Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - KELLY SERVICES INC | a20194qearningsrelease.htm |

| 8-K - 8-K - KELLY SERVICES INC | kelya-20200213.htm |

Exhibit 99.2 FOURTH QUARTER AND FULL YEAR 2019

FOURTH QUARTER 2019 TAKEAWAYS PRESSURE ON PROFITS REVENUE GROWTH IN A MORE CHALLENGING Earnings from ENVIRONMENT Operations, excluding asset impairment Revenue down 5.4%; charge(2), was $28.9 Down 5.2% in constant million, down 12.9% currency(1) FOCUSING ON OUR FUTURE Unlocking capital to invest in growth platforms by entering Corporate Campus sales and leaseback transaction ----- (1)Constant Currency represents year-over-year changes resulting from translating 2019 financial data into USD using 2018 exchange rates. (2)Asset impairment charge of $15.8 million, $11.8 million net of tax or $0.30 per share in 2019. 2

FOURTH QUARTER 2019 FINANCIAL SUMMARY Constant Currency Actual Results Change Change(1) Revenue $1.3B (5.4%) (5.2%) GP % 18.3% 30 bps Earnings from Operations $13.1M (60.5%) (60.0%) ROS % 1.0% (130) bps EPS $0.43 $1.05 • Revenue declined in Americas Staffing and International Staffing segments in the face of a weakening manufacturing sector in the U.S. and softening demand in Europe, respectively. GTS returned to revenue growth in the fourth quarter • GP rate improved from the impact of higher margin acquisitions and structural improvement in product mix, partially offset by lower perm fees • Earnings from Operations declined primarily due to a $15.8 million asset impairment charge related to a technology development project and the impact of lower revenues in Americas Staffing • 2019 Q4 EPS includes a $0.30 impact from the asset impairment charge. Also driving the change is the $1.49 loss on equity investment in 2018 compared to a $0.01 gain in 2019 ----- (1)Constant Currency represents year-over-year changes resulting from translating 2019 financial data into USD using 2018 exchange rates. 3

