Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mediaco Holding Inc. | ck0001784254-8k_20200121.htm |

MediaCo Holding Inc. Investor Presentation January 2020

Safe Harbor / Forward-Looking Statements Certain statements included in this presentation which are not statements of historical fact, including but not limited to the preliminary full year pro forma financial information for 2019 and the budgeted financial information for 2020, as well as those identified with the words “expect,” “should,” “will” or “look,” are intended to be, and are, by this disclaimer, identified as “forward-looking statements,” as defined in the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future result, performance or achievement expressed or implied by such forward-looking statement. Such factors include, among others: our relationship with Emmis Communication Corporation and Emmis Operating Company’s ability to effectively manage our operations; potential conflicts of interest with S.G. Broadcasting and our status as a “controlled company”; our ability to operate as a standalone public company and to execute on our business strategy; our ability to compete with, and integrate into our operations, new media channels, such as digital video, YouTube, and real-time media delivery; our ability to continue to exchange advertising time for goods or services; our ability to use market research, advertising and promotions to attract and retain audiences; U.S. regulatory requirements for owning and operating media broadcasting channels and our ability to maintain regulatory licenses granted by the FCC; industry and economic trends within the U.S. radio industry; our ability to finance our operations or to obtain financing on terms that are favorable to MediaCo; our ability to successfully complete and integrate any future acquisitions; the accuracy of management’s estimates and assumptions on which our financial projections are based; and other factors mentioned in documents that we file with the Securities and Exchange Commission. We do not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or otherwise.

MediaCo Holding Inc. MediaCo Holding Inc. (“MediaCo”) is a diversified media company currently operating in two segments: Radio Broadcasting Outdoor Advertising (i.e., Billboards) These businesses benefit from low capital intensity and high free cash flow conversion rates The Company’s strategy is to generate attractive shareholder returns via operational excellence, increased scale, and accretive acquisitions MediaCo’s M&A strategy is focused on smaller “off-the-run” opportunities which can be acquired at attractive prices in the private market and are expected to trade at higher valuations as part of a publicly-traded media platform

MediaCo Overview MediaCo Radio Outdoor Advertising

Radio Segment Overview MediaCo operates two radio stations in the highly coveted New York City metropolitan market WQHT-FM (Hot 97) and WBLS-FM Hot 97 is the #1 Hip-Hop station in New York Sponsor of Summer Jam, the largest hip-hop festival in the world WBLS is the #1 R&B station in New York MediaCo is the #3 radio broadcaster in New York City in both revenue and ratings Only iHeart Radio (six stations) and Entercom (seven stations) rank higher Source: Miller Kaplan YTD 12/19, Nielsen YTD 12/19

