Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HEARTLAND FINANCIAL USA INC | ex991acquisitionaccoun.htm |

| 8-K - 8-K - HEARTLAND FINANCIAL USA INC | htlf-20200211.htm |

Acquisition of AIM Bancshares, Inc. Executing on Heartland’s Growth Strategy in Texas February 11, 2020 Lynn B. Fuller Executive Operating Chairman Bruce K. Lee President and Chief Executive Officer HTLF | www.htlf.com

Disclaimer Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about: (1) the benefits of the acquisition by Heartland Financial USA, Inc. (“Heartland” or “HTLF”) of AIM Bancshares, Inc. (“ABI”), and its wholly owned banking subsidiary, AimBank (“AIM”), including anticipated future results, cost savings and accretion to reported earnings that may be realized from the acquisition; (2) ABI’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (3) other statements identified by words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates” or works of similar meaning. Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such statements. The following factors, among others, could cause actual results to differ materially from the anticipated results expressed in the forward-looking statements: the businesses of HTLF, ABI, First Bank & Trust (Heartland’s Texas banking subsidiary, “FB&T”), New Mexico Bank & Trust (Heartland’s New Mexico banking subsidiary, “NMB&T”), and AIM may not be combined successfully, or such combination may take longer than expected; the cost savings from the acquisition may be less than expected; governmental approvals of the acquisition may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the acquisition or otherwise; the stockholders of ABI may fail to approve the acquisition; credit and interest rate risks associated with HTLF’s and ABI’s respective businesses may be greater than anticipated; and difficulties associated with achieving expected future financial results may occur. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K of Heartland) filed with the Securities and Exchange Commission (“SEC“) and available at the SEC’s Internet website (www.sec.gov). All subsequent written and oral forward-looking statements concerning the proposed acquisition and other matters relating to HTLF and ABI or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, HTLF and ABI do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made. Important Information for Shareholders & Investors This presentation is being made in respect of the proposed mergers between HTLF and ABI, and FB&T and AIM. This presentation does not constitute an offer to sell or the solicitation of an offer to buy securities or a solicitation of any vote or approvals. In connection with the proposed acquisition, HTLF intends to file a registration statement on Form S-4 with the SEC, which will include a proxy statement for ABI shareholders, and a prospectus of HTLF, and HTLF will file other documents regarding the proposed acquisition with the SEC. THE REGISTRATION STATEMENT AND PROXY STATEMENT WILL CONTAIN INFORMATION ABOUT THE PROPOSED TRANSACTION, THEREFORE, BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, SECURITY HOLDERS OF ABI ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, WHEN THEY BECOME AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS. The documents filed by HTLF with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by HTLF may be obtained free of charge at its website at www.htlf.com or by contacting Heartland Financial USA, Inc., 1398 Central Avenue, Dubuque, IA 52004, Attention: Bryan R. McKeag, Executive Vice President and Chief Financial Officer, Telephone: (563) 589-1994. Holders of ABI common stock may also obtain free copies of the information related to ABI at its website at www.aimbankonline.com (which website is not incorporated herein by reference) or by contacting AIM Bancshares, Inc., 110 College Avenue, Levelland, TX 79336, Attention: Mike Epps, Chief Financial Officer, Telephone: (806) 894-2265. ABI and its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of ABI in connection with the proposed Acquisition. Information regarding these persons who may, under the rules of the SEC, be considered participants in the solicitation of shareholder votes in connection with the proposed Acquisition will be provided in the proxy statement/prospectus described above when it is filed with the SEC. 2

