Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - Synacor, Inc. | ex994.htm |

| EX-99.3 - EXHIBIT 99.3 - Synacor, Inc. | ex993.htm |

| EX-99.1 - EXHIBIT 99.1 - Synacor, Inc. | ex991.htm |

| EX-10.2 - EXHIBIT 10.2 - Synacor, Inc. | ex102.htm |

| EX-10.1 - EXHIBIT 10.1 - Synacor, Inc. | ex101.htm |

| EX-2.1 - EXHIBIT 2.1 - Synacor, Inc. | ex21.htm |

| 8-K - FORM 8-K - Synacor, Inc. | form8-k.htm |

SYNACOR & QUMU MERGER PRESENTATION CREATING GLOBAL SAAS - FOCUSED LEADER IN COLLABORATION SOFTWARE FEBRUARY 2020 1

LEGAL DISCLAIMERS Forward Looking Statements This presentation contains forward-looking statements within the meaning of the federal securities law, including, without limitation, financial results of the companies individually or on a combined basis, potential cost savings, timing of the closing of the transaction, potential benefits of the transaction, and strategic and operational plans, that are subject to various risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Words such as “anticipate,” “expect,” “project,” “intend,” “believe,” and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. Such statements are subject to risks and uncertainties that include, but are not limited to: (i) Synacor or Qumu may be unable to obtain shareholder approval as required for the merger; (ii) other conditions to the closing of the merger may not be satisfied; (iii) the merger may involve unexpected costs, liabilities or delays; (iv) the effect of the announcement of the merger on the ability of Synacor or Qumu to retain and hire key personnel and maintain relationships with customers, suppliers and others with whom Synacor or Qumu does business, or on Synacor’s or Qumu’s operating results and business generally; (v) Synacor’s or Qumu’s respective businesses may suffer as a result of uncertainty surrounding the merger and disruption of management’s attention due to the merger; (vi) the outcome of any legal proceedings related to the merger; (vii) Synacor or Qumu may be adversely affected by other economic, business, and/or competitive factors; (viii) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (ix) the estimated financial results of each company for 2019 may not be representative of the combined company’s results for 2020 or any future period; (x) risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; and (xi) other risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all. Additional factors that may affect the future results of Synacor and Qumu are set forth in their respective filings with the Securities and Exchange Commission (SEC), including each of Synacor’s and Qumu’s most recently filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the SEC, which are available on the SEC’s website at www.sec.gov. The risks and uncertainties described above and in Synacor’s most recent Annual Report on Form 10-K and Qumu’s most recent Annual Report on Form 10-K are not exclusive and further information concerning Synacor and Qumu and their respective businesses, including factors that potentially could materially affect its business, financial condition or operating results, may emerge from time to time. Readers are urged to consider these factors carefully in evaluating these forward-looking statements. Readers should also carefully review the risk factors described in other documents that Synacor and Qumu file from time to time with the SEC. The forward-looking statements in this presentation speak only as of February 11, 2020. Except as required by law, Synacor and Qumu assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future. No Offer or Solicitation This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed merger or otherwise. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Additional Information and Where to Find It In connection with the proposed merger between Synacor and Qumu, Synacor intends to file a registration statement on Form S-4 containing a joint proxy statement/prospectus of Synacor and Qumu and other documents concerning the proposed merger with the SEC. The definitive proxy statement will be mailed to the shareholders of Synacor and Qumu in advance of the meeting. BEFORE MAKING ANY VOTING DECISION, SYNACOR’S AND QUMU’S RESPECTIVE SHAREHOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED BY EACH OF SYNACOR AND QUMU WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER AND THE PARTIES TO THE PROPOSED MERGER. Investors and security holders will be able to obtain a free copy of the joint proxy statement/prospectus and other documents containing important information about Synacor and Qumu, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Synacor and Qumu make available free of charge at www.synacor.com and www.qumu.com, respectively (in the “Investor Relations” and “Investors” sections, respectively), copies of materials they file with, or furnish to, the SEC. The contents of the websites referenced above are not deemed to be incorporated by reference into the registration statement or the joint proxy statement/prospectus. Nasdaq: SYNC 2

