Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WSFS FINANCIAL CORP | wsfs-20200121.htm |

| EX-99.1 - EX-99.1 - WSFS FINANCIAL CORP | a8kexhibitearningsrele.htm |

WSFS Financial Exhibit 99.2 Corporation 4Q 2019 Earnings Release Supplement January 21, 2020

Forward Looking Statements and Non-GAAP Financial Measures Forward Looking Statements This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. The words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify forward-looking statements. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company's control) and are subject to risks and uncertainties (which change over time) and other factors which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties are discussed in detail the Company's Form 10-K for the year ended December 31, 2018 and other documents filed by the Company with the Securities and Exchange Commission from time to time. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date on which they are made, and the Company disclaims any duty to revise or update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company for any reason, except as specifically required by law. As used in this presentation, the terms "WSFS," "the Company," "registrant," "we," "us," and "our" mean WSFS Financial Corporation and its subsidiaries, on a consolidated basis, unless the context indicates otherwise. Non-GAAP Financial Measures This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP measures include core noninterest (fee) income, core efficiency ratio, core effective tax rate, tangible common equity to asset ratio, and core return on average assets. The Company’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Company’s management believes that investors may use these non-GAAP measures to analyze the Company’s financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. For a reconciliation of these non- GAAP measures to their comparable GAAP measures, see our Earnings Release filed as Exhibit 99.1 to our January 22, 2020 8-K filing. 2

Table of Contents 2020 Core Outlook Page 4 Strategic Plan Update Page 5 Delivery Transformation Page 6 CECL Adoption Page 8 2019 Core Results Page 10 Loan and Deposit Growth & Net Interest Margin Page 11 3

