Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SLM Corp | slm021220208kinv.htm |

Exhibit 99.1 Investor Presentation First Quarter 2020 Confidential and proprietary information. © 2019 Sallie Mae Bank. All rights reserved.

Forward-Looking Statements and Disclaimer Cautionary Note Regarding Forward-Looking Statements The following information is current as of January 22, 2020 (unless otherwise noted) and should be read in connection with the press release of SLM Corporation (the “Company”) announcing its financial results for the quarter and full-year ended December 31, 2019, filed with the Securities and Exchange Commission (“SEC”) on January 22, 2020, and subsequent reports filed with the SEC. This Presentation contains “forward-looking” statements and information based on management’s current expectations as of the date of this Presentation. Statements that are not historical facts, including statements about the Company’s beliefs, opinions or expectations and statements that assume or are dependent upon future events, are forward- looking statements. This includes, but is not limited to: the Company’s expectation and ability to pay a quarterly cash dividend on its common stock in the future, subject to the determination by, and discretion of, the Company’s Board of Directors, and based on an evaluation of the Company’s earnings, financial condition and requirements, business conditions, capital allocation determinations, and other factors, risks and uncertainties; the Company’s 2020 guidance; the Company’s three-year horizon outlook; the Company’s expectation and ability to execute loan sales and share repurchases; the Company’s projections for originations and earnings growth and balance sheet position; and any estimates related to accounting standard changes. Forward-looking statements are subject to risks, uncertainties, assumptions and other factors that may cause actual results to be materially different from those reflected in such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in Item 1A. “Risk Factors” and elsewhere in the Company’s Annual Report on Form 10-K for the year ended Dec. 31, 2018 (filed with the SEC on Feb. 28, 2019) and subsequent filings with the SEC; increases in financing costs; limits on liquidity; increases in costs associated with compliance with laws and regulations; failure to comply with consumer protection, banking and other laws; changes in accounting standards and the impact of related changes in significant accounting estimates, including any regarding the measurement of the Company’s allowance for loan losses and the related provision expense; any adverse outcomes in any significant litigation to which the Company or any subsidiary is a party; credit risk associated with the Company’s (or any subsidiary's) exposure to third parties, including counterparties to the Company’s (or any subsidiary's) derivative transactions; and changes in the terms of education loans and the educational credit marketplace (including changes resulting from new laws and the implementation of existing laws). The Company could also be affected by, among other things: changes in its funding costs and availability; reductions to its credit ratings; cybersecurity incidents, cyberattacks, and other failures or breaches of its operating systems or infrastructure, including those of third-party vendors; damage to its reputation; risks associated with restructuring initiatives, including failures to successfully implement cost-cutting programs and the adverse effects of such initiatives on the Company’s business; changes in the demand for educational financing or in financing preferences of lenders, educational institutions, students and their families; changes in law and regulations with respect to the student lending business and financial institutions generally; changes in banking rules and regulations, including increased capital requirements; increased competition from banks and other consumer lenders; the creditworthiness of customers; changes in the general interest rate environment, including the rate relationships among relevant money-market instruments and those of earning assets versus funding arrangements; rates of prepayments on the loans owned by the Company and its subsidiaries; changes in general economic conditions and the Company’s ability to successfully effectuate any acquisitions; and other strategic initiatives. The preparation of the Company’s consolidated financial statements also requires management to make certain estimates and assumptions, including estimates and assumptions about future events. These estimates or assumptions may prove to be incorrect. All forward-looking statements contained in this Presentation are qualified by these cautionary statements and are made only as of the date of this Presentation. The Company does not undertake any obligation to update or revise these forward-looking statements to conform such statements to actual results or changes in its expectations. The Company reports financial results on a GAAP basis and also provides certain non-GAAP “Core Earnings” performance measures. The difference between the Company’s “Core Earnings” and GAAP results for the periods presented were the unrealized, mark-to-fair value gains/losses on derivative contracts (excluding current period accruals on the derivative instruments), net of tax. These are recognized in GAAP, but not in “Core Earnings” results. The Company provides “Core Earnings” measures because this is what management uses when making management decisions regarding the Company’s performance and the allocation of corporate resources. The Company’s “Core Earnings” are not defined terms within GAAP and may not be comparable to similarly titled measures reported by other companies. For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations –’Core Earnings’” in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2019 for a further discussion and the “’Core Earnings’ to GAAP Reconciliation” table in this Presentation for a complete reconciliation between GAAP net income and “Core Earnings”. 2

Well-Positioned for Long-Term Success and Value Creation MARKET LEADING BRAND ATTRACTIVE PRODUCTS EXCEPTIONAL SERVICE • Leader of the education • Products designed to provide • Largest salesforce in the finance market customers success through industry higher education • Industry leading 54% market • Complaints per customer share1 • Diverse portfolio offers decreased 42% over the last financing solutions for all forms 4 years31 • Over 2,400 actively of higher education, including managed university • Customer satisfaction undergraduate, parent, relationships across the U.S. reached an all-time high of medical, dental, MBA, law, 80% in 201931 • Appear on 98% of preferred health professions and general lender lists studies • Sallie Mae has been recognized by J.D. Power by providing “An Outstanding Customer Service Experience” for Phone support30 Providing access, planning outcomes, and helping students and families responsibly fund their future 3

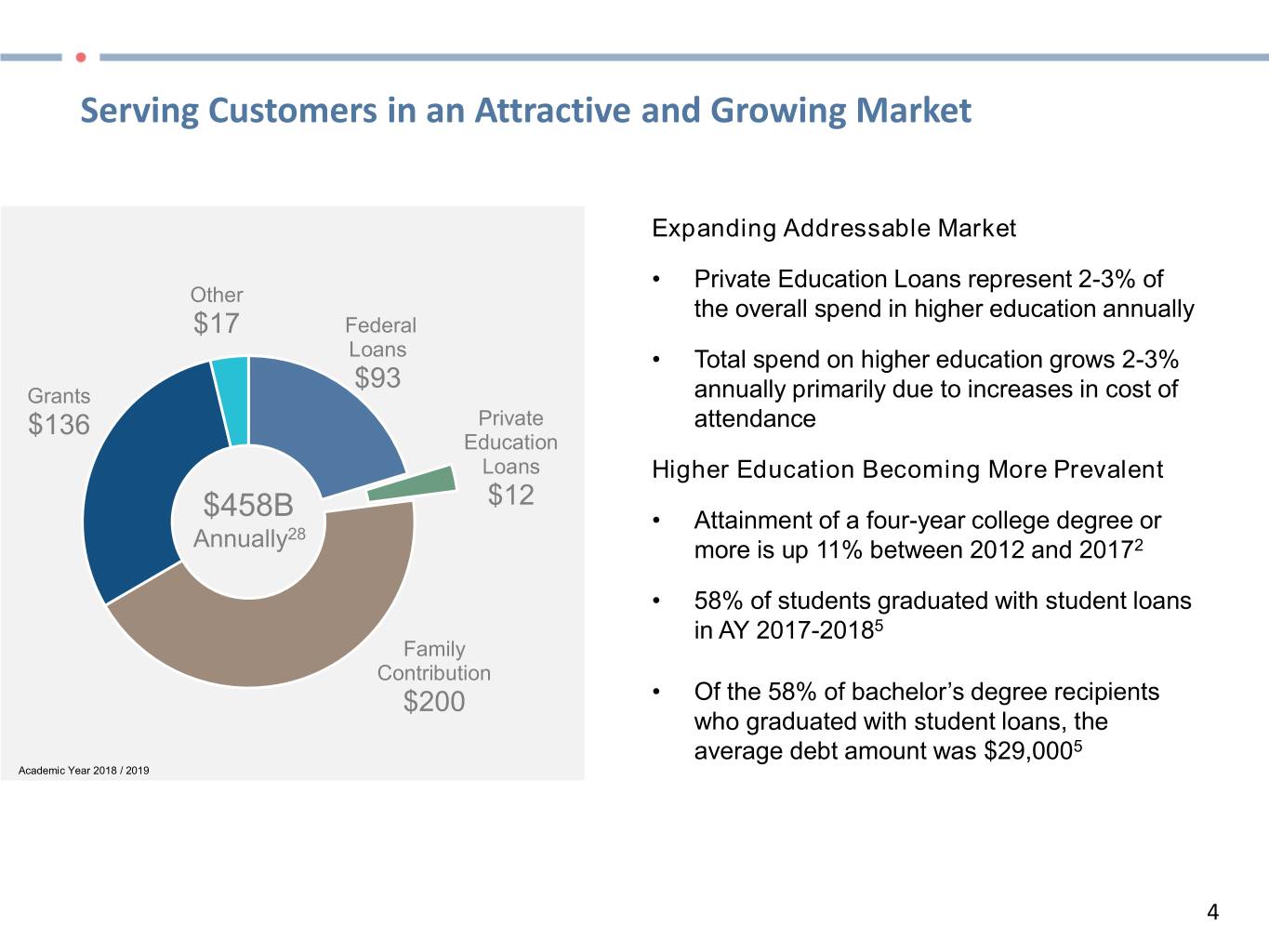

Serving Customers in an Attractive and Growing Market Expanding Addressable Market • Private Education Loans represent 2-3% of Other the overall spend in higher education annually $17 Federal Loans • Total spend on higher education grows 2-3% $93 Grants annually primarily due to increases in cost of $136 Private attendance Education Loans Higher Education Becoming More Prevalent $12 $458B • Attainment of a four-year college degree or 28 Annually more is up 11% between 2012 and 20172 • 58% of students graduated with student loans in AY 2017-20185 Family Contribution $200 • Of the 58% of bachelor’s degree recipients who graduated with student loans, the average debt amount was $29,0005 Academic Year 2018 / 2019 4

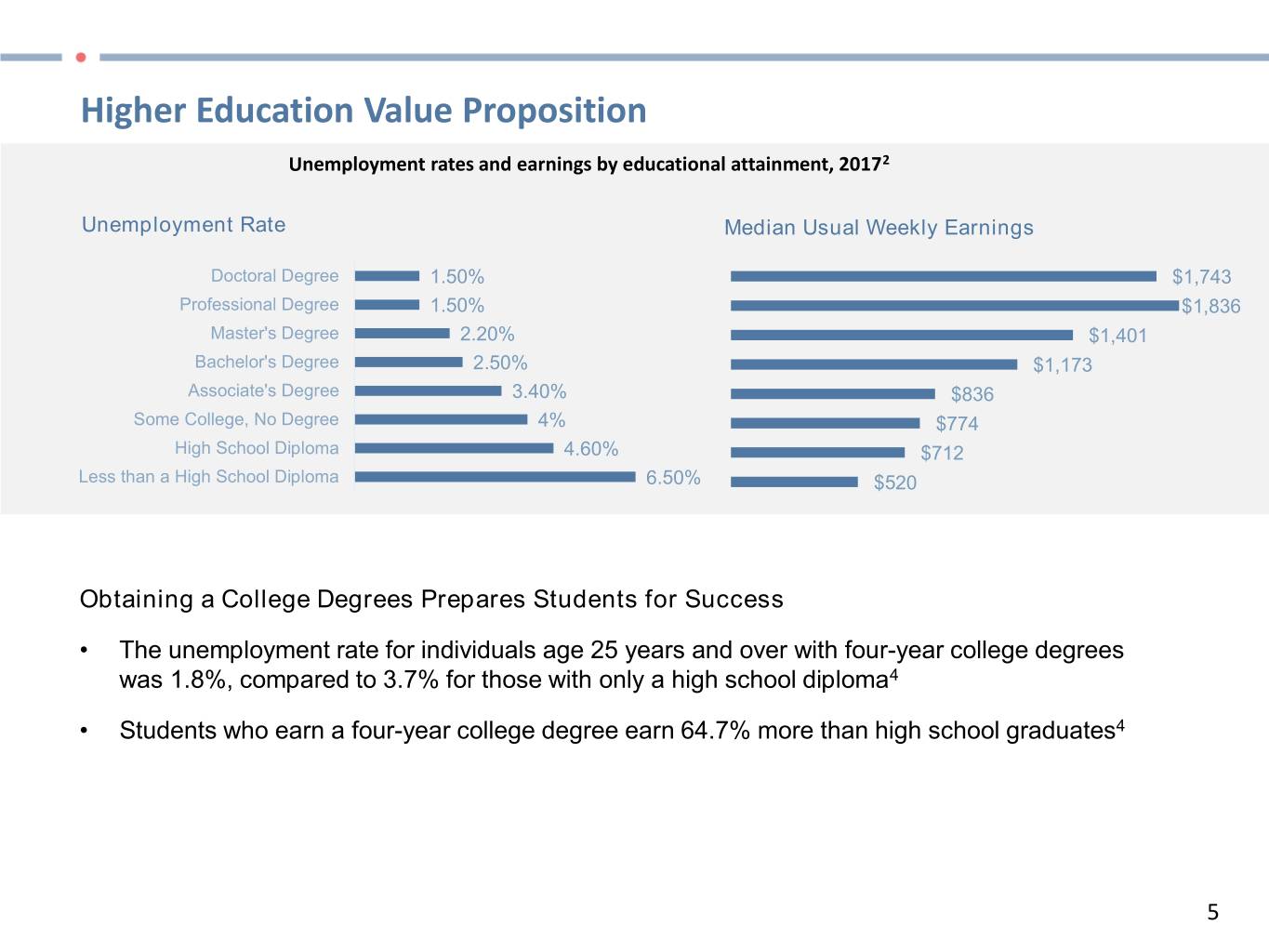

Higher Education Value Proposition Unemployment rates and earnings by educational attainment, 20172 Unemployment Rate Median Usual Weekly Earnings Unemployment Rate Median Usual Weekly Earnings Doctoral Degree 1.50% $1,743 Doctoral Degree 1.50% $1,743 Professional Degree 1.50% $1,836 Professional Degree 1.50% $1,836 Master's Degree 2.20% $1,401 Master's Degree 2.20% $1,401 Bachelor's Degree 2.50% $1,173 Bachelor's Degree 2.50% $1,173 Associate's Degree 3.40% $836 Associate's Degree 3.40% $836 Some College, No Degree 4% $774 Some College, No Degree 4% $774 High School Diploma 4.60% $712 High School Diploma 4.60% $712 Less than a High School Diploma 6.50% $520 Less than a High School Diploma 6.50% $520 Obtaining a College Degrees Prepares Students for Success • The unemployment rate for individuals age 25 years and over with four-year college degrees was 1.8%, compared to 3.7% for those with only a high school diploma4 • Students who earn a four-year college degree earn 64.7% more than high school graduates4 5

