Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MEDICAL PROPERTIES TRUST INC | d881788dex991.htm |

| 8-K - FORM 8-K - MEDICAL PROPERTIES TRUST INC | d881788d8k.htm |

Exhibit 99.2

Medical Properties Trust FOURTH QUARTER 2019 Supplemental Information

TABLE OF CONTENTS COMPANY OVERVIEW Company Information 3 FINANCIAL INFORMATION Reconciliation of Net Income to Funds from Operations 5 Debt Summary 6 Debt Maturity Schedule 7 Pro Forma Net Debt /Annualized Adjusted EBITDA 8 PORTFOLIO INFORMATION Lease and Loan Maturity Schedule 9 Total Pro Forma Gross Assets and Actual Revenue by Asset Type, Operator, State and Country 10 EBITDARM to Rent Coverage 13 Summary of Acquisitions and Development Projects 14 FINANCIAL STATEMENTS Consolidated Statements of Income 15 Consolidated Balance Sheets 16 Unconsolidated Joint Venture Investments 17 MEDICALPROPERTIESTRUST.COM FORWARD-LOOKING STATEMENT Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results of the Company or future events to differ materially from those expressed in or underlying such forward-looking statements, including without limitation: Normalized FFO per share; expected payout ratio, the amount of acquisitions of healthcare real estate, if any; estimated debt metrics, portfolio diversification, capital markets conditions, the repayment of debt arrangements; statements concerning the additional income to the Company as a result of ownership interests in certain hospital operations and the timing of such income; the payment of future dividends, if any; completion of additional debt arrangement, and additional investments; national and international economic, business, real estate and other market conditions; the competitive environment in which the Company operates; the execution of the Company’s business plan; financing risks; the Company’s ability to maintain its status as a REIT for federal income tax purposes; acquisition and development risks; potential environmental and other liabilities; and other factors affecting the real estate industry generally or healthcare real estate in particular. For further discussion of the factors that could affect outcomes, please refer to the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, and as updated by the Company’s subsequently filed Quarterly Reports on Form 10-Q and other SEC filings. Except as otherwise required by the federal securities laws, the Company undertakes no obligation to update the information in this report. Certain information in the supplemental package is shown pro forma for the consummation of pending transactions. The pro forma adjustments are based upon available information and assumptions that we believe are reasonable. There is no assurance that the pending transactions will occur. On the cover: Clinique Valmont, an acute care hospital in Switzerland owned by Infracore SA. MPT owns a minority interest in Infracore. On page 2: Clinique de Genolier, an acute care hospital in Switzerland owned by Infracore SA. Q4 2019 | SUPPLEMENTAL INFORMATION

COMPANY OVERVIEW Medical Properties Trust, Inc. is a self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities. From its inception in Birmingham, Alabama, the Company has grown to become one of the world’s largest owners of hospitals with 389 facilities and approximately 41,000 licensed beds in eight countries and across three continents. MPT’s financing model facilitates acquisitions and recapitalizations and allows operators of hospitals to unlock the value of their real estate assets to fund facility improvements, technology upgrades and other investments in operations. Edward K. Aldag, Jr. Chairman, President and Chief Executive Officer R. Steven Hamner Executive Vice President and Chief Financial Officer Emmett E. McLean Executive Vice President, Chief Operating Officer and Secretary J. Kevin Hanna Vice President, Controller and Chief Accounting Officer Rosa H. Hooper Vice President, Managing Director of Asset Management and Underwriting R. Lucas Savage Vice President, International Acquisitions Charles R. Lambert Treasurer and Managing Director of Capital Markets BOARD OF DIRECTORS Edward K. Aldag, Jr. G. Steven Dawson R. Steven Hamner Elizabeth N. Pitman D. Paul Sparks, Jr. Michael G. Stewart C. Reynolds Thompson, III CORPORATE HEADQUARTERS Medical Properties Trust, Inc. 1000 Urban Center Drive, Suite 501 Birmingham, AL 35242 (205) 969-3755 (205) 969-3756 (fax) www.medicalpropertiestrust.com MPT Officers: R. Steven Hamner, Emmett E. McLean, Edward K. Aldag, Jr., Rosa H. Hooper, J. Kevin Hanna and Charles R. Lambert. Not pictured: R. Lucas Savage. Q4 2019 | SUPPLEMENTAL INFORMATION 3

COMPANY OVERVIEW (continued) INVESTOR RELATIONS Tim Berryman Director of Investor Relations (205) 397-8589 tberryman@medicalpropertiestrust.com CAPITAL MARKETS Charles Lambert Treasurer and Managing Director of Capital Markets (205) 397-8897 clambert@medicalpropertiestrust.com TRANSFER AGENT American Stock Transfer and Trust Company 6201 15th Avenue Brooklyn, NY 11219 STOCK EXCHANGE LISTING AND TRADING SYMBOL New York Stock Exchange (NYSE): MPW SENIOR UNSECURED DEBT RATINGS Moody’s – Ba1 Standard & Poor’s – BBB- Q4 Above: Clinique de Valère, an acute care hospital in Switzerland owned by Infracore SA. MEDICALPROPERTIESTRUST.COM Q4 2019 | SUPPLEMENTAL INFORMATION 4