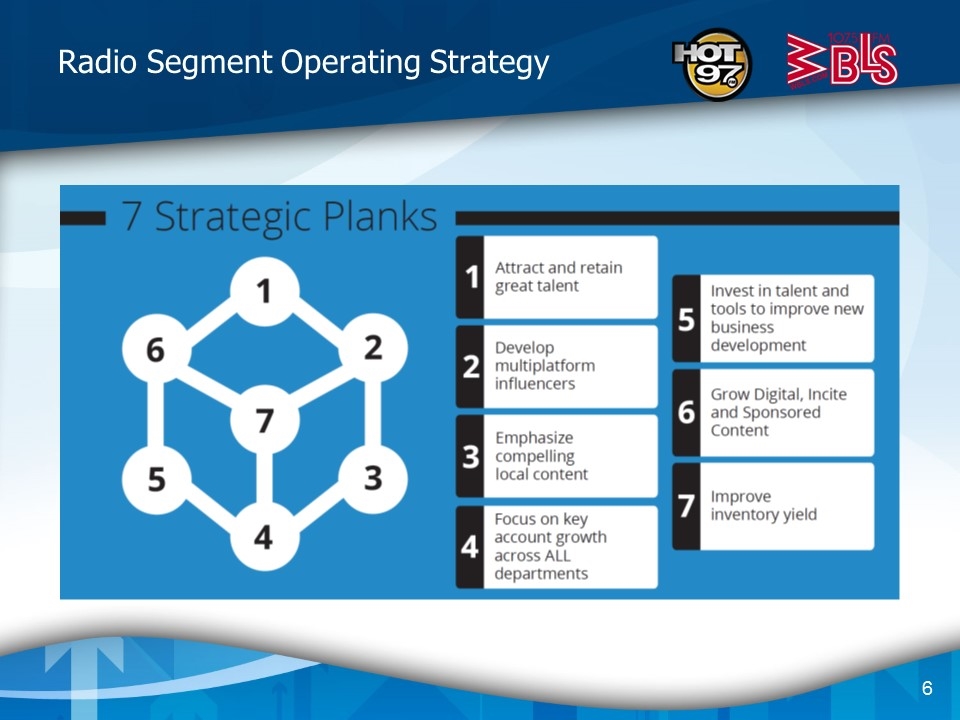

Radio Segment Operating Strategy

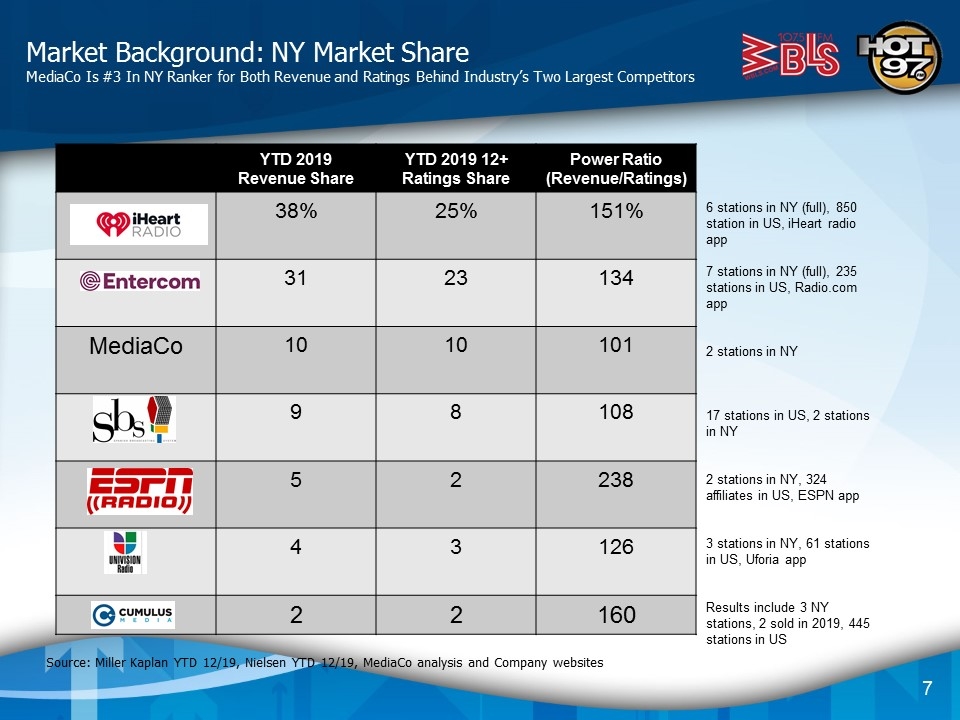

YTD 2019 Revenue Share YTD 2019 12+ Ratings Share Power Ratio (Revenue/Ratings) 38% 25% 151% 31 23 134 MediaCo 10 10 101 9 8 108 5 2 238 4 3 126 2 2 160 Market Background: NY Market Share MediaCo Is #3 In NY Ranker for Both Revenue and Ratings Behind Industry’s Two Largest Competitors Source: Miller Kaplan YTD 12/19, Nielsen YTD 12/19, MediaCo analysis and Company websites 6 stations in NY (full), 850 station in US, iHeart radio app 7 stations in NY (full), 235 stations in US, Radio.com app 2 stations in NY 17 stations in US, 2 stations in NY 2 stations in NY, 324 affiliates in US, ESPN app 3 stations in NY, 61 stations in US, Uforia app Results include 3 NY stations, 2 sold in 2019, 445 stations in US

