Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MACERICH CO | d797141dex991.htm |

| 8-K - 8-K - MACERICH CO | d797141d8k.htm |

Exhibit 99.2

Supplemental Financial Information

For the three and twelve months ended December 31, 2019

The Macerich Company

Supplemental Financial and Operating Information

Table of Contents

All information included in this supplemental financial package is unaudited, unless otherwise indicated.

| Page No. | ||||

| Corporate Overview |

1-4 | |||

| Overview |

1-2 | |||

| Capital Information and Market Capitalization |

3 | |||

| Changes in Total Common and Equivalent Shares/Units |

4 | |||

| Financial Data |

5-11 | |||

| Consolidated Statements of Operations (Unaudited) |

5 | |||

| Consolidated Balance Sheet (Unaudited) |

6 | |||

| Non-GAAP Pro Rata Financial Information (Unaudited) |

7-9 | |||

| 2020 Guidance Range |

10 | |||

| Supplemental FFO Information |

11 | |||

| Capital Expenditures |

12 | |||

| Operational Data |

13-27 | |||

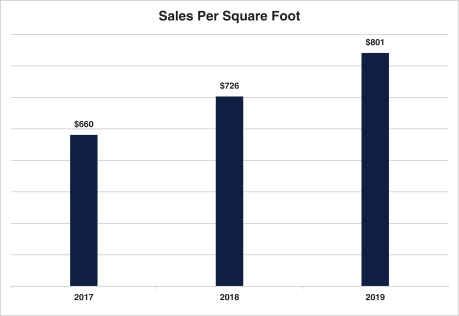

| Sales Per Square Foot |

13 | |||

| Sales Per Square Foot by Property Ranking |

14-17 | |||

| Occupancy |

18 | |||

| Average Base Rent Per Square Foot |

19 | |||

| Cost of Occupancy |

20 | |||

| Percentage of Net Operating Income by State |

21 | |||

| Property Listing |

22-25 | |||

| Joint Venture List |

26-27 | |||

| Debt Tables |

28-30 | |||

| Debt Summary |

28 | |||

| Outstanding Debt by Maturity Date |

29-30 | |||

| Development Pipeline |

31-32 | |||

| Corporate Information |

33 | |||

This Supplemental Financial Information should be read in connection with the Company’s fourth quarter 2019 earnings announcement (included as Exhibit 99.1 of the Company’s Current Report on 8-K, event date February 6, 2020) as certain disclosures, definitions and reconciliations in such announcement have not been included in this Supplemental Financial Information.

The Macerich Company

Supplemental Financial and Operating Information

Overview

The Macerich Company (the “Company”) is involved in the acquisition, ownership, development, redevelopment, management and leasing of regional shopping centers located in the United States in many of the country’s most attractive, densely populated markets with significant presence on the West Coast, Arizona, Chicago and the Metro New York to Washington, DC corridor. A recognized leader in sustainability, the Company has achieved the #1 GRESB ranking in the North American Retail Sector for five straight years 2015 – 2019.

The Company is the sole general partner of, and owns a majority of the ownership interests in, The Macerich Partnership, L.P., a Delaware limited partnership (the “Operating Partnership”).

As of December 31, 2019, the Operating Partnership owned or had an ownership interest in 51 million square feet of gross leasable area (“GLA”) consisting primarily of interests in 47 regional shopping centers and five community/power shopping centers. These 52 centers (which include any related office space) are referred to hereinafter as the “Centers”, unless the context requires otherwise.

The Company is a self-administered and self-managed real estate investment trust (“REIT”) and conducts all of its operations through the Operating Partnership and the Company’s management companies (collectively, the “Management Companies”).

All references to the Company in this Exhibit include the Company, those entities owned or controlled by the Company and predecessors of the Company, unless the context indicates otherwise.

The Company presents certain measures in this Exhibit on a pro rata basis which represents (i) the measure on a consolidated basis, minus the Company’s partners’ share of the measure from its consolidated joint ventures (calculated based upon the partners’ percentage ownership interest); plus (ii) the Company’s share of the measure from its unconsolidated joint ventures (calculated based upon the Company’s percentage ownership interest). Management believes that these measures provide useful information to investors regarding its financial condition and/or results of operations because they include the Company’s share of the applicable amount from unconsolidated joint ventures and exclude the Company’s partners’ share from consolidated joint ventures, in each case presented on the same basis. The Company has several significant joint ventures and the Company believes that presenting various measures in this manner can help investors better understand the Company’s financial condition and/or results of operations after taking into account its economic interest in these joint ventures. Management also uses these measures to evaluate regional property level performance and to make decisions about resource allocations. The Company’s economic interest (as distinct from its legal ownership interest) in certain of its joint ventures could fluctuate from time to time and may not wholly align with its legal ownership interests because of provisions in certain joint venture agreements regarding distributions of cash flow based on capital account balances, allocations of profits and losses, payments of preferred returns and control over major decisions. Additionally, the Company does not control its unconsolidated joint ventures and the presentation of certain items, such as assets, liabilities, revenues and expenses, from these unconsolidated joint ventures does not represent the Company’s legal claim to such items.

This document contains information constituting forward-looking statements and includes expectations regarding the Company’s future operational results as well as development, redevelopment and expansion activities. Stockholders are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to vary materially from those anticipated, expected or projected. Such factors include, among others, general industry, economic and business conditions, which will, among other things, affect demand for retail space or retail goods, availability and creditworthiness of current and prospective tenants, anchor or tenant bankruptcies, closures, mergers or consolidations, lease rates, terms and payments,

1

interest rate fluctuations, availability, terms and cost of financing, operating expenses, and competition; adverse changes in the real estate markets, including the liquidity of real estate investments; and risks of real estate development, redevelopment, and expansion, including availability, terms and cost of financing, construction delays, environmental and safety requirements, budget overruns, sunk costs and lease-up; the inability to obtain, or delays in obtaining, all necessary zoning, land-use, building, and occupancy and other required governmental permits and authorizations; and governmental actions and initiatives (including legislative and regulatory changes) as well as terrorist activities or other acts of violence which could adversely affect all of the above factors. Furthermore, occupancy rates and rents at a newly completed property may not be sufficient to make the property profitable. The reader is directed to the Company’s various filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year ended December 31, 2018, for a discussion of such risks and uncertainties, which discussion is incorporated herein by reference. The Company does not intend, and undertakes no obligation, to update any forward-looking information to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events unless required by law to do so.

2

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Capital Information and Market Capitalization

| Period Ended | ||||||||||||

| 12/31/2019 | 12/31/2018 | 12/31/2017 | ||||||||||

| dollars in thousands, except per share data | ||||||||||||

| Closing common stock price per share |

$ | 26.92 | $ | 43.28 | $ | 65.68 | ||||||

| 52 week high |

$ | 47.05 | $ | 69.73 | $ | 73.34 | ||||||

| 52 week low |

$ | 25.53 | $ | 40.90 | $ | 52.12 | ||||||

| Shares outstanding at end of period |

||||||||||||

| Class A non-participating convertible preferred units |

90,619 | 90,619 | 90,619 | |||||||||

| Common shares and partnership units |

151,892,138 | 151,655,147 | 151,253,557 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total common and equivalent shares/units outstanding |

151,982,757 | 151,745,766 | 151,344,176 | |||||||||

|

|

|

|

|

|

|

|||||||

| Portfolio capitalization data |

||||||||||||

| Total portfolio debt, including joint ventures at pro rata |

$ | 8,074,867 | $ | 7,850,669 | $ | 7,692,719 | ||||||

| Equity market capitalization |

4,091,376 | 6,567,557 | 9,940,285 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total market capitalization |

$ | 12,166,243 | $ | 14,418,226 | $ | 17,633,004 | ||||||

|

|

|

|

|

|

|

|||||||

| Debt as a percentage of total market capitalization |

66.4 | % | 54.5 | % | 43.6 | % | ||||||

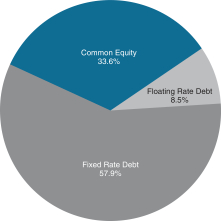

Portfolio Capitalization at December 31, 2019

3

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Changes in Total Common and Equivalent Shares/Units

| Partnership Units |

Company Common Shares |

Class A Non-Participating Convertible Preferred Units |

Total Common and Equivalent Shares/ Units |

|||||||||||||

| Balance as of December 31, 2018 |

10,433,435 | 141,221,712 | 90,619 | 151,745,766 | ||||||||||||

| Conversion of partnership units to cash |

(590 | ) | — | — | (590 | ) | ||||||||||

| Conversion of partnership units to common shares |

(21,000 | ) | 21,000 | — | — | |||||||||||

| Issuance of stock/partnership units from restricted stock issuance or other share or unit-based plans |

3,407 | 90,074 | — | 93,481 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance as of March 31, 2019 |

10,415,252 | 141,332,786 | 90,619 | 151,838,657 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Conversion of partnership units to cash |

(244 | ) | — | — | (244 | ) | ||||||||||

| Conversion of partnership units to common shares |

— | — | — | — | ||||||||||||

| Issuance of stock/partnership units from restricted stock issuance or other share or unit-based plans |

