Attached files

As filed with the Securities and Exchange Commission on February 12, 2020.

Registration No. 333-236302

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SENESTECH, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2879 | 20-2079805 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification No.) |

23460 N 19th Ave., Suite 110

Phoenix, AZ 85027

(928) 779-4143

(Address, including zip code and telephone number, including area code, of registrant’s principal place of business)

Kenneth Siegel

Chief Executive Officer

SenesTech, Inc.

23460 N 19th Ave., Suite 110

Phoenix, AZ 85027

(928) 779-4143

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

Chris Hall Kara Tatman Perkins Coie LLP 1120 NW Couch Street, 10th Floor Portland, Oregon 97209 (503) 727-2000 |

Jeffrey J. Fessler, Esq. Sheppard, Mullin, Richter & Hampton LLP 30 Rockefeller Plaza, 39th Floor New York, New York 10112 Tel: (212) 653-8700 Fax: (212) 653-8701 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, or the Securities Act, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an “emerging growth company.” See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | ||

If an emerging growth company, indicated by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

| Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1) | Amount of Registration Fee | ||||||

| Class A Units consisting of: | $ | 8,000,000 | $ | 1,038.40 | ||||

| (i) Common Stock, par value $0.001 (2) | ||||||||

| (ii) Warrants to purchase shares of Common Stock (3) | — | — | ||||||

| Class B Units consisting of: | ||||||||

| (i) Pre-funded Warrants to purchase Common Stock | ||||||||

| (ii) Warrants to purchase shares of Common Stock (3) | — | — | ||||||

| Placement Agent Warrants to purchase Common Stock (4) | — | — | ||||||

| Common Stock issuable upon exercise of Pre-funded Warrants to purchase Common Stock (2) | ||||||||

| Common Stock issuable upon exercise of Warrants to purchase Common Stock included in the Class A Units and Class B Units (2) | $ | 8,000,000 | $ | 1,038.40 | ||||

| Common Stock issuable upon exercise of Placement Agent Warrants to purchase Common Stock (2) | $ | 750,000 | $ | 97.35 | ||||

| Total (5) | $ | 16,750,000 | $ | 2,174.15 | (6) | |||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional securities as may, from time to time, become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions. |

| (3) | No additional registration fee is payable pursuant to Rule 457(i) under the Securities Act. |

| (4) | No additional registration fee is payable pursuant to Rule 457(g) under the Securities Act. |

| (5) | The proposed maximum aggregate offering price of the Class A Units will be reduced on a dollar-for-dollar basis based on the offering price of any Class B Units offered and sold in the offering, and the proposed maximum aggregate offering price of the Class B Units to be sold in the offering will be reduced on a dollar-for-dollar basis based on the offering price of any Class A Units sold in the offering. |

| (6) | The Registrant previously paid a registration fee of $1,087.08 in connection with the initial filing of this registration statement. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 12, 2020

PRELIMINARY PROSPECTUS

SenesTech, Inc.

Up to 1,687,763 Class A Units consisting of Common Stock and Warrants or

Up to 1,687,763 Class B Units consisting of Pre-Funded Warrants and Warrants (or some combination of Class A Units and Class B Units)

(Up to 1,687,763 shares of Common Stock Underlying the Pre-Funded Warrants) and

(Up to 1,687,763 shares of Common Stock Underlying the Warrants)

We are offering in a best-efforts offering up to 1,687,763 Class A Units with each Class A Unit consisting of one share of our common stock, par value $0.001 per share (the “Common Stock”), and one warrant to purchase one share of our Common Stock at an exercise price of $ per share (the “Warrant”). The Class A Units will not be certificated and the share of Common Stock and the Warrant comprising such unit are immediately separable and will be issued separately in this offering.

We are also offering to those purchasers, whose purchase of Class A Units in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Stock following the consummation of this offering, the opportunity to purchase, in lieu of Class A Units that would result in ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%) or otherwise at such purchaser’s election, Class B Units, with each Class B Unit consisting of one pre-funded warrant to purchase one share of our Common Stock (the “Pre-Funded Warrant”) and one Warrant to purchase one share of Common Stock. The purchase price for each Class B Unit would equal the public offering price per Class A Unit in this offering less the $ per share exercise price of the Pre-Funded Warrant included in the Class B Unit, and the exercise price of each Pre-Funded Warrant would equal $ per share. We are also offering the shares of Common Stock that are issuable from time to time upon exercise of the Pre-Funded Warrants being offered by this prospectus. The Class B Units will not be certificated and the Pre-Funded Warrants and the Warrants comprising such unit are immediately separable and will be issued separately in this offering. Each purchase of Class B Units in this offering will reduce the number of Class A Units in this offering on a one-for-one basis.

The Warrants contained in the Class A and the Class B Units (collectively, the “Units”) will be exercisable immediately and will expire five years from the date of issuance.

Assuming we sell all $8,000,000 of Class A Units (and no Class B Units) being offered in this offering at an assumed public offering price of $4.74 per Class A Unit, the last reported sale price of Common Stock on The Nasdaq Capital Market on February 12, 2020, we would issue in this offering an aggregate of 1,687,763 shares of our Common Stock and Warrants to purchase 1,687,763 shares of our Common Stock. There is no minimum number of Class A Units or Class B Units or aggregate amount of proceeds for this offering to close.

Our Common Stock is listed on The Nasdaq Capital Market under the symbol “SNES.” On February 12, 2020, the last reported sale price for our Common Stock on The Nasdaq Capital Market was $4.74 per share. The public offering price per Class A Unit or Class B Unit, as the case may be, will be determined between us, the placement agent and the investors based on the closing price of our Common Stock prior to pricing and market conditions at the time of pricing, among other things, and may be at a discount to the current market price of our Common Stock or the assumed public offering price used in this prospectus. Therefore, the recent market price of Common Stock used throughout this prospectus may not be indicative of the final offering price of the Class A or Class B Units. There is no public trading market for the Pre-Funded Warrants or Warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Pre-Funded Warrants or Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Pre-Funded Warrants and Warrants will be limited.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed as exhibits to the registration statement of which this prospectus forms a part, and you may obtain copies of those documents as described in this prospectus under the heading “Where You Can Find Additional Information.”

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and are subject to reduced public company reporting requirements. Please read “Prospectus Summary — Implications of Being an Emerging Growth Company.”

