Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE DATED FEBRUARY 10, 2020 - Alpha Metallurgical Resources, Inc. | a02102020pressrelease.htm |

| 8-K - 8-K - Alpha Metallurgical Resources, Inc. | contura8-k02102020.htm |

Exhibit 99.2 Contura Energy: Investor Presentation February 2020 1

Certain Financial Results This presentation contains certain financial results for the three months and year ended December 31, 2019. This information is preliminary, unaudited and subject to material revision, and the company cautions investors and potential investors not to place undue reliance upon this information. 2

Forward Looking Statements This document includes forward-looking statements. These forward-looking statements are based on Contura's expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Contura’s control. Examples of forward-looking statements include, but are not limited to: . the financial performance of the company; . our liquidity, results of operations and financial condition; . our ability to generate sufficient cash or obtain financing to fund our business operations; . depressed levels or declines in coal prices; . worldwide market demand for coal, steel, and electricity, including demand for U.S. coal exports, and competition in coal markets; . the imposition or continuation of barriers to trade, such as tariffs; . utilities switching to alternative energy sources such as natural gas, renewables and coal from basins where we do not operate; . reductions or increases in customer coal inventories and the timing of those changes; . our production capabilities and costs; . inherent risks of coal mining beyond our control; . changes in, interpretations of, or implementations of domestic or international tax or other laws and regulations; . changes in domestic or international environmental laws and regulations, and court decisions, including those directly affecting our coal mining and production, and those affecting our customers’ coal usage, including potential climate change initiatives; . our relationships with, and other conditions affecting, our customers, including the inability to collect payments from our customers if their creditworthiness declines; . changes in, renewal or acquisition of, terms of and performance of customers under coal supply arrangements and the refusal by our customers to receive coal under agreed contract terms; . our ability to obtain, maintain or renew any necessary permits or rights, and our ability to mine properties due to defects in title on leasehold interests; . attracting and retaining key personnel and other employee workforce factors, such as labor relations; . funding for and changes in employee benefit obligations; . any new or increased liabilities, including reclamation obligations, that we may incur in connection with our former mines in Wyoming; . cybersecurity attacks or failures, threats to physical security, extreme weather conditions or other natural disasters; . reclamation and mine closure obligations; . our assumptions concerning economically recoverable coal reserve estimates; . our ability to negotiate new United Mine Workers of America wage agreements on terms acceptable to us, increased unionization of our workforce in the future, and any strikes by our workforce; . disruptions in delivery or changes in pricing from third party vendors of key equipment and materials that are necessary for our operations, such as diesel fuel, steel products, explosives, tires and purchased coal; . inflationary pressures on supplies and labor and significant or rapid increases in commodity prices; . railroad, barge, truck and other transportation availability, performance and costs; . disruption in third party coal supplies; . the consummation of financing or refinancing transactions, acquisitions or dispositions and the related effects on our business and financial position; . our indebtedness and potential future indebtedness; and . our ability to obtain or renew surety bonds on acceptable terms or maintain our current bonding status; Forward-looking statements in this document or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Contura to predict these events or how they may affect Contura. Except as required by law, Contura has no duty to, and does not intend to, update or revise the forward-looking statements in this document or elsewhere. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this document may not occur. Third Party Information This presentation, including certain forward-looking statements herein, includes information obtained from third party sources that we believe to be reliable. However, we have not independently verified this third party information and cannot assure you of its accuracy or completeness. While we are not aware of any misstatements regarding any third party data contained in this presentation, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed in detail in our filings with the U.S. Securities and Exchange Commission. We assume no obligation to revise or update this third party information to reflect future events or circumstances. 3

Table of Contents Company Overview 5 Leadership Introduction & Vision 13 Operations & Capital Projects Overview 17 Financial Highlights 20 Conclusion 23 Appendix 25 4

Company Overview

Contura Investment Thesis & Highlights Investment Thesis Levered to a market turn-around given scale, Favorable asset and market position strategic asset base and cost position Leading management team to take advantage Significant liquidity and cash position of Contura’s key strategic strengths to ($363 million(1)) as well as discretion over proactively meet sector dynamics capital spend Investment Highlights •1 Largest and Most Diverse Metallurgical Coal Producer in U.S. •2 Portfolio of Long-Lived Mines and Substantial Organic Reserve Growth Opportunities •3 Operational Excellence: Cost Reductions, Safety, Environmental •4 Advantaged Sales & Logistics Platform Serving Both Domestic and International Markets •5 Well Positioned for Opportunistic Growth (1) See slide 22 for additional details. 6

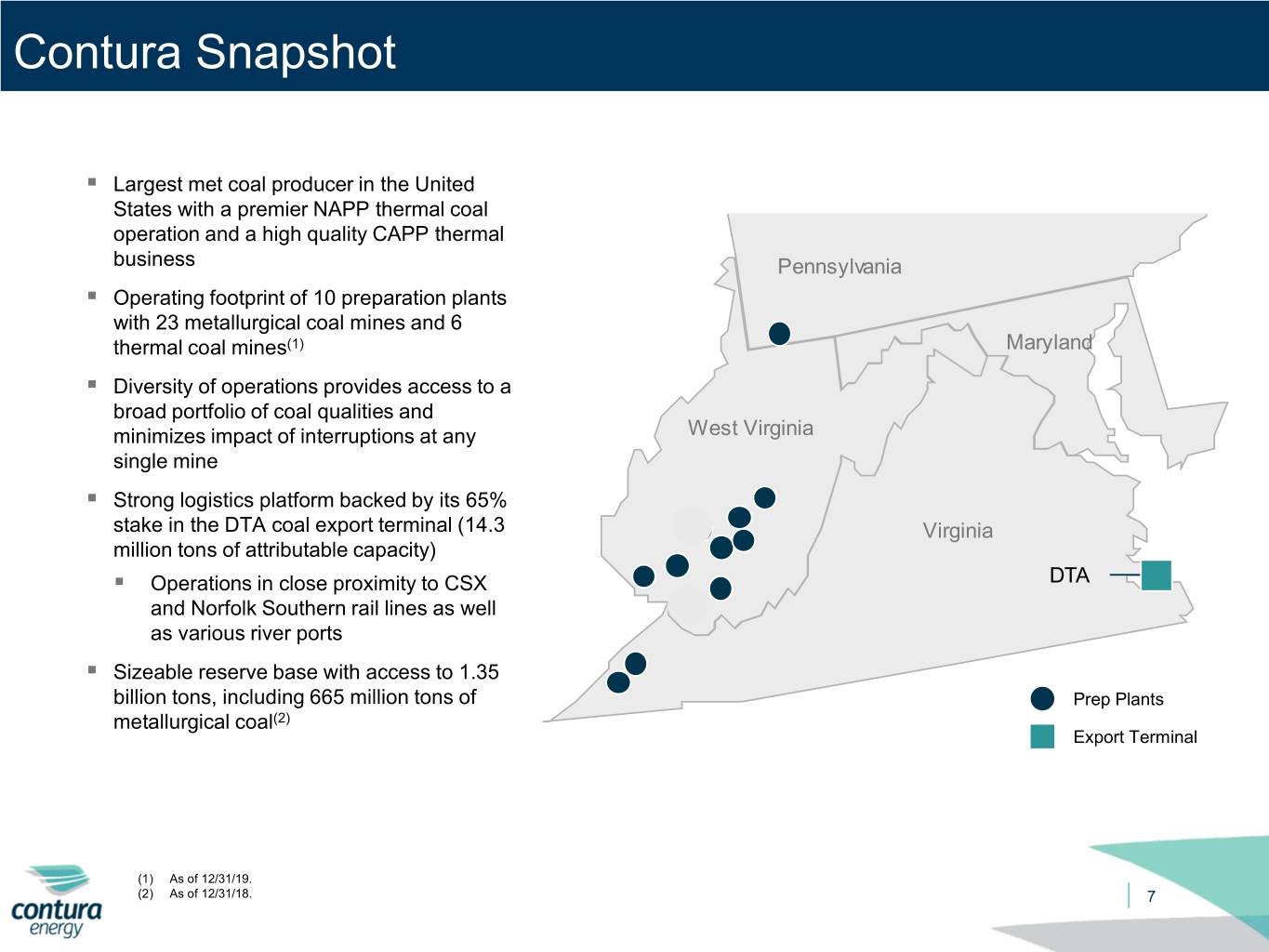

Contura Snapshot . Largest met coal producer in the United States with a premier NAPP thermal coal operation and a high quality CAPP thermal business Pennsylvania . Operating footprint of 10 preparation plants with 23 metallurgical coal mines and 6 thermal coal mines(1) Maryland . Diversity of operations provides access to a broad portfolio of coal qualities and minimizes impact of interruptions at any West Virginia single mine . Strong logistics platform backed by its 65% stake in the DTA coal export terminal (14.3 Virginia million tons of attributable capacity) . Operations in close proximity to CSX DTA and Norfolk Southern rail lines as well as various river ports . Sizeable reserve base with access to 1.35 billion tons, including 665 million tons of Prep Plants metallurgical coal(2) Export Terminal (1) As of 12/31/19. (2) As of 12/31/18. 7

