Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Senmiao Technology Ltd | tm205275d1_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Senmiao Technology Ltd | tm205275d1_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Senmiao Technology Ltd | tm205275d1_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Senmiao Technology Ltd | tm205275d1_ex31-1.htm |

| EX-10.3 - EXHIBIT 10.3 - Senmiao Technology Ltd | tm205275d1_ex10-3.htm |

| EX-10.2 - EXHIBIT 10.2 - Senmiao Technology Ltd | tm205275d1_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - Senmiao Technology Ltd | tm205275d1_ex10-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the quarterly period ended December 31, 2019

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from ________ to________.

Commission File Number: 001-38426

SENMIAO TECHNOLOGY LIMITED

(Exact name of registrant as specified in its charter)

| Nevada | 35-2600898 | |

| (State or other jurisdiction | (IRS Employer Identification No.) | |

| of incorporation or organization) | ||

|

16F, Shihao Square, Middle Jiannan Blvd. High-Tech Zone, Chengdu Sichuan, People’s Republic of China |

610000 | |

| (Address of principal executive offices) | (Zip Code) |

+86 28 61554399

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 per share | AIHS | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |

| Non-accelerated filer | x | Smaller reporting company | x | |

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of February 13, 2020, there were 28,839,803 shares of the issuer’s common stock, par value $0.0001 per share, outstanding.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (the “Report”), including, without limitation, statements under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, including but not limited to, the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,” “will,” “potential,” “projects,” “predicts,” “continues,” or “should,” or, in each case, their negative or other variations or comparable terminology. We have based these forward-looking statements largely on management's current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. However, actual results may differ materially due to various factors, including, but not limited to:

| · | our goals and strategies (including, without limitation, our ability to effectively wind down our peer-to-peer online lending business and establish and grow our other businesses); | |

| · | our future business development, financial condition and results of operations; | |

| · | the growth of disposable household income and the availability and cost of credit available to finance car purchases; | |

| · | the growth of China’s ride-hailing, automobile financing and leasing industries; | |

| · | taxes and other incentives or disincentives related to car purchases and ownership; | |

| · | fluctuations in the sales and price of new and used cars and consumer acceptance of financing car purchases; | |

| · | ride-hailing, transportation networks, and other fundamental changes in transportation pattern; | |

| · | our expectations regarding demand for and market acceptance of our products and services; | |

| · | our expectations regarding our customer base; | |

| · | our plans to invest in our automobile transaction and related services business; | |

| · | our relationships with our business partners; | |

| · | competition in our industries; | |

| · | possible disruptions in commercial activities caused by events such as natural disasters, terrorist activity and armed conflict, including the disruption caused by the ongoing coronavirus outbreak in China; | |

| · | macro-economic and political conditions affecting the global economy generally and the market in China specifically; and | |

| · | relevant government policies and regulations relating to our industries. |

You should read this Report and the documents that we refer to in this Report with the understanding that our actual future results may be materially different from and worse than what we expect. Other sections of this Report and our other reports filed with the Securities and Exchange Commission (the “SEC”) include additional factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

This Report also contains statistical data and estimates that we obtained from industry publications and reports generated by third-parties. Although we have not independently verified the data, we believe that the publications and reports are reliable. The market data contained in this Report involves a number of assumptions, estimates and limitations. The ride-hailing and automobile financing markets in China may not grow at the rates projected by market data, or at all. The failure of these markets to grow at the projected rates may have a material adverse effect on our business and the market price of our common stock. If any one or more of the assumptions underlying the market data turns out to be incorrect, actual results may differ from the projections based on these assumptions. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described herein or our other reports filed with the SEC. You should not place undue reliance on these forward-looking statements.

3

PART I - FINANCIAL INFORMATION

| Item 1. | Financial Statements. |

SENMIAO TECHNOLOGY LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Expressed in U.S. dollar, except for the number of shares)

| December 31, | March 31, | |||||||

| 2019 | 2019 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 1,173,521 | $ | 3,967,980 | ||||

| Accounts receivable, net, current portion | 2,009,589 | 199,909 | ||||||

| Inventories | 1,526,077 | 1,508,244 | ||||||

| Finance lease receivables, net, current portion | 428,958 | 10,254 | ||||||

| Prepayments, receivables and other assets, net | 4,701,683 | 3,787,254 | ||||||

| Escrow receivable due within one year | - | 600,000 | ||||||

| Due from related parties | 107,855 | 140,498 | ||||||

| Current assets - discontinued operations | 920,085 | 1,185,016 | ||||||

| Total Current Assets | 10,867,768 | 11,399,155 | ||||||

| Property and equipment, net | ||||||||

| Property and equipment, net | 417,141 | 100,680 | ||||||

| Property and equipment, net - discontinued operations | 13,883 | 25,205 | ||||||

| Total Property and equipment, net | 431,024 | 125,885 | ||||||

| Other Assets | ||||||||

| Right-of-use assets, net | 659,961 | - | ||||||

| Intangible assets, net | 1,372 | 1,627 | ||||||

| Prepayment for intangible assets | 750,000 | 280,000 | ||||||

| Accounts receivable, noncurrent | 1,090,787 | - | ||||||

| Finance lease receivables, net, noncurrent | 748,249 | 22,298 | ||||||

| Other assets - discontinued operations | 161,881 | 485,170 | ||||||

| Total Other Assets | 3,412,250 | 789,095 | ||||||

| Total Assets | $ | 14,711,042 | $ | 12,314,135 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Current Liabilities | ||||||||

| Borrowings from financial institutions | $ | 211,248 | $ | 219,157 | ||||

| Borrowings from third parties | - | 476,765 | ||||||

| Accounts payable | 55,453 | - | ||||||

| Advance from customers | 60,317 | 31,776 | ||||||

| Income tax payable | 26,975 | 21,905 | ||||||

| Accrued expenses and other liabilities | 1,482,933 | 962,291 | ||||||

| Due to related parties and affiliates | 212,144 | 415,931 | ||||||

| Lease liabilities | 209,188 | - | ||||||

| Derivative liabilities | 629,848 | - | ||||||

| Current liabilities - discontinued operations | 4,954,400 | 1,625,779 | ||||||

| Total Current Liabilities | 7,842,506 | 3,753,604 | ||||||

| Other Liabilities | ||||||||

| Borrowings from financial institutions, noncurrent | 41,696 | 177,789 | ||||||

| Lease liabilities, noncurrent | 421,109 | - | ||||||

| Total Other Liabilities | 462,805 | 177,789 | ||||||

| Total liabilities | 8,305,311 | 3,931,393 | ||||||

| Commitments and Contingencies | ||||||||

| Stockholders' Equity | ||||||||

| Common stock (par value $0.0001 per share, 100,000,000 shares authorized; 28,839,803 and 25,945,255 shares issued and outstanding at December 31, 2019 and March 31, 2019, respectively) | 2,884 | 2,595 | ||||||

| Additional paid-in capital | 26,835,804 | 23,833,112 | ||||||

| Accumulated deficit | (19,846,811 | ) | (15,031,538 | ) | ||||

| Accumulated other comprehensive loss | (621,957 | ) | (428,771 | ) | ||||

| Total Senmiao Technology Limited Stockholders' Equity | 6,369,920 | 8,375,398 | ||||||

| Noncontrolling interests | 35,811 | 7,344 | ||||||

| Total Equity | 6,405,731 | 8,382,742 | ||||||

| Total Liabilities and Equity | $ | 14,711,042 | $ | 12,314,135 | ||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

