Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Cerence Inc. | crnc-ex991_7.htm |

| 8-K - 8-K - Cerence Inc. | crnc-8k_20200211.htm |

Q1FY20 Financial Results Conference Call Sanjay Dhawan, CEO Mark Gallenberger, CFO February 11, 2020 Exhibit 99.2

Forward Looking Statements and Non-GAAP Financial Measures Statements in this presentation regarding Cerence’s future performance and our management’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,” "intends" or “estimates” or similar expressions) should also be considered to be forward-looking statements. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including but not limited to: the highly competitive and rapidly changing market in which we operate; adverse conditions in the automotive industry or the global economy more generally; our ability to control and successfully manage our expenses and cash position; our strategy to increase cloud; escalating pricing pressures from our customers; our failure to win, renew or implement service contracts; the loss of business from any of our largest customers; the inability to recruit and retain qualified personnel; cybersecurity and data privacy incidents; fluctuating currency rate; and the other factors described in our Form 10 and other filings with the Securities and Exchange Commission. We disclaim any obligation to update any forward-looking statements as a result of developments occurring after the date of this document. This presentation also includes certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles, or GAAP. These non-GAAP financial measures are in addition to, and not as a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. We have provided a reconciliation of non-GAAP measures to the most directly comparable GAAP measures, which is available in the earnings press release and the prepared remarks furnished as exhibits to the Company’s Form 8-K submitted to the SEC on February 11, 2020. This presentation should be read in conjunction with the earnings release, prepared remarks and Form 10-Q.

Cerence is Off to a Fast Start Separation from Nuance effectively transacted First quarter as stand-alone public company delivered strong financial results Met or exceeded all key financial goals for the quarter Focus shifts to profitably growing the business

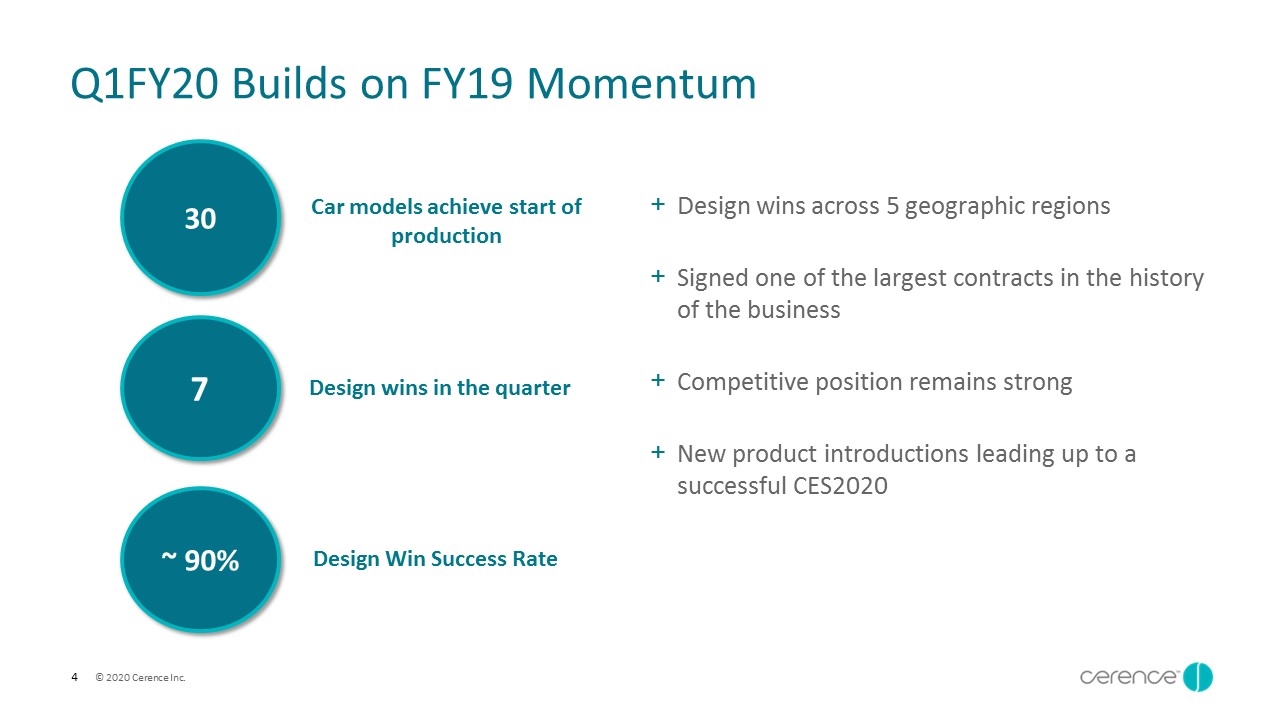

Q1FY20 Builds on FY19 Momentum Design wins across 5 geographic regions Signed one of the largest contracts in the history of the business Competitive position remains strong New product introductions leading up to a successful CES2020 Car models achieve start of production 30 Design Win Success Rate ~ 90% Design wins in the quarter 7