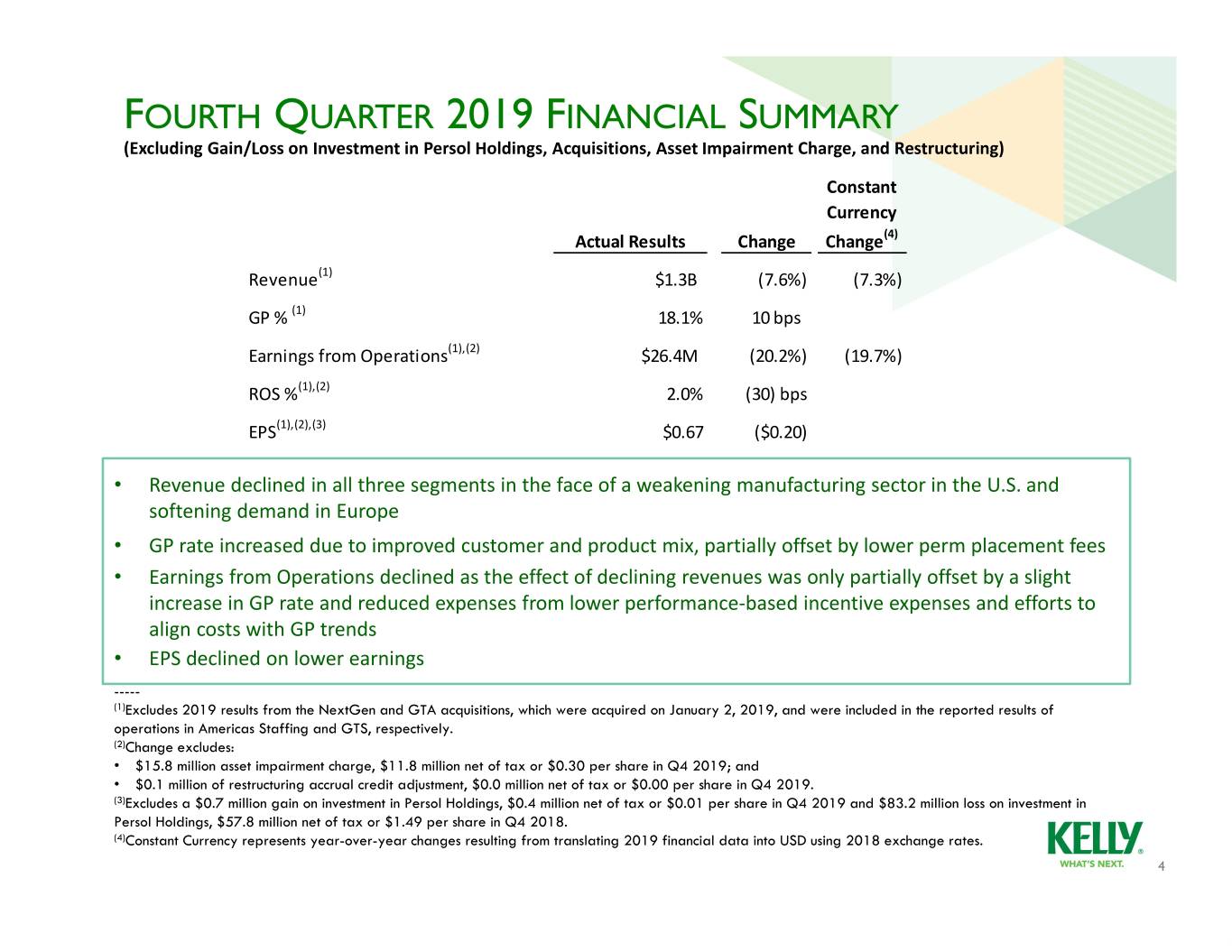

FOURTH QUARTER 2019 FINANCIAL SUMMARY (Excluding Gain/Loss on Investment in Persol Holdings, Acquisitions, Asset Impairment Charge, and Restructuring) Constant Currency Actual Results Change Change(4) Revenue(1) $1.3B (7.6%) (7.3%) GP % (1) 18.1% 10 bps Earnings from Operations(1),(2) $26.4M (20.2%) (19.7%) ROS %(1),(2) 2.0% (30) bps EPS(1),(2),(3) $0.67 ($0.20) • Revenue declined in all three segments in the face of a weakening manufacturing sector in the U.S. and softening demand in Europe • GP rate increased due to improved customer and product mix, partially offset by lower perm placement fees • Earnings from Operations declined as the effect of declining revenues was only partially offset by a slight increase in GP rate and reduced expenses from lower performance‐based incentive expenses and efforts to align costs with GP trends • EPS declined on lower earnings ----- (1)Excludes 2019 results from the NextGen and GTA acquisitions, which were acquired on January 2, 2019, and were included in the reported results of operations in Americas Staffing and GTS, respectively. (2)Change excludes: • $15.8 million asset impairment charge, $11.8 million net of tax or $0.30 per share in Q4 2019; and • $0.1 million of restructuring accrual credit adjustment, $0.0 million net of tax or $0.00 per share in Q4 2019. (3)Excludes a $0.7 million gain on investment in Persol Holdings, $0.4 million net of tax or $0.01 per share in Q4 2019 and $83.2 million loss on investment in Persol Holdings, $57.8 million net of tax or $1.49 per share in Q4 2018. (4)Constant Currency represents year-over-year changes resulting from translating 2019 financial data into USD using 2018 exchange rates. 4

FULL YEAR 2019 FINANCIAL SUMMARY Constant Currency Actual Results Change Change(1) Revenue $5.4B (2.9%) (1.9%) GP % 18.1% 50 bps Earnings from Operations $81.8M (6.5%) (5.0%) ROS %1.5%(10) bps EPS $2.84 $2.26 • Revenue declined in Americas Staffing and International Staffing in the face of a weakening manufacturing sector in the U.S. and softening demand in Europe, respectively. GTS revenue improved year‐over‐year • GP rate improved from the impact of higher margin acquisitions and structural improvement in product mix in GTS • Earnings from Operations declined compared to last year as a higher GP rate on lower revenue resulted in lower gross profit. The decline was partially offset by lower performance‐based incentive expenses and expense control efforts. Asset impairment and restructuring charges were partially offset by gain on sale of assets • EPS favorably impacted by a $0.63 gain on equity investment in 2019 compared to a $1.69 loss in 2018 ----- (1)Constant Currency represents year-over-year changes resulting from translating 2019 financial data into USD using 2018 exchange rates. 5

FULL YEAR 2019 FINANCIAL SUMMARY (Excluding Gain/Loss on Investment in Persol Holdings, Acquisitions, Asset Impairment Charge, Restructuring, and Gain on Sale of Assets) Constant Currency Actual Results Change Change(4) Revenue(1) $5.2B (5.4%) (4.4%) GP % (1) 17.8% 20 bps Earnings from Operations(1),(2) $78.9M (9.7%) (8.1%) ROS %(1),(2) 1.5% (10) bps EPS(1),(2),(3) $2.16 ($0.11) • Revenue declined in Americas Staffing and International Staffing in the face of a weakening manufacturing sector in the U.S. and softening demand in Europe, respectively • GP rate improved due to structural improvement in product mix in GTS, partially offset by lower perm fees • Earnings from Operations declined as the effect of declining revenues was only partially offset by improving GP rate and reduced expenses from lower performance‐based incentive expenses and efforts to align costs with revenue trends • EPS declined on lower earnings ----- (1)Excludes 2019 results from the NextGen and GTA acquisitions, which were acquired on January 2, 2019, and were included in the reported results of operations in Americas Staffing and GTS, respectively. (2)Change excludes: • 2019 asset impairment charge of $15.8 million, $11.8 million net of tax or $0.30 per share; and • 2019 restructuring charges of $5.5 million, $4.1 million net of tax or $0.10 per share. (3)Change excludes: • 2019 gain on investment in Persol Holdings of $35.8 million, $24.8 million net of tax or $0.63 per share; and • 2018 loss on investment in Persol Holdings of $96.2 million, $66.8 million net of tax or $1.69 per share. (4)Constant Currency represents year-over-year changes resulting from translating 2019 financial data into USD using 2018 exchange rates. 6

FOURTH QUARTER 2019 EPS SUMMARY $ in millions except per share data Fourth Quarter 2019 2018 Amount Per Share Amount Per Share Net earnings (loss) $ 17.0 $ 0.43 $ (23.9) $ (0.62) (Gain) loss on investment in Persol Holdings, net of taxes(1) (0.4) (0.01) 57.8 1.49 Net earnings from acquisitions(2) (1.9) (0.04) ‐ ‐ Asset impairment charge, net of taxes(3) 11.8 0.30 ‐ ‐ Adjusted net earnings $ 26.5 $ 0.67 $ 33.9 $ 0.87 • As adjusted, net earnings and EPS declined on lower earnings ----- (1)Gain on investment in Persol Holdings of $0.7 million, $0.4 million net of tax or $0.01 per share in Q4 2019 and loss on investment in Persol Holdings of $83.2 million, $57.8 million net of tax or $1.49 per share in Q4 2018. (2)NextGen and GTA were acquired on January 2, 2019, and were included in the reported results of operations of Americas Staffing and GTS segments, respectively, from the date of acquisition. (3)Asset impairment charge of $15.8 million, $11.8 million net of tax or $0.30 per share in Q4 2019. 7