Outdoor Advertising Segment Overview In December 2019 MediaCo purchased two outdoor advertising companies from Fairway Outdoor Advertising Group for approximately $43 million 2,205 faces in the Southeast (Valdosta) region 1,141 faces in Mid-Atlantic (Kentucky) region “Fairway Outdoor Advertising” trade name Select infrastructure assets Highly experienced Fairway managers to continue to run the business MediaCo believes this is a highly-scalable business model with attractive operative leverage

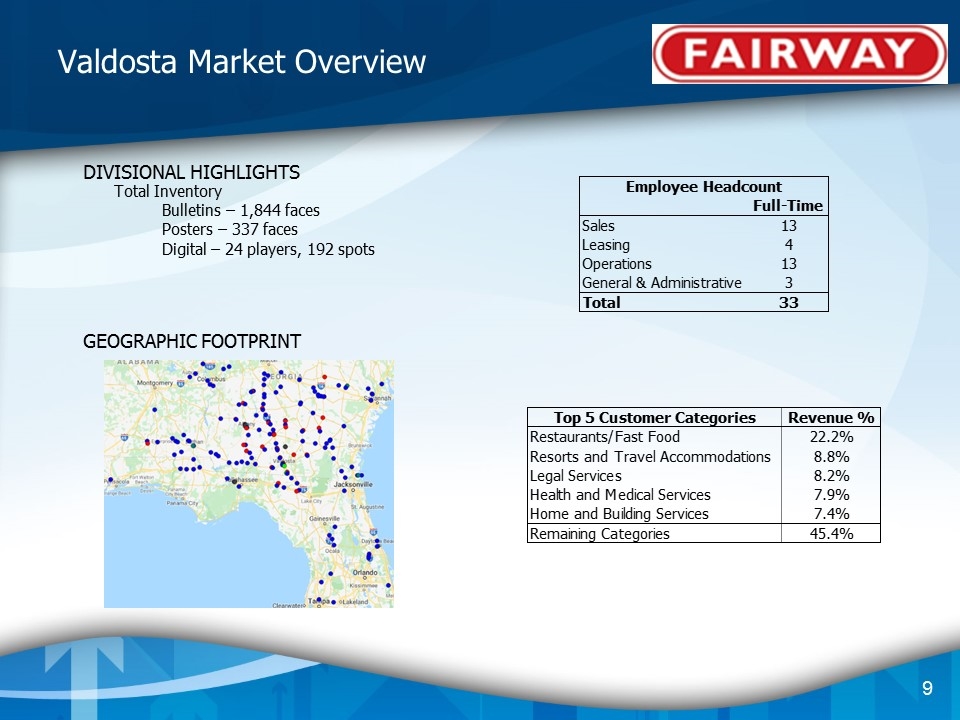

Valdosta Market Overview Total Inventory Bulletins – 1,844 faces Posters – 337 faces Digital – 24 players, 192 spots DIVISIONAL HIGHLIGHTS GEOGRAPHIC FOOTPRINT

