Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CareTrust REIT, Inc. | exhibit991-ctreq42019e.htm |

| 8-K - 8-K - CareTrust REIT, Inc. | ctre201912318-kearning.htm |

EXHIBITEXHIBITEXHIBITEXHIBITEXHIBIT 99.2 99.2 99.299.2 99.2 Avantara Crown Point (Parker, CO) Downey Care Center (Downey, CA)

Disclaimers This supplement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical statements of fact and statements regarding our intent, belief or expectations, including, but not limited to, statements regarding future financial and financing positions, business and acquisition strategies, growth prospects, operating and financial performance, expectations regarding the making of distributions, payment of dividends, compliance with and changes in governmental regulations, and the performance of our operators and their respective facilities. Words such as “anticipate,” “believe,” “could,” "expect,” “estimate,” “intend,” “may,” “plan,” “seek,” “should,” “will,” “would,” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements, though not all forward-looking statements contain these identifying words. Our forward-looking statements are based on our current expectations and beliefs, and are subject to a number of risks and uncertainties that could lead to actual results differing materially from those projected, forecasted or expected. Although we believe that the assumptions underlying these forward-looking statements are reasonable, they are not guarantees and we can give no assurance that our expectations will be attained. Factors which could have a material adverse effect on our operations and future prospects or which could cause actual results to differ materially from expectations include, but are not limited to: (i) the ability and willingness of our tenants to meet and/or perform their obligations under the triple-net leases we have entered into with them, including, without limitation, their respective obligations to indemnify, defend and hold us harmless from and against various claims, litigation and liabilities; (ii) the ability of our tenants to comply with applicable laws, rules and regulations in the operation of the properties we lease to them; (iii) the ability and willingness of our tenants to renew their leases with us upon their expiration, and the ability to reposition our properties on the same or better terms in the event of nonrenewal or in the event we replace an existing tenant, as well as any obligations, including indemnification obligations, we may incur in connection with the replacement of an existing tenant; (iv) the availability of and the ability to identify (a) tenants who meet our credit and operating standards, and (b) suitable acquisition opportunities, and the ability to acquire and lease the respective properties to such tenants on favorable terms; (v) the ability to generate sufficient cash flows to service our outstanding indebtedness; (vi) access to debt and equity capital markets; (vii) fluctuating interest rates; (viii) the ability to retain our key management personnel; (ix) the ability to maintain our status as a real estate investment trust (“REIT”); (x) changes in the U.S. tax law and other state, federal or local laws, whether or not specific to REITs; (xi) other risks inherent in the real estate business, including potential liability relating to environmental matters and illiquidity of real estate investments; and (xii) any additional factors included in our Annual Report on Form 10-K for the year ended December 31, 2019, including in the section entitled “Risk Factors” in Item 1A of Part I of such report, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the Securities and Exchange Commission (the “SEC”). This supplement contains certain non-GAAP financial information relating to CareTrust REIT including EBITDA, Normalized EBITDA, FFO, Normalized FFO, FAD, Normalized FAD, and certain related ratios. Explanatory footnotes and a glossary explaining this non-GAAP information are included in this supplement. Reconciliations of these non-GAAP measures are also included in this supplement. Other financial information, including GAAP financial information, is also available on our website. Non-GAAP financial information does not represent financial performance under GAAP and should not be considered in isolation, as a measure of liquidity, as an alternative to net income, or as an indicator of any other performance measure determined in accordance with GAAP. You should not rely on non-GAAP financial information as a substitute for GAAP financial information, and should recognize that non-GAAP information presented herein may not compare to similarly-termed non-GAAP information of other companies (i.e., because they do not use the same definitions for determining any such non-GAAP information). This supplement also includes certain information regarding operators of our properties (such as EBITDARM Coverage, EBITDAR Coverage, and Occupancy), most of which are not subject to audit or SEC reporting requirements. The operator information provided in this supplement has been provided by the operators. We have not independently verified this information, but have no reason to believe that such information is inaccurate in any material respect. We are providing this information for informational purposes only. The Ensign Group, Inc. ("Ensign") and Pennant Group, Inc. ("Pennant") are subject to the registration and reporting requirements of the SEC and are required to file with the SEC annual reports containing audited financial information and quarterly reports containing unaudited financial information. Ensign’s and Pennant's financial statements, as filed with the SEC, can be found at the SEC's website at www.sec.gov. This supplement provides information about our financial results as of and for the quarter and the year ended December 31, 2019 and is provided as of the date hereof, unless specifically stated otherwise.2 We expressly disclaim any obligation to update or revise any information in this supplement (including forward-looking statements), whether to reflect any change in our expectations, any change in events, conditions or circumstances, or otherwise. As used in this supplement, unless the context requires otherwise, references to “CTRE,” “CareTrust,” “CareTrust REIT” or the “Company” refer to CareTrust REIT, Inc. and its consolidated subsidiaries. GAAP refers to generally accepted accounting principles in the United States of America. 2

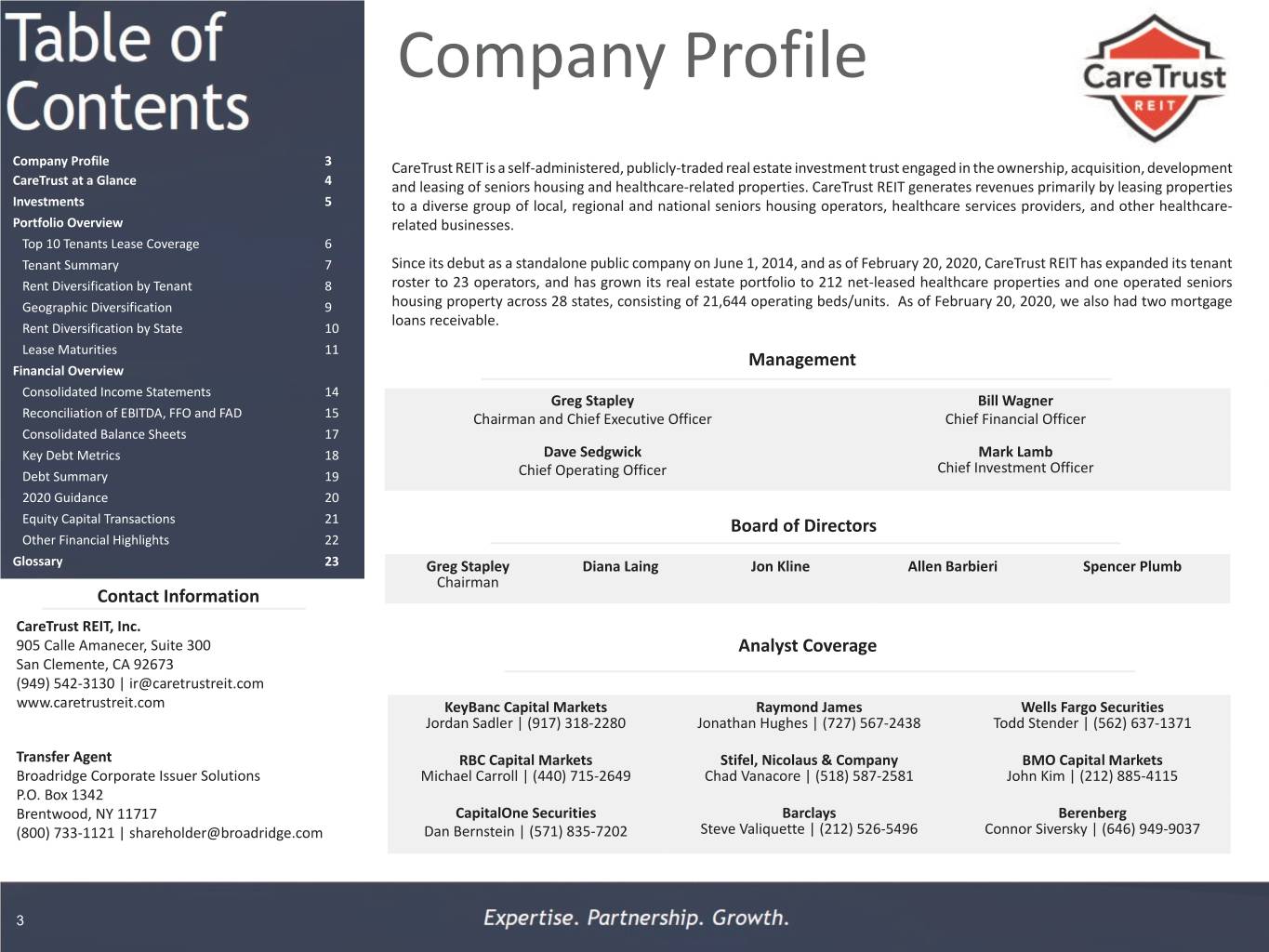

Company Profile Company Profile 3 CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development CareTrust at a Glance 4 and leasing of seniors housing and healthcare-related properties. CareTrust REIT generates revenues primarily by leasing properties Investments 5 to a diverse group of local, regional and national seniors housing operators, healthcare services providers, and other healthcare- Portfolio Overview related businesses. Top 10 Tenants Lease Coverage 6 Tenant Summary 7 Since its debut as a standalone public company on June 1, 2014, and as of February 20, 2020, CareTrust REIT has expanded its tenant Rent Diversification by Tenant 8 roster to 23 operators, and has grown its real estate portfolio to 212 net-leased healthcare properties and one operated seniors Geographic Diversification 9 housing property across 28 states, consisting of 21,644 operating beds/units. As of February 20, 2020, we also had two mortgage loans receivable. Rent Diversification by State 10 Lease Maturities 11 Management Financial Overview Consolidated Income Statements 14 Greg Stapley Bill Wagner Reconciliation of EBITDA, FFO and FAD 15 Chairman and Chief Executive Officer Chief Financial Officer Consolidated Balance Sheets 17 Key Debt Metrics 18 Dave Sedgwick Mark Lamb Chief Investment Officer Debt Summary 19 Chief Operating Officer 2020 Guidance 20 Equity Capital Transactions 21 Board of Directors Other Financial Highlights 22 Glossary 23 Greg Stapley Diana Laing Jon Kline Allen Barbieri Spencer Plumb Chairman Contact Information CareTrust REIT, Inc. 905 Calle Amanecer, Suite 300 Analyst Coverage San Clemente, CA 92673 (949) 542-3130 | ir@caretrustreit.com www.caretrustreit.com KeyBanc Capital Markets Raymond James Wells Fargo Securities Jordan Sadler | (917) 318-2280 Jonathan Hughes | (727) 567-2438 Todd Stender | (562) 637-1371 Transfer Agent RBC Capital Markets Stifel, Nicolaus & Company BMO Capital Markets Broadridge Corporate Issuer Solutions Michael Carroll | (440) 715-2649 Chad Vanacore | (518) 587-2581 John Kim | (212) 885-4115 P.O. Box 1342 Brentwood, NY 11717 CapitalOne Securities Barclays Berenberg (800) 733-1121 | shareholder@broadridge.com Dan Bernstein | (571) 835-7202 Steve Valiquette | (212) 526-5496 Connor Siversky | (646) 949-9037 3

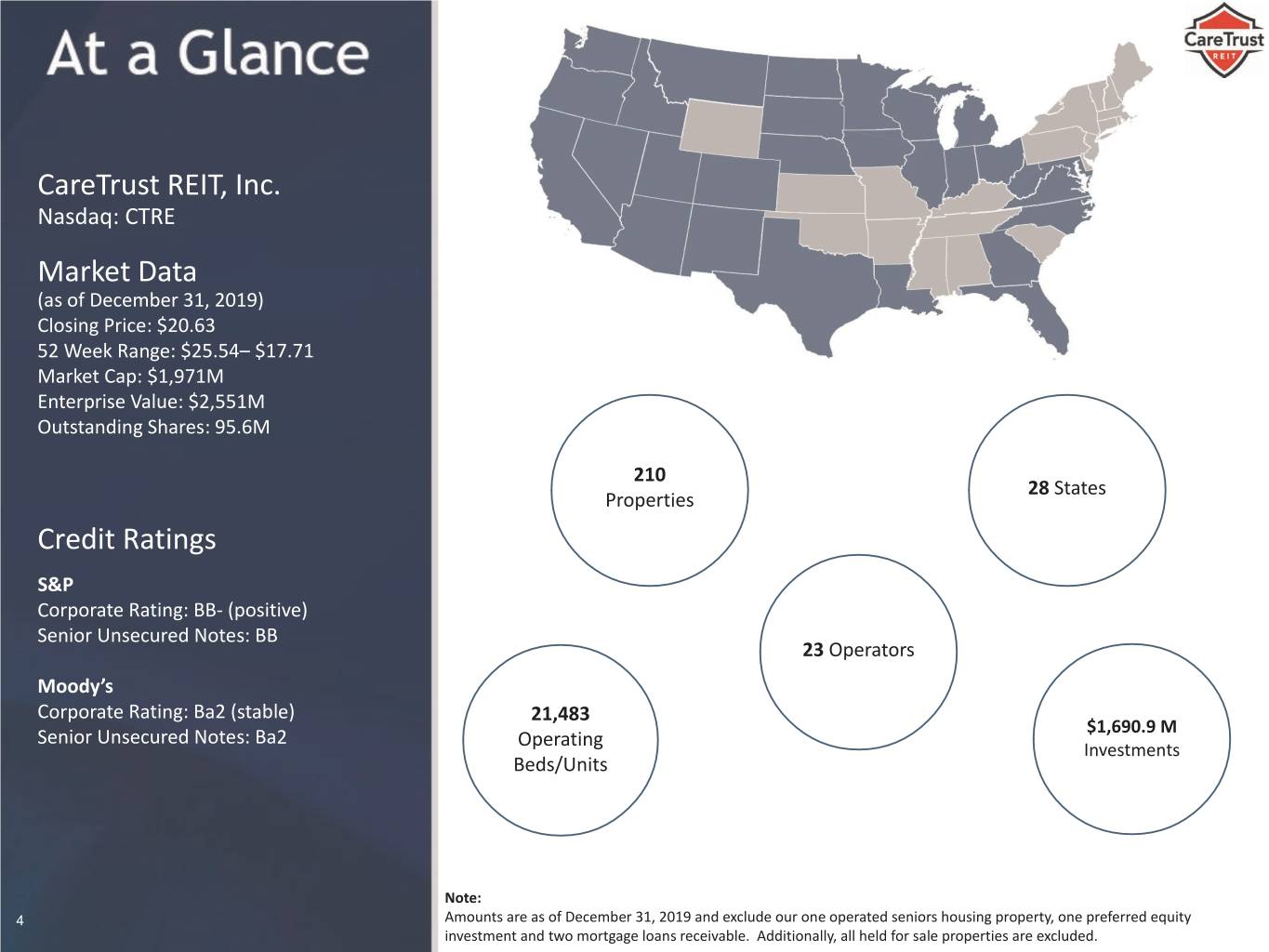

CareTrust REIT, Inc. Nasdaq: CTRE Market Data (as of December 31, 2019) Closing Price: $20.63 52 Week Range: $25.54– $17.71 Market Cap: $1,971M Enterprise Value: $2,551M Outstanding Shares: 95.6M 210 28 States Credit Ratings Properties Credit Ratings S&P S&PCorporate Rating: B+ (positive) CorporateSenior Unsecured Rating: BB-Notes: (positive) BB- Senior Unsecured Notes: BB Moody’s 23 Operators Moody’sCorporate Rating: B1 (positive) CorporateSenior Unsecured Rating: Ba2Notes: (stable) B1 21,483 $1,690.9 M Senior Unsecured Notes: Ba2 Operating Investments Beds/Units Note: 44 Amounts are as of December 31, 2019 and exclude our one operated seniors housing property, one preferred equity investment and two mortgage loans receivable. Additionally, all held for sale properties are excluded.