FULL YEAR 2019 EPS SUMMARY $ in millions except per share data Full Year 2019 2018 Amount Per Share Amount Per Share Net earnings $ 112.4 $ 2.84 $ 22.9 $ 0.58 (Gain) loss on investment in Persol Holdings, net of taxes(1) (24.8) (0.63) 66.8 1.69 Restructuring charges, net of taxes(2) 4.1 0.10 ‐ ‐ Net earnings from acquisitions(3) (9.0) (0.22) ‐ ‐ Gain on sale of assets, net of taxes(4) (9.0) (0.23) ‐ ‐ Asset impairment charge, net of taxes(5) 11.8 0.30 ‐ ‐ Adjusted net earnings $ 85.5 .$ 2.16 $ 89.7 $ 2.27 • As adjusted, net earnings and EPS declined on lower earnings ----- (1)Gain on investment in Persol Holdings of $35.8 million, $24.8 million net of tax or $0.63 per share in 2019 and loss on investment in Persol Holdings of $96.2 million, $66.8 million net of tax or $1.69 per share in 2018. (2)Restructuring charges of $5.5 million, $4.1 million net of tax or $0.10 per share. (3)NextGen and GTA were acquired on January 2, 2019, and were included in the reported results of operations of Americas Staffing and GTS segments, respectively, from the date of acquisition. (4)Gain on sale of assets of $12.3 million, $9.0 million net of tax or $0.23 per share in 2019. (5)Asset impairment charge of $15.8 million, $11.8 million net of tax or $0.30 per share in 2019. 8