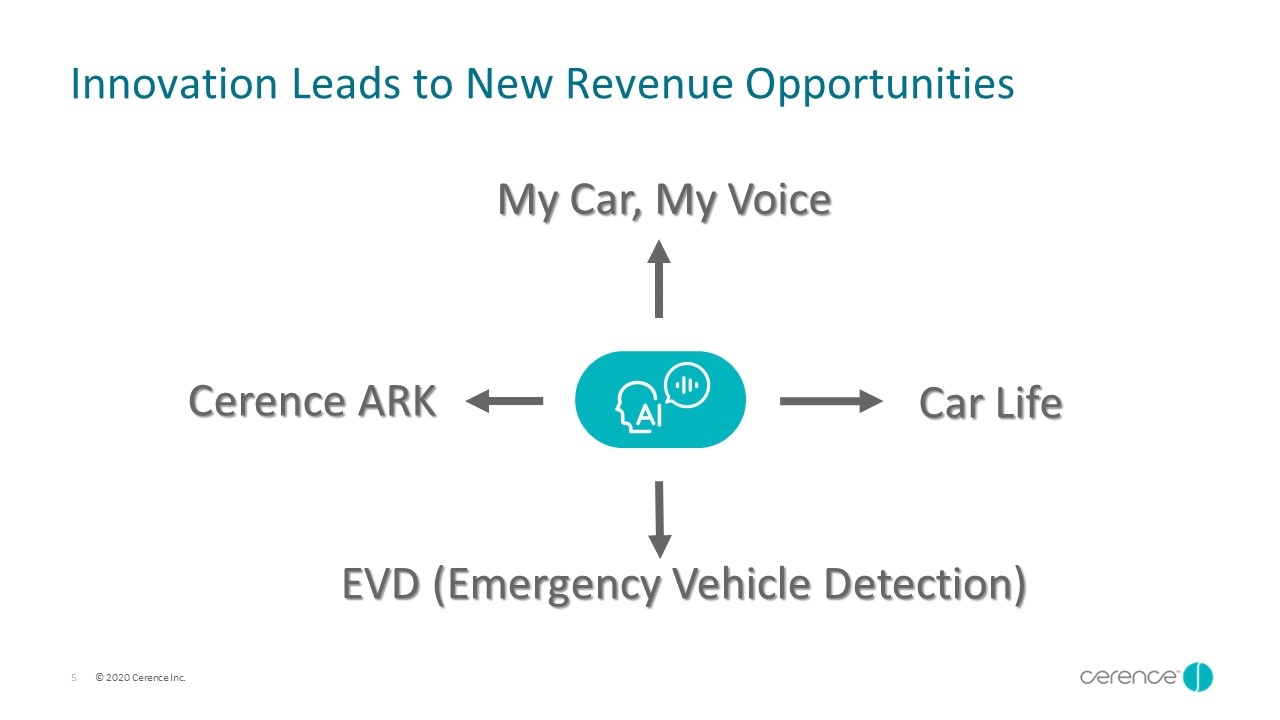

Innovation Leads to New Revenue Opportunities Cerence ARK My Car, My Voice Car Life EVD (Emergency Vehicle Detection)