508 | 31,782 | — | 32,290 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance as of June 30, 2019 |

10,415,516 | 141,364,568 | 90,619 | 151,870,703 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Conversion of partnership units to cash |

(435 | ) | — | — | (435 | ) | ||||||||||

| Issuance of stock/partnership units from restricted stock issuance or other share or unit-based plans |

— | 6,157 | — | 6,157 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance as of September 30, 2019 |

10,415,081 | 141,370,725 | 90,619 | 151,876,425 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Conversion of partnership units to cash |

(575 | ) | — | — | (575 | ) | ||||||||||

| Issuance of stock/partnership units from restricted stock issuance or other share or unit-based plans |

69,982 | 36,925 | — | 106,907 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance as of December 31, 2019 |

10,484,488 | 141,407,650 | 90,619 | 151,982,757 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

4

The Macerich Company

Consolidated Statements of Operations (Unaudited)

(Dollars in thousands)

| For the Three Months Ended December 31, 2019 |

For the Twelve Months Ended December 31, 2019 |

|||||||

| Revenues: |

||||||||

| Leasing revenue |

$ | 222,584 | $ | 858,874 | ||||

| Other income |

7,825 | 27,879 | ||||||

| Management Companies’ revenues |

11,432 | 40,709 | ||||||

|

|

|

|

|

|||||

| Total revenues |

241,841 | 927,462 | ||||||

|

|

|

|

|

|||||

| Expenses: |

||||||||

| Shopping center and operating expenses |

68,523 | 271,547 | ||||||

| Management Companies’ operating expenses |

16,575 | 66,795 | ||||||

| Leasing expenses |

7,267 | 29,611 | ||||||

| REIT general and administrative expenses |

5,799 | 22,634 | ||||||

| Depreciation and amortization |

84,086 | 330,726 | ||||||

| Interest expense |

47,989 | 138,254 | ||||||

| Loss on extinguishment of debt |

— | 351 | ||||||

|

|

|

|

|

|||||

| Total expenses |

230,239 | 859,918 | ||||||

| Equity in income of unconsolidated joint ventures |

14,426 | 48,508 | ||||||

| Income tax benefit (expense) |

114 | (1,589 | ) | |||||

| Gain (loss) on sale or write down of assets, net |

3,597 | (11,909 | ) | |||||

|

|

|

|

|

|||||

| Net income |

29,739 | 102,554 | ||||||

| Less net income attributable to noncontrolling interests |

2,848 | 5,734 | ||||||

|

|

|

|

|

|||||

| Net income attributable to the Company |

$ | 26,891 | $ | 96,820 | ||||

|

|

|

|

|

|||||

5

The Macerich Company

Consolidated Balance Sheet (Unaudited)

As of December 31, 2019

(Dollars in thousands)

| ASSETS: |

||||

| Property, net (a) |

$ | 6,643,513 | ||

| Cash and cash equivalents |

100,005 | |||

| Restricted cash |

14,211 | |||

| Tenant and other receivables, net |

144,035 | |||

| Right-of-use assets, net |

148,087 | |||

| Deferred charges and other assets, net |

277,866 | |||

| Due from affiliates |

6,157 | |||

| Investments in unconsolidated joint ventures |

1,519,697 | |||

|

|

|

|||

| Total assets |

$ | 8,853,571 | ||

|

|

|

|||

| LIABILITIES AND EQUITY: |

||||

| Mortgage notes payable |

$ | 4,392,599 | ||

| Bank and other notes payable |

817,377 | |||

| Accounts payable and accrued expenses |

51,027 | |||

| Lease liabilities |

114,201 | |||

| Other accrued liabilities |

265,595 | |||

| Distributions in excess of investments in unconsolidated joint ventures |

107,902 | |||

| Financing arrangement obligation |

273,900 | |||

|

|

|

|||

| Total liabilities |

6,022,601 | |||

|

|

|

|||

| Commitments and contingencies |

||||

| Equity: |

||||

| Stockholders’ equity: |

||||

| Common stock |

1,414 | |||

| Additional paid-in capital |

4,583,911 | |||

| Accumulated deficit |

(1,944,012 | ) | ||

| Accumulated other comprehensive loss |

(9,051 | ) | ||

|

|

|

|||

| Total stockholders’ equity |

2,632,262 | |||

| Noncontrolling interests |

198,708 | |||

|

|

|

|||

| Total equity |

2,830,970 | |||

|

|

|

|||

| Total liabilities and equity |

$ | 8,853,571 | ||

|

|

|

|||

| (a) | Includes construction in progress of $126,165. |

6

The Macerich Company

Non-GAAP Pro Rata Financial Information (Unaudited)

(Dollars in thousands)

| For the Three Months Ended December 31, 2019 |

For the Twelve Months Ended December 31, 2019 |

|||||||||||||||

| Noncontrolling Interests of Consolidated Joint Ventures (a) |

Company’s Share of Unconsolidated Joint Ventures |

Noncontrolling Interests of Consolidated Joint Ventures (a) |

Company’s Share of Unconsolidated Joint Ventures |

|||||||||||||

| Revenues: |

||||||||||||||||

| Leasing revenue |

$ | (13,584 | ) | $ | 126,928 | $ | (51,534 | ) | $ | 468,146 | ||||||

| Other income |

(73 | ) | 6,314 | (753 | ) | 27,024 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

(13,657 | ) | 133,242 | (52,287 | ) | 495,170 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Expenses: |

||||||||||||||||

| Shopping center and operating expenses |

(3,450 | ) | 42,103 | (14,241 | ) | 145,585 | ||||||||||

| Leasing expenses |

(131 | ) | 1,014 | (644 | ) | 4,353 | ||||||||||

| Depreciation and amortization |

(4,057 | ) | 48,058 | (15,124 | ) | 189,728 | ||||||||||

| Interest expense |

(5,698 | ) | 27,560 | (20,853 | ) | 106,534 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

(13,336 | ) | 118,735 | (50,862 | ) | 446,200 | ||||||||||

| Equity in income of unconsolidated joint ventures |

— | (14,426 | ) | — | (48,508 | ) | ||||||||||

| Gain/loss on sale or write down of assets, net |

(547 | ) | (81 | ) | 2,822 | (462 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net (income) loss |

(868 | ) | — | 1,397 | — | |||||||||||

| Less net (income) loss attributable to noncontrolling interests |

(868 | ) | — | 1,397 | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income attributable to the Company |

$ | — | $ | — | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Represents the Company’s partners’ share of consolidated joint ventures. |

7

The Macerich Company

Non-GAAP Pro Rata Financial Information (Unaudited)

(Dollars in thousands)

| As of December 31, 2019 | ||||||||

| Noncontrolling Interests of Consolidated Joint Ventures (a) |

Company’s Share of Unconsolidated Joint Ventures |

|||||||

| ASSETS: |

||||||||

| Property, net (b) |

$ | (337,063 | ) | $ | 4,559,013 | |||

| Cash and cash equivalents |

(9,376 | ) | 77,110 | |||||

| Restricted cash |

(2,151 | ) | 7,412 | |||||

| Tenant and other receivables, net |

(5,406 | ) | 74,749 | |||||

| Right-of-use assets, net |

(780 | ) | 61,150 | |||||

| Deferred charges and other assets, net |

(3,135 | ) | 144,307 | |||||

| Due from affiliates |

17 | (2,506 | ) | |||||

| Investments in unconsolidated joint ventures, at equity |

— | (1,519,697 | ) | |||||

|

|

|

|

|

|||||

| Total assets |

$ | (357,894 | ) | $ | 3,401,538 | |||

|

|

|

|

|

|||||

| LIABILITIES AND EQUITY: |

||||||||

| Mortgage notes payable |

$ | (359,125 | ) | $ | 3,040,712 | |||

| Bank and other notes payable |

— | 183,304 | ||||||

| Accounts payable and accrued expenses |

(2,243 | ) | 74,332 | |||||

| Lease liabilities |

(3,087 | ) | 61,566 | |||||

| Other accrued liabilities |

(5,070 | ) | 149,526 | |||||

| Distributions in excess of investments in unconsolidated joint ventures |

— | (107,902 | ) | |||||

| Financing arrangement obligation |

(273,900 | ) | — | |||||

|

|

|

|

|

|||||

| Total liabilities |

(643,425 | ) | 3,401,538 | |||||

|

|

|

|

|

|||||

| Equity: |

||||||||

| Stockholders’ equity |

289,152 | — | ||||||

| Noncontrolling interests |

(3,621 | ) | — | |||||

|

|

|

|

|

|||||

| Total equity |

285,531 | — | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | (357,894 | ) | $ | 3,401,538 | |||

|

|

|

|

|

|||||

| (a) | Represents the Company’s partners’ share of consolidated joint ventures. |

| (b) | This includes $9,404 of construction in progress relating to the Company’s partners’ share from consolidated joint ventures and $368,967 of construction in progress relating to the Company’s share from unconsolidated joint ventures. |

8

The Macerich Company

Non-GAAP Pro Rata Schedule of Leasing Revenue (Unaudited)