Sallie Mae is an ESG Company Serving our Customers Providing Financial Education & Assistance • Financing assistance to 1.2 million families since 2014 • Free Scholarship Search tool with 5 million to provide access to postsecondary education and scholarships worth more than $25 billion opportunities for success • 20,000 students earned at least 1 scholarship via our • Policies help to ensure that 98% of customers are search tool last year and received $61 million effectively managing their payments • $785,000 in Sallie Mae Bridging the Dream • Sallie Mae has been recognized by J.D. Power by Scholarships awarded since 2016, with $192,000 of providing “An Outstanding Customer Service that directly raised by employees Experience” for Phone support30 Committed to an Ethical & Diverse Workplace Building Strong Communities • Board of Directors composition is 33% women, • Giving back through employee volunteer work and earning the Winning “W” Company designation from community investments Women on Boards • $1.06 million in total charitable giving in 2019 • Marketplace Ethics Award from the Better Business • Employee Volunteer Program that encourages Bureau employees to participate in activities they are • Listing among America’s Best Midsize Employers by passionate about Forbes Committed to operating with integrity and engaging with stakeholders on key topics 6

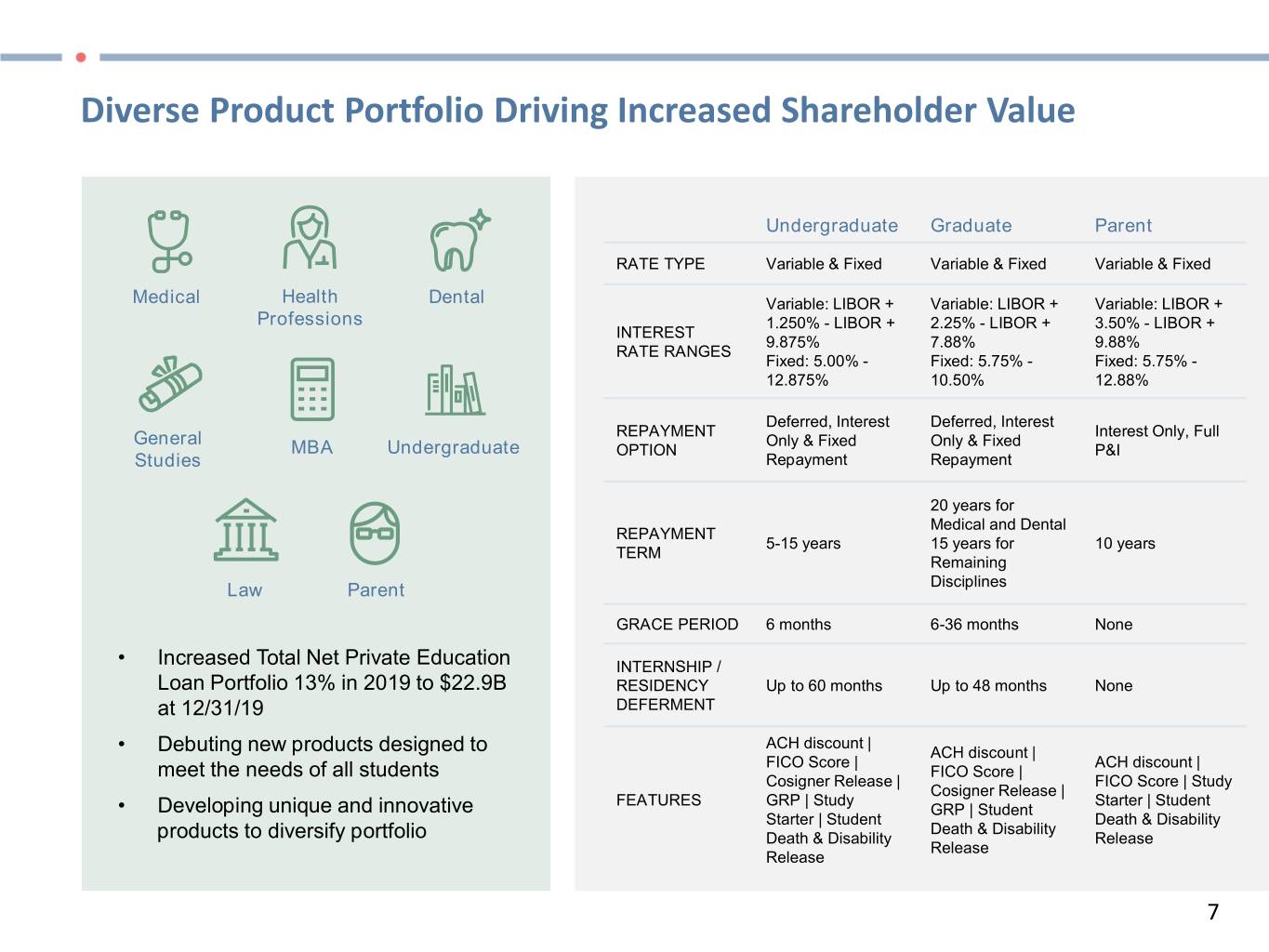

Diverse Product Portfolio Driving Increased Shareholder Value Undergraduate Graduate Parent RATE TYPE Variable & Fixed Variable & Fixed Variable & Fixed Medical Health Dental Variable: LIBOR + Variable: LIBOR + Variable: LIBOR + Professions 1.250% - LIBOR + 2.25% - LIBOR + 3.50% - LIBOR + INTEREST 9.875% 7.88% 9.88% RATE RANGES Fixed: 5.00% - Fixed: 5.75% - Fixed: 5.75% - 12.875% 10.50% 12.88% Deferred, Interest Deferred, Interest REPAYMENT Interest Only, Full General Only & Fixed Only & Fixed MBA Undergraduate OPTION P&I Studies Repayment Repayment 20 years for Medical and Dental REPAYMENT 5-15 years 15 years for 10 years TERM Remaining Law Parent Disciplines GRACE PERIOD 6 months 6-36 months None • Increased Total Net Private Education INTERNSHIP / Loan Portfolio 13% in 2019 to $22.9B RESIDENCY Up to 60 months Up to 48 months None at 12/31/19 DEFERMENT ACH discount | • Debuting new products designed to ACH discount | FICO Score | ACH discount | meet the needs of all students FICO Score | Cosigner Release | FICO Score | Study Cosigner Release | FEATURES GRP | Study Starter | Student • Developing unique and innovative GRP | Student Starter | Student Death & Disability Death & Disability products to diversify portfolio Death & Disability Release Release Release 7

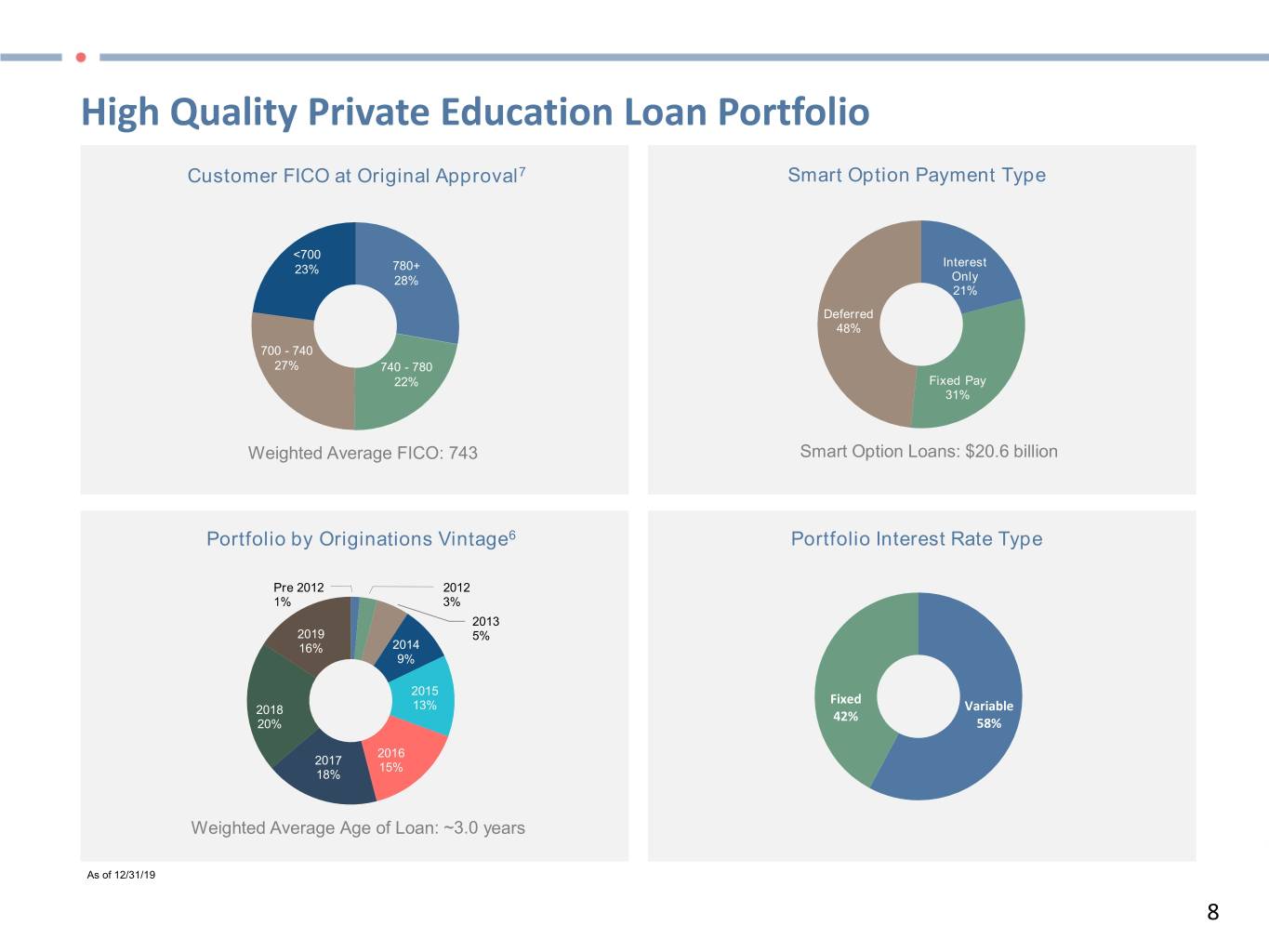

High Quality Private Education Loan Portfolio Customer FICO at Original Approval7 Smart Option Payment Type <700 Interest 23% 780+ 28% Only 21% Deferred 48% 700 - 740 27% 740 - 780 22% Fixed Pay 31% Weighted Average FICO: 743 Smart Option Loans: $20.6 billion Portfolio by Originations Vintage6 Portfolio Interest Rate Type Pre 2012 2012 1% 3% 2013 2019 5% 16% 2014 9% 2015 13% Fixed Variable 2018 42% 20% 58% 2016 2017 15% 18% Weighted Average Age of Loan: ~3.0 years As of 12/31/19 8

Successfully Executing Strategy and Growing Originations PRIVATE EDUCATION LOANS OUTSTANDING, NET ORIGINATIONS CAGR: 22% CAGR: 6.8% $22.9 $5,625 $4,330 $10.5 2015 2019 2015 2019 Expect to maintain momentum and continue originations growth in 2020 9

