Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Alkermes plc. | alks-ex991_6.htm |

| 8-K - 8-K - Alkermes plc. | alks-8k_20200213.htm |

Fourth Quarter and Year-End 2019 Financial Results & Business Update February 13, 2020 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Information Certain statements set forth in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: the company’s expectations with respect to its future financial and operating performance, business plans or prospects, including expected revenue growth and non-GAAP net income growth, including continued growth of revenue from the company’s commercial products and expectations regarding the related gross-to-net deductions, and the expected impact of the restructuring, including cost savings that may be achieved in connection therewith; the potential therapeutic and commercial value of the company’s marketed and development products; timelines, plans and expectations for development activities relating to the company’s products and product development candidates, including progress across the ARTISTRY clinical development program for ALKS 4230 and emerging data from such program, and IND-enabling activities for the company’s HDAC inhibitor platform; the company’s expectations regarding the timing of regulatory action by the U.S. Food and Drug Administration (“FDA”) in respect of the new drug application (“NDA”) for ALKS 3831 for the treatment of schizophrenia and the treatment of bipolar I disorder and the company’s expectations and timelines for commercial activities, including preparations for the potential launch of ALKS 3831. The company cautions that forward-looking statements are inherently uncertain. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to various risks and uncertainties. These risks, assumptions and uncertainties include, among others: that the expected annual cost savings related to the company’s implementation of a restructuring may not be achieved or may be lower than anticipated; the unfavorable outcome of litigation, including so-called “Paragraph IV” litigation and other patent litigation, related to any of the company’s products, which may lead to competition from generic drug manufacturers; data from clinical trials may be interpreted by the FDA in different ways than the company interprets it; the FDA may not agree with the company’s regulatory approval strategies or components of the company’s filings for its products, including its clinical trial designs, conduct and methodologies or the adequacy of the company’s filings or the data included in the company’s filings to support the FDA’s requirements for approval of the proposed indications; the company’s development activities may not be completed on time or at all; the results of the company’s development activities may not be positive, or predictive of real-world results or of results in subsequent trials, and preliminary or interim results of the company’s development activities may not be predictive of final results of such activities, results of future preclinical or clinical trials or real-world results; regulatory submissions may not occur or be submitted or approved in a timely manner; the company and its licensees may not be able to continue to successfully commercialize their products; there may be a reduction in payment rate or reimbursement for the company’s products or an increase in the company’s financial obligations to governmental payers; the FDA or regulatory authorities outside the U.S. may make adverse decisions regarding the company’s products; the company’s products may prove difficult to manufacture, be precluded from commercialization by the proprietary rights of third parties, or have unintended side effects, adverse reactions or incidents of misuse; and those risks, assumptions and uncertainties described under the heading “Risk Factors” in the company’s most recent Annual Report on Form 10-K and in subsequent filings made by the company with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov, and on the company’s website at www.alkermes.com in the ‘Investors – SEC filings’ section. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, the company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this presentation. Non-GAAP Financial Measures: This presentation includes information about certain financial measures that are not prepared in accordance with generally accepted accounting principles in the U.S. (GAAP), including non-GAAP net income and non-GAAP earnings per share. These non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similar measures presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found in the Alkermes plc Current Report on Form 8-K filed with the SEC on Feb. 13, 2020. Note Regarding Trademarks: The company is the owner of various U.S. federal trademark registrations (®) and other trademarks (TM), including ARISTADA®, ARISTADA INITIO® and VIVITROL®. VUMERITY® is a registered trademark of Biogen MA Inc., used by Alkermes under license. Any other trademarks referred to in this presentation are the property of their respective owners. Appearances of such other trademarks herein should not be construed as any indicator that their respective owners will not assert their rights thereto.

Q4 & FY 2019 Financial Results; 2020 Guidance Jim Frates, Chief Financial Officer Business Update Richard Pops, Chief Executive Officer Agenda

Financial Highlights Q4 2019 Completed acquisition of Rodin Therapeutics, Inc. (“Rodin”); accounted for as an asset acquisition; included upfront cash payment of $98.1M to Rodin’s former security holders, of which $86.6M recorded as R&D expense in Q4 2019 Received $150M milestone payment from Biogen related to FDA approval of VUMERITY® 2020 financial expectations Excluding 2019 license and R&D revenues from Biogen of ~$195M related to development and approval of VUMERITY, 2020 revenue guidance range of $1.03B to $1.08B† represents revenue growth of ~8% compared to 2019 Excluding 2019 VUMERITY milestone payment from Biogen of $150M, 2020 non-GAAP net income guidance range of $40M to $70M† represents non-GAAP net income growth of ~$90M compared to 2019 Strategic restructuring plan implemented in 2019 expected to result in cost savings of ~$150M in 2020, excluding $20M of incremental R&D spend resulting from subsequent acquisition of Rodin † This guidance is provided by Alkermes plc (the “Company”) in its Current Report on Form 8-K filed with the SEC on Feb. 13, 2020 and is effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm this guidance and only provides guidance in a Regulation FD compliant manner. Growth is measured against the midpoint of the applicable 2020 guidance range.

