Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BlackRock Inc. | d838378d8k.htm |

Fixed Income Investor Presentation January 2020 Exhibit 99.1

Forward-looking Statements This presentation, and other statements that BlackRock may make, may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act, with respect to BlackRock’s future financial or business performance, strategies or expectations. Forward-looking statements are typically identified by words or phrases such as “trend,” “potential,” “opportunity,” “pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions. BlackRock cautions that forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made, and BlackRock assumes no duty to and does not undertake to update forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements and future results could differ materially from historical performance. BlackRock has previously disclosed risk factors in its Securities and Exchange Commission (“SEC”) reports. These risk factors and those identified elsewhere in this presentation, among others, could cause actual results to differ materially from forward-looking statements or historical performance and include: (1) the introduction, withdrawal, success and timing of business initiatives and strategies; (2) changes and volatility in political, economic or industry conditions, the interest rate environment, foreign exchange rates or financial and capital markets, which could result in changes in demand for products or services or in the value of assets under management; (3) the relative and absolute investment performance of BlackRock’s investment products; (4) the impact of increased competition; (5) the impact of future acquisitions or divestitures; (6) the unfavorable resolution of legal proceedings; (7) the extent and timing of any share repurchases; (8) the impact, extent and timing of technological changes and the adequacy of intellectual property, information and cyber security protection; (9) the potential for human error in connection with BlackRock’s operational systems; (10) the impact of legislative and regulatory actions and reforms and regulatory, supervisory or enforcement actions of government agencies relating to BlackRock or The PNC Financial Services Group, Inc. (“PNC”); (11) changes in law and policy and uncertainty pending any such changes; (12) terrorist activities, international hostilities and natural disasters, which may adversely affect the general economy, domestic and local financial and capital markets, specific industries or BlackRock; (13) the ability to attract and retain highly talented professionals; (14) fluctuations in the carrying value of BlackRock’s economic investments; (15) the impact of changes to tax legislation, including income, payroll and transaction taxes, and taxation on products or transactions, which could affect the value proposition to clients and, generally, the tax position of the Company; (16) BlackRock’s success in negotiating distribution arrangements and maintaining distribution channels for its products; (17) the failure by a key vendor of BlackRock to fulfill its obligations to the Company; (18) any disruption to the operations of third parties whose functions are integral to BlackRock’s exchange traded funds (“ETF”) platform; (19) the impact of BlackRock electing to provide support to its products from time to time and any potential liabilities related to securities lending or other indemnification obligations; and (20) the impact of problems at other financial institutions or the failure or negative performance of products at other financial institutions. BlackRock’s Annual Report on Form 10-K and BlackRock’s subsequent filings with the SEC, accessible on the SEC’s website at www.sec.gov and on BlackRock’s website at www.blackrock.com, discuss these factors in more detail and identify additional factors that can affect forward-looking statements. The information contained on the Company’s website is not a part of this presentation. BlackRock reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP”); however, management believes evaluating the Company’s ongoing operating results may be enhanced if investors have additional non-GAAP financial measures. Management reviews non-GAAP financial measures to assess ongoing operations and considers them to be helpful, for both management and investors, in evaluating BlackRock’s financial performance over time. Management also uses non-GAAP financial measures as a benchmark to compare its performance with other companies and to enhance the comparability of this information for the reporting periods presented. Non-GAAP measures may pose limitations because they do not include all of BlackRock’s revenue and expense. BlackRock’s management does not advocate that investors consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Non-GAAP measures may not be comparable to other similarly titled measures of other companies. This presentation also includes non-GAAP financial measures. These non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. You can find our presentations on the most directly comparable GAAP financial measures calculated in accordance with GAAP and our reconciliations in the appendix to this presentation, as well as BlackRock’s other periodic reports which are available on BlackRock’s website at www.blackrock.com. The information provided on our website is not part of this presentation, and therefore, is not incorporated herein by reference. BlackRock has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents that BlackRock has filed with the SEC for more complete information about BlackRock and the offering. You may get these documents for free by visiting EDGAR on the SEC's website at www.sec.gov. Alternatively, BlackRock, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and the prospectus supplement if you request it by calling (i) J.P. Morgan Securities LLC collect at 1-212-834-4533; (ii) BofA Securities, Inc. at 1-800-294-1322; and (iii) Wells Fargo Securities, LLC at 1-800-645-3751. Important Note As indicated in this presentation, certain financial information for 2016 and 2017 reflects previously reported amounts and reflect the recast related to the adoption of the new revenue recognition standard. For further information, refer to Note 2, Significant Accounting Policies, in the consolidated financial statements in our 2018 Form 10-K. Certain financial information for 2014 and 2015 reflect accounting guidance prior to the adoption of the new revenue recognition standard.