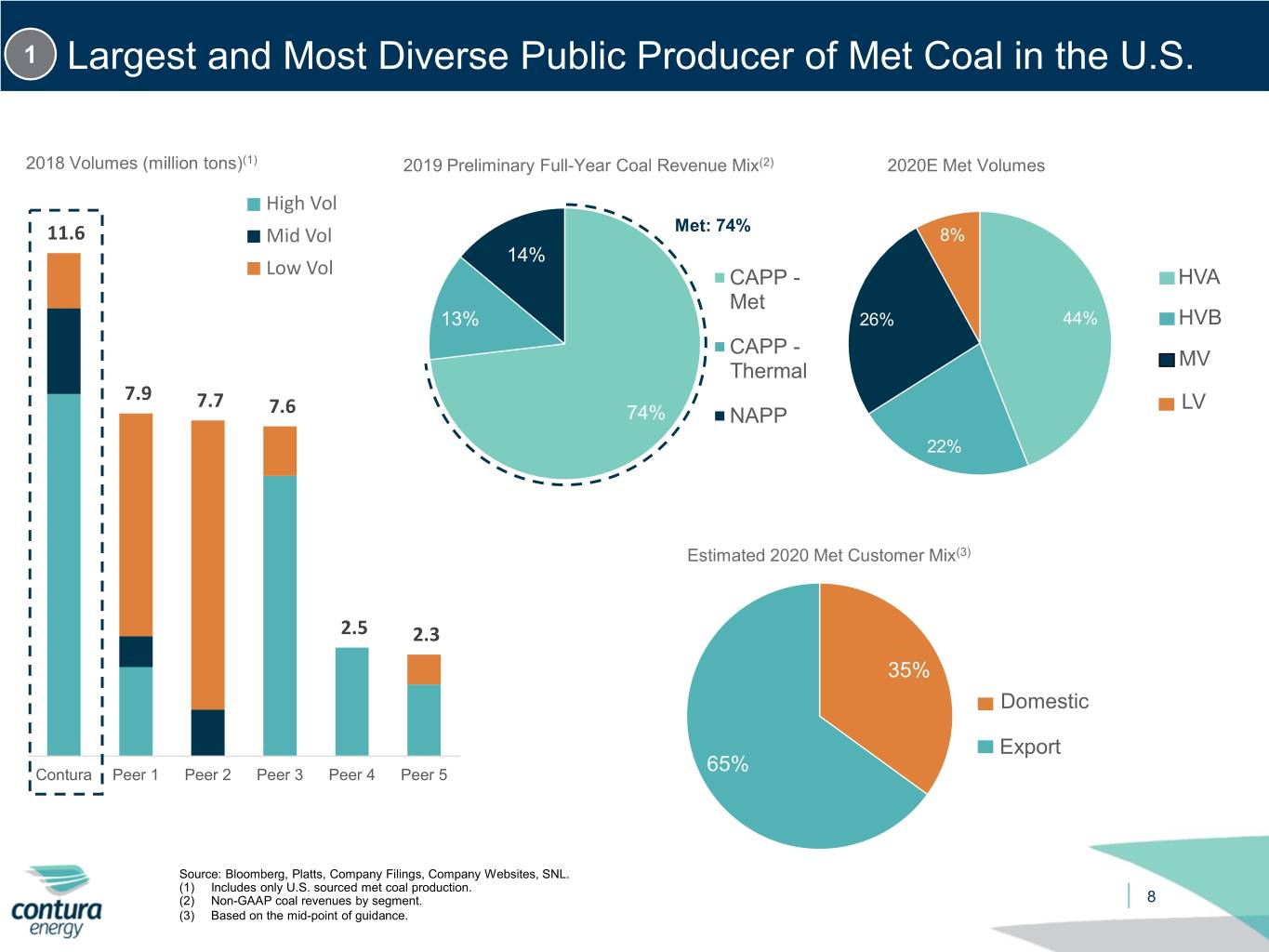

1 Largest and Most Diverse Public Producer of Met Coal in the U.S. 2018 Volumes (million tons)(1) 2019 Preliminary Full-Year Coal Revenue Mix(2) 2020E Met Volumes High Vol 11.6 Mid Vol Met: 74% 8% 14% Low Vol CAPP - HVA Met 13% 26% 44% HVB CAPP - MV Thermal 7.9 7.7 LV 7.6 74% NAPP 22% Estimated 2020 Met Customer Mix(3) 2.5 2.3 35% Domestic Export Contura Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 65% Source: Bloomberg, Platts, Company Filings, Company Websites, SNL. (1) Includes only U.S. sourced met coal production. (2) Non-GAAP coal revenues by segment. 8 (3) Based on the mid-point of guidance.

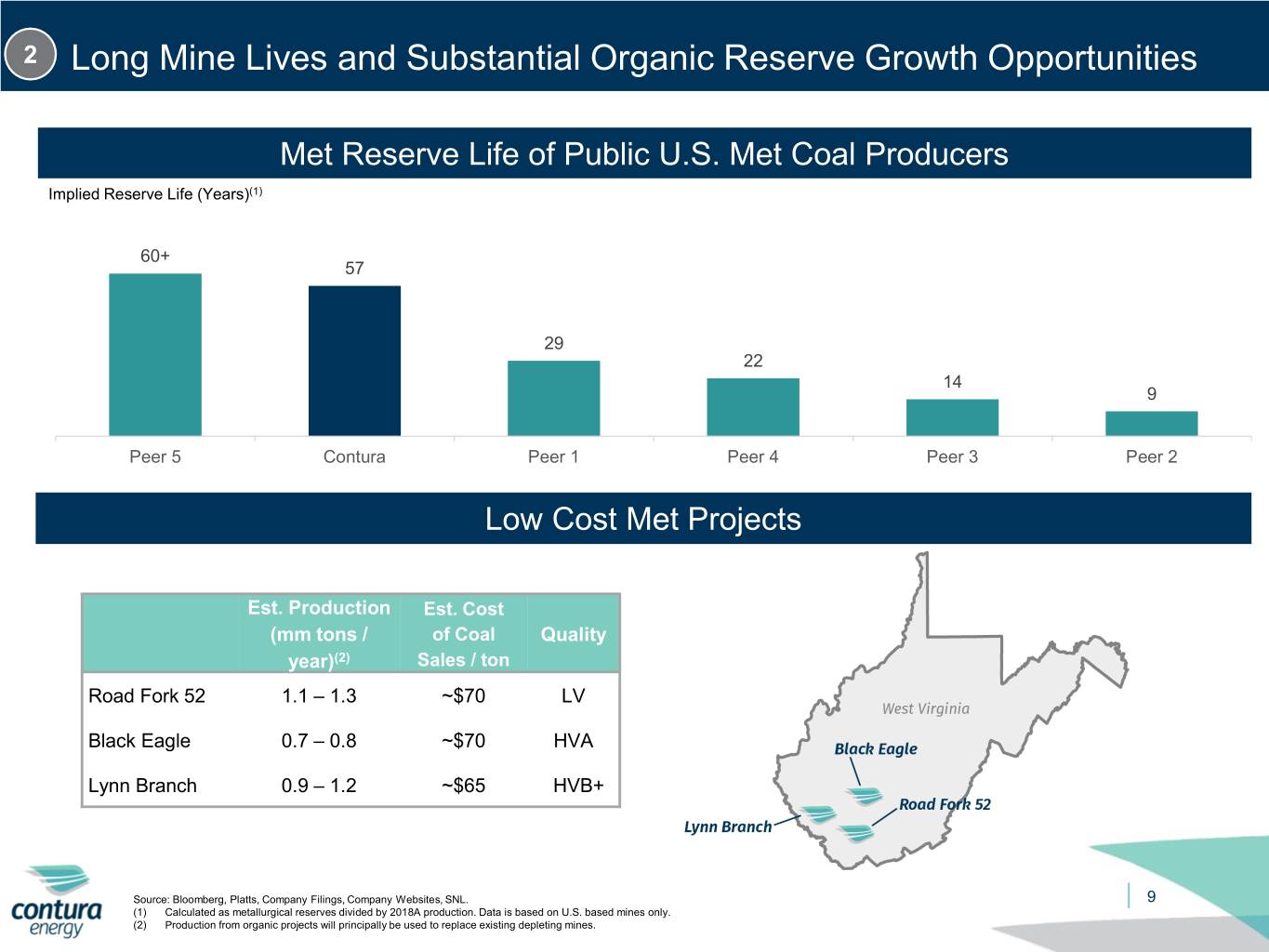

2 Long Mine Lives and Substantial Organic Reserve Growth Opportunities Met Reserve Life of Public U.S. Met Coal Producers Implied Reserve Life (Years)(1) 60+ 57 29 22 14 9 Peer 5 Contura Peer 1 Peer 4 Peer 3 Peer 2 Low Cost Met Projects Est. Production Est. Cost (mm tons / of Coal Quality year)(2) Sales / ton Road Fork 52 1.1 – 1.3 ~$70 LV Black Eagle 0.7 – 0.8 ~$70 HVA Lynn Branch 0.9 – 1.2 ~$65 HVB+ Source: Bloomberg, Platts, Company Filings, Company Websites, SNL. 9 (1) Calculated as metallurgical reserves divided by 2018A production. Data is based on U.S. based mines only. (2) Production from organic projects will principally be used to replace existing depleting mines.

