Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CITIZENS FINANCIAL GROUP INC/RI | d880784d8k.htm |

KBW Winter Financial Services Symposium Michael Ruttledge Chief Information Officer, Head of Technology February 13, 2020 Exhibit 99.1

Forward-looking statements and use of key performance metrics and non-GAAP financial measures This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements regarding potential future share repurchases and future dividends are forward-looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management, and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: Negative economic and political conditions that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits which may affect, among other things, the level of nonperforming assets, charge-offs and provision expense; The rate of growth in the economy and employment levels, as well as general business and economic conditions, and changes in the competitive environment; Our ability to implement our business strategy, including the cost savings and efficiency components, and achieve our financial performance goals; Our ability to meet heightened supervisory requirements and expectations; Liabilities and business restrictions resulting from litigation and regulatory investigations; Our capital and liquidity requirements (including under regulatory capital standards, such as the U.S. Basel III capital rules) and our ability to generate capital internally or raise capital on favorable terms; The effect of changes in interest rates on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale; Changes in interest rates and market liquidity, as well as the magnitude of such changes, which may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and secondary markets; The effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin; Financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including the Dodd-Frank Act and other legislation and regulation relating to bank products and services; A failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors or other service providers, including as a result of cyber-attacks; and Management’s ability to identify and manage these and other risks. In addition to the above factors, we also caution that the actual amounts and timing of any future common stock dividends or share repurchases will be subject to various factors, including our capital position, financial performance, capital impacts of strategic initiatives, market conditions, and regulatory and accounting considerations, as well as any other factors that our Board of Directors deems relevant in making such a determination. Therefore, there can be no assurance that we will repurchase shares or pay any dividends to holders of our common stock, or as to the amount of any such repurchases or dividends. More information about factors that could cause actual results to differ materially from those described in the forward-looking statements can be found under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2018. Key Performance Metrics and Non-GAAP Financial Measures and Reconciliations Key Performance Metrics: Our Management uses certain key performance metrics (KPMs) to gauge our progress against strategic and operational goals, as well as to compare our performance against peers. The KPMs are referred to in our Registration Statements on Form S-1 and our external financial reports filed with the Securities and Exchange Commission. The KPMs include: Return on average tangible common equity (ROTCE); Efficiency ratio; Operating leverage; and Common equity tier 1 capital ratio. Established targets for the KPMs are based on Management-reporting results which are currently referred to by the Company as “Underlying” results. In historical periods, these results may have been referred to as "Adjusted" or "Adjusted/Underlying" results. We believe that Underlying results, which exclude notable items, provide the best representation of our underlying financial progress toward the KPMs as the results exclude items that our Management does not consider indicative of our on-going financial performance. We have consistently shown investors our KPMs on a Management-reporting basis since our initial public offering in September of 2014. KPMs that reflect Underlying results are considered non-GAAP financial measures. Non-GAAP Financial Measures: This document contains non-GAAP financial measures denoted as Underlying results. In historical periods, these results may have been referred to as Adjusted or Adjusted/Underlying results. Underlying results for any given reporting period exclude certain items that may occur in that period which Management does not consider indicative of the Company’s on-going financial performance. We believe these non-GAAP financial measures provide useful information to investors because they are used by our Management to evaluate our operating performance and make day-to-day operating decisions. In addition, we believe our Underlying results in any given reporting period reflect our on-going financial performance in that period and, accordingly, are useful to consider in addition to our GAAP financial results. We further believe the presentation of Underlying results increases comparability of period-to-period results. Other companies may use similarly titled non-GAAP financial measures that are calculated differently from the way we calculate such measures. Accordingly, our non-GAAP financial measures may not be comparable to similar measures used by such companies. We caution investors not to place undue reliance on such non-GAAP financial measures, but to consider them with the most directly comparable GAAP measures. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for our results reported under GAAP.

Accelerating technology capabilities Significantly modernized and strengthened technology capabilities since IPO Well-positioned to compete with sufficient scale and smart use of resources Strong foundation in place: Top leadership team, excellent business alignment, disciplined prioritization, innovative culture Transforming enterprise-wide infrastructure to benefit customers and improve efficiency Growing and upscaling talent to drive transformation Focused on improving customer experience through new products and secure, reliable platforms Increasing speed of business innovation by adopting Agile and transforming technology Driving toward an adaptable, resilient and secure technology environment that delivers well for all stakeholders Integral component of TOP 6 and strategic revenue initiatives