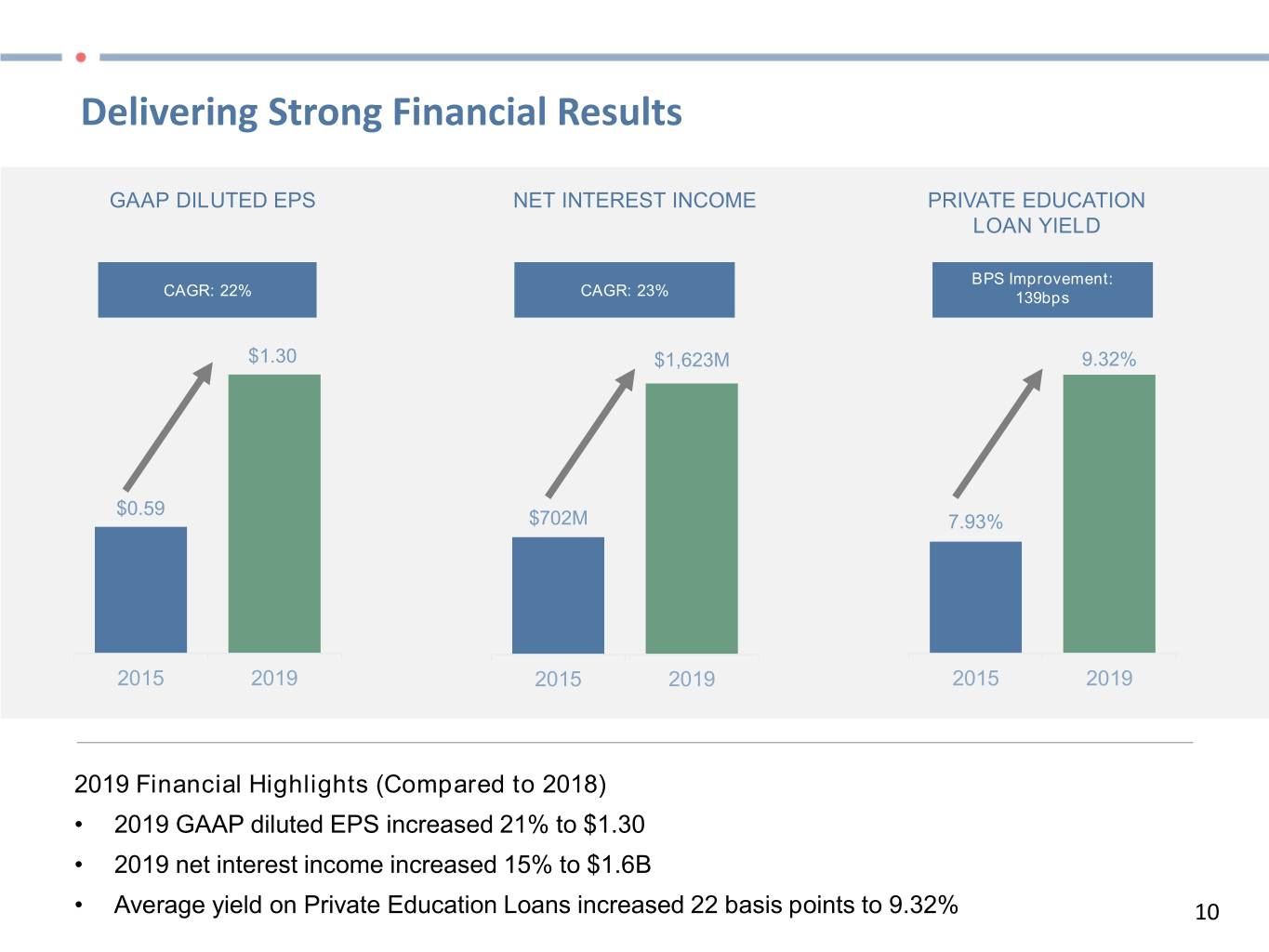

Delivering Strong Financial Results GAAP DILUTED EPS NET INTEREST INCOME PRIVATE EDUCATION LOAN YIELD BPS Improvement: CAGR: 22% CAGR: 23% 139bps $1.30 $1,623M 9.32% $0.59 $702M 7.93% 2015 2019 2015 2019 2015 2019 2019 Financial Highlights (Compared to 2018) • 2019 GAAP diluted EPS increased 21% to $1.30 • 2019 net interest income increased 15% to $1.6B • Average yield on Private Education Loans increased 22 basis points to 9.32% 10

Product suite tailored to meet the needs of undergraduate and graduate students • Introduced Smart Option Student Loan in 2009 • Flexible repayment options while in school • Fixed and Variable rates for repayment • Differentiated products for undergraduates and graduate students 11

Conservative underwriting has contributed to consistent credit performance • Proprietary Scorecard built with Experian Decision Analytics • Initial credit screen removes applicants with low FICO scores or prior derogatory trades on file • Manually review ~8% of applications • Through-the-cycle data was used to develop our conservative underwriting models 12

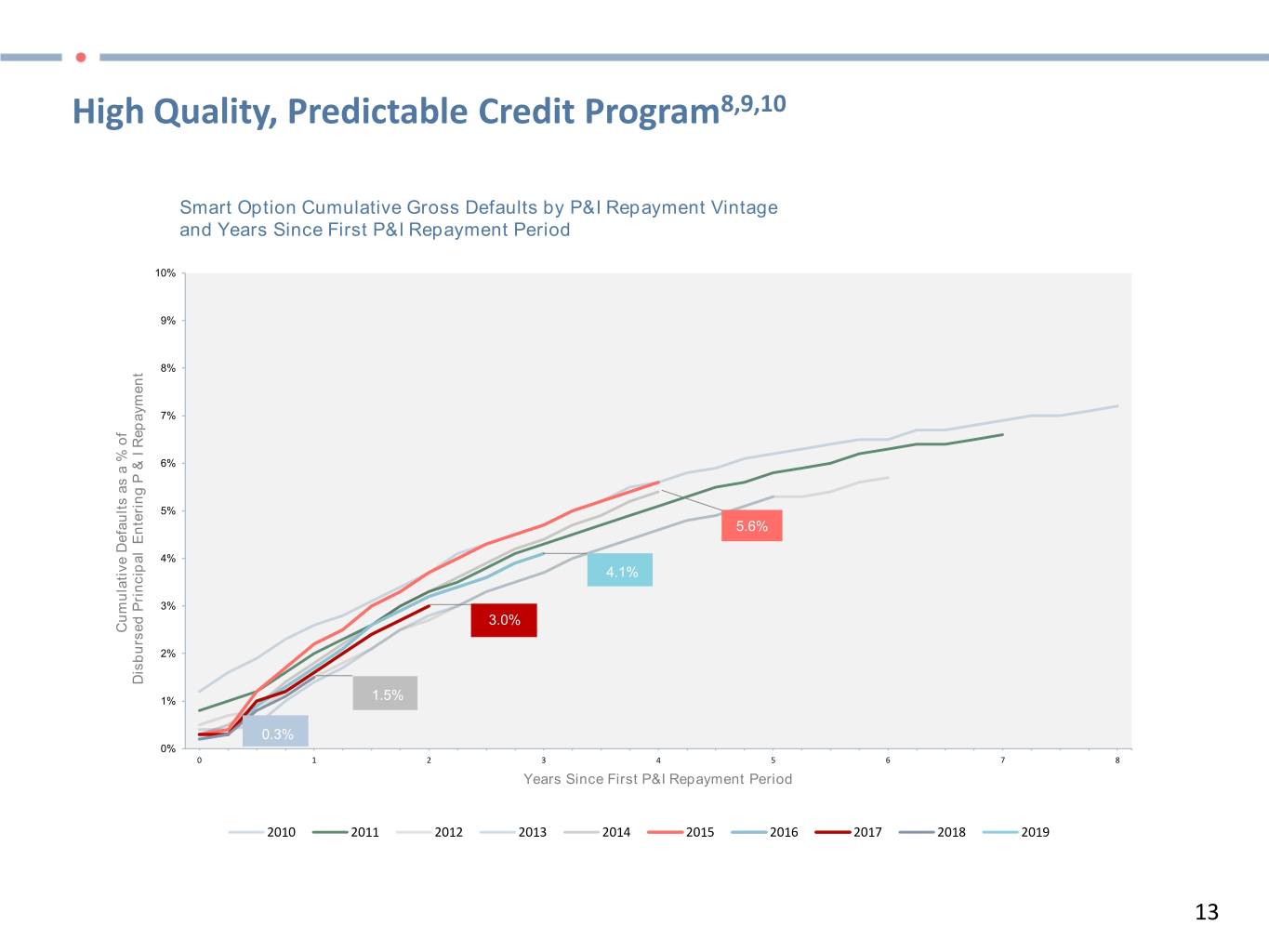

High Quality, Predictable Credit Program8,9,10 Smart Option Cumulative Gross Defaults by P&I Repayment Vintage and Years Since First P&I Repayment Period 10% 9% 8% 7% 6% 5% 5.6% 4% 4.1% 3% 3.0% Cumulative Defaults as a % of a % as Defaults Cumulative 2% Disbursed Principal Entering P & Repayment I& P Entering Principal Disbursed 1% 1.5% 0.3% 0% 0 1 2 3 4 5 6 7 8 Years Since First P&I Repayment Period 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 13

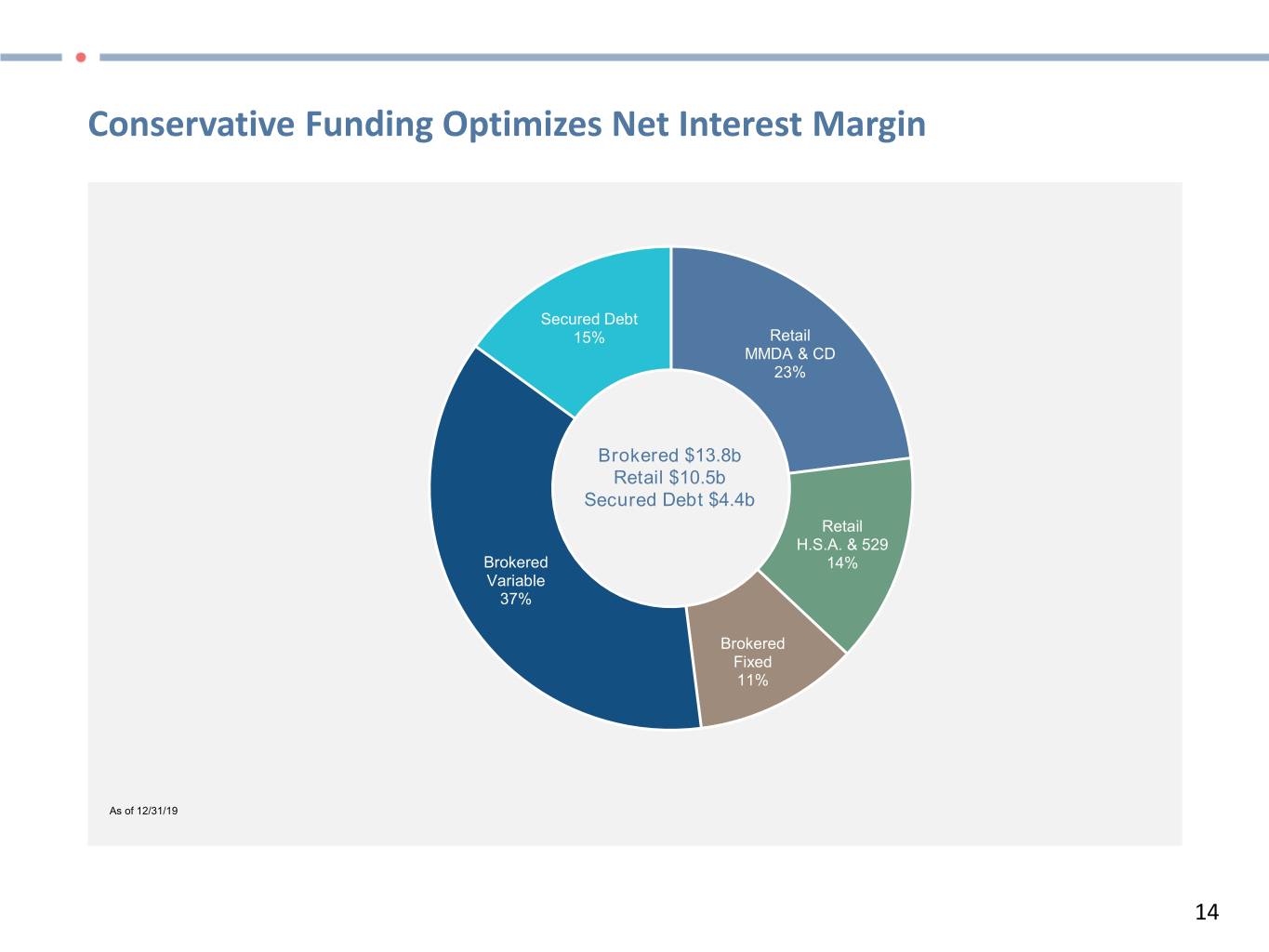

Conservative Funding Optimizes Net Interest Margin Secured Debt 15% Retail MMDA & CD 23% Brokered $13.8b Retail $10.5b Secured Debt $4.4b Retail H.S.A. & 529 Brokered 14% Variable 37% Brokered Fixed 11% As of 12/31/19 14

Optimizing our Portfolio25 Continue to Focus on High- Quality Private Education Loan LOAN SALES CONTINUE TO INVEST IN Originations CREDIT CARD • Expect to grow • Expect to sell ~$3B in • Launched new credit originations 6% in loans in 2020, dependent card in October 2019 2020 upon market conditions designed for college • Discontinued students and young • Loan sales allow SLM to adults originations of return excess capital to Personal Loans shareholders through • Rewards can be used as of December share repurchases to repay student loan 15, 2019 debt • To drive continued success, expect to invest $0.05 per share in 2020 15

CECL Update24,25 • Financial Accounting Standards Board’s Current Expected Credit Loss (“CECL”) impairment standard will require “life of loan” estimates of losses to be recorded at origination and became effective for the Company on January 1, 2020. • CECL requires the Company to measure its allowance for losses based upon the estimate of current expected credit losses, and will have a significant impact on diluted GAAP earnings per share and diluted “Core Earnings” per share as adjustments are made to the allowance for loan losses in future periods to reflect life-of-loan expected losses. • CECL will have a material impact on how the Company records and reports its financial condition and results of operations and on regulatory capital. • The Company’s first-quarter 2020 financial results will reflect a transition adjustment that is currently estimated to increase the allowance for loan losses by approximately $1.1 billion, increase the liability representing its off-balance sheet exposure for unfunded commitments by approximately $115 million, and increase the deferred tax asset by approximately $300 million, resulting in a cumulative effect adjustment currently estimated to reduce retained earnings by approximately $950 million. • The Private Education Loan allowance for losses as a percentage of ending total Private Education Loan balance after the adoption of CECL is estimated to initially be approximately 6.7 percent. • These adjustments will be refined and reflected in the Company’s first-quarter 2020 financial results. • The Company has elected the three-year phase in for the initial impact of adopting CECL for regulatory capital adequacy purposes. • Sallie Mae intends to elect the three-year phase in for the initial impact of adopting CECL for regulatory capital adequacy purposes, and expects to remain above the current definition of “Well Capitalized” after implementation of CECL. 16