4

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Expressed in U.S. dollar, except for the number of shares)

| For the Three Months Ended December 31, | For the Nine Months Ended December 31, | |||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| Revenues | $ | 2,745,579 | $ | 118,736 | $ | 13,643,429 | $ | 118,736 | ||||||||

| Cost of revenues | (1,901,405 | ) | - | (10,632,901 | ) | - | ||||||||||

| Gross profit | 844,174 | 118,736 | 3,010,528 | 118,736 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Selling, general and administrative expenses | (1,339,238 | ) | (529,913 | ) | (3,486,410 | ) | (1,028,314 | ) | ||||||||

| Total operating expenses | (1,339,238 | ) | (529,913 | ) | (3,486,410 | ) | (1,028,314 | ) | ||||||||

| Loss from operations | (495,064 | ) | (411,177 | ) | (475,882 | ) | (909,578 | ) | ||||||||

| Other income (expense) | ||||||||||||||||

| Other income (expense), net | (37,636 | ) | 10,785 | (53,364 | ) | 10,786 | ||||||||||

| Interest expense | (17,248 | ) | (6,239 | ) | (79,593 | ) | (6,239 | ) | ||||||||

| Change in fair value of derivative liabilities | (485,400 | ) | - | 1,509,406 | - | |||||||||||

| Total other income (expense), net | (540,284 | ) | 4,546 | 1,376,449 | 4,547 | |||||||||||

| Income (loss) before income taxes | (1,035,348 | ) | (406,631 | ) | 900,567 | (905,031 | ) | |||||||||

| Income tax benefits (expenses) | 72,648 | - | (32,950 | ) | - | |||||||||||

| Net income (loss) from continuing operations | (962,700 | ) | (406,631 | ) | 867,617 | (905,031 | ) | |||||||||

| Net loss from discontinued operations | (4,399,236 | ) | (361,661 | ) | (5,593,627 | ) | (1,583,630 | ) | ||||||||

| Net loss | (5,361,936 | ) | (768,292 | ) | (4,726,010 | ) | (2,488,661 | ) | ||||||||

| Less: Net (income) loss attributable to noncontrolling interests from continuing operations | 34,769 | (3,041 | ) | (89,264 | ) | (3,041 | ) | |||||||||

| Net loss attributable to stockholders | $ | (5,327,167 | ) | $ | (771,333 | ) | $ | (4,815,274 | ) | $ | (2,491,702 | ) | ||||

| Net loss | $ | (5,361,936 | ) | $ | (768,292 | ) | $ | (4,726,010 | ) | $ | (2,488,661 | ) | ||||

| Other comprehensive income (loss) | ||||||||||||||||

| Foreign currency translation adjustment | 206,432 | (26,063 | ) | (253,983 | ) | (132,763 | ) | |||||||||

| Comprehensive loss | (5,155,504 | ) | (794,355 | ) | (4,979,993 | ) | (2,621,424 | ) | ||||||||

| Less: Total comprehensive (income) loss attributable to noncontrolling interests | 30,015 | (3,041 | ) | 28,467 | - | |||||||||||

| Total comprehensive loss attributable to stockholders | $ | (5,185,519 | ) | $ | (791,314 | ) | $ | (5,008,460 | ) | $ | (2,621,424 | ) | ||||

| Weighted average number of common stock | ||||||||||||||||

| Basic and diluted | 28,825,281 | 25,879,400 | 27,733,885 | 25,879,400 | ||||||||||||

| Earnings (loss) per share - basic and diluted | ||||||||||||||||

| Continuing operations | $ | (0.03 | ) | $ | (0.02 | ) | $ | 0.03 | $ | (0.04 | ) | |||||

| Discontinued operations | $ | (0.15 | ) | $ | (0.01 | ) | $ | (0.20 | ) | $ | (0.06 | ) | ||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

5

SENMIAO TECHNOLOGY LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Expressed in U.S. dollar, except for the number of shares)

| For the Nine Months Ended December 31, 2018 | ||||||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||||||

| Additional | other | Non- | ||||||||||||||||||||||||||

| Common stock | paid-in | Accumulated | comprehensive | controlling | Total | |||||||||||||||||||||||

| Shares | Par value | capital | deficit | income (loss) | interest | equity | ||||||||||||||||||||||

| BALANCE, March 31, 2018 | 25,879,400 | $ | 2,588 | $ | 23,611,512 | $ | (10,481,669 | ) | $ | (253,761 | ) | $ | - | $ | 12,878,670 | |||||||||||||

| Net loss | - | - | - | (930,364 | ) | - | - | (930,364 | ) | |||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | (48,735 | ) | - | (48,735 | ) | |||||||||||||||||||

| BALANCE, June 30, 2018 (Unaudited) | 25,879,400 | 2,588 | 23,611,512 | (11,412,033 | ) | (302,496 | ) | - | 11,899,571 | |||||||||||||||||||

| Net loss | - | - | - | (790,005 | ) | - | - | (790,005 | ) | |||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | (57,965 | ) | - | (57,965 | ) | |||||||||||||||||||

| BALANCE, September 30, 2018 (Unaudited) | 25,879,400 | $ | 2,588 | $ | 23,611,512 | $ | (12,202,038 | ) | $ | (360,461 | ) | $ | - | $ | 11,051,601 | |||||||||||||

| Gain from acquisition of variable interest entities | - | - | 45,895 | - | - | - | 45,895 | |||||||||||||||||||||

| Net income (loss) | - | - | - | (771,333 | ) | - | 3,041 | (768,292 | ) | |||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | (26,063 | ) | - | (26,063 | ) | |||||||||||||||||||

| BALANCE, December 31, 2018 (Unaudited) | 25,879,400 | $ | 2,588 | $ | 23,657,407 | $ | (12,973,371 | ) | $ | (386,524 | ) | $ | 3,041 | $ | 10,303,141 | |||||||||||||

| For the Nine Months Ended December 31, 2019 | ||||||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||||||

| Additional | other | Non- | ||||||||||||||||||||||||||

| Common stock | paid-in | Accumulated | comprehensive | controlling | Total | |||||||||||||||||||||||

| Shares | Par value | capital | deficit | income (loss) | interest | equity | ||||||||||||||||||||||

| BALANCE, March 31, 2019 | 25,945,255 | $ | 2,595 | $ | 23,833,112 | $ | (15,031,538 | ) | $ | (428,771 | ) | $ | 7,344 | $ | 8,382,742 | |||||||||||||

| Net income (loss) | - | - | - | (578,360 | ) | - | 72,928 | (505,432 | ) | |||||||||||||||||||

| Issuance of common stock in registered direct offering net of issuance costs | 1,781,360 | 178 | 1,991,940 | - | - | - | 1,992,118 | |||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | (57,947 | ) | (28,276 | ) | (86,223 | ) | ||||||||||||||||||

| BALANCE, June 30, 2019 (Unaudited) | 27,726,615 | 2,773 | 25,825,052 | (15,609,898 | ) | (486,718 | ) | 51,996 | 9,783,205 | |||||||||||||||||||

| Net income | - | - | - | 1,090,254 | - | 51,105 | 1,141,359 | |||||||||||||||||||||

| Exercise of Series B warrants into common stock | 964,741 | 96 | 961,631 | 961,727 | ||||||||||||||||||||||||

| Foreign currency translation adjustment | (276,887 | ) | (97,305 | ) | (374,192 | ) | ||||||||||||||||||||||

| BALANCE, September 30, 2019 (Unaudited) | 28,691,356 | 2,869 | 26,786,683 | (14,519,644 | ) | (763,605 | ) | 5,796 | 11,512,099 | |||||||||||||||||||

| Net loss | - | - | - | (5,327,167 | ) | - | (34,769 | ) | (5,361,936 | ) | ||||||||||||||||||

| Exercise of Series B warrants into common stock | 148,447 | 15 | 49,121 | - | - | - | 49,136 | |||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 141,648 | 64,784 | 206,432 | |||||||||||||||||||||

| BALANCE, December 31, 2019 (Unaudited) | 28,839,803 | $ | 2,884 | $ | 26,835,804 | $ | (19,846,811 | ) | $ | (621,957 | ) | $ | 35,811 | $ | 6,405,731 | |||||||||||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