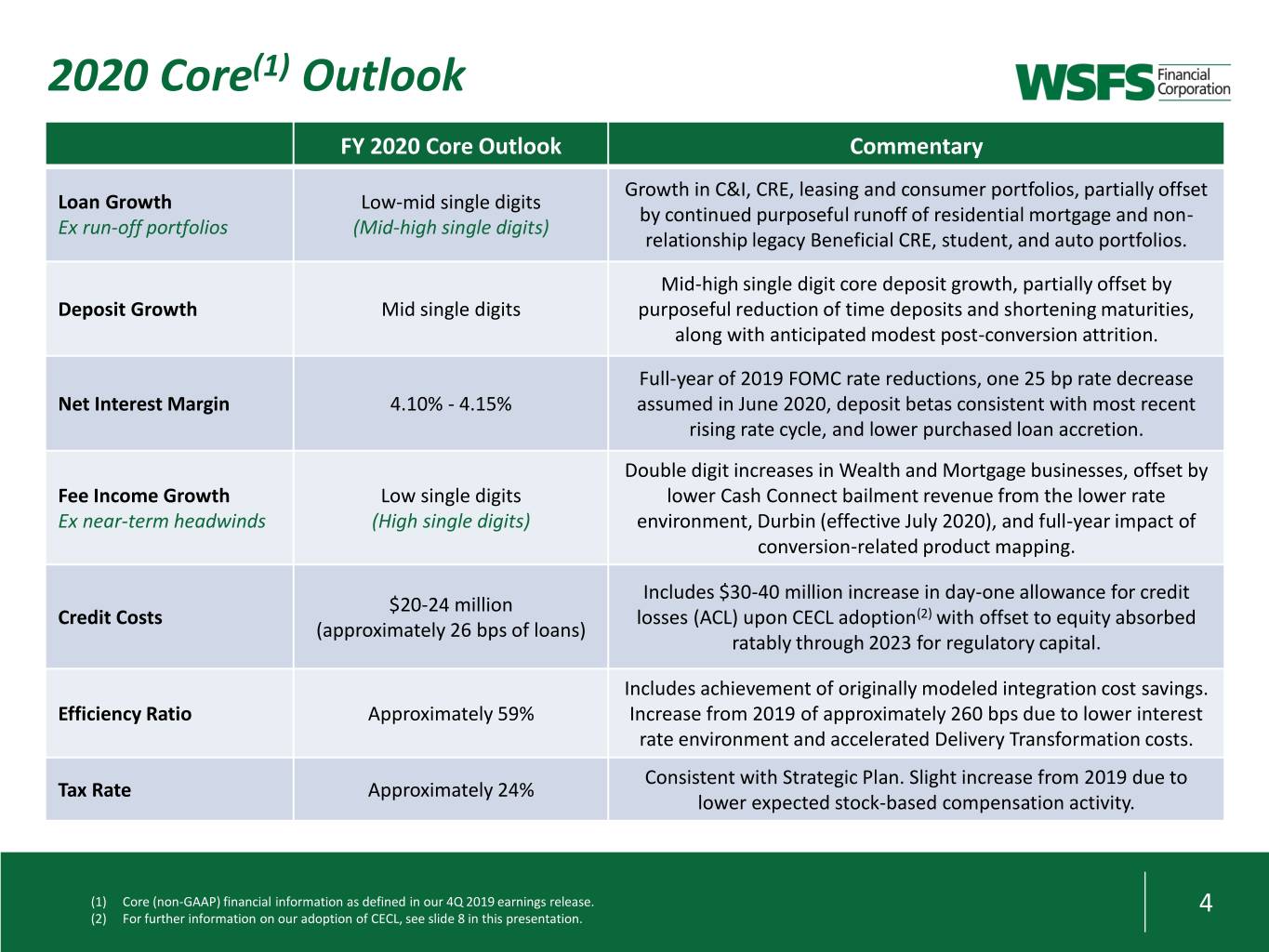

2020 Core(1) Outlook FY 2020 Core Outlook Commentary Growth in C&I, CRE, leasing and consumer portfolios, partially offset Loan Growth Low-mid single digits by continued purposeful runoff of residential mortgage and non- Ex run-off portfolios (Mid-high single digits) relationship legacy Beneficial CRE, student, and auto portfolios. Mid-high single digit core deposit growth, partially offset by Deposit Growth Mid single digits purposeful reduction of time deposits and shortening maturities, along with anticipated modest post-conversion attrition. Full-year of 2019 FOMC rate reductions, one 25 bp rate decrease Net Interest Margin 4.10% - 4.15% assumed in June 2020, deposit betas consistent with most recent rising rate cycle, and lower purchased loan accretion. Double digit increases in Wealth and Mortgage businesses, offset by Fee Income Growth Low single digits lower Cash Connect bailment revenue from the lower rate Ex near-term headwinds (High single digits) environment, Durbin (effective July 2020), and full-year impact of conversion-related product mapping. Includes $30-40 million increase in day-one allowance for credit $20-24 million Credit Costs losses (ACL) upon CECL adoption(2) with offset to equity absorbed (approximately 26 bps of loans) ratably through 2023 for regulatory capital. Includes achievement of originally modeled integration cost savings. Efficiency Ratio Approximately 59% Increase from 2019 of approximately 260 bps due to lower interest rate environment and accelerated Delivery Transformation costs. Consistent with Strategic Plan. Slight increase from 2019 due to Tax Rate Approximately 24% lower expected stock-based compensation activity. (1) Core (non-GAAP) financial information as defined in our 4Q 2019 earnings release. 4 (2) For further information on our adoption of CECL, see slide 8 in this presentation.

