Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - COLUMBIA PROPERTY TRUST, INC. | ex991202002earningsrel.htm |

| 8-K - 8-K - COLUMBIA PROPERTY TRUST, INC. | cxp8-k202002q4earnings.htm |

Supplemental Information

Columbia Property Trust, Inc. Table of Contents Introduction Executive Summary 3 Company Profile & Investor Contacts 4 Capitalization Analysis & Research Coverage 5 2020 Guidance 6 Financial Information Consolidated Balance Sheet - GAAP 7 Elements of Pro-Rata Balance Sheet - CXP's Interest in Unconsolidated Joint Ventures 8 Consolidated Statements of Operations - GAAP 9 Elements of Pro-Rata Statement of Operations - CXP's Interest in Unconsolidated Joint Ventures 10 Normalized Funds From Operations (NFFO) & Adjusted Funds From Operations (AFFO) 11 Net Operating Income 12 - 13 Third-Party Management Income 14 Capital Expenditure Summary 15 Debt Overview 16 Debt Covenant Compliance 17 Debt Maturities 18 Summary of Unconsolidated Joint Ventures 19 Operational & Portfolio Information Property Overview - Gross Real Estate Assets, Net Operating Income & Annualized Lease Revenue 20 Property Overview - Square Feet & Occupancy 21 Occupancy Summary 22 Leasing Summary 23 Lease Expiration Schedule 24 Lease Expiration by Market 25 Top 20 Tenants & Tenant Industry Profile 26 Transaction Activity (1/1/17 - 2/12/20) 27 - 28 Development Projects 29 Additional Information Reconciliation of Net Income to Normalized Funds From Operations (NFFO) 30 Reconciliation of Cash Flows From Operations to Adjusted Funds From Operations (AFFO) 30 Reconciliation of Net Operating Income (based on GAAP rents) to Net Operating Income (based on cash rents) 31 Reconciliation of Funds From Operations (FFO) to Adjusted Funds From Operations (AFFO) 31 Reconciliation of Net Income to Net Operating Income (based on cash rents), and Same Store Net Operating Income (based on cash rents) - wholly-owned properties 32 - 33 Reconciliation of Net Income to Net Operating Income (based on GAAP rents), and Same Store Net Operating Income (based on GAAP rents) - wholly-owned properties 34 - 35 Definitions 36 Forward Looking Statements: This supplemental package contains certain statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. These forward-looking statements include information about possible or assumed future results of the business and our financial condition, liquidity, results of operations, future plans, and objectives. They also include, among other things, statements regarding subjects that are forward-looking by their nature, such as, our business and financial strategy; our guidance and underlying assumptions; expectations on timing of completion of announced acquisitions; expectations on occupancy rates and additional growth in same store net operating income; our ability to obtain future financing; future acquisitions and dispositions of operating assets; future repurchases of common stock; and market and industry trends. Readers are cautioned not to place undue reliance on these forward- looking statements, which speak only as of the date this supplemental package is published, and which are subject to certain risks and uncertainties which could cause actual results to differ materially from those projected or anticipated. These risks and uncertainties include, without limitation: risks affecting the real estate industry and the office sector, in particular (such as the inability to enter into new leases, dependence on tenants’ financial condition, and competition from other owners of real estate); risks relating to our ability to maintain and increase property occupancy rates and rental rates; adverse economic or real estate market developments in our target markets; risks relating to the use of debt to fund acquisitions; availability and terms of financing; ability to refinance indebtedness as it comes due; sensitivity of our operations and financing arrangements to fluctuations in interest rates; reductions in asset valuations and related impairment charges; risks relating to construction, development, and redevelopment activities; risks associated with joint ventures, including disagreements with, or misconduct by, joint venture partners; risks relating to repositioning our portfolio; risks relating to reduced demand for, or over supply of, office space in our markets; risks relating to lease terminations, lease defaults, or changes in the financial condition of our tenants, particularly by a significant tenant; risks relating to acquisition and disposition activities; the ability to successfully integrate our operations and employees in connection with the acquisition of Normandy Real Estate Management (“Normandy”); the ability to realize anticipated benefits and synergies of the acquisition of Normandy; the amount of the costs, fees, expenses, and charges related to the acquisition of Normandy; risks associated with our ability to continue to qualify as a real estate investment trust (“REIT”); risks associated with possible cybersecurity attacks against us or any of our tenants; potential liability for uninsured losses and environmental contamination; potential adverse impact of market interest rates on the market price for our securities; and risks associated with our dependence on key personnel whose continued service is not guaranteed. We do not intend to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional risks and uncertainties that may cause actual results to differ from expectation, see our Annual Report on Form 10-K for the year ended December 31, 2019 and subsequently filed periodic reports. On the Cover: 201 California, San Francisco. Supplemental Information - Q4 2019 2

Columbia Property Trust, Inc. Q4 2019 Executive Summary Financial Highlights & Guidance: • For the fourth quarter of 2019, net loss per diluted share was $(0.19) (page 9), Normalized FFO (NFFO)(1) per diluted share was $0.34 (page 11), cash flows from operations were $33.4 million (page 30), Adjusted FFO (AFFO)(1) was $2.6 million (page 11), and same store net operating income (based on cash rents) increased 3.8% (page 12). • For 2019, net income per diluted share was $0.08 (page 9), Normalized FFO (NFFO)(1) per diluted share was $1.50 (page 11), cash flows from operations were $137.4 million (page 30), Adjusted FFO (AFFO)(1) was $104.3 million (page 11), and same store net operating income (based on cash rents) increased 7.6% (page 13). • We are updating 2020 guidance for net income in a range of $0.28 to $0.31 per diluted share, and for NFFO in a range of $1.46 to $1.51. See page 6 for more information regarding our guidance. E Transactional and Operational Highlights: • On January 24, 2020, we acquired Normandy Real Estate Management, a leading developer, operator, and investment manager of office and mixed-use assets in New York; Boston; and Washington, D.C. for $100 million payable in a combination of cash ($13.5 million) and equity (3,264,151 Convertible, Preferred Units with a liquidation preference of $26.50 per unit). • In December 2019, we acquired a 92.5% interest in 101 Franklin Street through a joint venture. 101 Franklin Street is a 16-story, 235,000-square-foot office building in Manhattan that will be fully redeveloped, and was acquired by the joint venture for $205.5 million. We also acquired 201 California Street, a 17-story, 252,000-square-foot office tower in San Francisco that is 99% leased to 34 tenants, for $238.9 million. • In January 2020, we sold Cranberry Woods Drive in Pittsburgh for a gross sale price of $180.0 million. • As of December 31, 2019, our portfolio is 97.1% leased and 96.0% occupied (page 21). We leased 418,000 square feet during the quarter with positive GAAP and cash rent releasing spreads of 52.0% and 20.0%, respectively (page 23), including a renewal lease with Pershing for 330,000 square feet at 95 Columbus in Jersey City. Capital Structure: • As of December 31, 2019, our net debt (2) to real estate asset ratio was 34.8%, with no mortgage debt on any of our consolidated properties (page 16). • During the fourth quarter, we repurchased $33.5 million of common stock (page 5). • We paid quarterly dividends of $0.21 per share ($0.84 annualized), which represents a $0.01 per share, or 5.0%, increase from the prior quarter (page 5). (1) For definitions and reconciliations of these non-GAAP financial metrics see pages 30 - 36. (2) Net debt is calculated by reducing our debt balance for cash on hand. Supplemental Information – Q4 2019 3

Columbia Property Trust, Inc. Company Profile & Investor Contacts Company Overview Columbia Property Trust (NYSE: CXP) creates value through owning, operating and developing Class-A office buildings in high-barrier U.S. office markets, primarily New York, San Francisco, and Washington D.C. Columbia is deeply experienced in transactions, asset management and repositioning, leasing, and property management. It employs these competencies to grow value across its high-quality, well-leased portfolio of 17 operating properties that contain over seven million rentable square feet, as well as three properties under development or redevelopment. Columbia has investment-grade ratings from both Moody’s and S&P Global Ratings. For more information, please visit www.columbia.reit. When evaluating the Company’s performance and capital resources, management considers the financial impact of investments held directly and through subsidiaries. This report includes financial and operating information of our wholly-owned investments, and of our proportional interests in investments owned through consolidated and unconsolidated subsidiaries as appropriate. We calculate Funds From Operations (“FFO”) based on amounts attributable to our common stockholders, which includes earnings from investments owned directly, and our proportional share of earnings from investments owned through consolidated and unconsolidated subsidiaries. We recognize that proportional financial data may not depict all of the legal and economic implications of our interests in partially owned subsidiaries. Executive and Senior Management E. Nelson Mills James A. Fleming Jeffrey K. Gronning Gavin Evans Kevin A. Hoover Chief Executive Officer, Executive Vice President Chief Investment Officer Executive Vice President Executive Vice President President and Director Chief Financial Officer Acquisitions Portfolio Management David T. Cheikin David S. Dowdney Travis W. Feehan Wendy W. Gill Patrick J. Keeley Senior Vice President Senior Vice President Senior Vice President Senior Vice President Senior Vice President Asset Management and West Coast Asset Management Chief Accounting Officer Asset Management Leasing Stephen K. Smith Amy C. Tabb Paul H. Teti Stephen P. Trapp Elka L. Wilson Senior Vice President Senior Vice President Senior Vice President Senior Vice President Senior Vice President Property Management Business Development Asset Management and Construction Corporate Operations Leasing Board of Directors Carmen M. Bowser John L. Dixon David B. Henry Murray J. McCabe E. Nelson Mills Independent Director Independent Director Independent Director Independent Director Chief Executive Officer Chairman President Constance B. Moore Michael S. Robb George W. Sands Thomas G. Wattles Francis X. Wentworth, Jr. Independent Director Independent Director Independent Director Independent Director Non-Independent Director Investor Relations Shareholder Services Corporate Counsel James A. Fleming T 855-347-0042 (toll free) King & Spalding LLP Executive Vice President & Chief Financial Officer F 816-701-7629 1180 Peachtree Street T 404-465-2126 E shareholders@columbia.reit Atlanta, GA 30309 E Jim.Fleming@columbia.reit T 404-572-4600 www.kslaw.com Matt W. Stover Senior Director - Finance & Investor Relations T 404-465-2227 E Matt.Stover@columbia.reit Supplemental Information - Q4 2019 4

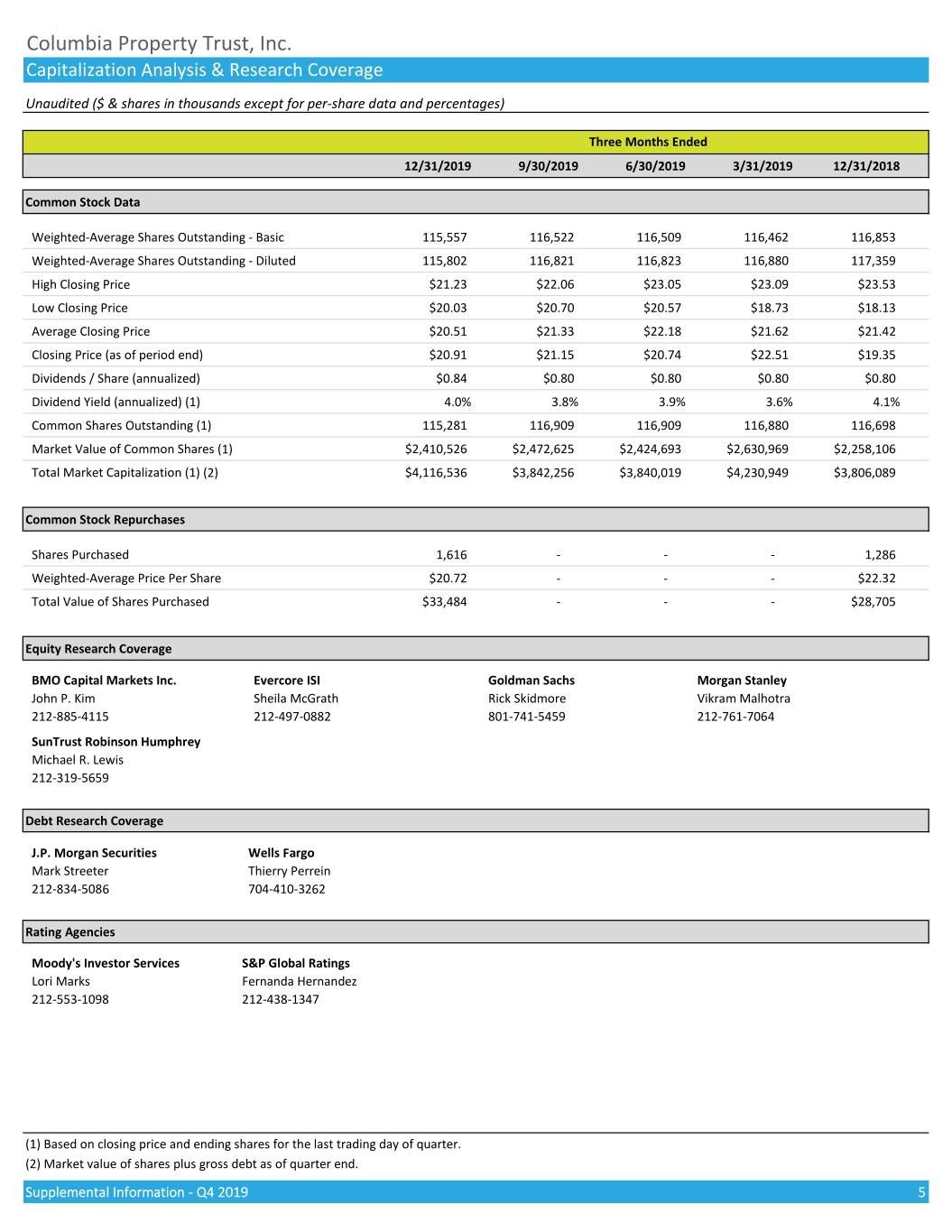

Columbia Property Trust, Inc. Capitalization Analysis & Research Coverage Unaudited ($ & shares in thousands except for per-share data and percentages) Three Months Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Common Stock Data Weighted-Average Shares Outstanding - Basic 115,557 116,522 116,509 116,462 116,853 Weighted-Average Shares Outstanding - Diluted 115,802 116,821 116,823 116,880 117,359 High Closing Price $21.23 $22.06 $23.05 $23.09 $23.53 Low Closing Price $20.03 $20.70 $20.57 $18.73 $18.13 Average Closing Price $20.51 $21.33 $22.18 $21.62 $21.42 Closing Price (as of period end) $20.91 $21.15 $20.74 $22.51 $19.35 Dividends / Share (annualized) $0.84 $0.80 $0.80 $0.80 $0.80 Dividend Yield (annualized) (1) 4.0% 3.8% 3.9% 3.6% 4.1% Common Shares Outstanding (1) 115,281 116,909 116,909 116,880 116,698 Market Value of Common Shares (1) $2,410,526 $2,472,625 $2,424,693 $2,630,969 $2,258,106 Total Market Capitalization (1) (2) $4,116,536 $3,842,256 $3,840,019 $4,230,949 $3,806,089 Common Stock Repurchases Shares Purchased 1,616 - - - 1,286 Weighted-Average Price Per Share $20.72 - - - $22.32 Total Value of Shares Purchased $33,484 - - - $28,705 Equity Research Coverage BMO Capital Markets Inc. Evercore ISI Goldman Sachs Morgan Stanley John P. Kim Sheila McGrath Rick Skidmore Vikram Malhotra 212-885-4115 212-497-0882 801-741-5459 212-761-7064 SunTrust Robinson Humphrey Michael R. Lewis 212-319-5659 Debt Research Coverage J.P. Morgan Securities Wells Fargo Mark Streeter Thierry Perrein 212-834-5086 704-410-3262 Rating Agencies Moody's Investor Services S&P Global Ratings Lori Marks Fernanda Hernandez 212-553-1098 212-438-1347 (1) Based on closing price and ending shares for the last trading day of quarter. (2) Market value of shares plus gross debt as of quarter end. Supplemental Information - Q4 2019 5

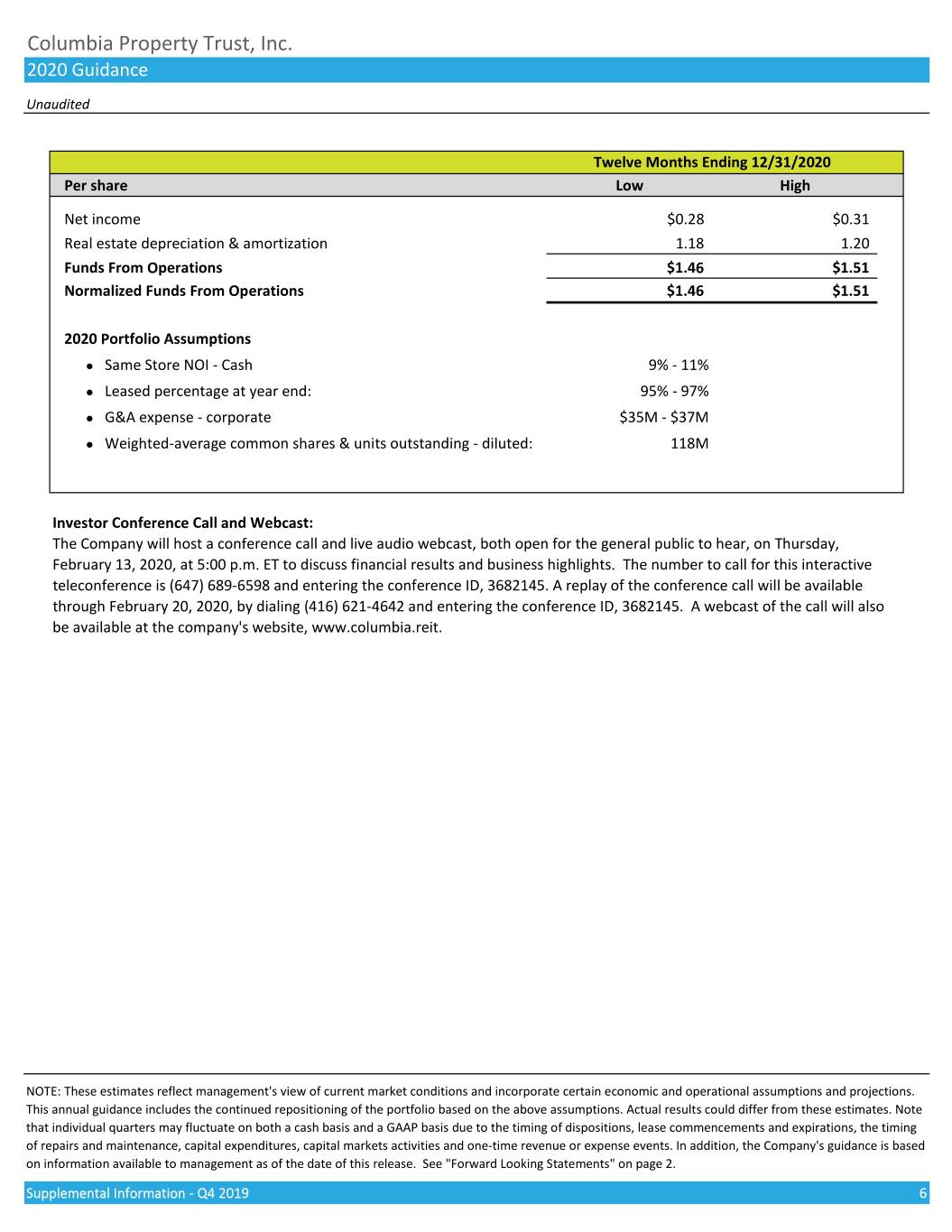

Columbia Property Trust, Inc. 2020 Guidance Unaudited Twelve Months Ending 12/31/2020 Per share Low High Net income $0.28 $0.31 Real estate depreciation & amortization 1.18 1.20 Funds From Operations $1.46 $1.51 Normalized Funds From Operations $1.46 $1.51 2020 Portfolio Assumptions l Same Store NOI - Cash 9% - 11% l Leased percentage at year end: 95% - 97% l G&A expense - corporate $35M - $37M l Weighted-average common shares & units outstanding - diluted: 118M Investor Conference Call and Webcast: The Company will host a conference call and live audio webcast, both open for the general public to hear, on Thursday, February 13, 2020, at 5:00 p.m. ET to discuss financial results and business highlights. The number to call for this interactive teleconference is (647) 689-6598 and entering the conference ID, 3682145. A replay of the conference call will be available through February 20, 2020, by dialing (416) 621-4642 and entering the conference ID, 3682145. A webcast of the call will also be available at the company's website, www.columbia.reit. NOTE: These estimates reflect management's view of current market conditions and incorporate certain economic and operational assumptions and projections. This annual guidance includes the continued repositioning of the portfolio based on the above assumptions. Actual results could differ from these estimates. Note that individual quarters may fluctuate on both a cash basis and a GAAP basis due to the timing of dispositions, lease commencements and expirations, the timing of repairs and maintenance, capital expenditures, capital markets activities and one-time revenue or expense events. In addition, the Company's guidance is based on information available to management as of the date of this release. See "Forward Looking Statements" on page 2. Supplemental Information - Q4 2019 6