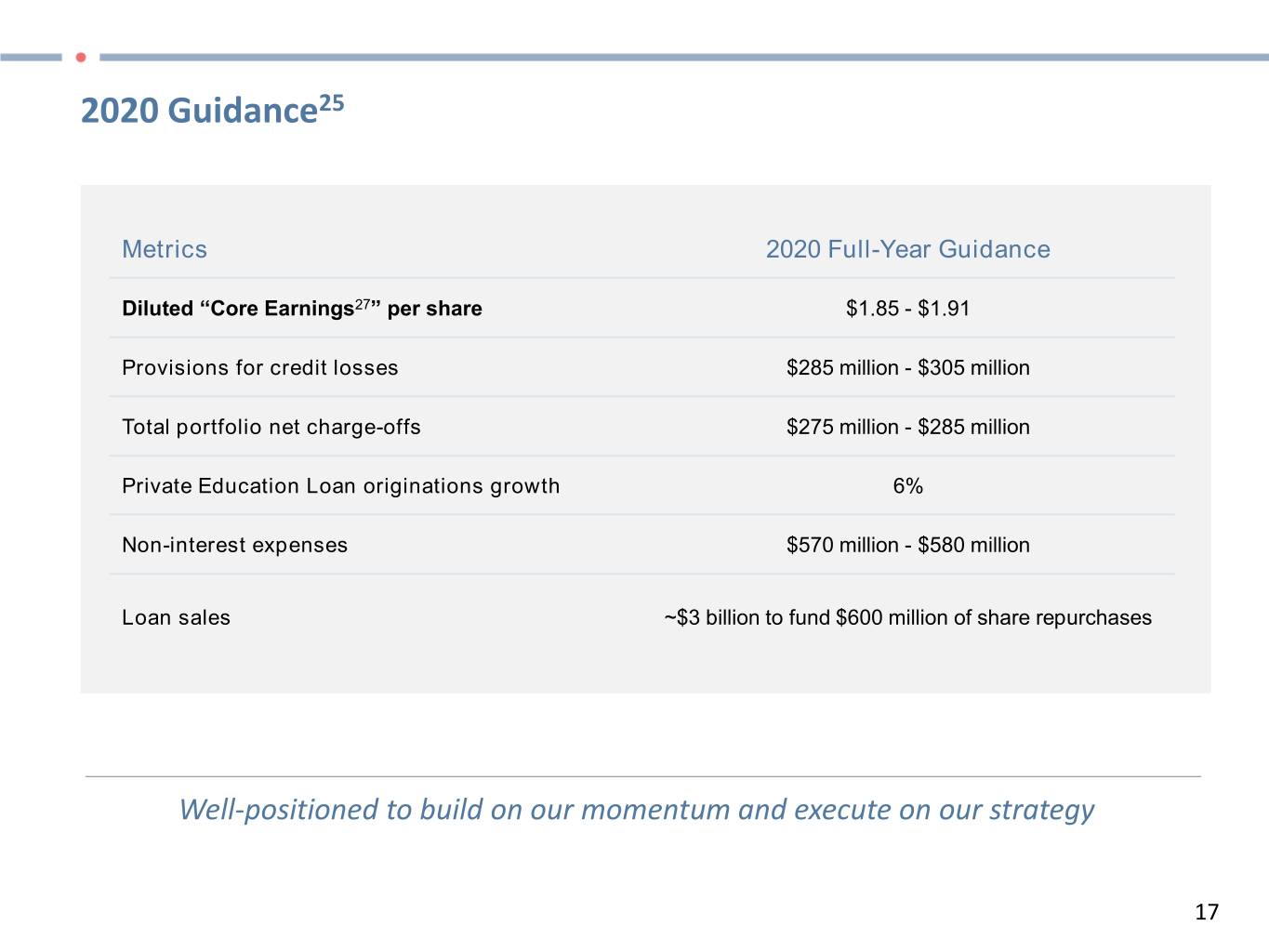

2020 Guidance25 Metrics 2020 Full-Year Guidance Diluted “Core Earnings27” per share $1.85 - $1.91 Provisions for credit losses $285 million - $305 million Total portfolio net charge-offs $275 million - $285 million Private Education Loan originations growth 6% Non-interest expenses $570 million - $580 million Loan sales ~$3 billion to fund $600 million of share repurchases Well-positioned to build on our momentum and execute on our strategy 17

Strong Balance Sheet Entering 2020, Total Common Equity Tier Risk-Based Capital 1 Risk-Based Capital ratio was at ratio of 13.4% 12.2% Planned loan Expect the balance sheet asset sales of to be flat over the next ~$3B 3 years will provide flexibility to despite the impact the balance sheet25 of CECL25 As of 12/31/19 18

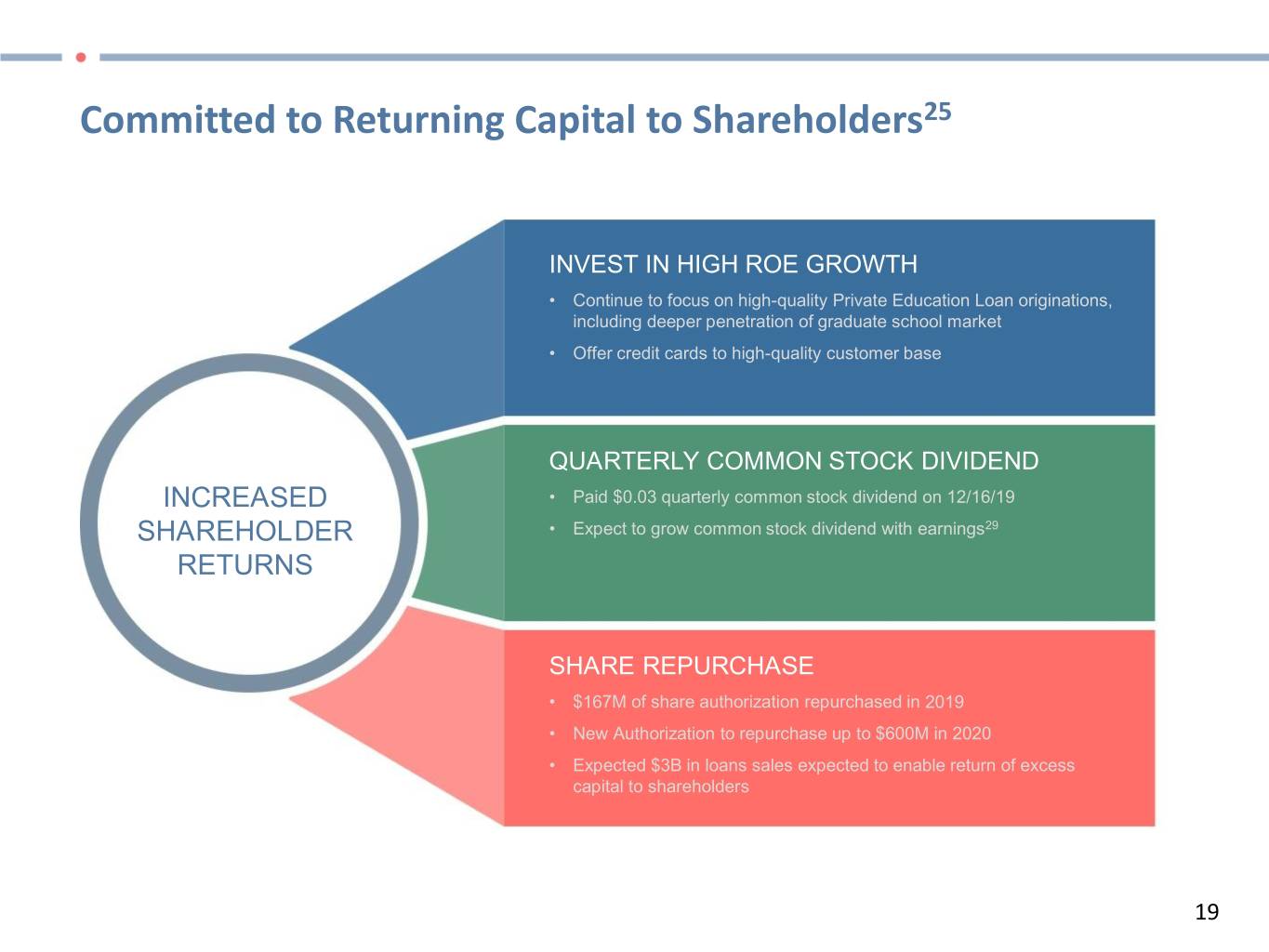

Committed to Returning Capital to Shareholders25 INVEST IN HIGH ROE GROWTH • Continue to focus on high-quality Private Education Loan originations, including deeper penetration of graduate school market • Offer credit cards to high-quality customer base QUARTERLY COMMON STOCK DIVIDEND INCREASED • Paid $0.03 quarterly common stock dividend on 12/16/19 SHAREHOLDER • Expect to grow common stock dividend with earnings29 RETURNS SHARE REPURCHASE • $167M of share authorization repurchased in 2019 • New Authorization to repurchase up to $600M in 2020 • Expected $3B in loans sales expected to enable return of excess capital to shareholders 19

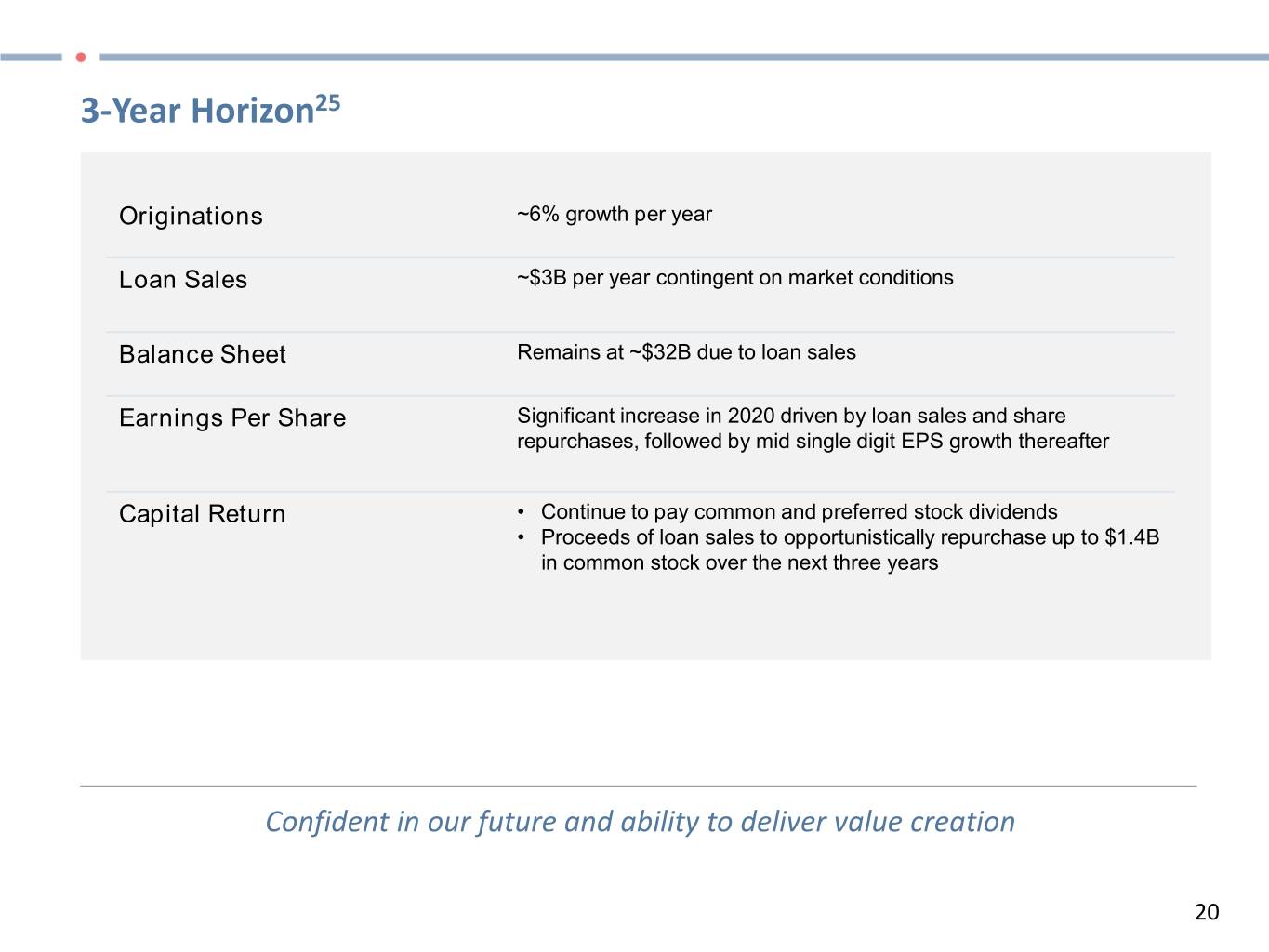

3-Year Horizon25 Originations ~6% growth per year Loan Sales ~$3B per year contingent on market conditions Balance Sheet Remains at ~$32B due to loan sales Earnings Per Share Significant increase in 2020 driven by loan sales and share repurchases, followed by mid single digit EPS growth thereafter Capital Return • Continue to pay common and preferred stock dividends • Proceeds of loan sales to opportunistically repurchase up to $1.4B in common stock over the next three years Confident in our future and ability to deliver value creation 20