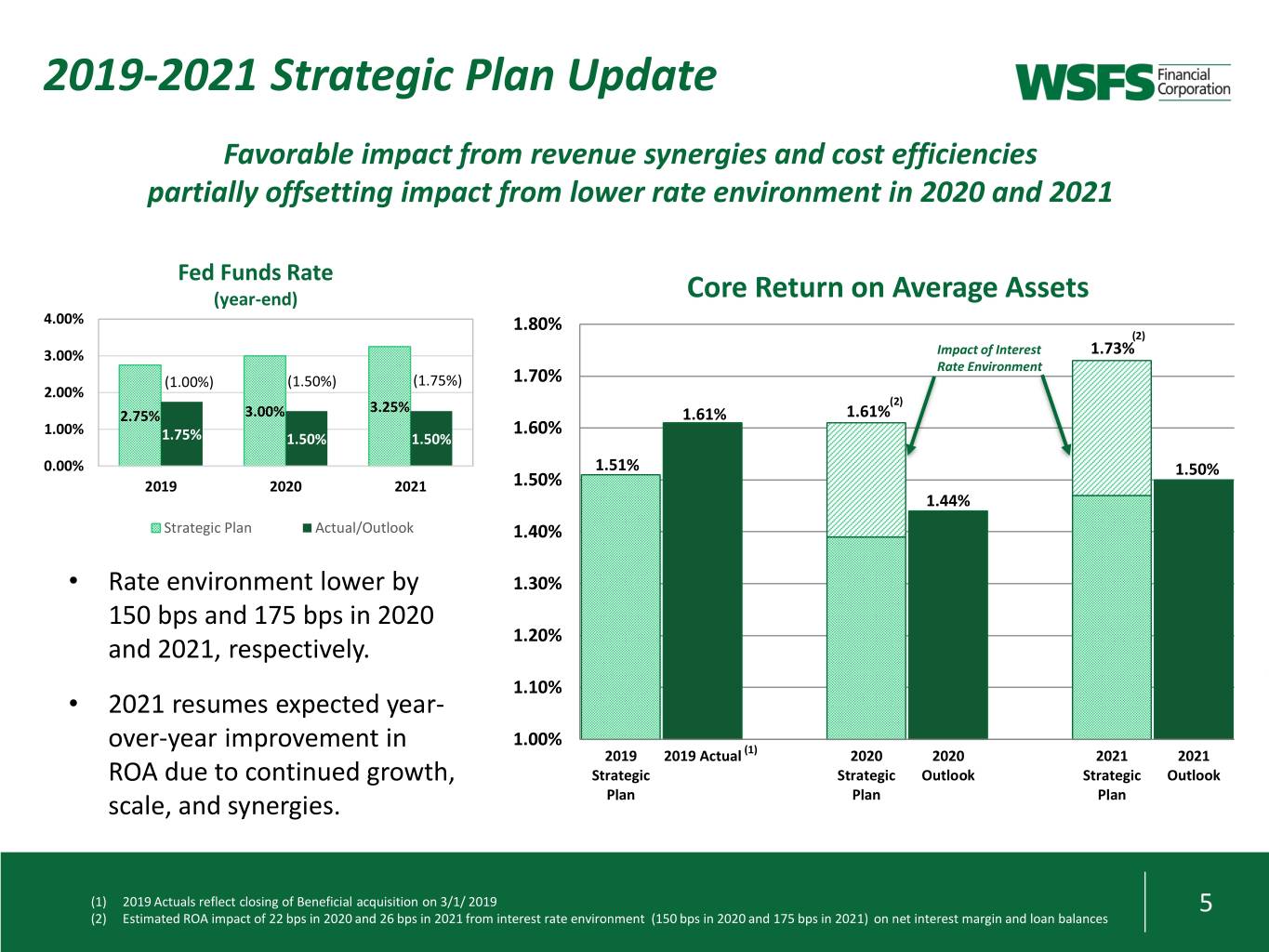

2019-2021 Strategic Plan Update Favorable impact from revenue synergies and cost efficiencies partially offsetting impact from lower rate environment in 2020 and 2021 Fed Funds Rate (year-end) Core Return on Average Assets 4.00% 1.80% (2) 3.00% Impact of Interest 1.73% Rate Environment (1.00%) (1.50%) (1.75%) 1.70% 2.00% 3.25% (2) 2.75% 3.00% 1.61% 1.61% 1.00% 1.60% 1.75% 1.50% 1.50% 0.00% 1.51% 1.50% 2019 2020 2021 1.50% 1.44% Strategic Plan Actual/Outlook 1.40% • Rate environment lower by 1.30% 150 bps and 175 bps in 2020 1.20% and 2021, respectively. 1.10% • 2021 resumes expected year- over-year improvement in 1.00% 2019 2019 Actual (1) 2020 2020 2021 2021 ROA due to continued growth, Strategic Strategic Outlook Strategic Outlook scale, and synergies. Plan Plan Plan (1) 2019 Actuals reflect closing of Beneficial acquisition on 3/1/ 2019 5 (2) Estimated ROA impact of 22 bps in 2020 and 26 bps in 2021 from interest rate environment (150 bps in 2020 and 175 bps in 2021) on net interest margin and loan balances

Delivery Transformation Strategy to meld physical and digital delivery, consistent with our brand, by enabling our Associates with the latest technology and actionable data to better serve our Customers. Initial investment will be accelerated to 3 years based on the continued rapid evolution of technology and the opportunity to enhance Customer experience and operational efficiencies, accelerating ROI. 2019 Review ✓ Established strategic objectives for Delivery Transformation ✓ Finalized program roadmap with prominent consulting firm ✓ Hired Chief Digital Officer and identified resource needs for Delivery Transformation team ✓ Launched pilot of ®, a highly personalized messaging application that securely connects WSFS Customers to their selected live Personal Banker ✓ Completed the redesign of WSFSbank.com; early observations indicate a 100% increase in user activity while using the website ✓ Introduced Zelle® for mobile payments 6