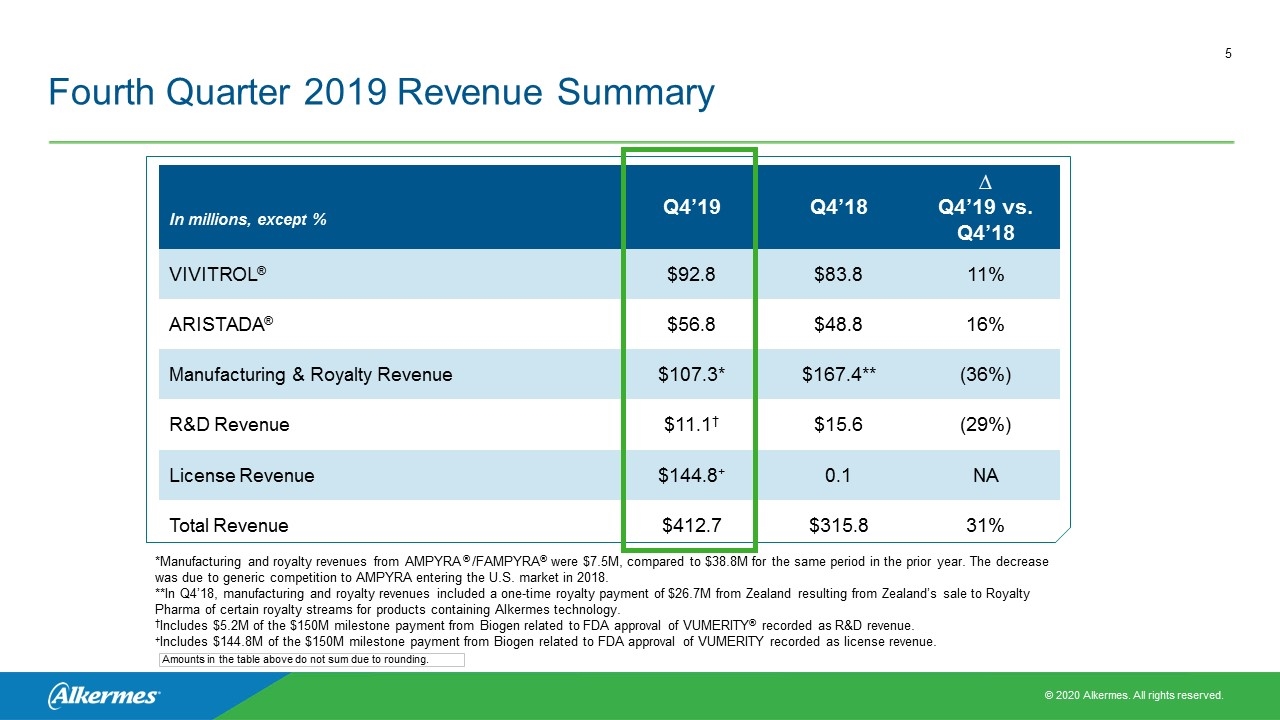

Fourth Quarter 2019 Revenue Summary In millions, except % Q4’19 Q4’18 ∆ Q4’19 vs. Q4’18 VIVITROL® $92.8 $83.8 11% ARISTADA® $56.8 $48.8 16% Manufacturing & Royalty Revenue $107.3* $167.4** (36%) R&D Revenue $11.1† $15.6 (29%) License Revenue $144.8+ 0.1 NA Total Revenue $412.7 $315.8 31% *Manufacturing and royalty revenues from AMPYRA ® /FAMPYRA® were $7.5M, compared to $38.8M for the same period in the prior year. The decrease was due to generic competition to AMPYRA entering the U.S. market in 2018. **In Q4’18, manufacturing and royalty revenues included a one-time royalty payment of $26.7M from Zealand resulting from Zealand’s sale to Royalty Pharma of certain royalty streams for products containing Alkermes technology. †Includes $5.2M of the $150M milestone payment from Biogen related to FDA approval of VUMERITY® recorded as R&D revenue. +Includes $144.8M of the $150M milestone payment from Biogen related to FDA approval of VUMERITY recorded as license revenue. Amounts in the table above do not sum due to rounding.

