Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Citizens Community Bancorp Inc. | a8kjanneyinvconfpresentati.htm |

Filed Pursuant to Rule 433 Registration Statement No. __________ Issuer Free Writing Prospectus Dated October __, 2015 Relating to Preliminary Prospectus Supplement Dated October __, 2015 Citizens Community Bancorp Inc. Investor Conference 2019 Fourth Quarter 1

Cautionary Notes and Additional Disclosures CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, descriptions of the financial condition, results of operations, asset and credit quality trends, profitability, projected earnings, future plans, strategies and expectations of Citizens Community Bancorp, Inc. (“CZWI” or the “Company”) and its subsidiary, Citizens Community Federal, National Association (“CCFBank”) . The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of complying with those safe harbor provisions. Forward-looking statements, which are based on certain assumptions of the Company, are generally identifiable by use of the words “believe,” “expect,” “estimates,” “intend,” “anticipate,” “estimate,” “project,” “seek,” “target,” “potential,” “focus,” “may,” “preliminary,” “could,” “should” or similar expressions. These forward-looking statements express management’s current expectations or forecasts of future events, and by their nature, are subject to risks and uncertainties. Therefore, there are a number of factors that might cause actual results to differ materially from those in such statements. These uncertainties include conditions in the financial markets and economic conditions generally; the possibility of a deterioration in the residential real estate markets; interest rate risk; lending risk; the sufficiency of loan allowances; changes in the fair value or ratings downgrades of our securities; competitive pressures among depository and other financial institutions; our ability to realize the benefits of net deferred tax assets; our ability to maintain or increase our market share; acts of terrorism and political or military actions by the United States or other governments; legislative or regulatory changes or actions, or significant litigation, adversely affecting the Company or Bank; increases in FDIC insurance premiums or special assessments by the FDIC; disintermediation risk; our inability to obtain needed liquidity; risks related to the integration of F&M into the Company’s operations; the risk that the combined company may be unable to retain the Company and/or F&M personnel successfully after the F&M Merger is completed; our ability to successfully execute our acquisition growth strategy; risks posed by acquisitions and other expansion opportunities, including difficulties and delays in integrating the acquired business operations or fully realizing the cost savings and other benefits; our ability to raise capital needed to fund growth or meet regulatory requirements; the possibility that our internal controls and procedures could fail or be circumvented; our ability to attract and retain key personnel; our ability to keep pace with technological change; cybersecurity risks; changes in federal or state tax laws; changes in accounting principles, policies or guidelines and their impact on financial performance; restrictions on our ability to pay dividends; and the potential volatility of our stock price. Stockholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward- looking statements. Such uncertainties and other risks that may affect the Company's performance are discussed further in Part I, Item 1A, "Risk Factors," in the Company's Form 10-K, for the year ended September 30, 2018 filed with the Securities and Exchange Commission ("SEC") on December 10, 2018, Part I, Item 1A, "Risk Factors," in the Company’s Form 10-KT for the transition period ended December 31, 2018 filed with the SEC on March 8, 2019, and the Company's subsequent filings with the SEC. The Company undertakes no obligation to make any revisions to the forward-looking statements contained herein or to update them to reflect events or circumstances occurring after the date hereof. UNAUDITED PRO FORMA FINANCIAL INFORMATION This presentation contains certain unaudited pro forma information regarding the financial condition and results of operations of the company after giving effect to the acquisition of F. & M. Bancorp. of Tomah, Inc. (“F&M”) and other pro forma adjustments. The unaudited pro forma information assumes that the acquisition is accounted for under the acquisition method of accounting, and that the assets and liabilities of F&M will be recorded by CZWI at their respective fair values as of the date the acquisition is completed. The unaudited pro forma balance sheet gives effect to the transaction as if the acquisition had occurred on June 30, 2019. The unaudited pro forma information has been derived from and should be read in conjunction with the consolidated financial statements and related notes of CZWI, which are included in its Annual Report on Form 10-K for the year ended September 30, 2018, its Form 10-KT for the transition period ended December 31, 2018 filed with the SEC on March 8, 2019, and subsequent Quarterly Reports on Form 10-Q. The unaudited pro forma information is presented for illustrative purposes only and does not indicate the financial results of the combined company had the companies actually been combined at the beginning of each period presented, nor the impact of possible business model changes. This unaudited pro forma information reflects adjustments to illustrate the effect of the acquisition had it been completed on the date indicated, which are based upon preliminary estimates, to record F&M’s identifiable assets acquired and liabilities assumed at fair value and the resulting goodwill recognized. The unaudited pro forma information also does not consider any potential effects of changes in market conditions on revenues, potential revenue enhancements, or asset dispositions, among other factors. NON-GAAP FINANCIAL MEASURES These slides may contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Non·GAAP financial measures referred to herein include net income as adjusted, EPS as adjusted, ROAA as adjusted, ROATCE, tangible book value per share, efficiency ratio, efficiency ratio as adjusted and tangible common equity / tangible assets. Reconciliations of all non·GAAP financial measures used herein to the comparable GAAP financial measures in the appendix at the end of this presentation. 2

Cautionary Notes and Additional Disclosures (Cont’d) Additional Information and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. CZWI’s Form 10-K, for the year ended September 30, 2018 filed with the Securities and Exchange Commission ("SEC") on December 10, 2018, Form 10-KT for the transition period ended December 31, 2018 filed with the SEC on March 8, 2019, and any other documents filed by CZWI with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from CZWI's website at www.ccf.us, or by directing a request to CZWI’s CFO, Jim Broucek at Citizens Community Bancorp, Inc., 2174 EastRidge Center, Eau Claire, Wisconsin 54701, Attention: James S. Broucek or by e-mail at jbroucek@ccf.us. 3

CZWI Focus Items ENHANCING THE QUANTITY AND QUALITY OF EARNINGS We are enhancing shareholder value by improving the loan and deposit mix, deepening customer relationships and strengthening other sources of revenue. EXPERTISE IN COMMERCIAL & AG BANKING We take pride in serving small and mid-sized business and Ag operators in our communities with the best professionals, products and processes. EXPERIENCED & PROVEN STRATEGIC LEADERSHIP TEAM Our team has over 182 years of banking experience to draw upon with national, regional and community banks. ENTERPRISE PRODUCTIVITY & RISK MANAGEMENT We are leveraging technology to improve productivity and support future growth, while proactively managing operating and credit risk. 4

Key Market Differentiators • Serving small to mid-sized • Experienced, energetic entrepreneurs leadership team • Responsive professionals • Accountability for doing the • Products to compete vs. right thing and getting results BUSINESS CULTURE big banks, superior to MODEL • Entrepreneurial spirit, smaller community banks winning attitude STRATEGIC CREDIT • Loan and deposit growth GROWTH • Prudent risk taking through prudent M&A • Process driven, transparent • Robust commercial loan and • Nimble, centralized approval process deposit growth • Proactive risk management • Quality and quantity of earnings improving 5

Mission, Vision and Values Mission Provide the best products, service, and ideas to our customers every interaction every day. Vision Values Make more possible for our Our six main values are: customers, colleagues, integrity, commitment, communities, and shareholders! innovation, collaboration, focus, and sustainability. 6

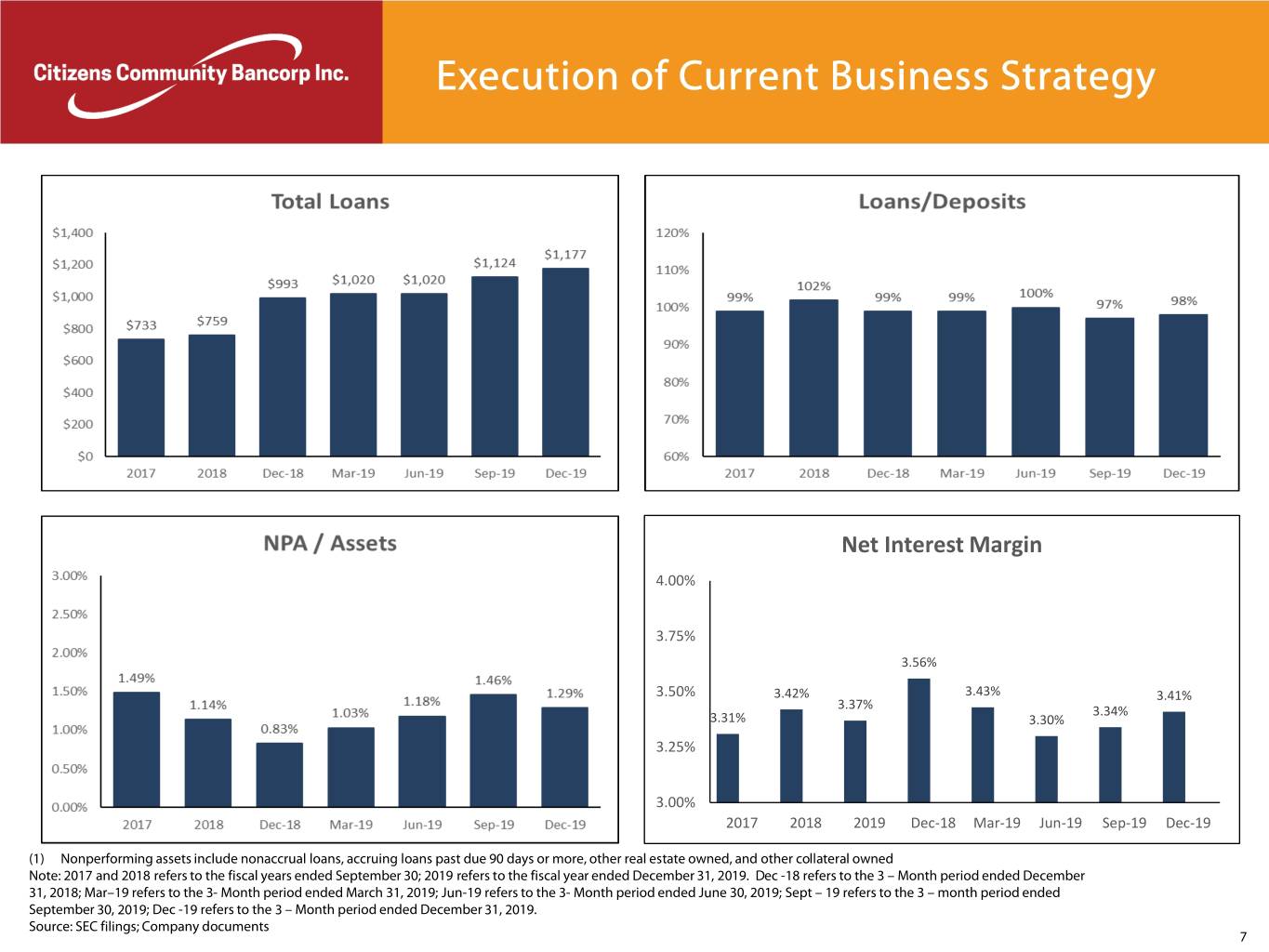

Execution of Current Business Strategy Net Interest Margin 4.00% 3.75% 3.56% 3.50% 3.42% 3.43% 3.41% 3.37% 3.34% 3.31% 3.30% 3.25% 3.00% 2017 2018 2019 Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 (1) Nonperforming assets include nonaccrual loans, accruing loans past due 90 days or more, other real estate owned, and other collateral owned Note: 2017 and 2018 refers to the fiscal years ended September 30; 2019 refers to the fiscal year ended December 31, 2019. Dec -18 refers to the 3 – Month period ended December 31, 2018; Mar–19 refers to the 3- Month period ended March 31, 2019; Jun-19 refers to the 3- Month period ended June 30, 2019; Sept – 19 refers to the 3 – month period ended September 30, 2019; Dec -19 refers to the 3 – Month period ended December 31, 2019. Source: SEC filings; Company documents 7

