Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - EASTGROUP PROPERTIES INC | exhibit991262020.htm |

| 8-K - 8-K - EASTGROUP PROPERTIES INC | form8-k262020.htm |

Table of Contents Conference Call 877-876-9173 | ID – EastGroup February 7, 2020 11:00 a.m. Eastern Time 2019 webcast available at EastGroup.net FOURTH QUARTER Supplemental Information December 31, 2019 400 W. Parkway Place, Suite 100, Ridgeland, MS 39157 | TEL: 601-354-3555 | FAX: 601-352-1441 | EastGroup.net Page 1 of 24

Table of Contents Financial Information: Consolidated Balance Sheets ..................................................................................... 3 Consolidated Statements of Income and Comprehensive Income ............................ 4 Reconciliations of GAAP to Non-GAAP Measures .................................................. 5 Consolidated Statements of Cash Flows .................................................................... 7 Same Property Portfolio Analysis ............................................................................. 8 Additional Financial Information .............................................................................. 9 Financial Statistics ..................................................................................................... 10 Capital Deployment: Development and Value-Add Properties Summary .................................................. 11 Development and Value-Add Properties Transferred to Real Estate Properties ....... 12 Acquisitions and Dispositions ................................................................................... 13 Real Estate Improvements and Leasing Costs ........................................................... 14 Property Information: Leasing Statistics and Occupancy Summary ............................................................. 15 Core Market Operating Statistics ............................................................................... 16 Lease Expiration Summary ........................................................................................ 17 Top 10 Customers by Annualized Base Rent ............................................................ 18 Capitalization: Debt and Equity Market Capitalization ..................................................................... 19 Continuous Common Equity Program ....................................................................... 20 Debt-to-EBITDAre Ratios ......................................................................................... 21 Other Information: Outlook for 2020 ........................................................................................................ 22 Glossary of REIT Terms ............................................................................................ 23 FORWARD-LOOKING STATEMENTS The statements and certain other information contained in this press release, which can be identified by the use of forward-looking terminology such as "believes," "expects," "may," "should," "intends," "plans," "estimates" or "anticipates" and variations of such words or similar expressions or the negative of such words, constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbors created thereby. These forward-looking statements reflect the Company's current views about its plans, intentions, expectations, strategies and prospects, which are based on the information currently available to the Company and on assumptions it has made. Although the Company believes that its plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, the Company can give no assurance that such plans, intentions, expectations or strategies will be attained or achieved. Furthermore, these forward-looking statements should be considered as subject to the many risks and uncertainties that exist in the Company's operations and business environment. Such risks and uncertainties could cause actual results to differ materially from those projected. These uncertainties include, but are not limited to: changes in general economic conditions; the extent of customer defaults or of any early lease terminations; the Company's ability to lease or re-lease space at current or anticipated rents; the availability of financing; failure to maintain credit ratings with rating agencies; changes in the supply of and demand for industrial/warehouse properties; increases in interest rate levels; increases in operating costs; natural disasters, terrorism, riots and acts of war, and the Company's ability to obtain adequate insurance; changes in governmental regulation, tax rates and similar matters; attracting and retaining key personnel; other risks associated with the development and acquisition of properties, including risks that development projects may not be completed on schedule, development or operating costs may be greater than anticipated or acquisitions may not close as scheduled; and other risks detailed in the sections of the Company's most recent Forms 10-K and 10-Q filed with the SEC titled "Risk Factors." The Company assumes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Page 2 of 24

Consolidated Balance Sheets (In thousands, except share and per share data) (Unaudited) December 31, 2019 December 31, 2018 ASSETS Real estate properties$ 2,844,567 2,553,481 Development and value-add properties 419,999 263,664 3,264,566 2,817,145 Less accumulated depreciation (871,139) (814,915) 2,393,427 2,002,230 Unconsolidated investment 7,805 7,870 Cash 224 374 Other assets 144,622 121,231 TOTAL ASSETS $ 2,546,078 2,131,705 LIABILITIES AND EQUITY LIABILITIES Unsecured bank credit facilities$ 111,394 193,926 Unsecured debt 938,115 723,400 Secured debt 133,093 188,461 Accounts payable and accrued expenses 92,024 86,563 Other liabilities 69,123 34,652 Total Liabilities 1,343,749 1,227,002 EQUITY Stockholders' Equity: Common stock; $.0001 par value; 70,000,000 shares authorized; 38,925,953 shares issued and outstanding at December 31, 2019 and 36,501,356 at December 31, 2018 4 4 Excess shares; $.0001 par value; 30,000,000 shares authorized; no shares issued - - Additional paid-in capital 1,514,055 1,222,547 Distributions in excess of earnings (316,302) (326,193) Accumulated other comprehensive income 2,807 6,701 Total Stockholders' Equity 1,200,564 903,059 Noncontrolling interest in joint ventures 1,765 1,644 Total Equity 1,202,329 904,703 TOTAL LIABILITIES AND EQUITY $ 2,546,078 2,131,705 Page 3 of 24

Consolidated Statements of Income and Comprehensive Income (In thousands, except per share data) (Unaudited) Three Months Ended Twelve Months Ended December 31, December 31, 2019 2018 2019 2018 REVENUES Income from real estate operations$ 86,480 77,872 330,813 299,018 Other revenue 70 106 574 1,374 86,550 77,978 331,387 300,392 EXPENSES Expenses from real estate operations 24,294 22,547 93,274 86,394 Depreciation and amortization 27,697 24,241 104,724 91,704 General and administrative 4,905 3,475 16,406 13,738 Indirect leasing costs 105 - 411 - 57,001 50,263 214,815 191,836 OTHER INCOME (EXPENSE) Interest expense (8,249) (8,853) (34,463) (35,106) Gain on sales of real estate investments 29,662 - 41,068 14,273 Other 320 (279) 163 913 NET INCOME 51,282 18,583 123,340 88,636 Net income attributable to noncontrolling interest in joint ventures (1,673) (27) (1,678) (130) NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS 49,609 18,556 121,662 88,506 Other comprehensive income (loss) - cash flow hedges 2,429 (3,992) (3,894) 1,353 TOTAL COMPREHENSIVE INCOME $ 52,038 14,564 117,768 89,859 BASIC PER COMMON SHARE DATA FOR NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS Net income attributable to common stockholders$ 1.29 0.51 3.25 2.50 Weighted average shares outstanding 38,561 36,135 37,442 35,439 DILUTED PER COMMON SHARE DATA FOR NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS Net income attributable to common stockholders$ 1.28 0.51 3.24 2.49 Weighted average shares outstanding 38,687 36,232 37,527 35,506 Page 4 of 24