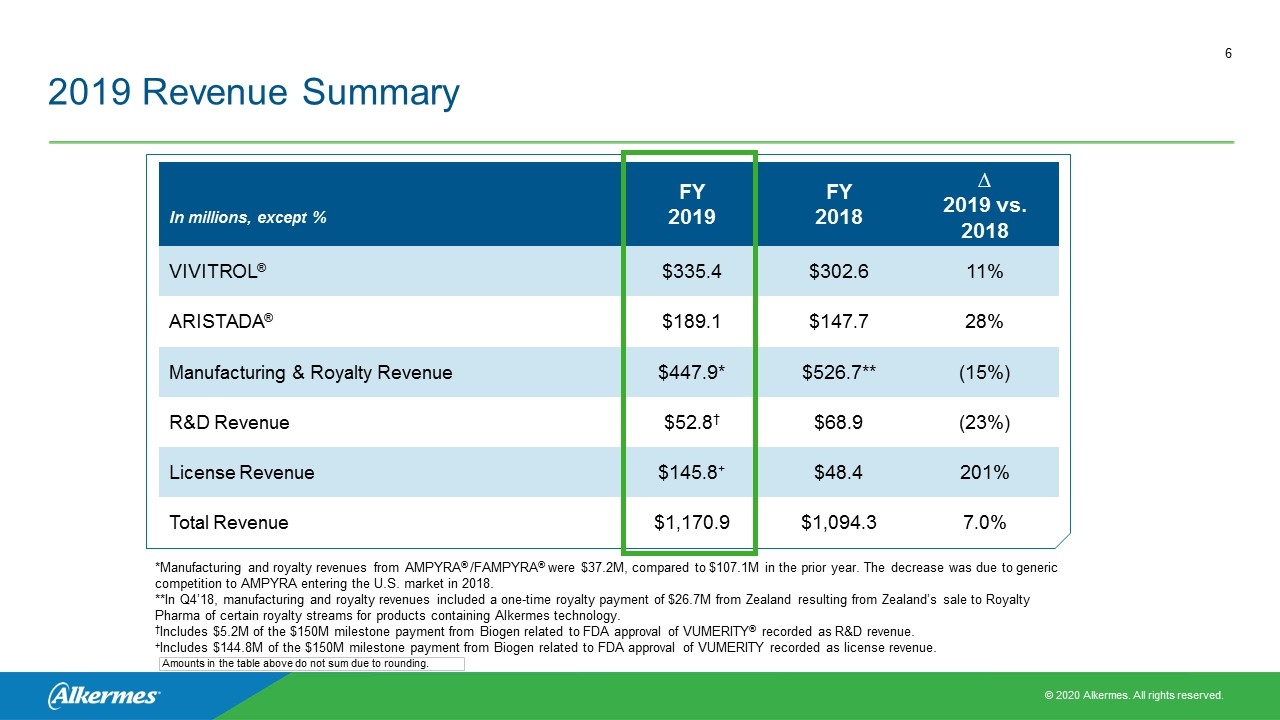

2019 Revenue Summary In millions, except % FY 2019 FY 2018 ∆ 2019 vs. 2018 VIVITROL® $335.4 $302.6 11% ARISTADA® $189.1 $147.7 28% Manufacturing & Royalty Revenue $447.9* $526.7** (15%) R&D Revenue $52.8† $68.9 (23%) License Revenue $145.8+ $48.4 201% Total Revenue $1,170.9 $1,094.3 7.0% *Manufacturing and royalty revenues from AMPYRA® /FAMPYRA® were $37.2M, compared to $107.1M in the prior year. The decrease was due to generic competition to AMPYRA entering the U.S. market in 2018. **In Q4’18, manufacturing and royalty revenues included a one-time royalty payment of $26.7M from Zealand resulting from Zealand’s sale to Royalty Pharma of certain royalty streams for products containing Alkermes technology. †Includes $5.2M of the $150M milestone payment from Biogen related to FDA approval of VUMERITY® recorded as R&D revenue. +Includes $144.8M of the $150M milestone payment from Biogen related to FDA approval of VUMERITY recorded as license revenue. Amounts in the table above do not sum due to rounding.

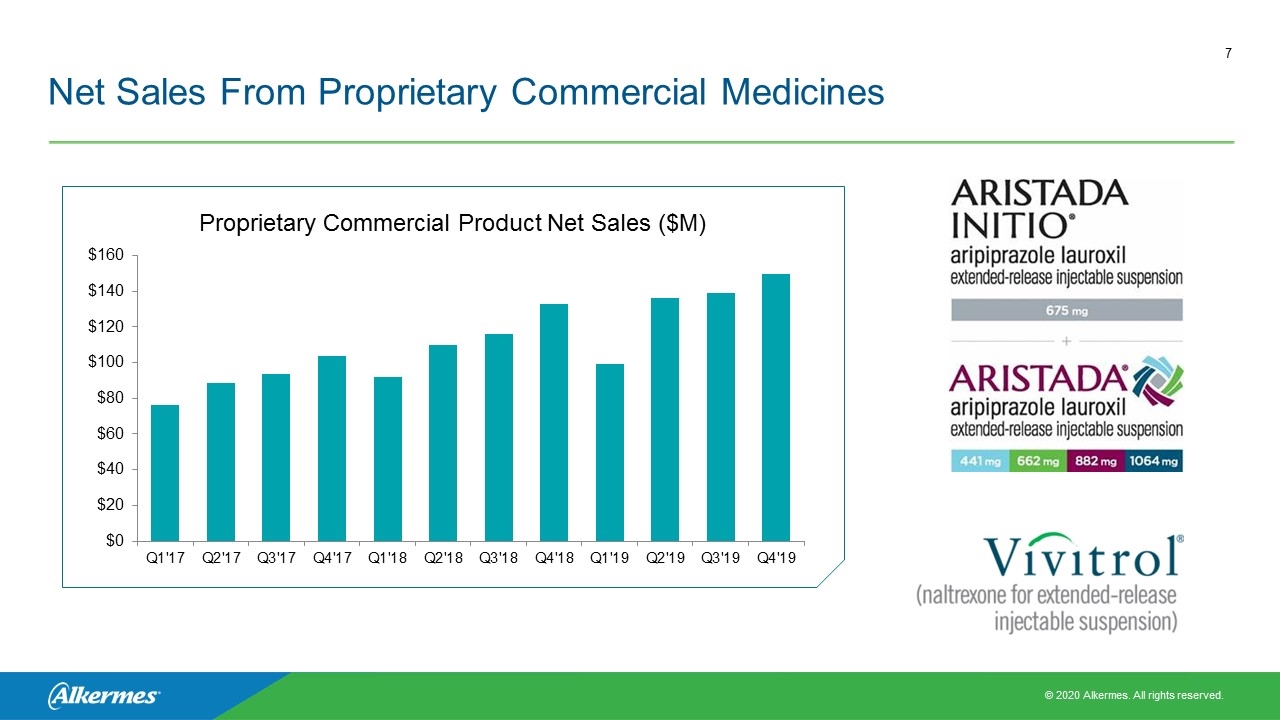

Net Sales From Proprietary Commercial Medicines Proprietary Commercial Product Net Sales ($M)