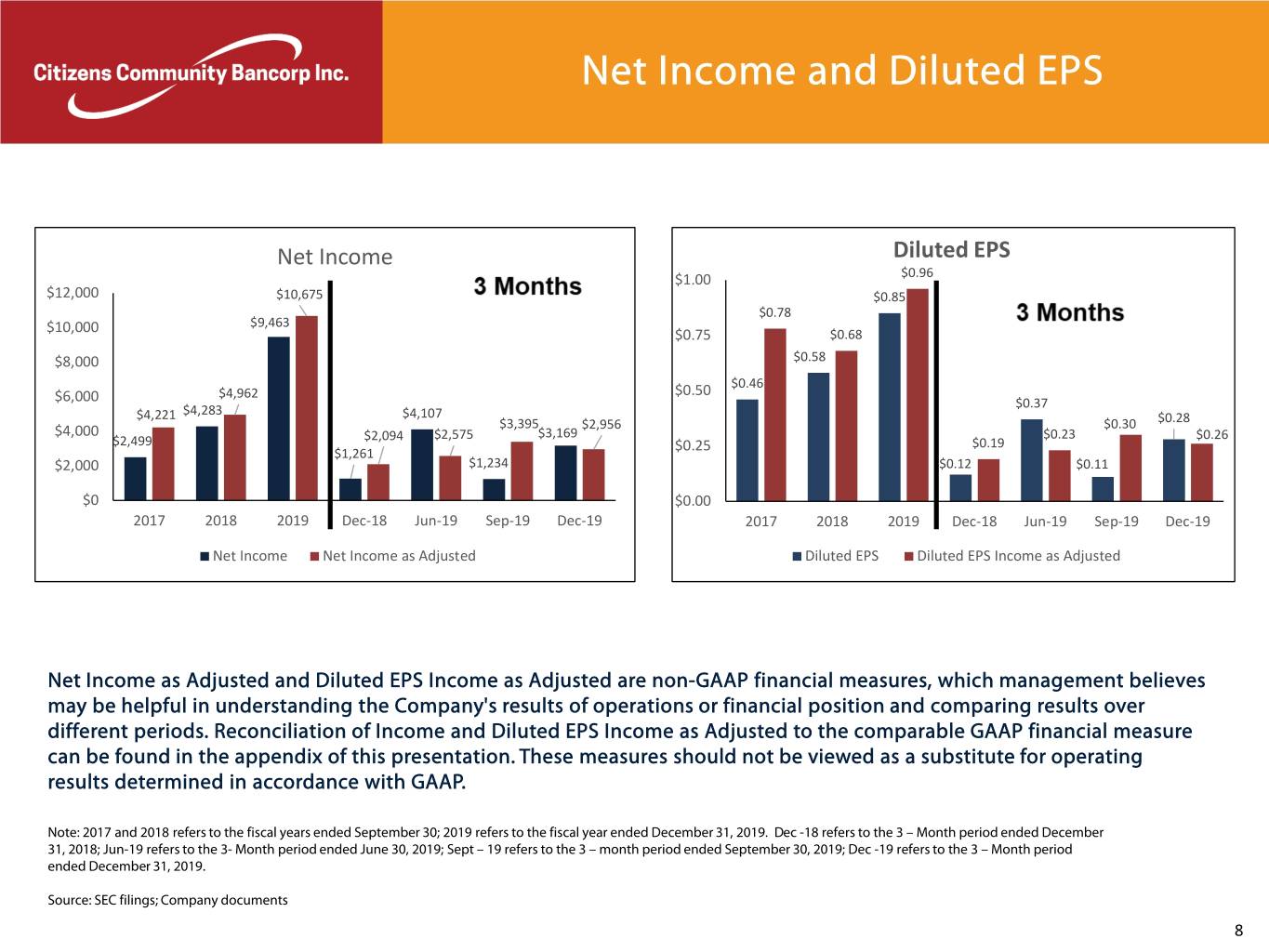

Net Income and Diluted EPS Net Income Diluted EPS $1.00 $0.96 $12,000 $10,675 $0.85 $0.78 $9,463 $10,000 $0.75 $0.68 $8,000 $0.58 $0.46 $4,962 $0.50 $6,000 $0.37 $4,221 $4,283 $4,107 $3,395 $2,956 $0.30 $0.28 $4,000 $2,094 $2,575 $3,169 $0.23 $0.26 $2,499 $0.25 $0.19 $1,261 $2,000 $1,234 $0.12 $0.11 $0 $0.00 2017 2018 2019 Dec-18 Jun-19 Sep-19 Dec-19 2017 2018 2019 Dec-18 Jun-19 Sep-19 Dec-19 Net Income Net Income as Adjusted Diluted EPS Diluted EPS Income as Adjusted Net Income as Adjusted and Diluted EPS Income as Adjusted are non-GAAP financial measures, which management believes may be helpful in understanding the Company's results of operations or financial position and comparing results over different periods. Reconciliation of Income and Diluted EPS Income as Adjusted to the comparable GAAP financial measure can be found in the appendix of this presentation. These measures should not be viewed as a substitute for operating results determined in accordance with GAAP. Note: 2017 and 2018 refers to the fiscal years ended September 30; 2019 refers to the fiscal year ended December 31, 2019. Dec -18 refers to the 3 – Month period ended December 31, 2018; Jun-19 refers to the 3- Month period ended June 30, 2019; Sept – 19 refers to the 3 – month period ended September 30, 2019; Dec -19 refers to the 3 – Month period ended December 31, 2019. Source: SEC filings; Company documents 8

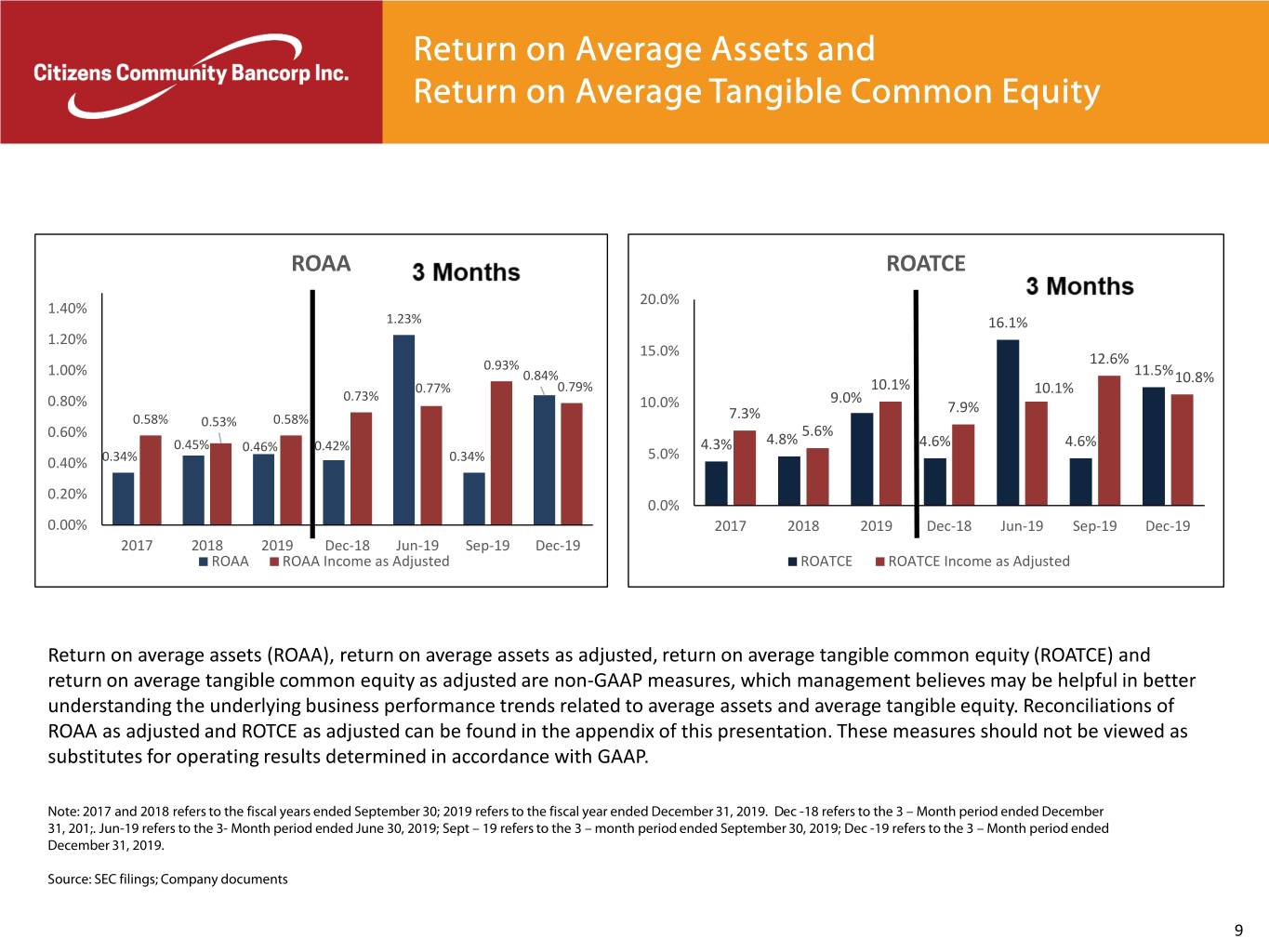

Return on Average Assets and Return on Average Tangible Common Equity ROAA ROATCE 20.0% 1.40% 1.23% 16.1% 1.20% 15.0% 0.93% 12.6% 1.00% 0.84% 11.5%10.8% 0.77% 0.79% 10.1% 10.1% 0.80% 0.73% 10.0% 9.0% 7.3% 7.9% 0.58% 0.53% 0.58% 0.60% 5.6% 0.45% 0.42% 4.3% 4.8% 4.6% 4.6% 0.46% 5.0% 0.40% 0.34% 0.34% 0.20% 0.0% 0.00% 2017 2018 2019 Dec-18 Jun-19 Sep-19 Dec-19 2017 2018 2019 Dec-18 Jun-19 Sep-19 Dec-19 ROAA ROAA Income as Adjusted ROATCE ROATCE Income as Adjusted Return on average assets (ROAA), return on average assets as adjusted, return on average tangible common equity (ROATCE) and return on average tangible common equity as adjusted are non-GAAP measures, which management believes may be helpful in better understanding the underlying business performance trends related to average assets and average tangible equity. Reconciliations of ROAA as adjusted and ROTCE as adjusted can be found in the appendix of this presentation. These measures should not be viewed as substitutes for operating results determined in accordance with GAAP. Note: 2017 and 2018 refers to the fiscal years ended September 30; 2019 refers to the fiscal year ended December 31, 2019. Dec -18 refers to the 3 – Month period ended December 31, 201;. Jun-19 refers to the 3- Month period ended June 30, 2019; Sept – 19 refers to the 3 – month period ended September 30, 2019; Dec -19 refers to the 3 – Month period ended December 31, 2019. Source: SEC filings; Company documents 9