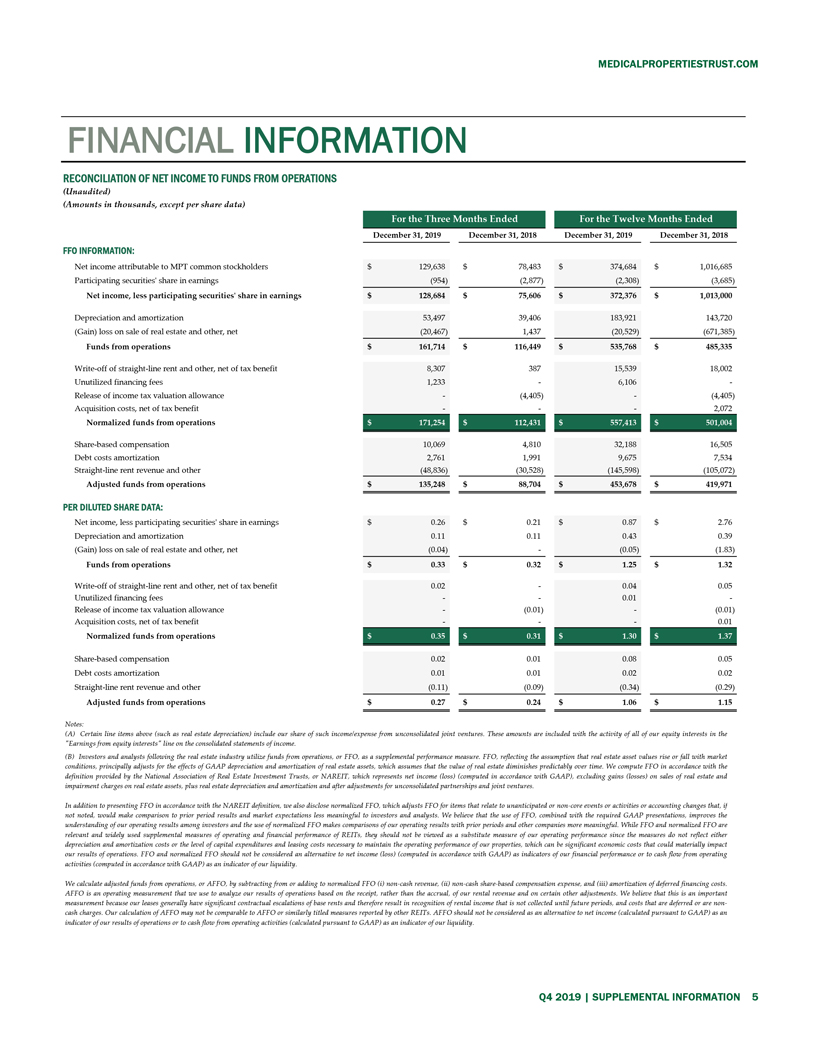

FINANCIAL INFORMATION RECONCILIATION OF NET INCOME TO FUNDS FROM OPERATIONS (Unaudited) (Amounts in thousands, except per share data) December 31, 2019 December 31, 2018 December 31, 2019 December 31, 2018 FFO INFORMATION: Net income attributable to MPT common stockholders $ 129,638 $ 78,483 $ 374,684 $ 1,016,685 Participating securities’ share in earnings (954) (2,877) (2,308) (3,685) Net income, less participating securities’ share in earnings $ 128,684 $ 75,606 $ 372,376 $ 1,013,000 Depreciation and amortization 53,497 39,406 183,921 143,720 (Gain) loss on sale of real estate and other, net (20,467) 1,437 (20,529) (671,385) Funds from operations $ 161,714 $ 116,449 $ 535,768 $ 485,335 Write-off of straight-line rent and other, net of tax benefit 8,307 387 15,539 18,002 Unutilized financing fees 1,233 — 6,106 — Release of income tax valuation allowance — (4,405) — (4,405) Acquisition costs, net of tax benefit — — — 2,072 Normalized funds from operations Share-based compensation 10,069 4,810 32,188 16,505 Debt costs amortization 2,761 1,991 9,675 7,534 Straight-line rent revenue and other (48,836) (30,528) (145,598) (105,072) Adjusted funds from operations $ 135,248 $ 88,704 $ 453,678 $ 419,971 PER DILUTED SHARE DATA: Net income, less participating securities’ share in earnings $ 0.26 $ 0.21 $ 0.87 $ 2.76 Depreciation and amortization 0.11 0.11 0.43 0.39 (Gain) loss on sale of real estate and other, net (0.04) — (0.05) (1.83) Funds from operations $ 0.33 $ 0.32 $ 1.25 $ 1.32 Write-off of straight-line rent and other, net of tax benefit 0.02 — 0.04 0.05 Unutilized financing fees — — 0.01 — Release of income tax valuation allowance — (0.01) — (0.01) Acquisition costs, net of tax benefit — — — 0.01 Normalized funds from operations Share-based compensation 0.02 0.01 0.08 0.05 Debt costs amortization 0.01 0.01 0.02 0.02 Straight-line rent revenue and other (0.11) (0.09) (0.34) (0.29) Adjusted funds from operations $ 0.27 $ 0.24 $ 1.06 $ 1.15 Notes: (A) Certain line items above (such as real estate depreciation) include our share of such income/expense from unconsolidated joint ventures. These amounts are included with the activity of all of our equity interests in the “Earnings from equity interests” line on the consolidated statements of income. (B) Investors and analysts following the real estate industry utilize funds from operations, or FFO, as a supplemental performance measure. FFO, reflecting the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation and amortization of real estate assets, which assumes that the value of real estate diminishes predictably over time. We compute FFO in accordance with the definition provided by the National Association of Real Estate Investment Trusts, or NAREIT, which represents net income (loss) (computed in accordance with GAAP), excluding gains (losses) on sales of real estate and impairment charges on real estate assets, plus real estate depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures. In addition to presenting FFO in accordance with the NAREIT definition, we also disclose normalized FFO, which adjusts FFO for items that relate to unanticipated or non-core events or activities or accounting changes that, if not noted, would make comparison to prior period results and market expectations less meaningful to investors and analysts. We believe that the use of FFO, combined with the required GAAP presentations, improves the understanding of our operating results among investors and the use of normalized FFO makes comparisons of our operating results with prior periods and other companies more meaningful. While FFO and normalized FFO are relevant and widely used supplemental measures of operating and financial performance of REITs, they should not be viewed as a substitute measure of our operating performance since the measures do not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties, which can be significant economic costs that could materially impact our results of operations. FFO and normalized FFO should not be considered an alternative to net income (loss) (computed in accordance with GAAP) as indicators of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity. We calculate adjusted funds from operations, or AFFO, by subtracting from or adding to normalized FFO (i) non-cash revenue, (ii) non-cash share-based compensation expense, and (iii) amortization of deferred financing costs. AFFO is an operating measurement that we use to analyze our results of operations based on the receipt, rather than the accrual, of our rental revenue and on certain other adjustments. We believe that this is an important measurement because our leases generally have significant contractual escalations of base rents and therefore result in recognition of rental income that is not collected until future periods, and costs that are deferred or are non-cash charges. Our calculation of AFFO may not be comparable to AFFO or similarly titled measures reported by other REITs. AFFO should not be considered as an alternative to net income (calculated pursuant to GAAP) as an indicator of our results of operations or to cash flow from operating activities (calculated pursuant to GAAP) as an indicator of our liquidity. Q4 2019 | SUPPLEMENTAL INFORMATION 5

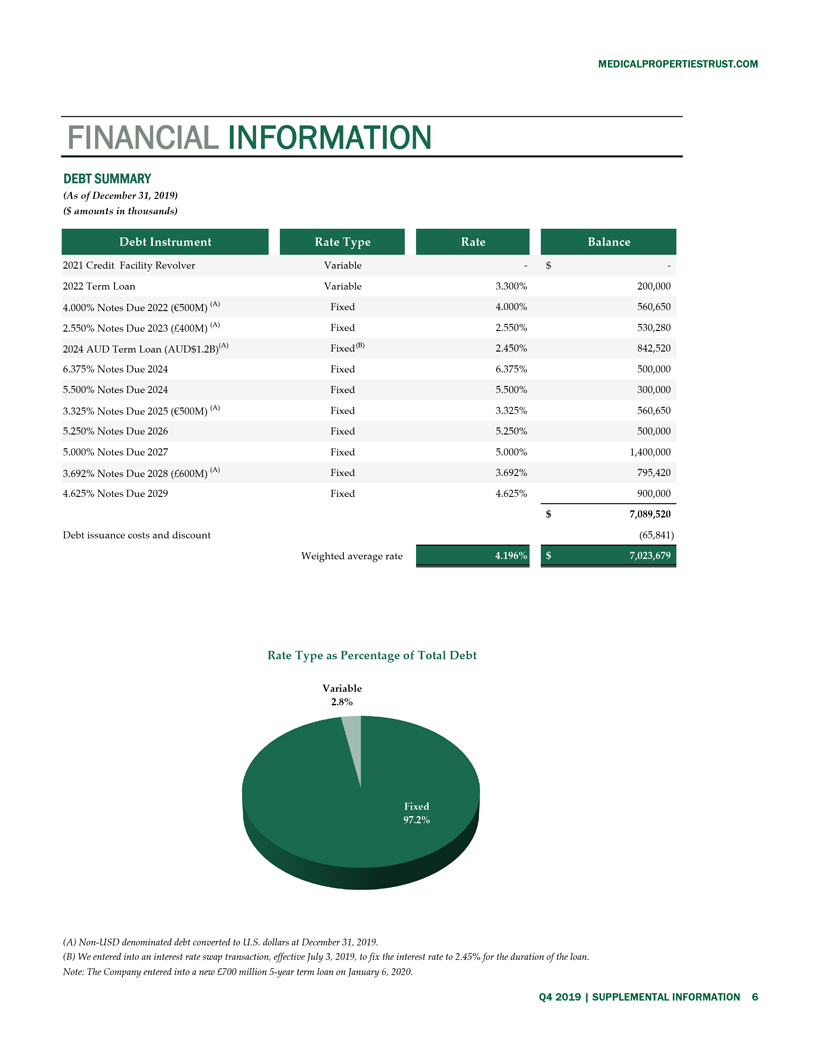

FINANCIAL INFORMATION DEBT SUMMARY (As of December 31, 2019) ($ amounts in thousands) Rate Type RateBalance

2021 Credit Facility Revolver Variable — $ — 2022 Term Loan Variable 3.300% 200,000 4.000% Notes Due 2022 (€500M) (A) Fixed 4.000% 560,650 2.550% Notes Due 2023 (£400M) (A) Fixed 2.550% 530,280 2024 AUD Term Loan (AUD$1.2B)(A) Fixed 2.450% 842,520 6.375% Notes Due 2024 Fixed 6.375% 500,000 5.500% Notes Due 2024 Fixed 5.500% 300,000 3.325% Notes Due 2025 (€500M) (A) Fixed 3.325% 560,650 5.250% Notes Due 2026 Fixed 5.250% 500,000 5.000% Notes Due 2027 Fixed 5.000% 1,400,000 3.692% Notes Due 2028 (£600M) (A) Fixed 3.692% 795,420 4.625% Notes Due 2029 Fixed 4.625% 900,000 $ 7,089,520 Debt issuance costs and discount (65,841) Weighted average rate Rate Type as Percentage of Total Debt Variable 2.8% (A) Non-USD denominated debt converted to U.S. dollars at December 31, 2019. (B) We entered into an interest rate swap transaction, effective July 3, 2019, to fix the interest rate to 2.45% for the duration of the loan. Note: The Company entered into a new £700 million 5-year term loan on January 6, 2020.

