Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BENCHMARK ELECTRONICS INC | ex991.htm |

| 8-K - FORM 8-K - BENCHMARK ELECTRONICS INC | bhe-20200206.htm |

Exhibit 99.2

| 1 Q4 - 19 and 2019 Earnings Call February 6, 2020

| 2 | 2 This press release contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “expect,” “estimate,” “anticipate,” “could” “predict” and similar expressions, and the negatives thereof, often identify forward - looking statements, which are not limited to historical facts. Forward - looking statements include, among other things, guidance for first quarter 2020 results; statements, express or implied, concerning future operating results or margins, the ability to generate sales and income or cash flow, and expected revenue mix; and Benchmark’s business and growth strategies. Although Benchmark believes these statements are based upon reasonable assumptions, they involve risks and uncertainties relating to operations, markets and the business environment generally. If one or more of these risks or uncertainties materializes, or underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. Readers are advised to consult further disclosures on these risks and uncertainties, particularly in Part 1, Item 1A, “Risk Factors”, of the Company’s Annual Report on Form 10 - K for the year ended December 31, 2018 and in Part II, Item 1A, “Risk Factors” in the Company’s Quarterly Report on Form 10 - Q for the quarter ended September 30, 2019, and in its subsequent filings with the Securities and Exchange Commission. All forward - looking statements included in this document are based upon information available to the Company as of the date of this document, and it assumes no obligation to update them. . This document includes certain financial measures that exclude items and therefore are not in accordance with U.S. generally accepted accounting principles (“GAAP”). A detailed reconciliation between GAAP results and results excluding special items (“non - GAAP”) is included in the Appendix of this document. Management discloses non - GAAP information to provide investors with additional information to analyze the Company’s performance and underlying trends. Management uses non - GAAP measures that exclude certain items in order to better assess operating performance and help investors compare results with our previous guidance. This document also references “free cash flow”, which the Company defines as cash flow from operations less additions to property, plant and equipment and purchased software. The Company’s non - GAAP information is not necessarily comparable to the non - GAAP information used by other companies. Non - GAAP information should not be viewed as a substitute for, or superior to, net income or other data prepared in accordance with GAAP as a measure of the Company’s profitability or liquidity. Readers should consider the types of events and transactions for which adjustments have been made. Forward - Looking Statements Non - GAAP Financial Information

| 3 CEO Perspective Jeff Benck President & Chief Executive Officer

| 4 Fourth Quarter and 2019 Summary Better than expected quarterly results in Semi - cap Year - over - year growth in Semi - cap and A&D in Q4 Medical revenues up >14% annually Momentum in Targeted Higher - value Markets Go - to - Market organization making progress Sector strategies driving disciplined customer selection Key new wins selling the full breadth of capabilities Continued Go - to - Market Progress San Jose site closure on track for 1H - 20; customer transitions underway Guaymas, Mexico operations sold versus closed First micro - electronics production units from Benchmark’s Lark facility in Phoenix Progress on Operational Efficiencies Working capital normalized at ~80 days after exiting the legacy computing contract Operating cash flow of $93 million and free cash flow of $58 million for the year Repurchased $122 million shares in 2019; $79 million authorization remaining Paid quarterly dividend of $0.15 per share Cash Flow and Capital Allocation