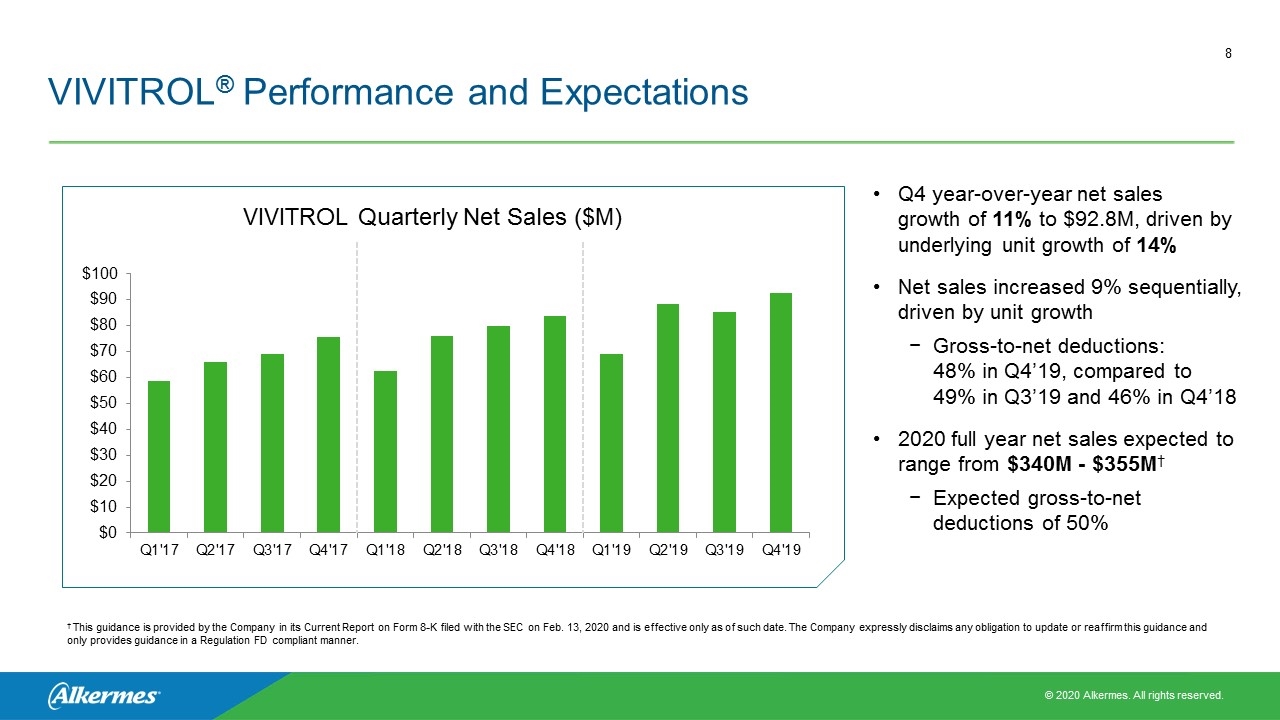

VIVITROL® Performance and Expectations Q4 year-over-year net sales growth of 11% to $92.8M, driven by underlying unit growth of 14% Net sales increased 9% sequentially, driven by unit growth Gross-to-net deductions: 48% in Q4’19, compared to 49% in Q3’19 and 46% in Q4’18 2020 full year net sales expected to range from $340M - $355M† Expected gross-to-net deductions of 50% VIVITROL Quarterly Net Sales ($M) † This guidance is provided by the Company in its Current Report on Form 8-K filed with the SEC on Feb. 13, 2020 and is effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm this guidance and only provides guidance in a Regulation FD compliant manner.