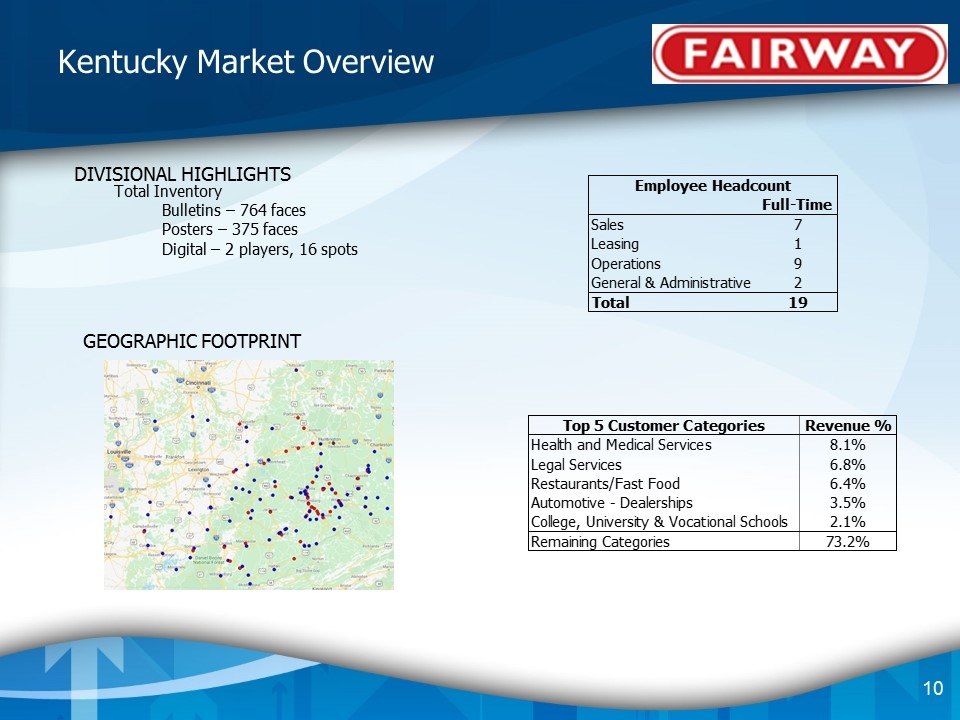

Kentucky Market Overview Total Inventory Bulletins – 764 faces Posters – 375 faces Digital – 2 players, 16 spots DIVISIONAL HIGHLIGHTS GEOGRAPHIC FOOTPRINT