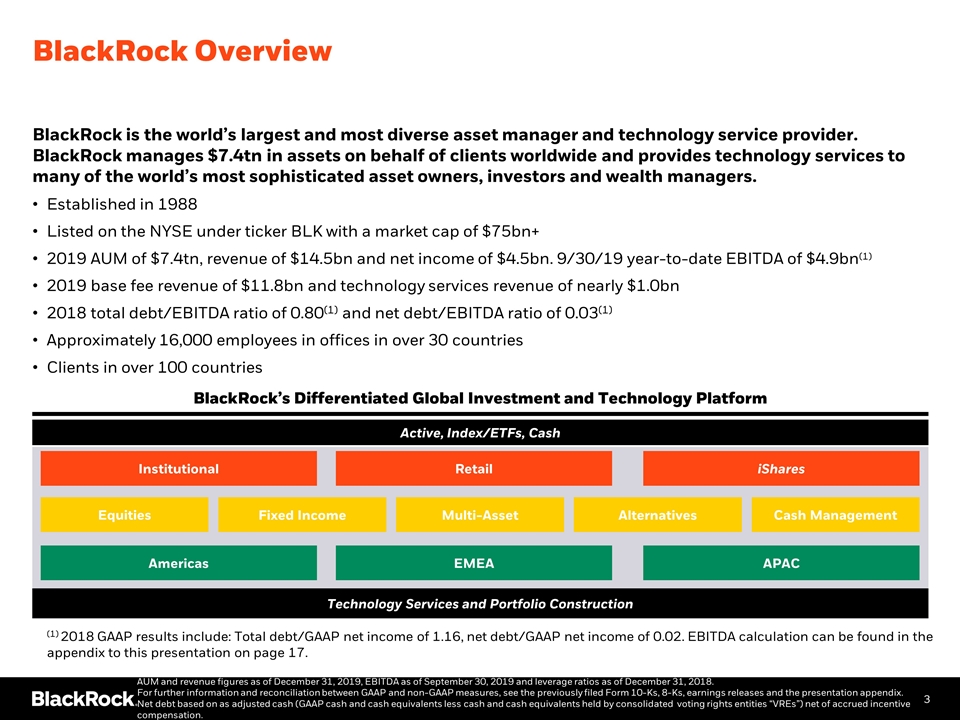

BlackRock Overview BlackRock is the world’s largest and most diverse asset manager and technology service provider. BlackRock manages $7.4tn in assets on behalf of clients worldwide and provides technology services to many of the world’s most sophisticated asset owners, investors and wealth managers. Established in 1988 Listed on the NYSE under ticker BLK with a market cap of $75bn+ 2019 AUM of $7.4tn, revenue of $14.5bn and net income of $4.5bn. 9/30/19 year-to-date EBITDA of $4.9bn(1) 2019 base fee revenue of $11.8bn and technology services revenue of nearly $1.0bn 2018 total debt/EBITDA ratio of 0.80(1) and net debt/EBITDA ratio of 0.03(1) Approximately 16,000 employees in offices in over 30 countries Clients in over 100 countries AUM and revenue figures as of December 31, 2019, EBITDA as of September 30, 2019 and leverage ratios as of December 31, 2018. For further information and reconciliation between GAAP and non-GAAP measures, see the previously filed Form 10-Ks, 8-Ks, earnings releases and the presentation appendix. Net debt based on as adjusted cash (GAAP cash and cash equivalents less cash and cash equivalents held by consolidated voting rights entities “VREs”) net of accrued incentive compensation. Institutional Retail iShares Equities Fixed Income Multi-Asset Alternatives Americas EMEA APAC Technology Services and Portfolio Construction Cash Management BlackRock’s Differentiated Global Investment and Technology Platform Active, Index/ETFs, Cash (1) 2018 GAAP results include: Total debt/GAAP net income of 1.16, net debt/GAAP net income of 0.02. EBITDA calculation can be found in the appendix to this presentation on page 17.

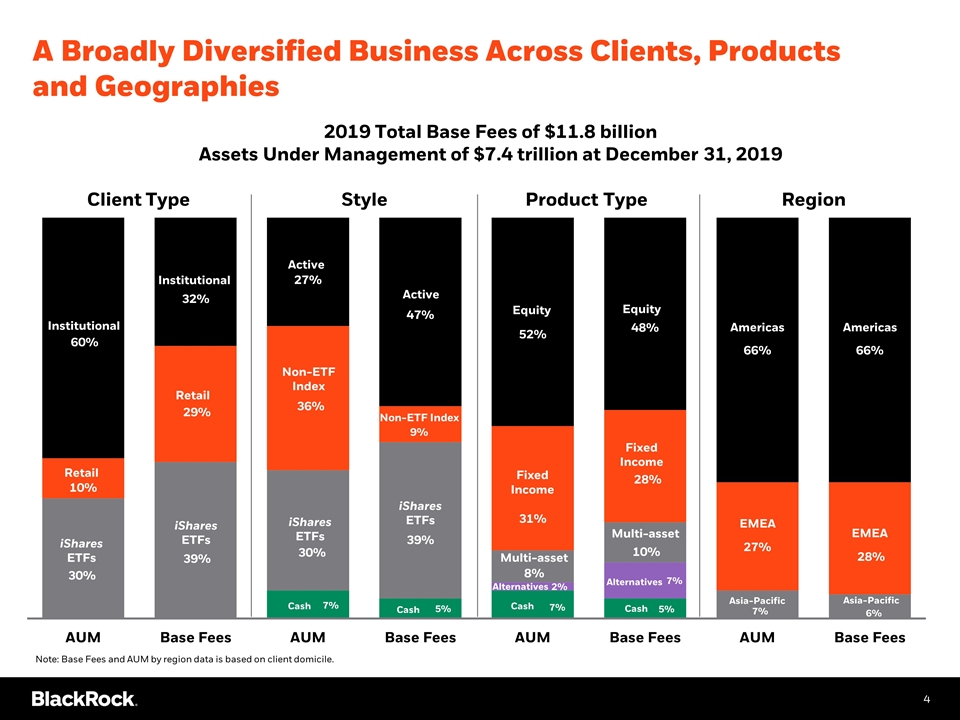

A Broadly Diversified Business Across Clients, Products and Geographies Note: Base Fees and AUM by region data is based on client domicile. Client Type Style Product Type Region 2019 Total Base Fees of $11.8 billion Assets Under Management of $7.4 trillion at December 31, 2019