FINANCIAL INFORMATION

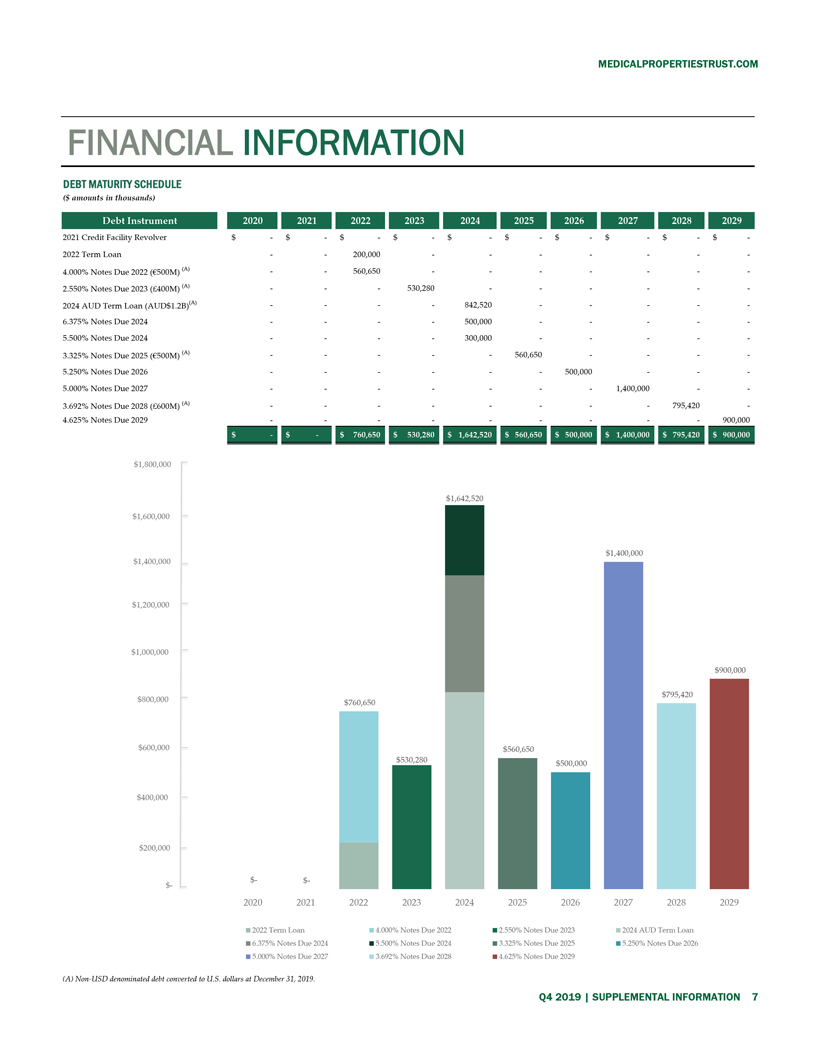

DEBT MATURITY SCHEDULE ($ amounts in thousands)

| 2021 Credit Facility Revolver |

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

| ||||||||||

| 2022 Term Loan |

|

— |

|

|

— |

|

|

200,000 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| ||||||||||

| 4.000% Notes Due 2022 (€500M) (A) |

|

— |

|

|

— |

|

|

560,650 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| ||||||||||

| 2.550% Notes Due 2023 (£400M) (A) |

|

— |

|

|

— |

|

|

— |

|

|

530,280 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| ||||||||||

| 2024 AUD Term Loan (AUD$1.2B)(A) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

842,520 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| ||||||||||

| 6.375% Notes Due 2024 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

500,000 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| ||||||||||

| 5.500% Notes Due 2024 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

300,000 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| ||||||||||

| 3.325% Notes Due 2025 (€500M) (A) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

560,650 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| ||||||||||

| 5.250% Notes Due 2026 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

500,000 |

|

|

— |

|

|

— |

|

|

— |

| ||||||||||

| 5.000% Notes Due 2027 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,400,000 |

|

|

— |

|

|

— |

| ||||||||||

| 3.692% Notes Due 2028 (£600M) (A) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

795,420 |

|

|

— |

| ||||||||||

| 4.625% Notes Due 2029 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

900,000 |

| ||||||||||

(A) Non-USD denominated debt converted to U.S. dollars at December 31, 2019.

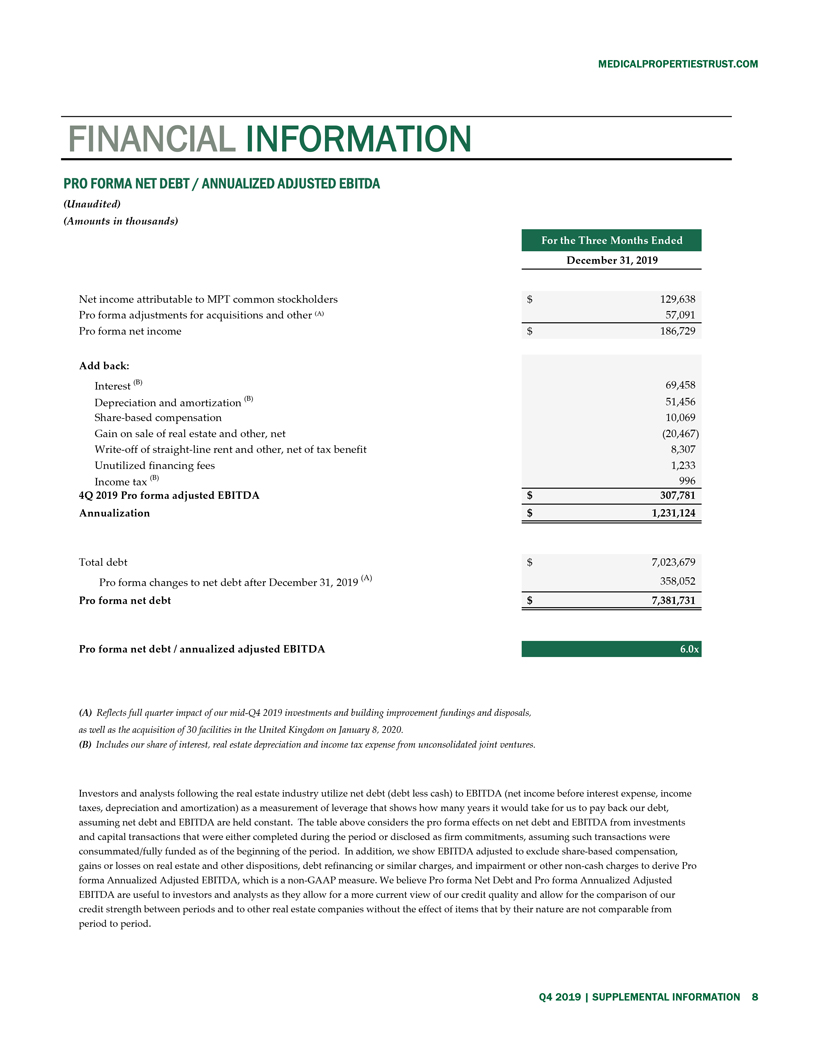

MEDICALPROPERTIESTRUST.COMFINANCIAL INFORMATION PRO FORMA NET DEBT / ANNUALIZED ADJUSTED EBITDA (Unaudited) (Amounts in thousands) December 31, 2019 Net income attributable to MPT common stockholders $ 129,638 Pro forma adjustments for acquisitions and other â½á´¬â¾ 57,091 Pro forma net income $ 186,729 Add back: Interest (B) 69,458 Depreciation and amortization (B) 51,456 Share-based compensation 10,069 Gain on sale of real estate and other, net (20,467) Impairment and other charges Write-off of straight-line rent and other, net of tax benefit 8,307 Unutilized financing fees 1,233 Income tax (B) 996 4Q 2019 Pro forma adjusted EBITDA $ 307,781 Annualization $ 1,231,124 Total debt $ 7,023,679 Pro forma changes to net debt after December 31, 2019 (A) 358,052 Pro forma net debt $ 7,381,731 Pro forma net debt / annualized adjusted EBITDA (A) Reflects full quarter impact of our mid-Q4 2019 investments and building improvement fundings and disposals, as well as the acquisition of 30 facilities in the United Kingdom on January 8, 2020. (B) Includes our share of interest, real estate depreciation and income tax expense from unconsolidated joint ventures. Investors and analysts following the real estate industry utilize net debt (debt less cash) to EBITDA (net income before interest expense, income taxes, depreciation and amortization) as a measurement of leverage that shows how many years it would take for us to pay back our debt, assuming net debt and EBITDA are held constant. The table above considers the pro forma effects on net debt and EBITDA from investments and capital transactions that were either completed during the period or disclosed as firm commitments, assuming such transactions were consummated/fully funded as of the beginning of the period. In addition, we show EBITDA adjusted to exclude share-based compensation, gains or losses on real estate and other dispositions, debt refinancing or similar charges, and impairment or other non-cash charges to derive Pro forma Annualized Adjusted EBITDA, which is a non-GAAP measure. We believe Pro forma Net Debt and Pro forma Annualized Adjusted EBITDA are useful to investors and analysts as they allow for a more current view of our credit quality and allow for the comparison of our credit strength between periods and to other real estate companies without the effect of items that by their nature are not comparable from period to period.Q4 2019 | SUPPLEMENTAL INFORMATION 8