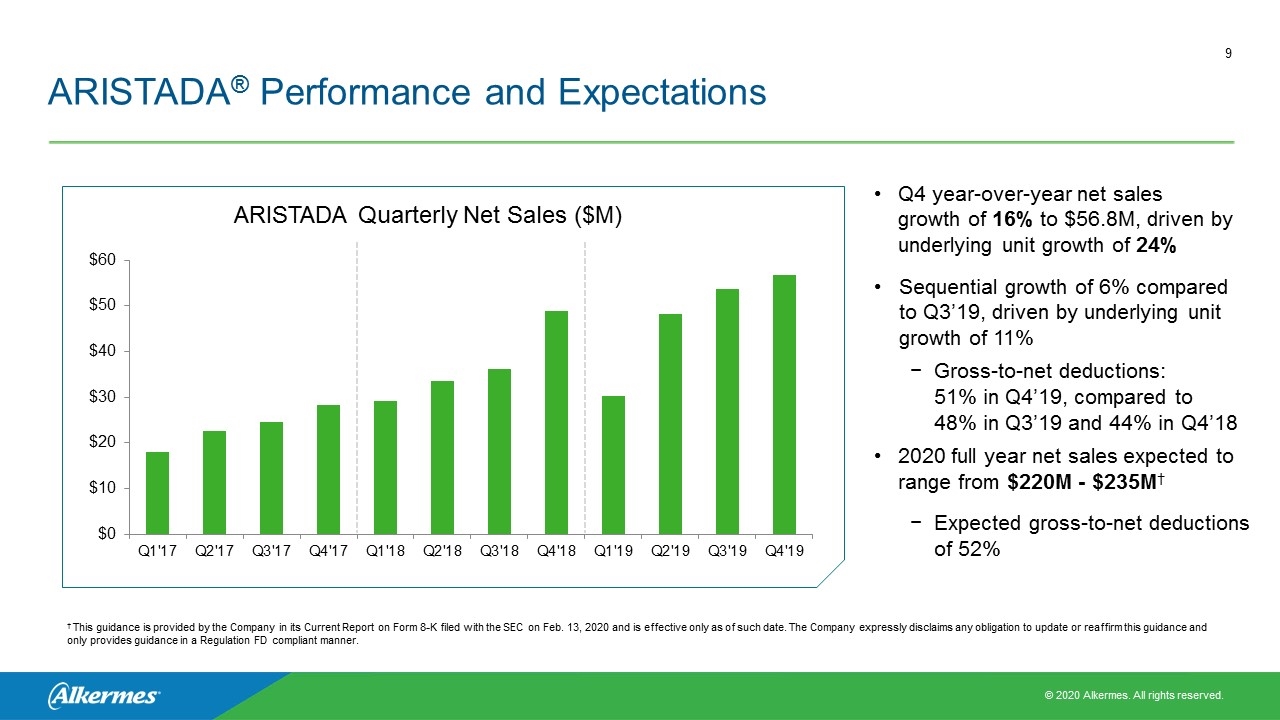

ARISTADA® Performance and Expectations Q4 year-over-year net sales growth of 16% to $56.8M, driven by underlying unit growth of 24% Sequential growth of 6% compared to Q3’19, driven by underlying unit growth of 11% Gross-to-net deductions: 51% in Q4’19, compared to 48% in Q3’19 and 44% in Q4’18 2020 full year net sales expected to range from $220M - $235M† Expected gross-to-net deductions of 52% ARISTADA Quarterly Net Sales ($M) † This guidance is provided by the Company in its Current Report on Form 8-K filed with the SEC on Feb. 13, 2020 and is effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm this guidance and only provides guidance in a Regulation FD compliant manner.

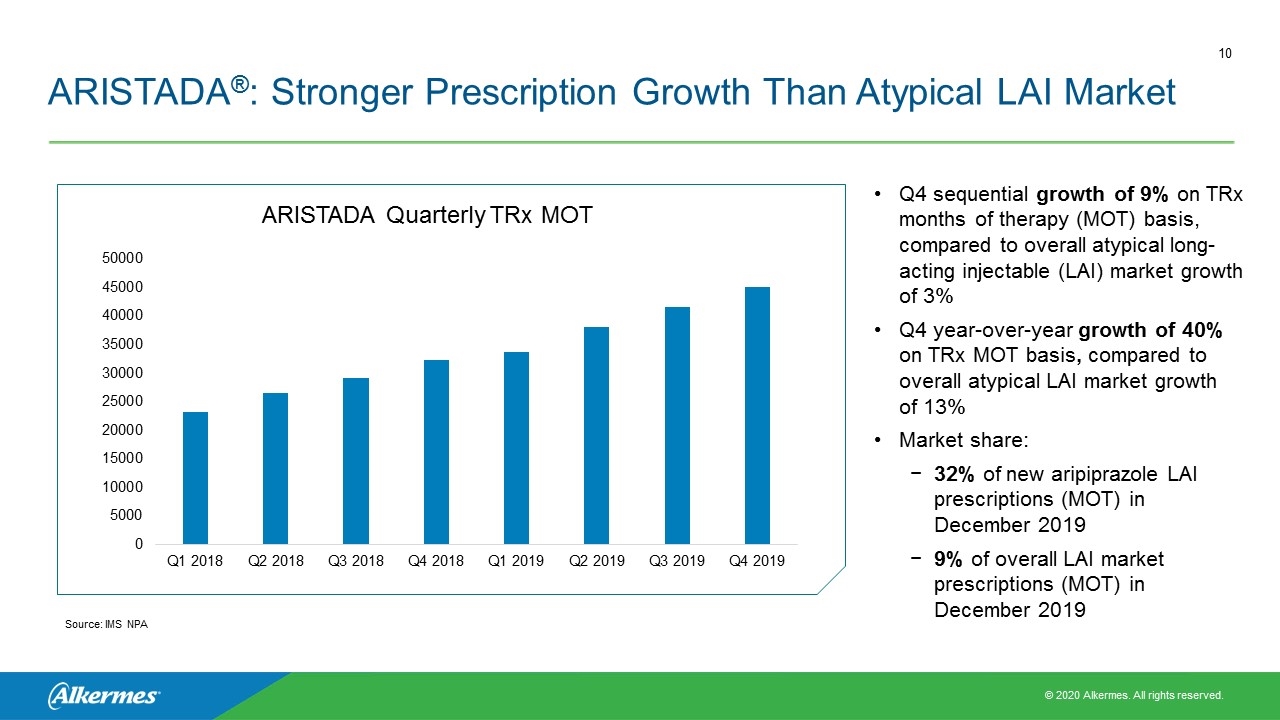

ARISTADA®: Stronger Prescription Growth Than Atypical LAI Market Q4 sequential growth of 9% on TRx months of therapy (MOT) basis, compared to overall atypical long-acting injectable (LAI) market growth of 3% Q4 year-over-year growth of 40% on TRx MOT basis, compared to overall atypical LAI market growth of 13% Market share: 32% of new aripiprazole LAI prescriptions (MOT) in December 2019 9% of overall LAI market prescriptions (MOT) in December 2019 ARISTADA Quarterly TRx MOT Source: IMS NPA

