Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SIMON PROPERTY GROUP INC /DE/ | tm205424d1_8k.htm |

QuickLinks -- Click here to rapidly navigate through this document

EARNINGS RELEASE AND SUPPLEMENTAL INFORMATION |

| PAGE | ||

|

||||

| 2-13 | ||||

Overview |

||||

The Company |

14 | |||

Stock Information, Credit Ratings and Senior Unsecured Debt Covenants |

15 | |||

Financial Data |

||||

Selected Financial and Equity Information |

16 | |||

Net Operating Income (NOI) Composition |

17 | |||

Net Operating Income Overview |

18 | |||

Reconciliations of Non-GAAP Financial Measures |

19 | |||

Consolidated Net Income to NOI |

19 | |||

FFO of the Operating Partnership to Funds Available for Distribution (Our Share) |

20 | |||

Other Income, Other Expense and Capitalized Interest |

21 | |||

Operational Data |

||||

U.S. Malls and Premium Outlets Operating Information |

22 | |||

The Mills and International Operating Information |

23 | |||

U.S. Malls and Premium Outlets Lease Expirations |

24 | |||

U.S. Malls and Premium Outlets Top Tenants |

25 | |||

Development Activity |

||||

Capital Expenditures |

26 | |||

Development Activity Summary |

27-28 | |||

Development Activity Report |

29-30 | |||

Balance Sheet Information |

||||

Common and Preferred Stock Information |

31 | |||

Changes in Common Share and Limited Partnership Unit Ownership |

31 | |||

Preferred Stock/Units Outstanding |

31 | |||

Credit Profile |

32 | |||

Summary of Indebtedness |

33 | |||

Total Debt Amortization and Maturities by Year (Our Share) |

34 | |||

Property and Debt Information |

35-44 |

|||

Other |

||||

Non-GAAP Pro-Rata Financial Information |

45-48 |

- (1)

- Includes reconciliation of consolidated net income to funds from operations.

| 4Q 2019 SUPPLEMENTAL |

|

1 |

| Contacts: | FOR IMMEDIATE RELEASE | |||

| Tom Ward | 317-685-7330 Investors | |||

| Ali Slocum | 317-264-3079 Media | |||

SIMON PROPERTY GROUP REPORTS FOURTH QUARTER AND FULL YEAR 2019 RESULTS

INDIANAPOLIS, February 4, 2020 - Simon, a global leader in premier shopping, dining, entertainment and mixed-use destinations, today reported results for the quarter and twelve months ended December 31, 2019.

- •

- Net income attributable to common stockholders was $2.098 billion, or $6.81 per diluted share, as compared to $2.437 billion, or

$7.87 per diluted share in 2018. Results for 2019 include $116.3 million, or $0.33 per diluted share, for a loss on extinguishment of debt related to the redemption of certain senior notes of

Simon Property Group, L.P. The prior year period also included net gains of $324.4 million, or $0.91 per diluted share, primarily related to disposition activity.

- •

- Funds from Operations ("FFO") was $4.272 billion, or $12.04 per diluted share, as compared to $4.325 billion, or $12.13 per

diluted share, in the prior year period. The 2019 results included the $0.33 per diluted share loss on the extinguishment of debt. FFO per diluted share, before this $0.33 debt charge, was $12.37, at

the high end of the Company's original guidance for 2019.

- •

- Growth in Comparable FFO per diluted share for the twelve months ended December 31, 2019 was 4.4%.

- •

- Net income attributable to common stockholders was $510.2 million, or $1.66 per diluted share, as compared to $712.8 million, or

$2.30 per diluted share in 2018. Results for the fourth quarter of 2019 include the aforementioned loss on extinguishment of debt of $0.33 per diluted share. The prior year period included gains of

$143.9 million, or $0.40 per diluted share.

- •

- FFO was $1.045 billion, or $2.96 per diluted share, as compared to $1.151 billion, or $3.23 per diluted share, in the prior year period. The fourth quarter 2019 results included the $0.33 per diluted share loss on the extinguishment of debt. Comparable FFO per diluted share was $3.29 in the fourth quarter 2019 compared to $3.20 in the prior year period, growth of 2.8%.

- (1)

- For a reconciliation of FFO and net income per diluted share on a comparable basis, please see Footnote E of the Footnotes to Unaudited Financial Information.

| 4Q 2019 SUPPLEMENTAL |

|

2 |

EARNINGS RELEASE

"I am pleased with our fourth quarter results, concluding another successful and productive year for our company," said David Simon, Chairman, Chief Executive Officer and President. "In 2019, we opened one new shopping destination; delivered six international expansions; completed four redevelopments of former department stores and started construction on nine additional projects; and made several strategic investments in companies focused on enhancing our consumer experience. During 2019, we returned approximately $3.3 billion to shareholders, including approximately $3.0 billion in dividends paid. We continue to strengthen our portfolio through our innovative and disciplined investment activities that will allow us to continue to deliver long-term cash flow, FFO and dividends per share growth."

U.S. MALLS AND PREMIUM OUTLETS OPERATING STATISTICS

- •

- Reported retailer sales per square foot was $693, an increase of 4.8%, for the trailing 12 months ended December 31, 2019.

- •

- Occupancy was 95.1% at December 31, 2019.

- •

- Base minimum rent per square foot was $54.59 at December 31, 2019.

- •

- Leasing spread per square foot for the trailing 12 months ended December 31, 2019 was $7.83, an increase of 14.4%.

COMPARABLE PROPERTY NET OPERATING INCOME ("NOI") AND PORTFOLIO NOI

Comparable property NOI growth for the full year 2019, including international comparable properties on a constant currency basis, was 1.7%. Comparable property NOI growth for North American properties was 1.4%. Total portfolio NOI growth for the full year 2019 was 1.7%. Total portfolio NOI includes NOI from comparable properties, new developments, redevelopments, expansions, acquisitions and our share of NOI from investments.

During 2019, the Company paid $8.30 per share in dividends, an increase of 5.1% compared to the prior year. Today, Simon's Board of Directors declared a common stock dividend of $2.10 per share for the first quarter of 2020. This is a 2.4% increase year-over-year. The dividend will be payable on February 28, 2020 to shareholders of record on February 14, 2020. The Company has paid more than $31 billion of dividends since its initial public offering.

Simon's Board of Directors also declared the quarterly dividend on its 83/8% Series J Cumulative Redeemable Preferred Stock (NYSE: SPGPrJ) of $1.046875 per share, payable on March 31, 2020 to shareholders of record on March 17, 2020.

| 4Q 2019 SUPPLEMENTAL |

|

3 |

Construction continues on five new outlet development projects: one in the U.S. and four internationally. Three projects are scheduled to open in 2020, including Malaga Designer Outlet (Malaga, Spain), Siam Premium Outlets Bangkok (Bangkok, Thailand) and West Midlands Designer Outlet (Cannock, England) and two are scheduled to open in 2021, including Tulsa Premium Outlets (Jenks (Tulsa), Oklahoma) and Paris-Giverny Designer Outlet (Vernon (Normandy), France).

There are currently 15 redevelopment projects of former department store spaces under construction that will add compelling retail, entertainment and mixed-uses to centers such as Burlington Mall (Burlington (Boston), MA), Phipps Plaza (Atlanta, GA) and Northgate (Seattle, WA).

Construction also continues on other significant redevelopment and expansion projects including The Shops at Riverside (Hackensack, NJ), Sawgrass Mills (Miami, FL), Gotemba Premium Outlets (Gotemba, Japan) and Rinku Premium Outlets (Izumisano (Osaka), Japan).

At quarter-end, redevelopment and expansion projects, including the redevelopment of former department store spaces, were underway at more than 30 properties in the U.S., Asia and Europe. Simon's share of the costs of all new development and redevelopment projects under construction at quarter-end was approximately $1.8 billion.

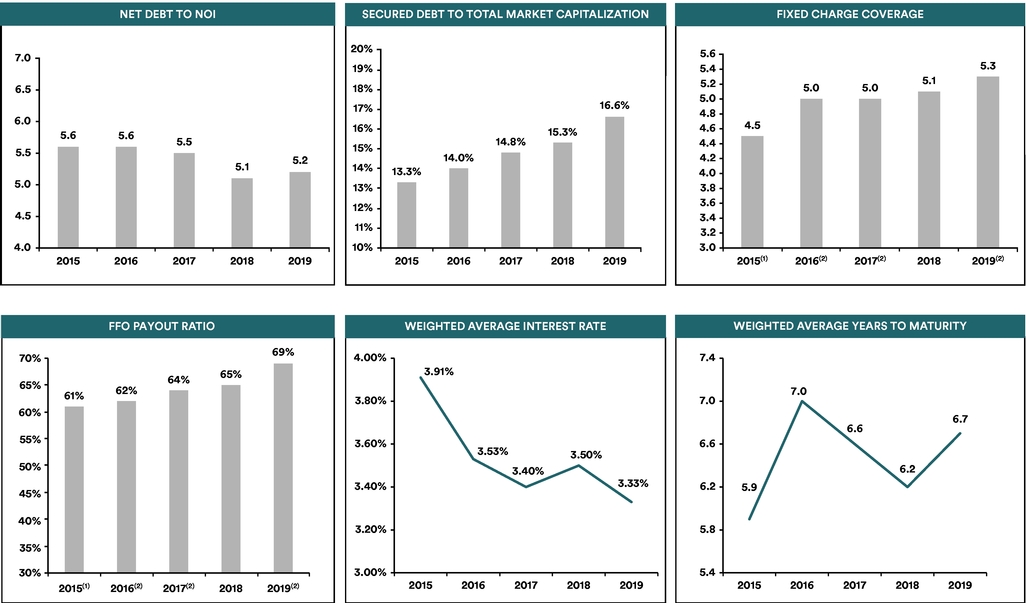

The Company was active in the debt markets in 2019, continuing to lower our effective borrowing costs and extend our maturity profile.

