Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HEALTHCARE TRUST OF AMERICA, INC. | q42019earningsrelease.htm |

| 8-K - 8-K - HEALTHCARE TRUST OF AMERICA, INC. | q42019earnings8k.htm |

EXHIBIT 99.2

Table of Contents Company Overview Company Information 3 Quarter and Year Ended 2019 Highlights 6 Financial Highlights 8 Company Snapshot 9 Financial Statements Consolidated Balance Sheets 10 Consolidated Statements of Operations 11 Consolidated Statements of Cash Flows 12 Financial Information FFO, Normalized FFO, Normalized FAD and Adjusted EBITDAre 13 Debt Composition and Maturity Schedule 14 Capitalization and Covenants 15 Portfolio Information Same-Property Performance and NOI 16 Investment Activity 17 Development/Redevelopment Summary and Property Capital Expenditures 18 Key Markets/Top 75 MSA Concentration and Regional Portfolio Distribution 19 Portfolio Diversification by Type, Historical Campus Proximity and Tenant Specialty 20 New and Renewal Leasing Activity, Historical Leased Rate and Tenant Lease Expirations 21 Top MOB Tenants and Ownership Interests 22 Reporting Definitions 23 Forward-Looking Statements: Certain statements contained in this report constitute forward-looking statements within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act). Such statements include, in particular, statements about our plans, strategies, prospects and estimates regarding future medical office building market performance. Additionally, such statements are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially and in adverse ways from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Forward-looking statements are generally identifiable by the use of such terms as “expect,” “project,” “may,” “should,” “could,” “would,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “opinion,” “predict,” “potential,” “pro forma” or the negative of such terms and other comparable terminology. Readers are cautioned not to place undue reliance on these forward-looking statements. We cannot guarantee the accuracy of any such forward-looking statements contained in this report, and we do not intend to publicly update or revise any forward- looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Any such forward-looking statements reflect our current views about future events, are subject to unknown risks, uncertainties, and other factors, and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, provide dividends to stockholders, and maintain the value of our real estate properties, may be significantly hindered. Forward-looking statements express expectations of future events. All forward-looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties that could cause actual events or results to differ materially from those projected. Due to these inherent uncertainties, our stockholders are urged not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date made. In addition, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to projections over time, except as required by law. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning us and our business, including additional factors that could materially affect our financial results, is included herein and in our filings with the SEC. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 2

Company Information Healthcare Trust of America, Inc. (NYSE: HTA) is the largest dedicated owner and operator of medical office buildings (“MOBs”) in the United States, comprising approximately 24.8 million square feet of gross leasable area (“GLA”), with $7.3 billion invested primarily in MOBs. HTA provides real estate infrastructure for the integrated delivery of healthcare services in highly-desirable locations. Investments are targeted to build critical mass in 20 to 25 leading gateway markets that generally have leading university and medical institutions, which translates to superior demographics, high-quality graduates, intellectual talent and job growth. The strategic markets HTA invests in support a strong, long-term demand for quality medical office space. HTA utilizes an integrated asset management platform consisting of on-site leasing, property management, engineering and building services, and development capabilities to create complete, state of the art facilities in each market. This drives efficiencies, strong tenant and health system relationships, and strategic partnerships that result in high levels of tenant retention, rental growth and long-term value creation. Headquartered in Scottsdale, Arizona, HTA has developed a national brand with dedicated relationships at the local level. Founded in 2006 and listed on the New York Stock Exchange in 2012, HTA has produced attractive returns for its stockholders that have outperformed the S&P 500 and US REIT index. More information about HTA can be found on the Company’s Website (www.htareit.com), Facebook, LinkedIn, Instagram and Twitter. Senior Management Scott D. Peters I Chairman, Chief Executive Officer and President Robert A. Milligan I Chief Financial Officer, Secretary and Treasurer Amanda L. Houghton I Executive Vice President - Asset Management David A. Gershenson I Chief Accounting Officer Caroline E. Chiodo I Senior Vice President - Acquisitions and Development David W. Chung I Senior Vice President - Development Brock J. Cusano I Vice President - Operations Contact Information Corporate Headquarters Healthcare Trust of America, Inc. I NYSE: HTA 16435 North Scottsdale Road, Suite 320 Scottsdale, Arizona 85254 480.998.3478 www.htareit.com Follow Us: Investor Relations Robert A. Milligan I Chief Financial Officer, Secretary and Treasurer 16435 North Scottsdale Road, Suite 320 Scottsdale, Arizona 85254 480.998.3478 info@htareit.com Transfer Agent Computershare P.O. Box 505000 Louisville, KY 40233 888.801.0107 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 3

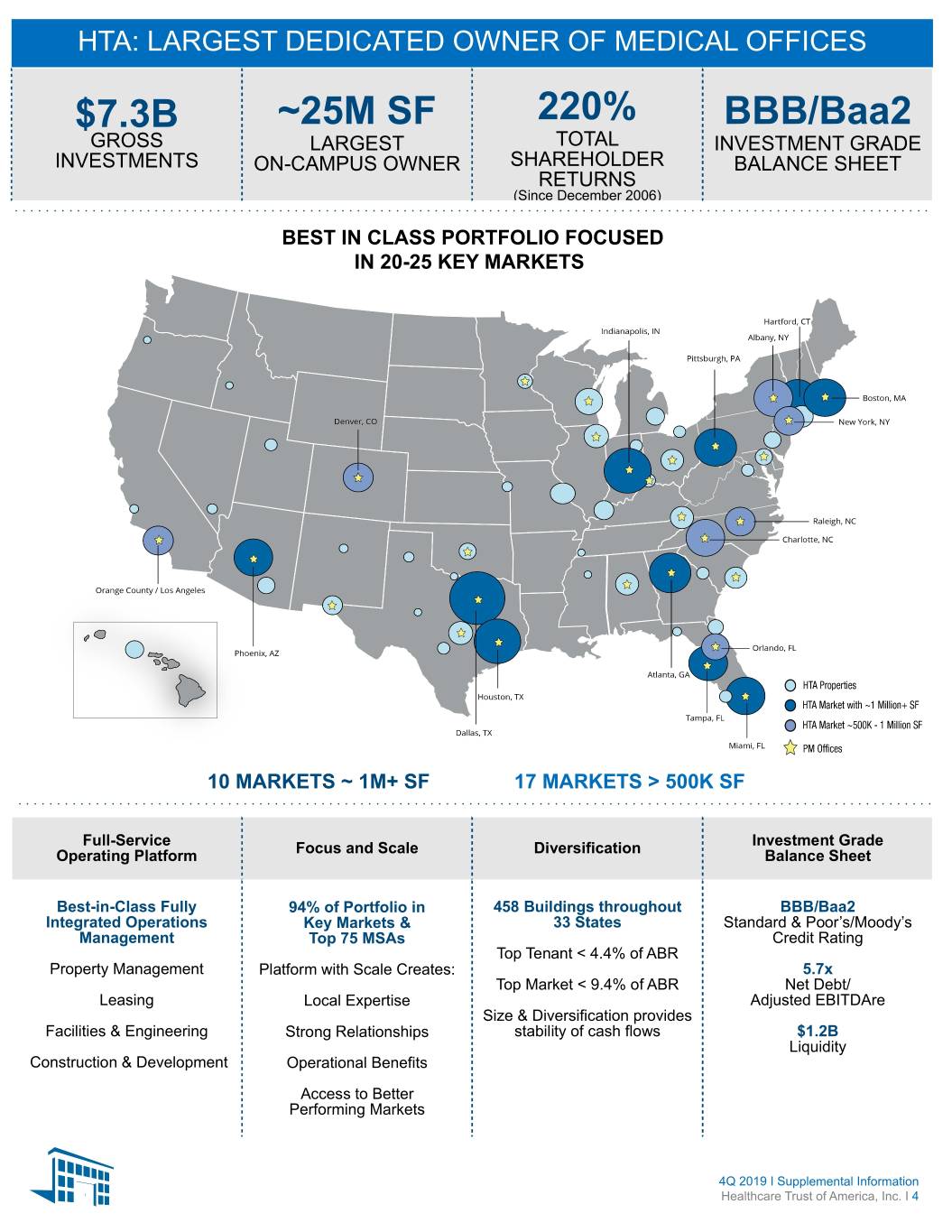

HTA: LARGEST DEDICATED OWNER OF MEDICAL OFFICES $7.3B ~25M SF 220% BBB/Baa2 GROSS LARGEST TOTAL INVESTMENT GRADE INVESTMENTS ON-CAMPUS OWNER SHAREHOLDER BALANCE SHEET RETURNS (Since December 2006) BEST IN CLASS PORTFOLIO FOCUSED IN 20-25 KEY MARKETS 10 MARKETS ~ 1M+ SF 17 MARKETS > 500K SF Full-Service Investment Grade Operating Platform Focus and Scale Diversification Balance Sheet Best-in-Class Fully 94% of Portfolio in 458 Buildings throughout BBB/Baa2 Integrated Operations Key Markets & 33 States Standard & Poor’s/Moody’s Management Top 75 MSAs Credit Rating Top Tenant < 4.4% of ABR Property Management Platform with Scale Creates: 5.7x Top Market < 9.4% of ABR Net Debt/ Leasing Local Expertise Adjusted EBITDAre Size & Diversification provides Facilities & Engineering Strong Relationships stability of cash flows $1.2B Liquidity Construction & Development Operational Benefits Access to Better Performing Markets 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 4

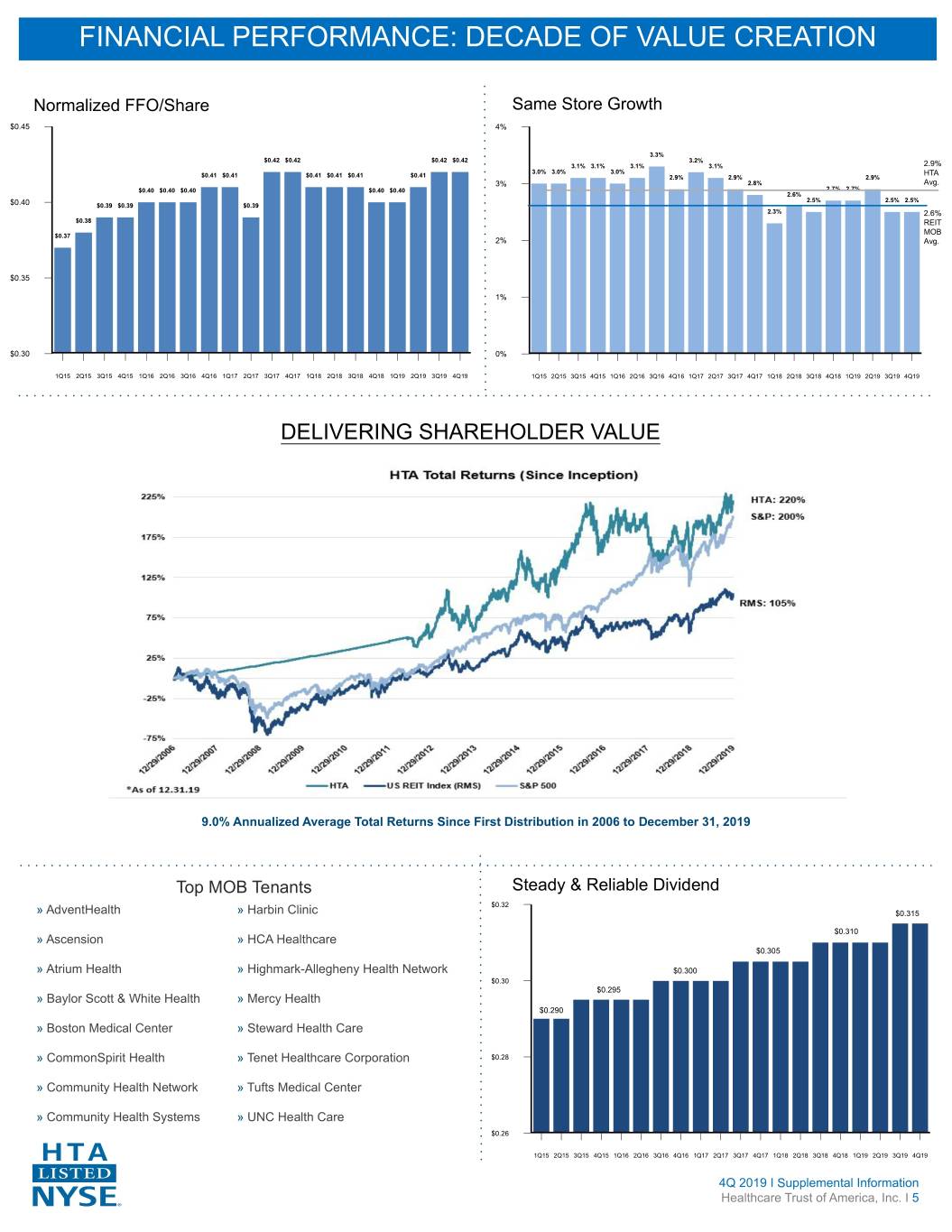

FINANCIAL PERFORMANCE: DECADE OF VALUE CREATION Normalized FFO/Share Same Store Growth $0.45 4% 3.3% $0.42 $0.42 $0.42 $0.42 3.2% 3.1% 3.1% 3.1% 3.1% 2.9% 3.0% 3.0% 3.0% HTA $0.41 $0.41 $0.41 $0.41 $0.41 $0.41 2.9% 2.9% 2.9% 3% 2.8% Avg. $0.40 $0.40 $0.40 $0.40 $0.40 2.7% 2.7% 2.6% 2.5% 2.5% 2.5% $0.40 $0.39 $0.39 $0.39 2.3% 2.6% $0.38 REIT MOB $0.37 2% Avg. $0.35 1% $0.30 0% 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 DELIVERING SHAREHOLDER VALUE 9.0% Annualized Average Total Returns Since First Distribution in 2006 to December 31, 2019 Top MOB Tenants Steady & Reliable Dividend $0.32 » AdventHealth » Harbin Clinic $0.315 $0.310 » Ascension » HCA Healthcare $0.305 » Atrium Health » Highmark-Allegheny Health Network $0.300 $0.30 $0.295 » Baylor Scott & White Health » Mercy Health $0.290 » Boston Medical Center » Steward Health Care » CommonSpirit Health » Tenet Healthcare Corporation $0.28 » Community Health Network » Tufts Medical Center » Community Health Systems » UNC Health Care $0.26 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 5

