Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - NOBLE ENERGY INC | nbl-20191231xerxex993.htm |

| EX-99.1 - EXHIBIT 99.1 - NOBLE ENERGY INC | nbl-20191231xerxex991.htm |

| 8-K - 8-K - NOBLE ENERGY INC | nbl-20191231x8kearning.htm |

4Q19 Results / 2020 Outlook February 12, 2020

4Q19 & FY19 Actuals vs. Guidance Midpoint www.nblenergy.com NASDAQ: NBL Outperformance on volumes on lower capital and costs 4Q 4Q ∆ FY19 FY19 ∆ Financial & Operating Metrics Adjusted Net Earnings 4Q ($MM) Guide Actuals Guide Guide Actuals Guide Net Loss Attributable to NBL (GAAP) (1,206) Organic Capital(1) ($MM) 450 406 (44) 2,500 2,263 (237) Adjustments to Net Loss, Before Tax 1,460 Total Sales Volumes (MBoe/d) 370 373 3 355 361 6 Oil (MBbl/d) 139 139 - 136 135 (1) Current Income Tax Effect of Adjustments (3) Total U.S. Onshore (MBoe/d) 282 285 3 270 274 4 Deferred Income Tax Effect of Adjustments (277) Oil (MBbl/d) 123 123 - 122 120 (2) Adjusted Net Loss Attributable to NBL(5) (Non-GAAP) (26) Unit Production Expenses ($/BOE) 9.00 8.01 (0.99) 9.50 8.62 (0.88) Lease Operating Expense 3.70 4.04 GT&P 3.24 3.16 Adjusted EBITDAX 4Q ($MM) Production Taxes 0.96 1.33 Net Loss Including Noncontrolling Interest (GAAP) (1,188) Other Royalty 0.12 0.10 Marketing and Other(2) ($MM) 15 18 3 100 76 (24) Adjustments to Net Loss, After Tax 1,180 DD&A ($/BOE) 17.13 16.84 (0.29) 17.40 16.67 (0.73) DD&A 578 Exploration(3) ($MM) 30 20 (10) 163 102 (61) Exploration 20 (4) G&A ($MM) 95 118 23 415 416 1 Interest, net 64 Interest, net ($MM) 63 64 1 255 260 5 Current Income Tax Expense, Adjusted 27 Equity Investment Income ($MM) 0 3 3 105 44 (61) Deferred Income Tax Benefit, Adjusted (41) Midstream Services Revenue ($MM) 35 31 (4) 130 94 (36) Adjusted EBITDAX(5) (Non-GAAP) 640 NCI – NBLX Public Unitholders ($MM) 25 18 (7) 93 79 (14) (1) Represents NBL organic capital expenditures, including NBL-funded midstream capital. (4) Fourth quarter G&A includes incentive comp, which reflects strong operating performance and (2) Represents marketing costs and mitigation of firm transportation through 3rd party commodity purchases/sales. major project delivery. 2 (3) After one-time exploration write-off of suspended costs. (5) Non-GAAP reconciliation to GAAP measure available in 4Q19 earnings release.

Delivering Key Outcomes For 2019 www.nblenergy.com NASDAQ: NBL Setting the stage for sustainable long-term FCF(1) Goals Accomplishments Further Enhance Capital / Cost Efficiency • 5% Proforma production growth on 17% less • 7% Proforma production growth on 25% less capital; 10% U.S. onshore oil growth capital as compared to 2018 • Capital reduced nearly $240 MM vs. 2019 guide; operating costs reduced $120 MM ✔ Top – Tier Onshore / Offshore Execution • Accelerate onshore development efficiencies • ~$2 MM per well savings in the DJ and Delaware Basins • First gas from Leviathan by YE 2019 • Leviathan first gas by YE 2019; capital budget more than $200 MM below sanction plan ✔ • Sanction Alen gas monetization project • Alen gas monetization project sanctioned with first production expected by early 2021 Ensure Financial Strength • Increased quarterly dividend 9% in 2019 • Increase return of capital to shareholders • Maintained investment grade across all agencies; upgrade from Fitch to BBB ✔ • Generate $500 MM - $1 B in portfolio proceeds • Non-core asset sale and midstream simplification generated >$800 MM in proceeds; ✔ exited 4Q19 with $4.5 B in liquidity Advance ESG Initiatives • Further improvement on safety performance • Record-low U.S. onshore recordable incident rate of 0.35 (per 200,000 hours worked) • Issue first Climate Resilience Report using TCFD • Climate Resilience Report issued in October, followed by extensive stakeholder engagement ✔ • Continue Board refreshment • Added 1 new member to the BOD; 3 new members in the last 2.5 years (1) Non-GAAP measure. Term defined in appendix. 3