Columbia Property Trust, Inc. Consolidated Balance Sheet - GAAP Unaudited (in thousands) As of Period End 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Assets: Real estate assets, at cost: Land (1) $ 870,352 $ 803,986 $ 803,986 $ 803,986 $ 817,975 Buildings and improvements (1) 2,000,455 1,937,772 2,180,244 2,167,907 2,313,396 Buildings and improvements, accumulated depreciation (281,248) (344,037) (395,250) (375,981) (403,355) Intangible lease asset 119,684 107,069 138,888 139,057 183,421 Intangible lease asset, accumulated amortization (58,659) (56,343) (78,234) (74,807) (84,881) Construction in progress (1) 53,621 33,663 39,893 37,772 33,800 Real estate assets held for sale 295,499 - - 202,294 - Real estate assets held for sale, accumulated depreciation (80,543) - - (56,948) - Total real estate assets $ 2,919,161 $ 2,482,110 $ 2,689,527 $ 2,843,280 $ 2,860,356 Operating lease assets 29,470 29,710 63,563 63,829 - Investment in unconsolidated joint ventures (page 8) 1,054,460 1,058,570 1,064,648 1,067,905 1,071,353 Cash and cash equivalents 12,303 147,485 11,981 18,551 17,118 Tenant receivables, net of allowance for doubtful accounts 2,464 2,474 2,904 3,760 3,258 Straight line rent receivable 77,330 87,076 87,190 83,828 87,159 Prepaid expenses and other assets 21,484 33,404 37,420 31,520 23,218 Intangible lease origination costs 61,702 56,147 91,744 91,812 99,440 Intangible lease origination costs, accumulated amortization (33,731) (32,630) (62,124) (60,186) (65,348) Deferred lease costs 93,117 86,520 81,792 81,257 105,174 Deferred lease costs, accumulated amortization (16,732) (25,065) (23,850) (22,325) (27,735) Other assets held for sale 34,139 - - 34,091 - Other assets held for sale, accumulated amortization (10,222) - - (13,593) - Total assets $ 4,244,945 $ 3,925,801 $ 4,044,795 $ 4,223,729 $ 4,173,993 Liabilities: Line of credit and notes payable $ 784,000 $ 450,000 $ 497,000 $ 683,000 $ 632,000 Bonds payable 700,000 700,000 700,000 700,000 700,000 Discount and fees on notes and bonds payable (6,760) (7,110) (7,461) (7,808) (8,154) Operating lease liabilities 2,186 2,335 34,684 34,738 - Accounts payable, accrued expenses, and accrued capital 70,845 53,281 43,403 37,962 49,117 expenditures Distributions payable 24,209 - - - 23,340 Deferred income 16,955 14,772 16,296 16,943 15,593 Intangible lease liabilities 36,966 28,902 42,350 42,351 42,847 Intangible lease liabilities, accumulated amortization (15,127) (13,913) (24,208) (22,812) (21,766) Liabilities held for sale 3,054 - - 20,871 - Liabilities held for sale, accumulated amortization - - - (380) - Total liabilities $ 1,616,328 $ 1,228,267 $ 1,302,064 $ 1,504,865 $ 1,432,977 Equity: Common stock $ 1,153 $ 1,169 $ 1,169 $ 1,169 $ 1,167 Additional paid in capital 4,392,322 4,424,372 4,422,833 4,420,727 4,421,587 Cumulative distributions in excess of earnings (1,769,234) (1,723,248) (1,679,580) (1,703,945) (1,684,082) Other comprehensive loss (1,101) (4,759) (1,691) 913 2,344 Total Columbia Property Trust, Inc. stockholders' equity $ 2,623,140 $ 2,697,534 $ 2,742,731 $ 2,718,864 $ 2,741,016 Noncontrolling interest in consolidated joint venture 5,477 - - - - Total equity $ 2,628,617 $ 2,697,534 $ 2,742,731 $ 2,718,864 $ 2,741,016 Total liabilities and equity $ 4,244,945 $ 3,925,801 $ 4,044,795 $ 4,223,729 $ 4,173,993 (1) As of December 31, 2019, the following amounts relate to the redevelopment of the 149 Madison and 101 Franklin, respectively: $59.1 million and $57.1 million in land, $29.0 million and $149.4 million in buildings and improvements, and $22.4 million and $2.3 million in construction in progress. Supplemental Information - Q4 2019 7

Columbia Property Trust, Inc. Elements of Pro-Rata Balance Sheet - CXP's Interest in Unconsolidated Joint Ventures (1) Unaudited (in thousands) As of Period End 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Assets: Real estate assets, at cost: Land (2) $ 297,785 $ 297,785 $ 297,785 $ 297,785 $ 297,785 Buildings and improvements 778,459 777,709 775,829 771,200 769,984 Buildings and improvements, accumulated depreciation (79,491) (73,365) (67,071) (60,705) (54,440) Intangible lease asset 41,944 41,944 41,944 41,944 43,163 Intangible lease asset, accumulated amortization (13,716) (12,483) (11,249) (10,014) (9,694) Construction in progress (2) 29,291 24,408 18,807 16,795 12,965 Total real estate assets $ 1,054,272 $ 1,055,998 $ 1,056,045 $ 1,057,005 $ 1,059,763 Operating lease assets 59,746 60,577 61,407 62,237 - Cash and cash equivalents 23,755 20,994 23,453 22,815 23,666 Tenant receivables, net of allowance for doubtful accounts 1,473 1,315 866 1,231 911 Straight line rent receivable 22,456 21,778 20,913 20,327 19,437 Prepaid expenses and other assets 4,314 3,627 4,962 2,941 4,008 Intangible lease origination costs 30,240 30,240 30,240 30,240 30,423 Intangible lease origination costs, accumulated amortization (9,821) (8,988) (8,155) (7,321) (6,593) Deferred lease costs 23,825 23,332 22,659 21,953 21,271 Deferred lease costs, accumulated amortization (7,151) (6,568) (6,035) (5,440) (4,960) Total assets $ 1,203,109 $ 1,202,305 $ 1,206,355 $ 1,205,988 $ 1,147,926 Liabilities: Line of credit and notes payable $ 222,010 $ 219,631 $ 218,326 $ 216,980 $ 215,983 Fees on notes payable (1,816) (2,069) (2,322) (2,574) (2,827) Operating lease liabilities 166,615 166,046 165,476 164,907 - Accounts payable, accrued expenses, and accrued capital 13,392 12,710 12,992 12,142 36,163 expenditures Deferred income 6,276 4,859 4,332 3,388 4,311 Intangible lease liabilities 34,177 34,177 34,177 34,177 116,422 Intangible lease liabilities, accumulated amortization (12,721) (11,724) (10,727) (9,730) (11,441) Total liabilities $ 427,933 $ 423,630 $ 422,254 $ 419,290 $ 358,611 Total equity $ 775,176 $ 778,675 $ 784,101 $ 786,698 $ 789,315 Total equity $ 775,176 $ 778,675 $ 784,101 $ 786,698 $ 789,315 Basis differences, net of $9,864 of accumulated amortization (3) 279,284 279,895 280,547 281,207 282,038 Investment in unconsolidated joint ventures (page 7) $ 1,054,460 $ 1,058,570 $ 1,064,648 $ 1,067,905 $ 1,071,353 $ - (1) Reflects CXP's ownership share of assets and liabilities for properties held in unconsolidated joint ventures (see page 19). (2) As of December 31, 2019, the following amounts relate to the development of the 799 Broadway property: $72.6 million in land and $25.8 million in construction in progress. (3) Reflects differences between historical costs recorded at the joint venture level and CXP's investment in the joint ventures. Basis differences result from differences in the timing of acquisition of interests in the joint venture, and formation costs incurred by CXP, and are amortized to income (loss) from unconsolidated joint ventures over the life of the related asset or liability. Supplemental Information - Q4 2019 8

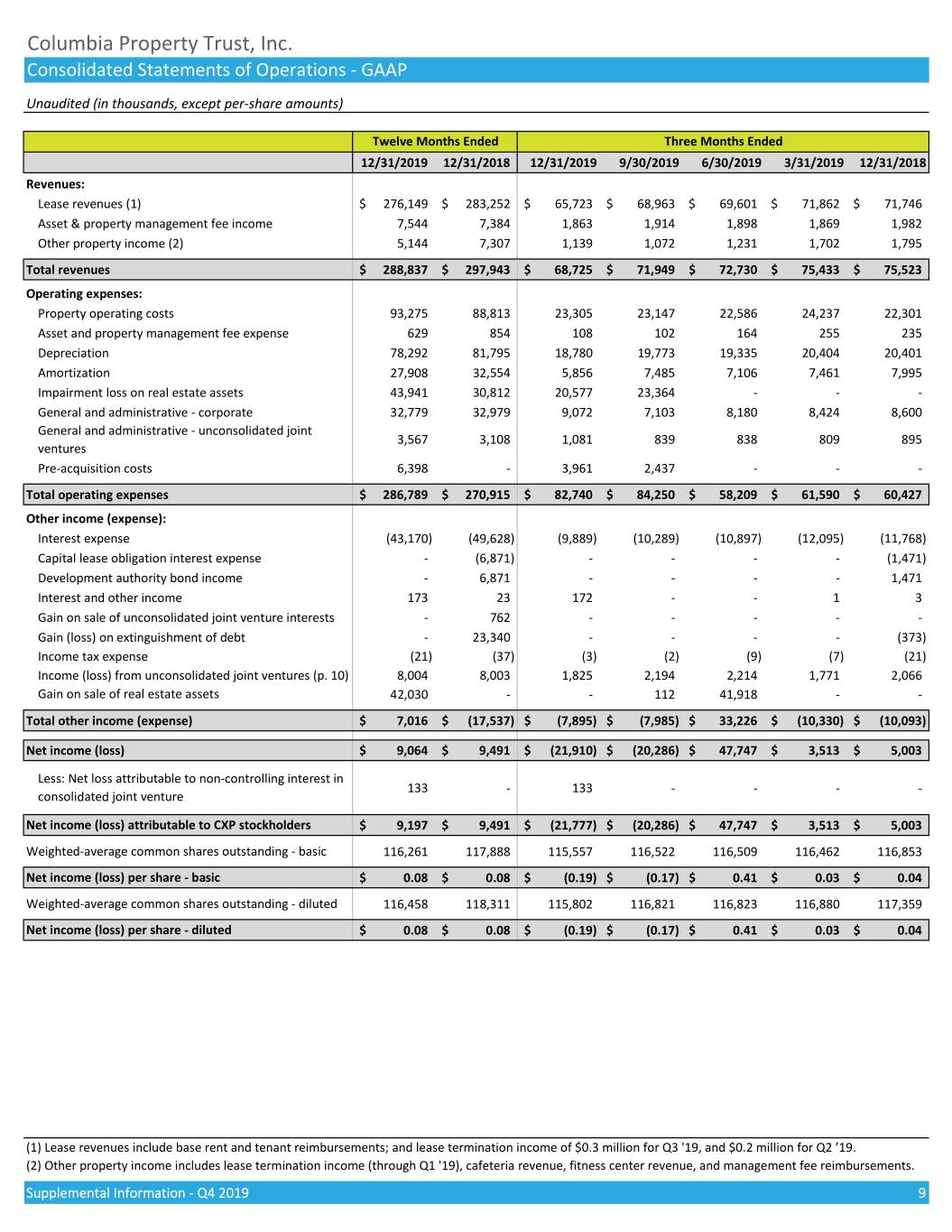

Columbia Property Trust, Inc. Consolidated Statements of Operations - GAAP Unaudited (in thousands, except per-share amounts) Twelve Months Ended Three Months Ended 12/31/2019 12/31/2018 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Revenues: Lease revenues (1) $ 276,149 $ 283,252 $ 65,723 $ 68,963 $ 69,601 $ 71,862 $ 71,746 Asset & property management fee income 7,544 7,384 1,863 1,914 1,898 1,869 1,982 Other property income (2) 5,144 7,307 1,139 1,072 1,231 1,702 1,795 Total revenues $ 288,837 $ 297,943 $ 68,725 $ 71,949 $ 72,730 $ 75,433 $ 75,523 Operating expenses: Property operating costs 93,275 88,813 23,305 23,147 22,586 24,237 22,301 Asset and property management fee expense 629 854 108 102 164 255 235 Depreciation 78,292 81,795 18,780 19,773 19,335 20,404 20,401 Amortization 27,908 32,554 5,856 7,485 7,106 7,461 7,995 Impairment loss on real estate assets 43,941 30,812 20,577 23,364 - - - General and administrative - corporate 32,779 32,979 9,072 7,103 8,180 8,424 8,600 General and administrative - unconsolidated joint 3,567 3,108 1,081 839 838 809 895 ventures Pre-acquisition costs 6,398 - 3,961 2,437 - - - Total operating expenses $ 286,789 $ 270,915 $ 82,740 $ 84,250 $ 58,209 $ 61,590 $ 60,427 Other income (expense): Interest expense (43,170) (49,628) (9,889) (10,289) (10,897) (12,095) (11,768) Capital lease obligation interest expense - (6,871) - - - - (1,471) Development authority bond income - 6,871 - - - - 1,471 Interest and other income 173 23 172 - - 1 3 Gain on sale of unconsolidated joint venture interests - 762 - - - - - Gain (loss) on extinguishment of debt - 23,340 - - - - (373) Income tax expense (21) (37) (3) (2) (9) (7) (21) Income (loss) from unconsolidated joint ventures (p. 10) 8,004 8,003 1,825 2,194 2,214 1,771 2,066 Gain on sale of real estate assets 42,030 - - 112 41,918 - - Total other income (expense) $ 7,016 $ (17,537) $ (7,895) $ (7,985) $ 33,226 $ (10,330) $ (10,093) Net income (loss) $ 9,064 $ 9,491 $ (21,910) $ (20,286) $ 47,747 $ 3,513 $ 5,003 Less: Net loss attributable to non-controlling interest in 133 - 133 - - - - consolidated joint venture Net income (loss) attributable to CXP stockholders $ 9,197 $ 9,491 $ (21,777) $ (20,286) $ 47,747 $ 3,513 $ 5,003 Weighted-average common shares outstanding - basic 116,261 117,888 115,557 116,522 116,509 116,462 116,853 Net income (loss) per share - basic $ 0.08 $ 0.08 $ (0.19) $ (0.17) $ 0.41 $ 0.03 $ 0.04 Weighted-average common shares outstanding - diluted 116,458 118,311 115,802 116,821 116,823 116,880 117,359 Net income (loss) per share - diluted $ 0.08 $ 0.08 $ (0.19) $ (0.17) $ 0.41 $ 0.03 $ 0.04 (1) Lease revenues include base rent and tenant reimbursements; and lease termination income of $0.3 million for Q3 '19, and $0.2 million for Q2 ’19. (2) Other property income includes lease termination income (through Q1 '19), cafeteria revenue, fitness center revenue, and management fee reimbursements. Supplemental Information - Q4 2019 9

Columbia Property Trust, Inc. Elements of Pro-Rata Statement of Operations - CXP's Interest in Unconsolidated Joint Ventures (1) Unaudited (in thousands, except per-share amounts) Twelve Months Ended Three Months Ended 12/31/2019 12/31/2018 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Revenues: Lease revenues (2) $ 114,944 $ 112,391 $ 29,080 $ 28,727 $ 28,592 $ 28,545 $ 28,441 Other property income (3) - 132 - - - - 68 Total revenues $ 114,944 $ 112,523 $ 29,080 $ 28,727 $ 28,592 $ 28,545 $ 28,509 Operating expenses: Property operating costs 45,026 41,617 11,822 11,166 11,134 10,904 10,797 Asset and property management fee expense 4,288 4,179 1,079 1,066 1,075 1,068 1,049 Depreciation 34,196 33,543 8,607 8,548 8,492 8,549 8,442 Amortization 16,421 17,842 4,006 4,026 4,010 4,379 4,228 General and administrative 292 578 80 77 26 109 270 Total operating expenses $ 100,223 $ 97,759 $ 25,594 $ 24,883 $ 24,737 $ 25,009 $ 24,786 Other income (expense): Interest expense (6,836) (6,838) (1,709) (1,709) (1,709) (1,709) (1,709) Loss on interest rate cap (124) - (1) (4) (2) (117) - Interest and other income 268 102 56 70 74 68 59 Total other income (expense) $ (6,692) $ (6,736) $ (1,654) $ (1,643) $ (1,637) $ (1,758) $ (1,650) Income (loss) before income tax expense $ 8,029 $ 8,028 $ 1,832 $ 2,201 $ 2,218 $ 1,778 $ 2,073 Income tax benefit (expense) (25) (25) (7) (7) (4) (7) (7) Income (loss) from unconsolidated joint ventures $ 8,004 $ 8,003 $ 1,825 $ 2,194 $ 2,214 $ 1,771 $ 2,066 (1) Reflects CXP's ownership share of revenues, expenses and amortization of basis differences (see page 8, footnote 3) for properties held in unconsolidated joint ventures (see page 19). (2) Lease revenues include base rent and tenant reimbursements. (3) Other property income includes lease termination income (through Q1 '19), cafeteria revenue, fitness center revenue, and management fee reimbursements. Supplemental Information - Q4 2019 10