Transaction Highlights » The acquisition of AIM Bancshares, Inc., with $1.8 billion in assets, brings HTLF to approximately $15 billion in total assets » AimBank combined with FirstBank & Trust creates HTLF’s largest independent bank charter with $2.8 billion in assets » Simultaneously strengthens HTLF’s New Mexico Bank & Trust to $2.0 billion in assets by adding approximately $250 million in assets Strategically » Excellent cultural fit, combining two teams sharing a common history Compelling • Growth-minded: AIM’s 5-year CAGR of +20% (organic and acquisition) • Highly profitable and efficient: AIM’s efficiency ratio of 54.5% and ROAA of 1.42% in 2019 » Additional scale and synergies enhance presence in West Texas and New Mexico • FB&T: #5 largest bank headquartered in West Texas • NMB&T: #1 largest bank headquartered in New Mexico and #5 deposit market share1 in New Mexico » ~10% EPS accretion in first full year Strong » Tangible Book Value per share earnback of approximately 3.6 years using crossover method Transaction » IRR in excess of 20% Economics » Reduces HTLF’s pro forma Efficiency Ratio to the upper 50% range in 2021 » Strong knowledge of local markets: FB&T has operated in West Texas since 1996, and NMB&T was a de-novo founded in 1998. HTLF has been familiar with ABI and its leadership for a number of years Low » Similar credit cultures focused on conservative underwriting with quality portfolios Execution » Comprehensive due diligence process completed Risk » Retention of key personnel: Scott Wade, Chairman, President & CEO of ABI, to become President - South Division of FB&T; Jeremy Ferrell, COO of ABI, to become Chief Integration Officer of FB&T (1) FDIC market rank per deposit market share as of June 30, 2019. 3

Snapshot of AIM Bancshares, Inc. Company Overview » $1.8 Billion in assets Texas bank chartered in 1925 Financial Highlights - AimBank1 » Headquartered in Levelland, TX (~30 miles west Dollars in $000s CAGR of Lubbock) 12 months ended December 31 2015 2016 2017 2018 2019 2015-2019 » Branch presence - 25 locations serving diverse Total Assets $838,344 $843,174 $1,088,263 $1,401,066 $1,775,803 20.6% Total Loans 629,329 666,384 770,988 980,678 1,159,883 16.5% economic markets in West Texas and New Mexico Total Deposits 750,921 750,498 973,625 1,232,126 1,542,828 19.7% » Excess liquidity and strong core deposit base – Tangible Common Equity 68,796 73,428 93,506 129,342 172,191 25.8% ~75% loan to deposit ratio, and 31% noninterest Net Income 10,898 8,966 13,361 15,692 22,001 19.2% bearing deposits ROAA (%) 1.38 1.08 1.35 1.22 1.42 ROAE (%) 15.72 11.21 14.34 12.35 13.35 » Focus on profitability – Bank-level 2019 ROAA and Net Interest Margin (%) 3.85 3.84 3.84 4.09 4.11 net interest margin of 1.42% and 4.11%, Efficiency Ratio (%) 59.83 63.05 62.88 65.04 54.50 respectively TCE/TA (%) 8.29 8.79 8.67 9.35 9.84 Total Risk-Based Capital Ratio (%) 12.16 12.30 12.89 13.58 13.98 » Commitment to sound underwriting – 11 bps NPLs NPAs/Assets 1.01 1.80 1.04 0.18 0.13 to Loans as of December 31, 2019 Net Charge-offs/Avg. Loans 0.05 0.44 0.32 0.04 0.06 » Seasoned management team, with experience Loan Loss Reserves/Gross Loans 1.53 1.69 1.46 1.16 1.13 executing 6 acquisitions ABI’s Growth Story $2,000 2015 PAMPA, SHAMROCK BRANCHES ACQUIRED $1,776 ABILENE, AMARILLO, PLAINS EXPANSION $1,750 2014 $1,500 FSB STATE BANK OF MIAMI ACQUIRED $1,401 2019 AIM MORTGAGE DIVISION FORMED FNB NEW MEXICO ACQUIRED $1,250 2012 $1,088 MIDLAND & SNYDER EXPANSION 2018 PLATINUM BANK ACQUIRED $1,000 2011 $838 $843 LEVELLAND BRANCH ACQUIRED 2017 $750 2005 MULESHOE STATE BANK ACQUIRED ASSETS IN MILLIONS 2010 LUBBOCK EXPANSION $591 ODESSA EXPANSION $500 2003 CURRENT MANAGEMENT ACQUIRED AIMBANK $299 ($13MM ASSETS, 4/23/2003) $250 $121 $24 $0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 (1) Reflects bank-level regulatory financial data. 4