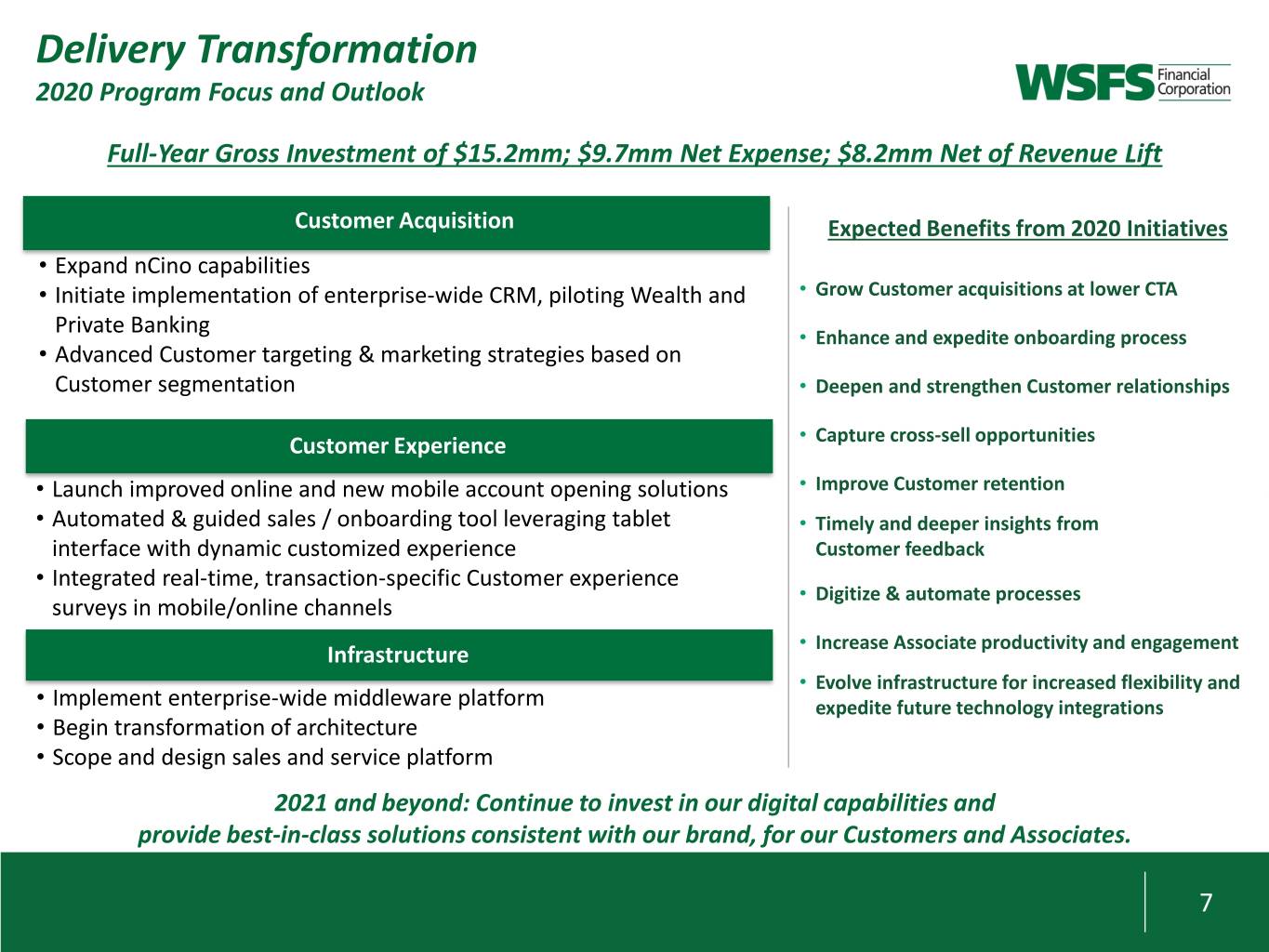

Delivery Transformation 2020 Program Focus and Outlook Full-Year Gross Investment of $15.2mm; $9.7mm Net Expense; $8.2mm Net of Revenue Lift Customer Acquisition Expected Benefits from 2020 Initiatives • Expand nCino capabilities • Initiate implementation of enterprise-wide CRM, piloting Wealth and • Grow Customer acquisitions at lower CTA Private Banking • Enhance and expedite onboarding process • Advanced Customer targeting & marketing strategies based on Customer segmentation • Deepen and strengthen Customer relationships Customer Experience • Capture cross-sell opportunities • Launch improved online and new mobile account opening solutions • Improve Customer retention • Automated & guided sales / onboarding tool leveraging tablet • Timely and deeper insights from interface with dynamic customized experience Customer feedback • Integrated real-time, transaction-specific Customer experience • Digitize & automate processes surveys in mobile/online channels • Increase Associate productivity and engagement Infrastructure • Evolve infrastructure for increased flexibility and • Implement enterprise-wide middleware platform expedite future technology integrations • Begin transformation of architecture • Scope and design sales and service platform 2021 and beyond: Continue to invest in our digital capabilities and provide best-in-class solutions consistent with our brand, for our Customers and Associates. 7