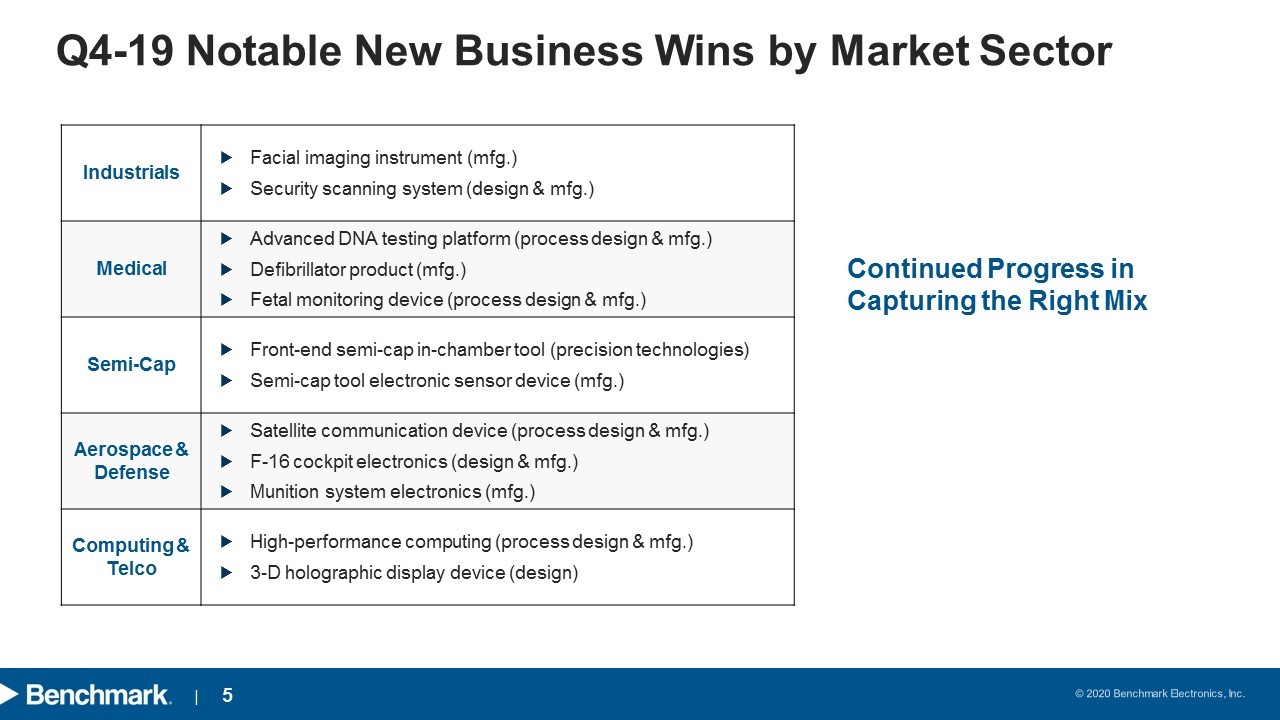

| 5 Q4 - 19 Notable New Business Wins by Market Sector Continued Progress in Capturing the Right Mix Industrials Facial imaging instrument (mfg.) Security scanning system (design & mfg.) Medical Advanced DNA testing platform ( process design & mfg.) Defibrillator product (mfg .) Fetal monitoring device ( process design & mfg.) Semi - Cap Front - end semi - cap in - chamber tool (precision technologies) Semi - cap tool electronic sensor device (mfg .) Aerospace & Defense Satellite communication device (process design & mfg.) F - 16 cockpit electronics (design & mfg.) Munition system electronics (mfg.) Computing & Telco High - performance computing (process design & mfg.) 3 - D holographic display device (design)

| 6 CFO Updates & Q4 - 19 and 2019 Financial Highlights Roop Lakkaraju Chief Financial Officer

| 7 Fourth Quarter 2019 Financial Summary See APPENDIX 1 for a reconciliation of GAAP to non - GAAP Financial Results For the Three Months Ended (In millions, except EPS) Dec. 31 , 2019 Sept. 30 , 2019 Q/Q Dec. 31 , 2018 Y/Y Net Sales $508 $555 (8%) $657 (23%) GAAP Operating Margin (1.8%) 1.8% (360 bps) 2.3% (410 bps) GAAP Diluted EPS ($0.19) $0.19 >(100%) $0.64 >(100%) Non - GAAP Operating Margin 2.6% 3.2% (60 bps) 3.2% (60 bps) Non - GAAP Diluted EPS $0.27 $0.36 (25%) $0.41 (34%) GAAP ROIC 2.9% 5.2% (230 bps) 6.2% (330 bps) Non - GAAP ROIC 7.4% 8.2% (80 bps) 9.2% (180 bps) Revenue (in millions) $ 505 – $ 510 Diluted EPS – non - GAAP $ 0.24 – $ 0.28 Updated Guidance for the Fourth Quarter:

| 8 Revenue by Market Sector For the Three Months Ended Higher - Value Markets Dec. 31 , 2019 Sept. 30 , 2019 Q/Q Dec. 31 , 2018 Y/Y Industrials 21% $107 21% $115 (6%) 18% $121 (11%) Aerospace & Defense 21% $106 21% $115 (8%) 16% $105 1% Medical 20% $103 23% $128 (20%) 16% $104 (1%) Semi - Cap 16% $81 12% $68 19% 11% $70 17% Total Revenue $397 $426 (7%) $400 (1%) (1) In millions Traditional Markets Dec. 31 , 2019 Sept. 30 , 2019 Q/Q Dec. 30 , 2018 Y/Y Computing 9% $45 11% $59 (25%) 26% $171 (74%) Telecommunications 13% $66 12% $70 (4%) 13% $86 (23%) Total Revenue $111 $129 (14%) $257 (57%)

