Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Repay Holdings Corp | d884933dex991.htm |

| EX-10.1 - EX-10.1 - Repay Holdings Corp | d884933dex101.htm |

| EX-2.1 - EX-2.1 - Repay Holdings Corp | d884933dex21.htm |

| 8-K - FORM 8-K - Repay Holdings Corp | d884933d8k.htm |

Acquisition of Ventanex February 2020 Exhibit 99.2

Disclaimer On July 11, 2019, Thunder Bridge Acquisition, Ltd. (“Thunder Bridge”) and Hawk Parent Holdings LLC completed their previously announced business combination (the “Business Combination”) under which Thunder Bridge acquired Hawk Parent Holdings LLC, upon which Thunder Bridge changed its name to Repay Holdings Corporation (“REPAY” or the “Company”). Unless otherwise indicated, information provided in this presentation that relates to the periods prior to the closing of the Business Combination on July 11, 2019 reflect that of Hawk Parent Holdings LLC prior to the Business Combination. The Company’s filings with the Securities and Exchange Commission (“SEC”), which you may obtain for free at the SEC’s website at http://www.sec.gov, discuss some of the important risk factors that may affect our business, results of operations and financial condition. Forward-Looking Statements This presentation (the “Presentation”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products and services; and other statements identified by words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning. These forward-looking statements include, but are not limited to, statements regarding REPAY’s industry and market sizes, future opportunities for REPAY and the estimated full year performance metrics for the Ventanex business. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated in these forward-looking statements. In addition to factors previously disclosed in prior reports filed with the SEC and those identified elsewhere in this Presentation, the following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: a delay or failure to integrate and realize the benefits of the Ventanex acquisition and any difficulties associated with marketing products and services in the mortgage and B2B healthcare vertical markets in which REPAY does not have any experience; a delay or failure to integrate and realize the benefits of the APS acquisition and any difficulties associated with marketing products and services in the B2B vertical market in which REPAY does not have any experience; a delay or failure to integrate and realize the benefits of the TriSource acquisition and any difficulties associated with operating in the back-end processing markets in which REPAY does not have any experience; changes in the payment processing market in which REPAY competes, including with respect to its competitive landscape, technology evolution or regulatory changes; changes in the vertical markets that REPAY targets; risks relating to REPAY’s relationships within the payment ecosystem; the risk that REPAY may not be able to execute its growth strategies, including identifying and executing acquisitions; risks relating to data security; changes in accounting policies applicable to REPAY; and the risk that REPAY may not be able to develop and maintain effective internal controls. Actual results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance as projected financial information and other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control. All information set forth herein speaks only as of the date hereof in the case of information about REPAY or the date of such information in the case of information from persons other than REPAY, and we disclaim any intention or obligation to update any forward looking statements as a result of developments occurring after the date of this Presentation. Forecasts and estimates regarding REPAY’s industry and end markets are based on sources we believe to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Industry and Market Data The information contained herein also includes information provided by third parties, such as market research firms. In particular, REPAY has commissioned independent research reports from Stax Inc. (“Stax”) and Ernst & Young LLP (“EY” or “EY Parthenon”) for market and industry information to be used by REPAY. Neither of REPAY nor its affiliates and any third parties that provide information to REPAY, such as market research firms, guarantee the accuracy, completeness, timeliness or availability of any information. Neither REPAY nor its affiliates and any third parties that provide information to REPAY, such as market research firms, such as Stax and EY, are responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or the results obtained from the use of such content. Neither REPAY nor its affiliates give any express or implied warranties, including. but not limited to, any warranties of merchantability or fitness for a particular purpose or use, and they expressly disclaim any responsibility or liability for direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees or losses (including lost income or profits and opportunity costs) in connection with the use of the information herein. No Offer or Solicitation This Presentation is for informational purposes only and is neither an offer to sell or purchase, nor a solicitation of an offer to sell, buy or subscribe for any securities, nor shall there be any sale, issuance or transfer or securities in any jurisdiction in contravention of applicable law.

