Attached files

| file | filename |

|---|---|

| 8-K - 8-K - U.S. CONCRETE, INC. | a8-k4q19earningsrelease.htm |

EXHIBIT 99.1 U.S. CONCRETE REPORTS STRATEGIC ACQUISITION AND 2019 FULL YEAR AND FOURTH QUARTER RESULTS EULESS, TEXAS – February 25, 2020 – U.S. Concrete, Inc. (NASDAQ: USCR), a leading heavy building materials supplier of aggregates and ready-mixed concrete in select major markets across the United States, the U.S. Virgin Islands and Canada, today announced a strategic acquisition as well as results for the full year and quarter ended December 31, 2019. William J. Sandbrook, Chairman and Chief Executive Officer of U.S. Concrete, Inc. stated, “Today we are excited to announce the completion of our most recent aggregates acquisition, Coram Materials Corp., for a purchase price of $142 million, which significantly expands our East Coast aggregates portfolio. The acquisition should produce a margin profile in excess of the Company's average within the first full year of ownership. Post synergies, which we expect to achieve within two years, the deal represents a multiple of approximately 7 times EBITDA. This acquisition possesses significant, premium sand reserves that will provide us with self-sufficiency in meeting our sand supply needs to our ready-mixed concrete operations in New York City as well as providing external sales to third party customers. Coram's 50 million tons of reserves, located in the quickly depleting Long Island sand market, increases the vertical integration of our New York operations, strengthens our competitive position and advances the continuation of our strategy of expanding into higher margin aggregates businesses. Following our successful Polaris acquisition, we continue to seek out accretive opportunities of coupling the pull through capabilities of our large regional footprints of ready-mixed concrete operations with attractive aggregate assets." Mr. Sandbrook concluded, "Alongside the acquisition, we continue to focus on previously discussed operational, technology and financial improvement initiatives. Through re-engineering certain of our processes and technology investments, we expect to generate enhanced margins. Our record high adjusted EBITDA in the second half of 2019 highlights the traction that our profit improvement initiatives are gaining within our operations. While our fourth quarter of 2019 results were negatively impacted by a significant increase in our self-insurance reserves, claim costs and premiums year-over-year, we experienced good growth in our aggregate products segment and are seeing positive momentum in ready-mixed concrete pricing to further enhance profitability." 1

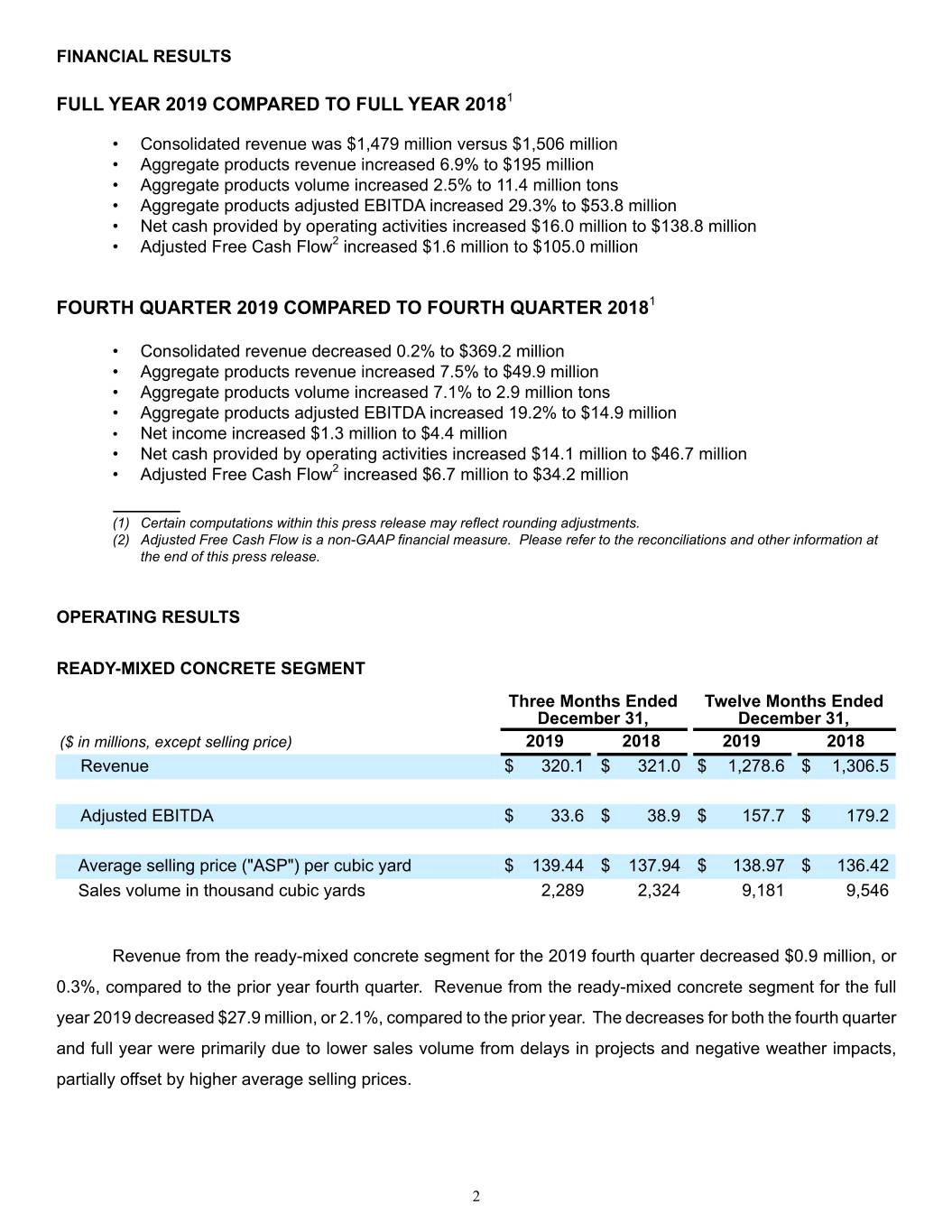

FINANCIAL RESULTS FULL YEAR 2019 COMPARED TO FULL YEAR 20181 • Consolidated revenue was $1,479 million versus $1,506 million • Aggregate products revenue increased 6.9% to $195 million • Aggregate products volume increased 2.5% to 11.4 million tons • Aggregate products adjusted EBITDA increased 29.3% to $53.8 million • Net cash provided by operating activities increased $16.0 million to $138.8 million • Adjusted Free Cash Flow2 increased $1.6 million to $105.0 million FOURTH QUARTER 2019 COMPARED TO FOURTH QUARTER 20181 • Consolidated revenue decreased 0.2% to $369.2 million • Aggregate products revenue increased 7.5% to $49.9 million • Aggregate products volume increased 7.1% to 2.9 million tons • Aggregate products adjusted EBITDA increased 19.2% to $14.9 million • Net income increased $1.3 million to $4.4 million • Net cash provided by operating activities increased $14.1 million to $46.7 million • Adjusted Free Cash Flow2 increased $6.7 million to $34.2 million (1) Certain computations within this press release may reflect rounding adjustments. (2) Adjusted Free Cash Flow is a non-GAAP financial measure. Please refer to the reconciliations and other information at the end of this press release. OPERATING RESULTS READY-MIXED CONCRETE SEGMENT Three Months Ended Twelve Months Ended December 31, December 31, ($ in millions, except selling price) 2019 2018 2019 2018 Revenue $ 320.1 $ 321.0 $ 1,278.6 $ 1,306.5 Adjusted EBITDA $ 33.6 $ 38.9 $ 157.7 $ 179.2 Average selling price ("ASP") per cubic yard $ 139.44 $ 137.94 $ 138.97 $ 136.42 Sales volume in thousand cubic yards 2,289 2,324 9,181 9,546 Revenue from the ready-mixed concrete segment for the 2019 fourth quarter decreased $0.9 million, or 0.3%, compared to the prior year fourth quarter. Revenue from the ready-mixed concrete segment for the full year 2019 decreased $27.9 million, or 2.1%, compared to the prior year. The decreases for both the fourth quarter and full year were primarily due to lower sales volume from delays in projects and negative weather impacts, partially offset by higher average selling prices. 2