ABS Supplement

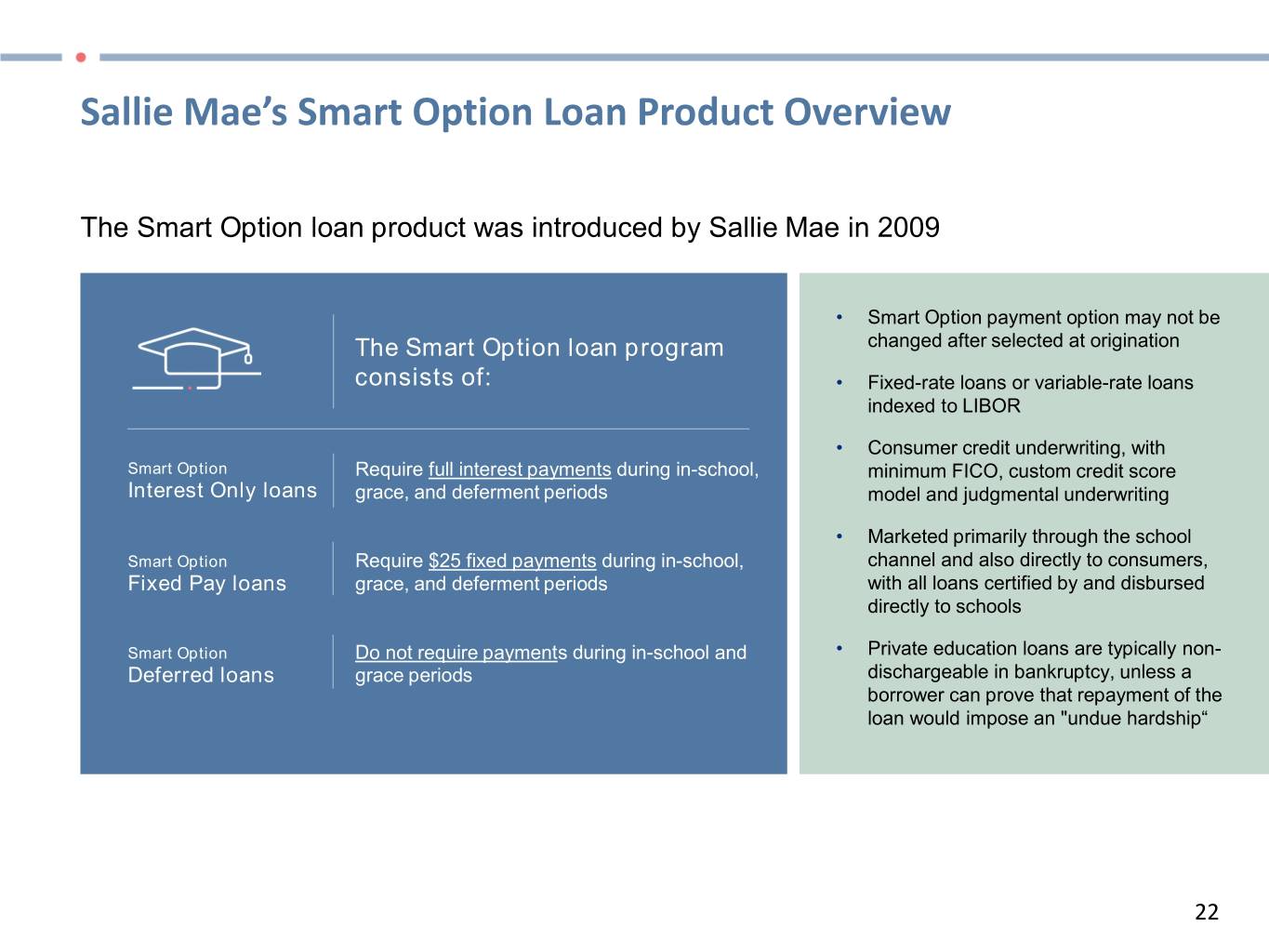

Sallie Mae’s Smart Option Loan Product Overview The Smart Option loan product was introduced by Sallie Mae in 2009 • Smart Option payment option may not be The Smart Option loan program changed after selected at origination consists of: • Fixed-rate loans or variable-rate loans indexed to LIBOR • Consumer credit underwriting, with Smart Option Require full interest payments during in-school, minimum FICO, custom credit score Interest Only loans grace, and deferment periods model and judgmental underwriting • Marketed primarily through the school Smart Option Require $25 fixed payments during in-school, channel and also directly to consumers, Fixed Pay loans grace, and deferment periods with all loans certified by and disbursed directly to schools Smart Option Do not require payments during in-school and • Private education loans are typically non- Deferred loans grace periods dischargeable in bankruptcy, unless a borrower can prove that repayment of the loan would impose an "undue hardship“ 22

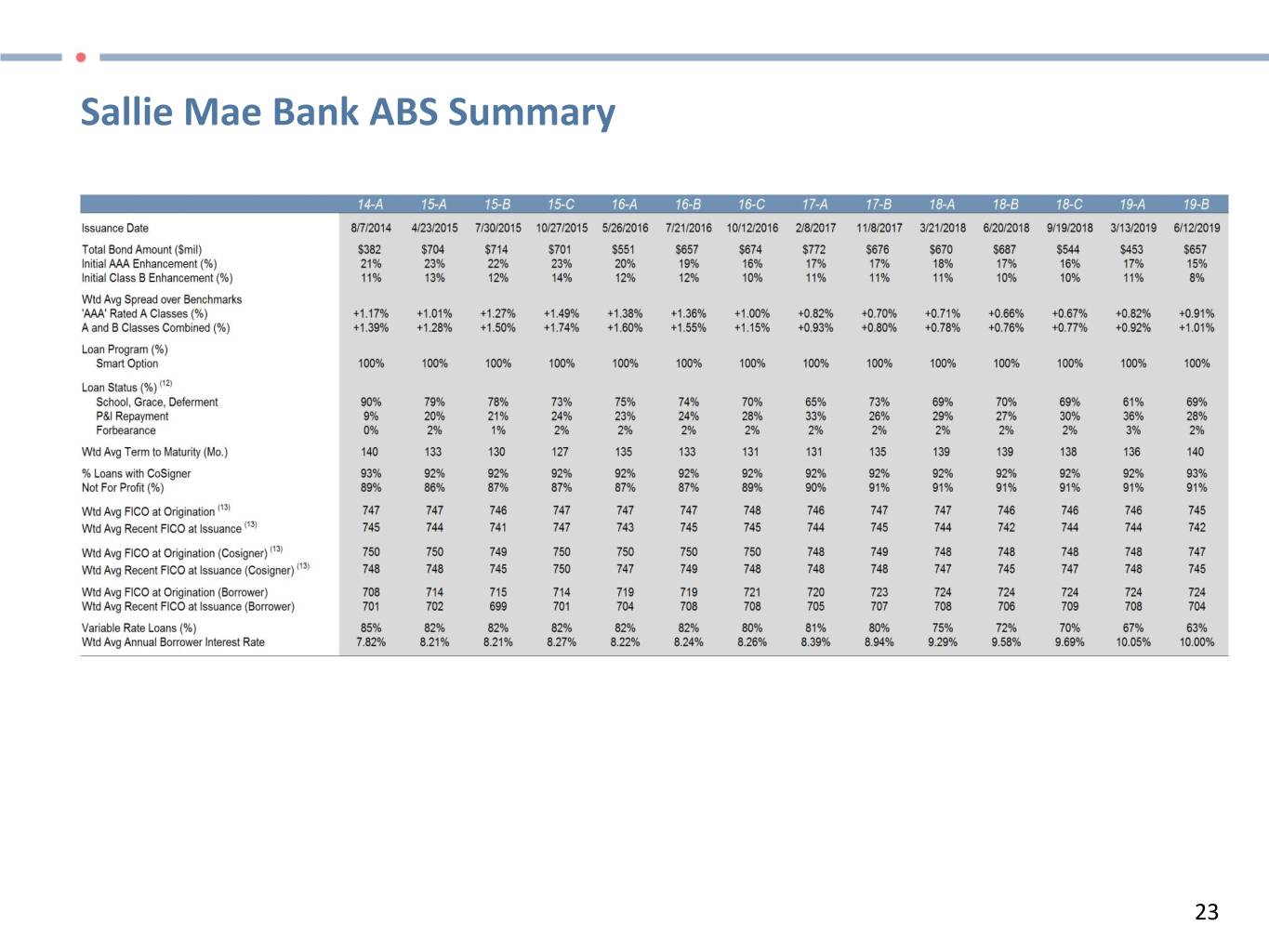

Sallie Mae Bank ABS Summary 23

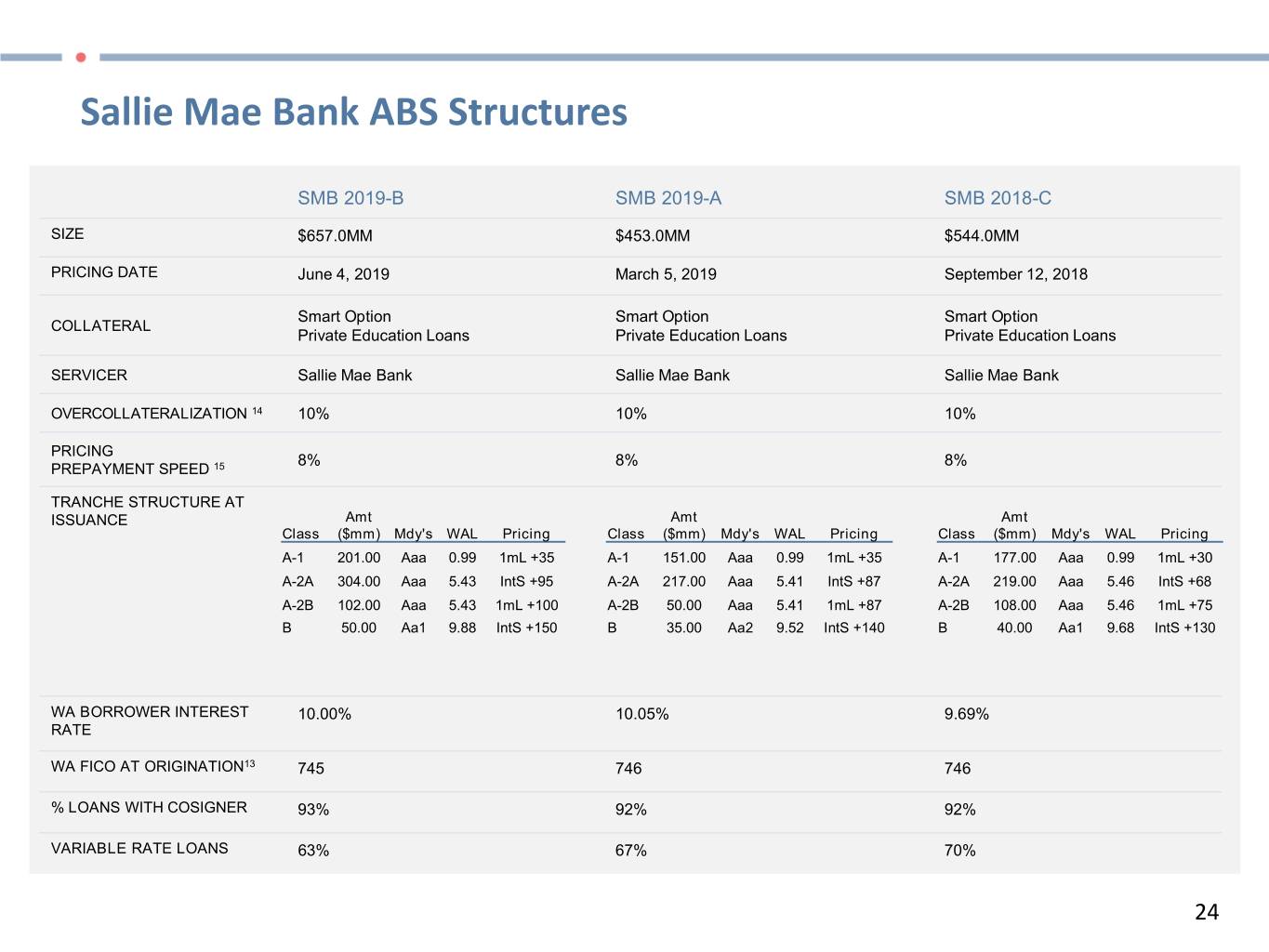

Sallie Mae Bank ABS Structures SMB 2019-B SMB 2019-A SMB 2018-C SIZE $657.0MM $453.0MM $544.0MM PRICING DATE June 4, 2019 March 5, 2019 September 12, 2018 Smart Option Smart Option Smart Option COLLATERAL Private Education Loans Private Education Loans Private Education Loans SERVICER Sallie Mae Bank Sallie Mae Bank Sallie Mae Bank OVERCOLLATERALIZATION 14 10% 10% 10% PRICING 8% 8% 8% PREPAYMENT SPEED 15 TRANCHE STRUCTURE AT ISSUANCE Amt Amt Amt Class ($mm) Mdy's WAL Pricing Class ($mm) Mdy's WAL Pricing Class ($mm) Mdy's WAL Pricing A-1 201.00 Aaa 0.99 1mL +35 A-1 151.00 Aaa 0.99 1mL +35 A-1 177.00 Aaa 0.99 1mL +30 A-2A 304.00 Aaa 5.43 IntS +95 A-2A 217.00 Aaa 5.41 IntS +87 A-2A 219.00 Aaa 5.46 IntS +68 A-2B 102.00 Aaa 5.43 1mL +100 A-2B 50.00 Aaa 5.41 1mL +87 A-2B 108.00 Aaa 5.46 1mL +75 B 50.00 Aa1 9.88 IntS +150 B 35.00 Aa2 9.52 IntS +140 B 40.00 Aa1 9.68 IntS +130 WA BORROWER INTEREST 10.00% 10.05% 9.69% RATE WA FICO AT ORIGINATION13 745 746 746 % LOANS WITH COSIGNER 93% 92% 92% VARIABLE RATE LOANS 63% 67% 70% 24