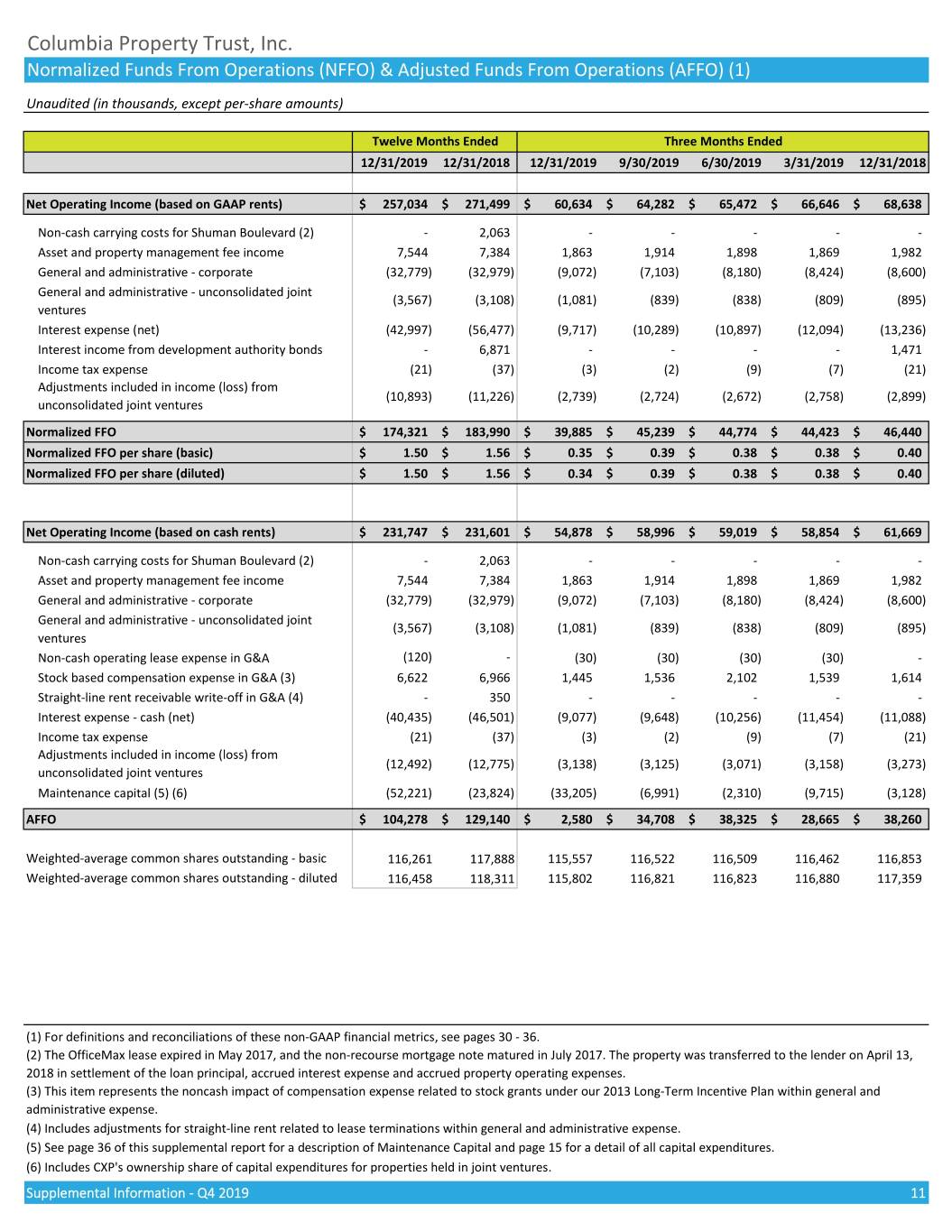

Columbia Property Trust, Inc. Normalized Funds From Operations (NFFO) & Adjusted Funds From Operations (AFFO) (1) Unaudited (in thousands, except per-share amounts) Twelve Months Ended Three Months Ended 12/31/2019 12/31/2018 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Net Operating Income (based on GAAP rents) $ 257,034 $ 271,499 $ 60,634 $ 64,282 $ 65,472 $ 66,646 $ 68,638 Non-cash carrying costs for Shuman Boulevard (2) - 2,063 - - - - - Asset and property management fee income 7,544 7,384 1,863 1,914 1,898 1,869 1,982 General and administrative - corporate (32,779) (32,979) (9,072) (7,103) (8,180) (8,424) (8,600) General and administrative - unconsolidated joint (3,567) (3,108) (1,081) (839) (838) (809) (895) ventures Interest expense (net) (42,997) (56,477) (9,717) (10,289) (10,897) (12,094) (13,236) Interest income from development authority bonds - 6,871 - - - - 1,471 Income tax expense (21) (37) (3) (2) (9) (7) (21) Adjustments included in income (loss) from (10,893) (11,226) (2,739) (2,724) (2,672) (2,758) (2,899) unconsolidated joint ventures Normalized FFO $ 174,321 $ 183,990 $ 39,885 $ 45,239 $ 44,774 $ 44,423 $ 46,440 Normalized FFO per share (basic) $ 1.50 $ 1.56 $ 0.35 $ 0.39 $ 0.38 $ 0.38 $ 0.40 Normalized FFO per share (diluted) $ 1.50 $ 1.56 $ 0.34 $ 0.39 $ 0.38 $ 0.38 $ 0.40 Net Operating Income (based on cash rents) $ 231,747 $ 231,601 $ 54,878 $ 58,996 $ 59,019 $ 58,854 $ 61,669 Non-cash carrying costs for Shuman Boulevard (2) - 2,063 - - - - - Asset and property management fee income 7,544 7,384 1,863 1,914 1,898 1,869 1,982 General and administrative - corporate (32,779) (32,979) (9,072) (7,103) (8,180) (8,424) (8,600) General and administrative - unconsolidated joint (3,567) (3,108) (1,081) (839) (838) (809) (895) ventures Non-cash operating lease expense in G&A (120) - (30) (30) (30) (30) - Stock based compensation expense in G&A (3) 6,622 6,966 1,445 1,536 2,102 1,539 1,614 Straight-line rent receivable write-off in G&A (4) - 350 - - - - - Interest expense - cash (net) (40,435) (46,501) (9,077) (9,648) (10,256) (11,454) (11,088) Income tax expense (21) (37) (3) (2) (9) (7) (21) Adjustments included in income (loss) from (12,492) (12,775) (3,138) (3,125) (3,071) (3,158) (3,273) unconsolidated joint ventures Maintenance capital (5) (6) (52,221) (23,824) (33,205) (6,991) (2,310) (9,715) (3,128) AFFO $ 104,278 $ 129,140 $ 2,580 $ 34,708 $ 38,325 $ 28,665 $ 38,260 Weighted-average common shares outstanding - basic 116,261 117,888 115,557 116,522 116,509 116,462 116,853 Weighted-average common shares outstanding - diluted 116,458 118,311 115,802 116,821 116,823 116,880 117,359 (1) For definitions and reconciliations of these non-GAAP financial metrics, see pages 30 - 36. (2) The OfficeMax lease expired in May 2017, and the non-recourse mortgage note matured in July 2017. The property was transferred to the lender on April 13, 2018 in settlement of the loan principal, accrued interest expense and accrued property operating expenses. (3) This item represents the noncash impact of compensation expense related to stock grants under our 2013 Long-Term Incentive Plan within general and administrative expense. (4) Includes adjustments for straight-line rent related to lease terminations within general and administrative expense. (5) See page 36 of this supplemental report for a description of Maintenance Capital and page 15 for a detail of all capital expenditures. (6) Includes CXP's ownership share of capital expenditures for properties held in joint ventures. Supplemental Information - Q4 2019 11

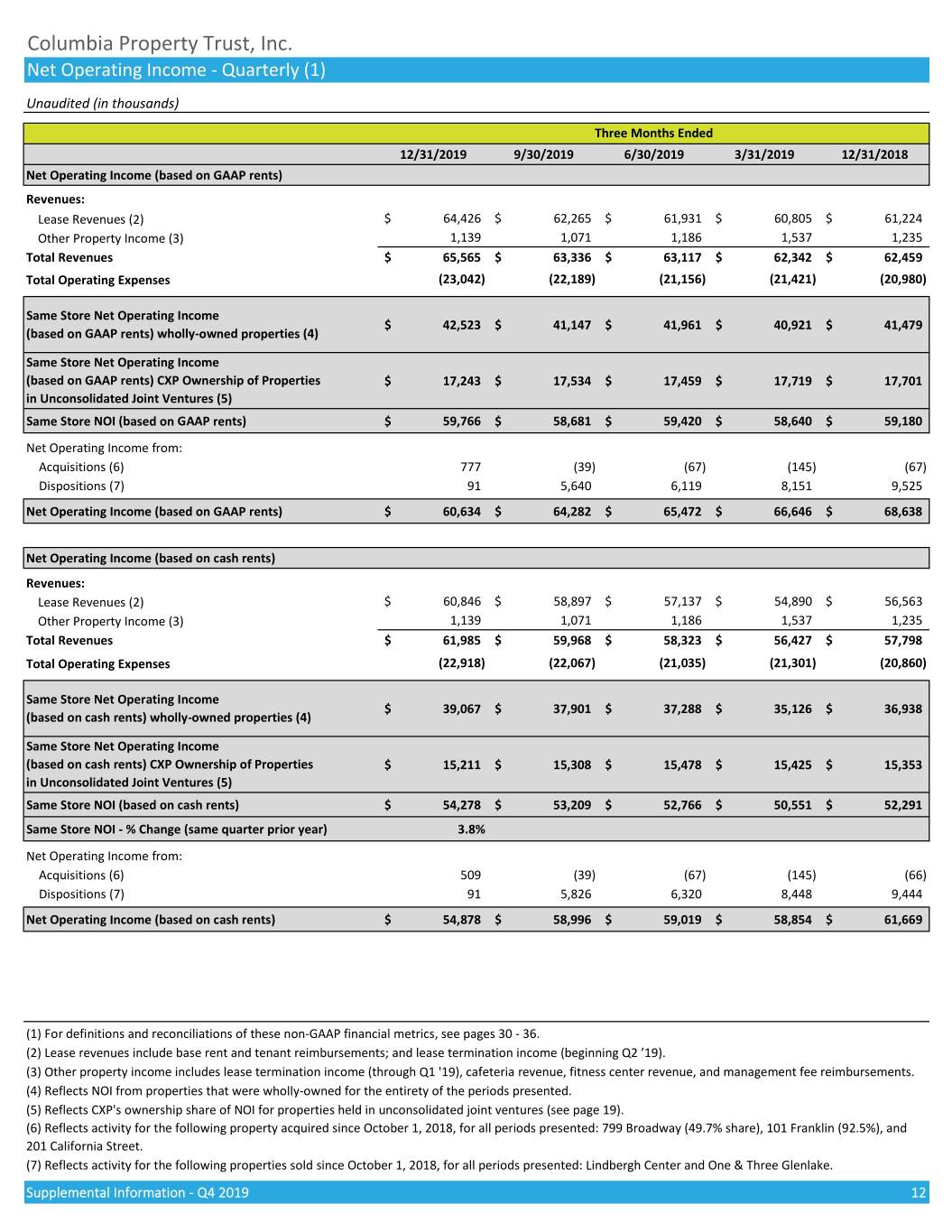

Columbia Property Trust, Inc. Net Operating Income - Quarterly (1) Unaudited (in thousands) Three Months Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Net Operating Income (based on GAAP rents) Revenues: Lease Revenues (2) $ 64,426 $ 62,265 $ 61,931 $ 60,805 $ 61,224 Other Property Income (3) 1,139 1,071 1,186 1,537 1,235 Total Revenues $ 65,565 $ 63,336 $ 63,117 $ 62,342 $ 62,459 Total Operating Expenses (23,042) (22,189) (21,156) (21,421) (20,980) Same Store Net Operating Income $ 42,523 $ 41,147 $ 41,961 $ 40,921 $ 41,479 (based on GAAP rents) wholly-owned properties (4) Same Store Net Operating Income (based on GAAP rents) CXP Ownership of Properties $ 17,243 $ 17,534 $ 17,459 $ 17,719 $ 17,701 in Unconsolidated Joint Ventures (5) Same Store NOI (based on GAAP rents) $ 59,766 $ 58,681 $ 59,420 $ 58,640 $ 59,180 Net Operating Income from: Acquisitions (6) 777 (39) (67) (145) (67) Dispositions (7) 91 5,640 6,119 8,151 9,525 Net Operating Income (based on GAAP rents) $ 60,634 $ 64,282 $ 65,472 $ 66,646 $ 68,638 Net Operating Income (based on cash rents) Revenues: Lease Revenues (2) $ 60,846 $ 58,897 $ 57,137 $ 54,890 $ 56,563 Other Property Income (3) 1,139 1,071 1,186 1,537 1,235 Total Revenues $ 61,985 $ 59,968 $ 58,323 $ 56,427 $ 57,798 Total Operating Expenses (22,918) (22,067) (21,035) (21,301) (20,860) Same Store Net Operating Income $ 39,067 $ 37,901 $ 37,288 $ 35,126 $ 36,938 (based on cash rents) wholly-owned properties (4) Same Store Net Operating Income (based on cash rents) CXP Ownership of Properties $ 15,211 $ 15,308 $ 15,478 $ 15,425 $ 15,353 in Unconsolidated Joint Ventures (5) Same Store NOI (based on cash rents) $ 54,278 $ 53,209 $ 52,766 $ 50,551 $ 52,291 Same Store NOI - % Change (same quarter prior year) 3.8% Net Operating Income from: Acquisitions (6) 509 (39) (67) (145) (66) Dispositions (7) 91 5,826 6,320 8,448 9,444 Net Operating Income (based on cash rents) $ 54,878 $ 58,996 $ 59,019 $ 58,854 $ 61,669 (1) For definitions and reconciliations of these non-GAAP financial metrics, see pages 30 - 36. (2) Lease revenues include base rent and tenant reimbursements; and lease termination income (beginning Q2 ’19). (3) Other property income includes lease termination income (through Q1 '19), cafeteria revenue, fitness center revenue, and management fee reimbursements. (4) Reflects NOI from properties that were wholly-owned for the entirety of the periods presented. (5) Reflects CXP's ownership share of NOI for properties held in unconsolidated joint ventures (see page 19). (6) Reflects activity for the following property acquired since October 1, 2018, for all periods presented: 799 Broadway (49.7% share), 101 Franklin (92.5%), and 201 California Street. (7) Reflects activity for the following properties sold since October 1, 2018, for all periods presented: Lindbergh Center and One & Three Glenlake. Supplemental Information - Q4 2019 12

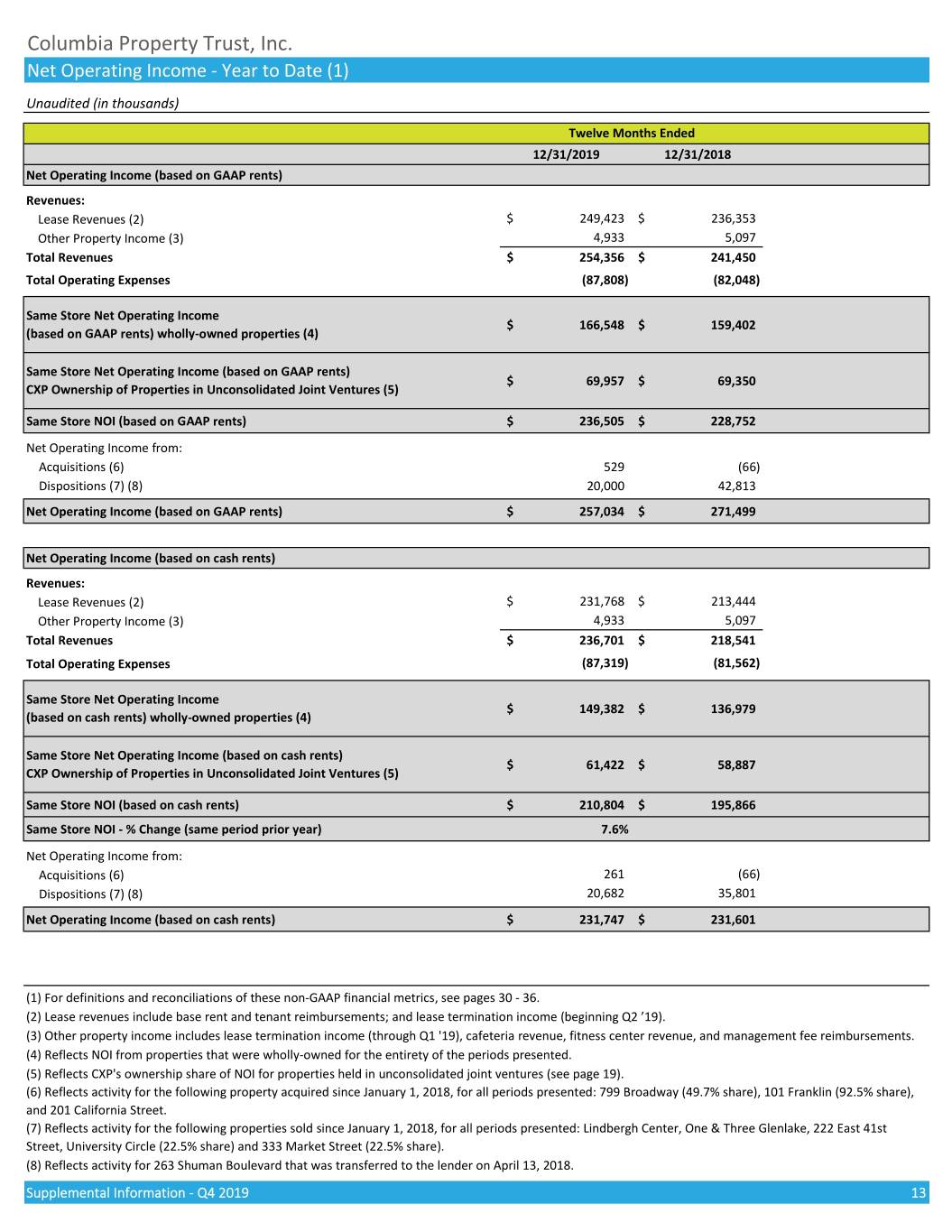

Columbia Property Trust, Inc. Net Operating Income - Year to Date (1) Unaudited (in thousands) Twelve Months Ended 12/31/2019 12/31/2018 Net Operating Income (based on GAAP rents) Revenues: Lease Revenues (2) $ 249,423 $ 236,353 Other Property Income (3) 4,933 5,097 Total Revenues $ 254,356 $ 241,450 Total Operating Expenses (87,808) (82,048) Same Store Net Operating Income $ 166,548 $ 159,402 (based on GAAP rents) wholly-owned properties (4) Same Store Net Operating Income (based on GAAP rents) $ 69,957 $ 69,350 CXP Ownership of Properties in Unconsolidated Joint Ventures (5) Same Store NOI (based on GAAP rents) $ 236,505 $ 228,752 Net Operating Income from: Acquisitions (6) 529 (66) Dispositions (7) (8) 20,000 42,813 Net Operating Income (based on GAAP rents) $ 257,034 $ 271,499 Net Operating Income (based on cash rents) Revenues: Lease Revenues (2) $ 231,768 $ 213,444 Other Property Income (3) 4,933 5,097 Total Revenues $ 236,701 $ 218,541 Total Operating Expenses (87,319) (81,562) Same Store Net Operating Income $ 149,382 $ 136,979 (based on cash rents) wholly-owned properties (4) Same Store Net Operating Income (based on cash rents) $ 61,422 $ 58,887 CXP Ownership of Properties in Unconsolidated Joint Ventures (5) Same Store NOI (based on cash rents) $ 210,804 $ 195,866 Same Store NOI - % Change (same period prior year) 7.6% Net Operating Income from: Acquisitions (6) 261 (66) Dispositions (7) (8) 20,682 35,801 Net Operating Income (based on cash rents) $ 231,747 $ 231,601 (1) For definitions and reconciliations of these non-GAAP financial metrics, see pages 30 - 36. (2) Lease revenues include base rent and tenant reimbursements; and lease termination income (beginning Q2 ’19). (3) Other property income includes lease termination income (through Q1 '19), cafeteria revenue, fitness center revenue, and management fee reimbursements. (4) Reflects NOI from properties that were wholly-owned for the entirety of the periods presented. (5) Reflects CXP's ownership share of NOI for properties held in unconsolidated joint ventures (see page 19). (6) Reflects activity for the following property acquired since January 1, 2018, for all periods presented: 799 Broadway (49.7% share), 101 Franklin (92.5% share), and 201 California Street. (7) Reflects activity for the following properties sold since January 1, 2018, for all periods presented: Lindbergh Center, One & Three Glenlake, 222 East 41st Street, University Circle (22.5% share) and 333 Market Street (22.5% share). (8) Reflects activity for 263 Shuman Boulevard that was transferred to the lender on April 13, 2018. Supplemental Information - Q4 2019 13

Columbia Property Trust, Inc. Third-Party Management Income Unaudited (in thousands) Income earned from managing the following properties, in which CXP owns interests through unconsolidated joint ventures at the following percentages as of 12/31/19: Market Square - 51%, University Circle - 55%, 333 Market Street - 55% and 1800 M Street - 55%. Twelve Months Ended Three Months Ended 12/31/2019 12/31/2018 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 JV Total: Asset and property management fee income (page 9) (1) $ 7,544 $ 7,384 $ 1,863 1,914 1,898 1,869 1,982 General and administrative - unconsolidated joint (3,567) (3,108) (1,081) (839) (838) (809) (895) ventures (page 9) Subtotal $ 3,977 $ 4,276 $ 782 $ 1,075 $ 1,060 $ 1,060 $ 1,087 Less CXP Share: Asset and property management fee income $ 4,066 $ 3,987 $ 1,003 $ 1,033 $ 1,023 $ 1,008 $ 1,070 General and administrative - unconsolidated joint (1,890) (1,689) (573) (443) (440) (434) (480) ventures Subtotal $ 2,176 $ 2,298 $ 430 $ 590 $ 583 $ 574 $ 590 JV Partner's Share: Asset and property management fee income $ 3,478 $ 3,397 $ 860 $ 881 $ 875 $ 861 $ 912 General and administrative - unconsolidated joint (1,677) (1,419) (508) (396) (398) (375) (415) ventures Total - Third-Party Management Income $ 1,801 $ 1,978 $ 352 $ 485 $ 477 $ 486 $ 497 (1) Includes non-recurring leasing fees. Supplemental Information - Q4 2019 14

Columbia Property Trust, Inc. Capital Expenditure Summary (1) Unaudited ($ in thousands) Capital Expenditures Three Months Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Maintenance Building Capital $ 1,974 $ 1,701 $ 1,626 $ 997 $ 2,548 Tenant Improvements 2,991 973 182 13,563 (2) (2,150) Leasing Commissions 15,632 2,223 425 489 2,841 Other Leasing Costs (3) 12,608 2,094 77 (5,334) (111) Total - Maintenance $ 33,205 $ 6,991 $ 2,310 $ 9,715 $ 3,128 Investment Building Capital $ 5,690 $ 3,537 $ 5,685 $ 4,451 $ 3,548 Tenant Improvements 6,706 4,737 7,996 4,740 6,229 Leasing Commissions 229 1,794 1,058 1,047 7,749 Other Leasing Costs (3) (290) 838 (63) 450 (85) Development Projects (see page 29) 149 Madison Avenue (4) 5,709 4,857 1,665 2,204 5,366 799 Broadway (5) 4,644 5,732 3,932 2,933 6,119 101 Franklin 2,194 - - - - Total - Investment $ 24,882 $ 21,495 $ 20,273 $ 15,825 $ 28,926 Maintenance & Investment Building Capital $ 7,664 $ 5,238 $ 7,311 $ 5,448 $ 6,096 Tenant Improvements 9,697 5,710 8,178 18,303 4,079 Leasing Commissions 15,861 4,017 1,483 1,536 10,590 Other Leasing Costs (3) 12,318 2,932 14 (4,884) (196) Development Projects 12,547 10,589 5,597 5,137 11,485 Total - Maintenance & Investment $ 58,087 $ 28,486 $ 22,583 $ 25,540 $ 32,054 (1) Includes CXP's ownership share of capital expenditures for properties held in joint ventures. (2) Excludes $13.4 million of accrued tenant improvements that reduced the sale price of Glenlake Parkway, which was sold on April 15, 2019. (3) Tenant allowances that cover soft costs are accrued as Other Leasing Costs at lease execution. If used to fund hard costs, they are reclassified to Tenant Improvements as incurred. (4) Amounts include capitalized interest of $0.9 million, $0.9 million, $0.9 million, $0.8 million, and $0.9 million, respectively. (5) Amounts include capitalized interest of $1.1 million, $1.1 million, $1.1 million, $1.0 million and $1.2 million, respectively. NOTE: See page 36 of this supplemental report for a description of Maintenance and Investment Capital. Supplemental Information - Q4 2019 15

