Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SunCoke Energy, Inc. | d878664dex991.htm |

| EX-99.3 - EX-99.3 - SunCoke Energy, Inc. | d878664dex993.htm |

| 8-K - 8-K - SunCoke Energy, Inc. | d878664d8k.htm |

SunCoke Energy, Inc. Q4 & FY 2019 Earnings and 2020 Guidance Conference Call Exhibit 99.2

This slide presentation should be reviewed in conjunction with the Fourth Quarter 2019 earnings release of SunCoke Energy, Inc. (SunCoke) and conference call held on January 29, 2020 at 10:00 a.m. ET. Except for statements of historical fact, information contained in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements are based upon information currently available, and express management’s opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to SunCoke’s anticipated future performance. These statements are not guarantees of future performance and undue reliance should not be placed on them. Although management believes that its plans, intentions and expectations reflected in, or suggested by, the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Forward-looking statements often may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “contemplate,” “estimate,” “predict,” “guidance,” “forecast,” “potential,” “continue,” “may,” “will,” “could,” “should,” or the negative of these terms or similar expressions, and include, but are not limited to, statements regarding: possible or assumed future results of operations, expected benefits and anticipated timing of proposed transactions; expected levels of distributions to shareholders; future credit ratings; financial condition; plans and objectives of management for future operations and growth; effects of competition; and the effects of future legislation or regulations. Such statements are subject to a number of known and unknown risks, and uncertainties, many of which are beyond control, or are difficult to predict, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. SunCoke has included in its filings with the Securities and Exchange Commission (SEC) cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. Such factors include, but are not limited to: changes in industry conditions; the ability to renew current customer, supplier and other material agreements; future liquidity, working capital and capital requirements; the ability to successfully implement business strategies and potential growth opportunities; the impact of indebtedness and financing plans, including sources and availability of third-party financing; possible or assumed future results of operations; the outcome of pending and future litigation; potential operating performance improvements and the ability to achieve anticipated cost savings from strategic revenue and efficiency initiatives. For more information concerning these factors, see SunCoke’s SEC filings. All forward-looking statements included in this presentation are expressly qualified in their entirety by the cautionary statements contained in such SEC filings. The forward-looking statements in this presentation speak only as of the date hereof. Except as required by applicable law, SunCoke does not have any intention or obligation to revise or update publicly any forward-looking statement (or associated cautionary language) made herein, whether as a result of new information, future events, or otherwise, after the date of this presentation. This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Furthermore, the non-GAAP financial measures presented herein may not be consistent with similar measures provided by other companies. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix. These data should be read in conjunction with SunCoke’s periodic reports previously filed with the SEC. Due to rounding, numbers presented throughout this presentation may not add up precisely to the totals indicated and percentages may not precisely reflect the absolute figures for the same reason. Industry and market data used in this presentation have been obtained from industry publications and sources as well as from research reports prepared for other purposes. SunCoke has not independently verified the data obtained from these sources and cannot assure investors of either the accuracy or completeness of such data. Forward-Looking Statements

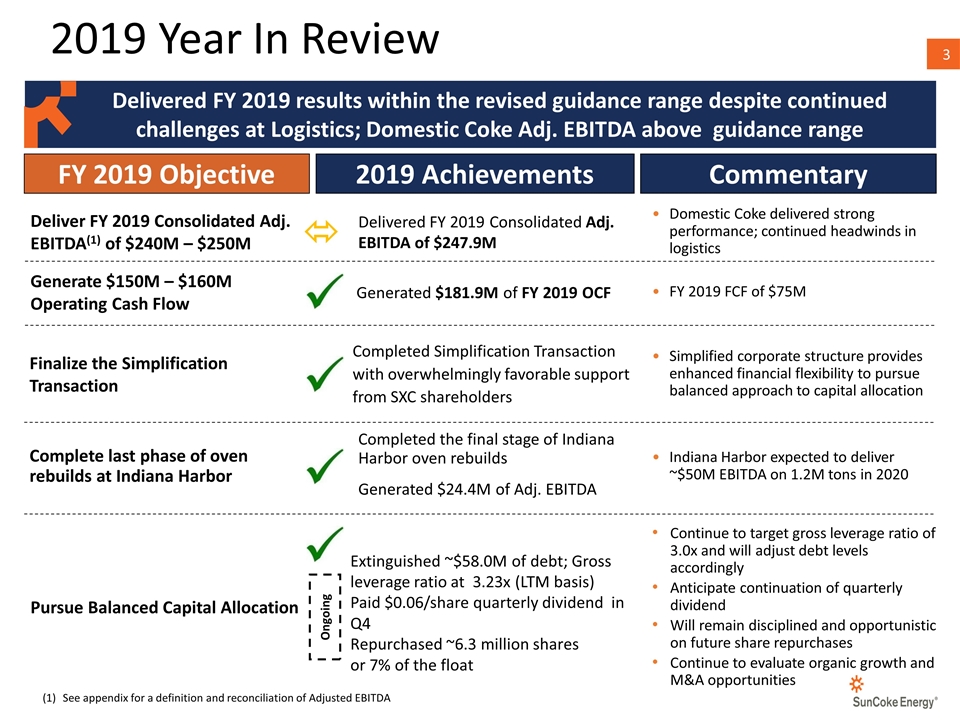

2019 Year In Review Delivered FY 2019 results within the revised guidance range despite continued challenges at Logistics; Domestic Coke Adj. EBITDA above guidance range FY 2019 Objective 2019 Achievements Commentary Deliver FY 2019 Consolidated Adj. EBITDA(1) of $240M – $250M Generate $150M – $160M Operating Cash Flow Finalize the Simplification Transaction Completed the final stage of Indiana Harbor oven rebuilds Generated $24.4M of Adj. EBITDA Pursue Balanced Capital Allocation Simplified corporate structure provides enhanced financial flexibility to pursue balanced approach to capital allocation Complete last phase of oven rebuilds at Indiana Harbor Extinguished ~$58.0M of debt; Gross leverage ratio at 3.23x (LTM basis) Paid $0.06/share quarterly dividend in Q4 Repurchased ~6.3 million shares or 7% of the float Ongoing Delivered FY 2019 Consolidated Adj. EBITDA of $247.9M Generated $181.9M of FY 2019 OCF Completed Simplification Transaction with overwhelmingly favorable support from SXC shareholders FY 2019 FCF of $75M Indiana Harbor expected to deliver ~$50M EBITDA on 1.2M tons in 2020 Domestic Coke delivered strong performance; continued headwinds in logistics Continue to target gross leverage ratio of 3.0x and will adjust debt levels accordingly Anticipate continuation of quarterly dividend Will remain disciplined and opportunistic on future share repurchases Continue to evaluate organic growth and M&A opportunities ó See appendix for a definition and reconciliation of Adjusted EBITDA