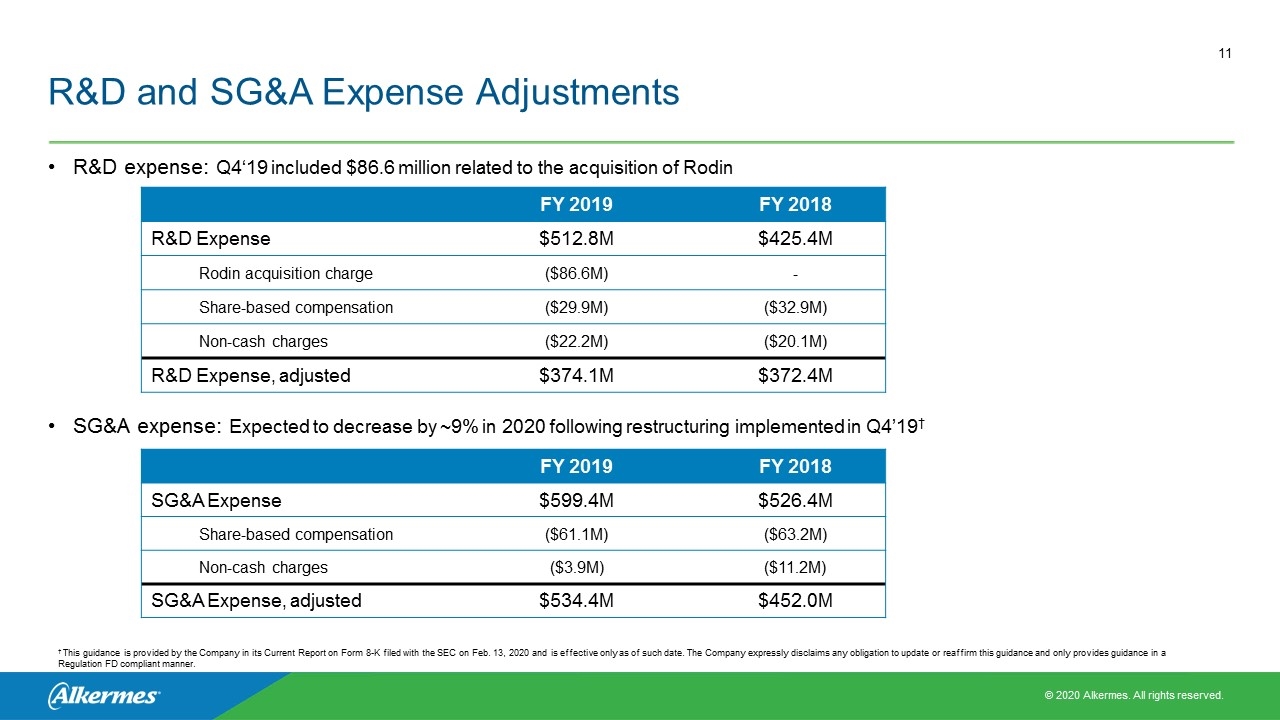

R&D and SG&A Expense Adjustments R&D expense: Q4‘19 included $86.6 million related to the acquisition of Rodin FY 2019 FY 2018 R&D Expense $512.8M $425.4M Rodin acquisition charge ($86.6M) - Share-based compensation ($29.9M) ($32.9M) Non-cash charges ($22.2M) ($20.1M) R&D Expense, adjusted $374.1M $372.4M FY 2019 FY 2018 SG&A Expense $599.4M $526.4M Share-based compensation ($61.1M) ($63.2M) Non-cash charges ($3.9M) ($11.2M) SG&A Expense, adjusted $534.4M $452.0M SG&A expense: Expected to decrease by ~9% in 2020 following restructuring implemented in Q4’19† † This guidance is provided by the Company in its Current Report on Form 8-K filed with the SEC on Feb. 13, 2020 and is effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm this guidance and only provides guidance in a Regulation FD compliant manner.

