Attached files

| file | filename |

|---|---|

| EX-99.2 - REVISED SUPPLEMENTAL FINANCIAL INFORMATION FOR THE QTR AND YR ENDED DEC 31, 2019 - FULTON FINANCIAL CORP | exhibit99212-31x19.htm |

| EX-99.1 - REVISED AND RESTATED PRESS RELEASE DATED FEBRUARY 12, 2020 - FULTON FINANCIAL CORP | exhibit99112-31x19.htm |

| 8-K/A - 8-K/A - FULTON FINANCIAL CORP | a8k2-12x20.htm |

2019 AND FOURTH QUARTER RESULTS NASDAQ: FULT Data as of December 31, 2019 unless otherwise noted

FORWARD-LOOKING STATEMENTS Revised as of February 12, 2020 This presentation may contain forward-looking statements with respect to the Corporation’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends," “projects,” the negative of these terms and other comparable terminology. These forward looking statements may include projections of, or guidance on, the Corporation’s future financial performance, expected levels of future expenses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in the Corporation’s business or financial results. Management’s 2020 Outlook contained herein is comprised of forward-looking statements. Forward-looking statements are neither historical facts, nor assurance of future performance. Instead, they are based on current beliefs, expectations and assumptions regarding the future of the Corporation’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Corporation’s control, and actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not unduly rely on any of these forward-looking statements. Any forward-looking statement is based only on information currently available and speaks only as of the date when made. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2018 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2019, June 30, 2019 and September 30, 2019, which have been filed with the Securities and Exchange Commission and are available in the Investor Relations section of the Corporation’s website (www.fult.com) and on the Securities and Exchange Commission’s website (www.sec.gov). The Corporation uses certain non-GAAP financial measures in this presentation. These non-GAAP financial measures are reconciled to the most comparable GAAP measures at the end of this presentation. 2

2019 HIGHLIGHTS Revised as of February 12, 2020 Net income of $226.3 million, or $1.35 per diluted share. Key Accomplishments Termination of remaining BSA/AML regulatory orders Successful consolidation of affiliate banks into Fulton Bank, N.A. Continuation of organic growth into fast growing urban markets Record year of revenues and net income Average loan growth of 4% Average deposit growth of 6% Net income increased 9% and pre-provision net revenue(1) increased 4% (1) Non-GAAP financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. 3

QUARTER HIGHLIGHTS: 4Q19 vs 3Q19 Revised as of February 12, 2020 Net income per diluted share: $0.29 in 4Q19, 22% decrease from 3Q19 Loan Growth: 2% increase in average balances driven by C&I, commercial and residential mortgages and construction. Deposit Growth: 3% increase in average balances, largely driven by interest bearing demand deposits. Net Interest Income & Margin: Net interest income decreased 1% from 3Q19, with the impact of a 9 basis point decrease in the net interest margin being partially offset by balance sheet growth. Non-Interest Income(1): Overall flat, with increases in wealth management fees, commercial banking income and other income, offset by decreases in mortgage and consumer banking income. Non-Interest Expense: 5% decrease, as 3Q19 included a $4 million prepayment penalty on certain FHLB advances and $5 million of charter consolidation costs, partially offset by FDIC insurance assessment credits. Asset Quality: Increases in provision for credit losses related to the C&I portfolio. (1) Excluding investment securities gains which were $0 and $4 million in the three months ended December 31, 2019 and September 30, 2019, respectively. 4

QUARTER HIGHLIGHTS: 4Q19 vs 4Q18 Revised as of February 12, 2020 Net income per diluted share: $0.29 in 4Q19, 12% decrease from 4Q18 Loan Growth: 5% increase in average balances with growth in all categories, except for home equity. Deposit Growth: 6% increase in average balances with growth in all categories. Net Interest Income & Margin: 2% decrease in net interest income, reflecting a 22 basis point decrease in net interest margin, partially offset by the impact of interest-earning asset growth. Non-Interest Income(1): 12% increase realized in all primary fee categories. Non-Interest Expense: 1% decrease, with decreases in professional fees, FDIC insurance and amortization of tax credit investments, largely offset by increases in salaries and benefits, data processing and software and other expense. Asset Quality: Increase in provision for credit losses related to the C&I portfolio. (1) No investment securities gains were recorded for the three months ended December 31, 2019 or 2018. 5