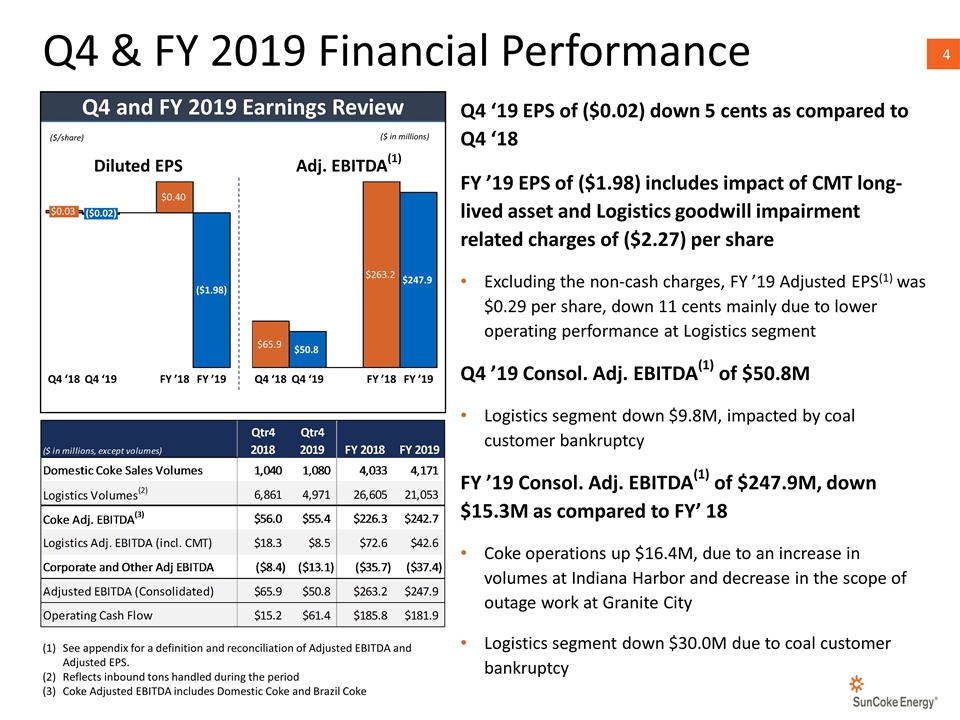

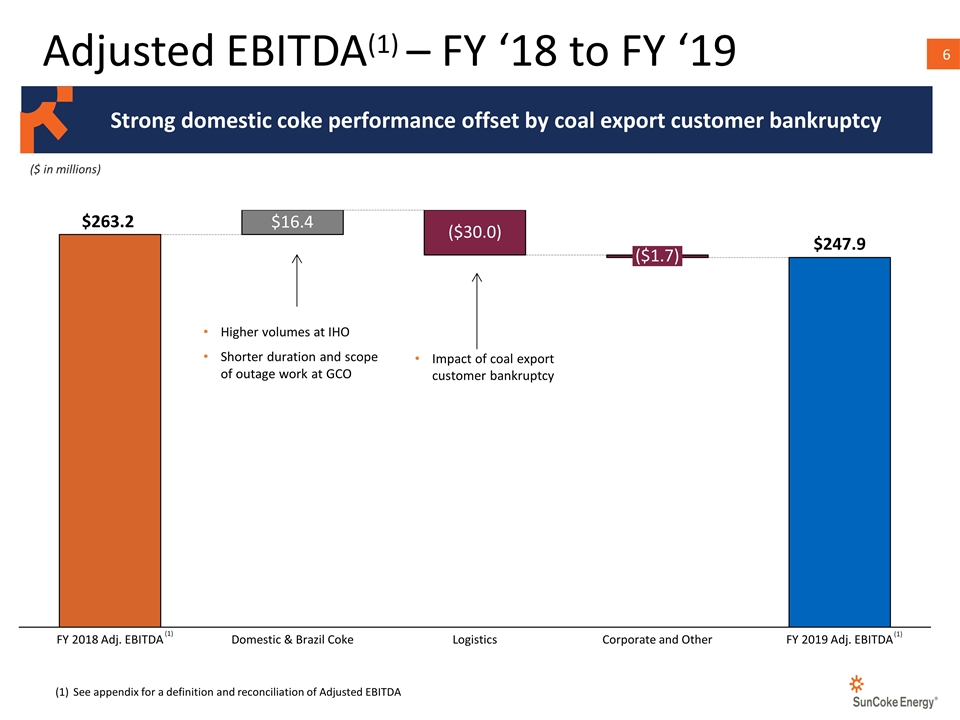

Q4 & FY 2019 Financial Performance Q4 ‘19 EPS of ($0.02) down 5 cents as compared to Q4 ‘18 FY ’19 EPS of ($1.98) includes impact of CMT long-lived asset and Logistics goodwill impairment related charges of ($2.27) per share Excluding the non-cash charges, FY ’19 Adjusted EPS(1) was $0.29 per share, down 11 cents mainly due to lower operating performance at Logistics segment Q4 ’19 Consol. Adj. EBITDA(1) of $50.8M Logistics segment down $9.8M, impacted by coal customer bankruptcy FY ’19 Consol. Adj. EBITDA(1) of $247.9M, down $15.3M as compared to FY’ 18 Coke operations up $16.4M, due to an increase in volumes at Indiana Harbor and decrease in the scope of outage work at Granite City Logistics segment down $30.0M due to coal customer bankruptcy ($/share) ($ in millions) Diluted EPS Adj. EBITDA(1) Q4 and FY 2019 Earnings Review See appendix for a definition and reconciliation of Adjusted EBITDA and Adjusted EPS. Reflects inbound tons handled during the period Coke Adjusted EBITDA includes Domestic Coke and Brazil Coke

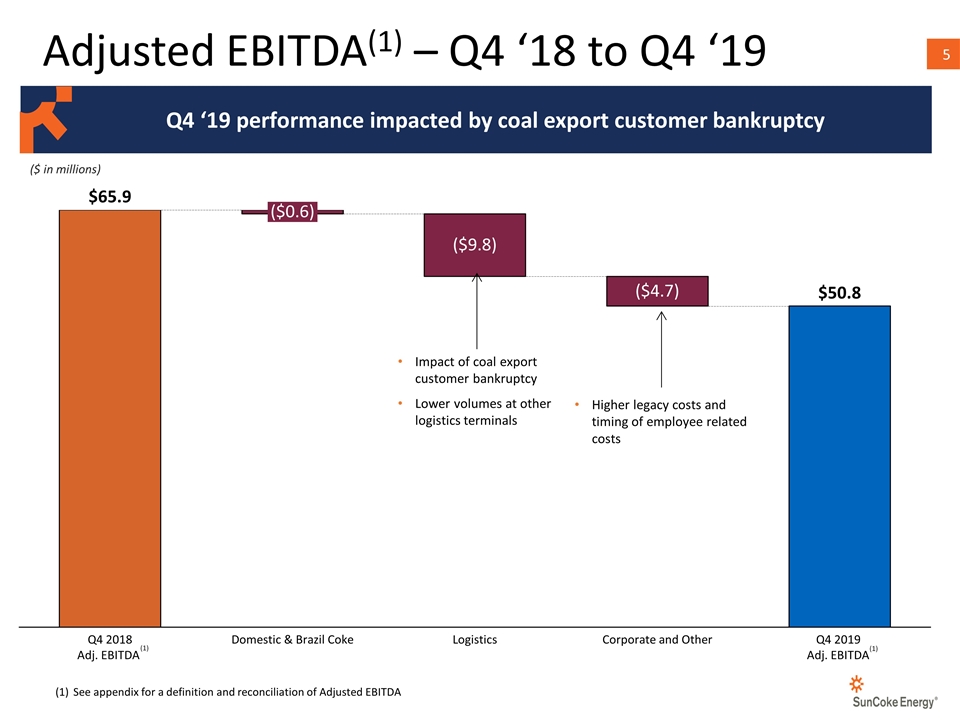

Adjusted EBITDA(1) – Q4 ‘18 to Q4 ‘19 ($0.6) ($9.8) $65.9 $50.8 See appendix for a definition and reconciliation of Adjusted EBITDA (1) Impact of coal export customer bankruptcy Lower volumes at other logistics terminals ($ in millions) (1) Q4 ‘19 performance impacted by coal export customer bankruptcy Higher legacy costs and timing of employee related costs