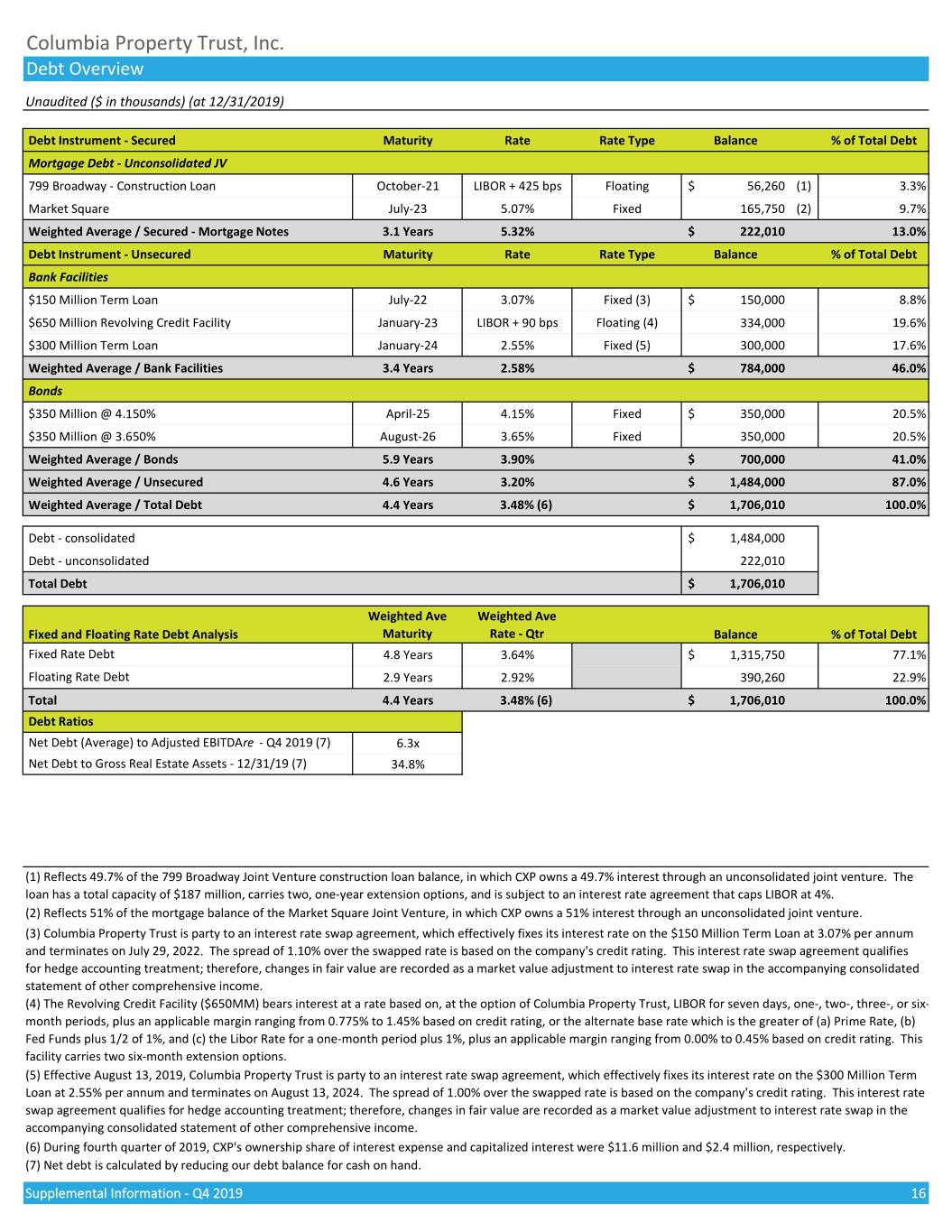

Columbia Property Trust, Inc. Debt Overview Unaudited ($ in thousands) (at 12/31/2019) Debt Instrument - Secured Maturity Rate Rate Type Balance % of Total Debt Mortgage Debt - Unconsolidated JV 799 Broadway - Construction Loan October-21 LIBOR + 425 bps Floating $ 56,260 (1) 3.3% Market Square July-23 5.07% Fixed 165,750 (2) 9.7% Weighted Average / Secured - Mortgage Notes 3.1 Years 5.32% $ 222,010 13.0% Debt Instrument - Unsecured Maturity Rate Rate Type Balance % of Total Debt Bank Facilities $150 Million Term Loan July-22 3.07% Fixed (3) $ 150,000 8.8% $650 Million Revolving Credit Facility January-23 LIBOR + 90 bps Floating (4) 334,000 19.6% $300 Million Term Loan January-24 2.55% Fixed (5) 300,000 17.6% Weighted Average / Bank Facilities 3.4 Years 2.58% $ 784,000 46.0% Bonds $350 Million @ 4.150% April-25 4.15% Fixed $ 350,000 20.5% $350 Million @ 3.650% August-26 3.65% Fixed 350,000 20.5% Weighted Average / Bonds 5.9 Years 3.90% $ 700,000 41.0% Weighted Average / Unsecured 4.6 Years 3.20% $ 1,484,000 87.0% Weighted Average / Total Debt 4.4 Years 3.48% (6) $ 1,706,010 100.0% Debt - consolidated $ 1,484,000 Debt - unconsolidated 222,010 Total Debt $ 1,706,010 Weighted Ave Weighted Ave Fixed and Floating Rate Debt Analysis Maturity Rate - Qtr Balance % of Total Debt Fixed Rate Debt 4.8 Years 3.64% $ 1,315,750 77.1% Floating Rate Debt 2.9 Years 2.92% 390,260 22.9% Total 4.4 Years 3.48% (6) $ 1,706,010 100.0% Debt Ratios Net Debt (Average) to Adjusted EBITDAre - Q4 2019 (7) 6.3x Net Debt to Gross Real Estate Assets - 12/31/19 (7) 34.8% (1) Reflects 49.7% of the 799 Broadway Joint Venture construction loan balance, in which CXP owns a 49.7% interest through an unconsolidated joint venture. The loan has a total capacity of $187 million, carries two, one-year extension options, and is subject to an interest rate agreement that caps LIBOR at 4%. (2) Reflects 51% of the mortgage balance of the Market Square Joint Venture, in which CXP owns a 51% interest through an unconsolidated joint venture. (3) Columbia Property Trust is party to an interest rate swap agreement, which effectively fixes its interest rate on the $150 Million Term Loan at 3.07% per annum and terminates on July 29, 2022. The spread of 1.10% over the swapped rate is based on the company's credit rating. This interest rate swap agreement qualifies for hedge accounting treatment; therefore, changes in fair value are recorded as a market value adjustment to interest rate swap in the accompanying consolidated statement of other comprehensive income. (4) The Revolving Credit Facility ($650MM) bears interest at a rate based on, at the option of Columbia Property Trust, LIBOR for seven days, one-, two-, three-, or six- month periods, plus an applicable margin ranging from 0.775% to 1.45% based on credit rating, or the alternate base rate which is the greater of (a) Prime Rate, (b) Fed Funds plus 1/2 of 1%, and (c) the Libor Rate for a one-month period plus 1%, plus an applicable margin ranging from 0.00% to 0.45% based on credit rating. This facility carries two six-month extension options. (5) Effective August 13, 2019, Columbia Property Trust is party to an interest rate swap agreement, which effectively fixes its interest rate on the $300 Million Term Loan at 2.55% per annum and terminates on August 13, 2024. The spread of 1.00% over the swapped rate is based on the company's credit rating. This interest rate swap agreement qualifies for hedge accounting treatment; therefore, changes in fair value are recorded as a market value adjustment to interest rate swap in the accompanying consolidated statement of other comprehensive income. (6) During fourth quarter of 2019, CXP's ownership share of interest expense and capitalized interest were $11.6 million and $2.4 million, respectively. (7) Net debt is calculated by reducing our debt balance for cash on hand. Supplemental Information - Q4 2019 16

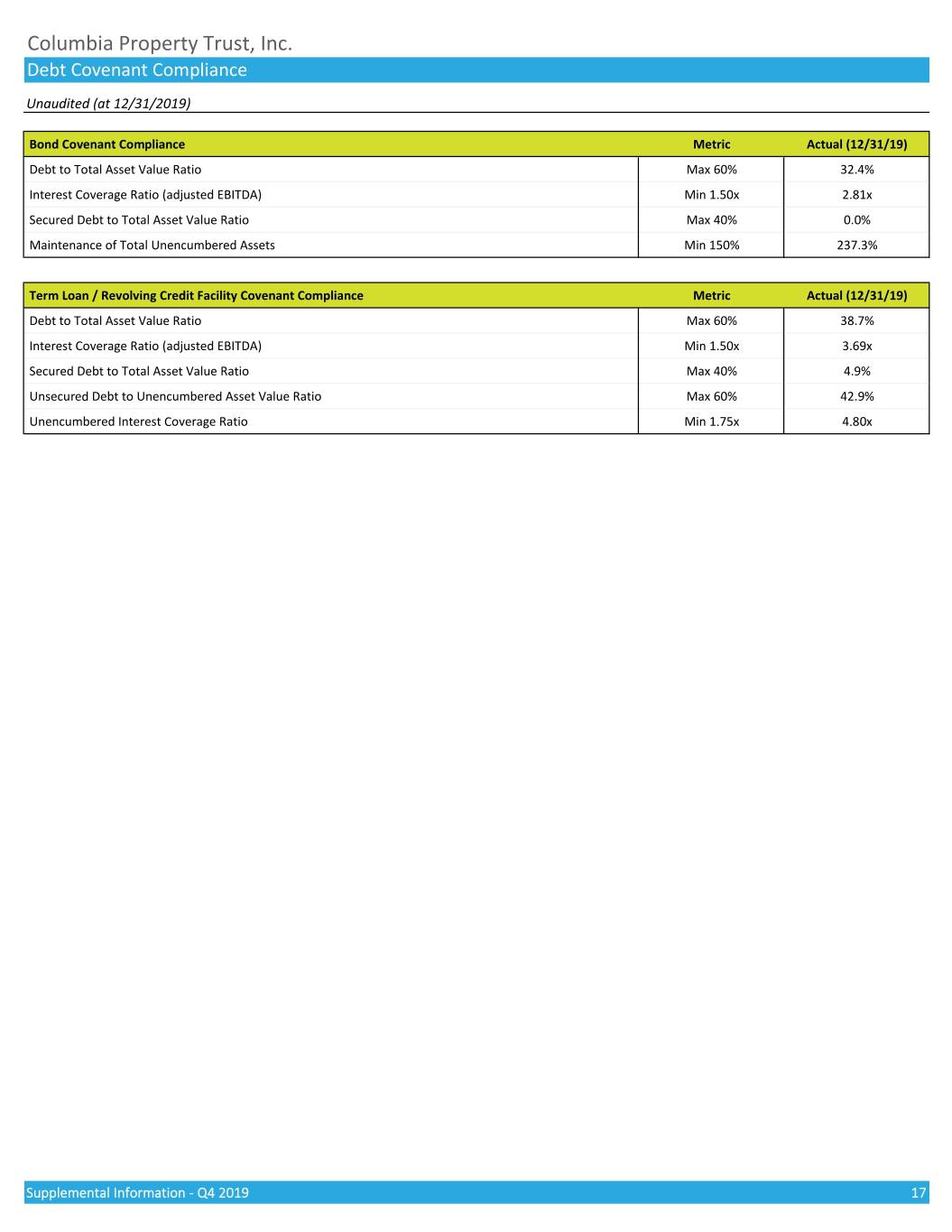

Columbia Property Trust, Inc. Debt Covenant Compliance Unaudited (at 12/31/2019) Bond Covenant Compliance Metric Actual (12/31/19) Debt to Total Asset Value Ratio Max 60% 32.4% Interest Coverage Ratio (adjusted EBITDA) Min 1.50x 2.81x Secured Debt to Total Asset Value Ratio Max 40% 0.0% Maintenance of Total Unencumbered Assets Min 150% 237.3% Term Loan / Revolving Credit Facility Covenant Compliance Metric Actual (12/31/19) Debt to Total Asset Value Ratio Max 60% 38.7% Interest Coverage Ratio (adjusted EBITDA) Min 1.50x 3.69x Secured Debt to Total Asset Value Ratio Max 40% 4.9% Unsecured Debt to Unencumbered Asset Value Ratio Max 60% 42.9% Unencumbered Interest Coverage Ratio Min 1.75x 4.80x Supplemental Information - Q4 2019 17

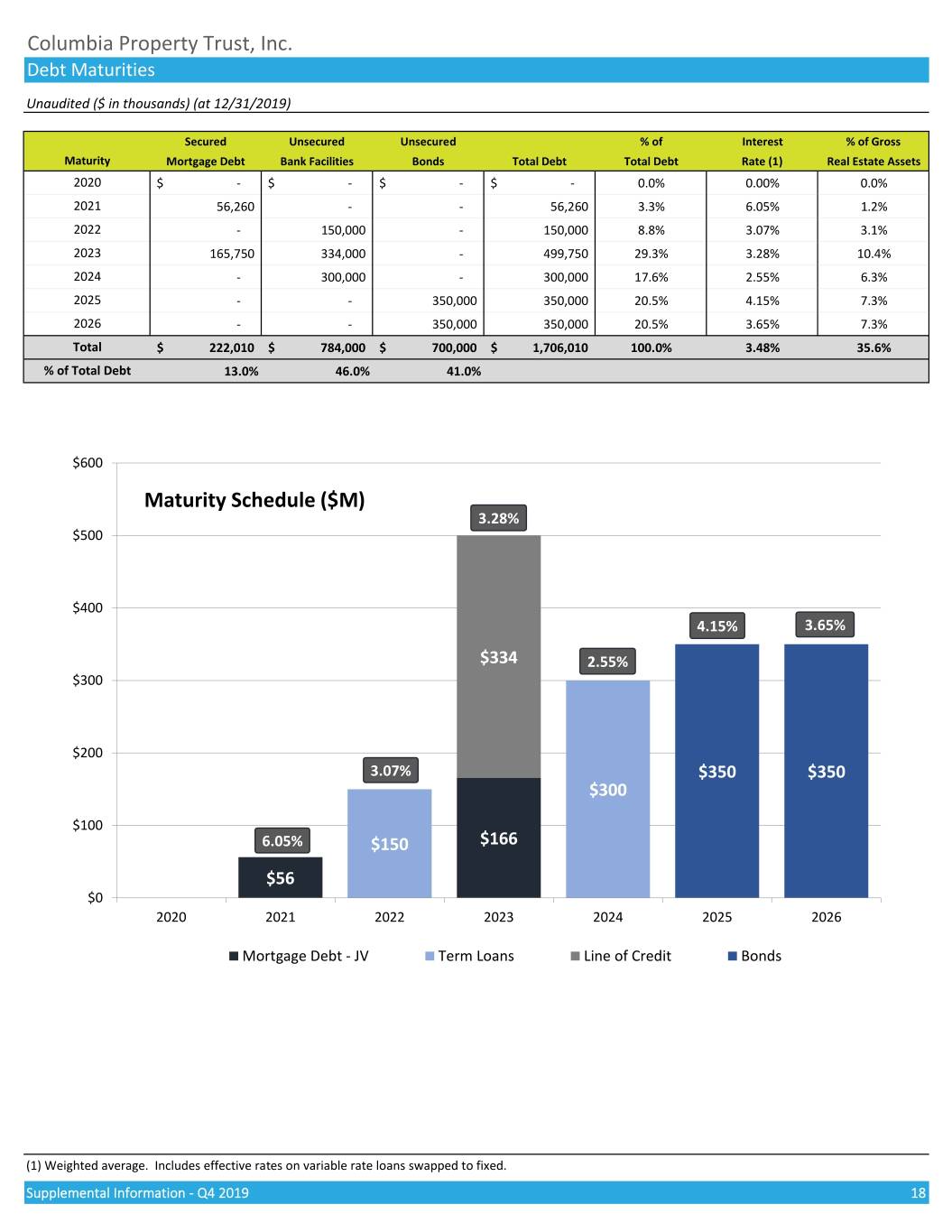

Columbia Property Trust, Inc. Debt Maturities Unaudited ($ in thousands) (at 12/31/2019) Secured Unsecured Unsecured % of Interest % of Gross Maturity Mortgage Debt Bank Facilities Bonds Total Debt Total Debt Rate (1) Real Estate Assets 2020 $ - $ - $ - $ - 0.0% 0.00% 0.0% 2021 56,260 - - 56,260 3.3% 6.05% 1.2% 2022 - 150,000 - 150,000 8.8% 3.07% 3.1% 2023 165,750 334,000 - 499,750 29.3% 3.28% 10.4% 2024 - 300,000 - 300,000 17.6% 2.55% 6.3% 2025 - - 350,000 350,000 20.5% 4.15% 7.3% 2026 - - 350,000 350,000 20.5% 3.65% 7.3% Total $ 222,010 $ 784,000 $ 700,000 $ 1,706,010 100.0% 3.48% 35.6% % of Total Debt 13.0% 46.0% 41.0% $600 Maturity Schedule ($M) 3.28% $500 $400 4.15% 3.65% $334 2.55% $300 $200 3.07% $350 $350 $300 $100 6.05% $150 $166 $56 $0 2020 2021 2022 2023 2024 2025 2026 Mortgage Debt - JV Term Loans Line of Credit Bonds (1) Weighted average. Includes effective rates on variable rate loans swapped to fixed. Supplemental Information - Q4 2019 18

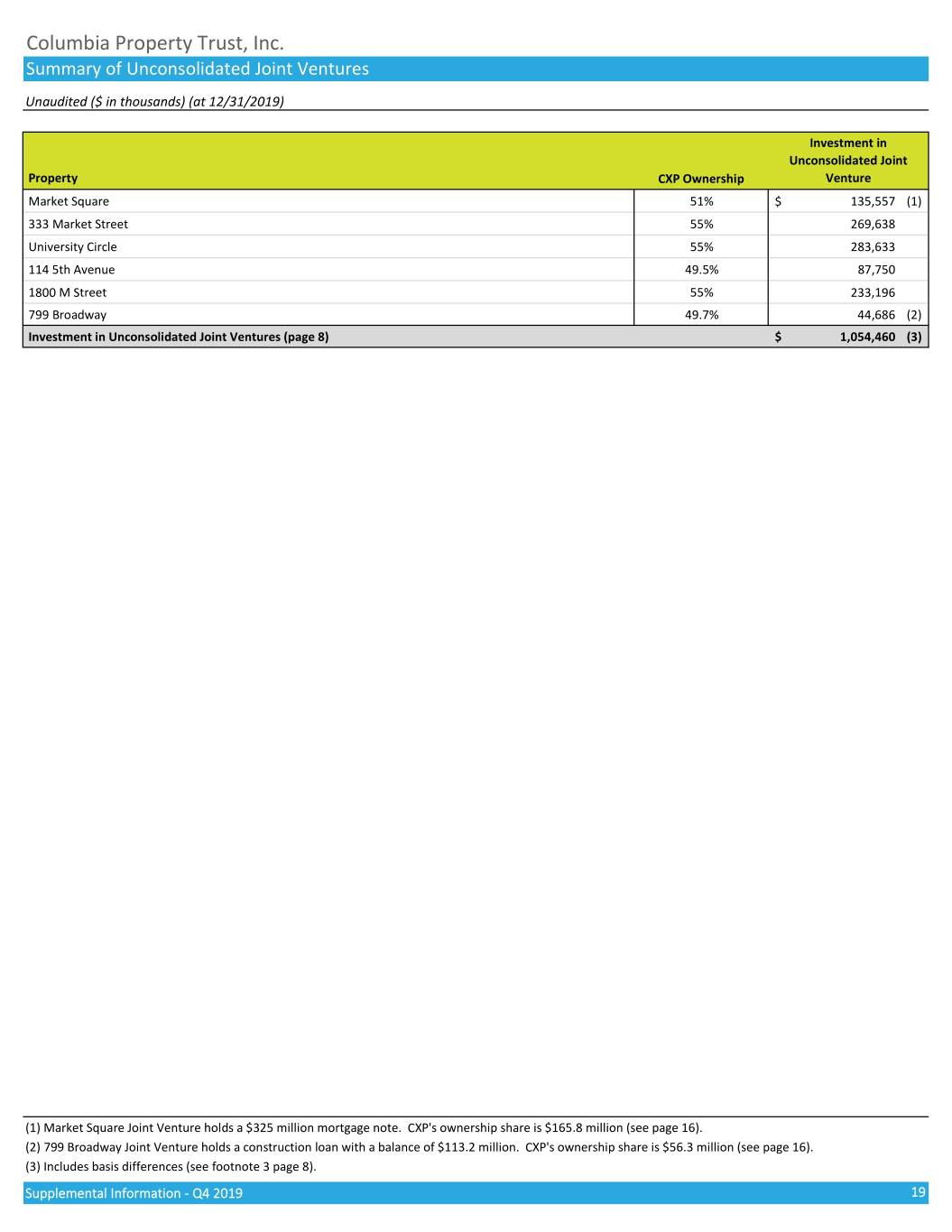

Columbia Property Trust, Inc. Summary of Unconsolidated Joint Ventures Unaudited ($ in thousands) (at 12/31/2019) Investment in Unconsolidated Joint Property CXP Ownership Venture Market Square 51% $ 135,557 (1) 333 Market Street 55% 269,638 University Circle 55% 283,633 114 5th Avenue 49.5% 87,750 1800 M Street 55% 233,196 799 Broadway 49.7% 44,686 (2) Investment in Unconsolidated Joint Ventures (page 8) $ 1,054,460 (3) (1) Market Square Joint Venture holds a $325 million mortgage note. CXP's ownership share is $165.8 million (see page 16). (2) 799 Broadway Joint Venture holds a construction loan with a balance of $113.2 million. CXP's ownership share is $56.3 million (see page 16). (3) Includes basis differences (see footnote 3 page 8). Supplemental Information - Q4 2019 19