During the year, the Company completed a three tranche senior notes offering totaling $3.5 billion with a weighted average coupon rate of 2.61% and weighted average term of 15.9 years.

The Company also retired all, or a portion of, four series of senior notes totaling approximately $2.6 billion (USD equivalent) with a combined weighted average coupon rate of 3.76%. The new notes offering had a weighted average coupon rate of approximately 115 basis points lower than the notes that were retired.

As of December 31, 2019, Simon had more than $7.1 billion of liquidity consisting of cash on hand, including its share of joint venture cash, and available capacity under its revolving credit facilities, net of outstanding U.S. and Euro commercial paper.

| 4Q 2019 SUPPLEMENTAL |

|

4 |

The Company currently estimates net income to be within a range of $7.15 to $7.30 per diluted share for the year ending December 31, 2020 and that FFO will be within a range of $12.25 to $12.40 per diluted share.

The following table provides the reconciliation for the expected range of estimated net income attributable to common stockholders per diluted share to estimated FFO per diluted share:

For the year ending December 31, 2020

| |

LOW END | HIGH END | |||||

|---|---|---|---|---|---|---|---|

Estimated net income attributable to common stockholders per diluted share |

$ | 7.15 | $ | 7.30 | |||

Depreciation and amortization including Simon's share of unconsolidated entities |

5.10 | 5.10 | |||||

| | | | | | | | |

Estimated FFO per diluted share |

$ | 12.25 | $ | 12.40 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Simon will hold a conference call to discuss the quarterly financial results today at 8:30 a.m. Eastern Time, Tuesday, February 4, 2020. A live webcast of the conference call will be accessible in listen-only mode at investors.simon.com. An audio replay of the conference call will be available until February 11, 2020. To access the audio replay, dial 1-855-859-2056 (international 404-537-3406) passcode 9776639.

SUPPLEMENTAL MATERIALS AND WEBSITE

Supplemental information on our fourth quarter 2019 performance is available at investors.simon.com. This information has also been furnished to the SEC in a current report on Form 8-K.

We routinely post important information online on our investor relations website, investors.simon.com. We use this website, press releases, SEC filings, quarterly conference calls, presentations and webcasts to disclose material, non-public information in accordance with Regulation FD. We encourage members of the investment community to monitor these distribution channels for material disclosures. Any information accessed through our website is not incorporated by reference into, and is not a part of, this document.

| 4Q 2019 SUPPLEMENTAL |

|

5 |

This press release includes FFO, FFO per share, comparable FFO per share, comparable earnings per share, portfolio net operating income growth and comparable property net operating income growth, which are financial performance measures not defined by generally accepted accounting principles in the United States ("GAAP"). Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are included in this press release and in Simon's supplemental information for the quarter. FFO and comparable property net operating income growth are financial performance measures widely used in the REIT industry. Our definitions of these non-GAAP measures may not be the same as similar measures reported by other REITs.

Certain statements made in this press release may be deemed "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can give no assurance that its expectations will be attained, and it is possible that the Company's actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks, uncertainties and other factors. Such factors include, but are not limited to: changes in economic and market conditions that may adversely affect the general retail environment; the potential loss of anchor stores or major tenants; the inability to collect rent due to the bankruptcy or insolvency of tenants or otherwise; decreases in market rental rates; the intensely competitive market environment in the retail industry; the inability to lease newly developed properties and renew leases and relet space at existing properties on favorable terms; risks related to international activities, including, without limitation, the impact, if any, of the United Kingdom's exit from the European Union; changes to applicable laws or regulations or the interpretation thereof; risks associated with the acquisition, development, redevelopment, expansion, leasing and management of properties; general risks related to real estate investments, including the illiquidity of real estate investments; the impact of our substantial indebtedness on our future operations; any disruption in the financial markets that may adversely affect our ability to access capital for growth and satisfy our ongoing debt service requirements; any change in our credit rating; changes in market rates of interest and foreign exchange rates for foreign currencies; changes in the value of our investments in foreign entities; our ability to hedge interest rate and currency risk; our continued ability to maintain our status as a REIT; changes in tax laws or regulations that result in adverse tax consequences; risks relating to our joint venture properties; environmental liabilities; changes in insurance costs, the availability of comprehensive insurance coverage; security breaches that could compromise our information technology or infrastructure; natural disasters; the potential for terrorist activities; the loss of key management personnel and the transition of LIBOR to an alternative reference rate. The Company discusses these and other risks and uncertainties under the heading "Risk Factors" in its annual and quarterly periodic reports filed with the SEC. The Company may update that discussion in subsequent other periodic reports, but except as required by law, the Company undertakes no duty or obligation to update or revise these forward-looking statements, whether as a result of new information, future developments, or otherwise.

Simon is a global leader in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company (Simon Property Group, NYSE:SPG). Our properties across North America, Europe and Asia provide community gathering places for millions of people every day and generate billions in annual sales. For more information, visit simon.com.

| 4Q 2019 SUPPLEMENTAL |

|

6 |

EARNINGS RELEASE

Simon Property Group, Inc.

Unaudited Consolidated Statements of Operations

(Dollars in thousands, except per share amounts)

| |

FOR THE THREE MONTHS ENDED DECEMBER 31, |

FOR THE TWELVE MONTHS ENDED DECEMBER 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2019 |

2018 |

2019 |

2018 |

|||||||||

REVENUE: |

|||||||||||||

Lease income |

$ | 1,356,238 | $ | 1,347,155 | $ | 5,243,771 | $ | 5,158,420 | |||||

Management fees and other revenues |

29,174 | 30,780 | 112,942 | 116,286 | |||||||||

Other income |

103,203 | 84,092 | 398,476 | 370,582 | |||||||||

| | | | | | | | | | | | | | |

Total revenue |

1,488,615 | 1,462,027 | 5,755,189 | 5,645,288 | |||||||||

| | | | | | | | | | | | | | |

EXPENSES: |

|||||||||||||

Property operating |

113,741 | 115,216 | 453,145 | 450,636 | |||||||||

Depreciation and amortization |

324,310 | 329,145 | 1,340,503 | 1,282,454 | |||||||||

Real estate taxes |

118,600 | 112,790 | 468,004 | 457,740 | |||||||||

Repairs and maintenance |

26,743 | 26,081 | 100,495 | 99,588 | |||||||||

Advertising and promotion |

41,216 | 43,262 | 150,344 | 151,241 | |||||||||

Home and regional office costs |

45,217 | 30,584 | 190,109 | 136,677 | |||||||||

General and administrative |

7,333 | 10,830 | 34,860 | 46,543 | |||||||||

Other |

34,579 | 23,607 | 109,898 | 94,110 | |||||||||

| | | | | | | | | | | | | | |

Total operating expenses |

711,739 | 691,515 | 2,847,358 | 2,718,989 | |||||||||

| | | | | | | | | | | | | | |

OPERATING INCOME BEFORE OTHER ITEMS |

776,876 | 770,512 | 2,907,831 | 2,926,299 | |||||||||

Interest expense |

(189,813) | (204,341) | (789,353) | (815,923) | |||||||||

Loss on extinguishment of debt |

(116,256) | — | (116,256) | — | |||||||||

Income and other taxes |

(6,744) | (10,422) | (30,054) | (36,898) | |||||||||

Income from unconsolidated entities |

127,657 | 149,987 | 444,349 | 475,250 | |||||||||

Unrealized losses in fair value of equity instruments |

(3,365) | (16,423) | (8,212) | (15,212) | |||||||||

Gain on sale or disposal of, or recovery on, assets and interests in unconsolidated entities and impairment, net |

2,061 | 143,879 | 14,883 | 288,827 | |||||||||

| | | | | | | | | | | | | | |

CONSOLIDATED NET INCOME |

590,416 | 833,192 | 2,423,188 | 2,822,343 | |||||||||

Net income attributable to noncontrolling interests |

79,388 | 119,562 | 321,604 | 382,285 | |||||||||

Preferred dividends |

834 | 834 | 3,337 | 3,337 | |||||||||

| | | | | | | | | | | | | | |

NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS |

$ | 510,194 | $ | 712,796 | $ | 2,098,247 | $ | 2,436,721 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

BASIC AND DILUTED EARNINGS PER COMMON SHARE: |

|||||||||||||

Net income attributable to common stockholders |

$ | 1.66 | $ | 2.30 | $ | 6.81 | $ | 7.87 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| 4Q 2019 SUPPLEMENTAL |

|

7 |

Simon Property Group, Inc.