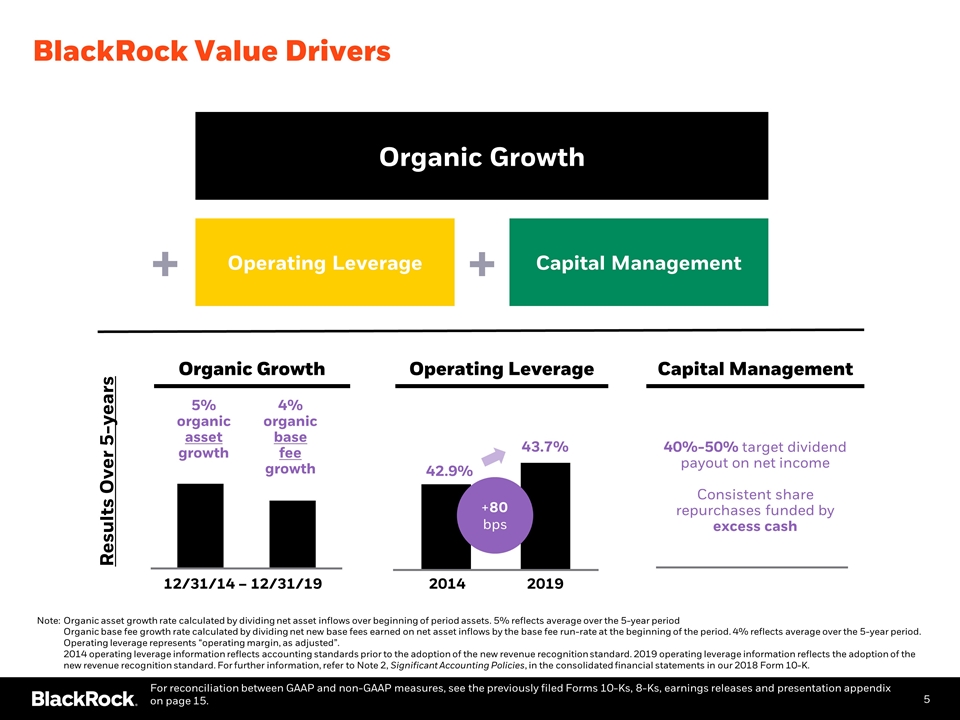

BlackRock Value Drivers Organic Growth Operating Leverage Capital Management Organic Growth Operating Leverage Capital Management 5% organic asset growth 4% organic base fee growth 42.9% 43.7% 12/31/14 – 12/31/19 2014 2019 +80 bps 40%-50% target dividend payout on net income Consistent share repurchases funded by excess cash Organic asset growth rate calculated by dividing net asset inflows over beginning of period assets. 5% reflects average over the 5-year period Organic base fee growth rate calculated by dividing net new base fees earned on net asset inflows by the base fee run-rate at the beginning of the period. 4% reflects average over the 5-year period. Operating leverage represents “operating margin, as adjusted”. 2014 operating leverage information reflects accounting standards prior to the adoption of the new revenue recognition standard. 2019 operating leverage information reflects the adoption of the new revenue recognition standard. For further information, refer to Note 2, Significant Accounting Policies, in the consolidated financial statements in our 2018 Form 10-K. For reconciliation between GAAP and non-GAAP measures, see the previously filed Forms 10-Ks, 8-Ks, earnings releases and presentation appendix on page 15. Results Over 5-years Note:

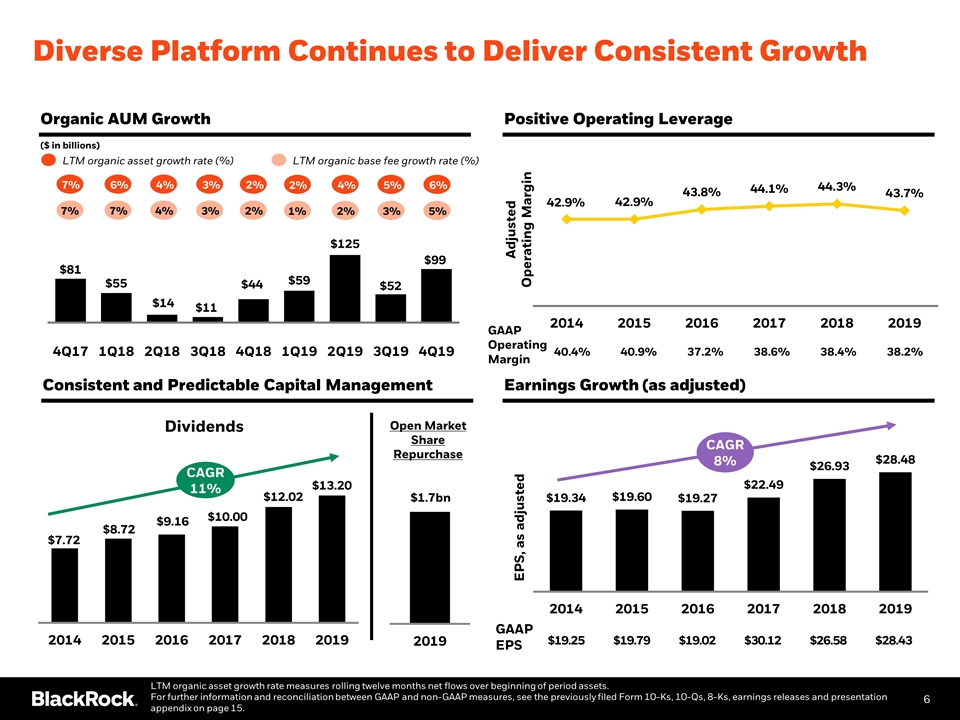

Diverse Platform Continues to Deliver Consistent Growth ($ in billions) CAGR 11% CAGR 8% 1 LTM organic asset growth rate (%) $1.7bn Positive Operating Leverage Organic AUM Growth Consistent and Predictable Capital Management Earnings Growth (as adjusted) LTM organic base fee growth rate (%) 6% 7% 7% 7% 4% 4% 3% 3% 2% 2% LTM organic asset growth rate measures rolling twelve months net flows over beginning of period assets. For further information and reconciliation between GAAP and non-GAAP measures, see the previously filed Form 10-Ks, 10-Qs, 8-Ks, earnings releases and presentation appendix on page 15. 40.4% 40.9% 37.2% 38.6% 38.4% 38.2% $19.25 $19.79 $19.02 $30.12 $26.58 $28.43 GAAP Operating Margin GAAP EPS 4% 2% 2% 1% 5% 3% 6% 5%