PORTFOLIO INFORMATION

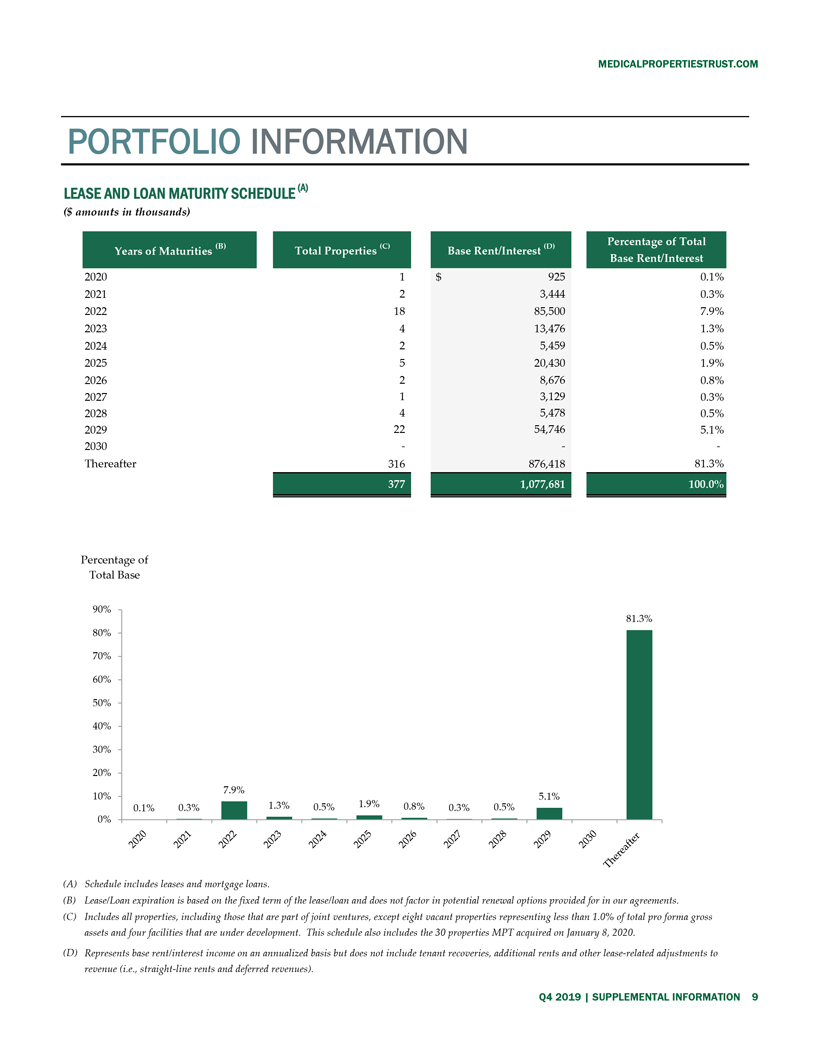

LEASE AND LOAN MATURITY SCHEDULE (A)

($ amounts in thousands)

2020

1

$ 925

0.1%

2021

2

3,444

0.3%

2022

18

85,500

7.9%

2023

4

13,476

1.3%

2024

2

5,459

0.5%

2025

5

20,430

1.9%

2026

2

8,676

0.8%

2027

1

3,129

0.3%

2028

4

5,478

0.5%

2029

22

54,746

5.1%

2030

—

—

—

Thereafter

316

876,418

81.3%

Percentage of Total Base Rent/Interest

(A) Schedule includes leases and mortgage loans.

(B) Lease/Loan expiration is based on the fixed term of the lease/loan and does not factor in potential renewal options provided for in our agreements.

(C) Includes all properties, including those that are part of joint ventures, except eight vacant properties representing less than 1.0% of total pro forma gross assets and four facilities that are under development. This schedule also includes the 30 properties MPT acquired on January 8, 2020.

(D) Represents base rent/interest income on an annualized basis but does not include tenant recoveries, additional rents and other lease-related adjustments to revenue (i.e., straight-line rents and deferred revenues).

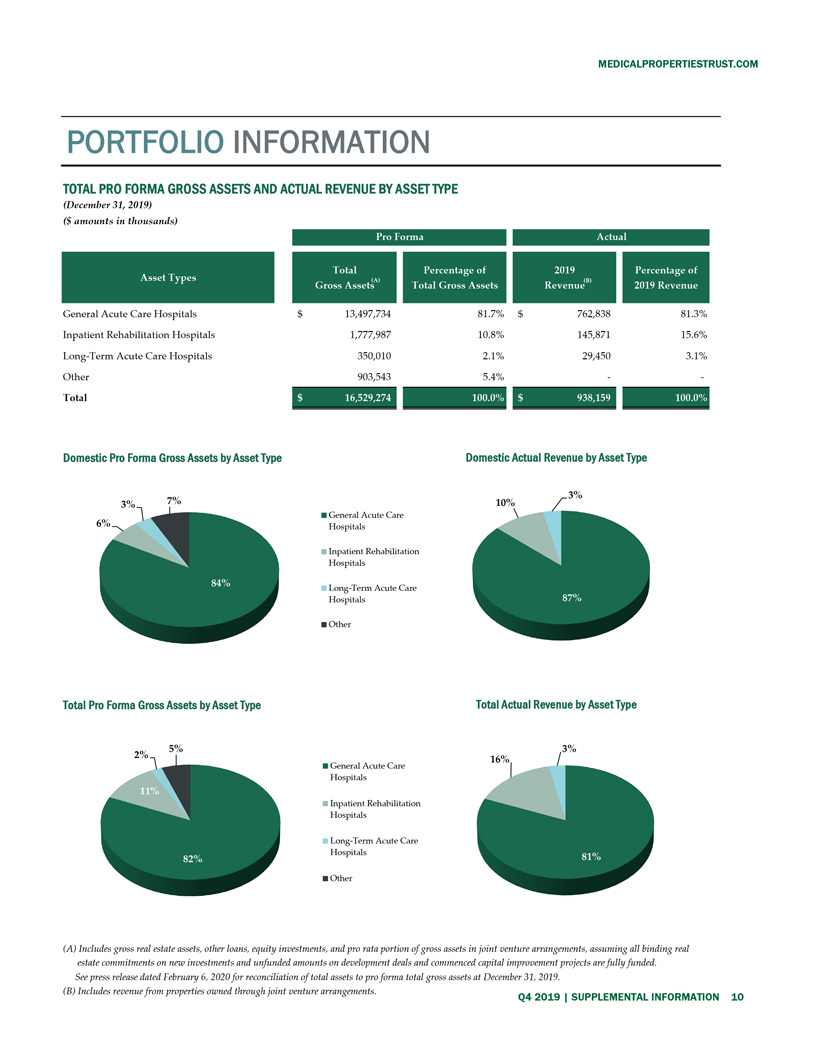

10 PORTFOLIO INFORMATION TOTAL PRO FORMA GROSS ASSETS AND ACTUAL REVENUE BY ASSET TYPE (December 31, 2019) ($ amounts in thousands) General Acute Care Hospitals $ 13,497,734 81.7% $ 762,838 81.3% Inpatient Rehabilitation Hospitals 1,777,987 10.8% 145,871 15.6% Long-Term Acute Care Hospitals 350,010 2.1% 29,450 3.1% Other 903,543 5.4% — — Total Domestic Pro Forma Gross Assets by Asset Type Domestic Actual Revenue by Asset Type Total Pro Forma Gross Assets by Asset Type Total Actual Revenue by Asset Type (A) Includes gross real estate assets, other loans, equity investments, and pro rata portion of gross assets in joint venture arrangements, assuming all binding real estate commitments on new investments and unfunded amounts on development deals and commenced capital improvement projects are fully funded. See press release dated February 6, 2020 for reconciliation of total assets to pro forma total gross assets at December 31, 2019. (B) Includes revenue from properties owned through joint venture arrangements. Q4 2019 | SUPPLEMENTAL INFORMATION 10 MEDICALPROPERTIESTRUST.COM

