Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ROYAL GOLD INC | ex-99d1.htm |

| 8-K - 8-K - ROYAL GOLD INC | rgld-20190205x8k69f72f5.htm |

Exhibit 99.2

| NASDAQ: RGLD February 6, 2020 Fiscal Q2 2020 Results |

| 2 Cautionary Statement Cautionary “Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from the projections and estimates contained in this presentation. These forward-looking statements include, among others, statements with regard to: the timing of various developments at Khoemacau, including first concentrate shipments, boxcut transfers, grid power connectivity and future payments of the Company’s remaining commitments under the Khoemacau stream agreement; the timing and potential impact of the updated 43-101 technical report at Mount Milligan; the anticipated schedule of concentrate shipments from Andacollo following the strike and suspension; the expected timing of release of the Rainy River study; Newmont’s anticipation of full-year production at higher grades at Peñasquito; expected tax rates for fiscal 2020; expected stream segment sales for the March quarter; expected non-cash compensation expenses to be incurred in connection with the changes in senior leadership; and expected DD&A price ranges per GEO for fiscal 2020. Factors that could cause actual results to differ materially from forward-looking statements include, among others: precious metals, copper and nickel prices; performance of and production at the Company's stream and royalty properties; decisions and activities of the operators of the Company's stream and royalty properties; unanticipated grade, environmental, geological, seismic, metallurgical, processing, liquidity or other problems the operators of the Company’s stream and royalty properties may encounter; operators’ inability to access sufficient raw materials; water or power problems; changes in operators’ project parameters as plans continue to be refined, including reductions in estimates of reserves and mineralization by the operators of the Company’s stream and royalty properties; the ability of operators to finance project construction to completion and bring projects into production as expected, including development stage mining properties, mine and mill expansion projects and other development and construction projects; operators’ delay in securing or inability to secure or maintain necessary governmental permits; contests to the Company’s stream and royalty interests and title and other defects in the properties where the Company holds stream and royalty interests; errors or disputes in calculating stream deliveries and royalty payments, or deliveries or payments not made in accordance with stream and royalty agreements; the risks associated with conducting business in foreign countries, including application of foreign laws to contract and other disputes, foreign environmental laws and enforcement of those laws; economic and market conditions; changes in laws governing the Company and its stream and royalty interests or the operators of the properties subject to the interests, and other subsequent events. These risks and other factors are discussed in more detail in the Company’s public filings with the Securities and Exchange Commission. Statements made in this presentation are as of the date hereof or as of the date indicated and should not be relied upon as of any subsequent date. The Company’s past performance is not necessarily indicative of its future performance. The Company disclaims any obligation to update any forward-looking statements. Third-party information: Certain information on slides 5 through 8 of this presentation was provided to the Company by Cupric Canyon Capital LP, the majority owner and developer of the Khoemacau Project. The production, design, engineering, construction and equipment information, and other technical and economic information provided to the Company and presented here, or forming the basis of information presented here, is not publicly available. This information may not have been prepared in accordance with applicable laws, stock exchange rules or international standards governing preparation and public disclosure of technical data and information relating to mineral properties. The Company has not verified, and is not in a position to verify, and expressly disclaims any responsibility for the accuracy, completeness, or fairness of this third-party information, and investors are cautioned not to rely on this information. Certain information on slides 9 and 10 of this presentation has been provided to the Company by the operators of properties subject to our stream and royalty interests, or is publicly available information filed by these operators with applicable securities regulatory bodies, including the Securities and Exchange Commission. The Company has not verified, and is not in a position to verify, and expressly disclaims any responsibility for the accuracy, completeness or fairness of third-party information and refers readers to the public reports filed by the operators for information regarding those properties . |

| Today’s Speakers 3 Bill Heissenbuttel President and CEO Paul Libner CFO and Treasurer Mark Isto Executive VP and COO |

| Q2 2020 Overview Highlights Volume of 83,500 GEOs1 Revenue of $123.6M $41.3M net income ($0.63/share) $78.3M cash flow from operations $17.4M in dividends Balance sheet continues to strengthen Revolver balance reduced by $35.0M ~$1B of liquidity at December 31, 2019 Well-positioned for new investment opportunities 4 |

| Recent Developments Khoemacau progress2 Construction activities advancing well • 1,600 workers on site • Overall progress ~26% • Capital committed ~77% $22.0M contribution made February 5 • $87.6M total contribution to date • Remaining commitment of $124.2M to $177.2M 5 Peñasquito Rainy River Khoemacau U/G mine equipment |