Unaudited Consolidated Balance Sheets

(Dollars in thousands, except share amounts)

| |

DECEMBER 31, 2019 |

DECEMBER 31, 2018 |

|||||

|---|---|---|---|---|---|---|---|

ASSETS: |

|||||||

Investment properties, at cost |

$ | 37,804,495 | $ | 37,092,670 | |||

Less — accumulated depreciation |

13,905,776 | 12,884,539 | |||||

| | | | | | | | |

|

23,898,719 | 24,208,131 | |||||

Cash and cash equivalents |

669,373 | 514,335 | |||||

Tenant receivables and accrued revenue, net |

832,151 | 763,815 | |||||

Investment in unconsolidated entities, at equity |

2,371,053 | 2,220,414 | |||||

Investment in Klépierre, at equity |

1,731,649 | 1,769,488 | |||||

Right-of-use assets, net |

514,660 | — | |||||

Deferred costs and other assets |

1,214,025 | 1,210,040 | |||||

| | | | | | | | |

Total assets |

$ | 31,231,630 | $ | 30,686,223 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

LIABILITIES: |

|||||||

Mortgages and unsecured indebtedness |

$ | 24,163,230 | $ | 23,305,535 | |||

Accounts payable, accrued expenses, intangibles, and deferred revenues |

1,390,682 | 1,316,861 | |||||

Cash distributions and losses in unconsolidated entities, at equity |

1,566,294 | 1,536,111 | |||||

Lease liabilities |

516,809 | — | |||||

Other liabilities |

464,304 | 500,597 | |||||

| | | | | | | | |

Total liabilities |

28,101,319 | 26,659,104 | |||||

| | | | | | | | |

Commitments and contingencies |

|||||||

Limited partners' preferred interest in the Operating Partnership and noncontrolling redeemable interests in properties |

219,061 | 230,163 | |||||

EQUITY: |

|||||||

Stockholders' Equity |

|||||||

Capital stock (850,000,000 total shares authorized, $0.0001 par value, 238,000,000 shares of excess common stock, 100,000,000 authorized shares of preferred stock): |

|||||||

Series J 83/8% cumulative redeemable preferred stock, 1,000,000 shares authorized, 796,948 issued and outstanding with a liquidation value of $39,847 |

42,420 |

42,748 |

|||||

|

|||||||

Common stock, $0.0001 par value, 511,990,000 shares authorized, 320,435,256 and 320,411,571 issued and outstanding, respectively |

32 | 32 | |||||

|

|||||||

Class B common stock, $0.0001 par value, 10,000 shares authorized, 8,000 issued and outstanding |

— | — | |||||

|

|||||||

Capital in excess of par value |

9,756,073 | 9,700,418 | |||||

Accumulated deficit |

(5,379,952) | (4,893,069) | |||||

Accumulated other comprehensive loss |

(118,604) | (126,017) | |||||

Common stock held in treasury, at cost, 13,574,296 and 11,402,103 shares, respectively |

(1,773,571) | (1,427,431) | |||||

| | | | | | | | |

Total stockholders' equity |

2,526,398 | 3,296,681 | |||||

Noncontrolling interests |

384,852 | 500,275 | |||||

| | | | | | | | |

Total equity |

2,911,250 | 3,796,956 | |||||

| | | | | | | | |

Total liabilities and equity |

$ | 31,231,630 | $ | 30,686,223 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| 4Q 2019 SUPPLEMENTAL |

|

8 |

Simon Property Group, Inc.

Unaudited Joint Venture Combined Statements of Operations

(Dollars in thousands)

| |

FOR THE THREE MONTHS ENDED DECEMBER 31, |

FOR THE TWELVE MONTHS ENDED DECEMBER 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2019 |

2018 |

2019 |

2018 |

|||||||||

REVENUE: |

|||||||||||||

Lease income |

$ | 802,746 | $ | 786,217 | $ | 3,088,594 | $ | 3,045,668 | |||||

Other income |

88,060 | 93,828 | 322,398 | 326,575 | |||||||||

| | | | | | | | | | | | | | |

Total revenue |

890,806 | 880,045 | 3,410,992 | 3,372,243 | |||||||||

OPERATING EXPENSES: |

|||||||||||||

Property operating |

152,320 | 153,203 | 587,062 | 590,921 | |||||||||

Depreciation and amortization |

169,693 | 164,870 | 681,764 | 652,968 | |||||||||

Real estate taxes |

65,314 | 62,070 | 266,013 | 259,567 | |||||||||

Repairs and maintenance |

23,491 | 23,441 | 85,430 | 87,408 | |||||||||

Advertising and promotion |

25,808 | 21,924 | 89,660 | 87,349 | |||||||||

Other |

53,374 | 43,757 | 196,178 | 187,292 | |||||||||

| | | | | | | | | | | | | | |

Total operating expenses |

490,000 | 469,265 | 1,906,107 | 1,865,505 | |||||||||

| | | | | | | | | | | | | | |

OPERATING INCOME BEFORE OTHER ITEMS |

400,806 |

410,780 |

1,504,885 |

1,506,738 |

|||||||||

Interest expense |

(163,074) | (158,154) | (636,988) | (663,693) | |||||||||

Gain on sale or disposal of, or recovery on, assets and interests in unconsolidated entities, net |

3,022 | 7,575 | 24,609 | 33,367 | |||||||||

| | | | | | | | | | | | | | |

NET INCOME |

$ | 240,754 | $ | 260,201 | $ | 892,506 | $ | 876,412 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Third-Party Investors' Share of Net Income |

$ | 128,618 | $ | 132,593 | $ | 460,696 | $ | 436,767 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Our Share of Net Income |

112,136 | 127,608 | 431,810 | 439,645 | |||||||||

Amortization of Excess Investment (A) |

(21,143) | (20,804) | (83,556) | (85,252) | |||||||||

Our Share of Gain on Sale or Disposal of Assets and Interests in Other Income in the Consolidated Financial Statements |

— | — | (9,156) | — | |||||||||

Our Share of Gain on Sale or Disposal of, or Recovery on, Assets and Interests in Unconsolidated Entities, net |

(1,133) | (2,841) | (1,133) | (12,513) | |||||||||

| | | | | | | | | | | | | | |

Income from Unconsolidated Entities (B) |

$ | 89,860 | $ | 103,963 | $ | 337,965 | $ | 341,880 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Note:- The above financial presentation does not include any information related to our investments in Klépierre S.A. ("Klépierre") and HBS Global Properties ("HBS"). For additional information, see footnote B.

| 4Q 2019 SUPPLEMENTAL |

|

9 |

Simon Property Group, Inc

Unaudited Joint Venture Combined Balance Sheets

(Dollars in thousands)

| |

DECEMBER 31, 2019 |

DECEMBER 31, 2018 |

|||||

|---|---|---|---|---|---|---|---|

Assets: |

|||||||

Investment properties, at cost |

$ | 19,525,665 | $ | 18,807,449 | |||

Less - accumulated depreciation |

7,407,627 | 6,834,633 | |||||

| | | | | | | | |

|

12,118,038 | 11,972,816 | |||||

Cash and cash equivalents |

1,015,864 |

1,076,398 |

|||||

Tenant receivables and accrued revenue, net |

510,157 | 445,148 | |||||

Right-of-use assets, net |

185,302 | — | |||||

Deferred costs and other assets |

384,663 | 390,818 | |||||

| | | | | | | | |

Total assets |

$ | 14,214,024 | $ | 13,885,180 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Liabilities and Partners' Deficit: |

|||||||

Mortgages |

$ | 15,391,781 | $ | 15,235,415 | |||

Accounts payable, accrued expenses, intangibles, and deferred revenue |

977,112 | 976,311 | |||||

Lease liabilities |

186,594 | — | |||||

Other liabilities |

338,412 | 344,205 | |||||

| | | | | | | | |

Total liabilities |

16,893,899 | 16,555,931 | |||||

Preferred units |

67,450 |

67,450 |

|||||

Partners' deficit |

(2,747,325) | (2,738,201) | |||||

| | | | | | | | |

Total liabilities and partners' deficit |

$ | 14,214,024 | $ | 13,885,180 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Our Share of: |

|||||||

Partners' deficit |

$ | (1,196,926) | $ | (1,168,216) | |||

Add: Excess Investment (A) |

1,525,903 | 1,594,198 | |||||

| | | | | | | | |

Our net Investment in unconsolidated entities, at equity |

$ | 328,977 | $ | 425,982 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Note:- The above financial presentation does not include any information related to our investments in Klépierre and HBS Global Properties. For additional information, see footnote B.

| 4Q 2019 SUPPLEMENTAL |

|

10 |

Simon Property Group, Inc.

Unaudited Reconciliation of Non-GAAP Financial Measures (C)

(Amounts in thousands, except per share amounts)

| |

Reconciliation of Consolidated Net Income to FFO |

|

|

|

|

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

FOR THE THREE MONTHS ENDED DECEMBER 31, |

FOR THE TWELVE MONTHS ENDED DECEMBER 31, |

|

||||||||||||

| |

|

2019 |

2018 |

2019 |

2018 |

|

||||||||||

|

Consolidated Net Income (D) |

$ | 590,416 | $ | 833,192 | $ | 2,423,188 | $ | 2,822,343 | |||||||

|

Adjustments to Arrive at FFO: |

|||||||||||||||

|

Depreciation and amortization from consolidated properties |

321,404 | 326,273 | 1,329,843 | 1,270,888 | |||||||||||

|

Our share of depreciation and amortization from unconsolidated entities, including Klépierre and HBS |

139,579 | 129,818 | 551,596 | 533,595 | |||||||||||

|

Gain on sale or disposal of, or recovery on, assets and interests in unconsolidated entities and impairment, net |

(2,061) | (137,263) | (14,883) | (282,211) | |||||||||||

|

Unrealized losses in fair value of equity instruments |

3,365 | 16,423 | 8,212 | 15,212 | |||||||||||

|

Net income attributable to noncontrolling interest holders in properties |

(1,172) | (10,642) | (991) | (11,327) | |||||||||||

|

Noncontrolling interests portion of depreciation and amortization |

(4,834) | (5,082) | (19,442) | (18,647) | |||||||||||

|

Preferred distributions and dividends |

(1,313) | (1,313) | (5,252) | (5,252) | |||||||||||

| | | | | | | | | | | | | | | | | |

|

FFO of the Operating Partnership |

$ | 1,045,384 | $ | 1,151,406 | $ | 4,272,271 | $ | 4,324,601 | |||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

|

Diluted net income per share to diluted FFO per share reconciliation: |

|||||||||||||||

|

Diluted net income per share |

$ | 1.66 | $ | 2.30 | $ | 6.81 | $ | 7.87 | |||||||

|

Depreciation and amortization from consolidated properties and our share of depreciation and amortization from unconsolidated entities, including Klépierre and HBS, net of noncontrolling interests portion of depreciation and amortization |