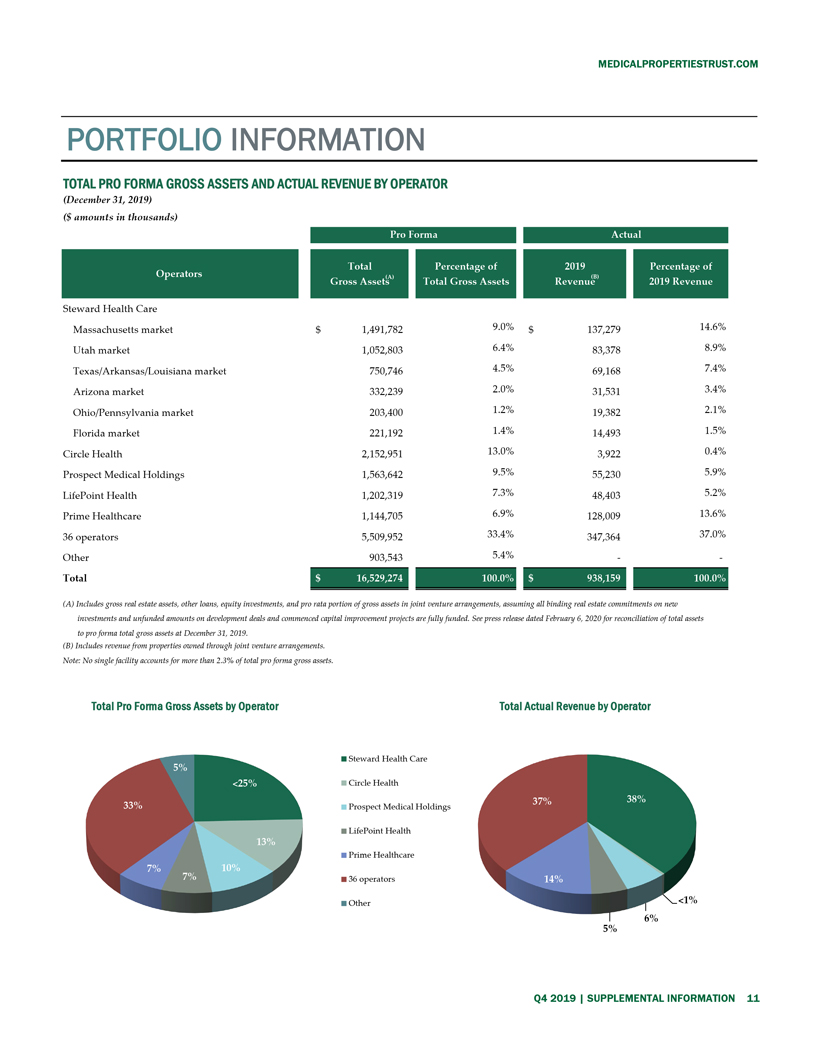

MEDICALPROPERTIESTRUST.COM

PORTFOLIO INFORMATION

TOTAL PRO FORMA GROSS ASSETS AND ACTUAL REVENUE BY OPERATOR

(December 31, 2019)

($ amounts in thousands)

Steward Health Care

Massachusetts market

$ 1,491,782

9.0%

$ 137,279

14.6%

Utah market

1,052,803

6.4%

83,378

8.9%

Texas/Arkansas/Louisiana market

750,746

4.5%

69,168

7.4%

Arizona market

332,239

2.0%

31,531

3.4%

Ohio/Pennsylvania market

203,400

1.2%

19,382

2.1%

Florida market

221,192

1.4%

14,493

1.5%

Circle Health

2,152,951

13.0%

3,922

0.4%

Prospect Medical Holdings

1,563,642

9.5%

55,230

5.9%

LifePoint Health

1,202,319

7.3%

48,403

5.2%

Prime Healthcare

1,144,705

6.9%

128,009

13.6%

36 operators

5,509,952

33.4%

347,364

37.0%

Other

903,543

5.4%

—

—

Total

(A) Includes gross real estate assets, other loans, equity investments, and pro rata portion of gross assets in joint venture arrangements, assuming all binding real estate commitments on new investments and unfunded amounts on development deals and commenced capital improvement projects are fully funded. See press release dated February 6, 2020 for reconciliation of total assets to pro forma total gross assets at December 31, 2019.

(B) Includes revenue from properties owned through joint venture arrangements.

Note: No single facility accounts for more than 2.3% of total pro forma gross assets.

Total Pro Forma Gross Assets by Operator

Total Actual Revenue by Operator

Q4 2019 SUPPLEMENTAL INFORMATION 11

MEDICALPROPERTIESTRUST.COM

Q4 2019 | SUPPLEMENTAL INFORMATION 12

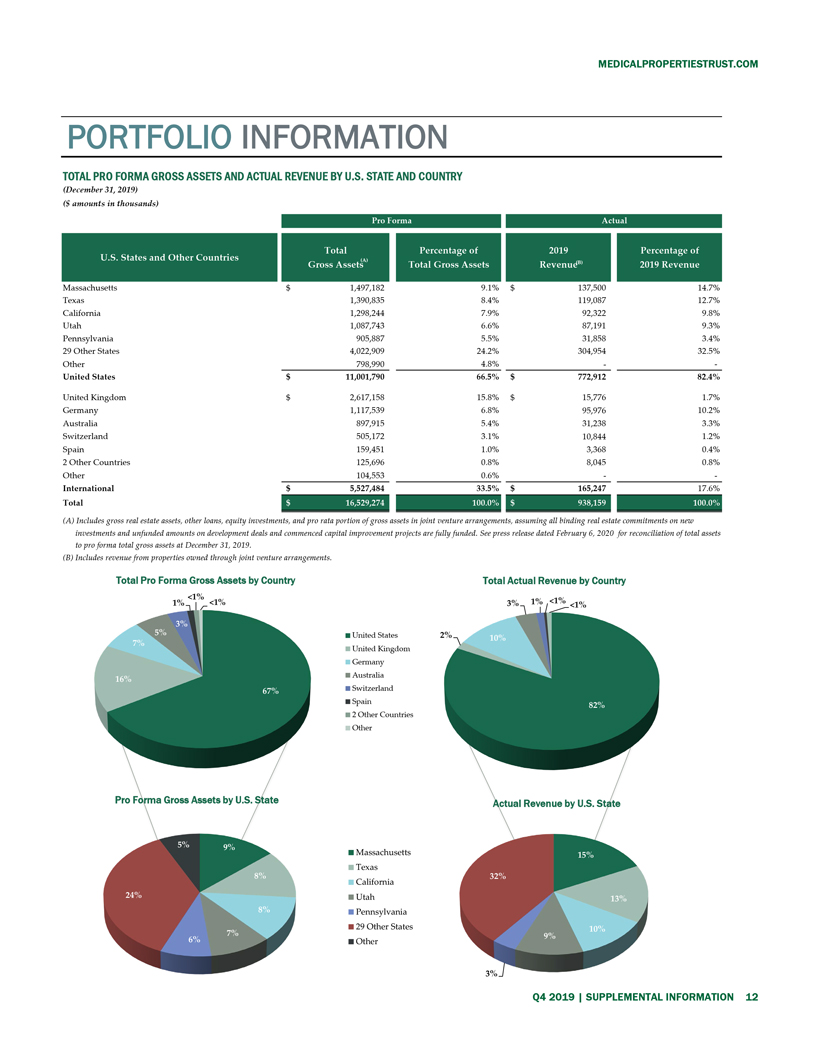

PORTFOLIO INFORMATION

TOTAL PRO FORMA GROSS ASSETS AND ACTUAL REVENUE BY U.S. STATE AND COUNTRY

(December 31, 2019)