(Dollars in thousands)

| For the Three Months Ended December 31, 2019 | ||||||||||||||||||||

| Consolidated | Non- Controlling Interests (a) |

Company’s Consolidated Share |

Company’s Share of Unconsolidated Joint Ventures |

Company’s Total Share |

||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Minimum rents |

$ |

140,853 |

|

$ |

(8,502 |

) |

$ |

132,351 |

|

$ |

84,974 |

|

$ |

217,325 |

| |||||

| Percentage rents |

|

12,476 |

|

|

(464 |

) |

|

12,012 |

|

|

6,266 |

|

|

18,278 |

| |||||

| Tenant recoveries |

|

60,570 |

|

|

(4,018 |

) |

|

56,552 |

|

|

32,123 |

|

|

88,675 |

| |||||

| Other |

|

9,600 |

|

|

(564 |

) |

|

9,036 |

|

|

4,346 |

|

|

13,382 |

| |||||

| Less: Bad debt expense |

|

(915 |

) |

|

(36 |

) |

|

(951 |

) |

|

(781 |

) |

|

(1,732 |

) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total leasing revenue |

$ |

222,584 |

|

$ |

(13,584 |

) |

$ |

209,000 |

|

$ |

126,928 |

|

$ |

335,928 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| For the Twelve Months Ended December 31, 2019 | ||||||||||||||||||||

| Consolidated | Non- Controlling Interests (a) |

Company’s Consolidated Share |

Company’s Share of Unconsolidated Joint Ventures |

Company’s Total Share |

||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Minimum rents |

$ |

566,924 |

|

$ |

(33,261 |

) |

$ |

533,663 |

|

$ |

327,625 |

|

$ |

861,288 |

| |||||

| Percentage rents |

|

20,826 |

|

|

(675 |

) |

|

20,151 |

|

|

11,390 |

|

|

31,541 |

| |||||

| Tenant recoveries |

|

251,266 |

|

|

(16,201 |

) |

|

235,065 |

|

|

120,934 |

|

|

355,999 |

| |||||

| Other |

|

27,540 |

|

|

(1,652 |

) |

|

25,888 |

|

|

11,285 |

|

|

37,173 |

| |||||

| Less: Bad debt expense |

|

(7,682 |

) |

|

255 |

|

|

(7,427 |

) |

|

(3,088 |

) |

|

(10,515 |

) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total leasing revenue |

$ |

858,874 |

|

$ |

(51,534 |

) |

$ |

807,340 |

|

$ |

468,146 |

|

$ |

1,275,486 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

(a) Represents the Company’s partners’ share of consolidated joint ventures.

9

The Macerich Company

2020 Guidance Range (Unaudited)

The Company is providing its 2020 guidance for estimated EPS-diluted and Funds from Operations (“FFO”) per share-diluted. A reconciliation of estimated EPS-diluted to FFO per share-diluted follows:

| Year 2020 Guidance |

||||

| Earnings per share-diluted |

$0.33 - $0.43 | |||

| Plus: real estate depreciation and amortization |

$3.15 - $3.15 | |||

| Less: Gain on sale of depreciable assets |

$0.08 - $0.08 | |||

|

|

|

|||

| FFO per share-diluted |

$3.40 - $3.50 | |||

|

|

|

|||

| Underlying Assumptions to 2020 Guidance |

||||

| Cash Same Center Net Operating Income (“NOI”) Growth(a) |

||||

| Excluding lease termination income |

0.50% - 1.00% | |||

| Year 2020 ($ millions)(b) |

Year 2020 FFO / Share Impact | |||||

| Lease termination income |

$7 | $0.05 | ||||

| Capitalized interest |

$25 | $0.16 | ||||

| Bad debt expense |

($7) | ($0.05) | ||||

| Dilutive impact of assets sold in 2020, net proceeds $300 million |

($4) | ($0.03) | ||||

| Straight-line rental income |

$13 | $0.09 | ||||

| Amortization of acquired above and below-market leases (net-revenue) |

$9 | $0.06 | ||||

| Interest expense(c) |

$295 | |||||

| (a) | Excludes non-cash items of straight-line and above/below market adjustments to minimum rents. |

| (b) | All joint venture amounts included at pro rata. |

| (c) | This amount represents the Company’s pro rata share of interest expense, excluding any financing expense in connection with Chandler Freehold. |

10

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Supplemental FFO Information(a)

| As of December 31, | ||||||||||||||||

| 2019 | 2018 | |||||||||||||||

| dollars in millions | ||||||||||||||||

| Straight-line rent receivable |

$ | 127.5 | $ | 113.8 | ||||||||||||

| For the Three Months Ended December 31, |

For the Twelve Months Ended December 31, |

|||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| dollars in millions | ||||||||||||||||

| Lease termination income |

$ | 0.4 | $ | 3.1 | $ | 5.7 | $ | 13.1 | ||||||||

| Straight-line rental income |

$ | 5.5 | $ | 4.4 | $ | 16.0 | $ | 18.6 | ||||||||

| Business development and parking income (b) |

$ | 21.2 | $ | 19.4 | $ | 66.0 | $ | 62.2 | ||||||||

| Gain (loss) on sales or write down of undepreciated assets |

$ | 3.2 | $ | 1.8 | $ | 3.8 | $ | 5.6 | ||||||||

| Amortization of acquired above and below-market leases (net revenue) |

$ | 1.6 | $ | 2.5 | $ | 14.7 | $ | 13.5 | ||||||||

| Amortization of debt premiums |

$ | 0.2 | $ | 0.2 | $ | 0.9 | $ | 0.9 | ||||||||

| Bad debt expense (c) |

$ | 1.7 | $ | 1.2 | $ | 10.5 | $ | 6.2 | ||||||||

| Leasing expenses |

$ | 8.1 | $ | 3.0 | $ | 33.3 | $ | 11.6 | ||||||||

| Interest capitalized |

$ | 6.1 | $ | 6.5 | $ | 28.8 | $ | 27.4 | ||||||||

| Chandler Freehold financing arrangement (d): |

||||||||||||||||

| Distributions equal to partners’ share of net income |

$ | 2.0 | $ | 2.5 | $ | 7.2 | $ | 9.1 | ||||||||

| Distributions in excess of partners’ share of net income (e) |

0.9 | 1.6 | 6.9 | 6.4 | ||||||||||||

| Fair value adjustment (e) |

(5.7 | ) | (5.9 | ) | (76.6 | ) | (15.2 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Chandler Freehold financing arrangement (income) expense (d) |

$ | (2.8 | ) | $ | (1.8 | ) | $ | (62.5 | ) | $ | 0.3 | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | All joint venture amounts included at pro rata. |

| (b) | Included in leasing revenue and other income. |

| (c) | Included in leasing revenue for the three and twelve months ended December 31, 2019 and included in shopping center and operating expenses for the three and twelve months ended December 31, 2018. |

| (d) | Included in interest expense. |

| (e) | The Company presents FFO excluding the expenses related to changes in fair value of the financing arrangement and the payments to such joint venture partner less than or in excess of their pro rata share of net income. |

11

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Capital Expenditures(a)

| Year Ended |

Year Ended 12/31/2018 |

Year Ended 12/31/2017 |

||||||||||

| 12/31/2019 | ||||||||||||

| dollars in millions |

||||||||||||

| Consolidated Centers |

||||||||||||

| Acquisitions of property, building improvement and equipment |

$ | 34.8 | $ | 53.4 | $ | 38.2 | ||||||

| Development, redevelopment, expansions and renovations of Centers |

112.3 | 173.3 | 152.1 | |||||||||

| Tenant allowances |

18.9 | 12.6 | 11.5 | |||||||||

| Deferred leasing charges |

3.2 | 17.3 | 26.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 169.2 | $ | 256.6 | $ | 228.3 | ||||||

|

|

|

|

|

|

|

|||||||

| Unconsolidated Joint Venture Centers |

||||||||||||

| Acquisitions of property, building improvement and equipment |

$ | 12.3 | $ | 15.7 | $ | 16.0 | ||||||

| Development, redevelopment, expansions and renovations of Centers |

210.6 | 145.9 | 121.8 | |||||||||

| Tenant allowances |

9.3 | 8.7 | 6.8 | |||||||||

| Deferred leasing charges |

3.4 | 10.9 | 6.2 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 235.6 | $ | 181.2 | $ | 150.8 | ||||||

|

|

|

|

|

|

|

|||||||

| (a) | All joint venture amounts at pro rata. |

12

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Regional Shopping Center Portfolio

Sales Per Square Foot(a)

| Consolidated Centers |

Unconsolidated Joint Venture Centers |

Total Centers |

||||||||||

| 12/31/2019 |

$ | 646 | $ | 998 | $ | 801 | ||||||

| 12/31/2018 |

$ | 612 | $ | 882 | $ | 726 | ||||||

| 12/31/2017 |

$ | 584 | $ | 765 | $ | 660 | ||||||

| (a) | Sales are based on reports by retailers leasing mall and freestanding stores for the trailing 12 months for tenants that have occupied such stores for a minimum of 12 months. Sales per square foot are based on tenants 10,000 square feet and under for regional shopping centers. Sales per square foot exclude Centers under development and redevelopment. |