Investing in our securities involves a high degree of risk. Please read “Risk Factors” beginning on page 5 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Class A Unit | Per Class B Unit | Total | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Placement agent’s fees(1) | $ | $ | $ | |||||||||

| Proceeds, before expenses, to us | $ | $ | $ | |||||||||

| (1) | In addition, we have agreed to reimburse the placement agent certain offering-related expenses, including a management fee of 1% of the gross proceeds raised in this offering, and to issue the placement agent or its designees warrants to purchase a number of shares of Common Stock equal to 7.5% of the number of the number of shares of Common Stock and Pre-Funded Warrants sold in this offering. See “Plan of Distribution” beginning on page 75 of this prospectus for a description of compensation payable to the placement agent. |

One or more of our directors and executive officers have indicated interest in participating in this offering at the public offering price and on the same terms as the other purchasers in this offering. However, because indications of interest are not binding, we cannot guarantee if any officer or director will participate in this offering.

We have retained H.C. Wainwright & Co., LLC as our exclusive placement agent to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. Because there is no minimum offering amount required as a condition to closing in this offering, the actual public offering amount, placement agent’s fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above.

Delivery of the securities is expected on or about , 2020, subject to satisfaction of certain conditions.

H.C. Wainwright & Co.

The date of this prospectus is , 2020

TABLE OF CONTENTS

You should read this prospectus before making an investment in the securities of SenesTech, Inc. Please read “Where You Can Find Additional Information” on page 77 for more information. We have not authorized anyone to provide you with any information or to make any representation, other than those contained in this prospectus or any free writing prospectus we have prepared. We take no responsibility for, and provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby, but only in circumstances and in jurisdictions where it is lawful to so do. The information contained in this prospectus is accurate only as of its date, regardless of the time of delivery of this prospectus or of any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the placement agent has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of securities and the distribution of this prospectus outside the United States.

On February 4, 2020, we amended our amended and restated certificate of incorporation to effect a 1-for-20 reverse split of our issued and outstanding shares of our Common Stock. All share and per share data in this prospectus gives effect to the reverse stock split.

i

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Unless the context requires otherwise, references in this prospectus to “Registrant,” “SenesTech,” “Company,” “we,” “us” and “our” refer to SenesTech, Inc.

Overview

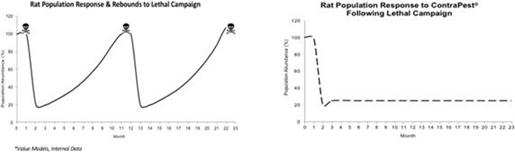

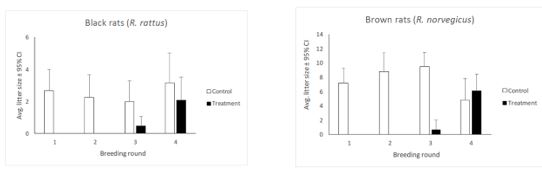

We have developed and are seeking to commercialize a global, proprietary technology for managing animal pest populations, initially rat populations, through fertility control. Although there are myriad tools available to control rat populations, most rely on some form of lethal method to achieve effectiveness. Each of these solutions is inherently limited by rat species’ resilience and survival mechanisms as well as their extraordinary rate of reproduction. ContraPest®, our initial product, is unique in the pest control industry in attacking the reproductive systems of both male and female rats, resulting in a sustained reduction of the rat population.

Rats have plagued humanity throughout history. They pose significant threats to the health and food security of many communities. In addition, rodents cause significant product loss and damage through consumption, contamination, equipment damage and asset deterioration. Rats also cause significant damage to critical infrastructure by burrowing beneath foundations and gnawing on electrical wiring, insulation, fire proofing systems, electronics and computer equipment.

The most prevalent solution to rat infestations is the use of increasingly powerful rodenticides. Although these solutions provide short term results, there are growing concerns about secondary exposure and bioaccumulation of rodenticides in the environment. The pest management industry and Pest Management Professionals (PMPs) are being asked for new solutions that are both effective and less toxic. Our goal is to provide customers with not only a solution to combat their most difficult rat problems, but also offer a non-lethal option to serve customers that are looking to decrease or remove the amount of rodenticide used in their pest control programs.

ContraPest is a liquid bait containing the active ingredients 4-vinylcyclohexene diepoxide (VCD) and triptolide. ContraPest limits reproduction of male and female rats beginning with the first breeding cycle following consumption. ContraPest is being marketed for use in controlling Norway and roof rat populations. SenesTech began the registration process with the United States Environmental Protection Agency (EPA) for ContraPest on August 23, 2015. On August 2, 2016, the EPA granted an unconditional registration for ContraPest as a Restricted Use Product (RUP), due to the need for applicator expertise for deployment. On October 18, 2018, the EPA approved the removal of the RUP designation. We believe ContraPest is the first and only non-lethal, fertility control product approved by the EPA for the management of rat populations.

In addition to the EPA registration, ContraPest must obtain registration from the various state regulatory agencies prior to selling in each state. As of the date of this prospectus, we have received registration for ContraPest in all 50 states and the District of Columbia, 47 of which have approved the removal of the RUP designation.

We expect to continue to pursue regulatory approvals and amendments to the existing U.S. registration for ContraPest, and if ContraPest begins to generate sufficient revenue, regulatory approvals for additional jurisdictions beyond the U.S. The Company also continues to research and develop enhancements to ContraPest that align with our target verticals and other potential fertility control options for additional species.

1

Recent Developments

Preliminary unaudited revenues for the fourth quarter were approximately $70,000, compared to $36,000 in the third quarter of 2019, and approximately $149,000 for fiscal 2019, compared to $297,000 in 2018.

All of our current deployments are designed to show the efficacy of ContraPest across each of our target markets. We believe that this will be critical to gaining widespread adoption of the product as we scale up our commercialization program. We are targeting both end user customers and PMPs in our marketing efforts to demonstrate economic value across the entire distribution channel.

Our Washington D.C. deployment continues to meet our expectations and, we believe, our customer’s expectations. Camera studies provide further support to our expectation that ContraPest will be a valuable tool for rodent control in D.C. and in other metropolitan areas.

Our projects in poultry farms are going well, as we learn with our partners the best protocols for deploying ContraPest in their unique environments. Our goal is to demonstrate both the economic value and efficacy of ContraPest as these projects reach six to nine months of deployment.

Our project in national retail continues to expand to additional locations. As with poultry farms, our goal is to demonstrate a clear economic benefit for the inclusion of ContraPest in their integrated pest management program.