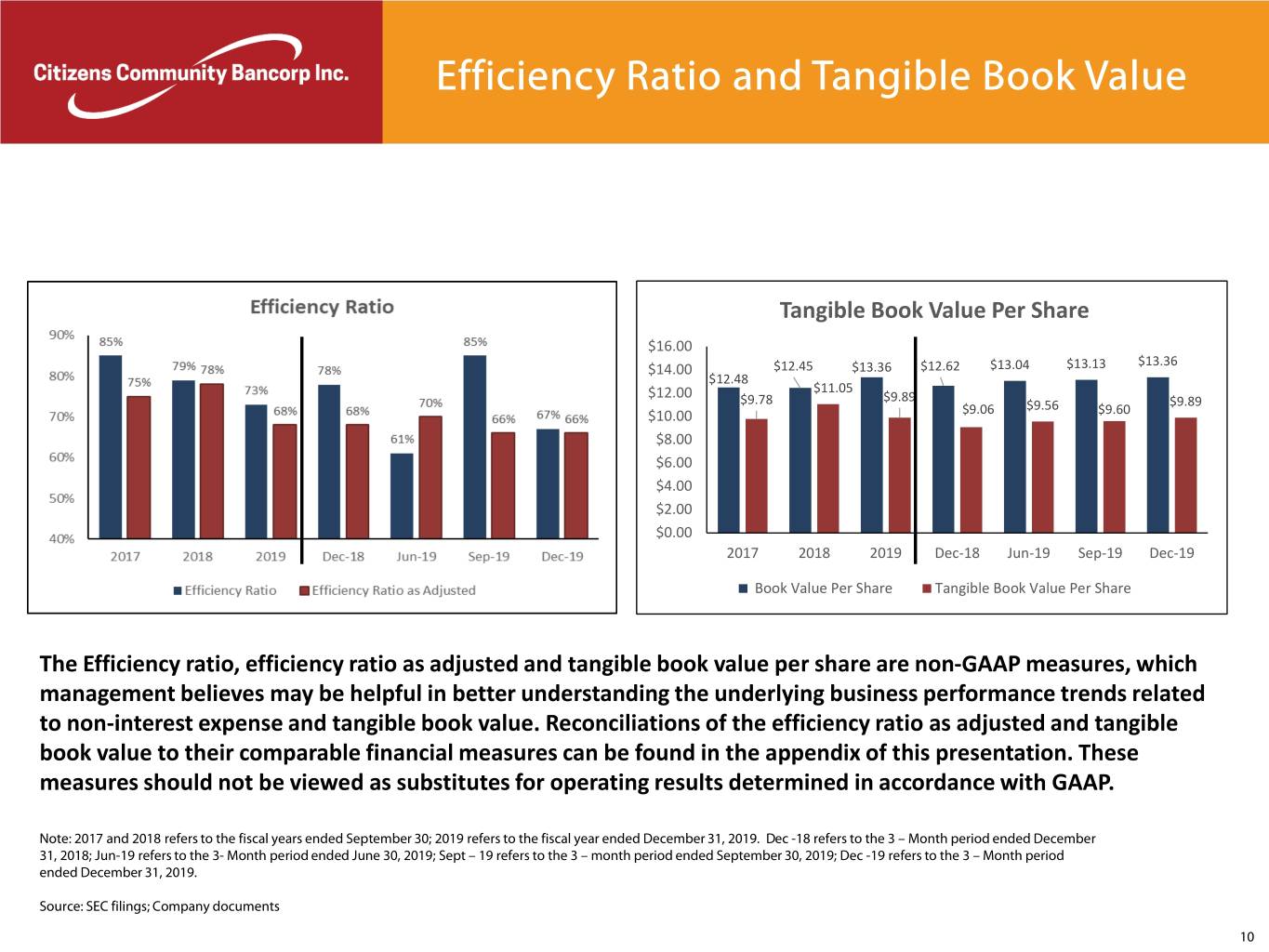

Efficiency Ratio and Tangible Book Value Tangible Book Value Per Share $16.00 $13.36 $14.00 $12.45 $13.36 $12.62 $13.04 $13.13 $12.48 $11.05 $12.00 $9.89 $9.78 $9.56 $9.89 $10.00 $9.06 $9.60 $8.00 $6.00 $4.00 $2.00 $0.00 2017 2018 2019 Dec-18 Jun-19 Sep-19 Dec-19 Book Value Per Share Tangible Book Value Per Share The Efficiency ratio, efficiency ratio as adjusted and tangible book value per share are non-GAAP measures, which management believes may be helpful in better understanding the underlying business performance trends related to non-interest expense and tangible book value. Reconciliations of the efficiency ratio as adjusted and tangible book value to their comparable financial measures can be found in the appendix of this presentation. These measures should not be viewed as substitutes for operating results determined in accordance with GAAP. Note: 2017 and 2018 refers to the fiscal years ended September 30; 2019 refers to the fiscal year ended December 31, 2019. Dec -18 refers to the 3 – Month period ended December 31, 2018; Jun-19 refers to the 3- Month period ended June 30, 2019; Sept – 19 refers to the 3 – month period ended September 30, 2019; Dec -19 refers to the 3 – Month period ended December 31, 2019. Source: SEC filings; Company documents 10

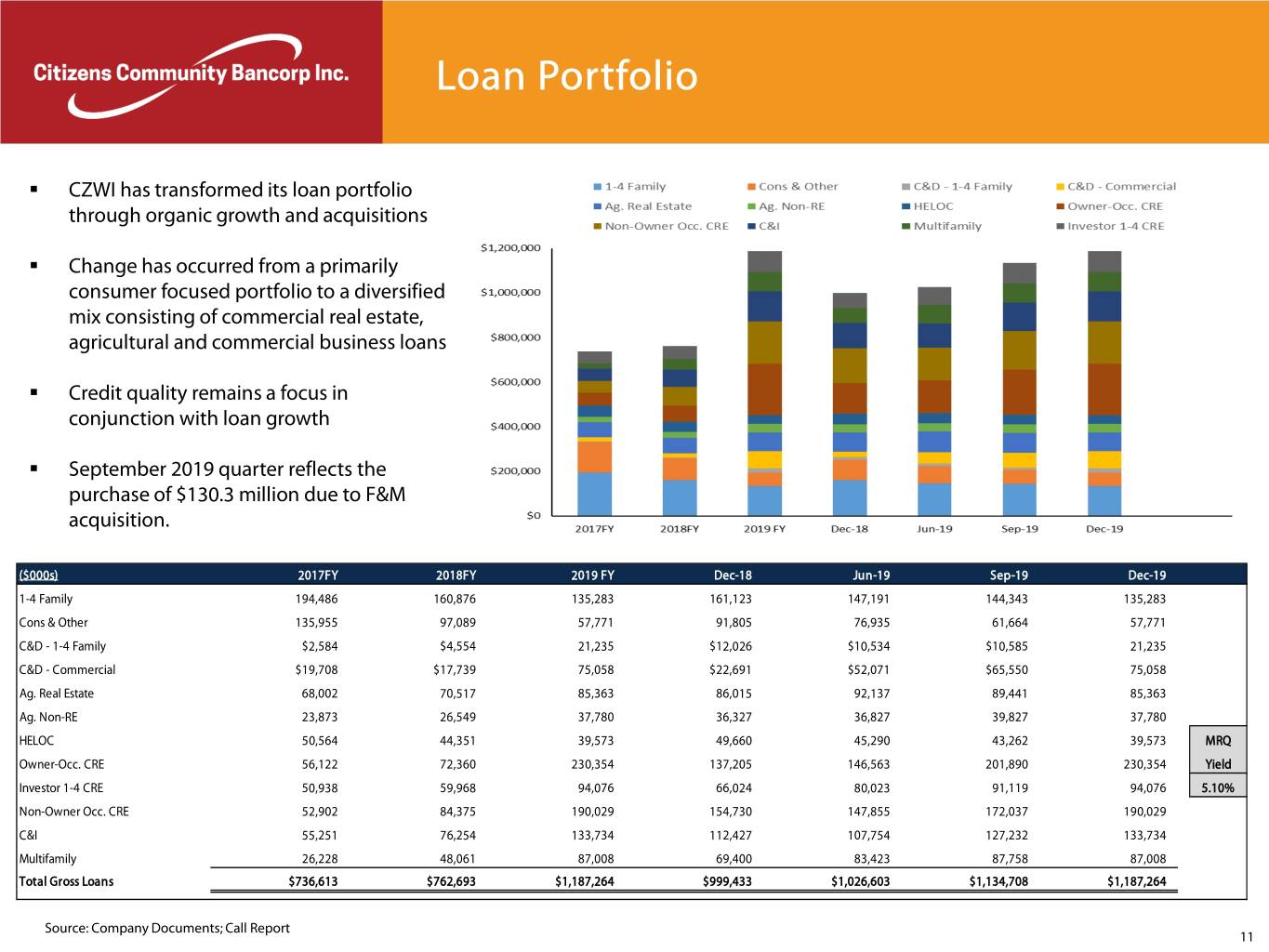

Loan Portfolio . CZWI has transformed its loan portfolio through organic growth and acquisitions . Change has occurred from a primarily consumer focused portfolio to a diversified mix consisting of commercial real estate, agricultural and commercial business loans . Credit quality remains a focus in conjunction with loan growth . September 2019 quarter reflects the purchase of $130.3 million due to F&M acquisition. ($000s) 2017FY 2018FY 2019 FY Dec-18 Jun-19 Sep-19 Dec-19 1-4 Family 194,486 160,876 135,283 161,123 147,191 144,343 135,283 Cons & Other 135,955 97,089 57,771 91,805 76,935 61,664 57,771 C&D - 1-4 Family $2,584 $4,554 21,235 $12,026 $10,534 $10,585 21,235 C&D - Commercial $19,708 $17,739 75,058 $22,691 $52,071 $65,550 75,058 Ag. Real Estate 68,002 70,517 85,363 86,015 92,137 89,441 85,363 Ag. Non-RE 23,873 26,549 37,780 36,327 36,827 39,827 37,780 HELOC 50,564 44,351 39,573 49,660 45,290 43,262 39,573 MRQ Owner-Occ. CRE 56,122 72,360 230,354 137,205 146,563 201,890 230,354 Yield Investor 1-4 CRE 50,938 59,968 94,076 66,024 80,023 91,119 94,076 5.10% Non-Owner Occ. CRE 52,902 84,375 190,029 154,730 147,855 172,037 190,029 C&I 55,251 76,254 133,734 112,427 107,754 127,232 133,734 Multifamily 26,228 48,061 87,008 69,400 83,423 87,758 87,008 Total Gross Loans $736,613 $762,693 $1,187,264 $999,433 $1,026,603 $1,134,708 $1,187,264 Source: Company Documents; Call Report 11