Reconciliations of GAAP to Non-GAAP Measures (In thousands, except per share data) (Unaudited) Three Months Ended Twelve Months Ended December 31, December 31, 2019 2018 2019 2018 NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS $ 49,609 18,556 121,662 88,506 Depreciation and amortization 27,697 24,241 104,724 91,704 Company's share of depreciation from unconsolidated investment 35 33 141 128 Depreciation and amortization from noncontrolling interest (45) (49) (186) (182) (Gain) on sales of real estate investments (29,662) - (41,068) (14,273) (Gain) on sales of non-operating real estate (83) - (83) (86) (Gain) on sales of other assets - - - (427) Noncontrolling interest in gain on sales of real estate investments of consolidated joint ventures 1,671 - 1,671 - FUNDS FROM OPERATIONS ("FFO") ATTRIBUTABLE TO COMMON STOCKHOLDERS 49,222 42,781 186,861 165,370 (Gain) on casualties and involuntary conversion (80) (95) (428) (1,245) FFO EXCLUDING GAIN ON CASUALTIES AND INVOLUNTARY CONVERSION $ 49,142 42,686 186,433 164,125 NET INCOME $ 51,282 18,583 123,340 88,636 Interest expense (1) 8,249 8,853 34,463 35,106 Depreciation and amortization 27,697 24,241 104,724 91,704 Company's share of depreciation from unconsolidated investment 35 33 141 128 EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION ("EBITDA") 87,263 51,710 262,668 215,574 (Gain) on sales of real estate investments (29,662) - (41,068) (14,273) (Gain) on sales of non-operating real estate (83) - (83) (86) (Gain) on sales of other assets - - - (427) EBITDA for Real Estate ("EBITDAre") $ 57,518 51,710 221,517 200,788 DILUTED PER COMMON SHARE DATA FOR NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS Net income attributable to common stockholders $ 1.28 0.51 3.24 2.49 FFO attributable to common stockholders $ 1.27 1.18 4.98 4.66 (2) FFO Excluding Gain on Casualties and Involuntary Conversion attributable to common stockholders$ 1.27 1.18 4.97 4.62 Weighted average shares outstanding for EPS and FFO purposes 38,687 36,232 37,527 35,506 (1) Net of capitalized interest of $2,386 and $1,789 for the three months ended December 31, 2019 and 2018, respectively; and $8,453 and $6,334 for the twelve months ended December 31, 2019 and 2018, respectively. (2) The Company initially reported FFO of $4.67 per share during the twelve months ended December 31, 2018. In connection with the Company's adoption of the Nareit Funds from Operations White Paper - 2018 Restatement, the Company now excludes from FFO the gains and losses on sales of non-operating real estate and assets incidental to the Company's business and therefore adjusted the prior year results, including the Company's FFO for 2018, to conform to the updated definition of FFO. There was no impact to the three months ended December 31, 2018, as there were no sales incidental to the Company's business during that period. Page 5 of 24

Reconciliations of GAAP to Non-GAAP Measures (Continued) (In thousands) (Unaudited) Three Months Ended Twelve Months Ended December 31, December 31, 2019 2018 2019 2018 NET INCOME $ 51,282 18,583 123,340 88,636 (Gain) on sales of real estate investments (29,662) - (41,068) (14,273) (Gain) on sales of non-operating real estate (83) - (83) (86) (Gain) on sales of other assets - - - (427) Net loss on other - 497 884 497 Interest income (28) (34) (129) (156) Other revenue (70) (106) (574) (1,374) Indirect leasing costs 105 - 411 - Depreciation and amortization 27,697 24,241 104,724 91,704 Company's share of depreciation from unconsolidated investment 35 33 141 128 Interest expense (1) 8,249 8,853 34,463 35,106 General and administrative expense (2) 4,905 3,475 16,406 13,738 Noncontrolling interest in PNOI of consolidated joint ventures (62) (77) (199) (314) PROPERTY NET OPERATING INCOME ("PNOI") 62,368 55,465 238,316 213,179 PNOI from 2018 and 2019 Acquisitions (2,442) (789) (6,520) (1,444) PNOI from 2018 and 2019 Development and Value-Add Properties (6,690) (2,992) (20,321) (7,771) PNOI from 2018 and 2019 Operating Property Dispositions (690) (1,196) (3,812) (4,783) Other PNOI 67 68 247 372 SAME PNOI (Straight-Line Basis) 52,613 50,556 207,910 199,553 Net lease termination fee (income) from same properties (317) (121) (1,257) (294) SAME PNOI EXCLUDING INCOME FROM LEASE TERMINATIONS (Straight-Line Basis) 52,296 50,435 206,653 199,259 Straight-line rent adjustment for same properties 399 36 408 (1,446) Acquired leases — market rent adjustment amortization for same properties (51) (77) (254) (383) SAME PNOI EXCLUDING INCOME FROM LEASE TERMINATIONS (Cash Basis) $ 52,644 50,394 206,807 197,430 (1) Net of capitalized interest of $2,386 and $1,789 for the three months ended December 31, 2019 and 2018, respectively; and $8,453 and $6,334 for the twelve months ended December 31, 2019 and 2018, respectively. (2) Net of capitalized development costs of $2,121 and $1,192 for the three months ended December 31, 2019 and 2018, respectively; and $6,918 and $4,696 for the twelve months ended December 31, 2019 and 2018, respectively. Page 6 of 24

Consolidated Statements of Cash Flows (In thousands) (Unaudited) Twelve Months Ended December 31, 2019 2018 OPERATING ACTIVITIES Net income $ 123,340 88,636 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 104,724 91,704 Stock-based compensation expense 6,838 5,283 Net gain on sales of real estate investments and non-operating real estate (41,151) (14,359) Gain on casualties and involuntary conversion on real estate assets (180) (1,245) Changes in operating assets and liabilities: Accrued income and other assets (5,558) (4,091) Accounts payable, accrued expenses and prepaid rent 6,514 (2,682) Other 1,385 1,485 NET CASH PROVIDED BY OPERATING ACTIVITIES 195,912 164,731 INVESTING ACTIVITIES Development and value-add properties (318,288) (167,667) Purchases of real estate (142,712) (57,152) Real estate improvements (37,775) (37,502) Net proceeds from sales of real estate investments and non-operating real estate 66,737 24,508 Proceeds from casualties and involuntary conversion on real estate assets 723 1,635 Repayments on mortgage loans receivable 915 1,987 Changes in accrued development costs (3,644) 5,711 Changes in other assets and other liabilities (9,293) (12,955) NET CASH USED IN INVESTING ACTIVITIES (443,337) (241,435) FINANCING ACTIVITIES Proceeds from unsecured bank credit facilities 932,658 448,100 Repayments on unsecured bank credit facilities (1,015,678) (448,709) Proceeds from unsecured debt 290,000 60,000 Repayments on unsecured debt (75,000) (50,000) Repayments on secured debt (55,593) (11,289) Debt issuance costs (893) (1,922) Distributions paid to stockholders (not including dividends accrued) (108,795) (71,294) Proceeds from common stock offerings 284,710 157,319 Proceeds from dividend reinvestment plan 212 221 Other (4,346) (5,364) NET CASH PROVIDED BY FINANCING ACTIVITIES 247,275 77,062 INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (150) 358 CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR 374 16 CASH AND CASH EQUIVALENTS AT END OF YEAR $ 224 374 SUPPLEMENTAL CASH FLOW INFORMATION Cash paid for interest, net of amounts capitalized of $8,453 and $6,334 for 2019 and 2018, respectively $ 30,839 33,458 Cash paid for operating lease liabilities 1,314 - NON-CASH OPERATING ACTIVITY Operating lease liabilities arising from obtaining right of use assets$ 15,435 - Page 7 of 24

Same Property Portfolio Analysis (In thousands) (Unaudited) Three Months Ended Twelve Months Ended December 31, December 31, Same Property Portfolio Analysis (Straight-Line Basis) (1) 2019 2018 % Change 2019 2018 % Change Square feet as of period end 36,391 36,391 36,391 36,391 Average occupancy 97.1% 96.5% 0.6% 96.9% 96.3% 0.6% Occupancy as of period end 97.0% 96.8% 0.2% 97.0% 96.8% 0.2% Income from real estate operations$ 73,649 71,652 2.8%$ 291,033 280,814 3.6% Less cash received for lease terminations (332) (126) (1,440) (323) Add straight-line rent write-offs for lease terminations 15 5 183 29 Income excluding lease termination income 73,332 71,531 2.5% 289,776 280,520 3.3% Expenses from real estate operations (21,036) (21,096) -0.3% (83,123) (81,261) 2.3% PNOI excluding income from lease terminations$ 52,296 50,435 3.7%$ 206,653 199,259 3.7% Same Property Portfolio Analysis (Cash Basis) (1) Income from real estate operations$ 74,012 71,322 3.8%$ 291,370 278,510 4.6% Less cash received for lease terminations (332) (126) (1,440) (323) Income excluding lease termination income 73,680 71,196 3.5% 289,930 278,187 4.2% Expenses from real estate operations (21,036) (20,802) 1.1% (83,123) (80,757) 2.9% PNOI excluding income from lease terminations$ 52,644 50,394 4.5%$ 206,807 197,430 4.7% (1) Includes properties which were included in the operating portfolio for the entire period of 1/1/18 through 12/31/19. Page 8 of 24