1.30 | 1.27 | 5.25 | 5.01 | |||||||||||

|

Gain on sale or disposal of, or recovery on, assets and interests in unconsolidated entities and impairment, net |

(0.01) | (0.39) | (0.04) | (0.79) | |||||||||||

|

Unrealized losses in fair value of equity instruments |

0.01 | 0.05 | 0.02 | 0.04 | |||||||||||

| | | | | | | | | | | | | | | | | |

|

Diluted FFO per share |

$ | 2.96 | $ | 3.23 | $ | 12.04 | $ | 12.13 | |||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

|

|

|||||||||||||||

|

Details for per share calculations: |

|||||||||||||||

|

FFO of the Operating Partnership |

$ | 1,045,384 | $ | 1,151,406 | $ | 4,272,271 | $ | 4,324,601 | |||||||

|

Diluted FFO allocable to unitholders |

(138,219) | (152,122) | (563,342) | (568,817) | |||||||||||

| | | | | | | | | | | | | | | | | |

|

Diluted FFO allocable to common stockholders |

$ | 907,165 | $ | 999,284 | $ | 3,708,929 | $ | 3,755,784 | |||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

|

Basic and Diluted weighted average shares outstanding |

306,869 | 309,294 | 307,950 | 309,627 | |||||||||||

|

Weighted average limited partnership units outstanding |

46,751 | 47,102 | 46,774 | 46,893 | |||||||||||

| | | | | | | | | | | | | | | | | |

|

Basic and Diluted weighted average shares and units outstanding |

353,620 | 356,396 | 354,724 | 356,520 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

|

Basic and Diluted FFO per Share |

$ | 2.96 | $ | 3.23 | $ | 12.04 | $ | 12.13 | |||||||

|

Percent Change |

–8.4% | –0.7% | |||||||||||||

| 4Q 2019 SUPPLEMENTAL |

|

11 |

Simon Property Group, Inc.

Footnotes to Unaudited Financial Information

- (A)

- Excess

investment represents the unamortized difference of our investment over equity in the underlying net assets of the related partnerships and joint ventures

shown therein. The Company generally amortizes excess investment over the life of the related assets.

- (B)

- The

Unaudited Joint Venture Combined Statements of Operations do not include any operations or our share of net income or excess investment amortization related to

our investments in Klépierre and HBS Global Properties. Amounts included in Footnote D below exclude our share of related activity for our investments in Klépierre and

HBS Global Properties. For further information on Klépierre, reference should be made to financial information in Klépierre's public filings and additional discussion and

analysis in our Form 10-K.

- (C)

- This report contains measures of financial or operating performance that are not specifically defined by GAAP, including FFO and FFO per share. FFO is a performance measure that is standard in the REIT business. We believe FFO provides investors with additional information concerning our operating performance and a basis to compare our performance with those of other REITs. We also use these measures internally to monitor the operating performance of our portfolio. Our computation of these non-GAAP measures may not be the same as similar measures reported by other REITs.

We determine FFO based upon the definition set forth by the National Association of Real Estate Investment Trusts ("NAREIT") Funds From Operations White Paper - 2018 Restatement. Our main business includes acquiring, owning, operating, developing, and redeveloping real estate in conjunction with the rental of real estate. Gains and losses of assets incidental to our main business are included in FFO. We determine FFO to be our share of consolidated net income computed in accordance with GAAP, excluding real estate related depreciation and amortization, excluding gains and losses from extraordinary items, excluding gains and losses from the sale, disposal or property insurance recoveries of, or any impairment related to, depreciable retail operating properties, plus the allocable portion of FFO of unconsolidated joint ventures based upon economic ownership interest, and all determined on a consistent basis in accordance with GAAP. However, you should understand that FFO does not represent cash flow from operations as defined by GAAP, should not be considered as an alternative to net income determined in accordance with GAAP as a measure of operating performance, and is not an alternative to cash flows as a measure of liquidity.

- (D)

- Includes

our share of:

- -

- Gains

on land sales of $3.2 million and $2.4 million for the three months ended December 31, 2019 and 2018, respectively, and $17.3 million

and $6.3 million for the twelve months ended December 31, 2019 and 2018, respectively.

- -

- Straight-line

adjustments increased income by $24.9 million and $6.7 million for the three months ended December 31, 2019 and 2018, respectively,

and $90.9 million and $28.5 million for the twelve months ended December 31, 2019 and 2018, respectively.

- -

- Amortization of fair market value of leases from acquisitions increased income by $1.4 million and $1.4 million for the three months ended December 31, 2019 and 2018, respectively, and $5.4 million and $4.4 million for the twelve months ended December 31, 2019 and 2018, respectively.

| 4Q 2019 SUPPLEMENTAL |

|

12 |

- (E)

- Reconciliation of reported earnings per share to comparable earnings per share and FFO per share to comparable FFO per share:

| |

THREE MONTHS ENDED DECEMBER 31, |

TWELVE MONTHS ENDED DECEMBER 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2019 |

2018 |

2019 |

2018 |

|||||||||

Reported earnings per share |

$ | 1.66 | $ | 2.30 | $ | 6.81 | $ | 7.87 | |||||

Add: Loss on extinguishment of debt |

0.33 | — | 0.33 | — | |||||||||

Less: Non-cash investment gain (ABG) |

— | — | — | (0.10) | |||||||||

Less: Higher distribution income from international investment |

— | — | — | (0.05) | |||||||||

Less: ASC 842 expensing internal leasing costs |

— | (0.03) | — | (0.13) | |||||||||

Less: Gains on sale or disposal of assets |

— | (0.40) | — | (0.81) | |||||||||

| | | | | | | | | | | | | | |

Comparable earnings per share |

$ | 1.99 | $ | 1.87 | $ | 7.14 | $ | 6.78 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Comparable earnings per share growth |

6.4% | 5.3% | |||||||||||

| |

THREE MONTHS ENDED DECEMBER 31, |

TWELVE MONTHS ENDED DECEMBER 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2019 |

2018 |

2019 |

2018 |

|||||||||

Reported FFO per share |

$ | 2.96 | $ | 3.23 | $ | 12.04 | $ | 12.13 | |||||

Add: Loss on extinguishment of debt |

0.33 | — | 0.33 | — | |||||||||

Less: Non-cash investment gain (ABG) |

— | — | — | (0.10) | |||||||||

Less: Higher distribution income from international investment |

— | — | — | (0.05) | |||||||||

Less: ASC 842 expensing internal leasing costs |

— | (0.03) | — | (0.13) | |||||||||

| | | | | | | | | | | | | | |

Comparable FFO per share |

$ | 3.29 | $ | 3.20 | $ | 12.37 | $ | 11.85 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Comparable FFO per share growth |

2.8% | 4.4% | |||||||||||

| 4Q 2019 SUPPLEMENTAL |

|

13 |

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust ("REIT"). Simon Property Group, L.P., or the Operating Partnership, is our majority-owned partnership subsidiary that owns all of our real estate properties and other assets. In this package, the terms Simon, we, our, or the Company refer to Simon Property Group, Inc., the Operating Partnership, and its subsidiaries. We own, develop and manage premier shopping, dining, entertainment and mixed-use destinations, which consist primarily of malls, Premium Outlets®, The Mills®, and International Properties. At December 31, 2019, we owned or had an interest in 233 properties comprising 191 million square feet in North America, Asia and Europe. Additionally, at December 31, 2019, we had a 22.2% ownership interest in Klépierre, a publicly traded, Paris-based real estate company, which owns shopping centers in 15 European countries.

This package was prepared to provide operational and balance sheet information as of December 31, 2019 for the Company and the Operating Partnership.

Certain statements made in this Supplemental Package may be deemed "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and it is possible that our actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks, uncertainties and other factors. Such factors include, but are not limited to: changes in economic and market conditions that may adversely affect the general retail environment; the potential loss of anchor stores or major tenants; the inability to collect rent due to the bankruptcy or insolvency of tenants or otherwise; decreases in market rental rates; the intensely competitive market environment in the retail industry; the inability to lease newly developed properties and renew leases and relet space at existing properties on favorable terms; risks related to international activities, including, without limitation, the impact of the United Kingdom's vote to leave the European Union; changes to applicable laws or regulations or the interpretation thereof; risks associated with the acquisition, development, redevelopment, expansion, leasing and management of properties; general risks related to real estate investments, including the illiquidity of real estate investments; the impact of our substantial indebtedness on our future operations; any disruption in the financial markets that may adversely affect our ability to access capital for growth and satisfy our ongoing debt service requirements; any change in our credit rating; changes in market rates of interest and foreign exchange rates for foreign currencies; changes in the value of our investments in foreign entities; our ability to hedge interest rate and currency risk; our continued ability to maintain our status as a REIT; changes in tax laws or regulations that result in adverse tax consequences; risks relating to our joint venture properties; environmental liabilities; changes in insurance costs, the availability of comprehensive insurance coverage; security breaches that could compromise our information technology or infrastructure; natural disasters; the potential for terrorist activities; the loss of key management personnel; and the transition of LIBOR to an alternative reference rate. We discuss these and other risks and uncertainties under the heading "Risk Factors" in our annual and quarterly periodic reports filed with the SEC. We may update that discussion in subsequent other periodic reports, but, except as required by law, we undertake no duty or obligation to update or revise these forward-looking statements, whether as a result of new information, future developments, or otherwise.