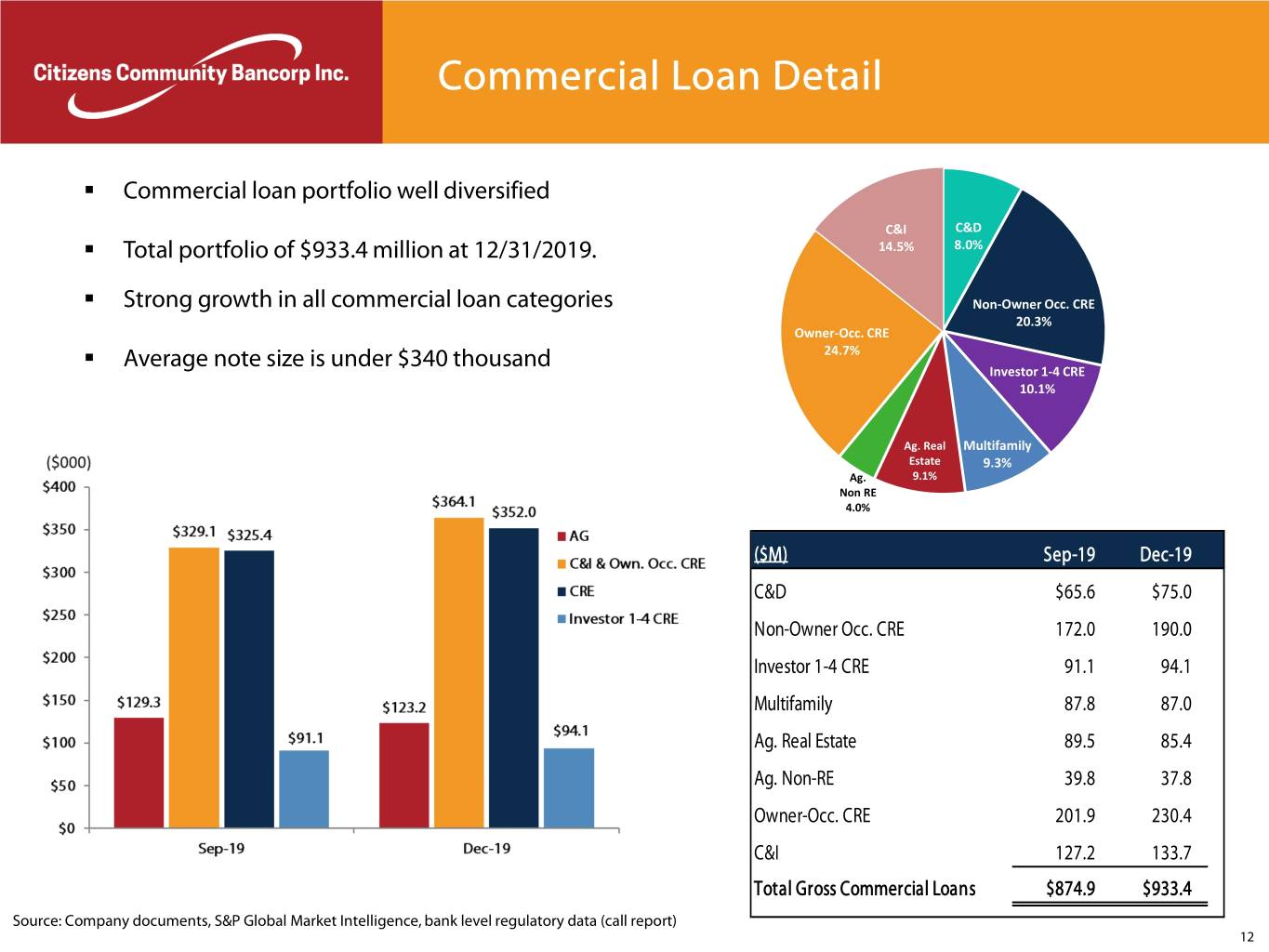

Commercial Loan Detail . Commercial loan portfolio well diversified C&I C&D . Total portfolio of $933.4 million at 12/31/2019. 14.5% 8.0% . Strong growth in all commercial loan categories Non-Owner Occ. CRE 20.3% Owner-Occ. CRE . Average note size is under $340 thousand 24.7% Investor 1-4 CRE 10.1% Ag. Real Multifamily Estate 9.3% Ag. 9.1% Non RE 4.0% ($M) Sep-19 Dec-19 C&D $65.6 $75.0 Non-Owner Occ. CRE 172.0 190.0 Investor 1-4 CRE 91.1 94.1 Multifamily 87.8 87.0 Ag. Real Estate 89.5 85.4 Ag. Non-RE 39.8 37.8 Owner-Occ. CRE 201.9 230.4 C&I 127.2 133.7 Total Gross Commercial Loans $874.9 $933.4 Source: Company documents, S&P Global Market Intelligence, bank level regulatory data (call report) 12

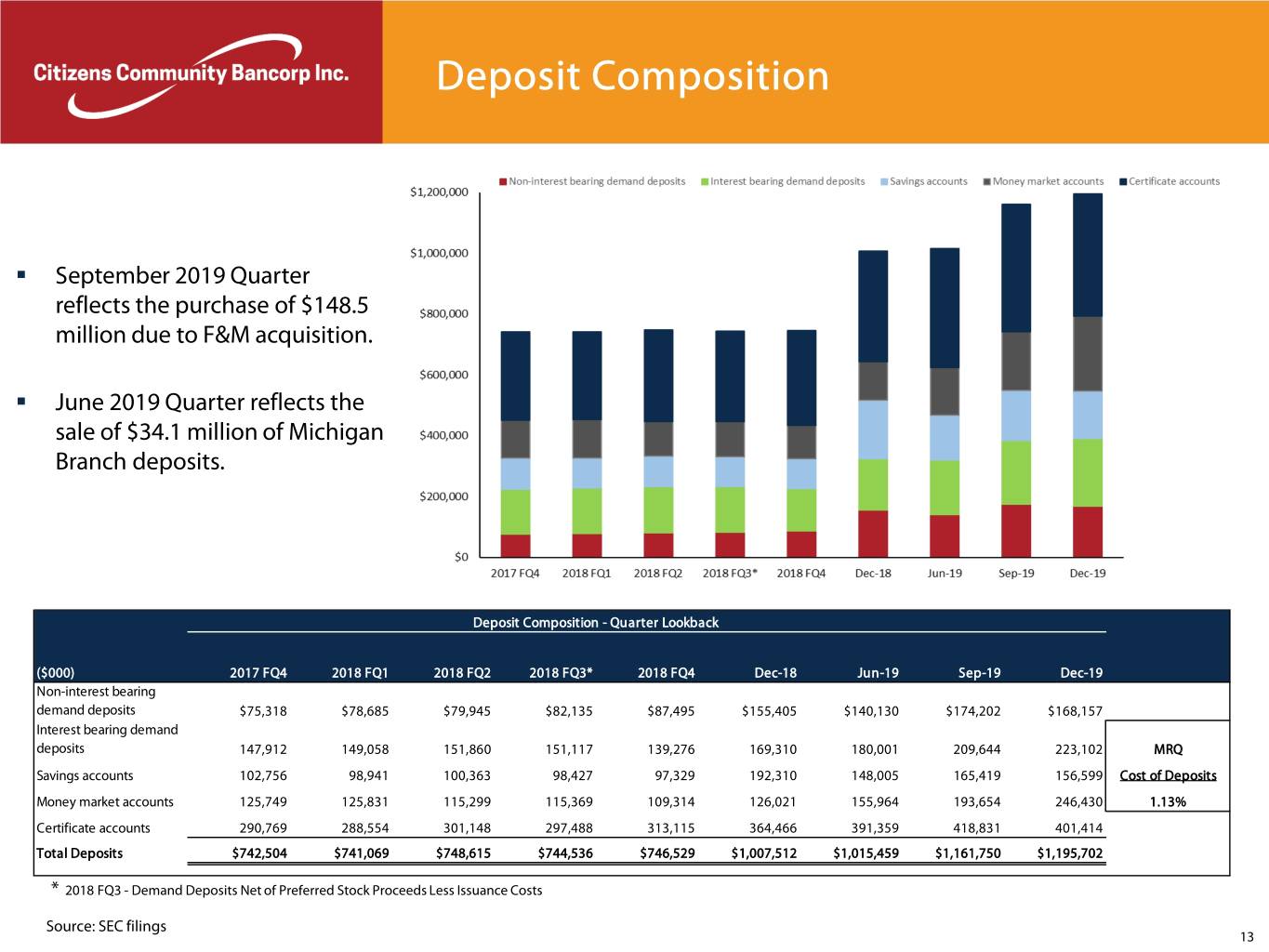

Deposit Composition . September 2019 Quarter reflects the purchase of $148.5 million due to F&M acquisition. . June 2019 Quarter reflects the sale of $34.1 million of Michigan Branch deposits. Deposit Composition - Quarter Lookback ($000) 2017 FQ4 2018 FQ1 2018 FQ2 2018 FQ3* 2018 FQ4 Dec-18 Jun-19 Sep-19 Dec-19 Non-interest bearing demand deposits $75,318 $78,685 $79,945 $82,135 $87,495 $155,405 $140,130 $174,202 $168,157 Interest bearing demand deposits 147,912 149,058 151,860 151,117 139,276 169,310 180,001 209,644 223,102 MRQ Savings accounts 102,756 98,941 100,363 98,427 97,329 192,310 148,005 165,419 156,599 Cost of Deposits Money market accounts 125,749 125,831 115,299 115,369 109,314 126,021 155,964 193,654 246,430 1.13% Certificate accounts 290,769 288,554 301,148 297,488 313,115 364,466 391,359 418,831 401,414 Total Deposits $742,504 $741,069 $748,615 $744,536 $746,529 $1,007,512 $1,015,459 $1,161,750 $1,195,702 * 2018 FQ3 - Demand Deposits Net of Preferred Stock Proceeds Less Issuance Costs Source: SEC filings 13