6

SENMIAO TECHNOLOGY LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in U.S. dollar, except for the number of shares)

| For the Nine Months Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net loss | $ | (4,726,010 | ) | $ | (2,488,661 | ) | ||

| Net loss from discontinued operations | (5,593,627 | ) | (1,583,630 | ) | ||||

| Net income (loss) from continuing operations | 867,617 | (905,031 | ) | |||||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization of property and equipment | 82,672 | 947 | ||||||

| Amortization of right-of-use assets | 89,095 | - | ||||||

| Amortization of intangible assets | 197 | 14 | ||||||

| Provision for doubtful accounts | 228,249 | - | ||||||

| Loss on disposal of equipment | 4,593 | - | ||||||

| Change in fair value of derivative liabilities | (1,509,406 | ) | - | |||||

| Change in operating assets and liabilities | ||||||||

| Accounts receivable | (2,985,722 | ) | 309 | |||||

| Inventories | (72,278 | ) | - | |||||

| Prepayments, receivables and other assets | (1,226,099 | ) | (280,402 | ) | ||||

| Finance lease receivables | (1,146,021 | ) | - | |||||

| Accounts payable | 55,464 | - | ||||||

| Advances from customers | 29,693 | - | ||||||

| Income tax payable | 5,860 | - | ||||||

| Accrued expenses and other liabilities | 548,545 | (3,179 | ) | |||||

| Lease liabilities | (80,297 | ) | - | |||||

| Net cash used in operating activities from continuing operations | (5,107,838 | ) | (1,187,342 | ) | ||||

| Net cash used in operating activities from discontinued operations | (1,896,242 | ) | (1,273,309 | ) | ||||

| Net Cash Used in Operating Activities | (7,004,080 | ) | (2,460,651 | ) | ||||

| Cash Flows from Investing Activities: | ||||||||

| Purchases of property and equipment | (414,958 | ) | (688 | ) | ||||

| Prepayment of intangible assets | (470,000 | ) | - | |||||

| Net cash used in investing activities from continuing operations | (884,958 | ) | (688 | ) | ||||

| Net cash provided by (used in) investing activities from discontinued operations | 1,822 | (448,575 | ) | |||||

| Net Cash Used in Investing Activities | (883,136 | ) | (449,263 | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Net proceeds from issuance of common stock in registered direct offering | 5,142,124 | - | ||||||

| Net proceeds from issuance of common stock upon warrants exercised | 111 | - | ||||||

| Repayments to stockholders | (90,000 | ) | (1,900,000 | ) | ||||

| Repayments to third parties | (459,635 | ) | - | |||||

| Repayments from (loans to) related parties | 27,577 | (1,441 | ) | |||||

| Borrowings from related parties and affiliates | 555,616 | 290,183 | ||||||

| Repayments to related parties and affiliates | (1,554,423 | ) | - | |||||

| Repayments of current borrowings from financial institutions | (129,698 | ) | - | |||||

| Repayments of noncurrent borrowings from financial institutions | - | (16,929 | ) | |||||

| Release of escrow receivable | 600,000 | 600,000 | ||||||

| Cash acquired from acquisition | - | 213,644 | ||||||

| Net cash provided by (used in) financing activities from continuing operations | 4,091,672 | (814,543 | ) | |||||

| Net cash provided by financing activities from discontinued operations | 154,103 | 1,974,617 | ||||||

| Net Cash Provided by Financing Activities | 4,245,775 | 1,160,074 | ||||||

| Effect of exchange rate changes on cash and cash equivalents | (196,028 | ) | (100,007 | ) | ||||

| Net decrease in cash and cash equivalents | (3,837,469 | ) | (1,849,847 | ) | ||||

| Cash and cash equivalents, beginning of period | 5,020,510 | 11,141,566 | ||||||

| Cash and cash equivalents, end of period | 1,183,041 | 9,291,719 | ||||||

| Less: Cash and cash equivalents from discontinued operations | (9,520 | ) | (1,839,722 | ) | ||||

| Cash and cash equivalents from continuing operations, end of period | $ | 1,173,521 | $ | 7,451,997 | ||||

| Supplemental Cash Flow Information | ||||||||

| Cash paid for interest expense | $ | 79,593 | $ | 6,239 | ||||

| Cash paid for income tax | $ | - | $ | - | ||||

| Non-cash Transaction in Investing and Financing Activities | ||||||||

| IPO expenses paid by the Company’s stockholders | $ | - | $ | 70,687 | ||||

| Right-of-use assets obtained in exchange of operating lease liabilities | $ | 957,472 | $ | - | ||||

| Allocation of fair value of derivative liabilities for issuance of common stock proceeds | $ | 3,150,006 | $ | - | ||||

| Allocation of fair value of derivative liabilities to additional paid in capital upon warrants exercised | $ | 1,010,752 | $ | - | ||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

7

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 1. | ORGANIZATION AND PRINCIPAL ACTITIVIES |

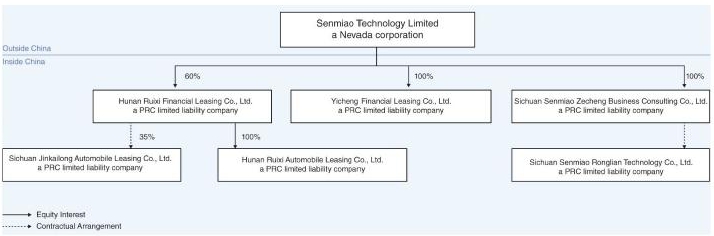

Senmiao Technology Limited (the “Company”) is a U.S. holding company incorporated in the State of Nevada on June 8, 2017. The Company provides automobile transaction and related services focusing on the ride-hailing industry in the People’s Republic of China (“PRC” or “China”) through its majority owned subsidiary, Hunan Ruixi Financial Leasing Co., Ltd. (“Hunan Ruixi”), a PRC limited liability company, its wholly owned subsidiary, Hunan Ruixi Automobile Leasing Co., Ltd. (“Ruixi Leasing”), and its variable interest entity (“VIE”), Sichuan Jinkailong Automobile Leasing Co., Ltd. (“Jinkailong”). The Company operated an online lending platform in China through its VIE, Sichuan Senmiao Ronglian Technology Co., Ltd. (“Sichuan Senmiao”), which facilitated peer-to-peer (“P2P”) loan transactions between Chinese investors and individual and small-to-medium-sized enterprise borrowers. The Company ceased its online lending services business in October 2019 and commenced a process of winding down such business.

On September 25, 2016, Sichuan Senmiao acquired a P2P platform (including website, internet content provider license, operating systems, servers, and management system) from Sichuan Chenghexin Investment and Asset Management Co., Ltd. On July 28, 2017, the Company established a wholly-owned subsidiary, Sichuan Senmiao Zecheng Business Consulting Co., Ltd. (“Senmiao Consulting”) in China. Sichuan Senmiao was established in China in June 2014. On September 18, 2017, the Company, through Senmiao Consulting, entered into a series of agreements (“VIE Agreements”) with Sichuan Senmiao and its equity holders (the “Sichuan Senmiao Shareholders”) to obtain control and became the primary beneficiary of Sichuan Senmiao (the “Restructuring”). In connection with the Restructuring, as partial consideration for the Sichuan Senmiao Shareholders’ commitment to perform their obligations under the VIE Agreements, the Company issued an aggregate of 45,000,000 shares of its common stock to the Sichuan Senmiao Shareholders pursuant to certain subscription agreements dated September 18, 2017.

On November 21, 2018, as part of its entry into the automobile transaction business, the Company entered into an Investment and Equity Transfer Agreement (the “Investment Agreement”) with Hunan Ruixi and all the shareholders of Hunan Ruixi (“Hunan Ruixi Shareholders”), pursuant to which the Company acquired from the Hunan Ruixi Shareholders an aggregate of 60% of the equity interest of Hunan Ruixi. The Company closed the acquisition on November 22, 2018 and agreed to make a cash contribution of $6,000,000 to Hunan Ruixi, representing 60% of its registered capital, in accordance with the Investment Agreement (Note 3). As of June 30, 2019, the Company made the full cash contributions in the aggregate amount of $6,000,000 to Hunan Ruixi.