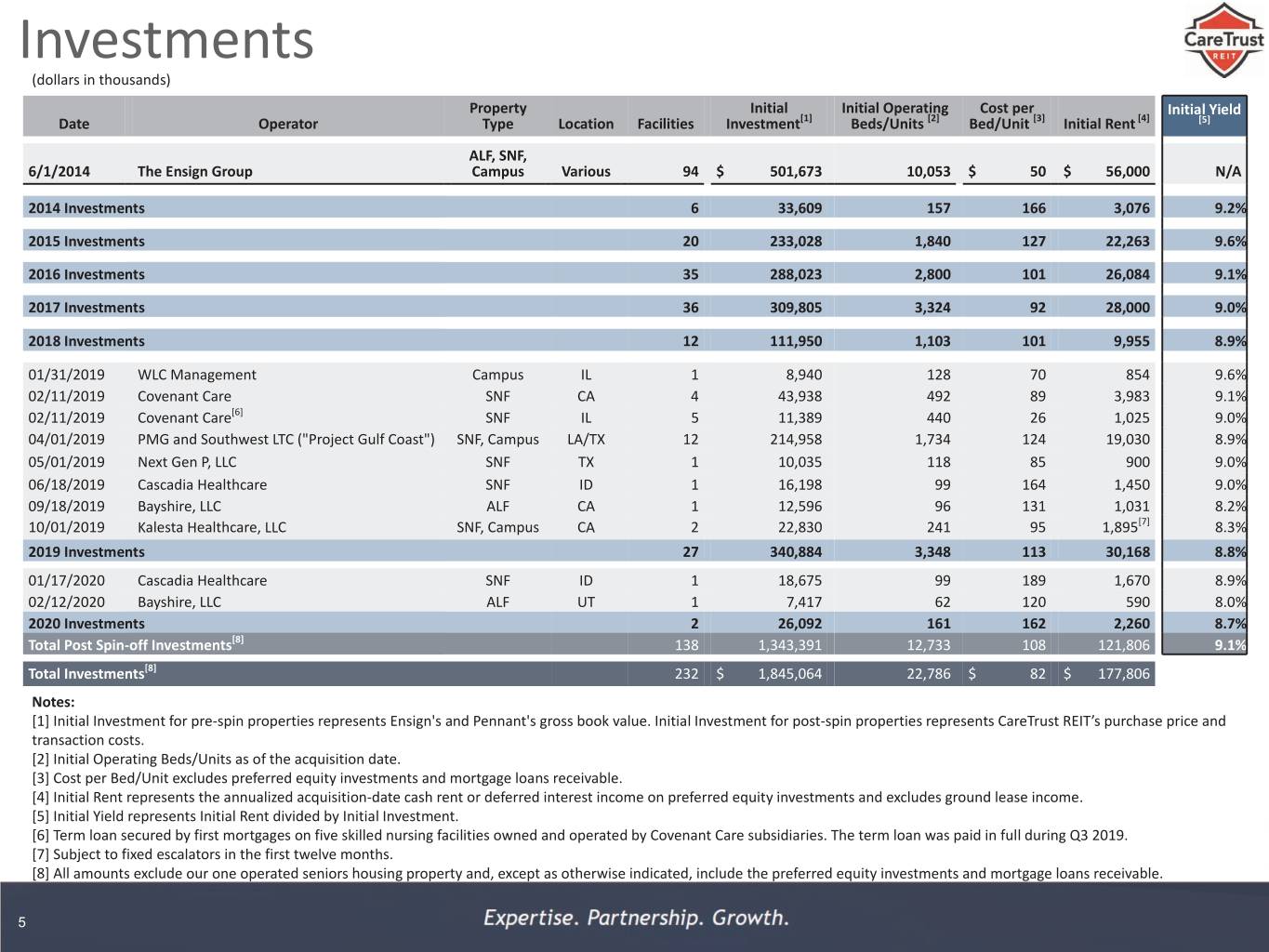

Investments (dollars in thousands) Property Initial Initial Operating Cost per Initial Yield Date Operator Type Location Facilities Investment[1] Beds/Units [2] Bed/Unit [3] Initial Rent [4] [5] ALF, SNF, 6/1/2014 The Ensign Group Campus Various 94 $ 501,673 10,053 $ 50 $ 56,000 N/A 2014 Investments 6 33,609 157 166 3,076 9.2% 2015 Investments 20 233,028 1,840 127 22,263 9.6% 2016 Investments 35 288,023 2,800 101 26,084 9.1% 2017 Investments 36 309,805 3,324 92 28,000 9.0% 2018 Investments 12 111,950 1,103 101 9,955 8.9% 01/31/2019 WLC Management Campus IL 1 8,940 128 70 854 9.6% 02/11/2019 Covenant Care SNF CA 4 43,938 492 89 3,983 9.1% 02/11/2019 Covenant Care[6] SNF IL 5 11,389 440 26 1,025 9.0% 04/01/2019 PMG and Southwest LTC ("Project Gulf Coast") SNF, Campus LA/TX 12 214,958 1,734 124 19,030 8.9% 05/01/2019 Next Gen P, LLC SNF TX 1 10,035 118 85 900 9.0% 06/18/2019 Cascadia Healthcare SNF ID 1 16,198 99 164 1,450 9.0% 09/18/2019 Bayshire, LLC ALF CA 1 12,596 96 131 1,031 8.2% 10/01/2019 Kalesta Healthcare, LLC SNF, Campus CA 2 22,830 241 95 1,895[7] 8.3% 2019 Investments 27 340,884 3,348 113 30,168 8.8% 01/17/2020 Cascadia Healthcare SNF ID 1 18,675 99 189 1,670 8.9% 02/12/2020 Bayshire, LLC ALF UT 1 7,417 62 120 590 8.0% 2020 Investments 2 26,092 161 162 2,260 8.7% Total Post Spin-off Investments[8] 138 1,343,391 12,733 108 121,806 9.1% Total Investments[8] 232 $ 1,845,064 22,786 $ 82 $ 177,806 Notes: [1] Initial Investment for pre-spin properties represents Ensign's and Pennant's gross book value. Initial Investment for post-spin properties represents CareTrust REIT’s purchase price and transaction costs. [2] Initial Operating Beds/Units as of the acquisition date. [3] Cost per Bed/Unit excludes preferred equity investments and mortgage loans receivable. [4] Initial Rent represents the annualized acquisition-date cash rent or deferred interest income on preferred equity investments and excludes ground lease income. [5] Initial Yield represents Initial Rent divided by Initial Investment. [6] Term loan secured by first mortgages on five skilled nursing facilities owned and operated by Covenant Care subsidiaries. The term loan was paid in full during Q3 2019. [7] Subject to fixed escalators in the first twelve months. [8] All amounts exclude our one operated seniors housing property and, except as otherwise indicated, include the preferred equity investments and mortgage loans receivable. 5

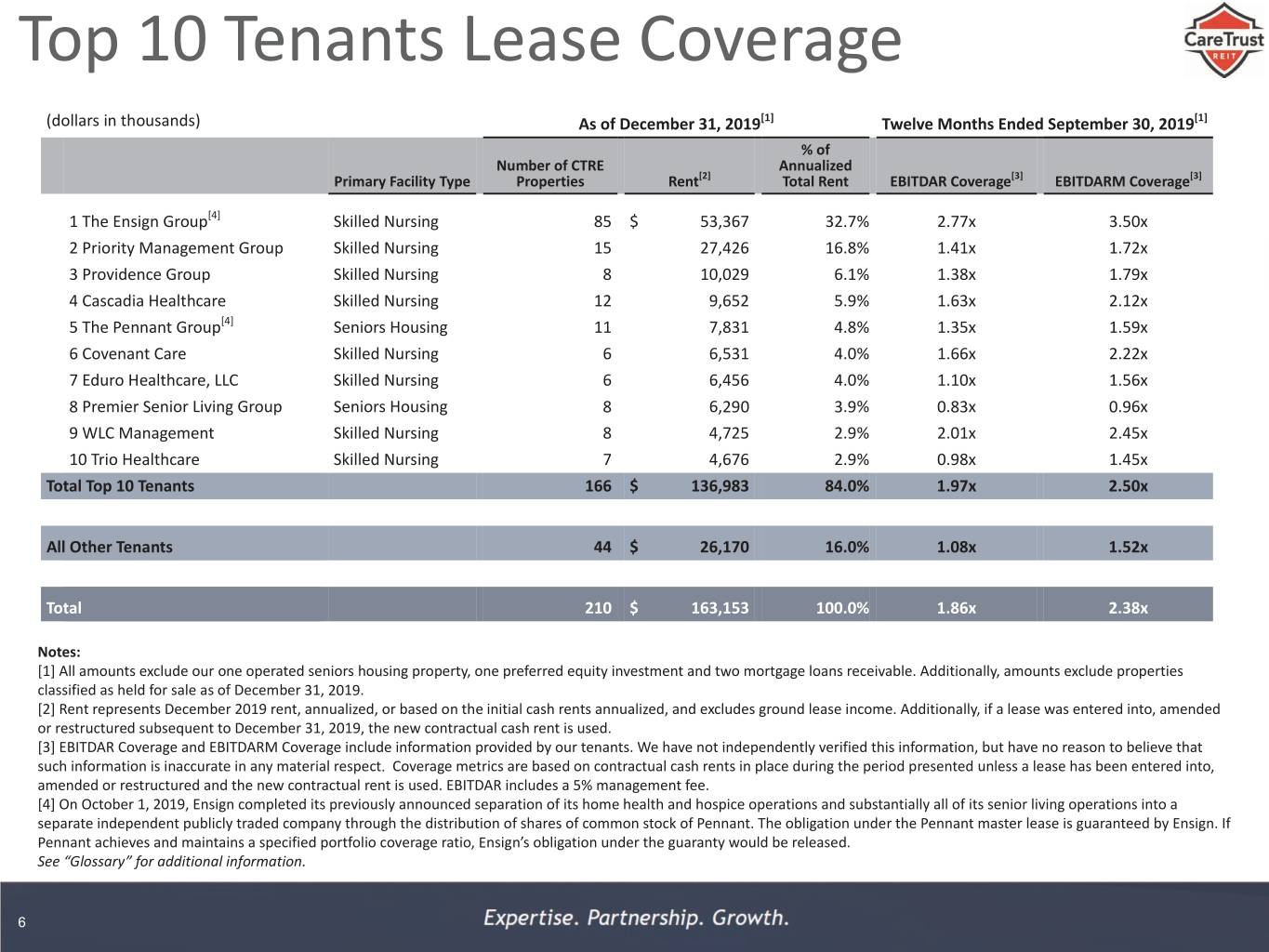

Top 10 Tenants Lease Coverage (dollars in thousands) As of December 31, 2019[1] Twelve Months Ended September 30, 2019[1] % of Number of CTRE Annualized Primary Facility Type Properties Rent[2] Total Rent EBITDAR Coverage[3] EBITDARM Coverage[3] 1 The Ensign Group[4] Skilled Nursing 85 $ 53,367 32.7% 2.77x 3.50x 2 Priority Management Group Skilled Nursing 15 27,426 16.8% 1.41x 1.72x 3 Providence Group Skilled Nursing 8 10,029 6.1% 1.38x 1.79x 4 Cascadia Healthcare Skilled Nursing 12 9,652 5.9% 1.63x 2.12x 5 The Pennant Group[4] Seniors Housing 11 7,831 4.8% 1.35x 1.59x 6 Covenant Care Skilled Nursing 6 6,531 4.0% 1.66x 2.22x 7 Eduro Healthcare, LLC Skilled Nursing 6 6,456 4.0% 1.10x 1.56x 8 Premier Senior Living Group Seniors Housing 8 6,290 3.9% 0.83x 0.96x 9 WLC Management Skilled Nursing 8 4,725 2.9% 2.01x 2.45x 10 Trio Healthcare Skilled Nursing 7 4,676 2.9% 0.98x 1.45x Total Top 10 Tenants 166 $ 136,983 84.0% 1.97x 2.50x All Other Tenants 44 $ 26,170 16.0% 1.08x 1.52x Total 210 $ 163,153 100.0% 1.86x 2.38x Notes: [1] All amounts exclude our one operated seniors housing property, one preferred equity investment and two mortgage loans receivable. Additionally, amounts exclude properties classified as held for sale as of December 31, 2019. [2] Rent represents December 2019 rent, annualized, or based on the initial cash rents annualized, and excludes ground lease income. Additionally, if a lease was entered into, amended or restructured subsequent to December 31, 2019, the new contractual cash rent is used. [3] EBITDAR Coverage and EBITDARM Coverage include information provided by our tenants. We have not independently verified this information, but have no reason to believe that such information is inaccurate in any material respect. Coverage metrics are based on contractual cash rents in place during the period presented unless a lease has been entered into, amended or restructured and the new contractual rent is used. EBITDAR includes a 5% management fee. [4] On October 1, 2019, Ensign completed its previously announced separation of its home health and hospice operations and substantially all of its senior living operations into a separate independent publicly traded company through the distribution of shares of common stock of Pennant. The obligation under the Pennant master lease is guaranteed by Ensign. If Pennant achieves and maintains a specified portfolio coverage ratio, Ensign’s obligation under the guaranty would be released. See “Glossary” for additional information. 6