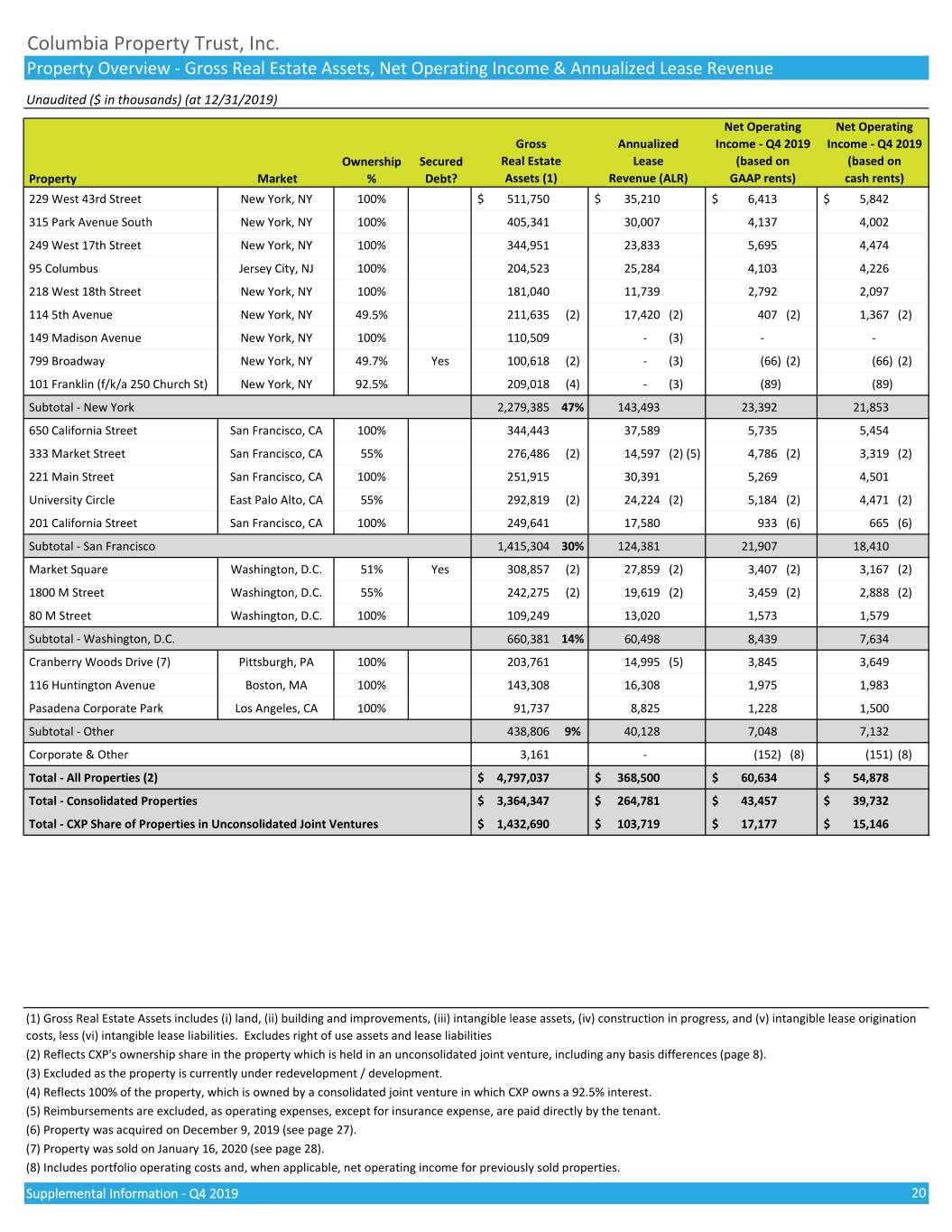

Columbia Property Trust, Inc. Property Overview - Gross Real Estate Assets, Net Operating Income & Annualized Lease Revenue Unaudited ($ in thousands) (at 12/31/2019) Net Operating Net Operating Gross Annualized Income - Q4 2019 Income - Q4 2019 Ownership Secured Real Estate Lease (based on (based on Property Market % Debt? Assets (1) Revenue (ALR) GAAP rents) cash rents) 229 West 43rd Street New York, NY 100% $ 511,750 $ 35,210 $ 6,413 $ 5,842 315 Park Avenue South New York, NY 100% 405,341 30,007 4,137 4,002 249 West 17th Street New York, NY 100% 344,951 23,833 5,695 4,474 95 Columbus Jersey City, NJ 100% 204,523 25,284 4,103 4,226 218 West 18th Street New York, NY 100% 181,040 11,739 2,792 2,097 114 5th Avenue New York, NY 49.5% 211,635 (2) 17,420 (2) 407 (2) 1,367 (2) 149 Madison Avenue New York, NY 100% 110,509 - (3) - - 799 Broadway New York, NY 49.7% Yes 100,618 (2) - (3) (66) (2) (66) (2) 101 Franklin (f/k/a 250 Church St) New York, NY 92.5% 209,018 (4) - (3) (89) (89) Subtotal - New York 2,279,385 47% 143,493 23,392 21,853 650 California Street San Francisco, CA 100% 344,443 37,589 5,735 5,454 333 Market Street San Francisco, CA 55% 276,486 (2) 14,597 (2) (5) 4,786 (2) 3,319 (2) 221 Main Street San Francisco, CA 100% 251,915 30,391 5,269 4,501 University Circle East Palo Alto, CA 55% 292,819 (2) 24,224 (2) 5,184 (2) 4,471 (2) 201 California Street San Francisco, CA 100% 249,641 17,580 933 (6) 665 (6) Subtotal - San Francisco 1,415,304 30% 124,381 21,907 18,410 Market Square Washington, D.C. 51% Yes 308,857 (2) 27,859 (2) 3,407 (2) 3,167 (2) 1800 M Street Washington, D.C. 55% 242,275 (2) 19,619 (2) 3,459 (2) 2,888 (2) 80 M Street Washington, D.C. 100% 109,249 13,020 1,573 1,579 Subtotal - Washington, D.C. 660,381 14% 60,498 8,439 7,634 Cranberry Woods Drive (7) Pittsburgh, PA 100% 203,761 14,995 (5) 3,845 3,649 116 Huntington Avenue Boston, MA 100% 143,308 16,308 1,975 1,983 Pasadena Corporate Park Los Angeles, CA 100% 91,737 8,825 1,228 1,500 Subtotal - Other 438,806 9% 40,128 7,048 7,132 Corporate & Other 3,161 - (152) (8) (151) (8) Total - All Properties (2) $ 4,797,037 $ 368,500 $ 60,634 $ 54,878 Total - Consolidated Properties $ 3,364,347 $ 264,781 $ 43,457 $ 39,732 Total - CXP Share of Properties in Unconsolidated Joint Ventures $ 1,432,690 $ 103,719 $ 17,177 $ 15,146 (1) Gross Real Estate Assets includes (i) land, (ii) building and improvements, (iii) intangible lease assets, (iv) construction in progress, and (v) intangible lease origination costs, less (vi) intangible lease liabilities. Excludes right of use assets and lease liabilities (2) Reflects CXP's ownership share in the property which is held in an unconsolidated joint venture, including any basis differences (page 8). (3) Excluded as the property is currently under redevelopment / development. (4) Reflects 100% of the property, which is owned by a consolidated joint venture in which CXP owns a 92.5% interest. (5) Reimbursements are excluded, as operating expenses, except for insurance expense, are paid directly by the tenant. (6) Property was acquired on December 9, 2019 (see page 27). (7) Property was sold on January 16, 2020 (see page 28). (8) Includes portfolio operating costs and, when applicable, net operating income for previously sold properties. Supplemental Information - Q4 2019 20

Columbia Property Trust, Inc. Property Overview - Square Feet & Occupancy Unaudited (SF in thousands) (at 12/31/2019) Average Ownership Rentable Leased Percent Commenced Economic Property Market % Square Feet Square Feet Leased Occupancy Occupancy (1) 229 West 43rd Street New York, NY 100% 482 450 93.4% 93.4% 89.0% 315 Park Avenue South New York, NY 100% 332 332 100.0% 89.7% 89.4% 249 West 17th Street New York, NY 100% 281 281 100.0% 100.0% 100.0% 95 Columbus Jersey City, NJ 100% 630 628 99.7% 99.7% 99.7% 218 West 18th Street New York, NY 100% 166 166 100.0% 100.0% 100.0% 114 5th Avenue New York, NY 49.5% 174 (2) 174 (2) 100.0% 100.0% 100.0% 149 Madison Avenue New York, NY 100% - (3) - (3) - - - 799 Broadway New York, NY 49.7% - (3) - (3) - - - 101 Franklin (f/k/a 250 Church St) New York, NY 92.5% - (3) - (3) - - - Subtotal - New York 2,065 2,031 98.4% 96.7% 95.6% 650 California Street San Francisco, CA 100% 470 465 98.9% 97.1% 93.0% 333 Market Street San Francisco, CA 55% 361 (2) 361 (2) 100.0% 100.0% 100.0% 221 Main Street San Francisco, CA 100% 381 378 99.2% 99.2% 91.3% University Circle East Palo Alto, CA 55% 249 (2) 222 (2) 89.2% 89.2% 89.2% 201 California Street San Francisco, CA 100% 252 (2) 249 (2) 98.8% 97.4% 93.6% Subtotal - San Francisco 1,713 1,675 97.8% 97.1% 93.6% Market Square Washington, D.C. 51% 355 (2) 323 (2) 91.0% 89.4% 77.3% 1800 M Street Washington, D.C. 55% 311 (2) 301 (2) 96.8% 95.7% 92.8% 80 M Street Washington, D.C. 100% 286 236 82.5% 82.5% 79.9% Subtotal - Washington, D.C. 952 860 90.3% 89.4% 83.2% Cranberry Woods Drive (4) Pittsburgh, PA 100% 824 824 100.0% 100.0% 100.0% 116 Huntington Avenue Boston, MA 100% 272 272 100.0% 96.5% 86.2% Pasadena Corporate Park Los Angeles, CA 100% 262 247 94.3% 94.3% 94.3% Subtotal - Other 1,358 1,343 98.9% 98.2% 96.1% Total - All Properties (2) 6,088 5,909 97.1% 96.0% 93.2% Total - All Properties (at 100%) 7,360 (5) 7,120 (5) (1) Total square feet of leases that have commenced and the tenant is paying rent divided by total rentable square feet. Monthly average for the current quarter. (2) Reflects CXP's ownership share in the property which is held in an unconsolidated joint venture. (3) Excluded as the property is currently under redevelopment / development. (4) Property was sold on January 16, 2020 (see page 28). (5) Includes 100% of properties held in joint ventures. Supplemental Information - Q4 2019 21

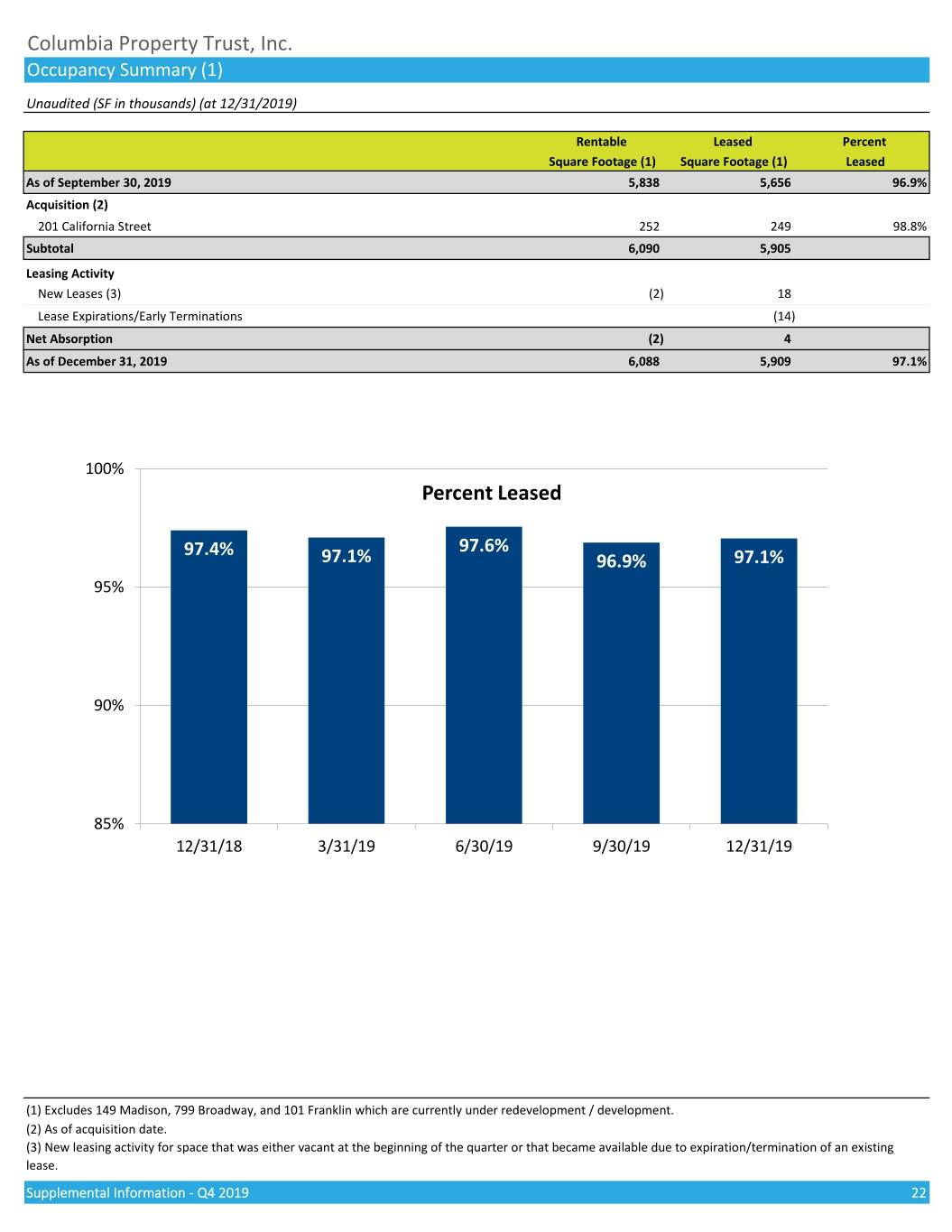

Columbia Property Trust, Inc. Occupancy Summary (1) Unaudited (SF in thousands) (at 12/31/2019) Rentable Leased Percent Square Footage (1) Square Footage (1) Leased As of September 30, 2019 5,838 5,656 96.9% Acquisition (2) 201 California Street 252 249 98.8% Subtotal 6,090 5,905 Leasing Activity New Leases (3) (2) 18 Lease Expirations/Early Terminations (14) Net Absorption (2) 4 As of December 31, 2019 6,088 5,909 97.1% 100% Percent Leased 97.4% 97.6% 97.1% 96.9% 97.1% 95% 90% 85% 12/31/18 3/31/19 6/30/19 9/30/19 12/31/19 (1) Excludes 149 Madison, 799 Broadway, and 101 Franklin which are currently under redevelopment / development. (2) As of acquisition date. (3) New leasing activity for space that was either vacant at the beginning of the quarter or that became available due to expiration/termination of an existing lease. Supplemental Information - Q4 2019 22

Columbia Property Trust, Inc. Leasing Summary Unaudited (weighted average unless otherwise noted) Three Months Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Renewal Leases Number of Leases 5 5 3 1 3 Square Feet of Leasing (at 100%) 396,673 150,751 14,138 7,697 243,717 Square Feet of Leasing (at CXP's share) (1) 392,120 144,418 7,210 3,925 234,791 Lease Term (months) 178 109 87 56 61 Tenant Improvements per Square Foot 47.83 69.68 90.00 102.91 30.77 Leasing Commissions per Square Foot 39.51 27.95 33.25 23.53 26.13 Total per Square Foot $ 87.34 $ 97.63 $ 123.25 $ 126.44 $ 56.90 Tenant Improvements per Square Foot per Year of Lease Term 3.23 7.69 12.47 22.05 6.03 Leasing Commissions per Square Foot per Year of Lease Term 2.67 3.08 4.61 5.04 5.12 Total per Square Foot per Year $ 5.90 $ 10.77 $ 17.08 $ 27.09 $ 11.15 Cash Rent Releasing Spread (2) 20.0% 53.7% -3.6% -0.6% 6.2% GAAP Rent Releasing Spread (2) 52.7% 79.6% -0.5% 0.0% 12.5% New Leases (Space Vacant > 1 Year) Number of Leases 2 3 9 7 8 Square Feet of Leasing (at 100%) 9,806 13,895 59,285 59,339 154,620 Square Feet of Leasing (at CXP's share) (1) 8,932 7,086 47,883 48,457 145,068 Lease Term (months) 95 119 115 91 190 Tenant Improvements per Square Foot 15.80 112.15 105.61 115.18 98.98 Leasing Commissions per Square Foot 21.20 44.62 21.81 26.93 29.54 Total per Square Foot $ 37.00 $ 156.77 $ 127.42 $ 142.11 $ 128.52 Tenant Improvements per Square Foot per Year of Lease Term 2.01 11.33 10.99 15.22 6.26 Leasing Commissions per Square Foot per Year of Lease Term 2.69 4.51 2.27 3.56 1.87 Total per Square Foot per Year $ 4.70 $ 15.84 $ 13.26 $ 18.78 $ 8.13 New Leases (Space Vacant < 1 Year) (3) Number of Leases 1 4 1 5 4 Square Feet of Leasing (at 100%) 11,906 33,636 5,838 16,301 43,447 Square Feet of Leasing (at CXP's share) (1) 9,873 32,264 5,838 14,834 35,527 Lease Term (months) 95 62 73 158 96 Tenant Improvements per Square Foot 30.21 48.19 70.79 58.71 64.53 Leasing Commissions per Square Foot 32.78 12.41 18.25 130.29 24.46 Total per Square Foot $ 62.99 $ 60.60 $ 89.04 $ 189.00 $ 88.99 Tenant Improvements per Square Foot per Year of Lease Term 3.80 9.36 11.64 4.45 8.08 Leasing Commissions per Square Foot per Year of Lease Term 4.13 2.41 3.00 9.87 3.06 Total per Square Foot per Year $ 7.93 $ 11.77 $ 14.64 $ 14.32 $ 11.14 Cash Rent Releasing Spread (2) 19.3% 44.6% 79.5% 41.0% 49.8% GAAP Rent Releasing Spread (2) 31.9% 54.3% 118.5% 65.8% 70.1% Total Leases Number of Leases 8 12 13 13 15 Square Feet of Leasing (at 100%) 418,385 198,282 79,261 83,337 441,784 Square Feet of Leasing (at CXP's share) (1) 410,925 183,768 60,931 67,216 415,386 Lease Term (months) 173 105 108 130 130 Tenant Improvements per Square Foot 46.29 69.28 100.43 92.01 68.10 Leasing Commissions per Square Foot 38.74 27.09 22.73 68.65 27.81 Total per Square Foot $ 85.03 $ 96.37 $ 123.16 $ 160.66 $ 95.91 Tenant Improvements per Square Foot per Year of Lease Term 3.21 8.12 11.23 13.24 6.29 Leasing Commissions per Square Foot per Year of Lease Term 2.70 3.02 2.62 5.04 3.81 Total per Square Foot per Year $ 5.91 $ 11.14 $ 13.85 $ 18.28 $ 10.10 Cash Rent Releasing Spread (2) 20.0% 52.8% 35.6% 38.2% 11.4% GAAP Rent Releasing Spread (2) 52.0% 77.0% 55.6% 61.7% 19.3% (1) Reflects CXP's ownership share for properties held in joint ventures. (2) Spread calculation is based on the change in net rent (base rent plus reimbursements less operating expenses) for square feet of leasing (at 100% ownership). (3) Includes executed leases that have not yet commenced for space covered by an existing lease. Supplemental Information - Q4 2019 23