Adjusted EBITDA(1) – FY ‘18 to FY ‘19 $16.4 ($30.0) $247.9 See appendix for a definition and reconciliation of Adjusted EBITDA (1) Higher volumes at IHO Shorter duration and scope of outage work at GCO Impact of coal export customer bankruptcy ($ in millions) (1) Strong domestic coke performance offset by coal export customer bankruptcy

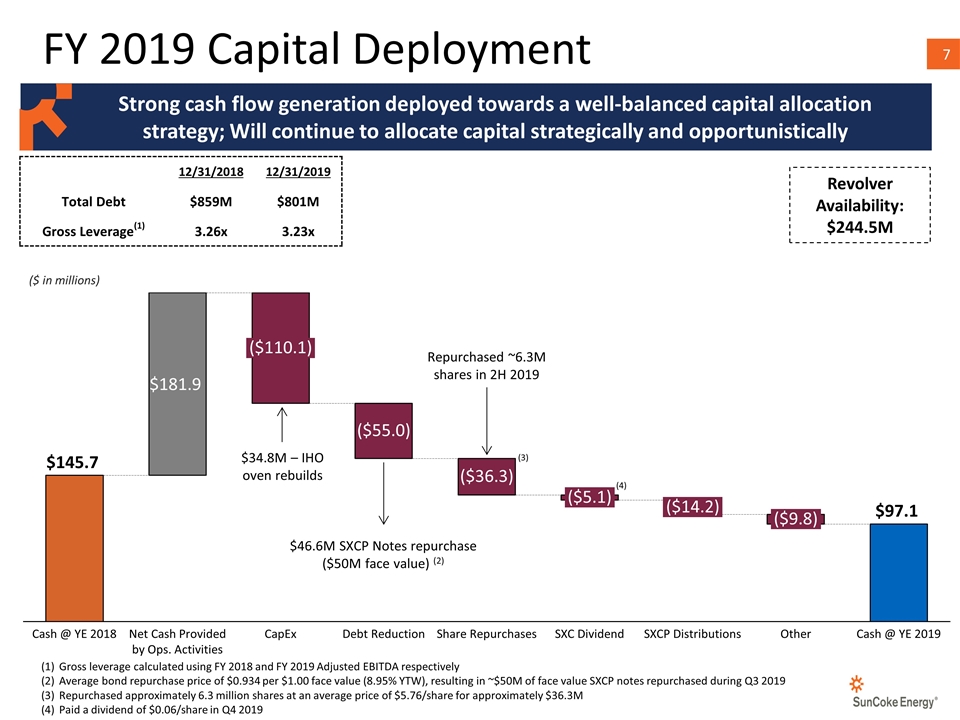

Revolver Availability: $244.5M 12/31/2018 12/31/2019 Total Debt $859M $801M Gross Leverage(1) 3.26x 3.23x Gross leverage calculated using FY 2018 and FY 2019 Adjusted EBITDA respectively Average bond repurchase price of $0.934 per $1.00 face value (8.95% YTW), resulting in ~$50M of face value SXCP notes repurchased during Q3 2019 Repurchased approximately 6.3 million shares at an average price of $5.76/share for approximately $36.3M Paid a dividend of $0.06/share in Q4 2019 Repurchased ~6.3M shares in 2H 2019 FY 2019 Capital Deployment Strong cash flow generation deployed towards a well-balanced capital allocation strategy; Will continue to allocate capital strategically and opportunistically ($ in millions) $46.6M SXCP Notes repurchase ($50M face value) (2) $34.8M – IHO oven rebuilds (4) (3)

2020 GUIDANCE

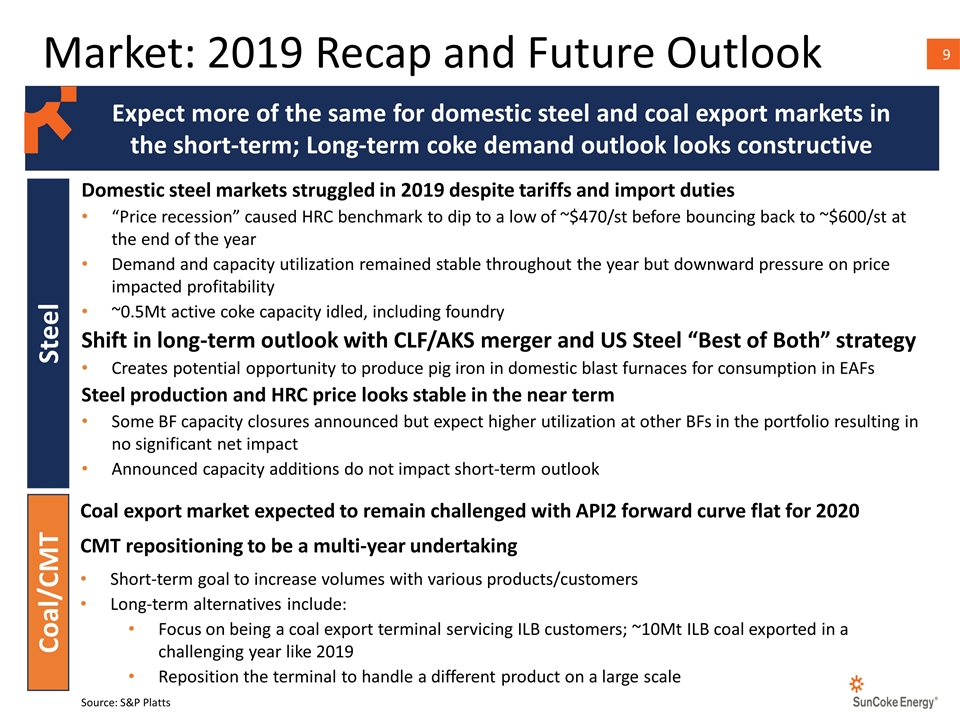

Market: 2019 Recap and Future Outlook Expect more of the same for domestic steel and coal export markets in the short-term; Long-term coke demand outlook looks constructive Domestic steel markets struggled in 2019 despite tariffs and import duties “Price recession” caused HRC benchmark to dip to a low of ~$470/st before bouncing back to ~$600/st at the end of the year Demand and capacity utilization remained stable throughout the year but downward pressure on price impacted profitability ~0.5Mt active coke capacity idled, including foundry Shift in long-term outlook with CLF/AKS merger and US Steel “Best of Both” strategy Creates potential opportunity to produce pig iron in domestic blast furnaces for consumption in EAFs Steel production and HRC price looks stable in the near term Some BF capacity closures announced but expect higher utilization at other BFs in the portfolio resulting in no significant net impact Announced capacity additions do not impact short-term outlook Steel Coal/CMT Coal export market expected to remain challenged with API2 forward curve flat for 2020 CMT repositioning to be a multi-year undertaking Short-term goal to increase volumes with various products/customers Long-term alternatives include: Focus on being a coal export terminal servicing ILB customers; ~10Mt ILB coal exported in a challenging year like 2019 Reposition the terminal to handle a different product on a large scale Source: S&P Platts