Appendix

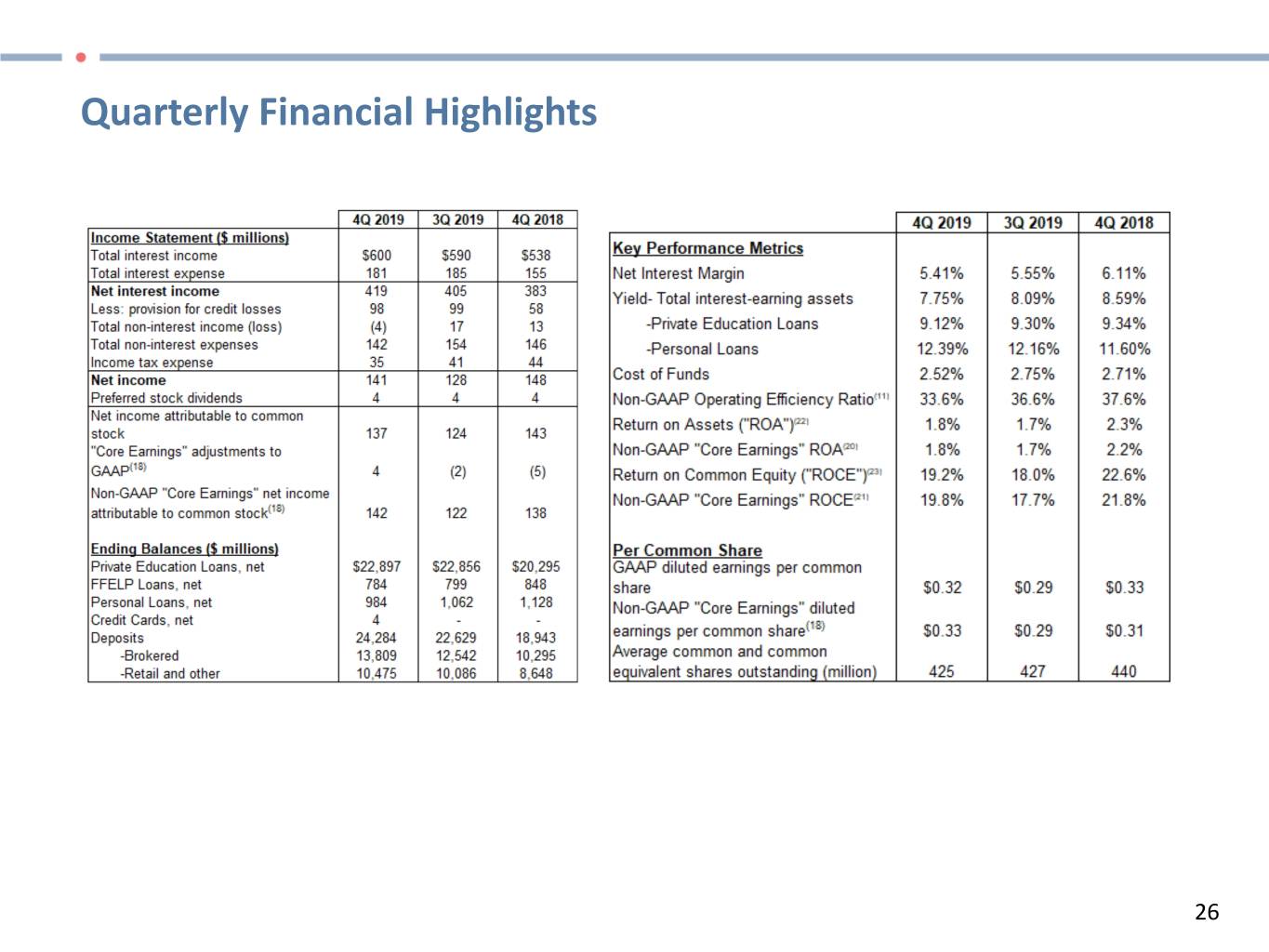

Quarterly Financial Highlights 26

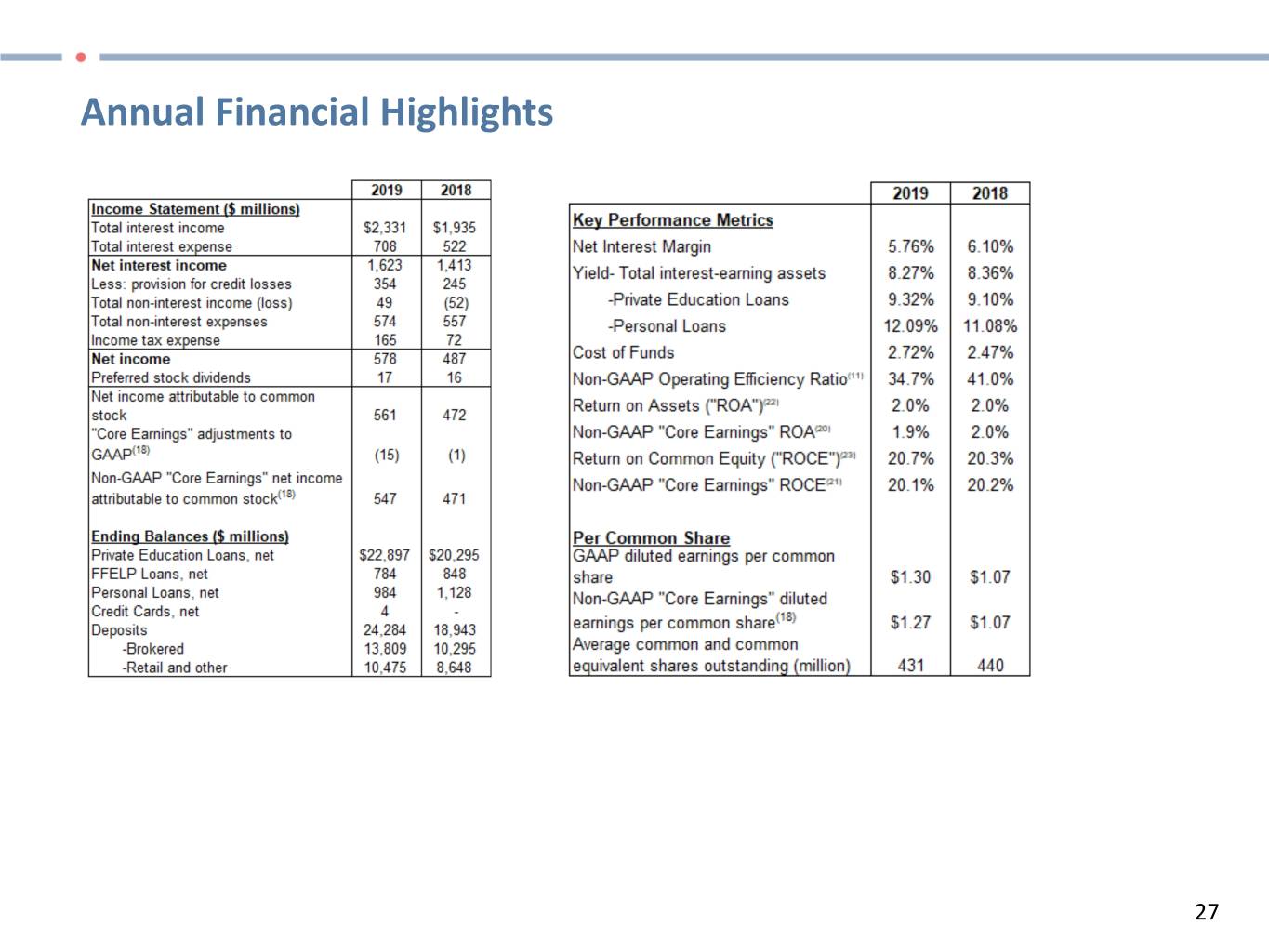

Annual Financial Highlights 27

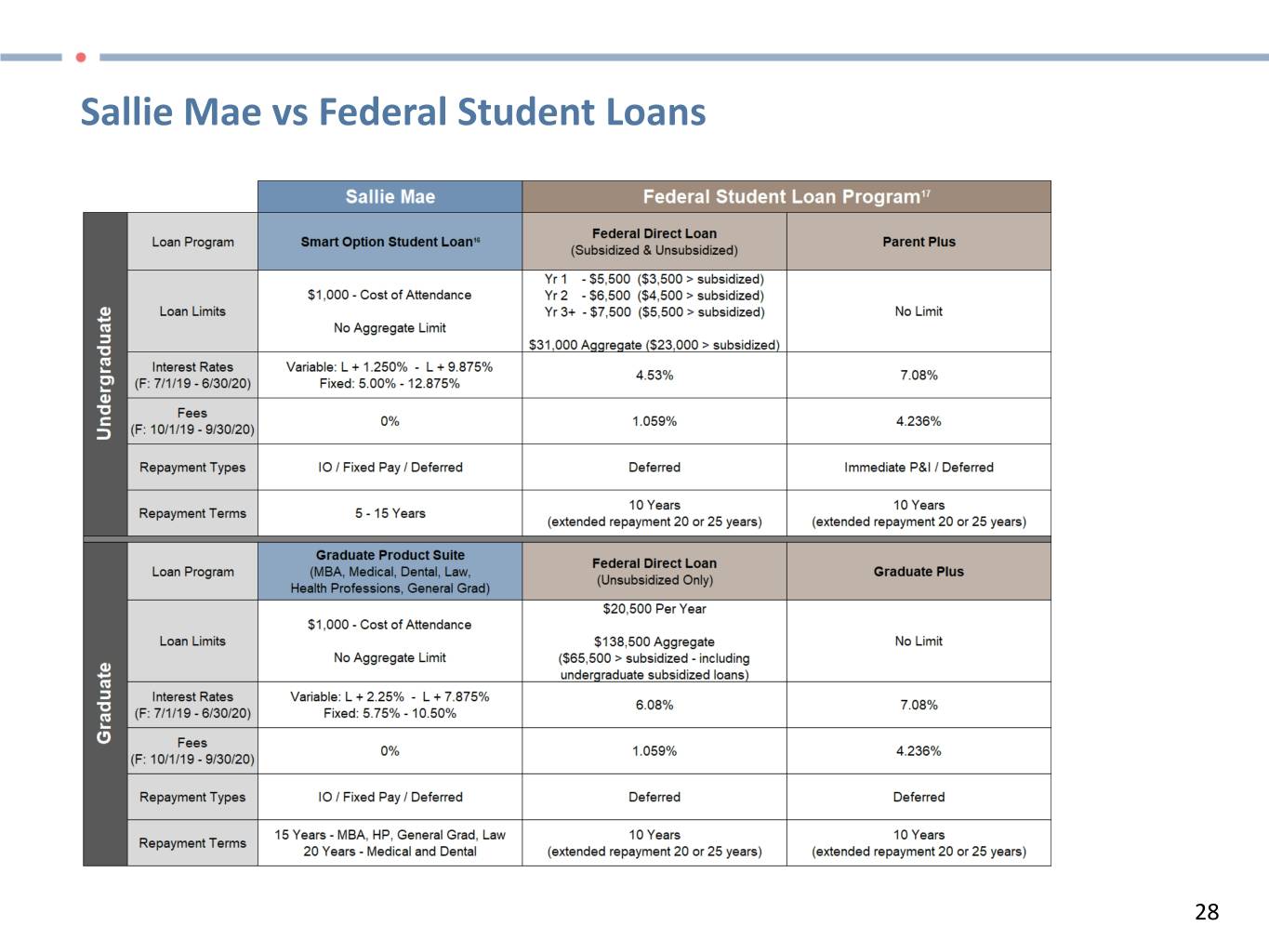

Sallie Mae vs Federal Student Loans 28

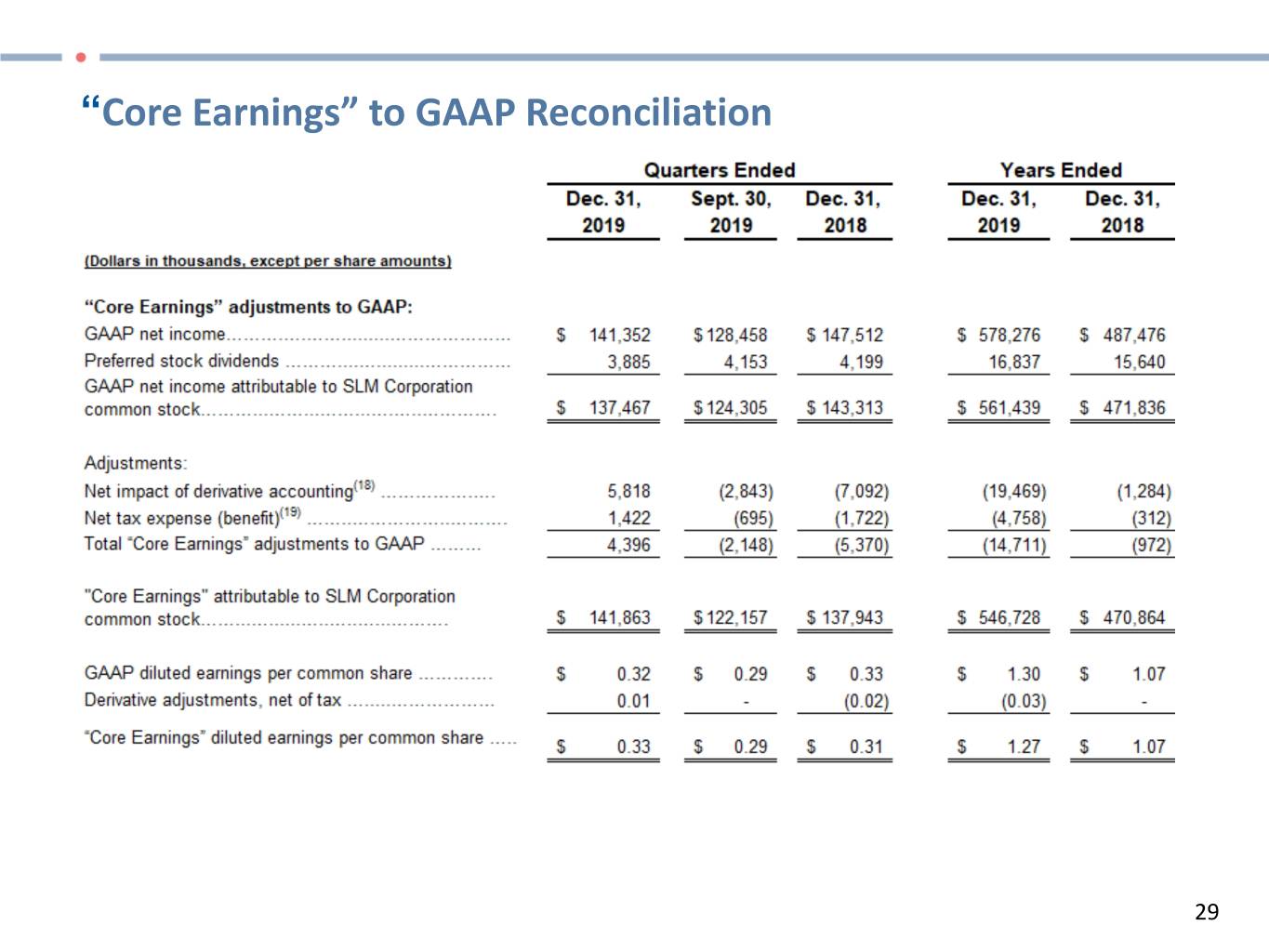

“Core Earnings” to GAAP Reconciliation 29

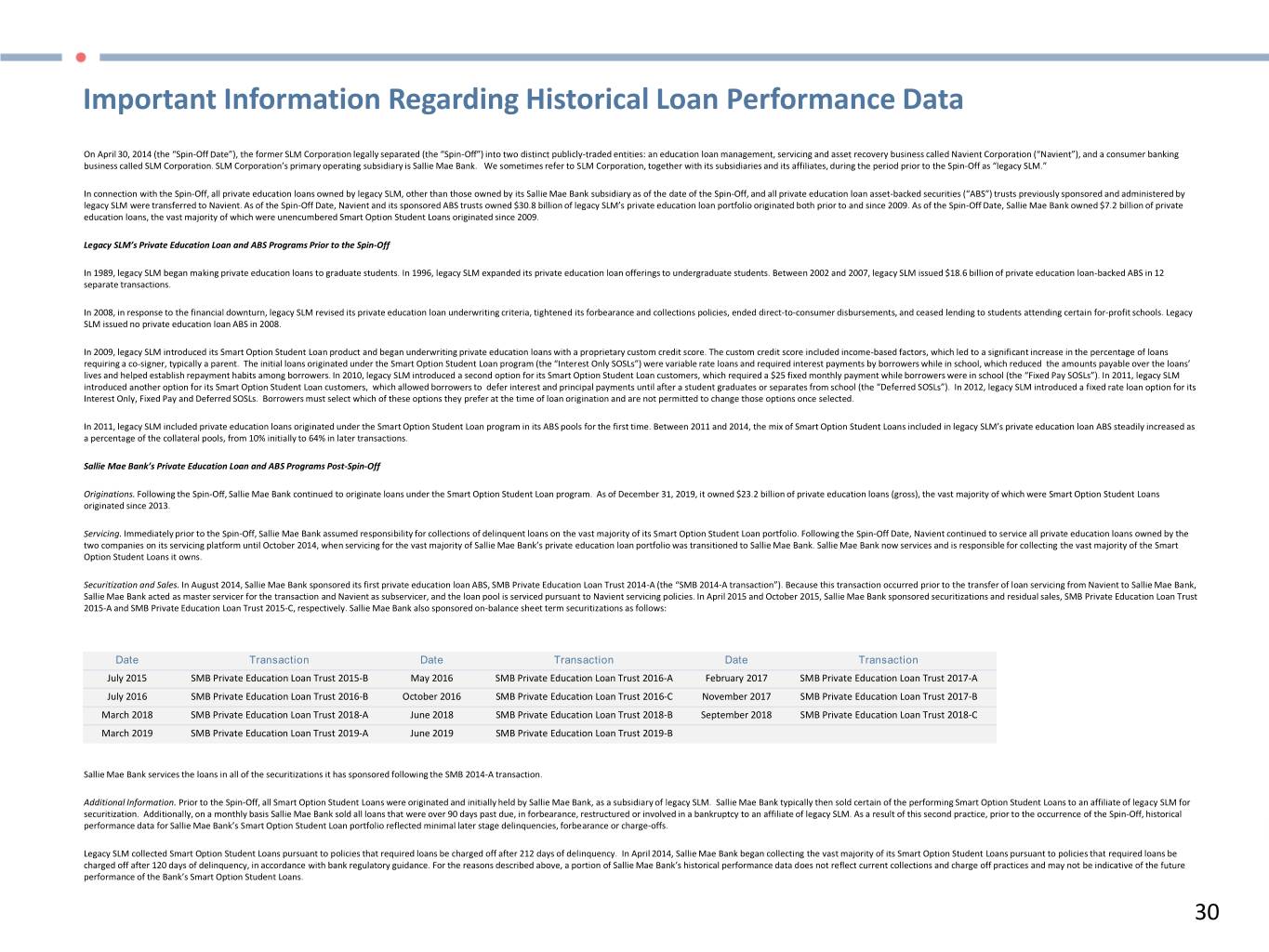

Important Information Regarding Historical Loan Performance Data On April 30, 2014 (the “Spin-Off Date”), the former SLM Corporation legally separated (the “Spin-Off”) into two distinct publicly-traded entities: an education loan management, servicing and asset recovery business called Navient Corporation (“Navient”), and a consumer banking business called SLM Corporation. SLM Corporation’s primary operating subsidiary is Sallie Mae Bank. We sometimes refer to SLM Corporation, together with its subsidiaries and its affiliates, during the period prior to the Spin-Off as “legacy SLM.” In connection with the Spin-Off, all private education loans owned by legacy SLM, other than those owned by its Sallie Mae Bank subsidiary as of the date of the Spin-Off, and all private education loan asset-backed securities (“ABS”) trusts previously sponsored and administered by legacy SLM were transferred to Navient. As of the Spin-Off Date, Navient and its sponsored ABS trusts owned $30.8 billion of legacy SLM’s private education loan portfolio originated both prior to and since 2009. As of the Spin-Off Date, Sallie Mae Bank owned $7.2 billion of private education loans, the vast majority of which were unencumbered Smart Option Student Loans originated since 2009. Legacy SLM’s Private Education Loan and ABS Programs Prior to the Spin-Off In 1989, legacy SLM began making private education loans to graduate students. In 1996, legacy SLM expanded its private education loan offerings to undergraduate students. Between 2002 and 2007, legacy SLM issued $18.6 billion of private education loan-backed ABS in 12 separate transactions. In 2008, in response to the financial downturn, legacy SLM revised its private education loan underwriting criteria, tightened its forbearance and collections policies, ended direct-to-consumer disbursements, and ceased lending to students attending certain for-profit schools. Legacy SLM issued no private education loan ABS in 2008. In 2009, legacy SLM introduced its Smart Option Student Loan product and began underwriting private education loans with a proprietary custom credit score. The custom credit score included income-based factors, which led to a significant increase in the percentage of loans requiring a co-signer, typically a parent. The initial loans originated under the Smart Option Student Loan program (the “Interest Only SOSLs”) were variable rate loans and required interest payments by borrowers while in school, which reduced the amounts payable over the loans’ lives and helped establish repayment habits among borrowers. In 2010, legacy SLM introduced a second option for its Smart Option Student Loan customers, which required a $25 fixed monthly payment while borrowers were in school (the “Fixed Pay SOSLs”). In 2011, legacy SLM introduced another option for its Smart Option Student Loan customers, which allowed borrowers to defer interest and principal payments until after a student graduates or separates from school (the “Deferred SOSLs”). In 2012, legacy SLM introduced a fixed rate loan option for its Interest Only, Fixed Pay and Deferred SOSLs. Borrowers must select which of these options they prefer at the time of loan origination and are not permitted to change those options once selected. In 2011, legacy SLM included private education loans originated under the Smart Option Student Loan program in its ABS pools for the first time. Between 2011 and 2014, the mix of Smart Option Student Loans included in legacy SLM’s private