We continue to monitor the political developments in California, and we continue to believe that AB1788 will resume its legislative progress in the current legislative session. In addition, our deployments in San Francisco and Los Angeles continue, with good consumption and possible expansion in the park deployment and the animal sanctuary deployment, respectively.

Finally, we have identified and recruited a new head of sales and marketing with extensive experience in commercializing environmentally responsible pest control products. We anticipate announcing his appointment in the near future, when he officially joins us.

Our goal has been to remove $1 million from the annual burn rate, and we are tracking well on that goal. One component has been the targeted elimination of certain positions, which has brought the total headcount down to 31 full-time employees as of February 5, 2020. In addition, our “front office” functions have been relocated from Flagstaff, Arizona to more compact and less expensive space in Phoenix, Arizona.

On January 28, 2020, we announced the closing of a registered direct stock offering. Cash at the end of 2019, pro forma for the inclusion of that offering, was $3.1 million.

Corporate and Other Information

We were incorporated in Nevada in July 2004 and reincorporated in Delaware in November 2015. Our principal executive offices are located at 23460 N 19th Ave., Suite 110, Phoenix, AZ 85027, and our telephone number is (928) 779-4143. Our corporate website address is www.senestech.com. The information contained on or accessible through our website is not a part of this prospectus and should not be relied upon in connection with making an investment decision.

This prospectus contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, and therefore we have elected to comply with certain reduced disclosure and regulatory requirements for this prospectus and future filings, including only presenting two years of audited financial statements and related financial information, not having our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and not holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We may take advantage of these reduced requirements until we are no longer an “emerging growth company.” We will remain an “emerging growth company” until the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of our initial public offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC. Under Section 107(b) of the JOBS Act, “emerging growth companies” may take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have irrevocably elected not to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies.

2

| Class A Units offered by us in this offering: | We are offering up to 1,687,763 Class A Units and Class B Units. Each Class A Unit consists of one share of our Common Stock, par value $0.001 per share (the “Common Stock”) and one warrant to purchase one share of our Common Stock (the “Warrant”). The Class A Units will not be certificated and the shares of Common Stock and Warrants comprising of such unit are immediately separable and will be issued separately in this offering.

This prospectus also relates to the offering of shares of our Common Stock issuable upon the exercise of the Warrants included in the Class A Units.

Assuming we sell all $8,000,000 of Class A Units (and no Class B Units) being offered in this offering at an assumed public offering price of $4.74 per Class A Unit, the last reported closing price of our Common Stock on The Nasdaq Capital Market on February 12, 2020, we would issue in this offering an aggregate of 1,687,763 shares of our Common Stock and Warrants to purchase 1,687,763 shares of our Common Stock. There is no minimum number of Class A Units or Class B Units or aggregate amount of proceeds for this offering to close.

| |

| Class B Units offered by us in this offering: | We are also offering to those purchasers, whose purchase of Class A Units in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Stock following the consummation of this offering, the opportunity to purchase, in lieu of Class A Units that would result in ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Stock following the consummation of this offering or otherwise at such purchaser’s election, Class B Units. Each Class B Unit consists of one pre-funded warrant (“Pre-Funded Warrant”) to purchase one share of our Common Stock and one Warrant to purchase one share of our Common Stock. The purchase price for each Class B Unit would equal the per unit public offering price for the Class A Units in this offering less the $ per share exercise price of the Pre-Funded Warrant included in the Class B Unit, and the exercise price of each Pre-Funded Warrant would equal $ per share. For each Class B Unit we sell, the number of Class A Units we are offering will be decreased on a one-for-one basis.

The Class B Units will not be certificated and the Pre-Funded Warrant and Warrants included in such unit are immediately separable and will be issued separately in this offering.

This prospectus also relates to the offering of shares of our Common Stock issuable upon exercise of the Warrants and the Pre-Funded Warrant included in the Class B Units. |

Warrants: |

Each Warrant (other than the Pre-Funded Warrant) included in the Class A Units and Class B Units (collectively, the “Units”) will have an exercise price equal to $ , will be exercisable upon issuance, and will expire five years from the date of issuance. | |

| Common stock to be outstanding after this offering: | 3,279,933 shares of Common Stock. | |

| Use of proceeds: | Assuming we sell all $8,000,000 of Class A Units (and no Class B Units) being offered in this offering at an assumed public offering price of $4.74 per Class A Unit, the last reported closing price of our Common Stock on The Nasdaq Capital Market on February 12, 2020, we estimate that we will receive net proceeds from the initial sale of Units in this offering of approximately $7,055,000 after deducting the placement agent fees and estimated offering expenses payable by us. We intend the net proceeds from this offering to be used for working capital and general corporate purposes, including our commercialization efforts of ContraPest. See “Use of Proceeds.” |

3

| Insider Participation: | One or more of our directors and executive officers have indicated interest in participating in this offering at the public offering price and on the same terms as the other purchasers in this offering. However, because indications of interest are not binding, we cannot guarantee if any officer or director will participate in this offering. | |

| Risk factors: | An investment in our securities involves a high degree of risk. You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in our securities. | |

| Market and Trading Symbol: | Our shares of Common Stock are traded on The Nasdaq Capital Market under the symbol “SNES.”

The Units will not be certificated and the securities included in such units are immediately separable and will be issued separately in this offering. There is no established trading market for the Pre-Funded Warrants or Warrants, and we do not expect a trading market to develop. We do not intend to list the Pre-Funded Warrants or Warrants on any securities exchange or other trading market. Without a trading market, the liquidity of the Pre-Funded Warrants and Warrants will be extremely limited. |

The number of shares of Common Stock outstanding after the offering is based on 1,592,170 shares outstanding as of February 5, 2020, and excludes as of such date:

| ● | 136,359 shares of Common Stock issuable upon the exercise of stock options at a weighted average exercise price of $27.85 per share; |

| ● | 3,877 shares of Common Stock issuable upon the vesting of restricted stock units; |

| ● | 679,989 shares of Common Stock issuable upon the exercise of outstanding Common Stock warrants at a weighted-average exercise price of $22.65 per share (see “Description of Capital Stock — Outstanding Warrants”); and |

| ● | 33,758 shares of Common Stock available for future issuance under our 2018 Equity Incentive Plan (the “2018 Plan”). |

As of February 5, 2020, the total number of our outstanding shares of Common Stock was 1,592,170. All share and per share data has been restated to reflect our 1-for-20 reverse stock split effectuated on February 4, 2020.