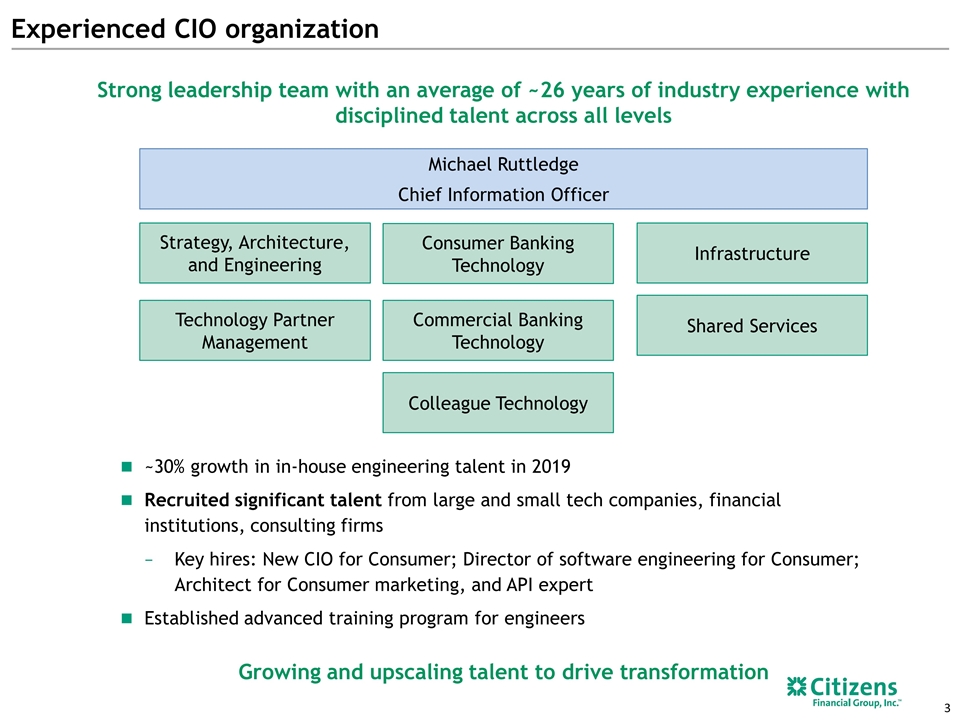

Experienced CIO organization Strong leadership team with an average of ~26 years of industry experience with disciplined talent across all levels ~30% growth in in-house engineering talent in 2019 Recruited significant talent from large and small tech companies, financial institutions, consulting firms Key hires: New CIO for Consumer; Director of software engineering for Consumer; Architect for Consumer marketing, and API expert Established advanced training program for engineers Michael Ruttledge Chief Information Officer Consumer Banking Technology Infrastructure Commercial Banking Technology Strategy, Architecture, and Engineering Colleague Technology Shared Services Technology Partner Management Growing and upscaling talent to drive transformation

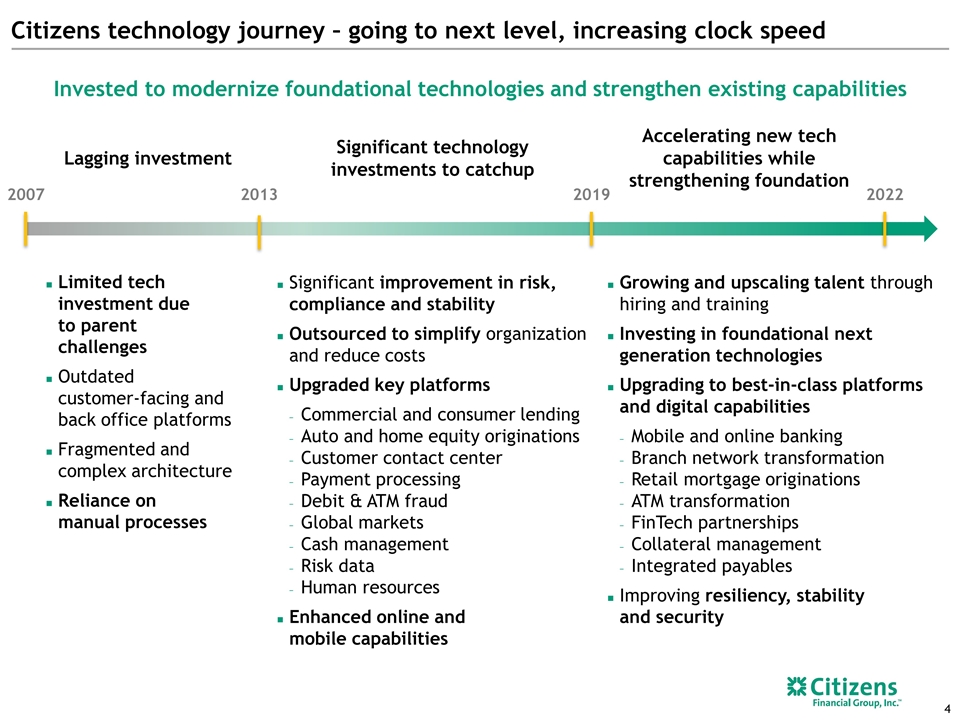

Citizens technology journey – going to next level, increasing clock speed Invested to modernize foundational technologies and strengthen existing capabilities Limited tech investment due to parent challenges Outdated customer‐facing and back office platforms Fragmented and complex architecture Reliance on manual processes Significant improvement in risk, compliance and stability Outsourced to simplify organization and reduce costs Upgraded key platforms Commercial and consumer lending Auto and home equity originations Customer contact center Payment processing Debit & ATM fraud Global markets Cash management Risk data Human resources Enhanced online and mobile capabilities Growing and upscaling talent through hiring and training Investing in foundational next generation technologies Upgrading to best-in-class platforms and digital capabilities Mobile and online banking Branch network transformation Retail mortgage originations ATM transformation FinTech partnerships Collateral management Integrated payables Improving resiliency, stability and security Significant technology investments to catchup Accelerating new tech capabilities while strengthening foundation 2007 2013 2019 2022 Lagging investment