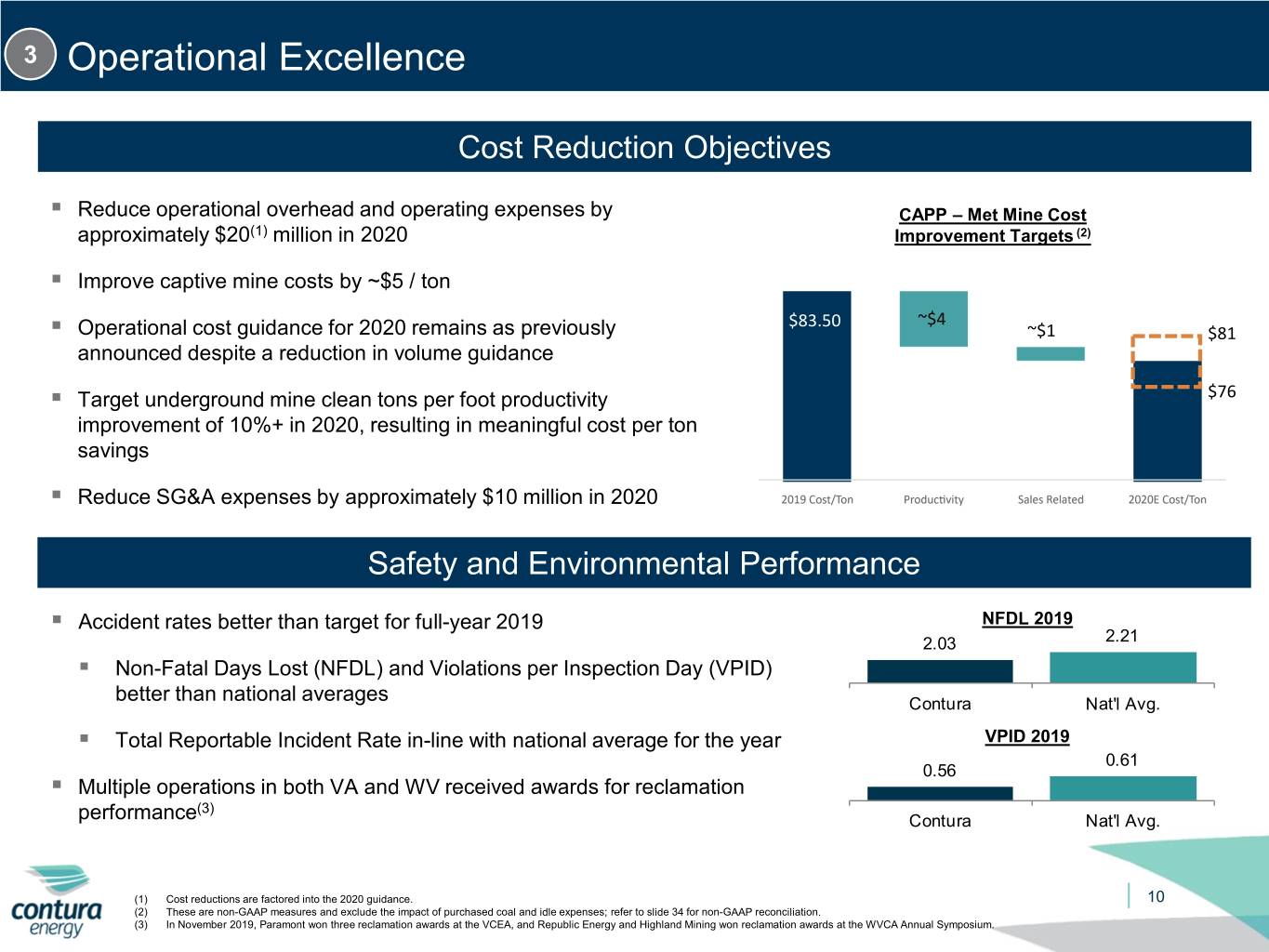

3 Operational Excellence Cost Reduction Objectives . Reduce operational overhead and operating expenses by CAPP – Met Mine Cost approximately $20(1) million in 2020 Improvement Targets (2) . Improve captive mine costs by ~$5 / ton $83.50 ~$4 . Operational cost guidance for 2020 remains as previously ~$1 $81 announced despite a reduction in volume guidance . Target underground mine clean tons per foot productivity $76 improvement of 10%+ in 2020, resulting in meaningful cost per ton savings . Reduce SG&A expenses by approximately $10 million in 2020 Safety and Environmental Performance . Accident rates better than target for full-year 2019 NFDL 2019 2.03 2.21 . Non-Fatal Days Lost (NFDL) and Violations per Inspection Day (VPID) better than national averages Contura Nat'l Avg. . Total Reportable Incident Rate in-line with national average for the year VPID 2019 0.61 0.56 . Multiple operations in both VA and WV received awards for reclamation (3) performance Contura Nat'l Avg. (1) Cost reductions are factored into the 2020 guidance. 10 (2) These are non-GAAP measures and exclude the impact of purchased coal and idle expenses; refer to slide 34 for non-GAAP reconciliation. (3) In November 2019, Paramont won three reclamation awards at the VCEA, and Republic Energy and Highland Mining won reclamation awards at the WVCA Annual Symposium.

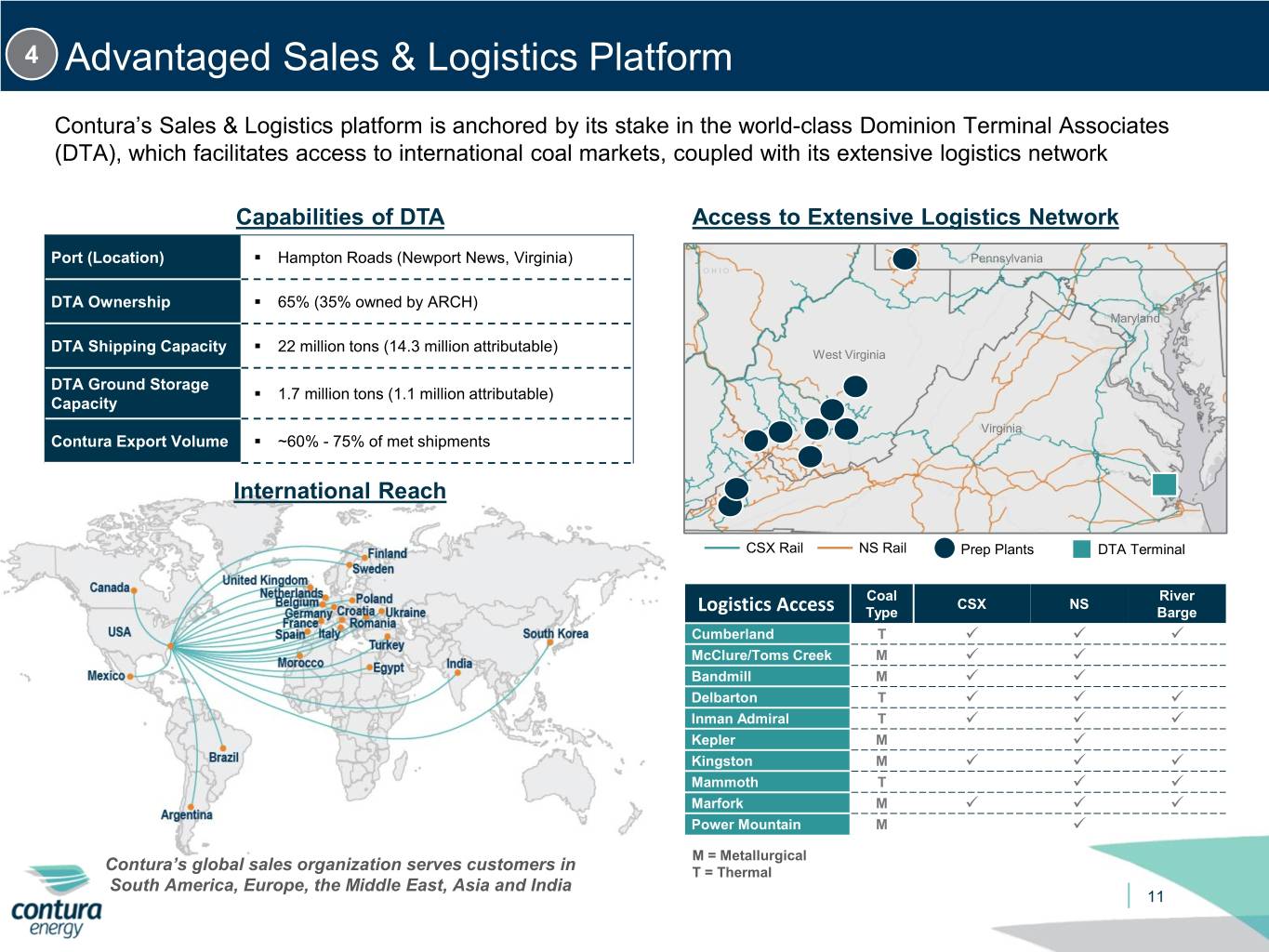

4 Advantaged Sales & Logistics Platform Contura’s Sales & Logistics platform is anchored by its stake in the world-class Dominion Terminal Associates (DTA), which facilitates access to international coal markets, coupled with its extensive logistics network Capabilities of DTA Access to Extensive Logistics Network Port (Location) . Hampton Roads (Newport News, Virginia) Pennsylvania DTA Ownership . 65% (35% owned by ARCH) Maryland . DTA Shipping Capacity 22 million tons (14.3 million attributable) West Virginia DTA Ground Storage . 1.7 million tons (1.1 million attributable) Capacity Virginia Contura Export Volume . ~60% - 75% of met shipments International Reach CSX Rail NS Rail Prep Plants DTA Terminal Coal River CSX NS Logistics Access Type Barge Cumberland T McClure/Toms Creek M Bandmill M Delbarton T Inman Admiral T Kepler M Kingston M Mammoth T Marfork M Power Mountain M M = Metallurgical Contura’s global sales organization serves customers in T = Thermal South America, Europe, the Middle East, Asia and India 11