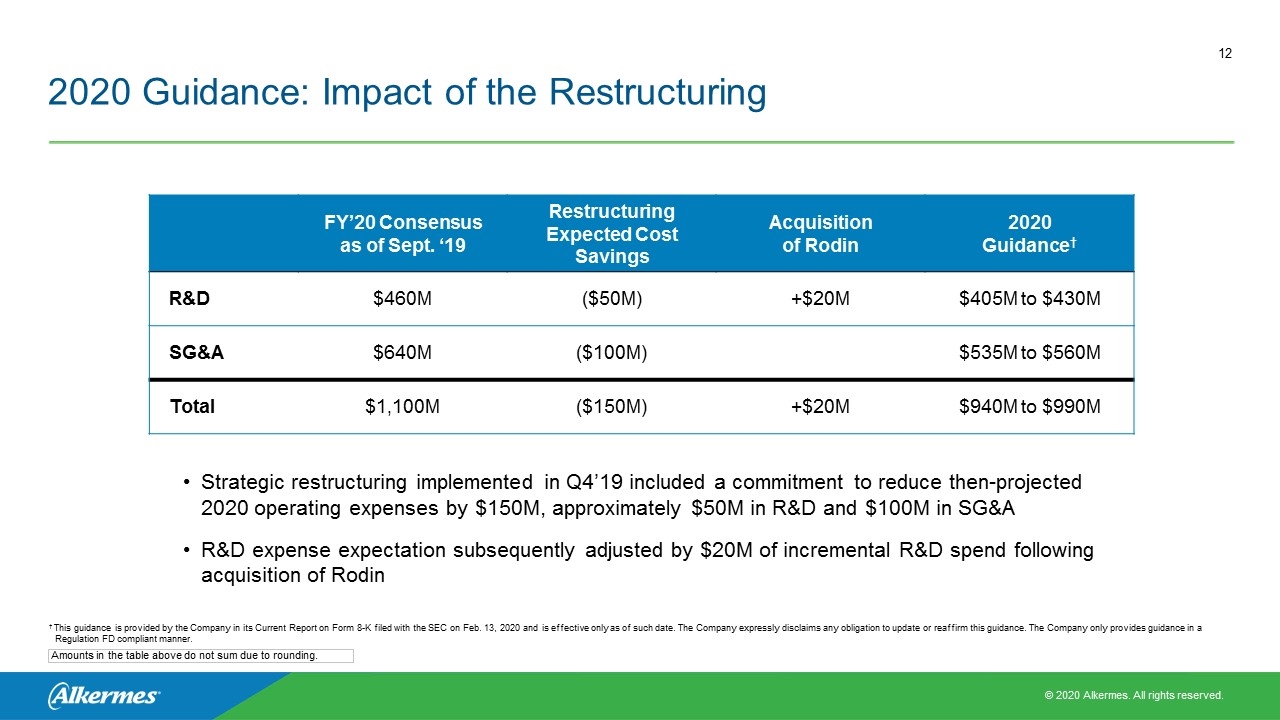

2020 Guidance: Impact of the Restructuring Strategic restructuring implemented in Q4’19 included a commitment to reduce then-projected 2020 operating expenses by $150M, approximately $50M in R&D and $100M in SG&A R&D expense expectation subsequently adjusted by $20M of incremental R&D spend following acquisition of Rodin Amounts in the table above do not sum due to rounding. FY’20 Consensus as of Sept. ‘19 Restructuring Expected Cost Savings Acquisition of Rodin 2020 Guidance† R&D $460M ($50M) +$20M $405M to $430M SG&A $640M ($100M) $535M to $560M Total $1,100M ($150M) +$20M $940M to $990M † This guidance is provided by the Company in its Current Report on Form 8-K filed with the SEC on Feb. 13, 2020 and is effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm this guidance. The Company only provides guidance in a Regulation FD compliant manner.