Financial Summary

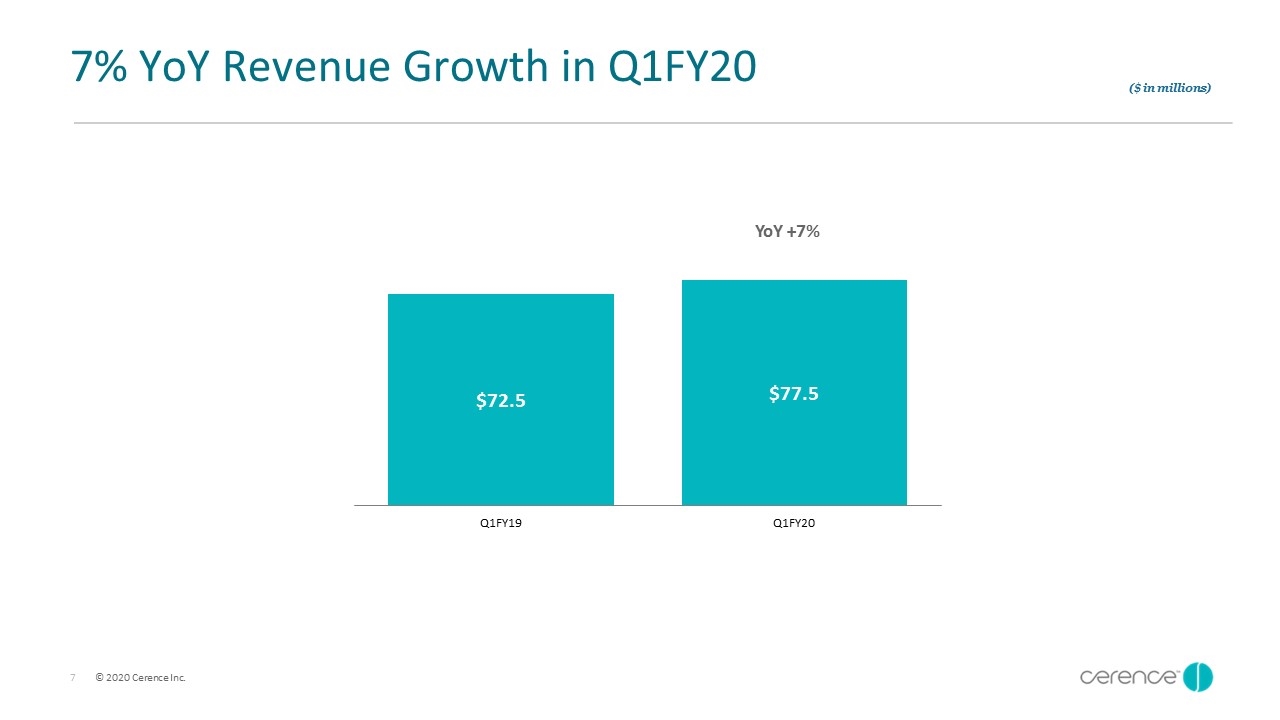

7% YoY Revenue Growth in Q1FY20 ($ in millions) YoY +7%

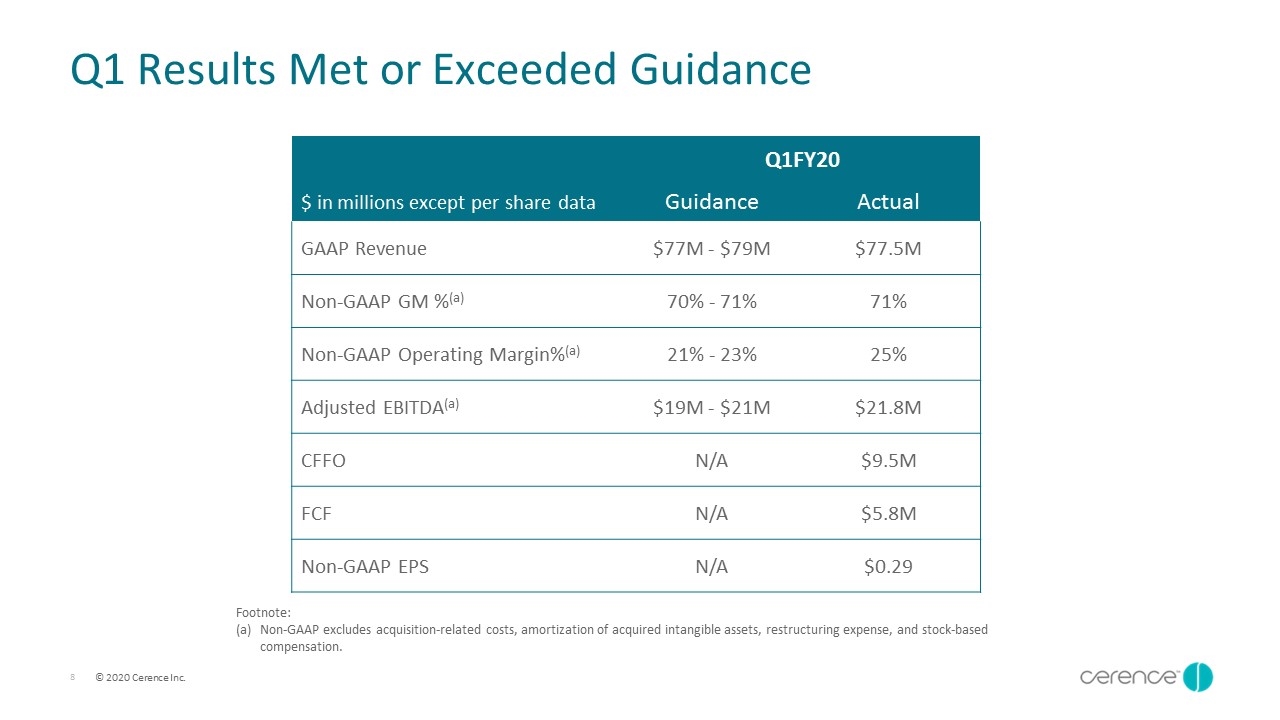

Q1 Results Met or Exceeded Guidance Footnote: Non-GAAP excludes acquisition-related costs, amortization of acquired intangible assets, restructuring expense, and stock-based compensation. Q1FY20 $ in millions except per share data Guidance Actual GAAP Revenue $77M - $79M $77.5M Non-GAAP GM %(a) 70% - 71% 71% Non-GAAP Operating Margin%(a) 21% - 23% 25% Adjusted EBITDA(a) $19M - $21M $21.8M CFFO N/A $9.5M FCF N/A $5.8M Non-GAAP EPS N/A $0.29