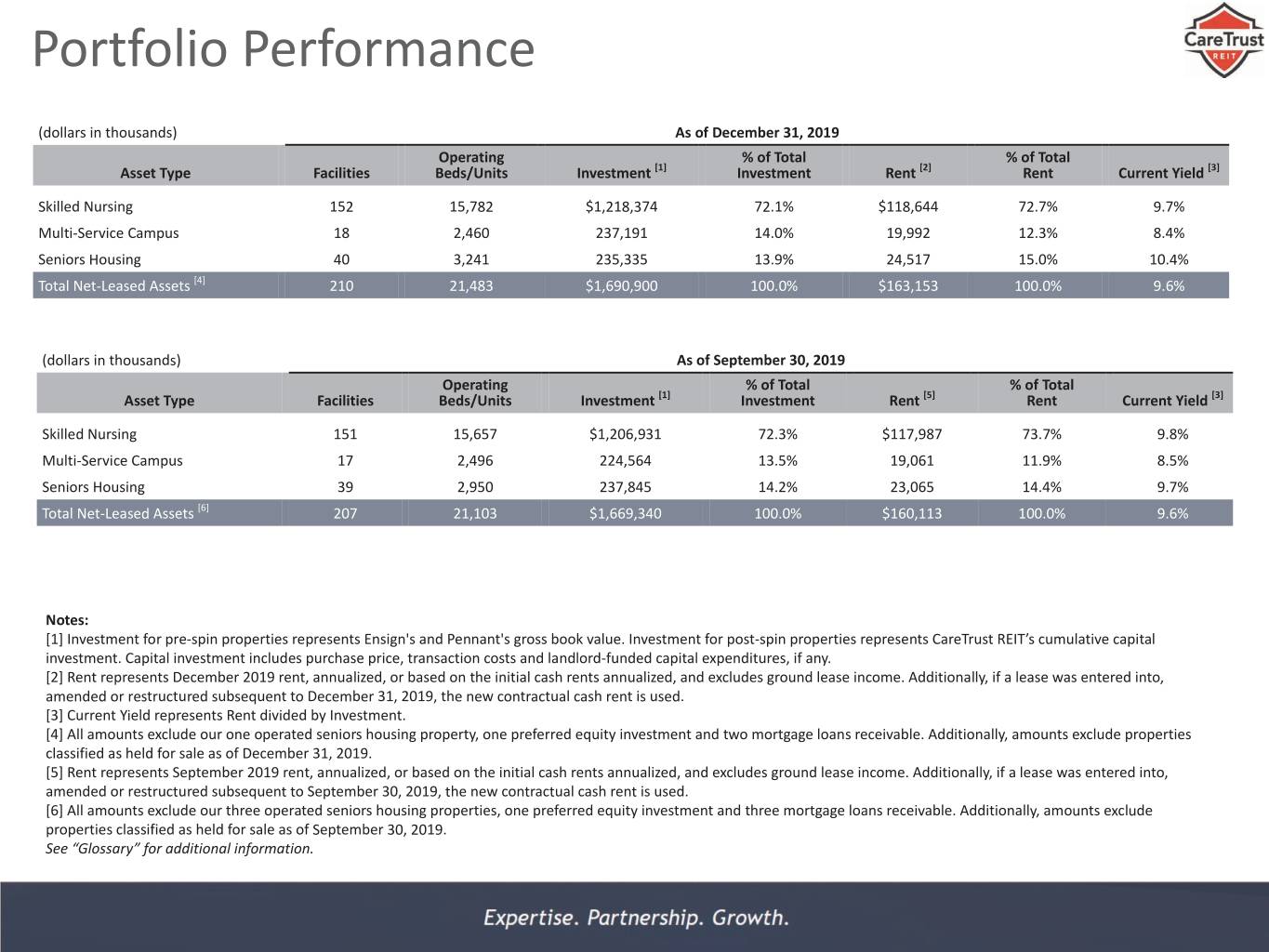

Portfolio Performance (dollars in thousands) As of December 31, 2019 Operating % of Total % of Total Asset Type Facilities Beds/Units Investment [1] Investment Rent [2] Rent Current Yield [3] Skilled Nursing 152 15,782 $1,218,374 72.1% $118,644 72.7% 9.7% Multi-Service Campus 18 2,460 237,191 14.0% 19,992 12.3% 8.4% Seniors Housing 40 3,241 235,335 13.9% 24,517 15.0% 10.4% Total Net-Leased Assets [4] 210 21,483 $1,690,900 100.0% $163,153 100.0% 9.6% (dollars in thousands) As of September 30, 2019 Operating % of Total % of Total Asset Type Facilities Beds/Units Investment [1] Investment Rent [5] Rent Current Yield [3] Skilled Nursing 151 15,657 $1,206,931 72.3% $117,987 73.7% 9.8% Multi-Service Campus 17 2,496 224,564 13.5% 19,061 11.9% 8.5% Seniors Housing 39 2,950 237,845 14.2% 23,065 14.4% 9.7% Total Net-Leased Assets [6] 207 21,103 $1,669,340 100.0% $160,113 100.0% 9.6% Notes: [1] Investment for pre-spin properties represents Ensign's and Pennant's gross book value. Investment for post-spin properties represents CareTrust REIT’s cumulative capital investment. Capital investment includes purchase price, transaction costs and landlord-funded capital expenditures, if any. [2] Rent represents December 2019 rent, annualized, or based on the initial cash rents annualized, and excludes ground lease income. Additionally, if a lease was entered into, amended or restructured subsequent to December 31, 2019, the new contractual cash rent is used. [3] Current Yield represents Rent divided by Investment. [4] All amounts exclude our one operated seniors housing property, one preferred equity investment and two mortgage loans receivable. Additionally, amounts exclude properties classified as held for sale as of December 31, 2019. [5] Rent represents September 2019 rent, annualized, or based on the initial cash rents annualized, and excludes ground lease income. Additionally, if a lease was entered into, amended or restructured subsequent to September 30, 2019, the new contractual cash rent is used. [6] All amounts exclude our three operated seniors housing properties, one preferred equity investment and three mortgage loans receivable. Additionally, amounts exclude properties classified as held for sale as of September 30, 2019. See “Glossary” for additional information.

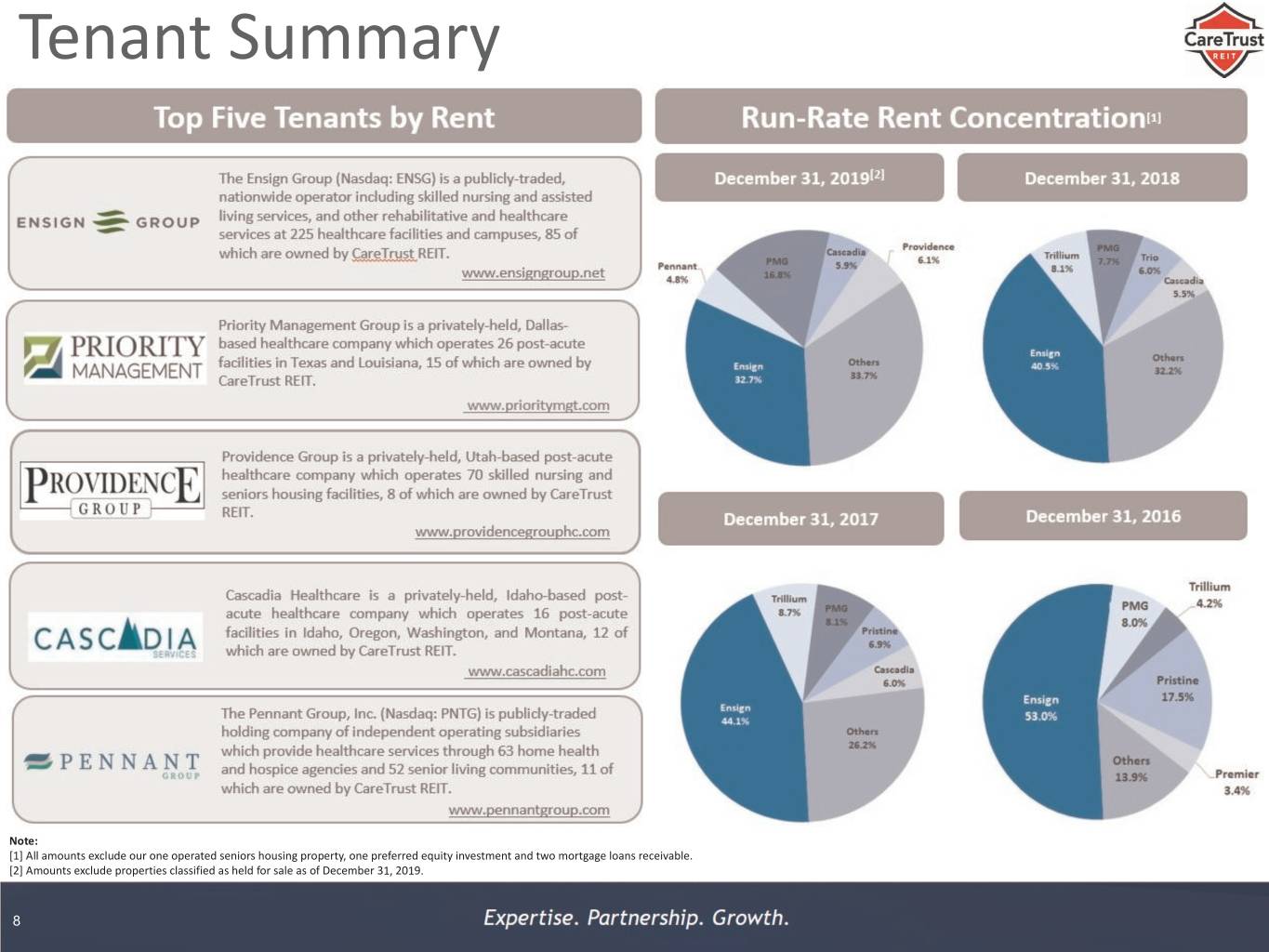

Tenant Summary Note: [1] All amounts exclude our one operated seniors housing property, one preferred equity investment and two mortgage loans receivable. [2] Amounts exclude properties classified as held for sale as of December 31, 2019. 8