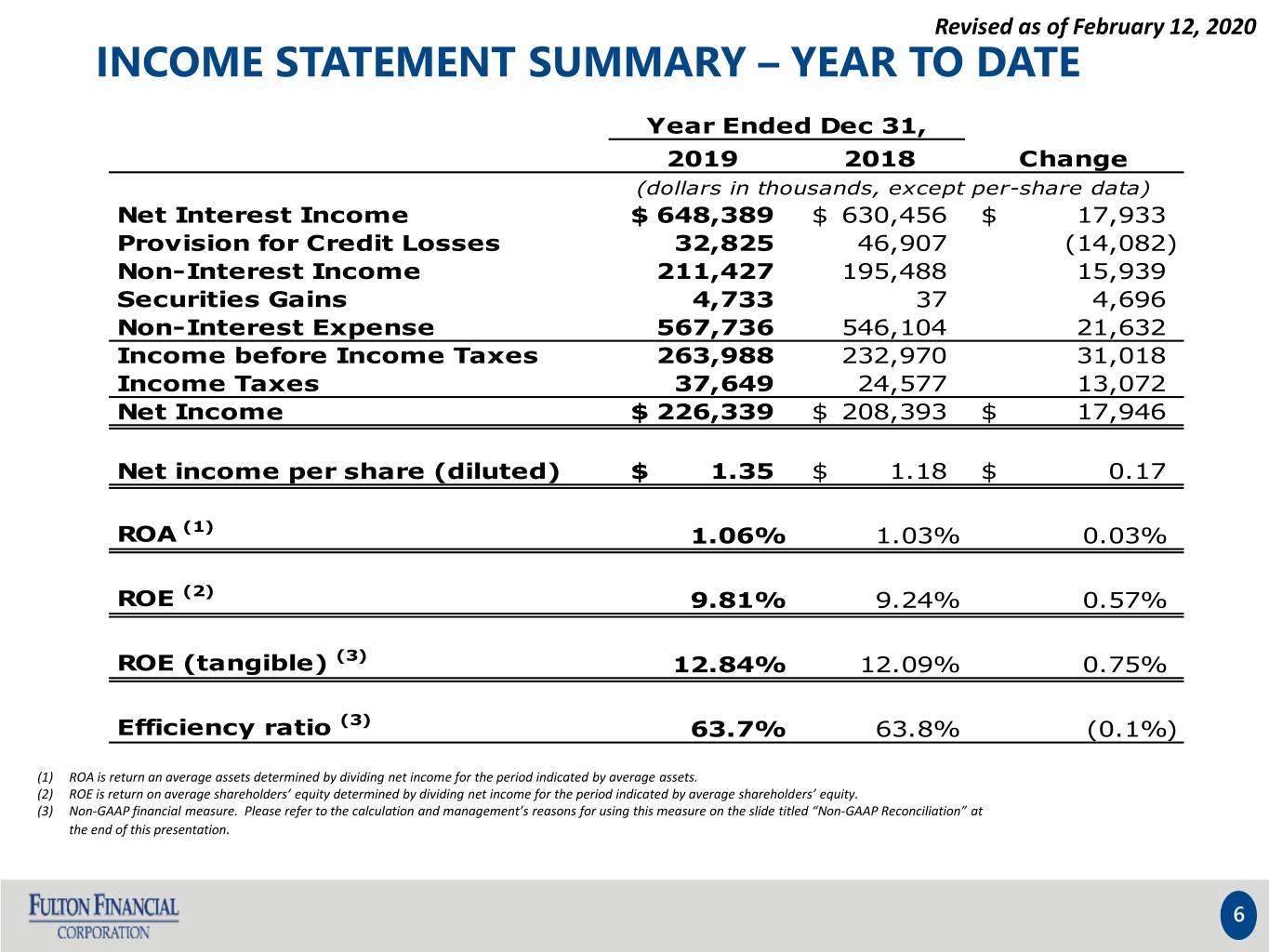

Revised as of February 12, 2020 INCOME STATEMENT SUMMARY – YEAR TO DATE Year Ended Dec 31, 2019 2018 Change (dollars in thousands, except per-share data) Net Interest Income $ 648,389 $ 630,456 $ 17,933 Provision for Credit Losses 32,825 46,907 (14,082) Non-Interest Income 211,427 195,488 15,939 Securities Gains 4,733 37 4,696 Non-Interest Expense 567,736 546,104 21,632 Income before Income Taxes 263,988 232,970 31,018 Income Taxes 37,649 24,577 13,072 Net Income $ 226,339 $ 208,393 $ 17,946 Net income per share (diluted) $ 1.35 $ 1.18 $ 0.17 ROA (1) 1.06% 1.03% 0.03% ROE (2) 9.81% 9.24% 0.57% ROE (tangible) (3) 12.84% 12.09% 0.75% Efficiency ratio (3) 63.7% 63.8% (0.1%) (1) ROA is return an average assets determined by dividing net income for the period indicated by average assets. (2) ROE is return on average shareholders’ equity determined by dividing net income for the period indicated by average shareholders’ equity. (3) Non-GAAP financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. 6