Additional Financial Information (In thousands) (Unaudited) Three Months Ended Twelve Months Ended December 31, December 31, 2019 2018 2019 2018 SELECTED INCOME STATEMENT INFORMATION (Items below represent increases or (decreases) in FFO) Straight-line (S/L) rent income adjustment$ 1,196 1,166 4,985 5,116 Reserves for uncollectible S/L rent (45) (295) (84) (504) Net straight-line rent adjustment 1,151 871 4,901 4,612 Cash received for lease terminations 332 126 1,519 323 Less S/L rent write-offs (15) (5) (183) (29) Net lease termination fee income 317 121 1,336 294 Reserves for uncollectible cash rent (64) (207) (364) (280) Stock-based compensation expense (2,661) (1,250) (6,838) (5,283) Debt issuance costs amortization (344) (346) (1,344) (1,352) Indirect leasing costs (105) - (411) - Gain on casualties and involuntary conversion (1) 80 95 428 1,245 Acquired leases - market rent adjustment amortization 387 190 1,229 667 Assumed mortgages - fair value adjustment amortization 5 6 23 27 Three Months Ended Twelve Months Ended December 31, December 31, 2019 2018 2019 2018 WEIGHTED AVERAGE COMMON SHARES Weighted average common shares 38,561 36,135 37,442 35,439 BASIC SHARES FOR EARNINGS PER SHARE (EPS) 38,561 36,135 37,442 35,439 Potential common shares: Unvested restricted stock 126 97 85 67 DILUTED SHARES FOR EPS AND FFO 38,687 36,232 37,527 35,506 (1) Included in Other revenue on the Consolidated Statements of Income and Comprehensive Income; included in FFO. Page 9 of 24

Financial Statistics ($ in thousands, except per share data) (Unaudited) Years Ended 2019 2018 2017 2016 2015 ASSETS/MARKET CAPITALIZATION Assets$ 2,546,078 2,131,705 1,953,221 1,825,764 1,661,904 Equity Market Capitalization 5,164,306 3,348,269 3,071,927 2,461,251 1,802,957 (1) Total Market Capitalization (Debt and Equity) 6,350,438 4,458,037 4,183,620 3,566,865 2,835,194 Shares Outstanding - Common 38,925,953 36,501,356 34,758,167 33,332,213 32,421,460 Price per share$ 132.67 91.73 88.38 73.84 55.61 FFO CHANGE FFO per diluted share (2) $ 4.98 4.66 4.25 4.00 3.67 Change compared to same period prior year 6.9% 9.6% 6.3% 9.0% 6.1% COMMON DIVIDEND PAYOUT RATIO Dividend distribution$ 2.94 2.72 2.52 2.44 2.34 FFO per diluted share (2) 4.98 4.66 4.25 4.00 3.67 Dividend payout ratio 59% 58% 59% 61% 64% COMMON DIVIDEND YIELD Dividend distribution$ 2.94 2.72 2.52 2.44 2.34 Price per share 132.67 91.73 88.38 73.84 55.61 Dividend yield 2.22% 2.97% 2.85% 3.30% 4.21% FFO MULTIPLE FFO per diluted share (2) $ 4.98 4.66 4.25 4.00 3.67 Price per share 132.67 91.73 88.38 73.84 55.61 Multiple 26.64 19.68 20.80 18.46 15.15 INTEREST & FIXED CHARGE COVERAGE RATIOS EBITDAre$ 221,517 200,788 180,214 166,463 153,451 Interest expense 34,463 35,106 34,775 35,213 34,666 Interest and fixed charge coverage ratios 6.43 5.72 5.18 4.73 4.43 DEBT-TO-EBITDAre RATIO Debt$ 1,182,602 1,105,787 1,108,282 1,101,333 1,027,909 EBITDAre 221,517 200,788 180,214 166,463 153,451 Debt-to-EBITDAre ratio 5.34 5.51 6.15 6.62 6.70 Adjusted debt-to-pro forma EBITDAre ratio 3.92 4.73 5.45 6.05 6.12 DEBT-TO-TOTAL MARKET CAPITALIZATION (1) 18.7% 24.9% 26.6% 31.0% 36.4% ISSUER RATINGS (3) Issuer Rating Outlook Moody's Investors Service Baa2 Stable (1) Before deducting unamortized debt issuance costs. (2) In connection with the Company's adoption of the Nareit Funds from Operations White Paper - 2018 Restatement, the Company now excludes from FFO the gains and losses on sales of non-operating real estate and assets incidental to the Company's business and therefore adjusted the prior years results to conform to the updated definition of FFO. (3) A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the assigning rating agency. Page 10 of 24