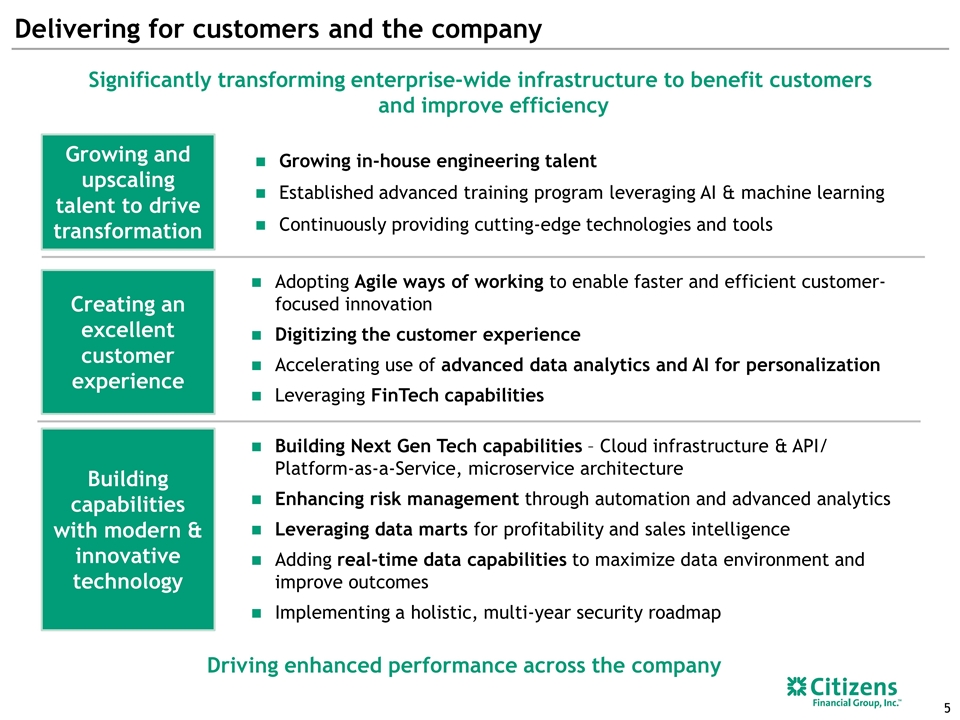

Delivering for customers and the company Significantly transforming enterprise-wide infrastructure to benefit customers and improve efficiency Adopting Agile ways of working to enable faster and efficient customer-focused innovation Digitizing the customer experience Accelerating use of advanced data analytics and AI for personalization Leveraging FinTech capabilities Creating an excellent customer experience Building Next Gen Tech capabilities – Cloud infrastructure & API/ Platform-as-a-Service, microservice architecture Enhancing risk management through automation and advanced analytics Leveraging data marts for profitability and sales intelligence Adding real-time data capabilities to maximize data environment and improve outcomes Implementing a holistic, multi-year security roadmap Building capabilities with modern & innovative technology Growing in-house engineering talent Established advanced training program leveraging AI & machine learning Continuously providing cutting-edge technologies and tools Growing and upscaling talent to drive transformation Driving enhanced performance across the company

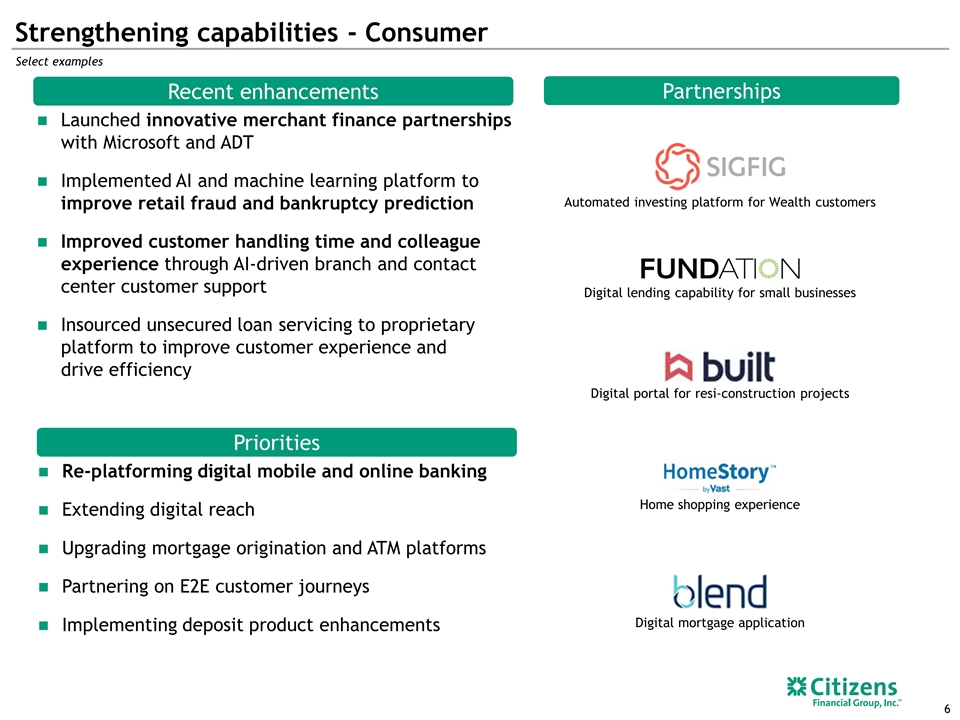

Strengthening capabilities - Consumer Partnerships Recent enhancements Launched innovative merchant finance partnerships with Microsoft and ADT Implemented AI and machine learning platform to improve retail fraud and bankruptcy prediction Improved customer handling time and colleague experience through AI-driven branch and contact center customer support Insourced unsecured loan servicing to proprietary platform to improve customer experience and drive efficiency Automated investing platform for Wealth customers Digital lending capability for small businesses Digital portal for resi-construction projects Home shopping experience Digital mortgage application Priorities Re-platforming digital mobile and online banking Extending digital reach Upgrading mortgage origination and ATM platforms Partnering on E2E customer journeys Implementing deposit product enhancements Select examples