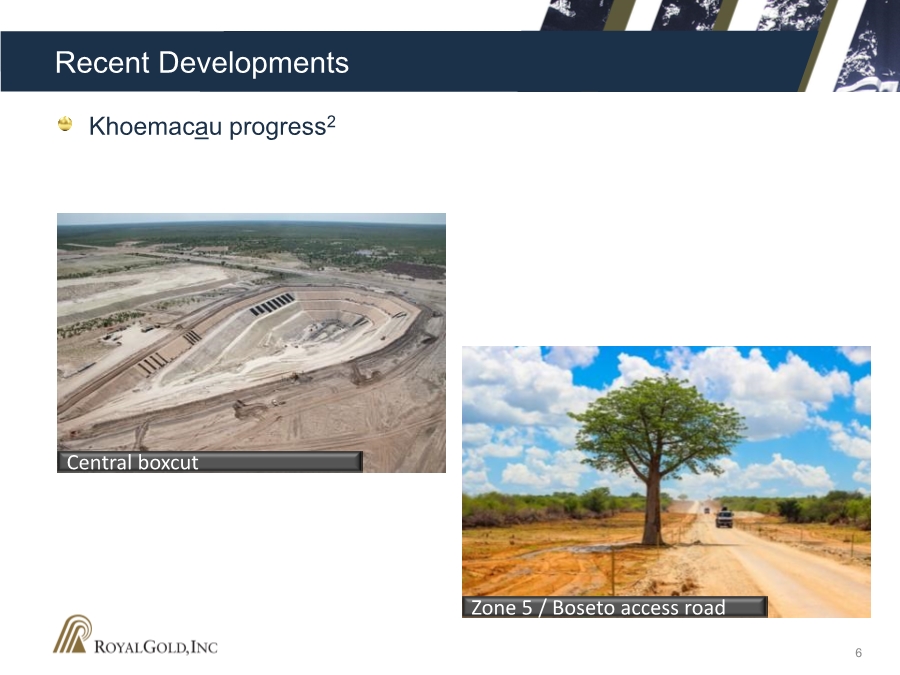

| Recent Developments Khoemacau progress2 6 Zone 5 / Boseto access road Central boxcut |

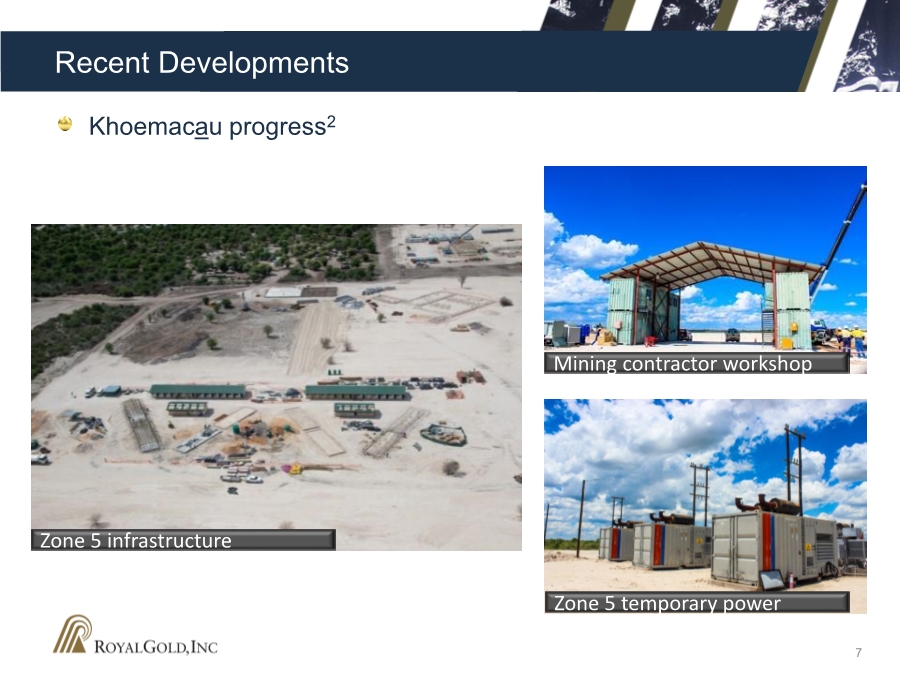

| Recent Developments Khoemacau progress2 7 Zone 5 infrastructure Mining contractor workshop Zone 5 temporary power |