Development and Value-Add Properties Summary ($ in thousands) (Unaudited) Costs Incurred Anticipated 4th Qtr Cumulative Projected Conversion % Leased Square Feet (SF) 2019 at 12/31/19 Total Costs Date (1) 2/5/20 Lease-up Logistics Center 6 & 7 (2) Dallas, TX 142,000 $ 1,273 15,735 16,400 01/20 100% Settlers Crossing 1 Austin, TX 77,000 2,025 9,259 10,200 01/20 100% Settlers Crossing 2 Austin, TX 83,000 132 8,475 9,200 01/20 80% Parc North 5 Dallas, TX 100,000 94 8,689 9,200 02/20 84% Airport Commerce Center 3 Charlotte, NC 96,000 59 8,556 9,100 03/20 100% Horizon VIII & IX Orlando, FL 216,000 1,691 16,601 18,800 04/20 100% Ten West Crossing 8 Houston, TX 132,000 451 9,764 10,900 04/20 65% Tri-County Crossing 1 & 2 San Antonio, TX 203,000 678 15,386 16,700 04/20 82% CreekView 121 5 & 6 Dallas, TX 139,000 712 13,151 16,200 06/20 100% Parc North 6 Dallas, TX 96,000 1,245 8,290 10,100 07/20 92% Arlington Tech Centre 1 & 2 (2) Dallas, TX 151,000 560 13,277 15,100 08/20 0% Gateway 5 Miami, FL 187,000 1,796 23,105 23,500 09/20 70% Grand Oaks 75 2 (2) Tampa, FL 150,000 236 13,115 13,600 09/20 0% Southwest Commerce Center (2) Las Vegas, NV 196,000 26,613 26,613 30,100 10/20 48% SunCoast 6 Ft Myers, FL 81,000 680 7,934 9,200 10/20 75% Rocky Point 2 (2) San Diego, CA 109,000 19,275 19,275 20,600 12/20 0% Steele Creek IX Charlotte, NC 125,000 859 9,120 9,800 12/20 18% Total Lease-up 2,283,000 58,379 226,345 248,700 64% Wgt Avg % Lease-Up: Projected Stabilized Yield (3) 7.2% Under Construction SunCoast 8 Ft Myers, FL 77,000 4,484 4,484 9,000 05/20 100% Gilbert Crossroads A & B Phoenix, AZ 140,000 4,400 13,950 16,000 01/21 39% Hurricane Shoals 3 Atlanta, GA 101,000 6,629 6,629 8,800 03/21 0% Interstate Commons 2 (2) Phoenix, AZ 142,000 9,882 9,882 11,800 03/21 22% Tri-County Crossing 3 & 4 San Antonio, TX 203,000 4,294 8,698 14,700 05/21 0% World Houston 44 Houston, TX 134,000 2,976 4,790 9,100 05/21 0% Ridgeview 1 & 2 San Antonio, TX 226,000 3,853 6,531 18,500 06/21 0% CreekView 121 7 & 8 Dallas, TX 137,000 6,799 6,799 16,300 07/21 0% Northwest Crossing 1-3 Houston, TX 278,000 11,535 11,535 25,700 07/21 0% Settlers Crossing 3 & 4 Austin, TX 173,000 3,903 8,089 18,400 07/21 0% LakePort 1-3 Dallas, TX 194,000 4,290 8,062 22,500 09/21 0% Total Under Construction 1,805,000 63,045 89,449 170,800 9% Wgt Avg % Under Construction: Projected Stabilized Yield (3) 7.2% 40% Wgt Avg % Development: Projected Stabilized Yield (3) 7.4% Value-Add: Projected Stabilized Yield (3) 6.4% Prospective Development Acres Projected SF Phoenix, AZ 13 178,000 286 4,373 Ft Myers, FL (4) 24 329,000 (4,039) 7,503 Miami, FL 43 463,000 3,564 34,185 Orlando, FL 2 - - 1,075 Tampa, FL 33 349,000 95 5,801 Atlanta, GA (4) - - (3,890) - Jackson, MS 3 28,000 - 706 Charlotte, NC 43 475,000 421 7,327 Dallas, TX 72 997,000 11,053 19,588 Houston, TX (4) 84 1,223,000 (5,660) 19,448 San Antonio, TX 24 373,000 244 4,199 Total Prospective Development 341 4,415,000 2,074 104,205 341 8,503,000 $ 123,498 419,999 (1) Development properties will transfer from Development and Value-Add properties to the operating portfolio at the earlier of 90% occupancy or one year after shell completion. Value-Add properties will transfer at the earlier of 90% occupancy or one year after acquisition. (2) These value-add projects were acquired by EastGroup. (3) Weighted average yield based on property net operating income at 100% occupancy and rents computed on a straight-line basis. (4) Negative amounts represent land inventory costs transferred to Under Construction. Page 11 of 24

Development and Value-Add Properties Transferred to Real Estate Properties ($ in thousands) (Unaudited) Costs Incurred 4th Qtr Cumulative Conversion % Leased Square Feet (SF) 2019 at 12/31/19 Date 2/5/20 1st Quarter SF Siempre Viva I San Diego, CA 115,000 $ (94) 14,048 01/19 100% CreekView 121 3 & 4 Dallas, TX 158,000 (191) 16,118 03/19 100% Horizon VI Orlando, FL 148,000 (29) 12,229 03/19 84% 421,000 (314) 42,395 2nd Quarter Horizon XI Orlando, FL 135,000 81 10,974 04/19 100% Falcon Field Phoenix, AZ 97,000 (3) 8,770 05/19 57% Gateway 1 Miami, FL 200,000 (69) 24,587 05/19 100% SunCoast 5 Ft Myers, FL 81,000 (6) 8,233 05/19 100% 513,000 3 52,564 3rd Quarter Steele Creek V Charlotte, NC 54,000 10 5,832 07/19 100% 54,000 10 5,832 4th Quarter Broadmoor 2 Atlanta, GA 111,000 4 7,889 11/19 100% Eisenhauer Point 9 San Antonio, TX 82,000 299 6,350 11/19 100% World Houston 43 Houston, TX 86,000 819 6,469 11/19 100% Eisenhauer Point 7 & 8 San Antonio, TX 336,000 631 23,200 12/19 100% World Houston 45 Houston, TX 160,000 1,372 16,954 12/19 100% 775,000 3,125 60,862 Total Transferred to Real Estate Properties 1,763,000 $ 2,824 161,653 (1) Projected Stabilized Yield 7.5% 96% Wgt Avg % (1) Weighted average yield based on property net operating income at 100% occupancy and rents computed on a straight-line basis. Page 12 of 24

Acquisitions and Dispositions Through December 31, 2019 ($ in thousands) (Unaudited) ACQUISITIONS Purchase Date Property Name Location Size Price (1) 1st Quarter None 2nd Quarter 04/23/19 Logistics Center 6 & 7 Dallas, TX 142,000 SF$ 12,960 (2) (3) 05/20/19 Airways Business Center Denver, CO 382,000 SF 48,327 05/31/19 Miramar Land San Diego, CA 6.5 Acres 13,386 05/31/19 Northwest Crossing Land Houston, TX 20.0 Acres 5,665 06/26/19 Grand West Crossing Land Houston, TX 33.2 Acres 8,757 3rd Quarter 07/31/19 385 Business Park Greenville, SC 155,000 SF 13,900 08/16/19 Arlington Tech Centre 1 & 2 Arlington (Dallas), TX 151,000 SF 12,615 (2) 09/06/19 Grand Oaks 75 Business Center 1 Tampa, FL 169,000 SF 17,974 09/06/19 Grand Oaks 75 Business Center 2 Tampa, FL 150,000 SF 12,815 (2) 09/06/19 Grand Oaks 75 Business Center Land Tampa, FL 25.3 Acres 4,101 4th Quarter 10/04/19 Siempre Viva Distribution Center 2 San Diego, CA 60,000 SF 8,621 10/21/19 Interstate Commons Distribution Center 2 Phoenix, AZ 142,000 SF 9,386 (2) 10/30/19 Southwest Commerce Center Las Vegas, NV 196,000 SF 25,609 (2) 12/12/19 Basswood Land Dallas, TX 61.5 Acres 15,766 12/17/19 Rocky Point Distribution Center 1 San Diego, CA 118,000 SF 24,396 12/17/19 Rocky Point Distribution Center 2 San Diego, CA 109,000 SF 19,238 (2) 12/31/19 Otay Mesa Land San Diego, CA 41.6 Acres 15,282 1,774,000 SF Total Acquisitions 188.1 Acres$ 268,798 DISPOSITIONS Date Property Name Location Size Gross Sales Price Realized Gain 1st Quarter 01/29/19 World Houston 5 Houston, TX 51,000 SF$ 3,808 2,325 (4) 2nd Quarter 05/20/19 Altamonte Commerce Center Orlando, FL 186,000 SF 14,850 9,081 (4) 3rd Quarter None 4th Quarter 11/07/19 University Business Center 130 Santa Barbara, CA 40,000 SF 11,515 8,354 (4) (5) 11/19/19 Siempre Viva Land (eminent domain) San Diego, CA 0.2 Acres 185 83 (6) 12/03/19 Southpointe Distribution Center Tucson, AZ 207,000 SF 14,050 11,418 (4) 12/11/19 University Business Center 125 & 175 Santa Barbara, CA 133,000 SF 24,250 9,890 (4) 617,000 SF Total Dispositions 0.2 Acres$ 68,658 41,151 (1) Represents acquisition price plus closing costs. (2) Value-add property acquisition; included in Development and value-add properties on the Consolidated Balance Sheets. (3) This property is located on land subject to a ground lease; therefore, no value was allocated to land for this transaction. (4) Included in Gain on sales of real estate investments on the Consolidated Statements of Income and Comprehensive Income; not included in FFO. (5) EastGroup owned 80% of University Business Center 130 through a joint venture. The information shown for this transaction also includes the 20% attributable to the Company's noncontrolling interest partner. (6) Included in Other on the Consolidated Statements of Income and Comprehensive Income; not included in FFO. Page 13 of 24