education loan ABS steadily increased as a percentage of the collateral pools, from 10% initially to 64% in later transactions. Sallie Mae Bank’s Private Education Loan and ABS Programs Post-Spin-Off Originations. Following the Spin-Off, Sallie Mae Bank continued to originate loans under the Smart Option Student Loan program. As of December 31, 2019, it owned $23.2 billion of private education loans (gross), the vast majority of which were Smart Option Student Loans originated since 2013. Servicing. Immediately prior to the Spin-Off, Sallie Mae Bank assumed responsibility for collections of delinquent loans on the vast majority of its Smart Option Student Loan portfolio. Following the Spin-Off Date, Navient continued to service all private education loans owned by the two companies on its servicing platform until October 2014, when servicing for the vast majority of Sallie Mae Bank’s private education loan portfolio was transitioned to Sallie Mae Bank. Sallie Mae Bank now services and is responsible for collecting the vast majority of the Smart Option Student Loans it owns. Securitization and Sales. In August 2014, Sallie Mae Bank sponsored its first private education loan ABS, SMB Private Education Loan Trust 2014-A (the “SMB 2014-A transaction”). Because this transaction occurred prior to the transfer of loan servicing from Navient to Sallie Mae Bank, Sallie Mae Bank acted as master servicer for the transaction and Navient as subservicer, and the loan pool is serviced pursuant to Navient servicing policies. In April 2015 and October 2015, Sallie Mae Bank sponsored securitizations and residual sales, SMB Private Education Loan Trust 2015-A and SMB Private Education Loan Trust 2015-C, respectively. Sallie Mae Bank also sponsored on-balance sheet term securitizations as follows: Date Transaction Date Transaction Date Transaction July 2015 SMB Private Education Loan Trust 2015-B May 2016 SMB Private Education Loan Trust 2016-A February 2017 SMB Private Education Loan Trust 2017-A July 2016 SMB Private Education Loan Trust 2016-B October 2016 SMB Private Education Loan Trust 2016-C November 2017 SMB Private Education Loan Trust 2017-B March 2018 SMB Private Education Loan Trust 2018-A June 2018 SMB Private Education Loan Trust 2018-B September 2018 SMB Private Education Loan Trust 2018-C March 2019 SMB Private Education Loan Trust 2019-A June 2019 SMB Private Education Loan Trust 2019-B Sallie Mae Bank services the loans in all of the securitizations it has sponsored following the SMB 2014-A transaction. Additional Information. Prior to the Spin-Off, all Smart Option Student Loans were originated and initially held by Sallie Mae Bank, as a subsidiary of legacy SLM. Sallie Mae Bank typically then sold certain of the performing Smart Option Student Loans to an affiliate of legacy SLM for securitization. Additionally, on a monthly basis Sallie Mae Bank sold all loans that were over 90 days past due, in forbearance, restructured or involved in a bankruptcy to an affiliate of legacy SLM. As a result of this second practice, prior to the occurrence of the Spin-Off, historical performance data for Sallie Mae Bank’s Smart Option Student Loan portfolio reflected minimal later stage delinquencies, forbearance or charge-offs. Legacy SLM collected Smart Option Student Loans pursuant to policies that required loans be charged off after 212 days of delinquency. In April 2014, Sallie Mae Bank began collecting the vast majority of its Smart Option Student Loans pursuant to policies that required loans be charged off after 120 days of delinquency, in accordance with bank regulatory guidance. For the reasons described above, a portion of Sallie Mae Bank’s historical performance data does not reflect current collections and charge off practices and may not be indicative of the future performance of the Bank’s Smart Option Student Loans. 30