13

The Macerich Company

Sales Per Square Foot by Property Ranking (Unaudited)

| Sales per square foot | Occupancy | Cost of Occupancy for the trailing 12 months Ended 12/31/2019 (c) |

% of Portfolio 2020 Forecast Pro Rata Real Estate NOI (d) |

|||||||||||||||||||||

| Properties |

12/31/2019 (a) |

12/31/2018 (a) |

12/31/2019 (b) |

12/31/2018 (b) |

||||||||||||||||||||

| Group 1: Top 10 |

||||||||||||||||||||||||

| Broadway Plaza |

$ | 2,032 | $ | 1,752 | 95.9 | % | 99.4 | % | ||||||||||||||||

| Corte Madera, Village at |

$ | 1,879 | $ | 2,166 | 94.9 | % | 94.4 | % | ||||||||||||||||

| Queens Center |

$ | 1,581 | $ | 1,506 | 98.9 | % | 99.7 | % | ||||||||||||||||

| Washington Square |

$ | 1,550 | $ | 1,261 | 95.1 | % | 98.8 | % | ||||||||||||||||

| Scottsdale Fashion Square |

$ | 1,437 | $ | 1,159 | 93.2 | % | 92.1 | % | ||||||||||||||||

| Kierland Commons |

$ | 1,413 | $ | 1,137 | 96.5 | % | 97.8 | % | ||||||||||||||||

| Los Cerritos Center |

$ | 1,030 | $ | 1,003 | 98.8 | % | 96.5 | % | ||||||||||||||||

| North Bridge, The Shops at |

$ | 1,021 | $ | 881 | 86.3 | % | 98.2 | % | ||||||||||||||||

| Tysons Corner Center |

$ | 981 | $ | 986 | 93.1 | % | 96.8 | % | ||||||||||||||||

| Country Club Plaza |

n/a | n/a | n/a | n/a | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Top 10: |

$ | 1,321 | $ | 1,164 | 93.8 | % | 95.5 | % | 11.0 | % | 32.6 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Group 2: Top 11-20 |

||||||||||||||||||||||||

| Tucson La Encantada |

$ | 927 | $ | 856 | 98.0 | % | 97.0 | % | ||||||||||||||||

| Arrowhead Towne Center |

$ | 922 | $ | 808 | 97.1 | % | 97.2 | % | ||||||||||||||||

| Fresno Fashion Fair |

$ | 874 | $ | 750 | 90.4 | % | 95.2 | % | ||||||||||||||||

| Fashion Outlets of Chicago |

$ | 864 | $ | 839 | 97.5 | % | 98.0 | % | ||||||||||||||||

| Santa Monica Place |

$ | 820 | $ | 808 | 94.7 | % | 93.4 | % | ||||||||||||||||

| Chandler Fashion Center |

$ | 752 | $ | 715 | 95.8 | % | 97.6 | % | ||||||||||||||||

| Vintage Faire Mall |

$ | 745 | $ | 709 | 98.0 | % | 97.3 | % | ||||||||||||||||

| Twenty Ninth Street |

$ | 741 | $ | 712 | 96.6 | % | 97.1 | % | ||||||||||||||||

| Kings Plaza Shopping Center |

$ | 731 | $ | 701 | 99.4 | % | 97.9 | % | ||||||||||||||||

| Biltmore Fashion Park |

$ | 714 | $ | 670 | 93.1 | % | 91.0 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Top 11-20: |

$ | 811 | $ | 759 | 96.1 | % | 96.6 | % | 12.0 | % | 26.2 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

14

The Macerich Company

Sales Per Square Foot by Property Ranking (Unaudited)

| Sales per square foot | Occupancy | Cost of Occupancy for the trailing 12 months Ended 12/31/2019 (c) |

% of Portfolio 2020 Forecast Pro Rata Real Estate NOI (d) |

|||||||||||||||||||||

| Properties |

12/31/2019 (a) |

12/31/2018 (a) |

12/31/2019 (b) |

12/31/2018 (b) |

||||||||||||||||||||

| Group 3: Top 21-30 |

||||||||||||||||||||||||

| Stonewood Center |

$ | 697 | $ | 665 | 94.0 | % | 91.9 | % | ||||||||||||||||

| Oaks, The |

$ | 673 | $ | 654 | 92.7 | % | 88.9 | % | ||||||||||||||||

| Danbury Fair Mall |

$ | 658 | $ | 627 | 93.2 | % | 96.1 | % | ||||||||||||||||

| Freehold Raceway Mall |

$ | 657 | $ | 639 | 97.5 | % | 97.8 | % | ||||||||||||||||

| SanTan Village Regional Center |

$ | 652 | $ | 588 | 96.3 | % | 98.1 | % | ||||||||||||||||

| Green Acres Mall |

$ | 626 | $ | 638 | 96.4 | % | 98.0 | % | ||||||||||||||||

| FlatIron Crossing |

$ | 599 | $ | 579 | 95.9 | % | 97.2 | % | ||||||||||||||||

| Victor Valley, Mall of |

$ | 574 | $ | 565 | 97.0 | % | 98.1 | % | ||||||||||||||||

| Inland Center |

$ | 570 | $ | 541 | 93.8 | % | 97.0 | % | ||||||||||||||||

| South Plains Mall |

$ | 535 | $ | 474 | 88.0 | % | 92.0 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Top 21-30: |

$ | 631 | $ | 606 | 94.8 | % | 95.8 | % | 12.8 | % | 24.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Group 4: Top 31-40 |

||||||||||||||||||||||||

| Deptford Mall |

$ | 533 | $ | 525 | 96.0 | % | 97.4 | % | ||||||||||||||||

| Lakewood Center |

$ | 522 | $ | 491 | 97.2 | % | 97.0 | % | ||||||||||||||||

| La Cumbre Plaza |

$ | 505 | $ | 488 | 86.8 | % | 80.7 | % | ||||||||||||||||

| Pacific View |

$ | 484 | $ | 450 | 85.2 | % | 91.3 | % | ||||||||||||||||

| Valley River Center |

$ | 457 | $ | 453 | 93.4 | % | 95.7 | % | ||||||||||||||||

| West Acres |

$ | 445 | $ | 467 | 98.1 | % | 97.2 | % | ||||||||||||||||

| Superstition Springs Center |

$ | 410 | $ | 366 | 93.9 | % | 96.8 | % | ||||||||||||||||

| Eastland Mall |

$ | 361 | $ | 360 | 92.5 | % | 94.9 | % | ||||||||||||||||

| Desert Sky Mall |

$ | 354 | $ | 346 | 98.9 | % | 99.1 | % | ||||||||||||||||

| Fashion Outlets of Niagara Falls USA |

$ | 342 | $ | 340 | 92.0 | % | 93.9 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Top 31-40: |

$ | 441 | $ | 427 | 94.0 | % | 95.2 | % | 14.0 | % | 12.4 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Top 40: |

$ | 830 | $ | 753 | 94.6 | % | 95.7 | % | 11.8 | % | 95.2 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

15

The Macerich Company

Sales Per Square Foot by Property Ranking (Unaudited)

| Sales per square foot | Occupancy | Cost of Occupancy for the trailing 12 months Ended 12/31/2019 (c) |

% of Portfolio 2020 Forecast Pro Rata Real Estate NOI (d) |

|||||||||||||||||||||

| Properties |

12/31/2019 (a) |

12/31/2018 (a) |

9/30/2019 (b) |

12/31/2018 (b) |

||||||||||||||||||||

| Group 5: 41-45 |

||||||||||||||||||||||||

| NorthPark Mall |

||||||||||||||||||||||||

| SouthPark Mall |

||||||||||||||||||||||||

| Towne Mall |

||||||||||||||||||||||||

| Valley Mall |

||||||||||||||||||||||||

| Wilton Mall |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total 41-45: |

$ | 290 | $ | 286 | 86.7 | % | 90.8 | % | 10.4 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Centers under Redevelopment |

||||||||||||||||||||||||

| Fashion District Philadelphia (e) (f) |

||||||||||||||||||||||||

| Paradise Valley Mall (e) |

||||||||||||||||||||||||

| 47 REGIONAL SHOPPING CENTERS |

$ | 801 | $ | 726 | 94.0 | % | 95.4 | % | 11.8 | % | 98.4 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Community / Power Centers and various other assets |

1.6 | % | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| TOTAL ALL PROPERTIES |

11.8 | % | 100.0 | % | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

16

The Macerich Company

Notes to Sales Per Square Foot by Property Ranking (unaudited)