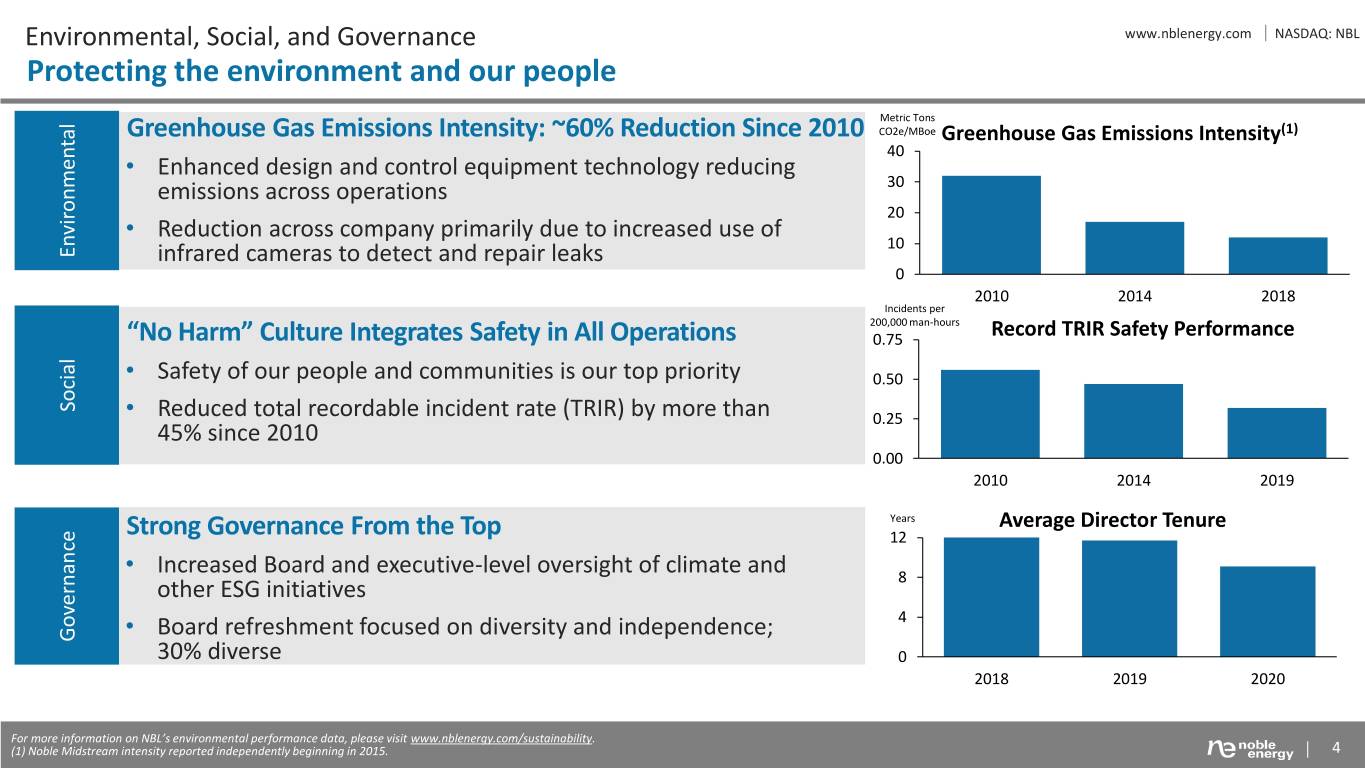

Environmental, Social, and Governance www.nblenergy.com NASDAQ: NBL Protecting the environment and our people Metric Tons Greenhouse Gas Emissions Intensity: ~60% Reduction Since 2010 CO2e/MBoe Greenhouse Gas Emissions Intensity(1) 40 • Enhanced design and control equipment technology reducing emissions across operations 30 20 • Reduction across company primarily due to increased use of 10 Environmental infrared cameras to detect and repair leaks 0 2010 2014 2018 Incidents per 200,000 man-hours “No Harm” Culture Integrates Safety in All Operations 0.75 Record TRIR Safety Performance • Safety of our people and communities is our top priority 0.50 Social • Reduced total recordable incident rate (TRIR) by more than 0.25 45% since 2010 0.00 2010 2014 2019 Years Average Director Tenure Strong Governance From the Top 12 • Increased Board and executive-level oversight of climate and other ESG initiatives 8 • Board refreshment focused on diversity and independence; 4 Governance 30% diverse 0 2018 2019 2020 For more information on NBL’s environmental performance data, please visit www.nblenergy.com/sustainability. (1) Noble Midstream intensity reported independently beginning in 2015. 4