Hunan Ruixi holds a business license for automobile sales and financial leasing and has been engaged in automobile financial leasing services and automobile sales since January 2019. Hunan Ruixi also controls Jinkailong through its 35% equity interest and a voting agreement with Jinkailong’s other shareholders. Jinkailong facilitates automobile sales and financing transactions for its clients, who are primarily ride-hailing drivers and provides them relevant after-transaction services. In March 2019, Hunan Ruixi began its financing leasing operation.

In May 2019, the Company formed a wholly owned subsidiary, Yicheng Financial Leasing Co., Ltd. (“Yicheng”), with a registered capital of $50 million in Chengdu City, Sichuan Province. Yicheng obtained its business licenses for automobiles sale and financial leasing on May 5, 2019. Yicheng has been engaged in automobile sales since June 2019.

On July 5, 2019, Yicheng entered into an Investment and Equity Transfer Agreement with Chengdu Mashangchuxing Automobile Leasing Co., Ltd. (“Mashang Chuxing”), Chengdu Yunche Chixun Business Consulting Co., Ltd. (“Yunche Chixun”), Mr. Zhiqiu Xia and all the shareholders of Mashang Chuxing (“Mashang Chuxing Shareholders”), pursuant to which, Yicheng, Yunche Chixun, Mr. Zhiqiu Xia acquired from the Mashang Chuxing Shareholders 49%, 5% and 46% of the equity interests of Mashang Chuxing for no consideration, respectively. As of the date of the financial statements, none of the shareholders of Mashang Chuxing made capital contribution. Mashang Chuxing commenced providing ride-hailing services in August 2019 and has not generated significant revenue due to limited operations. As a result, no equity investment income nor expense were recorded for the three and nine months ended December 31, 2019.

On October 17, 2019, the Board of Directors of the Company (the “Board”) approved a plan (the “Plan”) prepared by the Company’s executive officers for the Company to discontinue and wind down its online P2P lending services business. In connection with the Plan, the Company ceased facilitation of loan transactions on its online lending platform and assumed all the outstanding loans from investors on the platform. The decision and action taken by the Company to discontinue the online P2P lending services business represents a major shift that will have a material effect on the Company’s operations and financial results, which triggers discontinued operations accounting in accordance with ASC 205-20-45. See Note 4 – discontinued operations.

8

The following diagram illustrates the Company’s corporate structure, including its subsidiaries, and VIEs, as of the date of these financial statements:

VIE Agreements with Sichuan Senmiao

According to the VIE Agreements, Sichuan Senmiao is obligated to pay Senmiao Consulting service fees equal to its net income. Sichuan Senmiao’s entire operations are controlled by the Company. Although the Company discontinued Sichuan Senmiao’s online P2P lending services business commencing in October 2019, the VIE Agreements remain in place, and such agreements are described in detail below:

Equity Interest Pledge Agreement

Senmiao Consulting, Sichuan Senmiao and the Sichuan Senmiao Shareholders entered into an Equity Interest Pledge Agreement, pursuant to which the Sichuan Senmiao Shareholders pledged all of their equity interest in Sichuan Senmiao to Senmiao Consulting in order to guarantee the performance of Sichuan Senmiao’s obligations under the Exclusive Business Cooperation Agreement as described below. During the term of the pledge, Senmiao Consulting is entitled to receive any dividends declared on the pledged equity interest of Sichuan Senmiao. The Equity Interest Pledge Agreement terminates when all contractual obligations under the Exclusive Business Cooperation Agreement have been fully performed.

Exclusive Business Cooperation Agreement

Pursuant to an Exclusive Business Cooperation Agreement entered by and among the Company, Senmiao Consulting, Sichuan Senmiao and each of Sichuan Senmiao Shareholders, Senmiao Consulting will provide Sichuan Senmiao with complete technical support, business support and related consulting services for 10 years ended September 18, 2027. The Sichuan Senmiao Shareholders and Sichuan Senmiao will not engage any third party for the same or similar consultation services without Senmiao Consulting’s prior consent. Further, the Sichuan Senmiao Shareholders are entitled to receive an aggregate of 20,250,000 shares of common stock of the Company under the Exclusive Business Cooperation Agreement. Senmiao Consulting may terminate the Exclusive Business Cooperation Agreement at any time upon prior written notice to Sichuan Senmiao and the Sichuan Senmiao Shareholders.

Exclusive Option Agreement

Pursuant to an Exclusive Option Agreement entered by and among Senmiao Consulting, Sichuan Senmiao and the Sichuan Senmiao Shareholders, the Sichuan Senmiao Shareholders have granted Senmiao Consulting an exclusive option to purchase at any time their equity interests in Sichuan Senmiao at a purchase price equal to the capital paid by the Sichuan Senmiao Shareholders in whole or at a pro-rated price for any partial purchase. The Exclusive Option Agreement terminates after 10 years ending September 18, 2027 but can be renewed by Senmiao Consulting at its discretion.

9

Powers of Attorney

Each of the Sichuan Senmiao Shareholders has signed a power of attorney (the “Power of Attorney”), pursuant to which, each of the Sichuan Senmiao Shareholders has authorized Senmiao Consulting to act as his or her exclusive agent and attorney with respect to all rights of such individual as a shareholder of Sichuan Senmiao, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all the shareholder’s rights that shareholders are entitled to under PRC laws and the Articles of Association of Sichuan Senmiao, including but not limited to voting, sale, transfer, pledge and disposition of the equity interests of Sichuan Senmiao; and (c) designating and appointing the legal representative, chairperson, director, supervisor, chief executive officer and other senior management members of Sichuan Senmiao. The Power of Attorney has the same term as the Exclusive Option Agreement.

Timely Report Agreement

The Company and Sichuan Senmiao entered into a Timely Report Agreement, pursuant to which, Sichuan Senmiao agrees to make its officers and directors available to the Company and promptly provide all information required by the Company so that the Company can make necessary filings to the U.S. Securities and Exchange Commission (“SEC”) and other regulatory reports in a timely fashion.

The Company has concluded that it should consolidate the financial statements with Sichuan Senmiao because it is Sichuan Senmiao’s primary beneficiary based on the Power of Attorney from the Sichuan Senmiao Shareholders, who assigned their rights as shareholders of Sichuan Senmiao to Senmiao Consulting, the Company’s wholly-owned subsidiary. These rights include, but are not limited to, attending shareholders’ meetings, voting on matters submitted for shareholder approval and appointing legal representatives, directors, supervisors and senior management of Sichuan Senmiao. As a result, the Company, through Senmiao Consulting, is deemed to hold all of the voting equity interests in Sichuan Senmiao. Pursuant to Exclusive Business Cooperation Agreement, Senmiao Consulting shall provide complete technical support, business support and related consulting services for 10 years. Though not explicit in the VIE Agreements, the Company may provide financial support to Sichuan Senmiao to meet its working capital requirements and capitalization purposes. The terms of the VIE Agreements and the Company’s plan to provide financial support to Sichuan Senmiao were considered in determining that the Company is the primary beneficiary of Sichuan Senmiao. Accordingly, the financial statements of Sichuan Senmiao are consolidated in the Company’s consolidated financial statements.

The Restructuring constituted a reorganization. As all of the above mentioned companies are under common control, this series of transactions are considered as a reorganization of the entities under common control at carrying value and the consolidated financial statements have been prepared as if the reorganization had occurred retroactively. The consolidated financial statements have been prepared as if the existing corporate structure had been in existence throughout all periods and the reorganization had occurred as of the beginning of the earliest period presented in the accompanying consolidated financial statements.