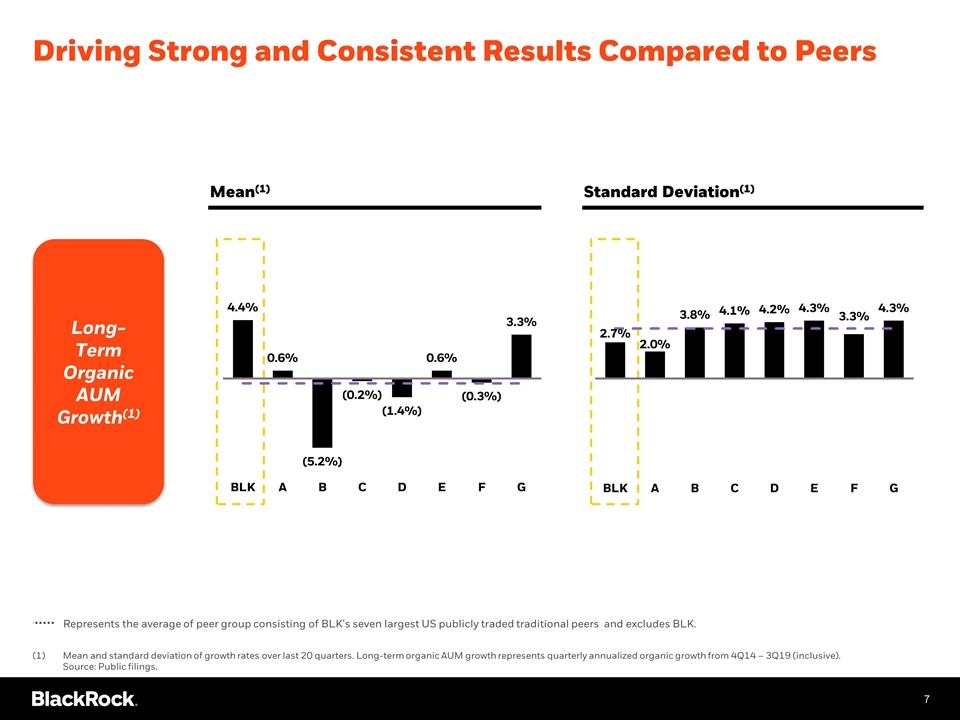

Driving Strong and Consistent Results Compared to Peers Long-Term Organic AUM Growth(1) Standard Deviation(1) Mean(1) Represents the average of peer group consisting of BLK’s seven largest US publicly traded traditional peers and excludes BLK. Mean and standard deviation of growth rates over last 20 quarters. Long-term organic AUM growth represents quarterly annualized organic growth from 4Q14 – 3Q19 (inclusive). Source: Public filings.

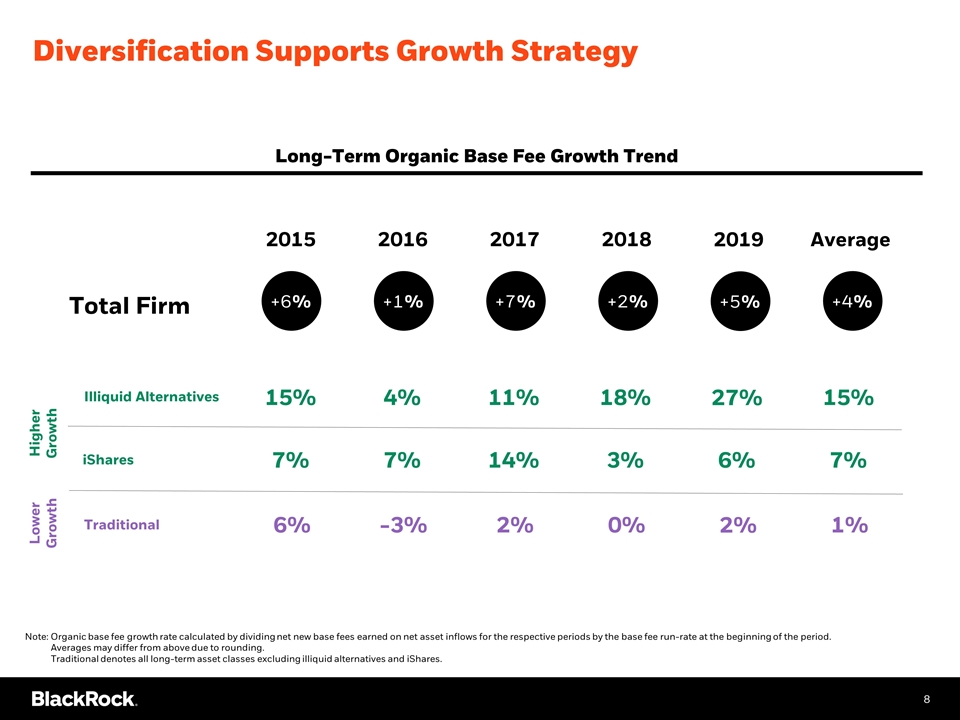

Diversification Supports Growth Strategy Total Firm Illiquid Alternatives iShares 15% 11% 18% 2015 2016 2017 2018 Traditional 4% 7% 14% 3% 7% 6% 2% 0% -3% +6% +1% +7% +2% 15% Average 7% 1% +4% Lower Growth Higher Growth Note: Organic base fee growth rate calculated by dividing net new base fees earned on net asset inflows for the respective periods by the base fee run-rate at the beginning of the period. Averages may differ from above due to rounding. Traditional denotes all long-term asset classes excluding illiquid alternatives and iShares. Long-Term Organic Base Fee Growth Trend 27% 2019 6% 2% +5%

Strategically Differentiated Through Technology Scaled distribution Alpha generation Product innovation Customized holistic solutions Technology-Enabled Revenue Direct Technology Revenue ® ® Provider wealth ®