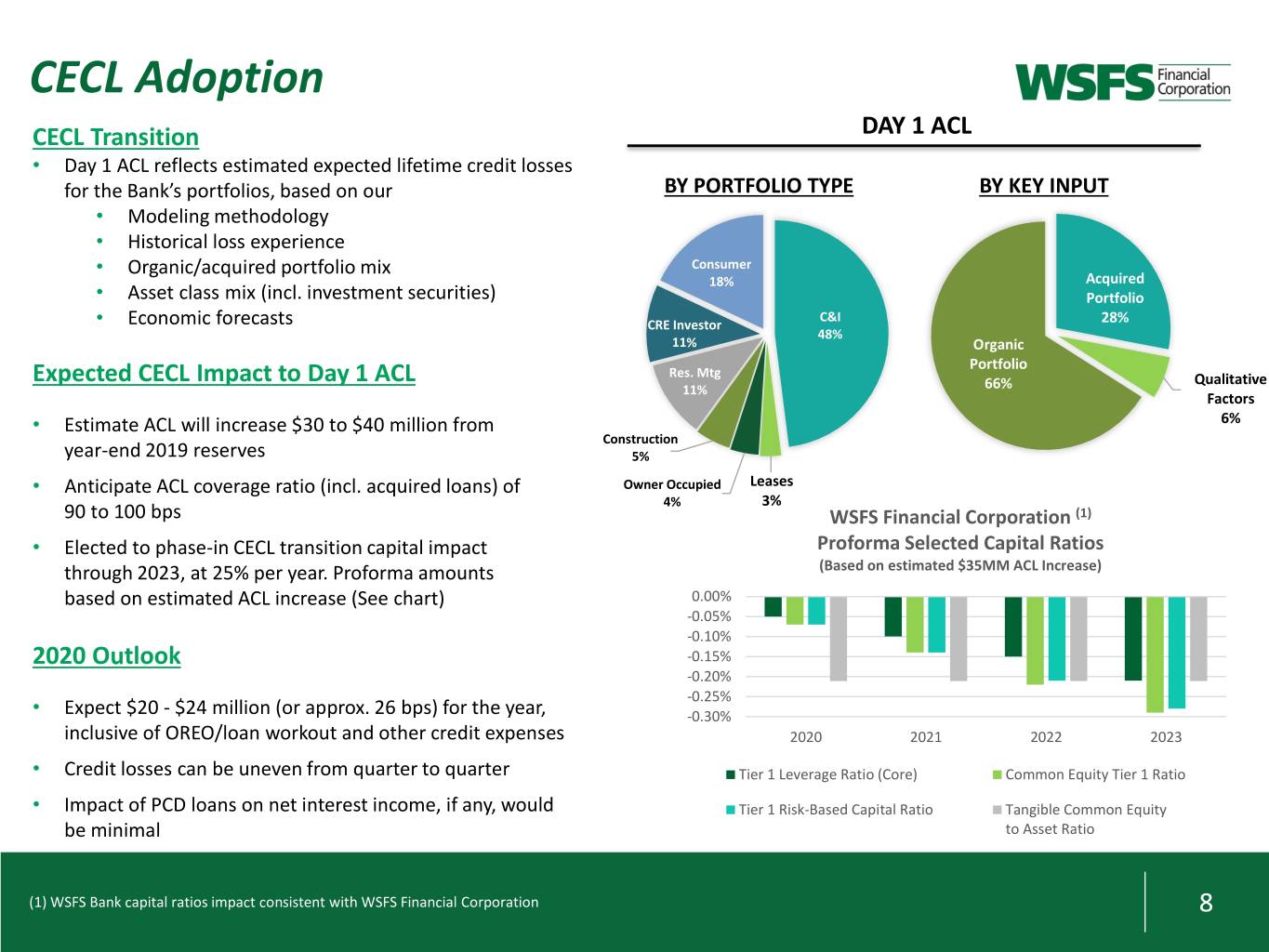

CECL Adoption CECL Transition DAY 1 ACL • Day 1 ACL reflects estimated expected lifetime credit losses for the Bank’s portfolios, based on our BY PORTFOLIO TYPE BY KEY INPUT • Modeling methodology • Historical loss experience • Organic/acquired portfolio mix Consumer 18% Acquired • Asset class mix (incl. investment securities) Portfolio C&I • Economic forecasts CRE Investor 28% 48% 11% Organic Portfolio Expected CECL Impact to Day 1 ACL Res. Mtg Qualitative 11% 66% Factors • Estimate ACL will increase $30 to $40 million from 6% Construction year-end 2019 reserves 5% • Anticipate ACL coverage ratio (incl. acquired loans) of Owner Occupied Leases 4% 3% 90 to 100 bps WSFS Financial Corporation (1) • Elected to phase-in CECL transition capital impact Proforma Selected Capital Ratios through 2023, at 25% per year. Proforma amounts (Based on estimated $35MM ACL Increase) based on estimated ACL increase (See chart) 0.00% -0.05% -0.10% 2020 Outlook -0.15% -0.20% -0.25% • Expect $20 - $24 million (or approx. 26 bps) for the year, -0.30% inclusive of OREO/loan workout and other credit expenses 2020 2021 2022 2023 • Credit losses can be uneven from quarter to quarter Tier 1 Leverage Ratio (Core) Common Equity Tier 1 Ratio • Impact of PCD loans on net interest income, if any, would Tier 1 Risk-Based Capital Ratio Tangible Common Equity be minimal to Asset Ratio (1) WSFS Bank capital ratios impact consistent with WSFS Financial Corporation 8