Real Estate Improvements and Leasing Costs (In thousands) (Unaudited) Three Months Ended Twelve Months Ended December 31, December 31, REAL ESTATE IMPROVEMENTS 2019 2018 2019 2018 Upgrade on Acquisitions$ 758 120 1,863 294 Tenant Improvements: New Tenants 1,605 2,682 13,113 12,896 Renewal Tenants 1,875 692 3,908 2,926 Other: Building Improvements 940 2,455 5,304 9,012 Roofs 3,940 2,172 12,179 9,053 Parking Lots 187 766 1,455 2,878 Other 18 96 834 861 TOTAL REAL ESTATE IMPROVEMENTS (2) $ 9,323 8,983 38,656 37,920 CAPITALIZED LEASING COSTS (Principally Commissions) (1) Development and Value-Add$ 1,980 1,086 8,065 4,843 New Tenants 1,422 938 5,900 5,880 Renewal Tenants 1,390 1,950 5,069 5,038 TOTAL CAPITALIZED LEASING COSTS $ 4,792 3,974 19,034 15,761 (1) Included in Other Assets . (2) Reconciliation of Total Real Estate Improvements to Real Estate Improvements on the Consolidated Statements of Cash Flows: Twelve Months Ended December 31, 2019 2018 Total Real Estate Improvements$ 38,656 37,920 Change in Real Estate Property Payables (876) 581 Change in Construction in Progress (5) (999) Real Estate Improvements on the Consolidated Statements of Cash Flows $ 37,775 37,502 Page 14 of 24

Leasing Statistics and Occupancy Summary (Unaudited) Three Months Ended Number of Square Feet Weighted Rental Change Rental Change PSF Tenant PSF Leasing PSF Total December 31, 2019 Leases Signed Signed Average Term Straight-Line Basis Cash Basis Improvement (1) Commission (1) Leasing Cost (1) (In Thousands) (In Years) New Leases (2) 37 660 4.5 16.8% 9.0%$ 2.62 $ 2.09 $ 4.71 Renewal Leases 53 1,163 3.9 19.3% 9.6% 0.97 0.99 1.96 Total/Weighted Average 90 1,823 4.2 18.3% 9.3%$ 1.57 $ 1.39 $ 2.96 Per Year$ 0.37 $ 0.33 $ 0.70 Weighted Average Retention (3) 67.3% Twelve Months Ended Number of Square Feet Weighted Rental Change Rental Change PSF Tenant PSF Leasing PSF Total December 31, 2019 Leases Signed Signed Average Term Straight-Line Basis Cash Basis Improvement (1) Commission (1) Leasing Cost (1) (In Thousands) (In Years) New Leases (2) 149 2,659 4.9 15.3% 7.2%$ 3.29 $ 2.22 $ 5.51 Renewal Leases 210 4,263 4.0 18.6% 8.3% 1.12 1.14 2.26 Total/Weighted Average 359 6,922 4.3 17.3% 7.9%$ 1.96 $ 1.56 $ 3.52 Per Year$ 0.46 $ 0.36 $ 0.82 Weighted Average Retention (3) 71.3% 12/31/19 09/30/19 06/30/19 03/31/19 12/31/18 Percentage Leased 97.6% 97.9% 97.5% 97.7% 97.3% Percentage Occupied 97.1% 97.4% 96.5% 96.9% 96.8% (1) Per square foot (PSF) amounts represent total amounts for the life of the lease, except as noted for the Per Year amounts. (2) Does not include leases with terms less than 12 months and leases for first generation space on properties acquired or developed by EastGroup. (3) Calculated as square feet of renewal leases signed during the quarter / square feet of leases expiring during the quarter (not including early terminations or bankruptcies). Page 15 of 24

Core Market Operating Statistics December 31, 2019 (Unaudited) Same Property PNOI Change Rental Change (excluding income from lease terminations) New and Renewal Leases (2) Total Lease Expirations QTR YTD QTR YTD Square Feet % Annualized % % in Square Feet Straight-Line Cash Straight-Line Cash Straight-Line Cash Straight-Line Cash of Properties of Total Base Rent (1) Leased Occupied 2020 2021 Basis Basis (3) Basis Basis (3) Basis Basis (3) Basis Basis (3) Florida Tampa 4,346,000 10.5% 9.8% 98.2% 97.5% 935,000 893,000 5.2% 4.9% 4.2% 3.9% 13.2% 2.1% 15.0% 3.7% Orlando 3,469,000 8.4% 9.0% 96.0% 96.0% 508,000 429,000 1.1% 3.1% 3.3% 8.7% 19.4% 9.6% 19.9% 7.8% Jacksonville 2,273,000 5.5% 4.3% 96.6% 96.4% 429,000 545,000 11.0% 12.7% 4.6% 5.3% 19.5% 11.2% 20.3% 9.6% Miami/Ft. Lauderdale 1,272,000 3.1% 3.8% 98.2% 98.2% 254,000 134,000 15.3% 15.8% 4.0% 4.5% 26.8% 10.2% 20.0% 10.0% Ft. Myers 392,000 1.0% 1.2% 100.0% 100.0% 21,000 103,000 4.3% 3.2% 5.8% 4.4% N/A N/A 14.0% 2.5% 11,752,000 28.5% 28.1% 97.3% 97.0% 2,147,000 2,104,000 5.8% 6.6% 4.0% 5.7% 16.6% 5.5% 17.8% 6.6% Texas Dallas 3,728,000 9.0% 8.1% 99.2% 99.1% 556,000 304,000 -3.0% -2.5% 2.2% 3.5% 47.1% 33.7% 22.4% 15.7% Houston 5,743,000 13.9% 13.9% 98.4% 98.4% 386,000 1,266,000 1.9% 2.2% 2.2% 2.1% 9.2% 3.4% 3.6% -2.5% San Antonio 3,460,000 8.4% 9.1% 96.7% 96.2% 481,000 477,000 1.5% 1.8% 1.4% 2.3% 11.9% 5.0% 15.0% 6.5% Austin 743,000 1.8% 2.1% 96.0% 96.0% 91,000 45,000 5.9% 8.3% 8.1% 10.6% 16.0% 3.5% 12.8% 5.4% El Paso 957,000 2.3% 1.7% 99.0% 99.0% 114,000 113,000 5.0% 6.7% 4.4% 5.4% 22.3% 13.3% 20.0% 11.6% 14,631,000 35.4% 34.9% 98.1% 98.0% 1,628,000 2,205,000 1.1% 1.7% 2.5% 3.2% 19.5% 11.3% 11.5% 4.3% California San Francisco 1,045,000 2.5% 2.7% 86.7% 78.9% 116,000 329,000 -5.6% -5.0% 4.8% 6.6% 34.0% 29.4% 52.7% 40.5% Los Angeles (4) 2,323,000 5.6% 7.2% 100.0% 100.0% 182,000 1,217,000 1.9% 3.5% 2.2% 3.9% N/A N/A 47.7% 32.1% Fresno 398,000 1.0% 0.7% 99.0% 97.5% 105,000 129,000 -8.2% -8.8% -1.7% 0.9% 16.0% 4.1% 13.4% 4.6% San Diego 758,000 1.8% 2.8% 100.0% 100.0% 48,000 112,000 25.3% 61.6% 12.8% 26.5% 35.3% 28.6% 21.5% 19.5% 4,524,000 10.9% 13.4% 96.8% 94.9% 451,000 1,787,000 1.7% 5.0% 3.9% 6.7% 29.0% 21.9% 40.4% 28.4% Arizona Phoenix 2,502,000 6.1% 5.9% 93.2% 92.6% 344,000 395,000 5.0% -2.0% 2.9% 1.8% 24.2% 12.5% 23.1% 7.5% Tucson 848,000 2.1% 2.0% 100.0% 100.0% 188,000 33,000 8.2% 27.9% 12.0% 17.7% -12.6% -14.4% 7.4% 0.3% 3,350,000 8.2% 7.9% 94.9% 94.5% 532,000 428,000 5.6% 2.5% 4.5% 4.4% 20.4% 9.9% 22.1% 7.1% Other Core Atlanta 891,000 2.2% 1.9% 100.0% 100.0% 105,000 70,000 141.2% 132.4% 40.1% 20.3% 15.8% 13.3% 3.1% 0.3% Charlotte 3,185,000 7.7% 6.7% 99.1% 99.1% 550,000 445,000 -1.7% -0.8% 1.0% 1.6% 17.9% 8.8% 16.8% 8.2% Denver 886,000 2.1% 2.6% 97.9% 94.9% 122,000 191,000 5.8% 10.4% 17.2% 16.5% 2.9% -1.8% 10.4% 0.8% Las Vegas 558,000 1.4% 1.6% 100.0% 100.0% - 221,000 2.3% 4.0% 9.5% 14.6% 30.1% 20.8% 25.3% 15.9% 5,520,000 13.4% 12.8% 99.1% 98.7% 777,000 927,000 7.7% 8.0% 7.4% 6.9% 14.1% 7.7% 13.3% 5.6% Total Core Markets 39,777,000 96.4% 97.1% 97.6% 97.1% 5,535,000 7,451,000 3.7% 4.4% 3.9% 4.9% 18.5% 9.5% 17.8% 8.2% Total Other Markets (4) 1,494,000 3.6% 2.9% 96.0% 95.4% 125,000 139,000 4.3% 7.3% -1.3% -0.7% -3.0% -4.1% 6.9% 0.6% Total Operating Properties 41,271,000 100.0% 100.0% 97.6% 97.1% 5,660,000 7,590,000 3.7% 4.5% 3.7% 4.7% 18.3% 9.3% 17.3% 7.9% (1) Based on the Annualized Base Rent as of the reporting period for occupied square feet (without S/L Rent). (2) Does not include leases with terms less than 12 months and leases for first generation space on properties acquired or developed by EastGroup. (3) Excludes straight-line rent adjustments and amortization of above/below market rent intangibles. (4) Includes the Company's share of its less-than-wholly-owned real estate investments. Page 16 of 24