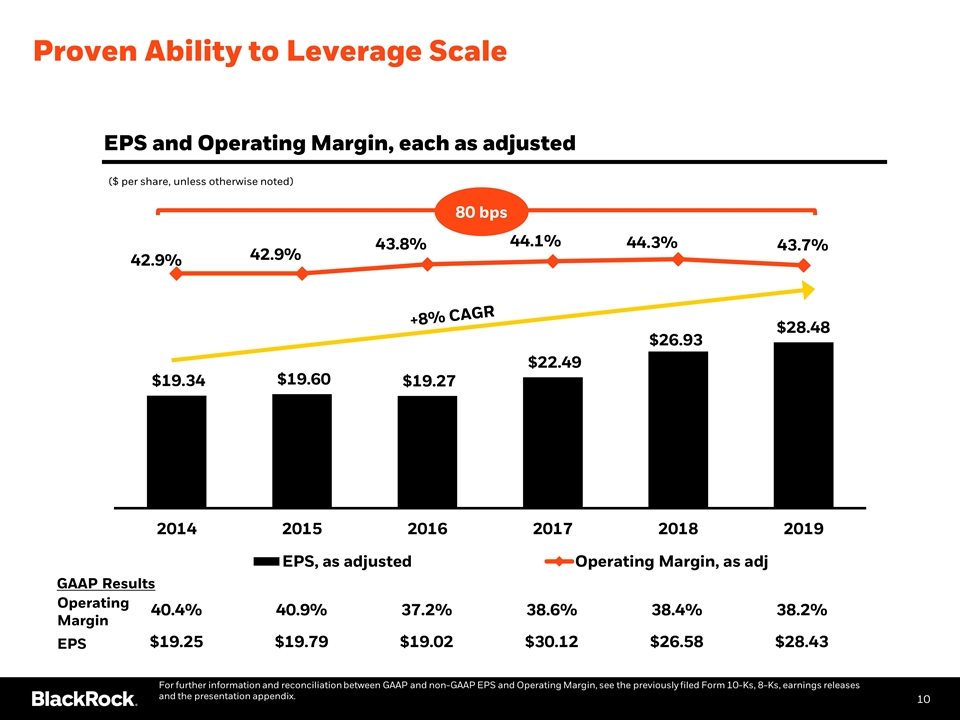

Proven Ability to Leverage Scale 80 bps +8% CAGR EPS and Operating Margin, each as adjusted ($ per share, unless otherwise noted) For further information and reconciliation between GAAP and non-GAAP EPS and Operating Margin, see the previously filed Form 10-Ks, 8-Ks, earnings releases and the presentation appendix. 40.4% 40.9% 37.2% 38.6% 38.4% 38.2% $19.25 $19.79 $19.02 $30.12 $26.58 $28.43 GAAP Results Operating Margin EPS