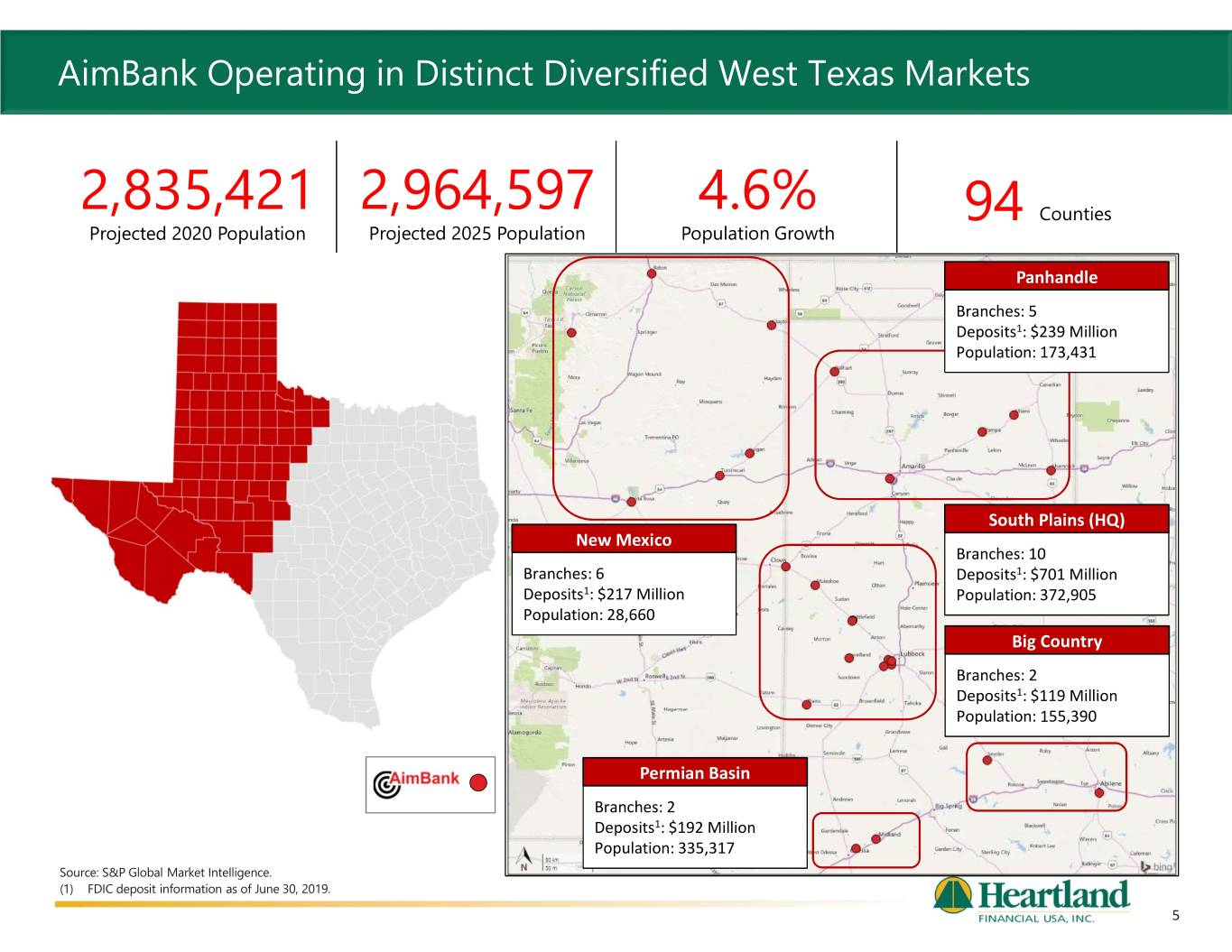

AimBank Operating in Distinct Diversified West Texas Markets 2,835,421 2,964,597 4.6% 94 Counties Projected 2020 Population Projected 2025 Population Population Growth Panhandle Branches: 5 Deposits1: $239 Million Population: 173,431 South Plains (HQ) New Mexico Branches: 10 Branches: 6 Deposits1: $701 Million Deposits1: $217 Million Population: 372,905 Population: 28,660 Big Country Branches: 2 Deposits1: $119 Million Population: 155,390 Permian Basin Branches: 2 Deposits1: $192 Million Population: 335,317 Source: S&P Global Market Intelligence. (1) FDIC deposit information as of June 30, 2019. 5

A Premier West Texas Community Bank Led by Exceptional Local Bankers » FB&T and AimBank combined will operate as FirstBank & Trust » Headquarters in Lubbock, TX, with 27 offices across West Texas • 5th largest bank headquartered in West Texas • 3rd largest deposit market share in Lubbock MSA » ABI’s 6 offices in New Mexico to transition to HTLF’s New Mexico Bank & Trust at conversion » Extensive lending team covering a broad territory with long history and deep local knowledge » Well diversified loan portfolio and attractive deposit base » Exceptional leadership team poised for accelerated growth in West Texas » ABI adds a young but seasoned team of executives (average age: 47 years old) LEADERSHIP TEAM OF THE MERGED SUBSIDIARY ABI Founding Chairman, President & CEO