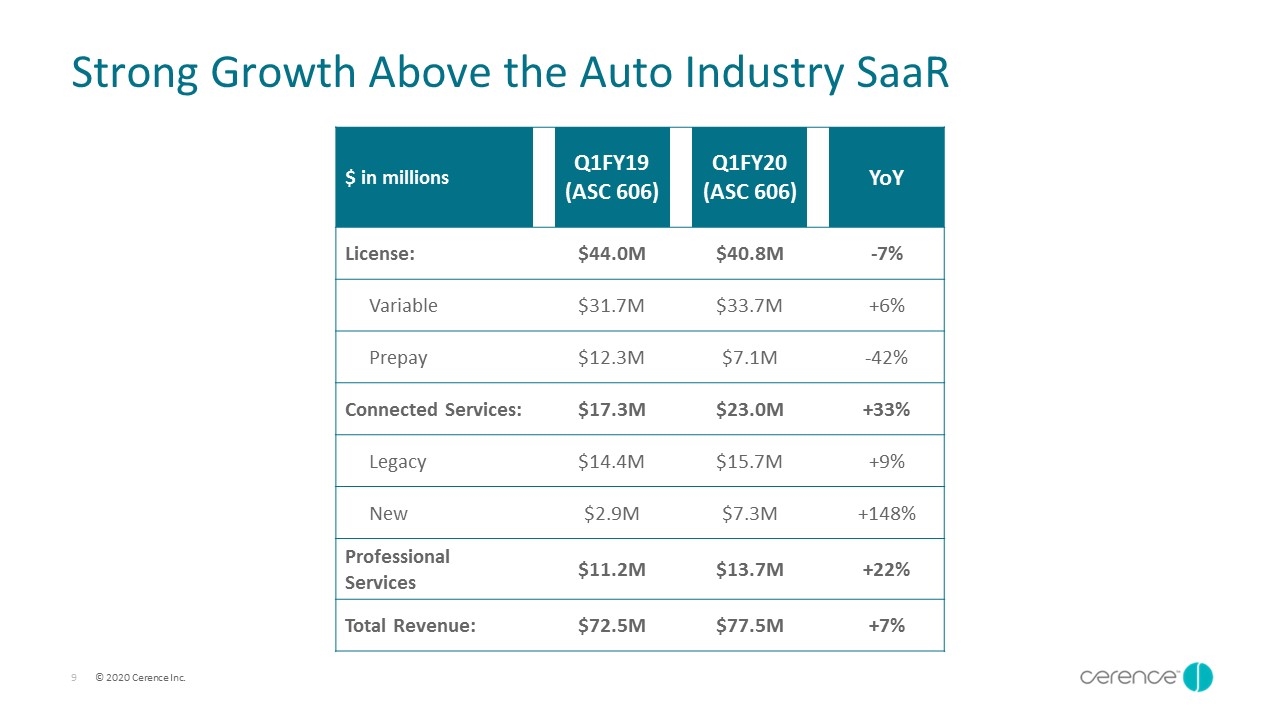

Strong Growth Above the Auto Industry SaaR $ in millions Q1FY19 (ASC 606) Q1FY20 (ASC 606) YoY License: $44.0M $40.8M -7% Variable $31.7M $33.7M +6% Prepay $12.3M $7.1M -42% Connected Services: $17.3M $23.0M +33% Legacy $14.4M $15.7M +9% New $2.9M $7.3M +148% Professional Services $11.2M $13.7M +22% Total Revenue: $72.5M $77.5M +7%

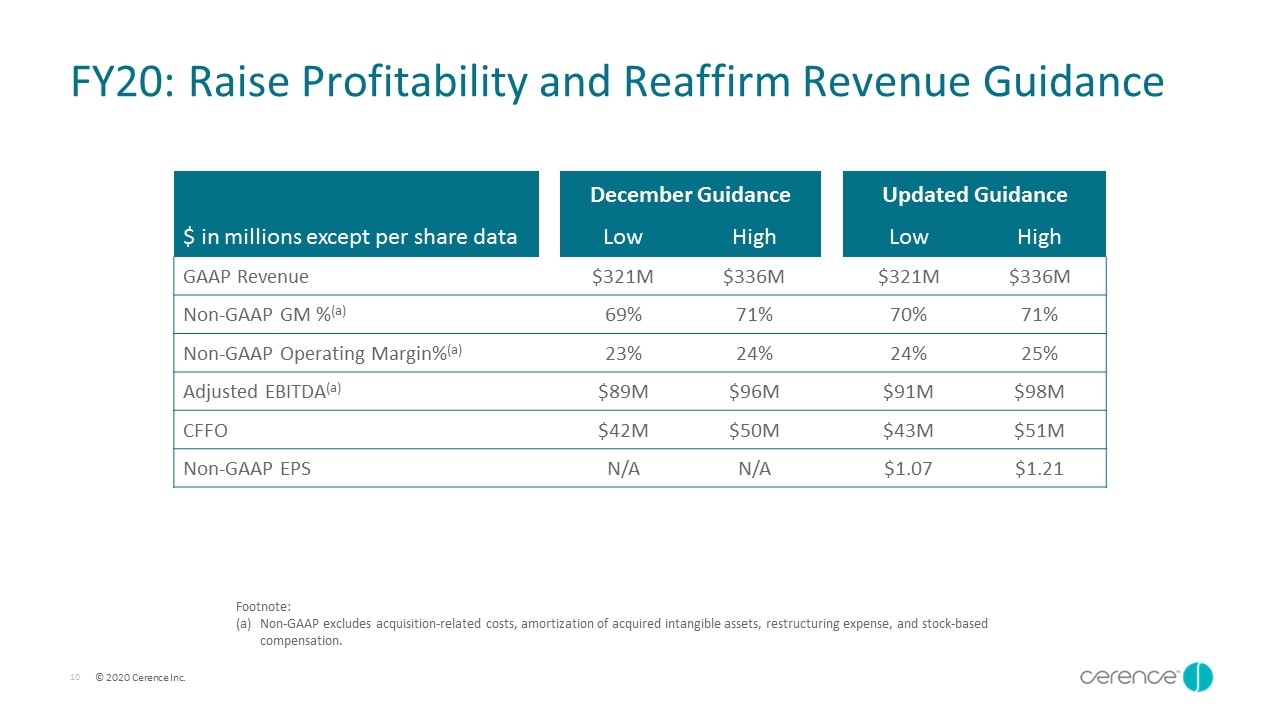

FY20: Raise Profitability and Reaffirm Revenue Guidance Footnote: Non-GAAP excludes acquisition-related costs, amortization of acquired intangible assets, restructuring expense, and stock-based compensation. December Guidance Updated Guidance $ in millions except per share data Low High Low High GAAP Revenue $321M $336M $321M $336M Non-GAAP GM %(a) 69% 71% 70% 71% Non-GAAP Operating Margin%(a) 23% 24% 24% 25% Adjusted EBITDA(a) $89M $96M $91M $98M CFFO $42M $50M $43M $51M Non-GAAP EPS N/A N/A $1.07 $1.21