Voting Agreement with Jinkailong’s Other Shareholders

In addition to obtaining 35% equity interests in Jinkailong, Hunan Ruixi entered into a voting agreement, as amended (the “Voting Agreement”), with Jinkailong and other Jinkailong’s shareholders holding an aggregate of 65% equity interests. Pursuant to the Voting Agreement, all other Jinkailong’s shareholders will vote in concert with Hunan Ruixi on all fundamental corporate transactions in the event of a disagreement for a period of 20 years, ending on August 25, 2038.

The Company has concluded that it should consolidate the financial statements with Jinkailong because it is Jinkailong’s primary beneficiary based on the Voting Agreement. Though not explicit in the Voting Agreement by and among Jinkailong, Hunan Ruixi, and other shareholders of Hunan Ruixi, the Company may provide financial support to Jinkailong to meet its working capital requirements and capitalization purposes. The terms of the Voting Agreement and the Company’s plan to provide financial support to Jinkailong were considered in determining that the Company is the primary beneficiary of Jinkailong. Accordingly, management has determined that Jinkailong is a VIE and the financial statements of Jinkailong are consolidated in the Company’s consolidated financial statements.

10

Total assets and total liabilities of the Company’s VIEs included in the Company’s consolidated financial statements as of December 31, 2019 and March 31, 2019 are as follows:

| December 31, 2019 | March 31, 2019 | |||||||

| (Unaudited) | ||||||||

| Total assets from continuing operations | $ | 7,256,048 | $ | 4,130,435 | ||||

| Total assets from discontinued operations | 1,499,618 | 1,083,579 | ||||||

| Total assets | $ | 8,775,666 | $ | 5,214,014 | ||||

| Total liabilities from continuing operations | $ | 7,096,861 | $ | 6,456,098 | ||||

| Total liabilities from discontinued operations | 7,973,676 | 396,671 | ||||||

| Total liabilities | $ | 15,070,537 | $ | 6,852,769 | ||||

Net revenue, income (loss) from operations and net loss of the VIEs that were included in the Company's consolidated financial statements for the three and nine months ended December 31, 2019 and 2018 are as follows:

| For the Three Months Ended December 31, | For the Nine Months Ended December 31, | |||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| Net revenue | $ | 414,077 | $ | 119,235 | $ | 2,302,940 | $ | 119,235 | ||||||||

| Income (loss) from operations | $ | 741,260 | $ | (7,014 | ) | $ | 600,455 | $ | (7,014 | ) | ||||||

| Net income (loss) from continuing operations attributable to stockholders | $ | (116,991 | ) | $ | 8,324 | $ | 95,976 | $ | 8,324 | |||||||

| Net loss from discontinued operations attributable to stockholders | (4,094,558 | ) | (78,459 | ) | (4,870,090 | ) | (929,698 | ) | ||||||||

| Net loss attributable to stockholders | $ | (4,211,549 | ) | $ | (70,135 | ) | $ | (4,774,114 | ) | $ | (921,374 | ) | ||||

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| (a) | Basis of presentation |

The accompanying interim unaudited condensed consolidated financial statements of the Company has been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

The unaudited interim financial information as of December 31, 2019 and for the nine months ended December 31, 2019 and 2018 have been prepared without audit, pursuant to the rules and regulations of the SEC and pursuant to Regulation S-X. Certain information and footnote disclosures, which are normally included in annual financial statements prepared in accordance with U.S. GAAP, have been omitted pursuant to those rules and regulations. The unaudited interim financial information should be read in conjunction with the audited financial statements and the notes thereto, included in the Form 10-K for the fiscal year ended March 31, 2019, which was filed with the SEC on July 5, 2019.

In the opinion of management, all adjustments (including normal recurring adjustments) necessary to present a fair statement of the Company’s unaudited financial position as of December 31, 2019, its unaudited results of operations for the three and nine months ended December 31, 2019 and 2018, and its unaudited cash flows for the nine months ended December 31, 2019 and 2018, as applicable, have been made. The unaudited interim results of operations are not necessarily indicative of the operating results for the full fiscal year or any future periods.

11

| (b) | Basis of consolidation |

The unaudited condensed consolidated financial statements include the accounts of the Company and include the assets, liabilities, revenues and expenses of the subsidiaries and VIEs. All inter-company accounts and transactions have been eliminated in consolidation.

| (c) | Foreign currency translation |

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing on the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates on the date of the balance sheet. The resulting exchange differences are recorded in the statement of operations.

The reporting currency of the Company and its subsidiaries and VIEs is U.S. dollars (“US$”) and the accompanying consolidated financial statements have been expressed in US$. However, the Company maintains the books and records in its functional currency, Chinese Renminbi (“RMB”), being the functional currency of the economic environment in which its operations are conducted.

In general, for consolidation purposes, assets and liabilities of the Company and its subsidiaries whose functional currency is not the US$, are translated into US$, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of the Company and its subsidiaries and VIEs are recorded as a separate component of accumulated other comprehensive income within the statement of stockholders’ equity.

Translation of amounts from RMB into US$ has been made at the following exchange rates for the respective periods:

| December 31, 2019 | March 31, 2019 | |||||||

| Balance sheet items, except for equity accounts | 6.9632 | 6.7119 | ||||||

| For the Three Months Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| Items in the statements of operations and comprehensive income (loss) | 7.0600 | 6.9162 | ||||||

| For the Nine Months Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| Items in the statements of operations and comprehensive income (loss), and statements of cash flows | 6.9620 | 6.7008 | ||||||

| (d) | Use of estimates |

In presenting the unaudited condensed consolidated financial statements in accordance with U.S. GAAP, management make estimates and assumptions that affect the amounts reported and related disclosures. Estimates, by their nature, are based on judgement and available information. Accordingly, actual results could differ from those estimates. On an ongoing basis, management reviews these estimates and assumptions using the currently available information. Changes in facts and circumstances may cause the Company to revise its estimates. The Company bases its estimates on past experience and on various other assumptions that are believed to be reasonable, the results of which form the basis for making judgments about the carrying values of assets and liabilities. Estimates are used when accounting for items and matters including, but not limited to, revenue recognition, residual values, lease classification and liabilities, finance lease receivables, inventory obsolescence, right-of-use assets, determinations of the useful lives and valuation of long-lived assets, estimates of allowances for doubtful accounts and prepayments, estimates of impairment of intangible assets, valuation of deferred tax assets, estimated fair value used in business acquisitions, valuation of derivative liabilities, allocation of fair value of derivative liabilities issuance of common stock and warrants exercised and other provisions and contingencies.

12

| (e) | Fair values of financial instruments |

Accounting Standards Codification (“ASC”) Topic 825, Financial Instruments (“Topic 825”) requires disclosure of fair value information of financial instruments, whether or not recognized in the balance sheets, for which it is practicable to estimate that value. In cases where quoted market prices are not available, fair values are based on estimates using present value or other valuation techniques. Those techniques are significantly affected by the assumptions used, including the discount rate and estimates of future cash flows. Topic 825 excludes certain financial instruments and all nonfinancial assets and liabilities from its disclosure requirements. Accordingly, the aggregate fair value amounts do not represent the underlying value of the Company. The three levels of valuation hierarchy are defined as follows:

| Level 1 | Inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| Level 2 | Inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments. |

| Level 3 | Inputs to the valuation methodology are unobservable and significant to the fair value. |

The following table sets forth by level within the fair value hierarchy our financial assets and liabilities that were accounted for at fair value on a recurring basis as of December 31, 2019:

| Carrying Value at December 31, 2019 |

Fair Value Measurement at December 31, 2019 |

|||||||||||||||

| (Unaudited) | Level 1 | Level 2 | Level 3 | |||||||||||||

| Derivative liabilities | $ | 629,848 | $ | - | $ | - | $ | 629,848 | ||||||||

The following is a reconciliation of the beginning and ending balance of the assets and liabilities measured at fair value on a recurring basis for the nine months ended December 31, 2019:

| December 31, 2019 |

||||

| Beginning balance | $ | - | ||

| Derivative liabilities recognized at grant date on June 20, 2019 | 3,150,006 | |||

| Change in fair value of derivative liabilities | (1,509,406 | ) | ||

| Fair value of Series B warrants exercised | (1,010,752 | ) | ||

| Ending balance | $ | 629,848 | ||

On June 21, 2019, the Company closed a registered direct offering of an aggregate of 1,781,361 shares of common stock, and in connection therewith, issued to the investors (i) for no additional consideration, Series A warrants to purchase up to an aggregate of 1,336,021 shares of common stock, (ii) for nominal additional consideration, Series B warrants to purchase up to a maximum aggregate of 1,116,320 shares of common stock and (iii) placement agent warrants to purchase up to 142,509 shares of common stock.