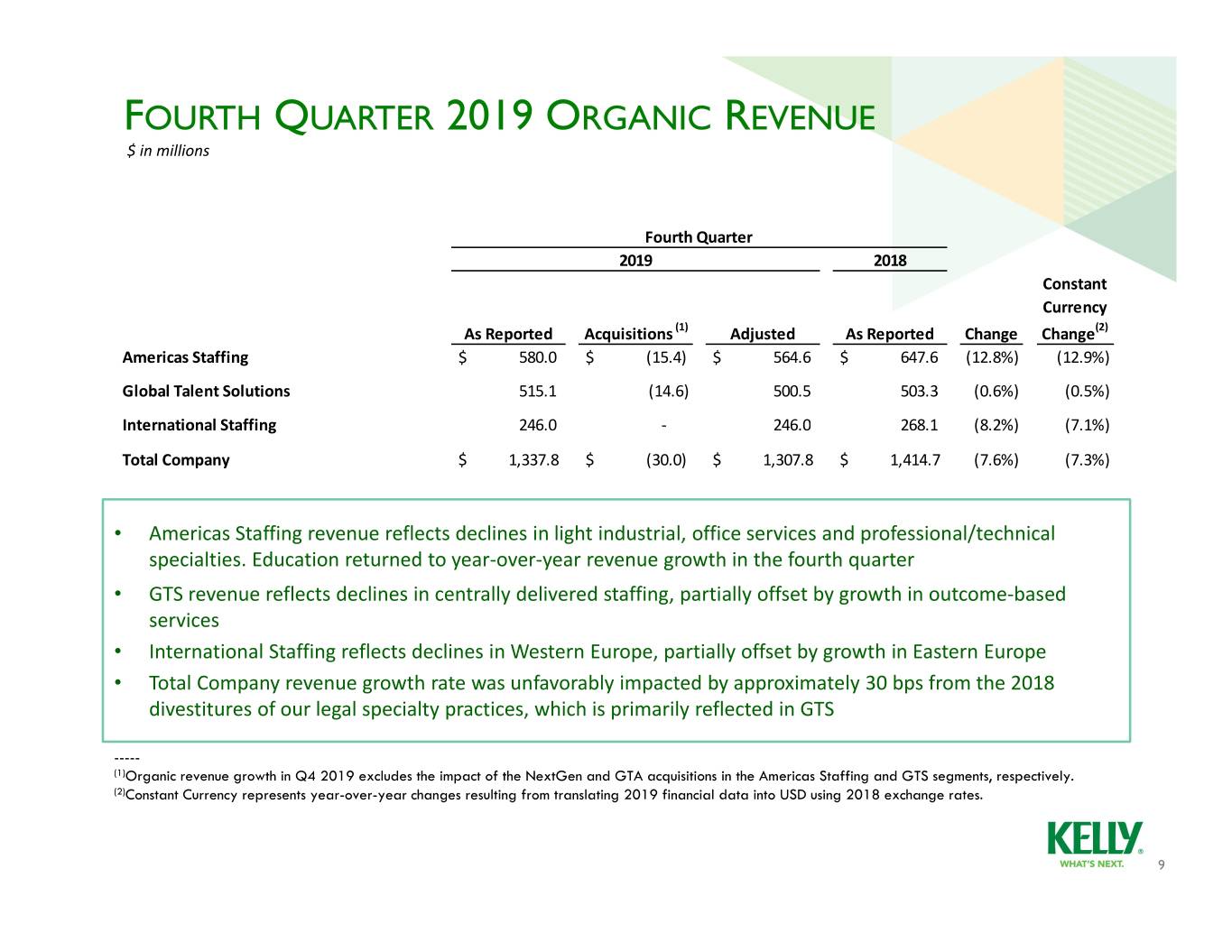

FOURTH QUARTER 2019 ORGANIC REVENUE $ in millions Fourth Quarter 2019 2018 Constant Currency As Reported Acquisitions (1) Adjusted As Reported Change Change(2) Americas Staffing $ 580.0 $ (15.4) $ 564.6 $ 647.6 (12.8%) (12.9%) Global Talent Solutions 515.1 (14.6) 500.5 503.3 (0.6%) (0.5%) International Staffing 246.0 ‐ 246.0 268.1 (8.2%) (7.1%) Total Company $ 1,337.8 $ (30.0) $ 1,307.8 $ 1,414.7 (7.6%) (7.3%) • Americas Staffing revenue reflects declines in light industrial, office services and professional/technical specialties. Education returned to year‐over‐year revenue growth in the fourth quarter • GTS revenue reflects declines in centrally delivered staffing, partially offset by growth in outcome‐based services • International Staffing reflects declines in Western Europe, partially offset by growth in Eastern Europe • Total Company revenue growth rate was unfavorably impacted by approximately 30 bps from the 2018 divestitures of our legal specialty practices, which is primarily reflected in GTS ----- (1)Organic revenue growth in Q4 2019 excludes the impact of the NextGen and GTA acquisitions in the Americas Staffing and GTS segments, respectively. (2)Constant Currency represents year-over-year changes resulting from translating 2019 financial data into USD using 2018 exchange rates. 9

FOURTH QUARTER 2019 REVENUE GROWTH (1) Revenue Mix by Segment Revenue Growth by Segment Reported Constant Currency Organic Growth (2) 7% 2.3%2.4% 2% 39% 43% ‐3% (0.5%) ‐8% (5.2%) (7.1%) (5.4%) (7.3%) (7.1%) (10.4%) ‐13% (8.2%) 18% (10.5%) ‐18% (12.9%) Total Americas Global Talent International Americas Staffing International Staffing Global Talent Solutions Staffing Solutions Staffing • Americas Staffing revenue declined on lower volume in light industrial, office services, partially offset by increases in professional/technical specialties, which includes the impact of the NextGen acquisition, and Education • GTS revenue growth includes the impact of the GTA acquisition in addition to organic growth in outcome‐ based services, however this growth was offset by declines in centrally delivered staffing • International Staffing reflects declines in Western Europe, partially offset by growth in Eastern Europe ----- (1)Revenue Mix by Segment includes the results from acquisitions. (2)Organic growth represents revenue growth excluding the results of acquisitions on a constant currency basis. 10

