Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - UGI CORP /PA/ | ugidec2019ex991.htm |

| 8-K - 8-K - UGI CORP /PA/ | ugidec2019er8k.htm |

Fiscal 2020 First Quarter Results John L. Walsh President & CEO, UGI Corporation Ted J. Jastrzebski Chief Financial Officer, UGI Corporation Robert F. Beard Executive Vice President Natural Gas, UGI Corporation

About This Presentation This presentation contains certain forward-looking statements that management believes to be reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control. You should read UGI’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. Among them are adverse weather conditions (particularly during the winter heating season), cost volatility and availability of all energy products, including propane, other LPG, natural gas, electricity and fuel oil, increased customer conservation measures, the impact of pending and future legal proceedings, the capacity to transport product to our customers, liability for uninsured claims and for claims in excess of insurance coverage, political, regulatory and economic conditions in the United States, Europe, and in other foreign countries, 2 including the current conflicts in the Middle East, the withdrawal of the United Kingdom from the European Union, and foreign currency exchange rate fluctuations (particularly the euro), changes in Marcellus and Utica Shale gas production, the availability, timing and success of our acquisitions, commercial initiatives and investments to grow our business, our ability to successfully integrate acquired businesses and achieve anticipated synergies, the interruption, disruption, failure, malfunction, or breach of our information technology systems, including due to cyber-attack, the inability to complete pending or future infrastructure projects, and our ability to achieve operational benefits and cost efficiencies from our business transformation initiatives. UGI undertakes no obligation to release revisions to its forward-looking statements to reflect events or circumstances occurring after today. UGI Corporation | Fiscal 2020 First Quarter Results 2