Lease Expiration Summary Total Square Feet of Operating Properties Based On Leases Signed Through December 31, 2019 ($ in thousands) (Unaudited) Annualized Current % of Total Base Rent of Base Rent of Square Footage of % of Leases Expiring Leases Expiring LEASE EXPIRATION Leases Expiring Total SF (without S/L Rent) (without S/L Rent) Vacancy 1,002,000 2.4%$ - 0.0% 2020 (1) 5,660,000 13.7% 36,530 14.6% 2021 7,590,000 18.4% 48,814 19.6% 2022 7,305,000 17.7% 43,535 17.5% 2023 4,649,000 11.3% 29,694 11.9% 2024 5,882,000 14.2% 36,426 14.6% 2025 3,264,000 7.9% 18,555 7.4% 2026 1,926,000 4.7% 12,793 5.1% 2027 1,305,000 3.2% 7,676 3.1% 2028 1,024,000 2.5% 5,899 2.4% 2029 and beyond 1,664,000 4.0% 9,467 3.8% TOTAL 41,271,000 100.0%$ 249,389 100.0% (1) Includes month-to-month leases. Page 17 of 24

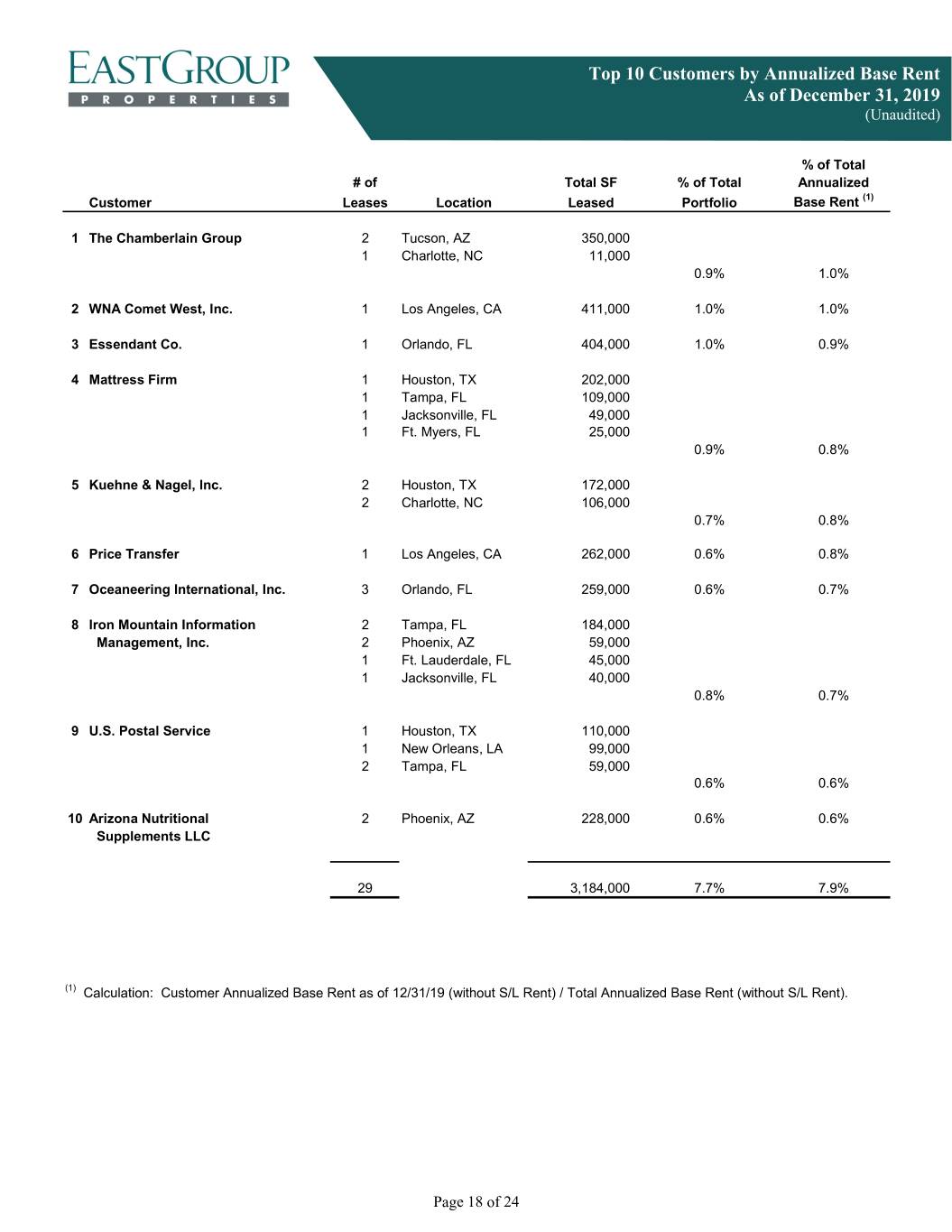

Top 10 Customers by Annualized Base Rent As of December 31, 2019 (Unaudited) % of Total # ofTotal SF % of Total Annualized Customer Leases LocationLeased Portfolio Base Rent (1) 1 The Chamberlain Group 2 Tucson, AZ 350,000 1 Charlotte, NC 11,000 0.9% 1.0% 2 WNA Comet West, Inc. 1 Los Angeles, CA 411,000 1.0% 1.0% 3 Essendant Co. 1 Orlando, FL 404,000 1.0% 0.9% 4 Mattress Firm 1 Houston, TX 202,000 1 Tampa, FL 109,000 1 Jacksonville, FL 49,000 1 Ft. Myers, FL 25,000 0.9% 0.8% 5 Kuehne & Nagel, Inc. 2 Houston, TX 172,000 2 Charlotte, NC 106,000 0.7% 0.8% 6 Price Transfer 1 Los Angeles, CA 262,000 0.6% 0.8% 7 Oceaneering International, Inc. 3 Orlando, FL 259,000 0.6% 0.7% 8 Iron Mountain Information 2 Tampa, FL 184,000 Management, Inc. 2 Phoenix, AZ 59,000 1 Ft. Lauderdale, FL 45,000 1 Jacksonville, FL 40,000 0.8% 0.7% 9 U.S. Postal Service 1 Houston, TX 110,000 1 New Orleans, LA 99,000 2 Tampa, FL 59,000 0.6% 0.6% 10 Arizona Nutritional 2 Phoenix, AZ 228,000 0.6% 0.6% Supplements LLC 29 3,184,000 7.7% 7.9% (1) Calculation: Customer Annualized Base Rent as of 12/31/19 (without S/L Rent) / Total Annualized Base Rent (without S/L Rent). Page 18 of 24

Debt and Equity Market Capitalization December 31, 2019 ($ in thousands, except per share data) (Unaudited) Average 2025 and Years to 2020 2021 2022 2023 2024 Beyond Total Maturity Unsecured debt (fixed rate) (1) $ 105,000 40,000 75,000 115,000 120,000 485,000 940,000 5.5 Weighted average interest rate 3.55% 2.34% 3.03% 2.96% 3.47% 3.63% 3.42% Secured debt (fixed rate) Balloon payments ‐ 85,600 32,655 ‐ ‐ 1,549 119,804 Amortization 9,047 3,962 115 119 122 253 13,618 9,047 89,562 32,770 119 122 1,802 133,422 1.4 Weighted average interest rate 4.42% 4.55% 4.09% 3.85% 3.85% 3.85% 4.42% Total unsecured debt and secured debt$ 114,047 129,562 107,770 115,119 120,122 486,802 1,073,422 5.0 Weighted average interest rate 3.62% 3.86% 3.35% 2.96% 3.47% 3.63% 3.54% Unsecured debt and secured debt (fixed rate) $ 1,073,422 Unsecured bank credit facilities (variable rate) $45MM Line ‐ 2.763% ‐ matures 7/30/2022 7,710 $350MM Line ‐ 2.776% ‐ matures 7/30/2022 105,000 Total carrying amount of debt $ 1,186,132 Total unamortized debt issuance costs (3,530) Total debt net of unamortized debt issuance costs $ 1,182,602 Equity market capitalization Shares outstanding ‐ common 38,925,953 Price per share at quarter end $ 132.67 Total equity market capitalization $ 5,164,306 (2) Total market capitalization (debt and equity) $ 6,350,438 (2) Total debt / total market capitalization 18.7% (1) These loans have a fixed interest rate or an effectively fixed interest rate due to interest rate swaps (2) Before deducting unamortized debt issuance costs Page 19 of 24