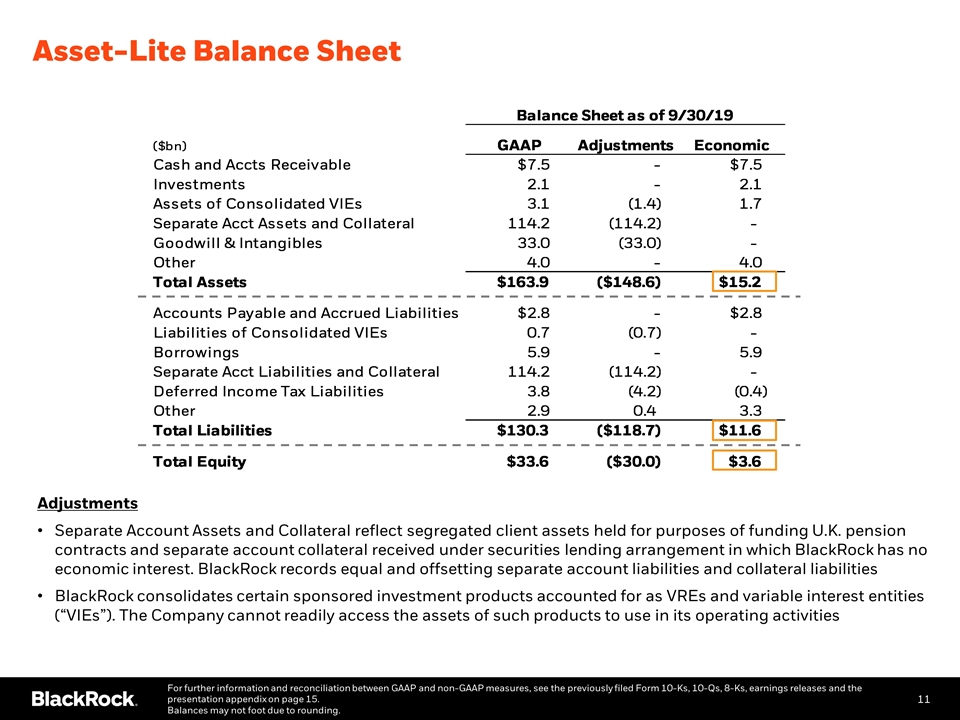

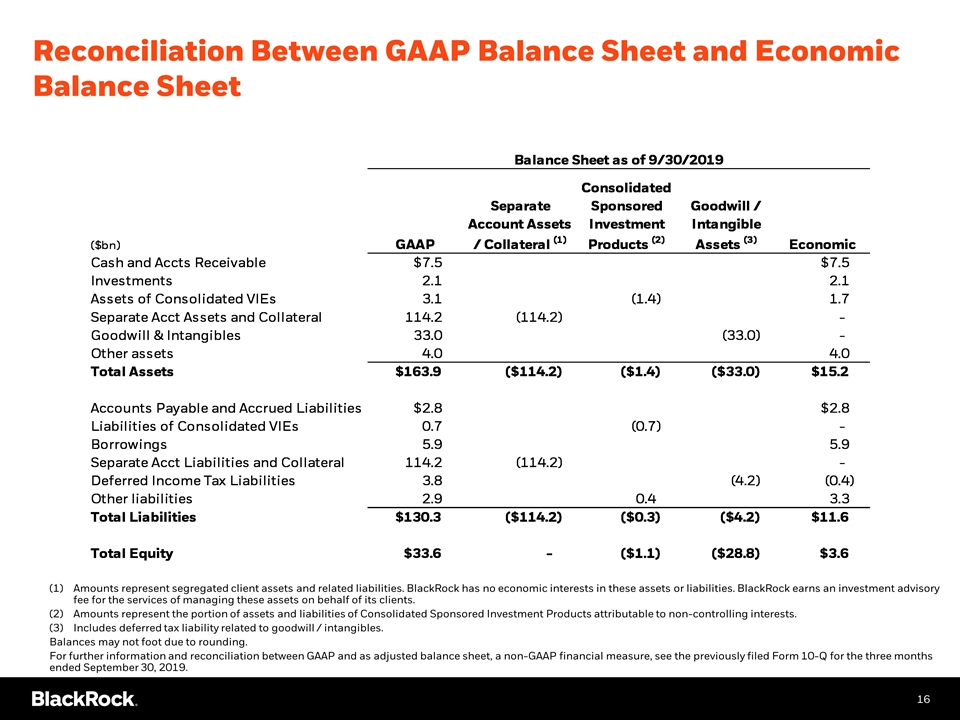

Asset-Lite Balance Sheet Adjustments Separate Account Assets and Collateral reflect segregated client assets held for purposes of funding U.K. pension contracts and separate account collateral received under securities lending arrangement in which BlackRock has no economic interest. BlackRock records equal and offsetting separate account liabilities and collateral liabilities BlackRock consolidates certain sponsored investment products accounted for as VREs and variable interest entities (“VIEs”). The Company cannot readily access the assets of such products to use in its operating activities For further information and reconciliation between GAAP and non-GAAP measures, see the previously filed Form 10-Ks, 10-Qs, 8-Ks, earnings releases and the presentation appendix on page 15. Balances may not foot due to rounding.

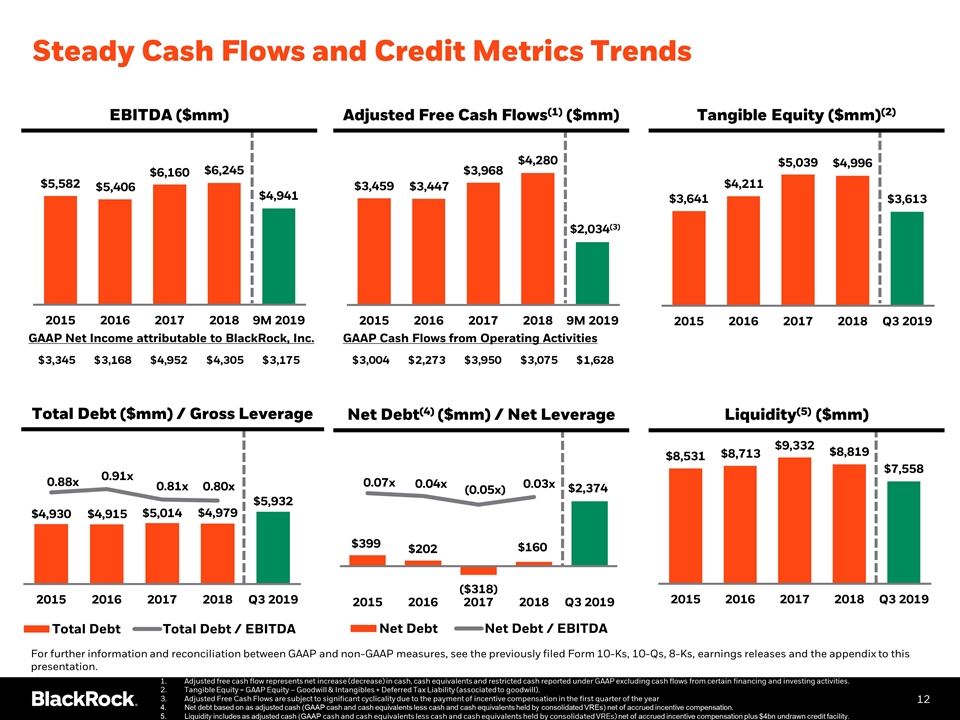

Steady Cash Flows and Credit Metrics Trends Adjusted free cash flow represents net increase (decrease) in cash, cash equivalents and restricted cash reported under GAAP excluding cash flows from certain financing and investing activities. Tangible Equity = GAAP Equity – Goodwill & Intangibles + Deferred Tax Liability (associated to goodwill). Adjusted Free Cash Flows are subject to significant cyclicality due to the payment of incentive compensation in the first quarter of the year Net debt based on as adjusted cash (GAAP cash and cash equivalents less cash and cash equivalents held by consolidated VREs) net of accrued incentive compensation. Liquidity includes as adjusted cash (GAAP cash and cash equivalents less cash and cash equivalents held by consolidated VREs) net of accrued incentive compensation plus $4bn undrawn credit facility. For further information and reconciliation between GAAP and non-GAAP measures, see the previously filed Form 10-Ks, 10-Qs, 8-Ks, earnings releases and the appendix to this presentation. GAAP Net Income attributable to BlackRock, Inc. GAAP Cash Flows from Operating Activities Total Debt ($mm) / Gross Leverage EBITDA ($mm) Adjusted Free Cash Flows(1) ($mm) Tangible Equity ($mm)(2) Liquidity(5) ($mm) Net Debt(4) ($mm) / Net Leverage