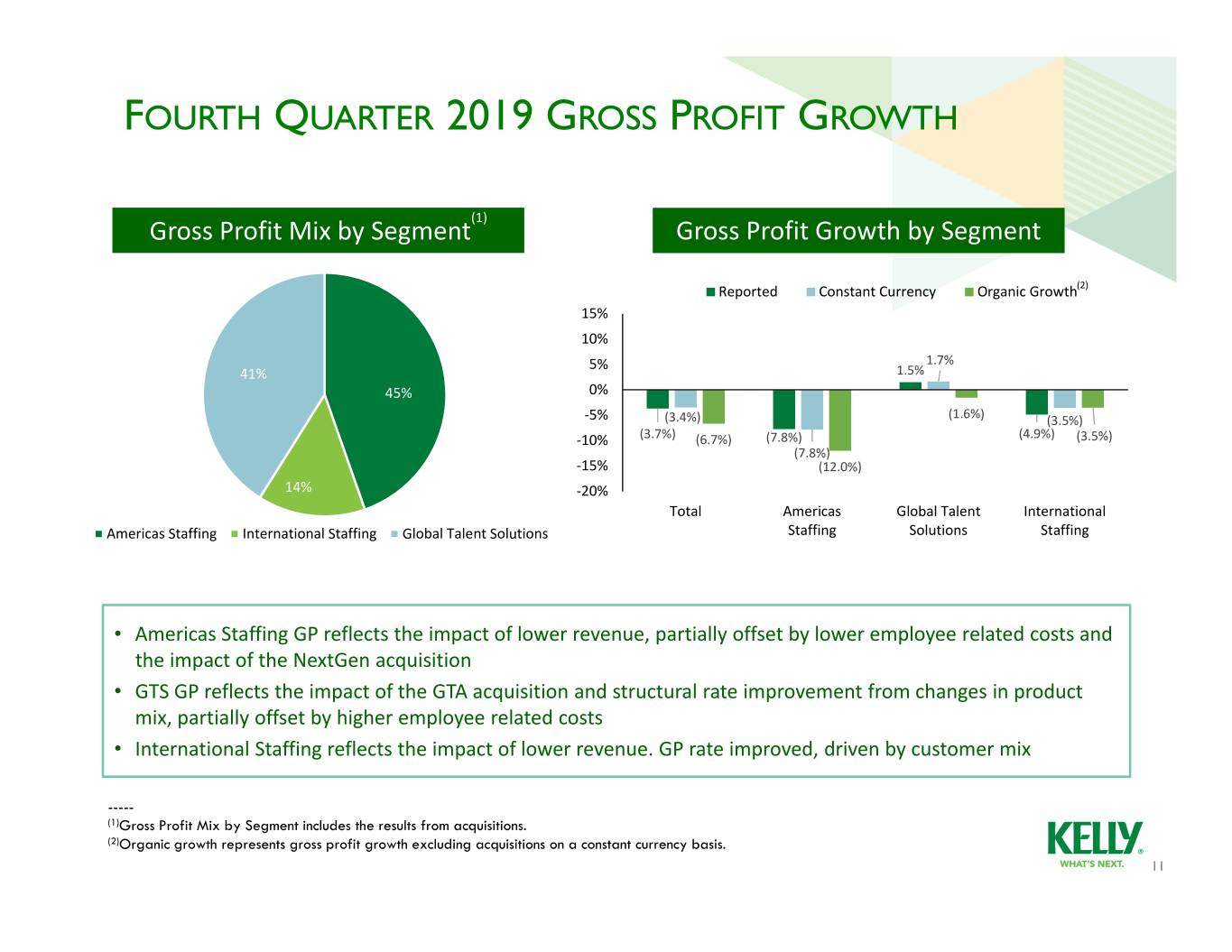

FOURTH QUARTER 2019 GROSS PROFIT GROWTH (1) Gross Profit Mix by Segment Gross Profit Growth by Segment Reported Constant Currency Organic Growth(2) 15% 10% 5% 1.7% 41% 1.5% 45% 0% ‐5% (3.4%) (1.6%) (3.5%) ‐10% (3.7%) (6.7%) (7.8%) (4.9%) (3.5%) (7.8%) ‐15% (12.0%) 14% ‐20% Total Americas Global Talent International Americas Staffing International Staffing Global Talent Solutions Staffing Solutions Staffing • Americas Staffing GP reflects the impact of lower revenue, partially offset by lower employee related costs and the impact of the NextGen acquisition • GTS GP reflects the impact of the GTA acquisition and structural rate improvement from changes in product mix, partially offset by higher employee related costs • International Staffing reflects the impact of lower revenue. GP rate improved, driven by customer mix ----- (1)Gross Profit Mix by Segment includes the results from acquisitions. (2)Organic growth represents gross profit growth excluding acquisitions on a constant currency basis. 11

FOURTH QUARTER 2019 GROSS PROFIT RATE GROWTH 20.0% 19.5% 19.0% 10 bps 18.5% 10 bps 18.3% 20 bps 18.0% (10) bps 18.0% 17.5% 17.0% 16.5% 16.0% 15.5% 15.0% Q4 2018 GP Rate Acquisitions Americas International Perm Fees Q4 2019 GP Rate Staffing Staffing • Overall GP rate improved due to the acquisitions of NextGen and GTA, which are higher margin specialty businesses • Organically, GP rate improved 10 bps as the impact of improved customer and product mix was partially offset by lower perm fees 12

FOURTH QUARTER 2019 SG&A $ in millions $250 $240 $230 $6 $221 $220 ($6) $216 ($2) ($1) ($1) ($1) $210 $200 $190 Q4 2018 SG&A Acquisitions Americas International Global Talent Corporate FX Q4 2019 SG&A Staffing Staffing Solutions • Acquisitions reflect the SG&A expenses of NextGen and GTA, acquired in January 2019 • Americas Staffing expenses were down due to lower performance‐based compensation and lower salary expense as a result of the Q1 2019 restructuring actions in U.S. Operations • International Staffing, GTS and Corporate expenses reflect continued cost management 13