Company Overview Highlights Fourth Quarter 2019: • Net income Attributable to Common Stockholders was $8.9 million, or $0.04 per diluted share, a decrease of $(0.03) per diluted share, compared to 2018. • Funds From Operations (“FFO”), as defined by the National Association of Real Estate Investment Trusts (“NAREIT”), was $87.3 million, or $0.41 per diluted share, for Q4 2019. Due to the adoption of Topic 842, certain initial direct costs are now reported in general and administrative expenses. For Q4 2018, HTA capitalized approximately $1.2 million of initial direct costs. • Normalized FFO was $88.9 million, or $0.42 per diluted share, for Q4 2019, an increase of $0.02 or 5.0%, per diluted share, compared to 2018. • Normalized Funds Available for Distribution (“FAD”) was $72.3 million for Q4 2019. • Same-Property Cash Net Operating Income (“NOI”) increased $2.8 million, or 2.5%, to $114.9 million, compared to Q4 2018. This included same-property rental revenue growth of 1.4%. • Leasing: HTA’s portfolio had a leased rate of 90.8% by gross leasable area (“GLA”) and an occupancy rate of 89.9% by GLA for Q4 2019. During Q4 2019, HTA executed approximately 1.0 million square feet of GLA of new and renewal leases. Re- leasing spreads increased to 3.4% and tenant retention for the Same-Property portfolio was 76% by GLA for Q4 2019. Year Ended 2019: • Net Income Attributable to Common Stockholders was $30.2 million, or $0.14 per diluted share, a decrease of $(0.88) per diluted share, compared to 2018. • FFO, as defined by NAREIT, was $319.7 million, or $1.53 per diluted share, for 2019 and includes a $21.6 million, or $(0.10) per diluted share, loss related to the extinguishment of debt. For 2018, HTA capitalized approximately $4.9 million of initial direct costs. • Normalized FFO was $344.3 million, or $1.64 per diluted share, for 2019, an increase of $0.02 or 1.2%, per diluted share, compared to 2018. • Normalized FAD was $289.4 million for 2019. • Same-Property Cash NOI increased $12.1 million, or 2.7%, to $450.9 million, compared to 2018. This included same- property rental revenue growth of 2.3%. • Leasing: During the year ended December 31, 2019, HTA executed approximately 3.6 million square feet of GLA of new and renewal leases, or over 14.6% of the total GLA of its portfolio. Re-leasing spreads increased to 3.5% and tenant retention for the Same-Property portfolio was 83% by GLA year-to-date. Balance Sheet and Capital Markets • Balance Sheet: HTA ended Q4 2019 with total liquidity of $1.2 billion, inclusive of $900.0 million available on our unsecured revolving credit facility, $306.2 million of unsettled equity sold under forward agreements, and $32.7 million of cash and cash equivalents. HTA also had total leverage of (i) 28.9%, measured as debt less cash and cash equivalents to total capitalization, and (ii) debt less cash and cash equivalents to Adjusted Earnings before Interest, Taxes, Depreciation and Amortization for real estate (“Adjusted EBITDAre”) of 5.7x. Including the impact of the remaining forward equity to be settled, leverage would be 25% and 5.0x, respectively, using the definitions from above. • Equity: During 2019, HTA issued a total of $637.6 million in equity, comprised of approximately 21.6 million shares of common stock under its at-the-market (“ATM”) offering program on a forward basis at an average price of $29.59, of which, $584.9 million comprised of 19.7 million shares were issued in Q4 2019 at an average price of $29.68. During 2019, HTA received net proceeds of $323.4 million on 11.1 million shares that settled, of which net proceeds of $271.6 million for 9.3 million shares were attributable to Q4 2019 settlements. Accordingly, we have approximately 10.5 million shares expected to settle in 2020 for net proceeds of $306.2 million, subject to adjustment for costs to borrow under the terms of the applicable equity distribution agreements. • Debt: In 2019, Healthcare Trust of America Holdings, LP (“HTALP”) and HTA completed two transactions: ◦ issued $900.0 million in senior, unsecured notes with a weighted average interest rate of 3.04% per annum and a weighted maturity of 9.5 years and used the net proceeds from the issuance to redeem $700.0 million worth of senior notes and to pay down the unsecured revolving credit facility. As part of these repayments, HTA incurred debt extinguishment costs of approximately $21.6 million; and ◦ hedged $500 million of HTALP and HTA's term loans at 2.44% which effectively fixed the interests rates of the entire portfolio of the Company, except for the revolving credit facility. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 6

Company Overview Noteworthy 2019 Activities • Investments: In the quarter, HTA closed on $330 million of investments totaling approximately 1.1 million square feet of GLA. For the year, HTA has now closed $558 million of investments totaling approximately 1.6 million square feet of GLA, with expected year-one contractual yields of approximately 6.1%, after operating synergies. These properties were approximately 93% occupied as of closing, and are located within HTA's key markets. Over 55% of these properties are located on or adjacent to hospital campuses, and, all were acquired on a fee-simple basis. • Development/Redevelopment: As of December 31, 2019, HTA had the following development and redevelopment projects in place: ◦ Developments: During 2019, HTA announced agreements to develop two new on-campus MOBs located in the key markets of Dallas, Texas and Bakersfield, California with anticipated costs of approximately $90 million totaling approximately 191,000 square feet of GLA. The new development projects have anticipated yields of over 6.5%. In total, HTA now has development projects of approximately $112 million totaling approximately 242,000 square feet of GLA and are expected to be more than 72% pre-leased upon completion. ◦ Redevelopments: During 2019, HTA announced plans to redevelop two MOBs located in Los Angeles, California with estimated costs of approximately $20 million totaling approximately 105,000 square feet of GLA. In total, HTA’s redevelopment projects have anticipated costs of approximately $64 million, covering approximately 230,000 square feet of GLA. • Dividends: On February 13, 2020, HTA’s Board of Directors announced a quarterly cash dividend of $0.315 per share of common stock and per OP Unit. The quarterly dividend is to be paid on April 9, 2020 to stockholders of record of its common stock and holders of its OP Units on April 2, 2020. Impact of Topic 842 Leases The Financial Accounting Standards Board issued Topic 842, which was effective for HTA as of January 1, 2019. Topic 842 modifies the treatment of initial direct costs, which historically under Topic 840 were capitalized in accordance with certain criteria provided for in the applicable guidance. Topic 842 also eliminates the accounting recognition of expenses paid directly by tenants and moves certain bad debt costs from expense to revenue. During the quarter and year ended 2018, HTA capitalized $1.2 million and $4.9 million, respectively, of initial direct costs, certain of which, would now be expensed under Topic 842. In addition, for the quarter and year ended 2018, HTA recognized $3.4 million and $13.9 million, respectively, of tenant paid property taxes in both revenues and expenses and a nominal amount of bad debt costs recognized as expenses. 2020 Guidance HTA expects 2020 guidance to range as follows: Annual Expectations Low to High Net income attributable to common stockholders per share $0.32 $0.36 Same-Property Cash NOI 2.0% 3.0% FFO per share, as defined by NAREIT $1.68 $1.71 Normalized FFO per share $1.69 $1.73 The 2020 outlook guidance includes the following additional assumptions: (i) $500 - $600 million of investments at a 5.5% to 6.25% yield; (ii) $50 million of dispositions at a 6.0% average yield; and (iii) general and administrative costs of $44 - $46 million, and (iv) approximately 226 million diluted, common shares outstanding. HTA expects leverage, measured as (i) debt less cash and cash equivalents to total capitalization, and (ii) measured as debt less cash and cash equivalents to Adjusted EBITDAre to remain stable year-over-year. HTA's 2020 guidance is based on a number of various assumptions that are subject to change and many of which are outside the control of the Company. Additionally, HTA's guidance does not contemplate impacts from gains or losses from dispositions, potential impairments, or debt extinguishment costs, if any. If actual results vary from these assumptions, HTA's expectations may change. There can be no assurance that HTA will achieve these results. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 7

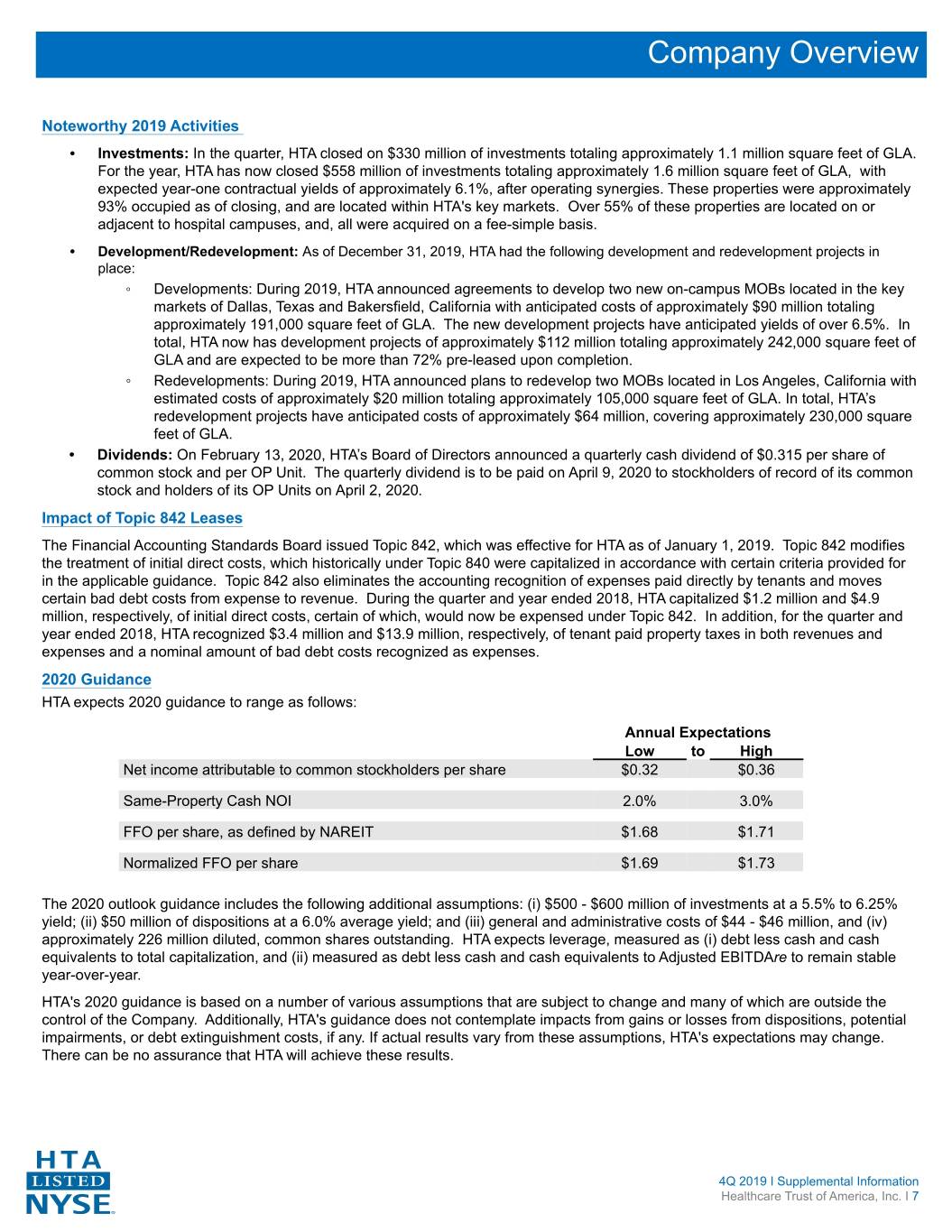

Company Overview Financial Highlights (unaudited and dollars in thousands, except per share data) Three Months Ended 4Q19 3Q19 2Q19 1Q19 4Q18 INCOME ITEMS Revenues $ 176,313 $ 175,004 $ 171,757 $ 168,966 $ 172,298 NOl (1)(2) 123,047 121,197 118,819 117,498 117,045 Adjusted EBITDAre, annualized (1)(3) 480,024 463,164 450,216 444,692 444,036 FFO (1)(3) 87,261 65,047 84,555 82,875 85,194 Normalized FFO (1)(3) 88,871 87,101 85,152 83,148 84,182 Normalized FAD (1)(3) 72,261 70,879 73,118 73,153 68,291 Net income attributable to common stockholders per diluted share $ 0.04 $ (0.04) $ 0.08 $ 0.06 $ 0.07 FFO per diluted share 0.41 0.31 0.40 0.40 0.41 Normalized FFO per diluted share 0.42 0.42 0.41 0.40 0.40 Same-Property Cash NOI growth (4) 2.5% 2.5% 2.9% 2.7% 2.7% Fixed charge coverage ratio (5) 4.52x 4.46x 4.45x 4.37x 4.28x As of 4Q19 3Q19 2Q19 1Q19 4Q18 ASSETS Gross real estate investments $ 7,493,616 $ 7,143,223 $ 6,985,828 $ 6,894,539 $ 6,873,790 Total assets 6,638,749 6,322,998 6,240,475 6,242,554 6,188,476 CAPITALIZATION Net debt (6) $ 2,717,062 $ 2,652,943 $ 2,543,814 $ 2,480,546 $ 2,415,011 Total capitalization (7) 9,387,352 8,853,151 8,279,235 8,456,142 7,709,762 Net debt/total capitalization (6) 28.9% 30.0% 30.7% 29.3% 31.3% (1) Refer to pages 23 and 24 for the reporting definitions of NOI, Adjusted EBITDAre, FFO, Normalized FFO and Normalized FAD. (2) Refer to page 16 for a reconciliation of GAAP Net Income to NOI. (3) Refer to page 13 for the reconciliations of GAAP Net Income Attributable to Common Stockholders to FFO, Normalized FFO, Normalized FAD and Adjusted EBITDAre. (4) Calculated as the increase in Same-Property Cash NOI for the quarter as compared to the same period in the previous year. (5) Calculated as Adjusted EBITDAre divided by interest expense and scheduled principal payments. (6) Refer to page 15 for components of net debt. (7) Calculated as the common stock price on the last trading day of the period multiplied by the total diluted common shares outstanding at the end of the period, plus net debt. Refer to page 15 for details. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 8