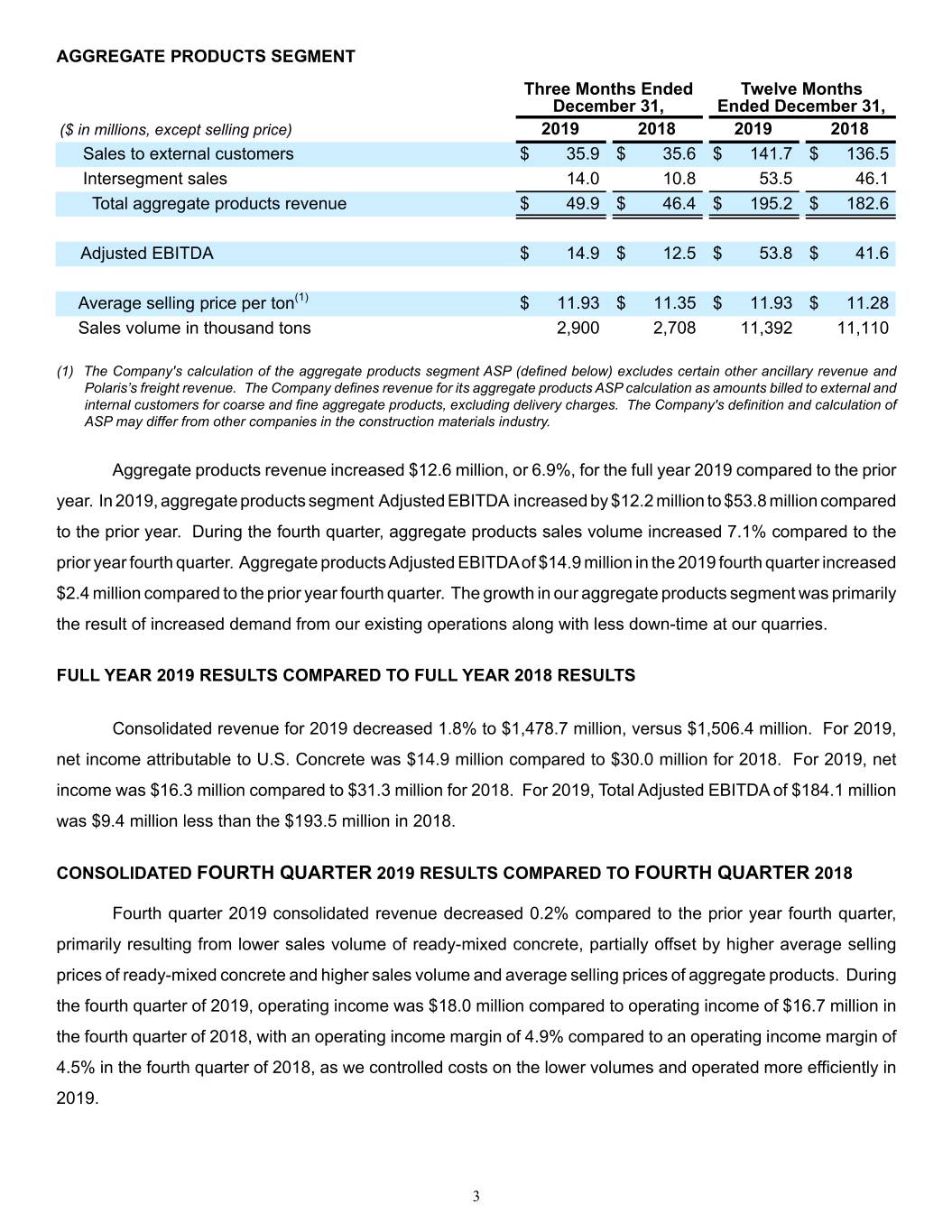

AGGREGATE PRODUCTS SEGMENT Three Months Ended Twelve Months December 31, Ended December 31, ($ in millions, except selling price) 2019 2018 2019 2018 Sales to external customers $ 35.9 $ 35.6 $ 141.7 $ 136.5 Intersegment sales 14.0 10.8 53.5 46.1 Total aggregate products revenue $ 49.9 $ 46.4 $ 195.2 $ 182.6 Adjusted EBITDA $ 14.9 $ 12.5 $ 53.8 $ 41.6 Average selling price per ton(1) $ 11.93 $ 11.35 $ 11.93 $ 11.28 Sales volume in thousand tons 2,900 2,708 11,392 11,110 (1) The Company's calculation of the aggregate products segment ASP (defined below) excludes certain other ancillary revenue and Polaris’s freight revenue. The Company defines revenue for its aggregate products ASP calculation as amounts billed to external and internal customers for coarse and fine aggregate products, excluding delivery charges. The Company's definition and calculation of ASP may differ from other companies in the construction materials industry. Aggregate products revenue increased $12.6 million, or 6.9%, for the full year 2019 compared to the prior year. In 2019, aggregate products segment Adjusted EBITDA increased by $12.2 million to $53.8 million compared to the prior year. During the fourth quarter, aggregate products sales volume increased 7.1% compared to the prior year fourth quarter. Aggregate products Adjusted EBITDA of $14.9 million in the 2019 fourth quarter increased $2.4 million compared to the prior year fourth quarter. The growth in our aggregate products segment was primarily the result of increased demand from our existing operations along with less down-time at our quarries. FULL YEAR 2019 RESULTS COMPARED TO FULL YEAR 2018 RESULTS Consolidated revenue for 2019 decreased 1.8% to $1,478.7 million, versus $1,506.4 million. For 2019, net income attributable to U.S. Concrete was $14.9 million compared to $30.0 million for 2018. For 2019, net income was $16.3 million compared to $31.3 million for 2018. For 2019, Total Adjusted EBITDA of $184.1 million was $9.4 million less than the $193.5 million in 2018. CONSOLIDATED FOURTH QUARTER 2019 RESULTS COMPARED TO FOURTH QUARTER 2018 Fourth quarter 2019 consolidated revenue decreased 0.2% compared to the prior year fourth quarter, primarily resulting from lower sales volume of ready-mixed concrete, partially offset by higher average selling prices of ready-mixed concrete and higher sales volume and average selling prices of aggregate products. During the fourth quarter of 2019, operating income was $18.0 million compared to operating income of $16.7 million in the fourth quarter of 2018, with an operating income margin of 4.9% compared to an operating income margin of 4.5% in the fourth quarter of 2018, as we controlled costs on the lower volumes and operated more efficiently in 2019. 3

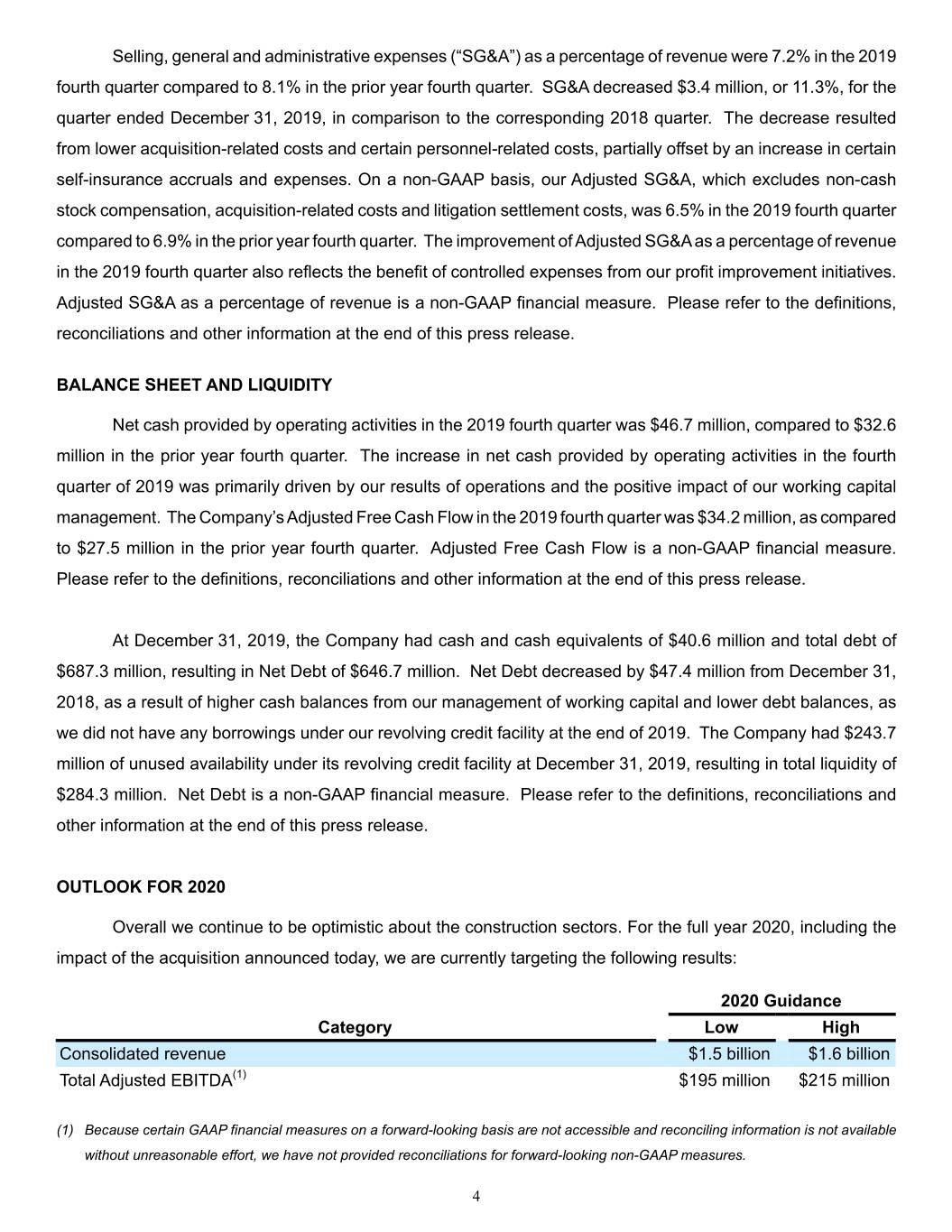

Selling, general and administrative expenses (“SG&A”) as a percentage of revenue were 7.2% in the 2019 fourth quarter compared to 8.1% in the prior year fourth quarter. SG&A decreased $3.4 million, or 11.3%, for the quarter ended December 31, 2019, in comparison to the corresponding 2018 quarter. The decrease resulted from lower acquisition-related costs and certain personnel-related costs, partially offset by an increase in certain self-insurance accruals and expenses. On a non-GAAP basis, our Adjusted SG&A, which excludes non-cash stock compensation, acquisition-related costs and litigation settlement costs, was 6.5% in the 2019 fourth quarter compared to 6.9% in the prior year fourth quarter. The improvement of Adjusted SG&A as a percentage of revenue in the 2019 fourth quarter also reflects the benefit of controlled expenses from our profit improvement initiatives. Adjusted SG&A as a percentage of revenue is a non-GAAP financial measure. Please refer to the definitions, reconciliations and other information at the end of this press release. BALANCE SHEET AND LIQUIDITY Net cash provided by operating activities in the 2019 fourth quarter was $46.7 million, compared to $32.6 million in the prior year fourth quarter. The increase in net cash provided by operating activities in the fourth quarter of 2019 was primarily driven by our results of operations and the positive impact of our working capital management. The Company’s Adjusted Free Cash Flow in the 2019 fourth quarter was $34.2 million, as compared to $27.5 million in the prior year fourth quarter. Adjusted Free Cash Flow is a non-GAAP financial measure. Please refer to the definitions, reconciliations and other information at the end of this press release. At December 31, 2019, the Company had cash and cash equivalents of $40.6 million and total debt of $687.3 million, resulting in Net Debt of $646.7 million. Net Debt decreased by $47.4 million from December 31, 2018, as a result of higher cash balances from our management of working capital and lower debt balances, as we did not have any borrowings under our revolving credit facility at the end of 2019. The Company had $243.7 million of unused availability under its revolving credit facility at December 31, 2019, resulting in total liquidity of $284.3 million. Net Debt is a non-GAAP financial measure. Please refer to the definitions, reconciliations and other information at the end of this press release. OUTLOOK FOR 2020 Overall we continue to be optimistic about the construction sectors. For the full year 2020, including the impact of the acquisition announced today, we are currently targeting the following results: 2020 Guidance Category Low High Consolidated revenue $1.5 billion $1.6 billion Total Adjusted EBITDA(1) $195 million $215 million (1) Because certain GAAP financial measures on a forward-looking basis are not accessible and reconciling information is not available without unreasonable effort, we have not provided reconciliations for forward-looking non-GAAP measures. 4