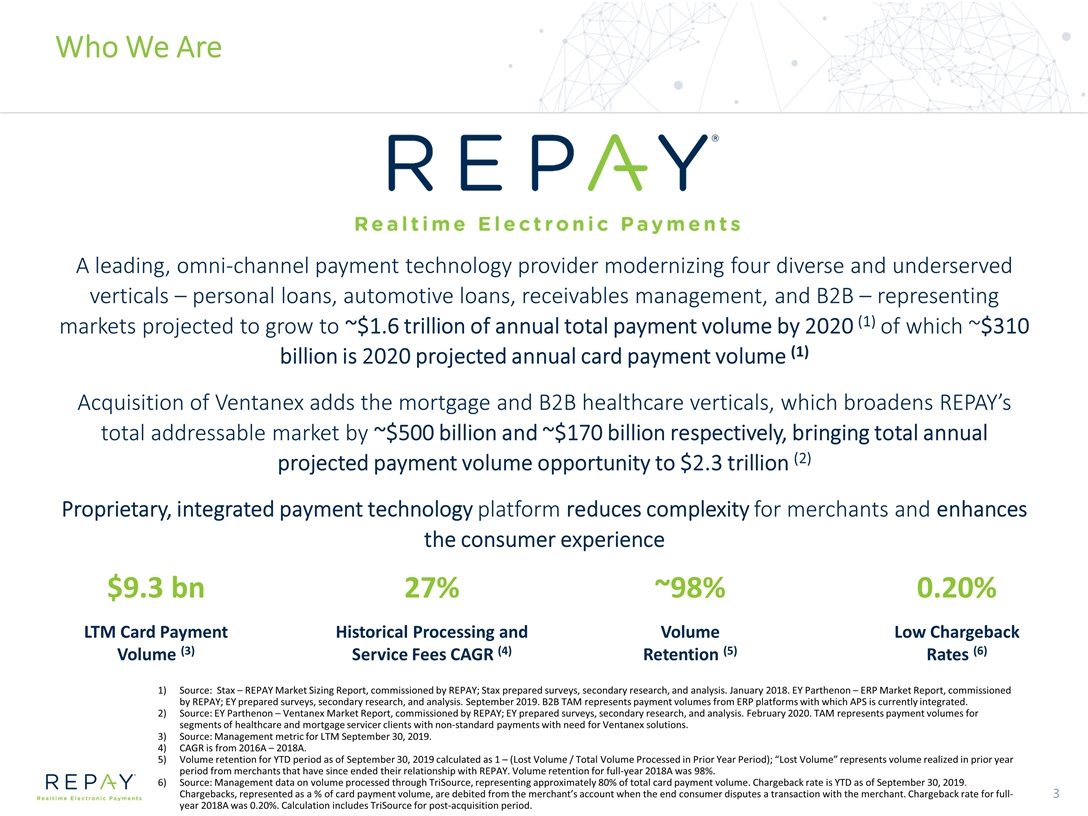

Low Chargeback Rates (6) 0.20% Historical Processing and Service Fees CAGR (4) 27% Who We Are Source: Stax – REPAY Market Sizing Report, commissioned by REPAY; Stax prepared surveys, secondary research, and analysis. January 2018. EY Parthenon – ERP Market Report, commissioned by REPAY; EY prepared surveys, secondary research, and analysis. September 2019. B2B TAM represents payment volumes from ERP platforms with which APS is currently integrated. Source: EY Parthenon – Ventanex Market Report, commissioned by REPAY; EY prepared surveys, secondary research, and analysis. February 2020. TAM represents payment volumes for segments of healthcare and mortgage servicer clients with non-standard payments with need for Ventanex solutions. Source: Management metric for LTM September 30, 2019. CAGR is from 2016A – 2018A. Volume retention for YTD period as of September 30, 2019 calculated as 1 – (Lost Volume / Total Volume Processed in Prior Year Period); “Lost Volume” represents volume realized in prior year period from merchants that have since ended their relationship with REPAY. Volume retention for full-year 2018A was 98%. Source: Management data on volume processed through TriSource, representing approximately 80% of total card payment volume. Chargeback rate is YTD as of September 30, 2019. Chargebacks, represented as a % of card payment volume, are debited from the merchant’s account when the end consumer disputes a transaction with the merchant. Chargeback rate for full-year 2018A was 0.20%. Calculation includes TriSource for post-acquisition period. A leading, omni-channel payment technology provider modernizing four diverse and underserved verticals – personal loans, automotive loans, receivables management, and B2B – representing markets projected to grow to ~$1.6 trillion of annual total payment volume by 2020 (1) of which ~$310 billion is 2020 projected annual card payment volume (1) Acquisition of Ventanex adds the mortgage and B2B healthcare verticals, which broadens REPAY’s total addressable market by ~$500 billion and ~$170 billion respectively, bringing total annual projected payment volume opportunity to $2.3 trillion (2) Proprietary, integrated payment technology platform reduces complexity for merchants and enhances the consumer experience LTM Card Payment Volume (3) $9.3 bn Volume Retention (5) ~98%