Unless otherwise indicated, all information contained in this prospectus assumes (i) no exercises by the placement agent of its option to purchase additional securities and (ii) no sale of any Class B Units.

4

Investing in our securities involves a number of risks. You should not invest unless you are able to bear the complete loss of your investment. You should carefully consider the risks described below, together with other information in this prospectus and the information. These risks and uncertainties described below are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. If any of the following risks actually occur, our business could be harmed. In such case, the trading price of our Common Stock could decline and investors could lose all or a part of the money paid to buy our securities. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of these and other factors.

Risks Relating to our Business

Our future success is dependent on the commercialization of ContraPest and regulatory approval and commercialization of our other product candidates.

The EPA granted registration approval for ContraPest effective August 2, 2016, and as of July 12, 2018, we have received registration for ContraPest in all 50 states and the District of Columbia. However, we have not yet had meaningful sales of ContraPest, which is our only product to date that is available for commercialization and the generation of revenue.

We cannot commercialize our other product candidates in the U.S. without first obtaining regulatory approval for each product and each use pattern from the EPA or, if applicable, the Food and Drug Administration, or FDA, and from any related applicable state authorities. Before obtaining regulatory approvals for the commercial sale of any product candidate for a target indication, the law requires that applicants demonstrate through laboratory and field studies and related data showing that the product candidate will perform its intended function without causing unreasonable adverse effects on the environment. The EPA or a comparable foreign regulatory authority may require more information, including additional data to support approval that may delay or prevent approval.

ContraPest and our other product candidates, if approved, may not achieve adequate market acceptance necessary for commercial success.

Even following receipt of regulatory approval for ContraPest or future regulatory approval of our other product candidates, such products may not gain market acceptance. Market acceptance of any of our product candidates for which we receive approval depends on a number of factors, including:

| ● | The potential and perceived advantages of product candidates over alternative or complementary products; |

| ● | The effectiveness of our sales and marketing efforts and those of our collaborators; |

| ● | The efficacy and safety of such product candidates as demonstrated in trials; |

| ● | The uses, indications or limitations for which the product candidate is approved; |

| ● | Product labeling or product insert requirements of the EPA or other regulatory authorities; |

| ● | The timing of market introduction of our products as well as future competitive or alternative products; |

| ● | Relative convenience and ease of use; and |

| ● | Unfavorable publicity relating to the product. |

If we cannot successfully commercialize our products, especially ContraPest, we will not become profitable.

If any of our approved product candidates fail to achieve sufficient market acceptance, we will not be able to generate significant revenues or become profitable. The commercial success of ContraPest will depend on a number of factors, including the following:

| ● | The development of a viable commercial strategy and the successful establishment of a commercial organization; |

| ● | Our success in educating end users about the benefits, administration and use of ContraPest; |

| ● | The effectiveness of our own or our potential strategic partners’ marketing, sales and distribution strategy and operations; |

5

| ● | Establishment of a commercially viable pricing; |

| ● | Our ability to manufacture quantities of ContraPest using commercially acceptable processes and at a scale sufficient to meet anticipated demand and enable us to reduce our cost of manufacturing; and |

| ● | A continued acceptable safety profile of ContraPest. |

Many of these factors are beyond our control. If we are unable to successfully commercialize ContraPest, we may not be able to earn sufficient revenues or profits to continue our business.

Depending on the commercial success of ContraPest, we may require additional capital to fund our operations. Failure to obtain this necessary capital if needed may force us to delay, limit, or terminate our product development efforts or other operations.

Commercialization of ContraPest and developing further product candidates, including conducting experiments and field studies, obtaining and maintaining regulatory approval and commercializing any products approved for sale, is a time-consuming, expensive and uncertain process that takes years to complete. We expect our expenses to continue and to increase in connection with our ongoing activities, particularly as we advance our commercialization activities. We may expand our operations, and as a result of many factors, some of which may be currently unknown to us, our expenses may be higher than expected. Securing additional financing may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our product candidates, including ContraPest. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. If we are unable to raise additional capital when required or on acceptable terms, we may be required to:

| ● | Significantly delay, scale back or discontinue the development or commercialization of our product candidates, including ContraPest; |

| ● | Seek strategic partners for the manufacturing, sales and distribution of ContraPest or any of our other product candidates at an earlier stage than otherwise would be desirable or on terms that are less favorable than might otherwise be available; and |

| ● | Relinquish, or license on unfavorable terms, our rights to technologies or product candidates that we otherwise would seek to develop or commercialize ourselves. |

The occurrence of any of the events described above would have a material adverse effect on our business, operating results and prospects and on our ability to develop our product candidates.

ContraPest is the first product we have marketed, and if we are unable to establish and maintain an effective sales force and marketing and distribution infrastructures, or enter into and rely upon acceptable third party relationships, we may be unable to generate any revenue.

We are continuing to develop a functional infrastructure for the sales, marketing, and distribution of our products and the cost of establishing and maintaining such an infrastructure may exceed the cost-effectiveness of doing so. In order to market ContraPest and any other products that may be approved by the EPA and comparable foreign regulatory authorities, we must continue to build our sales, marketing, managerial and other non-technical capabilities or make arrangements with third parties to perform these services for which we would incur substantial costs. If we are unable to establish and maintain adequate sales, marketing, and distribution capabilities, whether independently or with third parties, we may not be able to generate additional product revenue and may not become profitable. Without an effective internal commercial organization or the support of a third party to perform sales and marketing functions, we may be unable to compete successfully against more established companies.

6

Regulatory approval processes of the EPA and comparable foreign regulatory authorities are lengthy, time-consuming and unpredictable, and if we are ultimately unable to obtain regulatory approval for our product candidates, our business may fail.

Although we obtained EPA approval for ContraPest in less than one year, the EPA review process for a product with one or more new active ingredients typically takes approximately two years to complete and approval is never guaranteed. Our other product candidates could fail to receive marketing approval from the EPA or, with respect to ContraPest or our other product candidates, from a comparable foreign regulatory authority for many reasons, including:

| ● | Disagreement over the design or implementation of our trials; |

| ● | Failure to demonstrate a product candidate is safe; |

| ● | Failure to demonstrate a product candidate’s benefits outweigh its risks; |

| ● | Disagreement over our interpretation of data; |

| ● | Disagreement over whether to accept efficacy results from trials; |

| ● | The insufficiency of data collected from trials to obtain regulatory approval; |

| ● | Irreparable or critical compliance issues relating to our manufacturing process; or |

| ● | Changes in the approval policies or regulations that render our data insufficient for approval. |

Any of these factors, some of which are beyond our control, could jeopardize our ability to obtain regulatory approval for and successfully market any of our product candidates. Any such setback in our pursuit of regulatory approval could have a material adverse effect on our business and prospects.