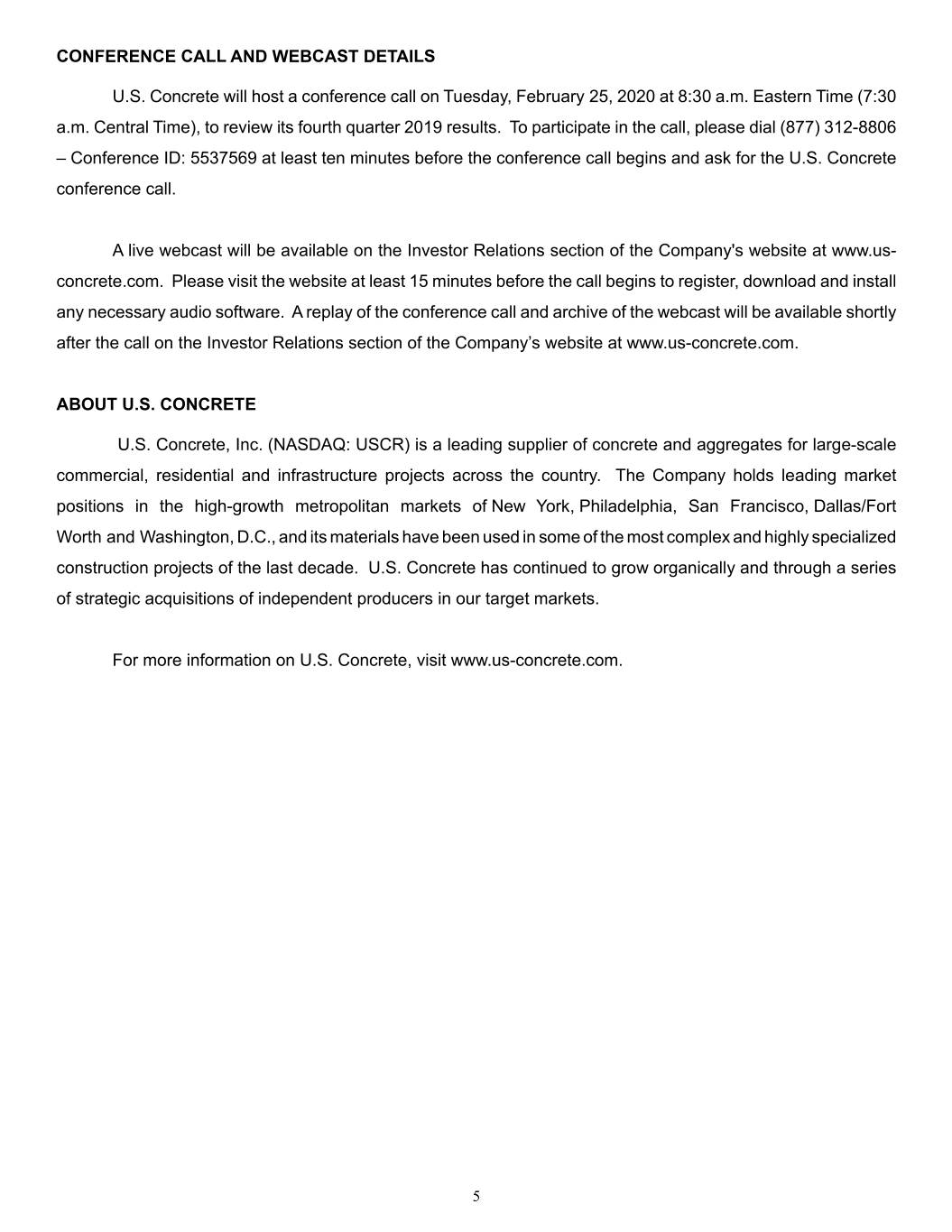

CONFERENCE CALL AND WEBCAST DETAILS U.S. Concrete will host a conference call on Tuesday, February 25, 2020 at 8:30 a.m. Eastern Time (7:30 a.m. Central Time), to review its fourth quarter 2019 results. To participate in the call, please dial (877) 312-8806 – Conference ID: 5537569 at least ten minutes before the conference call begins and ask for the U.S. Concrete conference call. A live webcast will be available on the Investor Relations section of the Company's website at www.us- concrete.com. Please visit the website at least 15 minutes before the call begins to register, download and install any necessary audio software. A replay of the conference call and archive of the webcast will be available shortly after the call on the Investor Relations section of the Company’s website at www.us-concrete.com. ABOUT U.S. CONCRETE U.S. Concrete, Inc. (NASDAQ: USCR) is a leading supplier of concrete and aggregates for large-scale commercial, residential and infrastructure projects across the country. The Company holds leading market positions in the high-growth metropolitan markets of New York, Philadelphia, San Francisco, Dallas/Fort Worth and Washington, D.C., and its materials have been used in some of the most complex and highly specialized construction projects of the last decade. U.S. Concrete has continued to grow organically and through a series of strategic acquisitions of independent producers in our target markets. For more information on U.S. Concrete, visit www.us-concrete.com. 5

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS Certain statements and information provided in this press release are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements include, without limitation, statements concerning plans, objectives, goals, projections, outlook, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “intend,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “outlook,” “predict,” “potential” or “continue,” the negative of such terms or other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial performance, our anticipated growth strategies and anticipated trends in our business. These statements are predictions based on our current expectations and projections about future events which we believe are reasonable. Actual events or results may differ materially. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We believe that these risks and uncertainties include, but are not limited to: general economic and business conditions, which will, among other things, affect demand for new residential and commercial construction; our ability to successfully identify, manage, and integrate acquisitions; the cyclical nature of, and changes in, the real estate and construction markets, including pricing changes by our competitors; governmental requirements and initiatives, including those related to mortgage lending, financing or deductions, funding for public or infrastructure construction, land usage, and environmental, health, and safety matters; disruptions, uncertainties or volatility in the credit markets that may limit our, our suppliers’ and our customers’ access to capital; our ability to successfully implement our operating strategy; weather conditions; our substantial indebtedness and the restrictions imposed on us by the terms of our indebtedness; the effects of currency fluctuations on our results of operations and financial condition; our ability to maintain favorable relationships with third parties who supply us with equipment and essential supplies; our ability to retain key personnel and maintain satisfactory labor relations; and product liability, property damage, results of litigation and other claims and insurance coverage issues. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. All written and oral forward-looking statements made in connection with this press release that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by the “Risk Factors” in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. We are under no duty to update any of the forward-looking statements after the date of this press release to conform such statements to actual results or to changes in our expectations, except as required by federal securities laws. There can be no assurance that other factors will not affect the accuracy of these forward-looking statements or that our actual results will not differ materially from the results anticipated in such forward- looking statements. Unpredictable or unknown factors we have not discussed in this press release also could have material effects on actual results or matters that are the subject of our forward-looking statements. We undertake no obligation to, and do not intend to, update our description of important factors each time a potential important factor arises. Non-GAAP Financial Measures Included in this press release are certain non-GAAP financial measures that we believe are useful for investors. These non- GAAP financial measures may not be comparable to similarly titled measures other companies report and are not intended to be used as an alternative to any measure of our performance in accordance with GAAP. Reconciliations and definitions of the non-GAAP measures used in this press release are included at the end of this press release. Because certain GAAP financial measures on a forward-looking basis are not accessible, and reconciling information is not available without unreasonable effort, we have not provided reconciliations for forward-looking non-GAAP measures. (Tables Follow) 6

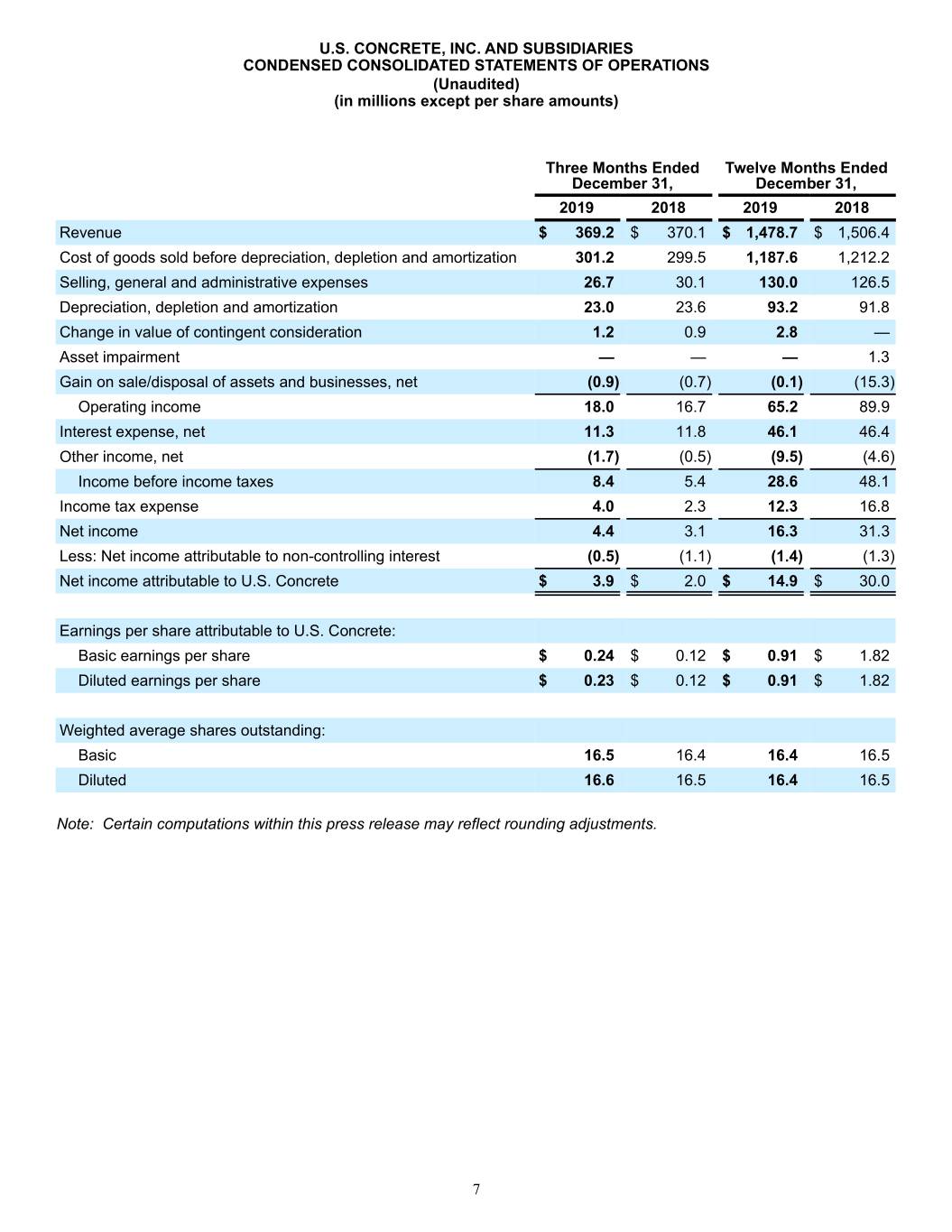

U.S. CONCRETE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) (in millions except per share amounts) Three Months Ended Twelve Months Ended December 31, December 31, 2019 2018 2019 2018 Revenue $ 369.2 $ 370.1 $ 1,478.7 $ 1,506.4 Cost of goods sold before depreciation, depletion and amortization 301.2 299.5 1,187.6 1,212.2 Selling, general and administrative expenses 26.7 30.1 130.0 126.5 Depreciation, depletion and amortization 23.0 23.6 93.2 91.8 Change in value of contingent consideration 1.2 0.9 2.8 — Asset impairment — — — 1.3 Gain on sale/disposal of assets and businesses, net (0.9) (0.7) (0.1) (15.3) Operating income 18.0 16.7 65.2 89.9 Interest expense, net 11.3 11.8 46.1 46.4 Other income, net (1.7) (0.5) (9.5) (4.6) Income before income taxes 8.4 5.4 28.6 48.1 Income tax expense 4.0 2.3 12.3 16.8 Net income 4.4 3.1 16.3 31.3 Less: Net income attributable to non-controlling interest (0.5) (1.1) (1.4) (1.3) Net income attributable to U.S. Concrete $ 3.9 $ 2.0 $ 14.9 $ 30.0 Earnings per share attributable to U.S. Concrete: Basic earnings per share $ 0.24 $ 0.12 $ 0.91 $ 1.82 Diluted earnings per share $ 0.23 $ 0.12 $ 0.91 $ 1.82 Weighted average shares outstanding: Basic 16.5 16.4 16.4 16.5 Diluted 16.6 16.5 16.4 16.5 Note: Certain computations within this press release may reflect rounding adjustments. 7