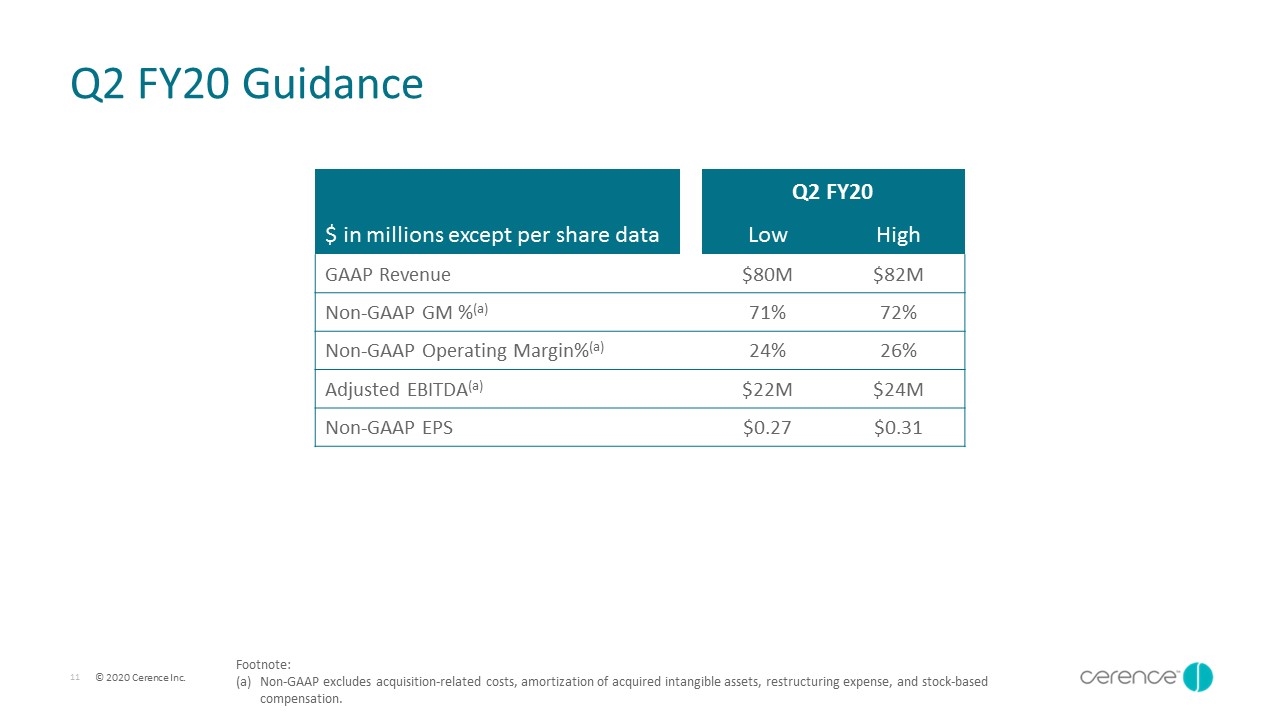

Q2 FY20 Guidance Footnote: Non-GAAP excludes acquisition-related costs, amortization of acquired intangible assets, restructuring expense, and stock-based compensation. Q2 FY20 $ in millions except per share data Low High GAAP Revenue $80M $82M Non-GAAP GM %(a) 71% 72% Non-GAAP Operating Margin%(a) 24% 26% Adjusted EBITDA(a) $22M $24M Non-GAAP EPS $0.27 $0.31