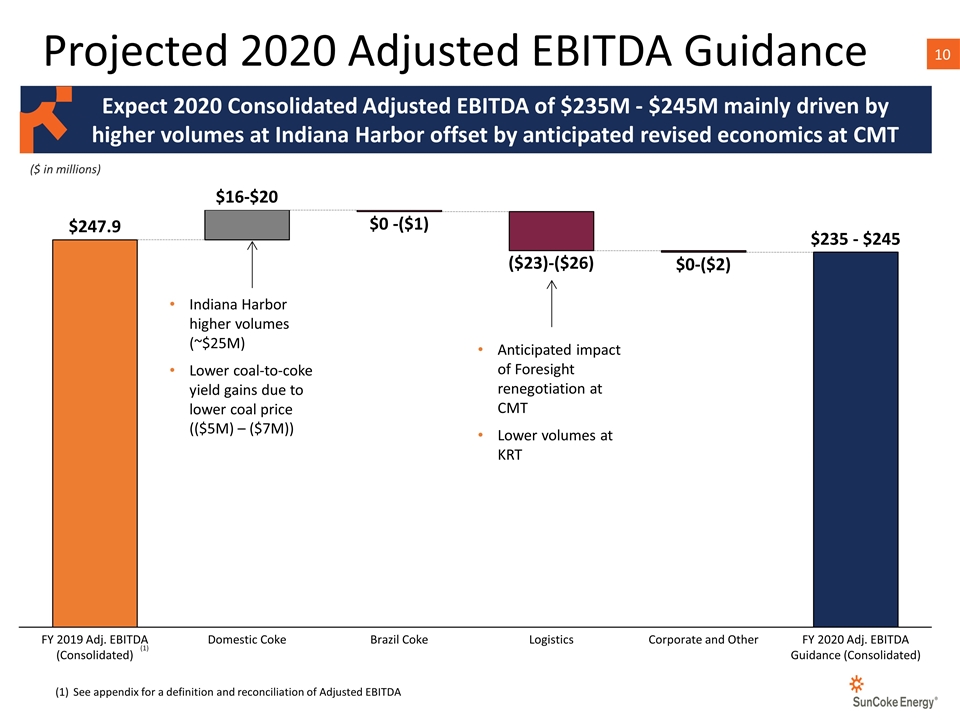

Projected 2020 Adjusted EBITDA Guidance $247.9 $16-$20 $0 -($1) ($23)-($26) $0-($2) $235 - $245 See appendix for a definition and reconciliation of Adjusted EBITDA (1) ($ in millions) Expect 2020 Consolidated Adjusted EBITDA of $235M - $245M mainly driven by higher volumes at Indiana Harbor offset by anticipated revised economics at CMT Indiana Harbor higher volumes (~$25M) Lower coal-to-coke yield gains due to lower coal price (($5M) – ($7M)) Anticipated impact of Foresight renegotiation at CMT Lower volumes at KRT

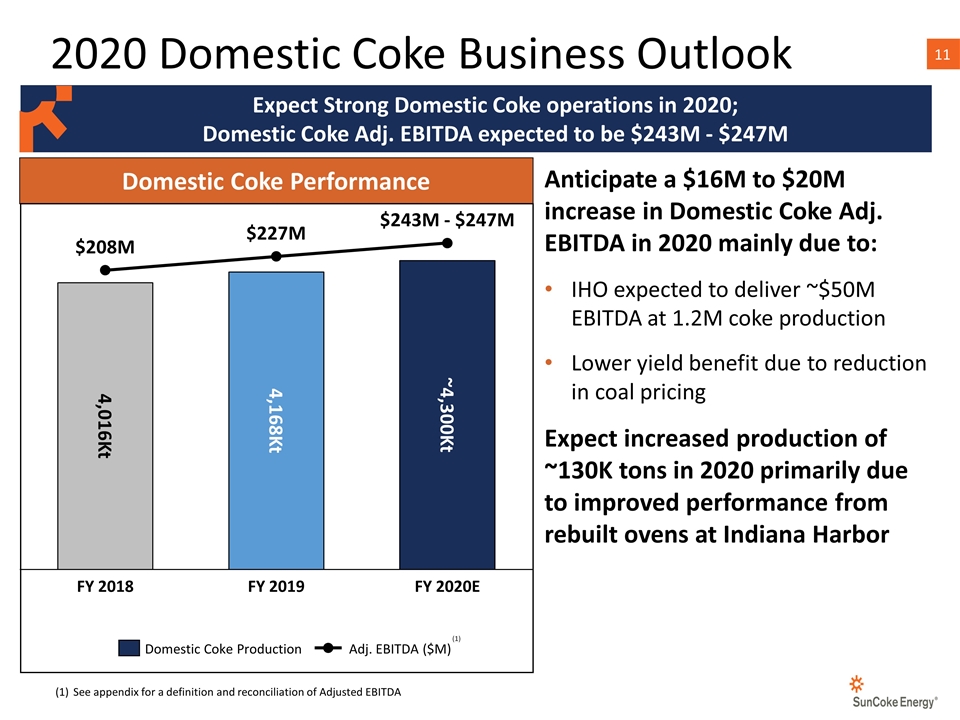

2020 Domestic Coke Business Outlook Expect Strong Domestic Coke operations in 2020; Domestic Coke Adj. EBITDA expected to be $243M - $247M Domestic Coke Performance $243M - $247M ~4,300Kt Kt Kt $M $M Anticipate a $16M to $20M increase in Domestic Coke Adj. EBITDA in 2020 mainly due to: IHO expected to deliver ~$50M EBITDA at 1.2M coke production Lower yield benefit due to reduction in coal pricing Expect increased production of ~130K tons in 2020 primarily due to improved performance from rebuilt ovens at Indiana Harbor See appendix for a definition and reconciliation of Adjusted EBITDA (1)

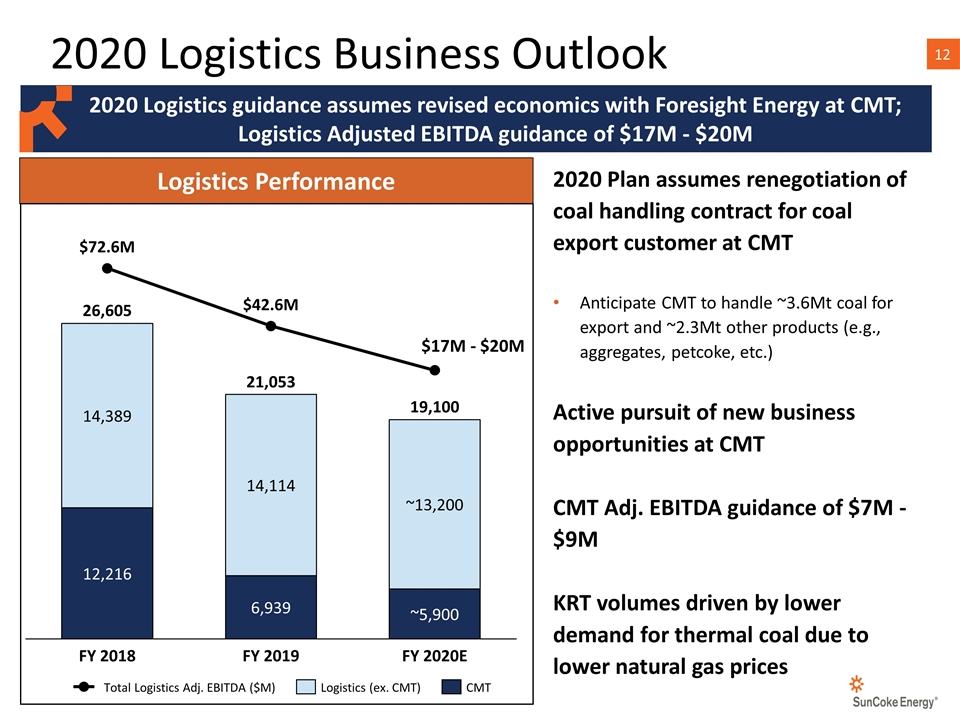

2020 Logistics Business Outlook 2020 Logistics guidance assumes revised economics with Foresight Energy at CMT; Logistics Adjusted EBITDA guidance of $17M - $20M Logistics Performance $42.6M M ~ $17M - $20M ~13,200 2020 Plan assumes renegotiation of coal handling contract for coal export customer at CMT Anticipate CMT to handle ~3.6Mt coal for export and ~2.3Mt other products (e.g., aggregates, petcoke, etc.) Active pursuit of new business opportunities at CMT CMT Adj. EBITDA guidance of $7M - $9M KRT volumes driven by lower demand for thermal coal due to lower natural gas prices