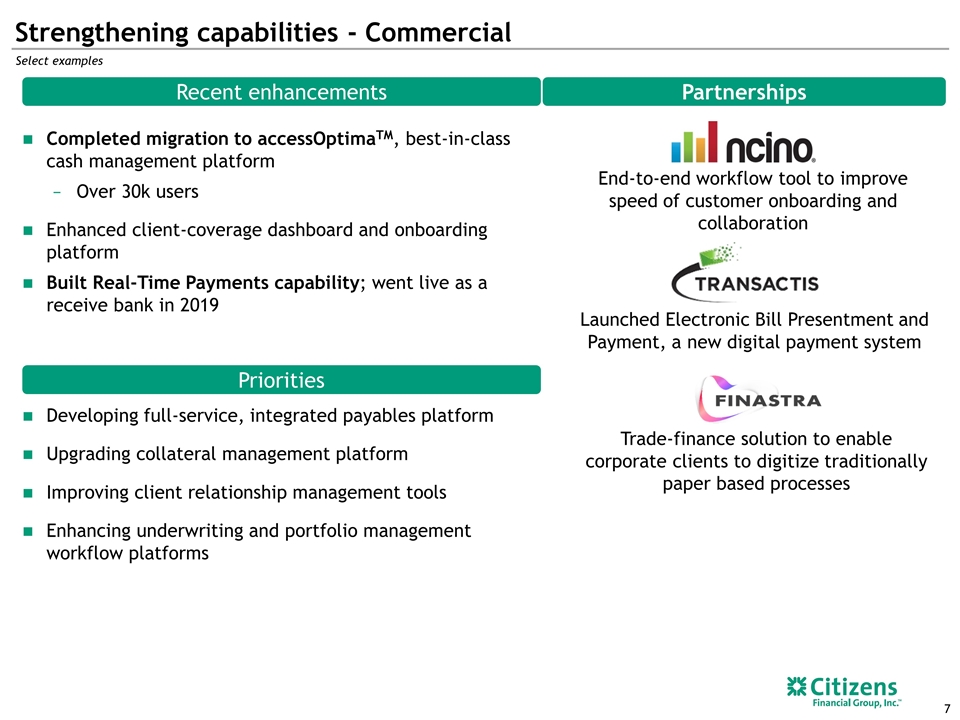

Strengthening capabilities - Commercial Partnerships End-to-end workflow tool to improve speed of customer onboarding and collaboration Trade-finance solution to enable corporate clients to digitize traditionally paper based processes Launched Electronic Bill Presentment and Payment, a new digital payment system Recent enhancements Completed migration to accessOptimaTM, best-in-class cash management platform Over 30k users Enhanced client-coverage dashboard and onboarding platform Built Real-Time Payments capability; went live as a receive bank in 2019 Priorities Developing full-service, integrated payables platform Upgrading collateral management platform Improving client relationship management tools Enhancing underwriting and portfolio management workflow platforms Select examples