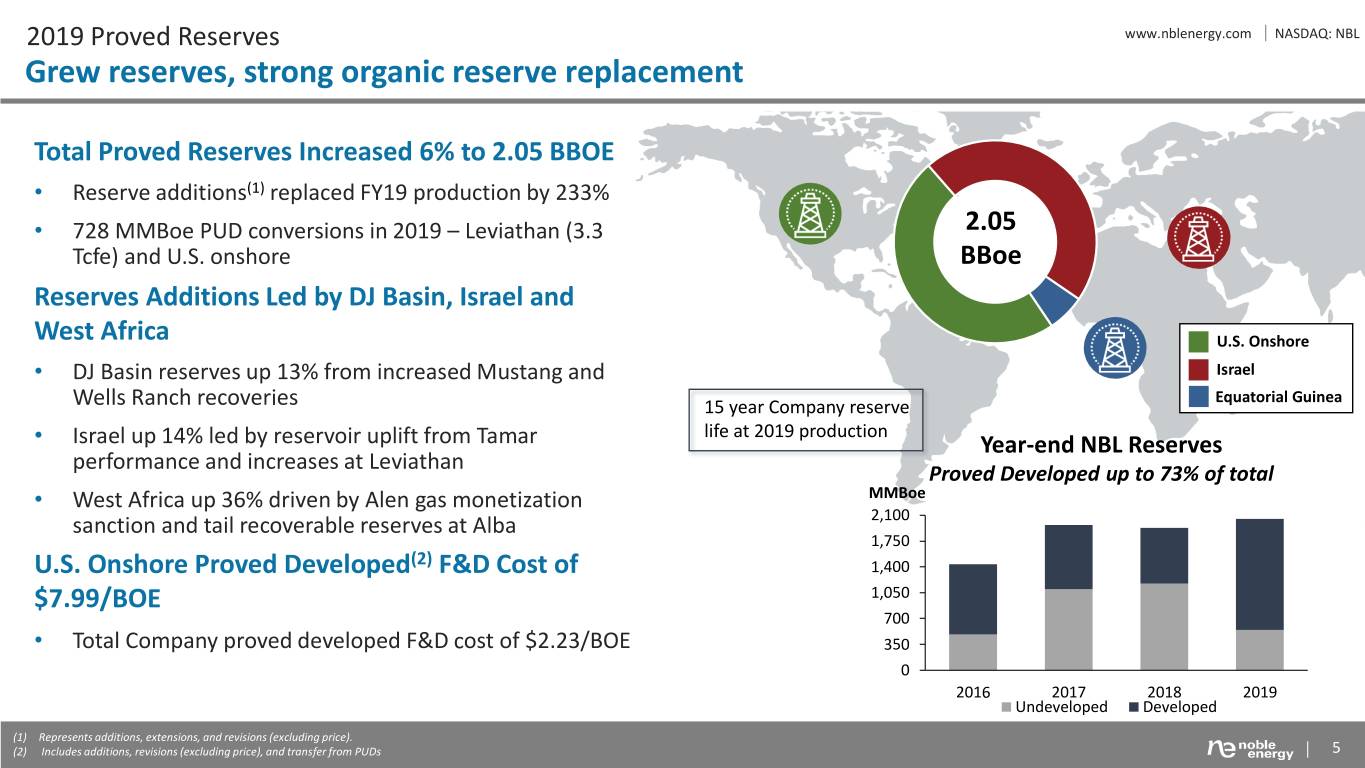

2019 Proved Reserves www.nblenergy.com NASDAQ: NBL Grew reserves, strong organic reserve replacement Total Proved Reserves Increased 6% to 2.05 BBOE • Reserve additions(1) replaced FY19 production by 233% • 728 MMBoe PUD conversions in 2019 – Leviathan (3.3 2.05 Tcfe) and U.S. onshore BBoe Reserves Additions Led by DJ Basin, Israel and West Africa U.S. Onshore • DJ Basin reserves up 13% from increased Mustang and Israel Equatorial Guinea Wells Ranch recoveries 15 year Company reserve life at 2019 production • Israel up 14% led by reservoir uplift from Tamar Year-end NBL Reserves performance and increases at Leviathan Proved Developed up to 73% of total • West Africa up 36% driven by Alen gas monetization MMBoe sanction and tail recoverable reserves at Alba 2,100 1,750 U.S. Onshore Proved Developed(2) F&D Cost of 1,400 $7.99/BOE 1,050 700 • Total Company proved developed F&D cost of $2.23/BOE 350 0 2016 2017 2018 2019 Undeveloped Developed (1) Represents additions, extensions, and revisions (excluding price). (2) Includes additions, revisions (excluding price), and transfer from PUDs 5

U.S. Onshore www.nblenergy.com NASDAQ: NBL Production toward high end on lower than expected capital USO Net Production and Capex 4Q19 Key Highlights MBoe/d $MM 300 600 U.S. Onshore Efficiencies Exceeding 3Q19 Performance 250 500 • Well costs reductions driven by shorter cycle times and 200 400 150 300 efficiency improvements 100 200 • Unit operating costs significantly below guidance, LOE of 50 100 $4.23 / BOE 0 0 4Q18 1Q19 2Q19 3Q19 4Q19 DJ Basin Continues Exceptional Performance Oil NGL Gas CAPEX • 4Q19 record production of 163 MBoe/d driven by Wells Ranch 4Q19 Activity DJ Basin Delaware Eagle Ford Total growth and strong base production • Record low LOE of ~$3.25 / BOE Oil (MBbl/d) 71 44 8 123 NGL (MBbl/d) 37 14 21 72 Gas (MMcf/d) 332 72 139 543 Delaware Basin Cycle Times and Well Performance Total Sales (MBoe/d) 163 70 52 285 Improvements Continue Organic Capital(1) ($MM) 154 100 2 256 • Avg. drilling days reduced to ~15; pump hours per day improved Operated Rigs (2) 2 3 0 5 30% from 4Q18 Wells Drilled (2) 27 15 0 42 Wells Completed (2) 16 9 0 25 • Strong 4Q19 well results, including southern wells Wells Brought Online (2) 25 13 0 38 Avg. Working Interest 94% 99% - Avg. Lateral Length (ft) 9,309 7,736 - (1) Excludes NBL funded midstream of $6 MM (2) Activity represents NBL operated only 6

Offshore www.nblenergy.com NASDAQ: NBL Strong base performance with major project catalysts MMcfe/d Israel Gross Sales Volumes 4Q19 Key Highlights 1,200 Nearly sold out Tamar capacity NBL Offshore Assets Average 99% Uptime, Demonstrating 900 Reliability of Production and Cash Flow 600 Tamar Production Above ~1 Bcfe/d Gross in 4Q 300 Leviathan First Gas in December 2019 0 • 4 subsea production wells online with substantial gas sales to Israel, 4Q17 4Q18 4Q19 Jordan and Egypt underway Africa Business Unit Maximizing Cash Flows from Existing MBoe/d Equatorial Guinea Sales Volumes Fully constructed Leviathan platform Production 75 Decline primarily from Alba natural gas • Improved volumes at Aseng and Alen via reservoir and base 50 production management • Development well at Aseng oil field commenced first production in 25 Oct. 2019 – performing better than expected at ~ 15 MBbl/d, gross 0 4Q17 4Q18 4Q19 Oil NGL Gas 7