Columbia Property Trust, Inc. Lease Expiration Schedule Unaudited (SF & $ in thousands) (at 12/31/2019) Expiring Annualized Lease Expiring Rentable Square % of Rentable Square Footage Year Revenue (ALR) % of ALR Expiring Footage Expiring Vacant $ - 0.0% 179 2.9% 2020 10,012 2.7% 129 2.1% 2021 31,033 8.4% 517 8.5% 2022 25,534 6.9% 445 7.3% 2023 36,818 10.0% 456 7.5% 2024 27,703 7.5% 322 5.3% 2025 52,922 14.4% 704 11.6% 2026 44,024 12.0% 818 13.4% 2027 16,292 4.4% 203 3.3% 2028 7,445 2.0% 92 1.5% 2029 18,833 5.1% 238 3.9% 2030 34,861 9.5% 424 7.0% 2031 2,683 0.7% 35 0.6% 2032 17,435 4.7% 857 14.1% 2033 15,859 4.3% 222 3.7% 2034+ 27,046 7.4% 447 7.3% Total $ 368,500 100.0% 6,088 100.0% 25.0% Lease Expiration Schedule 20.0% 15.0% 14.4% 12.0% 10.0% 10.0% 9.5% 8.4% 7.5% 6.9% 7.4% 5.0% 5.1% 4.7% 4.4% 4.3% 2.7% 2.0% 0.7% 0.0% 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034+ % of ALR Expiring NOTE: Expirations that have been renewed are reflected above based on the renewal expiration date. Supplemental Information - Q4 2019 24

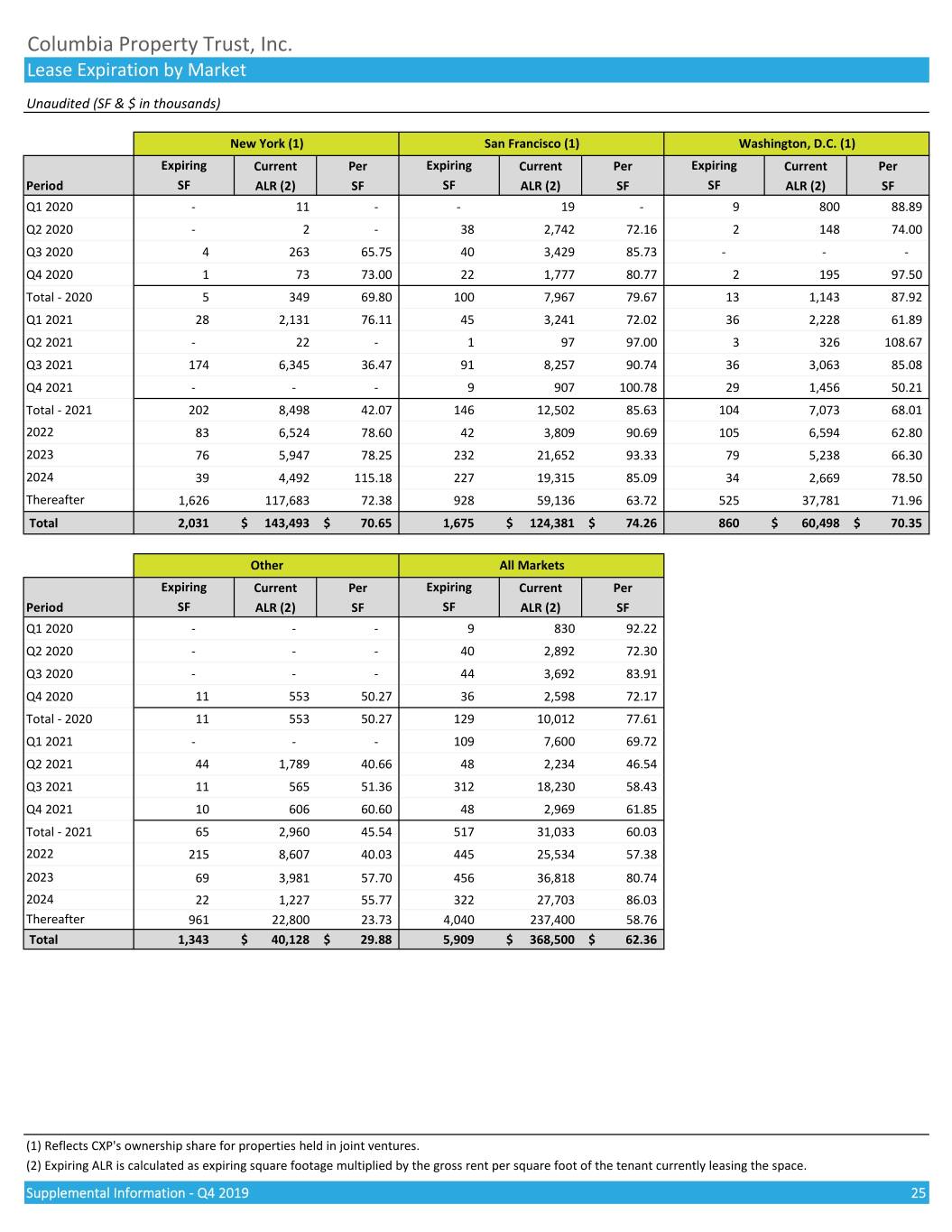

Columbia Property Trust, Inc. Lease Expiration by Market Unaudited (SF & $ in thousands) New York (1) San Francisco (1) Washington, D.C. (1) Expiring Current Per Expiring Current Per Expiring Current Per Period SF ALR (2) SF SF ALR (2) SF SF ALR (2) SF Q1 2020 - 11 - - 19 - 9 800 88.89 Q2 2020 - 2 - 38 2,742 72.16 2 148 74.00 Q3 2020 4 263 65.75 40 3,429 85.73 - - - Q4 2020 1 73 73.00 22 1,777 80.77 2 195 97.50 Total - 2020 5 349 69.80 100 7,967 79.67 13 1,143 87.92 Q1 2021 28 2,131 76.11 45 3,241 72.02 36 2,228 61.89 Q2 2021 - 22 - 1 97 97.00 3 326 108.67 Q3 2021 174 6,345 36.47 91 8,257 90.74 36 3,063 85.08 Q4 2021 - - - 9 907 100.78 29 1,456 50.21 Total - 2021 202 8,498 42.07 146 12,502 85.63 104 7,073 68.01 2022 83 6,524 78.60 42 3,809 90.69 105 6,594 62.80 2023 76 5,947 78.25 232 21,652 93.33 79 5,238 66.30 2024 39 4,492 115.18 227 19,315 85.09 34 2,669 78.50 Thereafter 1,626 117,683 72.38 928 59,136 63.72 525 37,781 71.96 Total 2,031 $ 143,493 $ 70.65 1,675 $ 124,381 $ 74.26 860 $ 60,498 $ 70.35 Other All Markets Expiring Current Per Expiring Current Per Period SF ALR (2) SF SF ALR (2) SF Q1 2020 - - - 9 830 92.22 Q2 2020 - - - 40 2,892 72.30 Q3 2020 - - - 44 3,692 83.91 Q4 2020 11 553 50.27 36 2,598 72.17 Total - 2020 11 553 50.27 129 10,012 77.61 Q1 2021 - - - 109 7,600 69.72 Q2 2021 44 1,789 40.66 48 2,234 46.54 Q3 2021 11 565 51.36 312 18,230 58.43 Q4 2021 10 606 60.60 48 2,969 61.85 Total - 2021 65 2,960 45.54 517 31,033 60.03 2022 215 8,607 40.03 445 25,534 57.38 2023 69 3,981 57.70 456 36,818 80.74 2024 22 1,227 55.77 322 27,703 86.03 Thereafter 961 22,800 23.73 4,040 237,400 58.76 Total 1,343 $ 40,128 $ 29.88 5,909 $ 368,500 $ 62.36 (1) Reflects CXP's ownership share for properties held in joint ventures. (2) Expiring ALR is calculated as expiring square footage multiplied by the gross rent per square foot of the tenant currently leasing the space. Supplemental Information - Q4 2019 25

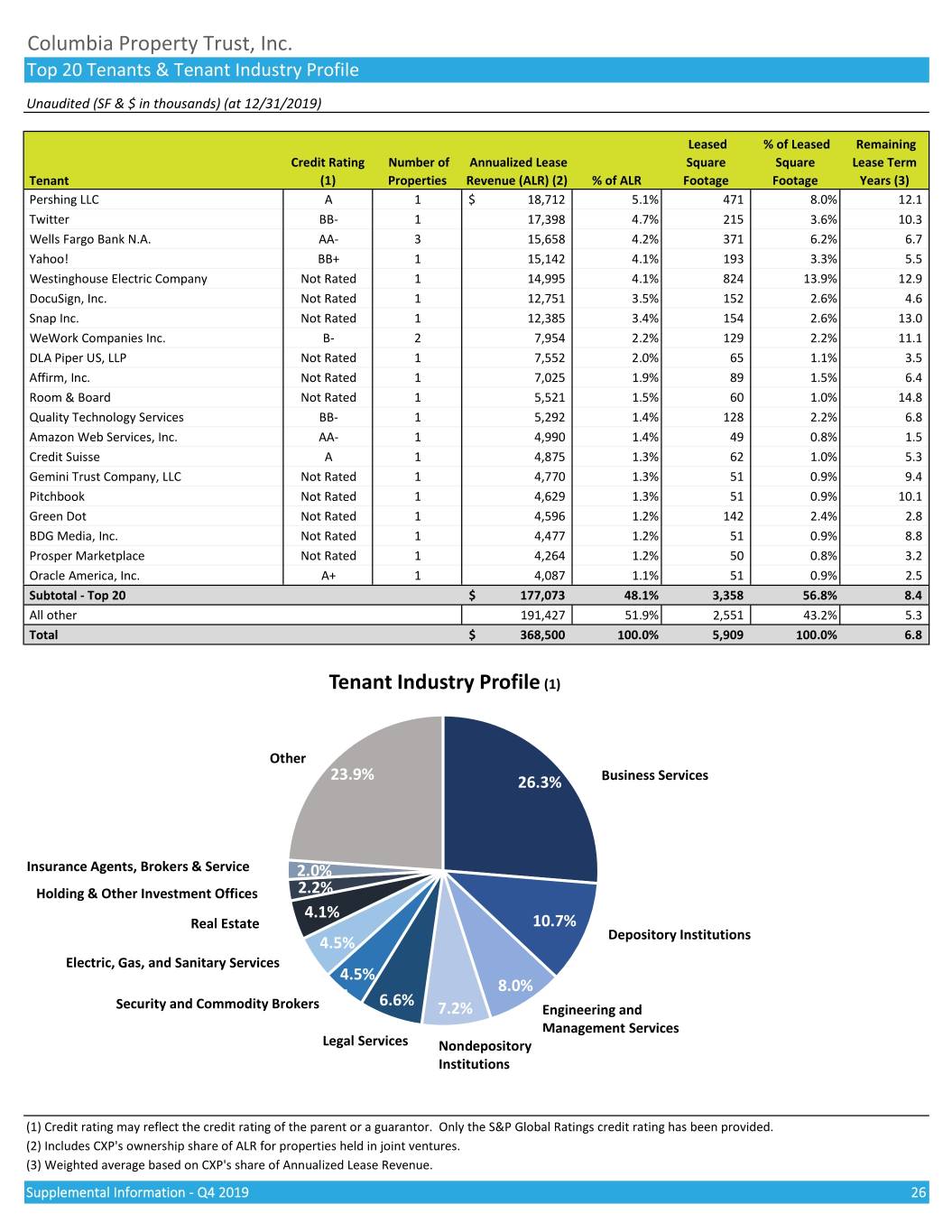

Columbia Property Trust, Inc. Top 20 Tenants & Tenant Industry Profile Unaudited (SF & $ in thousands) (at 12/31/2019) Leased % of Leased Remaining Credit Rating Number of Annualized Lease Square Square Lease Term Tenant (1) Properties Revenue (ALR) (2) % of ALR Footage Footage Years (3) Pershing LLC A 1 $ 18,712 5.1% 471 8.0% 12.1 Twitter BB- 1 17,398 4.7% 215 3.6% 10.3 Wells Fargo Bank N.A. AA- 3 15,658 4.2% 371 6.2% 6.7 Yahoo! BB+ 1 15,142 4.1% 193 3.3% 5.5 Westinghouse Electric Company Not Rated 1 14,995 4.1% 824 13.9% 12.9 DocuSign, Inc. Not Rated 1 12,751 3.5% 152 2.6% 4.6 Snap Inc. Not Rated 1 12,385 3.4% 154 2.6% 13.0 WeWork Companies Inc. B- 2 7,954 2.2% 129 2.2% 11.1 DLA Piper US, LLP Not Rated 1 7,552 2.0% 65 1.1% 3.5 Affirm, Inc. Not Rated 1 7,025 1.9% 89 1.5% 6.4 Room & Board Not Rated 1 5,521 1.5% 60 1.0% 14.8 Quality Technology Services BB- 1 5,292 1.4% 128 2.2% 6.8 Amazon Web Services, Inc. AA- 1 4,990 1.4% 49 0.8% 1.5 Credit Suisse A 1 4,875 1.3% 62 1.0% 5.3 Gemini Trust Company, LLC Not Rated 1 4,770 1.3% 51 0.9% 9.4 Pitchbook Not Rated 1 4,629 1.3% 51 0.9% 10.1 Green Dot Not Rated 1 4,596 1.2% 142 2.4% 2.8 BDG Media, Inc. Not Rated 1 4,477 1.2% 51 0.9% 8.8 Prosper Marketplace Not Rated 1 4,264 1.2% 50 0.8% 3.2 Oracle America, Inc. A+ 1 4,087 1.1% 51 0.9% 2.5 Subtotal - Top 20 $ 177,073 48.1% 3,358 56.8% 8.4 All other 191,427 51.9% 2,551 43.2% 5.3 Total $ 368,500 100.0% 5,909 100.0% 6.8 Tenant Industry Profile (1) Other 23.9% 26.3% Business Services Insurance Agents, Brokers & Service 2.0% Holding & Other Investment Offices 2.2% 4.1% Real Estate 10.7% 4.5% Depository Institutions Electric, Gas, and Sanitary Services 4.5% 8.0% 6.6% Security and Commodity Brokers 7.2% Engineering and Management Services Legal Services Nondepository Institutions (1) Credit rating may reflect the credit rating of the parent or a guarantor. Only the S&P Global Ratings credit rating has been provided. (2) Includes CXP's ownership share of ALR for properties held in joint ventures. (3) Weighted average based on CXP's share of Annualized Lease Revenue. Supplemental Information - Q4 2019 26

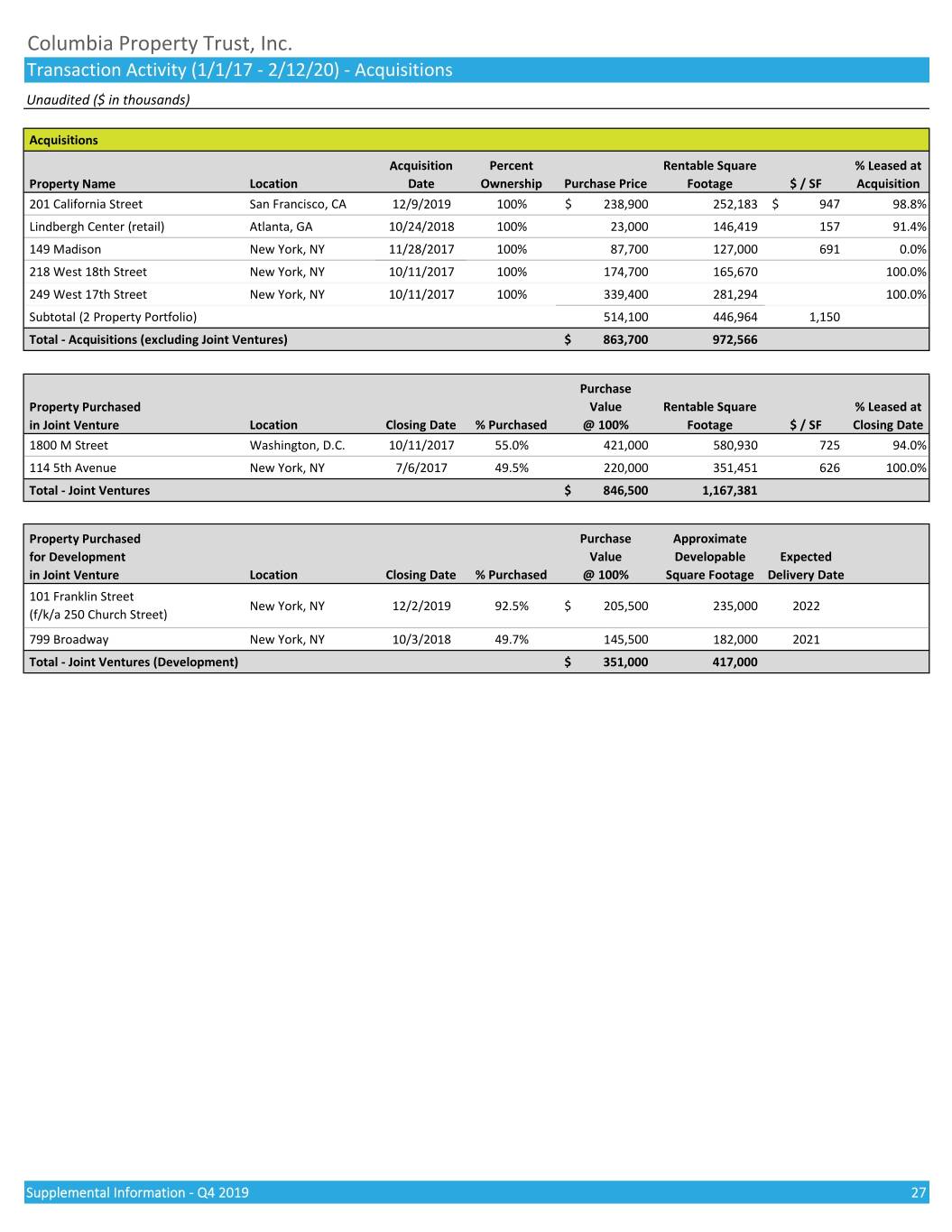

Columbia Property Trust, Inc. Transaction Activity (1/1/17 - 2/12/20) - Acquisitions Unaudited ($ in thousands) Acquisitions Acquisition Percent Rentable Square % Leased at Property Name Location Date Ownership Purchase Price Footage $ / SF Acquisition 201 California Street San Francisco, CA 12/9/2019 100% $ 238,900 252,183 $ 947 98.8% Lindbergh Center (retail) Atlanta, GA 10/24/2018 100% 23,000 146,419 157 91.4% 149 Madison New York, NY 11/28/2017 100% 87,700 127,000 691 0.0% 218 West 18th Street New York, NY 10/11/2017 100% 174,700 165,670 100.0% 249 West 17th Street New York, NY 10/11/2017 100% 339,400 281,294 100.0% Subtotal (2 Property Portfolio) 514,100 446,964 1,150 Total - Acquisitions (excluding Joint Ventures) $ 863,700 972,566 Purchase Property Purchased Value Rentable Square % Leased at in Joint Venture Location Closing Date % Purchased @ 100% Footage $ / SF Closing Date 1800 M Street Washington, D.C. 10/11/2017 55.0% 421,000 580,930 725 94.0% 114 5th Avenue New York, NY 7/6/2017 49.5% 220,000 351,451 626 100.0% Total - Joint Ventures $ 846,500 1,167,381 Property Purchased Purchase Approximate for Development Value Developable Expected in Joint Venture Location Closing Date % Purchased @ 100% Square Footage Delivery Date 101 Franklin Street New York, NY 12/2/2019 92.5% $ 205,500 235,000 2022 (f/k/a 250 Church Street) 799 Broadway New York, NY 10/3/2018 49.7% 145,500 182,000 2021 Total - Joint Ventures (Development) $ 351,000 417,000 Supplemental Information - Q4 2019 27