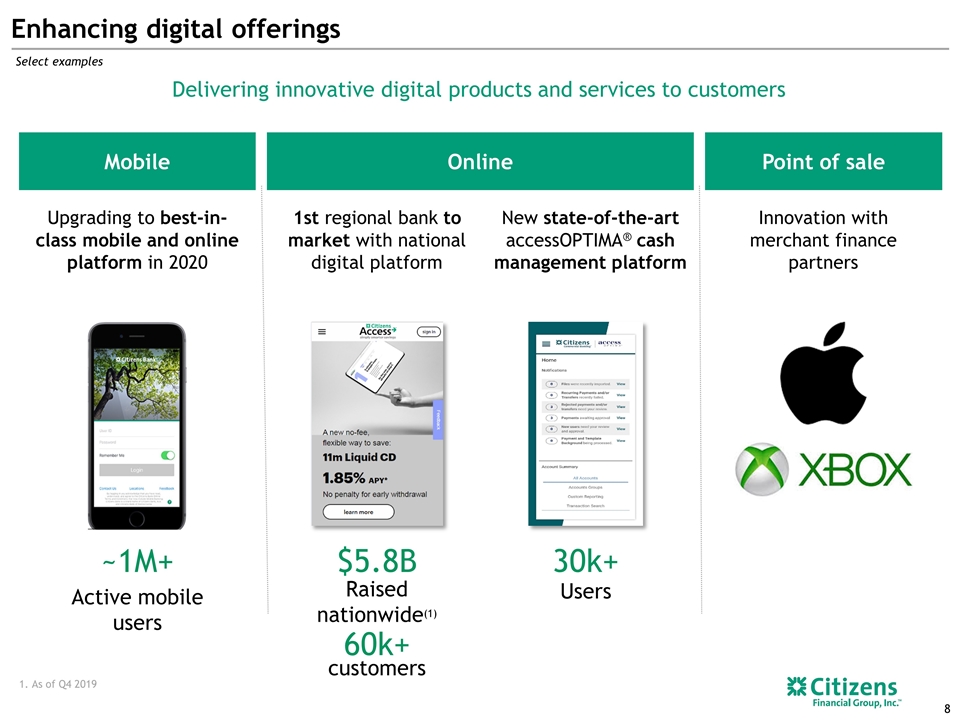

Enhancing digital offerings Upgrading to best-in-class mobile and online platform in 2020 1st regional bank to market with national digital platform New state-of-the-art accessOPTIMA® cash management platform Innovation with merchant finance partners ~1M+ $5.8B Active mobile users Raised nationwide(1) 1. As of Q4 2019 60k+ customers 30k+ Users Mobile Online Point of sale Delivering innovative digital products and services to customers Select examples

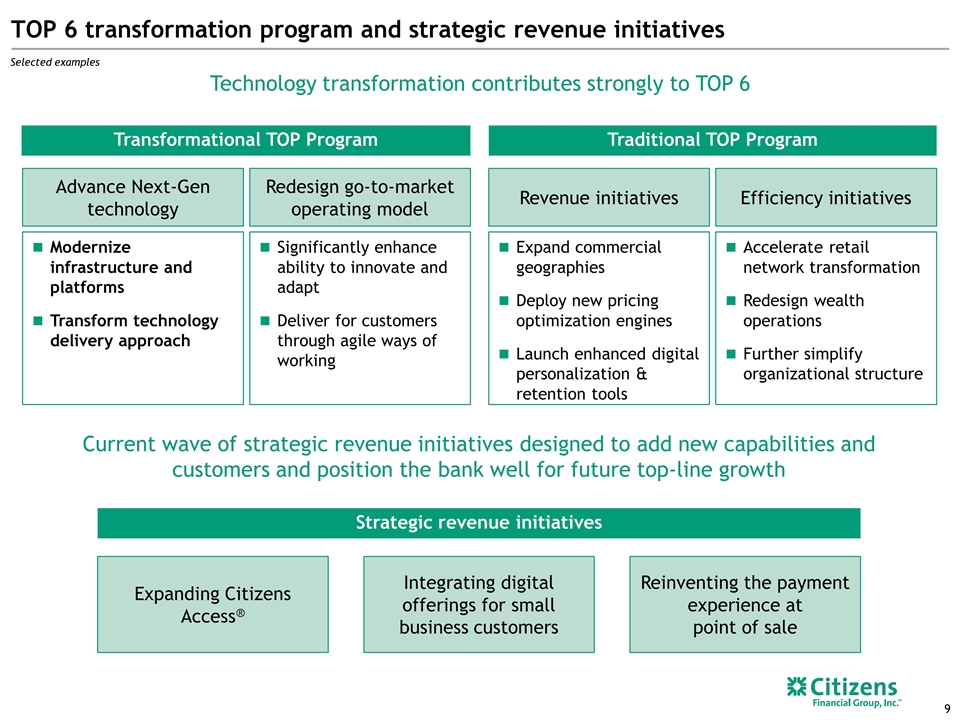

TOP 6 transformation program and strategic revenue initiatives Selected examples Current wave of strategic revenue initiatives designed to add new capabilities and customers and position the bank well for future top-line growth Technology transformation contributes strongly to TOP 6 Transformational TOP Program Modernize infrastructure and platforms Transform technology delivery approach Advance Next-Gen technology Significantly enhance ability to innovate and adapt Deliver for customers through agile ways of working Redesign go-to-market operating model Traditional TOP Program Expand commercial geographies Deploy new pricing optimization engines Launch enhanced digital personalization & retention tools Revenue initiatives Accelerate retail network transformation Redesign wealth operations Further simplify organizational structure Efficiency initiatives Expanding Citizens Access® Integrating digital offerings for small business customers Reinventing the payment experience at point of sale Strategic revenue initiatives