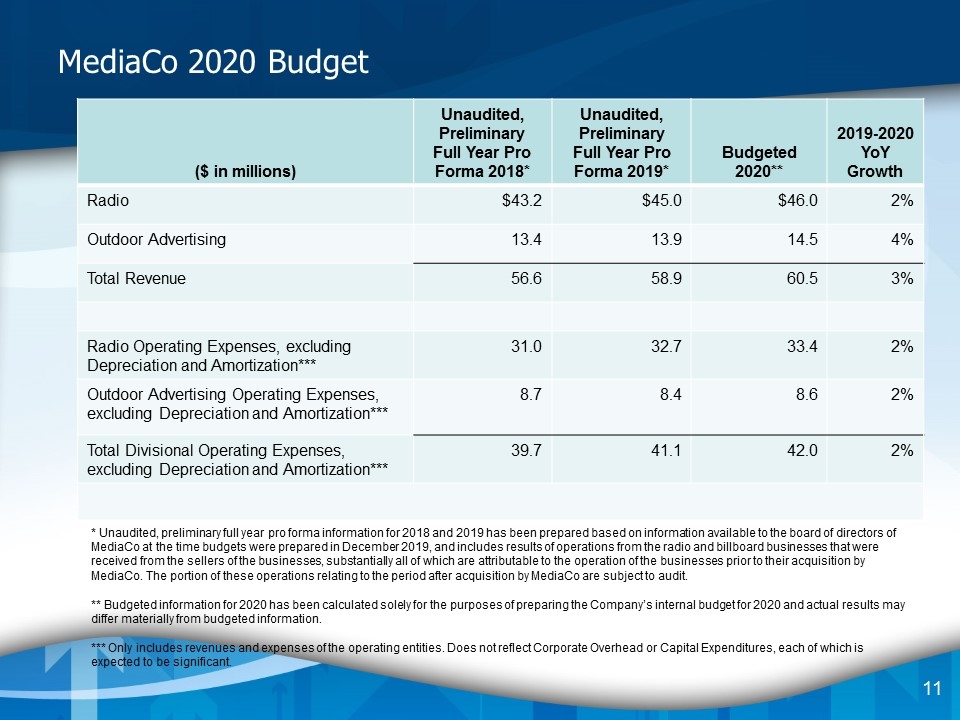

MediaCo 2020 Budget ($ in millions) Unaudited, Preliminary Full Year Pro Forma 2018* Unaudited, Preliminary Full Year Pro Forma 2019* Budgeted 2020** 2019-2020 YoY Growth Radio $43.2 $45.0 $46.0 2% Outdoor Advertising 13.4 13.9 14.5 4% Total Revenue 56.6 58.9 60.5 3% Radio Operating Expenses, excluding Depreciation and Amortization*** 31.0 32.7 33.4 2% Outdoor Advertising Operating Expenses, excluding Depreciation and Amortization*** 8.7 8.4 8.6 2% Total Divisional Operating Expenses, excluding Depreciation and Amortization*** 39.7 41.1 42.0 2% * Unaudited, preliminary full year pro forma information for 2018 and 2019 has been prepared based on information available to the board of directors of MediaCo at the time budgets were prepared in December 2019, and includes results of operations from the radio and billboard businesses that were received from the sellers of the businesses, substantially all of which are attributable to the operation of the businesses prior to their acquisition by MediaCo. The portion of these operations relating to the period after acquisition by MediaCo are subject to audit. ** Budgeted information for 2020 has been calculated solely for the purposes of preparing the Company’s internal budget for 2020 and actual results may differ materially from budgeted information. *** Only includes revenues and expenses of the operating entities. Does not reflect Corporate Overhead or Capital Expenditures, each of which is expected to be significant.

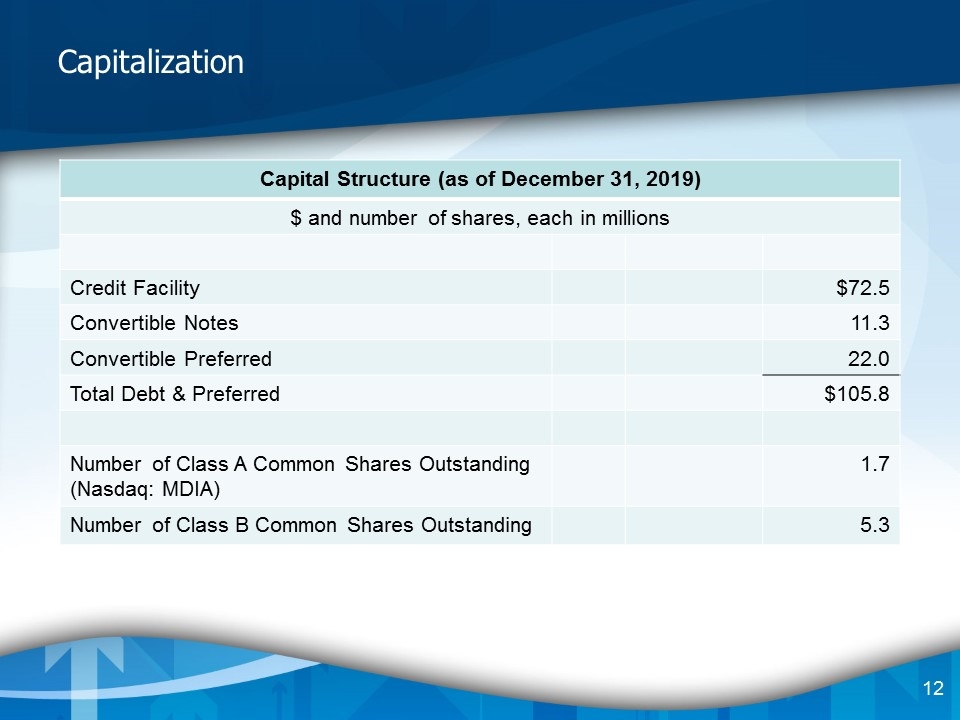

Capitalization Capital Structure (as of December 31, 2019) $ and number of shares, each in millions Credit Facility $72.5 Convertible Notes 11.3 Convertible Preferred 22.0 Total Debt & Preferred $105.8 Number of Class A Common Shares Outstanding (Nasdaq: MDIA) 1.7 Number of Class B Common Shares Outstanding 5.3