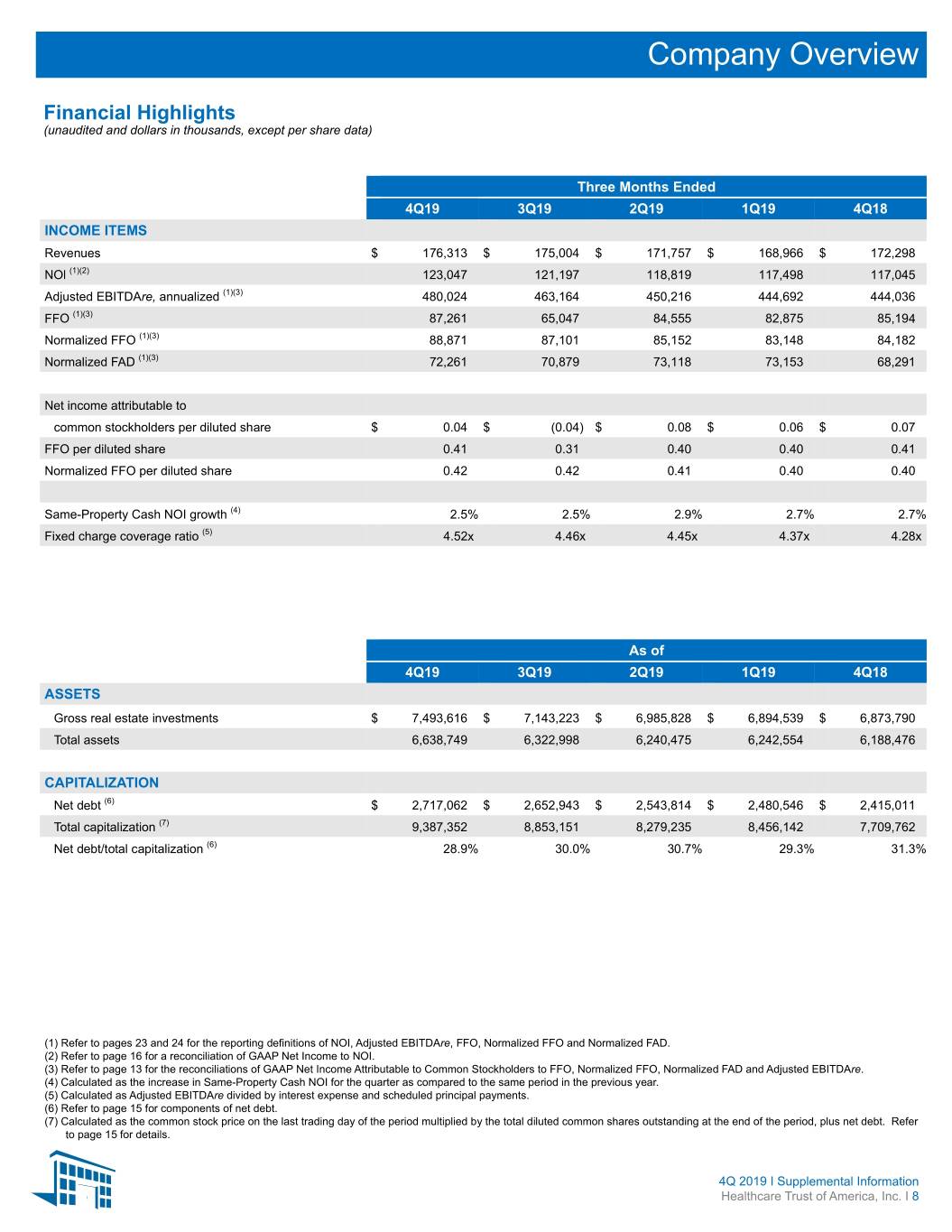

Company Overview Company Snapshot (as of December 31, 2019) Investments in Real Estate (1) $ 7.3 Total portfolio GLA (2) 24.8 Leased rate (3) 90.8% Same-Property portfolio tenant retention rate (YTD) (4) 83% % of GLA managed internally 95% % of GLA on-campus/adjacent 66% % of invested dollars in key markets & top 75 MSAs (5) 94% Weighted average remaining lease term for all buildings (6) 5.5 Weighted average remaining lease term for single-tenant buildings (6) 7.8 Weighted average remaining lease term for multi-tenant buildings (6) 4.4 Credit ratings (Standard & Poor’s/Moody’s) BBB(Stable)/Baa2(Stable) Cash and cash equivalents (2) $ 32.7 Net debt/total capitalization 28.9% Weighted average interest rate per annum on portfolio debt (7) 3.27% Building Type Presence in Top MSAs (8) % of Portfolio (based on GLA) % of Portfolio (based on invested dollars) Orange County/ Hartford/New Atlanta, GA Medical Office Buildings 4.6% Los Angeles, CA 95% Haven, CT 4.4% 4.7% Indianapolis, Tampa, FL IN 4.8% 3.9% Phoenix, AZ 3.7% Boston, MA 5.4% Denver, CO 3.6% Houston, TX 6.2% Senior Care 1% Hospitals 4% Dallas, TX 11.6% All Other Markets Remaining Top 5.7% MSAs 41.4% (1) Amount presented in billions. Refer to page 23 for the reporting definition of Investments in Real Estate. (2) Amounts presented in millions. Total portfolio GLA excludes GLA for projects under development and includes 100% of the GLA of its unconsolidated joint venture. (3) Calculations are based on percentage of total GLA, excluding GLA for development properties. (4) Refer to page 24 for the reporting definition of Retention. (5) Refer to page 23 for the reporting definition of Metropolitan Statistical Area. (6) Amounts presented in years. (7) Includes the impact of cash flow hedges. (8) Refer to page 19 for a detailed table of HTA’ s Key Markets and Top 75 MSA Concentration. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 9

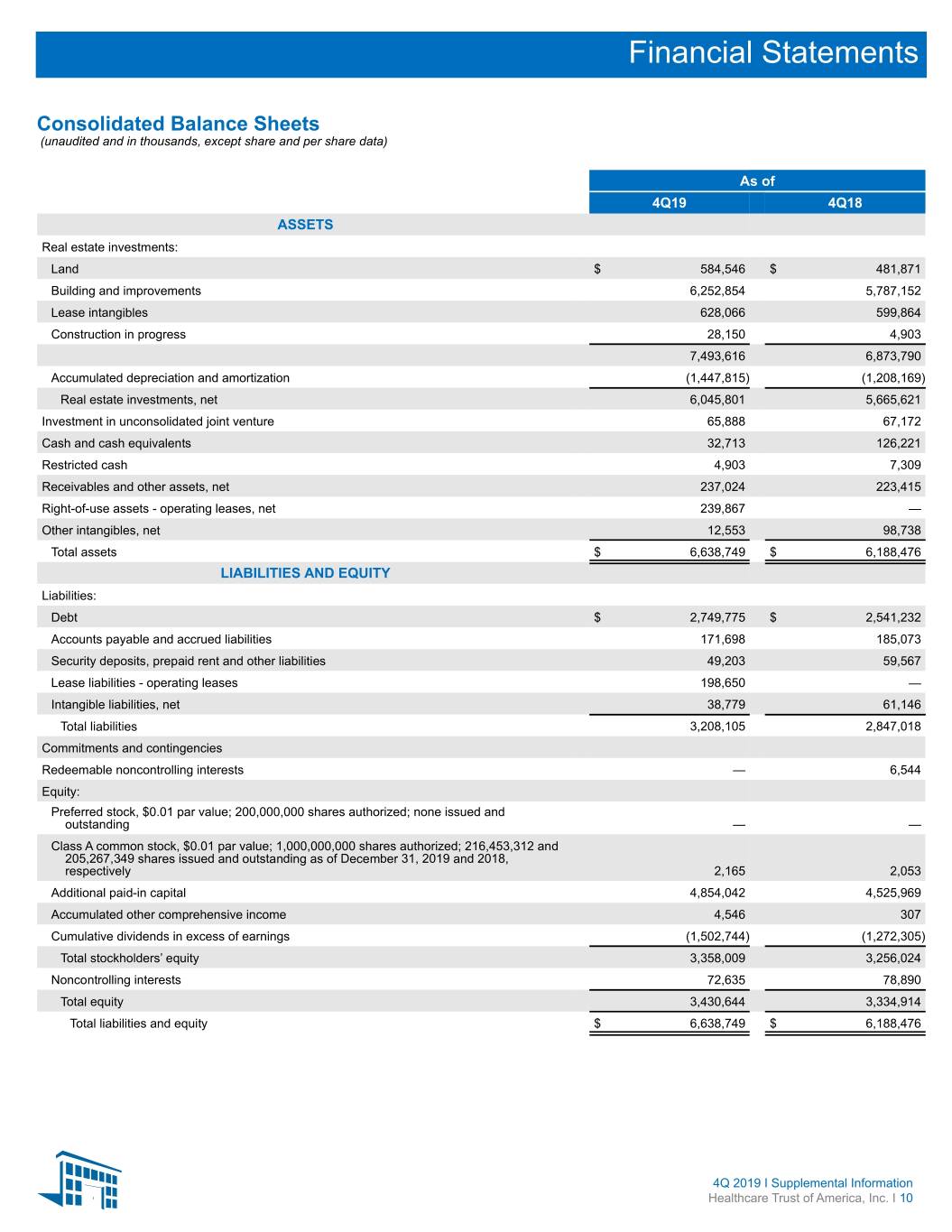

Financial Statements Consolidated Balance Sheets (unaudited and in thousands, except share and per share data) As of 4Q19 4Q18 ASSETS Real estate investments: Land $ 584,546 $ 481,871 Building and improvements 6,252,854 5,787,152 Lease intangibles 628,066 599,864 Construction in progress 28,150 4,903 7,493,616 6,873,790 Accumulated depreciation and amortization (1,447,815) (1,208,169) Real estate investments, net 6,045,801 5,665,621 Investment in unconsolidated joint venture 65,888 67,172 Cash and cash equivalents 32,713 126,221 Restricted cash 4,903 7,309 Receivables and other assets, net 237,024 223,415 Right-of-use assets - operating leases, net 239,867 — Other intangibles, net 12,553 98,738 Total assets $ 6,638,749 $ 6,188,476 LIABILITIES AND EQUITY Liabilities: Debt $ 2,749,775 $ 2,541,232 Accounts payable and accrued liabilities 171,698 185,073 Security deposits, prepaid rent and other liabilities 49,203 59,567 Lease liabilities - operating leases 198,650 — Intangible liabilities, net 38,779 61,146 Total liabilities 3,208,105 2,847,018 Commitments and contingencies Redeemable noncontrolling interests — 6,544 Equity: Preferred stock, $0.01 par value; 200,000,000 shares authorized; none issued and outstanding — — Class A common stock, $0.01 par value; 1,000,000,000 shares authorized; 216,453,312 and 205,267,349 shares issued and outstanding as of December 31, 2019 and 2018, respectively 2,165 2,053 Additional paid-in capital 4,854,042 4,525,969 Accumulated other comprehensive income 4,546 307 Cumulative dividends in excess of earnings (1,502,744) (1,272,305) Total stockholders’ equity 3,358,009 3,256,024 Noncontrolling interests 72,635 78,890 Total equity 3,430,644 3,334,914 Total liabilities and equity $ 6,638,749 $ 6,188,476 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 10

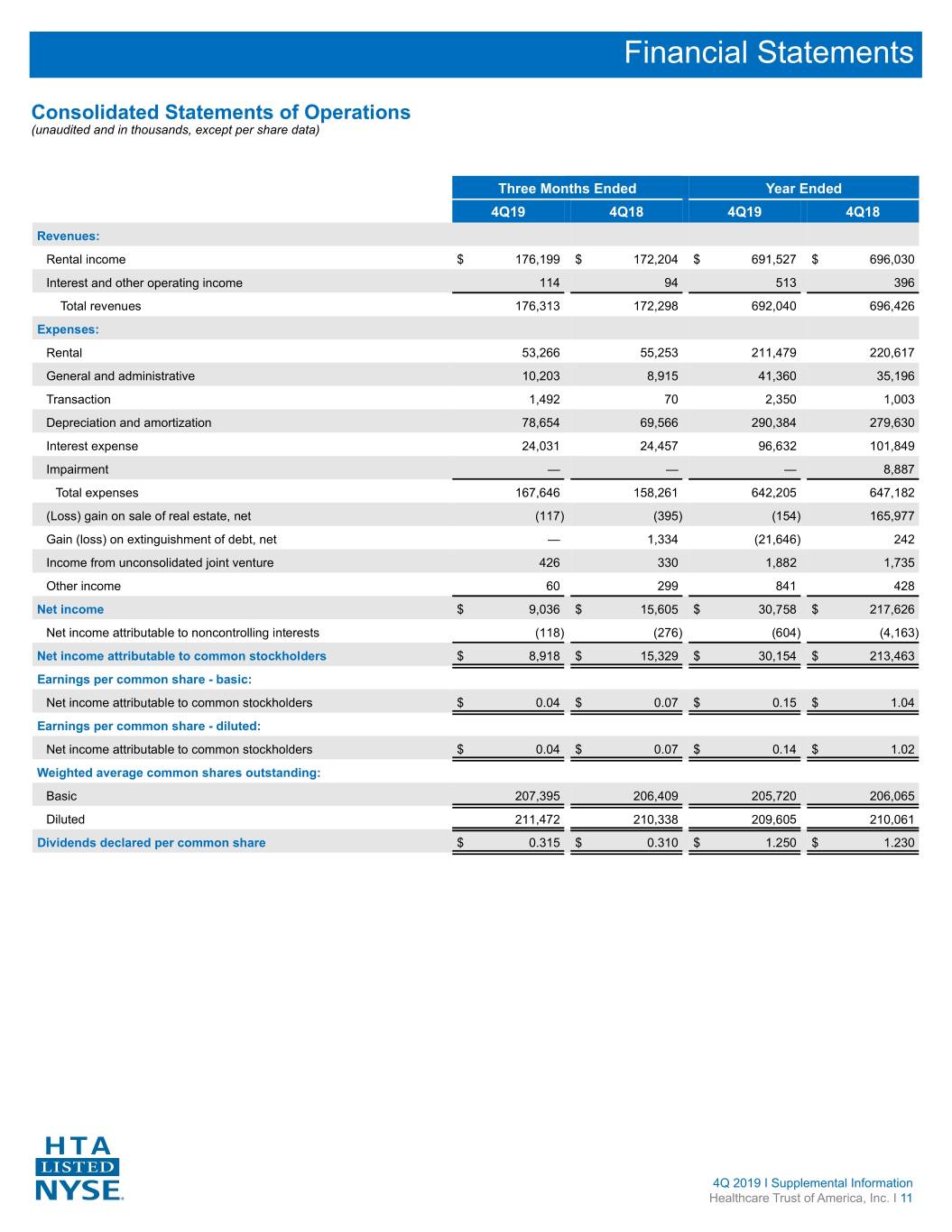

Financial Statements Consolidated Statements of Operations (unaudited and in thousands, except per share data) Three Months Ended Year Ended 4Q19 4Q18 4Q19 4Q18 Revenues: Rental income $ 176,199 $ 172,204 $ 691,527 $ 696,030 Interest and other operating income 114 94 513 396 Total revenues 176,313 172,298 692,040 696,426 Expenses: Rental 53,266 55,253 211,479 220,617 General and administrative 10,203 8,915 41,360 35,196 Transaction 1,492 70 2,350 1,003 Depreciation and amortization 78,654 69,566 290,384 279,630 Interest expense 24,031 24,457 96,632 101,849 Impairment — — — 8,887 Total expenses 167,646 158,261 642,205 647,182 (Loss) gain on sale of real estate, net (117) (395) (154) 165,977 Gain (loss) on extinguishment of debt, net — 1,334 (21,646) 242 Income from unconsolidated joint venture 426 330 1,882 1,735 Other income 60 299 841 428 Net income $ 9,036 $ 15,605 $ 30,758 $ 217,626 Net income attributable to noncontrolling interests (118) (276) (604) (4,163) Net income attributable to common stockholders $ 8,918 $ 15,329 $ 30,154 $ 213,463 Earnings per common share - basic: Net income attributable to common stockholders $ 0.04 $ 0.07 $ 0.15 $ 1.04 Earnings per common share - diluted: Net income attributable to common stockholders $ 0.04 $ 0.07 $ 0.14 $ 1.02 Weighted average common shares outstanding: Basic 207,395 206,409 205,720 206,065 Diluted 211,472 210,338 209,605 210,061 Dividends declared per common share $ 0.315 $ 0.310 $ 1.250 $ 1.230 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 11