Any questions, comments or suggestions regarding this Supplemental Information should be directed to Tom Ward, Senior Vice President of Investor Relations (tom.ward@simon.com or 317.685.7330).

| 4Q 2019 SUPPLEMENTAL |

|

14 |

The Company's common stock and one series of preferred stock are traded on the New York Stock Exchange under the following symbols:

|

Common Stock |

SPG | ||||||

|

8.375% Series J Cumulative Redeemable Preferred |

SPGPrJ | ||||||

|

||||||||

|

Standard & Poor's |

|

|

|||||

|

Corporate |

A | (Stable Outlook) | |||||

|

Senior Unsecured |

A | (Stable Outlook) | |||||

|

Commercial Paper |

A1 | (Stable Outlook) | |||||

|

Preferred Stock |

BBB+ | (Stable Outlook) | |||||

|

Moody's |

|

|

|||||

|

Senior Unsecured |

A2 | (Stable Outlook) | |||||

|

Commercial Paper |

P1 | (Stable Outlook) | |||||

|

Preferred Stock |

A3 | (Stable Outlook) | |||||

SENIOR UNSECURED DEBT COVENANTS (1)

|

Required | Actual | Compliance |

|||

| | | | | | | |

Total Debt to Total Assets (1) |

£65% | 40% | Yes | |||

Total Secured Debt to Total Assets (1) |

£50% | 18% | Yes | |||

Fixed Charge Coverage Ratio |

>1.5X | 5.3X | Yes | |||

Total Unencumbered Assets to Unsecured Debt |

³125% | 280% | Yes |

- (1)

- Covenants for indentures dated June 7, 2005 and later. Total Assets are calculated in accordance with the indenture and essentially represent net operating income (NOI) divided by a 7.0% capitalization rate plus the value of other assets at cost.

| 4Q 2019 SUPPLEMENTAL |

|

15 |

SELECTED FINANCIAL AND EQUITY INFORMATION

(In thousands, except as noted)

|

|

THREE MONTHS ENDED DECEMBER 31, |

|

TWELVE MONTHS ENDED DECEMBER 31, |

|||||||||

| | | | | | | | | | | | | | |

|

|

2019 |

|

2018 |

|

2019 | | 2018 | |||||

Financial Highlights |

|||||||||||||

Total Revenue - Consolidated Properties |

$ | 1,488,615 | $ | 1,462,027 | $ | 5,755,189 | $ | 5,645,288 | |||||

Consolidated Net Income |

$ |

590,416 |

$ |

833,192 |

$ |

2,423,188 |

$ |

2,822,343 |

|||||

Net Income Attributable to Common Stockholders |

$ | 510,194 | $ | 712,796 | $ | 2,098,247 | $ | 2,436,721 | |||||

Basic and Diluted Earnings per Common Share (EPS) |

$ | 1.66 | $ | 2.30 | $ | 6.81 | $ | 7.87 | |||||

Funds from Operations (FFO) of the Operating Partnership |

$ |

1,045,384 |

$ |

1,151,406 |

$ |

4,272,271 |

$ |

4,324,601 |

|||||

Basic and Diluted FFO per Share (FFOPS) |

$ | 2.96 | $ | 3.23 | $ | 12.04 | $ | 12.13 | |||||

Dividends/Distributions per Share/Unit |

$ |

2.10 |

$ |

2.00 |

$ |

8.30 |

$ |

7.90 |

|||||

Stockholders' Equity Information |

|

AS OF DECEMBER 31, 2019 |

|

AS OF DECEMBER 31, 2018 |

|||

Limited Partners' Units Outstanding at end of period |

46,740 | 46,807 | |||||

Common Shares Outstanding at end of period |

306,869 | 309,018 | |||||

| | | | | | | | |

Total Common Shares and Limited Partnership Units Outstanding at end of period |

353,609 | 355,825 | |||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Weighted Average Limited Partnership Units Outstanding |

46,744 | 46,893 | |||||

Weighted Average Common Shares Outstanding: |

|||||||

Basic and Diluted - for purposes of EPS and FFOPS |

307,950 | 309,627 | |||||

|

|||||||

Debt Information |

|||||||

Share of Consolidated Debt |

$ | 23,988,186 | $ | 23,139,977 | |||

Share of Joint Venture Debt |

7,214,181 | 7,160,392 | |||||

| | | | | | | | |

Share of Total Debt |

$ | 31,202,367 | $ | 30,300,369 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

|||||||

Market Capitalization |

|||||||

Common Stock Price at end of period |

$ | 148.96 | $ | 167.99 | |||

Common Equity Capitalization, including Limited Partnership Units |

$ | 52,673,608 | $ | 59,775,015 | |||

Preferred Equity Capitalization, including Limited Partnership Preferred Units |

83,236 | 80,287 | |||||

| | | | | | | | |

Total Equity Market Capitalization |

$ | 52,756,844 | $ | 59,855,302 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Total Market Capitalization - Including Share of Total Debt |

$ | 83,959,211 | $ | 90,155,671 | |||

|

|||||||

Net Debt to Total Market Capitalization |

35.8% | 32.5% |

| 4Q 2019 SUPPLEMENTAL |

|

16 |

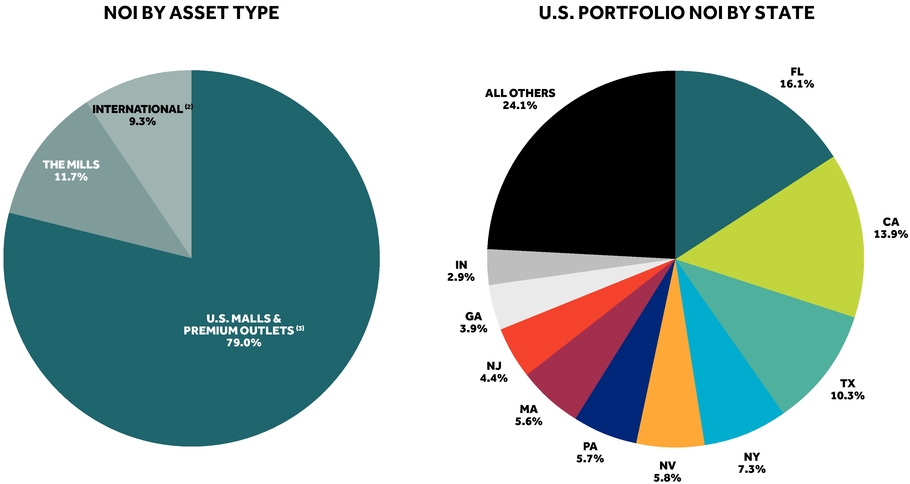

NET OPERATING INCOME (NOI) COMPOSITION (1)

For the Twelve Months Ended December 31, 2019

- (1)

- Based on our share of total NOI and does not reflect any property, entity or corporate-level debt.

- (2)

- Includes Klépierre, international Premium Outlets and international Designer Outlets.

- (3)

- Includes Lifestyle Centers.

| 4Q 2019 SUPPLEMENTAL |

|

17 |

NET OPERATING INCOME OVERVIEW (1)

(In thousands)

|

|

FOR THE THREE MONTHS ENDED DECEMBER 31, |

% GROWTH |

|

FOR THE TWELVE MONTHS ENDED DECEMBER 31, |

% GROWTH | ||||||||||

| | | | | | | | | | | | | | | | | |

|

|

2019 | | 2018 | |

|

2019 | | 2018 | |||||||

Comparable Property NOI (2) |

$ | 1,440,893 | $ | 1,433,452 | 0.5% | $ | 5,513,459 | $ | 5,435,326 | 1.4% | ||||||

NOI from New Development, Redevelopment, Expansion and Acquisitions (3) |

46,820 |

51,354 |

181,871 |

191,959 |

||||||||||||

International Properties (4) |

133,956 | 127,590 | 483,563 | 465,421 | ||||||||||||

Our share of NOI from Investments (5) |

85,006 | 80,054 | 293,979 | 292,513 | ||||||||||||

|

||||||||||||||||

Portfolio NOI |

$ | 1,706,675 | $ | 1,692,450 | 0.8% | $ | 6,472,872 | $ | 6,385,219 | 1.4% | ||||||

Corporate and Other NOI Sources (6) |

102,566 |

106,627 |

481,059 |

482,615 |

||||||||||||

| | | | | | | | | | | | | | | | | |

Combined NOI |

$ | 1,809,241 | $ | 1,799,077 | $ | 6,953,931 | $ | 6,867,834 | ||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Less: Joint Venture Partners' Share of NOI |

308,369 |

307,934 |

1,163,972 |

1,143,667 |

||||||||||||

| | | | | | | | | | | | | | | | | |

Our Share of Total NOI |

$ | 1,500,872 | $ | 1,491,143 | $ | 5,789,959 | $ | 5,724,167 | ||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

- (1)

- All amounts are presented at gross values unless otherwise indicated as our share. See reconciliation on following page.

- (2)

- Includes Malls, Premium Outlets, The Mills and Lifestyle Centers opened and operating as comparable for the period.

- (3)

- Includes total property NOI for properties undergoing redevelopment as well as incremental NOI for expansion properties not yet included in comparable properties.

- (4)

- Includes International Premium Outlets (except for Canadian Premium Outlets included in Comparable NOI) and International Designer Outlets.

- (5)

- Includes our share of NOI of Klépierre, HBS, and other corporate investments.