2019 Results

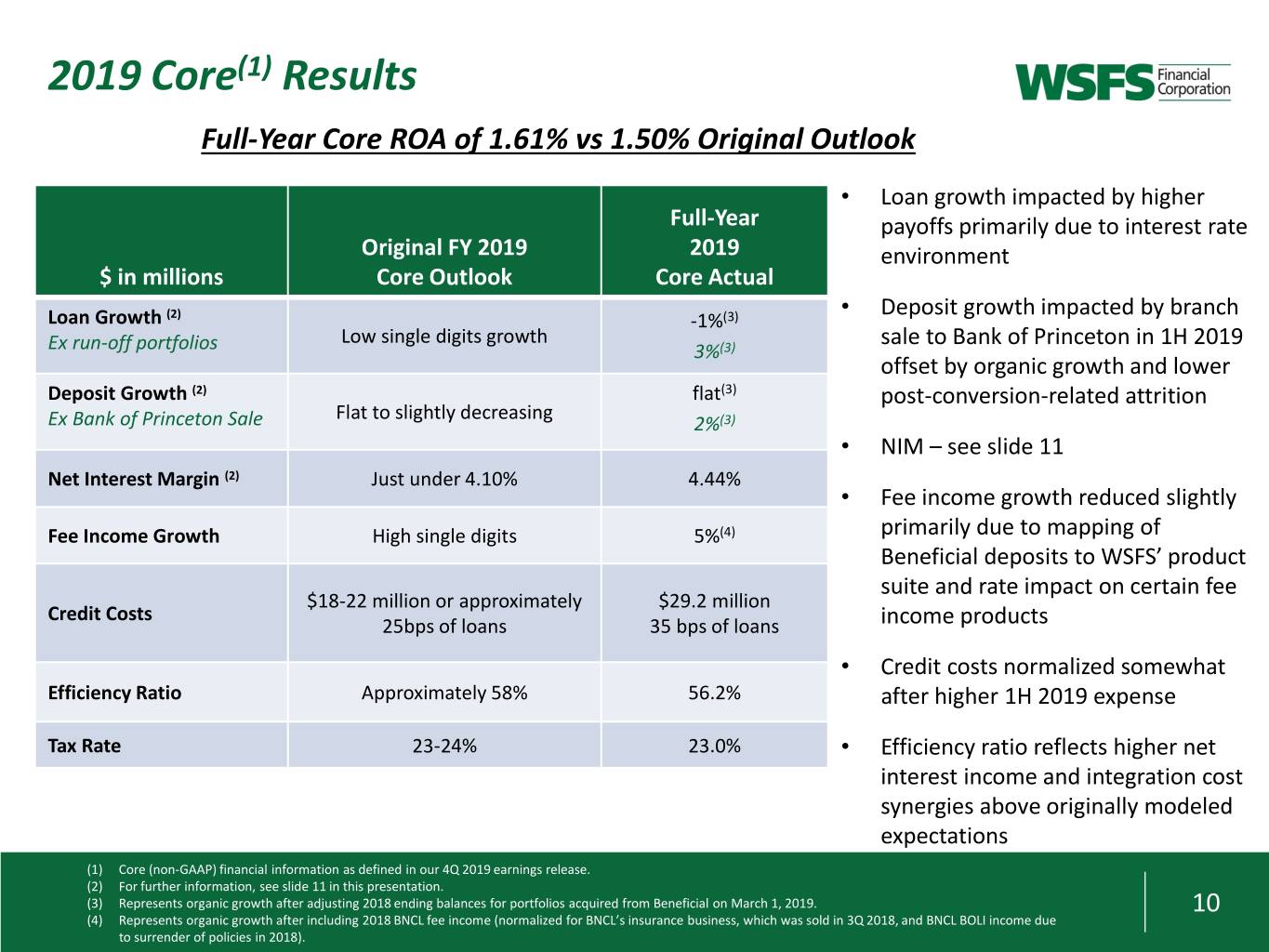

2019 Core(1) Results Full-Year Core ROA of 1.61% vs 1.50% Original Outlook • Loan growth impacted by higher Full-Year payoffs primarily due to interest rate Original FY 2019 2019 environment $ in millions Core Outlook Core Actual • Deposit growth impacted by branch Loan Growth (2) -1%(3) Low single digits growth sale to Bank of Princeton in 1H 2019 Ex run-off portfolios 3%(3) offset by organic growth and lower Deposit Growth (2) flat(3) post-conversion-related attrition Flat to slightly decreasing Ex Bank of Princeton Sale 2%(3) • NIM – see slide 11 Net Interest Margin (2) Just under 4.10% 4.44% • Fee income growth reduced slightly Fee Income Growth High single digits 5%(4) primarily due to mapping of Beneficial deposits to WSFS’ product suite and rate impact on certain fee $18-22 million or approximately $29.2 million Credit Costs 25bps of loans 35 bps of loans income products • Credit costs normalized somewhat Efficiency Ratio Approximately 58% 56.2% after higher 1H 2019 expense Tax Rate 23-24% 23.0% • Efficiency ratio reflects higher net interest income and integration cost synergies above originally modeled expectations (1) Core (non-GAAP) financial information as defined in our 4Q 2019 earnings release. (2) For further information, see slide 11 in this presentation. (3) Represents organic growth after adjusting 2018 ending balances for portfolios acquired from Beneficial on March 1, 2019. 10 (4) Represents organic growth after including 2018 BNCL fee income (normalized for BNCL’s insurance business, which was sold in 3Q 2018, and BNCL BOLI income due to surrender of policies in 2018).