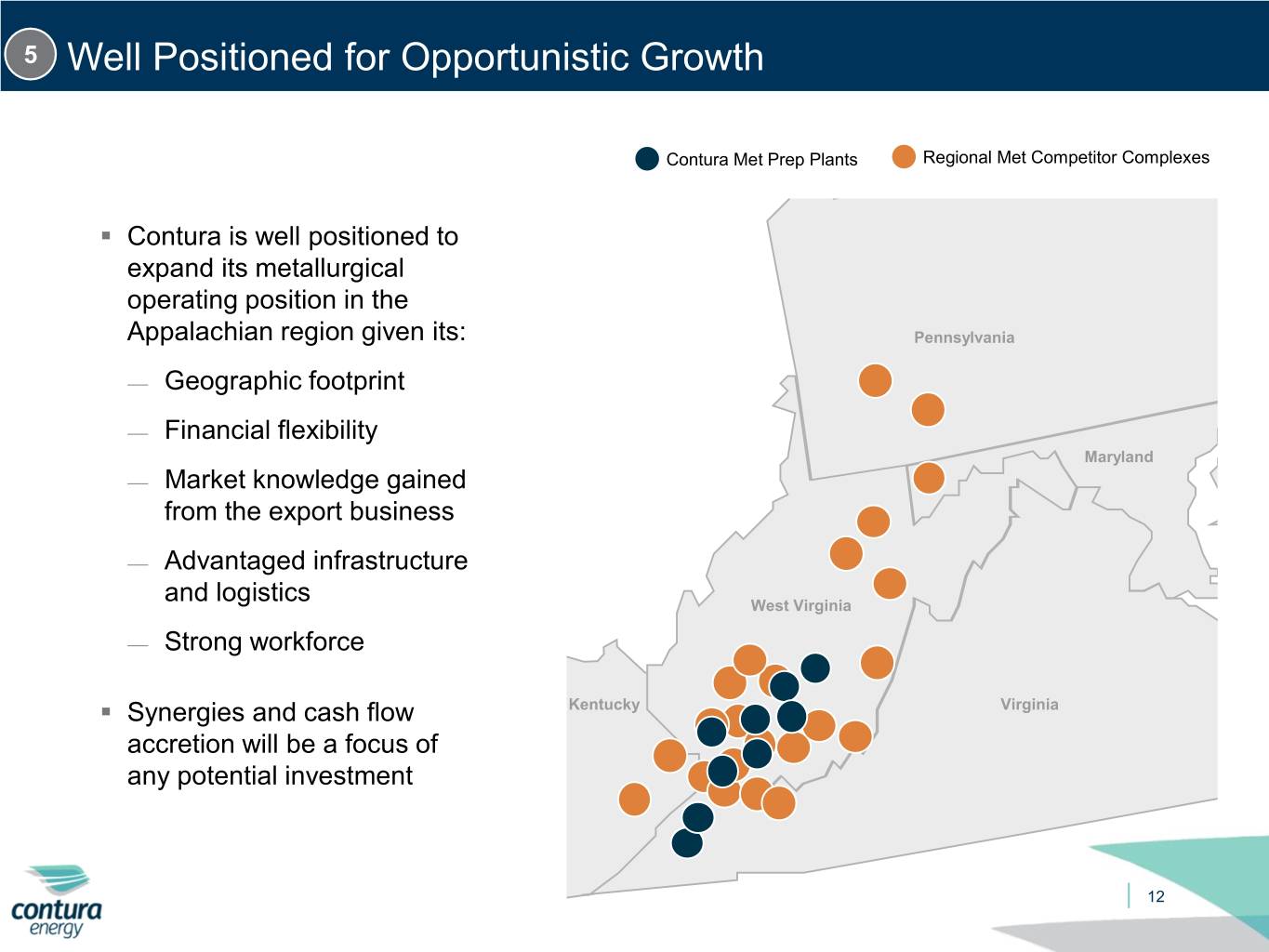

5 Well Positioned for Opportunistic Growth Contura Met Prep Plants Regional Met Competitor Complexes . Contura is well positioned to expand its metallurgical operating position in the Appalachian region given its: Pennsylvania Geographic footprint Financial flexibility Maryland Market knowledge gained from the export business Advantaged infrastructure and logistics West Virginia Strong workforce . Synergies and cash flow Kentucky Virginia accretion will be a focus of any potential investment 12

Leadership Introduction & Vision

Members of the Management Team David J. Stetson Andy Eidson Jason E. Roger L. Daniel Horn William Davison Chairman & CEO EVP and CFO Whitehead Nicholson SVP and Head of SVP and Head of EVP and COO EVP, General Counsel Metallurgical Coal Sales Thermal Coal Sales and Secretary . Has served as . Has served as . Has served as . Has served as . Has served as . Has served as senior Contura’s chief executive vice executive vice executive vice president of Contura vice president, sales executive officer since president and chief president and chief president, general Coal Sales since and marketing of July 2019 and financial officer of operating officer of counsel and secretary December 2019, Contura Coal Sales previously served on Contura since July Contura since August of Contura since leading metallurgical since December 2019, Contura’s Board of 2016 2019 December 2019 coal sales leading thermal coal directors from sales November 2018 . Previously served as . Previously served as . Practiced law as a . Was responsible for through April 2019 executive vice chief operating officer member of Steptoe & Alpha Natural . More than 15 years of president and chief and senior vice Johnson PLLC’s Resources’ North sales leadership . Extensive experience financial officer of president – operations Charleston office from American and export experience with in management, Alpha Natural for Alpha Natural 2015 sales for more than a Contura Energy, Alpha finance, mergers and Resources, Inc., a Resources Holdings decade Natural Resources and acquisitions, corporate position he held from from July 2016 until . Extensive experience Foundation Coal governance, March 2016 November 2018 and serving as general . Expansive background restructuring, the law vice president – counsel to a number of in operations, . Extensive sales and and reclamation operations of Alpha companies in the coal engineering and marketing experience Natural Resources, Inc. industry procurement for the with several leading . Served as chairman from November 2012 coal and steel coal companies and chief executive industries officer of Alpha from July 2016 until its merger with Contura in November 2018 14

Contura Vision 2020 1 . Continue focusing on safe, environmentally sound operations . Continue to lower costs and increase operational efficiencies by: Operational Focus . Improving feet/shift at mines . Increasing organic yields and throughput at prep plants . Leveraging larger scale to improve logistics performance and costs 2 . Broaden metallurgical footprint through investments in existing reserves and potential bolt-on Strategic Focus acquisitions . Continue to reduce thermal footprint through methodically winding down mines and divesting assets 3 . Optimize coordination between sales and operations . Reduce SG&A and overhead costs Financial Focus . Reduce outstanding debt when appropriate . Expect to receive a $35 million AMT credit monetization tax refund during the year(1) Goal: Maximize free cash flow, maintain strong liquidity position and focus on actively deleveraging (1) See slide 26 for additional details. 15

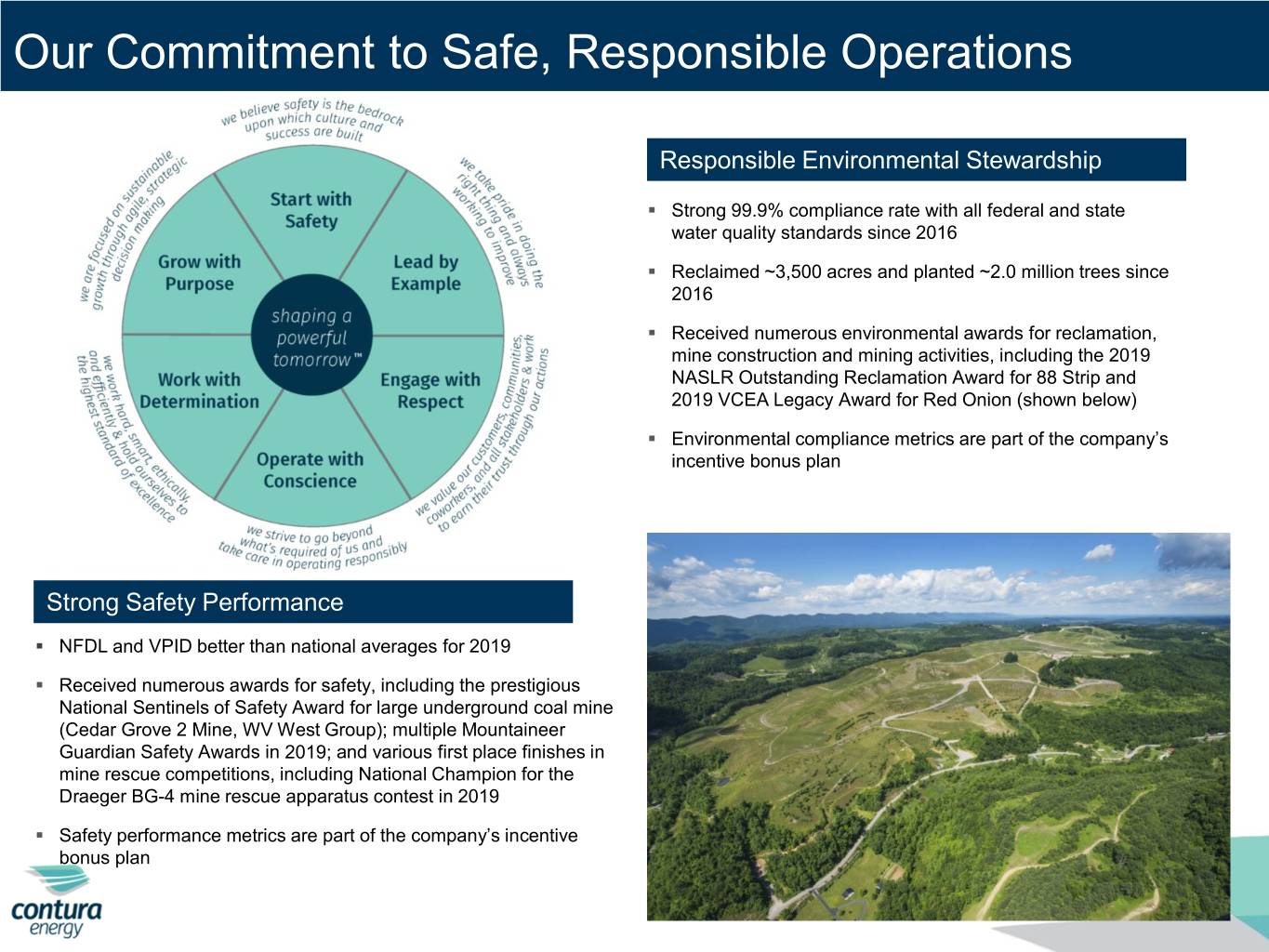

Our Commitment to Safe, Responsible Operations Responsible Environmental Stewardship . Strong 99.9% compliance rate with all federal and state water quality standards since 2016 . Reclaimed ~3,500 acres and planted ~2.0 million trees since 2016 . Received numerous environmental awards for reclamation, mine construction and mining activities, including the 2019 NASLR Outstanding Reclamation Award for 88 Strip and 2019 VCEA Legacy Award for Red Onion (shown below) . Environmental compliance metrics are part of the company’s incentive bonus plan Strong Safety Performance . NFDL and VPID better than national averages for 2019 . Received numerous awards for safety, including the prestigious National Sentinels of Safety Award for large underground coal mine (Cedar Grove 2 Mine, WV West Group); multiple Mountaineer Guardian Safety Awards in 2019; and various first place finishes in mine rescue competitions, including National Champion for the Draeger BG-4 mine rescue apparatus contest in 2019 . Safety performance metrics are part of the company’s incentive bonus plan 16