Even following receipt of any regulatory approval for ContraPest and our other product candidates, we will continue to face extensive regulatory requirements and our products may face future development and regulatory difficulties.

Even following receipt of any regulatory approval for ContraPest or our product candidates, such products will be subject to ongoing requirements by the EPA and comparable state and foreign regulatory authorities governing the manufacture, quality control, further development, labeling, packaging, storage, distribution, safety surveillance, import, export, advertising, promotion, recordkeeping and reporting of safety and other post-market information. The safety profile of any product will continue to be closely monitored by the EPA and comparable foreign regulatory authorities after approval. If the EPA or comparable foreign regulatory authorities become aware of new safety information after approval of ContraPest or any other product candidate, a number of potentially significant negative consequences could result, including:

| ● | We may be forced to suspend marketing of such product; |

| ● | Regulatory authorities may withdraw their approvals of such product after certain procedural requirements have been met; |

| ● | Regulatory authorities may require additional warnings on the label that could diminish the usage or otherwise limit the commercial success of such product; |

| ● | The EPA or other regulatory bodies may issue safety alerts, press releases or other communications containing warnings about such product; |

| ● | The EPA may require the establishment or modification of restricted use or a comparable foreign regulatory authority may require the establishment or modification of a similar strategy that may, for instance, restrict distribution of our product and impose burdensome implementation requirements on us; |

| ● | We may be required to change the way the product is administered or conduct additional trials; |

| ● | We could be sued and held liable for harm caused; |

| ● | We may be subject to litigation or product liability claims; and |

| ● | Our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining market acceptance of the particular product candidate, if approved, and could significantly harm our business, results of operations and prospects.

Moreover, existing government regulations may change, and additional government regulations may be enacted that could prevent, limit or delay regulatory approval of ContraPest or any other product candidates. If we are slow or unable to adapt to changes in existing requirements or the adoption of new requirements or policies, or if we are not able to maintain regulatory compliance, we may lose any marketing approval that we may have obtained and/or be subject to fines or enhanced government oversight and reporting obligations, which would adversely affect our business, prospects, and ability to achieve or sustain profitability.

7

Even following receipt of any regulatory approval for ContraPest and our other product candidates, we will continue to be subject to regulation of our manufacturing processes and advertising practices.

As a manufacturer of pest control products, we are subject to continual government oversight and periodic inspections by the EPA and other regulatory authorities. If we or a regulatory agency discover problems with a facility where our products are manufactured, a regulatory agency may impose restrictions on the manufacturing facility, including requiring recall or withdrawal of the product from the market or suspension of manufacturing until certain procedural requirements have been met. The occurrence of any such event or penalty could limit our ability to market ContraPest or any other product candidates and generate revenue.

In addition, the EPA strictly regulates the advertising and promotion of pest control products, and these pest control products may only be marketed or promoted for their EPA approved uses, consistent with the product’s approved labeling. Advertising and promotion of any product candidate that obtains approval in the U.S. will be heavily scrutinized by the EPA, other applicable state regulatory agencies and the public. Violations, including promotion of our products for unapproved or off-label uses, are subject to enforcement actions, inquiries and investigations, and civil, criminal and/or administrative sanctions imposed by the EPA.

Failure to obtain regulatory approval in foreign jurisdictions would prevent ContraPest or any other product candidates from being marketed in those jurisdictions.

To market and sell our products globally, we must obtain separate marketing approvals and comply with numerous and varying regulatory requirements. The approval procedure varies among countries and can involve additional testing. The time required to obtain approval may differ substantially from that required to obtain EPA approval. Obtaining foreign regulatory approvals and maintaining compliance with foreign regulatory requirements could result in significant delays, difficulties, and cost for us and could delay or prevent the introduction of our products in certain countries. Approval by the EPA does not ensure approval by regulatory authorities in other countries or jurisdictions, but EPA approval may influence decisions by the foreign regulatory authority. If we are unable to obtain approval of ContraPest or for any of our other product candidates by regulatory authorities in the world market, the commercial prospects of that product candidate may be significantly diminished and our business prospects could decline.

We have internal manufacturing capabilities to meet our current demand for ContraPest, however, we must develop additional manufacturing capability or rely upon third parties to manufacture our products to meet future demand.

Our existing internal manufacturing platform is adequate for meeting our current demand for ContraPest. We may be required to spend significant time and resources to expand these manufacturing facilities to fully meet future demand. If we are unable to develop full-scale manufacturing capabilities, we may not be able to meet demand of our products without relying on third party manufacturers, which could adversely affect our operations or financial condition.

We will need to expand our operations and grow the size of our organization, and we may experience difficulties in managing this growth.

As of January 31, 2020, we had 31 full-time and four part-time employees. As our development and commercialization plans and strategies develop, we will need additional managerial, operational, sales, marketing, scientific, financial headcount and other resources. Our management, personnel, and systems currently in place may not be adequate to support this future growth. Future growth would impose significant added responsibilities on members of management, including:

| ● | Identifying, recruiting, maintaining, motivating and integrating additional employees with the expertise and experience we will require; |

| ● | Managing our internal development efforts effectively while complying with our contractual obligations to licensors, licensees, contractors and other third parties; |

| ● | Managing additional relationships with various strategic partners, suppliers and other third parties; |

| ● | Managing our trials effectively, which we anticipate being conducted at numerous field study sites; |

| ● | Improving our managerial, development, operational, marketing, production and finance reporting systems and procedures; and |

| ● | Expanding our facilities. |

Our failure to accomplish any of these tasks could prevent us from successfully growing our business.

8

We depend on key personnel to operate our business. If we are unable to retain, attract and integrate qualified personnel, our ability to develop and successfully grow our business could be harmed.