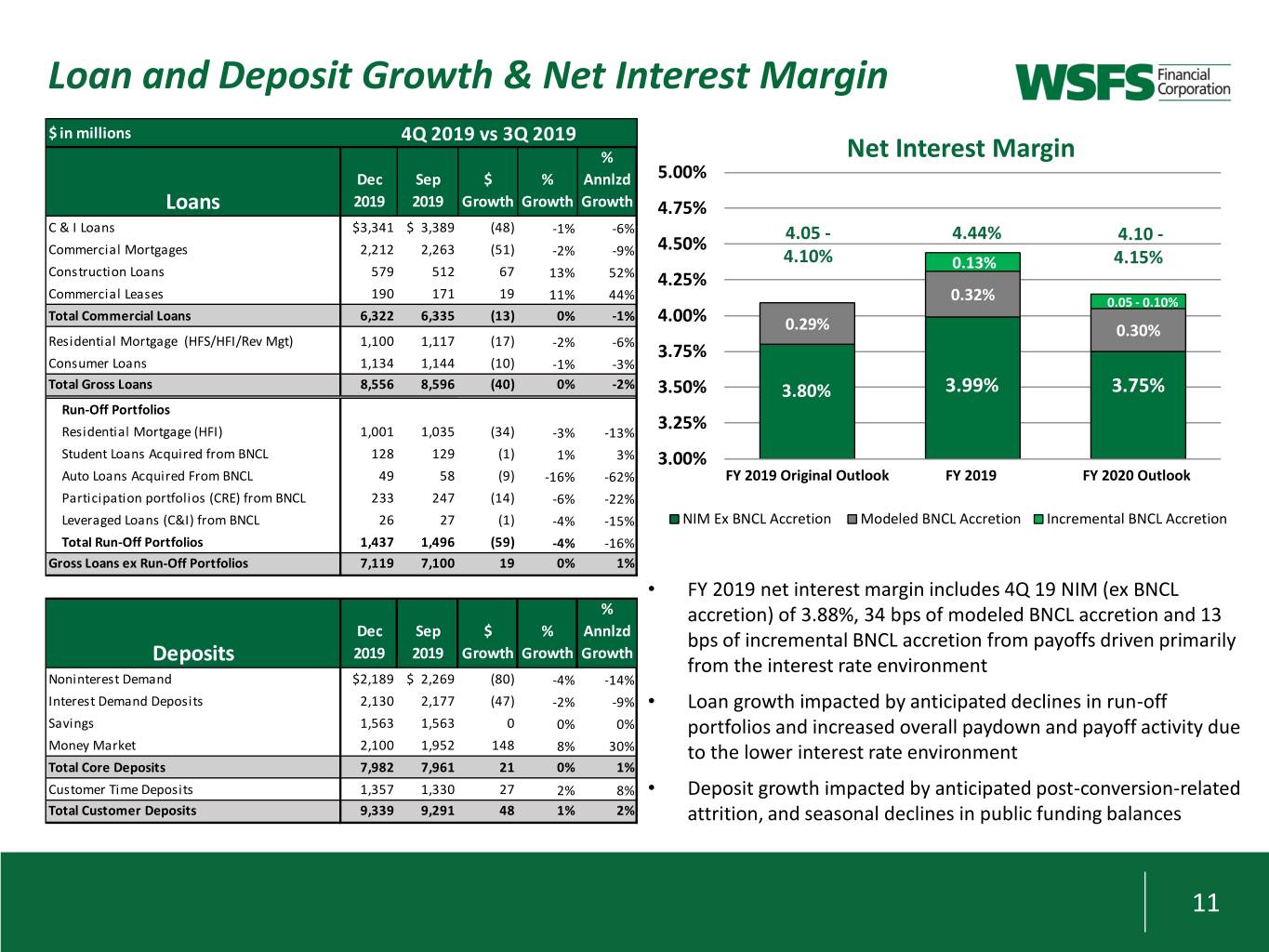

Loan and Deposit Growth & Net Interest Margin $ in millions 4Q 2019 vs 3Q 2019 % Net Interest Margin Dec Sep $ % Annlzd 5.00% Loans 2019 2019 Growth Growth Growth 4.75% C & I Loans $3,341 $ 3,389 (48) -1% -6% 4.05 - 4.44% 4.10 - Commercial Mortgages 2,212 2,263 (51) -2% -9% 4.50% 4.10% 0.13% 4.15% Construction Loans 579 512 67 13% 52% 4.25% Commercial Leases 190 171 19 11% 44% 0.32% 0.05 - 0.10% Total Commercial Loans 6,322 6,335 (13) 0% -1% 4.00% 0.29% 0.30% Residential Mortgage (HFS/HFI/Rev Mgt) 1,100 1,117 (17) -2% -6% 3.75% Consumer Loans 1,134 1,144 (10) -1% -3% Total Gross Loans 8,556 8,596 (40) 0% -2% 3.50% 3.80% 3.99% 3.75% Run-Off Portfolios 3.25% Residential Mortgage (HFI) 1,001 1,035 (34) -3% -13% Student Loans Acquired from BNCL 128 129 (1) 1% 3% 3.00% Auto Loans Acquired From BNCL 49 58 (9) -16% -62% FY 2019 Original Outlook FY 2019 FY 2020 Outlook Participation portfolios (CRE) from BNCL 233 247 (14) -6% -22% Leveraged Loans (C&I) from BNCL 26 27 (1) -4% -15% NIM Ex BNCL Accretion Modeled BNCL Accretion Incremental BNCL Accretion Total Run-Off Portfolios 1,437 1,496 (59) -4% -16% Gross Loans ex Run-Off Portfolios 7,119 7,100 19 0% 1% • FY 2019 net interest margin