Continuous Common Equity Program Through December 31, 2019 ($ in thousands, except per share data) (Unaudited) Average Shares Issued Sales Price Offering-Related and Sold (1) (Per Share) Gross Proceeds Fees and Expenses Net Proceeds 1st Quarter 232,205 $ 107.66 $ 25,000 $ (600) $ 24,400 2nd Quarter 790,052 113.91 89,995 (959) 89,036 3rd Quarter 849,751 123.56 104,999 (1,088) 103,911 4th Quarter 516,334 132.52 68,425 (1,062) 67,363 TOTAL 2019 2,388,342 $ 120.76 $ 288,419 $ (3,709) $ 284,710 (1) On December 20, 2019, the Company filed with the Securities and Exchange Commission a prospectus supplement in connection with the establishment of a new continuous equity offering program pursuant to which the Company may sell shares of its common stock having an aggregate offering price of up to $750.0 million from time to time in at-the-market offerings or certain other transactions. This new program is intended to replace the Company's former continuous equity offering progam under which the shares in the table above were issued and sold. Page 20 of 24

Debt-to-EBITDAre Ratios ($ in thousands) (Unaudited) Quarter Ended Years Ended December 31, December 31, 2019 2019 2018 2017 2016 2015 EBITDAre$ 57,518 $ 221,517 200,788 180,214 166,463 153,451 Debt 1,182,602 1,182,602 1,105,787 1,108,282 1,101,333 1,027,909 DEBT-TO-EBITDAre RATIO 5.14 5.34 5.51 6.15 6.62 6.70 EBITDAre$ 57,518 $ 221,517 200,788 180,214 166,463 153,451 Adjust for acquisitions as if owned for entire period 630 5,590 1,909 859 991 1,959 Adjust for development and value-add properties in lease-up (1,330) (2,072) (304) (679) (939) (271) or under construction Adjust for properties sold during the period (690) (3,812) (474) (1,031) (1,308) (96) Pro Forma EBITDAre $ 56,128 $ 221,223 201,919 179,363 165,207 155,043 Debt$ 1,182,602 $ 1,182,602 1,105,787 1,108,282 1,101,333 1,027,909 Subtract development and value-add properties in lease-up or under construction (315,794) (315,794) (149,860) (130,505) (101,520) (79,705) Adjusted Debt$ 866,808 $ 866,808 955,927 977,777 999,813 948,204 ADJUSTED DEBT-TO-PRO FORMA EBITDAre RATIO 3.86 3.92 4.73 5.45 6.05 6.12 Page 21 of 24

Outlook for 2020 (Unaudited) Low Range High Range Q1 2020 Y/E 2020 Q1 2020 Y/E 2020 (In thousands, except per share data) Net income attributable to common stockholders$ 19,658 88,703 21,214 92,643 Depreciation and amortization 29,892 118,278 29,892 118,278 Funds from operations attributable to common stockholders$ 49,550 206,981 51,106 210,921 Diluted shares 38,923 39,394 38,923 39,394 Per share data (diluted): Net income attributable to common stockholders$ 0.51 2.25 0.55 2.35 Funds from operations attributable to common stockholders 1.27 5.25 1.31 5.35 The following assumptions were used for the mid-point: Initial Guidance Actual for Year Metrics for Year 2020 2019 FFO per share $5.25 - $5.35 $4.98 FFO per share increase over prior year period 6.4% 6.9% Same PNOI growth (excluding income from lease terminations): Straight-line basis — same property pool 1.7% - 2.7% (1) 3.7% Cash basis — same property pool (2) 2.5% - 3.5% (1) 4.7% Average month-end occupancy 96.3% 96.9% Lease termination fee income $500,000 $1,336,000 Reserves for uncollectible rent $800,000 $448,000 Development starts: Square feet 1.6 million 2.7 million Projected total investment $150 million $262 million Value-add property acquisitions (projected total investment) $30 million $108 million Operating property acquisitions $65 million $142 million Operating property dispositions (potential gains on dispositions are not included in the projections) $40 million $66 million Unsecured debt closing in period $100 million at $290 million at 3.75% 3.45% weighted average interest rate Common stock issuances $170 million $288 million General and administrative expense $16.4 million $16.4 million (1) Includes properties which have been in the operating portfolio since 1/1/19 and are projected to be in the operating portfolio through 12/31/20; includes 38,737,000 square feet. (2) Cash basis excludes straight-line rent adjustments and amortization of market rent intangibles for acquired leases. Page 22 of 24