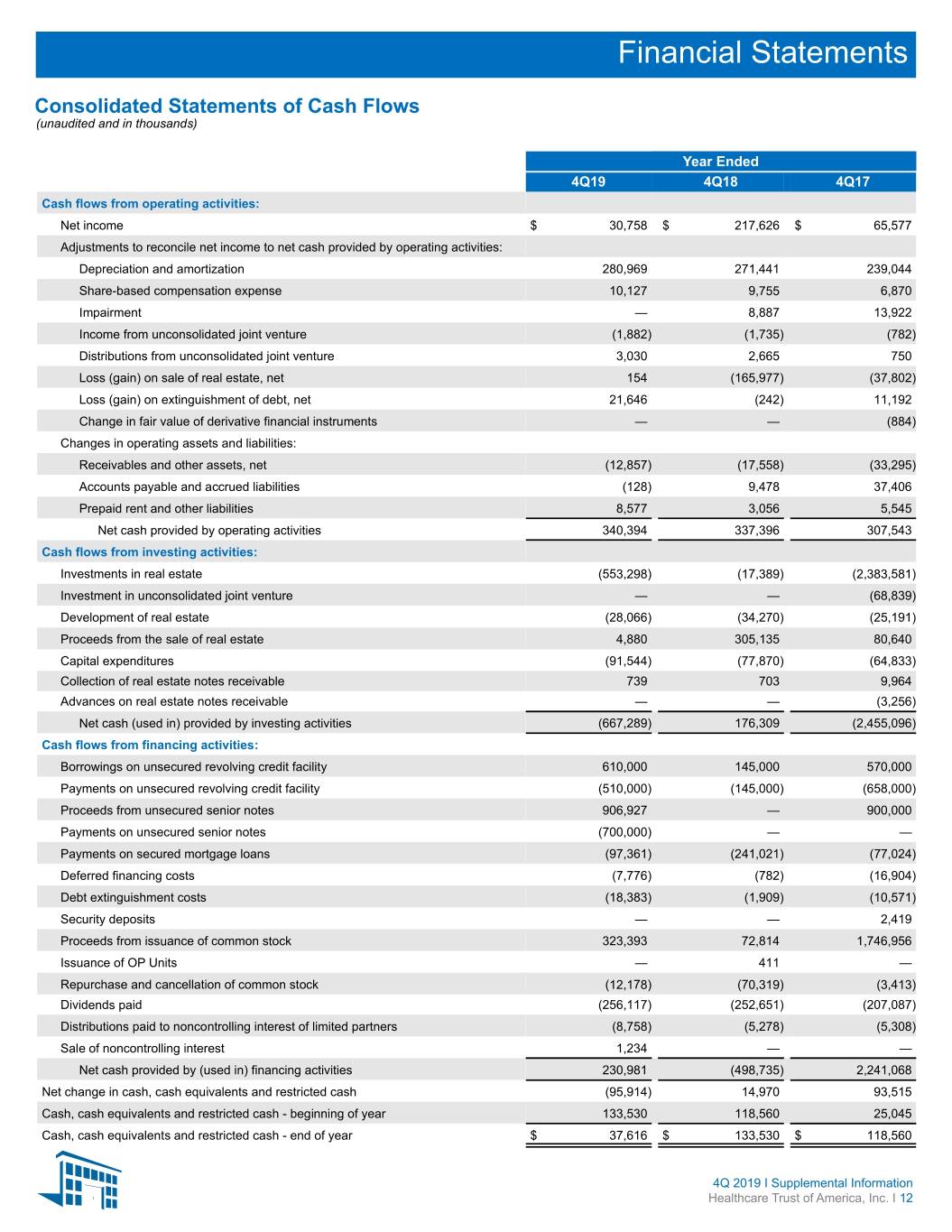

Financial Statements Consolidated Statements of Cash Flows (unaudited and in thousands) Year Ended 4Q19 4Q18 4Q17 Cash flows from operating activities: Net income $ 30,758 $ 217,626 $ 65,577 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 280,969 271,441 239,044 Share-based compensation expense 10,127 9,755 6,870 Impairment — 8,887 13,922 Income from unconsolidated joint venture (1,882) (1,735) (782) Distributions from unconsolidated joint venture 3,030 2,665 750 Loss (gain) on sale of real estate, net 154 (165,977) (37,802) Loss (gain) on extinguishment of debt, net 21,646 (242) 11,192 Change in fair value of derivative financial instruments — — (884) Changes in operating assets and liabilities: Receivables and other assets, net (12,857) (17,558) (33,295) Accounts payable and accrued liabilities (128) 9,478 37,406 Prepaid rent and other liabilities 8,577 3,056 5,545 Net cash provided by operating activities 340,394 337,396 307,543 Cash flows from investing activities: Investments in real estate (553,298) (17,389) (2,383,581) Investment in unconsolidated joint venture — — (68,839) Development of real estate (28,066) (34,270) (25,191) Proceeds from the sale of real estate 4,880 305,135 80,640 Capital expenditures (91,544) (77,870) (64,833) Collection of real estate notes receivable 739 703 9,964 Advances on real estate notes receivable — — (3,256) Net cash (used in) provided by investing activities (667,289) 176,309 (2,455,096) Cash flows from financing activities: Borrowings on unsecured revolving credit facility 610,000 145,000 570,000 Payments on unsecured revolving credit facility (510,000) (145,000) (658,000) Proceeds from unsecured senior notes 906,927 — 900,000 Payments on unsecured senior notes (700,000) — — Payments on secured mortgage loans (97,361) (241,021) (77,024) Deferred financing costs (7,776) (782) (16,904) Debt extinguishment costs (18,383) (1,909) (10,571) Security deposits — — 2,419 Proceeds from issuance of common stock 323,393 72,814 1,746,956 Issuance of OP Units — 411 — Repurchase and cancellation of common stock (12,178) (70,319) (3,413) Dividends paid (256,117) (252,651) (207,087) Distributions paid to noncontrolling interest of limited partners (8,758) (5,278) (5,308) Sale of noncontrolling interest 1,234 — — Net cash provided by (used in) financing activities 230,981 (498,735) 2,241,068 Net change in cash, cash equivalents and restricted cash (95,914) 14,970 93,515 Cash, cash equivalents and restricted cash - beginning of year 133,530 118,560 25,045 Cash, cash equivalents and restricted cash - end of year $ 37,616 $ 133,530 $ 118,560 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 12

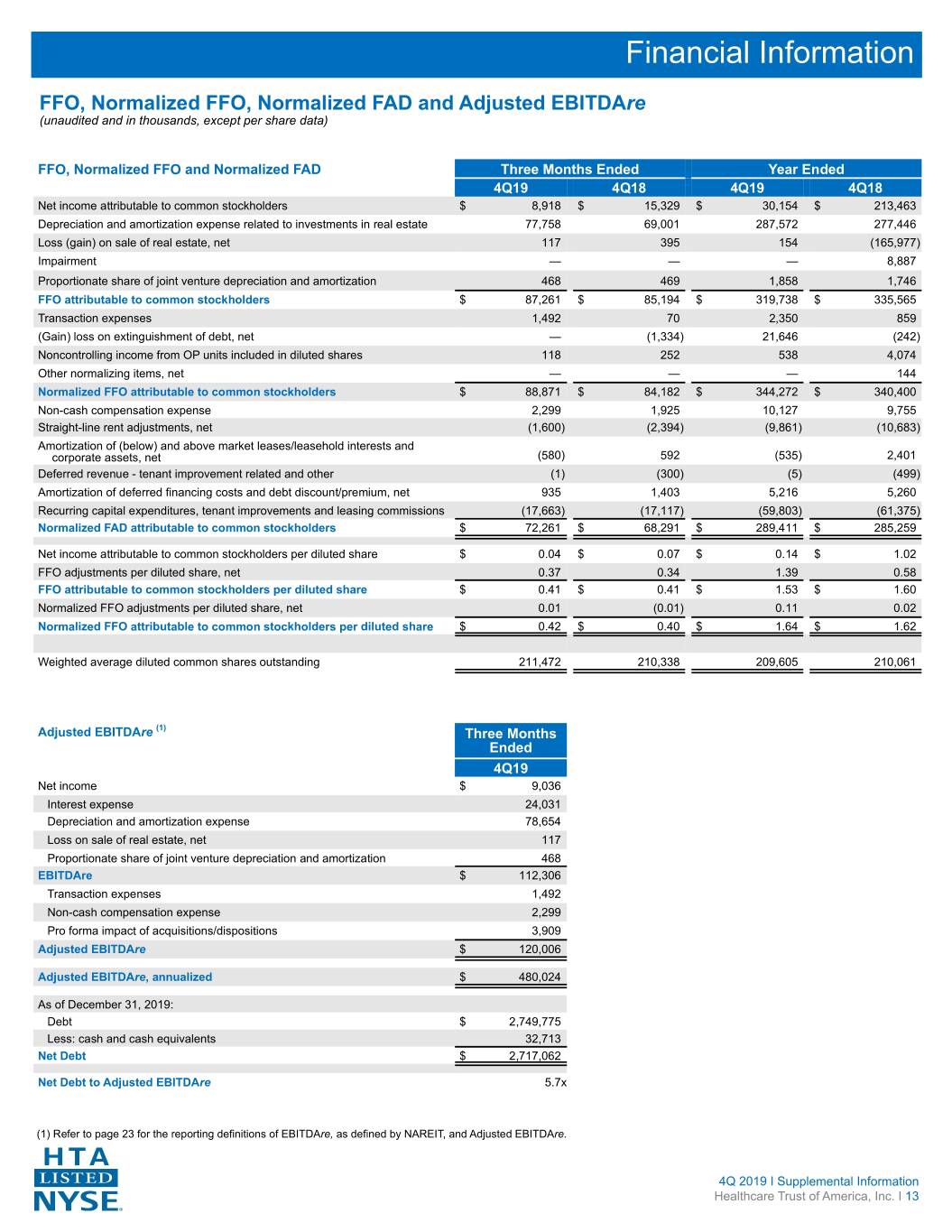

Financial Information FFO, Normalized FFO, Normalized FAD and Adjusted EBITDAre (unaudited and in thousands, except per share data) FFO, Normalized FFO and Normalized FAD Three Months Ended Year Ended 4Q19 4Q18 4Q19 4Q18 Net income attributable to common stockholders $ 8,918 $ 15,329 $ 30,154 $ 213,463 Depreciation and amortization expense related to investments in real estate 77,758 69,001 287,572 277,446 Loss (gain) on sale of real estate, net 117 395 154 (165,977) Impairment — — — 8,887 Proportionate share of joint venture depreciation and amortization 468 469 1,858 1,746 FFO attributable to common stockholders $ 87,261 $ 85,194 $ 319,738 $ 335,565 Transaction expenses 1,492 70 2,350 859 (Gain) loss on extinguishment of debt, net — (1,334) 21,646 (242) Noncontrolling income from OP units included in diluted shares 118 252 538 4,074 Other normalizing items, net — — — 144 Normalized FFO attributable to common stockholders $ 88,871 $ 84,182 $ 344,272 $ 340,400 Non-cash compensation expense 2,299 1,925 10,127 9,755 Straight-line rent adjustments, net (1,600) (2,394) (9,861) (10,683) Amortization of (below) and above market leases/leasehold interests and corporate assets, net (580) 592 (535) 2,401 Deferred revenue - tenant improvement related and other (1) (300) (5) (499) Amortization of deferred financing costs and debt discount/premium, net 935 1,403 5,216 5,260 Recurring capital expenditures, tenant improvements and leasing commissions (17,663) (17,117) (59,803) (61,375) Normalized FAD attributable to common stockholders $ 72,261 $ 68,291 $ 289,411 $ 285,259 Net income attributable to common stockholders per diluted share $ 0.04 $ 0.07 $ 0.14 $ 1.02 FFO adjustments per diluted share, net 0.37 0.34 1.39 0.58 FFO attributable to common stockholders per diluted share $ 0.41 $ 0.41 $ 1.53 $ 1.60 Normalized FFO adjustments per diluted share, net 0.01 (0.01) 0.11 0.02 Normalized FFO attributable to common stockholders per diluted share $ 0.42 $ 0.40 $ 1.64 $ 1.62 Weighted average diluted common shares outstanding 211,472 210,338 209,605 210,061 Adjusted EBITDAre (1) Three Months Ended 4Q19 Net income $ 9,036 Interest expense 24,031 Depreciation and amortization expense 78,654 Loss on sale of real estate, net 117 Proportionate share of joint venture depreciation and amortization 468 EBITDAre $ 112,306 Transaction expenses 1,492 Non-cash compensation expense 2,299 Pro forma impact of acquisitions/dispositions 3,909 Adjusted EBITDAre $ 120,006 Adjusted EBITDAre, annualized $ 480,024 As of December 31, 2019: Debt $ 2,749,775 Less: cash and cash equivalents 32,713 Net Debt $ 2,717,062 Net Debt to Adjusted EBITDAre 5.7x (1) Refer to page 23 for the reporting definitions of EBITDAre, as defined by NAREIT, and Adjusted EBITDAre. 4Q 2019 I Supplemental Information . Healthcare Trust of America, Inc. I 13