First Quarter Recap 3 John L. Walsh President & CEO, UGI

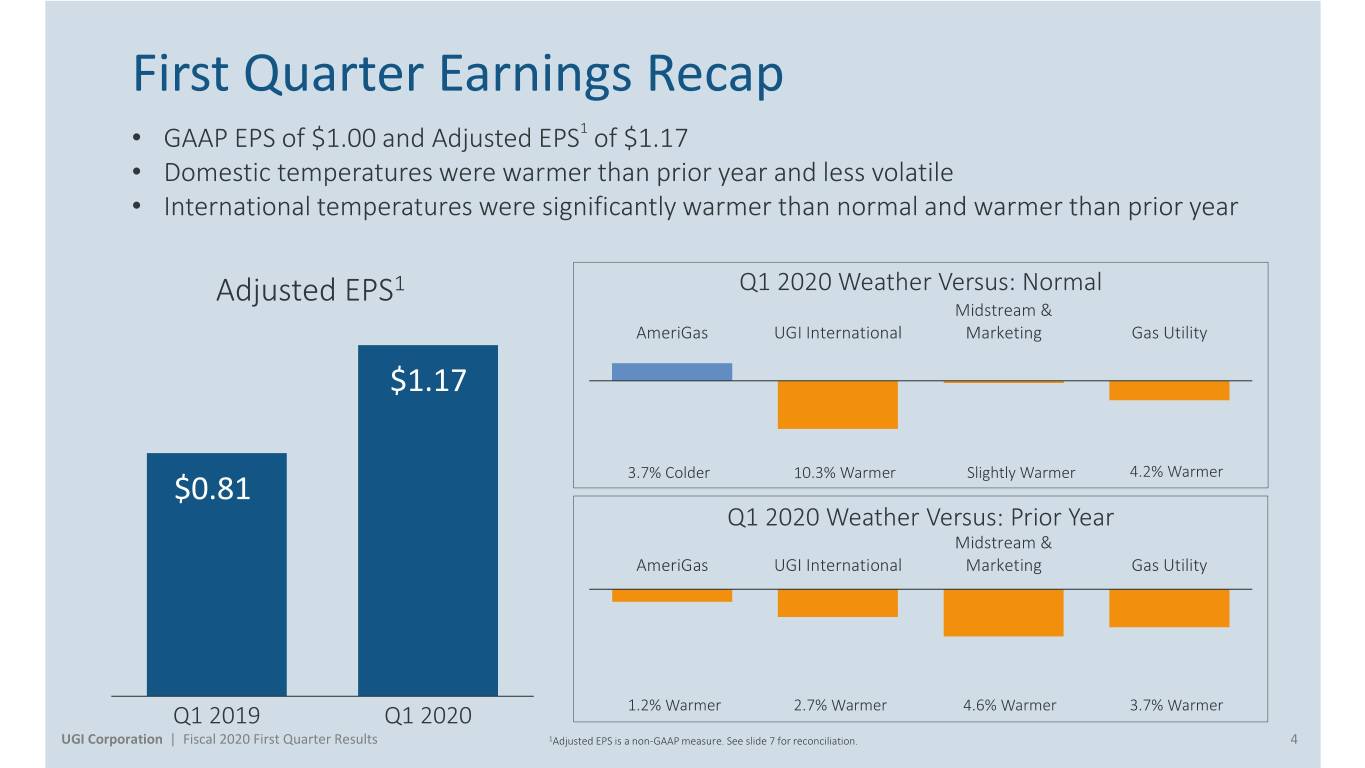

First Quarter Earnings Recap • GAAP EPS of $1.00 and Adjusted EPS1 of $1.17 • Domestic temperatures were warmer than prior year and less volatile • International temperatures were significantly warmer than normal and warmer than prior year Adjusted EPS1 Q1 2020 Weather Versus: Normal Midstream & AmeriGas UGI International Marketing Gas Utility $1.17 4.2% Warmer $0.81 3.7% Colder 10.3% Warmer Slightly Warmer Q1 2020 Weather Versus: Prior Year Midstream & AmeriGas UGI International Marketing Gas Utility Q1 2019 Q1 2020 1.2% Warmer 2.7% Warmer 4.6% Warmer 3.7% Warmer UGI Corporation | Fiscal 2020 First Quarter Results 1Adjusted EPS is a non-GAAP measure. See slide 7 for reconciliation. 4

Key Accomplishments • Midstream & Marketing had a very successful first full quarter with the CMG systems and team fully integrated. The additional fee- based revenue contributed to a 45% EBIT increase vs. the prior year. • Utilities added approximately 4,000 new residential heating and commercial customers in Q1 and remains on pace with its infrastructure replacement program. • Growth drivers continue to deliver for AmeriGas as National Accounts and Cylinder Exchange volumes increased 12% and 7%, respectively. • UGI International benefitted from higher grain drying volumes, strong margin management enabled by lower LPG costs, and lower operating expenses resulting from lower maintenance and outside services costs. UGI Corporation | Fiscal 2020 First Quarter Results 5

First Quarter Financial Review Ted J. Jastrzebski Chief Financial Officer, UGI

First Quarter Adjusted Earnings UGI Corporation | Fiscal 2020 First Quarter Results 7

First Quarter Results Recap Adjusted EPS1 $0.14 $0.00 $0.01 $(0.05) $1.173 $1.17 $0.26 $0.29 UGI Utilities 1 $0.81 $0.812 Midstream & $0.17 Marketing $0.28 UGI $0.34 International Adjusted EPS Adjusted 1.2% 2.7% 4.6% 3.7% $0.17 Warmer Warmer Warmer Warmer than prior year $0.20 $0.43 $0.17 AmeriGas Q1 2019 AmeriGas UGI Midstream & UGI Utilities Corp & Other Q1 2020 Q1 2019 Q1 2020 International Marketing 1Adjusted EPS is a non-GAAP measure. See slide 7 for reconciliation. UGI Corporation | Fiscal 2020 First Quarter Results 2 Includes ($0.01) Corporate & Other 8 3 Includes ($0.06) Corporate & Other

Financial Results - AmeriGas (Millions of dollars) FY 2019 FY 2020 Weather versus normal Earnings Before Interest Expense & Income Taxes $166.6 Total Margin (0.5) Operating and Administrative Expenses (4.9) 4.9% Depreciation and Amortization 1.8 3.7% Other Income and Expense, net 2.3 Q1 2019 Q1 2020 Earnings Before Interest Expense & Income Taxes $165.3 Item Primary Drivers Warmer Volume ↓ Colder weather in October and November offset by December weather that was 9% warmer than normal Total Margin Lower volume largely offset by higher retail and wholesale unit margins 1.2% warmer than prior Operating and Admin Expenses ↑ Higher general insurance and vehicle lease expenses year Other Income ↑ Gain on sale of excess real estate UGI Corporation | Fiscal 2020 First Quarter Results 9

Financial Results – UGI International (Millions of dollars) FY 2019 FY 2020 Weather versus normal Earnings Before Interest Expense & Income Taxes $59.0 Colder Total Margin 30.9 Operating and Administrative Expenses 6.9 Realized FX Gains 3.6 Other Income and Expense, net (0.2) Earnings Before Interest Expense & Income Taxes $100.2 (8.0)% (10.3)% Item Primary Drivers Volume ↑ Strong bulk volumes associated with crop drying Q1 2019 Q1 2020 Total Margin ↑ Higher LPG unit margins, higher crop drying volumes, partially offset by the translation effects of the weaker euro, lower cylinder volumes and the effects of warm weather on Warmer heating-related bulk sales 2.7% warmer than prior Operating and Admin Weaker euro ($4 million), lower maintenance and outside service costs year Expenses ↓ 10 UGI Corporation | Fiscal 2020 First Quarter Results