Barry Orr Greg Garland Scott Wade Executive Chairman & CEO President - North Division President - South Division Barry has over 40 years of banking experience Greg has been in the banking industry in Scott was born in Levelland, Texas and has over including founding FirstBank Lubbock Lubbock, Texas since 1983. In 1996, Greg joined 30 years of banking experience in West Texas. Bancshares. He has completed 14 mergers or FB&T as Chief Loan Officer, and was named He assembled an investor group to purchase acquisitions during his tenure as Chairman and President of FB&T in 2003. AimBank in 2003 and began effecting the bank CEO of FirstBank Lubbock Bancshares. business plan. 6

Expanding Heartland’s Reach Throughout the Southwest Pro Forma Franchise1 Dollars in $MMs FirstBank New Mexico Pro Forma2 Pro Forma2 AimBank 12 months ended December 31 & Trust Bank & Trust FB&T NMB&T Branches 8 17 25 27 23 Total Assets $1,138 $1,763 $1,776 $2,669 $2,008 Gross Loans 612 1,076 1,160 1,598 1,250 Nonint. Bearing Deposits 190 569 480 599 639 Total Deposits 893 1,565 1,543 2,211 1,790 Texas Deposits 893 - 1,318 2,211 - New Mexico Deposits - 1,565 225 - 1,790 Lubbock Market Overlap Note: Regulatory financial data for the quarter ended December 31, 2019. (1) Excludes the impact of purchase accounting adjustments. (2) Pro forma FB&T includes AimBank’s Texas operations; Pro forma NMB&T includes AimBank’s New Mexico operations. 7