| 9 GAAP Key Business Trends 15.3 16.1 11.9 9.8 - 9.3 2.3% 2.7% 2.0% 1.8% - 1.8% -3.0% -1.0% 1.0% 3.0% 5.0% 7.0% -20.0 -10.0 0.0 10.0 20.0 30.0 40.0 50.0 60.0 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 34.0 33.8 35.3 34.9 37.7 5.2% 5.6% 5.9% 6.3% 7.4% 0.0% 2.0% 4.0% 6.0% 8.0% 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 657 603 602 555 508 8.4% 8.9% 8.8% 9.5% 8.0% 1.0% 3.0% 5.0% 7.0% 9.0% 11.0% 13.0% 15.0% 0 500 1,000 1,500 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 829 835 840 835 819 51 47 44 43 24 6.2% 5.7% 5.3% 5.2% 2.9% -25.0% -15.0% -5.0% 5.0% 15.0% 0 500 1000 1500 2000 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Revenue ($M) and Gross Margin Operating Profit ($M) and Margin Return on Invested Capital (LTM) SG&A ($M) NOPAT Inv. Capital GAAP ROIC = (GAAP TTM income from operations – GAAP Tax Impact) ÷ (Average Invested Capital for last 5 quarters) Q4 - 19 Reflects Ransomware Incident Q4 - 19 Reflects Ransomware Incident

| 10 21.1 17.3 18.5 18.0 13.3 3.2% 2.9% 3.1% 3.2% 2.6% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 0.0 10.0 20.0 30.0 40.0 50.0 60.0 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 657 603 602 555 508 8.4% 8.8% 8.9% 9.5% 8.0% -1.0% 1.0% 3.0% 5.0% 7.0% 9.0% 11.0% 13.0% 15.0% 0 200 400 600 800 1,000 1,200 1,400 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q4 - 19 Reflects Ransomware Incident 829 835 840 835 819 76 70 69 68 61 9.2% 8.3% 8.2% 8.2% 7.4% -50.0% -40.0% -30.0% -20.0% -10.0% 0.0% 10.0% 20.0% 0 200 400 600 800 1000 1200 1400 1600 1800 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Non - GAAP Key Business Trends Revenue ($M) and Gross Margin Return on Invested Capital (LTM) SG&A ($M) 34.0 35.5 35.3 34.9 27.6 5.2% 5.9% 5.9% 6.3% 5.4% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Operating Profit ($M) and Margin NOPAT Inv. Capital Non - GAAP ROIC = (Non - GAAP TTM income from operations – Non - GAAP Tax Impact) ÷ [Average Invested Capital for last 5 quarters] Q4 - 19 Reflects Ransomware Incident

| 11 (In millions, except EPS) Dec. 31 , 2019 Dec. 31 , 2018 Q’18 to ‘19 Y/Y Net Sales $2,268 $2,566 ($298) (12%) Non - GAAP Gross Profit $200 $221 ($21) (10%) Non - GAAP Gross Margin % 8.8% 8.6% (20 bps) Non - GAAP SG&A $133 $141 ($8) (6%) Non - GAAP SG&A % 5.9% 5.5% 40 bps Non - GAAP Operating Profit $67 $80 ($13 ) (16%) Non - GAAP Operating Margin % 3.0% 3.1% (10 bps) Non - GAAP Diluted EPS $1.32 $1.45 ($0.13) (9%) Non - GAAP ROIC 7.4% 9.2% (180 bps) 2019 Financial Summary See APPENDIX 1 for a reconciliation of GAAP to non - GAAP Financial Results For the Twelve Months Ended