LEGAL DISCLAIMERS CONTINUED Non-GAAP Financial Information This press release includes references to Adjusted EBITDA and Adjusted EPS, financial measures that are not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). The companies compute Adjusted EBITDA differently, but each use Adjusted EBITDA in operating their respective businesses because management believes they are less susceptible to variances in actual operating performance that can result from the excluded items. The companies present Adjusted EBITDA to investors because it is a key measure used by their respective management and Board of Directors to understand and evaluate core operating performance and trends, to prepare and approve the annual budget and to develop short- and long-term operational plans. The items excluded from Adjusted EBITDA are important in understanding Synacor’s and Qumu’s financial performance, and should not be considered in isolation of, or as an alternative to, GAAP financial measures. Since Adjusted EBITDA for both companies are not measures determined in accordance with GAAP, have no standardized meaning prescribed by GAAP and are susceptible to varying calculations, these measures, as presented, may not be comparable to other similarly titled measures of other companies. Adjusted EBITDA is defined as net income (loss) before stock-based compensation expense, asset impairment, restructuring costs, and certain legal and professional fees. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for projections prepared in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant elements that are required to be recorded by GAAP. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management in determining these non-GAAP financial measures. Participants in the Solicitation This presentation does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Synacor, Qumu and their respective directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the shareholders of Synacor and Qumu in connection with the proposed merger. Information regarding the special interests of these directors and executive officers in the proposed merger will be included in the joint proxy statement/prospectus referred to above. Security holders may also obtain information regarding the names, affiliations and interests of Qumu’s directors and executive officers in Qumu’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 filed with the SEC on March 15, 2019, the definitive proxy statement for the 2019 Annual Meeting of Shareholders of Qumu filed with the SEC on April 9, 2019, and the additional definitive proxy soliciting materials for Qumu’s 2019 Annual Meeting of Shareholders filed on April 19, 2019. Security holders may obtain information regarding the names, affiliations and interests of Synacor’s directors and executive officers in Synacor’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 filed with the SEC on March 14, 2019, and the definitive proxy statement for the Synacor 2019 Annual Meeting of Stockholders filed with the SEC on April 5, 2019. To the extent the holdings of Synacor securities by Synacor’s directors and executive officers or the holdings of Qumu securities by Qumu’s directors and executive officers have changed since the amounts set forth in Synacor’s or Qumu’s respective proxy statement for its 2019 annual meeting of shareholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such individuals in the proposed merger will be included in the joint proxy statement/prospectus relating to the proposed merger when it is filed with the SEC. These documents (when available) may be obtained free of charge in the manner described above under “Additional Information and Where to Find It”. Nasdaq: SYNC 3

A STRATEGIC AND HIGHLY SYNERGISTIC MERGER • Zimbra Email & Collaboration • Best-in-class software platform that enterprises Collaboration-Centric Product • Cloud ID Identity & Access Management use to create, manage, secure, distribute and • Publisher advertising measure the success of both live & on-demand Fit • Portal & Web services video • $49M in software & service revenues1 • $25.4M in preliminary FY 2019 revenue 3 Operating Scale - $50M of • >70% recurring software revenue • 70% recurring software revenue Recurring Software Revenue • $53M in portal & advertising revenue2 • 4,000+ business, government, service provider, • 175 Global 2000 & Fortune 500 customer base Accelerated go-to Market & content provider, and publisher customers • Primarily direct sales, nascent channels Cross-Sell • 1,900 channel partners + direct sales Accretive to Adjusted EPS and $4 - $5 million Adjusted EBITDA In annualized operating synergies expected in the first fiscal year following closing 1 Synacor Full-Year 2018 Nasdaq: SYNC 2 Synacor Full-Year 2018 pro forma excluding $42M related to one portal service contract that has been terminated as of September 30, 2019 3 Based on preliminary and unaudited financial results for full-year 2019 issued on February 11, 2020 4

OVERVIEW: QUMU Market Leading $25.4 M Enterprise Video 2019 Preliminary and Unaudited Platform Revenue Attractive Market with Favorable +>70% Growth Trends Gross Margin Marquee Customer 196 Base of End Enterprise Customer Market Leaders Deployments Improving 91% Recurring Revenue Customer Retention Rate Metrics High-Margin Gartner Ranked Subscription Leader in the Enterprise Video Business space in the Magic Quadrant Nasdaq: SYNC 5

MARKET OVERVIEW Worldwide Business Email Identity as a Service 2017-2020, CAGR1 2017-2020 CAGR1 Revenue CAGR +19% Revenue CAGR +37% Enterprise Streaming Video Digital Ad Spending 2018-2022 CAGR2 2017-2020 CAGR3 Revenue CAGR +12% Revenue CAGR +14% 1 Source: Radicati Group; Technavio, September 2017-22 Nasdaq: SYNC 2 Source: Wainhouse Research: Enterprise Streaming and Webcasting Report, 2019 3 Source: eMarketer, growth for 2017 – 2020 6

CUSTOMER OVERVIEW 4,000+ Customers 175+ Customers Business, Government, Service Provider, Content Provider, and Global 2000 and Fortune 500-Heavy Customer Base Publisher Customers Customers Served 7

2019 FINANCIAL SNAPSHOT Continuing operations ex AT&T FY 2019 Revenue Guidance Range1 Preliminary & Unaudited FY 2019 Results2 Revenue $120.5 - $122.5 Million $25.4 Million 3 Revenue $93.9 - $95.9 Million N/A adjusted to exclude revenue related to ATT.net GAAP Net Loss ($9.2) – ($10.2) Million ($6.5) Million Adjusted EBITDA $8.0 - $9.0 Million ($2.9) Million $4 - $5 million Expected Annualized Operational Synergies 1 Synacor Full-Year 2019 Guidance as updated and reported on November 6, 2019 2 Nasdaq: SYNC Qumu Preliminary and Unaudited Financial Results as updated and reported on February 11, 2020 8 3 Synacor Full-Year 2019 Revenue Guidance adjusted excluding $26.6M related to one portal service contract that has been terminated as of September 30, 2019