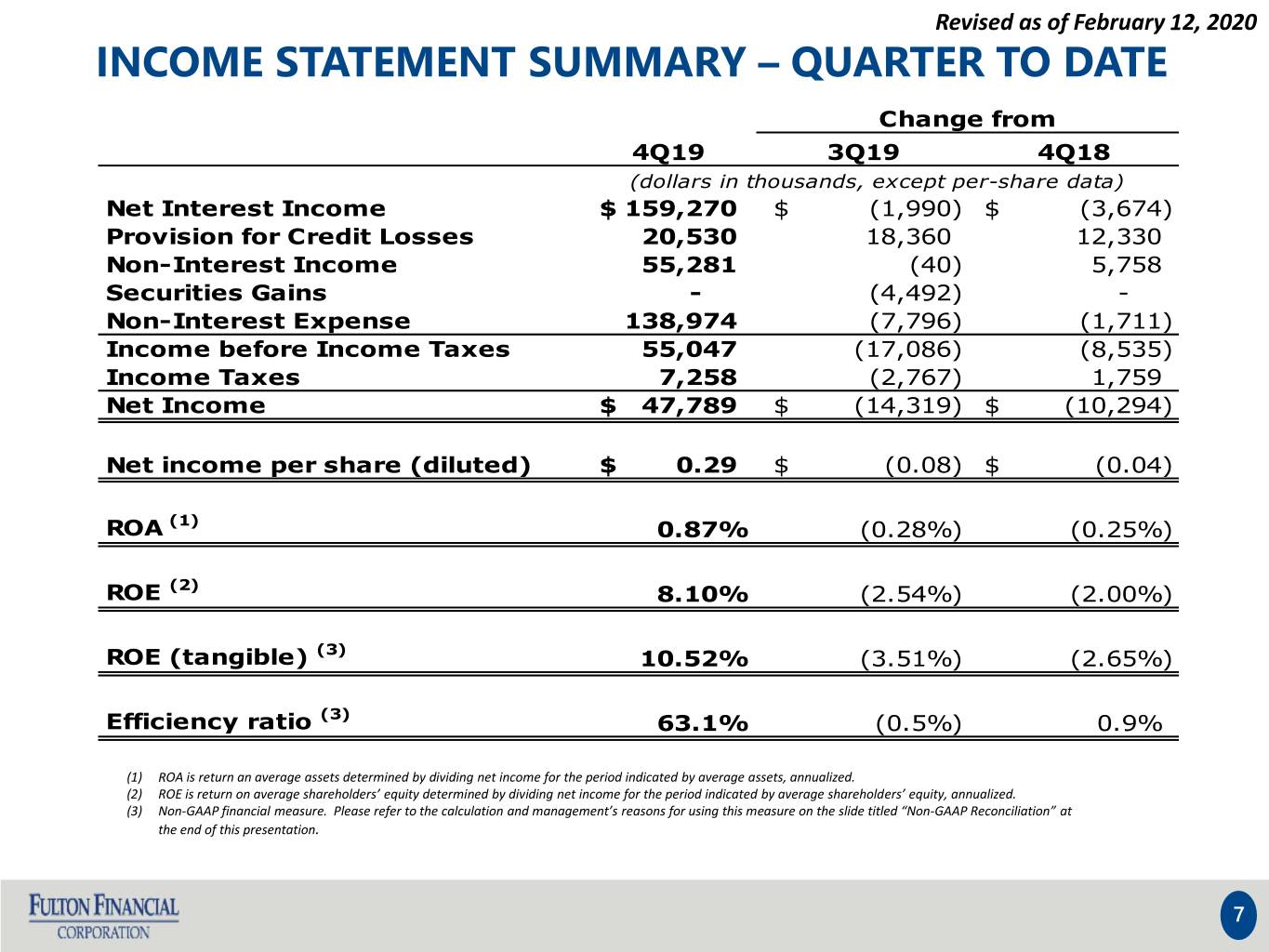

Revised as of February 12, 2020 INCOME STATEMENT SUMMARY – QUARTER TO DATE Change from 4Q19 3Q19 4Q18 (dollars in thousands, except per-share data) Net Interest Income $ 159,270 $ (1,990) $ (3,674) Provision for Credit Losses 20,530 18,360 12,330 Non-Interest Income 55,281 (40) 5,758 Securities Gains - (4,492) - Non-Interest Expense 138,974 (7,796) (1,711) Income before Income Taxes 55,047 (17,086) (8,535) Income Taxes 7,258 (2,767) 1,759 Net Income $ 47,789 $ (14,319) $ (10,294) Net income per share (diluted) $ 0.29 $ (0.08) $ (0.04) ROA (1) 0.87% (0.28%) (0.25%) ROE (2) 8.10% (2.54%) (2.00%) ROE (tangible) (3) 10.52% (3.51%) (2.65%) Efficiency ratio (3) 63.1% (0.5%) 0.9% (1) ROA is return an average assets determined by dividing net income for the period indicated by average assets, annualized. (2) ROE is return on average shareholders’ equity determined by dividing net income for the period indicated by average shareholders’ equity, annualized. (3) Non-GAAP financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. 7

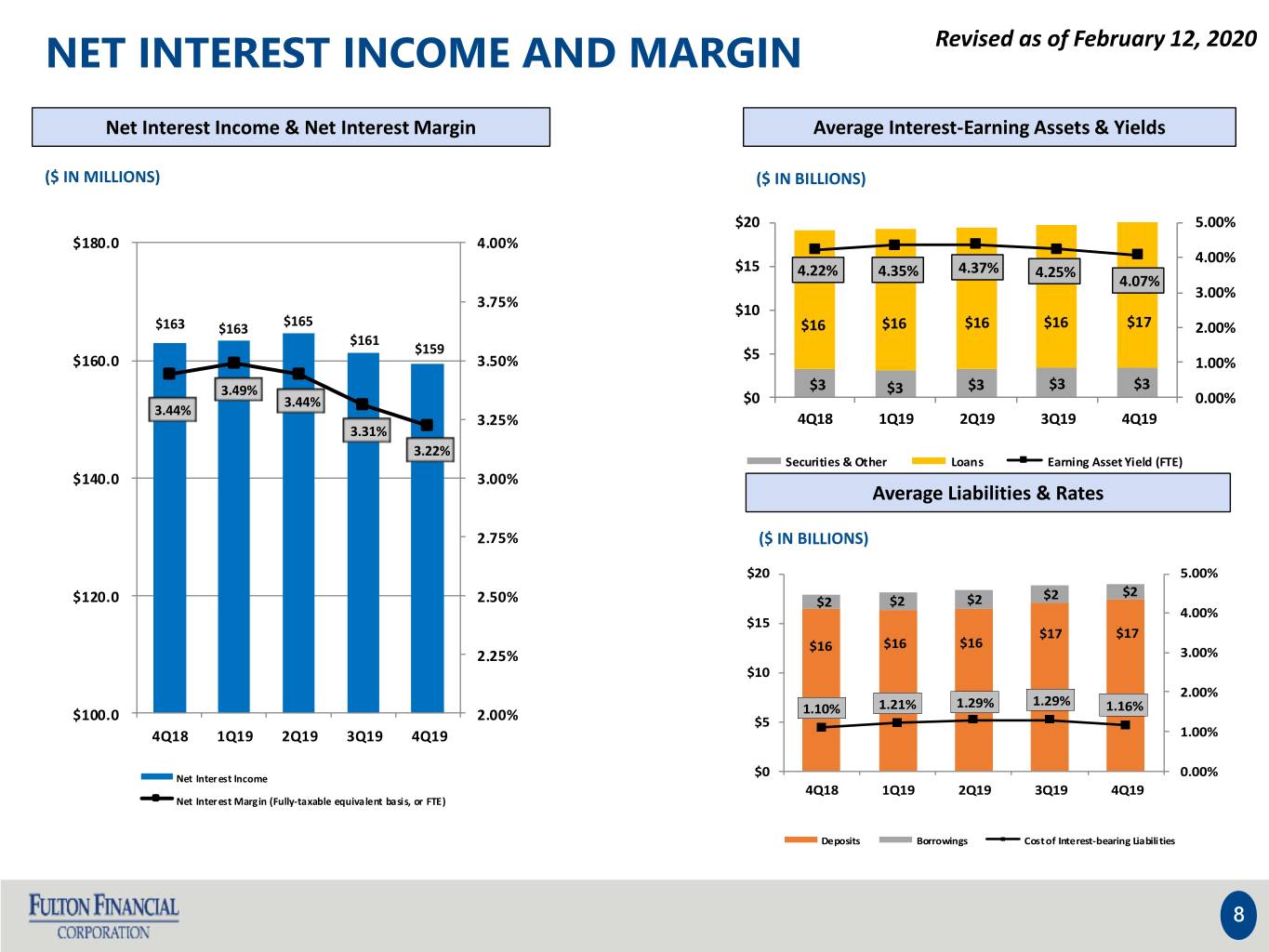

NET INTEREST INCOME AND MARGIN Revised as of February 12, 2020 Net Interest Income & Net Interest Margin Average Interest-Earning Assets & Yields ($ IN MILLIONS) ($ IN BILLIONS) $20 5.00% $180.0 4.00% 4.00% $15 4.22% 4.35% 4.37% 4.25% 4.07% 3.00% 3.75% $10 $165 $163 $163 $16 $16 $16 $16 $17 2.00% $161 $159 $5 $160.0 3.50% ~ $730 1.00% million 3.49% $3 $3 $3 $3 $3 3.44% $0 0.00% 3.44% 3.25% 4Q18 1Q19 2Q19 3Q19 4Q19 3.31% ~ $610 3.22% million Securities & Other Loans Earning Asset Yield (FTE) $140.0 3.00% Average Liabilities & Rates 2.75% ($ IN BILLIONS) $20 5.00% $2 $2 $120.0 2.50% $2 $2 $2 4.00% $15 $17 $17 $16 $16 $16 2.25% 3.00% $10 2.00% 1.29% 1.10% 1.21% 1.29% 1.16% $100.0 2.00% $5 4Q18 1Q19 2Q19 3Q19 4Q19 1.00% Net Interest Income $0 0.00% 4Q18 1Q19 2Q19 3Q19 4Q19 Net Interest Margin (Fully-taxable equivalent basis, or FTE) Deposits Borrowings Cost of Interest-bearing Liabilities 8