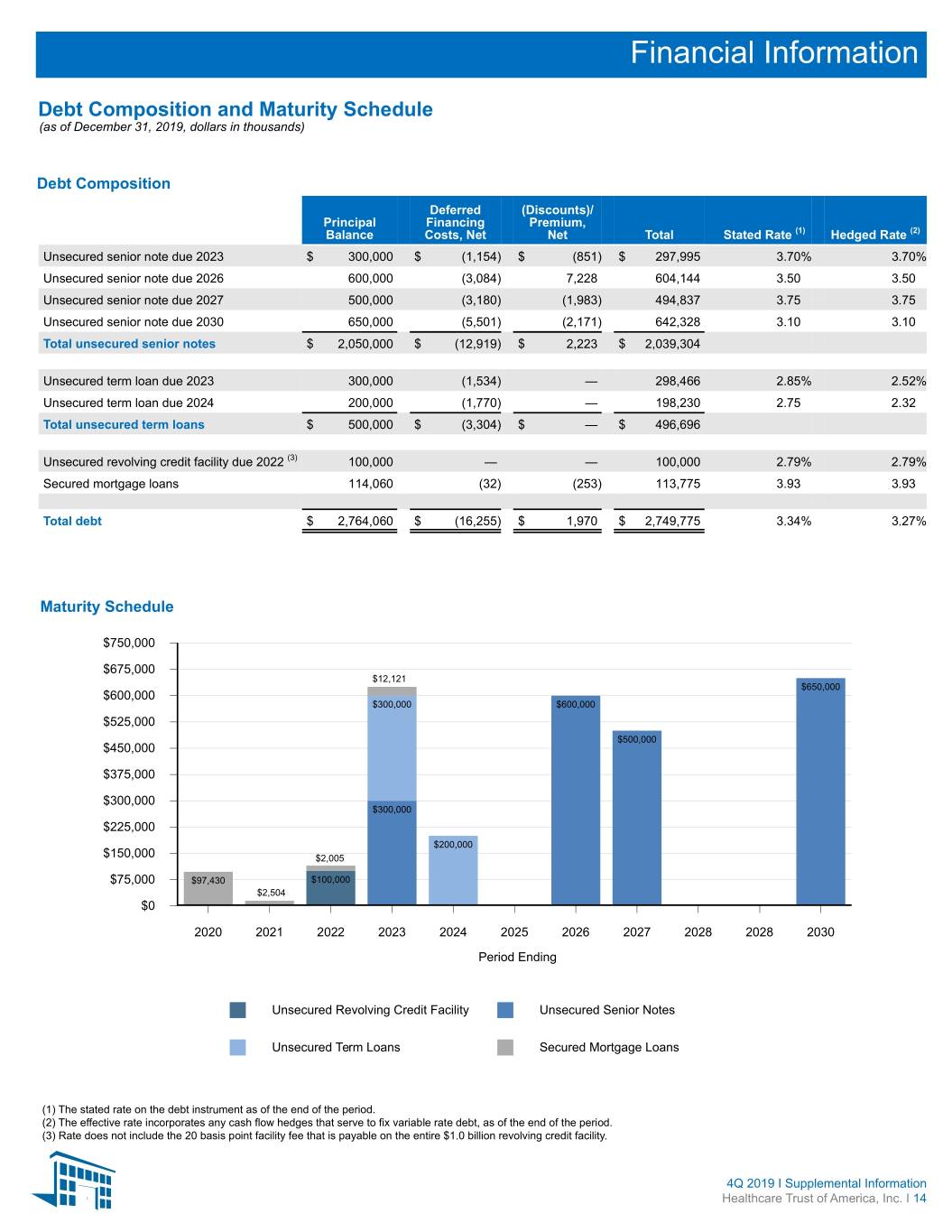

Financial Information Debt Composition and Maturity Schedule (as of December 31, 2019, dollars in thousands) Debt Composition Deferred (Discounts)/ Principal Financing Premium, Balance Costs, Net Net Total Stated Rate (1) Hedged Rate (2) Unsecured senior note due 2023 $ 300,000 $ (1,154) $ (851) $ 297,995 3.70% 3.70% Unsecured senior note due 2026 600,000 (3,084) 7,228 604,144 3.50 3.50 Unsecured senior note due 2027 500,000 (3,180) (1,983) 494,837 3.75 3.75 Unsecured senior note due 2030 650,000 (5,501) (2,171) 642,328 3.10 3.10 Total unsecured senior notes $ 2,050,000 $ (12,919) $ 2,223 $ 2,039,304 Unsecured term loan due 2023 300,000 (1,534) — 298,466 2.85% 2.52% Unsecured term loan due 2024 200,000 (1,770) — 198,230 2.75 2.32 Total unsecured term loans $ 500,000 $ (3,304) $ — $ 496,696 Unsecured revolving credit facility due 2022 (3) 100,000 — — 100,000 2.79% 2.79% Secured mortgage loans 114,060 (32) (253) 113,775 3.93 3.93 Total debt $ 2,764,060 $ (16,255) $ 1,970 $ 2,749,775 3.34% 3.27% Maturity Schedule $750,000 $675,000 $12,121 $650,000 $600,000 $300,000 $600,000 $525,000 $500,000 $450,000 $375,000 $300,000 $300,000 $225,000 $200,000 $150,000 $2,005 $75,000 $97,430 $100,000 $2,504 $0 2020 2021 2022 2023 2024 2025 2026 2027 2028 2028 2030 Period Ending Unsecured Revolving Credit Facility Unsecured Senior Notes Unsecured Term Loans Secured Mortgage Loans (1) The stated rate on the debt instrument as of the end of the period. (2) The effective rate incorporates any cash flow hedges that serve to fix variable rate debt, as of the end of the period. (3) Rate does not include the 20 basis point facility fee that is payable on the entire $1.0 billion revolving credit facility. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 14

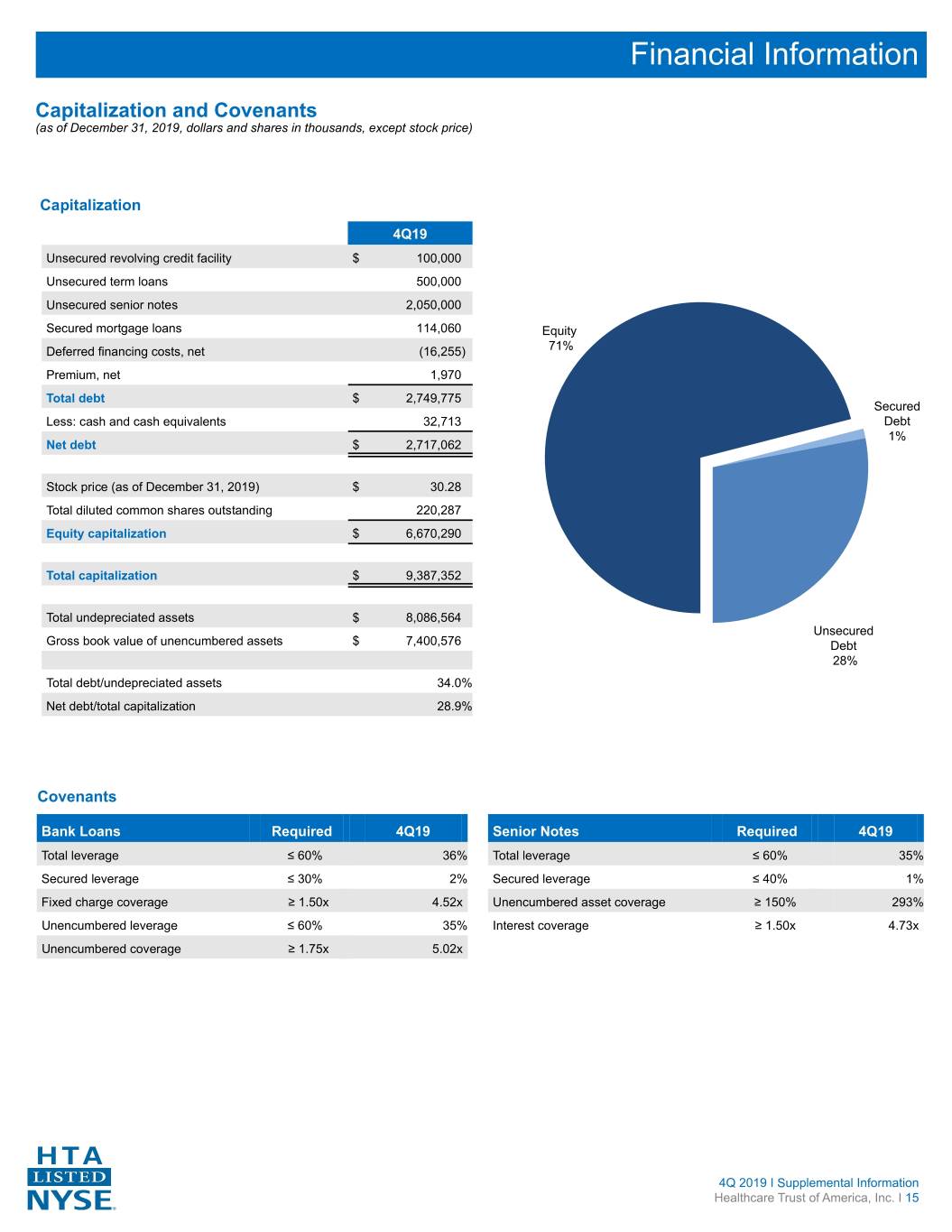

Financial Information Capitalization and Covenants (as of December 31, 2019, dollars and shares in thousands, except stock price) Capitalization 4Q19 Unsecured revolving credit facility $ 100,000 Unsecured term loans 500,000 Unsecured senior notes 2,050,000 Secured mortgage loans 114,060 Equity Deferred financing costs, net (16,255) 71% Premium, net 1,970 Total debt $ 2,749,775 Secured Less: cash and cash equivalents 32,713 Debt 1% Net debt $ 2,717,062 Stock price (as of December 31, 2019) $ 30.28 Total diluted common shares outstanding 220,287 Equity capitalization $ 6,670,290 Total capitalization $ 9,387,352 Total undepreciated assets $ 8,086,564 Unsecured Gross book value of unencumbered assets $ 7,400,576 Debt 28% Total debt/undepreciated assets 34.0% Net debt/total capitalization 28.9% Covenants Bank Loans Required 4Q19 Senior Notes Required 4Q19 Total leverage ≤ 60% 36% Total leverage ≤ 60% 35% Secured leverage ≤ 30% 2% Secured leverage ≤ 40% 1% Fixed charge coverage ≥ 1.50x 4.52x Unencumbered asset coverage ≥ 150% 293% Unencumbered leverage ≤ 60% 35% Interest coverage ≥ 1.50x 4.73x Unencumbered coverage ≥ 1.75x 5.02x 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 15

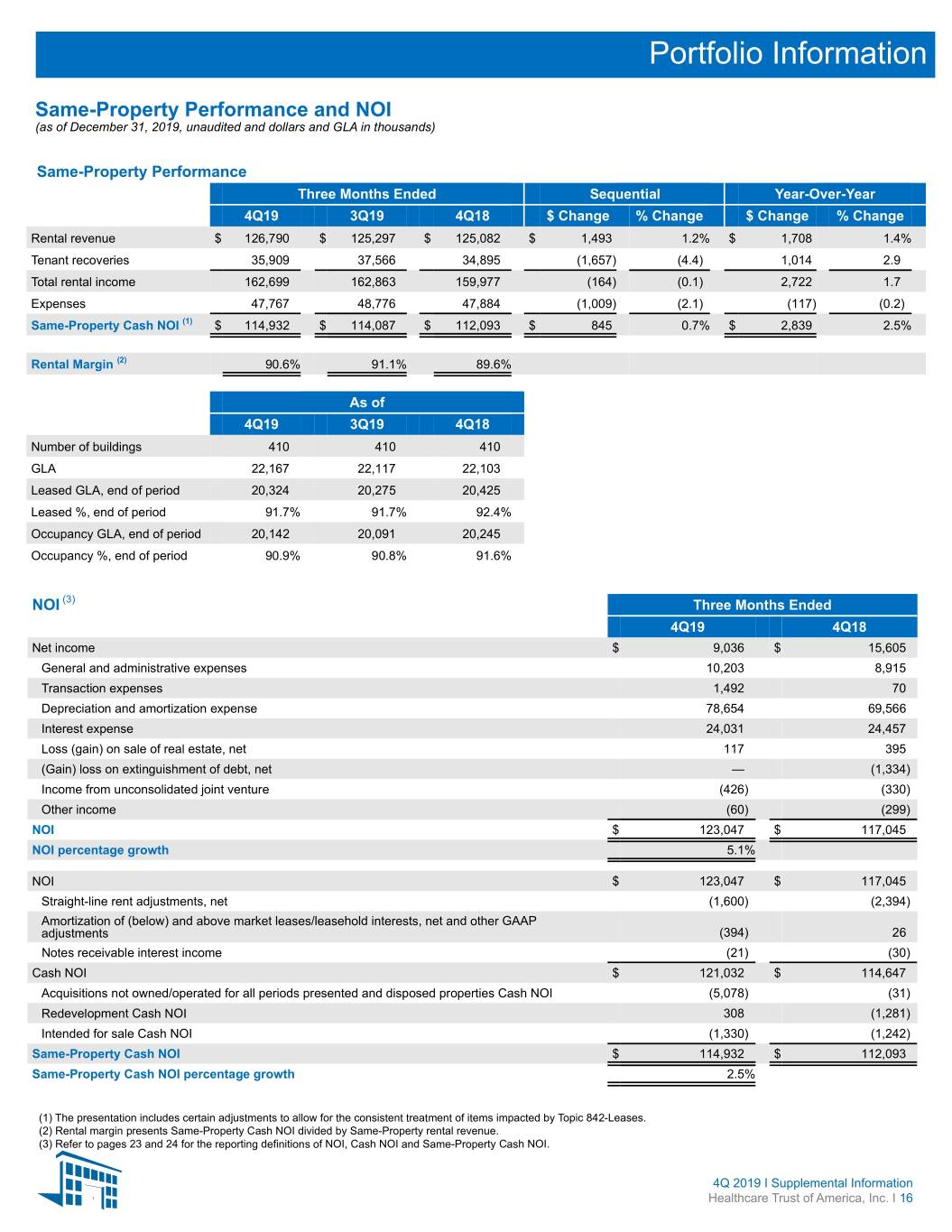

Portfolio Information Same-Property Performance and NOI (as of December 31, 2019, unaudited and dollars and GLA in thousands) Same-Property Performance Three Months Ended Sequential Year-Over-Year 4Q19 3Q19 4Q18 $ Change % Change $ Change % Change Rental revenue $ 126,790 $ 125,297 $ 125,082 $ 1,493 1.2% $ 1,708 1.4% Tenant recoveries 35,909 37,566 34,895 (1,657) (4.4) 1,014 2.9 Total rental income 162,699 162,863 159,977 (164) (0.1) 2,722 1.7 Expenses 47,767 48,776 47,884 (1,009) (2.1) (117) (0.2) Same-Property Cash NOI (1) $ 114,932 $ 114,087 $ 112,093 $ 845 0.7% $ 2,839 2.5% Rental Margin (2) 90.6% 91.1% 89.6% As of 4Q19 3Q19 4Q18 Number of buildings 410 410 410 GLA 22,167 22,117 22,103 Leased GLA, end of period 20,324 20,275 20,425 Leased %, end of period 91.7% 91.7% 92.4% Occupancy GLA, end of period 20,142 20,091 20,245 Occupancy %, end of period 90.9% 90.8% 91.6% NOI (3) Three Months Ended 4Q19 4Q18 Net income $ 9,036 $ 15,605 General and administrative expenses 10,203 8,915 Transaction expenses 1,492 70 Depreciation and amortization expense 78,654 69,566 Interest expense 24,031 24,457 Loss (gain) on sale of real estate, net 117 395 (Gain) loss on extinguishment of debt, net — (1,334) Income from unconsolidated joint venture (426) (330) Other income (60) (299) NOI $ 123,047 $ 117,045 NOI percentage growth 5.1% NOI $ 123,047 $ 117,045 Straight-line rent adjustments, net (1,600) (2,394) Amortization of (below) and above market leases/leasehold interests, net and other GAAP adjustments (394) 26 Notes receivable interest income (21) (30) Cash NOI $ 121,032 $ 114,647 Acquisitions not owned/operated for all periods presented and disposed properties Cash NOI (5,078) (31) Redevelopment Cash NOI 308 (1,281) Intended for sale Cash NOI (1,330) (1,242) Same-Property Cash NOI $ 114,932 $ 112,093 Same-Property Cash NOI percentage growth 2.5% (1) The presentation includes certain adjustments to allow for the consistent treatment of items impacted by Topic 842-Leases. (2) Rental margin presents Same-Property Cash NOI divided by Same-Property rental revenue. (3) Refer to pages 23 and 24 for the reporting definitions of NOI, Cash NOI and Same-Property Cash NOI. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 16