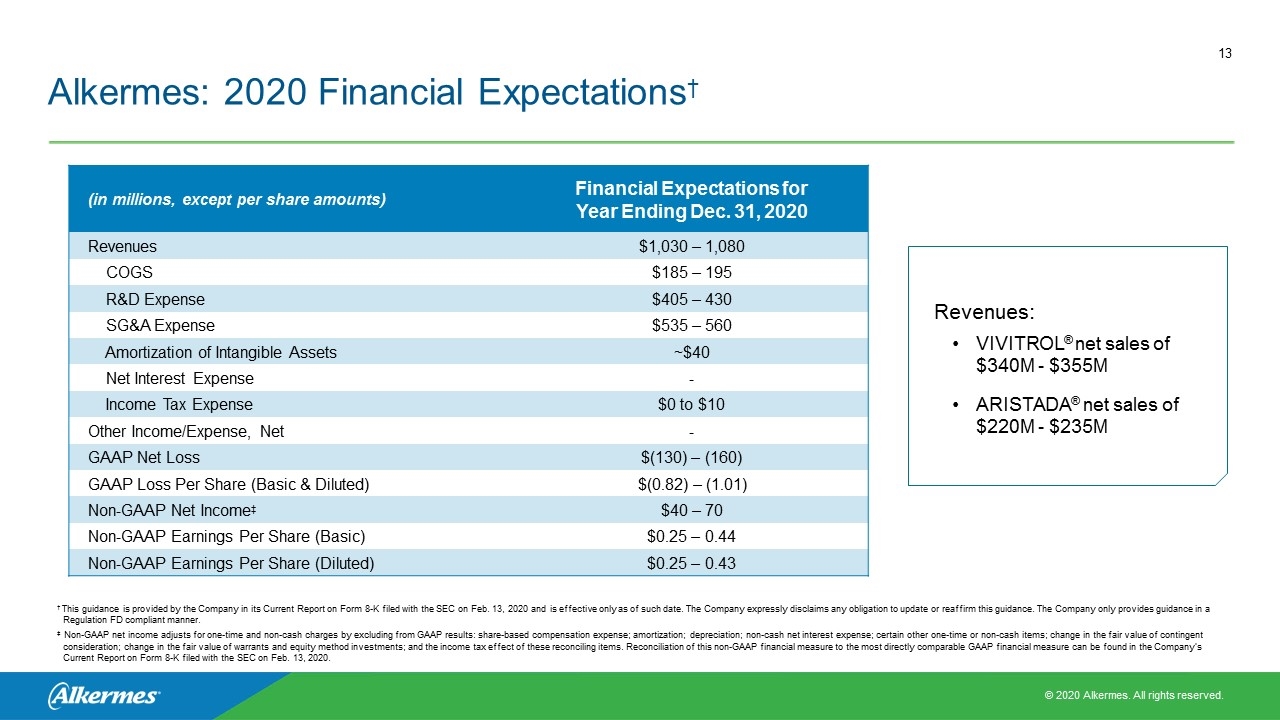

(in millions, except per share amounts) Financial Expectations for Year Ending Dec. 31, 2020 Revenues $1,030 – 1,080 COGS $185 – 195 R&D Expense $405 – 430 SG&A Expense $535 – 560 Amortization of Intangible Assets ~$40 Net Interest Expense - Income Tax Expense $0 to $10 Other Income/Expense, Net - GAAP Net Loss $(130) – (160) GAAP Loss Per Share (Basic & Diluted) $(0.82) – (1.01) Non-GAAP Net Income‡ $40 – 70 Non-GAAP Earnings Per Share (Basic) $0.25 – 0.44 Non-GAAP Earnings Per Share (Diluted) $0.25 – 0.43 † This guidance is provided by the Company in its Current Report on Form 8-K filed with the SEC on Feb. 13, 2020 and is effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm this guidance. The Company only provides guidance in a Regulation FD compliant manner. ‡ Non-GAAP net income adjusts for one-time and non-cash charges by excluding from GAAP results: share-based compensation expense; amortization; depreciation; non-cash net interest expense; certain other one-time or non-cash items; change in the fair value of contingent consideration; change in the fair value of warrants and equity method investments; and the income tax effect of these reconciling items. Reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure can be found in the Company’s Current Report on Form 8-K filed with the SEC on Feb. 13, 2020. Revenues: VIVITROL® net sales of $340M - $355M† ARISTADA® net sales of $220M - $235M Alkermes: 2020 Financial Expectations†

2019 Operational Achievements Announced positive topline results from ARISTADA® ALPINE phase 3 study Announced positive topline results from VUMERITY® EVOLVE-MS-2 phase 3 study Received FDA approval for VUMERITY and a $150M milestone payment from Biogen Implemented strategic restructuring to reduce cost structure and accelerate toward sustained non-GAAP profitability Acquired Rodin: Expanded neuroscience development efforts into a wide range of neurodegenerative disorders Submitted single NDA for ALKS 3831 for treatment of schizophrenia and treatment of bipolar I disorder; NDA accepted by FDA in Jan. 2020 and assigned PDUFA target action date of Nov. 15, 2020 Advanced ALKS 4230 ARTISTRY-1 and ARTISTRY-2 clinical development programs; Initial efficacy data from ARTISTRY-1 presented at the Society for Immunotherapy of Cancer Annual Meeting in Nov. 2019

ALKS 3831: A Potential New Oral Treatment for Adults With Schizophrenia and Adults With Bipolar I Disorder Investigational antipsychotic designed to offer efficacy of olanzapine; addition of samidorphan intended to mitigate olanzapine-associated weight gain Single NDA for treatment of adults with schizophrenia and adults with bipolar I disorder under FDA review: PDUFA target action date of Nov. 15, 2020 Conducted pre-NDA meeting to discuss contents of NDA and FDA requirements Fixed-dose combination Bilayer tablet of samidorphan (10 mg) and olanzapine (5 mg, 10 mg, 15 mg, or 20 mg) ALKS 3831 Launch Preparations Disease State Awareness Payer Engagement Building on existing commercial infrastructure and capabilities in schizophrenia

ALKS 4230 ARTISTRY-2 Subcutaneous Dosing Study Initial Escalation Cohorts Emerging pharmacokinetic (PK) and pharmacodynamic profile† PK profile consistent with predictions based on profile from intravenous (IV) dosing in ARTISTRY-1 Demonstrated biological activity, as measured by expansion of effector cells Emerging tolerability profile As of Feb. 11, 2020, 11 of 19 patients dosed with the subcutaneous regimen of ALKS 4230 continued on treatment and 5 patients had received six months of treatment or more Observations thus far suggest that both the weekly and once-every-three-week subcutaneous regimens may have potential for an improved tolerability profile as compared to the IV dosing regimen† No serious adverse events related to study drug or discontinuations due to adverse events have been observed† Efficacy 9 of 11 patients who completed first scans demonstrated stable disease; a majority of these 9 patients continued to demonstrate stable disease upon their second scan† † As of Dec. 19, 2019 data cut

HDAC Inhibitor Platform: Advancing Preclinical Research and IND-Enabling Activities HDAC* CoREST inhibitors for synaptopathies Pursue IND-enabling activities for lead preclinical compounds Potential utility across highly-prevalent neurodegenerative diseases such as Alzheimer’s Disease as well as orphan diseases such as frontotemporal dementia and Huntington’s Disease Oncology and other disease areas Continue exploratory work to assess the potential utility of selective HDAC modulation Translational development and biomarkers Continue development of biomarker and translational tools to help demonstrate potential target engagement and efficacy * HDAC: Histone deacetylase

2020 Key Priorities Drive growth of VIVITROL® and ARISTADA® through commercial execution Prepare for potential launch of ALKS 3831 for the treatment of schizophrenia and the treatment of bipolar I disorder Advance the development of ALKS 4230 in oncology

www.alkermes.com