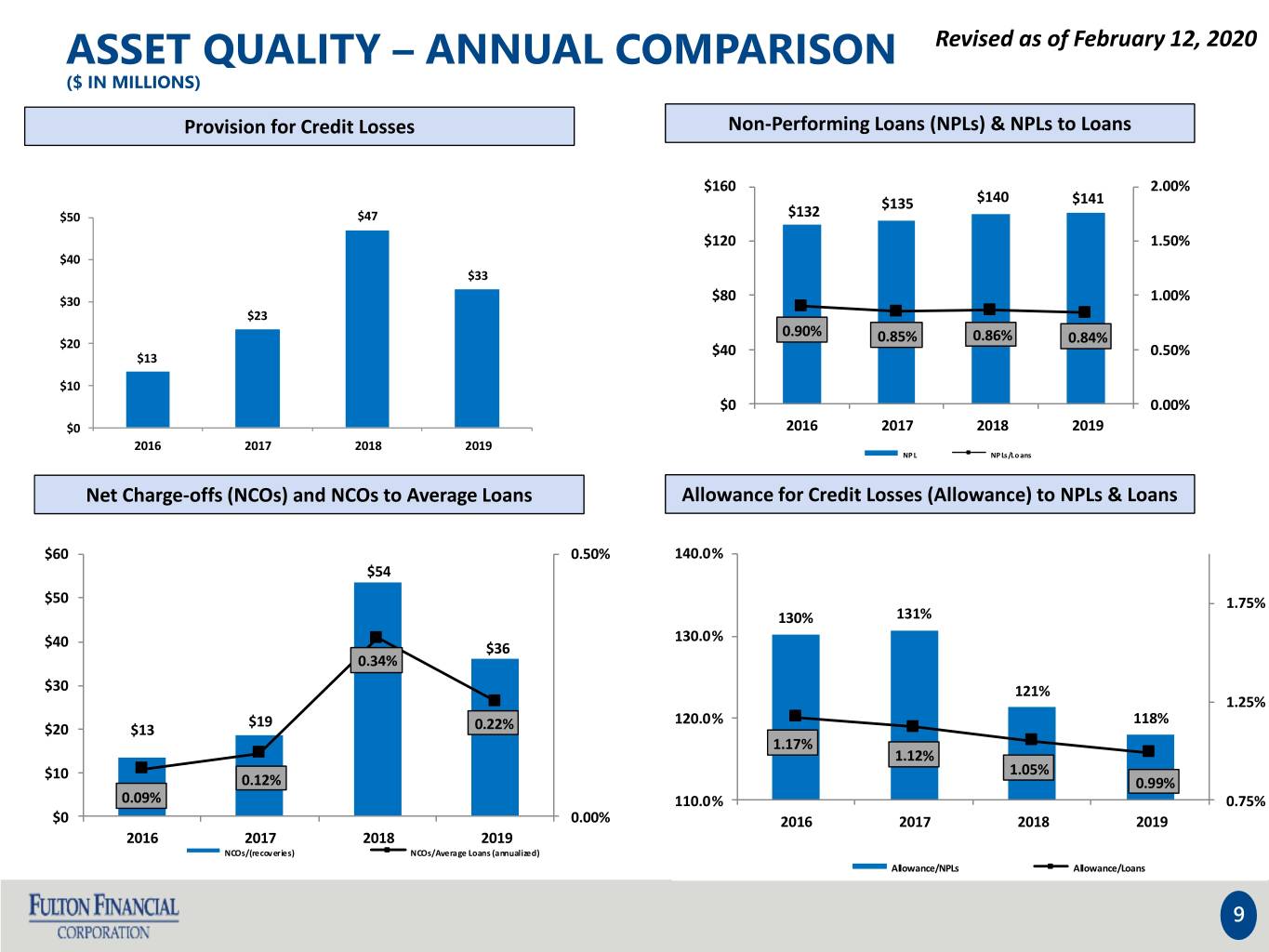

ASSET QUALITY – ANNUAL COMPARISON Revised as of February 12, 2020 ($ IN MILLIONS) Provision for Credit Losses Non-Performing Loans (NPLs) & NPLs to Loans $160 2.00% $135 $140 $141 $50 $47 $132 $120 1.50% $40 $33 $30 $80 1.00% $23 0.90% 0.85% 0.86% 0.84% $20 $40 0.50% $13 $10 $0 0.00% $0 2016 2017 2018 2019 2016 2017 2018 2019 NP L NP Ls/Loans Net Charge-offs (NCOs) and NCOs to Average Loans Allowance for Credit Losses (Allowance) to NPLs & Loans $60 0.50% 140.0% $54 $50 1.75% 130% 131% 130.0% $40 $36 0.34% $30 121% 1.25% $19 120.0% 118% $20 $13 0.22% 1.17% 1.12% $10 1.05% 0.12% 0.99% 0.09% 110.0% 0.75% $0 0.00% 2016 2017 2018 2019 2016 2017 2018 2019 NCOs/(recoveries) NCOs/Average Loans (annualized) Allowance/NPLs Allowance/Loans 9