includes 4Q 19 NIM (ex BNCL % accretion) of 3.88%, 34 bps of modeled BNCL accretion and 13 Dec Sep $ % Annlzd bps of incremental BNCL accretion from payoffs driven primarily Deposits 2019 2019 Growth Growth Growth from the interest rate environment Noninterest Demand $2,189 $ 2,269 (80) -4% -14% Interest Demand Deposits 2,130 2,177 (47) -2% -9% • Loan growth impacted by anticipated declines in run-off Savings 1,563 1,563 0 0% 0% portfolios and increased overall paydown and payoff activity due Money Market 2,100 1,952 148 8% 30% to the lower interest rate environment Total Core Deposits 7,982 7,961 21 0% 1% Customer Time Deposits 1,357 1,330 27 2% 8% • Deposit growth impacted by anticipated post-conversion-related Total Customer Deposits 9,339 9,291 48 1% 2% attrition, and seasonal declines in public funding balances 11

Stockholders or others seeking information regarding the Company may call or write: WSFS Financial Corporation Investor Relations WSFS Bank Center 500 Delaware Avenue Wilmington, DE 19801 302-792-6009 stockholderrelations@wsfsbank.com www.wsfsbank.com Rodger Levenson Dominic C. Canuso President and CEO Chief Financial Officer 302-571-7296 302-571-6833 rlevenson@wsfsbank.com dcanuso@wsfsbank.com 12