($ amounts in thousands)

| Massachusetts |

$ |

1,497,182 |

|

|

9.1 |

% |

$ |

|

|

|

14.7 |

% | ||||

| Texas |

|

1,390,835 |

|

|

8.4 |

% |

|

119,087 |

|

|

12.7 |

% | ||||

| California |

|

1,298,244 |

|

|

7.9 |

% |

|

92,322 |

|

|

9.8 |

% | ||||

| Utah |

|

1,087,743 |

|

|

6.6 |

% |

|

87,191 |

|

|

9.3 |

% | ||||

| Pennsylvania |

|

905,887 |

|

|

5.5 |

% |

|

31,858 |

|

|

3.4 |

% | ||||

| 29 Other States |

|

4,022,909 |

|

|

24.2 |

% |

|

304,954 |

|

|

32.5 |

% | ||||

| Other |

|

798,990 |

|

|

4.8 |

% |

|

— |

|

|

— |

| ||||

| United States |

$ |

|

|

|

66.5 |

% |

$ |

|

|

|

82.4 |

% | ||||

| United Kingdom |

$ |

2,617,158 |

|

|

15.8 |

% |

$ |

15,776 |

|

|

1.7 |

% | ||||

| Germany |

|

1,117,539 |

|

|

6.8 |

% |

|

95,976 |

|

|

10.2 |

% | ||||

| Australia |

|

897,915 |

|

|

5.4 |

% |

|

31,238 |

|

|

3.3 |

% | ||||

| Switzerland |

|

505,172 |

|

|

3.1 |

% |

|

10,844 |

|

|

1.2 |

% | ||||

| Spain |

|

159,451 |

|

|

1.0 |

% |

|

3,368 |

|

|

0.4 |

% | ||||

| 2 Other Countries |

|

125,696 |

|

|

0.8 |

% |

|

8,045 |

|

|

0.8 |

% | ||||

| Other |

|

104,553 |

|

|

0.6 |

% |

|

— |

|

|

— |

| ||||

| International |

$ |

5,527,484 |

|

|

33.5 |

% |

$ |

165,247 |

|

|

17.6 |

% | ||||

| Total |

||||||||||||||||

(A) Includes gross real estate assets, other loans, equity investments, and pro rata portion of gross assets in joint venture arrangements, assuming all binding real estate commitments on new

investments and unfunded amounts on development deals and commenced capital improvement projects are fully funded. See press release dated February 6, 2020 for reconciliation of total assets to pro forma total gross assets at December 31, 2019.

(B) Includes revenue from properties owned through joint venture arrangements.

| Total Pro Forma Gross Assets by Country |

|

Total |

|

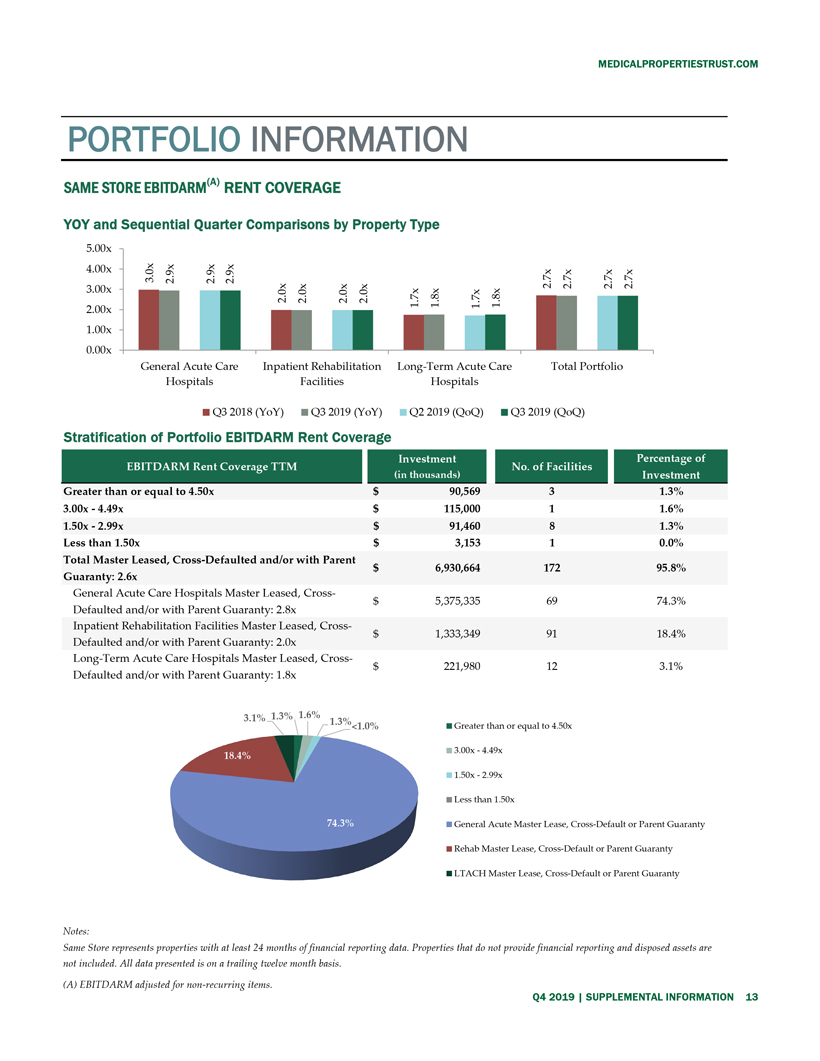

PORTFOLIO INFORMATION

SAME STORE EBITDARM(A) RENT COVERAGE

YOY and Sequential Quarter Comparisons by Property Type

Stratification of Portfolio EBITDARM Rent Coverage

Greater than or equal to 4.50x

$ 90,569

3

1.3%

3.00x—4.49x

$ 115,000

1

1.6%

1.50x—2.99x

$ 91,460

8

1.3%

Less than 1.50x

$ 3,153

1

0.0%

Total Master Leased, Cross-Defaulted and/or with Parent Guaranty: 2.6x

$ 6,930,664

172

95.8%

General Acute Care Hospitals Master Leased, Cross-Defaulted and/or with Parent Guaranty: 2.8x

$ 5,375,335

69

74.3%

Inpatient Rehabilitation Facilities Master Leased, Cross-Defaulted and/or with Parent Guaranty: 2.0x

$ 1,333,349

91

18.4%

Long-Term Acute Care Hospitals Master Leased, Cross-Defaulted and/or with Parent Guaranty: 1.8x

$ 221,980

12

3.1%

Notes:

Same Store represents properties with at least 24 months of financial reporting data. Properties that do not provide financial reporting and disposed assets are not included. All data presented is on a trailing twelve month basis.

(A) EBITDARM adjusted for non-recurring items.

MEDICALPROPERTIESTRUST.COM

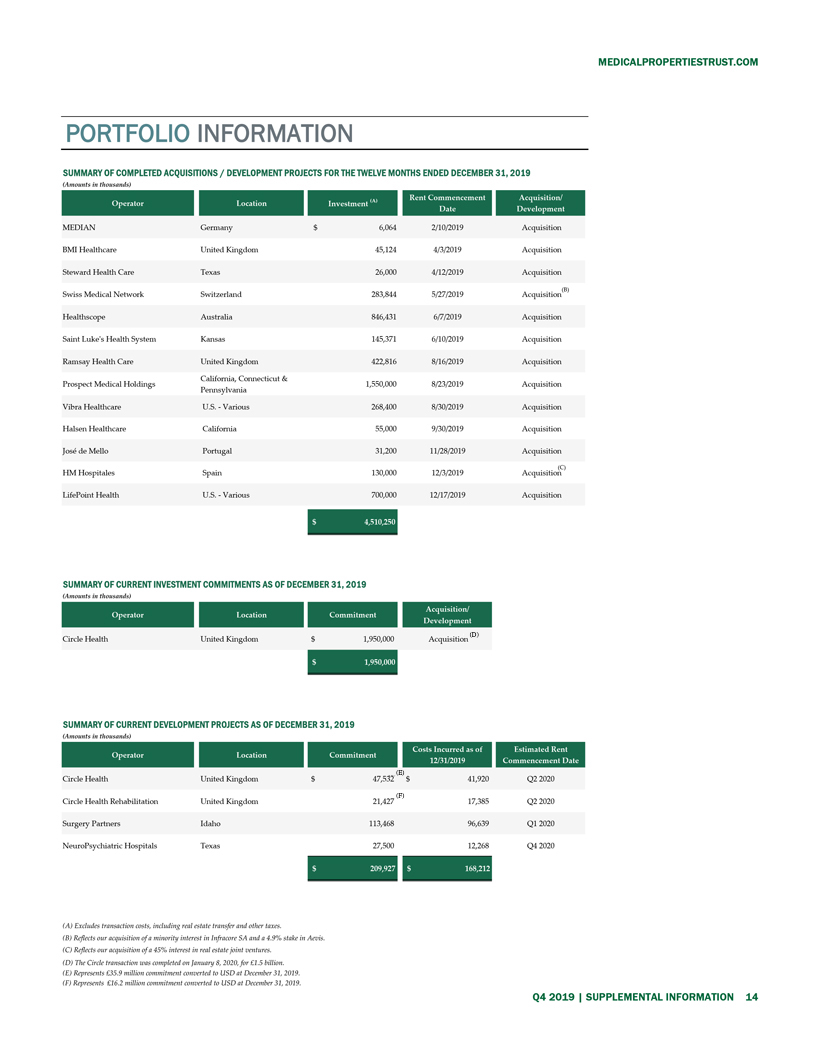

PORTFOLIO INFORMATION

SUMMARY OF COMPLETED ACQUISITIONS / DEVELOPMENT PROJECTS FOR THE TWELVE MONTHS ENDED DECEMBER 31, 2019

(Amounts in thousands)