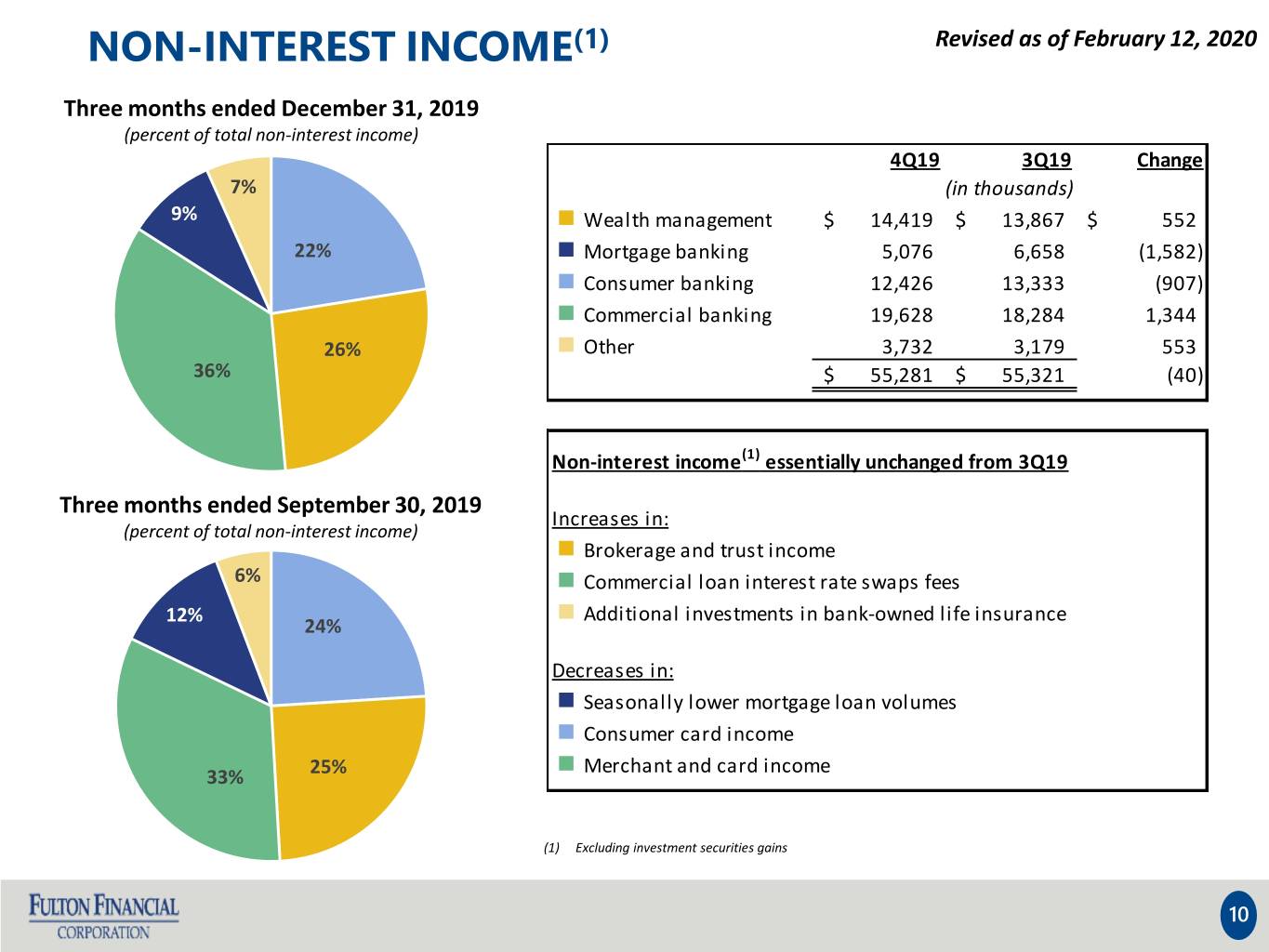

NON-INTEREST INCOME(1) Revised as of February 12, 2020 Three months ended December 31, 2019 (percent of total non-interest income) 4Q19 3Q19 Change 7% (in thousands) 9% n Wealth management $ 14,419 $ 13,867 $ 552 22% n Mortgage banking 5,076 6,658 (1,582) n Consumer banking 12,426 13,333 (907) n Commercial banking 19,628 18,284 1,344 26% n Other 3,732 3,179 553 36% ~ $730 $ 55,281 million$ 55,321 (40) ~ $610 million Non-interest income(1) essentially unchanged from 3Q19 Three months ended September 30, 2019 Increases in: (percent of total non-interest income) n Brokerage and trust income 6% n Commercial loan interest rate swaps fees 12% n Additional investments in bank-owned life insurance 24% Decreases in: n Seasonally lower mortgage loan volumes n Consumer card income n Merchant and card income 33% 25% (1) Excluding investment securities gains 10