We believe that our future success is highly dependent on the contributions of our significant employees, as well as our ability to attract and retain highly skilled and experienced sales, research and development, and other personnel in the U.S. and internationally. All of our employees are free to terminate their employment relationship with us at any time, subject to any applicable notice requirements, and their knowledge of our business and industry would be difficult to replace. If one or more of our executive officers or significant employees terminates his or her employment or becomes disabled or experiences long-term illness, we may not be able to replace their expertise, fully integrate new personnel or replicate the prior working relationships, and the loss of their services might significantly delay or prevent the achievement of our research, development and business objectives. Qualified individuals with the breadth of skills and experience in our industry that we require are in high demand, and we may incur significant costs to attract them. Many of the other companies that we compete against for qualified personnel have greater financial and other resources, different risk profiles and a more established history in the industry. They also may provide more diverse opportunities and better chances for career advancement. Additionally, our facilities are located in Arizona, which may make attracting and retaining qualified scientific and technical personnel from outside of Arizona difficult. Our failure to attract or retain key personnel could impede the achievement of our research, development and commercialization objectives.

We have not fully assessed our internal control over financial reporting. If we experience material weaknesses in the future or otherwise fail to maintain an effective system of internal controls, we may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect investor confidence in us and, as a result, the value of our Common Stock.

A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our financial statements will not be prevented or detected on a timely basis. There are currently no material weaknesses in our internal controls over financial reporting and we are in the process of implementing measures designed to further improve our internal control over financial reporting.

Our annual report on Form 10-K for the year ended December 31, 2018 did not include an attestation report of the company’s registered public accounting firm due to a transition period established by rules of the SEC for smaller reporting companies and emerging growth companies. As a result, we have not yet fully assessed our internal control over financial reporting and are unable to assure that the measures we have taken to date, together with any measures we may take in the future, will be sufficient to remediate the control deficiencies that led to our material weaknesses in our internal control over financial reporting, or to avoid potential future material weaknesses.

If we are unable to develop and maintain an effective system of internal control over financial reporting, successfully remediate any existing or future material weaknesses in our internal control over financial reporting, or identify any additional material weaknesses, the accuracy and timing of our financial reporting may be adversely affected, we may be unable to maintain compliance with securities law requirements regarding timely filing of periodic reports and Nasdaq listing requirements, investors may lose confidence in our financial reporting, and our stock price may decline as a result.

We may be subject to legal proceedings in the ordinary course of our business that could result in significant harm to our business, financial condition and operating results.

We could be subject to legal proceedings and claims from time to time in the ordinary course of our business, including actions arising from tort, contract or other claims. See “Legal Proceedings” elsewhere in this prospectus for more information. Litigation is expensive, time consuming, and could divert management’s attention away from running our business. The outcome of litigation or other proceedings is subject to significant uncertainty, and it is possible that an adverse resolution of one or more such proceedings could result in reputational harm and/or significant monetary damages, injunctive relief or settlement costs that could adversely affect our results of operations or financial condition as well as our ability to conduct our business as it is presently being conducted. Insurance might not cover such claims, might not provide sufficient payments to cover all the costs to resolve one or more such claims and might not be available on terms acceptable to us. In addition, regardless of merit or outcome, claims brought against us that are uninsured or underinsured could result in unanticipated costs, which could harm our business, financial condition and operating results and reduce the trading price of our stock.

9

Product liability lawsuits against us could cause us to incur substantial liabilities and to limit commercialization of any products that we may develop.

We face an inherent risk of product liability exposure related to the use of ContraPest and any of our other products. If we cannot successfully defend ourselves against claims from our product users, we could incur substantial liabilities. Regardless of merit or eventual outcome, liability claims may result in:

| ● | Decreased demand for any product that we may develop; |

| ● | Termination of field studies or other research and development efforts; |

| ● | Injury to our reputation and significant negative media attention; |

| ● | Significant costs to defend the related litigation; |

| ● | Substantial monetary awards to plaintiffs; |

| ● | Loss of revenue; |

| ● | Diversion of management and scientific resources from our business operations; and |

| ● | The inability to commercialize our product candidates. |

We may be unable to obtain commercially reasonable product liability insurance for any products approved for marketing. Large judgments have been awarded in class action lawsuits based on products that had unanticipated side effects, including, without limitation, any potential adverse effects of our products on humans or other species. A successful product liability claim or series of claims brought against us, particularly if judgments exceed our insurance coverage, could decrease our cash and adversely affect our business.

Business or supply chain disruptions could seriously harm our future revenues and financial condition and increase our costs and expenses.

Our operations could be subject to a variety of potential business disruptions, including power shortages, telecommunications failures, water shortages, floods, fires, earthquakes, extreme weather conditions, medical epidemics and other natural or manmade disasters or other interruptions, for which we are predominantly self-insured. We do not carry insurance for all categories of risk that our business may encounter. The occurrence of any of these business disruptions could seriously harm our operations and financial condition and increase our costs and expenses. Moreover, we rely on third parties to supply various ingredients and other items which are critical for producing our product candidates. We currently use one supplier for each of our two active ingredients, Triptolide and VCD. Our ability to produce our product candidates would be disrupted if the operations of these suppliers are affected by a manmade or natural disaster or other business interruption. The ultimate impact on our operations from any business interruption impacting us or any of our significant suppliers is unknown, but our operations and financial condition would likely suffer adverse consequences. Further, any significant uninsured liability may require us to pay substantial amounts, which would adversely affect our business, results of operations, financial condition and cash flows from future prospects.

We are dependent on triptolide, a key ingredient for ContraPest, which has limited sources and must be in a very refined condition.

If we are unable to develop additional sources of or alternatives to triptolide, a key ingredient for ContraPest, our long term ability to produce ContraPest at a cost effective price could be in jeopardy. If market demand for triptolide causes the price to increase beyond our ability to market at a competitive price or causes the quality of the refined ingredient to be less than needed for our production, our ability to commercialize ContraPest could be limited or delayed, which would adversely affect our business, results of operations and financial condition.

10

A variety of risks associated with marketing our product candidates internationally could materially adversely affect our business.