- (6)

- Includes income components excluded from Portfolio NOI and Comparable Property NOI (domestic lease termination income, interest income, land sale gains, straight line lease income, above/below market lease adjustments), unrealized and realized gains/losses on non-real estate related equity instruments, Northgate, Simon management company revenues, and other assets.

| 4Q 2019 SUPPLEMENTAL |

|

18 |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

(In thousands, except as noted)

RECONCILIATION OF NET INCOME TO NOI |

||||||||||||

|

||||||||||||

|

|

THREE MONTHS ENDED DECEMBER 31, |

|

TWELVE MONTHS ENDED DECEMBER 31, | ||||||||

| | | | | | | | | | | | | |

|

| 2019 | | 2018 | | 2019 | | 2018 | ||||

Reconciliation of NOI of consolidated entities: |

| | ||||||||||

Consolidated Net Income |

$ | 590,416 | $ | 833,192 | $ | 2,423,188 | $ | 2,822,343 | ||||

Income and other tax expense |

| 6,744 | 10,422 | | 30,054 | 36,898 | ||||||

Interest expense |

| 189,813 | 204,341 | | 789,353 | 815,923 | ||||||

Loss on extinguishment of debt |

| 116,256 | — | | 116,256 | — | ||||||

Income from unconsolidated entities |

| (127,657) | (149,987) | | (444,349) | (475,250) | ||||||

Unrealized losses in fair value of equity instruments |

| 3,365 | 16,423 | | 8,212 | 15,212 | ||||||

Gain on sale or disposal of, or recovery on, assets and interests in unconsolidated entities and impairment, net |

| (2,061) | (143,879) | | (14,883) | (288,827) | ||||||

| | | | | | | | | | | | | |

Operating Income Before Other Items |

| 776,876 | 770,512 | | 2,907,831 | 2,926,299 | ||||||

Depreciation and amortization |

| 324,310 | 329,145 | | 1,340,503 | 1,282,454 | ||||||

Home and regional office costs |

| 45,217 | 30,584 | | 190,109 | 136,677 | ||||||

General and administrative |

| 7,333 | 10,830 | | 34,860 | 46,543 | ||||||

| | | | | | | | | | | | | |

NOI of consolidated entities |

$ | 1,153,736 | $ | 1,141,071 | $ | 4,473,303 | $ | 4,391,973 | ||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Reconciliation of NOI of unconsolidated entities: |

| | ||||||||||

Net Income |

$ | 240,754 | $ | 260,201 | $ | 892,506 | $ | 876,412 | ||||

Interest expense |

| 163,074 | 158,154 | | 636,988 | 663,693 | ||||||

Gain on sale or disposal of, or recovery on, assets and interests in unconsolidated entities, net |

| (3,022) | (7,575) | | (24,609) | (33,367) | ||||||

| | | | | | | | | | | | | |

Operating Income Before Other Items |

| 400,806 | 410,780 | | 1,504,885 | 1,506,738 | ||||||

Depreciation and amortization |

| 169,693 | 164,870 | | 681,764 | 652,968 | ||||||

| | | | | | | | | | | | | |

NOI of unconsolidated entities |

$ | 570,499 | $ | 575,650 | $ | 2,186,649 | $ | 2,159,706 | ||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Add: Our share of NOI from Klépierre, HBS and other corporate investments |

| 85,006 | 82,356 | | 293,979 | 316,155 | ||||||

| | | | | | | | | | | | | |

Combined NOI |

$ | 1,809,241 | $ | 1,799,077 | $ | 6,953,931 | $ | 6,867,834 | ||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| 4Q 2019 SUPPLEMENTAL |

|

19 |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

(In thousands, except as noted)

RECONCILIATION OF FFO OF THE OPERATING PARTNERSHIP TO FUNDS AVAILABLE FOR DISTRIBUTION (OUR SHARE) |

| ||||||||

|

| | | | | ||||

|

|

THREE MONTHS ENDED DECEMBER 31, 2019 |

TWELVE MONTHS ENDED DECEMBER 31, 2019 |

| |||||

FFO of the Operating Partnership |

| | $ | 1,045,384 | | | $ | 4,272,271 | |

Non-cash impacts to FFO(1) |

| | (15,365) | | | (41,259) | | ||

| | | | | | | | | ||

FFO of the Operating Partnership excluding non-cash impacts |

| | 1,030,019 | | | 4,231,012 | | ||

Tenant allowances |

| | (47,147) | | | (192,252) | | ||

Operational capital expenditures |

| | (72,330) | | | (195,350) | | ||

| | | | | | | | | ||

Funds available for distribution |

| | $ | 910,542 | | | $ | 3,843,410 | |

| | | | | | | | | ||

| | | | | | | | | ||

| | | | | | | | | ||

- (1)

- Non-cash impacts to FFO of the Operating Partnership include:

|

| | | | | ||||

|

|

THREE MONTHS ENDED DECEMBER 31, 2019 |

TWELVE MONTHS ENDED DECEMBER 31, 2019 |

| |||||

Deductions: |

| | | | | ||||

Straight-line lease income |

| | (24,952) | | | (90,907) | | ||

Fair market value of lease amortization |

| | (1,382) | | | (5,424) | | ||

Fair value of debt amortization |

| | (822) | | | (814) | | ||

Additions: |

| | | | | ||||

Stock based compensation expense |

| | 5,883 | | | 27,030 | | ||

Mortgage, financing fee and terminated swap amortization expense |

| | 5,908 | | | 28,856 | | ||

| | | | | | | | | ||

|

| | $ | (15,365) | | | $ | (41,259) | |

| | | | | | | | | ||

| | | | | | | | | ||

| | | | | | | | | ||

This report contains measures of financial or operating performance that are not specifically defined by generally accepted accounting principles (GAAP) in the United States, including FFO, FFO per share, comparable FFO per share, comparable earnings per share, funds available for distribution, net operating income (NOI), portfolio NOI, and comparable property NOI. FFO and NOI are performance measures that are standard in the REIT business. We believe FFO and NOI provide investors with additional information concerning our operating performance and a basis to compare our performance with the performance of other REITs. We also use these measures internally to monitor the operating performance of our portfolio. Our computation of these non-GAAP measures may not be the same as similar measures reported by other REITs.

The non-GAAP financial measures used in this report should not be considered as alternatives to net income as a measure of our operating performance or to cash flows computed in accordance with GAAP as a measure of liquidity nor are they indicative of cash flows from operating and financial activities. Reconciliations of other non-GAAP measures used in this report to the most-directly comparable GAAP measure are included in the tables on pages 18 - 20 and in the Earnings Release for the latest period.

| 4Q 2019 SUPPLEMENTAL |

|

20 |

OTHER INCOME, OTHER EXPENSE AND CAPITALIZED INTEREST

(In thousands)

|

|

THREE MONTHS ENDED DECEMBER 31, |

|

TWELVE MONTHS ENDED DECEMBER 31, |

||||||||

| | | | | | | | | | | | | |

|

|

2019 |

|

2018 |

|

2019 | | 2018 | ||||

Consolidated Properties |

||||||||||||

Other Income |

||||||||||||

Interest, dividend and distribution income (1) |

$ | 11,457 | $ | 5,843 | $ | 36,982 | $ | 48,469 | ||||

Lease settlement income |

1,982 | 2,700 | 17,493 | 44,174 | ||||||||

Gains on land sales |

3,597 | 114 | 13,753 | 3,362 | ||||||||

Other (2) |

86,167 | 75,435 | 330,248 | 274,577 | ||||||||

| | | | | | | | | | | | | |

Totals |

$ | 103,203 | $ | 84,092 | $ | 398,476 | $ | 370,582 | ||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

|

||||||||||||

Other Expense |

||||||||||||

Ground leases |

$ | 11,179 | $ | 10,957 | $ | 43,499 | $ | 42,683 | ||||

Professional fees and other |

23,400 | 12,650 | 66,399 | 51,427 | ||||||||

| | | | | | | | | | | | | |

Totals |

$ | 34,579 | $ | 23,607 | $ | 109,898 | $ | 94,110 | ||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

|

||||||||||||

| | | | | | | | | | | | | |

Capitalized Interest |

|

THREE MONTHS ENDED DECEMBER 31, |

|

TWELVE MONTHS ENDED DECEMBER 31, |

||||||||

| | | | | | | | | | | | | |

|

|

2019 |

|

2018 |

|

2019 | | 2018 | ||||

Interest Capitalized during the Period: |

||||||||||||

Our Share of Consolidated Properties |

$ | 9,366 | $ | 4,683 | $ | 33,324 | $ | 19,867 | ||||

Our Share of Joint Venture Properties |

$ | 293 | $ | 409 | $ | 1,187 | $ | 2,077 | ||||

|

||||||||||||

|

||||||||||||

- (1)

- Includes

distributions from other international investments.

- (2)

- Includes ancillary property revenues, gift cards, marketing, media, parking and sponsorship revenues, gains on sale of non-retail investments, non-real estate investments, insurance proceeds from business interruption and other miscellaneous income items.

| 4Q 2019 SUPPLEMENTAL |

|

21 |

U.S. MALLS AND PREMIUM OUTLETS OPERATING INFORMATION

|

|

AS OF DECEMBER 31, | ||||

| | | | | | | |

|

|

2019 | | 2018 | ||

Total Number of Properties |

| 175 | 176 | |||

Total Square Footage of Properties (in millions) |

|

150.3 |

151.2 |

|||

Ending Occupancy (1): |

|

|||||

Consolidated Assets |

| 95.3% | 95.9% | |||

Unconsolidated Assets |

| 94.5% | 95.8% | |||

Total Portfolio |

| 95.1% | 95.9% | |||

Total Sales per Square Foot (PSF) (2): |

|

|||||

Consolidated Assets |

$ | 662 | $ | 641 | ||

Unconsolidated Assets |

$ | 783 | $ | 719 | ||

Total Portfolio |

$ | 693 | $ | 661 | ||

Base Minimum Rent PSF (3): |

|

|||||

Consolidated Assets |

$ | 53.06 | $ | 52.51 | ||

Unconsolidated Assets |

$ | 58.71 | $ | 58.59 | ||

Total Portfolio |

$ | 54.59 | $ | 54.18 | ||

|

|

|

RENT PSF (BASE MINIMUM RENT & CAM) |

| | ||||||||||

| | | | | | | | | | | | | | | | |

|

|

SQUARE FOOTAGE OF OPENINGS |

|

AVERAGE OPENING RATE PSF (4) |

|

AVERAGE CLOSING RATE PSF (4) |

|

LEASING SPREAD (4) |

|

SPREAD TO CLOSE % |

|||||

12/31/19 |

| 8,216,167 | $ | 62.39 | $ | 54.56 | $ | 7.83 | | 14.4% | |||||

12/31/18 |

8,722,732 | $ | 62.04 | $ | 54.29 | $ | 7.75 | 14.3% | |||||||

Occupancy Cost as a Percentage of Sales (5): |

|||||||||||||||

12/31/19 |

| 12.5% | |||||||||||||

12/31/18 |

12.8% | ||||||||||||||

- (1)

- Ending Occupancy is the percentage of total owned square footage (GLA) which is leased as of the last day of the reporting period. We include all company owned space except for mall anchors, mall majors, mall freestanding and mall outlots in the calculation.