Leviathan Production Online www.nblenergy.com NASDAQ: NBL World-class field and execution: project more than $200 MM under budget Largest Private Infrastructure Project In Israel’s History and for NBL • Doubles Israel’s total production capacity to ~2.3 Bcfe/d • Enables further reduction of coal usage for electricity generation, significantly improving air quality and reducing electricity cost First Gas to Israel Commenced December 31, 2019; Jordan and Egypt Exports Began January 2020 2010 Discovery – 17 TCF recoverable resource >22 TCF Recoverable Leviathan Field With Resource appraisal Production Less than 3 Years from Sanction 2011 - 2013 4 wells drilled Recoverable resource revised to 22 TCF • NBL operator with 39.66% WI Natural gas framework implemented • Largest natural gas field in the Eastern Med with >35 Tcfe 2015 - 2016 Plan of Development approved by government gas resource in place. 2017 Project sanction 2018 Development drilling and completions Leviathan Startup – VIEW VIDEO Platform jacket installed 2019 Topside installation and commissioning First Gas 8

Portfolio Combination Provides Competitive Advantage www.nblenergy.com NASDAQ: NBL Step change in sustainable production profile with Leviathan start-up Eastern Mediterranean World-class natural gas reservoirs with low decline profile Leviathan driving material 2020 cash flow and production increase NBL vs. Onshore Basin Base Decline Rates High-margin, capital-efficient growth opportunities Annual Diverse Portfolio Drives Lower Corporate Decline Rate Decline 50% U.S. Onshore 40% Generating free cash flow and moderate oil growth DJ Basin: Significant cash flow in 30% excess of capital; increasing volumes Delaware: Driving capital and operating efficiencies through row development 20% Eagle Ford: Cash generation 10% West Africa Delivering substantial cash flow from 0% oil and condensate Alen gas monetization (early 2021) Eagle Delaware DJ Bakken Scoop Appalachia NBL Prior NBL drives high-margin growth linked to Ford Stack Current global LNG markets Source: RS Energy Group, Inc. analysis of aggregate basin-level base production declines from 2019 to 2020, as of January 2020. NBL data based on company estimates. 9

Multi-Year Capital Allocation Framework www.nblenergy.com NASDAQ: NBL Low maintenance capital allows for sustainable free cash flow(1) 2020 Plan $200-300 MM Prioritizing FCF (1) Target of At Least $500 MM U.S. Onshore Growth Capital(2) Growth driven by Leviathan (10%) $200-300 MM Return to investors - dividend growth and balance sheet Growth Major Projects and ~$300 MM Major Project and Exploration Capital Exploration Capital Alen Gas Monetization and Colombia exploration well Israel pipeline expansion ~$1.4 B Maintenance Capital U.S. Onshore ~$1.6 B $1.4 B ~$800 MM DJ Basin; driving ~10% growth Total ~$500 MM Delaware Basin; maintaining 2019 production Production Maintenance Capital(2) ~3-5% U.S. Onshore oil growth ~$100 MM International/corporate International $2.0-2.2 B $1.8-2.0 B $1.6 – 1.8 B Long-term Capital(2) Outlook 2020 Capital Outlook (1) Non-GAAP measure. Term defined in appendix. (2) Represents NBL organic capital expenditures. Maintenance capital term defined in appendix. 10