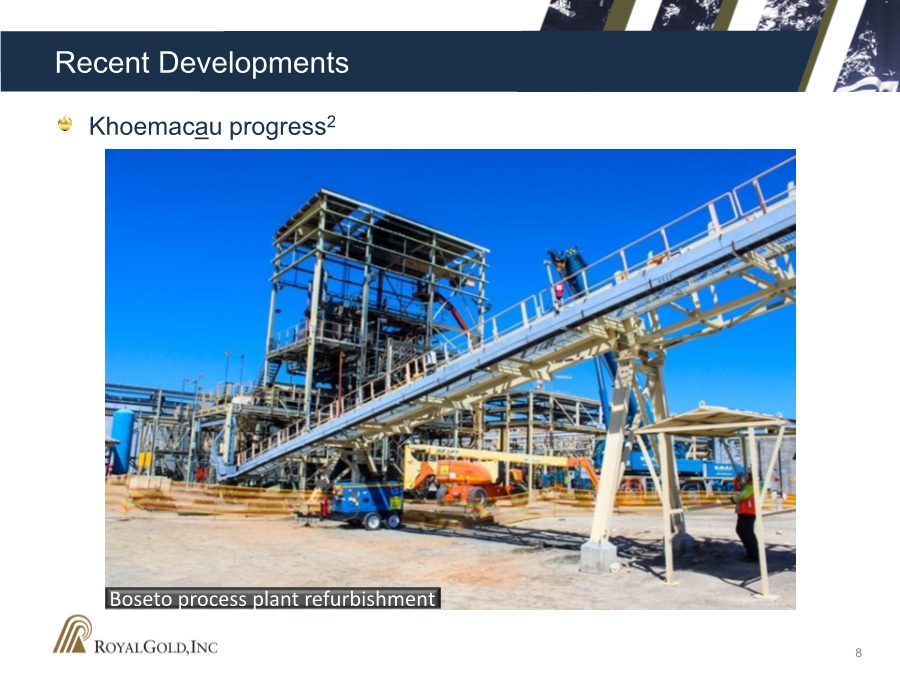

| Recent Developments Khoemacau progress2 8 Boseto process plant refurbishment |

| Recent Developments Mount Milligan, Rainy River as reported by the operators3 9 Stream deliveries received*: • 18.8k oz gold • 4.4M lb copper Updated 43-101 report underway Royal Gold depletion $402/oz gold, $0.81/lb copper* Mount Milligan 254k oz gold production in calendar 2019 22.5k tpd average throughput for the quarter • 89% mill availability, 91% gold recovery Optimization study continuing • Results to be released February 13 Royal Gold depletion $591/oz gold, $6.34/oz silver* Rainy River |

| Recent Developments Andacollo, Peñasquito as reported by the operators3 10 Operations resumed December 5 • 36-month collective agreement reached Production suspended for ~8 weeks • Stream deliveries typically received ~6 months after shipment* Rainy River Peñasquito Andacollo Blockade lifted October 8 • Concentrate shipments resumed immediately • Operations restarted October 22 • 30-year water agreement with San Juan de Cedros community reached December 13 Higher grades expected in 2020 • Full year production target of 575k oz gold, 30M oz silver, 425M lb zinc, 200M lb lead Peñasquito |