The strike price of the Company’s Series A and Series B warrants is denominated in US$ and the Company’s functional currency is RMB, therefore, those warrant shares are not considered indexed to the Company’s own stock which should be classified as derivative liability.

13

The Company’s Series A and Series B warrants are not traded in an active securities market; therefore, the Company estimates the fair value to those warrants using the Black-Scholes valuation model on June 20, 2019 (the grant date) and December 31, 2019.

| June 20, 2019 | ||||||||||||

| Series A Warrants |

Series B Warrants |

Placement Agent Warrants |

||||||||||

| # of shares exercisable | 1,336,021 | 1,116,320 | 142,509 | |||||||||

| Valuation date | 6/20/2019 | 6/20/2019 | 6/20/2019 | |||||||||

| Exercise price | $ | 3.72 | $ | 3.72 | $ | 3.38 | ||||||

| Stock price | $ | 2.80 | $ | 2.80 | $ | 2.80 | ||||||

| Expected term(year) | 4.00 | 1.00 | 4.00 | |||||||||

| Risk-free interest rate | 1.77 | % | 1.77 | % | 1.77 | % | ||||||

| Expected volatility | 86 | % | 86 | % | 86 | % | ||||||

| December 31, 2019 | ||||||||||||

| Series A Warrants |

Series B Warrants |

Placement Agent Warrants |

||||||||||

| # of shares exercisable | 1,336,021 | 3,132 | 142,509 | |||||||||

| Valuation date | 12/31/2019 | 12/31/2019 | 12/31/2019 | |||||||||

| Exercise price | $ | 1.50 | $ | 0.0001 | $ | 3.38 | ||||||

| Stock price | $ | 0.67 | $ | 0.67 | $ | 0.67 | ||||||

| Expected term (year) | 3.47 | 0.47 | 3.47 | |||||||||

| Risk-free interest rate | 1.64 | % | 1.60 | % | 1.64 | % | ||||||

| Expected volatility | 123 | % | 123 | % | 123 | % | ||||||

As of December 31, 2019 and March 31, 2019, financial instruments of the Company comprised primarily current assets and current liabilities including cash and cash equivalents, accounts receivable, finance lease receivables and other assets, escrow receivables, due from related parties, borrowings from financial institutions, other liabilities, due to stockholders and due to related parties and affiliates, which approximate their fair values because of the short-term nature of these instruments, and noncurrent liabilities of borrowings from financial institutions, which approximate their fair values because of the stated loan interest rate to the rate charged by similar financial institutions.

The finance lease receivables were recorded at gross adjusted for the deferred interest income using the effective interest rate method. The Company believes that the effective interest rates underlying the finance lease receivables approximate current market rates for such finance leasing products as of December 31, 2019.

Other than as listed above, the Company did not identify any assets or liabilities that are required to be presented on the balance sheet at fair value.

| (f) | Business combinations and noncontrolling interests |

The Company accounts for its business combinations using the acquisition method of accounting in accordance with ASC 805 "Business Combinations." The cost of an acquisition is measured as the aggregate of the acquisition date fair value of the assets transferred to the sellers and liabilities incurred by the Company and equity instruments issued. Transaction costs directly attributable to the acquisition are expensed as incurred. Identifiable assets and liabilities acquired or assumed are measured separately at their fair values as of the acquisition date, irrespective of the extent of any noncontrolling interests. The excess of (i) the total costs of acquisition, fair value of the noncontrolling interests and acquisition date fair value of any previously held equity interest in the acquiree over (ii) the fair value of the identifiable net assets of the acquiree is recorded as goodwill. If the cost of acquisition is less than the fair value of the net assets of the subsidiary acquired, the difference is recognized directly in the consolidated income statements. During the measurement period, which can be up to one year from the acquisition date, the Company may record adjustments to the assets acquired and liabilities assumed with the corresponding offset to goodwill. Upon the conclusion of the measurement period or final determination of the values of assets acquired or liabilities assumed, whichever comes first, any subsequent adjustments are recorded to the consolidated income statements.

For the Company's non-wholly owned subsidiaries, a noncontrolling interest is recognized to reflect portion of equity that is not attributable, directly or indirectly, to the Company. The cumulative results of operations attributable to noncontrolling interests are also recorded as noncontrolling interests in the Company's consolidated balance sheets and consolidated statements of operations and comprehensive loss. Cash flows related to transactions with noncontrolling interests are presented under financing activities in the consolidated statements of cash flows.

14

| (g) | Segment reporting |

Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating decision maker (the “CODM”), which is comprised of certain members of the Company's management team. Historically, the Company had one single operating and reportable segment, namely the provision of an online lending services. During the year ended March 31, 2019, the Company acquired Hunan Ruixi and Jinkailong and evaluated how the CODM manages the businesses of the Company to maximize efficiency in allocating resources and assessing performance. Consequently, the Company presents two operating and reportable segments as set forth in Note 2(p). The Company has discontinued the online P2P lending services segment and has only one segment in the period after October 17, 2019.

| (h) | Cash and cash equivalents |

Cash and cash equivalents primarily consist of bank deposits with original maturities of three months or less, which are unrestricted as to withdrawal and use. Cash and cash equivalents also consist of funds received from automobile purchasers as payment for automobiles, related Insurances and taxes to be paid on behalf of the automobile purchasers, which funds were held at the third party platforms’ fund accounts and which are unrestricted and immediately available for withdrawal and use.

| (i) | Accounts receivable, net |

Accounts receivable are recorded at the invoiced amount less an allowance for any uncollectible accounts and do not bear interest, and are due on demand. Management reviews the adequacy of the allowance for doubtful accounts on an ongoing basis, using historical collection trends and aging of receivables. Management also periodically evaluates individual customer’s financial condition, credit history and the current economic conditions to make adjustments in the allowance when necessary. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. As of December 31, 2019 and March 31, 2019, allowance for doubtful accounts amounted to $84,415 and $0, respectively.

| (j) | Inventories |

Inventories consist of automobiles which are held primarily for sale and for leasing purposes, and are stated at lower of cost or net realizable value, as determined using the weighted average cost method. Management compares the cost of inventories with the net realizable value and if applicable, an allowance is made for writing down the inventory to its net realizable value, if lower than cost. On an ongoing basis, inventories are reviewed for potential write-down for estimated obsolescence or unmarketable inventories which equals the difference between the costs of inventories and the estimated net realizable value based upon forecasts for future demand and market conditions. When inventories are written-down to the lower of cost or net realizable value, it is not marked up subsequently based on changes in underlying facts and circumstances.

| (k) | Finance lease receivables, net |

Finance lease receivables, which result from sales-type leases, are measured at discounted present value of (i) future minimum lease payments, (ii) any residual value not subject to a bargain purchase option as a finance lease receivables on its balance sheet and (iii) accrued interest on the balance of the finance lease receivables based on the interest rate inherent in the applicable lease over the term of the lease. Management also periodically evaluates individual customer’s financial condition, credit history and the current economic conditions to make adjustments in the allowance when necessary. Finance lease receivables is charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. As of December 31, 2019, the Company determined no allowance for doubtful accounts was necessary for finance lease receivables.