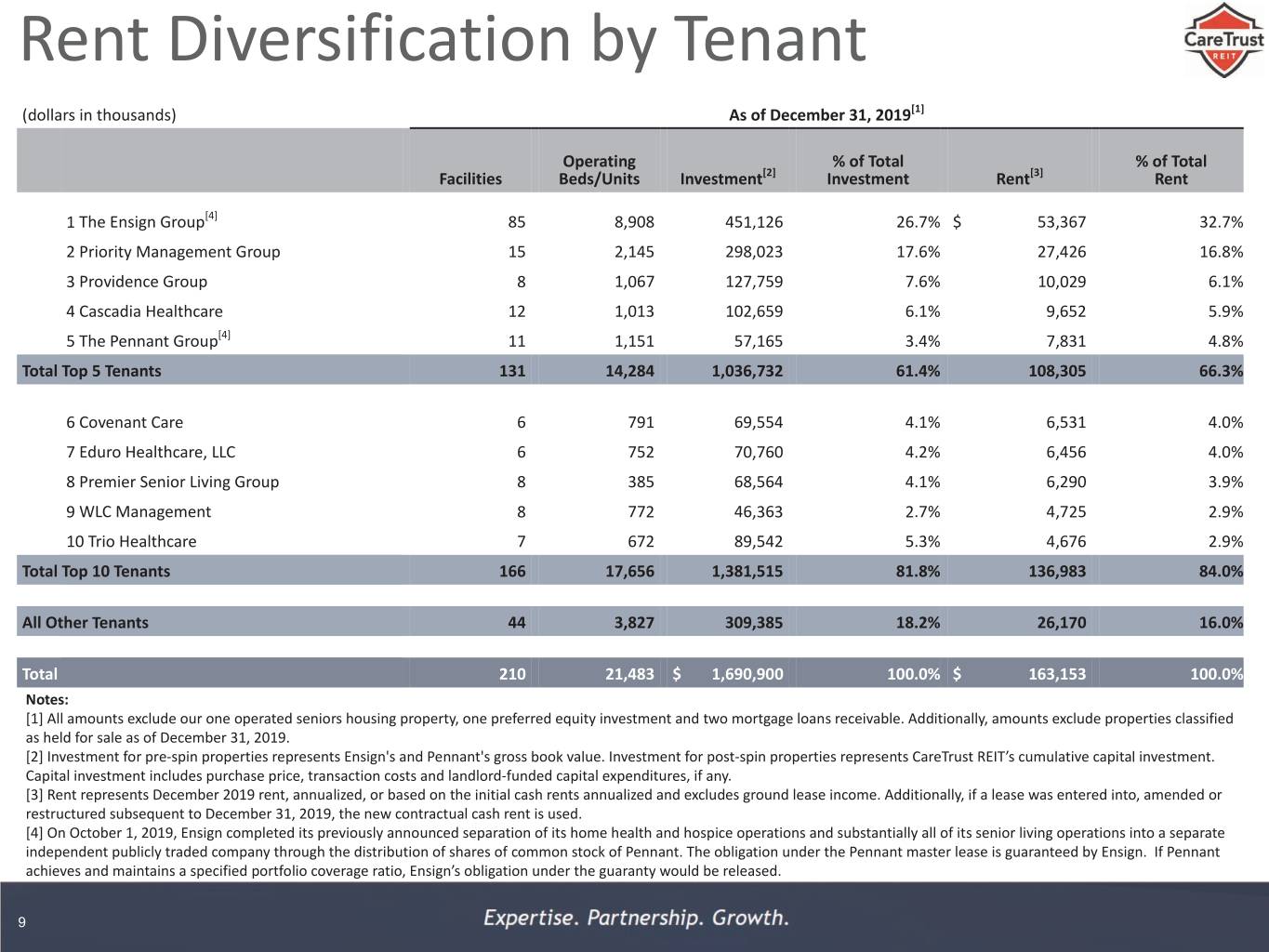

Rent Diversification by Tenant (dollars in thousands) As of December 31, 2019[1] Operating % of Total % of Total Facilities Beds/Units Investment[2] Investment Rent[3] Rent 1 The Ensign Group[4] 85 8,908 451,126 26.7% $ 53,367 32.7% 2 Priority Management Group 15 2,145 298,023 17.6% 27,426 16.8% 3 Providence Group 8 1,067 127,759 7.6% 10,029 6.1% 4 Cascadia Healthcare 12 1,013 102,659 6.1% 9,652 5.9% 5 The Pennant Group[4] 11 1,151 57,165 3.4% 7,831 4.8% Total Top 5 Tenants 131 14,284 1,036,732 61.4% 108,305 66.3% 6 Covenant Care 6 791 69,554 4.1% 6,531 4.0% 7 Eduro Healthcare, LLC 6 752 70,760 4.2% 6,456 4.0% 8 Premier Senior Living Group 8 385 68,564 4.1% 6,290 3.9% 9 WLC Management 8 772 46,363 2.7% 4,725 2.9% 10 Trio Healthcare 7 672 89,542 5.3% 4,676 2.9% Total Top 10 Tenants 166 17,656 1,381,515 81.8% 136,983 84.0% All Other Tenants 44 3,827 309,385 18.2% 26,170 16.0% Total 210 21,483 $ 1,690,900 100.0% $ 163,153 100.0% Notes: [1] All amounts exclude our one operated seniors housing property, one preferred equity investment and two mortgage loans receivable. Additionally, amounts exclude properties classified as held for sale as of December 31, 2019. [2] Investment for pre-spin properties represents Ensign's and Pennant's gross book value. Investment for post-spin properties represents CareTrust REIT’s cumulative capital investment. Capital investment includes purchase price, transaction costs and landlord-funded capital expenditures, if any. [3] Rent represents December 2019 rent, annualized, or based on the initial cash rents annualized and excludes ground lease income. Additionally, if a lease was entered into, amended or restructured subsequent to December 31, 2019, the new contractual cash rent is used. [4] On October 1, 2019, Ensign completed its previously announced separation of its home health and hospice operations and substantially all of its senior living operations into a separate independent publicly traded company through the distribution of shares of common stock of Pennant. The obligation under the Pennant master lease is guaranteed by Ensign. If Pennant achieves and maintains a specified portfolio coverage ratio, Ensign’s obligation under the guaranty would be released. 9

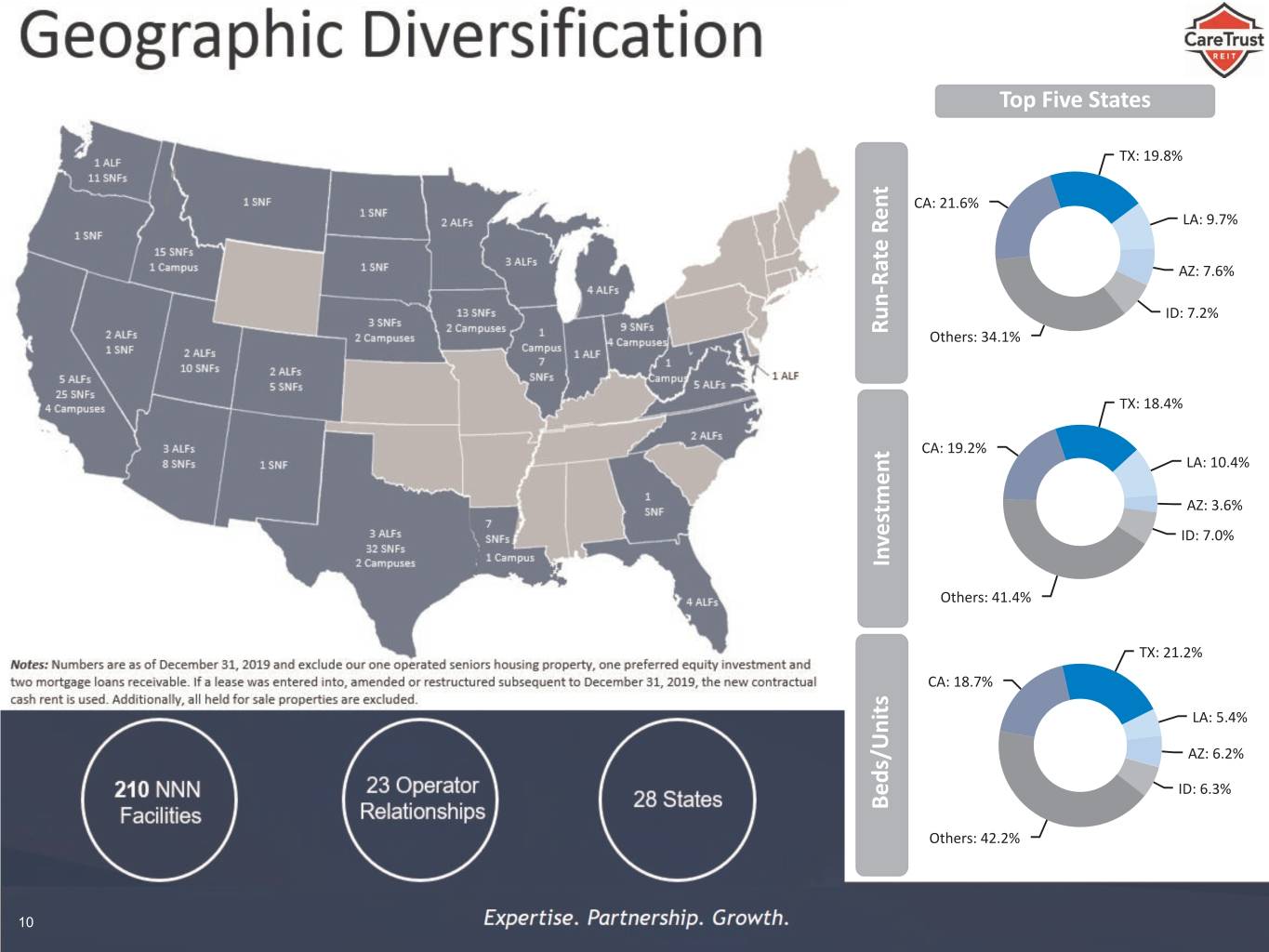

Top Five States TX: 19.8% CA: 21.6% LA: 9.7% AZ: 7.6% 1 ALF ID: 7.2% Run-Rate Rent Run-Rate Others: 34.1% 1 ALF TX: 18.4% CA: 19.2% LA: 10.4% AZ: 3.6% 1 SNF ID: 7.0% Investment Others: 41.4% TX: 21.2% CA: 18.7% LA: 5.4% AZ: 6.2% ID: 6.3% Beds/Units Others: 42.2% 10

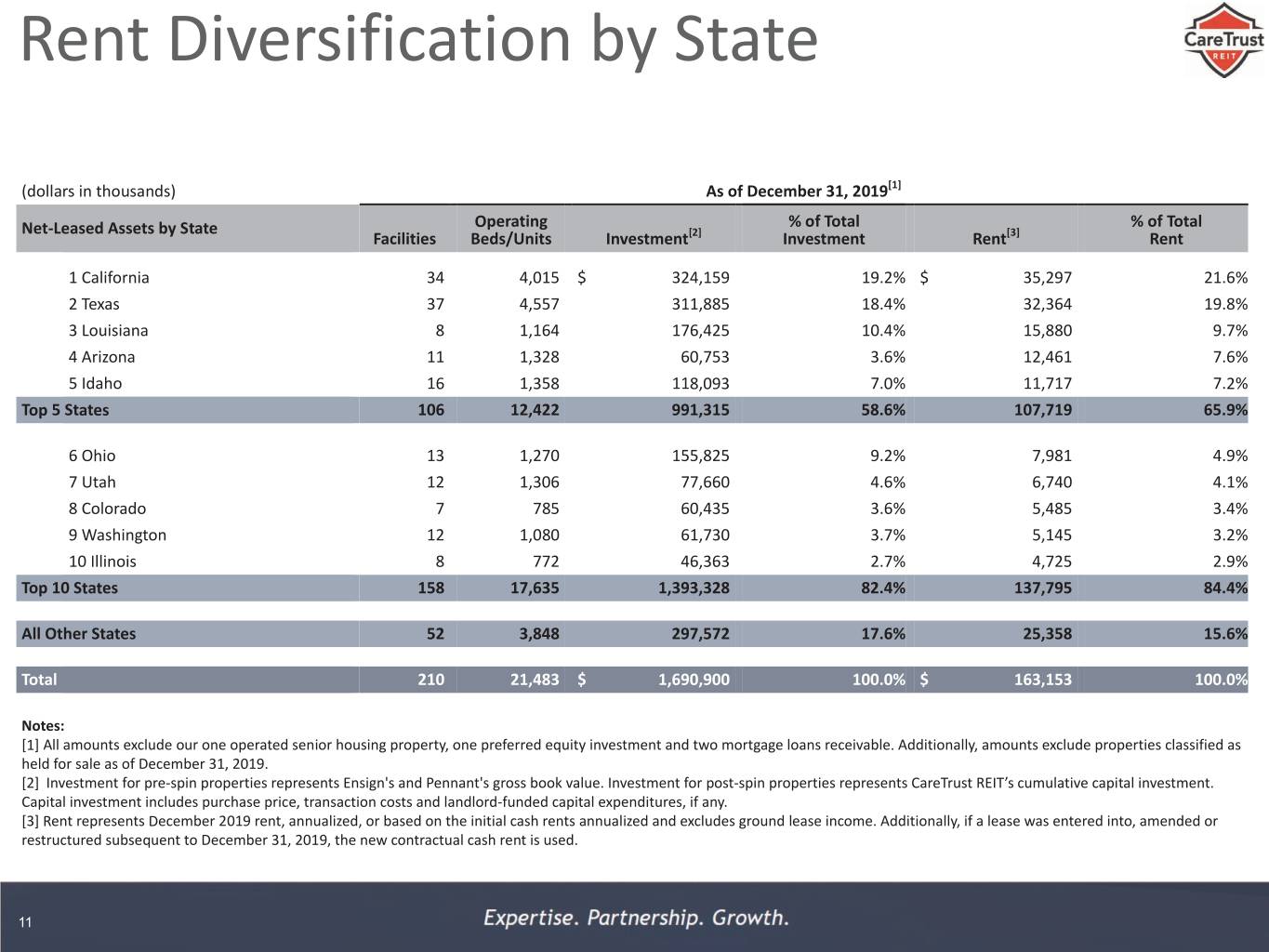

Rent Diversification by State (dollars in thousands) As of December 31, 2019[1] Net-Leased Assets by State Operating % of Total % of Total Facilities Beds/Units Investment[2] Investment Rent[3] Rent 1 California 34 4,015 $ 324,159 19.2% $ 35,297 21.6% 2 Texas 37 4,557 311,885 18.4% 32,364 19.8% 3 Louisiana 8 1,164 176,425 10.4% 15,880 9.7% 4 Arizona 11 1,328 60,753 3.6% 12,461 7.6% 5 Idaho 16 1,358 118,093 7.0% 11,717 7.2% Top 5 States 106 12,422 991,315 58.6% 107,719 65.9% 6 Ohio 13 1,270 155,825 9.2% 7,981 4.9% 7 Utah 12 1,306 77,660 4.6% 6,740 4.1% 8 Colorado 7 785 60,435 3.6% 5,485 3.4% 9 Washington 12 1,080 61,730 3.7% 5,145 3.2% 10 Illinois 8 772 46,363 2.7% 4,725 2.9% Top 10 States 158 17,635 1,393,328 82.4% 137,795 84.4% All Other States 52 3,848 297,572 17.6% 25,358 15.6% Total 210 21,483 $ 1,690,900 100.0% $ 163,153 100.0% Notes: [1] All amounts exclude our one operated senior housing property, one preferred equity investment and two mortgage loans receivable. Additionally, amounts exclude properties classified as held for sale as of December 31, 2019. [2] Investment for pre-spin properties represents Ensign's and Pennant's gross book value. Investment for post-spin properties represents CareTrust REIT’s cumulative capital investment. Capital investment includes purchase price, transaction costs and landlord-funded capital expenditures, if any. [3] Rent represents December 2019 rent, annualized, or based on the initial cash rents annualized and excludes ground lease income. Additionally, if a lease was entered into, amended or restructured subsequent to December 31, 2019, the new contractual cash rent is used. 11