Thank you

Appendix

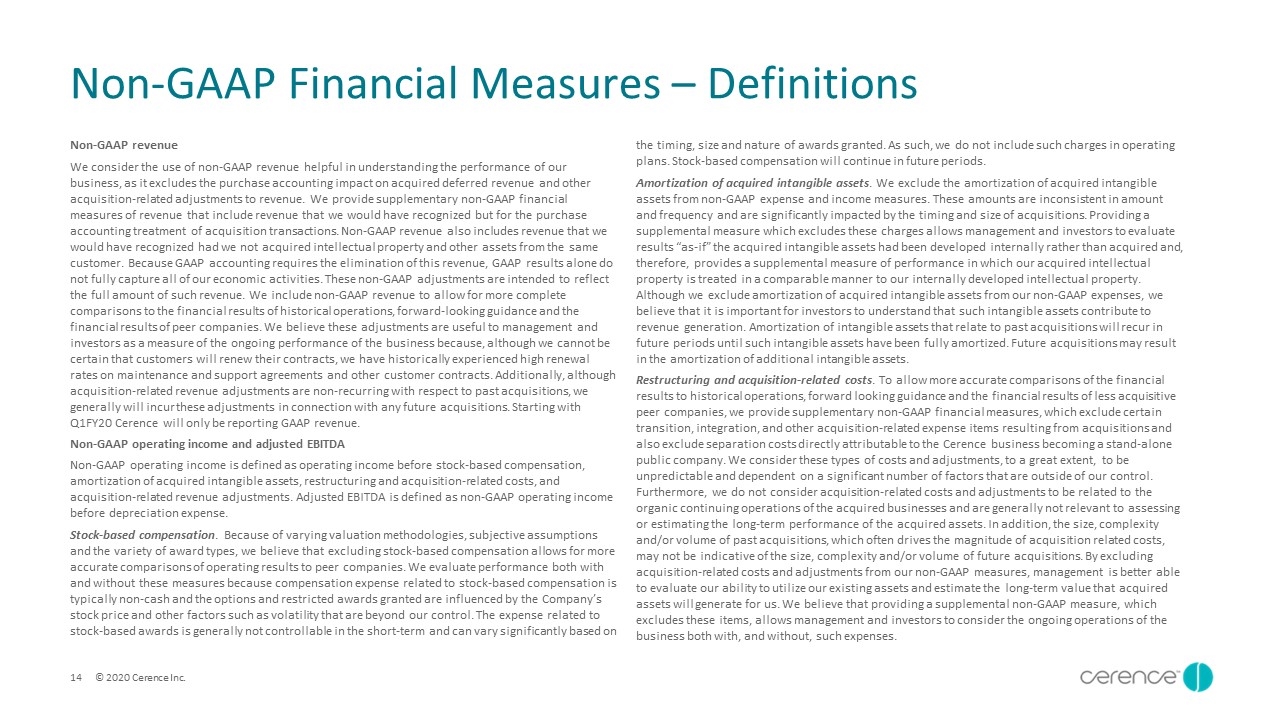

Non-GAAP Financial Measures – Definitions Non-GAAP revenue We consider the use of non-GAAP revenue helpful in understanding the performance of our business, as it excludes the purchase accounting impact on acquired deferred revenue and other acquisition-related adjustments to revenue. We provide supplementary non-GAAP financial measures of revenue that include revenue that we would have recognized but for the purchase accounting treatment of acquisition transactions. Non-GAAP revenue also includes revenue that we would have recognized had we not acquired intellectual property and other assets from the same customer. Because GAAP accounting requires the elimination of this revenue, GAAP results alone do not fully capture all of our economic activities. These non-GAAP adjustments are intended to reflect the full amount of such revenue. We include non-GAAP revenue to allow for more complete comparisons to the financial results of historical operations, forward-looking guidance and the financial results of peer companies. We believe these adjustments are useful to management and investors as a measure of the ongoing performance of the business because, although we cannot be certain that customers will renew their contracts, we have historically experienced high renewal rates on maintenance and support agreements and other customer contracts. Additionally, although acquisition-related revenue adjustments are non-recurring with respect to past acquisitions, we generally will incur these adjustments in connection with any future acquisitions. Starting with Q1FY20 Cerence will only be reporting GAAP revenue. Non-GAAP operating income and adjusted EBITDA Non-GAAP operating income is defined as operating income before stock-based compensation, amortization of acquired intangible assets, restructuring and acquisition-related costs, and acquisition-related revenue adjustments. Adjusted EBITDA is defined as non-GAAP operating income before depreciation expense. Stock-based compensation. Because of varying valuation methodologies, subjective assumptions and the variety of award types, we believe that excluding stock-based compensation allows for more accurate comparisons of operating results to peer companies. We evaluate performance both with and without these measures because compensation expense related to stock-based compensation is typically non-cash and the options and restricted awards granted are influenced by the Company’s stock price and other factors such as volatility that are beyond our control. The expense related to stock-based awards is generally not controllable in the short-term and can vary significantly based on the timing, size and nature of awards granted. As such, we do not include such charges in operating plans. Stock-based compensation will continue in future periods. Amortization of acquired intangible assets. We exclude the amortization of acquired intangible assets from non-GAAP expense and income measures. These amounts are inconsistent in amount and frequency and are significantly impacted by the timing and size of acquisitions. Providing a supplemental measure which excludes these charges allows management and investors to evaluate results “as-if” the acquired intangible assets had been developed internally rather than acquired and, therefore, provides a supplemental measure of performance in which our acquired intellectual property is treated in a comparable manner to our internally developed intellectual property. Although we exclude amortization of acquired intangible assets from our non-GAAP expenses, we believe that it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Future acquisitions may result in the amortization of additional intangible assets. Restructuring and acquisition-related costs. To allow more accurate comparisons of the financial results to historical operations, forward looking guidance and the financial results of less acquisitive peer companies, we provide supplementary non-GAAP financial measures, which exclude certain transition, integration, and other acquisition-related expense items resulting from acquisitions and also exclude separation costs directly attributable to the Cerence business becoming a stand-alone public company. We consider these types of costs and adjustments, to a great extent, to be unpredictable and dependent on a significant number of factors that are outside of our control. Furthermore, we do not consider acquisition-related costs and adjustments to be related to the organic continuing operations of the acquired businesses and are generally not relevant to assessing or estimating the long-term performance of the acquired assets. In addition, the size, complexity and/or volume of past acquisitions, which often drives the magnitude of acquisition related costs, may not be indicative of the size, complexity and/or volume of future acquisitions. By excluding acquisition-related costs and adjustments from our non-GAAP measures, management is better able to evaluate our ability to utilize our existing assets and estimate the long-term value that acquired assets will generate for us. We believe that providing a supplemental non-GAAP measure, which excludes these items, allows management and investors to consider the ongoing operations of the business both with, and without, such expenses.