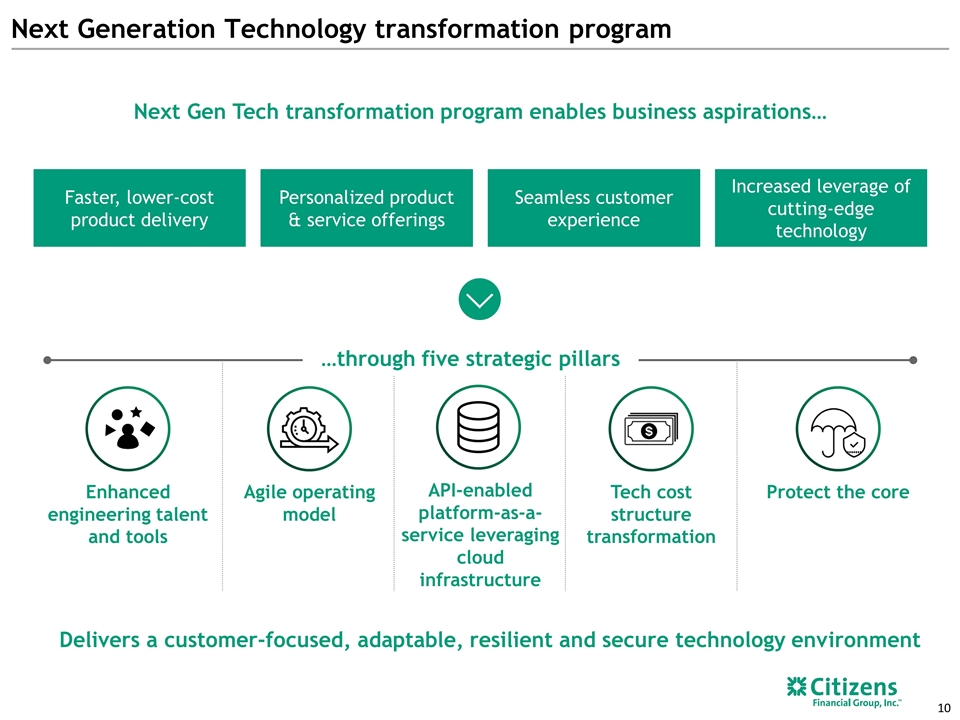

Next Generation Technology transformation program Tech cost structure transformation Protect the core …through five strategic pillars Enhanced engineering talent and tools Agile operating model API-enabled platform-as-a-service leveraging cloud infrastructure Seamless customer experience Personalized product & service offerings Increased leverage of cutting-edge technology Faster, lower-cost product delivery Next Gen Tech transformation program enables business aspirations… Delivers a customer-focused, adaptable, resilient and secure technology environment

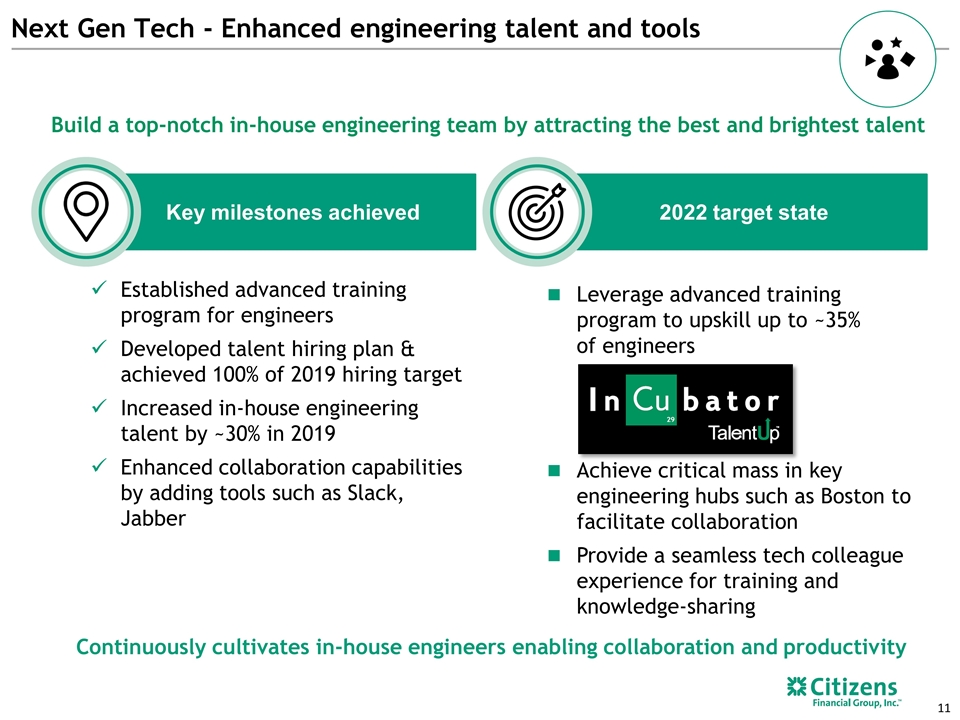

Next Gen Tech - Enhanced engineering talent and tools Key milestones achieved Established advanced training program for engineers Developed talent hiring plan & achieved 100% of 2019 hiring target Increased in-house engineering talent by ~30% in 2019 Enhanced collaboration capabilities by adding tools such as Slack, Jabber 2022 target state Leverage advanced training program to upskill up to ~35% of engineers Achieve critical mass in key engineering hubs such as Boston to facilitate collaboration Provide a seamless tech colleague experience for training and knowledge-sharing Build a top-notch in-house engineering team by attracting the best and brightest talent Continuously cultivates in-house engineers enabling collaboration and productivity