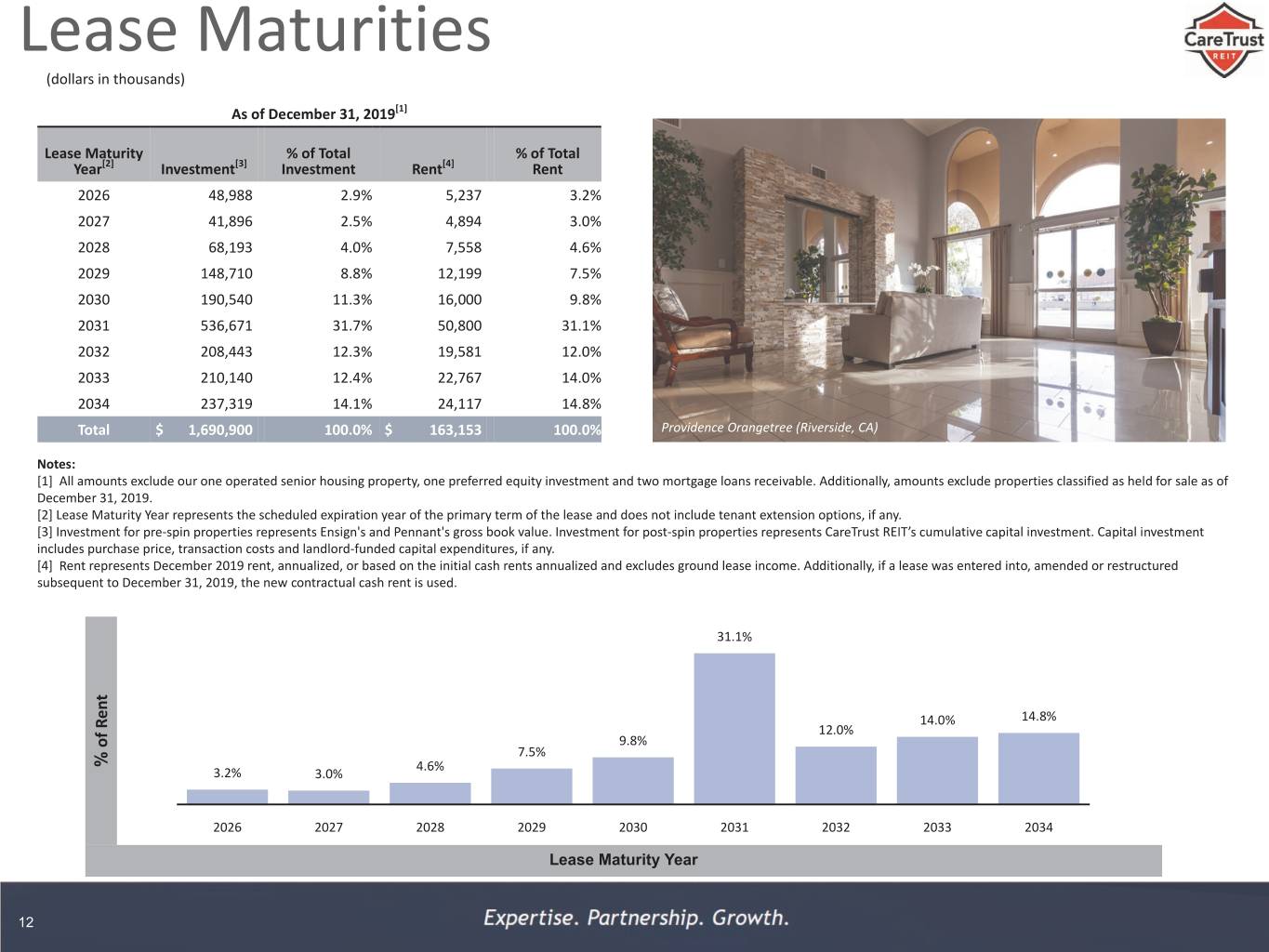

Lease Maturities (dollars in thousands) As of December 31, 2019[1] Lease Maturity % of Total % of Total Year[2] Investment[3] Investment Rent[4] Rent 2026 48,988 2.9% 5,237 3.2% 2027 41,896 2.5% 4,894 3.0% 2028 68,193 4.0% 7,558 4.6% 2029 148,710 8.8% 12,199 7.5% 2030 190,540 11.3% 16,000 9.8% 2031 536,671 31.7% 50,800 31.1% 2032 208,443 12.3% 19,581 12.0% 2033 210,140 12.4% 22,767 14.0% 2034 237,319 14.1% 24,117 14.8% Total $ 1,690,900 100.0% $ 163,153 100.0% Providence Orangetree (Riverside, CA) Notes: [1] All amounts exclude our one operated senior housing property, one preferred equity investment and two mortgage loans receivable. Additionally, amounts exclude properties classified as held for sale as of December 31, 2019. [2] Lease Maturity Year represents the scheduled expiration year of the primary term of the lease and does not include tenant extension options, if any. [3] Investment for pre-spin properties represents Ensign's and Pennant's gross book value. Investment for post-spin properties represents CareTrust REIT’s cumulative capital investment. Capital investment includes purchase price, transaction costs and landlord-funded capital expenditures, if any. [4] Rent represents December 2019 rent, annualized, or based on the initial cash rents annualized and excludes ground lease income. Additionally, if a lease was entered into, amended or restructured subsequent to December 31, 2019, the new contractual cash rent is used. 31.1% 14.0% 14.8% 12.0% 9.8% of Rent 7.5% % 4.6% 3.2% 3.0% 2026 2027 2028 2029 2030 2031 2032 2033 2034 Lease Maturity Year 12

13

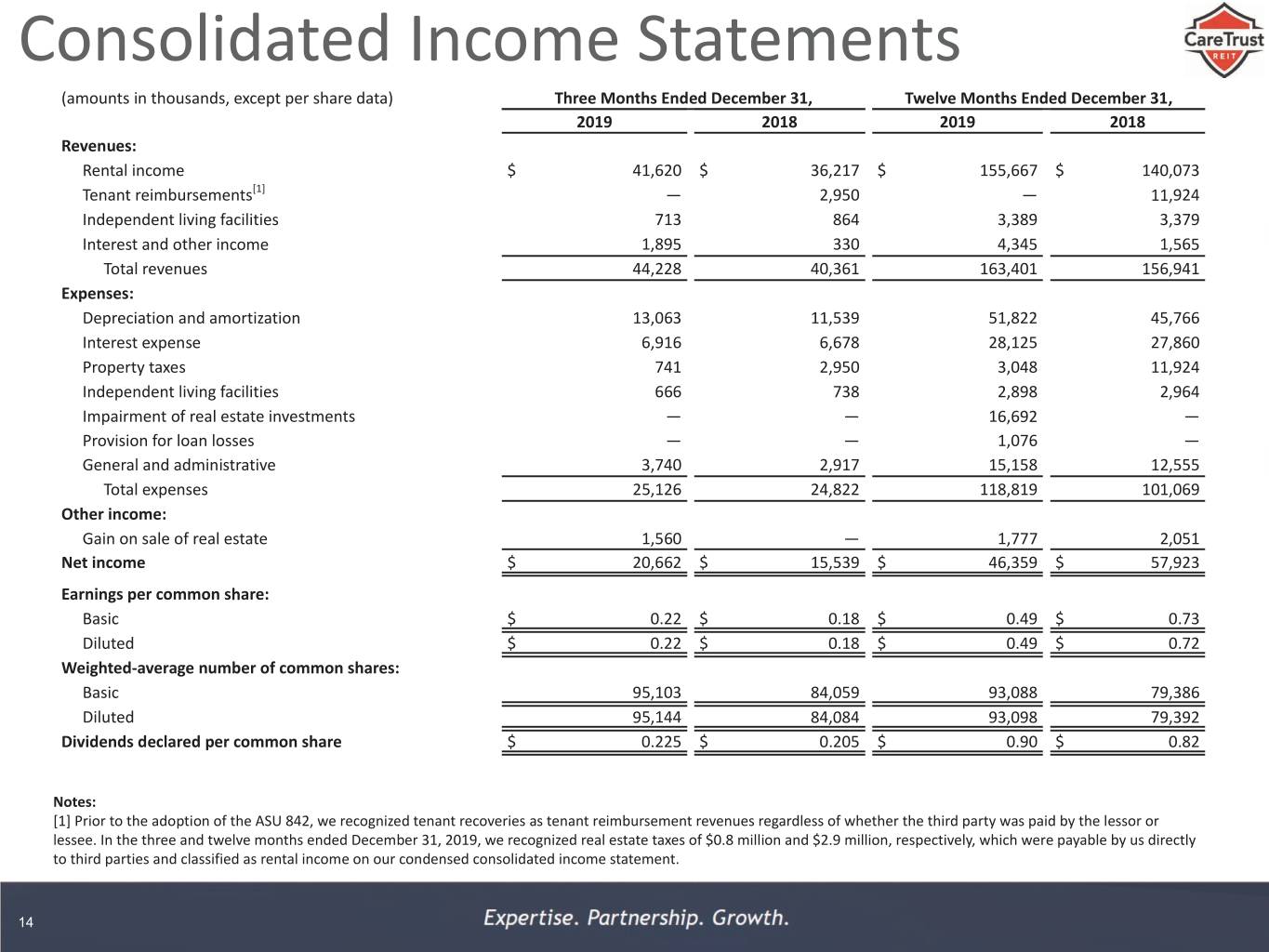

Consolidated Income Statements (amounts in thousands, except per share data) Three Months Ended December 31, Twelve Months Ended December 31, 2019 2018 2019 2018 Revenues: Rental income $ 41,620 $ 36,217 $ 155,667 $ 140,073 Tenant reimbursements[1] — 2,950 — 11,924 Independent living facilities 713 864 3,389 3,379 Interest and other income 1,895 330 4,345 1,565 Total revenues 44,228 40,361 163,401 156,941 Expenses: Depreciation and amortization 13,063 11,539 51,822 45,766 Interest expense 6,916 6,678 28,125 27,860 Property taxes 741 2,950 3,048 11,924 Independent living facilities 666 738 2,898 2,964 Impairment of real estate investments — — 16,692 — Provision for loan losses — — 1,076 — General and administrative 3,740 2,917 15,158 12,555 Total expenses 25,126 24,822 118,819 101,069 Other income: Gain on sale of real estate 1,560 — 1,777 2,051 Net income $ 20,662 $ 15,539 $ 46,359 $ 57,923 Earnings per common share: Basic $ 0.22 $ 0.18 $ 0.49 $ 0.73 Diluted $ 0.22 $ 0.18 $ 0.49 $ 0.72 Weighted-average number of common shares: Basic 95,103 84,059 93,088 79,386 Diluted 95,144 84,084 93,098 79,392 Dividends declared per common share $ 0.225 $ 0.205 $ 0.90 $ 0.82 Notes: [1] Prior to the adoption of the ASU 842, we recognized tenant recoveries as tenant reimbursement revenues regardless of whether the third party was paid by the lessor or lessee. In the three and twelve months ended December 31, 2019, we recognized real estate taxes of $0.8 million and $2.9 million, respectively, which were payable by us directly to third parties and classified as rental income on our condensed consolidated income statement. 14