Footnotes

| (a) | Sales are based on reports by retailers leasing mall and freestanding stores for the trailing 12 months for tenants that have occupied such stores for a minimum of 12 months. Sales per square foot are based on tenants 10,000 square feet and under. Properties are ranked by Sales per square foot as of December 31, 2019. |

| (b) | Occupancy is the percentage of mall and freestanding GLA leased as of the last day of the reporting period. Occupancy excludes Centers under development and redevelopment. |

| (c) | Cost of Occupancy represents “Tenant Occupancy Costs” divided by “Tenant Sales”. Tenant Occupancy Costs in this calculation are the amounts paid to the Company, including minimum rents, percentage rents and recoverable expenditures, which consist primarily of property operating expenses, real estate taxes and repair and maintenance expenditures. |

| (d) | The percentage of Portfolio 2020 Forecast Pro Rata Real Estate NOI is based on guidance assumptions provided on February 6, 2020, see page 10. Real Estate NOI excludes straight-line and above/below market adjustments to minimum rents. Real Estate NOI also does not reflect REIT expenses and Management Company revenues and expenses. See the Company’s forward-looking statements disclosure on pages 1 and 2 for factors that may affect the information provided in this column. |

| (e) | These assets are under redevelopment including demolition and reconfiguration of the Centers and tenant spaces. Accordingly, the Sales per square foot and Occupancy during the periods of redevelopment are not included. |

| (f) | On September 19, 2019, the Company’s joint venture opened Fashion District Philadelphia in downtown Philadelphia. |

17

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Occupancy(a)

| Regional Shopping Centers: |

Consolidated Centers |

Unconsolidated Joint Venture Centers |

Total Centers |

|||||||||

| 12/31/2019 |

93.7 | % | 94.4 | % | 94.0 | % | ||||||

| 12/31/2018 |

95.2 | % | 95.6 | % | 95.4 | % | ||||||

| 12/31/2017 |

94.4 | % | 95.6 | % | 95.0 | % | ||||||

| (a) | Occupancy is the percentage of mall and freestanding GLA leased as of the last day of the reporting period. Occupancy excludes Centers under development and redevelopment. |

18

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Average Base Rent Per Square Foot(a)

| Average Base Rent PSF(b) |

Average Base Rent PSF on Leases Executed during the trailing twelve months ended(c) |

Average Base Rent PSF on Leases Expiring during the trailing twelve months ended(d) |

||||||||||

| Consolidated Centers |

||||||||||||

| 12/31/2019 |

$ | 58.76 | $ | 53.29 | $ | 53.20 | ||||||

| 12/31/2018 |

$ | 56.82 | $ | 54.00 | $ | 49.07 | ||||||

| 12/31/2017 |

$ | 55.08 | $ | 57.36 | $ | 49.61 | ||||||

| Unconsolidated Joint Venture Centers |

||||||||||||

| 12/31/2019 |

$ | 65.67 | $ | 73.05 | $ | 65.22 | ||||||

| 12/31/2018 |

$ | 63.84 | $ | 66.95 | $ | 59.49 | ||||||

| 12/31/2017 |

$ | 60.99 | $ | 63.50 | $ | 55.50 | ||||||

| All Regional Shopping Centers |

||||||||||||

| 12/31/2019 |

$ | 61.06 | $ | 59.15 | $ | 56.50 | ||||||

| 12/31/2018 |

$ | 59.09 | $ | 57.55 | $ | 51.80 | ||||||

| 12/31/2017 |

$ | 56.97 | $ | 59.20 | $ | 51.39 | ||||||

| (a) | Average base rent per square foot is based on spaces 10,000 square feet and under. All joint venture amounts are included at pro rata. Centers under development and redevelopment are excluded. |

| (b) | Average base rent per square foot gives effect to the terms of each lease in effect, as of the applicable date, including any concessions, abatements and other adjustments or allowances that have been granted to the tenants. |

| (c) | The average base rent per square foot on leases executed during the period represents the actual rent to be paid during the first twelve months. |

| (d) | The average base rent per square foot on leases expiring during the period represents the final year minimum rent on a cash basis. |

19

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Cost of Occupancy

| For Years Ended December 31, | ||||||||||

| 2019 | 2018 | 2017 | ||||||||

| Consolidated Centers |

||||||||||

| Minimum rents |

9.1% | 9.3% | 9.5% | |||||||

| Percentage rents |

0.4% | 0.3% | 0.3% | |||||||

| Expense recoveries(a) |

3.6% | 3.9% | 4.2% | |||||||

|

|

|

|

|

|

||||||

| Total |

13.1% | 13.5% | 14.0% | |||||||

|

|

|

|

|

|

||||||

| For Years Ended December 31, | ||||||||||

| 2019 | 2018 | 2017 | ||||||||

| Unconsolidated Joint Venture Centers |

||||||||||

| Minimum rents |

7.3% | 7.8% | 8.6% | |||||||

| Percentage rents |

0.3% | 0.3% | 0.3% | |||||||

| Expense recoveries(a) |

3.2% | 3.4% | 3.8% | |||||||

|

|

|

|

|

|

||||||

| Total |

10.8% | 11.5% | 12.7% | |||||||

|

|

|

|

|

|

||||||

| For Years Ended December 31, | ||||||||||

| 2019 | 2018 | 2017 | ||||||||

| All Centers |

||||||||||

| Minimum rents |

8.1% | 8.5% | 9.0% | |||||||

| Percentage rents |

0.3% | 0.3% | 0.3% | |||||||

| Expense recoveries(a) |

3.4% | 3.6% | 4.0% | |||||||

|

|

|

|

|

|

||||||

| Total |

11.8% | 12.4% | 13.3% | |||||||

|

|

|

|

|

|

||||||

| (a) | Represents real estate tax and common area maintenance charges. |

20

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Percentage of Net Operating Income by State

| State |

% of Portfolio 2020 Forecast Real Estate Pro Rata NOI(a) |

|||

| California |

26.7 | % | ||

| New York |

23.7 | % | ||

| Arizona |

16.1 | % | ||

| Pennsylvania & Virginia |

10.0 | % | ||

| Colorado, Illinois & Missouri |

8.8 | % | ||

| New Jersey & Connecticut |

6.9 | % | ||

| Oregon |

4.2 | % | ||

| Other(b) |

3.6 | % | ||

|

|

|

|||

| Total |

100.0 | % | ||

|

|

|

|||

| (a) | The percentage of Portfolio 2020 Forecast Pro Rata Real Estate NOI is based on guidance assumptions provided on February 6, 2020, see page 10. Real Estate NOI excludes straight-line and above/below market adjustments to minimum rents. Real Estate NOI also does not reflect REIT expenses and Management Company revenues and expenses. See the Company’s forward-looking statements disclosure on pages 1 and 2 for factors that may affect the information provided in this column. |

| (b) | “Other” includes Indiana, Iowa, Kentucky, North Dakota and Texas. |

21

The Macerich Company

Property Listing

December 31, 2019

The following table sets forth certain information regarding the Centers and other locations that are wholly owned or partly owned by the Company.