- (2)

- Total Sales PSF is defined as total sales as reported of the tenants open and operating in the center during the reporting period divided by the associated company owned and occupied GLA on a trailing 12-month basis. Includes tenant sales activity for all months a tenant is open within the trailing 12-month period. In accordance with the standard definition of sales for regional malls adopted by the International Council of Shopping Centers, stores with less than 10,000 square feet are included for malls and stores with less than 20,000 square feet are included for Premium Outlets.

- (3)

- Base Minimum Rent PSF is the average base minimum rent charge in effect for the reporting period for all tenants that would qualify to be included in Ending Occupancy as defined above.

- (4)

- The Open / Close Spread is a measure that compares opening and closing rates on all spaces. The Opening Rate is the initial cash Rent PSF for spaces leased during the trailing 12-month period, and includes new leases, renewals, amendments and relocations (including expansions and downsizings) if lease term is greater than one year. The Closing Rate is the final cash Rent PSF as of the month the tenant terminates or closes. Rent PSF includes Base Minimum Rent and Common Area Maintenance (CAM) rents.

- (5)

- Occupancy Cost as a Percentage of Sales is the trailing 12-month Base Minimum Rent, plus all applicable ancillary charges, plus overage rent, if applicable (based on last 12 months of sales), divided by the trailing 12-month Total Sales PSF for the same tenants.

| 4Q 2019 SUPPLEMENTAL |

|

22 |

THE MILLS AND INTERNATIONAL OPERATING INFORMATION

|

|

AS OF DECEMBER 31, | ||||

| | | | | | | |

|

|

2019 | | 2018 | ||

The Mills |

| |||||

Total Number of Properties |

|

14 |

14 |

|||

Total Square Footage of Properties (in millions) |

|

21.5 |

21.4 |

|||

Ending Occupancy(1) |

|

97.0% |

97.6% |

|||

Total Sales PSF(2) |

$ |

620 |

$ |

614 |

||

Base Minimum Rent PSF(3) |

$ |

33.09 |

$ |

32.63 |

||

Leasing Spread PSF(4) |

$ |

5.48 |

$ |

15.21 |

||

Leasing Spread (Percentage Change)(4) |

|

13.2% |

34.6% |

|||

|

|

|||||

International Properties |

|

|||||

Premium Outlets |

|

|||||

Total Number of Properties |

|

20 |

19 |

|||

Total Square Footage of Properties (in millions) |

|

7.7 |

7.3 |

|||

Designer Outlets |

|

|||||

Total Number of Properties |

|

9 |

9 |

|||

Total Square Footage of Properties (in millions) |

|

2.4 |

2.2 |

|||

Statistics for Premium Outlets in Japan(5) |

|

|||||

Ending Occupancy |

|

99.5% |

99.7% |

|||

Total Sales PSF |

|

¥ 107,866 |

¥ 107,265 |

|||

Base Minimum Rent PSF |

|

¥ 5,269 |

¥ 5,156 |

|||

- (1)

- See footnote 1 on page 22 for definition, except Ending Occupancy is calculated on all company owned space.

- (2)

- See footnote 2 on page 22 for definition; calculation methodology is the same as for malls.

- (3)

- See footnote 3 on page 22 for definition.

- (4)

- See footnote 4 on page 22 for definition.

- (5)

- Information supplied by the managing venture partner; includes 9 properties.

| 4Q 2019 SUPPLEMENTAL |

|

23 |

U.S. MALLS AND PREMIUM OUTLETS LEASE EXPIRATIONS (1)

YEAR |

|

NUMBER OF LEASES EXPIRING |

|

SQUARE FEET |

|

AVG. BASE MINIMUM RENT PSF AT 12/31/19 |

|

PERCENTAGE OF GROSS ANNUAL RENTAL REVENUES (2) |

||||

Inline Stores and Freestanding |

||||||||||||

Month to Month Leases |

651 |

2,021,771 |

$ |

58.01 |

2.0% |

|||||||

2020 |

2,473 | 8,606,035 | $ | 50.60 | 7.6% | |||||||

2021 |

2,424 | 9,066,802 | $ | 50.64 | 8.0% | |||||||

2022 |

2,326 | 8,754,342 | $ | 49.66 | 7.7% | |||||||

2023 |

2,277 | 9,381,279 | $ | 56.10 | 9.1% | |||||||

2024 |

1,919 | 7,462,106 | $ | 59.29 | 7.6% | |||||||

2025 |

1,478 | 5,658,208 | $ | 63.78 | 6.4% | |||||||

2026 |

1,275 | 4,630,900 | $ | 63.93 | 5.2% | |||||||

2027 |

985 | 3,708,647 | $ | 65.27 | 4.2% | |||||||

2028 |

851 | 3,660,770 | $ | 59.68 | 3.8% | |||||||

2029 |

723 | 3,132,495 | $ | 62.27 | 3.2% | |||||||

2030 and Thereafter |

445 | 2,853,217 | $ | 41.65 | 2.2% | |||||||

Specialty Leasing Agreements w/ terms in excess of 12 months |

1,836 | 4,658,652 | $ | 18.28 | 1.6% | |||||||

|

||||||||||||

Anchors |

||||||||||||

2020 |

3 |

371,955 |

$ |

4.21 |

0.0% |

|||||||

2021 |

10 | 1,113,351 | $ | 6.32 | 0.1% | |||||||

2022 |

16 | 2,033,754 | $ | 6.14 | 0.2% | |||||||

2023 |

17 | 2,386,762 | $ | 6.67 | 0.3% | |||||||

2024 |

24 | 2,027,154 | $ | 8.30 | 0.3% | |||||||

2025 |

16 | 1,480,858 | $ | 7.21 | 0.2% | |||||||

2026 |

7 | 804,111 | $ | 4.30 | 0.1% | |||||||

2027 |

6 | 920,224 | $ | 4.16 | 0.1% | |||||||

2028 |

9 | 857,119 | $ | 7.58 | 0.1% | |||||||

2029 |

5 | 577,818 | $ | 5.02 | 0.1% | |||||||

2030 and Thereafter |

25 | 2,455,938 | $ | 8.50 | 0.4% |

- (1)

- Does not consider the impact of renewal options that may be contained in leases.

- (2)

- Annual rental revenues represent 2019 consolidated and joint venture combined base rental revenue.

| 4Q 2019 SUPPLEMENTAL |

|

24 |

U.S. MALLS AND PREMIUM OUTLETS TOP TENANTS

Top Inline Store Tenants (sorted by percentage of total base minimum rent for U.S. properties)

TENANT |

|

NUMBER OF STORES |

|

SQUARE FEET (000's) |

|

PERCENT OF TOTAL SQ. FT. IN U.S. PROPERTIES |

|

PERCENT OF TOTAL BASE MINIMUM RENT FOR U.S. PROPERTIES |

||||

|

||||||||||||

The Gap, Inc. |

412 | 3,843 | 2.1% | 3.4% | ||||||||

L Brands, Inc. |

307 | 1,895 | 1.0% | 2.2% | ||||||||

Ascena Retail Group Inc |

435 | 2,420 | 1.3% | 1.8% | ||||||||

PVH Corporation |

237 | 1,476 | 0.8% | 1.6% | ||||||||

Tapestry, Inc. |

253 | 1,016 | 0.6% | 1.5% | ||||||||

Signet Jewelers, Ltd. |

363 | 526 | 0.3% | 1.5% | ||||||||

Foot Locker, Inc. |

224 | 1,031 | 0.6% | 1.2% | ||||||||

Luxottica Group SPA |

386 | 689 | 0.4% | 1.2% | ||||||||

American Eagle Outfitters, Inc |

195 | 1,280 | 0.7% | 1.2% | ||||||||

Capri Holdings Limited |

138 | 530 | 0.3% | 1.2% |

Top Anchors (sorted by percentage of total square footage in U.S. properties) (1)

TENANT |

|

NUMBER OF STORES |

|

SQUARE FEET (000's) |

|

PERCENT OF TOTAL SQ. FT. IN U.S. PROPERTIES |

|

PERCENT OF TOTAL BASE MINIMUM RENT FOR U.S. PROPERTIES |

||||

|

||||||||||||

Macy's Inc. |

113 | 21,736 | 12.0% | 0.3% | ||||||||

J.C. Penney Co., Inc. |

63 | 10,201 | 5.6% | 0.3% | ||||||||

Dillard's, Inc. |

36 | 6,532 | 3.6% | * | ||||||||

Nordstrom, Inc. |

27 | 4,556 | 2.5% | 0.1% | ||||||||

Sears |

22 | 3,796 | 2.1% | * | ||||||||

Dick's Sporting Goods, Inc. |

36 | 2,410 | 1.3% | 0.6% | ||||||||

Hudson's Bay Company |

16 | 2,128 | 1.2% | 0.1% | ||||||||

The Neiman Marcus Group, Inc. |

12 | 1,458 | 0.8% | 0.1% | ||||||||

Belk, Inc. |

8 | 1,323 | 0.7% | * | ||||||||

Target Corporation |

6 | 831 | 0.5% | 0.1% | ||||||||

Von Maur, Inc. |

6 | 768 | 0.4% | * |

- (1)

- Includes space leased and owned by anchors in U.S. Malls; does not include Bloomingdale's The Outlet Store, Neiman Marcus Last Call, Nordstrom Rack, and Saks Fifth Avenue Off 5th.