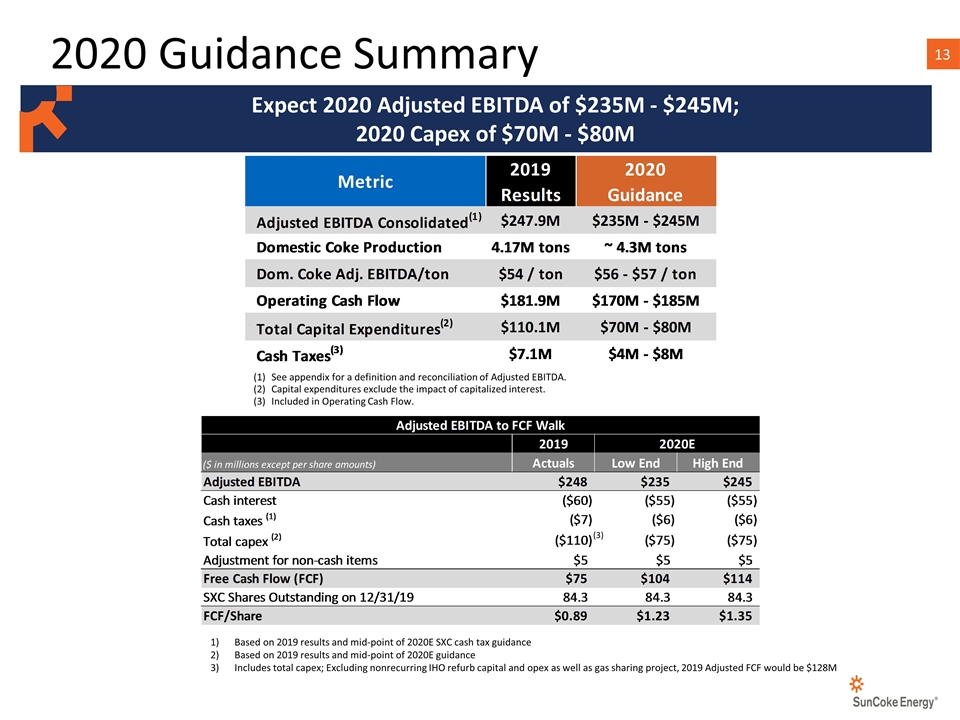

2020 Guidance Summary See appendix for a definition and reconciliation of Adjusted EBITDA. Capital expenditures exclude the impact of capitalized interest. Included in Operating Cash Flow. Expect 2020 Adjusted EBITDA of $235M - $245M; 2020 Capex of $70M - $80M Based on 2019 results and mid-point of 2020E SXC cash tax guidance Based on 2019 results and mid-point of 2020E guidance Includes total capex; Excluding nonrecurring IHO refurb capital and opex as well as gas sharing project, 2019 Adjusted FCF would be $128M (3)

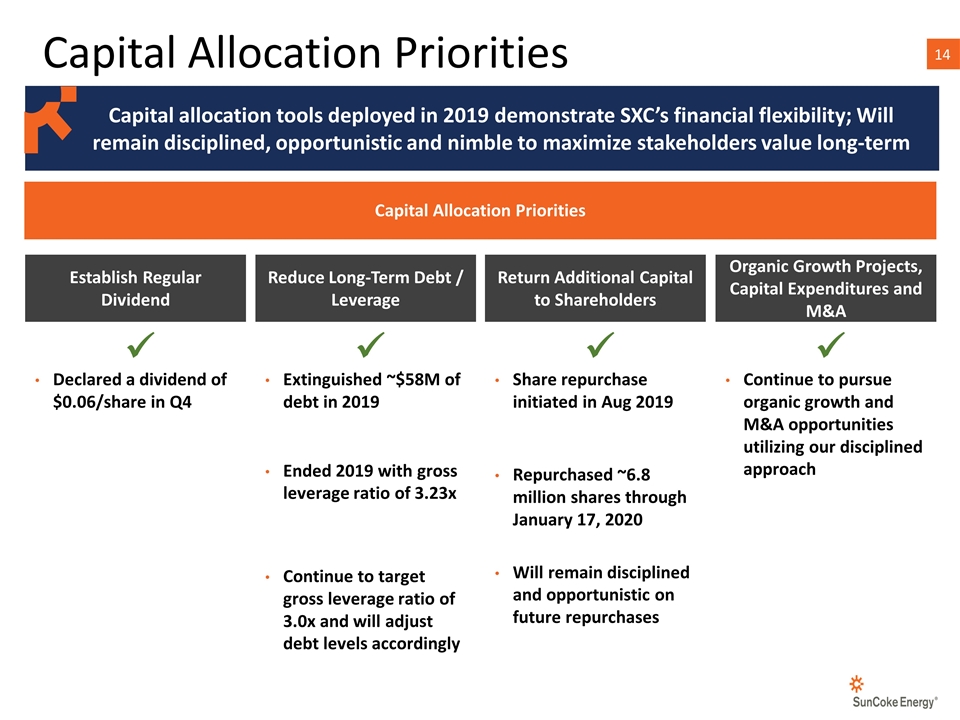

Capital Allocation Priorities Capital allocation tools deployed in 2019 demonstrate SXC’s financial flexibility; Will remain disciplined, opportunistic and nimble to maximize stakeholders value long-term Capital Allocation Priorities Organic Growth Projects, Capital Expenditures and M&A Return Additional Capital to Shareholders Establish Regular Dividend Reduce Long-Term Debt / Leverage Declared a dividend of $0.06/share in Q4 Extinguished ~$58M of debt in 2019 Ended 2019 with gross leverage ratio of 3.23x Continue to target gross leverage ratio of 3.0x and will adjust debt levels accordingly Share repurchase initiated in Aug 2019 Repurchased ~6.8 million shares through January 17, 2020 Will remain disciplined and opportunistic on future repurchases Continue to pursue organic growth and M&A opportunities utilizing our disciplined approach ü ü ü ü

Continued strong operational and safety performance while optimizing asset utilization Successfully execute on capital plan Deliver Operations Excellence and Optimize Asset Base Revitalize Convent Marine Terminal with new product and customer mix New Customer and Business Development at CMT Successfully navigate upcoming contract negotiations given existing market conditions Position Coke Business for Long-Term Success $235M – $245M Consol. Adj. EBITDA $170M – $185M Operating Cash Flow Achieve 2020 Financial Objectives Execute against our capital allocation priorities of reducing debt, returning capital to shareholders and exploring growth opportunities Pursue Balanced Capital Allocation 2020 Key Initiatives