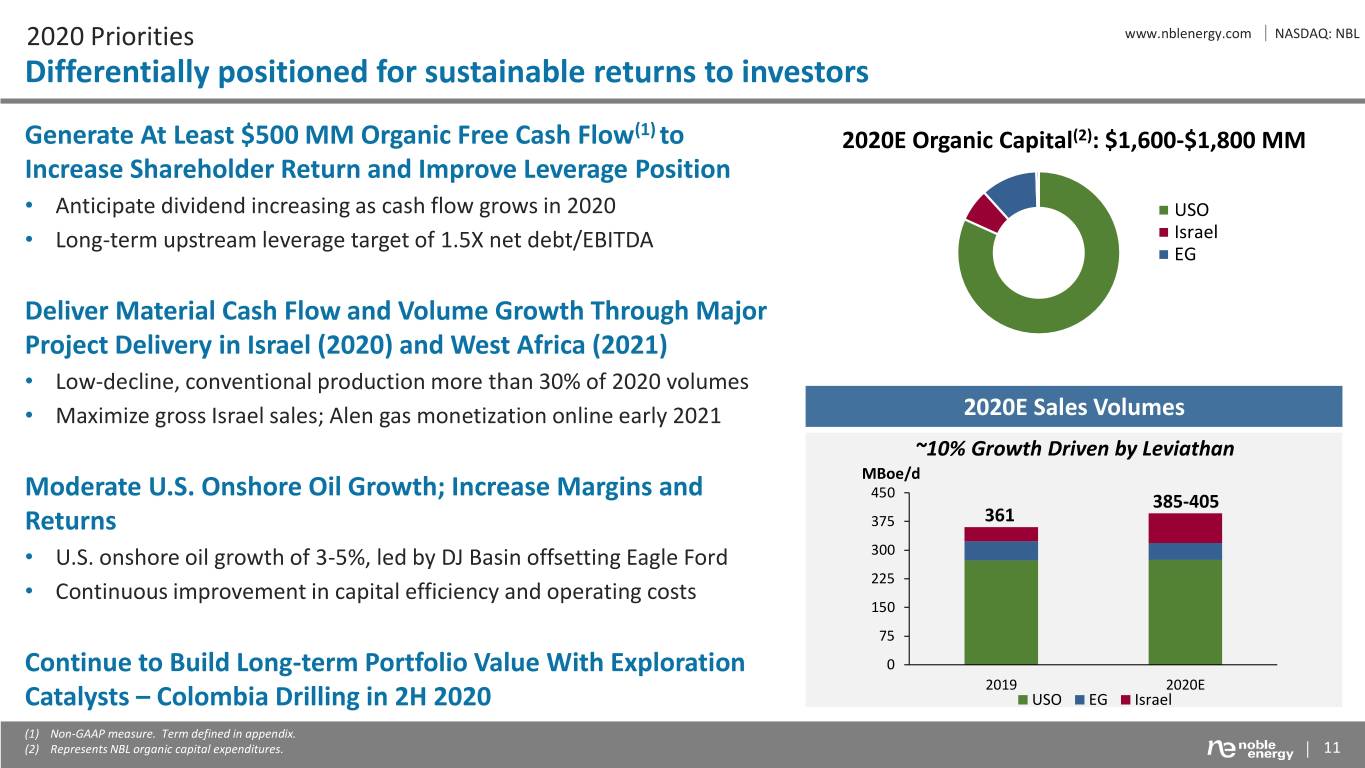

2020 Priorities www.nblenergy.com NASDAQ: NBL Differentially positioned for sustainable returns to investors Generate At Least $500 MM Organic Free Cash Flow(1) to 2020E Organic Capital(2): $1,600-$1,800 MM Increase Shareholder Return and Improve Leverage Position • Anticipate dividend increasing as cash flow grows in 2020 USO • Long-term upstream leverage target of 1.5X net debt/EBITDA Israel EG Deliver Material Cash Flow and Volume Growth Through Major Project Delivery in Israel (2020) and West Africa (2021) • Low-decline, conventional production more than 30% of 2020 volumes • Maximize gross Israel sales; Alen gas monetization online early 2021 2020E Sales Volumes ~10% Growth Driven by Leviathan MBoe/d Moderate U.S. Onshore Oil Growth; Increase Margins and 450 385-405 Returns 375 361 • U.S. onshore oil growth of 3-5%, led by DJ Basin offsetting Eagle Ford 300 225 • Continuous improvement in capital efficiency and operating costs 150 75 Continue to Build Long-term Portfolio Value With Exploration 0 2019 2020E Catalysts – Colombia Drilling in 2H 2020 USO EG Israel (1) Non-GAAP measure. Term defined in appendix. (2) Represents NBL organic capital expenditures. 11

Continuous Improvement in 2020 www.nblenergy.com NASDAQ: NBL Enhancing capital efficiency, reducing costs, improving profitability Decreasing Capital Spend Growing Production $ MM MBoe/d 2,800 Capital efficiency 400 2,400 ~10% annual and moderate 300 2,000 growth reducing production growth 1,600 capital needs both 200 in 2020 – primarily 1,200 onshore and from international 800 offshore 100 offshore assets 400 0 0 2018 2019 2020E 2018 2019 2020E Reducing Cost Structure Lowering F&D Costs $/BOE Unit Production Costs and G&A(1) / BOE $/BOE DD&A / BOE $16 $18 Reductions in G&A $15 DD&A rate down $12 ~$2.40/BOE in and GTP lead $12 continued 2020, led by $8 downward trend $9 Leviathan impact and improving $6 and lower onshore $4 cost structure margins $3 $0 $0 2018 2019 2020E 2018 2019 2020E (1) Unit production costs (LOE, production taxes, gathering and transport, plus other royalty) shown net of GTP costs eliminated in consolidation with NBLX. 12

U.S. Onshore www.nblenergy.com NASDAQ: NBL Focused on continuous improvement $MM USO Capital Allocation 2020 Key Focus 2,500 Lowering capital, focused on oil-rich basins Cash Flow Generation 2,000 • All 3 basins expected to generate asset level free cash flow 1,500 • USO oil production up 3-5% FY and 5-7% 4Q over similar period 1,000 in 2019 500 Capital Efficiency Continues to Improve 0 2018 2019 2020E • Well costs down ~30% in 2019, with gains continuing into 2020 DJ Delaware Eagle Ford USO Production Activity Concentrated in High Return Areas MBoe/d Oil Mix • DJ Basin activity focused ~75% in Mustang, ~25% in Wells Ranch 300 3-5% USO oil growth in 2020 46% • Delaware Basin activity focused in north and central areas 250 200 44% Operational Execution Remains Priority in 2020 150 • Anticipate 4 rigs (2 DJ, 2 Delaware) and 3 crews (2 DJ, 1 100 42% Delaware) in 2020 50 • 110-120 TILs in the DJ, 50-60 TILs in the Delaware 0 40% 2018 2019 2020E Oil NGL Gas Oil Mix 13

DJ Basin www.nblenergy.com NASDAQ: NBL Long-term planning and execution continues to pay dividends Continued Outperformance in DJ Basin NBL Acreage Municipalities GOR: Low Mid High East Pony • Nearly $800 MM in asset level free cash flow generated 2016-2019 Weld • Record 4Q19 production of 163 MBoe/d driven by strong base and new well performance Wells Ranch • LOE down ~15% year over year with a record low of $3.25/BOE in 4Q19 Mustang 349,000 net acres Reduced Capital and Cost Structure in 2020 86% avg. WI • Well costs for 2020 budgeted to be ~$0.5 MM under 2019 average; down ~20% from 4Q ‘18 • 2020 activity primarily in Mustang, utilizing shared Frac facilities for increased efficiency Mustang Row 2 Shared • ~20 TILs anticipated in 1Q (Mustang, Wells Ranch) Facilities Mustang Row 3 Approximately ~400 Permits in Hand; >85% with Drill 6-Year Term • North Wells Ranch CDP anticipated to add an additional 250 permits 2020 Mustang Activity 14