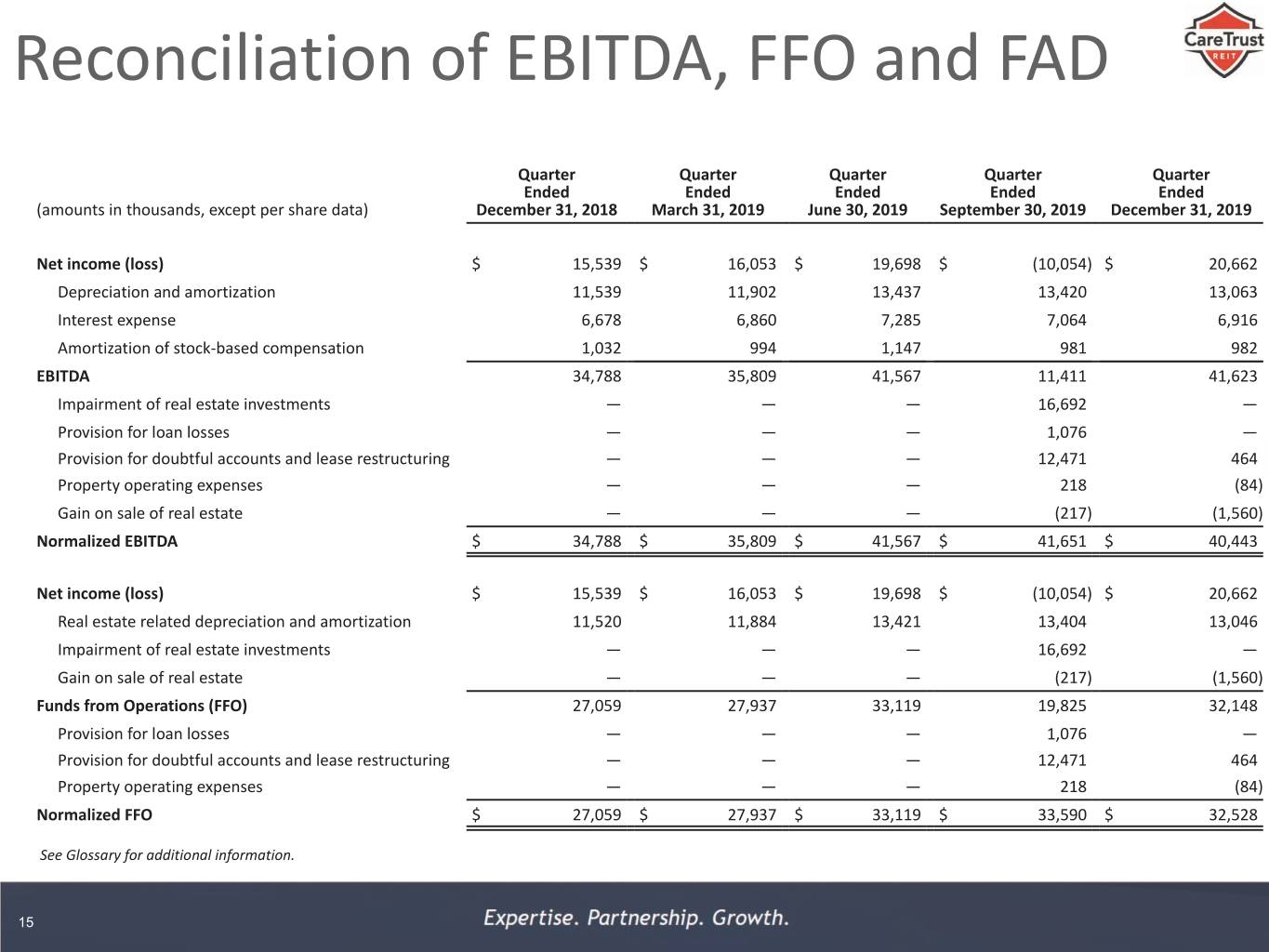

Reconciliation of EBITDA, FFO and FAD Quarter Quarter Quarter Quarter Quarter Ended Ended Ended Ended Ended (amounts in thousands, except per share data) December 31, 2018 March 31, 2019 June 30, 2019 September 30, 2019 December 31, 2019 Net income (loss) $ 15,539 $ 16,053 $ 19,698 $ (10,054) $ 20,662 Depreciation and amortization 11,539 11,902 13,437 13,420 13,063 Interest expense 6,678 6,860 7,285 7,064 6,916 Amortization of stock-based compensation 1,032 994 1,147 981 982 EBITDA 34,788 35,809 41,567 11,411 41,623 Impairment of real estate investments — — — 16,692 — Provision for loan losses — — — 1,076 — Provision for doubtful accounts and lease restructuring — — — 12,471 464 Property operating expenses — — — 218 (84) Gain on sale of real estate — — — (217) (1,560) Normalized EBITDA $ 34,788 $ 35,809 $ 41,567 $ 41,651 $ 40,443 Net income (loss) $ 15,539 $ 16,053 $ 19,698 $ (10,054) $ 20,662 Real estate related depreciation and amortization 11,520 11,884 13,421 13,404 13,046 Impairment of real estate investments — — — 16,692 — Gain on sale of real estate — — — (217) (1,560) Funds from Operations (FFO) 27,059 27,937 33,119 19,825 32,148 Provision for loan losses — — — 1,076 — Provision for doubtful accounts and lease restructuring — — — 12,471 464 Property operating expenses — — — 218 (84) Normalized FFO $ 27,059 $ 27,937 $ 33,119 $ 33,590 $ 32,528 See Glossary for additional information. 15

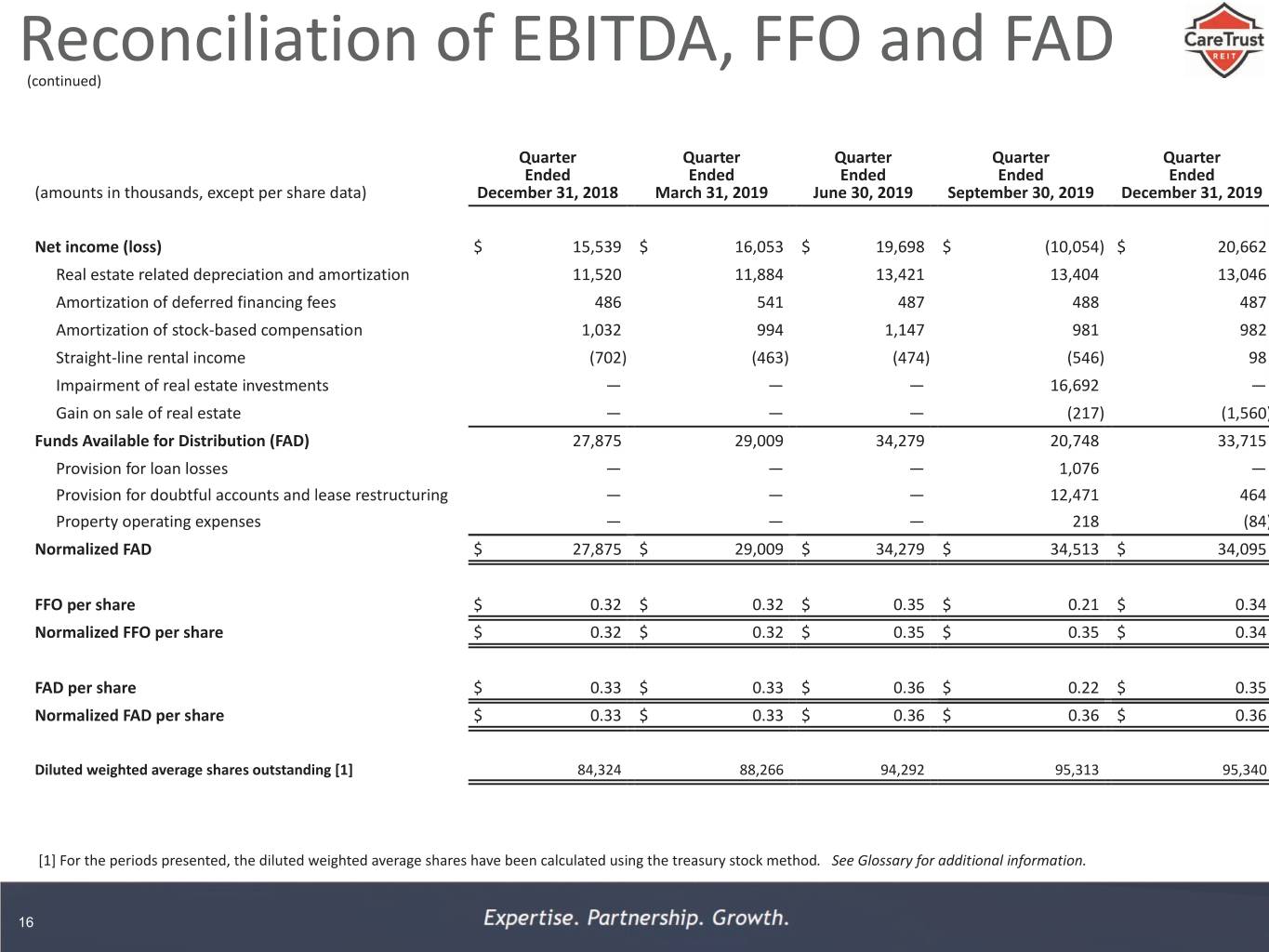

Reconciliation of EBITDA, FFO and FAD (continued) Quarter Quarter Quarter Quarter Quarter Ended Ended Ended Ended Ended (amounts in thousands, except per share data) December 31, 2018 March 31, 2019 June 30, 2019 September 30, 2019 December 31, 2019 Net income (loss) $ 15,539 $ 16,053 $ 19,698 $ (10,054) $ 20,662 Real estate related depreciation and amortization 11,520 11,884 13,421 13,404 13,046 Amortization of deferred financing fees 486 541 487 488 487 Amortization of stock-based compensation 1,032 994 1,147 981 982 Straight-line rental income (702) (463) (474) (546) 98 Impairment of real estate investments — — — 16,692 — Gain on sale of real estate — — — (217) (1,560) Funds Available for Distribution (FAD) 27,875 29,009 34,279 20,748 33,715 Provision for loan losses — — — 1,076 — Provision for doubtful accounts and lease restructuring — — — 12,471 464 Property operating expenses — — — 218 (84) Normalized FAD $ 27,875 $ 29,009 $ 34,279 $ 34,513 $ 34,095 FFO per share $ 0.32 $ 0.32 $ 0.35 $ 0.21 $ 0.34 Normalized FFO per share $ 0.32 $ 0.32 $ 0.35 $ 0.35 $ 0.34 FAD per share $ 0.33 $ 0.33 $ 0.36 $ 0.22 $ 0.35 Normalized FAD per share $ 0.33 $ 0.33 $ 0.36 $ 0.36 $ 0.36 Diluted weighted average shares outstanding [1] 84,324 88,266 94,292 95,313 95,340 [1] For the periods presented, the diluted weighted average shares have been calculated using the treasury stock method. See Glossary for additional information. 16

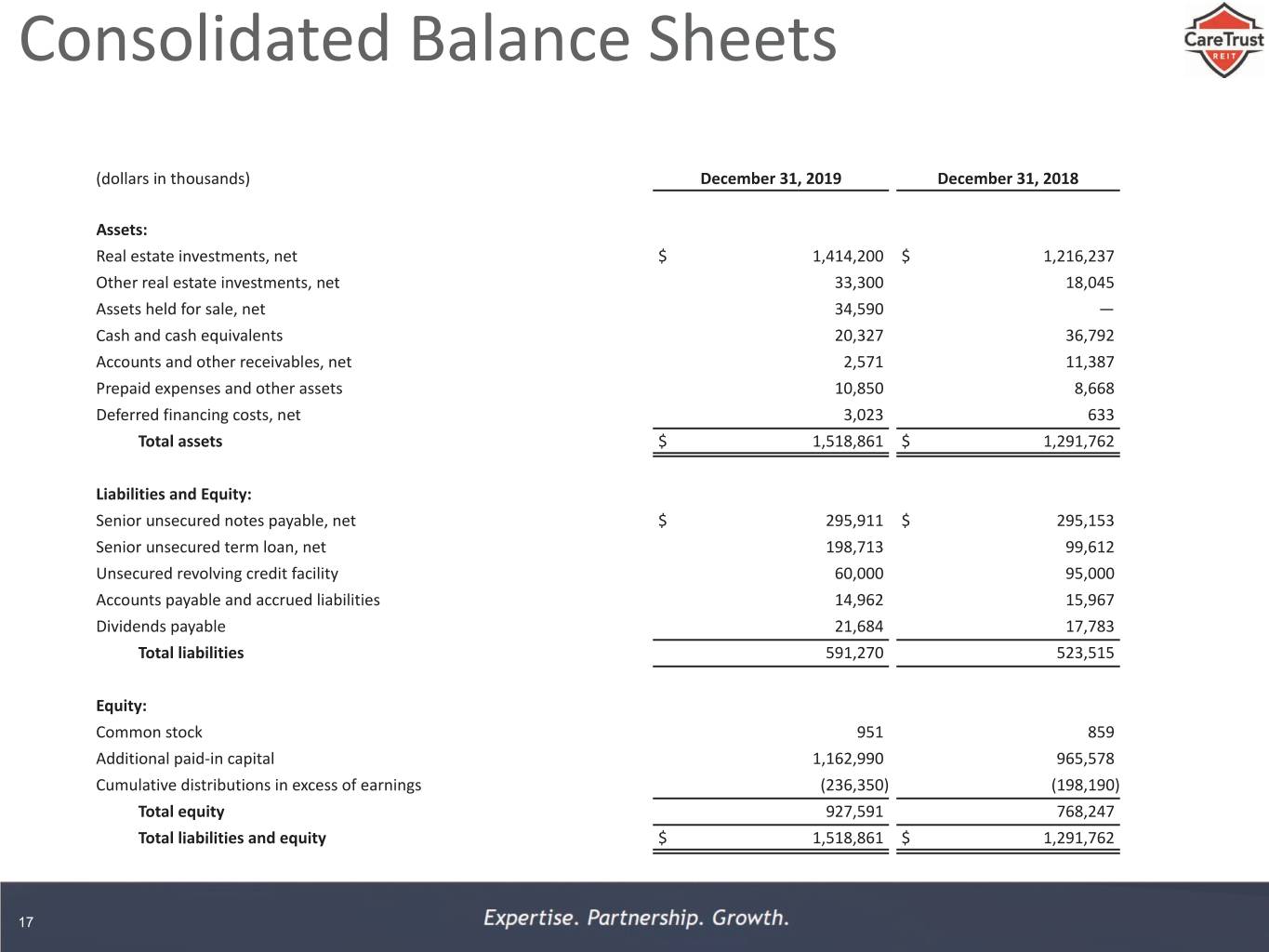

Consolidated Balance Sheets (dollars in thousands) December 31, 2019 December 31, 2018 Assets: Real estate investments, net $ 1,414,200 $ 1,216,237 Other real estate investments, net 33,300 18,045 Assets held for sale, net 34,590 — Cash and cash equivalents 20,327 36,792 Accounts and other receivables, net 2,571 11,387 Prepaid expenses and other assets 10,850 8,668 Deferred financing costs, net 3,023 633 Total assets $ 1,518,861 $ 1,291,762 Liabilities and Equity: Senior unsecured notes payable, net $ 295,911 $ 295,153 Senior unsecured term loan, net 198,713 99,612 Unsecured revolving credit facility 60,000 95,000 Accounts payable and accrued liabilities 14,962 15,967 Dividends payable 21,684 17,783 Total liabilities 591,270 523,515 Equity: Common stock 951 859 Additional paid-in capital 1,162,990 965,578 Cumulative distributions in excess of earnings (236,350) (198,190) Total equity 927,591 768,247 Total liabilities and equity $ 1,518,861 $ 1,291,762 17

Key Debt Metrics Net Debt to Normalized EBITDA [1][2] Net Debt to Enterprise Value [3] 36.5% 4.6 4.5 4.4 30.5% 4.1 28.8% 24.7% 24.2% 3.6 3.5 22.3% 21.2% 3.4 20.2% 19.9% 3.3 3.3 3.3 3.3 18.1% 19.1% 7 7 7 8 8 8 8 9 9 9 9 7 7 7 8 8 8 8 9 9 9 9 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 0 0 1 1 0 0 1 1 0 0 1 0 0 1 1 0 0 1 1 0 0 1 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 6 9 2 3 6 9 2 3 6 9 2 6 9 2 3 6 9 2 3 6 9 2 1 1 0 1 1 1 1 [1] Net Debt to Normalized EBITDA compares total debt as of the last day of the quarter to the annualized Normalized EBITDA for the quarter. [2] See "Financials & Filings - Quarterly Results" on the Investors section of our website at http://investor.caretrustreit.com for reconciliations of Normalized EBITDA to the most directly comparable GAAP measure for the periods presented. [3] Net Debt to Enterprise Value compares total debt as of the last day of the quarter to CareTrust REIT’s Enterprise Value as of the last day of the quarter. See “Glossary” for additional information. 18