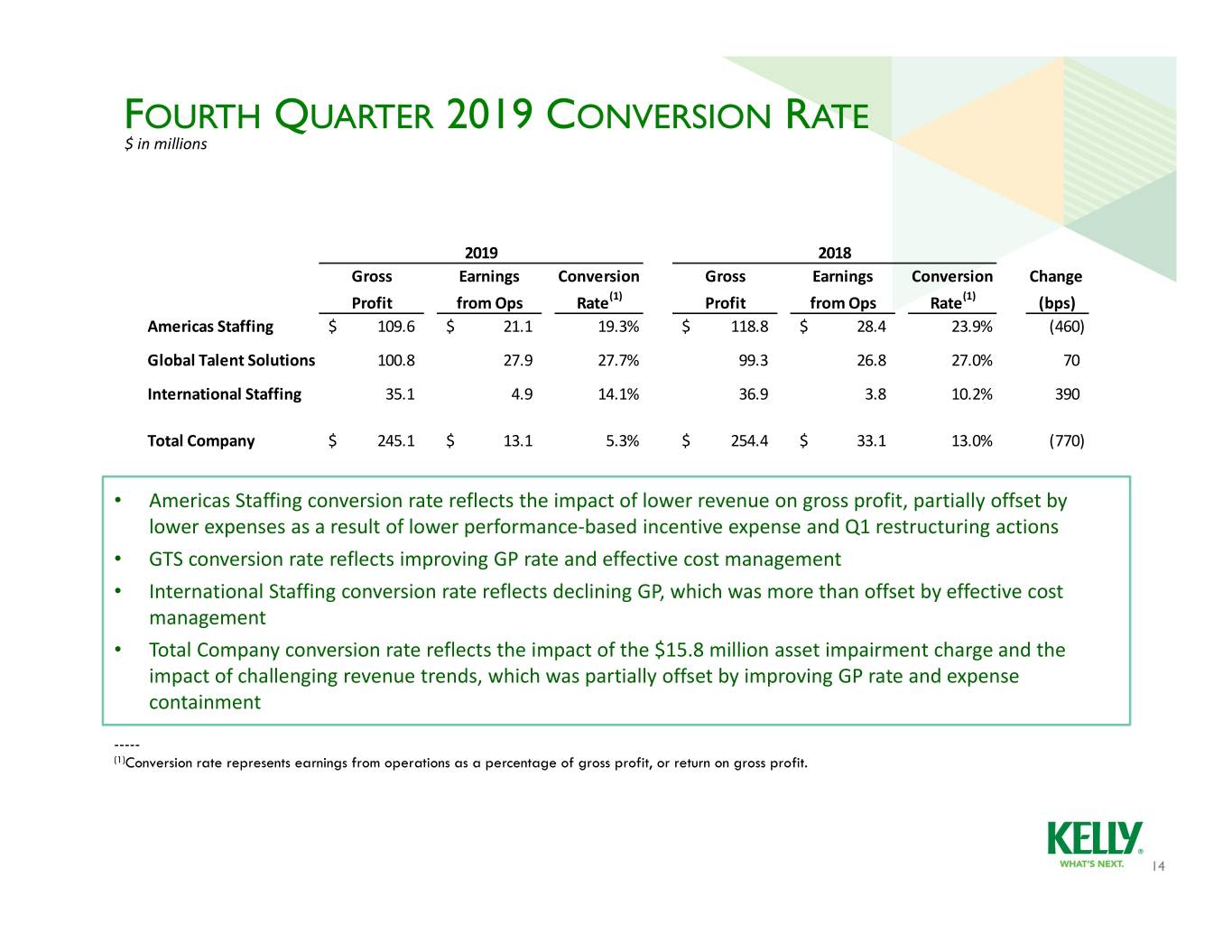

FOURTH QUARTER 2019 CONVERSION RATE $ in millions 2019 2018 Gross Earnings Conversion Gross Earnings Conversion Change Profit from Ops Rate(1) Profit from Ops Rate(1) (bps) Americas Staffing $ 109.6 $ 21.1 19.3%$ 118.8 $ 28.4 23.9% (460) Global Talent Solutions 100.8 27.9 27.7% 99.3 26.8 27.0% 70 International Staffing 35.1 4.9 14.1% 36.9 3.8 10.2% 390 Total Company $ 245.1 $ 13.1 5.3%$ 254.4 $ 33.1 13.0% (770) • Americas Staffing conversion rate reflects the impact of lower revenue on gross profit, partially offset by lower expenses as a result of lower performance‐based incentive expense and Q1 restructuring actions • GTS conversion rate reflects improving GP rate and effective cost management • International Staffing conversion rate reflects declining GP, which was more than offset by effective cost management • Total Company conversion rate reflects the impact of the $15.8 million asset impairment charge and the impact of challenging revenue trends, which was partially offset by improving GP rate and expense containment ----- (1)Conversion rate represents earnings from operations as a percentage of gross profit, or return on gross profit. 14

FOURTH QUARTER 2019 CONVERSION RATE (Excluding Acquisitions, Asset Impairment Charge, and Restructuring) $ in millions 2019 2018 Gross Earnings Conversion Gross Earnings Conversion Change Profit(1) from Ops(1)(2) Rate(3) Profit from Ops Rate(3) (bps) Americas Staffing $ 104.6 $ 20.0 19.1% $ 118.8 $ 28.4 23.9% (480) Global Talent Solutions 97.5 26.5 27.3% 99.3 26.8 27.0% 30 International Staffing 35.1 4.9 14.1% 36.9 3.8 10.2% 390 Total Company $ 236.8 $ 26.4 11.2% $ 254.4 $ 33.1 13.0% (180) • Americas Staffing conversion rate reflects the impact of lower revenue on gross profit, partially offset by lower expenses as a result of lower performance‐based incentive expense and Q1 restructuring actions • GTS conversion rate reflects effective cost management • International Staffing conversion rate reflects declining GP, which was more than offset by effective cost management • Total Company conversion rate improvement reflects the impact of challenging revenue trends, which was partially offset by expense containment ----- (1)Excludes 2019 results related to the NextGen and GTA acquisitions in Americas Staffing and GTS, respectively. (2)Excludes $0.1 million of restructuring accrual credit adjustment, $0.0 million net of tax or $0.00 per share in Q4 2019 in Americas Staffing and a $15.8 million asset impairment charge, $11.8 million net of tax or $0.30 per share in Q4 2019 in Corporate. (3)Conversion rate represents earnings from operations as a percentage of gross profit, or return on gross profit. 15