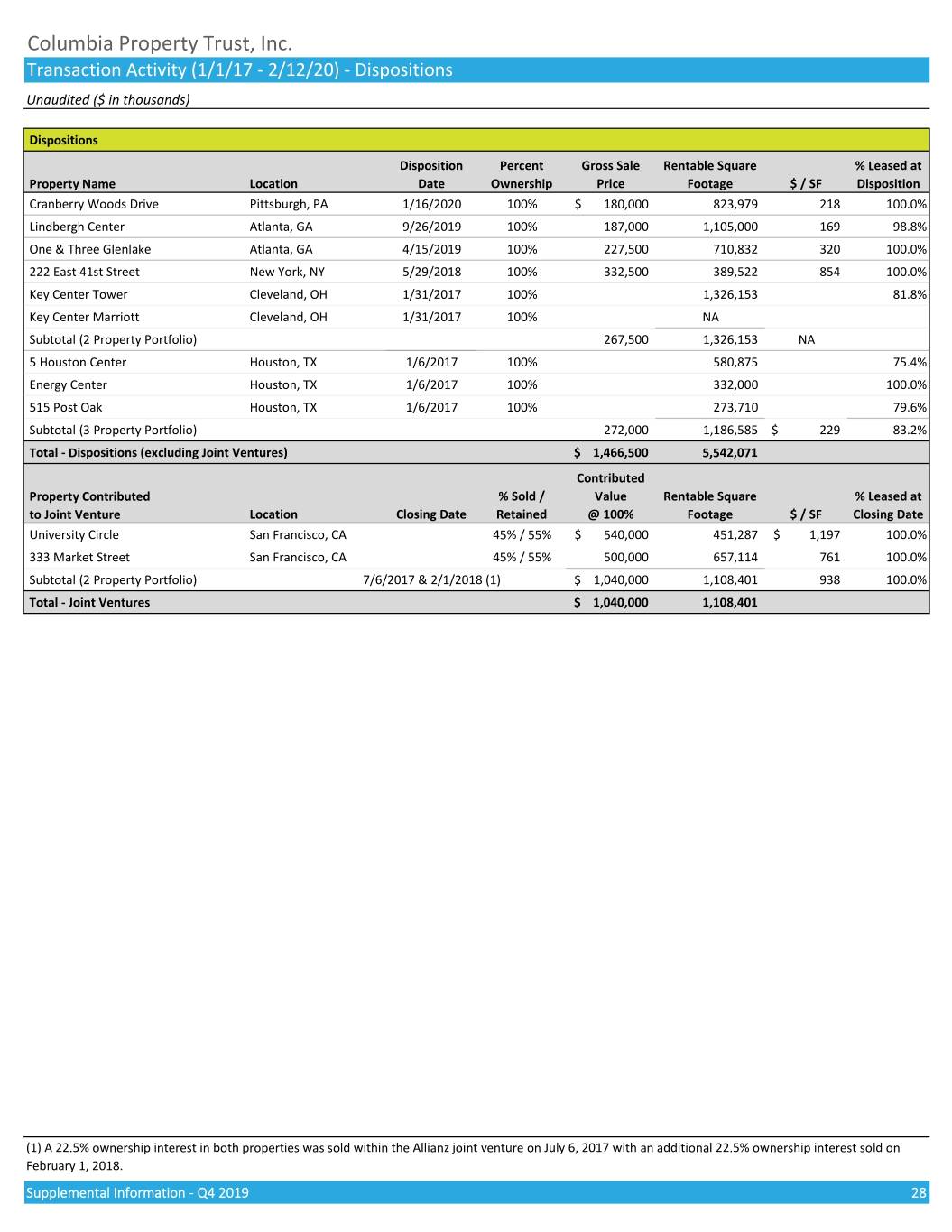

Columbia Property Trust, Inc. Transaction Activity (1/1/17 - 2/12/20) - Dispositions Unaudited ($ in thousands) Dispositions Disposition Percent Gross Sale Rentable Square % Leased at Property Name Location Date Ownership Price Footage $ / SF Disposition Cranberry Woods Drive Pittsburgh, PA 1/16/2020 100% $ 180,000 823,979 218 100.0% Lindbergh Center Atlanta, GA 9/26/2019 100% 187,000 1,105,000 169 98.8% One & Three Glenlake Atlanta, GA 4/15/2019 100% 227,500 710,832 320 100.0% 222 East 41st Street New York, NY 5/29/2018 100% 332,500 389,522 854 100.0% Key Center Tower Cleveland, OH 1/31/2017 100% 1,326,153 81.8% Key Center Marriott Cleveland, OH 1/31/2017 100% NA Subtotal (2 Property Portfolio) 267,500 1,326,153 NA 5 Houston Center Houston, TX 1/6/2017 100% 580,875 75.4% Energy Center Houston, TX 1/6/2017 100% 332,000 100.0% 515 Post Oak Houston, TX 1/6/2017 100% 273,710 79.6% Subtotal (3 Property Portfolio) 272,000 1,186,585 $ 229 83.2% Total - Dispositions (excluding Joint Ventures) $ 1,466,500 5,542,071 Contributed Property Contributed % Sold / Value Rentable Square % Leased at to Joint Venture Location Closing Date Retained @ 100% Footage $ / SF Closing Date University Circle San Francisco, CA 45% / 55% $ 540,000 451,287 $ 1,197 100.0% 333 Market Street San Francisco, CA 45% / 55% 500,000 657,114 761 100.0% Subtotal (2 Property Portfolio) 7/6/2017 & 2/1/2018 (1) $ 1,040,000 1,108,401 938 100.0% Total - Joint Ventures $ 1,040,000 1,108,401 (1) A 22.5% ownership interest in both properties was sold within the Allianz joint venture on July 6, 2017 with an additional 22.5% ownership interest sold on February 1, 2018. Supplemental Information - Q4 2019 28

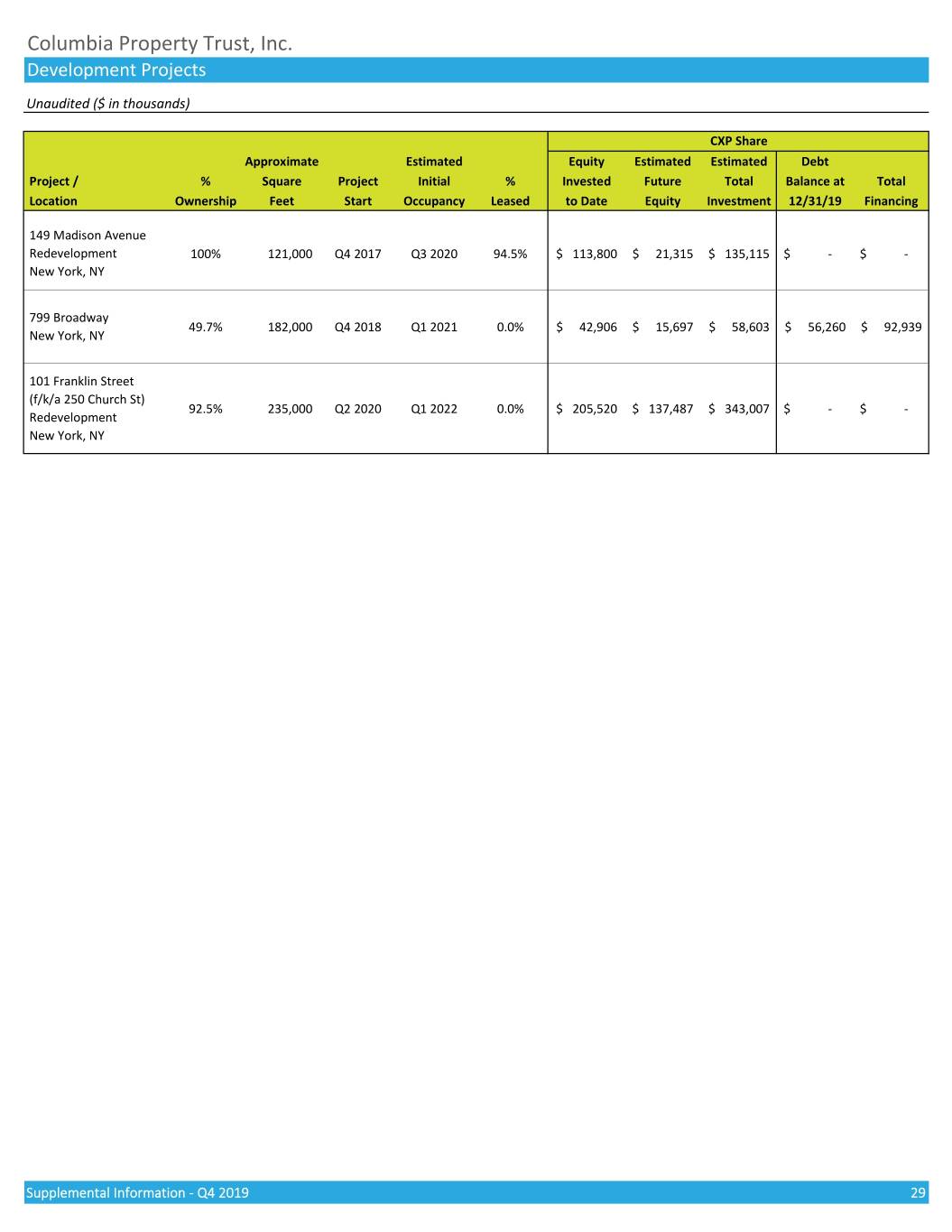

Columbia Property Trust, Inc. Development Projects Unaudited ($ in thousands) CXP Share Approximate Estimated Equity Estimated Estimated Debt Project / % Square Project Initial % Invested Future Total Balance at Total Location Ownership Feet Start Occupancy Leased to Date Equity Investment 12/31/19 Financing 149 Madison Avenue Redevelopment 100% 121,000 Q4 2017 Q3 2020 94.5% $ 113,800 $ 21,315 $ 135,115 $ - $ - New York, NY 799 Broadway 49.7% 182,000 Q4 2018 Q1 2021 0.0% $ 42,906 $ 15,697 $ 58,603 $ 56,260 $ 92,939 New York, NY 101 Franklin Street (f/k/a 250 Church St) 92.5% 235,000 Q2 2020 Q1 2022 0.0% $ 205,520 $ 137,487 $ 343,007 $ - $ - Redevelopment New York, NY Supplemental Information - Q4 2019 29

Columbia Property Trust, Inc. Reconciliation of Net Income to Normalized Funds From Operations (NFFO) Unaudited (in thousands, except per-share amounts) Twelve Months Ended Three Months Ended 12/31/2019 12/31/2018 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Net income (loss) attributable to CXP stockholders $ 9,197 $ 9,491 $ (21,777) $ (20,286) $ 47,747 $ 3,513 $ 5,003 Depreciation 78,292 81,795 18,780 19,773 19,335 20,404 20,401 Amortization 27,908 32,554 5,856 7,485 7,106 7,461 7,995 Adjustments included in income (loss) from 50,617 51,377 12,613 12,574 12,502 12,928 12,668 unconsolidated joint ventures Gain on sale of unconsolidated joint venture interests - (762) - - - - - Gain on sale of real estate assets (42,030) - - (112) (41,918) - - Impairment loss on real estate assets 43,941 30,812 20,577 23,364 - - - FFO $ 167,925 $ 205,267 $ 36,049 $ 42,798 $ 44,772 $ 44,306 $ 46,067 Adjustments included in income (loss) from 124 - 1 4 2 117 - unconsolidated joint ventures Non-cash carrying costs for Shuman Boulevard - 2,063 - - - - - (Gain) loss on extinguishment of debt - (23,340) - - - - 373 Pre-acquisition costs 6,398 - 3,961 2,437 - - - Adjustments included in net loss attributable to non- (126) - (126) - - - - controlling interest in consolidated joint venture Normalized FFO $ 174,321 $ 183,990 $ 39,885 $ 45,239 $ 44,774 $ 44,423 $ 46,440 Normalized FFO per share (basic) $ 1.50 $ 1.56 $ 0.35 $ 0.39 $ 0.38 $ 0.38 $ 0.40 Normalized FFO per share (diluted) $ 1.50 $ 1.56 $ 0.34 $ 0.39 $ 0.38 $ 0.38 $ 0.40 Weighted-average common shares outstanding - basic 116,261 117,888 115,557 116,522 116,509 116,462 116,853 Weighted-average common shares outstanding - diluted 116,458 118,311 115,802 116,821 116,823 116,880 117,359 Reconciliation of Cash Flows From Operations to Adjusted Funds From Operations (AFFO) Unaudited (in thousands, except per-share amounts) Twelve Months Ended Three Months Ended 12/31/2019 12/31/2018 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Net Cash Provided by Operating Activities $ 137,443 $ 97,625 $ 33,379 $ 40,548 $ 28,437 $ 35,079 $ 36,588 Adjustments included in income (loss) from 48,618 47,069 12,013 12,147 12,335 12,123 12,013 unconsolidated joint ventures Distributions from unconsolidated joint ventures (27,977) (28,802) (7,376) (7,075) (7,365) (6,161) (7,338) Net changes in operating assets and liabilities (7,983) 37,072 (6,192) (6,358) 7,228 (2,661) 125 Pre-acquisition costs 6,398 - 3,961 2,437 - - - Maintenance capital (1) (2) (52,221) (23,824) (33,205) (6,991) (2,310) (9,715) (3,128) AFFO $ 104,278 $ 129,140 $ 2,580 $ 34,708 $ 38,325 $ 28,665 $ 38,260 Weighted-average common shares outstanding - basic 116,261 117,888 115,557 116,522 116,509 116,462 116,853 Weighted-average common shares outstanding - diluted 116,458 118,311 115,802 116,821 116,823 116,880 117,359 (1) See page 36 of this supplemental report for a description of Maintenance Capital and page 15 for a detail of all capital expenditures. (2) Reflects CXP's ownership share of capital expenditures for properties held in joint ventures. Supplemental Information - Q4 2019 30

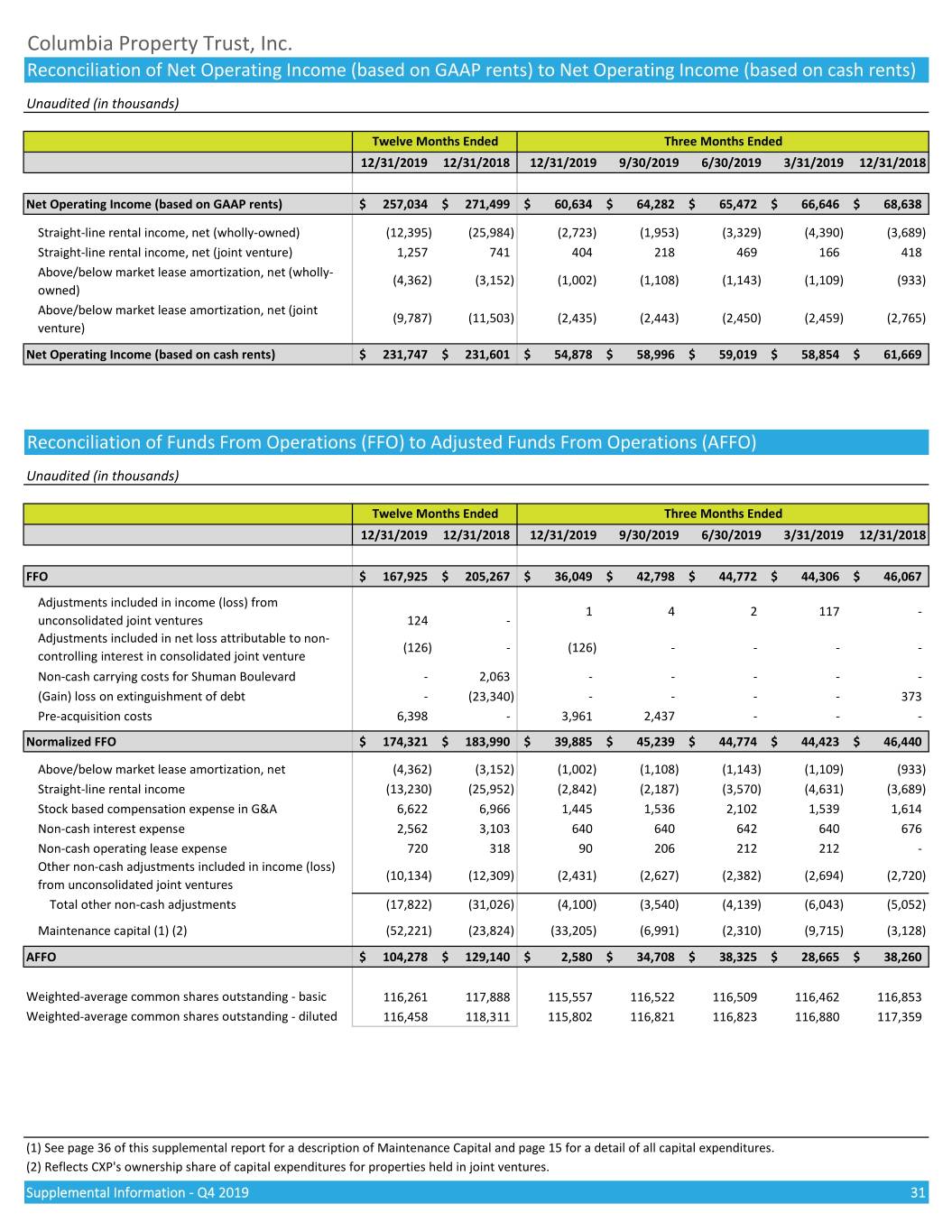

Columbia Property Trust, Inc. Reconciliation of Net Operating Income (based on GAAP rents) to Net Operating Income (based on cash rents) Unaudited (in thousands) Twelve Months Ended Three Months Ended 12/31/2019 12/31/2018 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Net Operating Income (based on GAAP rents) $ 257,034 $ 271,499 $ 60,634 $ 64,282 $ 65,472 $ 66,646 $ 68,638 Straight-line rental income, net (wholly-owned) (12,395) (25,984) (2,723) (1,953) (3,329) (4,390) (3,689) Straight-line rental income, net (joint venture) 1,257 741 404 218 469 166 418 Above/below market lease amortization, net (wholly- (4,362) (3,152) (1,002) (1,108) (1,143) (1,109) (933) owned) Above/below market lease amortization, net (joint (9,787) (11,503) (2,435) (2,443) (2,450) (2,459) (2,765) venture) Net Operating Income (based on cash rents) $ 231,747 $ 231,601 $ 54,878 $ 58,996 $ 59,019 $ 58,854 $ 61,669 Reconciliation of Funds From Operations (FFO) to Adjusted Funds From Operations (AFFO) Unaudited (in thousands) Twelve Months Ended Three Months Ended 12/31/2019 12/31/2018 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 FFO $ 167,925 $ 205,267 $ 36,049 $ 42,798 $ 44,772 $ 44,306 $ 46,067 Adjustments included in income (loss) from 1 4 2 117 - unconsolidated joint ventures 124 - Adjustments included in net loss attributable to non- (126) - (126) - - - - controlling interest in consolidated joint venture Non-cash carrying costs for Shuman Boulevard - 2,063 - - - - - (Gain) loss on extinguishment of debt - (23,340) - - - - 373 Pre-acquisition costs 6,398 - 3,961 2,437 - - - Normalized FFO $ 174,321 $ 183,990 $ 39,885 $ 45,239 $ 44,774 $ 44,423 $ 46,440 Above/below market lease amortization, net (4,362) (3,152) (1,002) (1,108) (1,143) (1,109) (933) Straight-line rental income (13,230) (25,952) (2,842) (2,187) (3,570) (4,631) (3,689) Stock based compensation expense in G&A 6,622 6,966 1,445 1,536 2,102 1,539 1,614 Non-cash interest expense 2,562 3,103 640 640 642 640 676 Non-cash operating lease expense 720 318 90 206 212 212 - Other non-cash adjustments included in income (loss) (10,134) (12,309) (2,431) (2,627) (2,382) (2,694) (2,720) from unconsolidated joint ventures Total other non-cash adjustments (17,822) (31,026) (4,100) (3,540) (4,139) (6,043) (5,052) Maintenance capital (1) (2) (52,221) (23,824) (33,205) (6,991) (2,310) (9,715) (3,128) AFFO $ 104,278 $ 129,140 $ 2,580 $ 34,708 $ 38,325 $ 28,665 $ 38,260 Weighted-average common shares outstanding - basic 116,261 117,888 115,557 116,522 116,509 116,462 116,853 Weighted-average common shares outstanding - diluted 116,458 118,311 115,802 116,821 116,823 116,880 117,359 (1) See page 36 of this supplemental report for a description of Maintenance Capital and page 15 for a detail of all capital expenditures. (2) Reflects CXP's ownership share of capital expenditures for properties held in joint ventures. Supplemental Information - Q4 2019 31