Delaware Basin www.nblenergy.com NASDAQ: NBL Improving capital efficiency across the acreage position Capital and Operating Cost Focus NBL Acreage 2020 Development • Well costs continue to decrease, with >$3 MM in savings from Focus 4Q18 • LOE/BOE down 31% from the 4Q18 and 14% year over year Design Modifications Adding Value • Electrical substations decrease downtime and increase productivity Optimized Landing Zone ✔ Modified Completion Design ✔ Improved Cycle Times and Well Results • Modified Wellbore Orientation ✔ 94,000 net acres Strong 4Q19 well results across the acreage position 82% avg. WI • Avg. drilling days reduced to ~15 for 8,430’ lateral well Improved Well Performance ✔ • Completion pump hours per day improved 30% from 4Q18 Feet/Day Delaware Basin Drilling Performance • ~15 TILs anticipated in 1Q20 (WCA, 3BS) 1,400 >45% Improvement in 2019 1,200 1,000 EPIC Crude Line to Startup for Service in 1Q20 800 • NBL barrels benefit from lower transport cost and Gulf Coast 600 pricing 400 • Line fill impacting 1Q capital, approximately $35 MM 200 0 1Q19 2Q19 3Q19 4Q19 15

U.S. Onshore www.nblenergy.com NASDAQ: NBL Continued capital and LOE reductions (1) (1) $MM DJ Well Cost $MM Delaware Well Cost $8 Normalized to 9,500’ $12 Normalized to 7,500’ $7 Down $10 $6 $2.5 MM Down $8 >$3 MM $5 $4 $6 $3 $4 $2 $2 $1 $0 $0 4Q18 1H19 2H19 2020E 4Q18 1H19 2H19 2020E DJ Lease Operating Expense $/BOE $/BOE Delaware Lease Operating Expense $12 $4 Down >15% $10 $3 Down $8 >30% $2 $6 $1 $4 $- $2 4Q 2018 1Q 2019 2Q 2019 3Q 2019 4Q 2019 4Q 2018 1Q 2019 2Q 2019 3Q 2019 4Q 2019 (1) Includes drilling, completions, and well level facilities, excludes approximately $0.5 MM per well in water handling fees 16

Offshore www.nblenergy.com NASDAQ: NBL Conventional, low decline assets provide growing cash flows in 2020 International Capital Allocation 2020 Key Highlights EMed spend rolls off, Alen development starts $MM Israel WA Israel Volumes on Track to Deliver 1.6 - 1.8 Bcfe/d Average 700 in 2020 600 500 • Successful start-up and ramp of Leviathan volumes demonstrates 400 market availability and improves confidence in 2020 sales 300 • January sales averaged 1.6 Bcfe/d gross from Leviathan and Tamar 200 100 0 Leviathan Driving Total Company 2020 Volume Growth of 2018 2019 2020E ~10% MBoe/d Offshore Production 125 West Africa Focused on Next Major Project and Base 100 Decline Management 75 • Capital spend has commenced on the $165 MM net Alen Gas 50 Monetization project with start-up expected early 2021 25 • Aseng 6P production reducing base decline rate at the Aseng field 0 2018 2019 2020E • Maintenance/downtime impacting 2020 volumes by ~2 MBoe/d WA Israel 17

Eastern Mediterranean www.nblenergy.com NASDAQ: NBL 2020 begins new era of long-term sustainable growth Aphrodite Leviathan Tamar 35% WI 39.7% WI 25% WI Strong Regional Sales Outlook Dalit 25% WI • Expecting combined regional sales for Tamar and Leviathan Tamar SW Dor to range between 1.6 and 1.8 Bcfe/d for 2020 25% WI Tel Aviv • Substantial cashflow uplift from 2019 to 2020, Ashdod demonstrating critical inflection point for company Ashkelon Jordan Demand Growth to Utilize Installed Capacity El Arish Israel • Israel: Continued coal conversion, industrial usage, and Egypt transportation ▪ Natural gas electricity generation has grown from ~50% in Eastern Mediterranean Sales Outlook 2015 to ~70% in 2019 Bcfe/d Volumes ramping to 2H20 average of 1.8-2.0 Bcfe/d • Jordan: Industrialization leading to commercial and 2.4 Tamar & Leviathan 2.3. Bcfe/d installed capacity residential natural gas consumption 2.0 • Egypt: Growth anticipated in all market segments 1.6 1.2 ▪ Focus on becoming a regional hub for natural gas 0.8 0.4 - 1H 2020E 2H 2020E 18

Leviathan www.nblenergy.com NASDAQ: NBL World-class reservoir size and quality Subsurface Quality Similar to Tamar, Larger Scale Tamar: 100 km2 • Leviathan, similar to Tamar, produces dry natural gas (~99% methane) • Largest natural gas discovery in the region at >35 Tcfe in place and >22 Tcfe recoverable Well Deliverability Greater than Initial Leviathan net pay map ranging from Expectations 45-180 meters • 7” tubing allows for single well rates exceeding 400 Reservoir Facts: MMcfe/d Permeability 400-1200 mD Leviathan: Porosity 21% - 25% 325 km2 ▪ Single well max rate of 340 MMcfe/d to date Recovery Factor 60%-70% • Wells designed for long life and cumulative production of 1 Leviathan Well Equals 1-2 Tcf The resource of 210 DJ Basin wells • Extensive lateral connectivity demonstrated with The daily rate of 66 Appalachian Basin wells pressure communication The energy to heat 23 million American homes for one year 19