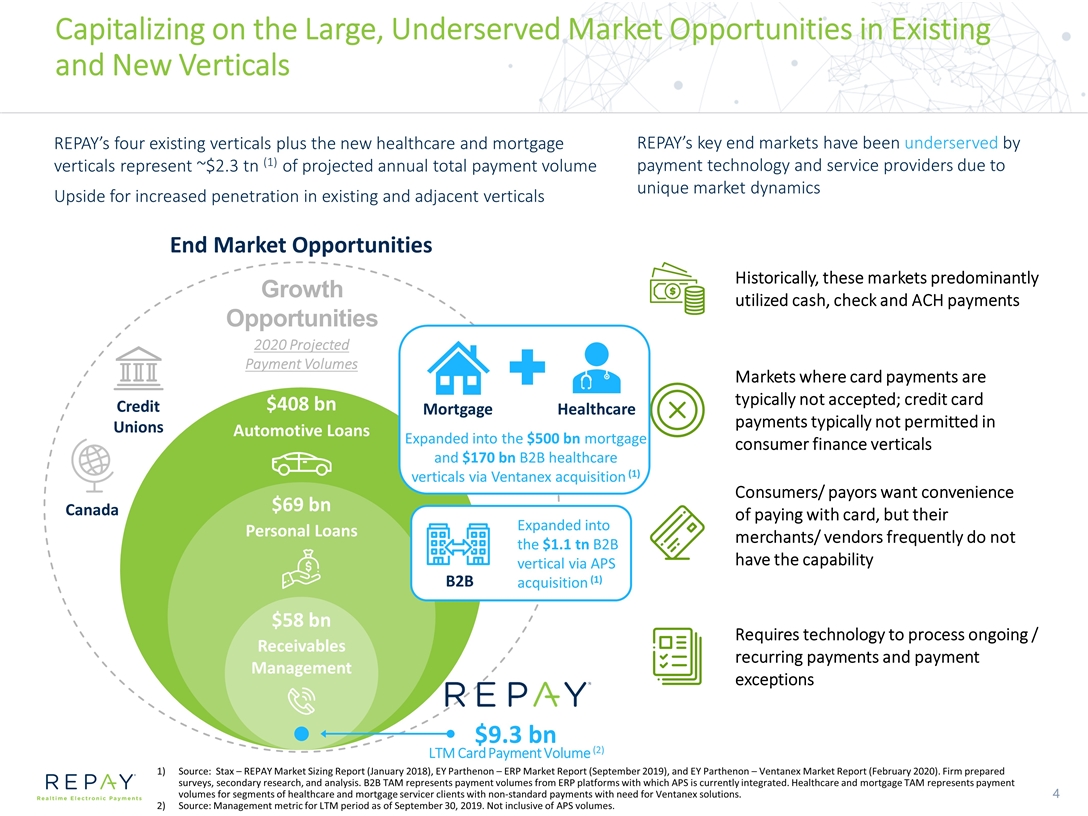

Growth Opportunities $408 bn Automotive Loans $69 bn Personal Loans $58 bn Receivables Management Capitalizing on the Large, Underserved Market Opportunities in Existing and New Verticals Source: Stax – REPAY Market Sizing Report (January 2018), EY Parthenon – ERP Market Report (September 2019), and EY Parthenon – Ventanex Market Report (February 2020). Firm prepared surveys, secondary research, and analysis. B2B TAM represents payment volumes from ERP platforms with which APS is currently integrated. Healthcare and mortgage TAM represents payment volumes for segments of healthcare and mortgage servicer clients with non-standard payments with need for Ventanex solutions. Source: Management metric for LTM period as of September 30, 2019. Not inclusive of APS volumes. REPAY’s four existing verticals plus the new healthcare and mortgage verticals represent ~$2.3 tn (1) of projected annual total payment volume Upside for increased penetration in existing and adjacent verticals REPAY’s key end markets have been underserved by payment technology and service providers due to unique market dynamics Historically, these markets predominantly utilized cash, check and ACH payments Consumers/ payors want convenience of paying with card, but their merchants/ vendors frequently do not have the capability Requires technology to process ongoing / recurring payments and payment exceptions Markets where card payments are typically not accepted; credit card payments typically not permitted in consumer finance verticals LTM Card Payment Volume (2) End Market Opportunities Credit Unions Canada $9.3 bn 2020 Projected Payment Volumes Mortgage Healthcare Expanded into the $500 bn mortgage and $170 bn B2B healthcare verticals via Ventanex acquisition (1) B2B Expanded into the $1.1 tn B2B vertical via APS acquisition (1)