Operations & Capital Projects Overview

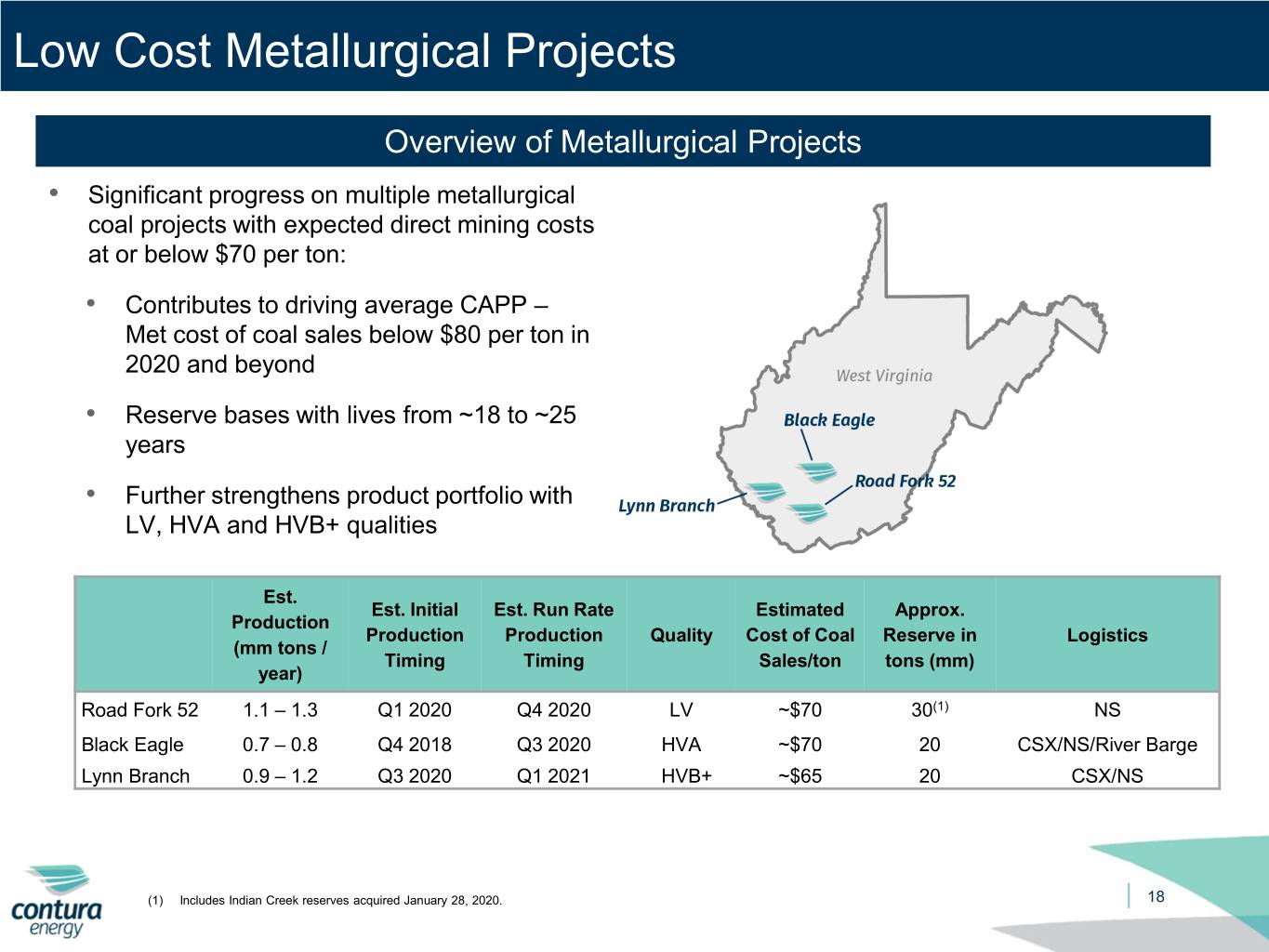

Low Cost Metallurgical Projects Overview of Metallurgical Projects • Significant progress on multiple metallurgical coal projects with expected direct mining costs at or below $70 per ton: • Contributes to driving average CAPP – Met cost of coal sales below $80 per ton in 2020 and beyond • Reserve bases with lives from ~18 to ~25 years • Further strengthens product portfolio with LV, HVA and HVB+ qualities Est. Est. Initial Est. Run Rate Estimated Approx. Production Production Production Quality Cost of Coal Reserve in Logistics (mm tons / Timing Timing Sales/ton tons (mm) year) Road Fork 52 1.1 – 1.3 Q1 2020 Q4 2020 LV ~$70 30(1) NS Black Eagle 0.7 – 0.8 Q4 2018 Q3 2020 HVA ~$70 20 CSX/NS/River Barge Lynn Branch 0.9 – 1.2 Q3 2020 Q1 2021 HVB+ ~$65 20 CSX/NS (1) Includes Indian Creek reserves acquired January 28, 2020. 18

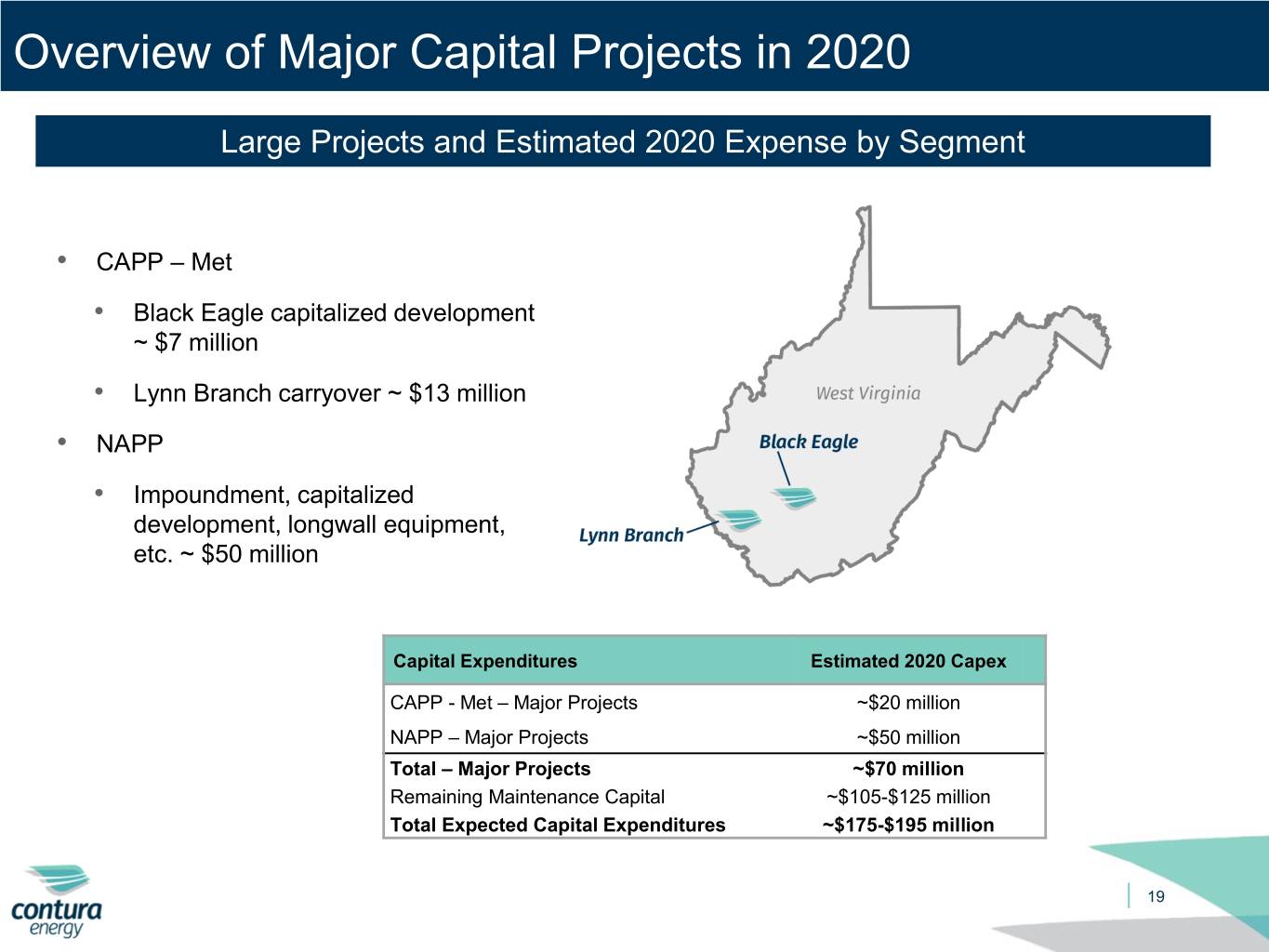

Overview of Major Capital Projects in 2020 Large Projects and Estimated 2020 Expense by Segment • CAPP – Met • Black Eagle capitalized development ~ $7 million • Lynn Branch carryover ~ $13 million • NAPP • Impoundment, capitalized development, longwall equipment, etc. ~ $50 million Capital Expenditures Estimated 2020 Capex CAPP - Met – Major Projects ~$20 million NAPP – Major Projects ~$50 million Total – Major Projects ~$70 million Remaining Maintenance Capital ~$105-$125 million Total Expected Capital Expenditures ~$175-$195 million 19