APPENDIX

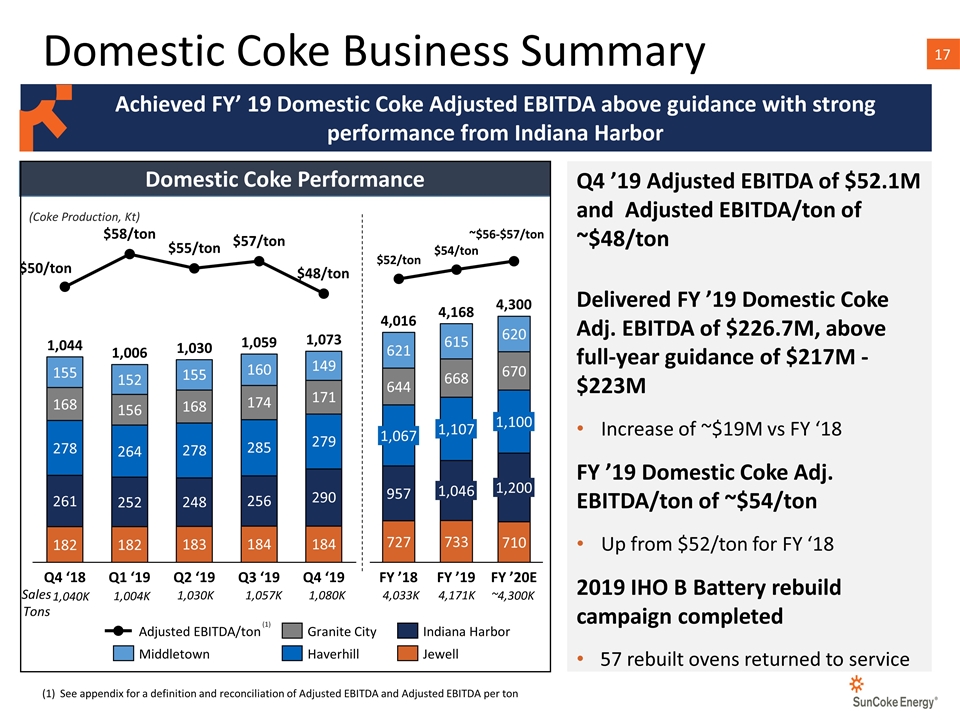

Domestic Coke Performance Domestic Coke Business Summary /ton /ton /ton $55/ton /ton Sales Tons (Coke Production, Kt) Q4 ’19 Adjusted EBITDA of $52.1M and Adjusted EBITDA/ton of ~$48/ton Delivered FY ’19 Domestic Coke Adj. EBITDA of $226.7M, above full-year guidance of $217M - $223M Increase of ~$19M vs FY ‘18 FY ’19 Domestic Coke Adj. EBITDA/ton of ~$54/ton Up from $52/ton for FY ‘18 2019 IHO B Battery rebuild campaign completed 57 rebuilt ovens returned to service See appendix for a definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA per ton (1) 1,040K 1,004K 1,030K Achieved FY’ 19 Domestic Coke Adjusted EBITDA above guidance with strong performance from Indiana Harbor 1,057K 1,080K /ton /ton ~$56-$57/ton 4,033K 4,171K ~4,300K

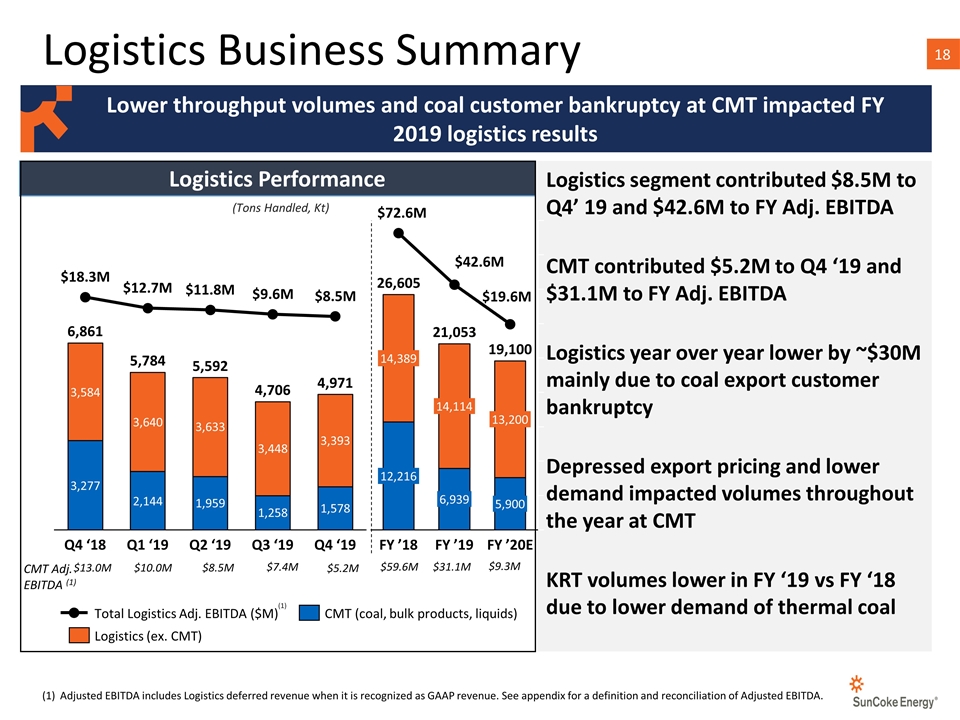

Logistics Business Summary M M M M M (Tons Handled, Kt) Logistics segment contributed $8.5M to Q4’ 19 and $42.6M to FY Adj. EBITDA CMT contributed $5.2M to Q4 ‘19 and $31.1M to FY Adj. EBITDA Logistics year over year lower by ~$30M mainly due to coal export customer bankruptcy Depressed export pricing and lower demand impacted volumes throughout the year at CMT KRT volumes lower in FY ‘19 vs FY ‘18 due to lower demand of thermal coal $13.0M $10.0M CMT Adj. EBITDA (1) $7.4M (1) Adjusted EBITDA includes Logistics deferred revenue when it is recognized as GAAP revenue. See appendix for a definition and reconciliation of Adjusted EBITDA. Lower throughput volumes and coal customer bankruptcy at CMT impacted FY 2019 logistics results $8.5M Logistics Performance $5.2M M M M $59.6M $31.1M $9.3M