MEDIAN

Germany

$ 6,064

2/10/2019

Acquisition

BMI Healthcare

United Kingdom

45,124

4/3/2019

Acquisition

Steward Health Care

Texas

26,000

4/12/2019

Acquisition

Swiss Medical Network

Switzerland

283,844

5/27/2019

Acquisition

Healthscope

Australia

846,431

6/7/2019

Acquisition

Saint Luke’s Health System

Kansas

145,371

6/10/2019

Acquisition

Ramsay Health Care

United Kingdom

422,816

8/16/2019

Acquisition

Prospect Medical Holdings

California, Connecticut & Pennsylvania

1,550,000

8/23/2019

Acquisition

Vibra Healthcare

U.S.—Various

268,400

8/30/2019

Acquisition

Halsen Healthcare

California

55,000

9/30/2019

Acquisition

José de Mello

Portugal

31,200

11/28/2019

Acquisition

HM Hospitales

Spain

130,000

12/3/2019

Acquisition

LifePoint Health

U.S.—Various

700,000

12/17/2019

Acquisition

SUMMARY OF CURRENT INVESTMENT COMMITMENTS AS OF DECEMBER 31, 2019

(Amounts in thousands)

Circle Health

United Kingdom

$ 1,950,000

Acquisition

SUMMARY OF CURRENT DEVELOPMENT PROJECTS AS OF DECEMBER 31, 2019

(Amounts in thousands)

Circle Health

United Kingdom

$ 47,532

$ 41,920

Q2 2020

Circle Health Rehabilitation

United Kingdom

21,427

17,385

Q2 2020

Surgery Partners

Idaho

113,468

96,639

Q1 2020

NeuroPsychiatric Hospitals

Texas

27,500

12,268

Q4 2020

(A) Excludes transaction costs, including real estate transfer and other taxes.

(B) Reflects our acquisition of a minority interest in Infracore SA and a 4.9% stake in Aevis.

(C) Reflects our acquisition of a 45% interest in real estate joint ventures.

(D) The Circle transaction was completed on January 8, 2020, for £1.5 billion.

(E) Represents £35.9 million commitment converted to USD at December 31, 2019.

(F) Represents £16.2 million commitment converted to USD at December 31, 2019.

Q4 2019 SUPPLEMENTAL INFORMATION

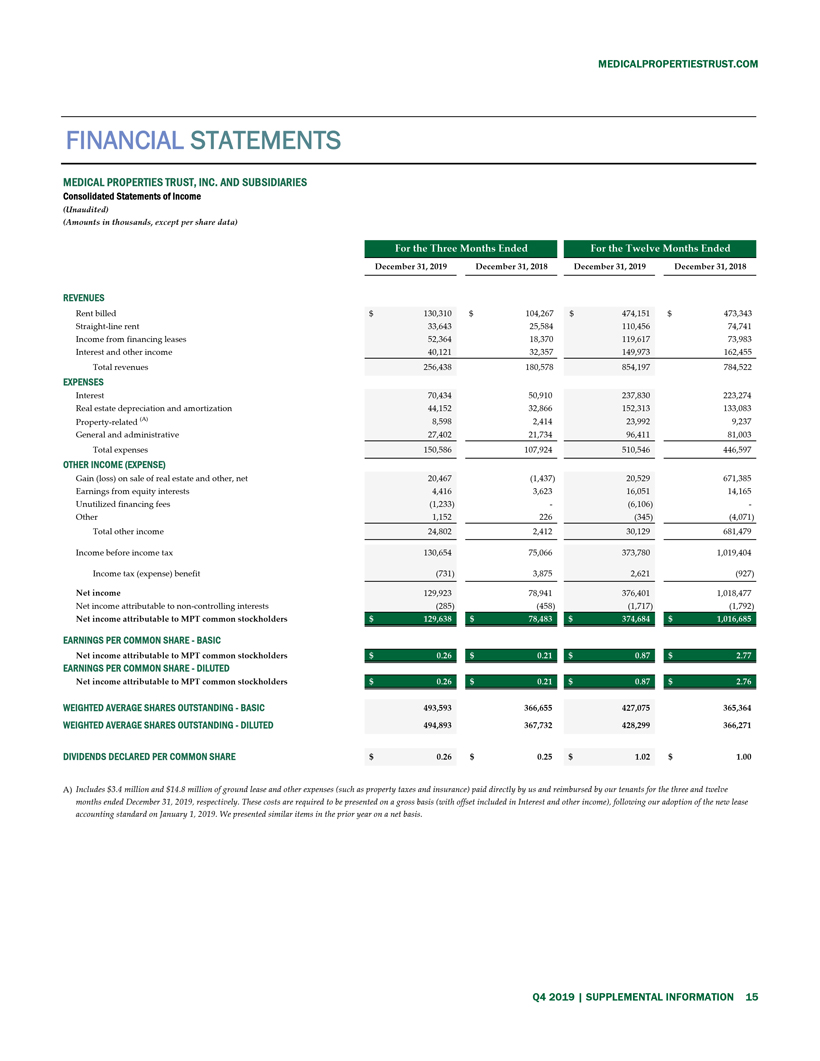

FINANCIAL STATEMENTS MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES Consolidated Statements ofIncome (Unaudited) (Amounts in thousands, except per share data) December 31, 2019 December 31, 2018 December 31,2019 December 31, 2018 REVENUES Rent billed $ 130,310 $ 104,267 $ 474,151 $ 473,343

Straight-line rent

33,643

25,584

110,456

74,741

Income from financing leases

52,364

18,370

119,617

73,983

Interest and other income

40,121

32,357

149,973

162,455

Total revenues

256,438

180,578

854,197

784,522

EXPENSES

Interest

70,434

50,910

237,830

223,274

Real estate depreciation and amortization

44,152

32,866

152,313

133,083

Property-related (A)

8,598

2,414

23,992

9,237

General and administrative

27,402

21,734

96,411

81,003

Total expenses

150,586

107,924

510,546

446,597

OTHER INCOME (EXPENSE) Gain (loss) on sale of real estate and other, net

20,467

(1,437)

20,529

671,385

Earnings from equity interests

4,416

3,623

16,051

14,165

Unutilized financing fees

(1,233)

—

(6,106)

—

Other

1,152

226

(345)

(4,071)

Total other income

24,802

2,412

30,129

681,479

Income before income tax

130,654

75,066

373,780

1,019,404

Income tax (expense) benefit

(731)

3,875

2,621

(927)

Net income

129,923

78,941

376,401

1,018,477

Net income attributable to non-controlling interests

(285)

(458)

(1,717)

(1,792)

Net income attributable to MPT common stockholders

EARNINGS PER COMMON SHARE—BASIC

Net income attributable to MPT common stockholders

EARNINGS PER COMMON SHARE—DILUTED

Net income attributable to MPT common stockholders

WEIGHTED AVERAGE SHARES OUTSTANDING—BASIC

493,593

366,655

427,075

365,364

WEIGHTED AVERAGE SHARES OUTSTANDING—DILUTED

494,893

367,732

428,299

366,271

DIVIDENDS DECLARED PER COMMON SHARE

$ 0.26

$ 0.25

$ 1.02

$ 1.00 A) Includes $3.4 million and $14.8 million of ground lease and other expenses (such as property taxes and insurance) paid directly by us and reimbursed by our tenants for the three and twelve months ended December 31, 2019, respectively. These costs are required to be presented on a gross basis (with offset included in Interest and other income), following our adoption of the new lease accounting standard on January 1, 2019. We presented similar items in the prior year on a net basis.