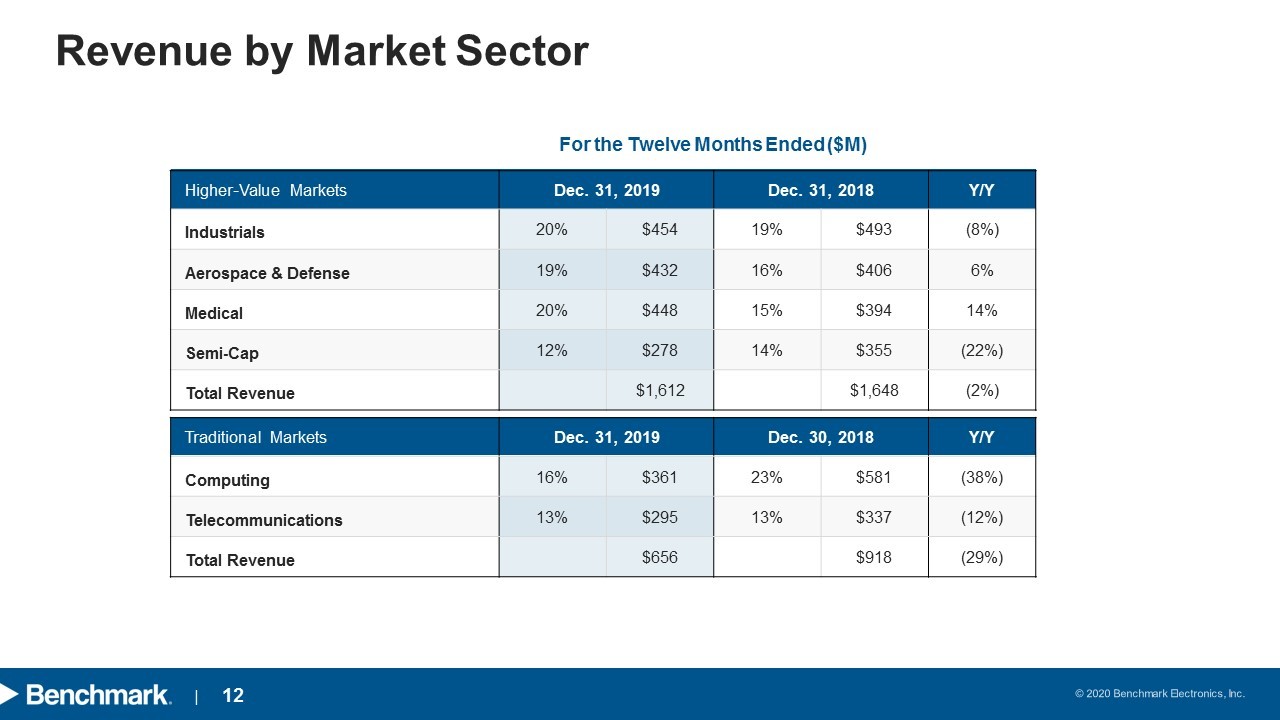

| 12 Revenue by Market Sector For the Twelve Months Ended ($M) Higher - Value Markets Dec. 31 , 2019 Dec. 31 , 2018 Y/Y Industrials 20% $454 19% $493 (8%) Aerospace & Defense 19% $432 16% $406 6% Medical 20% $448 15% $394 14% Semi - Cap 12% $278 14% $355 (22%) Total Revenue $1,612 $1,648 (2%) Traditional Markets Dec. 31 , 2019 Dec. 30 , 2018 Y/Y Computing 16% $361 23% $581 (38%) Telecommunications 13% $295 13% $337 (12%) Total Revenue $656 $918 (29%)

| 13 Cash Flow / Working Capital Highlights For the Twelve Months Ended For the Three Months Ended (1) Free cash flow (FCF) defined as net cash provided by (used in) operations less capex (In millions, except EPS) Dec. 31 , 2019 Dec. 31, 2018 Dec. 31 , 2019 Sept. 30 , 2019 Dec. 31, 2018 Cash Flows from (used in) Operations $93 $77 $36 ($11) $94 FCF $58 $10 $27 ($22) $80 Cash $364 $458 $364 $348 $458 International $198 $154 $198 $180 $154 US $166 $304 $166 $168 $304 Inventory $315 $310 $315 $316 $310 Accounts Receivable $324 $468 $324 $348 $468 Contract Assets $161 $140 $161 $161 $140 Accounts Payable $303 $422 $303 $296 $422 (1)