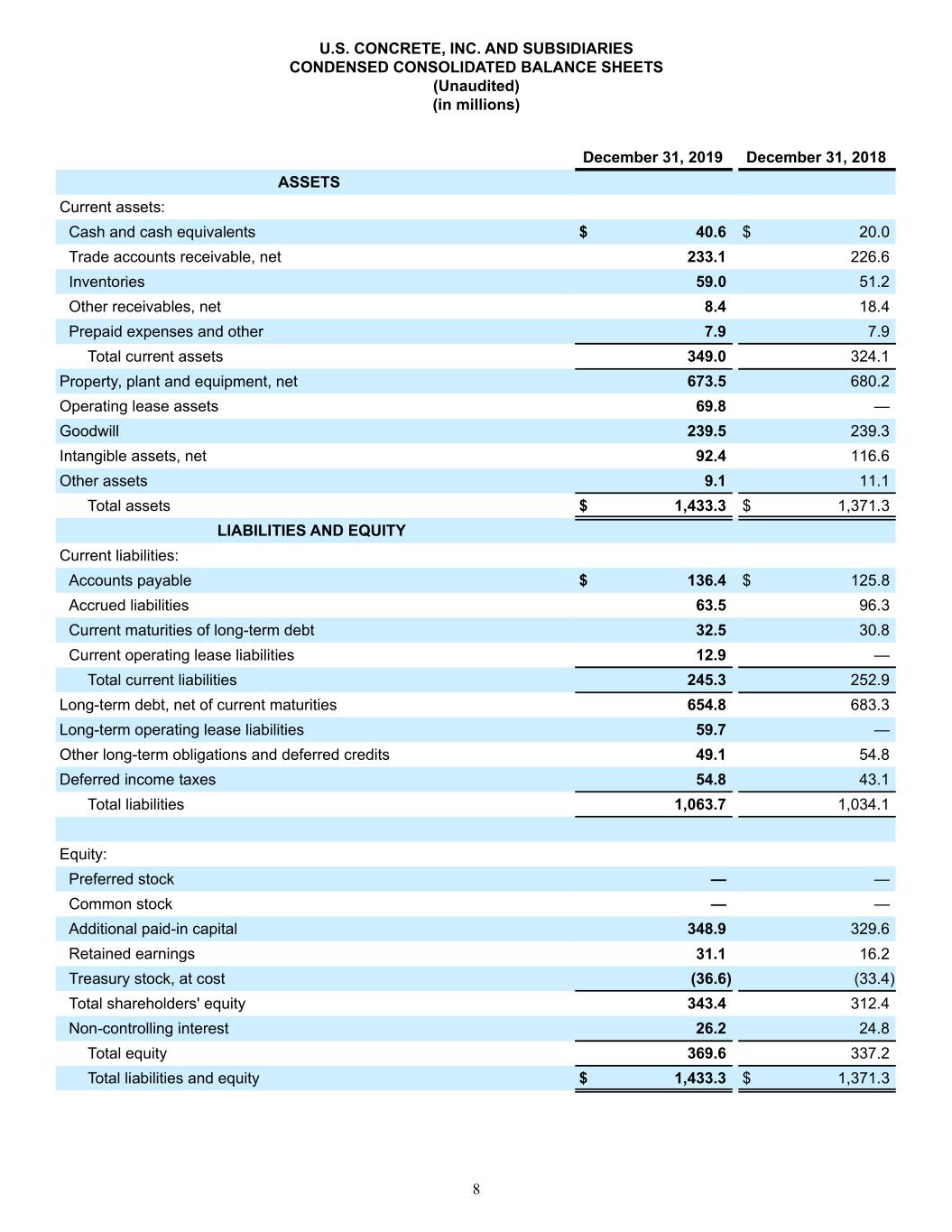

U.S. CONCRETE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (in millions) December 31, 2019 December 31, 2018 ASSETS Current assets: Cash and cash equivalents $ 40.6 $ 20.0 Trade accounts receivable, net 233.1 226.6 Inventories 59.0 51.2 Other receivables, net 8.4 18.4 Prepaid expenses and other 7.9 7.9 Total current assets 349.0 324.1 Property, plant and equipment, net 673.5 680.2 Operating lease assets 69.8 — Goodwill 239.5 239.3 Intangible assets, net 92.4 116.6 Other assets 9.1 11.1 Total assets $ 1,433.3 $ 1,371.3 LIABILITIES AND EQUITY Current liabilities: Accounts payable $ 136.4 $ 125.8 Accrued liabilities 63.5 96.3 Current maturities of long-term debt 32.5 30.8 Current operating lease liabilities 12.9 — Total current liabilities 245.3 252.9 Long-term debt, net of current maturities 654.8 683.3 Long-term operating lease liabilities 59.7 — Other long-term obligations and deferred credits 49.1 54.8 Deferred income taxes 54.8 43.1 Total liabilities 1,063.7 1,034.1 Equity: Preferred stock — — Common stock — — Additional paid-in capital 348.9 329.6 Retained earnings 31.1 16.2 Treasury stock, at cost (36.6) (33.4) Total shareholders' equity 343.4 312.4 Non-controlling interest 26.2 24.8 Total equity 369.6 337.2 Total liabilities and equity $ 1,433.3 $ 1,371.3 8

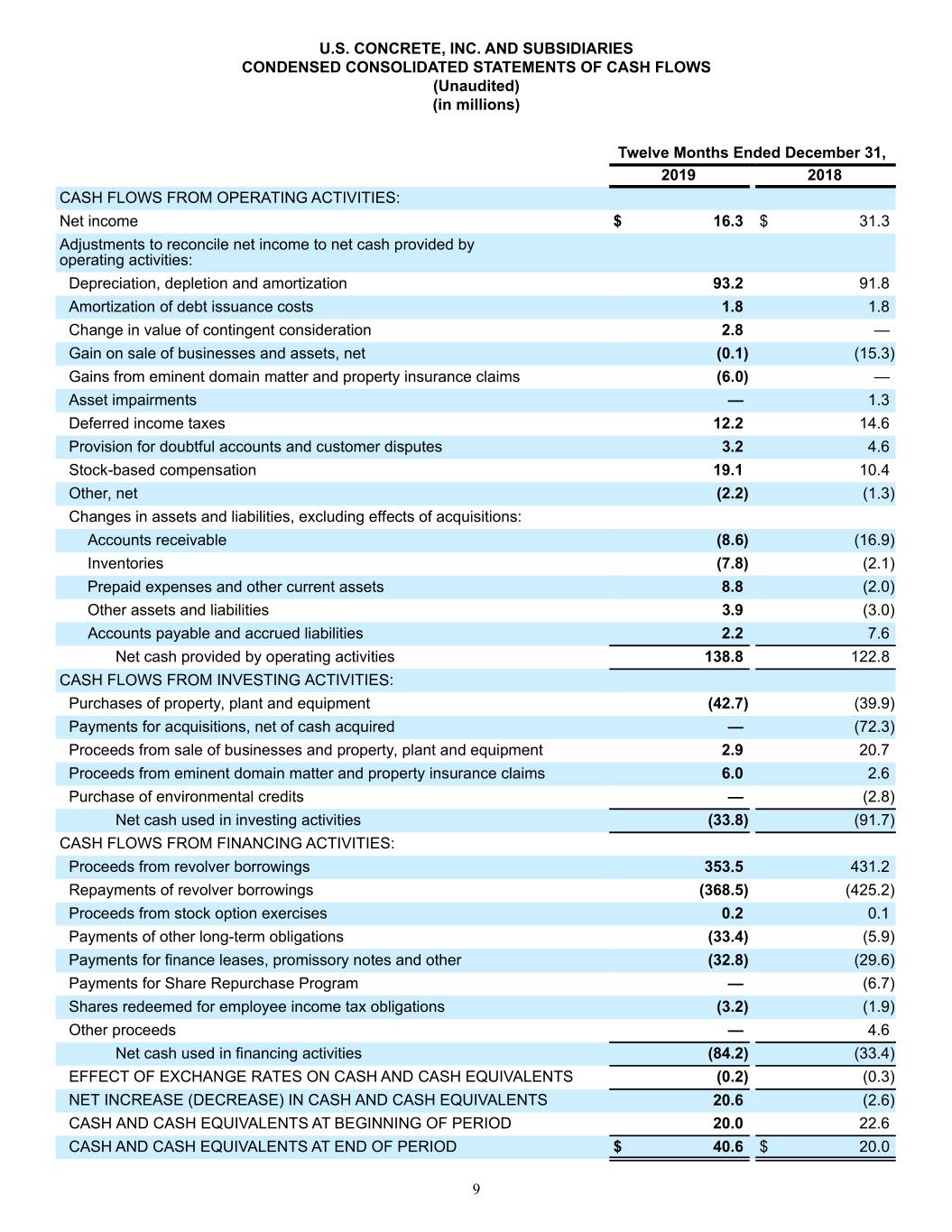

U.S. CONCRETE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (in millions) Twelve Months Ended December 31, 2019 2018 CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 16.3 $ 31.3 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, depletion and amortization 93.2 91.8 Amortization of debt issuance costs 1.8 1.8 Change in value of contingent consideration 2.8 — Gain on sale of businesses and assets, net (0.1) (15.3) Gains from eminent domain matter and property insurance claims (6.0) — Asset impairments — 1.3 Deferred income taxes 12.2 14.6 Provision for doubtful accounts and customer disputes 3.2 4.6 Stock-based compensation 19.1 10.4 Other, net (2.2) (1.3) Changes in assets and liabilities, excluding effects of acquisitions: Accounts receivable (8.6) (16.9) Inventories (7.8) (2.1) Prepaid expenses and other current assets 8.8 (2.0) Other assets and liabilities 3.9 (3.0) Accounts payable and accrued liabilities 2.2 7.6 Net cash provided by operating activities 138.8 122.8 CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of property, plant and equipment (42.7) (39.9) Payments for acquisitions, net of cash acquired — (72.3) Proceeds from sale of businesses and property, plant and equipment 2.9 20.7 Proceeds from eminent domain matter and property insurance claims 6.0 2.6 Purchase of environmental credits — (2.8) Net cash used in investing activities (33.8) (91.7) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from revolver borrowings 353.5 431.2 Repayments of revolver borrowings (368.5) (425.2) Proceeds from stock option exercises 0.2 0.1 Payments of other long-term obligations (33.4) (5.9) Payments for finance leases, promissory notes and other (32.8) (29.6) Payments for Share Repurchase Program — (6.7) Shares redeemed for employee income tax obligations (3.2) (1.9) Other proceeds — 4.6 Net cash used in financing activities (84.2) (33.4) EFFECT OF EXCHANGE RATES ON CASH AND CASH EQUIVALENTS (0.2) (0.3) NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS 20.6 (2.6) CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 20.0 22.6 CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 40.6 $ 20.0 9