| Count |

Company’s Ownership(a) |

Name of |

Year of Original Construction/ Acquisition |

Year of Most Recent Expansion/ Renovation |

Total GLA(b) |

|||||||||||

| CONSOLIDATED CENTERS: |

|

|||||||||||||||

| 1 | 50.1% | Chandler Fashion Center |

2001/2002 | — | 1,318,000 | |||||||||||

| 2 | 100% | Danbury Fair Mall |

1986/2005 | 2016 | 1,271,000 | |||||||||||

| 3 | 100% | Desert Sky Mall |

1981/2002 | 2007 | 746,000 | |||||||||||

| 4 | 100% | Eastland Mall(c) |

1978/1998 | 1996 | 1,034,000 | |||||||||||

| 5 | 100% | Fashion Outlets of Chicago |

2013/— | — | 537,000 | |||||||||||

| 6 | 100% | Fashion Outlets of Niagara Falls USA |

1982/2011 | 2014 | 689,000 | |||||||||||

| 7 | 50.1% | Freehold Raceway Mall |

1990/2005 | 2007 | 1,673,000 | |||||||||||

| 8 | 100% | Fresno Fashion Fair |

1970/1996 | 2006 | 995,000 | |||||||||||

| 9 | 100% | Green Acres Mall(c) |

1956/2013 | 2016 | 2,063,000 | |||||||||||

| 10 | 100% | Inland Center |

1966/2004 | 2016 | 605,000 | |||||||||||

| 11 | 100% | Kings Plaza Shopping Center(c) |

1971/2012 | 2018 | 1,137,000 | |||||||||||

| 12 | 100% | La Cumbre Plaza(c) |

1967/2004 | 1989 | 492,000 | |||||||||||

| 13 | 100% | NorthPark Mall |

1973/1998 | 2001 | 934,000 | |||||||||||

| 14 | 100% | Oaks, The |

1978/2002 | 2009 | 1,209,000 | |||||||||||

| 15 | 100% | Pacific View |

1965/1996 | 2001 | 900,000 | |||||||||||

| 16 | 100% | Queens Center(c) |

1973/1995 | 2004 | 965,000 | |||||||||||

| 17 | 100% | Santa Monica Place |

1980/1999 | 2015 | 526,000 | |||||||||||

| 18 | 84.9% | SanTan Village Regional Center |

2007/— | 2018 | 1,124,000 | |||||||||||

| 19 | 100% | SouthPark Mall |

1974/1998 | 2015 | 863,000 | |||||||||||

| 20 | 100% | Stonewood Center(c) |

1953/1997 | 1991 | 935,000 | |||||||||||

| 21 | 100% | Superstition Springs Center |

1990/2002 | 2002 | 922,000 | |||||||||||

| 22 | 100% | Towne Mall |

1985/2005 | 1989 | 350,000 | |||||||||||

22

The Macerich Company

Property Listing

December 31, 2019

| Count |

Company’s Ownership(a) |

Name of |

Year of Original Construction/ Acquisition |

Year of Most Recent Expansion/ Renovation |

Total GLA(b) |

|||||||||

| 23 |

100% | Tucson La Encantada |

2002/2002 | 2005 | 246,000 | |||||||||

| 24 |

100% | Valley Mall |

1978/1998 | 1992 | 505,000 | |||||||||

| 25 |

100% | Valley River Center |

1969/2006 | 2007 | 871,000 | |||||||||

| 26 |

100% | Victor Valley, Mall of |

1986/2004 | 2012 | 577,000 | |||||||||

| 27 |

100% | Vintage Faire Mall |

1977/1996 | 2008 | 984,000 | |||||||||

| 28 |

100% | Wilton Mall |

1990/2005 | 1998 | 709,000 | |||||||||

|

|

|

|||||||||||||

| Total Consolidated Centers | 25,180,000 | |||||||||||||

|

|

|

|||||||||||||

| UNCONSOLIDATED JOINT VENTURE CENTERS: |

|

|||||||||||||

| 29 |

60% | Arrowhead Towne Center |

1993/2002 | 2015 | 1,197,000 | |||||||||

| 30 |

50% | Biltmore Fashion Park |

1963/2003 | 2006 | 597,000 | |||||||||

| 31 |

50% | Broadway Plaza |

1951/1985 | 2016 | 927,000 | |||||||||

| 32 |

50.1% | Corte Madera, The Village at |

1985/1998 | 2005 | 501,000 | |||||||||

| 33 |

50% | Country Club Plaza |

1922/2016 | 2015 | 947,000 | |||||||||

| 34 |

51% | Deptford Mall |

1975/2006 | 1990 | 1,040,000 | |||||||||

| 35 |

51% | FlatIron Crossing |

2000/2002 | 2009 | 1,428,000 | |||||||||

| 36 |

50% | Kierland Commons |

1999/2005 | 2003 | 437,000 | |||||||||

| 37 |

60% | Lakewood Center |

1953/1975 | 2008 | 2,069,000 | |||||||||

| 38 |

60% | Los Cerritos Center |

1971/1999 | 2016 | 1,023,000 | |||||||||

| 39 |

50% | North Bridge, The Shops at(c) |

1998/2008 | — | 670,000 | |||||||||

| 40 |

50% | Scottsdale Fashion Square |

1961/2002 | 2019 | 1,835,000 | |||||||||

| 41 |

60% | South Plains Mall |

1972/1998 | 2017 | 1,136,000 | |||||||||

| 42 |

51% | Twenty Ninth Street(c) |

1963/1979 | 2007 | 845,000 | |||||||||

| 43 |

50% | Tysons Corner Center |

1968/2005 | 2014 | 1,971,000 | |||||||||

| 44 |

60% | Washington Square |

1974/1999 | 2005 | 1,296,000 | |||||||||

| 45 |

19% | West Acres |

1972/1986 | 2001 | 691,000 | |||||||||

|

|

|

|||||||||||||

| Total Unconsolidated Joint Venture Centers | 18,610,000 | |||||||||||||

|

|

|

|||||||||||||

23

The Macerich Company

Property Listing

December 31, 2019

| Count |

Company’s Ownership(a) |

Name of |

Year of Original Construction/ Acquisition |

Year of Most Recent Expansion/ Renovation |

Total GLA(b) |

|||||||||||

| REGIONAL SHOPPING CENTERS UNDER REDEVELOPMENT: |

|

|||||||||||||||

| 46 |

50% | Fashion District Philadelphia(c)(d)(e) |

1977/2014 | 2019 | 899,000 | |||||||||||

| 47 |

100% | Paradise Valley Mall(f) |

1979/2002 | 2009 | 1,202,000 | |||||||||||

|

|

|

|||||||||||||||

| Total Regional Shopping Centers | 45,891,000 | |||||||||||||||

|

|

|

|||||||||||||||

| COMMUNITY / POWER CENTERS: |

|

|||||||||||||||

| 1 |

50% | Atlas Park, The Shops at(d) |

2006/2011 | 2013 | 369,000 | |||||||||||

| 2 |

50% | Boulevard Shops(d) |

2001/2002 | 2004 | 184,000 | |||||||||||

| 3 |

100% | Southridge Center(f) |

1975/1998 | 2013 | 848,000 | |||||||||||

| 4 |

100% | Superstition Springs Power Center(f) |

1990/2002 | — | 206,000 | |||||||||||

| 5 |

100% | The Marketplace at Flagstaff(c)(f) |

2007/— | — | 268,000 | |||||||||||

|

|

|

|||||||||||||||

| Total Community / Power Centers | 1,875,000 | |||||||||||||||

|

|

|

|||||||||||||||

| OTHER ASSETS: |

||||||||||||||||

| 100% | Various(f)(g) |

427,000 | ||||||||||||||

| 83.2% | Estrella Falls(f) |

79,000 | ||||||||||||||

| 50% | Scottsdale Fashion Square-Office(d) |

124,000 | ||||||||||||||

| 50% | Tysons Corner Center-Office(d) |

174,000 | ||||||||||||||

| 50% | Hyatt Regency Tysons Corner Center(d) |

290,000 | ||||||||||||||

| 50% | VITA Tysons Corner Center(d)(h) |

510,000 | ||||||||||||||

| 50% | Tysons Tower(d) |

529,000 | ||||||||||||||

| OTHER ASSETS UNDER REDEVELOPMENT: |

||||||||||||||||

| 25% | One Westside(d)(i) |

680,000 | ||||||||||||||

|

|

|

|||||||||||||||

| Total Other Assets | 2,813,000 | |||||||||||||||

|

|

|

|||||||||||||||

| Grand Total | 50,579,000 | |||||||||||||||

|

|

|

|||||||||||||||

| (a) | The Company’s ownership interest in this table reflects its legal ownership interest. See footnotes (a) and (b) on pages 26 and 27 regarding the legal versus economic ownership of joint venture entities. |

| (b) | Includes GLA attributable to anchors (whether owned or non-owned) and mall and freestanding stores. |

| (c) | Portions of the land on which the Center is situated are subject to one or more long-term ground leases. With respect to 42 Centers, the underlying land controlled by the Company is owned in fee entirely by the Company, or, in the case of jointly-owned Centers, by the joint venture property partnership or limited liability company. |

24

The Macerich Company

Property Listing

December 31, 2019

| (d) | Included in Unconsolidated Joint Venture Centers. |

| (e) | On September 19, 2019, the Company’s joint venture opened Fashion District Philadelphia in downtown Philadelphia. |

| (f) | Included in Consolidated Centers. |

| (g) | The Company owns an office building and six stores located at shopping centers not owned by the Company. Of the six stores, one is leased to Kohl’s, two are vacant, and three have been leased for non-Anchor uses. With respect to the office building and three of the six stores, the underlying land is owned in fee entirely by the Company. With respect to the remaining three stores, the underlying land is owned by third parties and leased to the Company pursuant to long-term building or ground leases. |

| (h) | This property is under contract to be sold. The Company anticipates this residential tower will be sold in the first half of 2020. |

| (i) | Construction is underway to convert former Regional Shopping Center Westside Pavilion, which closed in January 2019, into an approximately 584,000 square foot Class A creative office campus called One Westside leased solely to Google, while maintaining approximately 96,000 square feet of adjacent entertainment and retail space at 10850 Pico Boulevard. |

25

The Macerich Company

Joint Venture List as of December 31, 2019

The following table sets forth certain information regarding the Centers and other operating properties that are not wholly owned by the Company. This list of properties includes unconsolidated joint ventures, consolidated joint ventures, and financing arrangements. The percentages shown are the effective legal ownership and economic ownership interests of the Company as of December 31, 2019.