We may seek regulatory approval of our product candidates outside of the U.S. and, in that case, we expect that we will be subject to additional risks related to operating in foreign countries if we obtain the necessary approvals, including:

| ● | Differing regulatory requirements in foreign countries; |

| ● | Unexpected changes in tariffs, trade barriers, price and exchange controls and other regulatory requirements; |

| ● | Economic weakness, including inflation or political instability in particular foreign economies and markets; |

| ● | Compliance with tax, employment, immigration and labor laws for employees living or traveling internationally; |

| ● | Foreign taxes, including withholding of payroll taxes; |

| ● | Foreign currency fluctuations, which could result in increased operating expenses and reduced revenue, and other obligations incident to doing business in another country; |

| ● | Difficulties staffing and managing foreign operations; |

| ● | Workforce uncertainty in countries where labor unrest is more common than in the United States; |

| ● | Potential liability under the U.S. Foreign Corrupt Practices Act of 1977, as amended, or the FCPA, or comparable foreign regulations; |

| ● | Challenges enforcing our contractual and intellectual property rights, especially in those foreign countries that do not respect and protect intellectual property rights to the same extent as the United States; |

| ● | Production shortages resulting from any events affecting raw material supply or manufacturing capabilities internationally; and |

| ● | Business interruptions resulting from geopolitical actions, including war and terrorism. |

These and other risks associated with our international operations may materially adversely affect our ability to attain or maintain profitable operations.

We are subject to anti-corruption and anti-money laundering laws with respect to our operations and noncompliance with such laws can subject us to criminal and/or civil liability and harm our business.

We are subject to the FCPA, which is the U.S. domestic bribery statute contained in 18 U.S.C. §201, the U.S. Travel Act, the USA PATRIOT Act and other anti-bribery and anti-money laundering laws in countries in which we conduct our business. Anti-corruption laws are interpreted broadly and prohibit companies and their employees and third-party intermediaries from authorizing, offering or providing, directly or indirectly, improper payments or benefits to recipients in the public or private sector. As we commercialize our product candidates and commence international sales and business, we may engage with collaborators and third-party intermediaries to sell our products internationally and to obtain necessary permits, licenses and other regulatory approvals. We or our third-party intermediaries may have direct or indirect interactions with officials and employees of government agencies or state-owned or affiliated entities. We may be found liable for the corrupt or other illegal activities of these third-party intermediaries, our employees, representatives, contractors, partners and agents, even if we do not explicitly authorize such activities.

Noncompliance with anti-corruption and anti-money laundering laws could subject us to whistleblower complaints, investigations, sanctions, settlements, prosecution, other enforcement actions, disgorgement of profits, significant fines, damages, other civil and criminal penalties or injunctions, suspension and/or debarment from contracting with certain persons, the loss of export privileges, reputational harm, adverse media coverage and other collateral consequences. Responding to any action will likely result in a materially significant diversion of management’s attention and resources and significant defense costs and other professional fees.

If we are unable to obtain or protect intellectual property rights, our competitive position could be harmed.

We depend on our ability to protect our proprietary technology. We rely on trade secret, patent, copyright and trademark laws, and confidentiality, licensing, and other agreements with employees and third parties, all of which offer only limited protection. Our commercial success will depend in part on our ability to obtain and maintain intellectual property protection in the United States and other countries with respect to our proprietary technology and products. Where we deem appropriate, we seek to protect our proprietary position by filing patent applications in the U.S. and internationally related to our novel technologies and products that are important to our business. Patent positions can be highly uncertain, involve complex legal and factual questions and be the subject of litigation. As a result, the issuance, scope, validity, enforceability and commercial value of our patents, including those patent rights licensed to us by third parties, are highly uncertain.

11

The steps we have taken to protect our proprietary rights may not be adequate to preclude misappropriation of our proprietary information or infringement of our intellectual property rights, both inside and outside the U.S. The rights already granted under any of our currently issued patents and those that may be granted under future issued patents may not provide us with the proprietary protection or competitive advantages we are seeking. If we are unable to obtain and maintain protection for our technology and products, or if the scope of the protection obtained is not sufficient, our competitors could develop and commercialize technology and products similar or superior to ours, and our ability to successfully commercialize our technology and products may be adversely affected.

With respect to patent rights, we do not know whether any of our pending patent applications for any of our technologies or products will result in the issuance of patents that protect such technologies or products, or if our licensed patent will effectively prevent others from commercializing competitive technologies and products. Our pending patent applications cannot be enforced against third parties practicing the technology claimed in such applications unless and until a patent issues from such applications. Further, the examination process may require us to narrow the claims for our pending patent applications, which may limit the scope of patent protection that may be obtained if these applications issue. Because the issuance of a patent is not conclusive as to its inventorship, scope, validity or enforceability, issued patents that we own or have licensed from third parties may be challenged in the courts or patent offices in the U.S. and internationally. Such challenges may result in the loss of patent protection, the narrowing of claims in such patents, or the invalidity or unenforceability of such patents, which could limit our ability to stop others from using or commercializing similar or identical technology and products or limit the duration of the patent protection for our technology and products. Protecting against the unauthorized use of our patented technology, trademarks and other intellectual property rights, is expensive, difficult, and in some cases, may not be possible. In some cases, it may be difficult or impossible to detect third party infringement or misappropriation of our intellectual property rights, even in relation to issued patent claims, and proving any such infringement may be even more difficult.

Intellectual property rights do not necessarily address all potential threats to any competitive advantage we may have.

The degree of future protection afforded by our intellectual property rights is uncertain because intellectual property rights have limitations, and may not adequately protect our business, or permit us to maintain our competitive advantage. The following examples are illustrative:

| ● | Others may be able to make compounds that are the same as or similar to our future products but that are not covered by the claims of the patents that we own or have exclusively licensed; |

| ● | We might not have been the first to file patent applications covering certain of our inventions; |

| ● | Others may independently develop similar or alternative technologies or duplicate any of our technologies without infringing on our intellectual property rights; |

| ● | Issued patents that we own or have exclusively licensed may not provide us with any competitive advantages, or may be held invalid or unenforceable, as a result of legal challenges by our competitors; |

| ● | Our competitors might conduct research and development activities in the U.S. and other countries that provide a safe harbor from patent infringement claims for certain research and development activities, as well as in countries where we do not have patent rights and then use the information learned from such activities to develop competitive products for sale in our major commercial markets; |

| ● | We may not develop additional proprietary technologies that are patentable; and |

| ● | The patents of others may have an adverse effect on our business. |

Our technology may be found to infringe third party intellectual property rights.

Third parties may in the future assert claims or initiate litigation related to their patent, copyright, trademark and other intellectual property rights in technology that is important to us. The asserted claims and/or litigation could include claims against us, our licensors, or our suppliers alleging infringement of intellectual property rights with respect to our product candidates or components of those products. Regardless of the merit of the claims, they could be time consuming, resulting in costly litigation and diversion of technical and management personnel, or require us to develop non-infringing technology or enter into license agreements. We cannot assure you that licenses will be available on acceptable terms, if at all. Furthermore, because of the potential for significant damage awards, which are not necessarily predictable, it is not unusual to find even arguably unmeritorious claims resulting in large settlements. If any infringement or other intellectual property claim made against us by any third party is successful, or if we fail to develop non-infringing technology or license the proprietary rights on commercially reasonable terms and conditions, our business, operating results and financial condition could be materially adversely affected.