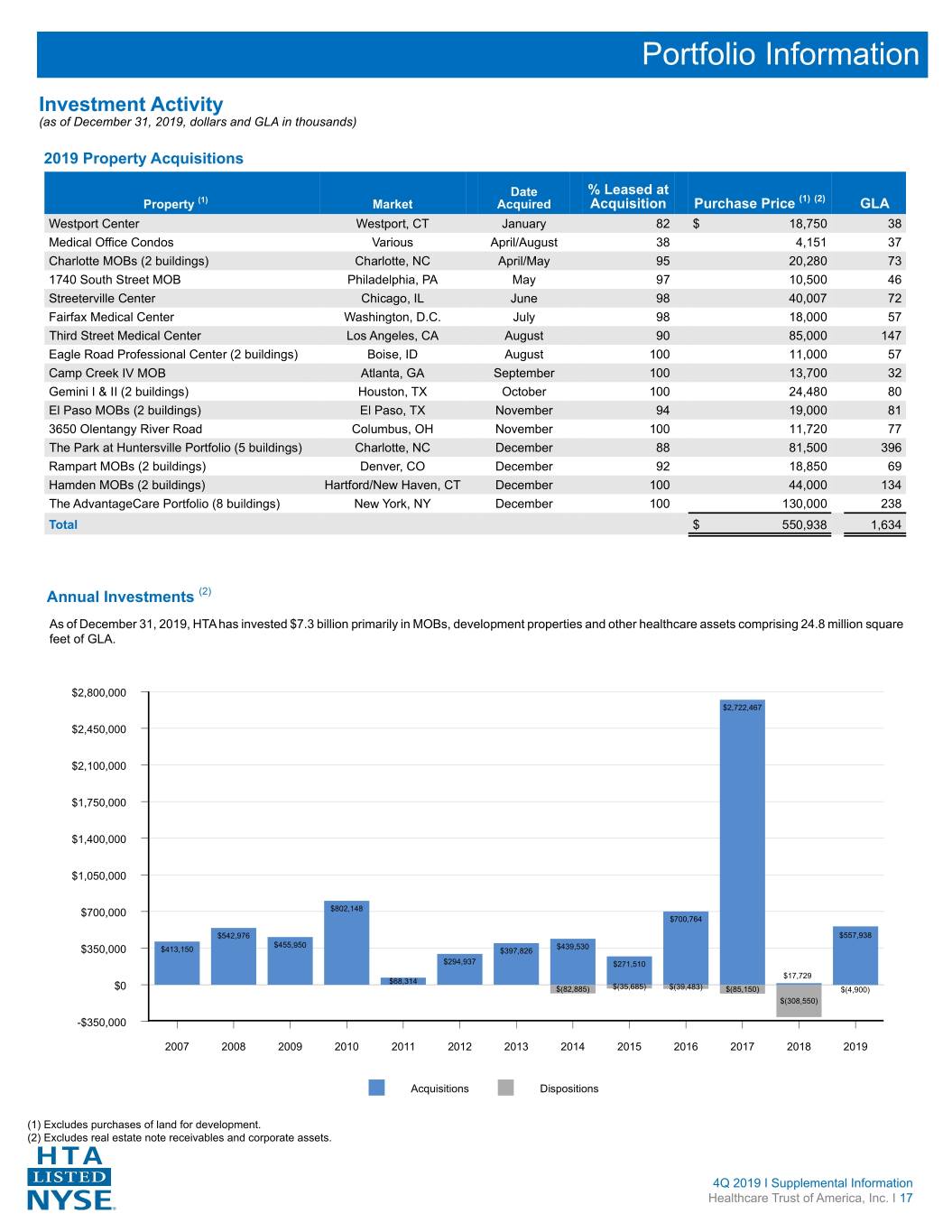

Portfolio Information Investment Activity (as of December 31, 2019, dollars and GLA in thousands) 2019 Property Acquisitions Date % Leased at Property (1) Market Acquired Acquisition Purchase Price (1) (2) GLA Westport Center Westport, CT January 82 $ 18,750 38 Medical Office Condos Various April/August 38 4,151 37 Charlotte MOBs (2 buildings) Charlotte, NC April/May 95 20,280 73 1740 South Street MOB Philadelphia, PA May 97 10,500 46 Streeterville Center Chicago, IL June 98 40,007 72 Fairfax Medical Center Washington, D.C. July 98 18,000 57 Third Street Medical Center Los Angeles, CA August 90 85,000 147 Eagle Road Professional Center (2 buildings) Boise, ID August 100 11,000 57 Camp Creek IV MOB Atlanta, GA September 100 13,700 32 Gemini I & II (2 buildings) Houston, TX October 100 24,480 80 El Paso MOBs (2 buildings) El Paso, TX November 94 19,000 81 3650 Olentangy River Road Columbus, OH November 100 11,720 77 The Park at Huntersville Portfolio (5 buildings) Charlotte, NC December 88 81,500 396 Rampart MOBs (2 buildings) Denver, CO December 92 18,850 69 Hamden MOBs (2 buildings) Hartford/New Haven, CT December 100 44,000 134 The AdvantageCare Portfolio (8 buildings) New York, NY December 100 130,000 238 Total $ 550,938 1,634 Annual Investments (2) As of December 31, 2019, HTA has invested $7.3 billion primarily in MOBs, development properties and other healthcare assets comprising 24.8 million square feet of GLA. $2,800,000 $2,722,467 $2,450,000 $2,100,000 $1,750,000 $1,400,000 $1,050,000 $700,000 $802,148 $700,764 $542,976 $557,938 $455,950 $439,530 $350,000 $413,150 $397,826 $294,937 $271,510 $17,729 $68,314 $0 $(82,885) $(35,685) $(39,483) $(85,150) $(4,900) $(308,550) -$350,000 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Acquisitions Dispositions (1) Excludes purchases of land for development. (2) Excludes real estate note receivables and corporate assets. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 17

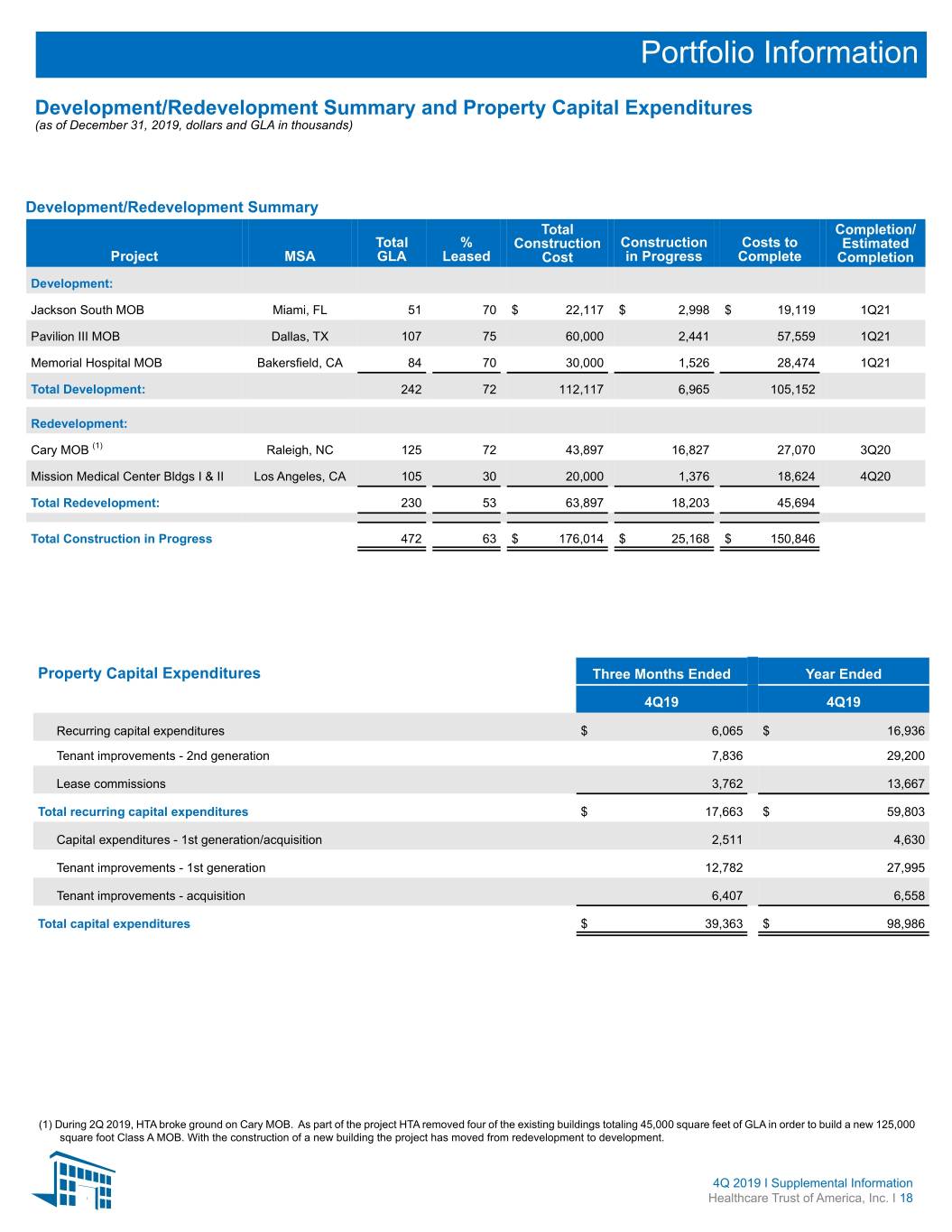

Portfolio Information Development/Redevelopment Summary and Property Capital Expenditures (as of December 31, 2019, dollars and GLA in thousands) Development/Redevelopment Summary Total Completion/ Total % Construction Construction Costs to Estimated Project MSA GLA Leased Cost in Progress Complete Completion Development: Jackson South MOB Miami, FL 51 70 $ 22,117 $ 2,998 $ 19,119 1Q21 Pavilion III MOB Dallas, TX 107 75 60,000 2,441 57,559 1Q21 Memorial Hospital MOB Bakersfield, CA 84 70 30,000 1,526 28,474 1Q21 Total Development: 242 72 112,117 6,965 105,152 Redevelopment: Cary MOB (1) Raleigh, NC 125 72 43,897 16,827 27,070 3Q20 Mission Medical Center Bldgs I & II Los Angeles, CA 105 30 20,000 1,376 18,624 4Q20 Total Redevelopment: 230 53 63,897 18,203 45,694 Total Construction in Progress 472 63 $ 176,014 $ 25,168 $ 150,846 Property Capital Expenditures Three Months Ended Year Ended 4Q19 4Q19 Recurring capital expenditures $ 6,065 $ 16,936 Tenant improvements - 2nd generation 7,836 29,200 Lease commissions 3,762 13,667 Total recurring capital expenditures $ 17,663 $ 59,803 Capital expenditures - 1st generation/acquisition 2,511 4,630 Tenant improvements - 1st generation 12,782 27,995 Tenant improvements - acquisition 6,407 6,558 Total capital expenditures $ 39,363 $ 98,986 (1) During 2Q 2019, HTA broke ground on Cary MOB. As part of the project HTA removed four of the existing buildings totaling 45,000 square feet of GLA in order to build a new 125,000 square foot Class A MOB. With the construction of a new building the project has moved from redevelopment to development. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 18