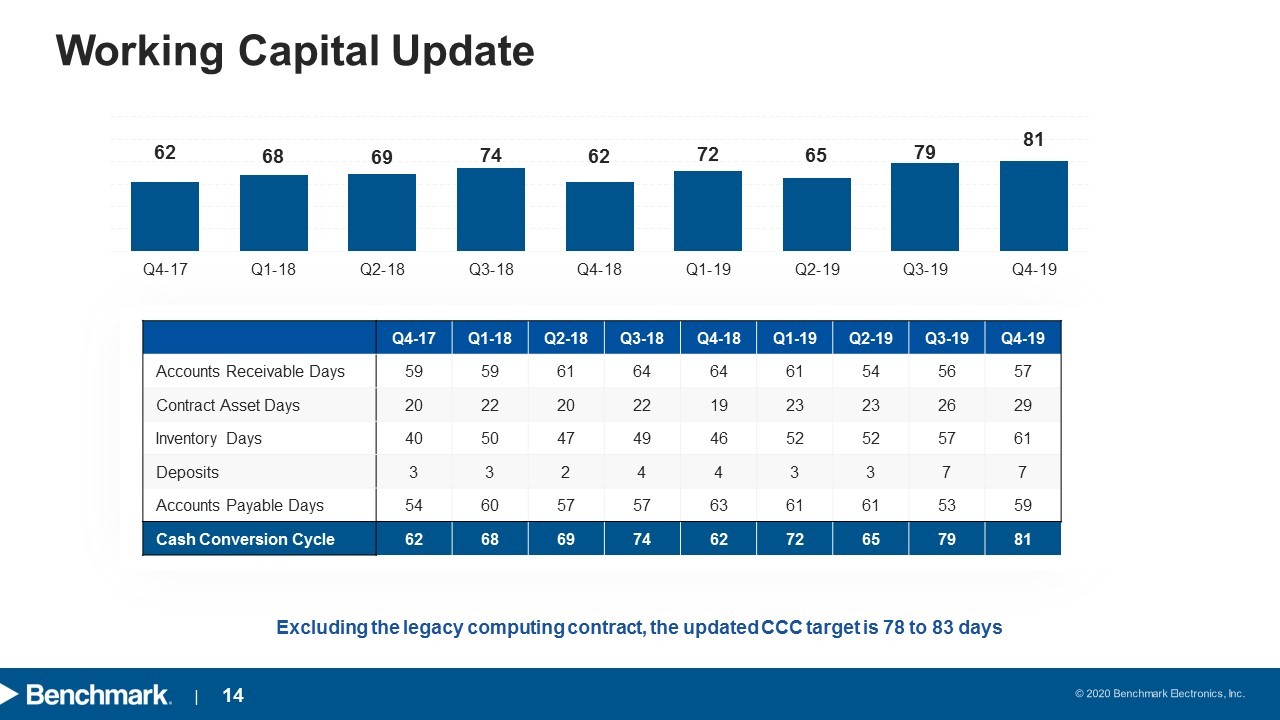

| 14 Working Capital Update Q4 - 17 Q1 - 18 Q2 - 18 Q3 - 18 Q4 - 18 Q1 - 19 Q2 - 19 Q3 - 19 Q4 - 19 Accounts Receivable Days 59 59 61 64 64 61 54 56 57 Contract Asset Days 20 22 20 22 19 23 23 26 29 Inventory Days 40 50 47 49 46 52 52 57 61 Deposits 3 3 2 4 4 3 3 7 7 Accounts Payable Days 54 60 57 57 63 61 61 53 59 Cash Conversion Cycle 62 68 69 74 62 72 65 79 81 Excluding the legacy computing contract, the updated CCC target is 78 to 83 days 62 68 69 74 62 72 65 79 81 Q4-17 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19

| 15 Capital Allocation Update Dividends Recurring quarterly dividend of $0.15 per share declared Dividend of $5.6 million paid in October 2019 Share Repurchases Share repurchases of $122 million completed as of December 31, 2019 Remaining authorization to repurchase shares of $79 million at December 31, 2019

| 16 First Quarter 2020 Guidance * The above guidance excludes the impact of amortization of intangible assets and estimated restructuring charges and other costs Guidance Net Sales (in millions) $ 530 – $570 Diluted EPS – non - GAAP* $0.32 – $ 0.38