Accelerating Heartland’s Expansion in Attractive West Texas Markets Unemployment Rate » Lubbock is known as the “Hub City” due to its geographically centralized and accessible location along I-27 and four major U.S. highways 3.4% 3.5% » Well-diversified economy – major industries include education, research, 2.8% Lubbock healthcare, agriculture and manufacturing “South Plains” » MSA population of over 320,000 with an unemployment rate of 2.8%, well below the Texas and nationwide averages of 3.4% and 3.5%, respectively » Home to Texas Tech University, which currently enrolls over 38,000 students » Ranked one of 2020’s Best Cities for Jobs, according to WalletHub Lubbock Texas Nationwide » Located in West Texas, the Permian Basin is responsible for over half of the 5-Year Historical Job Growth crude oil produced in the U.S. 11.6% » Midland and Odessa MSAs combined population is over 350,000 with 10.2% Midland-Odessa unemployment rates of 2.1% and 2.9%, respectively “Permian Basin” » Midland boasts the 2nd highest personal income in the U.S., according to the 5.2% Expansion Market Bureau of Economic Analysis » While much of the region’s wealth creation is credited to the oil and gas industry, initiatives to diversify the economy have lead to strong growth in Midland / Texas Nationwide other sectors including distribution / logistics, aviation, and alternative energy Odessa » Located in the heart of the Texas Panhandle region at the crossroads of I-40 and I-27 Amarillo » Home to Bell Helicopter manufacturing facility and located in the Competitive Renewable Energy Zone – allows for the “Panhandle” transmission of 18,500 megawatts of wind power upwards of 3,500 miles Expansion Market » Large agricultural operations from food producers, processors and distributors including Tyson, Cargill and MWI Abilene » Located on I-20 ~150 miles west of Fort Worth “Big Country” » Home to two major medical centers and the Texas Tech University Health Sciences Center at Abilene Expansion Market » Four universities, one community college and one technical school supports the local economy Source: S&P Global Market Intelligence, WalletHub, U.S. News, Bureau of Economic Analysis, Amarillo Economic Development, DevelopAbilene. 8

Diverse, Low Risk Loan Portfolio (As of December 31, 2019) (Dollars in $MMs) Loan Overview » Well diversified loan portfolio across types of credits » Strong commercial lending focus with C&I and Owner Occupied CRE loans totaling approximately 30% of AimBank loans » Low concentration in Commercial Real Estate, similar levels to HTLF – CRE1: 59.5%, CRE2: 171.8% » Excellent asset quality and strong loan loss reserves (including $8.3 million of purchase discount from ABI’s previous acquisitions) » In-depth review of credit files, underwriting methodology and policy HTLF AimBank Pro Forma1 Consumer & Other Consumer & Other Consumer & Other Ag. Residential Ag. 7.4% 2.1% Residential Ag. 6.8% Residential Production 13.9% Production 18.1% Production 14.4% 3.3% 12.0% 4.3% C&I C&I C&I 23.8% 24.4% 19.2% Pro Forma $8,395 $1,160 $9,555 CRE & CRE & CRE & Multi Construction Construction Multi Construction Multi 38.8% 12.2% 9.3% 39.3% 11.9% 38.9% Yield on Loans (MRQ): 5.32% Yield on Loans (MRQ): 6.19% Yield on Loans (MRQ): 5.43% NPAs/Assets: 0.66% NPAs/Assets: 0.13% NPAs/Assets: 0.60% Note: Regulatory financial data for the quarter ended December 31, 2019. (1) Pro Forma combines loans of HTLF and AimBank but excludes purchase accounting adjustments. 9

Attractive Deposit Base (As of December 31, 2019) (Dollars in $MMs) Deposit Overview » 31% Non-Interest Bearing Deposits » Similar customer base and funding mix as First Bank & Trust » Strong pro forma core deposit franchise » Similar liquidity and loan to deposit ratio as HTLF HTLF AimBank Pro Forma1 Retail Time Retail Time Jumbo Retail Time Jumbo 8.1% NIB DDA 9.0% Time 15.3% Time 32.1% NIB DDA NIB DDA 2.7% 31.1% 3.9% 32.0% Jumbo Time 12.6% Pro Forma $11,044 $1,543 $12,587 MMDA & MMDA & MMDA & Savings Savings Savings 57.1% 41.0% 55.1% Cost of Deposits (MRQ): 0.61% Cost of Deposits (MRQ): 0.75% Cost of Deposits (MRQ): 0.63% Loans/Deposits: 76.0% Loans/Deposits: 75.4% Loans/Deposits: 75.9% Note: Regulatory financial data for the quarter ended December 31, 2019. (1) Pro Forma combines deposits of HTLF and AimBank but excludes purchase accounting adjustments. 10