| Properties |

Legal Ownership(a) |

Economic Ownership(b) |

Joint Venture |

Total GLA(c) | ||||||||||

| Arrowhead Towne Center(d) |

60 | % | 60 | % | New River Associates LLC | 1,197,000 | ||||||||

| Atlas Park, The Shops at |

50 | % | 50 | % | WMAP, L.L.C. | 369,000 | ||||||||

| Biltmore Fashion Park |

50 | % | 50 | % | Biltmore Shopping Center Partners LLC | 597,000 | ||||||||

| Boulevard Shops |

50 | % | 50 | % | Propcor II Associates, LLC | 184,000 | ||||||||

| Broadway Plaza(e) |

50 | % | 50 | % | Macerich HHF Broadway Plaza LLC | 927,000 | ||||||||

| Chandler Fashion Center(d)(f) |

50.1 | % | 50.1 | % | Freehold Chandler Holdings LP | 1,318,000 | ||||||||

| Corte Madera, The Village at |

50.1 | % | 50.1 | % | Corte Madera Village, LLC | 501,000 | ||||||||

| Country Club Plaza |

50 | % | 50 | % | Country Club Plaza KC Partners LLC | 947,000 | ||||||||

| Deptford Mall(d) |

51 | % | 51 | % | Macerich HHF Centers LLC | 1,040,000 | ||||||||

| Estrella Falls |

83.2 | % | 83.2 | % | Westcor Goodyear RSC LLC | 79,000 | ||||||||

| Fashion District Philadelphia |

50 | % | 50 | % | Various Entities | 899,000 | ||||||||

| FlatIron Crossing |

51 | % | 51 | % | Macerich HHF Centers LLC | 1,428,000 | ||||||||

| Freehold Raceway Mall(d)(f) |

50.1 | % | 50.1 | % | Freehold Chandler Holdings LP | 1,673,000 | ||||||||

| Hyatt Regency Tysons Corner Center |

50 | % | 50 | % | Tysons Corner Hotel I LLC | 290,000 | ||||||||

| Kierland Commons |

50 | % | 50 | % | Kierland Commons Investment LLC | 437,000 | ||||||||

| Lakewood Center |

60 | % | 60 | % | Pacific Premier Retail LLC | 2,069,000 | ||||||||

| Los Angeles Premium Outlets |

50 | % | 50 | % | CAM-CARSON LLC | — | ||||||||

| Los Cerritos Center(d) |

60 | % | 60 | % | Pacific Premier Retail LLC | 1,023,000 | ||||||||

| North Bridge, The Shops at |

50 | % | 50 | % | North Bridge Chicago LLC | 670,000 | ||||||||

| SanTan Village Regional Center |

84.9 | % | 84.9 | % | Westcor SanTan Village LLC | 1,124,000 | ||||||||

| Scottsdale Fashion Square |

50 | % | 50 | % | Scottsdale Fashion Square Partnership | 1,835,000 | ||||||||

| Scottsdale Fashion Square-Office |

50 | % | 50 | % | Scottsdale Fashion Square Partnership | 124,000 | ||||||||

| Macerich Seritage Portfolio(g) |

50 | % | 50 | % | MS Portfolio LLC | 1,060,000 | ||||||||

| South Plains Mall(d) |

60 | % | 60 | % | Pacific Premier Retail LLC | 1,136,000 | ||||||||

| Twenty Ninth Street |

51 | % | 51 | % | Macerich HHF Centers LLC | 845,000 | ||||||||

| Tysons Corner Center |

50 | % | 50 | % | Tysons Corner LLC | 1,971,000 | ||||||||

| Tysons Corner Center-Office |

50 | % | 50 | % | Tysons Corner Property LLC | 174,000 | ||||||||

| Tysons Tower |

50 | % | 50 | % | Tysons Corner Property LLC | 529,000 | ||||||||

| VITA Tysons Corner Center(h) |

50 | % | 50 | % | Tysons Corner Property LLC | 510,000 | ||||||||

| Washington Square(d) |

60 | % | 60 | % | Pacific Premier Retail LLC | 1,296,000 | ||||||||

| West Acres |

19 | % | 19 | % | West Acres Development, LLP | 691,000 | ||||||||

| One Westside(i) |

25 | % | 25 | % | HPP-MAC WSP, LLC | 680,000 | ||||||||

| (a) | This column reflects the Company’s legal ownership in the listed properties as of December 31, 2019. Legal ownership may, at times, not equal the Company’s economic interest in the listed properties because of various provisions in certain joint venture agreements regarding distributions of cash flow based on capital account balances, allocations of profits and losses and payments of preferred returns. As a result, the Company’s actual economic interest (as distinct from its legal ownership interest) in certain of the properties could fluctuate from time to time and may not wholly align with its legal ownership interests. Substantially all of the Company’s joint venture agreements contain rights of first refusal, buy-sell provisions, exit rights, default dilution remedies and/or other break up provisions or remedies which are customary in real estate joint venture agreements and which may, positively or negatively, affect the ultimate realization of cash flow and/or capital or liquidation proceeds. |

26

The Macerich Company

Joint Venture List as of December 31, 2019

| (b) | Economic ownership represents the allocation of cash flow to the Company as of December 31, 2019, except as noted below. In cases where the Company receives a current cash distribution greater than its legal ownership percentage due to a capital account greater than its legal ownership percentage, only the legal ownership percentage is shown in this column. The Company’s economic ownership of these properties may fluctuate based on a number of factors, including mortgage refinancings, partnership capital contributions and distributions, and proceeds and gains or losses from asset sales, and the matters set forth in the preceding paragraph. |

| (c) | Includes GLA attributable to anchors (whether owned or non-owned) and mall and freestanding stores as of December 31, 2019. |

| (d) | These centers have a former Sears store which is owned by MS Portfolio LLC, see footnote (g) below. The GLA of the former Sears store, or tenant replacing the former Sears store, at the seven centers indicated with footnote (d) in the table above is included in Total GLA at the center level. The GLA for the former Sears store at these seven centers plus the GLA of the former Sears store at two wholly owned centers, Danbury Fair Mall and Vintage Faire Mall, are also aggregated into the 1,060,000 square feet in the MS Portfolio LLC above. |

| (e) | In October 2018, the Company’s joint venture partner in Broadway Plaza sold its 50% interest to a third party investor. Thereafter, the joint venture restated its governing documents and changed its name to Macerich HHF Broadway Plaza LLC. |

| (f) | The joint venture entity was formed in September 2009. Upon liquidation of the partnership, distributions are made in the following order: to the third-party partner until it receives a 13% internal rate of return on and of its aggregate unreturned capital contributions; to the Company until it receives a 13% internal rate of return on and of its aggregate unreturned capital contributions; and, thereafter, pro rata 35% to the third-party partner and 65% to the Company. |

| (g) | On April 30, 2015 Sears Holdings Corporation (“Sears”) and the Company announced that they had formed a joint venture, MS Portfolio LLC. Sears contributed nine stores (located at Arrowhead Towne Center, Chandler Fashion Center, Danbury Fair Mall, Deptford Mall, Freehold Raceway Mall, Los Cerritos Center, South Plains Mall, Vintage Faire Mall and Washington Square) to the joint venture and the Company contributed $150 million in cash to the joint venture. On July 7, 2015, Sears assigned its ownership interest in MS Portfolio LLC to Seritage MS Holdings LLC. The Company expects to create additional value through re-leasing the former Sears boxes. For example, Primark has leased space in portions of the Sears stores at Danbury Fair Mall and Freehold Raceway Mall. Refer to the Development Pipeline Forecast on page 32 for details of the Former Sears Redevelopments at these properties. |

| (h) | This property is under contract to be sold. The Company anticipates this residential tower will be sold in the first half of 2020. |

| (i) | Construction is underway to convert former Regional Shopping Center Westside Pavilion, which closed in January 2019, into an approximately 584,000 square foot Class A creative office campus called One Westside leased solely to Google, while maintaining approximately 96,000 square feet of adjacent entertainment and retail space at 10850 Pico Boulevard. The Company contributed the existing buildings and land valued at $190.0 million to the joint venture on August 31, 2018. |

27

The Macerich Company

Supplemental Financial and Operating Information (Unaudited)

Debt Summary (at Company’s pro rata share) (a)

| As of December 31, 2019 | ||||||||||||

| Fixed Rate | Floating Rate |

Total | ||||||||||

| (Dollars in thousands) | ||||||||||||

| Mortgage notes payable |

$ | 3,965,856 | $ | 426,743 | $ | 4,392,599 | ||||||

| Bank and other notes payable |

400,000 | 417,377 | 817,377 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total debt per Consolidated Balance Sheet |

4,365,856 | 844,120 | 5,209,976 | |||||||||

| Adjustments: |

||||||||||||

| Less: Noncontrolling interests or financing arrangement share of debt from consolidated joint ventures |

(359,125 | ) | — | (359,125 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Adjusted Consolidated Debt |

4,006,731 | 844,120 | 4,850,851 | |||||||||

| Add: Company’s share of debt from unconsolidated joint ventures |

3,029,465 | 194,551 | 3,224,016 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Company’s Pro Rata Share of Debt |

$ | 7,036,196 | $ | 1,038,671 | $ | 8,074,867 | ||||||

|

|

|

|

|

|

|

|||||||

| Weighted average interest rate |

3.94 | % | 3.66 | % | 3.90 | % | ||||||

| Weighted average maturity (years) |

5.39 | |||||||||||

| (a) | The Company’s pro rata share of debt represents (i) consolidated debt, minus the Company’s partners’ share of the amount from consolidated joint ventures (calculated based upon the partners’ percentage ownership interest); plus (ii) the Company’s share of debt from unconsolidated joint ventures (calculated based upon the Company’s percentage ownership interest). Management believes that this measure provides useful information to investors regarding the Company’s financial condition because it includes the Company’s share of debt from unconsolidated joint ventures and, for consolidated debt, excludes the Company’s partners’ share from consolidated joint ventures, in each case presented on the same basis. The Company has several significant joint ventures and presenting its pro rata share of debt in this manner can help investors better understand the Company’s financial condition after taking into account the Company’s economic interest in these joint ventures. The Company’s pro rata share of debt should not be considered as a substitute to the Company’s total debt determined in accordance with GAAP or any other GAAP financial measures and should only be considered together with and as a supplement to the Company’s financial information prepared in accordance with GAAP. |