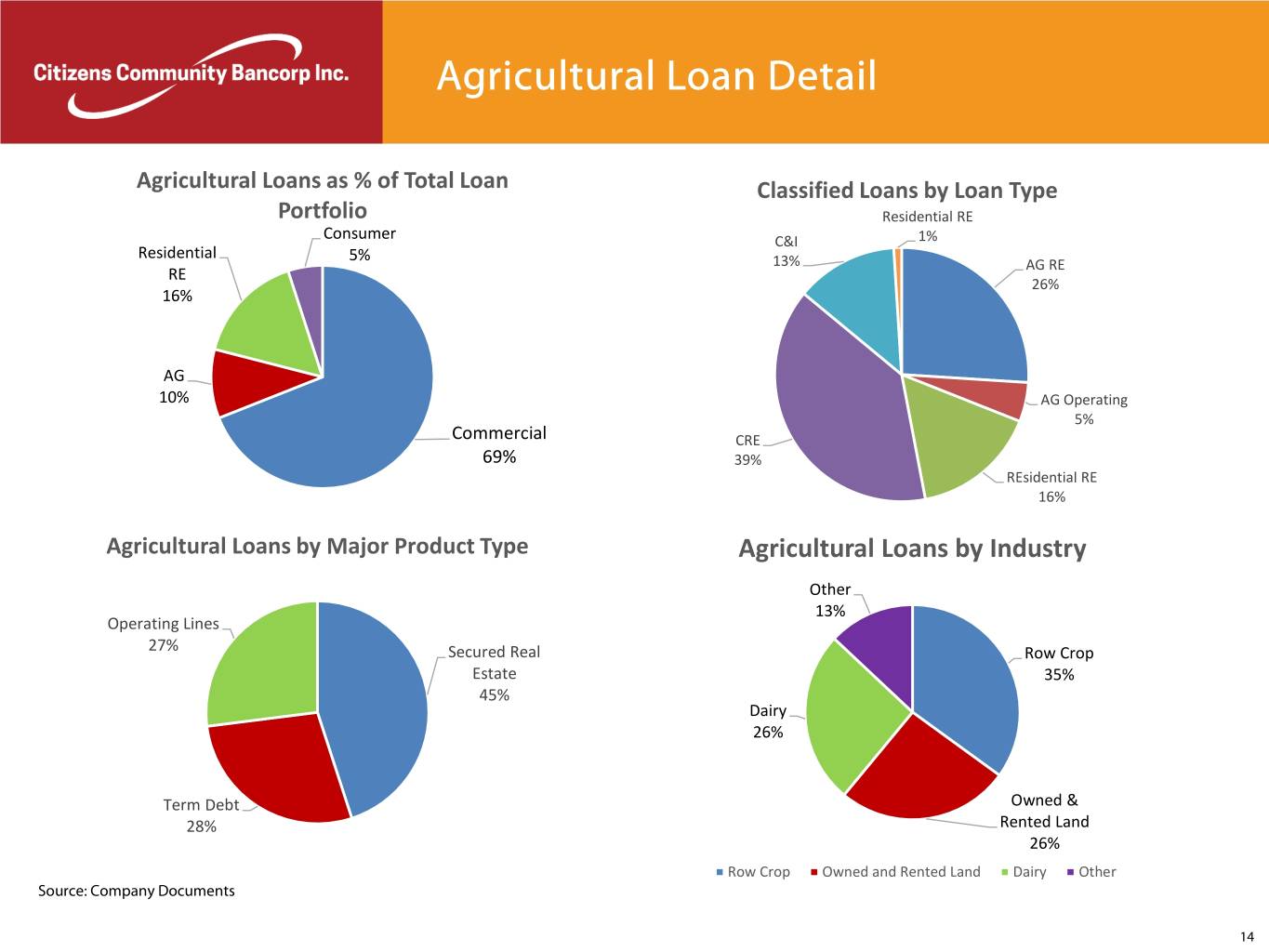

Agricultural Loan Detail Agricultural Loans as % of Total Loan Classified Loans by Loan Type Portfolio Residential RE Consumer C&I 1% Residential 5% 13% AG RE RE 26% 16% AG 10% AG Operating 5% Commercial CRE 69% 39% REsidential RE 16% Agricultural Loans by Major Product Type Agricultural Loans by Industry Other 13% Operating Lines 27% Secured Real Row Crop Estate 35% 45% Dairy 26% Term Debt Owned & 28% Rented Land 26% Row Crop Owned and Rented Land Dairy Other Source: Company Documents 14

Market Demographics CZWI operates in diverse markets within the northwestern region of Wisconsin, metro Twin Cities and the Mankato, Minnesota MSA Eau Claire: . Features a broad-based, diverse economy, which is driven by commercial, retail and medical industries Mankato: . The Mankato market also possesses a broad-based, diverse economy Eau Claire Area Employers Mankato Area Employers Source: S&P Global Market Intelligence, eauclairedevelopment.com, greatermankato.com, Google Images 15

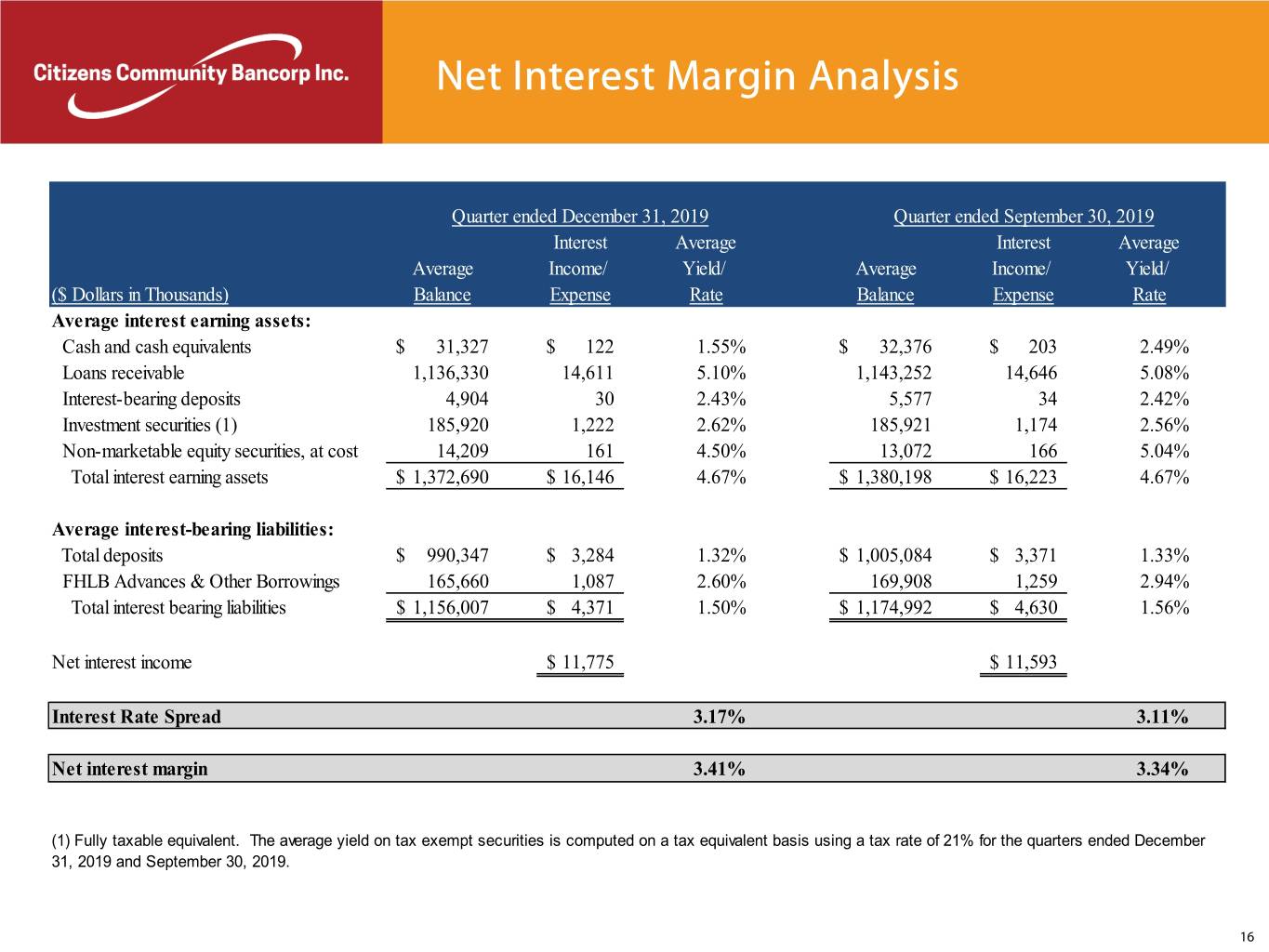

Net Interest Margin Analysis Quarter ended December 31, 2019 Quarter ended September 30, 2019 Interest Average Interest Average Average Income/ Yield/ Average Income/ Yield/ ($ Dollars in Thousands) Balance Expense Rate Balance Expense Rate Average interest earning assets: Cash and cash equivalents $ 31,327 $ 122 1.55% $ 32,376 $ 203 2.49% Loans receivable 1,136,330 14,611 5.10% 1,143,252 14,646 5.08% Interest-bearing deposits 4,904 30 2.43% 5,577 34 2.42% Investment securities (1) 185,920 1,222 2.62% 185,921 1,174 2.56% Non-marketable equity securities, at cost 14,209 161 4.50% 13,072 166 5.04% Total interest earning assets $ 1,372,690 $ 16,146 4.67% $ 1,380,198 $ 16,223 4.67% Average interest-bearing liabilities: Total deposits $ 990,347 $ 3,284 1.32% $ 1,005,084 $ 3,371 1.33% FHLB Advances & Other Borrowings 165,660 1,087 2.60% 169,908 1,259 2.94% Total interest bearing liabilities $ 1,156,007 $ 4,371 1.50% $ 1,174,992 $ 4,630 1.56% Net interest income $ 11,775 $ 11,593 Interest Rate Spread 3.17% 3.11% Net interest margin 3.41% 3.34% (1) Fully taxable equivalent. The average yield on tax exempt securities is computed on a tax equivalent basis using a tax rate of 21% for the quarters ended December 31, 2019 and September 30, 2019. 16

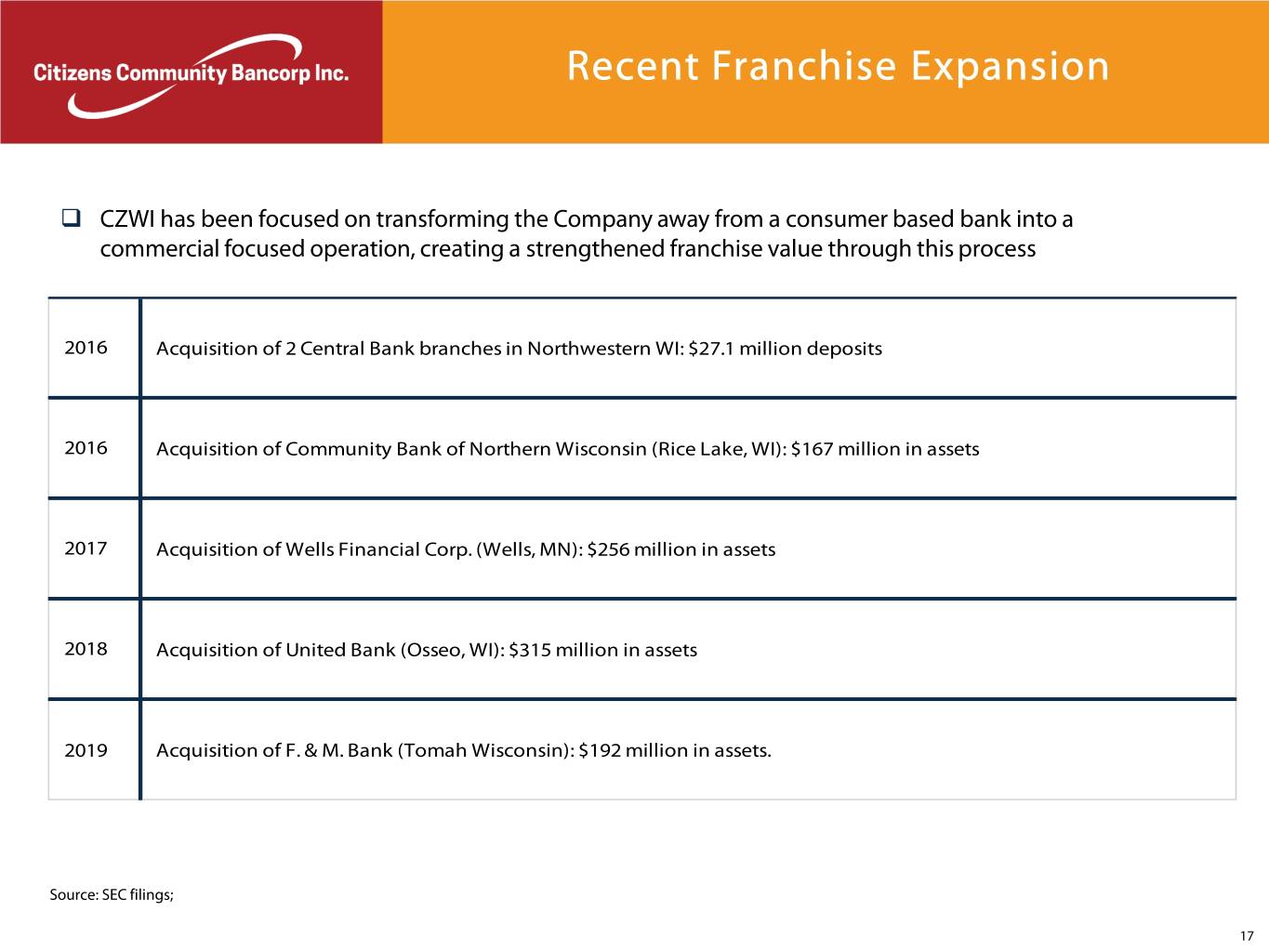

Recent Franchise Expansion CZWI has been focused on transforming the Company away from a consumer based bank into a commercial focused operation, creating a strengthened franchise value through this process 2016 Acquisition of 2 Central Bank branches in Northwestern WI: $27.1 million deposits 2016 Acquisition of Community Bank of Northern Wisconsin (Rice Lake, WI): $167 million in assets 2017 Acquisition of Wells Financial Corp. (Wells, MN): $256 million in assets 2018 Acquisition of United Bank (Osseo, WI): $315 million in assets 2019 Acquisition of F. & M. Bank (Tomah Wisconsin): $192 million in assets. Source: SEC filings; 17