Financial Highlights

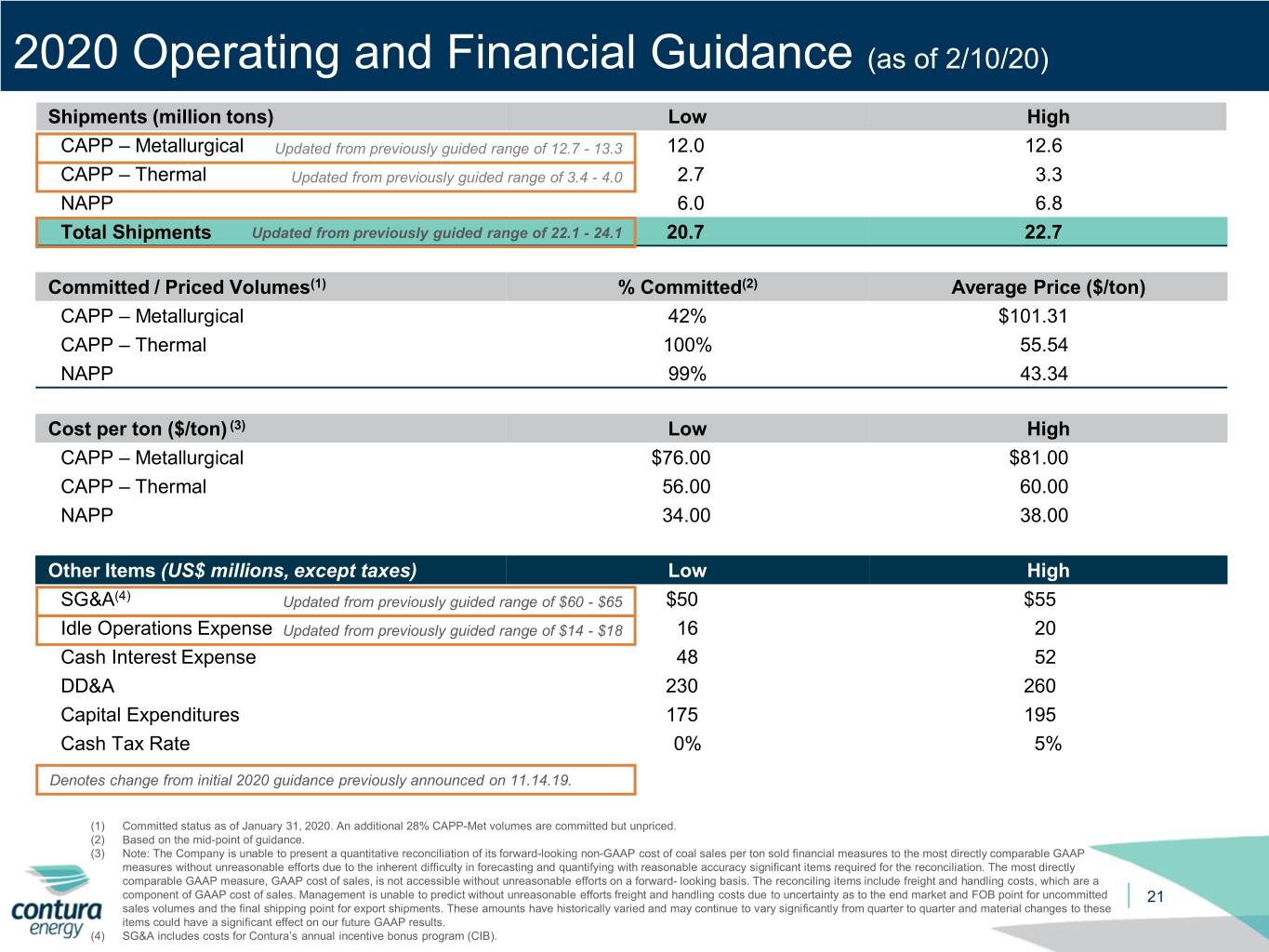

2020 Operating and Financial Guidance (as of 2/10/20) Shipments (million tons) Low High CAPP – Metallurgical Updated from previously guided range of 12.7 - 13.3 12.0 12.6 CAPP – Thermal Updated from previously guided range of 3.4 - 4.0 2.7 3.3 NAPP 6.0 6.8 Total Shipments Updated from previously guided range of 22.1 - 24.1 20.7 22.7 Committed / Priced Volumes(1) % Committed(2) Average Price ($/ton) CAPP – Metallurgical 42% $101.31 CAPP – Thermal 100% 55.54 NAPP 99% 43.34 Cost per ton ($/ton) (3) Low High CAPP – Metallurgical $76.00 $81.00 CAPP – Thermal 56.00 60.00 NAPP 34.00 38.00 Other Items (US$ millions, except taxes) Low High SG&A(4) Updated from previously guided range of $60 - $65 $50 $55 Idle Operations Expense Updated from previously guided range of $14 - $18 16 20 Cash Interest Expense 48 52 DD&A 230 260 Capital Expenditures 175 195 Cash Tax Rate 0% 5% Denotes change from initial 2020 guidance previously announced on 11.14.19. (1) Committed status as of January 31, 2020. An additional 28% CAPP-Met volumes are committed but unpriced. (2) Based on the mid-point of guidance. (3) Note: The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP cost of coal sales per ton sold financial measures to the most directly comparable GAAP measures without unreasonable efforts due to the inherent difficulty in forecasting and quantifying with reasonable accuracy significant items required for the reconciliation. The most directly comparable GAAP measure, GAAP cost of sales, is not accessible without unreasonable efforts on a forward- looking basis. The reconciling items include freight and handling costs, which are a component of GAAP cost of sales. Management is unable to predict without unreasonable efforts freight and handling costs due to uncertainty as to the end market and FOB point for uncommitted 21 sales volumes and the final shipping point for export shipments. These amounts have historically varied and may continue to vary significantly from quarter to quarter and material changes to these items could have a significant effect on our future GAAP results. (4) SG&A includes costs for Contura’s annual incentive bonus program (CIB).

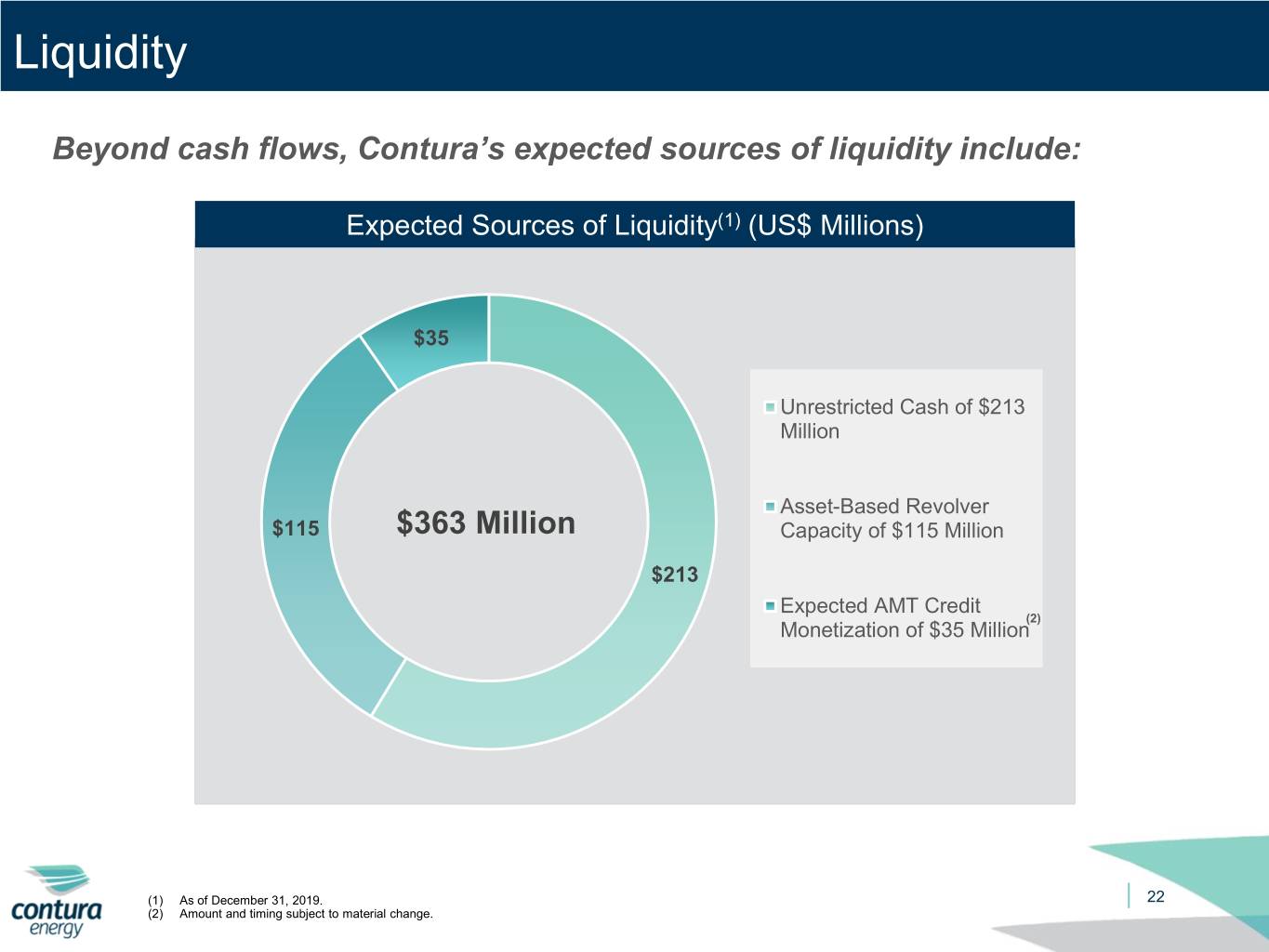

Liquidity Beyond cash flows, Contura’s expected sources of liquidity include: Expected Sources of Liquidity(1) (US$ Millions) $35 Unrestricted Cash of $213 Million Asset-Based Revolver $115 $363 Million Capacity of $115 Million $213 Expected AMT Credit (2) Monetization of $35 Million (1) As of December 31, 2019. 22 (2) Amount and timing subject to material change.