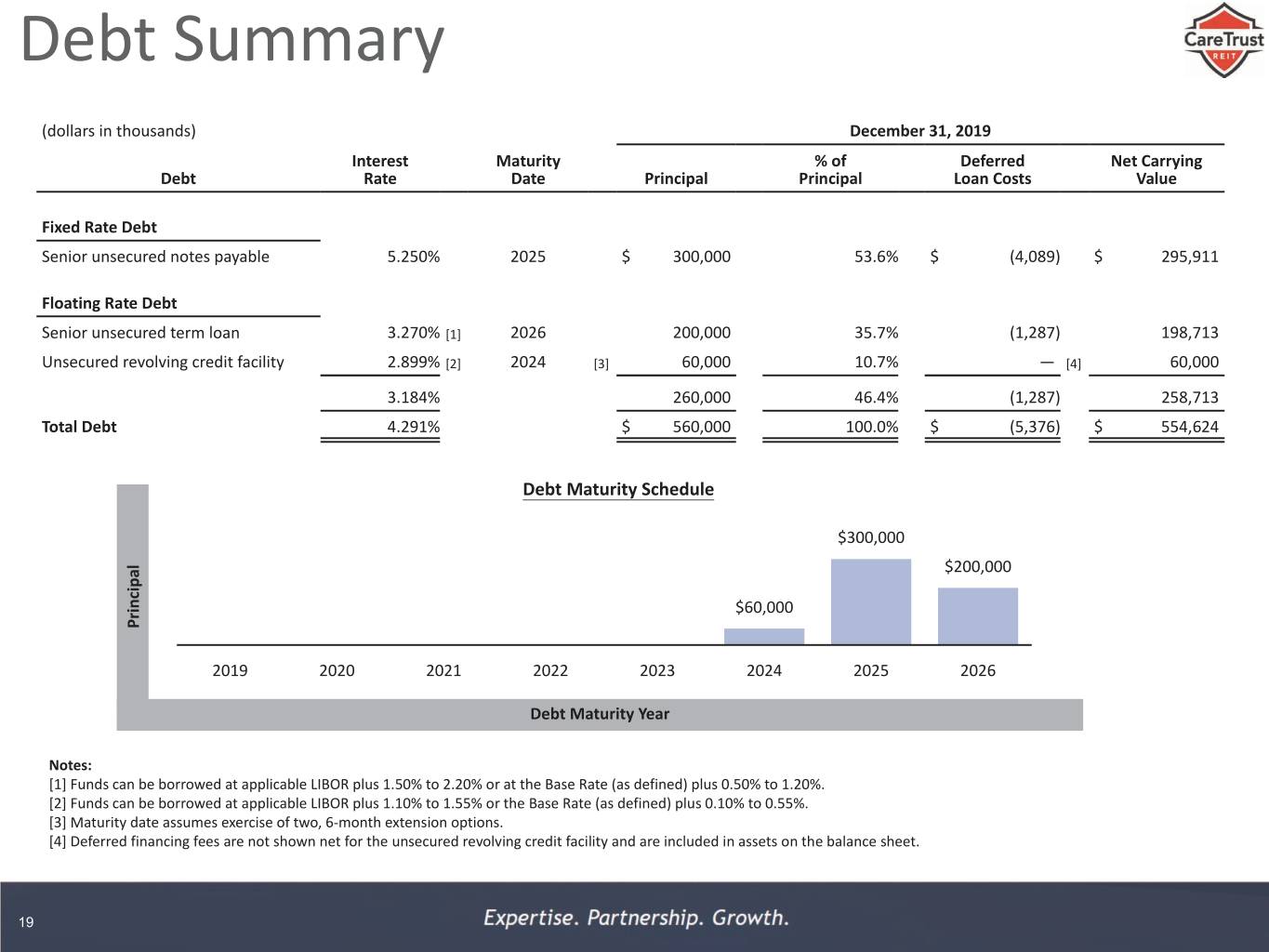

Debt Summary (dollars in thousands) December 31, 2019 Interest Maturity % of Deferred Net Carrying Debt Rate Date Principal Principal Loan Costs Value Fixed Rate Debt Senior unsecured notes payable 5.250% 2025 $ 300,000 53.6% $ (4,089) $ 295,911 Floating Rate Debt Senior unsecured term loan 3.270% [1] 2026 200,000 35.7% (1,287) 198,713 Unsecured revolving credit facility 2.899% [2] 2024 [3] 60,000 10.7% — [4] 60,000 3.184% 260,000 46.4% (1,287) 258,713 Total Debt 4.291% $ 560,000 100.0% $ (5,376) $ 554,624 Debt Maturity Schedule $300,000 $200,000 $60,000 Principal 2019 2020 2021 2022 2023 2024 2025 2026 Debt Maturity Year Notes: [1] Funds can be borrowed at applicable LIBOR plus 1.50% to 2.20% or at the Base Rate (as defined) plus 0.50% to 1.20%. [2] Funds can be borrowed at applicable LIBOR plus 1.10% to 1.55% or the Base Rate (as defined) plus 0.10% to 0.55%. [3] Maturity date assumes exercise of two, 6-month extension options. [4] Deferred financing fees are not shown net for the unsecured revolving credit facility and are included in assets on the balance sheet. 19

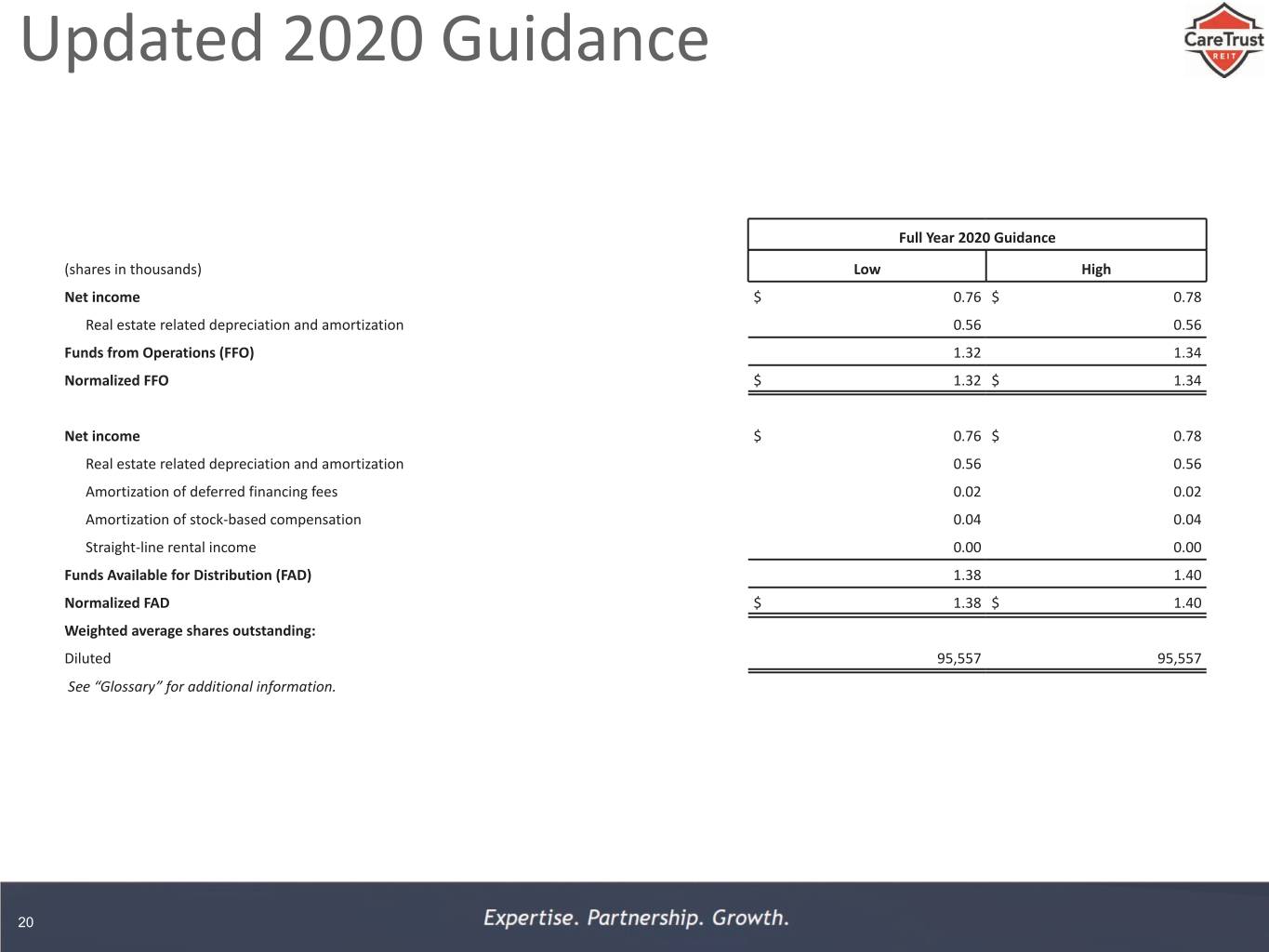

Updated 2020 Guidance Full Year 2020 Guidance (shares in thousands) Low High Net income $ 0.76 $ 0.78 Real estate related depreciation and amortization 0.56 0.56 Funds from Operations (FFO) 1.32 1.34 Normalized FFO $ 1.32 $ 1.34 Net income $ 0.76 $ 0.78 Real estate related depreciation and amortization 0.56 0.56 Amortization of deferred financing fees 0.02 0.02 Amortization of stock-based compensation 0.04 0.04 Straight-line rental income 0.00 0.00 Funds Available for Distribution (FAD) 1.38 1.40 Normalized FAD $ 1.38 $ 1.40 Weighted average shares outstanding: Diluted 95,557 95,557 See “Glossary” for additional information. 20