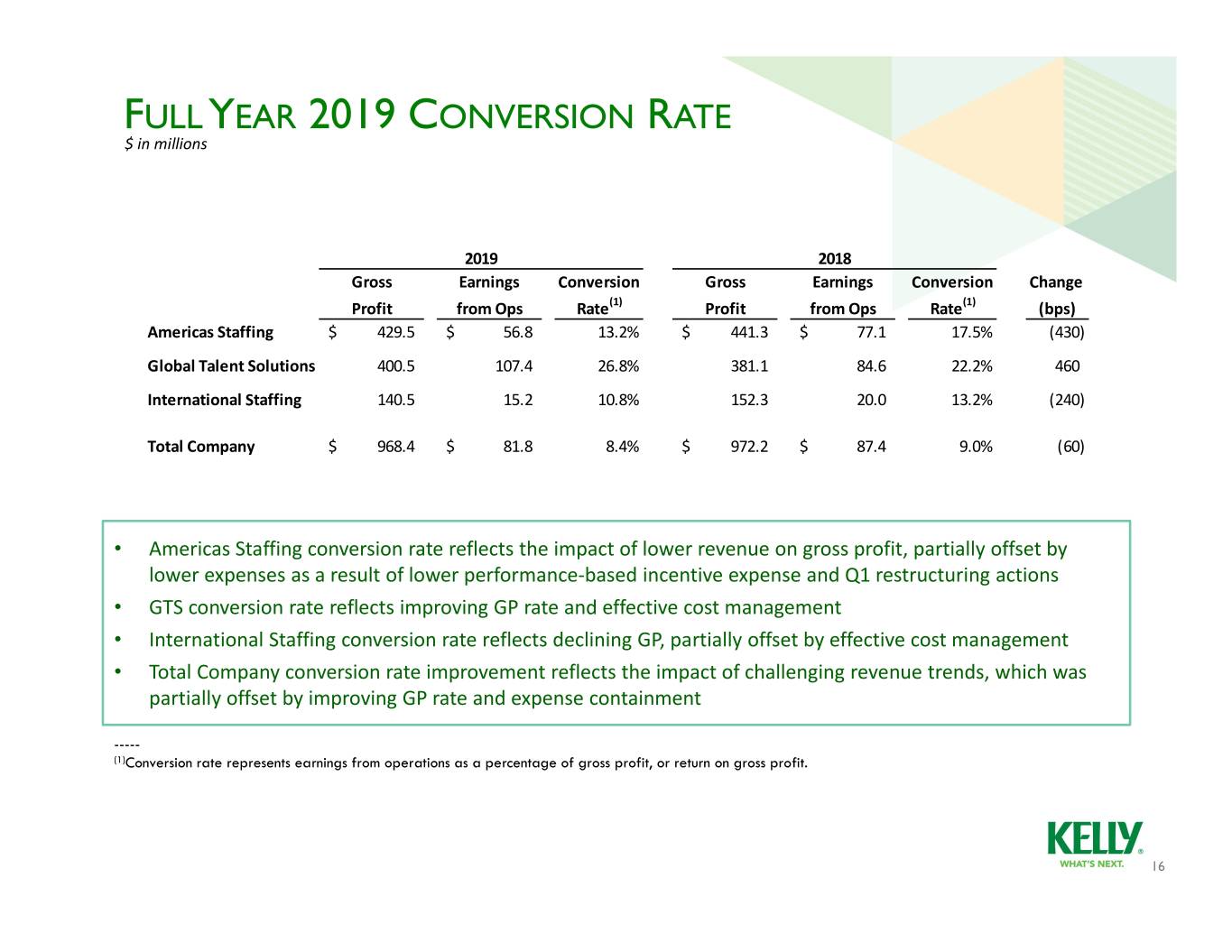

FULL YEAR 2019 CONVERSION RATE $ in millions 2019 2018 Gross Earnings Conversion Gross Earnings Conversion Change Profit from Ops Rate(1) Profit from Ops Rate(1) (bps) Americas Staffing $ 429.5 $ 56.8 13.2%$ 441.3 $ 77.1 17.5% (430) Global Talent Solutions 400.5 107.4 26.8% 381.1 84.6 22.2% 460 International Staffing 140.5 15.2 10.8% 152.3 20.0 13.2% (240) Total Company $ 968.4 $ 81.8 8.4%$ 972.2 $ 87.4 9.0% (60) • Americas Staffing conversion rate reflects the impact of lower revenue on gross profit, partially offset by lower expenses as a result of lower performance‐based incentive expense and Q1 restructuring actions • GTS conversion rate reflects improving GP rate and effective cost management • International Staffing conversion rate reflects declining GP, partially offset by effective cost management • Total Company conversion rate improvement reflects the impact of challenging revenue trends, which was partially offset by improving GP rate and expense containment ----- (1)Conversion rate represents earnings from operations as a percentage of gross profit, or return on gross profit. 16

FULL YEAR 2019 CONVERSION RATE (Excluding Acquisitions, Asset Impairment Charge, Restructuring, and Gain on Sale of Assets) $ in millions 2019 2018 Gross Earnings Conversion Gross Earnings Conversion Change Profit from Ops(1)(2) Rate(3) Profit from Ops Rate(3) (bps) Americas Staffing $ 404.7 $ 56.4 13.9% $ 441.3 $ 77.1 17.5% (360) Global Talent Solutions 386.9 101.4 26.2% 381.1 84.6 22.2% 400 International Staffing 140.5 15.2 10.8% 152.3 20.0 13.2% (240) Total Company $ 930.0 $ 78.9 8.5% $ 972.2 $ 87.4 9.0% (50) • Americas Staffing conversion rate reflects the impact of lower revenue on gross profit, partially offset by lower expenses as a result of lower performance‐based incentive expense • GTS conversion rate reflects improving GP rate and effective cost management • International Staffing conversion rate reflects declining GP, partially offset by effective cost management • Total Company conversion rate improvement reflects the impact of challenging revenue trends, which was partially offset by expense containment ----- (1)Excludes 2019 results related to the NextGen and GTA acquisitions in Americas Staffing and GTS, respectively. (2)Excludes $5.5 million of restructuring charges, $4.1 million net of tax or $0.10 per share in 2019 in Americas Staffing, a $15.8 million asset impairment charge, $11.8 million net of tax or $0.30 per share in 2019 in Corporate and gain on sale of assets of $12.3 million, $9.0 million net of tax or $0.23 per share in Corporate. (3)Conversion rate represents earnings from operations as a percentage of gross profit, or return on gross profit. 17