Conclusion

Conclusion Contura presents an attractive opportunity for investors as the Company: 1 Has significant liquidity and cash position as well as discretion over capital spend 2 Compares favorably to its peers given its asset position and market position 3 Levered to a market turn-around given scale, strategic asset base and cost position 4 Has assembled a leading management team to take advantage of Contura’s key strategic strengths to proactively meet sector dynamics and excel in the marketplace going forward 24

Appendix February 2020 16

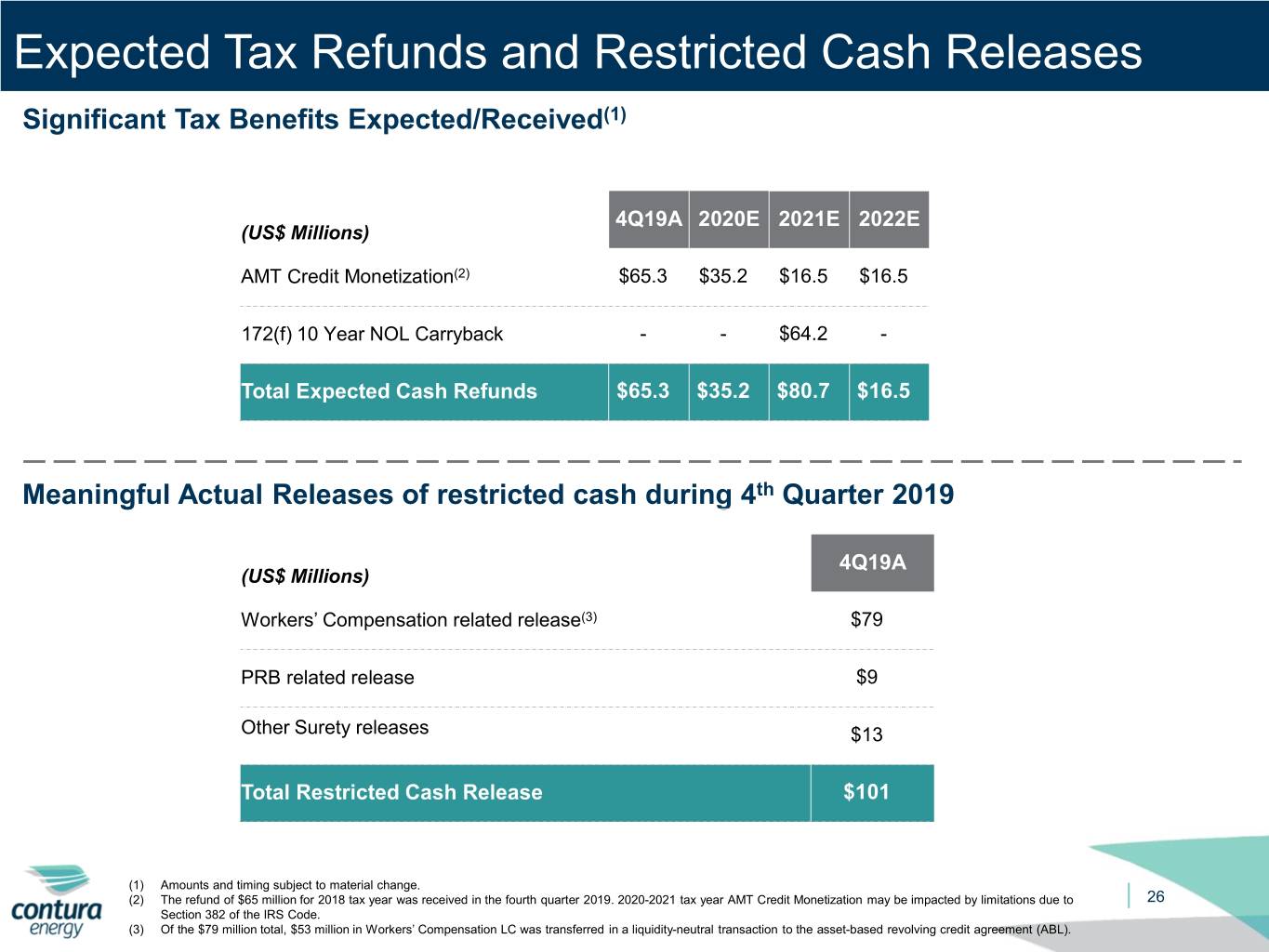

Expected Tax Refunds and Restricted Cash Releases Significant Tax Benefits Expected/Received(1) 4Q19A 2020E 2021E 2022E (US$ Millions) AMT Credit Monetization(2) $65.3 $35.2 $16.5 $16.5 172(f) 10 Year NOL Carryback - - $64.2 - Total Expected Cash Refunds $65.3 $35.2 $80.7 $16.5 Meaningful Actual Releases of restricted cash during 4th Quarter 2019 4Q19A (US$ Millions) Workers’ Compensation related release(3) $79 PRB related release $9 Other Surety releases $13 Total Restricted Cash Release $101 (1) Amounts and timing subject to material change. (2) The refund of $65 million for 2018 tax year was received in the fourth quarter 2019. 2020-2021 tax year AMT Credit Monetization may be impacted by limitations due to 26 Section 382 of the IRS Code. (3) Of the $79 million total, $53 million in Workers’ Compensation LC was transferred in a liquidity-neutral transaction to the asset-based revolving credit agreement (ABL).

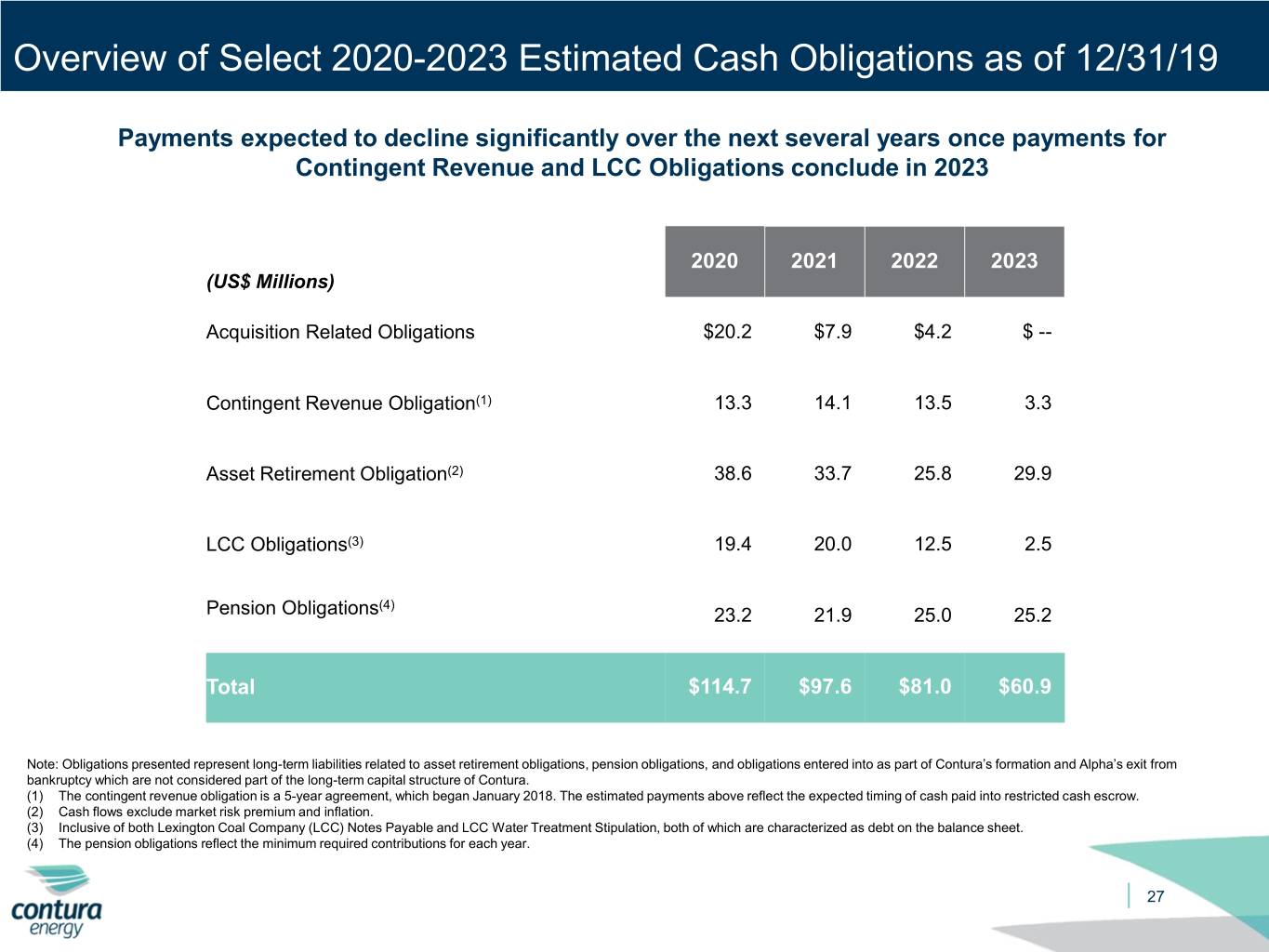

Overview of Select 2020-2023 Estimated Cash Obligations as of 12/31/19 Payments expected to decline significantly over the next several years once payments for Contingent Revenue and LCC Obligations conclude in 2023 2020 2021 2022 2023 (US$ Millions) Acquisition Related Obligations $20.2 $7.9 $4.2 $ -- Contingent Revenue Obligation(1) 13.3 14.1 13.5 3.3 Asset Retirement Obligation(2) 38.6 33.7 25.8 29.9 LCC Obligations(3) 19.4 20.0 12.5 2.5 (4) Pension Obligations 23.2 21.9 25.0 25.2 Total $114.7 $97.6 $81.0 $60.9 Note: Obligations presented represent long-term liabilities related to asset retirement obligations, pension obligations, and obligations entered into as part of Contura’s formation and Alpha’s exit from bankruptcy which are not considered part of the long-term capital structure of Contura. (1) The contingent revenue obligation is a 5-year agreement, which began January 2018. The estimated payments above reflect the expected timing of cash paid into restricted cash escrow. (2) Cash flows exclude market risk premium and inflation. (3) Inclusive of both Lexington Coal Company (LCC) Notes Payable and LCC Water Treatment Stipulation, both of which are characterized as debt on the balance sheet. (4) The pension obligations reflect the minimum required contributions for each year. 27