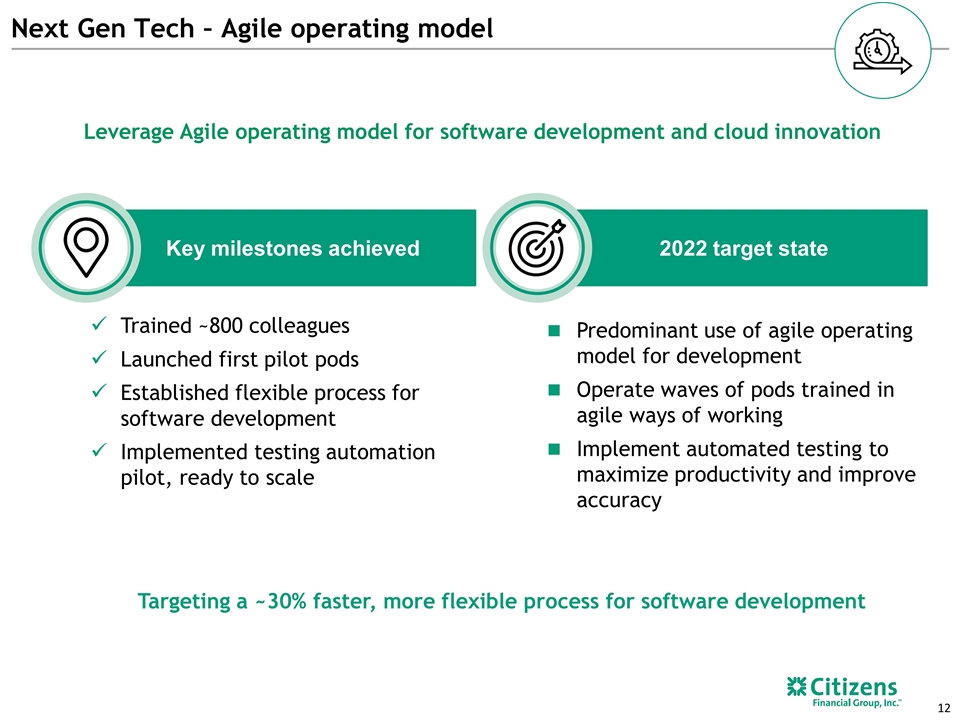

Next Gen Tech – Agile operating model Key milestones achieved Trained ~800 colleagues Launched first pilot pods Established flexible process for software development Implemented testing automation pilot, ready to scale 2022 target state Predominant use of agile operating model for development Operate waves of pods trained in agile ways of working Implement automated testing to maximize productivity and improve accuracy Leverage Agile operating model for software development and cloud innovation Targeting a ~30% faster, more flexible process for software development

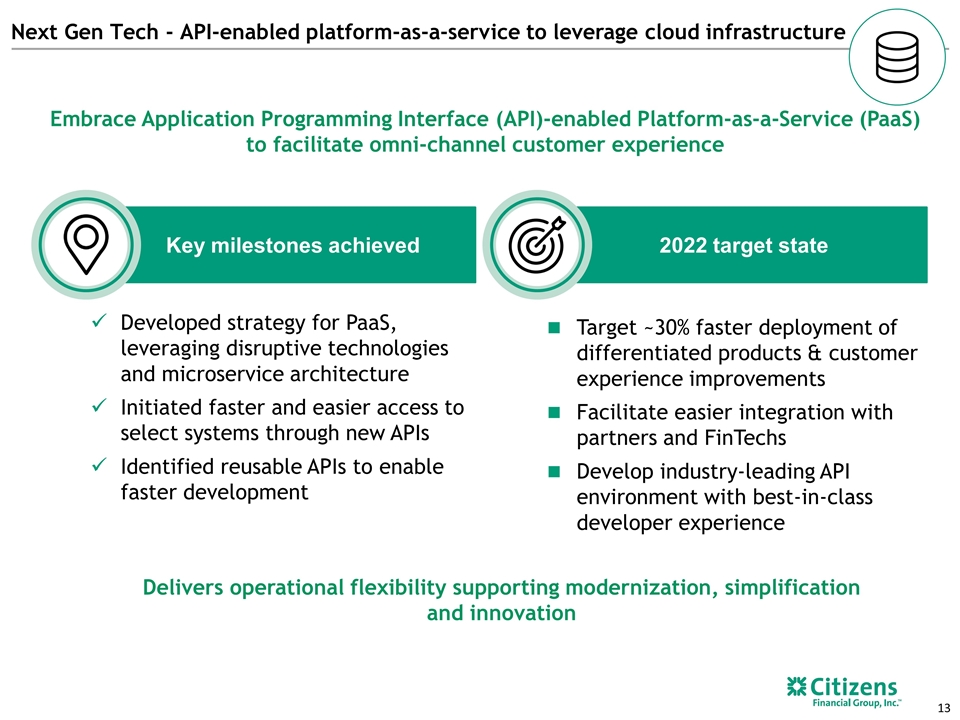

Next Gen Tech - API-enabled platform-as-a-service to leverage cloud infrastructure Key milestones achieved Developed strategy for PaaS, leveraging disruptive technologies and microservice architecture Initiated faster and easier access to select systems through new APIs Identified reusable APIs to enable faster development 2022 target state Target ~30% faster deployment of differentiated products & customer experience improvements Facilitate easier integration with partners and FinTechs Develop industry-leading API environment with best-in-class developer experience Embrace Application Programming Interface (API)-enabled Platform-as-a-Service (PaaS) to facilitate omni-channel customer experience Delivers operational flexibility supporting modernization, simplification and innovation