Financial Results – Midstream & Marketing (Millions of dollars) FY 2019 FY 2020 Weather versus normal Earnings Before Interest Expense & Income Taxes $42.6 Colder Total Margin 26.4 Operating and Administrative Expenses (5.7) Depreciation and Amortization (6.9) 4.1% Slightly Other Income and Expense, net 5.2 Warmer Earnings Before Interest Expense & Income Taxes $61.6 Q1 2019 Q1 2020 Item Primary Drivers Total Margin ↑ Incremental margin from CMG and Auburn IV, partially offset by lower capacity management and generation margins Warmer Operating and Admin Expenses ↑ Largely due to CMG expenses 4.6% warmer than prior Depreciation and Amortization↑ Expansion of gathering assets, principally CMG year Other Income↑ Equity income from Pennant system acquired as part of the CMG Acquisition UGI Corporation | Fiscal 2020 First Quarter Results 11

Financial Results – Utilities (Millions of dollars) FY 2019 FY 2020 Weather versus normal Earnings Before Interest Expense & Income Taxes $77.4 Colder Total Margin 14.7 Operating and Administrative Expenses 3.1 Depreciation (3.2) Other Income and Expense, net (0.4) (0.5)% (4.2)% Earnings Before Interest Expense & Income Taxes $91.6 Q1 2019 Q1 2020 Item Primary Drivers Core Market Volume ↓ Warm weather partially offset by customer growth and higher use per customer Total Margin ↑ Increase in base rates and higher margin from large firm and interruptible Warmer delivery service customers 3.7% warmer than prior Operating and Admin Expenses ↓ Lower uncollectible accounts and compensation and benefits expenses year Depreciation ↑ Increased IT and distribution system capital expenditure activity UGI Corporation | Fiscal 2020 First Quarter Results 12

Update on CMG Acquisition & Natural Gas Business Robert F. Beard Executive Vice President Natural Gas, UGI

Update • CMG delivered solid performance in Q1 • Driven by throughput contracts and efficiency gains • $300 - $500 million of expansion opportunities • Auburn IV placed in service November 1st; increasing the throughput of the system by over 40% • PennEast recently filed two requests with FERC • Routine filing to extend in-service date by 2 years • Request to phase construction of the project; initial delivery points in Pennsylvania include originally planned connections with UGI Utilities and Columbia Pipeline and an additional delivery to the Adelphia Gateway Pipeline • PennEast intends to file a petition with the US Supreme Court • Review 3rd Circuit decision regarding tracts in which the state holds an interest • FERC issued a declaratory order that aligns with PennEast’s view that the Natural Gas Act gives FERC the authority to grant condemnation rights over tracks in which the state holds an interest • On January 28th UGI Utilities filed a request with the PA PUC to increase base rates by $75 million • Driven by record capital spending to expand and replace infrastructure; $2 billion over the next 5 years UGI Corporation | Fiscal 2020 First Quarter Results 14

Conclusion and Q&A John L. Walsh President & CEO, UGI

Strategic Overview • Continue to see significant demand for LNG peaking • Bethlehem storage and vaporization facility remains on schedule for late 2020 completion • Portable LNG systems • Remain active in the NE Marcellus • Auburn IV expansion project placed in service November 1st, supported by 10-year take or pay commitment • PennEast to pursue a phased development plan • Made significant progress in Q1 on LPG business transformation programs • AmeriGas – target of $120 million of permanent operational efficiencies • UGI International –target of €30 million of permanent operational efficiencies • On January 28th we filed a new rate case for our Gas Utility • Request totals $74.6 million • Expect the process will conclude by early fall UGI Corporation | Fiscal 2020 First Quarter Results 16

Q&A

Appendix

UGI Supplemental Footnotes • Management uses "adjusted net income attributable to UGI Corporation" and "adjusted earnings per share," both of which are non-GAAP financial measures, when evaluating UGI's overall performance. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminates the impact of (1) gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions and (2) other significant discrete items that can affect the comparison of period-over-period results. Volatility in net income at UGI can occur as a result of gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions but included in earnings in accordance with U.S. generally accepted accounting principles ("GAAP"). • Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. • The table on slide 7 reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and reconciles diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to above. UGI Corporation | Fiscal 2020 First Quarter Results 19

Investor Relations: Brendan Heck Alanna Zahora 610-456-6608 610-337-1004 heckb@ugicorp.com zahoraa@ugicorp.com