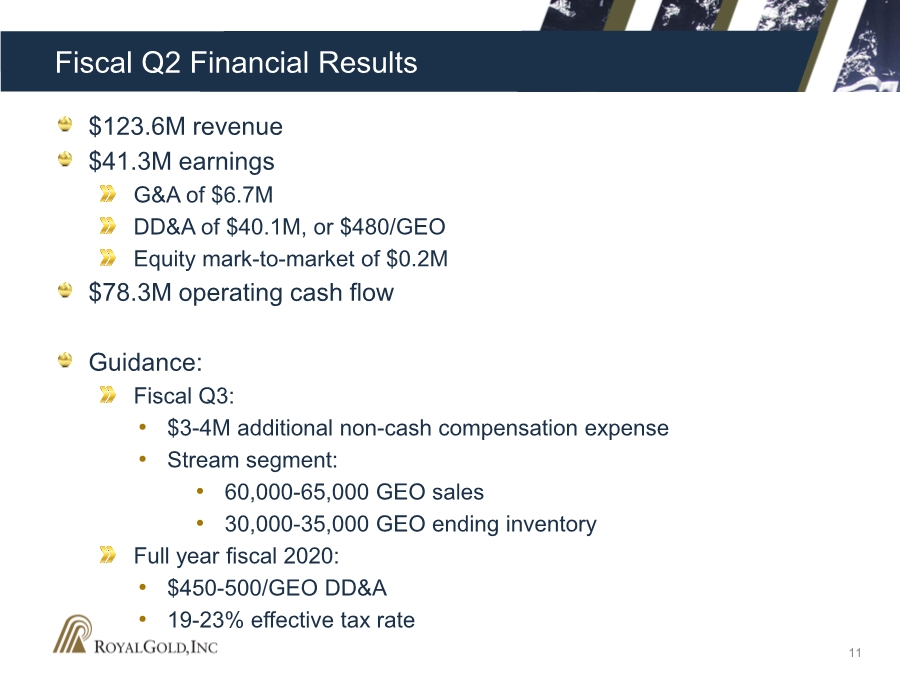

| Fiscal Q2 Financial Results 11 $123.6M revenue $41.3M earnings G&A of $6.7M DD&A of $40.1M, or $480/GEO Equity mark-to-market of $0.2M $78.3M operating cash flow Guidance: Fiscal Q3: • $3-4M additional non-cash compensation expense • Stream segment: • 60,000-65,000 GEO sales • 30,000-35,000 GEO ending inventory Full year fiscal 2020: • $450-500/GEO DD&A • 19-23% effective tax rate |

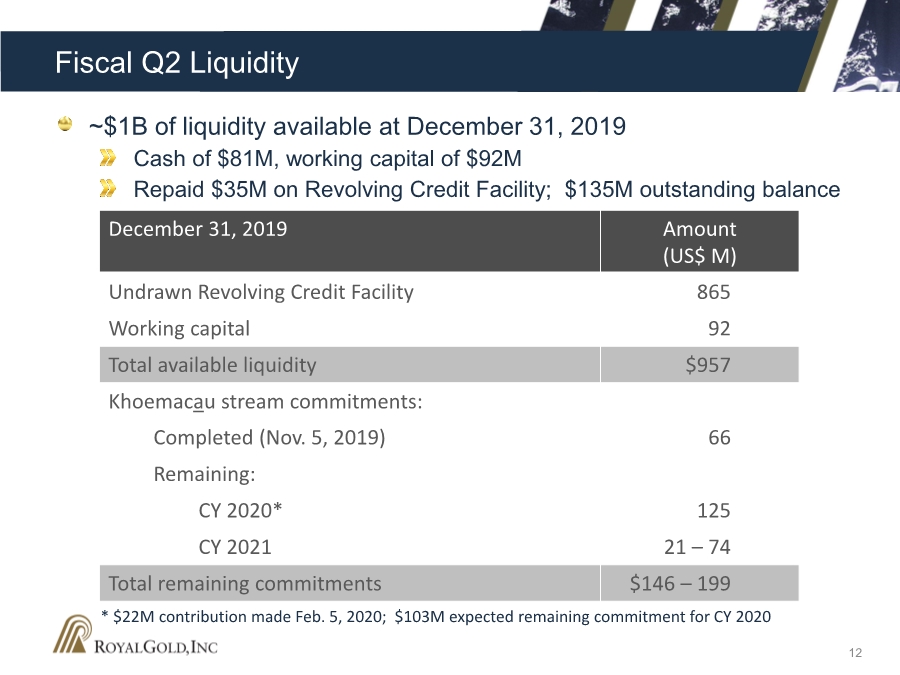

| Fiscal Q2 Liquidity ~$1B of liquidity available at December 31, 2019 Cash of $81M, working capital of $92M Repaid $35M on Revolving Credit Facility; $135M outstanding balance 12 December 31, 2019 Amount (US$ M) Undrawn Revolving Credit Facility 865 Working capital 92 Total available liquidity $957 Khoemacau stream commitments: Completed (Nov. 5, 2019) 66 Remaining: CY 2020* 125 CY 2021 21 – 74 Total remaining commitments $146 – 199 * $22M contribution made Feb. 5, 2020; $103M expected remaining commitment for CY 2020 |

| Disciplined Strategy, Successful Results Solid operating and financial performance Strong balance sheet Excellent access to liquidity Board and management team positioned for success 13 |

| Endnotes |

| Endnotes 1. Gold Equivalent Ounces (“GEOs”) are calculated as revenue divided by the average gold price for the corresponding period. 2. Certain information on this slide was provided to the Company by Khoemacau Copper Mining (Pty.) Limited, the majority owner and developer of the Khoemacau Project. The production, design, engineering, construction and equipment information, and other technical and economic information provided to the Company and presented here, or forming the basis of information presented here, is not publicly available. This information may not have been prepared in accordance with applicable laws, stock exchange rules or international standards governing preparation and public disclosure of technical data and information relating to mineral properties. The Company has not verified, and is not in a position to verify, and expressly disclaims any responsibility for the accuracy, completeness, or fairness of this third- party information, and investors are cautioned not to rely on this information. 3. Except as noted with an asterisk, all information on this slide has been provided by the operators of these properties or is publicly available information disclosed by the operators. 15 |

| 1144 15th St, #2500 Denver, Colorado 80202 303.573.1660 www.royalgold.com NASDAQ: RGLD |