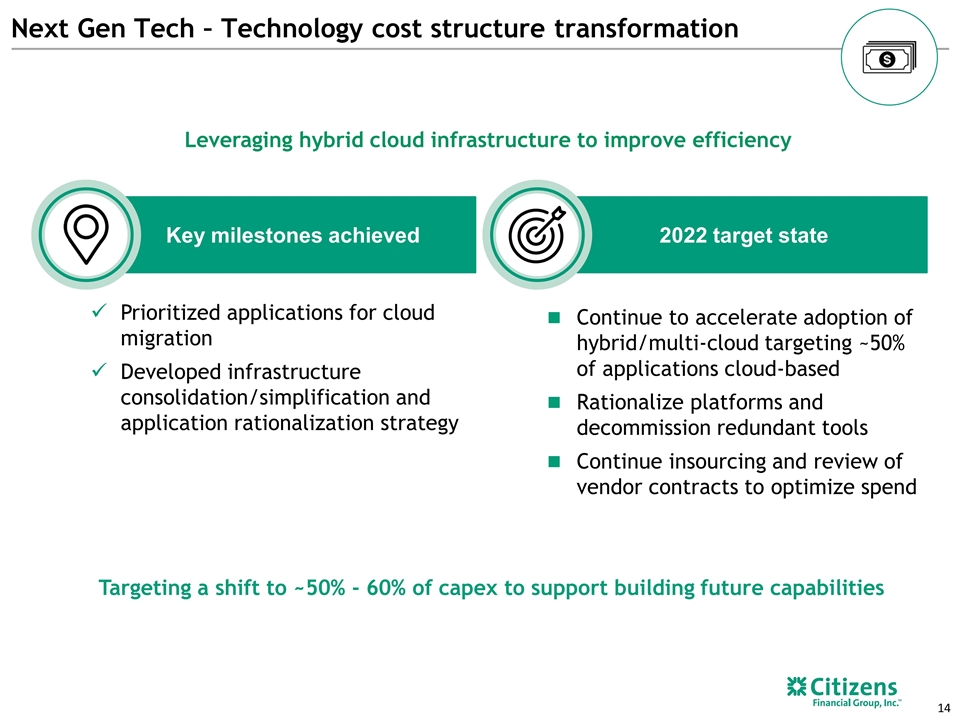

Next Gen Tech – Technology cost structure transformation Key milestones achieved Prioritized applications for cloud migration Developed infrastructure consolidation/simplification and application rationalization strategy 2022 target state Continue to accelerate adoption of hybrid/multi-cloud targeting ~50% of applications cloud-based Rationalize platforms and decommission redundant tools Continue insourcing and review of vendor contracts to optimize spend Leveraging hybrid cloud infrastructure to improve efficiency Targeting a shift to ~50% - 60% of capex to support building future capabilities

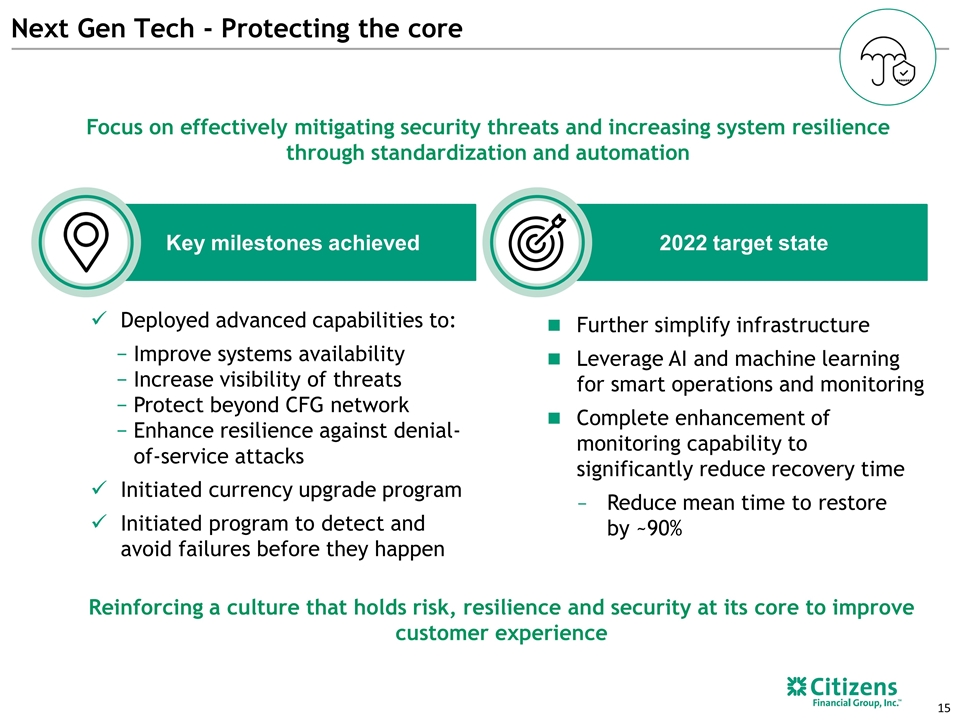

Next Gen Tech - Protecting the core Key milestones achieved Deployed advanced capabilities to: Improve systems availability Increase visibility of threats Protect beyond CFG network Enhance resilience against denial-of-service attacks Initiated currency upgrade program Initiated program to detect and avoid failures before they happen 2022 target state Further simplify infrastructure Leverage AI and machine learning for smart operations and monitoring Complete enhancement of monitoring capability to significantly reduce recovery time Reduce mean time to restore by ~90% Focus on effectively mitigating security threats and increasing system resilience through standardization and automation Reinforcing a culture that holds risk, resilience and security at its core to improve customer experience

Key messages Moving rapidly from laggard to leader Top leadership team, operating discipline, culture of innovation driving our success Strong evidence of our progress ~20 FinTech partnerships First regional to launch national digital bank Innovative merchant platform Top 6 Next Gen Tech and Modern Operating Model initiatives will propel us forward Technology capabilities will be a key strength in becoming a top performing regional bank > > > >