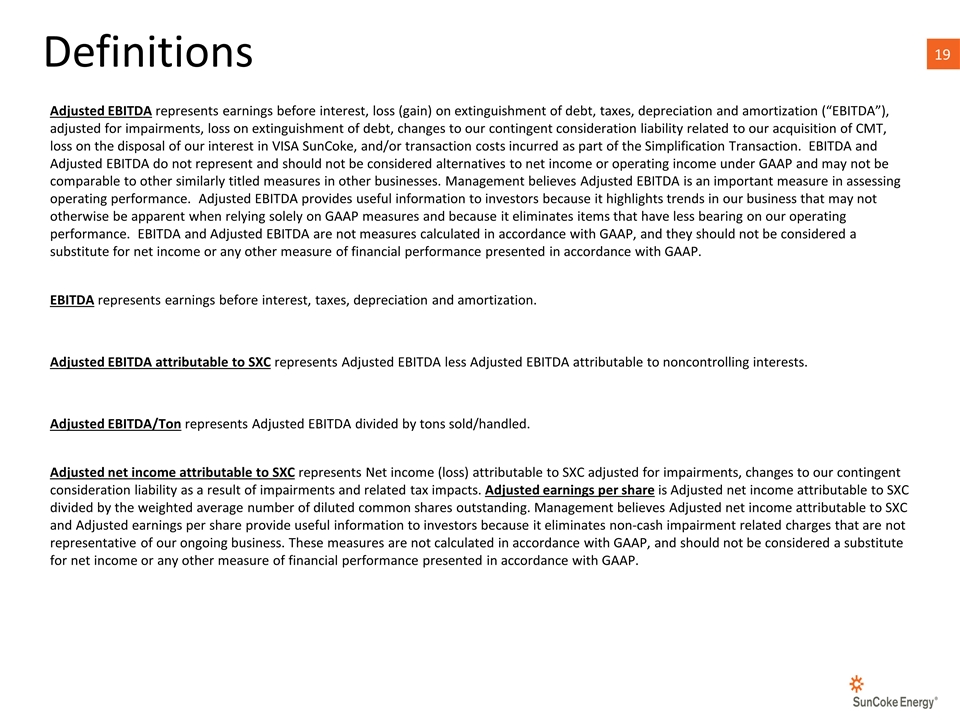

Adjusted EBITDA represents earnings before interest, loss (gain) on extinguishment of debt, taxes, depreciation and amortization (“EBITDA”), adjusted for impairments, loss on extinguishment of debt, changes to our contingent consideration liability related to our acquisition of CMT, loss on the disposal of our interest in VISA SunCoke, and/or transaction costs incurred as part of the Simplification Transaction. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure in assessing operating performance. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered a substitute for net income or any other measure of financial performance presented in accordance with GAAP. EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA attributable to SXC represents Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests. Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled. Adjusted net income attributable to SXC represents Net income (loss) attributable to SXC adjusted for impairments, changes to our contingent consideration liability as a result of impairments and related tax impacts. Adjusted earnings per share is Adjusted net income attributable to SXC divided by the weighted average number of diluted common shares outstanding. Management believes Adjusted net income attributable to SXC and Adjusted earnings per share provide useful information to investors because it eliminates non-cash impairment related charges that are not representative of our ongoing business. These measures are not calculated in accordance with GAAP, and should not be considered a substitute for net income or any other measure of financial performance presented in accordance with GAAP. Definitions

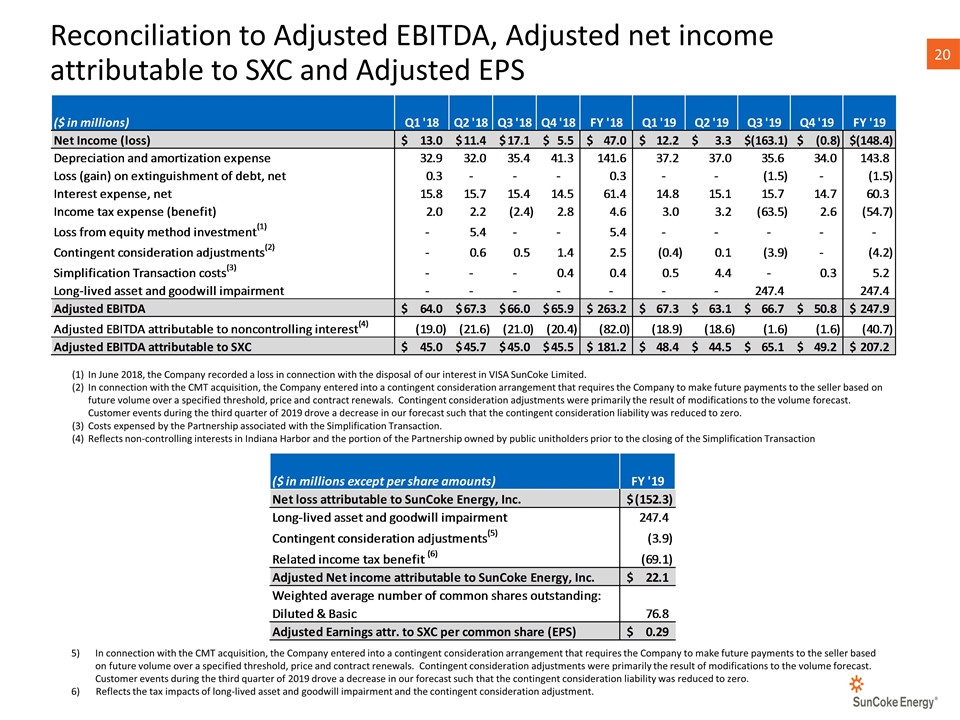

Reconciliation to Adjusted EBITDA, Adjusted net income attributable to SXC and Adjusted EPS In June 2018, the Company recorded a loss in connection with the disposal of our interest in VISA SunCoke Limited. In connection with the CMT acquisition, the Company entered into a contingent consideration arrangement that requires the Company to make future payments to the seller based on future volume over a specified threshold, price and contract renewals. Contingent consideration adjustments were primarily the result of modifications to the volume forecast. Customer events during the third quarter of 2019 drove a decrease in our forecast such that the contingent consideration liability was reduced to zero. Costs expensed by the Partnership associated with the Simplification Transaction. Reflects non-controlling interests in Indiana Harbor and the portion of the Partnership owned by public unitholders prior to the closing of the Simplification Transaction In connection with the CMT acquisition, the Company entered into a contingent consideration arrangement that requires the Company to make future payments to the seller based on future volume over a specified threshold, price and contract renewals. Contingent consideration adjustments were primarily the result of modifications to the volume forecast. Customer events during the third quarter of 2019 drove a decrease in our forecast such that the contingent consideration liability was reduced to zero. Reflects the tax impacts of long-lived asset and goodwill impairment and the contingent consideration adjustment.

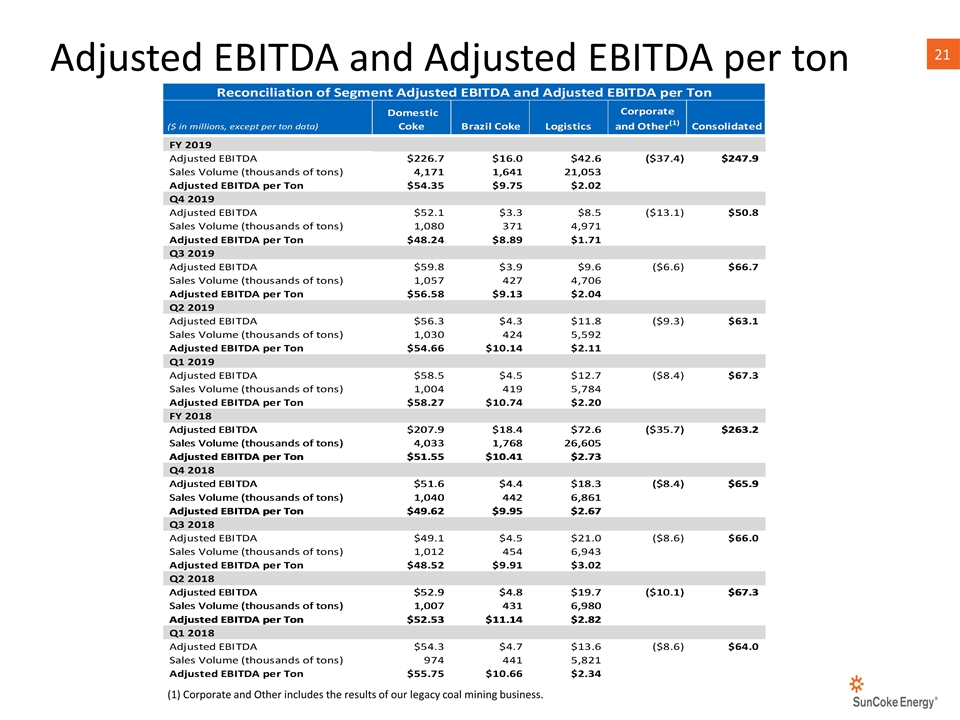

Adjusted EBITDA and Adjusted EBITDA per ton (1) Corporate and Other includes the results of our legacy coal mining business.