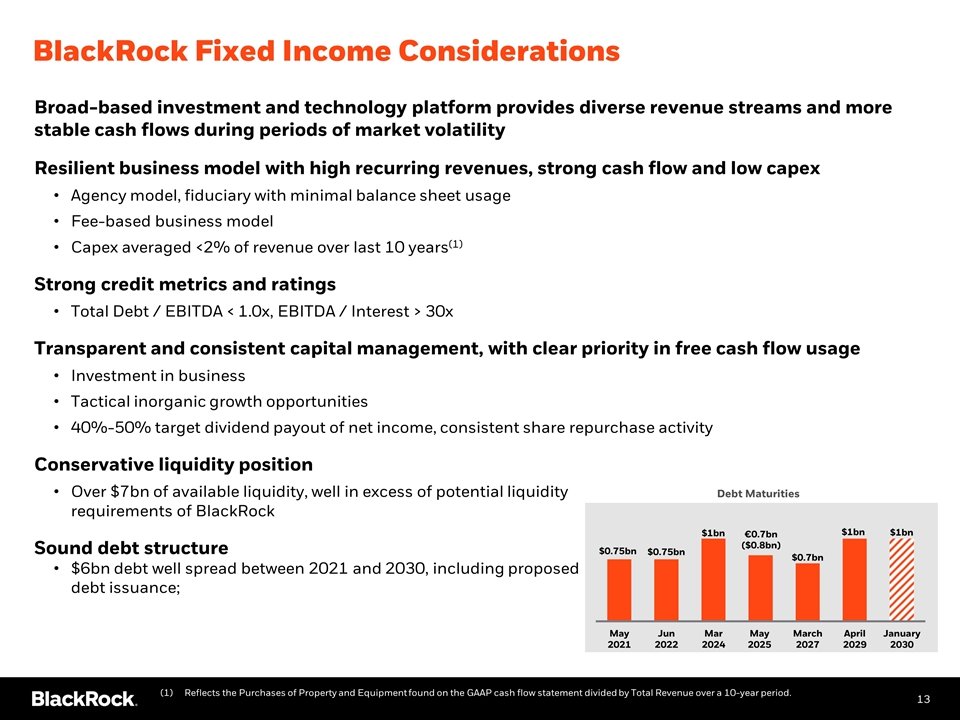

BlackRock Fixed Income Considerations Broad-based investment and technology platform provides diverse revenue streams and more stable cash flows during periods of market volatility Resilient business model with high recurring revenues, strong cash flow and low capex Agency model, fiduciary with minimal balance sheet usage Fee-based business model Capex averaged <2% of revenue over last 10 years(1) Strong credit metrics and ratings Total Debt / EBITDA < 1.0x, EBITDA / Interest > 30x Transparent and consistent capital management, with clear priority in free cash flow usage Investment in business Tactical inorganic growth opportunities 40%-50% target dividend payout of net income, consistent share repurchase activity Conservative liquidity position Over $7bn of available liquidity, well in excess of potential liquidity requirements of BlackRock Sound debt structure $6bn debt well spread between 2021 and 2030, including proposed debt issuance; Reflects the Purchases of Property and Equipment found on the GAAP cash flow statement divided by Total Revenue over a 10-year period. Debt Maturities

Appendix

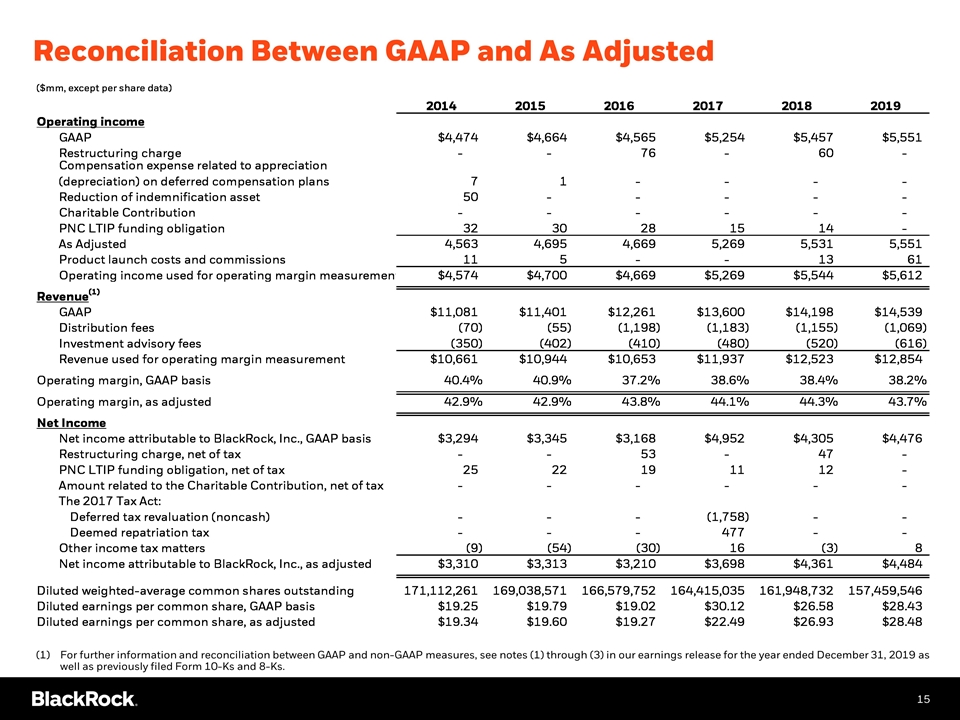

Reconciliation Between GAAP and As Adjusted For further information and reconciliation between GAAP and non-GAAP measures, see notes (1) through (3) in our earnings release for the year ended December 31, 2019 as well as previously filed Form 10-Ks and 8-Ks.

Reconciliation Between GAAP Balance Sheet and Economic Balance Sheet Amounts represent segregated client assets and related liabilities. BlackRock has no economic interests in these assets or liabilities. BlackRock earns an investment advisory fee for the services of managing these assets on behalf of its clients. Amounts represent the portion of assets and liabilities of Consolidated Sponsored Investment Products attributable to non-controlling interests. Includes deferred tax liability related to goodwill / intangibles. Balances may not foot due to rounding. For further information and reconciliation between GAAP and as adjusted balance sheet, a non-GAAP financial measure, see the previously filed Form 10-Q for the three months ended September 30, 2019.