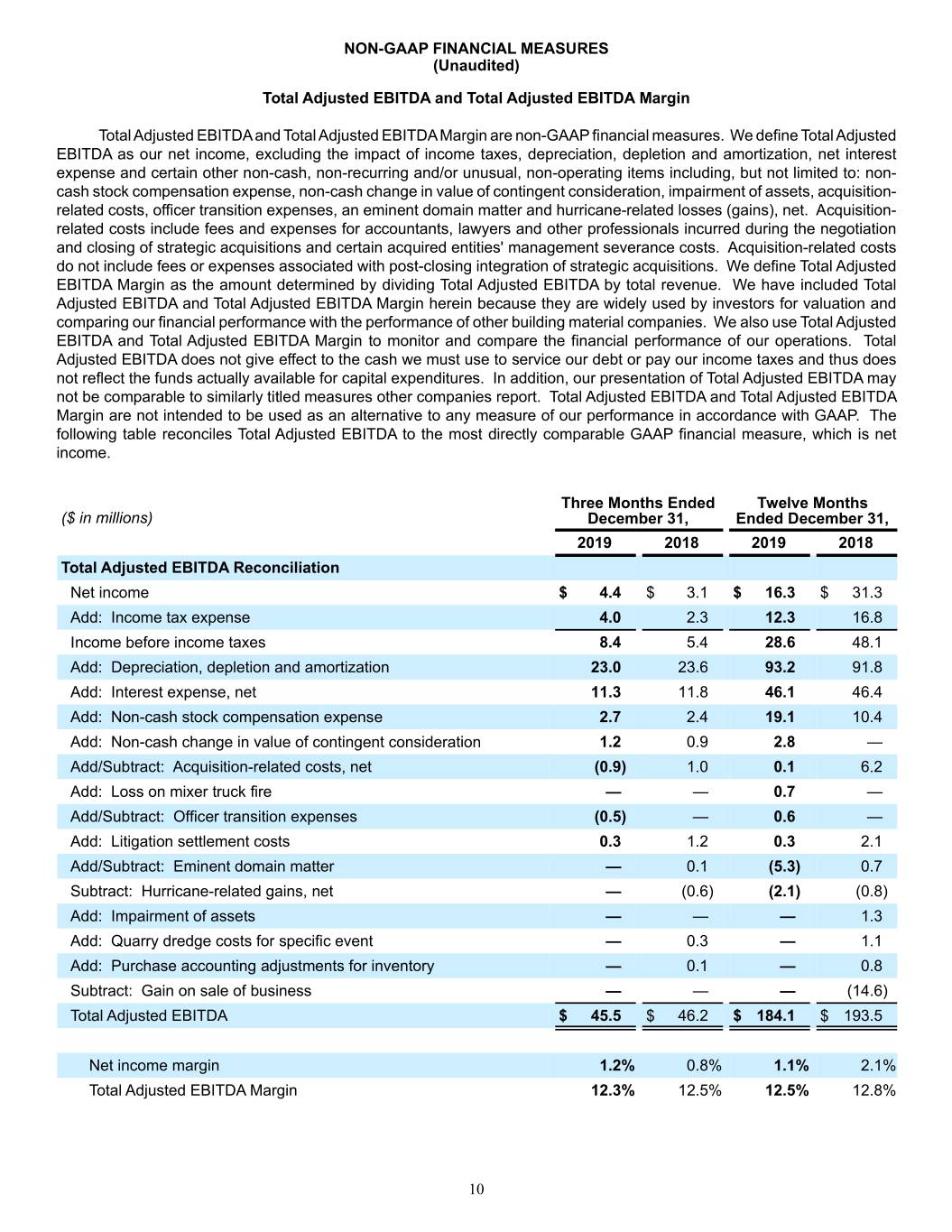

NON-GAAP FINANCIAL MEASURES (Unaudited) Total Adjusted EBITDA and Total Adjusted EBITDA Margin Total Adjusted EBITDA and Total Adjusted EBITDA Margin are non-GAAP financial measures. We define Total Adjusted EBITDA as our net income, excluding the impact of income taxes, depreciation, depletion and amortization, net interest expense and certain other non-cash, non-recurring and/or unusual, non-operating items including, but not limited to: non- cash stock compensation expense, non-cash change in value of contingent consideration, impairment of assets, acquisition- related costs, officer transition expenses, an eminent domain matter and hurricane-related losses (gains), net. Acquisition- related costs include fees and expenses for accountants, lawyers and other professionals incurred during the negotiation and closing of strategic acquisitions and certain acquired entities' management severance costs. Acquisition-related costs do not include fees or expenses associated with post-closing integration of strategic acquisitions. We define Total Adjusted EBITDA Margin as the amount determined by dividing Total Adjusted EBITDA by total revenue. We have included Total Adjusted EBITDA and Total Adjusted EBITDA Margin herein because they are widely used by investors for valuation and comparing our financial performance with the performance of other building material companies. We also use Total Adjusted EBITDA and Total Adjusted EBITDA Margin to monitor and compare the financial performance of our operations. Total Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of Total Adjusted EBITDA may not be comparable to similarly titled measures other companies report. Total Adjusted EBITDA and Total Adjusted EBITDA Margin are not intended to be used as an alternative to any measure of our performance in accordance with GAAP. The following table reconciles Total Adjusted EBITDA to the most directly comparable GAAP financial measure, which is net income. Three Months Ended Twelve Months ($ in millions) December 31, Ended December 31, 2019 2018 2019 2018 Total Adjusted EBITDA Reconciliation Net income $ 4.4 $ 3.1 $ 16.3 $ 31.3 Add: Income tax expense 4.0 2.3 12.3 16.8 Income before income taxes 8.4 5.4 28.6 48.1 Add: Depreciation, depletion and amortization 23.0 23.6 93.2 91.8 Add: Interest expense, net 11.3 11.8 46.1 46.4 Add: Non-cash stock compensation expense 2.7 2.4 19.1 10.4 Add: Non-cash change in value of contingent consideration 1.2 0.9 2.8 — Add/Subtract: Acquisition-related costs, net (0.9) 1.0 0.1 6.2 Add: Loss on mixer truck fire — — 0.7 — Add/Subtract: Officer transition expenses (0.5) — 0.6 — Add: Litigation settlement costs 0.3 1.2 0.3 2.1 Add/Subtract: Eminent domain matter — 0.1 (5.3) 0.7 Subtract: Hurricane-related gains, net — (0.6) (2.1) (0.8) Add: Impairment of assets — — — 1.3 Add: Quarry dredge costs for specific event — 0.3 — 1.1 Add: Purchase accounting adjustments for inventory — 0.1 — 0.8 Subtract: Gain on sale of business — — — (14.6) Total Adjusted EBITDA $ 45.5 $ 46.2 $ 184.1 $ 193.5 Net income margin 1.2% 0.8% 1.1% 2.1% Total Adjusted EBITDA Margin 12.3% 12.5% 12.5% 12.8% 10