15

As of December 31, 2019 and March 31, 2019, finance lease receivables consisted of the following:

| December 31, 2019 | March 31, 2019 | |||||||

| (Unaudited) | ||||||||

| Gross minimum lease payments receivable | $ | 1,637,763 | $ | 40,023 | ||||

| Less: Amounts representing estimated executory costs | - | - | ||||||

| Minimum lease payments receivable | 1,637,763 | 40,023 | ||||||

| Less Allowance for uncollectible minimum lease payments receivable | - | - | ||||||

| Net minimum lease payments receivable | 1,637,763 | 40,023 | ||||||

| Estimated residual value of leased automobiles | - | - | ||||||

| Less: Unearned interest | (460,556 | ) | (7,471 | ) | ||||

| Financing lease receivables, net | $ | 1,177,207 | $ | 32,552 | ||||

| Finance lease receivables, net, current portion | $ | 428,958 | $ | 10,254 | ||||

| Finance lease receivables, net, long-term portion | $ | 748,249 | $ | 22,298 | ||||

Future scheduled minimum lease payments for investments in sales-type leases as of December 31, 2019 are as follows:

| Minimum future payments receivable |

||||

| Twelve months ending December 31, 2020 | $ | 559,494 | ||

| Twelve months ending December 31, 2021 | 550,856 | |||

| Twelve months ending December 31, 2022 | 407,269 | |||

| Twelve months ending December 31, 2023 | 120,144 | |||

| Total | $ | 1,637,763 | ||

| (l) | Property and equipment |

Property and equipment primarily consists of computer equipment, which is stated at cost less accumulated depreciation less any provision required for impairment in value. Depreciation is computed using the straight-line method with no residual value based on the estimated useful life. The useful life of property and equipment is summarized as follows:

| Categories | Useful life | |

| Leasehold improvements | Shorter of the remaining lease terms or estimated useful lives | |

| Computer equipment | 2 - 5 years | |

| Office equipment | 3 - 5 years | |

| Automobiles | 3 - 4 years |

The Company reviews property and equipment for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. An asset is considered impaired if its carrying amount exceeds the future net undiscounted cash flows that the asset is expected to generate. If such asset is considered to be impaired, the impairment recognized is the amount by which the carrying amount of the asset, if any, exceeds its fair value determined using a discounted cash flow model. For the nine months ended December 31, 2019 and 2018, there was no impairment of property and equipment.

Costs of repairs and maintenance are expensed as incurred and asset improvements are capitalized. The cost and related accumulated depreciation of assets disposed of or retired are removed from the accounts, and any resulting gain or loss is reflected in the consolidated income statements.

16

| (m) | Intangible assets |

Purchased intangible assets are recognized and measured at fair value upon acquisition. Separately identifiable intangible assets that have determinable lives continue to be amortized over their estimated useful lives using the straight-line method as follows:

| Categories | Useful life | |

| Platform | 7 years | |

| Customer relationship | 10 years | |

| Software | 5-7 years |

Separately identifiable intangible assets to be held and used are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. Determination of recoverability is based on an estimate of undiscounted future cash flows resulting from the use of the asset and its eventual disposition. Measurement of any impairment loss for identifiable intangible assets is based on the amount by which the carrying amount of the assets exceeds the fair value of the assets. For the three and nine months ended December 31, 2019, there was a $0 and $264,958 impairment, respectively, on customer relationship from Sichuan Senmiao as a result of the Company’s decision to discontinue the P2P lending business in October 2019. For the three and nine months ended December 31, 2018, there was no impairment of intangible assets.

| (n) | Earnings (loss) per share |

Basic earnings (loss) per share is computed by dividing net loss attributable to stockholders by the weighted average number of outstanding shares of common stock, adjusted for outstanding shares of common stock that are subject to repurchase.

For the calculation of diluted earnings (loss) per share, net income (loss) attributable to stockholders for basic earnings (loss) per share is adjusted by the effect of dilutive securities, including share-based awards, under the treasury stock method. Potentially dilutive securities, of which the amounts are insignificant, have been excluded from the computation of diluted net earnings (loss) per share if their inclusion is anti-dilutive.

| (o) | Derivative liabilities |

A contract is designated as an asset or a liability and is carried at fair value on a company’s balance sheet, with any changes in fair value recorded in a company’s results of operations. The Company then determines which options, warrants and embedded features require liability accounting and records the fair value as a derivative liability. The changes in the values of these instruments are shown in the accompanying unaudited condensed consolidated statements of operations and comprehensive loss as “change in fair value of derivative liabilities”.

| (p) | Revenue recognition |

The Company adopted ASC 606, Revenue from Contracts with Customers (“ASC 606”) on April 1, 2019 using the modified retrospective approach. ASC 606 establishes principles for reporting information about the nature, amount, timing and uncertainty of revenue and cash flows arising from the entity's contracts to provide goods or services to customers. The core principle requires an entity to recognize revenue to depict the transfer of goods or services to customers in an amount that reflects the consideration that it expects to be entitled to receive in exchange for those goods or services recognized as performance obligations are satisfied.

The Company has assessed the impact of the guidance by reviewing its existing customer contracts and current accounting policies and practices to identify differences that will result from applying the new requirements, including the evaluation of its performance obligations, transaction price, customer payments, transfer of control and principal versus agent considerations. Based on the assessment, the Company concluded that there was no change to the timing and pattern of revenue recognition for its current revenue streams in scope of ASC 606 and therefore there was no material changes to the Company's consolidated financial statements upon adoption of ASC 606.

17

As of December 31, 2019, the Company had outstanding contracts for automobile transaction and related services amounting to $1,590,743, of which $629,787 is expected to be completed within 12 months after December 31, 2019, and $960,956 is expected to be completed after December 31, 2020.

Disaggregated information of revenues by business lines are as follows:

| For the Three Months Ended December 31, |

For the Nine Months Ended December 31, |

|||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| Automobile Transaction and Related Services (Continuing Operations) | ||||||||||||||||

| - Revenues from sales of automobiles | $ | 1,987,433 | $ | - | $ | 10,828,063 | $ | - | ||||||||

| - Service fees from automobile purchase services | 352,351 | 70,654 | 1,609,361 | 70,654 | ||||||||||||

| - Facilitation fees from automobile transactions | 21,031 | 16,424 | 164,294 | 16,424 | ||||||||||||

| - Service fees from management and guarantee services | 128,893 | 21,332 | 313,548 | 21,332 | ||||||||||||

| - Financing revenues | 44,149 | - | 105,413 | - | ||||||||||||

| - Other service fees | 211,722 | 10,326 | 622,750 | 10,326 | ||||||||||||

| Online Lending Services (Discontinued Operations) | ||||||||||||||||

| - Transaction fees | 1,160 | 80,564 | 72,394 | 261,450 | ||||||||||||

| - Service fees | 3,134 | 10,557 | 24,990 | 26,205 | ||||||||||||

| - Website development revenue | - | - | 15,234 | - | ||||||||||||

| Total revenues | 2,749,873 | 209,857 | 13,756,047 | 406,391 | ||||||||||||

| Total revenues from discontinued operations | (4,294 | ) | (91,121 | ) | (112,618 | ) | (287,655 | ) | ||||||||

| Total revenues from continuing operations | $ | 2,745,579 | $ | 118,736 | $ | 13,643,429 | $ | 118,736 | ||||||||

Automobile transaction and related services

Sales of automobiles – The Company generates revenue from sales of automobiles to the customers of Jinkailong, Hunan Ruixi and Mashang Chuxing. The control over the automobile is transferred to the purchaser along with the delivery of automobile. The amount of the revenue is based on the sale price agreed by Hunan Ruixi or Yicheng and the counterparties, including Jinkailong and Mashang Chuxing, who acts on behalf of its customers. The Company recognizes revenues when the automobile is delivered and control is transferred to the purchaser.