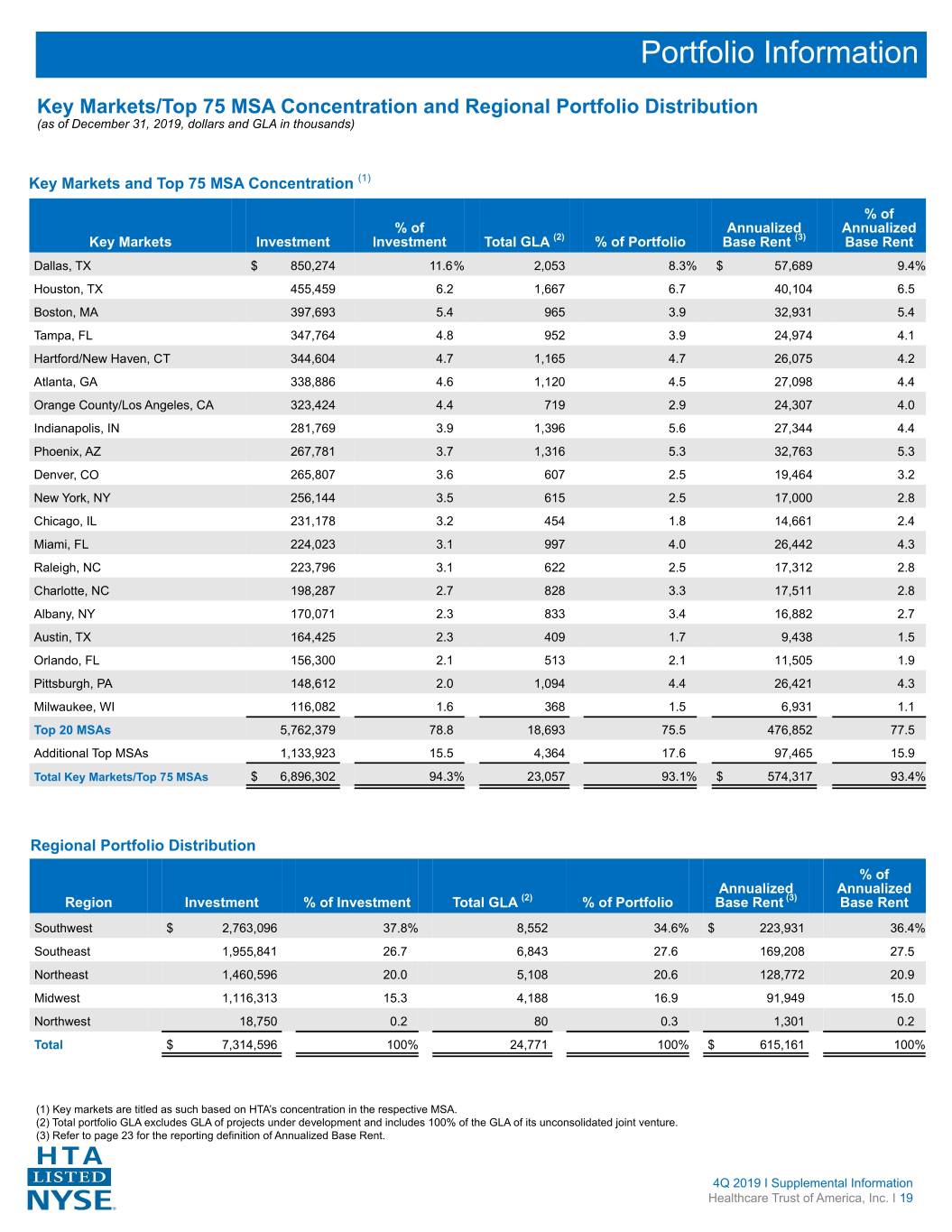

Portfolio Information Key Markets/Top 75 MSA Concentration and Regional Portfolio Distribution (as of December 31, 2019, dollars and GLA in thousands) Key Markets and Top 75 MSA Concentration (1) % of % of Annualized Annualized Key Markets Investment Investment Total GLA (2) % of Portfolio Base Rent (3) Base Rent Dallas, TX $ 850,274 11.6% 2,053 8.3% $ 57,689 9.4% Houston, TX 455,459 6.2 1,667 6.7 40,104 6.5 Boston, MA 397,693 5.4 965 3.9 32,931 5.4 Tampa, FL 347,764 4.8 952 3.9 24,974 4.1 Hartford/New Haven, CT 344,604 4.7 1,165 4.7 26,075 4.2 Atlanta, GA 338,886 4.6 1,120 4.5 27,098 4.4 Orange County/Los Angeles, CA 323,424 4.4 719 2.9 24,307 4.0 Indianapolis, IN 281,769 3.9 1,396 5.6 27,344 4.4 Phoenix, AZ 267,781 3.7 1,316 5.3 32,763 5.3 Denver, CO 265,807 3.6 607 2.5 19,464 3.2 New York, NY 256,144 3.5 615 2.5 17,000 2.8 Chicago, IL 231,178 3.2 454 1.8 14,661 2.4 Miami, FL 224,023 3.1 997 4.0 26,442 4.3 Raleigh, NC 223,796 3.1 622 2.5 17,312 2.8 Charlotte, NC 198,287 2.7 828 3.3 17,511 2.8 Albany, NY 170,071 2.3 833 3.4 16,882 2.7 Austin, TX 164,425 2.3 409 1.7 9,438 1.5 Orlando, FL 156,300 2.1 513 2.1 11,505 1.9 Pittsburgh, PA 148,612 2.0 1,094 4.4 26,421 4.3 Milwaukee, WI 116,082 1.6 368 1.5 6,931 1.1 Top 20 MSAs 5,762,379 78.8 18,693 75.5 476,852 77.5 Additional Top MSAs 1,133,923 15.5 4,364 17.6 97,465 15.9 Total Key Markets/Top 75 MSAs $ 6,896,302 94.3% 23,057 93.1% $ 574,317 93.4% Regional Portfolio Distribution % of Annualized Annualized Region Investment % of Investment Total GLA (2) % of Portfolio Base Rent (3) Base Rent Southwest $ 2,763,096 37.8% 8,552 34.6% $ 223,931 36.4% Southeast 1,955,841 26.7 6,843 27.6 169,208 27.5 Northeast 1,460,596 20.0 5,108 20.6 128,772 20.9 Midwest 1,116,313 15.3 4,188 16.9 91,949 15.0 Northwest 18,750 0.2 80 0.3 1,301 0.2 Total $ 7,314,596 100% 24,771 100% $ 615,161 100% (1) Key markets are titled as such based on HTA’s concentration in the respective MSA. (2) Total portfolio GLA excludes GLA of projects under development and includes 100% of the GLA of its unconsolidated joint venture. (3) Refer to page 23 for the reporting definition of Annualized Base Rent. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 19

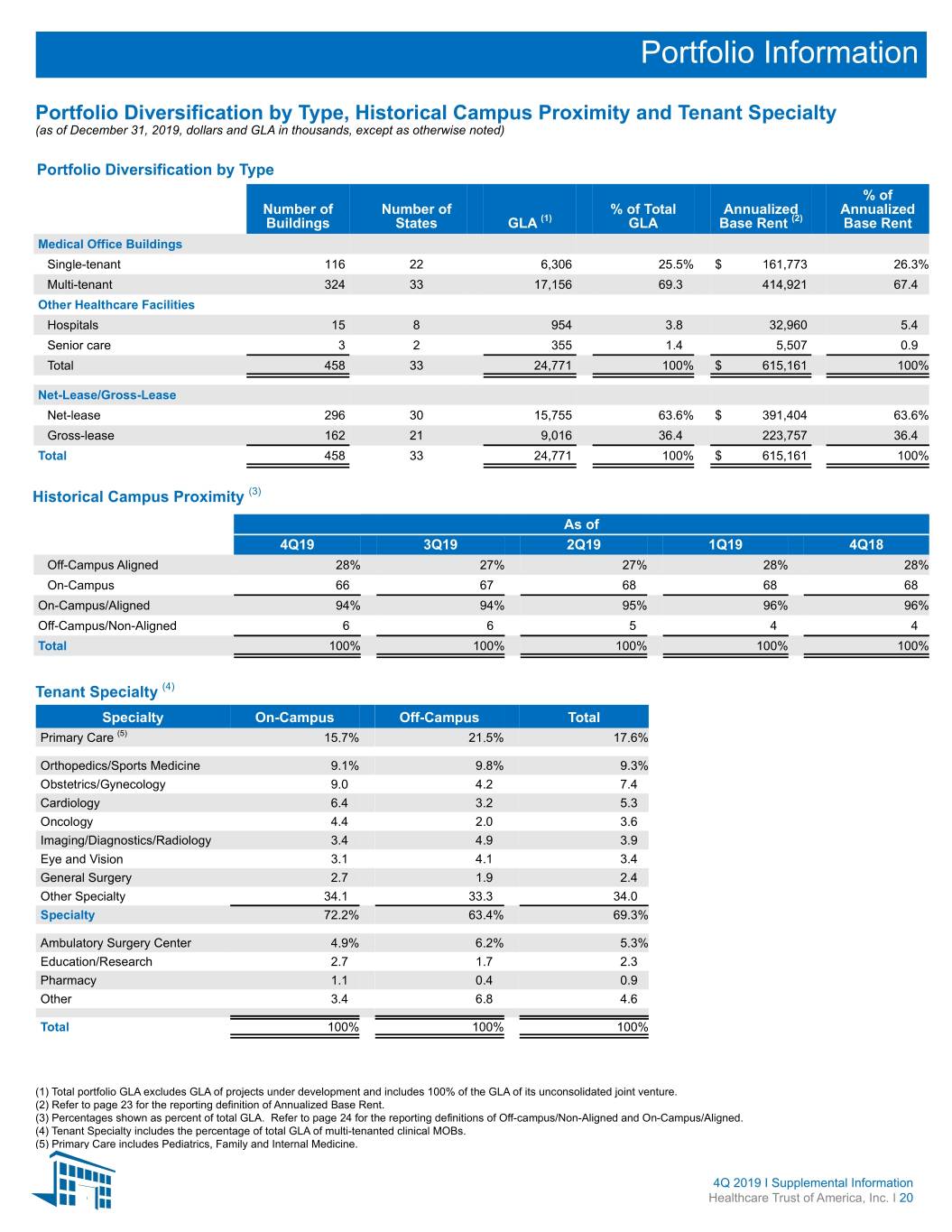

Portfolio Information Portfolio Diversification by Type, Historical Campus Proximity and Tenant Specialty (as of December 31, 2019, dollars and GLA in thousands, except as otherwise noted) Portfolio Diversification by Type % of Number of Number of % of Total Annualized Annualized Buildings States GLA (1) GLA Base Rent (2) Base Rent Medical Office Buildings Single-tenant 116 22 6,306 25.5% $ 161,773 26.3% Multi-tenant 324 33 17,156 69.3 414,921 67.4 Other Healthcare Facilities Hospitals 15 8 954 3.8 32,960 5.4 Senior care 3 2 355 1.4 5,507 0.9 Total 458 33 24,771 100% $ 615,161 100% Net-Lease/Gross-Lease Net-lease 296 30 15,755 63.6% $ 391,404 63.6% Gross-lease 162 21 9,016 36.4 223,757 36.4 Total 458 33 24,771 100% $ 615,161 100% Historical Campus Proximity (3) As of 4Q19 3Q19 2Q19 1Q19 4Q18 Off-Campus Aligned 28% 27% 27% 28% 28% On-Campus 66 67 68 68 68 On-Campus/Aligned 94% 94% 95% 96% 96% Off-Campus/Non-Aligned 6 6 5 4 4 Total 100% 100% 100% 100% 100% Tenant Specialty (4) Specialty On-Campus Off-Campus Total Primary Care (5) 15.7% 21.5% 17.6% Orthopedics/Sports Medicine 9.1% 9.8% 9.3% Obstetrics/Gynecology 9.0 4.2 7.4 Cardiology 6.4 3.2 5.3 Oncology 4.4 2.0 3.6 Imaging/Diagnostics/Radiology 3.4 4.9 3.9 Eye and Vision 3.1 4.1 3.4 General Surgery 2.7 1.9 2.4 Other Specialty 34.1 33.3 34.0 Specialty 72.2% 63.4% 69.3% Ambulatory Surgery Center 4.9% 6.2% 5.3% Education/Research 2.7 1.7 2.3 Pharmacy 1.1 0.4 0.9 Other 3.4 6.8 4.6 Total 100% 100% 100% (1) Total portfolio GLA excludes GLA of projects under development and includes 100% of the GLA of its unconsolidated joint venture. (2) Refer to page 23 for the reporting definition of Annualized Base Rent. (3) Percentages shown as percent of total GLA. Refer to page 24 for the reporting definitions of Off-campus/Non-Aligned and On-Campus/Aligned. (4) Tenant Specialty includes the percentage of total GLA of multi-tenanted clinical MOBs. (5) Primary Care includes Pediatrics, Family and Internal Medicine. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 20

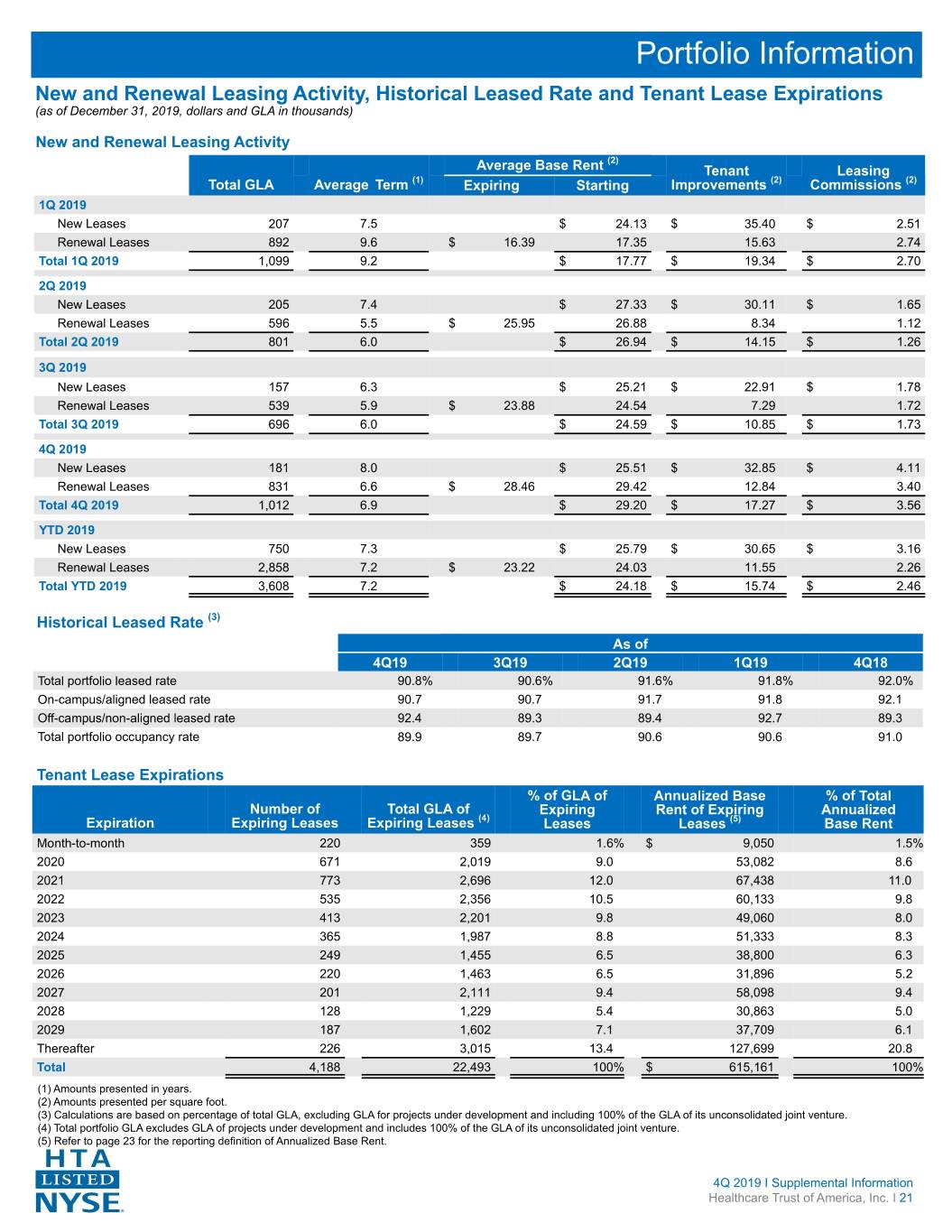

Portfolio Information New and Renewal Leasing Activity, Historical Leased Rate and Tenant Lease Expirations (as of December 31, 2019, dollars and GLA in thousands) New and Renewal Leasing Activity (2) Average Base Rent Tenant Leasing Total GLA Average Term (1) Expiring Starting Improvements (2) Commissions (2) 1Q 2019 New Leases 207 7.5 $ 24.13 $ 35.40 $ 2.51 Renewal Leases 892 9.6 $ 16.39 17.35 15.63 2.74 Total 1Q 2019 1,099 9.2 $ 17.77 $ 19.34 $ 2.70 2Q 2019 New Leases 205 7.4 $ 27.33 $ 30.11 $ 1.65 Renewal Leases 596 5.5 $ 25.95 26.88 8.34 1.12 Total 2Q 2019 801 6.0 $ 26.94 $ 14.15 $ 1.26 3Q 2019 New Leases 157 6.3 $ 25.21 $ 22.91 $ 1.78 Renewal Leases 539 5.9 $ 23.88 24.54 7.29 1.72 Total 3Q 2019 696 6.0 $ 24.59 $ 10.85 $ 1.73 4Q 2019 New Leases 181 8.0 $ 25.51 $ 32.85 $ 4.11 Renewal Leases 831 6.6 $ 28.46 29.42 12.84 3.40 Total 4Q 2019 1,012 6.9 $ 29.20 $ 17.27 $ 3.56 YTD 2019 New Leases 750 7.3 $ 25.79 $ 30.65 $ 3.16 Renewal Leases 2,858 7.2 $ 23.22 24.03 11.55 2.26 Total YTD 2019 3,608 7.2 $ 24.18 $ 15.74 $ 2.46 Historical Leased Rate (3) As of 4Q19 3Q19 2Q19 1Q19 4Q18 Total portfolio leased rate 90.8% 90.6% 91.6% 91.8% 92.0% On-campus/aligned leased rate 90.7 90.7 91.7 91.8 92.1 Off-campus/non-aligned leased rate 92.4 89.3 89.4 92.7 89.3 Total portfolio occupancy rate 89.9 89.7 90.6 90.6 91.0 Tenant Lease Expirations % of GLA of Annualized Base % of Total Number of Total GLA of Expiring Rent of Expiring Annualized Expiration Expiring Leases Expiring Leases (4) Leases Leases (5) Base Rent Month-to-month 220 359 1.6% $ 9,050 1.5% 2020 671 2,019 9.0 53,082 8.6 2021 773 2,696 12.0 67,438 11.0 2022 535 2,356 10.5 60,133 9.8 2023 413 2,201 9.8 49,060 8.0 2024 365 1,987 8.8 51,333 8.3 2025 249 1,455 6.5 38,800 6.3 2026 220 1,463 6.5 31,896 5.2 2027 201 2,111 9.4 58,098 9.4 2028 128 1,229 5.4 30,863 5.0 2029 187 1,602 7.1 37,709 6.1 Thereafter 226 3,015 13.4 127,699 20.8 Total 4,188 22,493 100% $ 615,161 100% (1) Amounts presented in years. (2) Amounts presented per square foot. (3) Calculations are based on percentage of total GLA, excluding GLA for projects under development and including 100% of the GLA of its unconsolidated joint venture. (4) Total portfolio GLA excludes GLA of projects under development and includes 100% of the GLA of its unconsolidated joint venture. (5) Refer to page 23 for the reporting definition of Annualized Base Rent. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 21