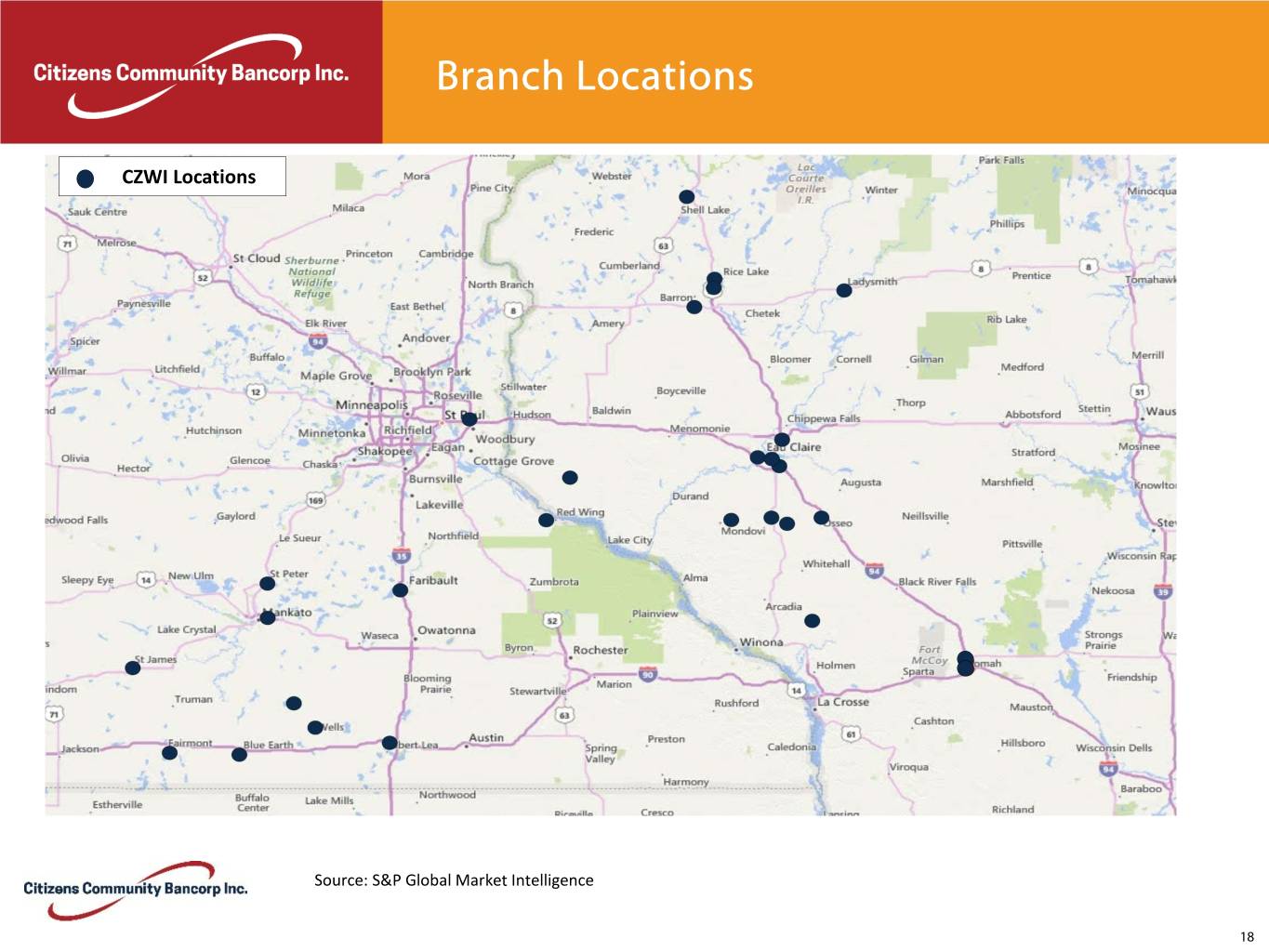

Branch Locations CZWI Locations Source: S&P Global Market Intelligence 18

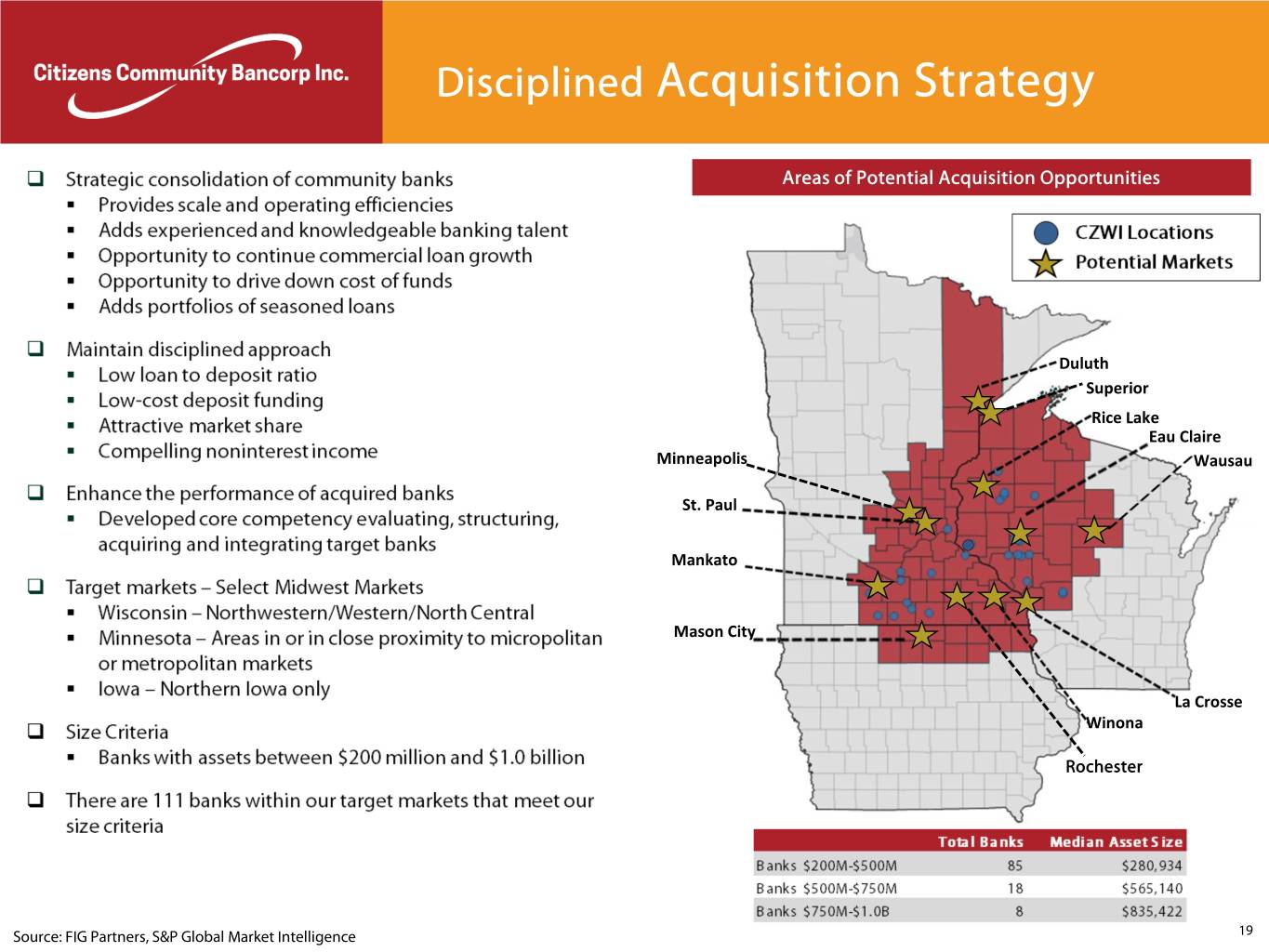

Disciplined Acquisition Strategy Areas of Potential Acquisition Opportunities Duluth Superior Rice Lake Eau Claire Minneapolis Wausau St. Paul Mankato Mason City La Crosse Winona Rochester Source: FIG Partners, S&P Global Market Intelligence 19