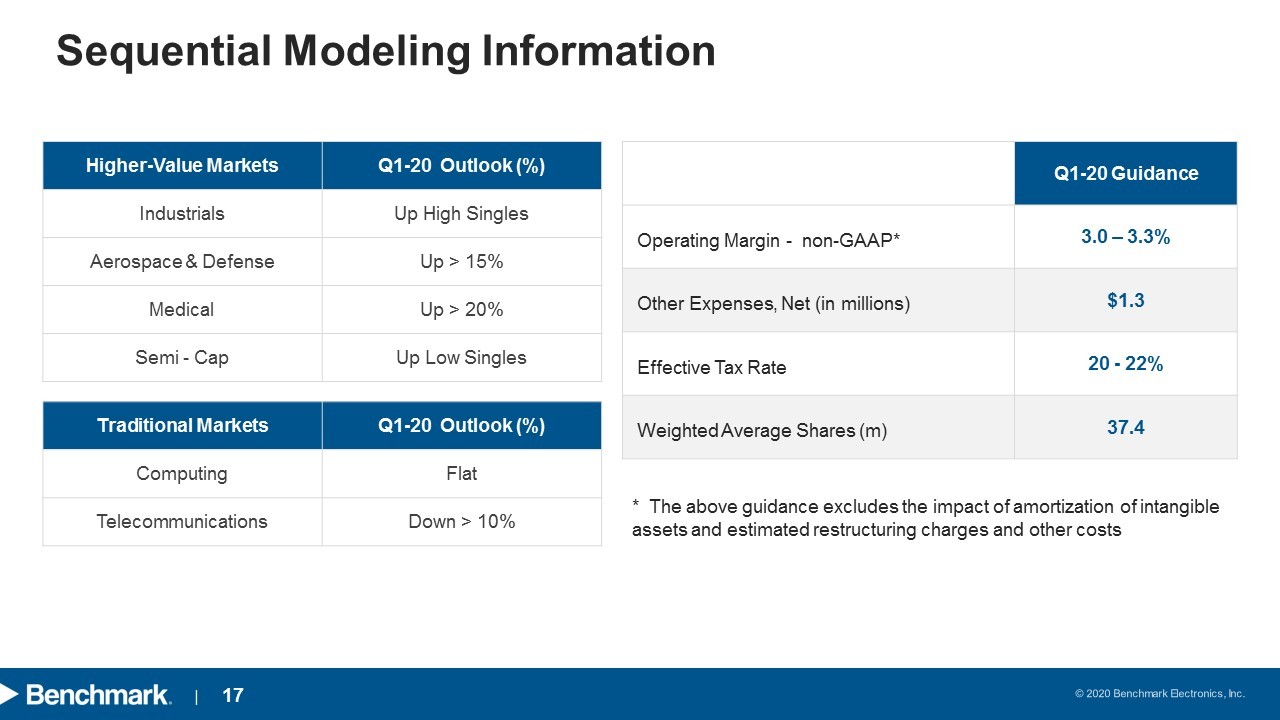

| 17 Sequential Modeling Information Higher - Value Markets Q1 - 20 Outlook (%) Industrials Up High Singles Aerospace & Defense Up > 15% Medical Up > 20% Semi - Cap Up Low Singles Traditional Markets Q1 - 20 Outlook (%) Computing Flat Telecommunication s Down > 10% Q1 - 20 Guidance Operating Margin - non - GAAP* 3.0 – 3.3% Other Expenses, Net (in millions) $ 1.3 Effective Tax Rate 20 - 22% Weighted Average Shares (m) 37.4 * The above guidance excludes the impact of amortization of intangible assets and estimated restructuring charges and other costs

| 18 2020 Goals and Initiatives Jeff Benck - CEO

| 19 2020 Expectations Overcoming revenue loss from exit of the legacy computing contract Higher - value market growth >10% to ~80% of total revenue Modest Year - over - Year Revenue Growth Targeting full year non - GAAP gross margins in the 9.2% to 9.6% range SG&A expenses in the range of $140 to $145 million Increasing M argins Expect full year cash flow from operations to be between $70 - $90 million Increased quarterly dividend by $0.01 to $0.16 per share Capital Allocation

| 20 Key Strategic Initiatives Change the relationship with our customers; differentiate with technology Revenue at the right target margin profile Focus on the Customer Be the best at what we do Effective asset utilization and margin expansion Drive Enterprise Efficiencies Invest in People, Process, and Solutions Revenue growth and margin expansion Growing our Business Drive empowerment, accountability, and ownership High functioning teams in a great workplace Engage Talent and Shift Culture