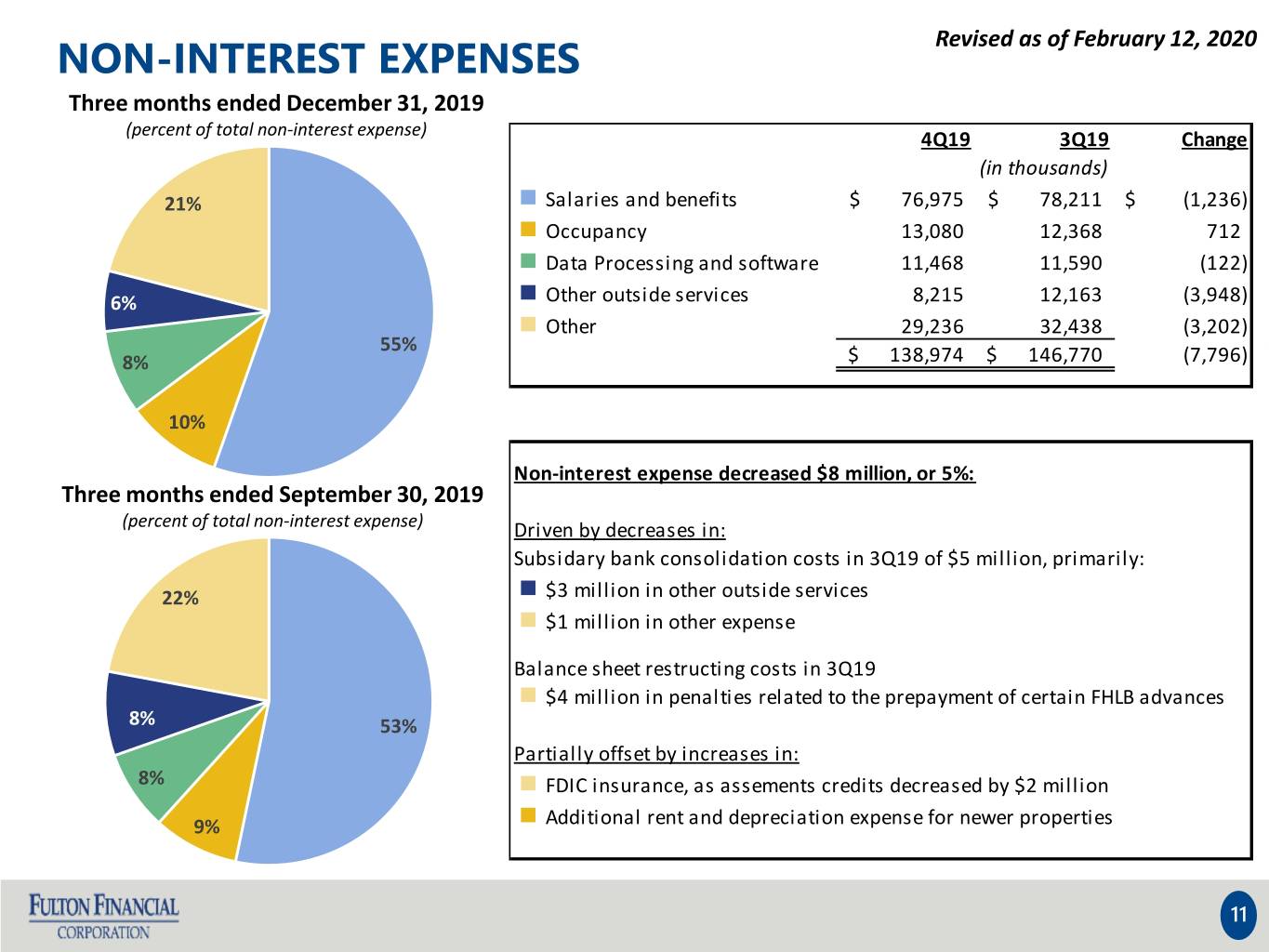

NON-INTEREST EXPENSES Revised as of February 12, 2020 Three months ended December 31, 2019 (percent of total non-interest expense) 4Q19 3Q19 Change (in thousands) 21% n Salaries and benefits $ 76,975 $ 78,211 $ (1,236) n Occupancy 13,080 12,368 712 n Data Processing and software 11,468 11,590 (122) 6% n Other outside services 8,215 12,163 (3,948) n Other 29,236 32,438 (3,202) 55% 8% $ 138,974 $ 146,770 (7,796) 10% Non-interest expense decreased $8 million, or 5%: Three months ended September 30, 2019 (percent of total non-interest expense) Driven by decreases in: Subsidary bank consolidation costs in 3Q19 of $5 million, primarily: 22% n $3 million in other outside services n $1 million in other expense Balance sheet restructing costs in 3Q19 n $4 million in penalties related to the prepayment of certain FHLB advances 8% 53% Partially offset by increases in: 8% n FDIC insurance, as assements credits decreased by $2 million 9% n Additional rent and depreciation expense for newer properties 11

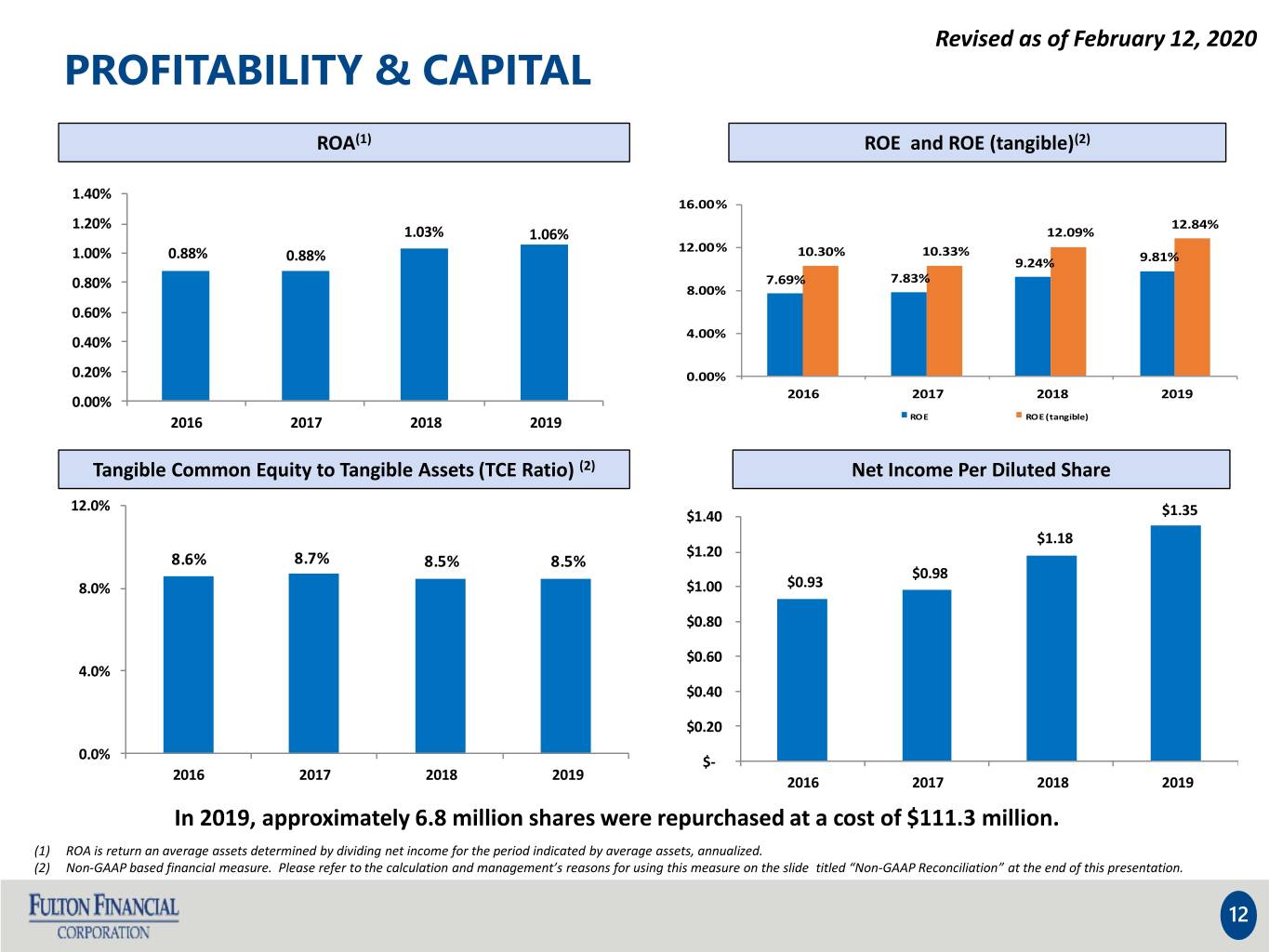

Revised as of February 12, 2020 PROFITABILITY & CAPITAL ROA(1) ROE and ROE (tangible)(2) 1.40% 16.00% 1.20% 12.84% 1.03% 1.06% 12.09% 1.00% 0.88% 12.00% 10.30% 10.33% 0.88% 9.24% 9.81% 7.69% 7.83% 0.80% 8.00% 0.60% 4.00% 0.40% 0.20% 0.00% 2016 2017 2018 2019 0.00% 2016 2017 2018 2019 ROE ROE (tangible) Tangible Common Equity to Tangible Assets (TCE Ratio) (2) Net Income Per Diluted Share 12.0% $1.40 $1.35 $1.18 $1.20 8.6% 8.7% 8.5% 8.5% $0.98 8.0% $1.00 $0.93 $0.80 $0.60 4.0% $0.40 $0.20 0.0% $- 2016 2017 2018 2019 2016 2017 2018 2019 In 2019, approximately 6.8 million shares were repurchased at a cost of $111.3 million. (1) ROA is return an average assets determined by dividing net income for the period indicated by average assets, annualized. (2) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. 12