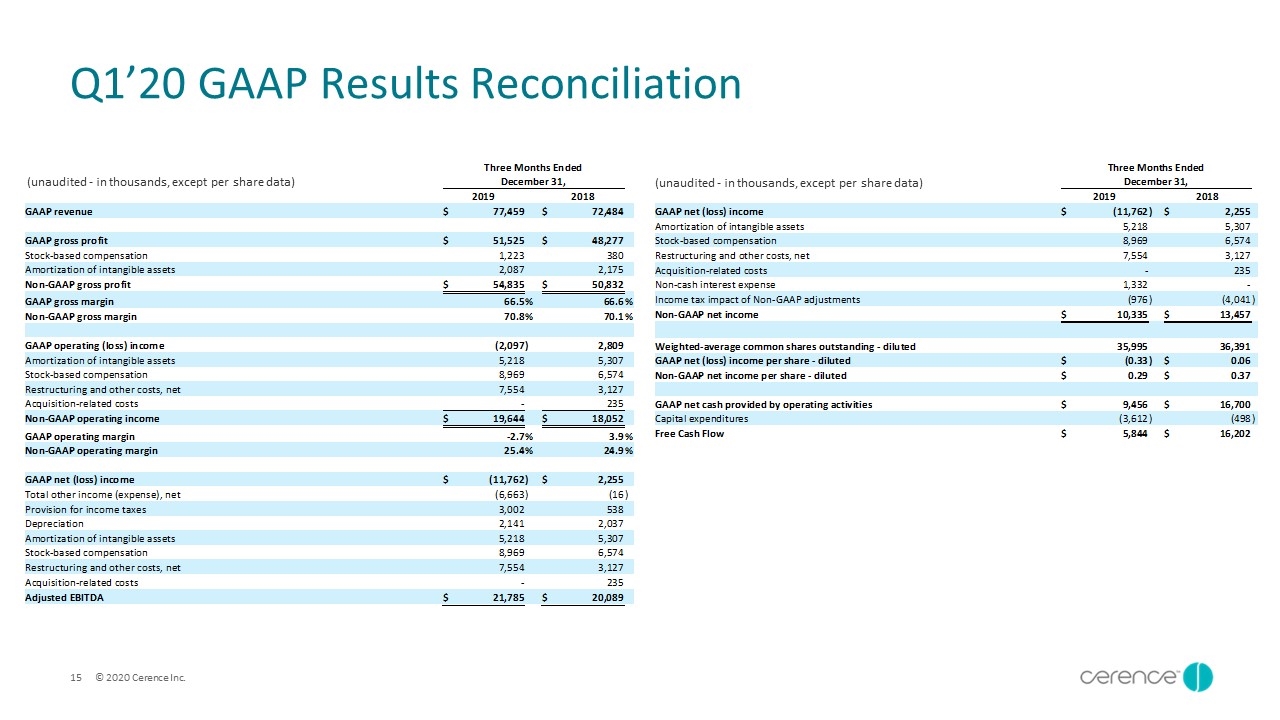

Q1’20 GAAP Results Reconciliation (unaudited - in thousands, except per share data) (unaudited - in thousands, except per share data) Three Months Ended ($ in thousands except per share data) December 31, 2019 2018 GAAP revenue $77,459 $72,484 GAAP gross profit $51,525 $48,277 Stock-based compensation 1,223 380 Amortization of intangible assets 2,087 2,175 Non-GAAP gross profit $54,835 $50,832 GAAP gross margin 66.5% 66.6% Non-GAAP gross margin 70.8% 70.1% GAAP operating (loss) income $(2,097) 2,809 Amortization of intangible assets 5,218 6,574 Stock-based compensation 8,969 3,127 Restructuring and other costs, net 7,554 235 Acquisition-related costs - 235 Non-GAAP operating income $19,644 $12,980 GAAP operating margin -2.7% 3.9% Non-GAAP operating margin 25.4% 17.9% GAAP net (loss) income $(11,762) $2,255 Total other income (expense), net (6,663) (16) Provision for income taxes 3,002 538 Depreciation 2,141 2,037 Amortization of intangible assets 5,218 6,574 Stock-based compensation 8,969 6,574 Restructuring and other costs, net 7,554 3,127 Acquisition-related costs - 235 Adjusted EBITDA $21,785 $21,356 GAAP net (loss) income (11,762) 2,255 Amortization of intangible assets 5,218 6,574 Stock-based compensation 8,969 6,574 Restructuring and other costs, net 7,554 3,127 Acquisition-related costs - 235 Non-cash interest expense 1,332 - Income tax impact of Non-GAAP adjustments (976) (4,041) Non-GAAP net income $10,335 $14,724 Weighted-average common shares outstanding - diluted 35,995 36,391 GAAP net (loss) income per share - diluted $(0.33) $0.06 Non-GAAP net income per share - diluted $0.29 $0.40 GAAP net cash provided by operating activities $9,456 $16,700 Capital expenditures (3,612) (498) Free Cash Flow $5,844 $16,202