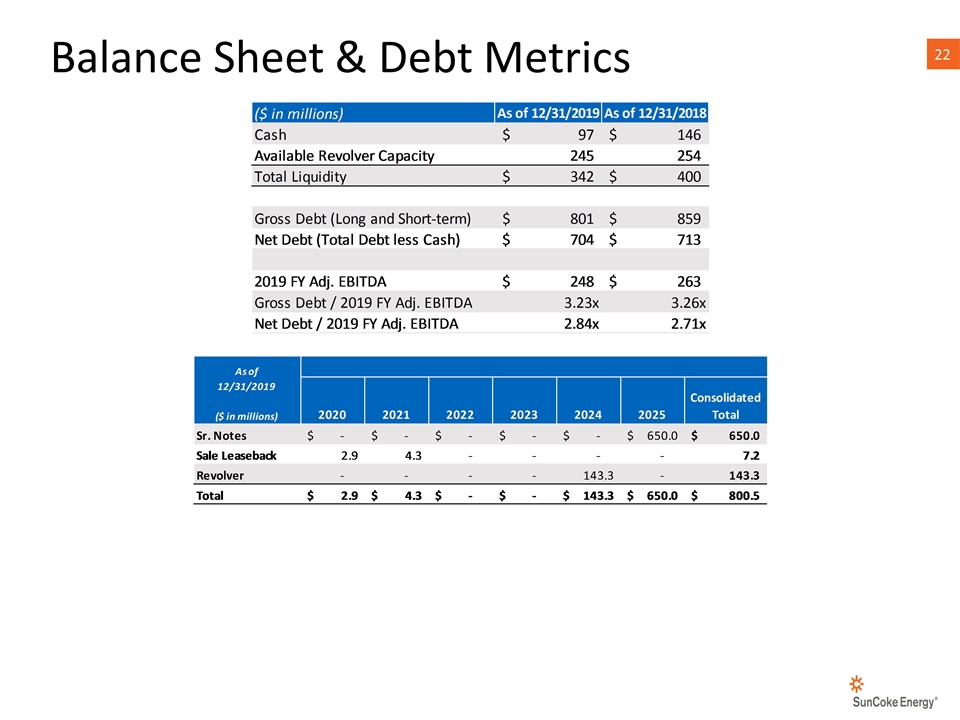

Balance Sheet & Debt Metrics

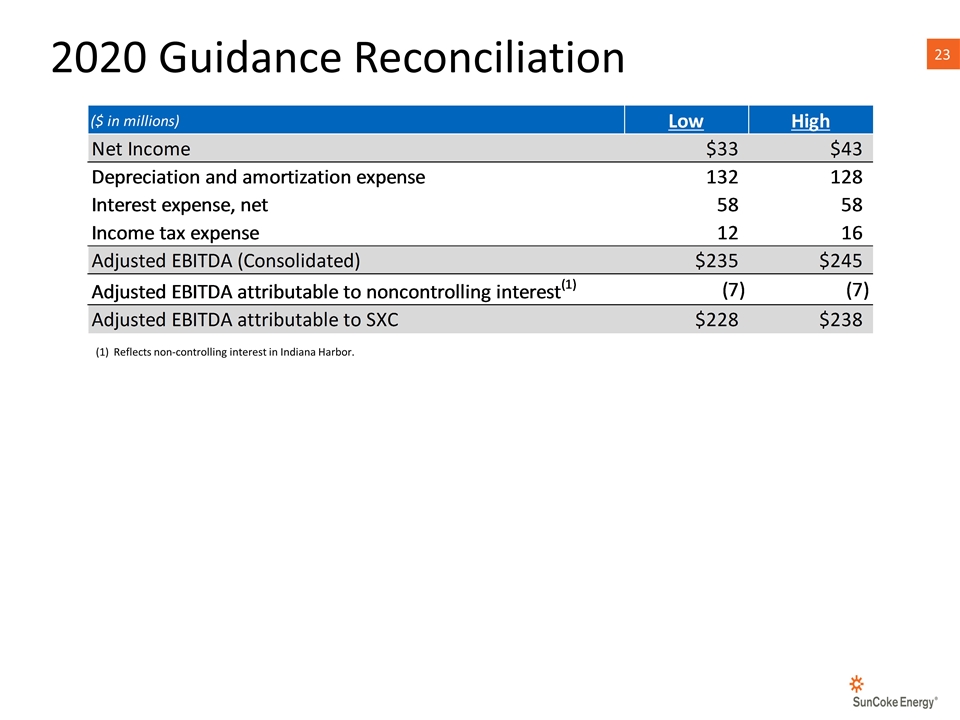

2020 Guidance Reconciliation Reflects non-controlling interest in Indiana Harbor.

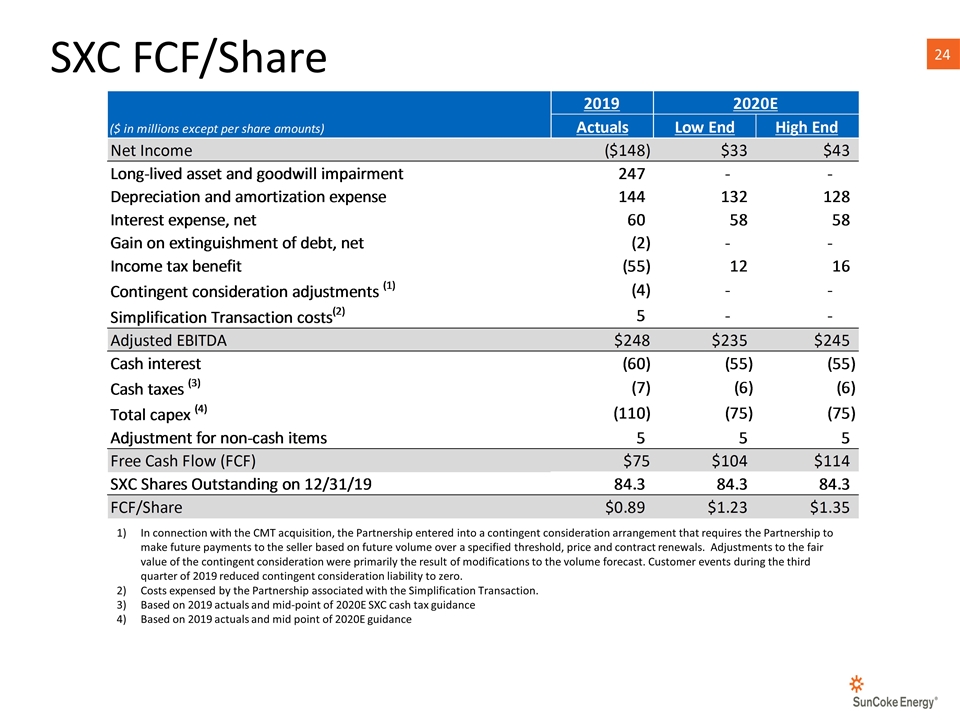

SXC FCF/Share In connection with the CMT acquisition, the Partnership entered into a contingent consideration arrangement that requires the Partnership to make future payments to the seller based on future volume over a specified threshold, price and contract renewals. Adjustments to the fair value of the contingent consideration were primarily the result of modifications to the volume forecast. Customer events during the third quarter of 2019 reduced contingent consideration liability to zero. Costs expensed by the Partnership associated with the Simplification Transaction. Based on 2019 actuals and mid-point of 2020E SXC cash tax guidance Based on 2019 actuals and mid point of 2020E guidance