West Africa www.nblenergy.com NASDAQ: NBL Strong cash flow profile from existing production and project developments 4Q20 Volumes Impacted by Field Downtime/Maintenance NBL Interests Alba Discoveries 33% WI • Alba downtime for LNG plant maintenance and readiness for Alen gas Aseng FPSO Alen Gas Monetization Future Pipeline ▪ 4Q impact 50-60 MMcf/d, FY impact 12-15 MMcf/d Existing Pipeline Equity Method • Aseng shut-in for maintenance and upgrades (~2 weeks) Investments Equatorial Alen Unaffiliated Party Guinea Punta 45% WI • Alen shut-in for platform modifications in preparation for gas Europa monetization start-up (~8 weeks) Bioko BLOCK O Island YoYo BLOCK I 75% WI AMPCO Alba Plant Alen Gas Monetization Provides Significant Cash Flow (Methanol Plant) (LPG Plant) Aseng • Start up early 2021 (initial production rate 200 – 300 MMcfe/d, gross); 38% WI Yolanda EG LNG 40% WI anticipated to pay-out in less than two years (LNG Plant) Cameroon • Backfill available capacity at E.G. LNG plant due to Alba declines • Opportunities for additional tie-ins beyond Alen include ~2.5 Tcfe of MMcfe/d Punta Europa Gas Outlook NBL discovered resources (pipeline sized for 950 MMcfe/d) 1,000 Alen Gas Monetization Overview 750 Capital Expenditure, net $165 MM 500 2021 – 2023 Average Annual Rates, Gross 250 Sales Gas 260 MMcf/d Condensate ~3 MBbl/d 0 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 LPGs ~7 MBbl/d Alba Alen Regional Discoveries Pipeline & Onshore Facility Capacity Note: Regional discoveries are NBL-operated fields yet to be sanctioned as development 20

Colombia Exploration Catalyst in 2020 www.nblenergy.com NASDAQ: NBL Material resource opportunity in frontier basin NBL 40% Operated WI in 2 MM acres Offshore Colombia • Colombia-3 and Guajira Offshore-3 blocks contain in excess of 2 BBoe gross unrisked resource potential • Shell is our co-venturer with 60% working interest BlockBlock GUAGUA OFFOFF--33 NBL/ShellNBL/Shell • Extensive 3D seismic data over nearly all of position ExplorationExploration Blocks Blocks StructuresStructures mappedmapped • Geochemical data provides outlook for both oil and/or liquids-rich gas onon 3D 3D seismicseismic • Tertiary-aged structures with potential direct hydrocarbon indicators BlockBlock GUAGUA--33 Cumbia #1 BlockBlock COLCOL--33 NW Cumbia #1 SE BlockBlock COLCOL--33 8,500 ft. ColombiaColombia ColombiaColombia Cumbia Exploration Prospect Drilling Est. to Commence 3Q20 • Substantial oil and natural gas potential resources • Water depth: 8,500 feet • Rig contracted – 60 to 75 day well Anticipated TD: 16,400 ft. • Potential to de-risk follow on opportunities 21

2020 Performance-Based Executive Incentive Plan www.nblenergy.com NASDAQ: NBL Compensation aligned with shareholder interests to drive superior returns Long-term Incentive Plan (LTIP) • LTIP represents approximately 70% of total executive compensation opportunity • PerformanceMetrics share (60%) award weighting represents 50% of total award ▪ Corporate Returns and ESG – 20%, Relative TSR – 30% Short-term Incentive Plan (STIP) Increased weighting to FCF and formalizing ESG metrics for 2020 Strategic Execution / Board Review TargetedTargeted Metrics Metrics 2019 2020 Items Organic Free Cash Flow 15% 30% Weighting decreased to 30% in 2020 Human & Process Safety (Qualitative) 10% Cash Costs 20% 10% • ESG initiatives U.S. Onshore Capital Efficiency 15% 10% • Balance Sheet Strength • Portfolio Sales Volumes 10% 10% Total Weighting 60% 70% 22