28

The Macerich Company

Supplemental Financial and Operating Information (Unaudited)

Outstanding Debt by Maturity Date

| As of December 31, 2019 | ||||||||||||||||||||

| Center/Entity (dollars in thousands) |

Maturity Date |

Effective Interest Rate (a) |

Fixed | Floating | Total Debt Balance (a) |

|||||||||||||||

| I. Consolidated Assets: |

||||||||||||||||||||

| Danbury Fair Mall |

10/01/20 | 5.53 | % | $ | 194,718 | — | $ | 194,718 | ||||||||||||

| Fashion Outlets of Niagara Falls USA |

10/06/20 | 4.89 | % | 106,398 | — | 106,398 | ||||||||||||||

| Green Acres Mall |

02/03/21 | 3.61 | % | 277,747 | — | 277,747 | ||||||||||||||

| The Macerich Partnership, L.P.—Line of Credit (b)(c) |

07/06/21 | 4.30 | % | 400,000 | — | 400,000 | ||||||||||||||

| Tucson La Encantada |

03/01/22 | 4.23 | % | 63,682 | — | 63,682 | ||||||||||||||

| Pacific View |

04/01/22 | 4.08 | % | 118,202 | — | 118,202 | ||||||||||||||

| Oaks, The |

06/05/22 | 4.14 | % | 187,142 | — | 187,142 | ||||||||||||||

| Towne Mall |

11/01/22 | 4.48 | % | 20,284 | — | 20,284 | ||||||||||||||

| Chandler Fashion Center (d) |

07/05/24 | 4.18 | % | 127,842 | — | 127,842 | ||||||||||||||

| Victor Valley, Mall of |

09/01/24 | 4.00 | % | 114,733 | — | 114,733 | ||||||||||||||

| Queens Center |

01/01/25 | 3.49 | % | 600,000 | — | 600,000 | ||||||||||||||

| Vintage Faire |

03/06/26 | 3.55 | % | 252,389 | — | 252,389 | ||||||||||||||

| Fresno Fashion Fair |

11/01/26 | 3.67 | % | 323,659 | — | 323,659 | ||||||||||||||

| SanTan Village Regional Center (e) |

07/01/29 | 4.34 | % | 186,138 | — | 186,138 | ||||||||||||||

| Freehold Raceway Mall (d) |

11/01/29 | 3.94 | % | 199,588 | — | 199,588 | ||||||||||||||

| Kings Plaza Shopping Center |

01/01/30 | 3.71 | % | 535,097 | — | 535,097 | ||||||||||||||

| Fashion Outlets of Chicago |

02/01/31 | 4.61 | % | 299,112 | — | 299,112 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Fixed Rate Debt for Consolidated Assets |

4.01 | % | $ | 4,006,731 | $ | — | $ | 4,006,731 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Green Acres Commons (c) |

03/29/21 | 4.40 | % | $ | — | $ | 128,926 | $ | 128,926 | |||||||||||

| The Macerich Partnership, L.P.—Line of Credit (b)(c) |

07/06/21 | 3.56 | % | — | 417,377 | 417,377 | ||||||||||||||

| Santa Monica Place (c) |

12/09/22 | 3.34 | % | — | 297,817 | 297,817 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Floating Rate Debt for Consolidated Assets |

3.61 | % | $ | — | $ | 844,120 | $ | 844,120 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Debt for Consolidated Assets |

3.94 | % | $ | 4,006,731 | $ | 844,120 | $ | 4,850,851 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| II. Unconsolidated Assets (At Company’s pro rata share): |

|

|||||||||||||||||||

| FlatIron Crossing (51%) |

01/05/21 | 2.81 | % | $ | 115,976 | $ | — | $ | 115,976 | |||||||||||

| One Westside—defeased (25%) |

10/01/22 | 4.77 | % | 33,758 | — | 33,758 | ||||||||||||||

| Washington Square Mall (60%) |

11/01/22 | 3.65 | % | 329,494 | — | 329,494 | ||||||||||||||

| Deptford Mall (51%) |

04/03/23 | 3.55 | % | 90,517 | — | 90,517 | ||||||||||||||

| Scottsdale Fashion Square (50%) |

04/03/23 | 3.02 | % | 223,190 | — | 223,190 | ||||||||||||||

| Tysons Corner Center (50%) |

01/01/24 | 4.13 | % | 373,024 | — | 373,024 | ||||||||||||||

| South Plains Mall (60%) |

11/06/25 | 4.22 | % | 120,000 | — | 120,000 | ||||||||||||||

| Twenty Ninth Street (51%) |

02/06/26 | 4.10 | % | 76,500 | — | 76,500 | ||||||||||||||

| Country Club Plaza (50%) |

04/01/26 | 3.88 | % | 157,788 | — | 157,788 | ||||||||||||||

| Lakewood Center (60%) |

06/01/26 | 4.15 | % | 214,660 | — | 214,660 | ||||||||||||||

| Kierland Commons (50%) |

04/01/27 | 3.98 | % | 106,836 | — | 106,836 | ||||||||||||||

| Los Cerritos Center (60%) |

11/01/27 | 4.00 | % | 315,000 | — | 315,000 | ||||||||||||||

| Arrowhead Towne Center (60%) |

02/01/28 | 4.05 | % | 240,000 | — | 240,000 | ||||||||||||||

| North Bridge, The Shops at (50%) |

06/01/28 | 3.71 | % | 187,045 | — | 187,045 | ||||||||||||||

| Corte Madera, The Village at (50.1%) |

09/01/28 | 3.53 | % | 112,415 | — | 112,415 | ||||||||||||||

| West Acres—Development (19%) |

10/10/29 | 3.72 | % | 170 | — | 170 | ||||||||||||||

| Tysons Tower (50%) |

11/11/29 | 3.38 | % | 94,380 | — | 94,380 | ||||||||||||||

| Broadway Plaza (50%) |

04/01/30 | 4.19 | % | 224,462 | — | 224,462 | ||||||||||||||

| West Acres (19%) |

03/01/32 | 4.61 | % | 14,250 | — | 14,250 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Fixed Rate Debt for Unconsolidated Assets |

3.84 | % | $ | 3,029,465 | $ | — | $ | 3,029,465 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

29

The Macerich Company

Supplemental Financial and Operating Information (Unaudited)

Outstanding Debt by Maturity Date

| As of December 31, 2019 | ||||||||||||||||||||

| Center/Entity (dollars in thousands) |

Maturity Date |

Effective Interest Rate (a) |

Fixed | Floating | Total Debt Balance (a) |

|||||||||||||||

| Atlas Park (50%) (c) |

10/28/21 | 4.65 | % | $ | — | $ | 35,742 | $ | 35,742 | |||||||||||

| Fashion District Philadelphia (50%) |

01/22/23 | 3.69 | % | — | 149,546 | 149,546 | ||||||||||||||

| Boulevard Shops (50%) |

12/05/23 | 3.91 | % | — | 9,253 | 9,253 | ||||||||||||||

| One Westside—Development (25%) (c) |

12/18/24 | 3.71 | % | — | 10 | 10 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Floating Rate Debt for Unconsolidated Assets |

3.88 | % | $ | — | $ | 194,551 | $ | 194,551 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Debt for Unconsolidated Assets |

3.84 | % | $ | 3,029,465 | $ | 194,551 | $ | 3,224,016 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Debt |

3.90 | % | $ | 7,036,196 | $ | 1,038,671 | $ | 8,074,867 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Percentage to Total |

87.14 | % | 12.86 | % | 100.00 | % | ||||||||||||||

| (a) | The debt balances include the unamortized debt premiums/discounts and loan finance costs. Debt premiums/discounts represent the excess of the fair value of debt over the principal value of debt assumed in various acquisitions. Debt premiums/discounts and loan finance costs are amortized into interest expense over the remaining term of the related debt in a manner that approximates the effective interest method. The annual interest rate in the table represents the effective interest rate, including the debt premiums/discounts and loan finance costs. |

| (b) | The revolving line of credit includes an interest rate swap that effectively converts $400 million of the outstanding balance to fixed rate debt through September 30, 2021. |

| (c) | The maturity date assumes that all available extension options are fully exercised and that the Company and/or its affiliates do not opt to refinance the debt prior to these dates. |

| (d) | This property is owned by a consolidated joint venture. The above debt balance represents the Company’s pro rata share of 50.1%. |

| (e) | This property is owned by a consolidated joint venture. The above debt balance represents the Company’s pro rata share of 84.9%. |

30

The Macerich Company

Supplemental Financial and Operating Information (Unaudited)

Development Pipeline Forecast

(Dollars in millions)

as of December 31, 2019

In-Process Developments and Redevelopments:

| Property |

Project Type |

Total Cost(a)(b) |

Ownership |