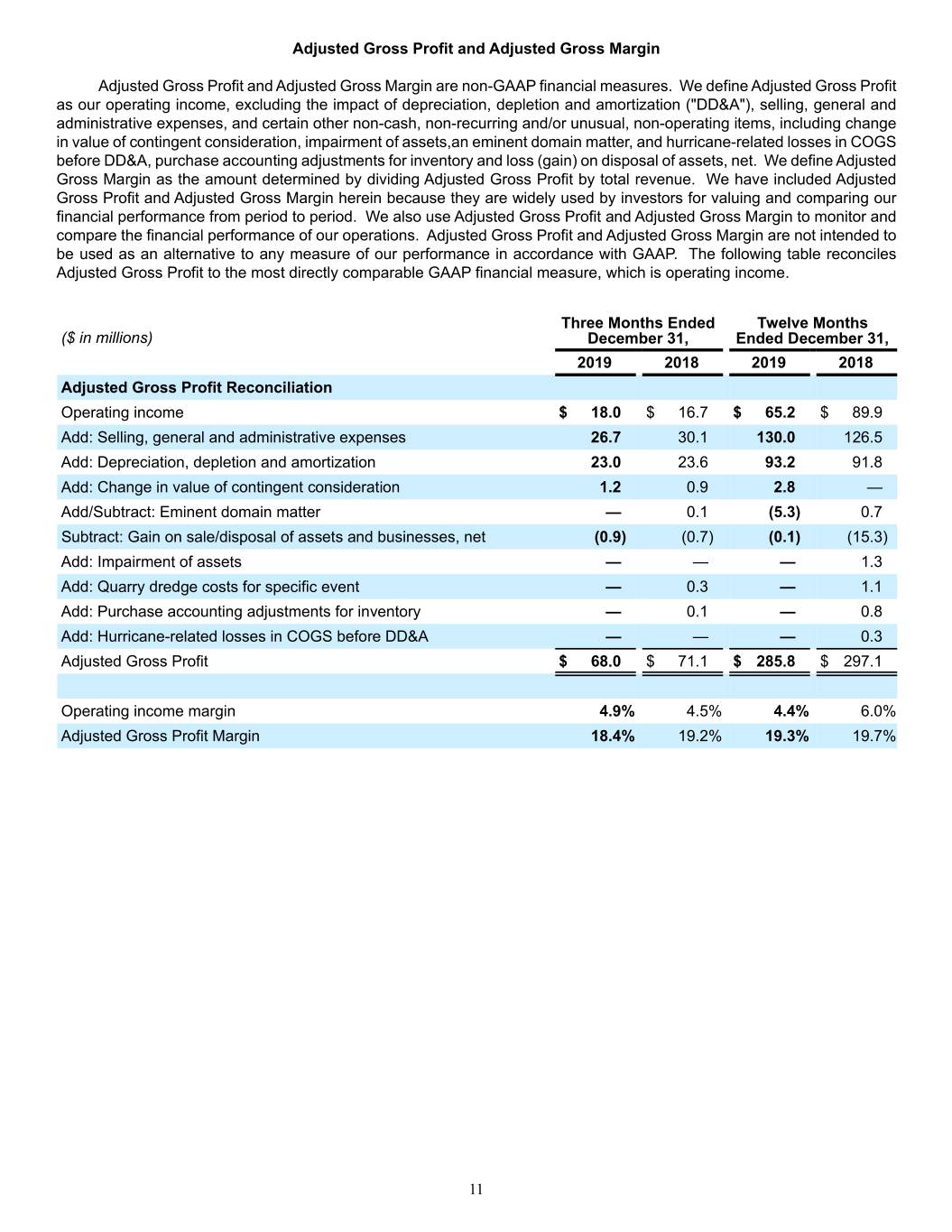

Adjusted Gross Profit and Adjusted Gross Margin Adjusted Gross Profit and Adjusted Gross Margin are non-GAAP financial measures. We define Adjusted Gross Profit as our operating income, excluding the impact of depreciation, depletion and amortization ("DD&A"), selling, general and administrative expenses, and certain other non-cash, non-recurring and/or unusual, non-operating items, including change in value of contingent consideration, impairment of assets,an eminent domain matter, and hurricane-related losses in COGS before DD&A, purchase accounting adjustments for inventory and loss (gain) on disposal of assets, net. We define Adjusted Gross Margin as the amount determined by dividing Adjusted Gross Profit by total revenue. We have included Adjusted Gross Profit and Adjusted Gross Margin herein because they are widely used by investors for valuing and comparing our financial performance from period to period. We also use Adjusted Gross Profit and Adjusted Gross Margin to monitor and compare the financial performance of our operations. Adjusted Gross Profit and Adjusted Gross Margin are not intended to be used as an alternative to any measure of our performance in accordance with GAAP. The following table reconciles Adjusted Gross Profit to the most directly comparable GAAP financial measure, which is operating income. Three Months Ended Twelve Months ($ in millions) December 31, Ended December 31, 2019 2018 2019 2018 Adjusted Gross Profit Reconciliation Operating income $ 18.0 $ 16.7 $ 65.2 $ 89.9 Add: Selling, general and administrative expenses 26.7 30.1 130.0 126.5 Add: Depreciation, depletion and amortization 23.0 23.6 93.2 91.8 Add: Change in value of contingent consideration 1.2 0.9 2.8 — Add/Subtract: Eminent domain matter — 0.1 (5.3) 0.7 Subtract: Gain on sale/disposal of assets and businesses, net (0.9) (0.7) (0.1) (15.3) Add: Impairment of assets — — — 1.3 Add: Quarry dredge costs for specific event — 0.3 — 1.1 Add: Purchase accounting adjustments for inventory — 0.1 — 0.8 Add: Hurricane-related losses in COGS before DD&A — — — 0.3 Adjusted Gross Profit $ 68.0 $ 71.1 $ 285.8 $ 297.1 Operating income margin 4.9% 4.5% 4.4% 6.0% Adjusted Gross Profit Margin 18.4% 19.2% 19.3% 19.7% 11

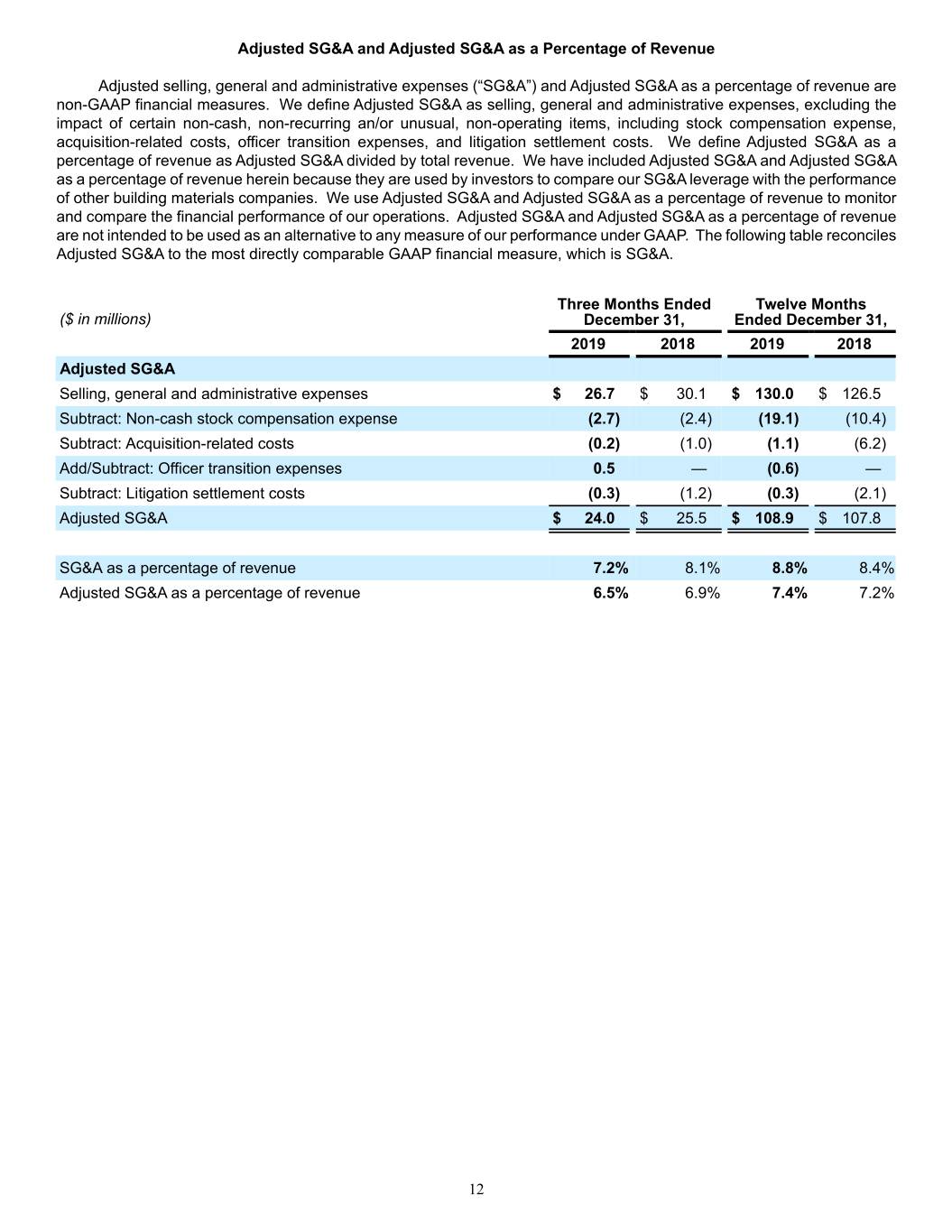

Adjusted SG&A and Adjusted SG&A as a Percentage of Revenue Adjusted selling, general and administrative expenses (“SG&A”) and Adjusted SG&A as a percentage of revenue are non-GAAP financial measures. We define Adjusted SG&A as selling, general and administrative expenses, excluding the impact of certain non-cash, non-recurring an/or unusual, non-operating items, including stock compensation expense, acquisition-related costs, officer transition expenses, and litigation settlement costs. We define Adjusted SG&A as a percentage of revenue as Adjusted SG&A divided by total revenue. We have included Adjusted SG&A and Adjusted SG&A as a percentage of revenue herein because they are used by investors to compare our SG&A leverage with the performance of other building materials companies. We use Adjusted SG&A and Adjusted SG&A as a percentage of revenue to monitor and compare the financial performance of our operations. Adjusted SG&A and Adjusted SG&A as a percentage of revenue are not intended to be used as an alternative to any measure of our performance under GAAP. The following table reconciles Adjusted SG&A to the most directly comparable GAAP financial measure, which is SG&A. Three Months Ended Twelve Months ($ in millions) December 31, Ended December 31, 2019 2018 2019 2018 Adjusted SG&A Selling, general and administrative expenses $ 26.7 $ 30.1 $ 130.0 $ 126.5 Subtract: Non-cash stock compensation expense (2.7) (2.4) (19.1) (10.4) Subtract: Acquisition-related costs (0.2) (1.0) (1.1) (6.2) Add/Subtract: Officer transition expenses 0.5 — (0.6) — Subtract: Litigation settlement costs (0.3) (1.2) (0.3) (2.1) Adjusted SG&A $ 24.0 $ 25.5 $ 108.9 $ 107.8 SG&A as a percentage of revenue 7.2% 8.1% 8.8% 8.4% Adjusted SG&A as a percentage of revenue 6.5% 6.9% 7.4% 7.2% 12