| 21 Appendix

| 22 (Amounts in Thousands, Except Per Share Data) – (UNAUDITED) APPENDIX 1 - Reconciliation of GAAP to non - GAAP Financial Results This amount represents the tax impact of the non - GAAP adjustments using the applicable effective tax rates. This amount represents the impact of repatriating foreign earnings from our foreign jurisdictions to the U.S. offset by available U.S. foreign tax credits, and a non - recurring tax true - up benefit as a result of finalizing our federal and state income tax accounting for the U.S. transitions toll tax from the 2017 Tax Cuts and Jobs Act. Three Months Ended Year Ended Dec 31, Sep 30, Dec 31, Dec 31, 2019 2019 2018 2019 2018 Income (loss) from operations (GAAP) $ (9,281) $ 9,798 $ 15,265 $ 28,545 $ 58,538 Restructuring charges and other costs 2,268 5,843 3,527 13,101 9,365 Ransomware incident related costs, net 7,681 - - 7,681 - Settlement (773) - - - - Customer insolvency (recovery) 11,036 - (113) 8,278 2,511 Amortization of intangible assets 2,366 2,367 2,384 9,461 9,485 Non - GAAP income from operations $ 13,297 $ 18,008 $ 21,063 $ 67,066 $ 79,899 Gross Profit (GAAP) $ 40,725 $ 52,883 $ 55,199 $ 200,406 $ 220,593 Settlement (773) - - - - Customer insolvency (recovery) 967 - (113) (73) 797 Non - GAAP gross profit $ 40,919 $ 52,883 $ 55,086 $ 200,333 $ 221,390 Net income (loss) (GAAP) $ (6,931) $ 7,136 $ 27,716 $ 23,425 $ 22,817 Restructuring charges and other costs 2,268 6,168 3,527 13,426 9,365 Ransomware incident related costs, net 7,681 - - 7,681 - Customer insolvency (recovery) 11,036 - (113) 8,278 2,511 Amortization of intangible assets 2,366 2,367 2,384 9,461 9,485 Settlements (773) (83) - (3,021) - Refinancing of credit facilities - - - - 1,982 Income tax adjustments (1) (5,385) (1,879) (1,050) (8,095) (4,592) Tax Cuts and Jobs Act (2) - - (14,529) - 26,008 Non - GAAP net income $ 10,262 $ 13,709 $ 17,935 $ 51,155 $ 67,576 Diluted earnings (loss) per share: Diluted (GAAP) $ (0.19) $ 0.19 $ 0.64 $ 0.60 $ 0.49 Diluted (Non - GAAP) $ 0.27 $ 0.36 $ 0.41 $ 1.32 $ 1.45 Weighted - average number of shares used in calculating diluted earnings (loss) per share: Diluted (GAAP) 36,928 37,645 43,229 38,763 46,655 Diluted (Non - GAAP) 37,374 37,645 43,229 38,763 46,655