Appendix 20

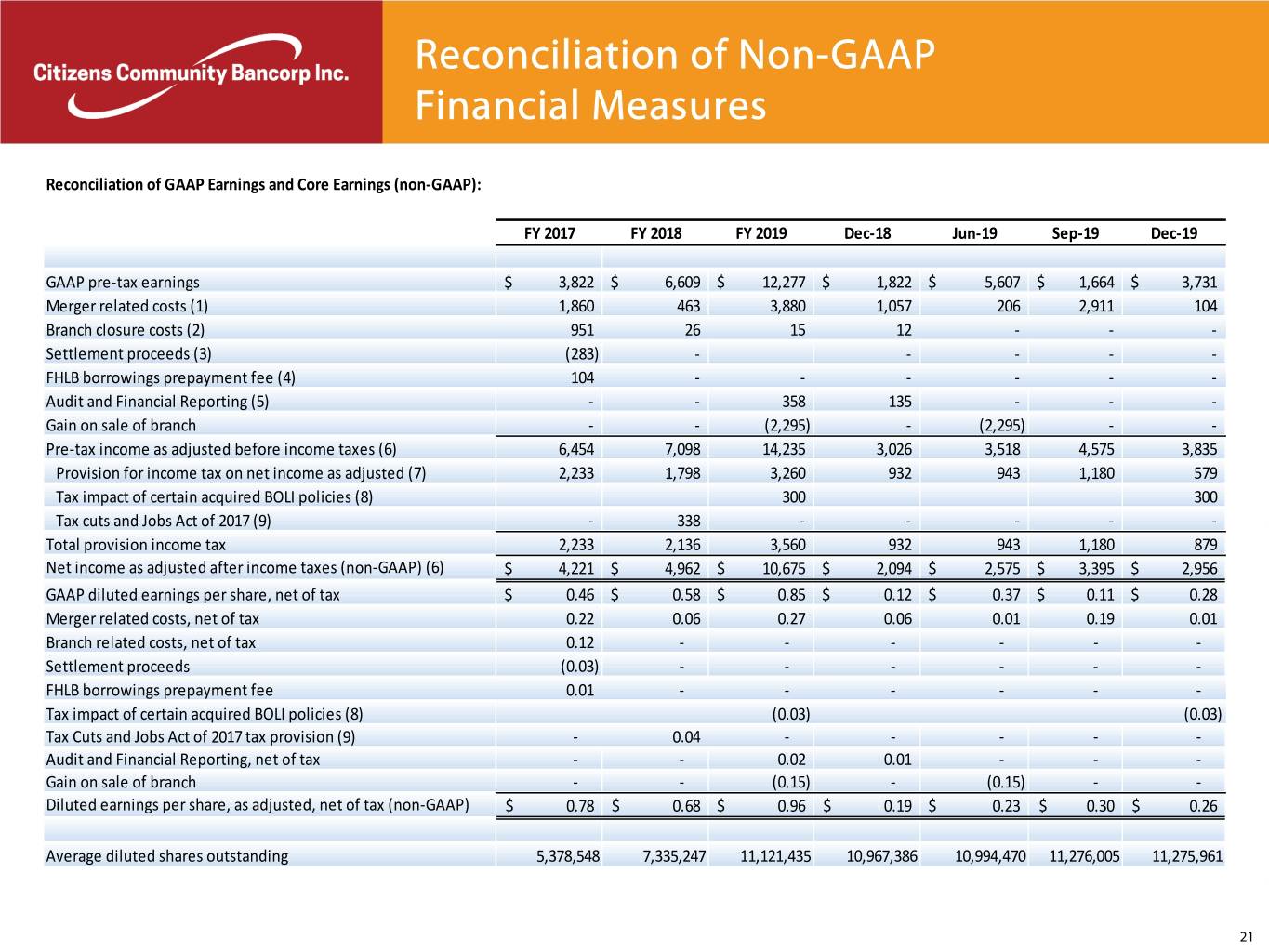

Reconciliation of Non-GAAP Financial Measures Reconciliation of GAAP Earnings and Core Earnings (non-GAAP): FY 2017 FY 2018 FY 2019 Dec-18 Jun-19 Sep-19 Dec-19 GAAP pre-tax earnings $ 3,822 $ 6,609 $ 12,277 $ 1,822 $ 5,607 $ 1,664 $ 3,731 Merger related costs (1) 1,860 463 3,880 1,057 206 2,911 104 Branch closure costs (2) 951 26 15 12 - - - Settlement proceeds (3) (283) - - - - - FHLB borrowings prepayment fee (4) 104 - - - - - - Audit and Financial Reporting (5) - - 358 135 - - - Gain on sale of branch - - (2,295) - (2,295) - - Pre-tax income as adjusted before income taxes (6) 6,454 7,098 14,235 3,026 3,518 4,575 3,835 Provision for income tax on net income as adjusted (7) 2,233 1,798 3,260 932 943 1,180 579 Tax impact of certain acquired BOLI policies (8) 300 300 Tax cuts and Jobs Act of 2017 (9) - 338 - - - - - Total provision income tax 2,233 2,136 3,560 932 943 1,180 879 Net income as adjusted after income taxes (non-GAAP) (6) $ 4,221 $ 4,962 $ 10,675 $ 2,094 $ 2,575 $ 3,395 $ 2,956 GAAP diluted earnings per share, net of tax $ 0.46 $ 0.58 $ 0.85 $ 0.12 $ 0.37 $ 0.11 $ 0.28 Merger related costs, net of tax 0.22 0.06 0.27 0.06 0.01 0.19 0.01 Branch related costs, net of tax 0.12 - - - - - - Settlement proceeds (0.03) - - - - - - FHLB borrowings prepayment fee 0.01 - - - - - - Tax impact of certain acquired BOLI policies (8) (0.03) (0.03) Tax Cuts and Jobs Act of 2017 tax provision (9) - 0.04 - - - - - Audit and Financial Reporting, net of tax - - 0.02 0.01 - - - Gain on sale of branch - - (0.15) - (0.15) - - Diluted earnings per share, as adjusted, net of tax (non-GAAP) $ 0.78 $ 0.68 $ 0.96 $ 0.19 $ 0.23 $ 0.30 $ 0.26 Average diluted shares outstanding 5,378,548 7,335,247 11,121,435 10,967,386 10,994,470 11,276,005 11,275,961 21

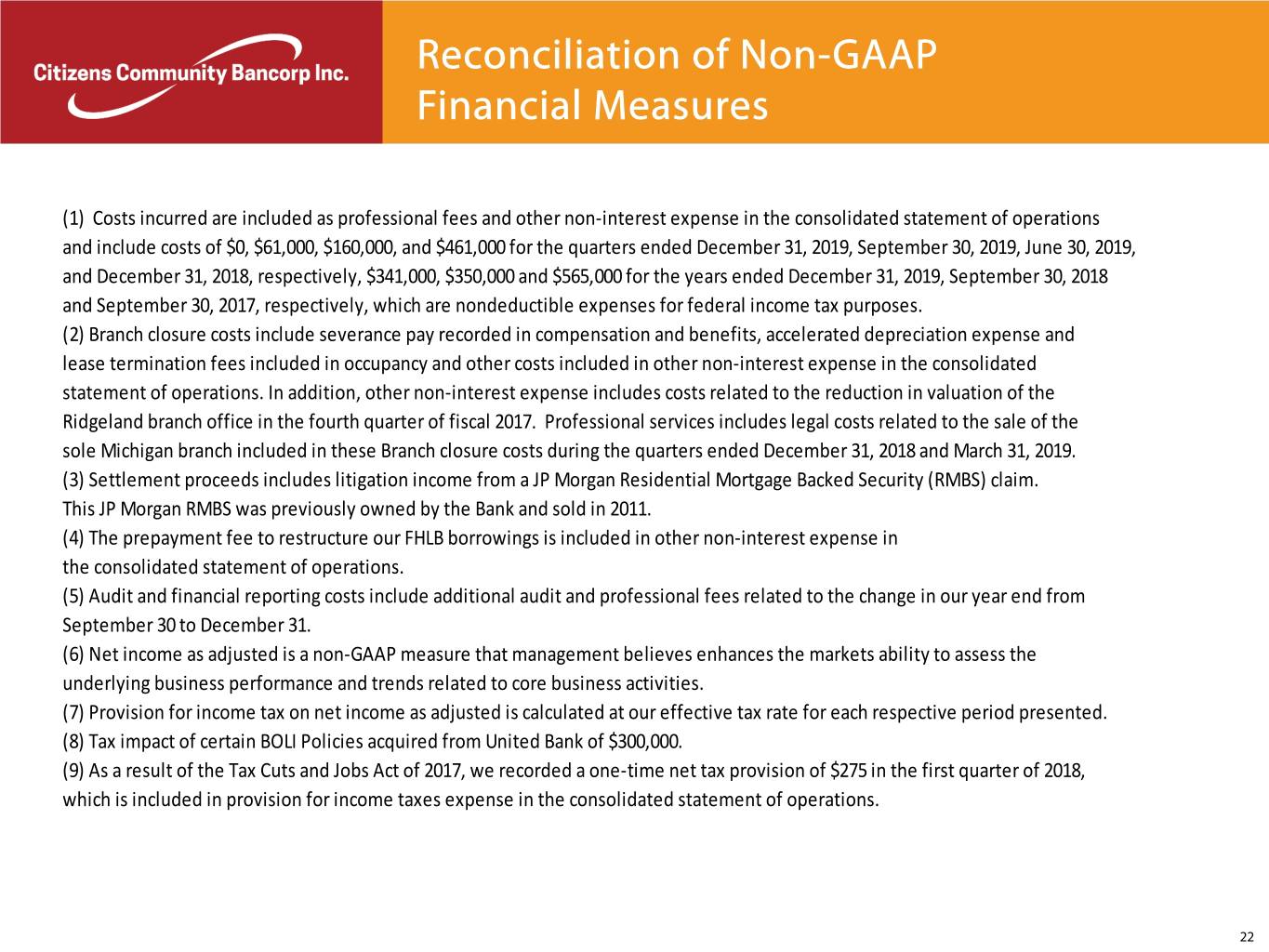

Reconciliation of Non-GAAP Financial Measures (1) Costs incurred are included as professional fees and other non-interest expense in the consolidated statement of operations and include costs of $0, $61,000, $160,000, and $461,000 for the quarters ended December 31, 2019, September 30, 2019, June 30, 2019, and December 31, 2018, respectively, $341,000, $350,000 and $565,000 for the years ended December 31, 2019, September 30, 2018 and September 30, 2017, respectively, which are nondeductible expenses for federal income tax purposes. (2) Branch closure costs include severance pay recorded in compensation and benefits, accelerated depreciation expense and lease termination fees included in occupancy and other costs included in other non-interest expense in the consolidated statement of operations. In addition, other non-interest expense includes costs related to the reduction in valuation of the Ridgeland branch office in the fourth quarter of fiscal 2017. Professional services includes legal costs related to the sale of the sole Michigan branch included in these Branch closure costs during the quarters ended December 31, 2018 and March 31, 2019. (3) Settlement proceeds includes litigation income from a JP Morgan Residential Mortgage Backed Security (RMBS) claim. This JP Morgan RMBS was previously owned by the Bank and sold in 2011. (4) The prepayment fee to restructure our FHLB borrowings is included in other non-interest expense in the consolidated statement of operations. (5) Audit and financial reporting costs include additional audit and professional fees related to the change in our year end from September 30 to December 31. (6) Net income as adjusted is a non-GAAP measure that management believes enhances the markets ability to assess the underlying business performance and trends related to core business activities. (7) Provision for income tax on net income as adjusted is calculated at our effective tax rate for each respective period presented. (8) Tax impact of certain BOLI Policies acquired from United Bank of $300,000. (9) As a result of the Tax Cuts and Jobs Act of 2017, we recorded a one-time net tax provision of $275 in the first quarter of 2018, which is included in provision for income taxes expense in the consolidated statement of operations. 22

