and related expenditures were disqualified, the respective R&D grant could be recalled with penalties and interest.

The Company is likely a “passive foreign investment company,” which will likely have adverse U.S. federal income tax consequences for U.S. shareholders.