Mid-West Virginia Underground Operations Underground Mines Allen Powellton, Black Eagle, Horse Creek, 2020 Estimated Production(2) (3) Panther Eagle, Slip Ridge, Slab Camp 1.9 MM Tons Met 1.6 MM Tons Thermal Prep Plants Met Thermal Mammoth (1,200 TPH), Marfork (2,400 TPH) Shipping Options Mid-West Virginia Underground (MWVUG) CSX Rail (Marfork), NS Rail (Mammoth), Vice President – Carl Lucas Kanawha River Barge Reserves(1) 231 MM Tons (1) Reserve figures are year-end 2018. 28 (2) Estimated production includes contractor mines and purchased coal. (3) All tons produced at predominantly met mines are attributed to met tons and all tons produced at thermal mines are attributed to thermal tons, consistent with financial reporting; estimated volume excludes nearly 400k tons of traded coal across the organization.

Mid-West Virginia Surface Operations Surface Mines Pax, Republic, Workman Creek North, Workman 2020 Estimated Production(2) (3) Creek South 3.3 MM Tons Met Loadouts Pax Loadout (3,500 TPH) Met Shipping Options Mid-West Virginia Surface (MWVS) CSX Rail (Marfork), NS Rail (Mammoth), Vice President – Jimmy Wood Kanawha River Barge Reserves(1) 116 MM Tons (1) Reserve figures are year-end 2018. 29 (2) Estimated production includes contractor mines and purchased coal. (3) All tons produced at predominantly met mines are attributed to met tons and all tons produced at thermal mines are attributed to thermal tons, consistent with financial reporting; estimated volume excludes nearly 400k tons of traded coal across the organization.

West Virginia East Operations Underground Mines Jerry Fork Eagle, Kingston #1, Kingston #2, Road 2020 Estimated Production(2) (3) Fork 51, Wyoming No. 2 2.2 MM Tons Met Prep Plants Kepler (900 TPH), Kingston (600 TPH), Power Met Mountain (1,200 TPH) Shipping Options West Virginia East CSX Rail, NS Rail, Kanawha River Barge Vice President – Johnny Jones Reserves(1) 132 MM Tons (1) Reserve figures are year-end 2018. 30 (2) Estimated production includes contractor mines and purchased coal. (3) All tons produced at predominantly met mines are attributed to met tons and all tons produced at thermal mines are attributed to thermal tons, consistent with financial reporting; estimated volume excludes nearly 400k tons of traded coal across the organization.

West Virginia West Operations Underground Mines Alma, Cedar Grove No. 2, Chilton/Hernshaw, Kielty 2020 Estimated Production(2) (3) Surface Mines 1.2 MM Tons Met 1.3 MM Tons Thermal Black Castle, Highland (Reylas) Prep Plants Met Thermal Bandmill (1,200 TPH), Delbarton (650 TPH), Inman (800 TPH) Shipping Options West Virginia West CSX Rail (Bandmill), NS Rail, Kanawha River Barge Vice President – Mike Jarrell Reserves(1) 144 MM Tons (1) Reserve figures are year-end 2018. 31 (2) Estimated production includes contractor mines and purchased coal. (3) All tons produced at predominantly met mines are attributed to met tons and all tons produced at thermal mines are attributed to thermal tons, consistent with financial reporting; estimated volume excludes nearly 400k tons of traded coal across the organization.

Virginia Operations Underground Mines Deep Mine 41, Deep Mine 44, Bear Ridge Upper 2020 Estimated Production(2) (3) Banner*, Toms Creek North*, Toms Creek South* 3.4 MM Tons Met Surface Mines 88 Surface, Long Branch Met Prep Plants McClure (1,000 TPH), Toms Creek (1,050 TPH) Virginia Vice President – Blake Hall Shipping Options CSX Rail (McClure), NS Rail (Toms Creek) Reserves(1) 74 MM Tons * Denotes contract mine. (1) Reserve figures are year-end 2018. 32 (2) Estimated production includes contractor mines and purchased coal. (3) All tons produced at predominantly met mines are attributed to met tons and all tons produced at thermal mines are attributed to thermal tons, consistent with financial reporting; estimated volume excludes nearly 400k tons of traded coal across the organization.

Pennsylvania Operations Underground Mines Cumberland 2020 Estimated Production Prep Plants 6.4 MM Tons Thermal Cumberland (1,600 TPH) Thermal Shipping Options CSX Rail, NS Rail, Monongahela River Barge Pennsylvania Vice President – Ryan Toler Reserves(1) 652 MM Tons (1) Reserve figures are year-end 2018 and include Freeport and Sewickley seams. 33

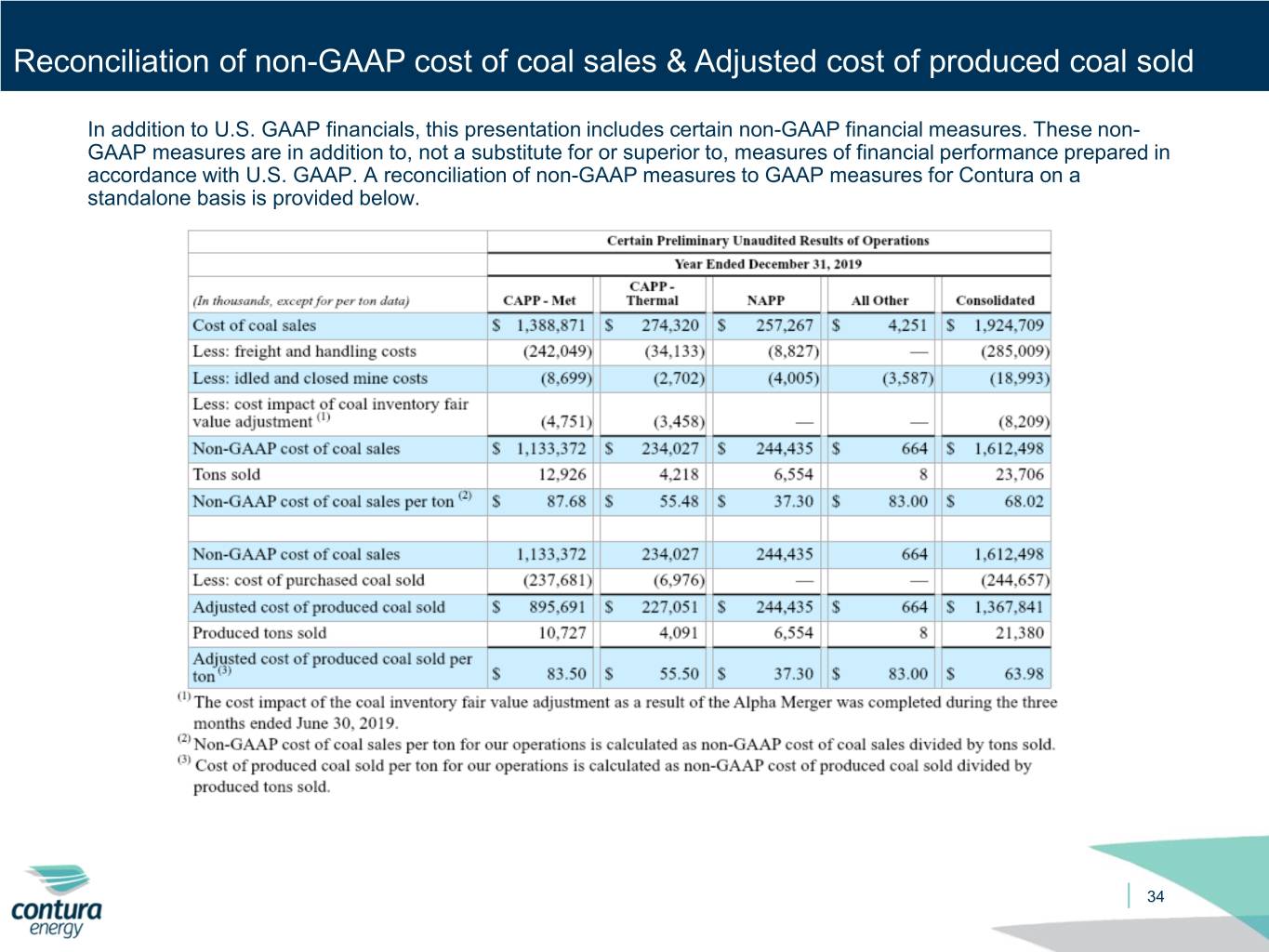

Reconciliation of non-GAAP cost of coal sales & Adjusted cost of produced coal sold In addition to U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. These non- GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of non-GAAP measures to GAAP measures for Contura on a standalone basis is provided below. 34