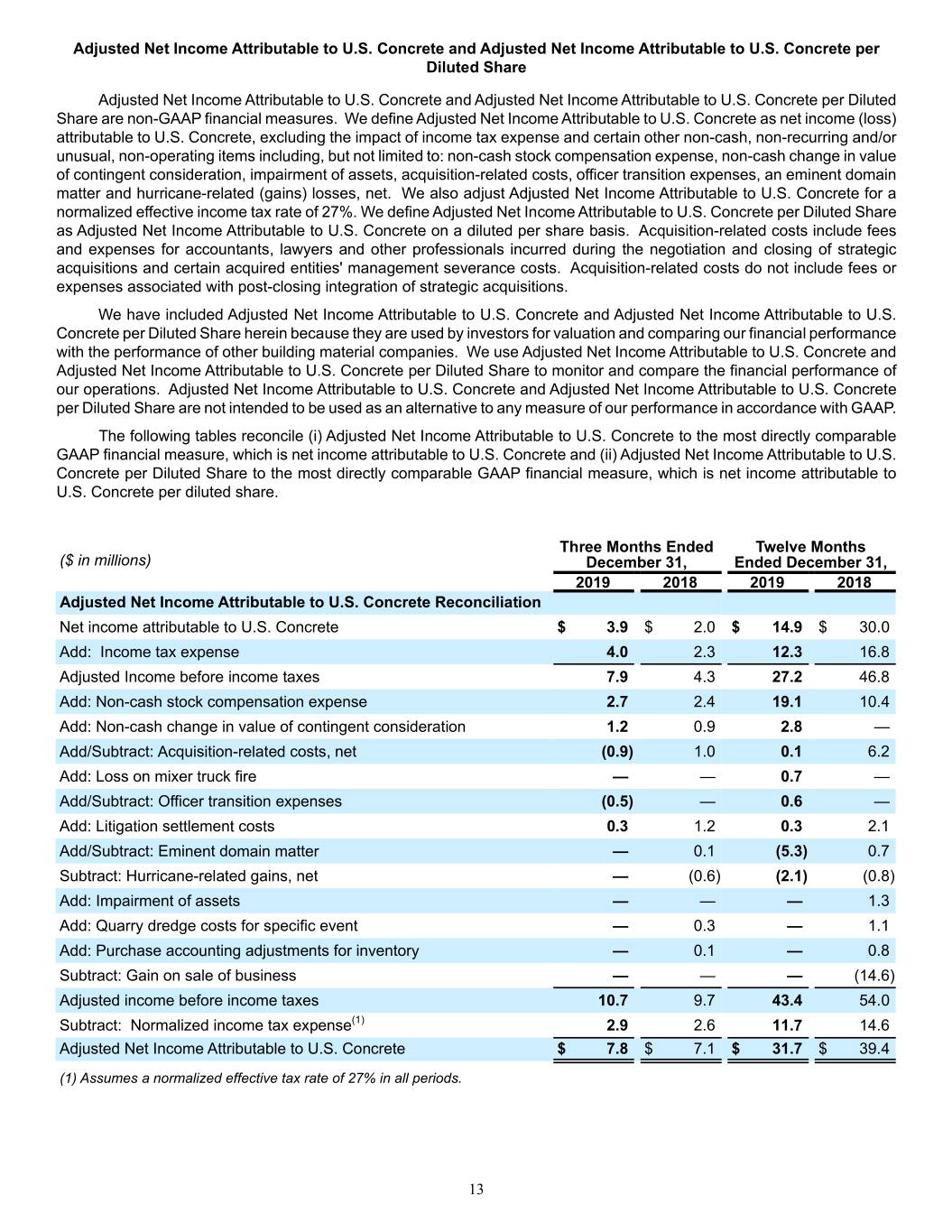

Adjusted Net Income Attributable to U.S. Concrete and Adjusted Net Income Attributable to U.S. Concrete per Diluted Share Adjusted Net Income Attributable to U.S. Concrete and Adjusted Net Income Attributable to U.S. Concrete per Diluted Share are non-GAAP financial measures. We define Adjusted Net Income Attributable to U.S. Concrete as net income (loss) attributable to U.S. Concrete, excluding the impact of income tax expense and certain other non-cash, non-recurring and/or unusual, non-operating items including, but not limited to: non-cash stock compensation expense, non-cash change in value of contingent consideration, impairment of assets, acquisition-related costs, officer transition expenses, an eminent domain matter and hurricane-related (gains) losses, net. We also adjust Adjusted Net Income Attributable to U.S. Concrete for a normalized effective income tax rate of 27%. We define Adjusted Net Income Attributable to U.S. Concrete per Diluted Share as Adjusted Net Income Attributable to U.S. Concrete on a diluted per share basis. Acquisition-related costs include fees and expenses for accountants, lawyers and other professionals incurred during the negotiation and closing of strategic acquisitions and certain acquired entities' management severance costs. Acquisition-related costs do not include fees or expenses associated with post-closing integration of strategic acquisitions. We have included Adjusted Net Income Attributable to U.S. Concrete and Adjusted Net Income Attributable to U.S. Concrete per Diluted Share herein because they are used by investors for valuation and comparing our financial performance with the performance of other building material companies. We use Adjusted Net Income Attributable to U.S. Concrete and Adjusted Net Income Attributable to U.S. Concrete per Diluted Share to monitor and compare the financial performance of our operations. Adjusted Net Income Attributable to U.S. Concrete and Adjusted Net Income Attributable to U.S. Concrete per Diluted Share are not intended to be used as an alternative to any measure of our performance in accordance with GAAP. The following tables reconcile (i) Adjusted Net Income Attributable to U.S. Concrete to the most directly comparable GAAP financial measure, which is net income attributable to U.S. Concrete and (ii) Adjusted Net Income Attributable to U.S. Concrete per Diluted Share to the most directly comparable GAAP financial measure, which is net income attributable to U.S. Concrete per diluted share. Three Months Ended Twelve Months ($ in millions) December 31, Ended December 31, 2019 2018 2019 2018 Adjusted Net Income Attributable to U.S. Concrete Reconciliation Net income attributable to U.S. Concrete $ 3.9 $ 2.0 $ 14.9 $ 30.0 Add: Income tax expense 4.0 2.3 12.3 16.8 Adjusted Income before income taxes 7.9 4.3 27.2 46.8 Add: Non-cash stock compensation expense 2.7 2.4 19.1 10.4 Add: Non-cash change in value of contingent consideration 1.2 0.9 2.8 — Add/Subtract: Acquisition-related costs, net (0.9) 1.0 0.1 6.2 Add: Loss on mixer truck fire — — 0.7 — Add/Subtract: Officer transition expenses (0.5) — 0.6 — Add: Litigation settlement costs 0.3 1.2 0.3 2.1 Add/Subtract: Eminent domain matter — 0.1 (5.3) 0.7 Subtract: Hurricane-related gains, net — (0.6) (2.1) (0.8) Add: Impairment of assets — — — 1.3 Add: Quarry dredge costs for specific event — 0.3 — 1.1 Add: Purchase accounting adjustments for inventory — 0.1 — 0.8 Subtract: Gain on sale of business — — — (14.6) Adjusted income before income taxes 10.7 9.7 43.4 54.0 Subtract: Normalized income tax expense(1) 2.9 2.6 11.7 14.6 Adjusted Net Income Attributable to U.S. Concrete $ 7.8 $ 7.1 $ 31.7 $ 39.4 (1) Assumes a normalized effective tax rate of 27% in all periods. 13

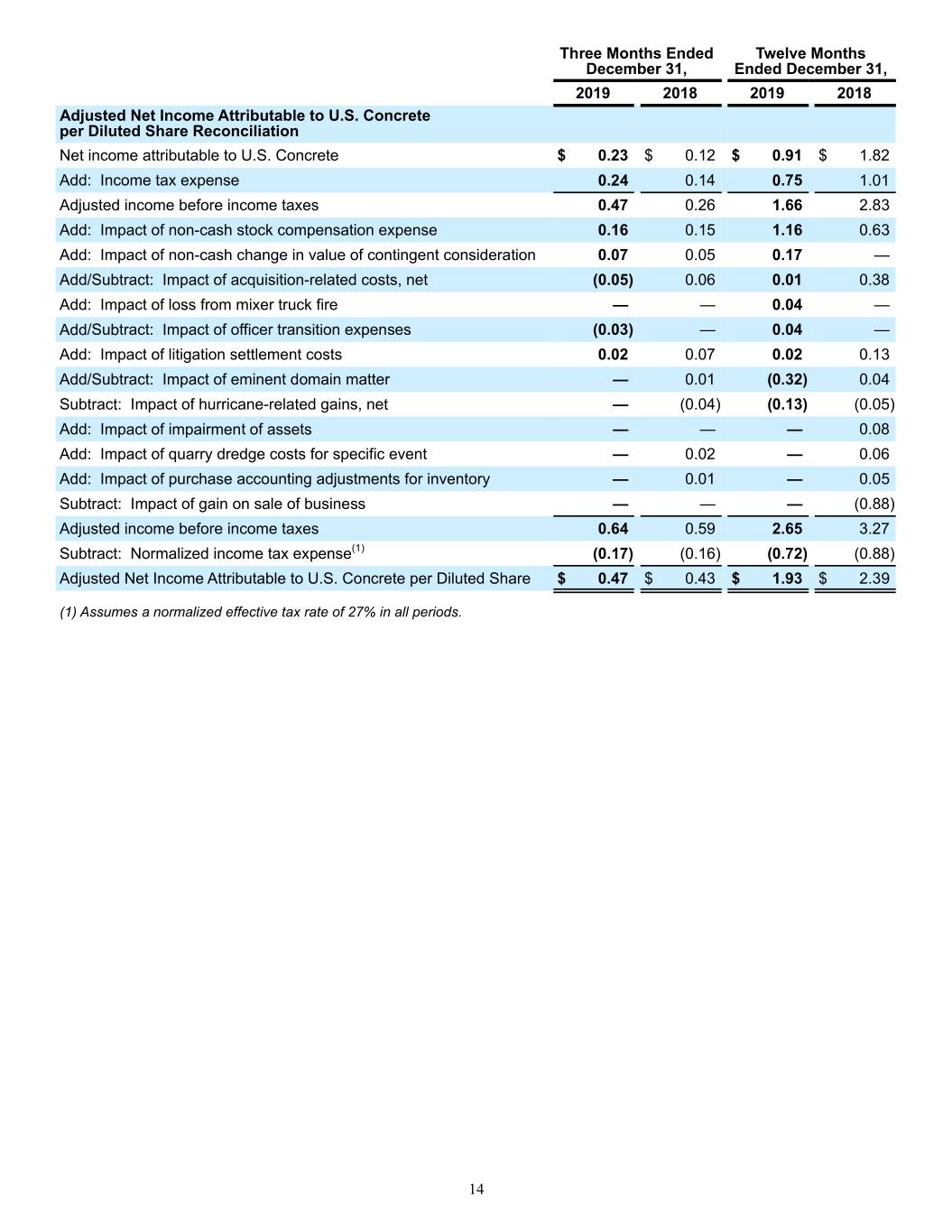

Three Months Ended Twelve Months December 31, Ended December 31, 2019 2018 2019 2018 Adjusted Net Income Attributable to U.S. Concrete per Diluted Share Reconciliation Net income attributable to U.S. Concrete $ 0.23 $ 0.12 $ 0.91 $ 1.82 Add: Income tax expense 0.24 0.14 0.75 1.01 Adjusted income before income taxes 0.47 0.26 1.66 2.83 Add: Impact of non-cash stock compensation expense 0.16 0.15 1.16 0.63 Add: Impact of non-cash change in value of contingent consideration 0.07 0.05 0.17 — Add/Subtract: Impact of acquisition-related costs, net (0.05) 0.06 0.01 0.38 Add: Impact of loss from mixer truck fire — — 0.04 — Add/Subtract: Impact of officer transition expenses (0.03) — 0.04 — Add: Impact of litigation settlement costs 0.02 0.07 0.02 0.13 Add/Subtract: Impact of eminent domain matter — 0.01 (0.32) 0.04 Subtract: Impact of hurricane-related gains, net — (0.04) (0.13) (0.05) Add: Impact of impairment of assets — — — 0.08 Add: Impact of quarry dredge costs for specific event — 0.02 — 0.06 Add: Impact of purchase accounting adjustments for inventory — 0.01 — 0.05 Subtract: Impact of gain on sale of business — — — (0.88) Adjusted income before income taxes 0.64 0.59 2.65 3.27 Subtract: Normalized income tax expense(1) (0.17) (0.16) (0.72) (0.88) Adjusted Net Income Attributable to U.S. Concrete per Diluted Share $ 0.47 $ 0.43 $ 1.93 $ 2.39 (1) Assumes a normalized effective tax rate of 27% in all periods. 14