12

If our product candidates, methods, processes and other technologies infringe the proprietary rights of other parties, we could incur substantial costs and we may have to:

| ● | Obtain licenses, which may not be available on commercially reasonable terms, if at all; |

| ● | Redesign our product candidates or processes to avoid infringement; |

| ● | Stop using the subject matter claimed in the patents held by others; |

| ● | Pay damages; or |

| ● | Defend litigation or administrative proceedings which may be costly whether we win or lose, and which could result in a substantial diversion of our financial and management resources. |

We may need to license intellectual property from third parties, and such licenses may not be available or may not be available on commercially reasonable terms.

A third party may hold intellectual property, including patent rights that are important or necessary to the development of our product candidates. It may be necessary for us to use the patented or proprietary technology of a third party to manufacture or otherwise commercialize our own technology or products, in which case we would be required to obtain a license from such third party. Licensing such intellectual property may not be available or may not be available on commercially reasonable terms, which could have a material adverse effect on our business and financial condition.

Risks Related to our Capital Stock

We have incurred significant operating losses every quarter since our inception and anticipate that we will continue to incur significant operating losses in the future.

Investment in product development is highly speculative because it entails substantial upfront capital expenditures and significant risk that any potential product candidate will fail to become commercially viable or gain regulatory approval. To date, we have financed our operations primarily through research grants as well as through the sale of equity securities and debt financings. Until August 2, 2016, we did not have any products approved by a regulatory authority for marketing or commercial sale, and we have generated minimal revenue from product sales to date. We continue to incur significant research, development, and other expenses related to our ongoing operations, including sales, marketing, and distribution functionality. As a result, we are not profitable and have incurred losses in every reporting period since our inception. For the years ended December 31, 2018 and 2017, we reported net losses of $12.2 million and $12.3 million, respectively, and for the nine months ended September 30, 2019, we reported net losses of $7.2 million. As of September 30, 2019, we had an accumulated deficit since inception of $93.1 million.

Since inception, we have dedicated a majority of our resources to the discovery and development of our proprietary product candidates. We expect to continue to incur significant expenses and operating losses for the foreseeable future. The size of our losses will depend, in part, on the rate of future expenditures and our ability to generate revenues. In particular, we expect to incur substantial and increased expenses as we:

| ● | Attempt to achieve market acceptance for our products; |

| ● | Continue to establish an infrastructure for the sales, marketing and distribution of ContraPest and any other product candidates for which we may receive regulatory approval; |

| ● | Scale up manufacturing processes and quantities to prepare for the commercialization of ContraPest and any other product candidates for which we receive regulatory approval; |

| ● | Continue the research and development of ContraPest and our other product candidates, including engaging in any necessary field studies; |

| ● | Seek regulatory approvals for ContraPest in various jurisdictions and for our other product candidates; |

13

| ● | Expand our research and development activities and advance the discovery and development programs for other product candidates; |

| ● | Maintain, expand and protect our intellectual property portfolio; and |

| ● | Add operational, financial and management information systems and personnel, including personnel to support our clinical development and commercialization efforts and operations as a public company. |

We may encounter unforeseen expenses, difficulties, complications, delays, and other unknown factors that may adversely affect our financial condition. Our prior losses and expected future losses have had, and will continue to have, an adverse effect on our financial condition. If ContraPest or any other product candidate does not gain sufficient regulatory approval, or if approved, fails to achieve market acceptance, we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Our failure to become and remain profitable would decrease the value of our company and could impair our ability to raise capital, expand our business, diversify our product offerings or continue our operations. A decline in the value of our company could cause you to lose all or part of your investment.

If we are unable to continue as a going concern, our securities will have little or no value.

We have incurred operating losses since our inception, and we expect to continue to incur significant expenses and operating losses for the foreseeable future. Our financial statements as of December 31, 2018 and 2017 have been prepared under the assumption that we will continue as a going concern. Our independent registered public accounting firm included in its opinion for the year ended December 31, 2018 and 2017 an explanatory paragraph referring to our net loss from operations and net capital deficiency and expressing substantial doubt in our ability to continue as a going concern without additional capital becoming available. If we encounter continued issues or delays in the commercialization of ContraPest, our prior losses and expected future losses could have an adverse effect on our financial condition and negatively impact our ability to fund continued operations, obtain additional financing in the future and continue as a going concern. There are no assurances that such financing, if necessary, will be available to us at all or will be available in sufficient amounts or on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. If we are unable to generate additional funds in the future through financings, sales of our products, licensing fees, royalty payments or from other sources or transactions, we will exhaust our resources and will be unable to continue operations. If we cannot continue as a going concern, our stockholders would likely lose most or all of their investment in us.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate sufficient product revenues, we expect to finance our cash needs primarily through the sale of equity securities and debt financings, and possibly through credit facilities and government and foundation grants. We may also seek to raise capital through third party collaborations, strategic alliances and similar arrangements. We currently do not have any committed external source of funds. Raising funds in the future may present additional challenges and future financing may not be available in sufficient amounts or on terms acceptable to us, if at all. The terms of any financing arrangements we enter into may adversely affect the holdings or the rights of our stockholders and the issuance of additional securities by us, or the possibility of such issuance, may cause the market price of our shares to decline.

Certain of our outstanding warrants contain provisions that impose limitations on our ability to participate in certain variable rate transactions, including at-the-market transactions, which may limit our opportunities to obtain financing in sufficient amounts or on acceptable terms. The sale of additional equity or convertible debt securities would dilute all of our stockholders, and if such sales occur at a deemed issuance price that is lower than the current exercise price of our outstanding warrants sold to investors in November 2017, the exercise price for those warrants would adjust downward to the deemed issuance price pursuant to price adjustment protection contained within those warrants.

The incurrence of indebtedness through credit facilities would result in increased fixed payment obligations and, potentially, the imposition of restrictive covenants. Those covenants may include limitations on our ability to incur additional debt, making capital expenditures or declaring dividends, and may impose limitations on our ability to acquire, sell, or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business.