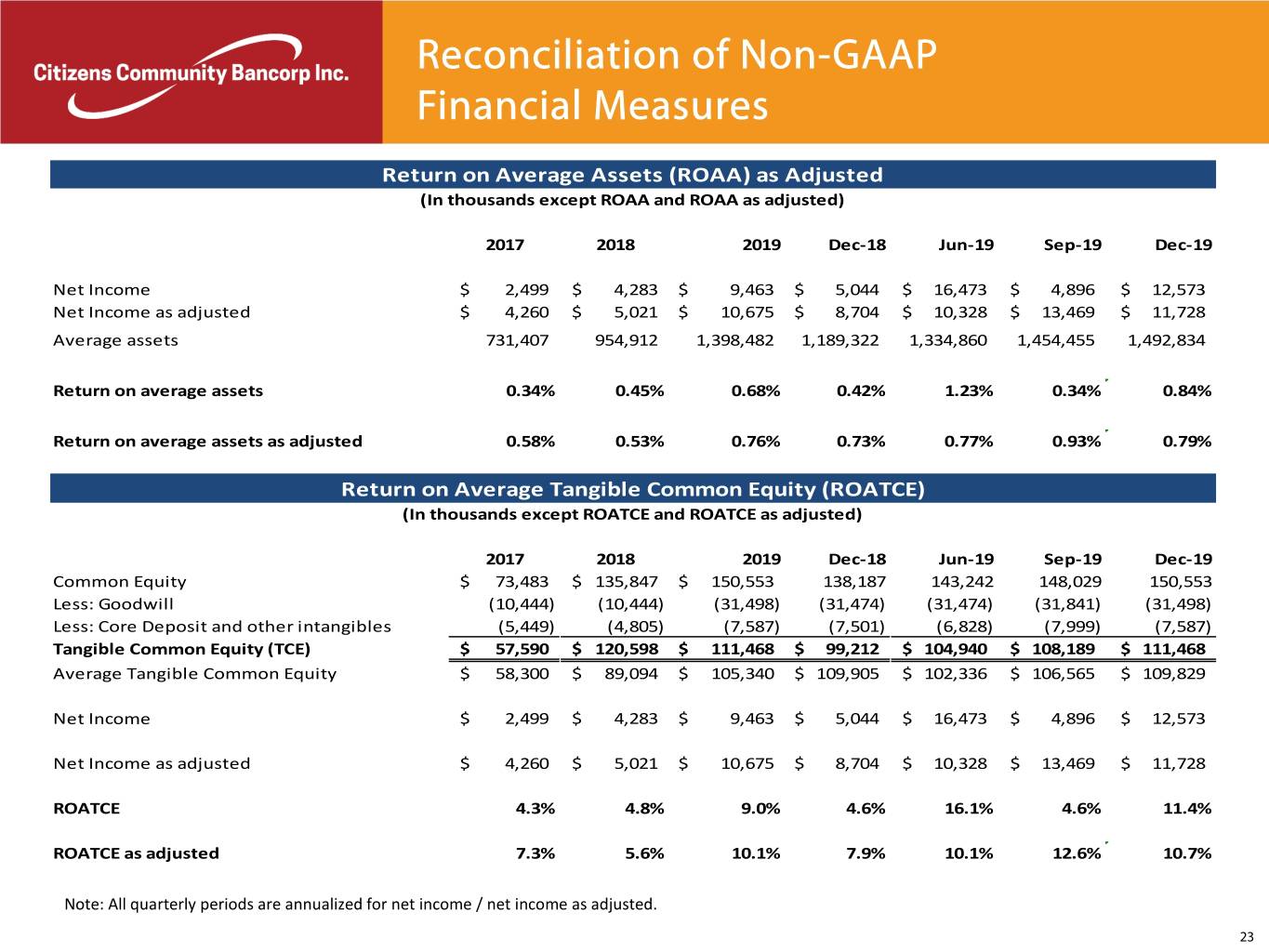

Reconciliation of Non-GAAP Financial Measures Return on Average Assets (ROAA) as Adjusted (In thousands except ROAA and ROAA as adjusted) 2017 2018 2019 Dec-18 Jun-19 Sep-19 Dec-19 Net Income $ 2,499 $ 4,283 $ 9,463 $ 5,044 $ 16,473 $ 4,896 $ 12,573 Net Income as adjusted $ 4,260 $ 5,021 $ 10,675 $ 8,704 $ 10,328 $ 13,469 $ 11,728 Average assets 731,407 954,912 1,398,482 1,189,322 1,334,860 1,454,455 1,492,834 Return on average assets 0.34% 0.45% 0.68% 0.42% 1.23% 0.34% 0.84% Return on average assets as adjusted 0.58% 0.53% 0.76% 0.73% 0.77% 0.93% 0.79% Return on Average Tangible Common Equity (ROATCE) (In thousands except ROATCE and ROATCE as adjusted) 2017 2018 2019 Dec-18 Jun-19 Sep-19 Dec-19 Common Equity $ 73,483 $ 135,847 $ 150,553 138,187 143,242 148,029 150,553 Less: Goodwill (10,444) (10,444) (31,498) (31,474) (31,474) (31,841) (31,498) Less: Core Deposit and other intangibles (5,449) (4,805) (7,587) (7,501) (6,828) (7,999) (7,587) Tangible Common Equity (TCE) $ 57,590 $ 120,598 $ 111,468 $ 99,212 $ 104,940 $ 108,189 $ 111,468 Average Tangible Common Equity $ 58,300 $ 89,094 $ 105,340 $ 109,905 $ 102,336 $ 106,565 $ 109,829 Net Income $ 2,499 $ 4,283 $ 9,463 $ 5,044 $ 16,473 $ 4,896 $ 12,573 Net Income as adjusted $ 4,260 $ 5,021 $ 10,675 $ 8,704 $ 10,328 $ 13,469 $ 11,728 ROATCE 4.3% 4.8% 9.0% 4.6% 16.1% 4.6% 11.4% ROATCE as adjusted 7.3% 5.6% 10.1% 7.9% 10.1% 12.6% 10.7% Note: All quarterly periods are annualized for net income / net income as adjusted. 23

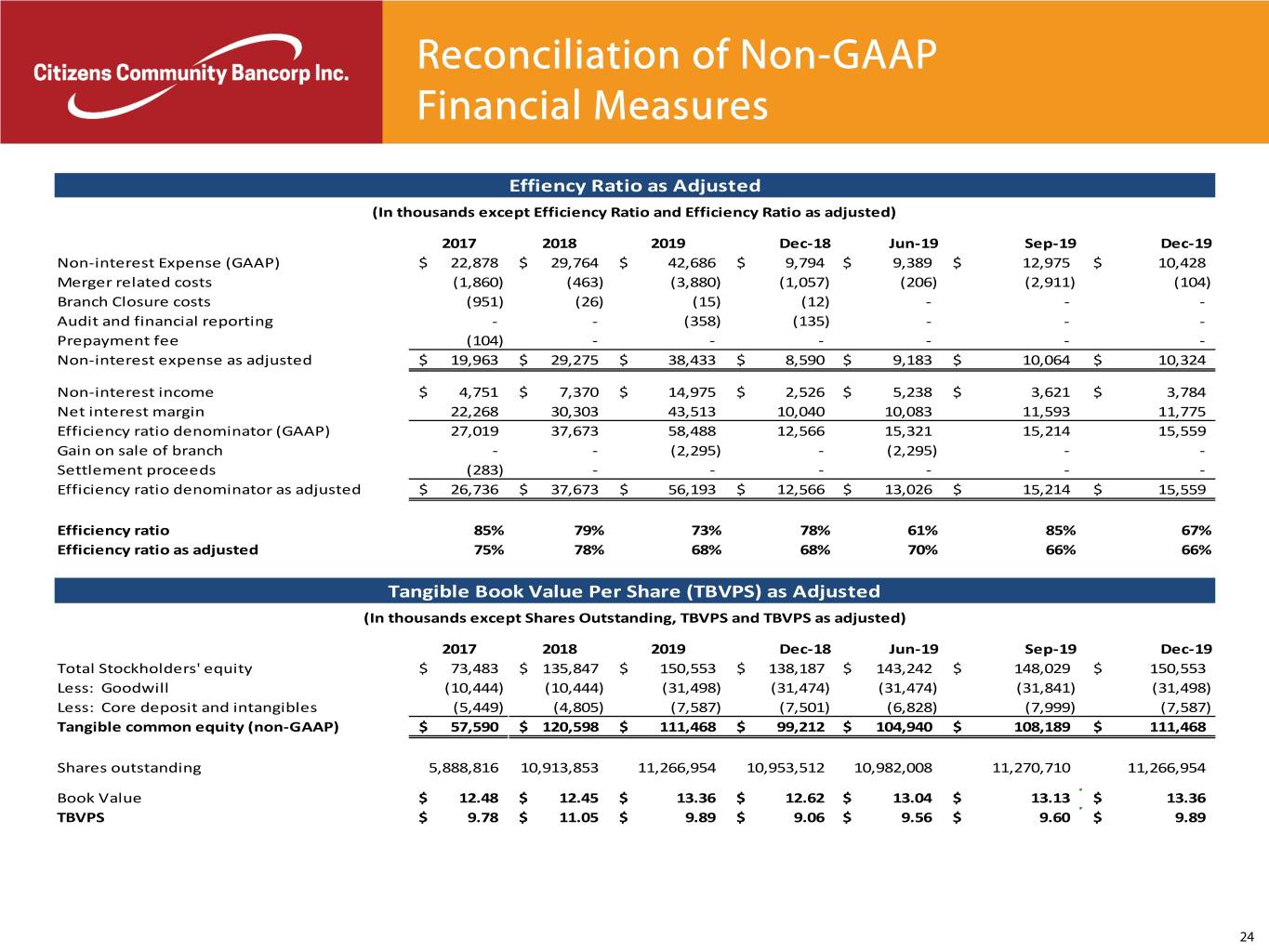

Reconciliation of Non-GAAP Financial Measures Effiency Ratio as Adjusted (In thousands except Efficiency Ratio and Efficiency Ratio as adjusted) 2017 2018 2019 Dec-18 Jun-19 Sep-19 Dec-19 Non-interest Expense (GAAP) $ 22,878 $ 29,764 $ 42,686 $ 9,794 $ 9,389 $ 12,975 $ 10,428 Merger related costs (1,860) (463) (3,880) (1,057) (206) (2,911) (104) Branch Closure costs (951) (26) (15) (12) - - - Audit and financial reporting - - (358) (135) - - - Prepayment fee (104) - - - - - - Non-interest expense as adjusted $ 19,963 $ 29,275 $ 38,433 $ 8,590 $ 9,183 $ 10,064 $ 10,324 Non-interest income $ 4,751 $ 7,370 $ 14,975 $ 2,526 $ 5,238 $ 3,621 $ 3,784 Net interest margin 22,268 30,303 43,513 10,040 10,083 11,593 11,775 Efficiency ratio denominator (GAAP) 27,019 37,673 58,488 12,566 15,321 15,214 15,559 Gain on sale of branch - - (2,295) - (2,295) - - Settlement proceeds (283) - - - - - - Efficiency ratio denominator as adjusted $ 26,736 $ 37,673 $ 56,193 $ 12,566 $ 13,026 $ 15,214 $ 15,559 Efficiency ratio 85% 79% 73% 78% 61% 85% 67% Efficiency ratio as adjusted 75% 78% 68% 68% 70% 66% 66% Tangible Book Value Per Share (TBVPS) as Adjusted (In thousands except Shares Outstanding, TBVPS and TBVPS as adjusted) 2017 2018 2019 Dec-18 Jun-19 Sep-19 Dec-19 Total Stockholders' equity $ 73,483 $ 135,847 $ 150,553 $ 138,187 $ 143,242 $ 148,029 $ 150,553 Less: Goodwill (10,444) (10,444) (31,498) (31,474) (31,474) (31,841) (31,498) Less: Core deposit and intangibles (5,449) (4,805) (7,587) (7,501) (6,828) (7,999) (7,587) Tangible common equity (non-GAAP) $ 57,590 $ 120,598 $ 111,468 $ 99,212 $ 104,940 $ 108,189 $ 111,468 Shares outstanding 5,888,816 10,913,853 11,266,954 10,953,512 10,982,008 11,270,710 11,266,954 Book Value $ 12.48 $ 12.45 $ 13.36 $ 12.62 $ 13.04 $ 13.13 $ 13.36 TBVPS $ 9.78 $ 11.05 $ 9.89 $ 9.06 $ 9.56 $ 9.60 $ 9.89 24