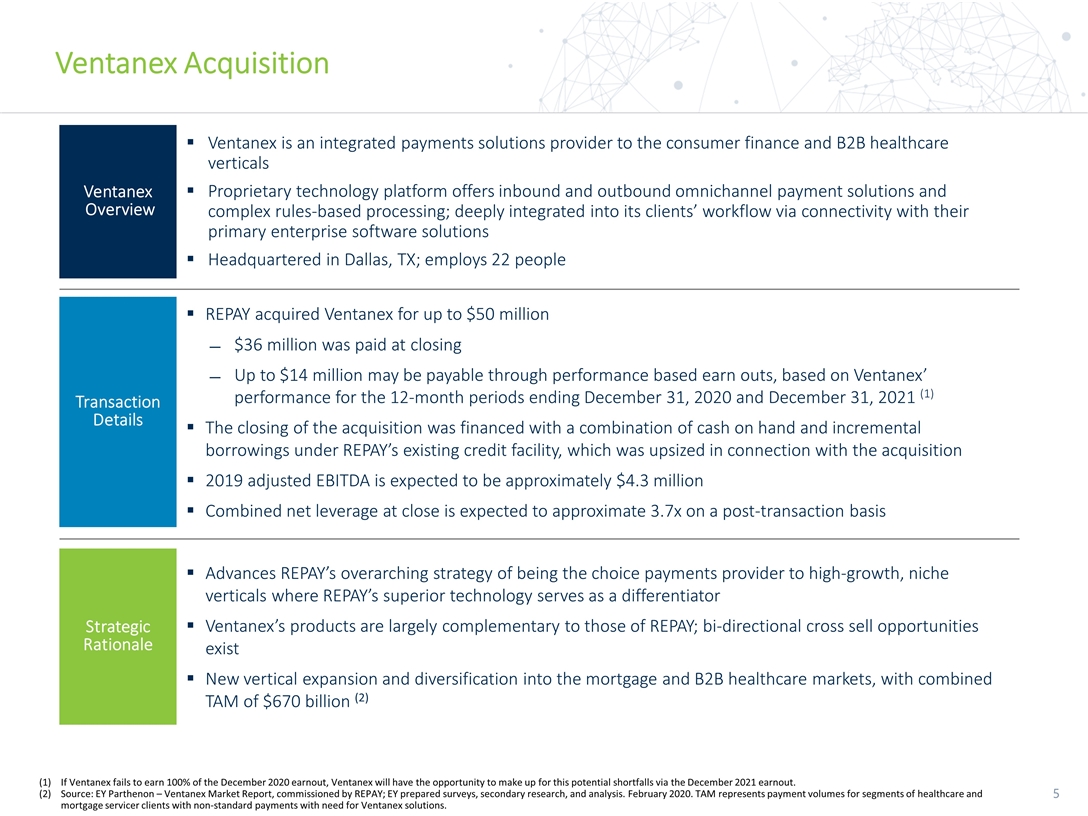

Ventanex Acquisition Strategic Rationale Transaction Details Ventanex Overview Ventanex is an integrated payments solutions provider to the consumer finance and B2B healthcare verticals Proprietary technology platform offers inbound and outbound omnichannel payment solutions and complex rules-based processing; deeply integrated into its clients’ workflow via connectivity with their primary enterprise software solutions Headquartered in Dallas, TX; employs 22 people REPAY acquired Ventanex for up to $50 million $36 million was paid at closing Up to $14 million may be payable through performance based earn outs, based on Ventanex’ performance for the 12-month periods ending December 31, 2020 and December 31, 2021 (1) The closing of the acquisition was financed with a combination of cash on hand and incremental borrowings under REPAY’s existing credit facility, which was upsized in connection with the acquisition 2019 adjusted EBITDA is expected to be approximately $4.3 million Combined net leverage at close is expected to approximate 3.7x on a post-transaction basis Advances REPAY’s overarching strategy of being the choice payments provider to high-growth, niche verticals where REPAY’s superior technology serves as a differentiator Ventanex’s products are largely complementary to those of REPAY; bi-directional cross sell opportunities exist New vertical expansion and diversification into the mortgage and B2B healthcare markets, with combined TAM of $670 billion (2) If Ventanex fails to earn 100% of the December 2020 earnout, Ventanex will have the opportunity to make up for this potential shortfalls via the December 2021 earnout. Source: EY Parthenon – Ventanex Market Report, commissioned by REPAY; EY prepared surveys, secondary research, and analysis. February 2020. TAM represents payment volumes for segments of healthcare and mortgage servicer clients with non-standard payments with need for Ventanex solutions.

Founded in 2012 Headquartered in Dallas, TX Ventanex goes to market in in the mortgage and B2B healthcare verticals via a direct salesforce and referral partners Enables clients to send and receive funds across numerous payment types, including but not limited to, ACH, debit card, credit card, virtual card, and check, with accompanying omnichannel communications Verticals are in the early stage of secular shift from legacy payment mediums to more innovative and varied payment solutions in which REPAY and Ventanex specialize LIFT Platform: Provides clients and their customers complete visibility into payments from initiation to settlement across any payment type (i.e., ACH, card, etc.) Payment IQ: Allows clients to customize business rules to handle exception based processing; robust workflow tool that applies client specific business logic to more easily track, research, and correct payments while maintaining compliance standards Lockbox Intelligence: Smart solutions to improve payment accuracy and reduce exceptions; faster and easier way to review and reconcile exceptions Communication Solutions: Unified communication solutions to provide customers the ability to create, deliver, and track messages across multiple channels; handles document level routing and intelligent mail & email tracking, including file receipt of delivery Solutions and Services Company Overview Ventanex Acquisition