Glossary of REIT Terms Listed below are definitions of commonly used real estate investment trust (“REIT”) industry terms. For additional information on REITs, please see the National Association of Real Estate Investment Trusts (“Nareit”) web site at www.reit.com. Adjusted Debt-to-Pro Forma EBITDAre Ratio: A ratio calculated by dividing a company’s adjusted debt by its pro forma EBITDAre. Debt is adjusted by subtracting the cost of development and value-add properties in lease-up or under construction. EBITDAre is further adjusted by adding an estimate of NOI for significant acquisitions as if the acquired properties were owned for the entire period, and by subtracting NOI from development and value-add properties in lease-up or under construction and from properties sold during the period. The Adjusted Debt-to-Pro Forma EBITDAre Ratio is a non-GAAP financial measure used to analyze the Company’s financial condition and operating performance relative to its leverage, on an adjusted basis, so as to normalize and annualize property changes during the period. Cash Basis: The Company adjusts its GAAP reporting to exclude straight-line rent adjustments and amortization of market rent intangibles for acquired leases. The cash basis is an indicator of the rents charged to customers by the Company during the periods presented and is useful in analyzing the embedded rent growth in the Company’s portfolio. Debt-to-EBITDAre Ratio: A ratio calculated by dividing a company’s debt by its EBITDAre; this non-GAAP measure is used to analyze the Company’s financial condition and operating performance relative to its leverage. Debt-to-Total Market Capitalization Ratio: A ratio calculated by dividing a company’s debt by the total amount of a company’s equity (at market value) and debt. Earnings Before Interest Taxes Depreciation and Amortization for Real Estate (“EBITDAre”): Earnings, defined as Net Income, excluding gains or losses from sales of real estate investments and non-operating real estate, plus interest, taxes, depreciation and amortization. EBITDAre is a non-GAAP financial measure used to measure the Company’s operating performance and its ability to meet interest payment obligations and pay quarterly stock dividends on an unleveraged basis. Funds From Operations (“FFO”): FFO is the most commonly accepted reporting measure of a REIT’s operating performance, and the Company computes FFO in accordance with standards established by Nareit in the Nareit Funds from Operations White Paper — 2018 Restatement. It is equal to a REIT’s net income (loss) attributable to common stockholders computed in accordance with generally accepted accounting principles (“GAAP”), excluding gains and losses from sales of real estate property (including other assets incidental to the Company’s business) and impairment losses, adjusted for real estate related depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. FFO is a non-GAAP financial measure used to evaluate the performance of the Company’s investments in real estate assets and its operating results. FFO Excluding Gain on Casualties and Involuntary Conversion: A reporting measure calculated as FFO (as defined above), adjusted to exclude gain on casualties and involuntary conversion. The Company believes that the exclusion of gain on casualties and involuntary conversion presents a more meaningful comparison of operating performance. Industrial Properties: Generally consisting of four concrete walls tilted up on a slab of concrete. An internal office component is then added. Business uses include warehousing, distribution, light manufacturing and assembly, research and development, showroom, office, or a combination of some or all of the aforementioned. Leases Expiring and Renewal Leases Signed of Expiring Square Feet: Includes renewals during the period with terms commencing during the period and after the end of the period. Operating Land: Land with no buildings or improvements that generates income from leases with tenants; included in Real estate properties on the Consolidated Balance Sheets. Operating Properties: Stabilized real estate properties (land including buildings and improvements) in the Company’s operating portfolio; included in Real estate properties on the Consolidated Balance Sheets. Percentage Leased: The percentage of total leasable square footage for which there is a signed lease, including month-to-month leases, as of the close of the reporting period. Space is considered leased upon execution of the lease. Page 23 of 24

Glossary of REIT Terms (Continued) Percentage Occupied: The percentage of total leasable square footage for which the lease term has commenced as of the close of the reporting period. Property Net Operating Income (“PNOI”): Income from real estate operations less Expenses from real estate operations (including market-based internal management fee expense) plus the Company’s share of income and property operating expenses from its less-than-wholly-owned real estate investments. PNOI is a non-GAAP, property-level supplemental measure of performance used to evaluate the performance of the Company’s investments in real estate assets and its operating results. Real Estate Investment Trust: A company that owns and, in most cases, operates income-producing real estate such as apartments, shopping centers, offices, hotels and warehouses. Some REITs also engage in financing real estate. The shares of most REITs are freely traded, usually on a major stock exchange. To qualify as a REIT, a company must distribute at least 90 percent of its taxable income to its stockholders annually. A company that qualifies as a REIT is permitted to deduct dividends paid to its stockholders from its corporate taxable income. As a result, most REITs remit at least 100 percent of their taxable income to their stockholders and therefore owe no corporate federal income tax. Taxes are paid by stockholders on the dividends received. Most states honor this federal treatment and also do not require REITs to pay state income tax. Rental changes on new and renewal leases: Rental changes are calculated as the difference, weighted by square feet, of the annualized base rent due the first month of the new lease’s term and the annualized base rent of the rent due the last month of the former lease’s term. If free rent is given, then the first positive full rent value is used. Rental amounts exclude base stop amounts, holdover rent, and premium or discounted rent amounts. This calculation excludes leases with terms less than 12 months and leases for first generation space on properties acquired or developed by EastGroup. Same Properties: Operating properties owned during the entire current and prior year reporting periods. Properties developed or acquired are excluded until held in the operating portfolio for both the current and prior year reporting periods. Properties sold during the current or prior year reporting periods are excluded. The Same Property Pool includes properties which were included in the operating portfolio for the entire period from January 1, 2018 through December 31, 2019. Same Property Net Operating Income (“Same PNOI”): Income from real estate operations less Expenses from real estate operations (including market-based internal management fee expense), plus the Company’s share of income and property operating expenses from its less-than-wholly-owned real estate investments, for the same properties owned by the Company during the entire current and prior year reporting periods. Same PNOI is a non-GAAP, property-level supplemental measure of performance used to evaluate the performance of the Company’s investments in real estate assets and its operating results on a same property basis. Same PNOI Excluding Income from Lease Terminations: Same PNOI (as defined above), adjusted to exclude income from lease terminations. The Company believes it is useful to evaluate Same PNOI Excluding Income from Lease Terminations on both a straight-line and cash basis. The straight-line basis is calculated by averaging the customers’ rent payments over the lives of the leases; GAAP requires the recognition of rental income on the straight-line basis. The cash basis excludes adjustments for straight-line rent and amortization of market rent intangibles for acquired leases; the cash basis is an indicator of the rents charged to customers by the Company during the periods presented and is useful in analyzing the embedded rent growth in the Company’s portfolio. Straight-Lining: The process of averaging the customer’s rent payments over the life of the lease. GAAP requires real estate companies to “straight-line” rents. Total Return: A stock’s dividend income plus capital appreciation/depreciation over a specified period as a percentage of the stock price at the beginning of the period. Value-Add Properties: Properties that are either acquired but not stabilized or can be converted to a higher and better use. Acquired properties meeting either of the following two conditions are considered value-add properties: (1) Less than 75% occupied as of the acquisition date (or will be less than 75% occupied within one year of acquisition date based on near term lease roll), or (2) 20% or greater of the acquisition cost will be spent to redevelop the property. Page 24 of 24