- *

- Less than one-tenth of one percent.

| 4Q 2019 SUPPLEMENTAL |

|

25 |

CAPITAL EXPENDITURES

(In thousands)

|

|

|

UNCONSOLIDATED PROPERTIES |

||||||

| | | | | | | | | | |

|

|

CONSOLIDATED PROPERTIES |

| TOTAL |

|

OUR SHARE |

|||

New development projects |

$ | 58,851 | $ | 286,231 | $ | 113,899 | |||

Redevelopment projects with incremental square footage and/or anchor replacement |

488,962 |

388,983 |

183,183 |

||||||

Redevelopment projects with no incremental square footage (1) |

109,665 |

23,675 |

7,798 |

||||||

| | | | | | | | | | |

|

|||||||||

Subtotal new development and redevelopment projects |

| 657,478 | | 698,889 | | 304,880 | |||

Tenant allowances |

159,165 |

72,571 |

33,087 |

||||||

Operational capital expenditures at properties: |

|||||||||

CAM expenditures |

118,080 | 69,145 | 31,492 | ||||||

Non-CAM expenditures |

30,130 | 31,529 | 15,648 | ||||||

| | | | | | | | | | |

|

|||||||||

Totals |

$ | 964,853 | $ | 872,134 | $ | 385,107 | |||

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Conversion from accrual to cash basis |

(88,842) |

(82,811) |

(36,567) |

||||||

| | | | | | | | | | |

|

|||||||||

Capital Expenditures for the Twelve Months Ended 12/31/19 (2) |

$ | 876,011 | $ | 789,323 | $ | 348,540 | |||

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

|

|||||||||

Capital Expenditures for the Twelve Months Ended 12/31/18 (2) |

$ | 781,909 | $ | 761,657 | $ | 361,848 | |||

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

- (1)

- Includes restoration projects as a result of property damage from natural disasters.

- (2)

- Agrees with the line item "Capital expenditures" on the Combined Statements of Cash Flows for the consolidated properties. No statement of cash flows is prepared for the joint venture properties; however, the above reconciliation was completed in the same manner as the reconciliation for the consolidated properties.

| 4Q 2019 SUPPLEMENTAL |

|

26 |

DEVELOPMENT ACTIVITY SUMMARY (1)

As of December 31, 2019

(in millions, except percent)

|

PLATFORM |

|

|

PROJECTED GROSS COST (2) |

|

|

PROJECTED NET COST (3) |

|

|

OUR SHARE OF NET COST (4) |

|

|

EXPECTED STABILIZED RATE OF RETURN (4) |

|

|

TOTAL CONSTRUCTION IN PROGRESS |

|

|

OUR SHARE OF TOTAL CONSTRUCTION IN PROGRESS |

| ||||||||||||||

|

Malls |

| | | | | | | | | | | | | | | | | | | ||||||||||||||

|

Redevelopments |

$ | 1,267 | $ | 1,234 | $ | 1,076 | 7% | $ | 635 | $ | 537 | ||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||

|

Premium Outlets |

| | | | | | |||||||||||||||||||||||||||

|

|

| | | | | | | | | | | | | | | | | | | ||||||||||||||

|

New Developments |

$ | 869 | $ | 760 | $ | 455 | 8% | $ | 289 | $ | 135 | ||||||||||||||||||||||

|

Redevelopments |

$ | 416 | $ | 385 | $ | 204 | 10% | $ | 191 | $ | 100 | ||||||||||||||||||||||

|

The Mills |

| | | | | | | | | | | | | | | | | | | ||||||||||||||

|

Redevelopments |

$ | 83 | $ | 83 | $ | 62 | 9% | $ | 37 | $ | 30 | ||||||||||||||||||||||

|

Totals |

| $ | 2,635 | | $ | 2,462 | | $ | 1,797 | | | 8% | | $ | 1,152 | | $ | 802 | | ||||||||||||||

Notes:

- (1)

- Represents projects under construction; new development and redevelopment projects with budgeted gross costs in excess of $5 million or incremental square footage. Includes both domestic and international properties.

- (2)

- Projected Gross Cost includes soft costs such as architecture and engineering fees, tenant costs (allowances/leasing commissions), development, legal and other fees, marketing costs, cost of capital, and other related costs.

- (3)

- Projected Net Cost includes cost recoveries such as land sales, tenant reimbursements, Tax Increment Financing (TIF), CAM, and other such recoveries.

- (4)

- Costs and returns are based upon current budget assumptions; actual costs may vary and no assurance can be given that expected returns will be achieved. Returns do not include any development or leasing fees earned as part of the development by Simon from joint venture partners.

| 4Q 2019 SUPPLEMENTAL |

|

27 |

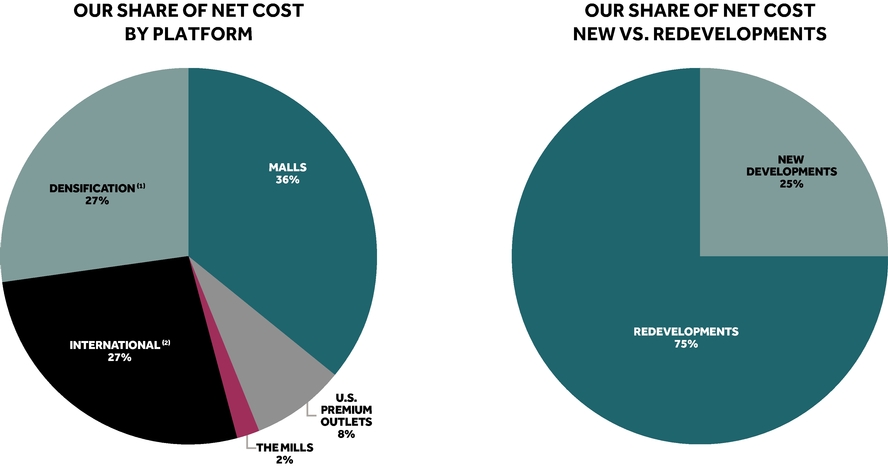

DEVELOPMENT ACTIVITY SUMMARY

As of December 31, 2019

- (1)

- Includes hotel, residential, office and other

- (2)

- Includes international Premium Outlets and international Designer Outlets

| 4Q 2019 SUPPLEMENTAL |

|

28 |

DEVELOPMENT ACTIVITY REPORT (1)

As of December 31, 2019

|

PROPERTY/ LOCATION |

PROJECT DESCRIPTION |

ACTUAL/ PROJECTED OPENING |

COMPANY'S OWNERSHIP PERCENTAGE |

|||

| Malls - Redevelopments | ||||||

Del Amo Fashion Mall - Torrance, CA |

Mitsuwa Marketplace |

2/20 |

50% |

|||

Roosevelt Field - Garden City (New York), NY |

163 room Residence Inn by Marriott |

2/20 |

50% |

|||

Shops at Riverside, The - Hackensack (New York), NJ |

Redevelopment |

3/20 |

100% |

|||

Broadway Square - Tyler, TX |

Redevelopment of the former Sears building with Dick's Sporting Goods, Home Goods, retail, and restaurants |

4/20 |

100% |

|||

Greenwood Park Mall - Indianapolis, IN |

Dave & Buster's |

4/20 |

100% |

|||

Copley Place - Boston, MA |

Saks Men's Store |

6/20 |

98% |

|||

Midland Park Mall - Midland, TX |

Redevelopment of the former Sears building with Dillard's (opened 4/19) and redevelopment of former Dillard's with Dick's Sporting Goods |

6/20 |

100% |

|||

Ocean County Mall - Toms River, NJ |

Redevelopment of the former Sears building with B.J.'s Restaurant & Brewhouse (opened 7/19), LA Fitness (opened 12/19), Ulta, and Homesense |

6/20 |

100% |

|||

Bay Park Square - Green Bay, WI |

Dave & Buster's |

7/20 |

100% |

|||

Cape Cod Mall - Hyannis, MA |

Redevelopment of the former Sears building and TBA with Target (opened 10/19), Dick's Sporting Goods, and other retailers |

7/20 |

56% |

|||

Lehigh Valley, Whitehall, PA |

Dave & Buster's |

7/20 |

50% |

|||

Burlington Mall - Burlington (Boston), MA |

Redevelopment of the former Sears lower level |

10/20 |

100% |

|||

Tacoma Mall - Tacoma, WA |

Redevelopment of the former Sears building with Marcus Theatres, Nordstrom Rack, Total Wine and Ulta |

10/20 |

100% |

|||

Northshore Mall - Peabody, MA |

Redevelopment of the former Sears building and TBA with Life Time Athletic and Tesla |

12/20 |

56% |

|||

Dadeland Mall - Miami, FL |

AC Hotel by Marriott |

1/21 |

33% |

|||

Dadeland Mall - Miami, FL |

Kendall West expansion including the addition of Apple and North Italia |

1/21 |

50% |

|||

Roosevelt Field - Garden City (New York), NY |

Redevelopment of the Bloomingdale's Furniture space with Century 21 |

2/21 |

100% |

|||

West Town Mall - Knoxville, TN |