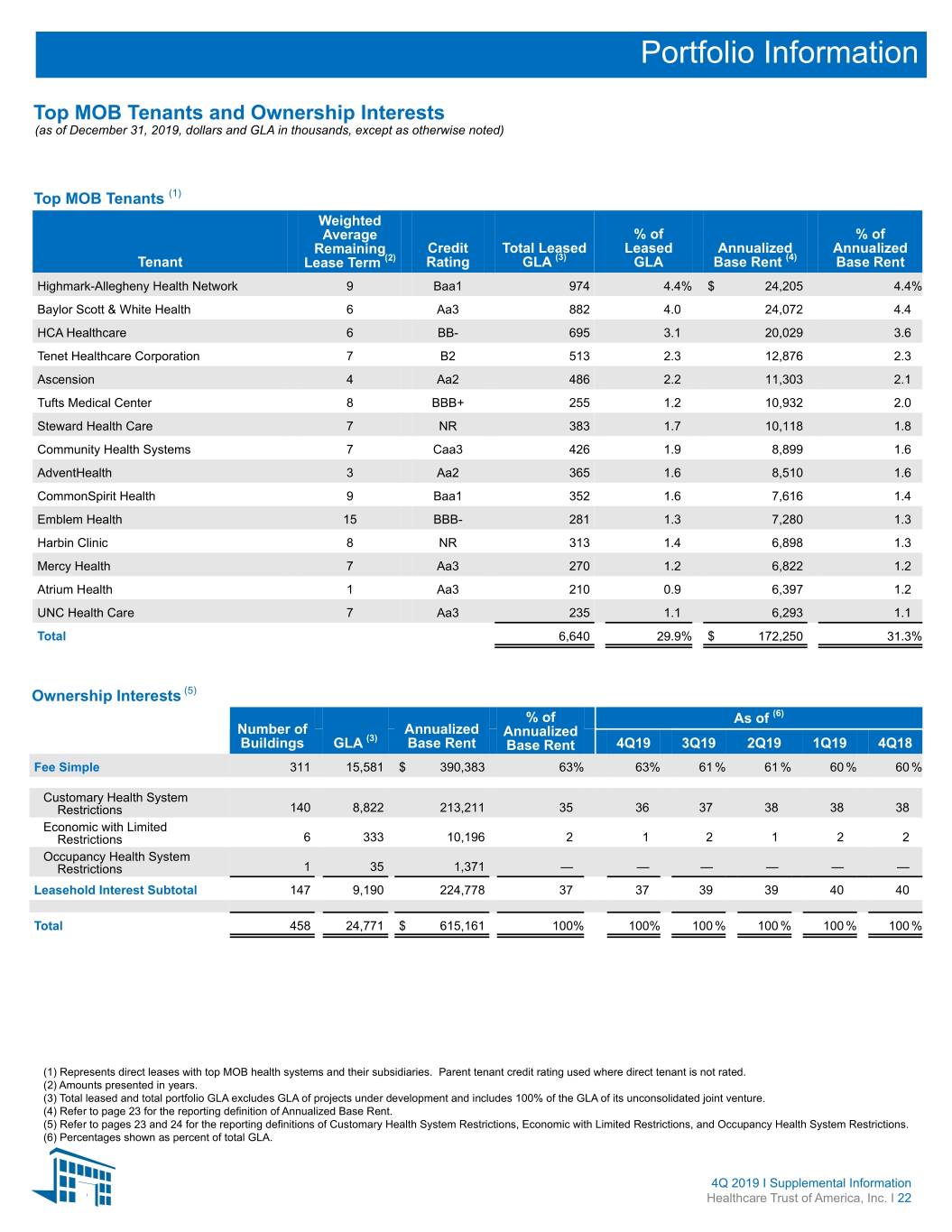

Portfolio Information Top MOB Tenants and Ownership Interests (as of December 31, 2019, dollars and GLA in thousands, except as otherwise noted) Top MOB Tenants (1) Weighted Average % of % of Remaining Credit Total Leased Leased Annualized Annualized Tenant Lease Term (2) Rating GLA (3) GLA Base Rent (4) Base Rent Highmark-Allegheny Health Network 9 Baa1 974 4.4% $ 24,205 4.4% Baylor Scott & White Health 6 Aa3 882 4.0 24,072 4.4 HCA Healthcare 6 BB- 695 3.1 20,029 3.6 Tenet Healthcare Corporation 7 B2 513 2.3 12,876 2.3 Ascension 4 Aa2 486 2.2 11,303 2.1 Tufts Medical Center 8 BBB+ 255 1.2 10,932 2.0 Steward Health Care 7 NR 383 1.7 10,118 1.8 Community Health Systems 7 Caa3 426 1.9 8,899 1.6 AdventHealth 3 Aa2 365 1.6 8,510 1.6 CommonSpirit Health 9 Baa1 352 1.6 7,616 1.4 Emblem Health 15 BBB- 281 1.3 7,280 1.3 Harbin Clinic 8 NR 313 1.4 6,898 1.3 Mercy Health 7 Aa3 270 1.2 6,822 1.2 Atrium Health 1 Aa3 210 0.9 6,397 1.2 UNC Health Care 7 Aa3 235 1.1 6,293 1.1 Total 6,640 29.9% $ 172,250 31.3% Ownership Interests (5) % of As of (6) Number of Annualized (3) Annualized Buildings GLA Base Rent Base Rent 4Q19 3Q19 2Q19 1Q19 4Q18 Fee Simple 311 15,581 $ 390,383 63% 63% 61 % 61 % 60 % 60 % Customary Health System Restrictions 140 8,822 213,211 35 36 37 38 38 38 Economic with Limited Restrictions 6 333 10,196 2 1 2 1 2 2 Occupancy Health System Restrictions 1 35 1,371 — — — — — — Leasehold Interest Subtotal 147 9,190 224,778 37 37 39 39 40 40 Total 458 24,771 $ 615,161 100% 100% 100 % 100 % 100 % 100 % (1) Represents direct leases with top MOB health systems and their subsidiaries. Parent tenant credit rating used where direct tenant is not rated. (2) Amounts presented in years. (3) Total leased and total portfolio GLA excludes GLA of projects under development and includes 100% of the GLA of its unconsolidated joint venture. (4) Refer to page 23 for the reporting definition of Annualized Base Rent. (5) Refer to pages 23 and 24 for the reporting definitions of Customary Health System Restrictions, Economic with Limited Restrictions, and Occupancy Health System Restrictions. (6) Percentages shown as percent of total GLA. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 22

Reporting Definitions Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate (“Adjusted EBITDAre”): Adjusted EBITDAre is presented on an assumed annualized basis. HTA defines Adjusted EBITDAre as EBITDAre (computed in accordance with NAREIT as defined below) plus: (i) transaction expenses; (ii) gain or loss on extinguishment of debt; (iii) non-cash compensation expense; (iv) pro forma impact of its acquisitions/dispositions; and (v) other normalizing items. HTA considers Adjusted EBITDAre an important measure because it provides additional information to allow management, investors, and its current and potential creditors to evaluate and compare its core operating results and its ability to service debt. Annualized Base Rent or (“ABR”): Annualized base rent is calculated by multiplying contractual base rent for the end of the period by 12 (excluding the impact of abatements, concessions, and straight-line rent). Cash Net Operating Income (“Cash NOI”): Cash NOI is a non-GAAP financial measure which excludes from NOI: (i) straight-line rent adjustments; (ii) amortization of below and above market leases/leasehold interests and other GAAP adjustments; and (iii) notes receivable interest income. Contractual base rent, contractual rent increases, contractual rent concessions and changes in occupancy or lease rates upon commencement and expiration of leases are a primary driver of HTA’s revenue performance. HTA believes that Cash NOI, which removes the impact of straight- line rent adjustments, provides another measurement of the operating performance of its operating assets. Additionally, HTA believes that Cash NOI is a widely accepted measure of comparative operating performance of real estate investment trusts (“REITs”). However, HTA’s use of the term Cash NOI may not be comparable to that of other REITs as they may have different methodologies for computing this amount. Cash NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of its financial performance. Cash NOI should be reviewed in connection with other GAAP measurements. Credit Ratings: Credit ratings of parent tenants and their subsidiaries. Customary Health System Restrictions: Ground leases with a health system ground lessor that include restrictions on tenants that may be considered competitive with the hospital, including provisions that tenants must have hospital privileges. Economic with Limited Restrictions: Ground leases that are primarily economic in nature and contain no material restrictions on tenancy. Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate (“EBITDAre”): As defined by NAREIT, EBITDAre is computed as net income or loss (computed in accordance with GAAP) plus: (i) interest expense; (ii) income tax expense (not applicable to HTA); (iii) depreciation and amortization; (iv) impairment; (v) gain or loss on the sale of real estate; and (vi) the proportionate share of joint venture depreciation and amortization. Funds from Operations (“FFO”): HTA computes FFO in accordance with the current standards established by NAREIT. NAREIT defines FFO as net income or loss attributable to common stockholders (computed in accordance with GAAP), excluding gains or losses from sales of real estate property and impairment write-downs of depreciable assets, plus depreciation and amortization related to investments in real estate, and after adjustments for unconsolidated partnerships and joint ventures. HTA presents this non-GAAP financial measure because it considers it an important supplemental measure of its operating performance and believes it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs. Historical cost accounting assumes that the value of real estate assets diminishes ratably over time. Since real estate values have historically risen or fallen based on market conditions, many industry investors have considered the presentation of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. Because FFO excludes depreciation and amortization unique to real estate, among other items, it provides a perspective not immediately apparent from net income or loss attributable to common stockholders. Gross Leasable Area (“GLA”): Gross leasable area in square feet. Investments in Real Estate: Based on acquisition price. Leased Rate: Leased rate represents the percentage of total GLA that is leased (excluding GLA for properties under development), including month-to-month leases and leases which have been executed, but which have not yet commenced, as of the date reported. Metropolitan Statistical Area (“MSA”): Is a geographical region with a relatively high population density at its core and close economic ties throughout the area. MSAs are defined by the Office of Management and Budget. Net Operating Income (“NOI”): NOI is a non-GAAP financial measure that is defined as net income or loss (computed in accordance with GAAP) before: (i) general and administrative expenses; (ii) transaction expenses; (iii) depreciation and amortization expense; (iv) impairment; (v) interest expense; (vi) gain or loss on sales of real estate; (vii) gain or loss on extinguishment of debt; (viii) income or loss from unconsolidated joint venture; and (ix) other income or expense. HTA believes that NOI provides an accurate measure of the operating performance of its operating assets because NOI excludes certain items that are not associated with the management of its properties. Additionally, HTA believes that NOI is a widely accepted measure of comparative operating performance of REITs. However, HTA’s use of the term NOI may not be comparable to that of other REITs as they may have different methodologies for computing this amount. NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of HTA’s financial performance. NOI should be reviewed in connection with other GAAP measurements. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 23

Reporting Definitions - Continued Normalized Funds Available for Distribution (“Normalized FAD”): HTA computes Normalized FAD, which excludes from Normalized FFO: (i) non-cash compensation expense; (ii) straight-line rent adjustments; (iii) amortization of below and above market leases/leasehold interests and corporate assets; (iv) deferred revenue - tenant improvement related and other income; (v) amortization of deferred financing costs and debt premium/discount; and (vi) recurring capital expenditures, tenant improvements and leasing commissions. HTA believes this non-GAAP financial measure provides a meaningful supplemental measure of its operating performance. Normalized FAD should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of its financial performance, nor is it indicative of cash available to fund cash needs. Normalized FAD should be reviewed in connection with other GAAP measurements. Normalized Funds From Operations (“Normalized FFO”): HTA computes Normalized FFO, which excludes from FFO: (i) transaction expenses; (ii) gain or loss on extinguishment of debt; (iii) noncontrolling income or loss from partnership units included in diluted shares; and (iv) other normalizing items, which include items that are unusual and infrequent in nature. HTA presents this non-GAAP financial measure because it allows for the comparison of its operating performance to other REITs and between periods on a consistent basis. HTA’s methodology for calculating Normalized FFO may be different from the methods utilized by other REITs and, accordingly, may not be comparable to other REITs. Normalized FFO should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of its financial performance, nor is it indicative of cash available to fund cash needs. Normalized FFO should be reviewed in connection with other GAAP measurements. Occupancy Health System Restrictions: Ground leases with customary health system restrictions whereby the restrictions cease if occupancy in the buildings/on-campus fall below stabilized occupancy, which is generally between 85% and 90%. Off-Campus/Non-Aligned: A building or portfolio that is not located on or adjacent to a healthcare or hospital campus or does not have full alignment with a recognized healthcare system. On-Campus/Aligned: On-campus refers to a property that is located on or adjacent to a healthcare or hospital campus. Aligned refers to a property that is not on a healthcare or hospital campus, but is anchored by a healthcare system. Recurring Capital Expenditures, Tenant Improvements and Leasing Commissions: Represents amounts paid for: (i) recurring capital expenditures required to maintain and re-tenant its properties; (ii) second generation tenant improvements; and (iii) leasing commissions paid to secure new tenants. Excludes capital expenditures and tenant improvements for recent acquisitions that were contemplated in the purchase price or closing agreements. Retention: Represents the sum of the total leased GLA of tenants that renewed a lease during the period over the total GLA of leases that renewed or expired during the period. Same-Property Cash Net Operating Income (“Same-Property Cash NOI”): To facilitate the comparison of Cash NOI between periods, HTA calculates comparable amounts for a subset of its owned and operational properties referred to as “Same-Property”. Same-Property Cash NOI excludes (i) properties which have not been owned and operated by HTA during the entire span of all periods presented and disposed properties, (ii) HTA’s share of unconsolidated joint ventures, (iii) development, redevelopment and land parcels, (iv) properties intended for disposition in the near term which have (a) been approved by the Board of Directors, (b) are actively marketed for sale, and (c) an offer has been received at prices HTA would transact and the sales process is ongoing, and (v) certain non-routine items. Same-Property Cash NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of its financial performance. Same-Property Cash NOI should be reviewed in connection with other GAAP measurements. Tenant Recoveries: Tenant reimbursement revenue, which is comprised of additional amounts recoverable from tenants for real estate taxes, common area maintenance and other certain operating expenses are recognized as revenue on a gross basis in the period in which the related recoverable expenses are incurred. HTA accrues revenue corresponding to these expenses on a quarterly basis to adjust recorded amounts to its best estimate of the final annual amounts to be billed. Subsequent to year-end, on a calendar year basis, HTA performs reconciliations on a lease-by-lease basis and bill or credit each tenant for any differences between the estimated expenses HTA billed and the actual expenses that were incurred. 4Q 2019 I Supplemental Information Healthcare Trust of America, Inc. I 24