Service fees from automobile purchase services – Services fees from automobile purchase services are paid by automobile purchasers for a series of the services provided to them throughout the purchase process such as credit assessment, preparation of financing application materials, assistance with closing of financing transactions, license and plate registration, payment of taxes and fees, purchase of insurance, installment of GPS devices, ride-hailing driver qualification and other administrative procedures. The amount of these fees is based on the sales price of the automobiles and relevant services provided. The Company recognizes revenue when all the services are completed and the automobile is delivered to the purchaser.

Facilitation fees from automobile transactions – Facilitation fees from automobile purchase transactions are paid by the Company’s customers including third-party sales teams or the automobile purchasers for the facilitation of the sales and financing of automobiles. The Company attracts automobile purchasers through third-party sales teams or its own sales department. For the sales facilitated between third-party sales teams and automobile purchasers, the Company charges the fees to the third-party sales teams, which derived from the commission paid by the automobile purchasers to the third-party sales teams. Relating to sales facilitated between automobile purchasers and dealers, the Company charges the fees to the automobile purchasers. The Company recognizes revenue from facilitation fees when the titles are transferred to the purchasers. The amount of fees is based on the type of automobile and negotiation with each sales team or automobile purchaser. The fees charged to third-party sales teams or automobile purchasers are paid before the automobile purchase transactions are consummated. These fees are non-refundable upon the delivery of automobiles.

18

Service fees from management and guarantee services – Over 95% of the Company’s customers are drivers of Didi Chuxing Technology Co., Ltd., the largest ride-hailing service platform in China. The drivers sign affiliation agreements with the Company, pursuant to which the Company provides them with management and guarantee services during the affiliation period. Service fees for management and guarantee services are paid by such automobile purchasers on a monthly basis for the management and guarantee services provided during the affiliation period. The Company recognizes revenue over the affiliation period when performance obligations are completed.

Financing revenues – Interest income from the lease arising from the Company’s sales-type leases and bundled lease arrangements is recognized as financing revenues over the lease term based on the effective rate of interest in the lease.

Lease

On April 1, 2019, the Company adopted ASU 2016-02, Leases (ASC Topic 842). This update, as well as additional amendments and targeted improvements issued in 2018 and early 2019, supersedes existing lease accounting guidance found under ASC 840, Leases (“ASC 840”). The accounting for lessors does not fundamentally change with this update except for changes to conform and align guidance to the lessee guidance, as well as to the revenue recognition guidance in ASU 2014-09, Revenue from Contracts with Customers (ASC Topic 606). Some of these conforming changes, such as those related to the definition of lease term and minimum lease payments, resulted in certain lease arrangements, that would have been previously accounted for as operating leases, to be classified and accounted for as sales-type leases with a corresponding up-front recognition of automobile sales revenue when the lessee obtained control over the automobile.

The two primary accounting provisions the Company uses to classify transactions as sales-type or operating leases are: (i) a review of the lease term to determine if it is for the major part of the economic life of the underlying equipment (defined as greater than 75%); and (ii) a review of the present value of the lease payments to determine if they are equal to or greater than substantially all of the fair market value of the equipment at the inception of the lease (defined as greater than 90%). Automobile included in arrangements meeting these conditions are accounted for as sales-type leases. Interest income from the lease is recognized in financing revenues over the lease term. Automobile included in arrangements that do not meet these conditions are accounted for as operating leases and revenue is recognized over the term of the lease.

The Company excludes from the measurement of its lease revenues any tax assessed by a governmental authority that is both imposed on and concurrent with a specific revenue-producing transaction and collected from a customer.

The Company consider the economic life of most of the automobiles to be three to four years, since this represents the most common lease term for its automobiles and the automobiles will be used for ride-hailing services. The Company believes three to four years is representative of the period during which an automobile is expected to be economically usable, with normal service, for the purpose for which it is intended.

19

A portion of the Company’s direct sales of automobile to end customers are made through bundled lease arrangements which typically include automobile, services (automobile purchase services, facilitation services, and management and guarantee services) and financing components where the customer pays a single negotiated fixed minimum monthly payment for all elements over the contractual lease term. Revenues under these bundled lease arrangements are allocated considering the relative standalone selling prices of the lease and non-lease deliverables included in the bundled arrangement and the financing components. Lease deliverables include the automobile and financing, while the non-lease deliverables generally consist of the services and repayment of advanced fees made on behalf of its customers. The Company considers the fixed payments for purposes of allocation to the lease elements of the contract. The fixed minimum monthly payments are multiplied by the number of months in the contract term to arrive at the total fixed lease payments that the customer is obligated to make over the lease term. Amounts allocated to the automobile and financing elements are then subjected to the accounting estimates under ASC 842 to ensure the values reflect standalone selling prices. The remainder of any fixed payments are allocated to non-lease elements (automobile purchase services, facilitation fees, and management and guarantee services), for which these revenues are recognized in a manner consistent with the guidance for service fees from automobile purchase services, facilitation fees from automobile transactions, and service fees from management and guarantee services as discussed above.

The Company’s lease pricing interest rates, which are used in determining customer payments in a bundled lease arrangement, are developed based upon the local prevailing rates in the marketplace where its customer will be able to obtain an automobile loan under similar terms from the bank. The Company reassess its pricing interest rates quarterly based on changes in the local prevailing rates in the marketplace. As of December 31, 2019, the Company's pricing interest rate was 6.0% per annum.

Online P2P Lending Services (Discontinued Operations)

Transaction fees – Prior to the Company’s P2P lending business discontinued on October 17, 2019, transaction fees were paid by borrowers to the Company for the work the Company performed through its platform. The amount of these fees was based upon the loan amount and the maturity date of the loan. The fees charged to borrowers were paid upon (i) disbursement of the proceeds for loans which accrued interest on a monthly basis or (ii) full payment of principal and interest of loans which accrued interest on a daily basis. These fees were non-refundable upon the issuance of loan. The Company recognized revenue when loan proceeds were disbursed to borrowers or borrowers paid their principal and interest on loans.

Service fees – The Company charged investors service fees on their actual return of investment (interest income). The Company generally received the service fees upon the investors’ receipt of their investment returns. The Company recognized revenue when loans were repaid and investors received their investment income.

Website development revenues – Revenue allocated to website development services is recognized as the service is performed over time using the Company’s efforts or inputs to the satisfaction of a performance obligation using an input measure method, under which the total value of revenue is recognized on the basis of the percentage that total cost to date bears to the total expected costs. The Company considers labor costs and related outsource labor costs for the input measurement as the best available indicator of the progress, pattern and timing in which contract obligations are fulfilled.

Provisions for estimated losses, if any, on uncompleted contracts are recorded in the period in which such losses become probable based on the current contract estimates. In instances where substantive acceptance provisions are specified in customer contracts, revenues are deferred until all acceptance criteria have been met. To date, the Company has not incurred a material loss on any contracts. However, as a policy, provisions for estimated losses on such engagements will be made during the period in which a loss becomes probable and can be reasonably estimated.

The Company generally does not enter into arrangements with multiple deliverables for website development services contracts. If the deliverables have standalone value at contract inception, the Company accounts for each deliverable separately.

20

| (q) | Income taxes |

Deferred income tax liabilities and assets are recognized for the expected future tax consequences of temporary differences between the income tax basis and financial reporting basis of assets and liabilities. Provisions or benefits for income taxes consists of tax estimated from taxable income plus or minus deferred tax expenses (benefits) if applicable.

Deferred tax is calculated using the balance sheet liability method in respect of temporary differences arising from differences between the carrying amount of assets and liabilities in the financial statements and the corresponding tax basis. Deferred tax assets are recognized to the extent that it is probable that taxable income will be utilized with prior net operating loss carried forwards using tax rates that are expected to apply to the period when the asset is realized or the liability is settled. Deferred tax is charged or credited in the income statement, except when it is related to items credited or charged directly to equity. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be utilized. Current income taxes are provided for in accordance with the laws of the relevant tax authorities.