MEDICALPROPERTIESTRUST.COM

FINANCIAL STATEMENTS

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(Amounts in thousands, except per share data)

(Unaudited)

(A)

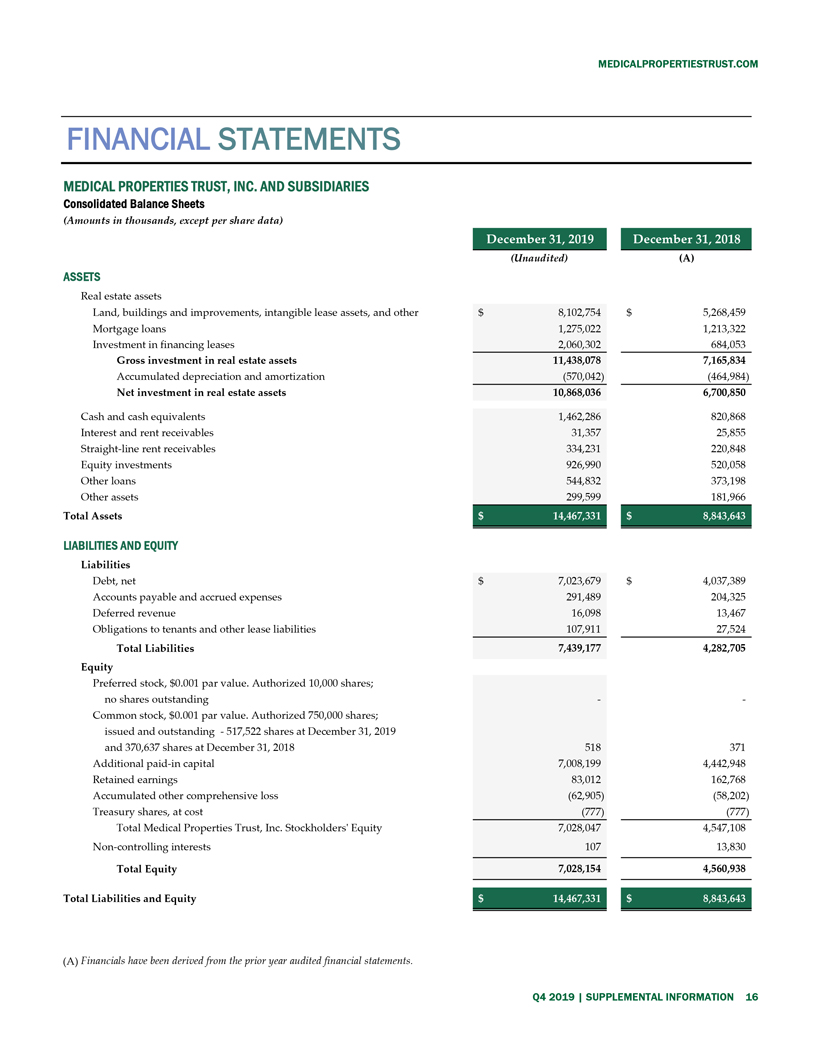

ASSETS

Real estate assets

Land, buildings and improvements, intangible lease assets, and other

$ 8,102,754

$ 5,268,459

Mortgage loans

1,275,022

1,213,322

Investment in financing leases

2,060,302

684,053

Gross investment in real estate assets

11,438,078

7,165,834

Accumulated depreciation and amortization

(570,042)

(464,984)

Net investment in real estate assets

10,868,036

6,700,850

Cash and cash equivalents

1,462,286

820,868

Interest and rent receivables

31,357

25,855

Straight-line rent receivables

334,231

220,848

Equity investments

926,990

520,058

Other loans

544,832

373,198

Other assets

299,599

181,966

Total Assets

LIABILITIES AND EQUITY

Liabilities

Debt, net

$ 7,023,679

$ 4,037,389

Accounts payable and accrued expenses

291,489

204,325

Deferred revenue

16,098

13,467

Obligations to tenants and other lease liabilities

107,911

27,524

Total Liabilities

7,439,177

4,282,705

Equity

Preferred stock, $0.001 par value. Authorized 10,000 shares;

no shares outstanding

—

—

Common stock, $0.001 par value. Authorized 750,000 shares;

issued and outstanding —517,522 shares at December 31, 2019

and 370,637 shares at December 31, 2018

518

371

Additional paid-in capital

7,008,199

4,442,948

Retained earnings

83,012

162,768

Accumulated other comprehensive loss

(62,905)

(58,202)

Treasury shares, at cost

(777)

(777)

Total Medical Properties Trust, Inc. Stockholders’ Equity

7,028,047

4,547,108

Non-controlling interests

107

13,830

Total Equity

7,028,154

4,560,938

Total Liabilities and Equity

(A) Financials have been derived from the prior year audited financial statements.

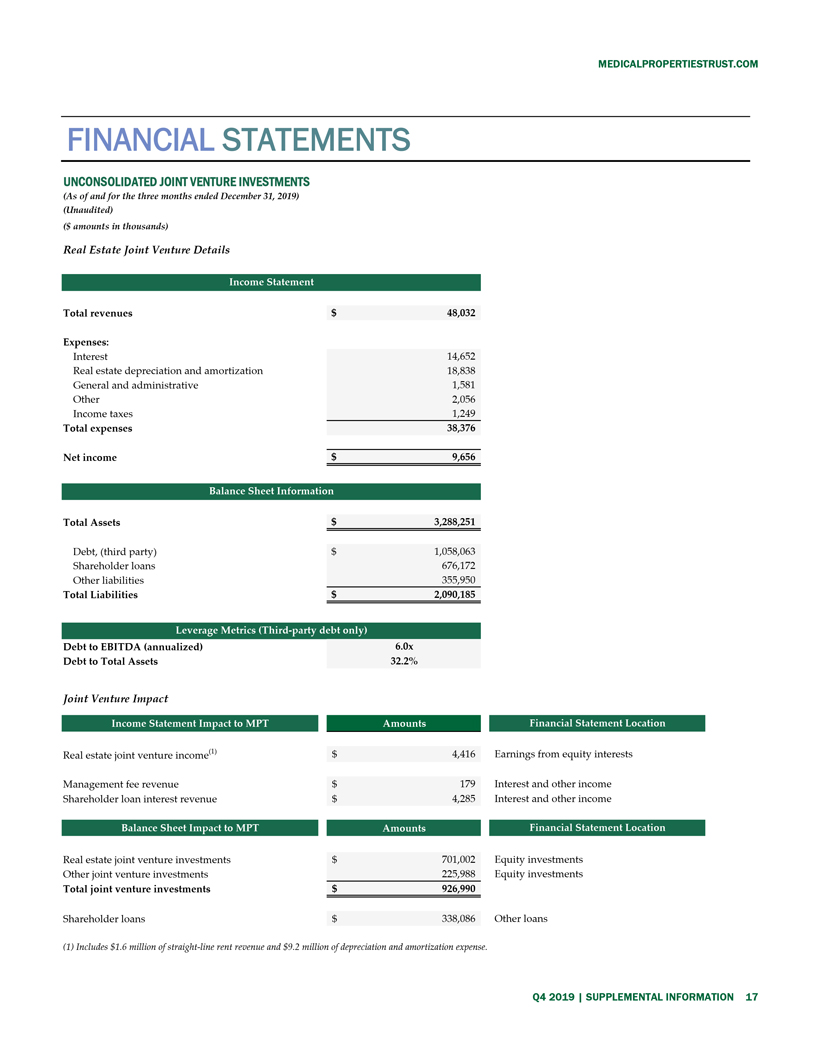

FINANCIAL STATEMENTS

UNCONSOLIDATED JOINT VENTURE INVESTMENTS

(As of and for the three months ended December 31, 2019)

(Unaudited)

($ amounts in thousands)

Real Estate Joint Venture Details

Total revenues

$ 48,032

Expenses:

Interest

14,652

Real estate depreciation and amortization

18,838

General and administrative

1,581

Other

2,056

Income taxes

1,249

Total expenses

38,376

Net income

$ 9,656

Total Assets

$ 3,288,251

Debt, (third party)

$ 1,058,063

Shareholder loans

676,172

Other liabilities

355,950

Total Liabilities

$ 2,090,185

Debt to EBITDA (annualized)

6.0x

Debt to Total Assets

32.2%

Joint Venture Impact

Real estate joint venture income(1)

$ 4,416

Earnings from equity interests

Management fee revenue

$ 179

Interest and other income

Shareholder loan interest revenue

$ 4,285

Interest and other income

Real estate joint venture investments

$ 701,002

Equity investments

Other joint venture investments

225,988

Equity investments

Total joint venture investments

$ 926,990

Shareholder loans

$ 338,086

Other loans

(1) Includes $1.6 million of straight-line rent revenue and $9.2 million of depreciation and amortization expense.

1000 Urban Center Drive, Suite 501 Birmingham, AL 35242 (205) 969-3755 NYSE: MPW www.medicalpropertiestrust.com Contact: Tim Berryman, Director of Investor Relations (205) 397-8589 or tberryman@medicalpropertiestrust.com or Charles Lambert, Treasurer and Managing Director of Capital Markets (205) 397-8897 or clambert@medicalpropertiestrust.com AT THE VERY HEART OF HEALTHCARE.®