Revised as of February 12, 2020 REVISED 2020 OUTLOOK • Loans & Deposits: Average annual loan and deposit growth rates in the low to mid single-digits • Net Interest Income: Low single digit growth rate • Net Interest Margin: 3.20% to 3.25% for the full year 2020; assumes a stable yield curve and one 25 bp rate cut in 2Q 2020 • Non-Interest Income: Mid single-digit growth rate • Non-Interest Expense: Excluding charter consolidation costs in 2019, low single-digit growth rate • Asset Quality: $25 million to $40 million provision for credit losses for full year 2020. CECL impact – 25% to 35% increase in allowance for credit losses. • Effective Tax Rate: Anticipated to range between 14% and 16% 13

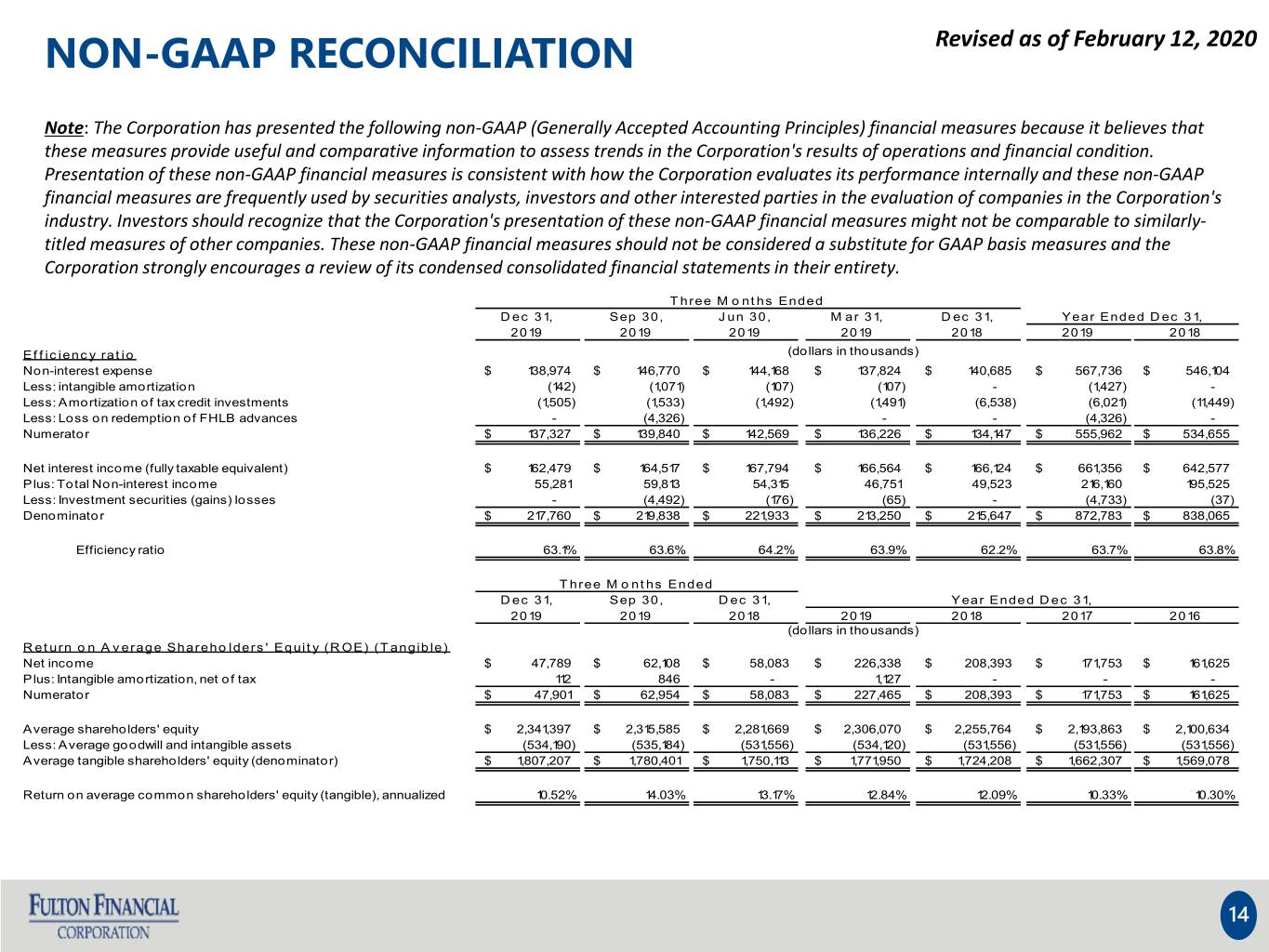

NON-GAAP RECONCILIATION Revised as of February 12, 2020 Note: The Corporation has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly- titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety. Three M onths Ended D ec 31, Sep 30, Jun 30, M ar 31, D ec 31, Year Ended Dec 31, 2019 2019 2019 2019 2018 2019 2018 Efficiency ratio (dollars in thousands) Non-interest expense $ 138,974 $ 146,770 $ 144,168 $ 137,824 $ 140,685 $ 567,736 $ 546,104 Less: intangible amortization (142) (1,071) (107) (107) - (1,427) - Less: Amortization of tax credit investments (1,505) (1,533) (1,492) (1,491) (6,538) (6,021) (11,449) Less: Loss on redemption of FHLB advances - (4,326) - - (4,326) - Numerator $ 137,327 $ 139,840 $ 142,569 $ 136,226 $ 134,147 $ 555,962 $ 534,655 Net interest income (fully taxable equivalent) $ 162,479 $ 164,517 $ 167,794 $ 166,564 $ 166,124 $ 661,356 $ 642,577 Plus: Total Non-interest income 55,281 59,813 54,315 46,751 49,523 216,160 195,525 Less: Investment securities (gains) losses - (4,492) (176) (65) - (4,733) (37) Denominator $ 217,760 $ 219,838 $ 221,933 $ 213,250 $ 215,647 $ 872,783 $ 838,065 Efficiency ratio 63.1% 63.6% 64.2% 63.9% 62.2% 63.7% 63.8% Three M onths Ended D ec 31, Sep 30, D ec 31, Year Ended Dec 31, 2019 2019 2018 2019 2018 2017 2016 (dollars in thousands) Return on Average Shareholders' Equity (ROE) (Tangible) Net income $ 47,789 $ 62,108 $ 58,083 $ 226,338 $ 208,393 $ 171,753 $ 161,625 Plus: Intangible amortization, net of tax 112 846 - 1,127 - - - Numerator $ 47,901 $ 62,954 $ 58,083 $ 227,465 $ 208,393 $ 171,753 $ 161,625 Average shareholders' equity $ 2,341,397 $ 2,315,585 $ 2,281,669 $ 2,306,070 $ 2,255,764 $ 2,193,863 $ 2,100,634 Less: Average goodwill and intangible assets (534,190) (535,184) (531,556) (534,120) (531,556) (531,556) (531,556) Average tangible shareholders' equity (denominator) $ 1,807,207 $ 1,780,401 $ 1,750,113 $ 1,771,950 $ 1,724,208 $ 1,662,307 $ 1,569,078 Return on average common shareholders' equity (tangible), annualized 10.52% 14.03% 13.17% 12.84% 12.09% 10.33% 10.30% 14