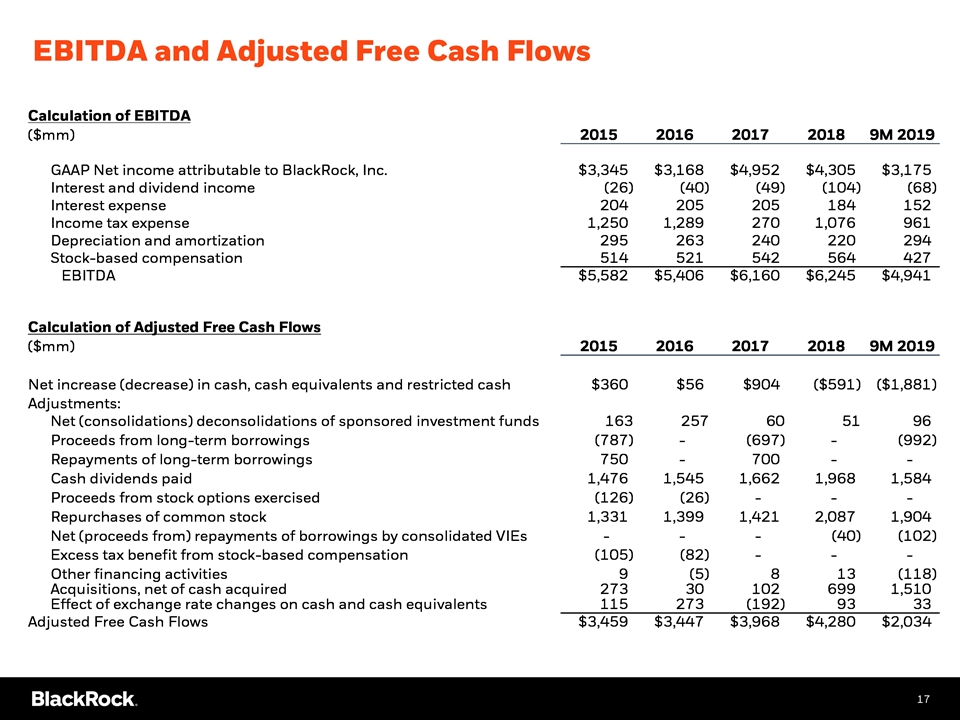

EBITDA and Adjusted Free Cash Flows

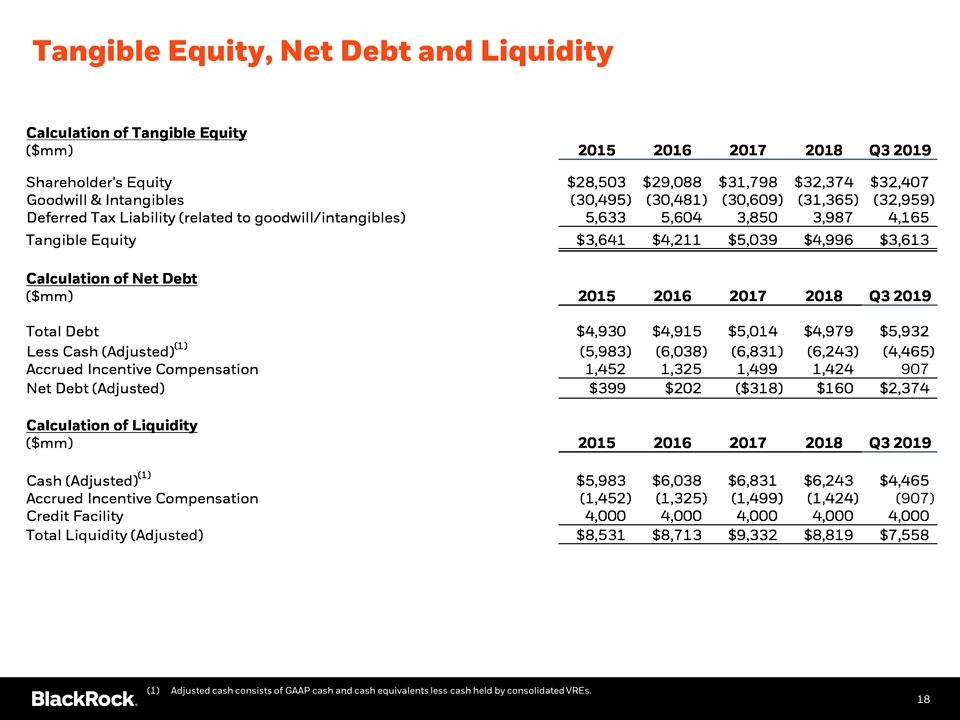

Tangible Equity, Net Debt and Liquidity Adjusted cash consists of GAAP cash and cash equivalents less cash held by consolidated VREs.

Important Notes The opinions expressed herein are as of January 2020 and are subject to change at any time due to changes in the market, the economic or regulatory environment or for other reasons. The information should not be construed as research or relied upon in making investment decisions or be used as legal advice. An assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a professional adviser before making an investment decision. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. The information and opinions contained herein are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, but are not necessarily all inclusive and are not guaranteed as to accuracy or completeness. Certain of the information presented herein is for illustrative purposes only. No part of this material may be reproduced, stored in any retrieval system or transmitted in any form or by any means, electronic, mechanical, recording or otherwise, without the prior written consent of BlackRock. This material is solely for informational purposes and does not constitute an offer or solicitation to sell or a solicitation of an offer to buy any shares of any fund (nor shall any such shares be offered or sold to any person) in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities law of that jurisdiction. The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”). ©2020 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, iRETIRE, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, FutureAdvisor, Cachematrix, eFront, the iShares Core Graphic, CoRI and the CoRI logo are registered and unregistered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.