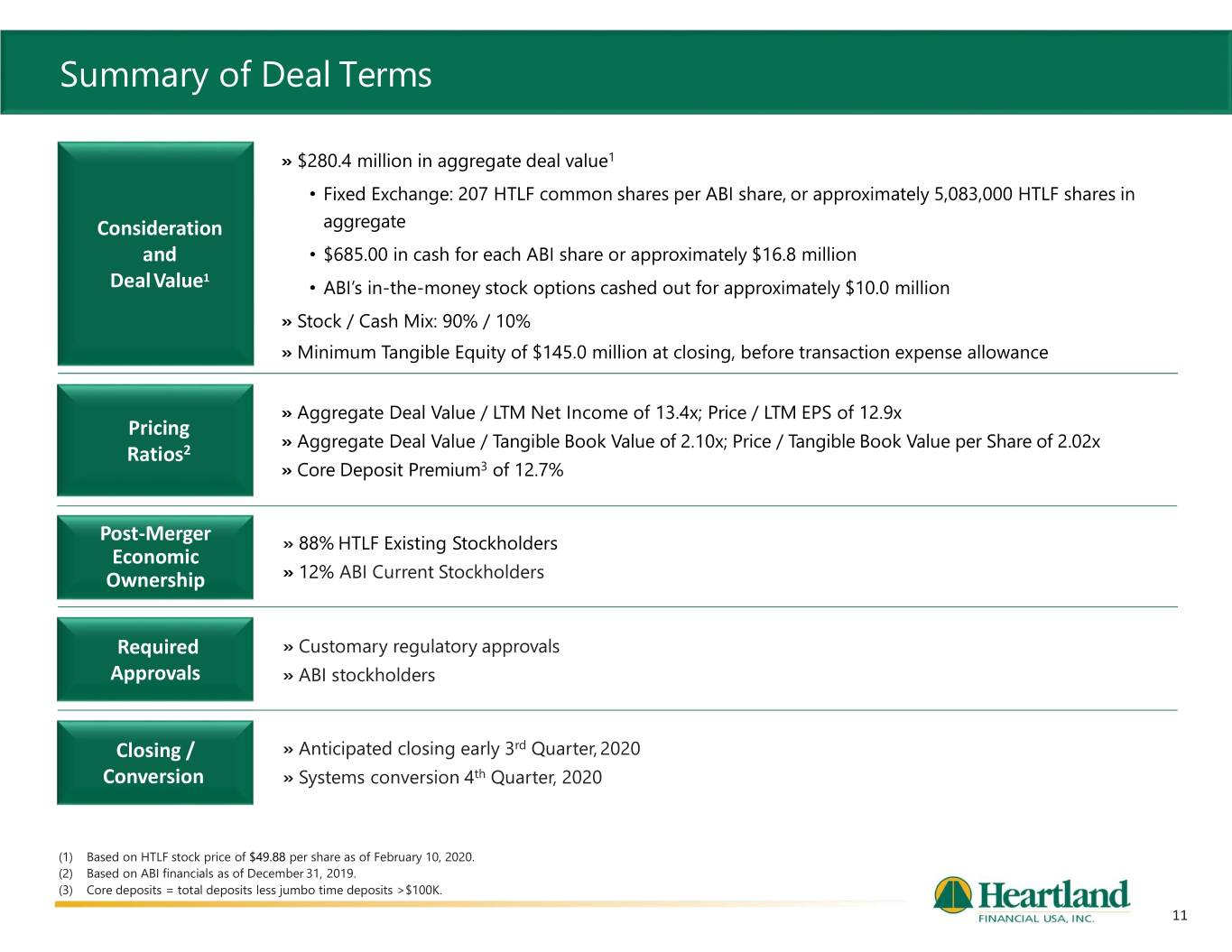

Summary of Deal Terms » $280.4 million in aggregate deal value1 • Fixed Exchange: 207 HTLF common shares per ABI share, or approximately 5,083,000 HTLF shares in Consideration aggregate and • $685.00 in cash for each ABI share or approximately $16.8 million 1 DealValue • ABI’s in-the-money stock options cashed out for approximately $10.0 million » Stock / Cash Mix: 90% / 10% » Minimum Tangible Equity of $145.0 million at closing, before transaction expense allowance » Aggregate Deal Value / LTM Net Income of 13.4x; Price / LTM EPS of 12.9x Pricing » Aggregate Deal Value / Tangible Book Value of 2.10x; Price / Tangible Book Value per Share of 2.02x Ratios2 » Core Deposit Premium3 of 12.7% Post-Merger » 88% HTLF Existing Stockholders Economic Ownership » 12% ABI Current Stockholders Required » Customary regulatory approvals Approvals » ABI stockholders Closing / » Anticipated closing early 3rd Quarter, 2020 Conversion » Systems conversion 4th Quarter, 2020 (1) Based on HTLF stock price of $49.88 per share as of February 10, 2020. (2) Based on ABI financials as of December 31, 2019. (3) Core deposits = total deposits less jumbo time deposits >$100K. 11

Assumptions & Financial Impact » EPS projections based on average consensus estimates for HTLF in 2020 and 2021 » Projected 30% cost savings, 25% phased-in during 2020 and 100% by 1st Quarter of 2021 Transaction » Pre-tax, one-time buyer and seller combined merger charges estimated at 4.6% of deal value Assumptions » Core deposit intangibles of 2.00% amortized over 10 years, using sum-of-the-years digits » Estimated annual interchange revenue loss of ~$0.8 million attributed to Durbin impact on ABI » Revenue enhancements expected but not modeled » Fair market value adjustment estimated at 2.65%, or $31.0 million, including credit mark and interest rate mark • Non-PCD Loans: Credit mark estimate of 0.95% and interest rate mark estimate of 0.25%, or $9.0 million and $2.4 million, respectively Loan Mark • PCD Loans: Interest rate mark estimate of $0.5 million & CECL » Accretable yield equal to $11.9 million, accreted over 4 years straight-line Assumptions1 » Non-PCD Loans: Day 2 CECL estimate reserve and provision expense of ~1.0x credit mark (results in “double count” of $9.0 million); assumed TBV impact at closing » PCD Loans: CECL reserve estimate of 8.74%, or $19.1 million, recorded directly to allowance PRIOR GAAP GAAP WITH CECL3 2020 Reported EPS Accretion/(Dilution) +0.2% (3.9%) 2020 Core EPS Accretion4 +1.9% +2.4% Consolidated 2021 EPS Accretion (Reported = Core) +8.7% +9.7% Financial Tangible Book Value Dilution (4.7%) (5.3%) Impact2 Tangible Book Value Earnback (Crossover) 3.6 Years 3.6 Years Pro Forma TCE/TA Ratio (at close) 8.5% 8.4% Pro Forma Tier 1 Common Ratio (at close) 10.7% 10.6% Pro Forma Total Risk-Based Capital Ratio (at close) 13.3% 13.5% IRR In excess of 20% (1) Aggregate $ amounts are based on 12/31/19 financials for ABI. (2) Pro Forma HTLF financials assuming deal closing of June 30, 2020. HTLF standalone financials include estimated 1/1/2020 CECL adjustment. (3) Includes estimated impacts of CECL in purchase accounting. (4) Excludes CECL “double count” provision and one-time merger costs in 2020. 12

A Compelling Opportunity for Heartland and its Stockholders » Doubling in size in West Texas, expansion in new markets and well positioned for future growth » Acquisition of high growth, high profitability and efficient bank with attractive core deposits » Retention of local management and expansion of relationship management talent » Low execution risk: “in-market” transaction of banks sharing common culture and practices » Strategically attractive with compelling financial metrics » Transaction expected to enhance HTLF’s long-term shareholder value 13

An Expanding Franchise – Heartland Financial USA, Inc. 11 INDEPENDENT BANK CHARTERS 115 OFFICES 84 COMMUNITIES As of December 31, 2019. 14

Heartland’s 12th Acquisition since 2015 2015 2016 2017 2018 2019 Total Acquisitions Closed 4 1 2 2 2 11 Assets Acquired $1.5 B $0.8 B $1.6 B $1.4 B $1.2 B $6.4 B As of December 31, 2019. 15

Contact Information 16