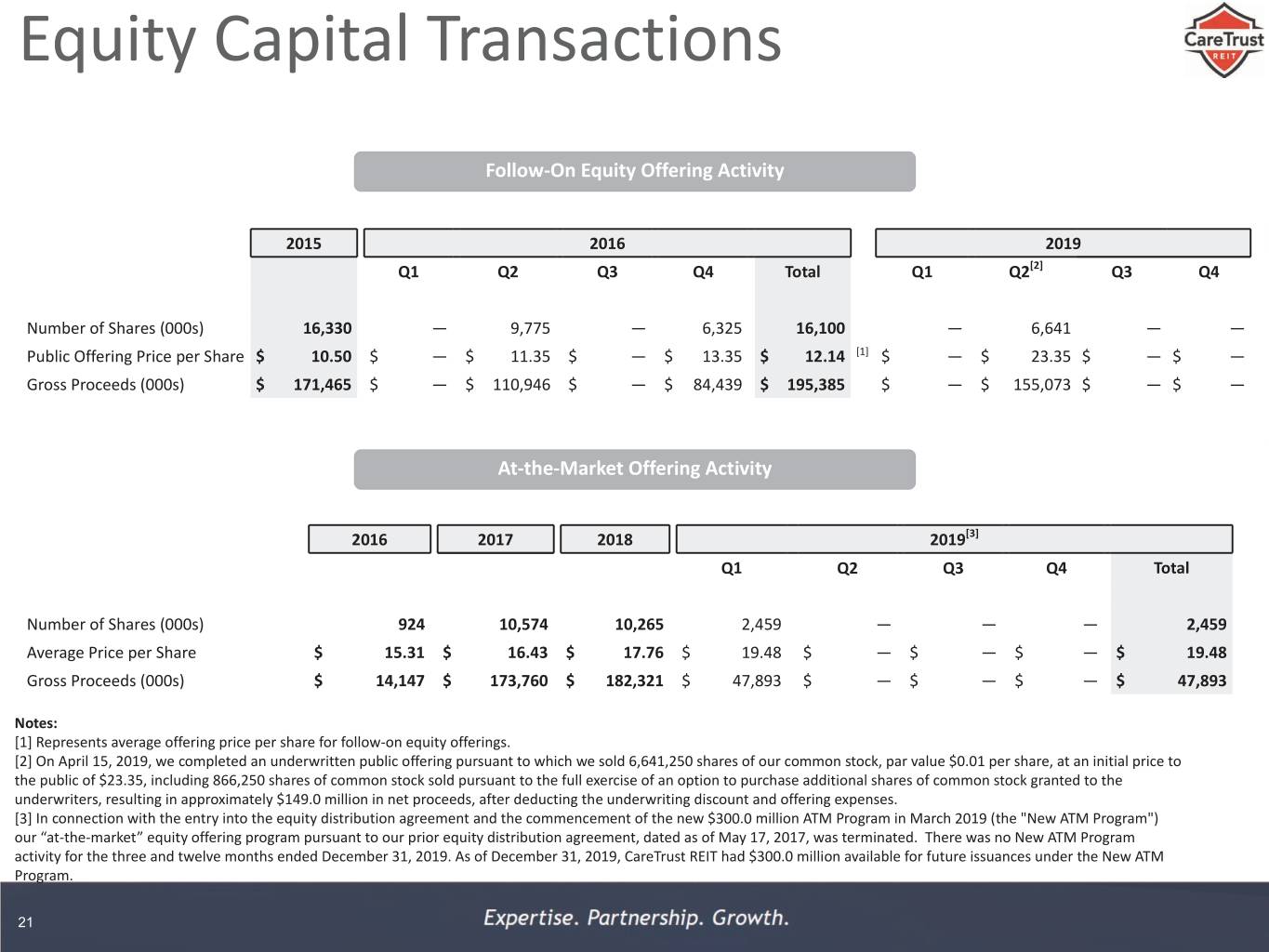

Equity Capital Transactions Follow-On Equity Offering Activity 2015 2016 2019 Q1 Q2 Q3 Q4 Total Q1 Q2[2] Q3 Q4 Number of Shares (000s) 16,330 — 9,775 — 6,325 16,100 — 6,641 — — Public Offering Price per Share $ 10.50 $ — $ 11.35 $ — $ 13.35 $ 12.14 [1] $ — $ 23.35 $ — $ — Gross Proceeds (000s) $ 171,465 $ — $ 110,946 $ — $ 84,439 $ 195,385 $ — $ 155,073 $ — $ — At-the-Market Offering Activity 2016 2017 2018 2019[3] Q1 Q2 Q3 Q4 Total Number of Shares (000s) 924 10,574 10,265 2,459 — — — 2,459 Average Price per Share $ 15.31 $ 16.43 $ 17.76 $ 19.48 $ — $ — $ — $ 19.48 Gross Proceeds (000s) $ 14,147 $ 173,760 $ 182,321 $ 47,893 $ — $ — $ — $ 47,893 Notes: [1] Represents average offering price per share for follow-on equity offerings. [2] On April 15, 2019, we completed an underwritten public offering pursuant to which we sold 6,641,250 shares of our common stock, par value $0.01 per share, at an initial price to the public of $23.35, including 866,250 shares of common stock sold pursuant to the full exercise of an option to purchase additional shares of common stock granted to the underwriters, resulting in approximately $149.0 million in net proceeds, after deducting the underwriting discount and offering expenses. [3] In connection with the entry into the equity distribution agreement and the commencement of the new $300.0 million ATM Program in March 2019 (the "New ATM Program") our “at-the-market” equity offering program pursuant to our prior equity distribution agreement, dated as of May 17, 2017, was terminated. There was no New ATM Program activity for the three and twelve months ended December 31, 2019. As of December 31, 2019, CareTrust REIT had $300.0 million available for future issuances under the New ATM Program. 21

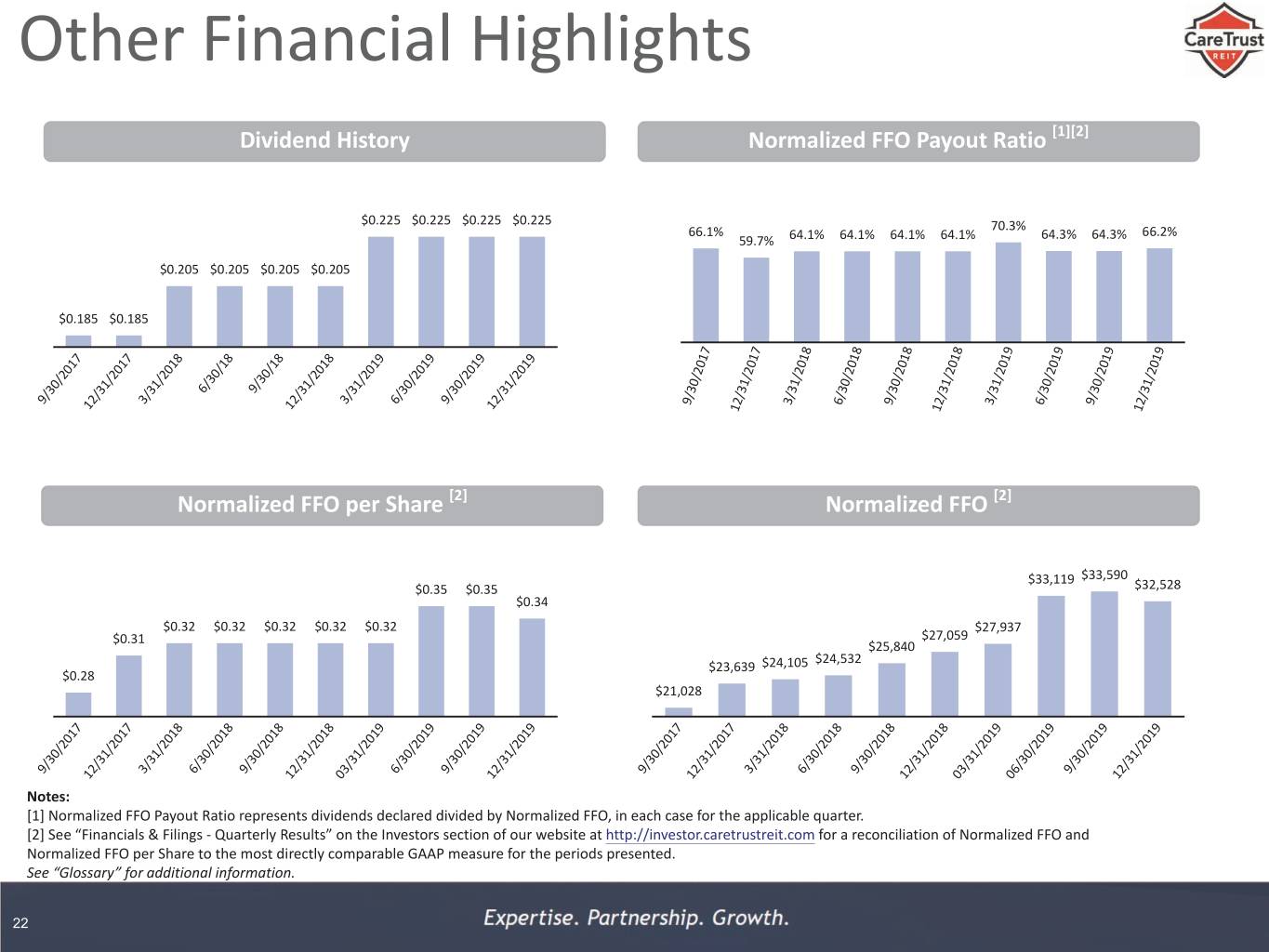

Other Financial Highlights Dividend History Normalized FFO Payout Ratio [1][2] $0.225 $0.225 $0.225 $0.225 66.1% 70.3% 66.2% 59.7% 64.1% 64.1% 64.1% 64.1% 64.3% 64.3% $0.205 $0.205 $0.205 $0.205 $0.185 $0.185 7 7 8 8 8 8 9 9 9 9 7 7 8 8 8 8 9 9 9 9 1 1 1 1 1 1 1 1 1 1 1 1 1 /1 /1 1 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2 2 2 2 2 2 2 2 2 2 /2 /2 /2 3 3 /2 /2 /2 /2 /2 / / / / / / / / / / 0 1 1 / / 1 1 0 0 1 0 1 1 0 0 1 1 0 0 1 3 3 3 6 9 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 / / / / / / / / / / / / / / / / / / 9 2 3 2 3 6 9 2 9 2 3 6 9 2 3 6 9 2 1 1 1 1 1 1 Normalized FFO per Share [2] Normalized FFO [2] $33,119 $33,590 $0.35 $0.35 $32,528 $0.34 $0.32 $0.32 $0.32 $0.32 $0.32 $27,937 $0.31 $27,059 $25,840 $24,532 $23,639 $24,105 $0.28 $21,028 7 7 8 8 8 8 9 9 9 9 7 7 8 8 8 8 9 9 9 9 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 0 1 1 0 0 1 1 0 0 1 0 1 1 0 0 1 1 0 0 1 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 /3 9 2 3 6 9 2 3 6 9 2 9 2 3 6 9 2 3 6 9 2 1 1 0 1 1 1 0 0 1 Notes: [1] Normalized FFO Payout Ratio represents dividends declared divided by Normalized FFO, in each case for the applicable quarter. [2] See “Financials & Filings - Quarterly Results” on the Investors section of our website at http://investor.caretrustreit.com for a reconciliation of Normalized FFO and Normalized FFO per Share to the most directly comparable GAAP measure for the periods presented. See “Glossary” for additional information. 22

Glossary Assisted Living Facilities (“ALFs”) EBITDARM Coverage Licensed healthcare facilities that provide personal care services, support and housing Aggregate EBITDARM produced by all facilities under a master lease (or other for those who need help with daily living activities, such as bathing, eating and grouping) for the trailing twelve-month period ended September 30, 2019 divided dressing, yet require limited medical care. The programs and services may include by the base rent payable to CareTrust REIT under such master lease (or other transportation, social activities, exercise and fitness programs, beauty or barber shop grouping) for the same period; provided that if the master lease has been amended access, hobby and craft activities, community excursions, meals in a dining room to change the base rent during or since such period, then the aggregate EBITDARM setting and other activities sought by residents. These facilities are often in apartment- for such period is divided by the annualized monthly base rent currently in effect. In like buildings with private residences ranging from single rooms to large apartments. addition, we may exclude from coverage disclosures those facilities which are (i) Certain ALFs may offer higher levels of personal assistance for residents requiring classified as Held for Sale, (ii) temporarily on Special Focus Facility (SFF) status, (iii) memory care as a result of Alzheimer’s disease or other forms of dementia. Levels of undergoing significant renovations that necessarily result in a material reduction in personal assistance are based in part on local regulations. occupancy, or (iv) have been acquired for or recently transferred to new operators for turnaround and are pre-stabilized. EBITDA Net income before interest expense, income tax, depreciation and amortization and Enterprise Value amortization of stock-based compensation.[1] Share price multiplied by the number of outstanding shares plus total outstanding debt minus cash, each as of a specified date. EBITDAR Net income before interest expense, income tax, depreciation, amortization and rent, Funds Available for Distribution (“FAD”) after applying a standardized management fee (5% of facility operating revenues). FFO, excluding straight-line rental income adjustments, amortization of deferred financing fees and stock-based compensation expense.[2] EBITDAR Coverage Aggregate EBITDAR produced by all facilities under a master lease (or other Funds from Operations (“FFO”) grouping) for the trailing twelve-month period ended September 30, 2019 divided Net income, excluding gains and losses from dispositions of real estate or other real by the base rent payable to CareTrust REIT under such master lease (or other estate, before real estate depreciation and amortization and real estate impairment grouping) for the same period; provided that if the master lease has been amended charges. CareTrust REIT calculates and reports FFO in accordance with the definition to change the base rent during or since such period, then the aggregate EBITDAR and interpretive guidelines issued by the National Association of Real Estate for such period is divided by the annualized monthly base rent currently in effect. In Investment Trusts.[2] addition, we may exclude from coverage disclosures those facilities which are (i) classified as Held for Sale, (ii) temporarily on Special Focus Facility (SFF) status, (iii) Independent Living Facilities (“ILFs”) undergoing significant renovations that necessarily result in a material reduction in Also known as retirement communities or senior apartments, ILFs are not healthcare occupancy, or (iv) have been acquired for or recently transferred to new operators facilities. ILFs typically consist of entirely self-contained apartments, complete with for turnaround and are pre-stabilized. their own kitchens, baths and individual living spaces, as well as parking for tenant vehicles. They are most often rented unfurnished, and generally can be personalized EBITDARM by the tenants, typically an individual or a couple over the age of 55. These facilities Earnings before interest expense, income tax, depreciation, amortization, cash rent, offer various services and amenities such as laundry, housekeeping, dining options/ and a standardized management fee (5% of facility operating revenues). meal plans, exercise and wellness programs, transportation, social, cultural and recreational activities, and on-site security. 23

Glossary Multi-Service Campus Notes: Facilities that include a combination of Skilled Nursing beds and Seniors Housing [1] EBITDA and Normalized EBITDA do not represent cash flows from operations or units. net income as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. EBITDA Normalized EBITDA and Normalized EBITDA do not purport to be indicative of cash available to fund future EBITDA, adjusted for certain income and expense items the Company does not believe cash requirements, including the Company’s ability to fund capital expenditures or are indicative of its ongoing results, such as certain acquisition costs, real estate make payments on its indebtedness. Further, the Company’s computation of EBITDA impairment charges, provision for loans, provision for doubtful accounts and lease and Normalized EBITDA may not be comparable to EBITDA and Normalized EBITDA restructuring, property operating expenses and gains or losses from dispositions of reported by other REITs. real estate or other real estate.[1] [2] CareTrust REIT believes FAD, FFO, Normalized FAD, and Normalized FFO (and their Normalized FAD related per-share amounts) are important non-GAAP supplemental measures of its FAD, adjusted for certain income and expense items the Company does not believe operating performance. Because the historical cost accounting convention used for are indicative of its ongoing results, such as certain provision for loans, provision for real estate assets requires straight-line depreciation (except on land), such accounting doubtful accounts and lease restructuring and property operating expenses.[2] presentation implies that the value of real estate assets diminishes predictably over time, even though real estate values have historically risen or fallen with market and Normalized FFO other conditions. Moreover, by excluding items not indicative of ongoing results, FFO, adjusted for certain income and expense items the Company does not believe Normalized FAD and Normalized FFO can facilitate meaningful comparisons of are indicative of its ongoing results, and certain provision for loans, provision for operating performance between periods and between other companies. However, doubtful accounts and lease restructuring and property operating expenses.[2] FAD, FFO, Normalized FAD, and Normalized FFO (and their per-share amounts) do not represent cash flows from operations or net income attributable to shareholders as Seniors Housing defined by GAAP and should not be considered an alternative to those measures in Includes ALFs, ILFs, dedicated memory care facilities and similar facilities. evaluating the Company’s liquidity or operating performance. Skilled Nursing or Skilled Nursing Facilities (“SNFs”) Licensed healthcare facilities that provide restorative, rehabilitative and nursing care for people not requiring the more extensive and sophisticated treatment available at an acute care hospital or long-term acute care hospital. Treatment programs include physical, occupational, speech, respiratory, ventilator, and wound therapy. 24

Cascadia of Nampa (Nampa, ID)