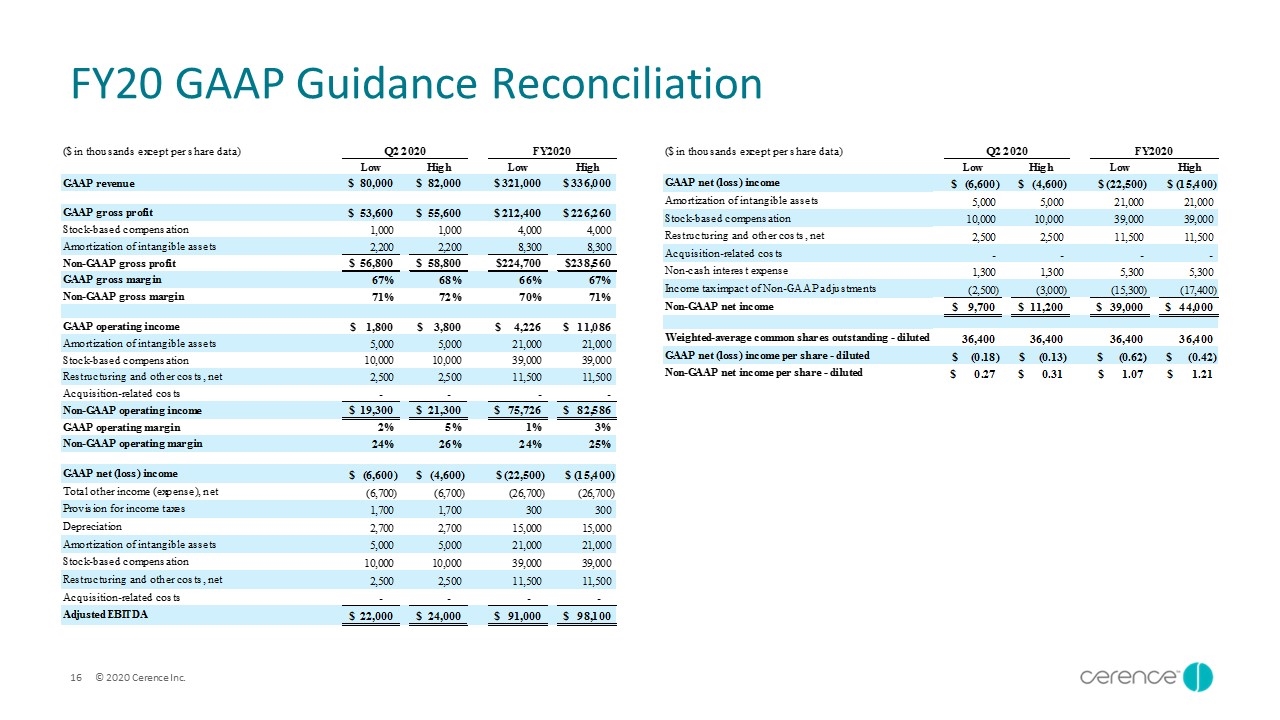

FY20 GAAP Guidance Reconciliation ($ in thousands except per share data) Q2 2020 FY2020 Low High Low High GAAP revenue $80,000 $82,000 $321,000 $336,000 GAAP gross profit $53,600 $55,600 $212,400 $226,260 Stock-based compensation 1,000 1,000 4,000 4,000 Amortization of intangible assets 2,200 2,200 8,300 8,300 Non-GAAP gross profit $56,800 $58,800 $224,700 $238,560 GAAP gross margin 67% 68% 66% 67% Non-GAAP gross margin 71% 72% 70% 71% GAAP operating income $1,800 $3,800 $4,226 $- $11,086 Amortization of intangible assets 5,000 5,000 21,000 21,000 Stock-based compensation 10,000 10,000 39,000 39,000 Restructuring and other costs, net 2,500 2,500 11,500 11,500 Acquisition-related costs - - - - Non-GAAP operating income $19,300 $21,300 $75,726 $82,586 GAAP operating margin 2% 5% 1% 3% Non-GAAP operating margin 24% 26% 24% 25% GAAP net (loss) income $(6,600) $(4,600) $(22,500) $- $(15,400) Total other income (expense), net (6,700) (6,700) (26,700) (26,700) Provision for income taxes 1,700 1,700 300 300 Depreciation 2,700 2,700 15,000 - 15,000 Amortization of intangible assets 5,000 5,000 21,000 21,000 Stock-based compensation 10,000 10,000 39,000 39,000 Restructuring and other costs, net 2,500 2,500 11,500 11,500 Acquisition-related costs - - - - Adjusted EBITDA $22,000 $24,000 $91,000 $98,100 GAAP net (loss) income $(6,600) $(4,600) $(22,500) $(15,400) Amortization of intangible assets 5,000 5,000 21,000 21,000 Stock-based compensation 10,000 10,000 39,000 39,000 Restructuring and other costs, net 2,500 2,500 11,500 11,500 Acquisition-related costs - - - - Non-cash interest expense 1,300 1,300 5,300 5,300 Income tax impact of Non-GAAP adjustments (2,500) (3,000) (15,300) (17,400) Non-GAAP net income $9,700 $11,200 $39,000 $44,000 Weighted-average common shares outstanding - diluted 36,400 36,400 36,400 36,400 GAAP net (loss) income per share - diluted $(0.18) $(0.13) $(0.62) $(0.42) Non-GAAP net income per share - diluted $0.27 $0.31 $1.07 $1.21