2020 Guidance www.nblenergy.com NASDAQ: NBL Full-Year and First Quarter Crude Oil and Natural Gas Total Natural Gas First Quarter 2020 Guidance FY 2020 Ancitipated Condensate Liquids Equivalent (MMcf/d) Sales Volumes LOW HIGH Sales Volume (MBbl/d) (MBbl/d) (MBoe/d) Total Company Equivalent (MBoe/d) 378 398 Low High Low High Low High Low High Total Company Oil (MBbl/d) 129 139 United States Onshore 118 130 62 70 480 520 265 283 Israel 1 1 435 480 74 81 Israel Natural Gas (MMcfe/d) 410 440 Equatorial Guinea 11 13 145 165 36 41 U.S. Onshore Oil (MBbl/d) 109 119 Equatorial Guinea – Equity 1 2 4 5 5 6 Capital Expenditures(1) ($MM) Method Investment Total Company Organic Capital $475 - $550 (4) Total Company 131 146 66 75 1,070 1,155 385 405 Cost Metrics LOW HIGH Unit Production Expenses(2) ($/BOE) 8.50 9.25 Full-Year 2020 Capital & Cost Metrics Equity Investment Income ($MM) 0 10 Capital Expenditures(1) ($MM) Total Company Organic Capital $1,600 - $1,800 1Q 2020 Guidance Commentary: Cost Metrics LOW HIGH Unit Production Expenses(2) ($/BOE) 8.25 9.00 • Capital Marketing & Other ($MM) 100 120 ▪ 1H weighted U.S. onshore spending, 2H weighted production ▪ Delaware basin line fill of ~$35 MM DD&A ($/BOE) 13.75 14.75 • Sales volumes Exploration(3) ($MM) 90 120 G&A ($MM) 350 390 ▪ U.S. Onshore – Anticipate declines in all B.U.s from 4Q19, resulting from Interest, net ($MM) 310 350 low TIL count in 4Q and 1Q ▪ Israel – Leviathan project drives volume growth with gas sales to Israel, Other Guidance Items ($MM) Egypt, and Jordan Equity Investment Income 35 55 ▪ E.G. – strong crude oil liftings Income Taxes, Current 150 200 • Unit production expenses – lower U.S. onshore production volumes impacting Midstream Services Revenue – 3rd Party 120 150 unit rate along with West Africa liquid liftings NCI – NBLX Public Unitholders 90 120 ▪ Anticipate unit rate decreasing with volume increase through 2020 (1) Represents NBL organic capital expenditures. (4) Includes $35 MM for linefill for the EPIC Crude pipeline. (2) Includes lease operating expenses, production and ad valorem taxes, gathering , transportation and processing expenses, and other royalty. 23 (3) Does not include risk-weighted costs for potential unsuccessful wells.

www.nblenergy.com NASDAQ: NBL Forward-Looking Statements and Other Matters This presentation contains certain "forward-looking statements" within the meaning of federal securities laws. Words such as "anticipates", "plans", "estimates", "believes", "expects", "intends", "will", "should", "may", and similar expressions may be used to identify forward-looking statements. Forward-looking statements are not statements of historical fact and reflect Noble Energy's current views about future events. Such forward-looking statements may include, but are not limited to, future financial and operating results, and other statements that are not historical facts, including estimates of oil and natural gas reserves and resources, estimates of future production, assumptions regarding future oil and natural gas pricing, planned drilling activity, future results of operations, projected cash flow and liquidity, business strategy and other plans and objectives for future operations. No assurances can be given that the forward-looking statements contained in this presentation will occur as projected and actual results may differ materially from those projected. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, without limitation, the volatility in commodity prices for crude oil and natural gas, the presence or recoverability of estimated reserves, the ability to replace reserves, environmental risks, drilling and operating risks, exploration and development risks, competition, government regulation or other actions, the ability of management to execute its plans to meet its goals and other risks inherent in Noble Energy's businesses that are discussed in Noble Energy's most recent annual report on Form 10-K, quarterly report on Form 10-Q, and in other Noble Energy reports on file with the Securities and Exchange Commission (the "SEC"). These reports are also available from the sources described above. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Noble Energy does not assume any obligation to update any forward-looking statements should circumstances or management’s estimates or opinions change. The SEC requires oil and gas companies, in their filings with the SEC, to disclose proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. The SEC permits the optional disclosure of probable and possible reserves, however, we have not disclosed our probable and possible reserves in our filings with the SEC. We may use certain terms in this presentation, such as “net unrisked resources” or “net risked resources” or “discovered resources”, which by their nature are more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized. The SEC guidelines strictly prohibit us from including these estimates in filings with the SEC. Investors are urged to consider closely the disclosures and risk factors in our most recent Form 10-K and in other reports on file with the SEC, available from Noble Energy’s offices or website, http://www.nblenergy.com. This presentation contains certain non-GAAP financial measures, such as Adjusted Net Income and Adjusted EBITDAX. Reconciliations of these non-GAAP measures to the most comparable financial measure calculated in accordance with GAAP can be found in our most recent earnings release covering the relevant reporting period. Management believes the aforementioned non-GAAP financial measures are good tools for internal use and the investment community in evaluating Noble Energy’s overall financial performance. These non-GAAP measures are broadly used to value and compare companies in the crude oil and natural gas industry. This presentation also contains a forward-looking non-GAAP financial measure of free cash flow, which we define as cash flow from operations (the most comparable GAAP measure) less consolidated capital investments. Because we provide this measure on a forward-looking basis, however, we cannot reliably or reasonably predict certain of the necessary components of the most directly comparable forward-looking GAAP measure, such as future impairments and future changes in working capital. Accordingly, we are unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measure to its most directly comparable forward-looking GAAP financial measure. Management believes this forward-looking non-GAAP measure is a useful tool for the investment community in evaluating Noble Energy’s future liquidity. As with any non-GAAP measure, amounts excluded from such measure may be significant and such measure is not a substitute for the comparable measure calculated in accordance with GAAP. 24

www.nblenergy.com NASDAQ: NBL Defined Terms and Price Deck Terms Definition Free Cash Flow (FCF) Upstream operating cash flow before working capital changes plus NBLX distribution to Noble Energy less Upstream organic capital Net Debt Total debt less cash on balance sheet EBITDA GAAP earnings before interest, taxes, depreciation, depletion, and amortization Maintenance Capital Capital investments required to hold total company full year average sales volumes flat year over year Benchmark Prices 2020 WTI $55/Bbl Brent $60/Bbl NGL $20.50/Bbl Henry Hub $2.50/Mcf 25

Investor Relations Contacts Brad Whitmarsh Kim Hendrix 281.943.1670 281.943.2197 brad.whitmarsh@nblenergy.com kim.hendrix@nblenergy.com Visit us on the Investor Relations Homepage at www.nblenergy.com