FOURTH QUARTER 2019 BALANCE SHEET DATA $ in millions Accounts Receivable Debt Excluding Acquisitions Acquisitions $1,500 $80 $74 $1,293 $1,283 $1,274 $1,282 $1,300 $1,262 $60 $1,100 $40 $900 $19 $18 $20 $700 $2 $2 $500 $0 2018 2019 Q1 2019 Q2 2019 Q3 2019 2018 2019 Q1 2019 Q2 2019 Q3 2019 • Accounts Receivable reflects the impact of recent acquisitions. Including acquisitions, DSO is 58 days, up 3 days from a year ago due to increasing pressure from global customers and timing of customer payments at year‐end • Debt from borrowings used to fund the January 2019 NextGen and GTA acquisitions has been repaid 18

OUTLOOK –FULL YEAR 2020 Reported Revenue up 3% to 4% YOY • No significant impact due to currency • Improving progressively throughout the year, but Q1 expected to decline YOY • Includes 100 bps of inorganic growth from recent acquisition Gross profit rate up slightly SG&A up 2% to 3% YOY Full Year Effective Tax Rate in the low to mid‐teens • Excluding the impact of Persol Holdings stock gains and losses • Includes benefit of Work Opportunity Tax Credit renewed for 2020 19

KELLY STRATEGIC M&A ACTIONS: 2017 - PRESENT April 2018 Kelly sells Kelly Aug. 2018 Jan. 2019 Jan. 2020 Healthcare Resources Kelly invests in Kelly acquires NextGen Kelly acquires to InGenesis BTG Global Resources, LLC Insight Workforce (NextGen) Solutions, LLC 2017 2018 2019 2020 Sept. 2017 July 2018 Dec. 2018 Jan. 2019 Kelly acquires Kelly Innovation Kelly sells Kelly Kelly acquires Teachers On Fund invests in Legal Managed Global Technology Call Kenzie Academy Services to Associates, LLC Trustpoint.One (GTA) 20

RECENT ACQUISITIONS: NEXTGEN, GTA & INSIGHT 2019 Leading provider of telecommunications, wireless, and connected technology staffing solutions to Fortune 500 companies Works side‐by‐side with clients, across the U.S. and in select global markets, to meet the staffing challenges of the ever‐changing tech landscape Leading provider of engineering, technology, and business consulting solutions and services in the telecommunications industry Provides telecommunication network design, implementation, testing optimization, and software development services Couples high‐value engineering, technology, and business consulting services with proprietary software products and solutions 2020 Education service staffing company with experience in partnering with school districts in Illinois, Massachusetts, New Jersey and Pennsylvania 21

NON-GAAP MEASURES Management believes that the non‐GAAP (Generally Accepted Accounting Principles) information excluding the 2019 and 2018 gains and losses on the investment in Persol Holdings, the 2019 restructuring charges, the 2019 acquisitions, the 2019 gain on sale of assets and the 2019 asset impairment charge are useful to understand the Company's fiscal 2019 financial performance and increases comparability. Specifically, Management believes that removing the impact of these items allows for a meaningful comparison of current period operating performance with the operating results of prior periods. Additionally, the Company does not acquire businesses on a predictable cycle and the terms of each acquisition are unique and may vary significantly. Management also believes that such measures are used by those analyzing performance of companies in the staffing industry to compare current performance to prior periods and to assess future performance. These non‐GAAP measures may have limitations as analytical tools because they exclude items which can have a material impact on cash flow and earnings per share. As a result, Management considers these measures, along with reported results, when it reviews and evaluates the Company's financial performance. Management believes that these measures provide greater transparency to investors and provide insight into how Management is evaluating the Company's financial performance. Non‐GAAP measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation to the most comparable GAAP measures is included with our earnings release dated February 13, 2020 and is available on our Investor Relations website. 22

SAFE HARBOR STATEMENT This release contains statements that are forward looking in nature and, accordingly, are subject to risks and uncertainties. These factors include, but are not limited to, competitive market pressures including pricing and technology introductions and disruptions, changing market and economic conditions, our ability to achieve our business strategy, the risk of damage to our brand, the risk our intellectual property assets could be infringed upon or compromised, our ability to successfully develop new service offerings, our exposure to risks associated with services outside traditional staffing, including business process outsourcing and services connecting talent to independent work, our increasing dependency on third parties for the execution of critical functions, the risks associated with past and future acquisitions, exposure to risks associated with investments in equity affiliates including PersolKelly Asia Pacific, material changes in demand from or loss of large corporate customers as well as changes in their buying practices, risks particular to doing business with the government or government contractors, risks associated with conducting business in foreign countries, including foreign currency fluctuations, the exposure to potential market and currency exchange risks relating to our investment in Persol Holdings, risks associated with violations of anti‐corruption, trade protection and other laws and regulations, availability of qualified full‐time employees, availability of temporary workers with appropriate skills required by customers, liabilities for employment‐related claims and losses, including class action lawsuits and collective actions, risks arising from failure to preserve the privacy of information entrusted to us or to meet our obligations under global privacy laws, the risk of cyberattacks or other breaches of network or information technology security, our ability to sustain critical business applications through our key data centers, our ability to effectively implement and manage our information technology projects, our ability to maintain adequate financial and management processes and controls, risk of potential impairment charges triggered by adverse industry developments or operational circumstances, unexpected changes in claim trends on workers’ compensation, unemployment, disability and medical benefit plans, the impact of changes in laws and regulations (including federal, state and international tax laws), competition law risks, the risk of additional tax or unclaimed property liabilities in excess of our estimates, our ability to realize value from our tax credit and net operating loss carryforwards, our ability to maintain specified financial covenants in our bank facilities to continue to access credit markets, and other risks, uncertainties and factors discussed in the Company’s filings with the Securities and Exchange Commission. Actual results may differ materially from any forward‐looking statements contained herein, and we have no intention to update these statements. 23