Important Information Regarding Historical Loan Performance Data (cont.) Types of Smart Option Student Loan Portfolio Data The portfolio data we used in this report comes from two separate sources of information: (1) Combined Smart Option Student Loan Portfolio Data for Legacy SLM, Navient and Sallie Mae Bank. Information in this category is presented on a combined basis for loans originated under the Smart Option Student Loan program, whether originated by Sallie Mae Bank when it was part of legacy SLM or by Sallie Mae Bank post Spin-Off, and regardless of whether the loan is currently held by an ABS trust, or held or serviced by Navient or Sallie Mae Bank. Data in this category is used in the tables below under the following headings: • “Cumulative Defaults by P&I Repayment Vintage and Years Since First P&I Repayment Period” – Only for 2010-2014 P&I Repayment Vintages This combined Smart Option Student Loan portfolio data provides insight into gross defaults of the covered vintages of Smart Option Student Loans since 2010, regardless of ownership or servicing standard. Data available for earlier periods includes a limited number of Smart Option Student Loan product types. Loans contained in the combined Smart Option Student Loan portfolio category were serviced by legacy SLM prior to the Spin-Off, and by either Navient or Sallie Mae Bank after the Spin-Off. As noted above, loans serviced by legacy SLM and Navient were serviced pursuant to different policies than those loans serviced by Sallie Mae Bank after the Spin-Off. Specifically, legacy SLM charged off loans after 212 days of delinquency, and Navient has continued this policy. Sallie Mae Bank currently charges off loans after 120 days of delinquency. All loans included in the combined Smart Option Student Loan portfolio that were serviced by legacy SLM prior to the Spin-Off were serviced pursuant to a 212-day charge off policy. Following the Spin-Off, a portion of the loans included in the combined Smart Option Student Loan portfolio data have been serviced by Navient pursuant to a 212-day charge off policy, and a portion have been serviced by Sallie Mae Bank pursuant to a 120-day charge off policy. As a result, future performance of loans serviced by Sallie Mae Bank may differ from the historical performance of loans reflected in this combined Smart Option Student Loan portfolio data. (2) Smart Option Student Loan Portfolio Data for Sallie Mae Bank Serviced Loans. Information in this category is presented for loans originated under the Smart Option Student Loan program, whether originated by Sallie Mae Bank when it was part of legacy SLM or by Sallie Mae Bank post Spin-Off, and regardless of whether the loan is currently held by an ABS trust. All loans in this category are serviced by Sallie Mae Bank. Data in this category is used in the tables below under the following headings: • “Cumulative Defaults by P&I Repayment Vintage and Years Since First P&I Repayment Period” – Only for 2015- 2019 P&I Repayment Vintages In relation to cumulative defaults, the Sallie Mae Bank Serviced portfolio data provides insight into gross defaults of the Smart Option Student Loans covered and serviced by Sallie Mae Bank since 2015, regardless of ownership. We believe historical loan performance data since 2015 is more representative of the expected performance of Smart Option Student Loans to be included in new Sallie Mae Bank trusts than data available for earlier periods. Loans contained in the Smart Option Student Loan Portfolio Data for Sallie Mae Bank Serviced Loans category were serviced by legacy SLM prior to the Spin-Off, and by Sallie Mae Bank after the Spin-Off. Sallie Mae Bank currently charges off loans after 120 days of delinquency. Any data or other information presented in the following charts is for comparative purposes only, and is not to be deemed a part of any offering of securities. A portion of the Smart Option Student Loan performance data described above was provided to Sallie Mae Bank by Navient under a data sharing agreement executed in connection with the Spin-Off. This data sharing agreement expired on April 29, 2019 and, as a result, cumulative gross default data for pre-2015 P&I Repayment Vintages is held static as of December 31, 2018. Under the data sharing agreement, Navient made no representations or warranties to Sallie Mae Bank concerning the accuracy and completeness of information that it provided. Sallie Mae Bank has not independently verified, and is not able to verify, the accuracy or completeness of the data provided under the agreement 31

Smart Option Loan Program Cohort Default Triangles Terms and calculations used in the cohort default triangles are defined below: First P&I Repayment Period – The month during which a borrower is first required to make a full principal and interest payment on a loan. P&I Repayment Vintage – The calendar year of a loan’s First P&I Repayment Period. Disbursed Principal Entering P&I Repayment – The total amount of disbursed loan principal in a P&I Repayment Vintage, excluding any interest capitalization. Reported Default Data – o For loans that default after their First P&I Repayment Period: Loans enter a particular annual P&I Repayment Vintage at different times during the P&I Repayment Vintage year. Default data is not reported for loans in a particular annual P&I Repayment Vintage until the First P&I Repayment Period has occurred for all loans in that annual P&I Repayment Vintage. Once reporting starts, data reflects defaults that occurred in a particular period through the number of months since December 31 of that annual P&I Repayment Vintage year. For example, in the relevant charts and tables included in this presentation as of December 31, 2019: (i) default data reported for loans in the 2018 P&I Repayment Vintage represents defaults occurring during the first 12 months after a loan’s First P&I Repayment Period regardless of the month in 2018 during which the first full principal and interest payment for that loan became due; and (ii) default data for loans in the 2017 P&I Repayment Vintage represents defaults occurring during the first 24 months after a loan’s First P&I Repayment Period regardless of the month in 2017 during which the first full principal and interest payment for that loan became due. o For loans that default prior to their First P&I Repayment Period: Loans defaulting prior to their First P&I Repayment Period are included in the P&I Repayment Vintage corresponding to the calendar year in which the default occurs, and are aggregated and reported in Year 0 of that P&I Repayment Vintage in the relevant charts and tables. For example: (a) if a loan’s First P&I Repayment Period was scheduled for 2018, but the loan defaulted in 2017, the default amount is reflected in Year 0 of the 2017 P&I Repayment Vintage; and (b) if a loan’s First P&I Repayment Period occurred in 2018, but the loan defaulted in 2018 before that First P&I Repayment Period, the default amount is reflected in Year 0 of the 2018 P&I Repayment Vintage. o For loans that pay off prior to their First P&I Repayment Period: Loans paid off prior to their First P&I Repayment Period are included in the Disbursed Principal Entering P&I Repayment of the P&I Repayment Vintage corresponding to the calendar year in which the payoff occurs. Periodic Defaults – For any loan in a particular P&I Repayment Vintage, the defaulted principal and interest is reflected in the year corresponding to the number of years since the First P&I Repayment Period for that loan. Cumulative Defaults – At any time for a particular P&I Repayment Vintage, the cumulative sum of Periodic Defaults for that vintage. o Defaulted principal includes any interest capitalization that occurred prior to default o Defaulted principal is not reduced by any amounts recovered after the loan defaulted o Because the numerator includes capitalized interest while the denominator (i.e., Disbursed Principal Entering P&I Repayment) does not, default rates are higher than they would be if the numerator and denominator both included capitalized interest Note: Cumulative gross defaults for pre-2015 P&I Repayment Vintages are held static as of December 31, 2018. Note: Historical trends suggested by the cohort default triangles may not be indicative of future performance. Legacy SLM and Navient serviced loans were serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank serviced loans were serviced pursuant to a 120 day charge-off policy. 32

Footnotes 1. Source: MeasureOne CBA Report as of September 2019 2. U.S. Bureau of Labor Statistics, Current Population Survey 3. Source: Trends in Student Aid,© 2019 The College Board, www.collegeboard.org, U.S. Department of Education 2019 4. Source: U.S. Bureau of Labor Statistics- “More education: Lower unemployment, higher earnings” as of December 2019 5. Source: Trends in Student Aid,© 2019 The College Board, www.collegeboard.org, U.S. Department of Education 2019 6. Originations represent loans that were funded or acquired during the period presented. 7. Represents the higher credit score of the cosigner or the borrower. 8. For important information regarding historical performance data and an explanation of the data and calculations underlying this chart, see pages 30-32. 9. For 2010-2014 P&I Repayment Vintages Only- Data static as of December 31, 2018 for Legacy SLM, Navient and Sallie Mae Bank serviced portfolios combined. Certain data used in the charts above was provided by Navient under a data sharing agreement which expired on April 29, 2019 (see page 31 for more details). Sallie Mae Bank has not independently verified, and is not able to verify, the accuracy or completeness of the data provided under the agreement. 10. For 2015-2019 P&I Repayment Vintages Only- Data as of December 31, 2019 for Sallie Mae Bank serviced loans only – All loans covered are serviced by Sallie Mae Bank, regardless of whether the loans were originated by Sallie Mae Bank when it was part of legacy SLM, or by Sallie Mae Bank post Spin-Off, and regardless of whether the loans were included in an ABS trust. Note: Legacy SLM and Navient portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future performance. 11. We calculate and report our non-GAAP operating efficiency ratio as the ratio of (a) the total non-interest expense numerator to (b) the net revenue denominator (which consists of the sum of net interest income, before provision for credit losses, and non-interest income, excluding any gains and losses on sales of loans and securities, net and the net impact of derivative accounting as defined in the "‘Core Earnings’ to GAAP Reconciliation" table on page 29). We believe doing so provides useful information to investors because it is a measure used by our management team to monitor our effectiveness in managing operating expenses. Other companies may use similarly titled non-GAAP financial measures that are calculated differently from the way we calculate our ratio. Accordingly, our non-GAAP operating efficiency ratio may not be comparable to similar measures used by other companies. 12. Smart Option loans considered in ‘P&I Repayment’ only if borrowers are subject to full principal and interest payments on the loan. 13. Represents the higher credit score of the cosigner or the borrower. Note: Pool characteristics as of the Statistical Cutoff Date for the respective transaction 14. Overcollateralization for Class A & B bonds 15. Estimated based on a variety of assumptions concerning loan repayment behavior. Actual prepayment rate may vary significantly from estimates. 16. Private education loans are typically non-dischargeable in bankruptcy, unless a borrower can prove that repayment of the loan imposes an "undue hardship“. 17. Source: U.S. Department of Education, Office of Federal Student Aid, https://studentaid.ed.gov/sa/types/loans 18. The difference between “Core Earnings” and GAAP net income is driven by mark-to-fair value unrealized gains and losses on derivative contracts recognized in GAAP, but not in “Core Earnings” results. See page 29 for a reconciliation of GAAP and “Core Earnings”. Derivative Accounting: “Core Earnings” exclude periodic unrealized gains and losses caused by the mark-to-fair value valuations on derivatives that do not qualify for hedge accounting treatment under GAAP, but include current period accruals on the derivative instruments. For periods prior to July 1, 2018, “Core Earnings” also exclude the periodic unrealized gains and losses that are a result of ineffectiveness recognized related to effective hedges under GAAP, net of tax. Under GAAP, for our derivatives held to maturity, the cumulative net unrealized gain or loss over the life of the contract will equal $0. 19. “Core Earnings” tax rate is based on the effective tax rate at Sallie Mae Bank where the derivative instruments are held. 20. We calculate and report our non-GAAP “Core Earnings” Return on Assets (“Core Earnings ROA”) as the ratio of (a) “Core Earnings” net income numerator (annualized) to (b) the GAAP total average assets denominator. 21. We calculate and report our non-GAAP “Core Earnings” Return on Common Equity (“Core Earnings ROCE”) as the ratio of (a) “Core Earnings” net income attributable to SLM Corporation common stock numerator (annualized) to (b) the net denominator, which consists of GAAP total average equity less total average preferred stock. 22. We calculate and report our Return on Assets (“ROA”) as the ratio of (a) GAAP net income numerator (annualized) to (b) the GAAP total average assets denominator. 23. We calculate and report our Return on Common Equity (“ROCE”) as the ratio of (a) GAAP net income attributable to SLM Corporation common stock numerator (annualized) to (b) the net denominator, which consists of GAAP total average equity less total average preferred stock. 24. Estimated CECL impacts are current as of January 22, 2020 and will be refined and reflected in the Company’s first quarter 2020 financial results. 25. The information on this page constitutes forward-looking statements. See page 2 of this Presentation for a cautionary note regarding forward-looking statements. 26. Derivative Accounting: we provide “Core Earnings” because it is one of several measures management uses to evaluate management performance and allocate corporate resources. “Core Earnings” exclude periodic unrealized gains and losses caused by the mark-to-fair value valuations on derivatives that do not qualify for hedge accounting treatment under GAAP, but include current period accruals on the derivative instruments. For periods prior to July 1, 2018, “Core Earnings” also exclude the periodic unrealized gains and losses that are a result of ineffectiveness recognized related to effective hedges under GAAP, net of tax. Under GAAP, for our derivatives held to maturity, the cumulative net unrealized gain or loss over the life of the contract will equal $0. Management believes the Company’s derivatives are effective economic hedges, and, as such, they are a critical element of the Company’s interest rate risk management strategy. Our “Core Earnings” are not defined terms within GAAP and may not be comparable to similarly tilted measures reported by other companies. 27. See footnote 26 and “Core Earnings” to GAAP Reconciliation on page 29 for a description of non-GAAP “Core Earnings.” GAAP net income attributable to SLM Corporation common stock is the most directly comparable GAAP measure. However, this GAAP measure is not accessible on a forward-looking basis because the Company is unable to estimate the net impact of derivative accounting and the associated net tax expense (benefit) for future periods. 28. Source: Total post-secondary education spending is estimated by Sallie Mae determining the full-time equivalents for both graduates and undergraduates and multiplying by the estimated total per person cost of attendance for each school type. In doing so, we utilize information from the U.S. Department of Education, National Center for Education Statistics, Projections of Education Statistics to 2027 (NCES 2019, February 2019), The Integrated Postsecondary Education Data System (IPEDS), College Board -Trends in Student Aid 2016. © 2016 The College Board, www.collegeboard.org, College Board -Trends in Student Aid 2019. © 2019 The College Board, www.collegeboard.org, College Board -Trends in Student Pricing 2019. © 2019 The College Board, www.collegeboard.org, National Student Clearinghouse - Term Enrollment Estimates, and Company analysis. 2019 Private Education Loan market assumptions use The College Board-Trends in Student Aid 2016 © 2016 trends and College Board-Trends in Student Aid 2019 © 2019 data. Other sources for these data points also exist publicly and may vary from our computed estimates. NCES, IPEDS, and College Board restate their data annually, which may cause previous reports to vary. We have also recalculated figures in our Company analysis to standardize all costs of attendance to dollars not adjusted for inflation. This has a minimal impact on historically-stated numbers. 29. The Company’s expectation and ability to pay a quarterly cash dividend on its common stock in the future will be subject to the determination by, and discretion of, the Company’s Board of Directors, and any determination by the Board will be based on an evaluation of the Company’s earnings, financial condition and requirements, business conditions, capital allocation determinations, and other factors, risks and uncertainties. 30. J.D. Power 2019 Certified Customer Service Program recognition is based on successful completion of an evaluation and exceeding a customer satisfaction benchmark through a survey of recent servicing interactions. For more information, visit www.jdpower.com/ccc. 31. Based on internal Company statistics. 33