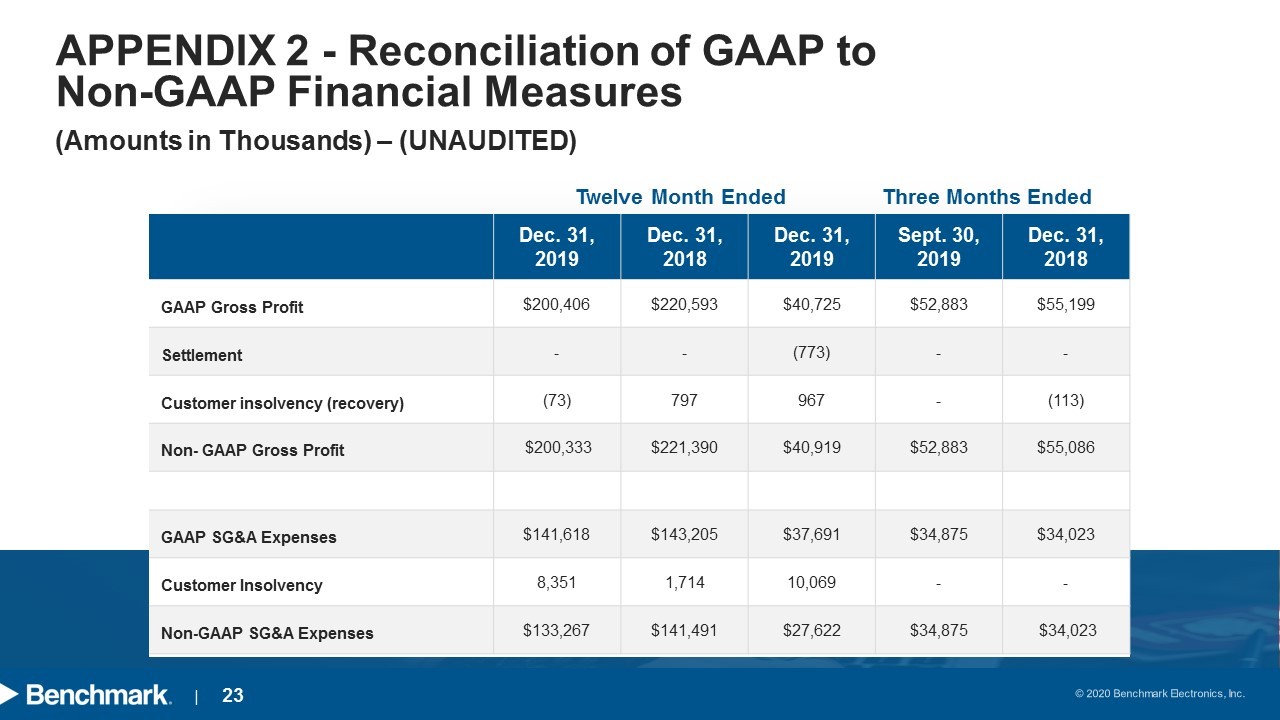

| 23 (Amounts in Thousands) – (UNAUDITED) APPENDIX 2 - Reconciliation of GAAP to Non - GAAP Financial Measures Twelve Month Ended Three Months Ended Dec. 31 , 2019 Dec. 31 , 2018 Dec. 31 , 2019 Sept. 30 , 2019 Dec. 31, 2018 GAAP Gross Profit $200,406 $ 220,593 $40,725 $52,883 $55,199 Settlement - - (773) - - Customer insolvency (recovery) (73) 797 967 - (113) Non - GAAP Gross Profit $200,333 $ 221,390 $40,919 $ 52,883 $55,086 GAAP SG&A Expenses $141,618 $143,205 $37,691 $34,875 $34,023 Customer Insolvency 8,351 1,714 10,069 - - Non - GAAP SG&A Expenses $133,267 $141,491 $27,622 $34,875 $34,023

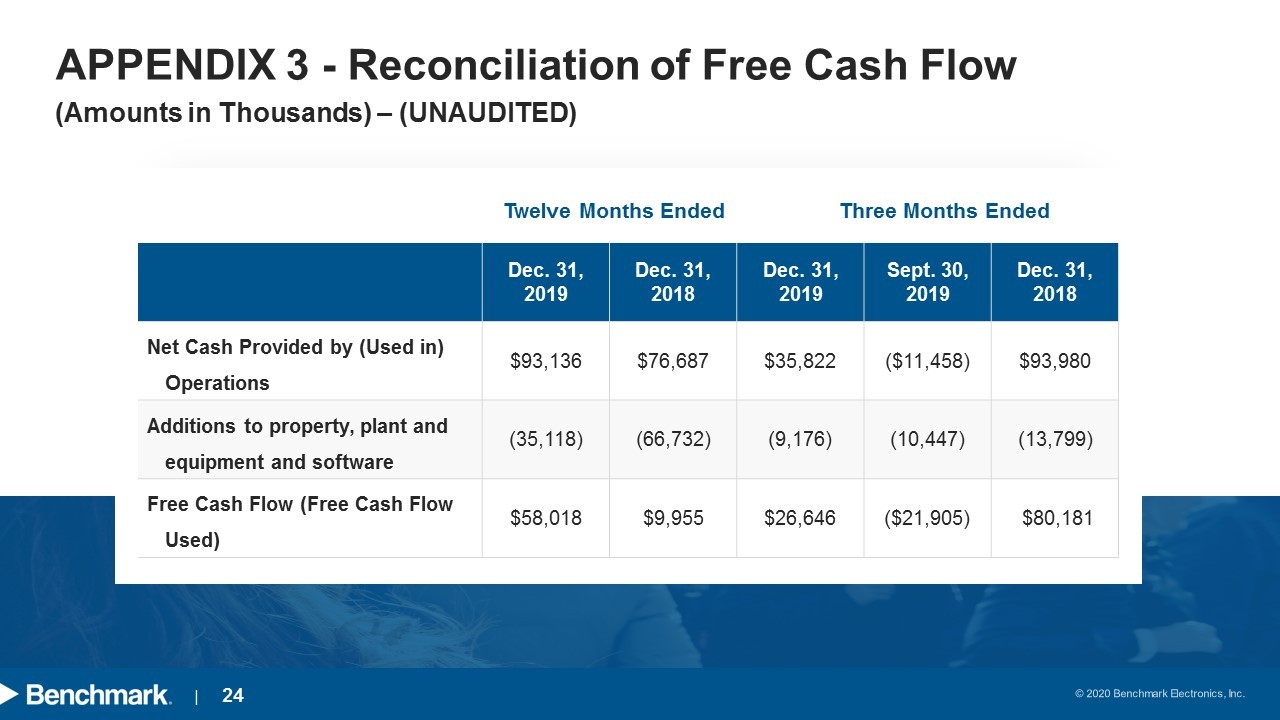

| 24 (Amounts in Thousands) – (UNAUDITED) APPENDIX 3 - Reconciliation of Free Cash Flow Twelve Months Ended Three Months Ended Dec. 31, 2019 Dec. 31, 2018 Dec. 31 , 2019 Sept. 30 , 2019 Dec. 31, 2018 Net Cash Provided by (Used in) Operations $93,136 $76,687 $35,822 ($11,458) $93,980 Additions to property, plant and equipment and software (35,118) (66,732) (9,176) (10,447) (13,799) Free Cash Flow (Free Cash Flow Used) $58,018 $9,955 $26,646 ($21,905) $80,181