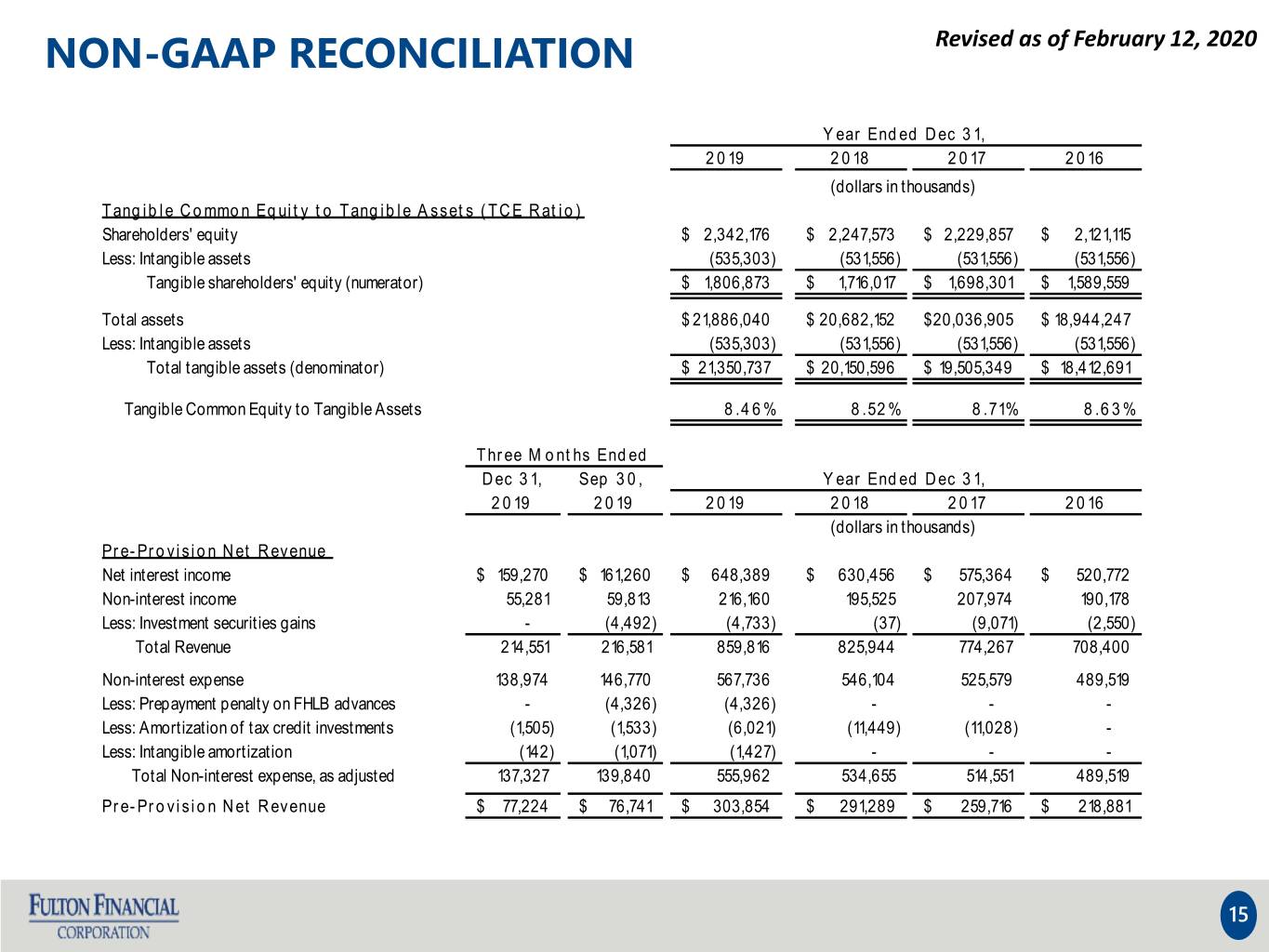

NON-GAAP RECONCILIATION Revised as of February 12, 2020 Year Ended Dec 31, 2 0 19 2 0 18 2 0 17 2 0 16 (dollars in thousands) Tangible Common Equity to Tangible Assets (TCE Ratio) Shareholders' equity $ 2,342,176 $ 2,247,573 $ 2,229,857 $ 2,121,115 Less: Intangible assets (535,303) (531,556) (531,556) (531,556) Tangible shareholders' equity (numerator) $ 1,806,873 $ 1,716,017 $ 1,698,301 $ 1,589,559 Total assets $ 21,886,040 $ 20,682,152 $ 20,036,905 $ 18,944,247 Less: Intangible assets (535,303) (531,556) (531,556) (531,556) Total tangible assets (denominator) $ 21,350,737 $ 20,150,596 $ 19,505,349 $ 18,412,691 Tangible Common Equity to Tangible Assets 8 .4 6 % 8 .52 % 8 .71% 8 .6 3 % Three M onths Ended D ec 3 1, Sep 3 0 , Year Ended Dec 31, 2 0 19 2 0 19 2 0 19 2 0 18 2 0 17 2 0 16 (dollars in thousands) Pre-Provision Net Revenue Net interest income $ 159,270 $ 161,260 $ 648,389 $ 630,456 $ 575,364 $ 520,772 Non-interest income 55,281 59,813 216,160 195,525 207,974 190,178 Less: Investment securities gains - (4,492) (4,733) (37) (9,071) (2,550) Total Revenue 214,551 216,581 859,816 825,944 774,267 708,400 Non-interest expense 138,974 146,770 567,736 546,104 525,579 489,519 Less: Prepayment penalty on FHLB advances - (4,326) (4,326) - - - Less: Amortization of tax credit investments (1,505) (1,533) (6,021) (11,449) (11,028) - Less: Intangible amortization (142) (1,071) (1,427) - - - Total Non-interest expense, as adjusted 137,327 139,840 555,962 534,655 514,551 489,519 Pre-Provision Net Revenue $ 77,224 $ 76,741 $ 303,854 $ 291,289 $ 259,716 $ 218,881 15