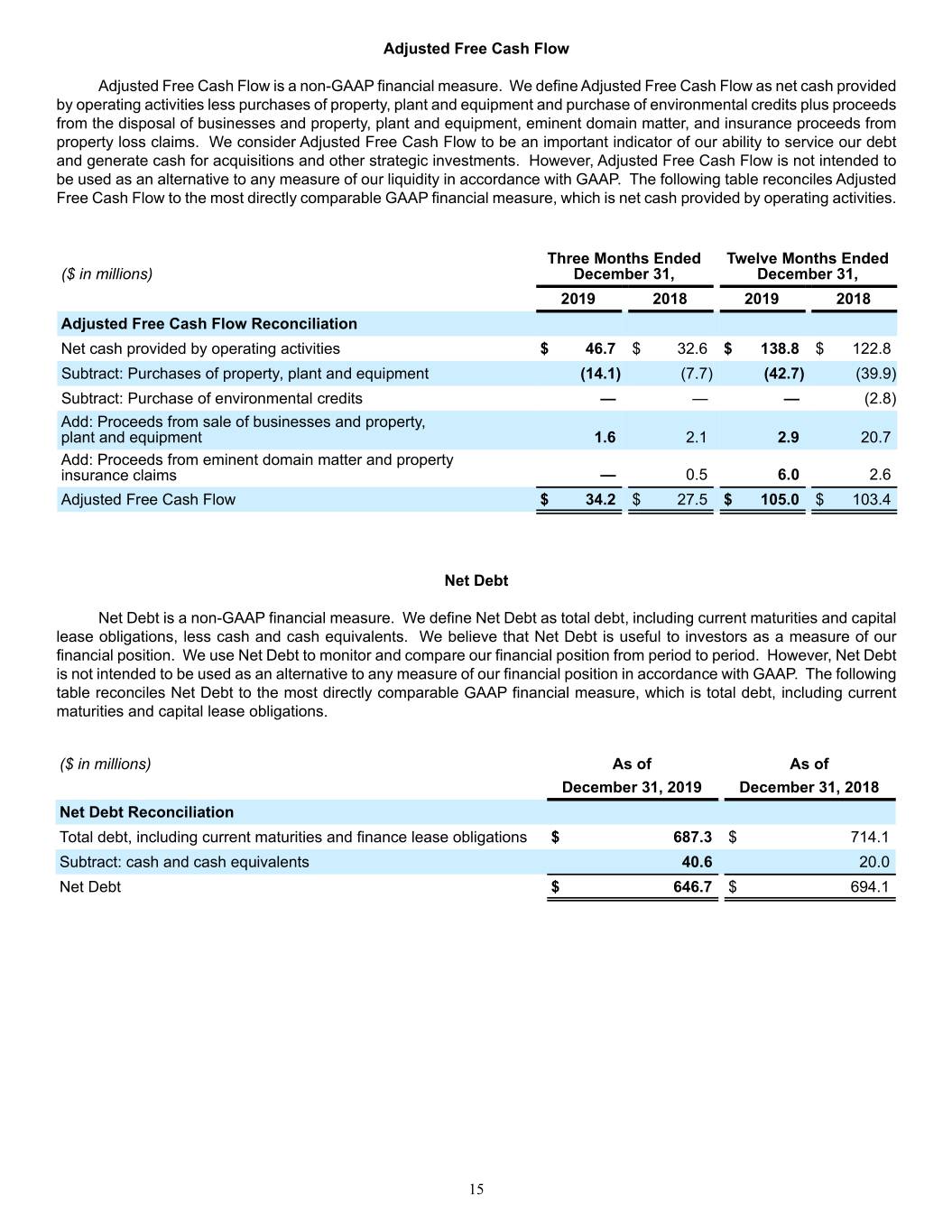

Adjusted Free Cash Flow Adjusted Free Cash Flow is a non-GAAP financial measure. We define Adjusted Free Cash Flow as net cash provided by operating activities less purchases of property, plant and equipment and purchase of environmental credits plus proceeds from the disposal of businesses and property, plant and equipment, eminent domain matter, and insurance proceeds from property loss claims. We consider Adjusted Free Cash Flow to be an important indicator of our ability to service our debt and generate cash for acquisitions and other strategic investments. However, Adjusted Free Cash Flow is not intended to be used as an alternative to any measure of our liquidity in accordance with GAAP. The following table reconciles Adjusted Free Cash Flow to the most directly comparable GAAP financial measure, which is net cash provided by operating activities. Three Months Ended Twelve Months Ended ($ in millions) December 31, December 31, 2019 2018 2019 2018 Adjusted Free Cash Flow Reconciliation Net cash provided by operating activities $ 46.7 $ 32.6 $ 138.8 $ 122.8 Subtract: Purchases of property, plant and equipment (14.1) (7.7) (42.7) (39.9) Subtract: Purchase of environmental credits — — — (2.8) Add: Proceeds from sale of businesses and property, plant and equipment 1.6 2.1 2.9 20.7 Add: Proceeds from eminent domain matter and property insurance claims — 0.5 6.0 2.6 Adjusted Free Cash Flow $ 34.2 $ 27.5 $ 105.0 $ 103.4 Net Debt Net Debt is a non-GAAP financial measure. We define Net Debt as total debt, including current maturities and capital lease obligations, less cash and cash equivalents. We believe that Net Debt is useful to investors as a measure of our financial position. We use Net Debt to monitor and compare our financial position from period to period. However, Net Debt is not intended to be used as an alternative to any measure of our financial position in accordance with GAAP. The following table reconciles Net Debt to the most directly comparable GAAP financial measure, which is total debt, including current maturities and capital lease obligations. ($ in millions) As of As of December 31, 2019 December 31, 2018 Net Debt Reconciliation Total debt, including current maturities and finance lease obligations $ 687.3 $ 714.1 Subtract: cash and cash equivalents 40.6 20.0 Net Debt $ 646.7 $ 694.1 15

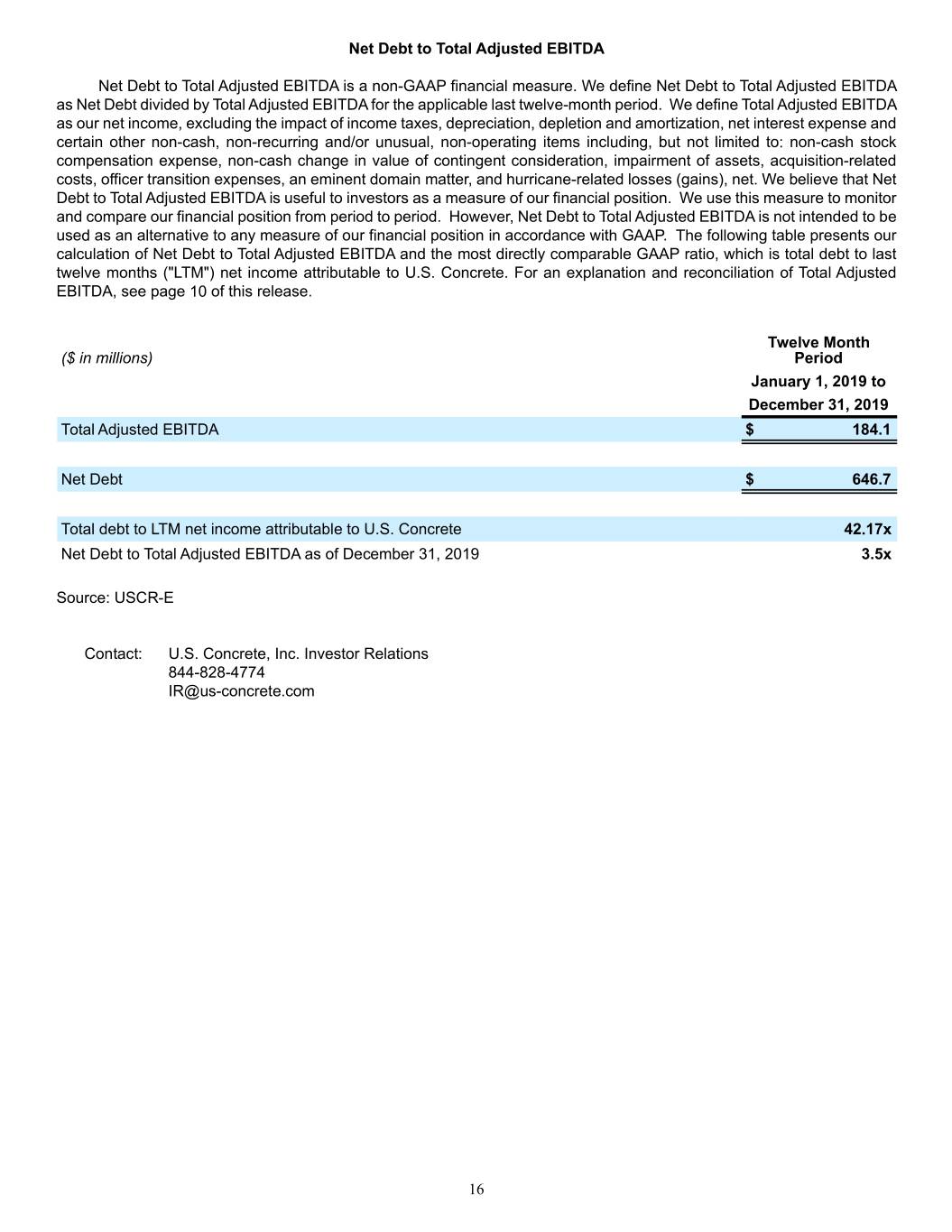

Net Debt to Total Adjusted EBITDA Net Debt to Total Adjusted EBITDA is a non-GAAP financial measure. We define Net Debt to Total Adjusted EBITDA as Net Debt divided by Total Adjusted EBITDA for the applicable last twelve-month period. We define Total Adjusted EBITDA as our net income, excluding the impact of income taxes, depreciation, depletion and amortization, net interest expense and certain other non-cash, non-recurring and/or unusual, non-operating items including, but not limited to: non-cash stock compensation expense, non-cash change in value of contingent consideration, impairment of assets, acquisition-related costs, officer transition expenses, an eminent domain matter, and hurricane-related losses (gains), net. We believe that Net Debt to Total Adjusted EBITDA is useful to investors as a measure of our financial position. We use this measure to monitor and compare our financial position from period to period. However, Net Debt to Total Adjusted EBITDA is not intended to be used as an alternative to any measure of our financial position in accordance with GAAP. The following table presents our calculation of Net Debt to Total Adjusted EBITDA and the most directly comparable GAAP ratio, which is total debt to last twelve months ("LTM") net income attributable to U.S. Concrete. For an explanation and reconciliation of Total Adjusted EBITDA, see page 10 of this release. Twelve Month ($ in millions) Period January 1, 2019 to December 31, 2019 Total Adjusted EBITDA $ 184.1 Net Debt $ 646.7 Total debt to LTM net income attributable to U.S. Concrete 42.17x Net Debt to Total Adjusted EBITDA as of December 31, 2019 3.5x Source: USCR-E Contact: U.S. Concrete, Inc. Investor Relations 844-828-4774 IR@us-concrete.com 16