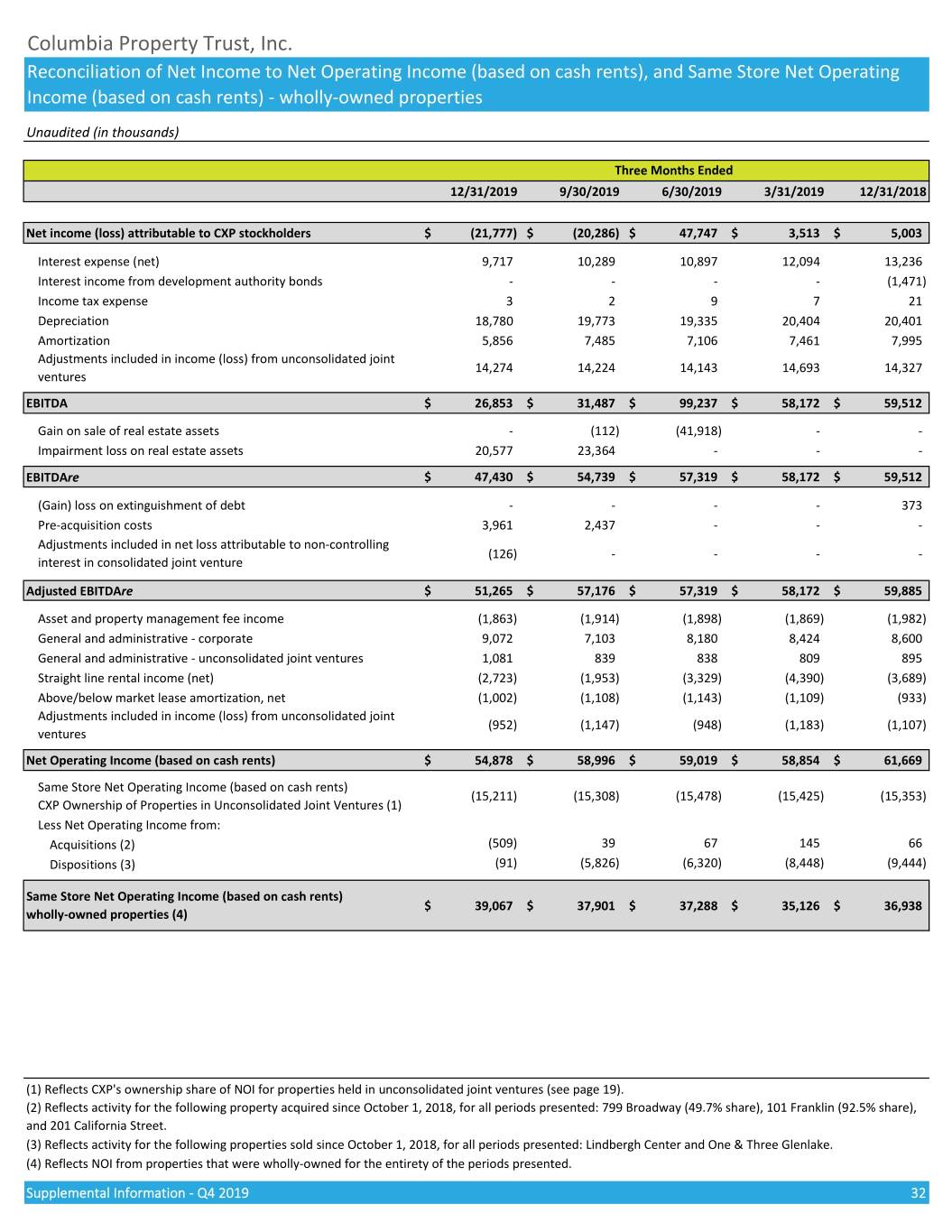

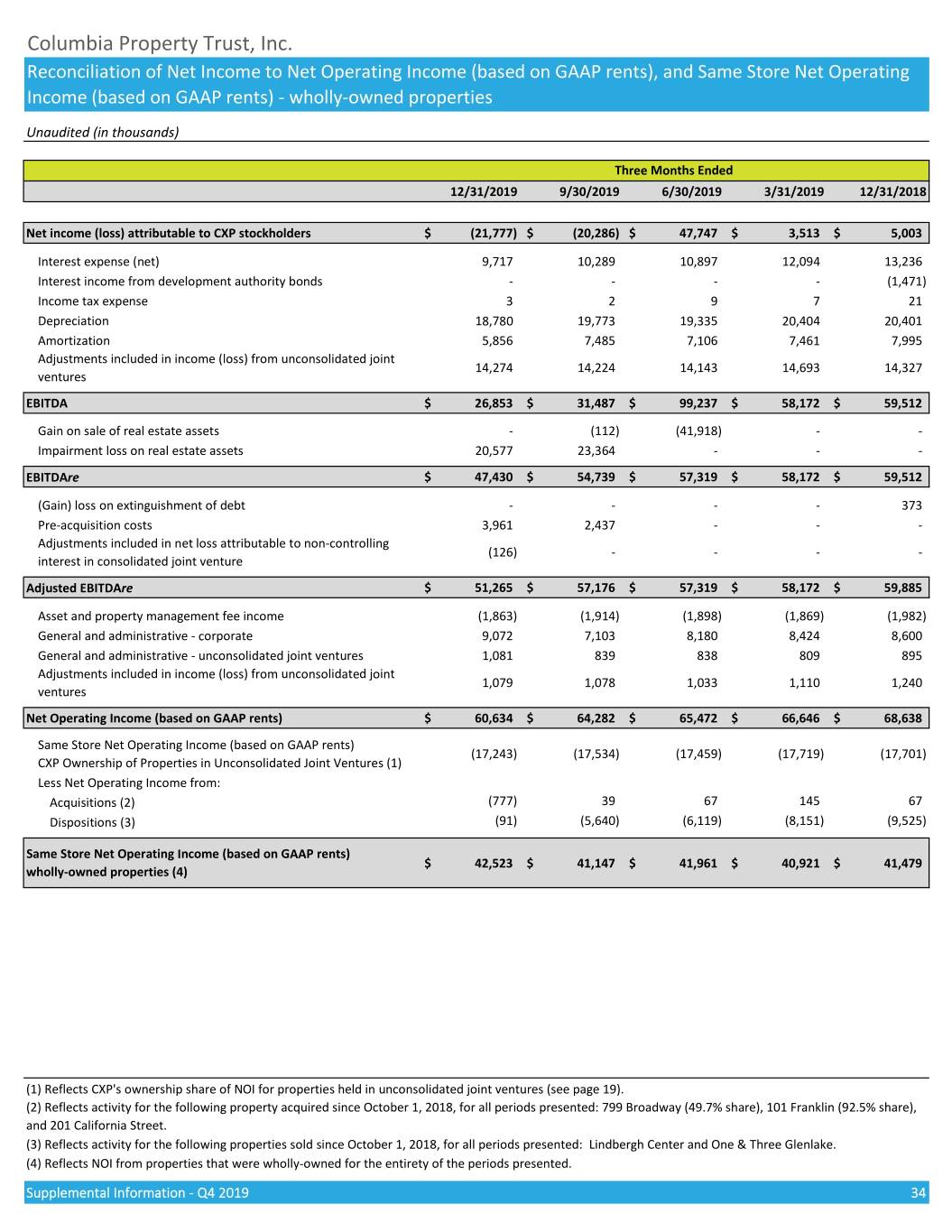

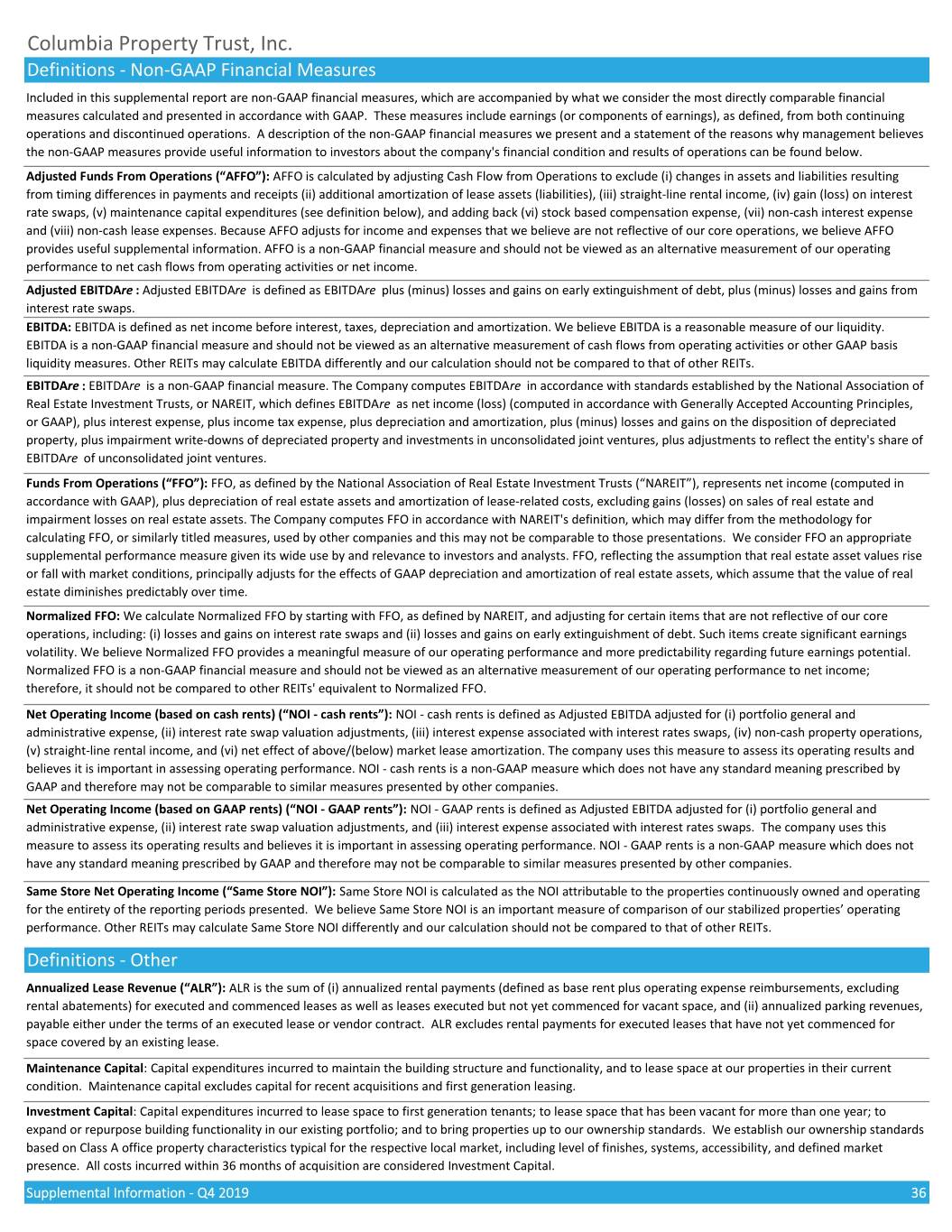

Columbia Property Trust, Inc. Reconciliation of Net Income to Net Operating Income (based on cash rents), and Same Store Net Operating Income (based on cash rents) - wholly-owned properties Unaudited (in thousands) Three Months Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Net income (loss) attributable to CXP stockholders $ (21,777) $ (20,286) $ 47,747 $ 3,513 $ 5,003 Interest expense (net) 9,717 10,289 10,897 12,094 13,236 Interest income from development authority bonds - - - - (1,471) Income tax expense 3 2 9 7 21 Depreciation 18,780 19,773 19,335 20,404 20,401 Amortization 5,856 7,485 7,106 7,461 7,995 Adjustments included in income (loss) from unconsolidated joint 14,274 14,224 14,143 14,693 14,327 ventures EBITDA $ 26,853 $ 31,487 $ 99,237 $ 58,172 $ 59,512 Gain on sale of real estate assets - (112) (41,918) - - Impairment loss on real estate assets 20,577 23,364 - - - EBITDAre $ 47,430 $ 54,739 $ 57,319 $ 58,172 $ 59,512 (Gain) loss on extinguishment of debt - - - - 373 Pre-acquisition costs 3,961 2,437 - - - Adjustments included in net loss attributable to non-controlling (126) - - - - interest in consolidated joint venture Adjusted EBITDAre $ 51,265 $ 57,176 $ 57,319 $ 58,172 $ 59,885 Asset and property management fee income (1,863) (1,914) (1,898) (1,869) (1,982) General and administrative - corporate 9,072 7,103 8,180 8,424 8,600 General and administrative - unconsolidated joint ventures 1,081 839 838 809 895 Straight line rental income (net) (2,723) (1,953) (3,329) (4,390) (3,689) Above/below market lease amortization, net (1,002) (1,108) (1,143) (1,109) (933) Adjustments included in income (loss) from unconsolidated joint (952) (1,147) (948) (1,183) (1,107) ventures Net Operating Income (based on cash rents) $ 54,878 $ 58,996 $ 59,019 $ 58,854 $ 61,669 Same Store Net Operating Income (based on cash rents) (15,211) (15,308) (15,478) (15,425) (15,353) CXP Ownership of Properties in Unconsolidated Joint Ventures (1) Less Net Operating Income from: Acquisitions (2) (509) 39 67 145 66 Dispositions (3) (91) (5,826) (6,320) (8,448) (9,444) Same Store Net Operating Income (based on cash rents) $ 39,067 $ 37,901 $ 37,288 $ 35,126 $ 36,938 wholly-owned properties (4) (1) Reflects CXP's ownership share of NOI for properties held in unconsolidated joint ventures (see page 19). (2) Reflects activity for the following property acquired since October 1, 2018, for all periods presented: 799 Broadway (49.7% share), 101 Franklin (92.5% share), and 201 California Street. (3) Reflects activity for the following properties sold since October 1, 2018, for all periods presented: Lindbergh Center and One & Three Glenlake. (4) Reflects NOI from properties that were wholly-owned for the entirety of the periods presented. Supplemental Information - Q4 2019 32

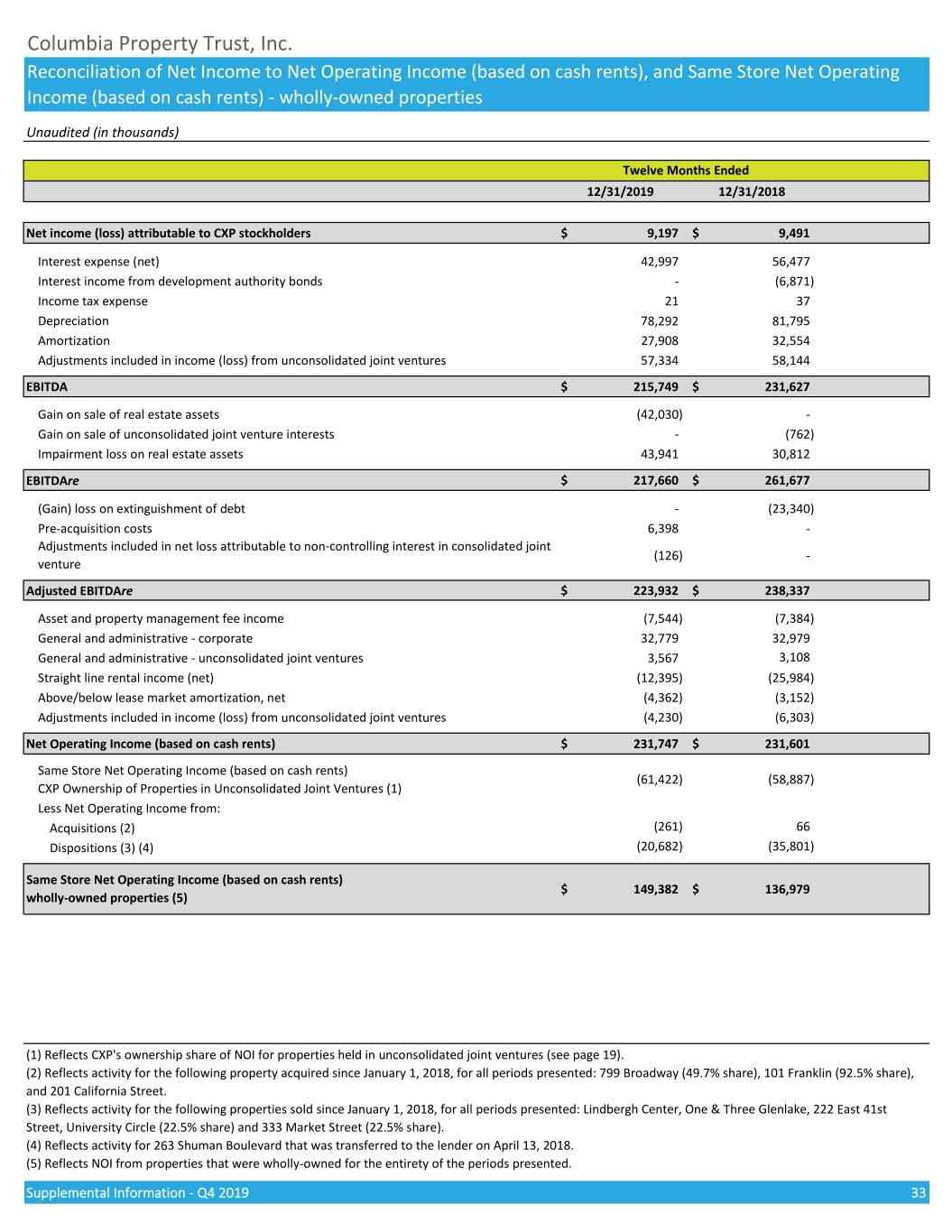

Columbia Property Trust, Inc. Reconciliation of Net Income to Net Operating Income (based on cash rents), and Same Store Net Operating Income (based on cash rents) - wholly-owned properties Unaudited (in thousands) Twelve Months Ended 12/31/2019 12/31/2018 Net income (loss) attributable to CXP stockholders $ 9,197 $ 9,491 Interest expense (net) 42,997 56,477 Interest income from development authority bonds - (6,871) Income tax expense 21 37 Depreciation 78,292 81,795 Amortization 27,908 32,554 Adjustments included in income (loss) from unconsolidated joint ventures 57,334 58,144 EBITDA $ 215,749 $ 231,627 Gain on sale of real estate assets (42,030) - Gain on sale of unconsolidated joint venture interests - (762) Impairment loss on real estate assets 43,941 30,812 EBITDAre $ 217,660 $ 261,677 (Gain) loss on extinguishment of debt - (23,340) Pre-acquisition costs 6,398 - Adjustments included in net loss attributable to non-controlling interest in consolidated joint (126) - venture Adjusted EBITDAre $ 223,932 $ 238,337 Asset and property management fee income (7,544) (7,384) General and administrative - corporate 32,779 32,979 General and administrative - unconsolidated joint ventures 3,567 3,108 Straight line rental income (net) (12,395) (25,984) Above/below lease market amortization, net (4,362) (3,152) Adjustments included in income (loss) from unconsolidated joint ventures (4,230) (6,303) Net Operating Income (based on cash rents) $ 231,747 $ 231,601 Same Store Net Operating Income (based on cash rents) (61,422) (58,887) CXP Ownership of Properties in Unconsolidated Joint Ventures (1) Less Net Operating Income from: Acquisitions (2) (261) 66 Dispositions (3) (4) (20,682) (35,801) Same Store Net Operating Income (based on cash rents) $ 149,382 $ 136,979 wholly-owned properties (5) (1) Reflects CXP's ownership share of NOI for properties held in unconsolidated joint ventures (see page 19). (2) Reflects activity for the following property acquired since January 1, 2018, for all periods presented: 799 Broadway (49.7% share), 101 Franklin (92.5% share), and 201 California Street. (3) Reflects activity for the following properties sold since January 1, 2018, for all periods presented: Lindbergh Center, One & Three Glenlake, 222 East 41st Street, University Circle (22.5% share) and 333 Market Street (22.5% share). (4) Reflects activity for 263 Shuman Boulevard that was transferred to the lender on April 13, 2018. (5) Reflects NOI from properties that were wholly-owned for the entirety of the periods presented. Supplemental Information - Q4 2019 33