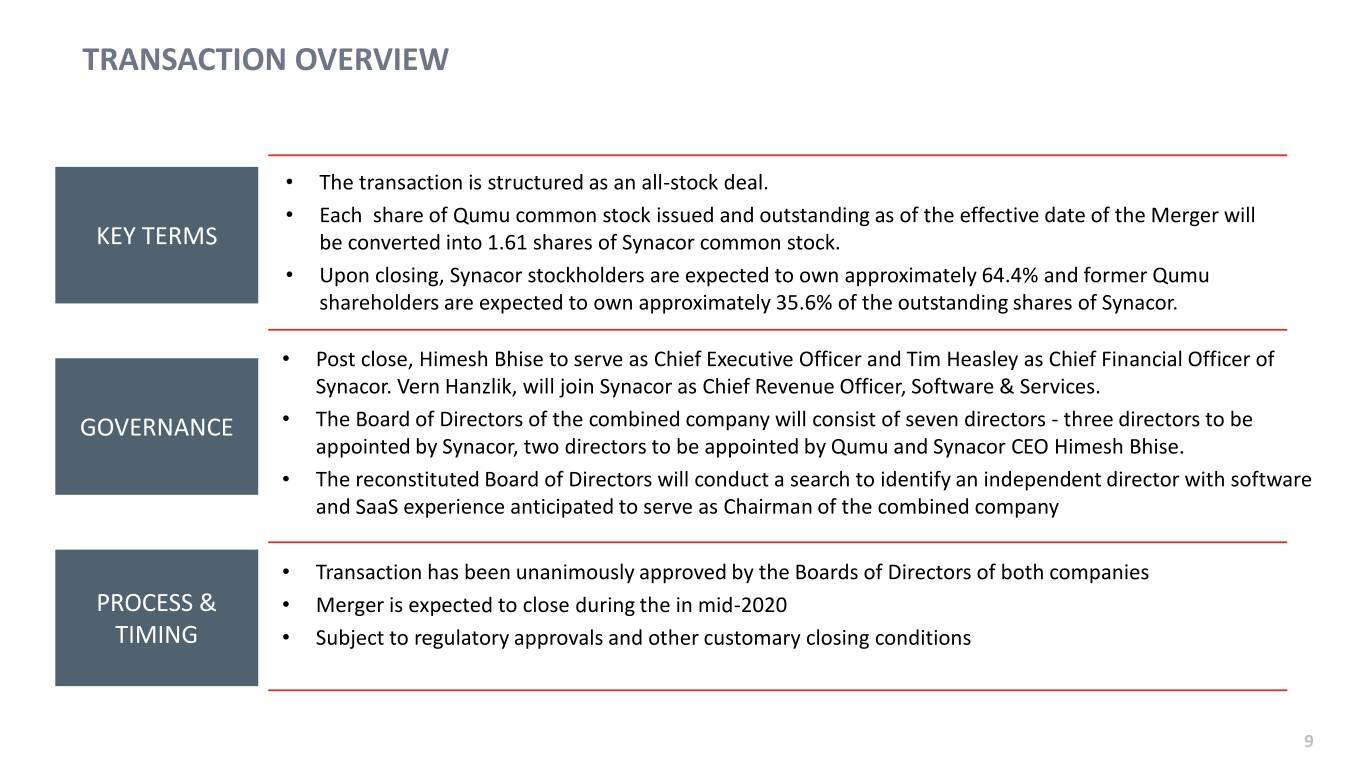

TRANSACTION OVERVIEW • The transaction is structured as an all-stock deal. • Each share of Qumu common stock issued and outstanding as of the effective date of the Merger will KEY TERMS be converted into 1.61 shares of Synacor common stock. • Upon closing, Synacor stockholders are expected to own approximately 64.4% and former Qumu shareholders are expected to own approximately 35.6% of the outstanding shares of Synacor. • Post close, Himesh Bhise to serve as Chief Executive Officer and Tim Heasley as Chief Financial Officer of Synacor. Vern Hanzlik, will join Synacor as Chief Revenue Officer, Software & Services. GOVERNANCE • The Board of Directors of the combined company will consist of seven directors - three directors to be appointed by Synacor, two directors to be appointed by Qumu and Synacor CEO Himesh Bhise. • The reconstituted Board of Directors will conduct a search to identify an independent director with software and SaaS experience anticipated to serve as Chairman of the combined company • Transaction has been unanimously approved by the Boards of Directors of both companies PROCESS & • Merger is expected to close during the in mid-2020 TIMING • Subject to regulatory approvals and other customary closing conditions 9